Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - DatChat, Inc. | datc-20210729_s1aex23z1.htm |

| EX-10.2 - EXHIBIT 10.2 - DatChat, Inc. | datc-20210729_s1aex10z2.htm |

| EX-3.5 - EXHIBIT 3.5 - DatChat, Inc. | datc-20210729_s1aex3z5.htm |

| EX-3.4 - EXHIBIT 3.4 - DatChat, Inc. | datc-20210729_s1aex3z4.htm |

As filed with the Securities and Exchange Commission on August 3 , 2021.

Registration Statement No. 333-257688

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No.1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DatChat, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 4822 | 47-2502264 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

DatChat, Inc.

65 Church Street

2nd Floor

New Brunswick, NJ 08901

(732) 354-4766

(Address and telephone number of registrant’s principal executive offices)

Darin Myman,

Chief Executive Officer

DatChat, Inc.

Chief Executive Officer

65 Church Street

New Brunswick, NJ 08901

(732) 354-4766

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Richard A. Friedman, Esq. Stephen Cohen, Esq. Facsimile: (212) 653-8701 |

Jolie Kahn, Esq. 12 E. 49th Street, 11th floor New York, NY 10017 Telephone: (516) 217-6379 Facsimile: (866) 705-3071 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for a registration statement pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same registration statement. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same registration statement. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same registration statement. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

| Units consisting of: | ||

| (i) Common stock, no par value per share(3) | $15,243,419.50 | $1,663.06 |

| (ii) Series A Warrants to purchase one common share(4) (5) | ||

| Common stock issuable upon exercise of the Series A Warrants | $15,243,419.50 | $1,663.06 |

| Representative’s warrants(5)(6) | $127.26 | |

| Common stock issuable upon exercise of the representative’s warrants | $1,166,452.97 | |

| Total | $31,652,291.97 | $3,453.37 |

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended, or the Securities Act. Fees were previously paid. |

| (2) | Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issuable to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

| (3) | Includes the offering price of any additional shares of common stock that the underwriters have the right to purchase from the Registrant to cover over-allotments, if any. |

| (4) | Includes the offering price of any additional Series A Warrants the underwriters have the right to purchase from the Registrant to cover over-allotments, if any. |

| (5) | No fee is required pursuant to Rule 457(i) under the Securities Act. |

| (6) | Represents 228,045 warrants to purchase a number of shares of common stock equal to 8% of the number of common stock sold in this offering at an exercise price equal to 110% of the public offering price. |

| * | $1,350.66 previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor is it a solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED AUGUST 3 , 2021 |

2,850,569 Units Consisting of Common Stock and Series A Warrants

This is a firm commitment initial public offering of units each consisting of one share of our common stock, $0.0001 par value per share, and one Series A Warrant to purchase one share of our common stock (and the shares issuable from time to time upon exercise of the Series A Warrants) pursuant to this prospectus based upon an anticipated combined offer price of between $4.15 and $5.15 per unit and an $4.65 assumed initial public offering (which, is the midpoint of the $4.15 to $5.15 range; this assumption is used throughout this preliminary prospectus). Each Series A Warrant will have an assumed exercise price of $5.58 per share, will be exercisable upon issuance and will expire five years from issuance. Prior to this offering, there has been no public market for our units, common shares or warrants. The components of the units will begin to trade separately immediately upon listing on The Nasdaq Capital Market.

We have applied to list our common stock on the Nasdaq Capital Market under the symbol “DATS.” No assurance can be given that our application will be approved. In conjunction therewith, we intend to also apply to have the Series A Warrants listed on The Nasdaq Capital Market under the symbol “DATSW.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

We are an “emerging growth company” under the federal securities laws and may elect to comply with certain reduced public company reporting requirements for future filings.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit | Total | |||||||

| Initial public offering price(1) | $ | $ | ||||||

| Underwriting discounts and commissions(2) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

(1) The assumed public offering price and underwriting discount corresponds to in respect of the units (a) an assumed public offering price per share of common stock of $4.64 and (b) an assumed public offering price per Series A Warrant of $0.01.

(2) Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to EF Hutton, division of Benchmark Investments, LLC , the representatives of the underwriters. See “Underwriting” for a description of compensation payable to the underwriters. We have agreed to issue warrants to the representative of the underwriters. See “Underwriting” on page 70 of this prospectus for a description of the compensation arrangements.

We have granted a 45-day option to the underwriters, exercisable one or more times in whole or in part, to purchase up to an additional 427,585 shares of common stock and/or Series A Warrants at the public offering price per unit and, in each case, less the underwriting discounts and commissions, to cover over-allotments, if any.

The underwriters expect to deliver our units against payment on or about , 2021.

Lead Book Running Manager

EF HUTTON

division of Benchmark Investments, LLC |

Joint Book Running Manager

TIGER BROKERS |

The

date of this prospectus is , 2021.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give to you. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

You should rely only on the information contained in this prospectus. No dealer, salesperson or other person is authorized to give information that is not contained in this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of these securities.

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside the United States: Neither we nor the underwriter has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management’s estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

The following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. It does not contain all the information that may be important to you and your investment decision. You should carefully read this entire prospectus, including the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless context requires otherwise, references to “we,” “us,” “our,” “DatChat,” or “the Company” refer to DatChat, Inc.

Unless otherwise expressly provided herein, all share and per share numbers set forth herein relating to our common stock (assume no exercise of (a) any warrants and/or options, (b) the representatives’ common stock purchase warrants and/or (c) the representatives’ over-allotment option.

Overview

We are a communication software company. We believe that one’s right to privacy should not end the moment they click “send.” Our flagship product, DatChat Messenger & Private Social Network (the “Application”), is a mobile application that gives users the ability to communicate with privacy and protection.

The Application allows users to exercise control over their messages, even after they are sent. Through the Application, users can delete messages that they have sent, on their own device and the recipient’s device as well. There is no set time limit within which they must exercise this choice. A user can elect at any time to delete a message that they previously sent to a recipient’s device.

The Application also enables users to hide secret and encrypted messages behind a cover, which messages can only be unlocked by the recipient and which are automatically destroyed after a fixed number of views or fixed amount of time. Users can decide how long their messages last on the recipient’s device. The Application also includes a screen shot protection system, which makes it virtually impossible for the recipient to screenshot a message or picture before it gets destroyed. In addition, users can delete entire conversations at any time, making it like the conversation never even happened.

