Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BLUE RIDGE BANKSHARES, INC. | d147134d8k.htm |

Blue Ridge Bankshares, Inc. Investor Presentation August 2021 Exhibit 99.1

Disclosure 1, 94, 92 25, 27, 120 2, 152, 52 1, 2, 94 (2) Forward-Looking Statements This presentation of Blue Ridge Bankshares, Inc. (the “Company,” “Blue Ridge” or “BRBS”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. These statements may include statements about the benefits of the Company’s pending merger with FVCB Bankcorp, Inc. (“FVCB”) or its completed merger with Bay Banks of Virginia, Inc. (“Bay Banks”), including future financial and operating results, cost savings, enhancements to revenue and accretion to reported earnings that may be realized from such mergers. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on its expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. The following factors, among others, could cause the Company’s financial performance to differ materially from that expressed in such forward-looking statements: (i) the strength of the United States economy in general and the strength of the local economies in which the Company conducts operations; (ii) geopolitical conditions, including acts or threats of terrorism, or actions taken by the United States or other governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and economic conditions in the United States and abroad; (iii) the effects of the COVID-19 pandemic, including the adverse impact on the Company’s business and operations and on the Company’s customers which may result, among other things, in increased delinquencies, defaults, foreclosures and losses on loans; (iv) the occurrence of significant natural disasters, including severe weather conditions, floods, health related issues, and other catastrophic events; (v) the Company’s management of risks inherent in its real estate loan portfolio, and the risk of a prolonged downturn in the real estate market, which could impair the value of the Company’s collateral and its ability to sell collateral upon any foreclosure; (vi) changes in consumer spending and savings habits; (vii) technological and social media changes; (viii) the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rate, market and monetary fluctuations; (ix) changing bank regulatory conditions, policies or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks generally, or the Company’s subsidiary bank in particular, more restrictive regulatory capital requirements, increased costs, including deposit insurance premiums, regulation or prohibition of certain income producing activities or changes in the secondary market for loans and other products; (x) the impact of changes in financial services policies, laws and regulations, including laws, regulations and policies concerning taxes, banking, securities and insurance, and the application thereof by regulatory bodies; (xi) the impact of changes in laws, regulations and policies affecting the real estate industry; (xii) the effect of changes in accounting policies and practices, as may be adopted from time to time by bank regulatory agencies, the Securities and Exchange Commission (the “SEC”), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other accounting standards setting bodies; (xiii) the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; (xiv) the willingness of users to substitute competitors’ products and services for the Company’s products and services; (xv) expenses related to the FVCB merger, unexpected delays related to the FVCB merger, or the inability to obtain regulatory and shareholder approvals or satisfy other closing conditions required to complete the FVCB merger within the expected time frame, or at all; (xvi) the businesses of the Company and FVCB may not be integrated successfully or such integration may be more difficult, time-consuming, or costly than expected; (xvii) customer and employee relationships and business operations may be disrupted by the Bay Banks merger or the FVCB merger; (xviii) the effects of the Bay Banks merger, the FVCB merger and other acquisitions the Company may make, including, without limitation, the failure to achieve the expected revenue growth and/or expense savings from such transactions; (xix) changes in the level of the Company’s nonperforming assets and charge-offs; (xx) the Company’s involvement, from time to time, in legal proceedings and examination and remedial actions by regulators; (xxi) potential exposure to fraud, negligence, computer theft and cyber-crime; (xxii) the Company’s ability to pay dividends; (xxiii) the Company’s involvement as a participating lender in the Paycheck Protection Program (“PPP”) as administered through the Small Business Administration; and (xxiv) other risks and factors identified in the “Risk Factors” sections and elsewhere in documents the Company files from time to time with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements or to update the reasons why actual results could differ from those contained in such statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking statements discussed might not occur, and you should not put undue reliance on any forward-looking statements. Non-GAAP Financial Measures This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Company’s management uses these non-GAAP financial measures in its analysis of the Company’s performance. These measures typically adjust GAAP performance measures to exclude the effects of the amortization of intangibles and include the tax benefit associated with revenue items that are tax-exempt, as well as adjust income available to common shareholders for certain significant activities or transactions that are infrequent in nature. Management believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

Important Information about the Merger and Where to Find It Blue Ridge intends to file a registration statement on Form S-4 with the SEC to register the shares of Blue Ridge’s common stock that will be issued to FVCB shareholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of Blue Ridge and FVCB that also constitutes a prospectus of Blue Ridge. The definitive joint proxy statement/prospectus will be sent to the shareholders of Blue Ridge and FVCB seeking their approval of the proposed merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 WHEN THEY BECOME AVAILABLE (AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING BLUE RIDGE, FVCB, THE PROPOSED MERGER AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents, once they are filed, and other documents filed with the SEC by Blue Ridge or FVCB through the website maintained by the SEC at http://www.sec.gov. Investors and security holders will also be able to obtain these documents, once they are filed, free of charge, by requesting them in writing from Brian K. Plum, Blue Ridge Bankshares, Inc., 17 West Main Street, Luray, Virginia 22835, or by telephone at (540) 743-6521, or from David W. Pijor, FVCBankcorp, Inc., 11325 Random Hills Road, Fairfax, Virginia 22030, or by telephone at (703) 436-3800. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or proxy in favor of the merger, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Blue Ridge, FVCB, and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from the shareholders of each of Blue Ridge and FVCB in connection with the proposed merger under the rules of the SEC. Certain information regarding the interests of the directors and executive officers of Blue Ridge and FVCB and other persons who may be deemed participants in the solicitation of the shareholders of Blue Ridge or of FVCB in connection with the proposed merger and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus related to the proposed merger, which will be filed with the SEC. Additional information about Blue Ridge, the directors and executive officers of Blue Ridge and their ownership of Blue Ridge common stock can also be found in Blue Ridge’ definitive proxy statement in connection with its 2021 annual meeting of shareholders, as filed with the SEC on April 30, 2021, and other documents subsequently filed by Blue Ridge with the SEC. Additional information about FVCB, the directors and executive officers of FVCB and their ownership of FVCB common stock can also be found in FVCB’s definitive proxy statement in connection with its 2021 annual meeting of shareholders, as filed with the SEC on April 8, 2021, and other documents subsequently filed by FVCB with the SEC. These documents can be obtained free of charge from the sources described above.

