Attached files

| file | filename |

|---|---|

| EX-23.3 - EX-23.3 - Driven Brands Holdings Inc. | d161883dex233.htm |

| EX-23.2 - EX-23.2 - Driven Brands Holdings Inc. | d161883dex232.htm |

| EX-23.1 - EX-23.1 - Driven Brands Holdings Inc. | d161883dex231.htm |

| EX-21.1 - EX-21.1 - Driven Brands Holdings Inc. | d161883dex211.htm |

| EX-10.33 - EX-10.33 - Driven Brands Holdings Inc. | d161883dex1033.htm |

| EX-5.1 - EX-5.1 - Driven Brands Holdings Inc. | d161883dex51.htm |

| EX-4.8 - EX-4.8 - Driven Brands Holdings Inc. | d161883dex48.htm |

| EX-1.1 - EX-1.1 - Driven Brands Holdings Inc. | d161883dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on August 2, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Driven Brands Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7538 | 47-3595252 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

440 S. Church Street, Suite 700

Charlotte, NC 28202

(704) 377-8855

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Jonathan Fitzpatrick

President and Chief Executive Officer

440 S. Church Street, Suite 700

Charlotte, NC 28202

(704) 377-8855

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| John C. Kennedy, Esq. Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, NY 10019-6064 (212) 373-3300 |

Tiffany Mason Executive Vice President and Chief Financial Officer Scott O’Melia Executive Vice President, General Counsel and Secretary 440 S. Church Street, Suite 700 Charlotte, NC 28202 (704) 377-8855 |

Ian D. Schuman, Esq. Stelios G. Saffos, Esq. Latham & Watkins LLP 885 Third Avenue New York, NY 10022-4834 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

| Non-accelerated filer |

☒ |

Smaller reporting company |

☐ | |||

| Emerging growth company |

☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price Per Share(2) |

Proposed Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Common Stock, par value $0.01 per share |

13,800,000 | $30.83 | $425,454,000 | $46,417.03 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,800,000 shares that the underwriters have the option to purchase. See “Underwriting.” |

| (2) | The offering price and the registration fee are estimated pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based upon the average high and low prices for the shares of Common Stock of Driven Brands Holdings Inc., as reported by The Nasdaq Global Select Market, on July 26, 2021. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated August 2, 2021

12,000,000 Shares

Driven Brands Holdings Inc.

Common Stock

Driven Equity LLC and RC IV Cayman ICW Holdings LLC (the “selling stockholders”), each of which is a related entity of Roark Capital Management, LLC, are offering 12,000,000 shares of common stock of Driven Brands Holdings Inc., a Delaware corporation.

Our shares of common stock are listed on The Nasdaq Global Select Market, or “NASDAQ” under the symbol “DRVN.”

We will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholders. We have agreed to pay all expenses relating to registering these shares of common stock. The selling stockholders will pay any brokerage commissions and/or similar charges incurred for the sale of these shares of common stock. See “Risk Factors—Risks Related to this Offering and Ownership of Our Common Stock” and “Summary–Principal Stockholders.”

Following the completion of this offering, our principal stockholders will continue to own a majority of the voting power of our outstanding common stock. As a result, we will remain a “controlled company” under the corporate governance rules for NASDAQ listed companies and will be exempt from certain corporate governance requirements of such rules.

Investing in our common stock involves a high degree of risk. See “Risk Factors” that are described beginning on page 21 of this prospectus and the documents incorporated by reference herein.

|

Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds to the selling stockholders, before expenses |

$ | $ | ||||||

| (1) | See “Underwriters” for a description of all compensation payable to the underwriters. |

The selling stockholders have granted the underwriters an option for a period of 30 days to purchase up to an additional 1,800,000 shares of common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock against payment on or about , 2021

| Morgan Stanley | BofA Securities | Goldman Sachs & Co. LLC | J.P. Morgan | Barclays | ||||

| Credit Suisse | Baird | Piper Sandler | William Blair | |||

Prospectus dated , 2021

Table of Contents

You should rely only on the information contained in this prospectus and any related free writing prospectus that we may provide to you in connection with this offering. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations, and prospects may have changed since that date.

