Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENTERPRISE FINANCIAL SERVICES CORP | efsc-20210803.htm |

Enterprise Financial Services Corp Second Quarter 2021 Investor Presentation Exhibit 99.1

Forward-Looking Statements Certain statements contained in this presentation may be considered “forward-looking statements” within the meaning of and intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 regarding Enterprise Financial Services Corp (the “Company,” “EFSC,” or “Enterprise”), including its wholly-owned subsidiary Enterprise Bank & Trust (“EB&T”). Such forward-looking statements may include projections based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, statements about the Company’s plans, strategies, goals, objectives, expectations, or consequences of statements about the future performance, operations, products and services of the Company and its subsidiaries, as well as statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, yields and returns, loan diversification and credit management, products and services, shareholder value creation and the impact of the Company’s acquisitions. Forward-looking statements are typically identified with the use of words such as “may,” “might,” “will,” “should,” “plan,” “believe,” “predict,” “potential,” “could,” “continue,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “pro forma” and the negative and other variations of these terms and similar words and expressions, although some forward-looking statements may be expressed differently. Forward-looking statements are inherently subject to numerous assumptions, risks and uncertainties, which change over time and speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that the Company anticipated in its forward-looking statements and future results could differ materially from historical performance. Given the ongoing and dynamic nature of the COVID-19 pandemic, the ultimate extent of the impacts on the Company’s business, financial position, results of operations, liquidity, and prospects remain uncertain. Continued deterioration in general business and economic conditions, including further increases in unemployment rates, or turbulence in domestic or global financial markets could adversely affect the Company’s revenues and the values of the Company’s assets and liabilities, reduce the availability of funding, lead to a tightening of credit, and further increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices as a result of, or in response to COVID-19, could affect the Company in substantial and unpredictable ways. Other factors that could cause or contribute to such differences include, but are not limited to: the Company’s ability to efficiently consummate and integrate acquisitions, including the Company’s recent acquisition of First Choice Bancorp, into the Company’s operations, retain the customers of these businesses and grow the acquired operations; credit risk; changes in the appraised valuation of real estate securing impaired loans; the Company’s ability to recover its investment in loans; fluctuations in the fair value of collateral underlying loans; outcomes of litigation and other contingencies; exposure to general and local economic conditions; risks associated with rapid increases or decreases in prevailing interest rates; changes in business prospects that could impact goodwill estimates and assumptions; consolidation within the banking industry; competition from banks and other financial institutions; the Company’s ability to attract and retain relationship officers and other key personnel; burdens imposed by federal and state regulation; changes in regulatory requirements; changes in accounting policies and practices or accounting standards, including ASU 2016-13 (Topic 326), “Measurement of Credit Losses on Financial Instruments,” commonly referenced as CECL model, which has changed how the Company estimates credit losses; uncertainty regarding the future of LIBOR; natural disasters, war or terrorist activities, or pandemics, or the outbreak of COVID-19 or similar outbreaks, and their effects on economic and business environments in which the Company and its subsidiaries operate; increased unemployment rates and defaults as a result of the economic disruptions caused by COVID-19; the impact of governmental orders issued in response to COVID-19; and those factors and risks referenced from time to time in the Company’s filings with the U.S. Securities and Exchange Commission (“SEC”), including in its Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and its other filings with the SEC. For any forward-looking statements made in this presentation or in any documents, Enterprise claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Annualized, pro forma, projected and estimated numbers in this document are used for illustrative purposes only, are not forecasts and may not reflect actual results. Except to the extent required by applicable law or regulation, Enterprise disclaims any obligation to revise or publicly release any revision or update to any of the forward-looking statements included herein to reflect events or circumstances that occur after the date on which such statements were made. 2

Executive Leadership Team JAMES B. LALLY 53, President & Chief Executive Officer, EFSC Enterprise Tenure – 17 years KEENE S. TURNER 41, EVP, Chief Financial Officer, EFSC Enterprise Tenure – 7 years SCOTT R. GOODMAN 57, President, Enterprise Bank & Trust Enterprise Tenure – 18 years DOUGLAS N. BAUCHE 51, EVP, Chief Credit Officer, Enterprise Bank & Trust Enterprise Tenure – 21 years MARK G. PONDER 50, EVP, Chief Administrative Officer, Enterprise Bank & Trust Enterprise Tenure – 9 years NICOLE M. IANNACONE 41, EVP, Chief Risk Officer & General Counsel, Enterprise Bank & Trust Enterprise Tenure – 7 years 3

Company Snapshot - EFSC Total Assets $10.3 Billion Market Cap FOCUSED BUSINESS MODEL: Operates in St. LouisKansas City Phoenix $1.4 Billion • Attract Top Talent in Markets • Proven Ability to Grow Commercial & Industrial “C&I” Loans • Product Breadth ◦ Banking ◦ Trust & Wealth Management ◦ Treasury Management • Strong Balance Sheet with Attractive Risk Profile • Concentrated on Private Businesses and Owner Families • Relationship Driven Talent Strength Passion New Mexico San Diego Las Vegas The Company has SBA loan and deposit production offices in nine additional states. 4