(2) Merger Announcement

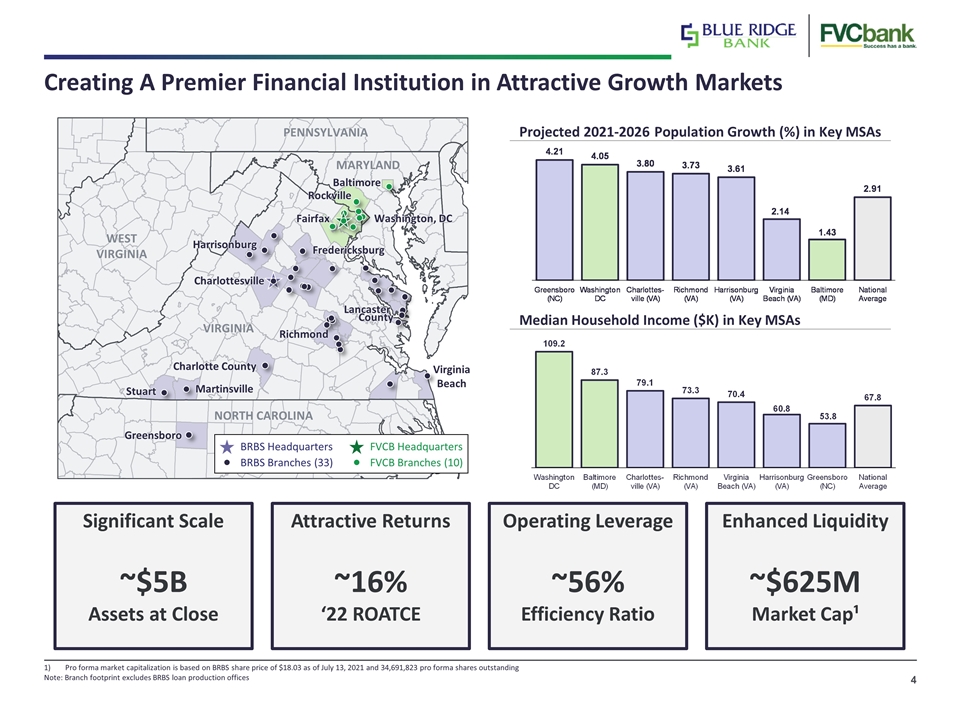

Creating A Premier Financial Institution in Attractive Growth Markets Pro forma market capitalization is based on BRBS share price of $18.03 as of July 13, 2021 and 34,691,823 pro forma shares outstanding Note: Branch footprint excludes BRBS loan production offices Attractive Returns ~16% ‘22 ROATCE Operating Leverage ~56% Efficiency Ratio Enhanced Liquidity ~$625M Market Cap¹ Significant Scale ~$5B Assets at Close Projected 2021-2026 Population Growth (%) in Key MSAs Median Household Income ($K) in Key MSAs BRBS Headquarters BRBS Branches (33) FVCB Headquarters FVCB Branches (10) WEST VIRGINIA PENNSYLVANIA MARYLAND VIRGINIA NORTH CAROLINA Baltimore Rockville Fairfax Fredericksburg Harrisonburg Charlottesville Richmond Virginia Beach Greensboro Charlotte County Lancaster County Washington, DC Martinsville Stuart

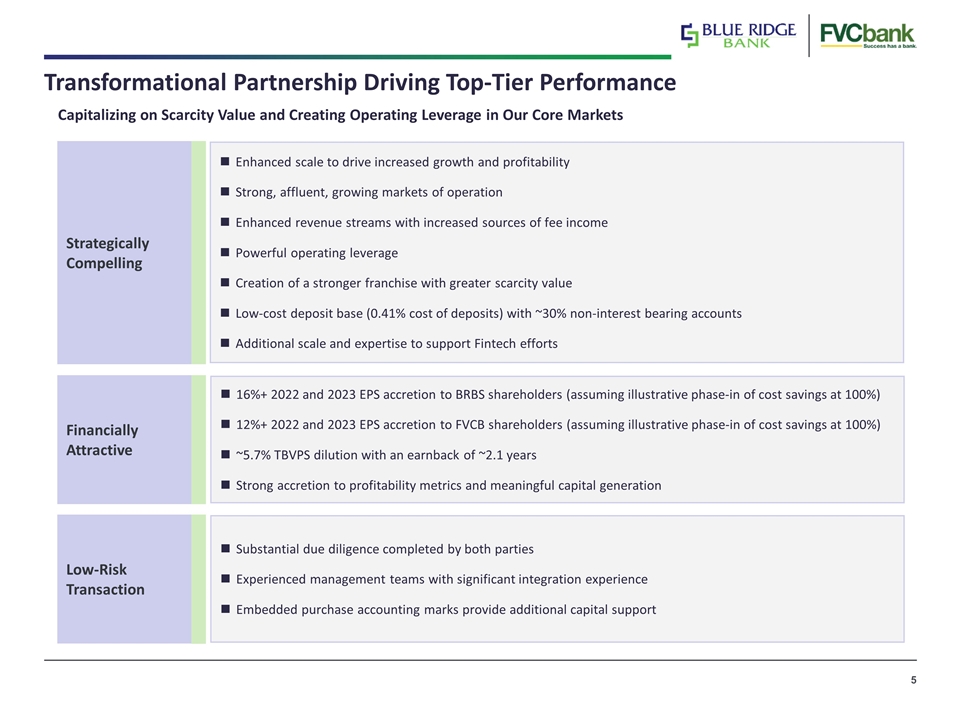

Transformational Partnership Driving Top-Tier Performance Capitalizing on Scarcity Value and Creating Operating Leverage in Our Core Markets Strategically Compelling Enhanced scale to drive increased growth and profitability Strong, affluent, growing markets of operation Enhanced revenue streams with increased sources of fee income Powerful operating leverage Creation of a stronger franchise with greater scarcity value Low-cost deposit base (0.41% cost of deposits) with ~30% non-interest bearing accounts Additional scale and expertise to support Fintech efforts Financially Attractive 16%+ 2022 and 2023 EPS accretion to BRBS shareholders (assuming illustrative phase-in of cost savings at 100%) 12%+ 2022 and 2023 EPS accretion to FVCB shareholders (assuming illustrative phase-in of cost savings at 100%) ~5.7% TBVPS dilution with an earnback of ~2.1 years Strong accretion to profitability metrics and meaningful capital generation Low-Risk Transaction Substantial due diligence completed by both parties Experienced management teams with significant integration experience Embedded purchase accounting marks provide additional capital support