The Application integrates with iMessage, making private messages potentially available to hundreds of millions of users.

Our Corporate Information

We were originally incorporated in the State of Nevada on December 4, 2014 under the name “YssUp, Inc.” On March 4, 2015, an amendment to our articles of incorporation was filed with the Nevada Secretary of State changing our name to “DatChat, Inc.”

Our principal executive offices are located at 65 Church Street, New Brunswick, New Jersey 08901, and our telephone number is (732) 354-4766. Our website address is www.datchat.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common shares.

Regulation “A” Offering

On September 23, 2016, we filed an Offering Statement on Form 1-A pursuant to Tier II of Regulation A under the Securities Act of 1933, as amended (the “Securities Act”), with the Securities and Exchange Commission (“SEC”) and subsequent amendments thereto on December 7, 2016, January 12, 2017, January 25, 2017 and January 31, 2017 (the “Offering Statement”). The Offering Statement was qualified by the SEC on February 2, 2017. Pursuant to the Regulation A offering, as of March 31, 2021, we have sold an aggregate of 1,230,701 shares of our common stock, $0.0001 par value per share, at a purchase price of $4.00 per share, resulting in aggregate gross proceeds of $4,922,804, before deducting offerings expenses of $794,790.

Out of the net proceeds, we spent approximately $2.6 million on developer and officer compensation, marketing and general operating expenses. As of the date hereof, we have retained $1.3 million in cash and cash equivalents. Furthermore, the common stock sold through the Regulation A offering is not quoted on any public markets such as the OTC Pink.

-1-

Reverse Stock Split

On July 28, 2021, we filed a certificate of change to our amended and restated certificate of incorporation, with the Secretary of State of the State of Nevada to effectuate a one-for-two (1:2) reverse stock split (the “Reverse Stock Split”) of our common stock without any change to its par value. The Reverse Split became effective on upon such filing. No fractional shares were issued in connection with the Reverse Stock Split as all fractional shares were rounded up to the next whole share. All share and per share amounts of our common stock listed in this prospectus have been adjusted to give effect to the Reverse Stock Split.

Implications of Being an Emerging Growth Company

Unless otherwise expressly provided herein, all share and per share numbers set forth herein relating to our common stock (i) assume no exercise of (a) any warrants and/or options, (b) the representatives’ common stock purchase warrants and/or (c) the representatives’ over-allotment option.

As an emerging growth company, we intend to take advantage of an extended transition period for complying with new or revised accounting standards as permitted by The JOBS Act.

To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including: (i) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (ii) scaled executive compensation disclosures; and (iii) the requirement to provide only two years of audited financial statements, instead of three years.

-2-

THE OFFERING

| Securities Offered by us: | 2,850,569 units (at an assumed offering price of $ 4.65 per share of common stock and Series A Warrant combined), each consisting of one share of common stock and one Series A Warrant. The units will split apart and the shares and Warrants will trade separately immediately upon listing. |

| Common Stock Outstanding before the Offering: | 13,388,887 shares |

| Common Stock to be Outstanding after this Offering: | 16,239,456 shares |

Over-allotment Option:

|

We have granted a 45-day option to the underwriters, exercisable one or more times in whole or in part, to purchase up to an additional 427,585 shares of common stock and/or Series A Warrants at an assumed offering price of $4.65 per unit, in each case, the underwriting discounts and commissions, to cover over-allotments, if any. |

Use of Proceeds:

|

We intend to use the net proceeds from this offering for product development, marketing, working capital and general corporate purposes. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

Proposed Listings on Nasdaq:

|

We have applied to list our common stock on The Nasdaq Capital Market under the symbol “DATS.” No assurance can be given that our application will be approved. In conjunction therewith, we have also applied to have the Series A Warrants listed on The Nasdaq Capital Market under the symbol “DATSW”. Our units will not trade and will be split into common stock and Series A Warrants immediately upon listing. |

Lock-up

|

We, our directors and officers have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for 180 days after the date of this prospectus. In addition, certain of our securityholders holding an aggregate of 138,250 shares have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for 45 days after the date of this prospectus and will thereafter each be permitted to sell, pledge or otherwise dispose of, directly or indirectly, $15,000 shares of common stock per month until 180 days after the date of this prospectus. See “Underwriting” on page 70 |

Risk Factors:

|

Investing in our securities is highly speculative and involves a significant degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| Representative’s Warrant | We will issue to EF Hutton, division of Benchmark Investments, LLC, as Lead Book Running Manager and representative of the underwriters, and US Tiger Securities, Inc., as Joint Book Running Manager, or its designees at the closing of this offering warrants to purchase the number of common shares equal to 8% of the aggregate number of common shares sold in this offering. The representative’s warrant will be exercisable six months from the effective date of the registration statement for this offering and will expire five years after the effective date. The exercise price of the representative’s warrant will equal 110% of the public offering price per share. See “Underwriting.” |

The number of shares of common stock to be outstanding after this offering is based on 13,388,887 shares of common stock issued and outstanding as of July 28, 2021, and excludes the following:

| · | 2,000,000 shares of common stock reserved for future issuance under our 2021 Equity Incentive Plan; |

Except as otherwise indicated herein, all information in this prospectus assumes the following:

| · | no exercise of the outstanding options or warrants described above; |

| · | no exercise by the underwriter of their option to purchase additional units consisting of common shares and Series A Warrants to purchase common shares to cover over-allotments, if any; and |

| · | no exercise of the representatives’ warrant; and |

| · | a 1-for-2 reverse stock split of our common stock that was completed on July 28, 2021, pursuant to which (i) every 2 shares of outstanding common stock was decreased to one share of common stock, (ii) the number of shares of common stock for which each outstanding warrant to purchase common stock is exercisable was proportionally decreased on a 1-for-2 basis, and (iii) the exercise price of each outstanding warrant to purchase common stock was proportionately increased on a 1-for-2 basis, (the “Reverse Stock Split”). |