■ There were no layoffs or pay reductions as a result of the pandemic and on-site essential employees received premium wages for a period of time. ■ 70% of employees worked remotely during the pandemic. ■ In 2020 we invested over $1.5 billion in programs designed to promote small business and community development. ■ Enterprise University, which provides training courses, has helped more than 25,000 professionals. ■ The Company has been named a best bank to work for numerous times. ESG Highlights The 2020 Environmental, Social and Governance Report is available at enterprisebank.com/esg. Our Framework Additional Policies Every associate and Board Member receives and attests to our Code of Ethics annually and has access to our Ethics and Compliance Hotline to report potential violations of policies, procedures or regulations in a confidential manner. Our commitment to sustainability begins with the Board of Directors of Enterprise. As the governing body responsible for our general oversight and strategic direction, the Board establishes parameters to ensure that our interactions with society and the environment are considered in connection with all business activities. Governance Pandemic Preparedness By utilizing our Business Continuity Plan and Pandemic Plan, we have been able to successfully navigate the COVID-19 pandemic with no significant interruptions. While the challenges brought on by COVID-19 are, in many ways, novel, we know we must remain prepared to deal with future pandemics. Climate With the oversight of our Board and the Risk Committee, we are beginning to formulate processes for identifying, measuring and modeling the impact of climate-related risks and their potential significance to our ongoing business operations and long-term value. Community Involvement We are committed to managing our business and community relationships in ways that positively impact our associates, clients and the diverse communities where we live and work. We have a long-standing history of supporting our communities. Our Community Impact Report is available at enterprisebank.com/ impact. Human Capital Several of our Guiding Principles focus on our associates and the communities in which we work and live. We pride ourselves on creating an open, diverse and transparent culture that celebrates teamwork and recognizes associates at all levels. Our Results 5

Differentiated Business Model: Built for Quality Earnings Growth Focused and Well-Defined Strategy Aimed at Business Owners, Executives and Professionals. Targeted Array of Banking and Wealth Management Services to Meet our Client’s Needs Experienced Bankers and Advisors Targeted Audience Focused and Well-Defined Strategy Aimed at Business Owners, and Professionals Tailored Solutions Targeted Array of Banking and Cash Management Services to Meet Our Clients’ Needs Expertise Experienced, Tenured Bankers and Advisors with Specialized Knowledge in Various Industries and Products 6

Customer Focus Source: Greenwich Associates 71 NPS NET PROMOTER SCORE A measure of client satisfaction INDUSTRY AVERAGE: 54 7

▪ Total Assets: $2.4 Billion ▪ Gross Loans: $2.0 Billion, including PPP of $296 Million ▪ Deposits: $1.9 Billion ▪ ROAA: 1.71% ytd June 2021, excluding merger costs ▪ ROATCE: 19.7% ytd June 2021, excluding merger costs ▪ Efficiency Ratio1: 44.8% ytd June 2021 ▪ NIM: 4.2% ytd June 2021 ▪ Attractive core deposit franchise: ◦ $1.9 Billion in Total Deposits ◦ 55% of Total Deposits are Noninterest Bearing ▪ Established presence in Los Angeles, Orange, and San Diego counties. ▪ 87.5% of loan portfolio composed of CRE and C&I relationships. First Choice Overview - Closed July 21, 2021 Company Business Highlights 2Q21 Highlights Southern California Branch Map1 ▪ Nasdaq Listed: FCBP ▪ Headquarters: Cerritos, California ▪ Focus: Commercial Banking ▪ With 8 full service branches and 2 LPOs across Los Angeles, Orange, and San Diego counties, First Choice specializes primarily in making loans across C&I, CRE, and SBA 7a and 504 loans. Source: Company financial reports 1. Branch map does not include loan production offices 8

Regional and National Markets Kansas City Phoenix New Mexico San Diego1 St. Louis Specialty Lending & Deposits Loans 2 $775MM $480MM $595MM $266MM $2.1B $2.4B Deposits $1.1B $343MM $1.3B $238MM $4.3B $1.4B Branches 7 2 6 5 19 17 LPO 5 DPO Deposit Market Share 3, 4 15th/1.45% 26th/0.22% 10th/2.91% 13th/0.93% 4th/4.50% SBA 7(a) Rank:Top 10 Primary Competitors UMB Commerce Bank of America JPMorgan Chase Wells Fargo Bank of America Wells Fargo Bank of America BOK Financial Corp Wells Fargo JPMorgan Chase Bank of America Bank of America US Bancorp Commerce SBA 7(a) Competitors: Live Oak Banking Co. Celtic Bank Corp. Huntington National 1 Includes one branch in Las Vegas. 2 Excludes $397MM of PPP, net of deferred fees and $225MM of Other loans. 3 Source: 6/30/20 data for branches, 12/31/20 data for SBA 7(a) Rank, S&P Global Market Intelligence. 41st/78.10% for Los Alamos, New Mexico MSA and 5th/12.23% for Santa Fe, New Mexico MSA 9