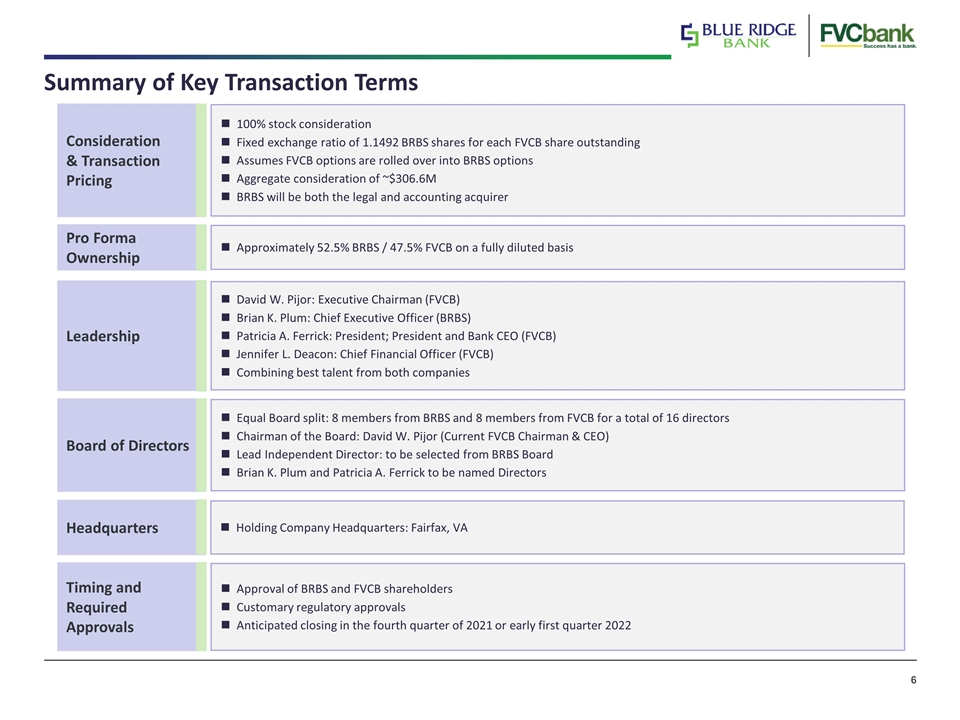

Consideration & Transaction Pricing 100% stock consideration Fixed exchange ratio of 1.1492 BRBS shares for each FVCB share outstanding Assumes FVCB options are rolled over into BRBS options Aggregate consideration of ~$306.6M BRBS will be both the legal and accounting acquirer Pro Forma Ownership Approximately 52.5% BRBS / 47.5% FVCB on a fully diluted basis Leadership David W. Pijor: Executive Chairman (FVCB) Brian K. Plum: Chief Executive Officer (BRBS) Patricia A. Ferrick: President; President and Bank CEO (FVCB) Jennifer L. Deacon: Chief Financial Officer (FVCB) Combining best talent from both companies Board of Directors Equal Board split: 8 members from BRBS and 8 members from FVCB for a total of 16 directors Chairman of the Board: David W. Pijor (Current FVCB Chairman & CEO) Lead Independent Director: to be selected from BRBS Board Brian K. Plum and Patricia A. Ferrick to be named Directors Headquarters Holding Company Headquarters: Fairfax, VA Timing and Required Approvals Approval of BRBS and FVCB shareholders Customary regulatory approvals Anticipated closing in the fourth quarter of 2021 or early first quarter 2022 Summary of Key Transaction Terms

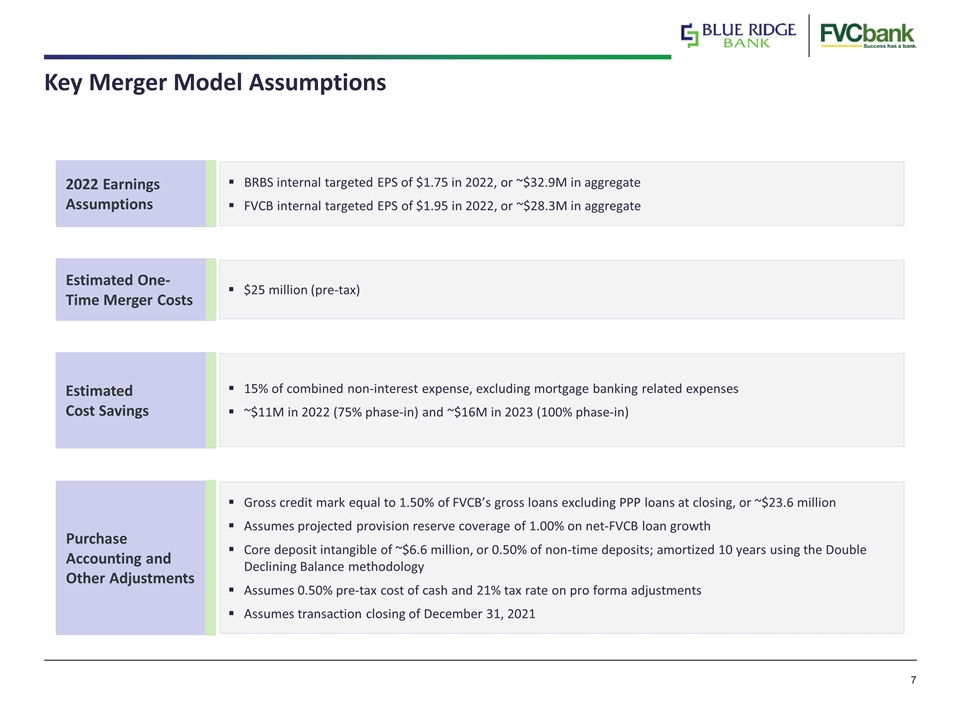

Key Merger Model Assumptions 2022 Earnings Assumptions BRBS internal targeted EPS of $1.75 in 2022, or ~$32.9M in aggregate FVCB internal targeted EPS of $1.95 in 2022, or ~$28.3M in aggregate Estimated One- Time Merger Costs $25 million (pre-tax) Estimated Cost Savings 15% of combined non-interest expense, excluding mortgage banking related expenses ~$11M in 2022 (75% phase-in) and ~$16M in 2023 (100% phase-in) Purchase Accounting and Other Adjustments Gross credit mark equal to 1.50% of FVCB’s gross loans excluding PPP loans at closing, or ~$23.6 million Assumes projected provision reserve coverage of 1.00% on net-FVCB loan growth Core deposit intangible of ~$6.6 million, or 0.50% of non-time deposits; amortized 10 years using the Double Declining Balance methodology Assumes 0.50% pre-tax cost of cash and 21% tax rate on pro forma adjustments Assumes transaction closing of December 31, 2021