-3-

SUMMARY OF RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors,” that represent challenges that we face in connection with the successful implementation of our strategy. The occurrence of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may have an adverse effect on our business, cash flows, financial condition and results of operations. Such risks include, but are not limited to:

| ● | We have a limited operating history and have not yet generated any revenues; |

| ● | We have not developed a strong customer base, and we have not generated sustainable revenue since inception. We cannot assure you that we ever will. We will incur significant losses in launching products and we may not realize sufficient subscriptions or profits in order to sustain our business; |

| ● | There is substantial doubt about our ability to continue as a going concern; |

| ● | We are dependent on the services of certain key management personnel, employees, and advisors. If we are unable to retain or motivate such individuals or hire qualified personnel, we may not be able to grow effectively; |

| ● | The Application is based on new and unproven technologies and is subject to the risks of failure inherent in the development of new products and services; |

| ● | If we are unable to maintain a good relationship with the markets where the Application is distributed, our business will suffer; |

| ● | The mobile application industry is subject to rapid technological change and, to compete, we must continually enhance the Application; |

| ● | Defects in the Application and the technology powering it may adversely affect our business; |

| ● | If we fail to retain current users or add new users, or if our users engage less with the Application, our business would be seriously harmed; |

| ● | There is a risk that the public will not perceive the privacy protections that we offer to be necessary or useful and therefore would not be interested in our services; |

| ● | The characteristics of the Application, including but not limited to privacy and encryption, may be exploited to facilitate illegal activity; if any of our users do so or are alleged to have done so, it could adversely affect us and generate negative perception of our products in the marketplace; |

| ● | We expect to derive substantially all of our revenue from a single product; |

| ● | The Application depends on effectively operating with mobile operating systems, hardware, networks, regulations, and standards that we do not control. Changes in our products or to those operating systems, hardware, networks, regulations, or standards may seriously harm our user growth, retention, and engagement; |

| ● | We rely on a single third-party provider, Amazon Web Services, for computing infrastructure, secure network connectivity, and other technology-related services needed to deliver our products. Any disruption in the services provided by such third-party provider could adversely affect our business; |

| ● | Major network failures could have an adverse effect on our business; |

| ● | We may not be able to adequately protect our proprietary technology, and our competitors may be able to offer similar products and services which would harm our competitive position; |

-4-

| ● | Unauthorized breaches or failures in cybersecurity measures adopted by us and/or included in our products and services could have a material adverse effect on our business; |

| ● | We may be subject to stringent and changing laws, regulations, standards, and contractual obligations related to privacy, data protection, and data security. Our actual or perceived failure to comply with such obligations could adversely affect our business; |

| ● | We do not expect to pay dividends in the foreseeable future; |

| ● | If our stock price fluctuates after the offering, you could lose a significant part of your investment; |

| ● | The delisting of our securities by Nasdaq; and |

| ● | Exclusive forum provisions in our amended and restated certificate of incorporation and amended and restated bylaws. |

-5-

SUMMARY FINANCIAL DATA

The following table sets forth our selected financial data as of the dates and for the periods indicated. We have derived the statement of operations data for the years ended December 31, 2020 and 2019 from our audited financial statements included elsewhere in this prospectus. The statements of operations data for the three months ended March 31, 2021 and 2020 and the balance sheet data as of March 31, 2021 have been derived from our unaudited financial statements included elsewhere in this prospectus. The following summary financial data should be read with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes and other information included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected in the future. The data below reflects a one-for-two (1:2) reverse stock split of our common stock that was effectuated on July 28, 2021.

Balance Sheet Data:

| December 31, | March

31, 2021 | |||||||||||

| 2020 | 2019 | (unaudited) | ||||||||||

| Cash | $ | 690,423 | $ | 70,774 | $ | 1,628,100 | ||||||

| Working capital (deficit) | $ | 555,690 | $ | (339,880 | ) | 1,627,260 | ||||||

| Total assets | $ | 744,315 | $ | 229,354 | 1,819,119 | |||||||

| Total liabilities | $ | 161,990 | $ | 569,234 | 170,593 | |||||||

| Accumulated deficit | $ | (16,761,512 | ) | $ | (15,782,042 | ) | (17,758,283 | ) | ||||

| Total stockholders’ equity (deficit) | $ | 582,325 | $ | (339,880 | ) | 1,648,526 | ||||||

Statement of Operations Data:

| Years Ended December 31, | Three Months Ended March 31, (unaudited) | |||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||

| Revenues | $— | $— | $— | $— | ||||||||||||

| Operating costs and expenses | ||||||||||||||||

| Compensation and related expenses | $ | 494,002 | $ | 502,277 | $ | 279,135 | $ | 79,601 | ||||||||

| Professional and consulting | $ | 263,245 | $ | 167,468 | $ | 604,036 | $ | 32,405 | ||||||||

| General and administrative | $ | 327,184 | $ | 310,854 | $ | 113,637 | $ | 81,781 | ||||||||

| Total operating expenses | $ | 1,084,431 | $ | 980,599 | $ | 996,808 | $ | 193,787 | ||||||||

| Net loss | $ | (979,470 | ) | $ | (6,557,336 | ) | $ | (996,771 | ) | $ | (207,962 | ) | ||||

| Net loss per common share—basic and diluted1 | $ | (0.07 | ) | $ | (0.51 | ) | $ | (0.08 | ) | $ | (0.02 | ) | ||||

| Weighted average common shares outstanding—basic and diluted | 13,245,088 | 12,762,576 | 12,963,374 | 13,206,345 | ||||||||||||

-6-

Any investment in our shares of common stock involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common shares. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus. See “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to our Business and Industry

We have a limited operating history and have not yet generated any revenues.

Our limited operating history makes evaluating the business and future prospects difficult, and may increase the risk of your investment. We were incorporated in 2014, and since then there have been a limited amount of downloads of the Application. To date, we have no revenues. Since inception through March 31, 2021, we have recorded accumulated losses totaling $17,758,283. We intend, in the long term, to derive revenues from advertisement sales, technology licensing, and other forms of revenue. The Application is available for download on certain mobile platforms and we are developing compatibility on with other platforms. We also continue to develop and refine functions of the Application.

We have not developed a strong customer base, and we have not generated sustainable revenue since inception. We cannot assure you that we ever will. We will incur significant losses in launching products and we may not realize sufficient subscriptions or profits in order to sustain our business.