Focused Loan Growth Strategies Total Loans Specialty market segments represent 34% of total loans, offering competitive advantages, risk adjusted pricing and fee income opportunities. Tax Credit Programs $423 million in loans outstanding related to Federal, Historic, and Missouri Affordable Housing tax credits. $183 million in Federal & State New Market tax credits awarded to date. Sponsor Finance $464 million in M&A related loans outstanding, Partnering with PE firms. Life Insurance Premium Financing $564 million in loans outstanding related to high net worth estate planning. Expectations for future growth includes continued focus in these specialized market segments. SBA Loans $1.0 billion in loans outstanding in SBA 7(a) loans, including $686 million guaranteed. 10

Total Loan Trends In Millions 18% Total Lo an Growth PPP $819 PPP* $613 PPP $738 *Represents PPP loans originated by EFSC Seacoast $1,224 PPP $397 PPP $808 11

Portfolio Balance Pe rc en ta ge G ro w th 2Q20 - 2Q21 $0.5B $1.0B $1.5B $2.0B $2.5B $3.0B (50)% (25)% 0% 25% 50% 75% 100% Drivers of Loan Growth - Year over Year 40% 17% -7% 50% 6% 91% -38% 9% 6% 4%7% -2% Increase of $1.1 Billion 12

Loan Portfolio Total $7.2 Billion CRE 31.2% Construction 6.5% Residential 4.2% Other 3.1% Sponsor Finance 6.4% LIPF 7.8% Tax Credit 5.9% SBA 14.0% PPP 5.5% C&I 15.4% Loans by Product Type Real Estate/ Rental/Leasing 24.0% Finance and Insurance 15.4% Accommodation/Food Service 8.1%Manufacturing 8.0% Other Services 7.5% Retail Trade 5.7% Other 31.3% Loans by Industry Type Libor 35.7% Fixed 37.2% PPP Fixed 5.5%Prime 19.1% Other Adjustable 2.5% Loans by Rate Type 13

Loan Details 2Q21 1Q21 QTR Change 2Q20 LTM Change C&I $ 1,116 $ 1,049 $ 67 $ 1,052 $ 64 CRE, Investor Owned 1,467 1,491 (24) 1,299 168 CRE, Owner Occupied 789 806 (17) 782 7 SBA loans*1 1,011 941 70 17 994 Sponsor Finance* 464 394 70 383 81 Life Insurance Premium Financing* 564 543 21 521 43 Tax Credits* 423 388 35 363 60 Residential Real Estate 302 300 2 327 (25) Construction and Land Development 468 438 30 456 12 Other 225 201 24 132 93 Subtotal $ 6,829 $ 6,551 $ 278 $ 5,332 $ 1,497 SBA PPP loans 397 738 (341) 808 (411) Total Loans $ 7,226 $ 7,289 $ (63) $ 6,140 $ 1,086 *Specialty loan category. 1Includes $686 million and $617 million of SBA guaranteed loans for 2Q21 and 1Q21, respectively. In Millions 14

Total Loans By Business Unit In Millions Note: Excludes PPP and Other loans **Acquisition of Seacoast closed on November 12, 2020 *1Q21 and 2Q21 include acquired Seacoast SBA loans 15

• 1% coupon, 4.3% ytd average yield • 24% 2 year maturity; 76% 5 year maturity • No PPP loans or servicing have been sold • Forgiveness process started October 29, 2020 • 1,190 PPP loans totaling $22.7 million are < $50,000; $2.2 million in fees • $779.4 million has been forgiven/repaid as of June 30, 2021 • Total PPP fees $39.0 million, $12.2 million unearned Total $397 Million PPP Loans by Size $ In Millions PPP Loans Size Number of Loans Balance Average Balance $5-10 Million 1 $8.1 $8.1 $2-5 Million 27 61.2 2.3 < $2 Million 2,295 327.4 0.1 Total 2,323 $396.7 $0.2 Construction 15.0% Manufacturing 14.8% Professional Technical 11.1% Accomodation 17.1% Health Care 8.8% Administrative 6.0% Other Services 5.5% Other 21.7% PPP Loans by Industry Midwest 63.7% Southwest 21.5% West 12.5% Northeast 1.5% Southeast 0.8% PPP Loans by Location 16

36% 35% 6% 23% Attractive Deposit Mix CD Interest-Bearing Transaction Accounts DDA MMA & Savings • Significant DDA Composition • Stable, Low Cost Deposit Portfolio • Improving Core Funding 29% Deposit Growth 2Q20 – 2Q21 In Millions Total Deposits $8.6 Billion 29.3% 28.9% 34.0% 34.2% 36.0% Seacoast $1,060 17