For investors outside the United States: neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

i

Table of Contents

TRADEMARKS, TRADE NAMES, AND SERVICE MARKS

We use various trademarks, trade names and service marks in our business, including ABRA®, CARSTAR®, DrivenBrands®, Fix Auto USA®, IMO®, MAACO®, Meineke®, PH Vitres D’Autos®, Spire Supply®, Take 5 Oil Change®, Uniban® and 1-800-Radiator & A/C®. This prospectus contains references to our trademarks and service marks. Solely for convenience, trademarks and trade names referred to in, or incorporated by reference into, this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by any other companies, including with respect to Fix Auto USA®.

INDUSTRY AND MARKET DATA

We include in, or incorporate by reference into, this prospectus statements regarding factors that have impacted our and our customers’ industries. Such statements are statements of belief and are based on industry data and forecasts that we have obtained from industry publications and surveys, such as the Auto Care Association’s 2022 and 2021 Auto Care Factbooks, CarWash.com, IBIS World Inc.’s Report, International Car Wash Association’s Total Conveyor Locations and National Oil and Lube News’ Industry Rankings as well as good faith estimates of our management which are based on such sources and internal company sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of such information. In addition, while we believe that the industry information included herein is generally reliable, such information is inherently imprecise. While we are not aware of any misstatements regarding the industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the caption “Risk Factors” in this prospectus.

BASIS OF PRESENTATION

The consolidated financial statements include the accounts of Driven Brands Holdings Inc. and its subsidiaries. On July 6, 2020, RC Driven Holdings LLC converted into a Delaware corporation pursuant to a statutory conversion, and changed its name to Driven Brands Holdings Inc. (the “Corporate Conversion”). As part of our Corporate Conversion, our direct parent, Driven Investor LLC, received all of our common stock in exchange for our equity interests. On January 14, 2021, in connection with and prior to the closing of our initial public offering, we effected a 88,990-for-one stock split and Driven Investor LLC was liquidated and all of our common stock was distributed to our Principal Stockholders, current and former employees and management and board members. In this prospectus, we refer to the foregoing Corporate Conversion, stock split and related transactions as the Reorganization.

In this prospectus, unless otherwise indicated or the context otherwise requires, references to the “Company,” “Driven Brands,” the “Issuer,” “we,” “us” and “our” refer, prior to the Corporate Conversion discussed herein, to RC Driven Holdings LLC and its subsidiaries, and after the Corporate Conversion, Driven Brands Holdings Inc. and its subsidiaries. On August 3, 2020, we completed the acquisition (the “ICWG Acquisition”) of International Car Wash Group (“ICWG”). References to “brands” refer to the brands under which we and our franchisees operate each store location or warehouse, as applicable (referred to as “locations,” “stores,” or “units”). References to the size of our business are based on store count. References to “franchise” or “franchisee” refer to third parties that operate locations under franchise or license agreements, references to “franchised locations” refer to locations operated by franchisees, references to “independent operator” refer to third parties that operate locations under independent operator agreements, references to “independently-operated locations” refer to international locations outside North America where independent operators are responsible for site-level labor and receive commissions based on a percent of site revenue from car washes and references to