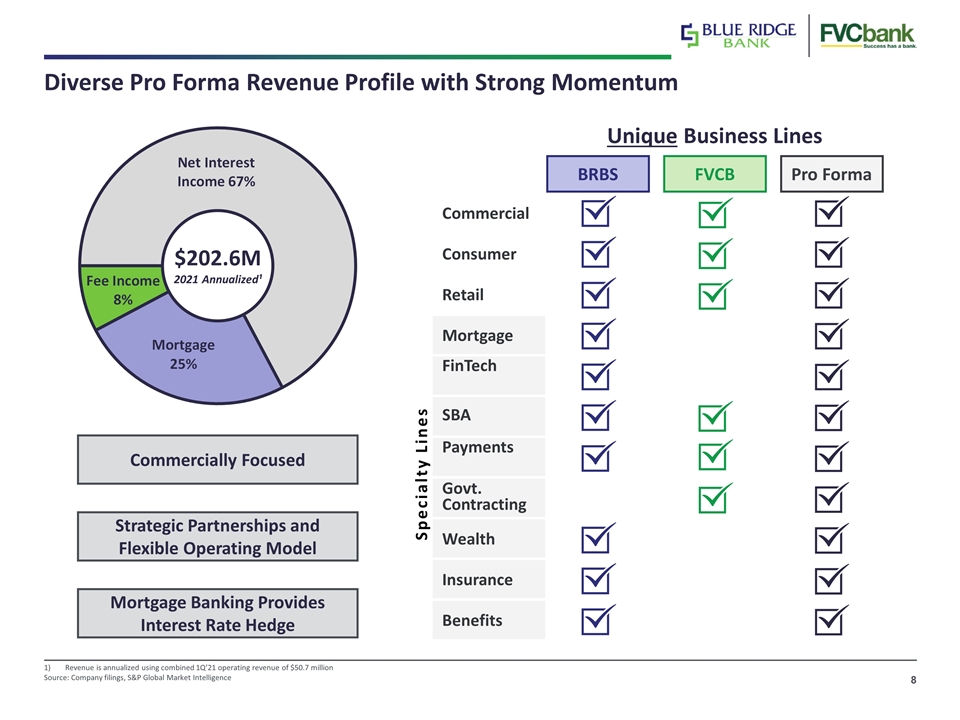

Diverse Pro Forma Revenue Profile with Strong Momentum Revenue is annualized using combined 1Q’21 operating revenue of $50.7 million Source: Company filings, S&P Global Market Intelligence $202.6M 2021 Annualized¹ Commercially Focused Strategic Partnerships and Flexible Operating Model Mortgage Banking Provides Interest Rate Hedge Mortgage FinTech SBA Payments BRBS FVCB Pro Forma Unique Business Lines Commercial Consumer Retail Specialty Lines Govt. Contracting Wealth Insurance Benefits

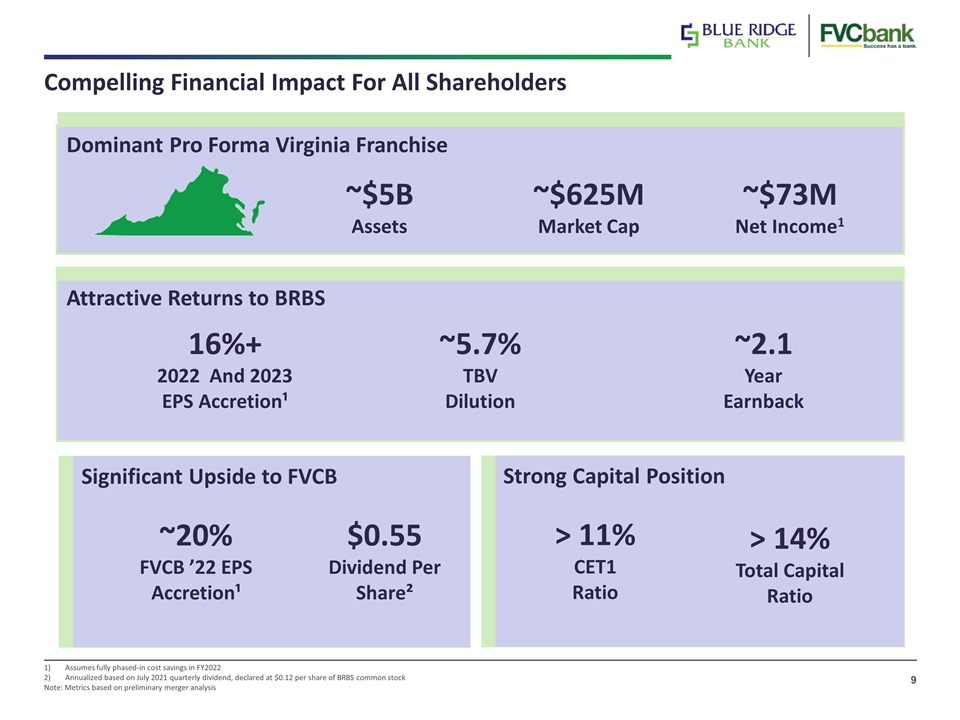

Compelling Financial Impact For All Shareholders Assumes fully phased-in cost savings in FY2022 Annualized based on July 2021 quarterly dividend, declared at $0.12 per share of BRBS common stock Note: Metrics based on preliminary merger analysis Dominant Pro Forma Virginia Franchise ~$5B Assets ~$73M Net Income1 ~$625M Market Cap Attractive Returns to BRBS 16%+ 2022 And 2023 EPS Accretion¹ ~5.7% TBV Dilution ~2.1 Year Earnback Significant Upside to FVCB ~20% FVCB ’22 EPS Accretion¹ $0.55 Dividend Per Share² Strong Capital Position > 11% CET1 Ratio > 14% Total Capital Ratio

1, 94, 92 25, 27, 120 2, 152, 52 1, 2, 94 (2) Blue Ridge Bankshares, Inc. Company Overview

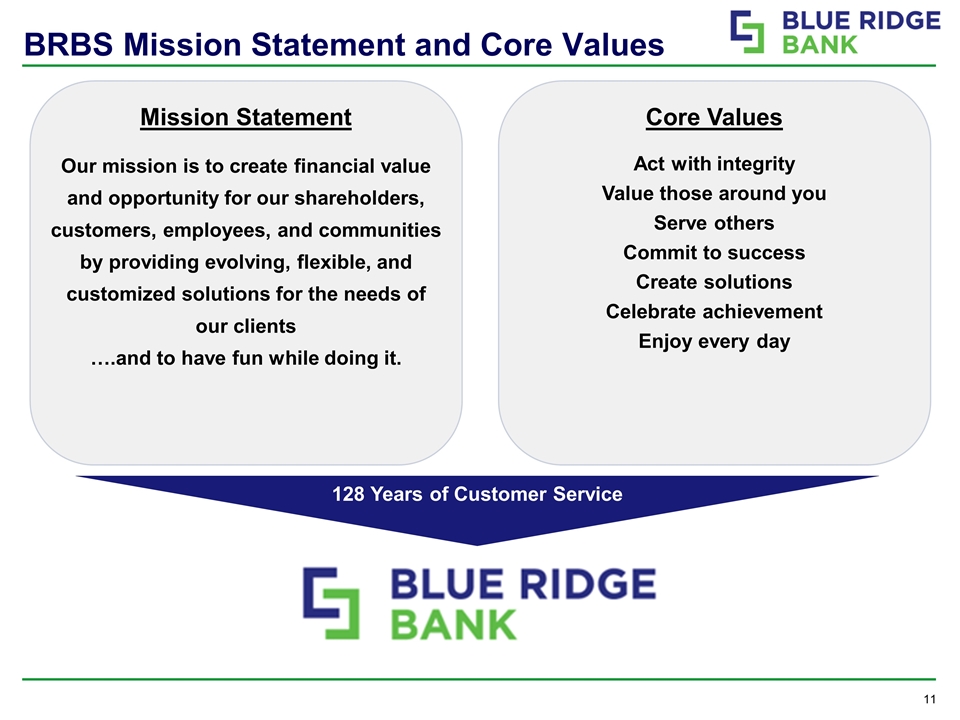

BRBS Mission Statement and Core Values 128 Years of Customer Service Mission Statement Our mission is to create financial value and opportunity for our shareholders, customers, employees, and communities by providing evolving, flexible, and customized solutions for the needs of our clients ….and to have fun while doing it. Act with integrity Value those around you Serve others Commit to success Create solutions Celebrate achievement Enjoy every day Core Values