We have not yet developed a strong customer base and we have not generated sustainable revenue since inception. We are subject to the substantial risk of failure facing businesses seeking to develop and commercialize new products and technologies. Maintaining and improving our platform will require significant capital. We will also incur substantial accounting, legal and other overhead costs as a public company. If our offerings to customers are unsuccessful, result in insufficient revenue or result in us not being able to sustain revenue, we will be forced to reduce expenses, which may result in an inability to gain new customers.

There is substantial doubt about our ability to continue as a going concern.

We are in the early stages of developing our customer base and have not completed our efforts to establish a stabilized source of revenue sufficient to cover our costs over an extended period of time. For the years ended December 31, 2020 and 2019, we had net losses of $979,470 and $6,557,336, respectively, and cash used in operations of $1,095,577 and $1,038,472. As of March 31, 2021, we had accumulated losses of $17,758,283. We have concluded that these conditions raise substantial doubt about our ability to continue as a going concern. There is uncertainty regarding our ability to implement our business plan and to grow our business to a greater extent than we can with our existing financial resources without additional financing. Our long-term future growth and success is dependent upon our ability to raise additional capital and implement our business plan. There is no assurance that we will be successful in implementing our business plan or that we will be able to generate sufficient cash from operations, sell securities or borrow funds on favorable terms or at all. Our inability to generate significant revenue or obtain additional financing could have a material adverse effect on our ability to fully implement our business plan and grow our business to a greater extent than we can with our existing financial resources.

We may fail to develop new products, or may incur unexpected expenses or delays.

Although the Application is currently available for download, we may need to develop various new technologies, products and product features to remain competitive. Due to the risks inherent in developing new products and technologies — limited financing, loss of key personnel, and other factors — we may fail to develop these technologies and products, or may experience lengthy and costly delays in doing so. Although we are able to license some of our technologies in their current stage of development, we cannot assure that we will be able to develop new products or enhancements to our existing products in order to remain competitive.

-7-

We are dependent on the services of certain key management personnel, employees, and advisors. If we are unable to retain or motivate such individuals or hire qualified personnel, we may not be able to grow effectively.

We depend on the services of a number of key management personnel, employees, and advisors and our future performance will largely depend on the talents and efforts of such individuals. We do not currently maintain “key person” life insurance on any of our employees. The loss of one or more of such key individuals, or failure to find a suitable successor, could hamper our efforts to successfully operate our business and achieve our business objectives. Our future success will also depend on our ability to identify, hire, develop, motivate and retain highly skilled personnel. Competition in our industry for qualified employees is intense, and our compensation arrangements may not always be successful in attracting new employees and/or retaining and motivating our existing employees. Future acquisitions by us may also cause uncertainty among our current employees and employees of the acquired entity, which could lead to the departure of key individuals. Such departures could have an adverse impact on the anticipated benefits of an acquisition.

We may face intense competition and expect competition to increase in the future, which could prohibit us from developing a customer base and generating revenue.

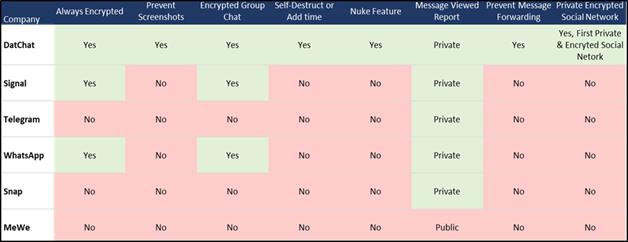

We are focused on the mobile application industry, specifically the mobile messaging market, which is already saturated with established companies. Many of these companies, including Apple Inc., Alphabet Inc., Facebook, Inc., and Snap Inc., already have an established market in our industry. Most of these companies have significantly greater financial and other resources than us and have been developing their products and services longer than we have been developing ours.

The Application is based on new and unproven technologies and is subject to the risks of failure inherent in the development of new products and services.

Because the Application is based on certain new technologies, it is subject to risks of failure that are particular to new technologies, including the possibility that:

| ● | the Application may not gain market acceptance; |

| ● | proprietary rights of third parties may preclude us from marketing a new product or service; |

| ● | the Application may not receive the exposure required to obtain new users; or |

| ● | third parties may market superior products or services. |

If we are unable to maintain a good relationship with the markets where the Application is distributed, our business will suffer.

The Apple App Store is the primary distribution, marketing, promotion and payment platform for the Application. Any deterioration in our relationship with Apple or any application market place we utilize in the future would harm our business and adversely affect the value of our common stock.

-8-

We are subject to Apple’s standard terms and conditions for application developers, which govern the promotion, distribution and operation of mobile applications on its platform. Our business would be harmed if:

| ● | Apple discontinues or limits access to its platform by us and other application developers; |

| ● | Apple modifies its terms of service or other policies, including fees charged to, or other restrictions on, us or other application developers, or Apple changes how the personal information of its users is made available to application developers on their respective platforms or shared by users; |

| ● | Apple establishes more favorable relationships with one or more of our competitors; |

| ● | Apple limits our access to its application marketplace because our application provides mobile messaging services similar to Apple; or |

| ● | Apple makes changes in its operating system or development platform that are incompatible with our technology. |

We expect to benefit from Apple’s strong brand recognition and large user base. If Apple loses its market position or otherwise falls out of favor with mobile users, we would need to identify alternative channels for marketing, promoting and distributing our application, which would consume substantial resources and may not be effective. In addition, Apple has broad discretion to change their terms of service and other policies with respect to us and other developers, and those changes may be unfavorable to us. Any such changes in the future could significantly alter our users experience or how interact within our application, which may harm our business.

In the event that Apple’s standard terms and conditions become prohibitively costly or unduly burdensome, we plan to host our own servers in a co-location facility and create a web-based, desktop version of the Application that does not require users to install the Application from the App store.

The mobile application industry is subject to rapid technological change and, to compete, we must continually enhance the Application.

We must continue to enhance and improve the performance, functionality and reliability of the Application. The mobile application industry is characterized by rapid technological change, changes in user requirements and preferences, frequent new product and services introductions embodying new technologies and the emergence of new industry standards and practices that could render our product and services obsolete. We have discovered that some of our customers’ desire additional performance and functionality that the Application, and the underlying technology, does not currently support. Our success will depend, in part, on our ability to both internally develop leading technologies to enhance the Application, develop new mobile applications and services that address the increasingly sophisticated and varied needs of our customers, and respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis. The development of our technology and other proprietary technology involves significant technical and business risks. We may fail to use new technologies effectively or to adapt our proprietary technology and systems to customer requirements or emerging industry standards. If we are unable to adapt to changing market conditions, customer requirements or emerging industry standards, we may not be able to create revenue and expand our business.