ii

Table of Contents

“company-operated locations” refer to locations operated by subsidiaries of the Company. References to our “Principal Stockholders” refer to Driven Equity LLC and RC IV Cayman ICW Holdings LLC, each of which is a related entity of Roark Capital Management, LLC (“Roark”) as described under “Prospectus Summary—Our Principal Stockholders.” References to “car parc” refer to the total number of registered vehicles within a geographic region. References to cash-on-cash returns refer to our estimates of annual unit-level earnings before interest expense, income tax expense, and depreciation and amortization expense (“EBITDA”) divided by initial investment, except that we calculate CARSTAR unit cash-on-cash returns using estimates of incremental EBITDA from conversion divided by conversion costs. We calculate Take 5 franchise unit cash-on-cash returns based on company operated unit-level economics for greenfield locations open for at least two years, adjusted to include franchise costs (e.g., royalties, supply margin and initial franchise fees). All cash-on-cash returns are based on financial information as disclosed in the 2020 franchise disclosure documents. We provide cash-on-cash returns as we believe it is frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry and we use it internally as a benchmark to compare our performance to that of our competitors. This measure has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under accounting principles generally acceptable in the United States (“GAAP” or “U.S. GAAP”).

Throughout this prospectus, we provide a number of key performance indicators used by management and typically used by our competitors in the automotive services industry. These and other key performance indicators are discussed in more detail in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Indicators” in our 2020Annual Report (as defined herein). Except as otherwise specified, the following are key performance indicators used throughout this prospectus:

| • | “System-wide sales” represents the total of net sales for our company-operated stores and independently-operated stores, and sales at franchised stores. Sales at franchised stores are not included as revenue in our consolidated statements of operations, but rather, the Company includes franchise royalties and fees that are derived from sales at franchised stores. Franchise royalties and fees revenue represented 13% and 19% of our total revenue in 2020 and 2019, respectively. Franchise royalties and fees revenue represented 10% and 17% of our total revenue for the six months ended June 26, 2021 and June 27, 2020, respectively. During 2020 and 2019, approximately 96% and 93%, respectively, of franchise royalties and fees revenue was attributable to royalties, with the balance attributable to license and development fees. For the six months ended June 26, 2021 and June 27, 2020, approximately 95% and 92%, respectively, of franchise royalties and fees revenue was attributable to royalties, with the balance attributable to license and development fees. Revenue from company-operated stores represented 54% and 55% of our total revenue in 2020 and 2019, respectively. Revenue from company-operated stores represented 55% and 52% of our total revenue in the six months ended June 26, 2021 and June 27, 2020, respectively. Revenue from independently-operated stores represented 7% of our total revenue in 2020. Revenue from independently-operated stores represented 16% of our total revenue in the six months ended June 26, 2021. |

| • | “Store count” reflects the number of franchised, independently-operated and company-operated stores open at the end of the reporting period. |

| • | “Same store sales” reflect the change in sales year-over-year for the same store base. We define the same store base to include all franchised, independently-operated and company-operated stores open for comparable weeks during the given fiscal period in both the current and prior year. |

| • | “Adjusted EBITDA” means earnings before interest expense, income tax expense, and depreciation and amortization, with further adjustments for acquisition-related costs, straight-line rent, equity compensation, loss on debt extinguishment and certain non-recurring, non-core, infrequent or unusual charges. |

| • | “Segment Adjusted EBITDA” means Adjusted EBITDA with a further adjustment for store opening costs. Segment Adjusted EBITDA is a supplemental measure of operating performance of our |

iii

Table of Contents

| segments and may not be comparable to similar measures reported by other companies. Segment Adjusted EBITDA is a performance metric utilized by the Company’s Chief Operating Decision Maker to allocate resources to and assess performance of the Company’s segments. |

Adjusted EBITDA is a non-GAAP financial measure, which is discussed in more detail in the section titled “Use of Non-GAAP Financial Information.” Our fiscal year ends on the last Saturday of each calendar year. Our most recent fiscal years ended on December 26, 2020 and December 28, 2019 and were both 52-week years. Our fiscal quarters are comprised of 13 weeks each, except for 53-week fiscal years for which the fourth quarter will be comprised of 14 weeks, and end on the 13th Saturday of each quarter (14th Saturday of the fourth quarter, when applicable). Our two most recent fiscal quarters ended on March 27, 2021 and June 26, 2021, respectively.