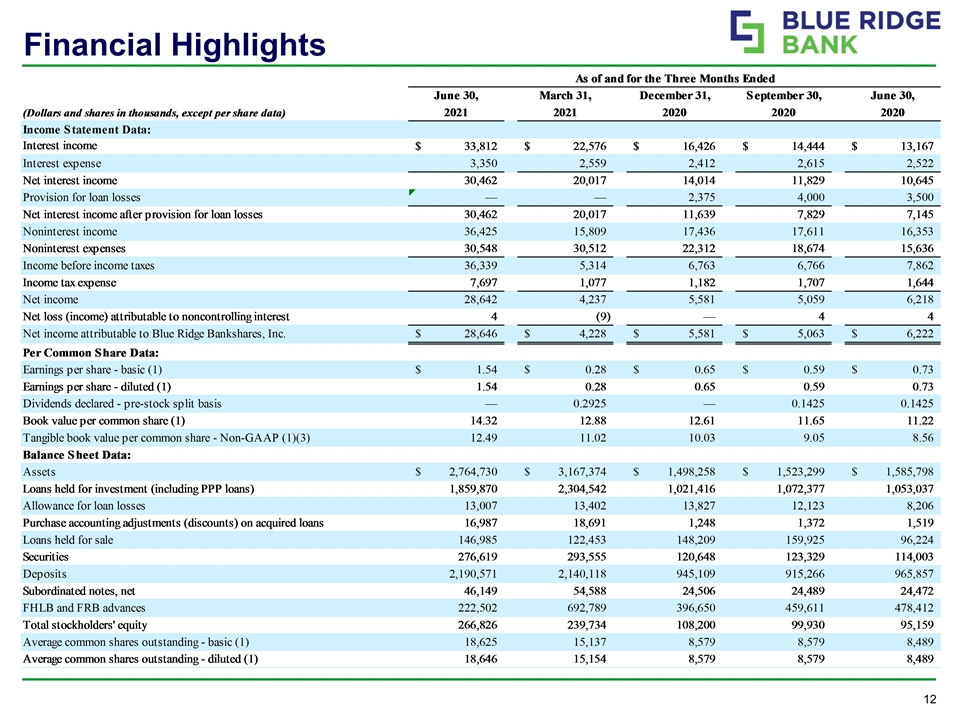

Financial Highlights

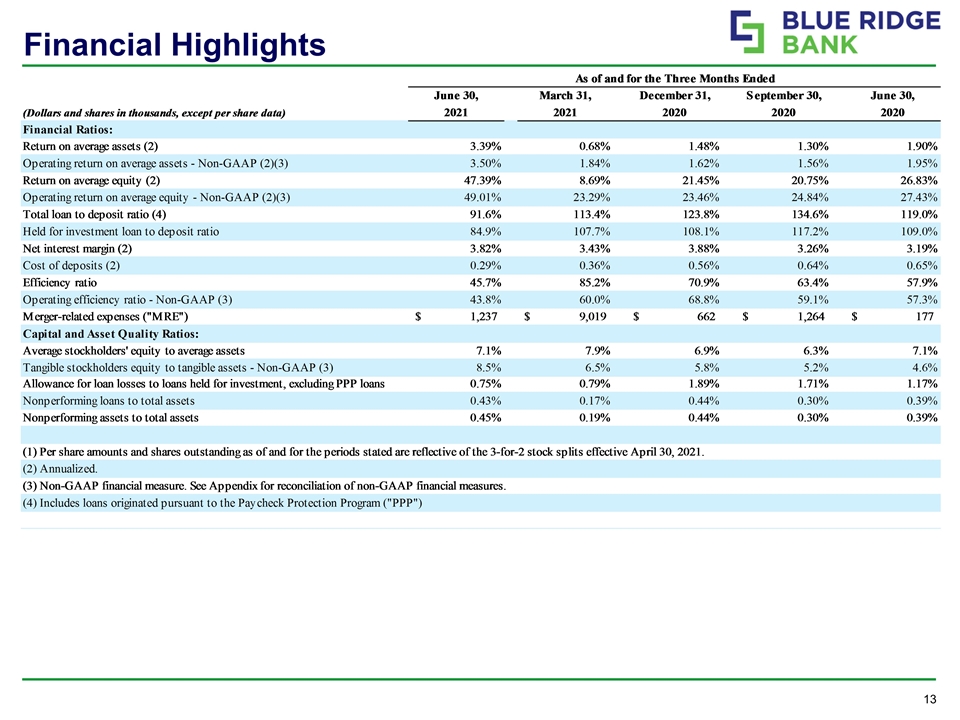

Financial Highlights

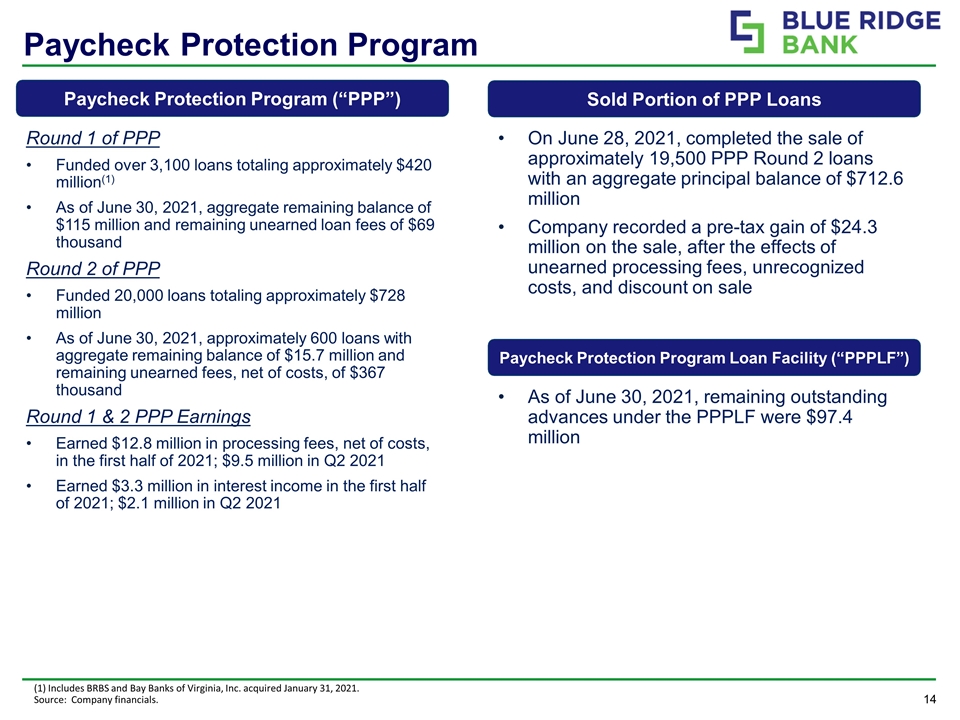

Round 1 of PPP Funded over 3,100 loans totaling approximately $420 million(1) As of June 30, 2021, aggregate remaining balance of $115 million and remaining unearned loan fees of $69 thousand Round 2 of PPP Funded 20,000 loans totaling approximately $728 million As of June 30, 2021, approximately 600 loans with aggregate remaining balance of $15.7 million and remaining unearned fees, net of costs, of $367 thousand Round 1 & 2 PPP Earnings Earned $12.8 million in processing fees, net of costs, in the first half of 2021; $9.5 million in Q2 2021 Earned $3.3 million in interest income in the first half of 2021; $2.1 million in Q2 2021 (1) Includes BRBS and Bay Banks of Virginia, Inc. acquired January 31, 2021. Source: Company financials. Paycheck Protection Program Paycheck Protection Program (“PPP”) Sold