Defects in the Application and the technology powering it may adversely affect our business.

Tools, code, subroutines and processes contained within the Application may contain defects not yet discovered or contained in updates and new versions. Our introduction of new mobile applications or updates and new versions with defects or quality problems may result in adverse publicity, reduced downloads and use, product redevelopment costs, loss of or delay in market acceptance of our products or claims by customers or others against us. Such problems or claims may have a material and adverse effect on our business, prospects, financial condition and results of operations.

-9-

If we fail to retain current users or add new users, or if our users engage less with the Application, our business would be seriously harmed.

Adding, maintaining, and engaging daily monthly users will be essential to attaining our growth targets and sustaining operations. If current and potential users do not perceive our products to be effective and useful, we may not be able to attract new users, retain existing users, or maintain or increase the frequency and duration of their engagement. In addition, our products typically require high bandwidth data capabilities, high-end mobile device penetration and high bandwidth capacity cellular networks with large coverage areas. We therefore do not expect to experience rapid user growth or engagement in countries with low smartphone penetration even if such countries have well-established and high bandwidth capacity cellular networks. We may also not experience rapid user growth or engagement in regions where, even though smartphone penetration is high, due to the lack of sufficient cellular based data networks, consumers rely heavily on Wi-Fi and may not access our products regularly.

There are many factors that could negatively affect user retention, growth, and engagement, including if:

| ● | users increasingly engage with competing products instead of ours; |

| ● | our competitors may mimic our products and therefore harm our user engagement and growth; |

| ● | we fail to introduce new and exciting products and services or those we introduce are poorly received; |

| ● | our products fail to operate effectively on the iOS and Android mobile operating systems; |

| ● | we are unable to continue to develop products that work with a variety of mobile operating systems, networks, and smartphones; |

| ● | we are unable to combat hostile or inappropriate usage on our products; |

| ● | there are changes in user sentiment about the quality or usefulness of the Application; |

| ● | there are concerns about the privacy implications, safety, or security of our products; |

| ● | there are changes in our products that are mandated by legislation, regulatory authorities, or litigation, including settlements or consent decrees that adversely affect the user experience; |

| ● | technical or other problems frustrate the user experience, particularly if those problems prevent us from delivering our products in a fast and reliable manner; |

| ● | we fail to provide adequate service to users; |

| ● | we are the subject of adverse media reports or other negative publicity; and |

| ● | we do not maintain our brand image or our reputation is damaged. |

Any decrease to user retention, growth, or engagement could render our products less attractive to users, advertisers, or partners, and would seriously harm our business.

There is a risk that the public will not perceive the privacy protections that we offer to be necessary or useful and therefore would not be interested in our services.

No matter how effective our products might be in affording users control over their privacy, the general public may not perceive our products to be necessary or useful. In general, although people are more aware than in the past of the amount of personal data that is tracked on a daily basis with the advent of social media and targeted advertising, mere awareness does not necessarily translate into a desire to take affirmative action with respect to one’s privacy. For us, this could mean that the average person might not feel the need to have the ability to delete messages that they have sent. While we believe that the general public will recognize the value of our products and feel empowered to take control of their privacy, it is possible that a great number of people have come to believe that their personal information cannot be protected and that any attempt to do so would be ineffective. As such, regardless of how effective our products might be, there is a risk that the general public might deem our products to be unnecessary and will not be drawn to download and use the Application.

-10-

Users may not want to change the way that they send messages and therefore would not be interested in our products.

Our success is dependent in part on users altering their behavior and changing the way that they send text messages. Although the Application is fully integrated with iMessage, the Application requires the user to send the message through a separate text bar, which is located below the ordinary iMessage bar. Even if users have downloaded the Application, it is possible that users will bypass this option when they go to send a text message. In addition, our user experience may not be received positively, as some users might find it inconvenient to have two text bars appearing on the screen at the same time when they go to send a text message. The iMessage integration figure does not currently allow a user to remove the iMessage bar so that only the Application’s bar appears and it is doubtful that Apple would ever allow such a feature. Moreover, because both text bars are displayed on the screen at the same time, users may inadvertently send a private message through iMessage that they intended to send through the Application, thereby defeating the data protection and privacy benefits that the Application offers. If users do not adapt to seeing and typing messages with two texts bars displayed, our user retention may suffer.

The characteristics of the Application, including but not limited to privacy and encryption, may be exploited to facilitate illegal activity; if any of our users do so or are alleged to have done so, it could adversely affect us and generate negative perception of our products in the marketplace.

For all of the same reasons that our products are attractive to the general public, the privacy, data protection and encryption features could appeal to persons and groups engaged in illegal activities due to the ability of the Application to delete messages from a recipient’s phone. In this context, the Application may be used to facilitate both illegal activity and the destruction of evidence, which could potentially draw scrutiny from regulators. In addition, the Application could develop a stigma that it is associated with illegal activity and deter certain people from communicating through the Application.

Negative publicity could adversely affect our reputation, our business, and our operating results.

Negative publicity about our company, including about the quality and reliability of our products, content shared by users through the Application, changes to our products, policies and services, our privacy and security practices, litigation, regulatory activity, the actions of users on the Application, or user experience with our products, even if inaccurate, could adversely affect our reputation and the confidence in and the use of our product. Such negative publicity could also have an adverse effect on the size, engagement, and loyalty of our user base and, in turn, adversely affect our business, results of operations and financial condition.

We expect to derive substantially all of our revenue from a single product.

We expect to derive substantially all of our revenue from the Application. As such, the continued growth in market demand for and market acceptance of the Application is critical to our continued success. Demand for the Application is affected by a number of factors, many of which are beyond our control, such as continued market acceptance; the timing of development and release of competing new products; consumer preferences; the development and acceptance of new features, integrations, and capabilities; price or product changes by us or our competitors; technological changes and developments within the markets we serve; growth, contraction, and rapid evolution of our market; and general economic conditions and trends. If we are unable to continue to meet demands of our users or trends in preferences or to achieve more widespread market acceptance of the Application, our business, results of operations, and financial condition could be harmed. Changes in preferences of users may have a disproportionately greater impact on us than if we offered multiple products. In addition, competitors may develop or acquire their own tools or software and people may continue to rely on traditional tools and software, such as text message and email, which would reduce or eliminate the demand for the Application. If demand declines for any of these or other reasons, our business could be adversely affected.