In this prospectus we include certain preliminary estimates of our results of operations for the six months ended June 26, 2021 as compared to our historical results of operations for the six months ended June 27, 2020. Such information is based on our internal management accounts and reporting as of and for the six months ended June 26, 2021, as compared to our reviewed results for, or financial metrics derived from, the six months ended June 27, 2020. We have not yet completed our financial statement review procedures for the six months ended June 26, 2021 and the preliminary financial and other data for this period has been prepared by, and is the responsibility of, management based on currently available information. The preliminary results of operations are subject to revision as we prepare our financial statements and disclosure for the six months ended June 26, 2021, and such revisions may be significant. In connection with our quarterly closing and review process for the fiscal quarter with our independent auditors, we may identify items that would require us to make adjustments to the preliminary results of operations for the six months ended June 26, 2021. As a result, the final results and other disclosures for the six months ended June 26, 2021 and for the six months ended June 27, 2020 may differ materially from the preliminary data presented in this prospectus. This preliminary financial data should not be viewed as a substitute for all financial statements prepared in accordance with U.S. GAAP. Our consolidated financial statements for the six months ended June 26, 2021 will not be available until after this offering is consummated, and consequently, will not be available to you prior to investing in this offering. Grant Thornton LLP has not audited, reviewed, compiled or performed any procedures with respect to the preliminary financial results for the six months ended June 26, 2021. Accordingly, Grant Thornton LLP does not express an opinion or any other form of assurance with respect thereto. For additional information, see “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors.”

REORGANIZATION

Prior to July 6, 2020, we operated as a Delaware limited liability company under the name RC Driven Holdings LLC. On July 6, 2020, we consummated the Corporate Conversion. In conjunction with the Corporate Conversion, all of our outstanding equity interests were converted into 1,000 shares of common stock held by our direct parent, Driven Investor LLC and we subsequently issued an additional 430 shares of common stock to Driven Investor LLC as part of the ICWG Acquisition. Prior to the closing of our initial public offering, (i) we effected a 88,990-for-one stock split of our common stock (the “Stock Split”), (ii) Driven Investor LLC was liquidated and all of our common stock was distributed to our Principal Stockholders, current and former employees and management and board members, (iii) profit interests in Driven Investor LLC were exchanged for an economically equivalent number of vested and unvested shares of our common stock and (iv) options to purchase units of Driven Investor LLC were converted into options to purchase shares of our common stock (collectively, the “Reorganization”). The purpose of the Corporate Conversion was to reorganize our structure so that the registrant entity is a corporation rather than a limited liability company and so that our existing investors will own our common stock rather than equity interests in a limited liability company.

Driven Brands Holdings Inc. now holds all of the assets of RC Driven Holdings LLC and has assumed all of its liabilities and obligations. We are a holding company and hold all of our assets and operating entities through our indirect subsidiary, Driven Holdings, LLC.

iv

Table of Contents

USE OF NON-GAAP FINANCIAL INFORMATION

To supplement our financial information presented in accordance with the U.S. GAAP, we have presented Adjusted EBITDA, Acquisition Adjusted EBITDA and Adjusted Net Income, each a non-GAAP financial measure.