Portion of PPP Loans As of June 30, 2021, remaining outstanding advances under the PPPLF were $97.4 million Paycheck Protection Program Loan Facility (“PPPLF”) On June 28, 2021, completed the sale of approximately 19,500 PPP Round 2 loans with an aggregate principal balance of $712.6 million Company recorded a pre-tax gain of $24.3 million on the sale, after the effects of unearned processing fees, unrecognized costs, and discount on sale

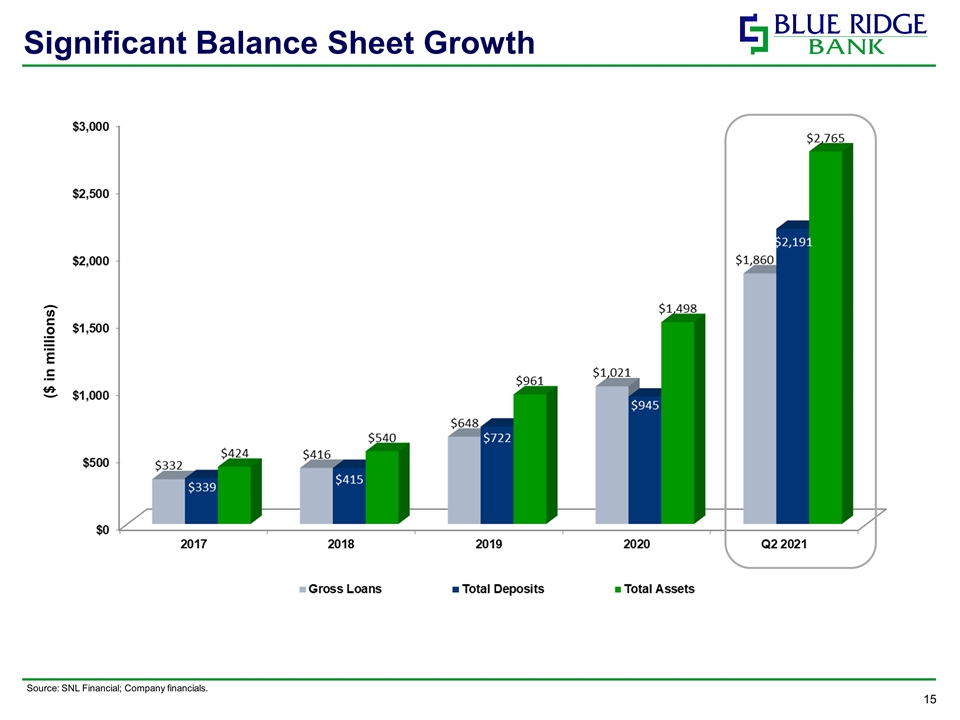

Significant Balance Sheet Growth ($ in millions) Source: SNL Financial; Company financials.

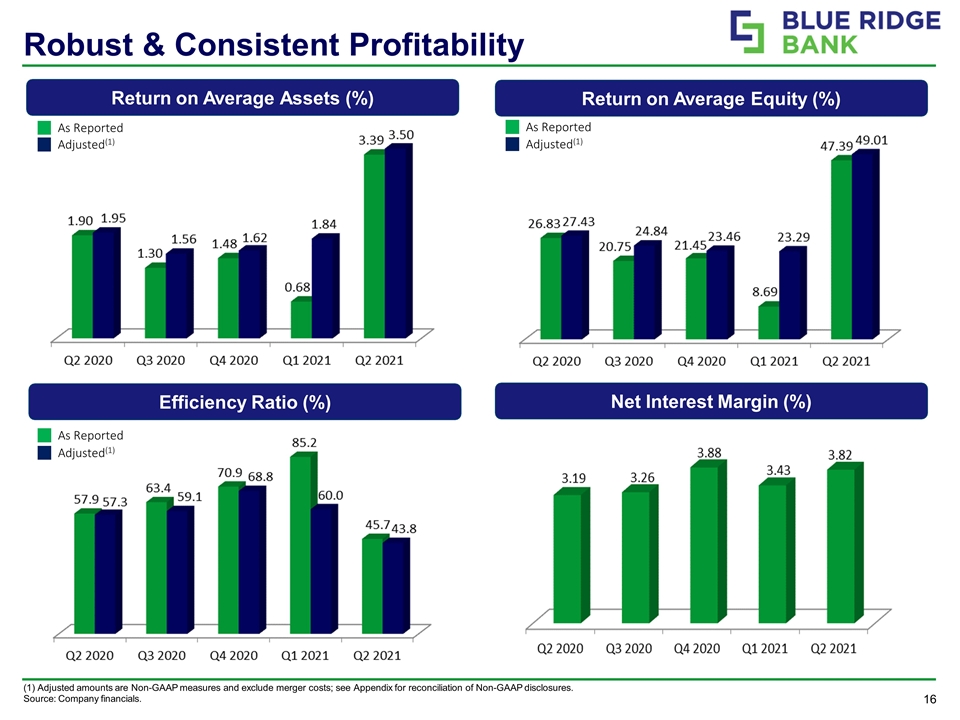

Robust & Consistent Profitability Efficiency Ratio (%) Net Interest Margin (%) Return on Average Assets (%) Return on Average Equity (%) Adjusted(1) As Reported As Reported Adjusted(1) As Reported Adjusted(1) (1) Adjusted amounts are Non-GAAP measures and exclude merger costs; see Appendix for reconciliation of Non-GAAP disclosures. Source: Company financials.