-11-

The Application depends on effectively operating with mobile operating systems, hardware, networks, regulations, and standards that we do not control. Changes in our products or to those operating systems, hardware, networks, regulations, or standards may seriously harm our user growth, retention, and engagement.

Because the Application is used primarily on mobile devices, the Application must remain interoperable with popular mobile operating systems, Android and iOS. The owners of such operating systems, Google and Apple, respectively, each provide consumers with products that compete with ours. We have no control over these operating systems or hardware, and any changes to these systems or hardware that degrade our products’ functionality, or give preferential treatment to competitive products, could seriously harm DatChat usage on mobile devices. Our competitors that control the operating systems and related hardware the Application runs on could make interoperability of our products with those mobile operating systems more difficult or display their competitive offerings more prominently than ours. When introducing new products, it takes time to optimize such products to function with these operating systems and hardware, impacting the popularity of such products, and we expect this trend to continue. Moreover, our products require high-bandwidth data capabilities. If the costs of data usage increase, our user growth, retention, and engagement may be seriously harmed.

We may not successfully cultivate relationships with key industry participants or develop products that operate effectively with these technologies, systems, networks, regulations, or standards. If it becomes more difficult for our users to access and use the Application on their mobile devices, if our users choose not to access or use the Application on their mobile devices, or if our users choose to use mobile products that do not offer access to the Application, our user growth, retention, and engagement could be seriously harmed.

Moreover, the adoption of any laws or regulations that adversely affect the popularity or growth in use of the internet or mobile applications, including laws or regulations that undermine open and neutrally administered internet access, could decrease user demand for the Application and increase our cost of doing business. For example, in December 2017, the Federal Communications Commission adopted an order reversing net neutrality protections in the United States, including the repeal of specific rules against blocking, throttling or “paid prioritization” of content or services by internet service providers. To the extent internet service providers engage in such blocking, throttling or “paid prioritization” of content or similar actions as a result of this order and the adoption of similar laws or regulations, our business, financial condition and results of operations could be materially adversely affected.

Risks Related to Information Technology Systems, Intellectual Property and Privacy Laws

We rely on a single third-party provider, Amazon Web Services (“AWS”), for computing infrastructure, secure network connectivity, and other technology-related services needed to deliver our products. Any disruption in the services provided by such third-party provider could adversely affect our business.

Our products are hosted from, and use computing infrastructure, secure network connectivity, and other technology-related services provided by AWS. We do not control the operations of this third-party provider or own the equipment used to provide such services. Because we cannot easily switch our AWS-serviced operations to another cloud provider, any disruption of or interference with our use of AWS, for example, due to natural disasters, cyber-attacks, terrorist attacks, power losses, telecommunications failures, or similar events, would impact our operations and may adversely affect our business, financial condition, operating results and cash flows. In addition, AWS has no obligation to renew its agreement with us on commercially reasonable terms or at all. If we are unable to renew our agreement on commercially reasonable terms or develop our blockchain capabilities, we may be required to transition to a new provider, and we may incur significant costs and possible service interruption in connection with doing so.

-12-

In addition, Amazon may take actions beyond our control that could seriously harm our business, including:

| ● | discontinuing or limiting our access to its cloud platform |

| ● | increasing pricing terms; |

| ● | terminating or seeking to terminate our contractual relationship altogether; |

| ● | establishing more favorable relationships or pricing terms with one or more of our competitors; and |

| ● | modifying or interpreting its terms of service or other policies in a manner that impacts our ability to run our business and operations. |

Amazon has broad discretion to change and interpret its terms of service and other policies with respect to us, and those actions may be unfavorable to us. They may also alter how we are able to process data on their cloud platform. If Amazon makes changes or interpretations that are unfavorable to us, our business could be seriously harmed.

Major network failures could have an adverse effect on our business.

Our technology infrastructure is critical to the performance of the Application and customer satisfaction. The Application runs on a complex distributed system, or what is commonly known as cloud computing. Some elements of this system are operated by third-parties that we do not control and which would require significant time to replace. We expect this dependence on third parties to continue. Major equipment failures, natural disasters, including severe weather, terrorist acts, acts of war, cyber-attacks or other breaches of network or information technology security that affect third-party networks, communications switches, routers, microwave links, cell sites or other third-party equipment on which we rely, could cause major network failures and/or unusually high network traffic demands that could have a material adverse effect on our operations or our ability to provide service to our customers. These events could disrupt our operations, require significant resources to resolve, result in a loss of customers or impair our ability to attract new customers, which in turn could have a material adverse effect on our business, prospects, results of operations and financial condition. If we experience significant service interruptions, which could require significant resources to resolve, it could result in a loss of customers or impair our ability to attract new customers, which in turn could have a material adverse effect on our business, prospects, results of operations and financial condition. In addition, with the growth of wireless data services, enterprise data interfaces and Internet-based or Internet Protocol enabled applications, wireless networks and devices are exposed to a greater degree to third-party data or applications over which we have less direct control. As a result, the network infrastructure and information systems on which we rely, as well as our customers’ wireless devices, may be subject to a wider array of potential security risks, including viruses and other types of computer-based attacks, which could cause lapses in our service or adversely affect the ability of our customers to access our service. Such lapses could have a material adverse effect on our business, prospects, results of operations and financial condition.

If third parties claim that we infringe their intellectual property, it may result in costly litigation.

We cannot assure you that third parties will not claim our current or future products or services infringe their intellectual property rights. Any such claims, with or without merit, could cause costly litigation that could consume significant management time. As the number of product and services offerings in the mobile application market increases and functionalities increasingly overlap, companies such as ours may become increasingly subject to infringement claims. Such claims also might require us to enter into royalty or license agreements. If required, we may not be able to obtain such royalty or license agreements, or obtain them on terms acceptable to us.

-13-

We may not be able to adequately protect our proprietary technology, and our competitors may be able to offer similar products and services which would harm our competitive position.