Specialty Deposits Community Associations $495 million in deposit accounts specifically designed to serve the needs of community associations. Property Management $362 million in deposits. Specializing in the compliance on Property Management Trust Accounts. Third-Party Escrow $101 million in deposits. Growing product line providing independent escrow services. Trust Services $76 million in deposit accounts. Providing services to nondepository trust companies. Specialty deposits of $1.4 billion represent 17% of total deposits. Includes high concentration of noninterest-bearing deposits with a low cost of funds. Other $387 million in deposit accounts primarily related to Sponsor Finance and Life Insurance Premium Financing loans. 4Q20 1Q21 2Q21 Community Assoc Property Mgmt Third- Party Escrow Trust Services Other $— $250 $500 In Millions 18

59%21% 10% 7% 37% 23% 22% 10% 4% 32% 23% 20% 16% 5% 48% 19% 31% Core Funding Mix Commercial Business Banking Consumer 2Q21 Brokered deposits: $449 2Q20 Brokered deposits: $548 In Millions $2,760 34% $2,480 40% $1,217 15% $1,019 17% $2,793 34% $2,653 43% Cost of Funds1 Commercial Business Banking Consumer Specialty Brokered Core 0.07% 0.02% 0.05% 0.06% Time Deposit 1.61% 0.95% 0.68% 0.31% Total 0.10% 0.04% 0.15% 0.07% 0.39% 1For the month ended June 30, 2021 63% 19% 8% 8% Specialty $1,421 17% 69% 28% 45% 25% 27%2Q21 2Q20 CD Maturities In Millions Balance Weighted Avg Rate 3Q21 $ 150 1.02% 4Q21 72 0.46% 1Q22 60 0.35% 2Q22 57 0.33% Thereafter 175 1.03% $ 514 0.79% 19

Earnings Per Share Trend - 2Q21 Change in EPS 1Q21 2Q21Net Interest Income Noninterest Income Provision for Credit Losses Merger-Related Expense $0.96 $1.23 Noninterest Expense 20

Net Interest Income Trend In Millions 24% NII Growth PPP Income $10.3 PPP Income $4.1 PPP Income $5.2 PPP Income $8.5 PPP Income $7.9 *Seacoast acquisition completed 11/12/20. 21

Net Interest Margin Components of Interest-bearing LiabilitiesComponents of Interest-earning Assets 1Q21 3.50 % Cash/Liquidity (0.05) % Loans 0.01 % Investments (0.01) % Cost of funds 0.01 % 2Q21 3.46 % Net Interest Margin Trend Net Interest Margin Bridge 0.37% 22

Credit Trends for Loans 2Q21 1Q21 2Q20 NPAs/Assets 0.44% 0.42% 0.55% NPLs/Loans 0.58% 0.50% 0.68% ALLL/NPLs 303.4% 358.8% 265.9% ALLL/Loans** 2.09% 2.22% 2.07% Net Charge-offs (Recoveries) In Millions bps bps bps bps bps In Millions Loan Growth and Line of Credit Utilization* *Excludes acquisition of Seacoast for 4Q20 **Excludes guaranteed loans. 23

Allowance for Credit Losses for Loans In Thousands $131,527 $128,185• New loans and changes in composition of existing loans • Changes in risk ratings, past due status and reserves on individually evaluated loans • Charge-offs and recoveries 2Q21 In Thousands ACL Loans ACL as a % of Loans Commercial and industrial $ 53,351 $ 2,930,805 1.82 % Commercial real estate 51,567 3,200,748 1.61 % Construction real estate 11,632 556,776 2.09 % Residential real estate 4,677 305,497 1.53 % Other 6,958 232,441 2.99 % Total loans $ 128,185 $ 7,226,267 1.77 % Reserves on sponsor finance, which is included in the categories above, represented $20.1 million. Total ACL percentage of loans excluding PPP and other government guaranteed loans was 2.09% Key Assumptions: • Reasonable and supportable forecast period is one year with a one year reversion period. • Forecast considers a weighted average of baseline, upside and downside scenarios. • Primary macroeconomic factors: ◦ Percentage change in GDP ◦ Unemployment ◦ Retail Sales ◦ CRE Index 24

Noninterest Income Trend Other Fee Income DetailFee Income In Millions 13.1% 16.6% 19.3% 12.5% 16.5% 25

Operating Expenses Trend * A Non-GAAP Measure, Refer to Appendix for Reconciliation In Millions 26