Adjusted EBITDA is defined above under “Basis of Presentation.” Acquisition Adjusted EBITDA represents Adjusted EBITDA for the applicable period as adjusted to give effect to management’s estimates of a full period of Adjusted EBITDA from any businesses acquired in such period as if such acquisitions had been completed on the first day of such period (“Acquisition EBITDA adjustments”). Acquisition EBITDA adjustments are based on the most recently available historical financial information of acquired businesses at the time of such acquisitions, as adjusted as permitted under the Amended and Restated Base Indenture, dated as of April 24, 2018, by and among Driven Brands Funding, LLC, Driven Brands Canada Funding Corporation, and Citibank, N.A., as trustee and securities intermediary (as further amended, modified, supplemented, the “Securitization Senior Notes Indenture”) to (a) eliminate expenses related to the prior owners and certain other non-recurring costs and expenses, if any, as if such businesses had been acquired on the first day of such period, (b) give effect to a full year of performance for any acquisitions completed by such acquired businesses prior to our acquisition and (c) give full year effect to sale leaseback transactions, including rent adjustments in connection with acquisitions, as if such transactions occurred on the first day of such period. Adjusted Net Income is calculated by eliminating from net income the adjustments described for Adjusted EBITDA, amortization related to acquired intangible assets and the tax effect of the adjustments. Our acquired intangible assets primarily relate to franchise agreements and trademarks. Although our intangible assets directly contribute to the Company’s revenue generation, the amortization related to acquired intangible assets is a non-cash amount which is not affected by operations of any particular period and which typically fluctuates period over period based on the size and timing of the Company’s acquisition activity. Accordingly, we believe excluding the amortization related to acquired intangible assets enhances the Company’s and our investors’ ability to compare our past performance with our current performance and to analyze underlying business trends.

We present these metrics because we believe they are a useful indicator of our operating performance. We believe Adjusted EBITDA and Adjusted Net Income are commonly used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours. Our management and certain investors use Acquisition Adjusted EBITDA as an estimate of the potential of our ongoing operations to generate Adjusted EBITDA after giving effect to recent acquisitions.

Adjusted EBITDA, Acquisition Adjusted EBITDA and Adjusted Net Income should not be construed as alternatives to net income and net income margin under GAAP as indicators of operating performance. Adjusted EBITDA, Acquisition Adjusted EBITDA and Adjusted Net Income may not be comparable to similarly titled measures reported by other companies. We have included these measures because we believe they provide management and investors with additional information to measure our performance.

The presentation of Acquisition Adjusted EBITDA should not be construed as an inference that our future results will be consistent with our “as if” estimates. These “as if” estimates of potential operating results were not prepared in accordance with GAAP or the pro forma rules of Regulation S-X promulgated by the Securities and Exchange Commission (the “SEC”). Furthermore, while Acquisition Adjusted EBITDA gives effect to management’s estimate of a full year of Adjusted EBITDA in respect of acquisitions completed in the applicable period, Acquisition Adjusted EBITDA does not give effect to any Adjusted EBITDA in respect of such acquisitions for any period prior to such applicable period. As a result, the Acquisition Adjusted EBITDA across different periods may not necessarily be comparable.

For reconciliations of these measures to the nearest GAAP measures, see “Prospectus Summary—Summary Historical Consolidated Financial and Other Data.”

v

Table of Contents

INCORPORATION BY REFERENCE

The rules of the SEC allow us to incorporate by reference information we file with the SEC. This means that we are disclosing important information to you by referring to other documents. The information incorporated by reference is considered to be part of this prospectus. To the extent there are inconsistencies between the information contained in this prospectus and the information contained in the documents filed with the SEC prior to the date of this prospectus and incorporated by reference, the information in this prospectus shall be deemed to supersede the information in such incorporated documents. We incorporate by reference the documents listed below (other than any portions thereof, which under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and applicable SEC rules, are not deemed “filed” under the Exchange Act):

| • | Our Annual Report on Form 10-K for the fiscal year ended December 26, 2020, filed with the SEC on March 24, 2021 (the “2020 Annual Report”); |

| • | Our Quarterly Report on Form 10-Q for the quarter ended March 27, 2021, filed with the SEC on May 11, 2021 (the “First Quarter 10-Q”); |

| • | The portions of our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 22, 2021 that are incorporated by reference in the 2020 Annual Report (the “Proxy Statement”); and |

| • | our Current Reports on Form 8-K, filed with the SEC on January 21, 2021, February 10, 2021, March 26, 2021, March 31, 2021, April 1, 2021, April 30, 2021, May 27, 2021, June 15, 2021 and July 2, 2021. |