Our success, in part, depends upon our proprietary technology. We have various forms of intellectual property including patent, copyright, trademark and trade secret laws, confidentiality procedures and contractual provisions to establish and protect our proprietary rights. Despite these precautions, third parties could copy or otherwise obtain and use our technology without authorization, or develop similar technology independently. We also pursue the registration of our domain names, trademarks, and service marks in the United States. We have also filed patent applications. However, we cannot provide any assurance that patent applications that we file will ultimately result in an issued patent or, if issued, that they will provide sufficient protections for our technology against competitors. We cannot assure you that the protection of our proprietary rights will be adequate or that our competitors will not independently develop similar technology, duplicate our products and services or design around any intellectual property rights we hold.

We could be harmed by improper disclosure or loss of sensitive or confidential data.

In connection with the operation of our business, we plan to process and transmit data. Unauthorized disclosure or loss of sensitive or confidential data may occur through a variety of methods. These include, but are not limited to, systems failure, employee negligence, fraud or misappropriation, or unauthorized access to or through our information systems, whether by our employees or third parties, including a cyberattack by computer programmers, hackers, members of organized crime and/or state-sponsored organizations, who may develop and deploy viruses, worms or other malicious software programs.

Such disclosure, loss or breach could harm our reputation and subject us to government sanctions and liability under laws and regulations that protect sensitive or personal data and confidential information, resulting in increased costs or loss of revenues. It is possible that security controls over sensitive or confidential data and other practices we and our third-party vendors follow may not prevent the improper access to, disclosure of, or loss of such information. The potential risk of security breaches and cyberattacks may increase as we introduce new services and offerings, such as mobile technology. Further, data privacy is subject to frequently changing rules and regulations, which sometimes conflict among the various jurisdictions in which we provide services. Any failure or perceived failure to successfully manage the collection, use, disclosure, or security of personal information or other privacy related matters, or any failure to comply with changing regulatory requirements in this area, could result in legal liability or impairment to our reputation in the marketplace.

Unauthorized breaches or failures in cybersecurity measures adopted by us and/or included in our products and services could have a material adverse effect on our business.

Information security risks have generally increased in recent years, in part because of the proliferation of new technologies and the use of the Internet, and the increased sophistication and activity of organized crime, hackers, terrorists, activists, cybercriminals and other external parties, some of which may be linked to terrorist organizations or hostile foreign governments. Cybersecurity attacks are becoming more sophisticated and include malicious attempts to gain unauthorized access to data and other electronic security breaches that could lead to disruptions in critical systems, unauthorized release of confidential or otherwise protected information and corruption of data, substantially damaging our reputation. Our security systems are designed to maintain the security of our users’ confidential information, as well as our own proprietary information. Accidental or willful security breaches or other unauthorized access by third parties or our employees, our information systems or the systems of our third-party providers, or the existence of computer viruses or malware in our or their data or software could expose us to risks of information loss and misappropriation of proprietary and confidential information, including information relating to our products or customers and the personal information of our employees.

-14-

In addition, we could become subject to unauthorized network intrusions and malware on our own IT networks. Any theft or misuse of confidential, personal or proprietary information as a result of such activities or failure to prevent security breaches could result in, among other things, unfavorable publicity, damage to our reputation, loss of our trade secrets and other competitive information, difficulty in marketing our products, allegations by our customers that we have not performed our contractual obligations, litigation by affected parties and possible financial obligations for liabilities and damages related to the theft or misuse of such information, as well as fines and other sanctions resulting from any related breaches of data privacy regulations, any of which could have a material adverse effect on our reputation, business, profitability and financial condition. Furthermore, the techniques used to obtain unauthorized access or to sabotage systems change frequently and are often not recognized until launched against a target, and we may be unable to anticipate these techniques or to implement adequate preventative measures.

We may be subject to stringent and changing laws, regulations, standards, and contractual obligations related to privacy, data protection, and data security. Our actual or perceived failure to comply with such obligations could adversely affect our business.

We receive, collect, store, and process certain personally identifiable information about individuals and other data relating to users of the Application. We have legal and contractual obligations regarding the protection of confidentiality and appropriate use of certain data, including personally identifiable and other potentially sensitive information about individuals. We may be subject to numerous federal, state, local, and international laws, directives, and regulations regarding privacy, data protection, and data security and the collection, storing, sharing, use, processing, transfer, disclosure, disposal and protection of information about individuals and other data, the scope of which are changing, subject to differing interpretations, and may be inconsistent among jurisdictions or conflict with other legal and regulatory requirements. We strive to comply with our applicable data privacy and security policies, regulations, contractual obligations, and other legal obligations relating to privacy, data protection, and data security. However, the regulatory framework for privacy, data protection and data security worldwide is, and is likely to remain for the foreseeable future, uncertain and complex, and it is possible that these or other actual or alleged obligations may be interpreted and applied in a manner that we do not anticipate or that is inconsistent from one jurisdiction to another and may conflict with other legal obligations or our practices. Further, any significant change to applicable laws, regulations or industry practices regarding the collection, use, retention, security, processing, transfer or disclosure of data, or their interpretation, or any changes regarding the manner in which the consent of users or other data subjects for the collection, use, retention, security, processing, transfer or disclosure of such data must be obtained, could increase our costs and require us to modify our services and features, possibly in a material manner, which we may be unable to complete, and may limit our ability to receive, collect, store, process, transfer, and otherwise use user data or develop new services and features.

If we are found in violation of any applicable laws or regulations relating to privacy, data protection, or security, our business may be materially and adversely affected and we would likely have to change our business practices and potentially the services and features, integrations or other capabilities of the Application. In addition, these laws and regulations could impose significant costs on us and could constrain our ability to use and process data in a commercially desirable manner. In addition, if a breach of data security were to occur or be alleged to have occurred, if any violation of laws and regulations relating to privacy, data protection or data security were to be alleged, or if we were to discover any actual or alleged defect in our safeguards or practices relating to privacy, data protection, or data security, the Application may be perceived as less desirable and our business, financial condition, results of operations and growth prospects could be materially and adversely affected.