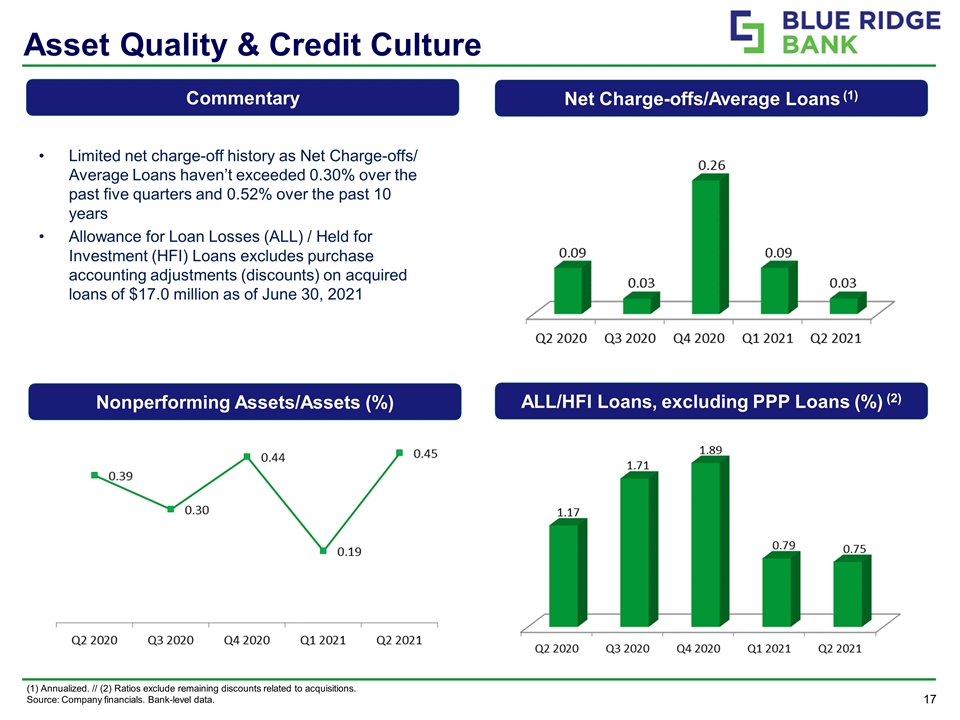

Asset Quality & Credit Culture Nonperforming Assets/Assets (%) ALL/HFI Loans, excluding PPP Loans (%) (2) Commentary Net Charge-offs/Average Loans (1) Limited net charge-off history as Net Charge-offs/ Average Loans haven’t exceeded 0.30% over the past five quarters and 0.52% over the past 10 years Allowance for Loan Losses (ALL) / Held for Investment (HFI) Loans excludes purchase accounting adjustments (discounts) on acquired loans of $17.0 million as of June 30, 2021 (1) Annualized. // (2) Ratios exclude remaining discounts related to acquisitions. Source: Company financials. Bank-level data.

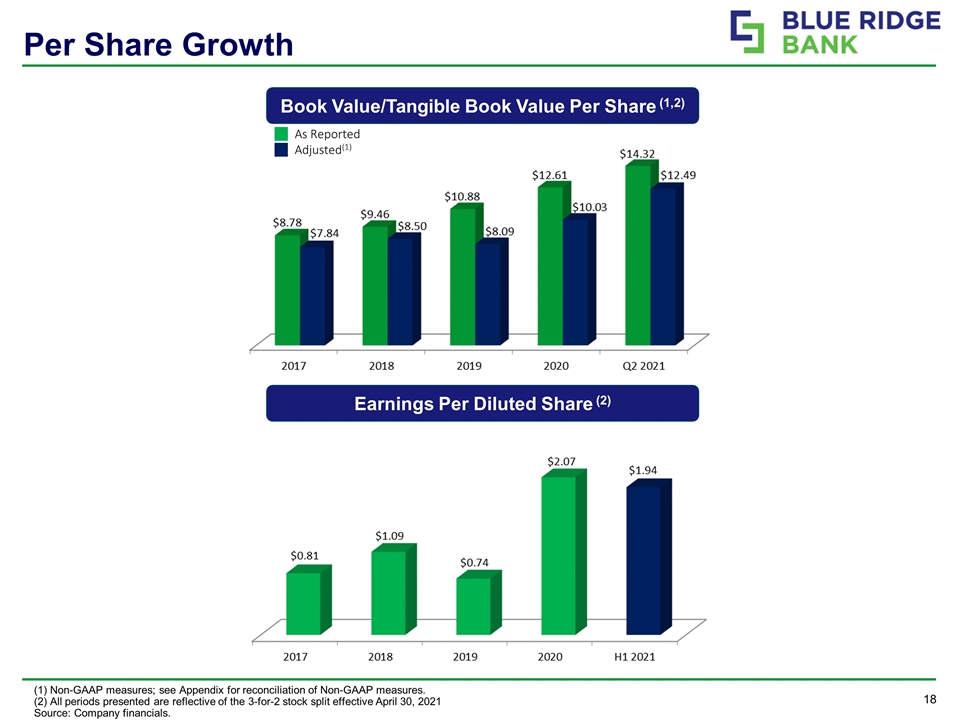

Per Share Growth Book Value/Tangible Book Value Per Share (1,2) Earnings Per Diluted Share (2) (1) Non-GAAP measures; see Appendix for reconciliation of Non-GAAP measures. (2) All periods presented are reflective of the 3-for-2 stock split effective April 30, 2021 Source: Company financials. As Reported Adjusted(1)