We will provide without charge to each person to whom a copy of this prospectus has been delivered, a copy of any and all of these filings. You may request a copy of these filings from the SEC as described under “Where You Can Find More Information” or by writing to us at:

Investor Relations

440 S. Church Street, Suite 700

Charlotte, NC 28202

(704)-377-8855

e-mail: investors@drivenbrands.com

This prospectus and the documents incorporated by reference therein may be accessed at our website that is located at www.drivenbrands.com. Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on our website or any such information in making your decision whether to purchase shares of our common stock.

vi

Table of Contents

The following summary contains selected information about us and about this offering. It does not contain all of the information that is important to you and your investment decision. Before you make an investment decision, you should review this prospectus in its entirety, including matters set forth under “Risk Factors” included in this prospectus, as well as the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included in the 2020 Annual Report and the First Quarter 10-Q. Some of the statements in the following summary constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

DRIVEN BRANDS’ OVERVIEW

Driven Brands is the largest automotive services company in North America with a growing and highly-franchised base of more than 4,300 locations across 49 U.S. states and 14 international countries. Our scaled, diversified platform fulfills an extensive range of core consumer and commercial automotive needs, including paint, collision, glass, vehicle repair, oil change, maintenance and car wash. Driven Brands provides a breadth of high-quality and high-frequency services to a wide range of customers who rely on their cars in all economic environments to get to work and in many other aspects of their daily lives. Our asset-light business model generates consistent recurring revenue and strong operating margins, and requires limited maintenance capital expenditures. Our significant free cash flow generation and capital-efficient growth results in meaningful shareholder value creation. Our diversified platform of needs-based service offerings has delivered revenue and Adjusted EBITDA growth at a compound annual growth rate (“CAGR”) of 40% and 31%, respectively, from 2015 to 2020.

We have a portfolio of highly recognized brands that compete in the large, growing, recession-resistant and highly-fragmented automotive care industry. Our U.S. industry is underpinned by a large, growing car parc of more than 275 million vehicles, and is expected to continue its long-term growth trajectory given (i) consumers more frequently outsourcing automotive services due to vehicle complexity; (ii) increases in average repair costs, (iii) average age of the car on the road getting older, and (iv) long-term increases in annual miles traveled. Outside of North America, our international business has a proud 55-year history providing express-style conveyor car wash services across Europe and Australia. Our network generated approximately $904 million in revenue from $3.4 billion in system-wide sales in 2020 and an estimated $704 million in revenue from approximately $2.2 billion in system-wide sales in the six months ended June 26, 2021. Including ICWG for the full 2020 fiscal year, our network would have serviced 50 million vehicles across a diverse mix of customers, with approximately 50% of our system-wide sales coming from retail customers and approximately 50% coming from commercial customers such as fleet operators and insurance carriers. Our success is driven in large part by our mutually beneficial relationships with more than 2,800 individual franchisees and independent operators. Our scale, geographic breadth, and best-in-class shared services provide significant competitive platform advantages. We increased our market share across all segments in the first and second quarters of 2021, and we believe that we are well positioned to continue gaining market share through organic and acquisition growth.

The Driven Brands’ platform enables our portfolio of brands to be stronger together than they are apart. We have invested heavily in the creation of unique and powerful shared services, which provides each brand with more resources and produces better results than any individual brand could achieve on its own. Our locations are strengthened by ongoing training initiatives, targeted marketing enhancements, procurement savings, and cost efficiencies, driving revenue and profitability growth for both Driven Brands and for our franchisees. Our performance is further enhanced by a data analytics engine of approximately 18 billion data elements informed by customers across our thousands of locations at every transaction. Our platform advantages combined with our brand heritage, dedicated marketing funds, culture of innovation, and best-in-class management team have positioned us as a leading automotive services provider and the consolidator of choice in North America.