-15-

We also expect that there will continue to be new laws, regulations, and industry standards concerning privacy, data protection, and information security proposed and enacted in various jurisdictions. For example, the California Consumer Privacy Act (“CCPA”), which came into force in 2020, provides new data privacy rights for California consumers and new operational requirements for covered companies. Specifically, the CCPA mandates that covered companies provide new disclosures to California consumers and afford such consumers new data privacy rights that include, among other things, the right to request a copy from a covered company of the personal information collected about them, the right to request deletion of such personal information, and the right to request to opt-out of certain sales of such personal information. The California Attorney General can enforce the CCPA, including seeking an injunction and civil penalties for violations. The CCPA also provides a private right of action for certain data breaches that is expected to increase data breach litigation. Additionally, a new privacy law, the California Privacy Rights Act (“CPRA”), was approved by California voters in the November 3, 2020 election. The CPRA generally takes effect on January 1, 2023 and significantly modifies the CCPA, including by expanding consumers’ rights with respect to certain personal information and creating a new state agency to oversee implementation and enforcement efforts, potentially resulting in further uncertainty and requiring us to incur additional costs and expenses in an effort to comply. Some observers have noted the CCPA and CPRA could mark the beginning of a trend toward more stringent privacy legislation in the United States, which could also increase our potential liability and adversely affect our business. For example, the CCPA has encouraged “copycat” or other similar laws to be considered and proposed in other states across the country, such as in Virginia, New Hampshire, Illinois and Nebraska. This legislation may add additional complexity, variation in requirements, restrictions and potential legal risk, require additional investment in resources to compliance programs, could impact strategies and availability of previously useful data and could result in increased compliance costs and/or changes in business practices and policies.

Various U.S. federal privacy laws are potentially relevant to our business, including the Federal Trade Commission Act, Controlling the Assault of Non-Solicited Pornography and Marketing Act, the Family Educational Rights and Privacy Act, the Children’s Online Privacy Protection Act, and the Telephone Consumer Protection Act. Any actual or perceived failure to comply with these laws could result in a costly investigation or litigation resulting in potentially significant liability, injunctions and other consequences, loss of trust by our users, and a material and adverse impact on our reputation and business.

In addition, the data protection landscape in the EU is continually evolving, resulting in possible significant operational costs for internal compliance and risks to our business. The EU adopted the General Data Protection Regulation (“GDPR”), which became effective in May 2018, and contains numerous requirements and changes from previously existing EU laws, including more robust obligations on data processors and heavier documentation requirements for data protection compliance programs by companies.

Among other requirements, the GDPR regulates the transfer of personal data subject to the GDPR to third countries that have not been found to provide adequate protection to such personal data, including the United States. Recent legal developments in Europe have created complexity and uncertainty regarding such transfers. For instance, on July 16, 2020, the Court of Justice of the European Union (the “CJEU”) invalidated the EU-U.S. Privacy Shield Framework (the “Privacy Shield”) under which personal data could be transferred from the European Economic Area to U.S. entities who had self-certified under the Privacy Shield scheme. While the CJEU upheld the adequacy of the standard contractual clauses (a standard form of contract approved by the European Commission as an adequate personal data transfer mechanism and potential alternative to the Privacy Shield), it made clear that reliance on such clauses alone may not necessarily be sufficient in all circumstances. Use of the standard contractual clauses must now be assessed on a case-by-case basis taking into account the legal regime applicable in the destination country, including, in particular, applicable surveillance laws and rights of individuals, and additional measures and/or contractual provisions may need to be put in place; however, the nature of these additional measures is currently uncertain. The CJEU also states that if a competent supervisory authority believes that the standard contractual clauses cannot be complied with in the destination country and that the required level of protection cannot be secured by other means, such supervisory authority is under an obligation to suspend or prohibit that transfer.

Additionally, the GDPR greatly increased the European Commission’s jurisdictional reach of its laws and added a broad array of requirements for handling personal data. EU member states are tasked under the GDPR to enact, and have enacted, certain implementing legislation that adds to and/or further interprets the GDPR requirements and potentially extends our obligations and potential liability for failing to meet such obligations. The GDPR, together with national legislation, regulations and guidelines of the EU member states a governing the processing of personal data, impose strict obligations and restrictions on the ability to collect, use, retain, protect, disclose, transfer and otherwise process personal data. In particular, the GDPR includes obligations and restrictions concerning the consent and rights of individuals to whom the personal data relates, security breach notifications and the security and confidentiality of personal data.

-16-

Failure to comply with the GDPR could result in penalties for noncompliance (including possible fines of up to the greater of €20 million and 4% of our global annual turnover for the preceding financial year for the most serious violations, as well as the right to compensation for financial or non-financial damages claimed by individuals under Article 82 of the GDPR).

In addition to the GDPR, the European Commission has another draft regulation in the approval process that focuses on a person’s right to conduct a private life. The proposed legislation, known as the Regulation of Privacy and Electronic Communications (“ePrivacy Regulation”), would replace the current ePrivacy Directive. While the text of the ePrivacy Regulation is still under development, a recent European court decision and regulators’ recent guidance are driving increased attention to cookies and tracking technologies. If regulators start to enforce the strict approach in recent guidance, this could lead to substantial costs, require significant systems changes, limit the effectiveness of our marketing activities, divert the attention of our technology personnel, adversely affect our margins, increase costs and subject us to additional liabilities. Regulation of cookies and similar technologies may lead to broader restrictions on our marketing and personalization activities and may negatively impact our efforts to understand users.

Further, in March 2017, the United Kingdom formally notified the European Council of its intention to leave the EU pursuant to Article 50 of the Treaty on European Union (“Brexit”). The United Kingdom ceased to be an EU Member State on January 31, 2020, but enacted a Data Protection Act substantially implementing the GDPR (“U.K. GDPR”), effective in May 2018, which was further amended to align more substantially with the GDPR following Brexit. It is unclear how U.K. data protection laws or regulations will develop in the medium to longer term and how data transfers to and from the United Kingdom will be regulated. Some countries also are considering or have enacted legislation requiring local storage and processing of data that could increase the cost and complexity of delivering our services. Beginning in 2021 when the transitional period following Brexit expired, we are required to comply with both the GDPR and the U.K. GDPR, with each regime having the ability to fine up to the greater of €20 million (in the case of the GDPR) or £17 million (in the case of the U.K. GDPR) and 4% of total annual revenue. The relationship between the United Kingdom and the EU in relation to certain aspects of data protection law remains unclear, including, for example, how data transfers between EU member states and the United Kingdom will be treated and the role of the United Kingdom’s Information Commissioner’s Office following the end of the transitional period. These changes could lead to additional costs and increase our overall risk exposure.