Capital *A Non-GAAP Measure, Refer to Appendix for Reconciliation. Excludes PPP loans. 8.0% 11.4% 11.6% 12.1% 12.3% 12.3% ♦ EFSC Capital Strategy: Low Cost - Highly Flexible High Capital Retention Rate – Strong earnings profile – Sustainable dividend profile Supporting Robust Asset Growth – Organic loan and deposit growth – High quality M&A to enhance commercial franchise and geographic diversification Maintain High Quality Capital Stock – Minimize WACC over time (preferred, sub debt, etc.) – Optimize capital levels T1 Common ~10%, Tier 1 ~12%, and Total Capital ~14% Maintain 8-9% TCE – Common stock repurchases – 251,637 repurchased at average price of $47.00 in 2Q21 – M&A deal structures – Drives ROATCE above peer levels TBV and Dividends per Share $24.22 $24.80 $25.48 $25.92 $26.85 $0.18 $0.18 $0.18 $0.18 $0.18 TBV/Share Dividends per Share 2Q20 3Q20 4Q20 1Q21 2Q21 ♦ Five-Year Total Shareholder Return 65% 27

Earnings Per Share Trend Note: 2Q21, 1Q21, 4Q20, 3Q20, 3Q19, 2Q19, 1Q19, 4Q18, 1Q17, 2Q17, and 4Q16 include merger related charges. Periods after 4Q19 include the impact of the adoption of CECL on the provision for credit losses. 4Q17 includes the impact of deferred tax asset charges due to tax reform. Five-Year CAGR 15% 28

Five-Year Financial Highlights Noninterest Income Net Income Earnings Per Share (diluted) Return on Average Tangible Common Equity(1) Return on Average Assets Total Assets Net Interest Income $38 $89 $3.83 19.83% 1.64% $5,646 $192 2018 $49 $93 $3.55 16.08% 1.35% $7,334 $239 2019 $55 $74 $2.76 11.23% 0.90% $9,752 $270 2020 $34 $48 $2.07 11.63% 0.97% $5,289 $177 2017In millions, except per share data (1)A Non-GAAP Measure, Refer to Appendix for Reconciliation. Adjusted Earnings Per Share (diluted)(1) $3.78 $4.08 $2.89$2.77 Pre-Provision Net Revenue Return on Average Assets(1) 2.07% 2.04% 1.96%2.07% Noninterest Expense to Average Assets (YTD amounts are annualized) 2.19% 2.40% 2.03%2.31% $27 $68 $2.18 16.71% 1.36% $10,347 $161 2021 YTD $2.30 1.76% 2.10% 29

Modest Asset Sensitivity (200 BPS Rate Shock Increases NII By 8.9%) 57% Floating Rate Loans, with Three-Year Average Duration High-quality, Cash-flowing Securities Portfolio with Six-Year Average Duration 36.0% Non- Interest Bearing DDA to Total Deposits 8.32% Tangible Common Equity/Tangible Assets* Balance Sheet Positioned for Growth *A Non-GAAP Measure, Refer to Appendix for Reconciliation. Excludes PPP loans. 30

Appendix Second Quarter 2021 EFSC Investor Presentation

Financial Highlights - 2Q21 Capital • Tangible Common Equity/Tangible Assets* - 8.32%; Adjusted for PPP* 8.66% • Quarterly dividend of $0.18 per share; increased 6% to $0.19 in third quarter 2021 • Repurchased 251,637 shares at an average price of $47.00 per share • Net Income $38.4 million; Earnings per Share $1.23 • PPNR* $47.4 million • ROAA 1.50%; PPNR ROAA* 1.85% • ROATCE* 18.44% Earnings *A Non-GAAP Measure, Refer to Appendix for Reconciliation. Loans & Deposits • Total Loans $7.2 billion • PPP Loans, net $396.7million • Loan/Deposits 84% • Total Deposits $8.6 billion • Noninterest-bearing Deposits/Total Deposits 36% Asset Quality • Nonperforming Assets/Assets 0.44% • Nonperforming Loans/Loans 0.58% • Allowance Coverage Ratio 1.77%; 2.09% adjusted for guaranteed loans including PPP Acquisitions • Completed acquisition of First Choice Bancorp on July 21, 2021 32

Total $464 Million • Internally reviewed 100% of the portfolio to identify businesses most at risk for impacts from COVID-19. • 30% of the portfolio is secured by working capital assets properly margined and monitored by borrowing base. • 60%+ of the portfolio companies have received PPP funding • 90% of the portfolio is sponsored by a Small Business Investment Company (“SBIC”) licensed by the SBA • Top 10 Sponsors make up half of the Sponsor Finance portfolio ◦ Average 8-year relationship and 10 deals • Independent external review (completed July 2020) of portfolio with 78% penetration confirmed bank’s risk recognition and further stressed portfolio for LGD in various economic recoveries Size Number of Loans Balance Average Balance > $10 Million 11 $144.4 $13.8 $5-10 Million 19 131.0 7.4 $2-5 Million 37 113.1 3.0 < $2 Million 89 75.2 1.2 Total 156 $463.7 $3.0 Sponsor Finance Loans by Size $ In Millions Sponsor Finance Manufacturing 25.4% Wholesale Trade 18.1% Professional Technical 12.3% Admin/ Support/ Waste Mgmt 9.2% Construction 7.7% Retail Trade 6.7% Other 20.6% Sponsor Finance Loans by Industry Midwest 33.6% Southwest 18.5% West 10.7% Northeast 15.6% Southeast 21.6% Sponsor Finance Loans by Location 33