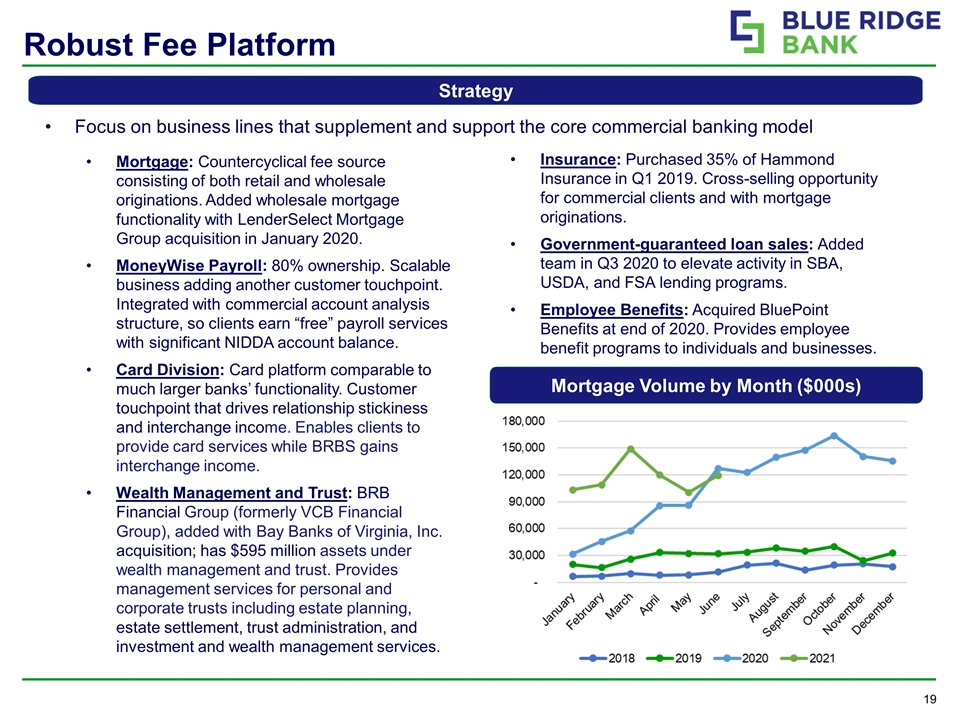

Focus on business lines that supplement and support the core commercial banking model Robust Fee Platform Strategy Mortgage: Countercyclical fee source consisting of both retail and wholesale originations. Added wholesale mortgage functionality with LenderSelect Mortgage Group acquisition in January 2020. MoneyWise Payroll: 80% ownership. Scalable business adding another customer touchpoint. Integrated with commercial account analysis structure, so clients earn “free” payroll services with significant NIDDA account balance. Card Division: Card platform comparable to much larger banks’ functionality. Customer touchpoint that drives relationship stickiness and interchange income. Enables clients to provide card services while BRBS gains interchange income. Wealth Management and Trust: BRB Financial Group (formerly VCB Financial Group), added with Bay Banks of Virginia, Inc. acquisition; has $595 million assets under wealth management and trust. Provides management services for personal and corporate trusts including estate planning, estate settlement, trust administration, and investment and wealth management services. Insurance: Purchased 35% of Hammond Insurance in Q1 2019. Cross-selling opportunity for commercial clients and with mortgage originations. Government-guaranteed loan sales: Added team in Q3 2020 to elevate activity in SBA, USDA, and FSA lending programs. Employee Benefits: Acquired BluePoint Benefits at end of 2020. Provides employee benefit programs to individuals and businesses. Mortgage Volume by Month ($000s)

Fintech Partnerships Actively engaged creating partnerships in Fintech community enabling the Fintech partners and Blue Ridge to capitalize on industry disruption Fintech relationships have resulted in over $80 million in related deposits on the balance sheet as of June 30, 2021

Looking Forward Obtain approvals and execute FVCB integration Grow efforts to partner with and integrate Fintech providers Leverage footprint and scale to grow quality relationships Drive cross-selling opportunities across business lines Manage slowing mortgage demand Minimize COVID-19 asset quality impacts as government support wanes

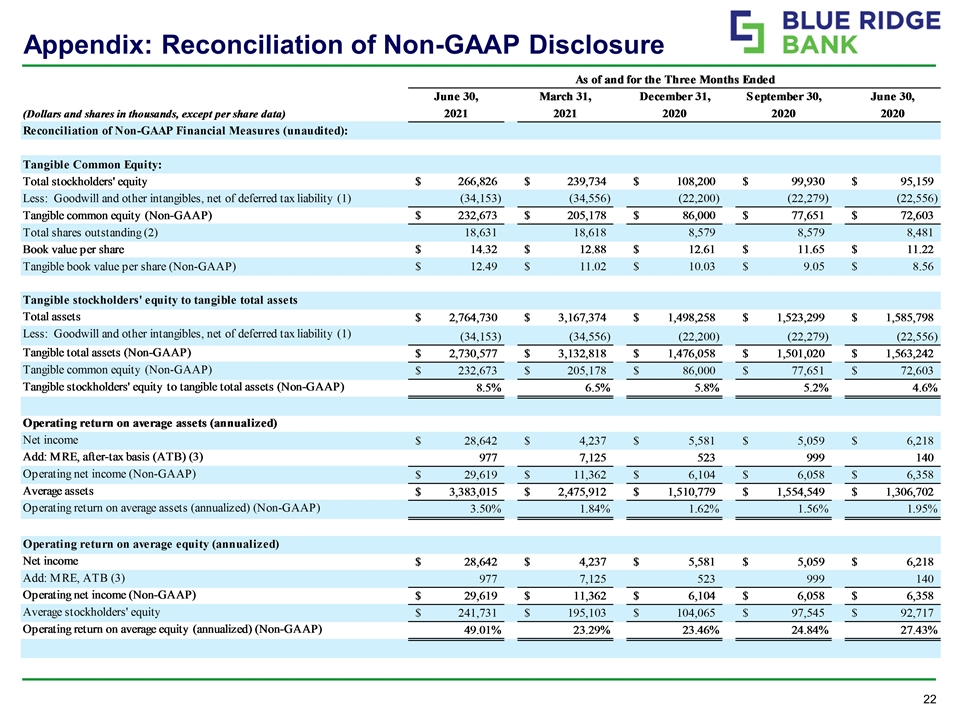

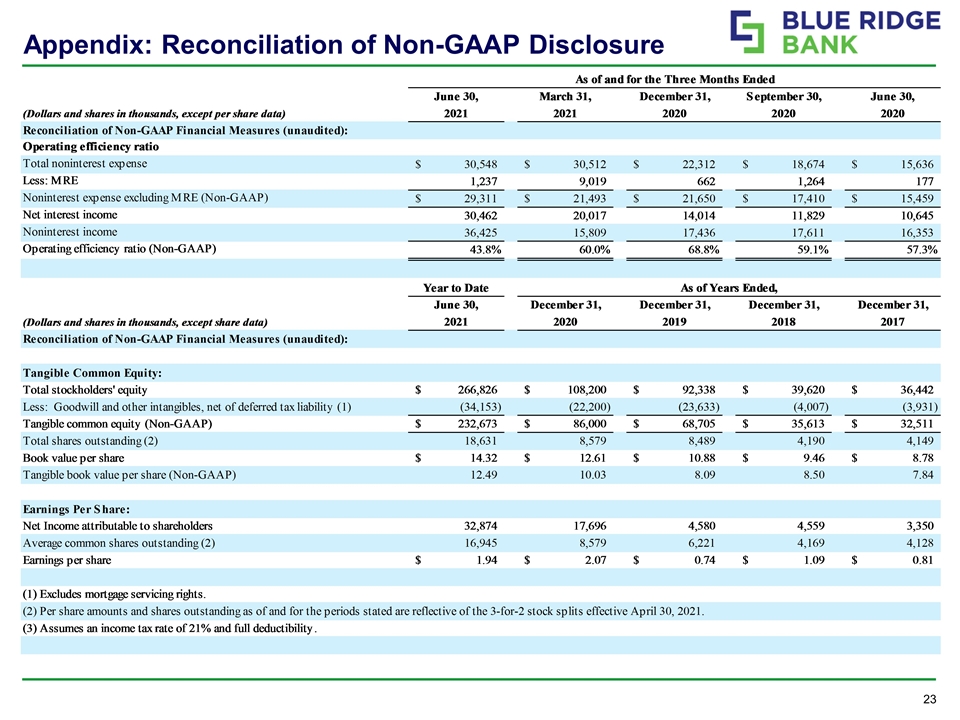

Appendix: Reconciliation of Non-GAAP Disclosure

Appendix: Reconciliation of Non-GAAP Disclosure

Contact Information Brian K. Plum Chief Executive Officer (540) 843-5207 Brian.Plum@mybrb.bank Judy C. Gavant Chief Financial Officer (804) 518-2606 Judy.Gavant@mybrb.bank www.mybrb.com