Hospitality Loans Size Number of Loans Balance Average Balance > $10 Million 6 $83.6 $13.9 $5-10 Million 18 126.4 7.0 $2-5 Million 52 184.2 3.5 < $2 Million 441 210.9 0.5 Total 517 $605.1 $1.2 Hospitality Loans by Size $ In Millions Total $605 Million • Weighted average LTV approximately 60-63% • Largest restaurant relationships have received PPP loans • Top x relationships represent $xx million of exposure ◦ These relationships have strong balance sheets, liquidity, personal sponsorships, and low loan to values • Seacoast acquisition added $243 million, including $134 million in guaranteed loans Commercial Real Estate 46.4% C&I 6.2% Construction 10.4% Sponsor Finance 2.5% Tax Credit 1.6% SBA 32.1% Residential 0.8% Hospitality Loans by Product Type Hotels and Campgrounds 61.8% Amusement and Recreation 11.5% Food and Drink Services 26.7% Hospitality Loans by Subsector 34

Use of Non-GAAP Financial Measures The Company’s accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as tangible common equity, ROATCE, PPNR, PPNR ROAA, financial metrics adjusted for PPP impact, and the tangible common equity ratio, in this release that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position, or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. The Company considers its tangible common equity, ROATCE, PPNR, PPNR ROAA, financial metrics adjusted for PPP impact, and the tangible common equity ratio, collectively “core performance measures,” presented in this earnings release and the included tables as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of non-core acquired loans, which were acquired from the FDIC and previously covered by loss share agreements, and the related income and expenses, the impact of certain non-comparable items, and the Company’s operating performance on an ongoing basis. Core performance measures include contractual interest on non-core acquired loans, but exclude incremental accretion on these loans. Core performance measures also exclude expenses directly related to non-core acquired loans. Core performance measures also exclude certain other income and expense items, such as merger related expenses, facilities charges, and the gain or loss on sale of investment securities, the Company believes to be not indicative of or useful to measure the Company’s operating performance on an ongoing basis. The attached tables contain a reconciliation of these core performance measures to the GAAP measures. The Company believes that the tangible common equity ratio provides useful information to investors about the Company’s capital strength even though it is considered to be a non-GAAP financial measure and is not part of the regulatory capital requirements to which the Company is subject. The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company’s performance and capital strength. The Company’s management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company’s operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP. In the attached tables, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measures for the periods indicated. 35

Reconciliation of Non-GAAP Financial Measures For the Quarter ended ($ in thousands, except per share data) Jun 30, 2021 Mar 31, 2021 Dec 31, 2020 Sep 30, 2020 Jun 30, 2020 CORE PERFORMANCE MEASURES Net interest income $ 81.738 $ 79.123 $ 77,446 $ 63,354 $ 65,833 Less: Incremental accretion income — — 856 1,235 719 Core net interest income 81.738 79.123 76,590 62,119 65,114 Total noninterest income 16,204 11,290 18,506 12,629 9,960 Less: Gain (loss) on sale of investment securities — — — 417 — Less: Gain on sale of other real estate owned 549 — — — — Less: Other non-core income — — — — 265 Core noninterest income 15,655 11,290 18,506 12,212 9,695 Total core revenue 97.393 90.413 95,096 74,331 74,809 Total noninterest expense 52.456 52.884 51.05 39,524 37,912 Less: Other expenses related to non-core acquired loans — — 8 25 12 Less: Merger-related expenses 1.949 3.142 2,611 1,563 — Core noninterest expense 50,507 49,742 48,431 37,936 37,900 Core efficiency ratio 51.86 % 55.02 % 50.93 % 51.04 % 50.66 % 36

Reconciliation of Non-GAAP Financial Measures (in thousands) June 30, 2021 December 31, 2020 December 31, 2019 December 31, 2018 December 31, 2017 Total shareholders' equity $ 1,118,301 $ 1,078,975 $ 867,185 $ 603,804 $ 548,573 Less: Goodwill 260,567 260,567 210,344 117,345 117,345 Less: Intangible assets 20,358 23,084 26,076 8,553 11,056 Tangible common equity $ 837,376 $ 795,324 $ 630,765 $ 477,906 $ 420,172 Total assets $ 10,346,993 $ 9,751,571 $ 7,333,791 $ 5,645,662 $ 5,289,225 Less: Goodwill 260,567 260,567 210,344 117,345 117,345 Less: Intangible assets 20,358 23,084 26,076 8,553 11,056 Tangible assets $ 10,066,068 $ 9,467,920 $ 7,097,371 $ 5,519,764 $ 5,160,824 Tangible common equity to tangible assets 8.32 % 8.40 % 8.89 % 8.66 % 8.14 % For the Quarter Ended For the Year Ended (in thousands) June 30, 2021 December 31, 2020 December 31, 2019 December 31, 2018 December 31, 2017 Average shareholder’s equity $ 1,116,969 $ 902,875 $ 795,477 $ 576,960 $ 532,306 Less: Average goodwill 260,567 217,205 193,804 117,345 106,850 Less: Average intangible assets 20,997 23,551 24,957 9,763 10,998 Average tangible common equity $ 835,405 $ 662,119 $ 576,716 $ 449,852 $ 414,458 Tangible Common Equity Ratio Average Shareholders’ Equity and Average Tangible Common Equity 37

Reconciliation of Non-GAAP Financial Measures (in thousands) June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Total shareholders' equity $ 1,118,301 $ 1,092,497 $ 1,078,975 $ 882,267 $ 867,963 Less: Goodwill 260,567 260,567 260,567 210,344 210,344 Less: Intangible assets 20,358 21,670 23,084 21,820 23,196 Tangible common equity $ 837,376 $ 810,260 $ 795,324 $ 650,103 $ 634,423 Total assets $ 10,346,993 $ 10,190,699 $ 9,751,571 $ 8,367,976 $ 8,357,501 Less: Goodwill 260,567 260,567 260,567 210,344 210,344 Less: Intangible assets 20,358 21,670 23,084 21,820 23,196 Tangible assets $ 10,066,068 $ 9,908,462 $ 9,467,920 $ 8,135,812 $ 8,123,961 Tangible common equity to tangible assets 8.32 % 8.18 % 8.40 % 7.99 % 7.81 % Tangible Common Equity Ratio Quarter Ended (in thousands) June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Tangible assets - Non-GAAP (see reconciliation above) $ 10,066,068 $ 9,908,462 $ 9,467,920 $ 8,135,812 $ 8,123,961 PPP loans outstanding, net (396,660) (737,660) (698,645) (819,100) (807,814) Adjusted tangible assets - Non-GAAP $ 9,669,408 $ 9,170,802 $ 8,769,275 $ 7,316,712 $ 7,316,147 Tangible common equity Non-GAAP (see reconciliation above) $ 837,376 $ 810,260 $ 795,324 $ 650,103 $ 634,423 Tangible common equity to tangible assets 8.32 % 8.18 % 8.40 % 7.99 % 7.81 % Tangible common equity to tangible assets - adjusted tangible assets 8.66 % 8.84 % 9.07 % 8.89 % 8.67 % Impact of Paycheck Protection Program 38

Reconciliation of Non-GAAP Financial Measures For the Six Months Ended For the Year Ended (in thousands) June 30, 2021 December 31, 2020 December 31, 2019 December 31, 2018 December 31, 2017 Net interest income $ 160,861 $ 270,001 $ 238,717 $ 191,905 $ 177,304 Noninterest income 27,494 54,503 49,176 38,347 34,394 Noninterest expense (105,340) (167,159) (165,485) (119,031) (115,051) Merger-related expenses 5,091 4,174 17,969 1,271 6,462 PPNR (excluding merger-related expenses) $ 88,106 $ 161,519 $ 140,377 $ 112,492 $ 103,109 Average assets $ 10,111,641 $ 8,253,913 $ 6,894,291 $ 5,436,963 $ 4,980,229 PPNR ROAA 1.76 % 1.96 % 2.04 % 2.07 % 2.07 % Pre-Provision Net Revenue Return on Average Assets 39

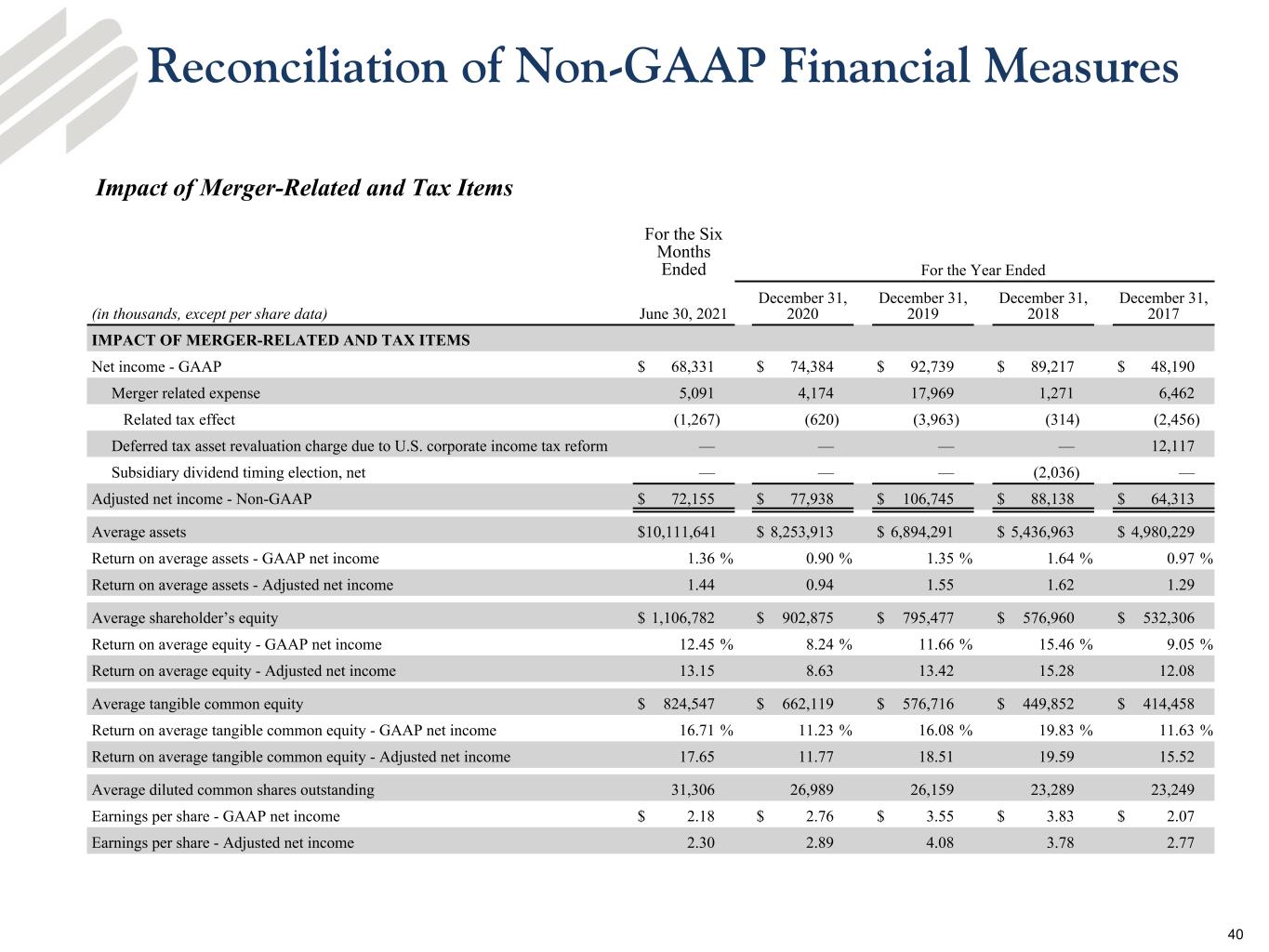

For the Six Months Ended For the Year Ended (in thousands, except per share data) June 30, 2021 December 31, 2020 December 31, 2019 December 31, 2018 December 31, 2017 IMPACT OF MERGER-RELATED AND TAX ITEMS Net income - GAAP $ 68,331 $ 74,384 $ 92,739 $ 89,217 $ 48,190 Merger related expense 5,091 4,174 17,969 1,271 6,462 Related tax effect (1,267) (620) (3,963) (314) (2,456) Deferred tax asset revaluation charge due to U.S. corporate income tax reform — — — — 12,117 Subsidiary dividend timing election, net — — — (2,036) — Adjusted net income - Non-GAAP $ 72,155 $ 77,938 $ 106,745 $ 88,138 $ 64,313 Average assets $ 10,111,641 $ 8,253,913 $ 6,894,291 $ 5,436,963 $ 4,980,229 Return on average assets - GAAP net income 1.36 % 0.90 % 1.35 % 1.64 % 0.97 % Return on average assets - Adjusted net income 1.44 0.94 1.55 1.62 1.29 Average shareholder’s equity $ 1,106,782 $ 902,875 $ 795,477 $ 576,960 $ 532,306 Return on average equity - GAAP net income 12.45 % 8.24 % 11.66 % 15.46 % 9.05 % Return on average equity - Adjusted net income 13.15 8.63 13.42 15.28 12.08 Average tangible common equity $ 824,547 $ 662,119 $ 576,716 $ 449,852 $ 414,458 Return on average tangible common equity - GAAP net income 16.71 % 11.23 % 16.08 % 19.83 % 11.63 % Return on average tangible common equity - Adjusted net income 17.65 11.77 18.51 19.59 15.52 Average diluted common shares outstanding 31,306 26,989 26,159 23,289 23,249 Earnings per share - GAAP net income $ 2.18 $ 2.76 $ 3.55 $ 3.83 $ 2.07 Earnings per share - Adjusted net income 2.30 2.89 4.08 3.78 2.77 Impact of Merger-Related and Tax Items Reconciliation of Non-GAAP Financial Measures 40

Q&A Second Quarter 2021 EFSC Investor Presentation For more information contact Keene Turner, Executive Vice President and CFO (314) 512-7233