1

Table of Contents

Driven Brands has a long track record of delivering strong growth through consistent same store sales performance, store count growth, and acquisitions. All of our brands produce highly-compelling unit-level economics and cash-on-cash returns, which results in recurring and growing income for Driven Brands and for our healthy and growing network of franchisees, and we have agreements to open more than 750 new franchised units as of June 26, 2021. Our organic growth is complemented by a consistent and repeatable mergers and acquisitions (“M&A”) strategy, having completed more than 70 acquisitions since 2015. Notably, in August 2020 we acquired ICWG, the world’s largest car wash company by location count with more than 900 locations across 14 countries, demonstrating our continued ability to pursue and execute upon scalable and highly strategic M&A. Our expansion into the car wash segment has been further complemented by the tuck-in acquisitions of more than 60 additional car wash sites since the acquisition of ICWG. Additionally, we have grown our collision service offerings through the acquisitions of CARSTAR in 2015, ABRA in 2019 and Fix Auto USA in 2020, and we have also expanded into adjacent, complementary service offerings, including oil change services through our acquisition of Take 5 in 2016 and glass services in 2019. Within our existing service categories, we believe we have enormous whitespace, with over 12,000 potential locations across North America alone. We are only in first gear.

RECENT GROWTH AND PERFORMANCE

We believe our historical success in driving revenue and profit growth is underpinned by our highly-recognized brands, dedicated marketing funds, exceptional in-store execution, franchisee support, and ability to provide a wide range of high-quality services for our retail and commercial customers. Following the acquisition of the Company by affiliates of Roark in early 2015, we made significant investments in our shared services and data analytics capabilities, which has enabled us to accelerate our growth, as evidenced by the following achievements from 2015 through 2020:

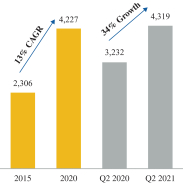

| • | Increased our total store count from 2,306 to 4,227, at a CAGR of 13% |

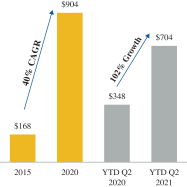

| • | Increased revenue from $168 million* to $904 million(1), at a CAGR of 40% |

| • | Increased system-wide sales from $1.4 billion to $3.4 billion, at a CAGR of 19% |

| • | Generated net income of $3 million in 2015 and net loss of $4 million in 2020 |

| • | Increased Adjusted Net Income from $18 million* to $43 million, at a CAGR of 19% |

| • | Increased Adjusted EBITDA from $53 million to $205 million, at a CAGR of 31% |

| • | Generated Acquisition Adjusted EBITDA(2) of $269 million in 2020 |

Our growth continued in the six months ended June 26, 2021 as compared to the six months ended June 27, 2020, as evidenced by the following achievements and preliminary estimated financial information for the six months ended June 26, 2021:

| • | Increased our total store count from 3,232 to 4,319, growth of 34% |

| • | Increased revenue from $348 million to $704 million, growth of 102% |

| • | Increased system-wide sales from $1.5 billion to $2.2 billion, growth of 46% |

| • | Increased net income from a net loss of $1 million to net income of $15 million |

| • | Increased Adjusted Net Income from $20 million to $72 million, growth of 270% |

| • | Increased Adjusted EBITDA from $71 million to $179 million, growth of 153% |

2

Table of Contents

| STORE COUNT | REVENUE(1) ($MM)

|

SYSTEM-WIDE SALES ($Bn) | ||

|

|

|

| (1) | As described in Note 1 to our consolidated financial statements included in our 2020 Annual Report, we adopted the new revenue recognition standard during the annual period beginning on December 31, 2017. Prior to that time, advertising contributions and related expenditures were not included in the consolidated statements of operations. Revenue for 2020 is inclusive of advertising contributions totaling $60 million in accordance with our adoption of the new revenue recognition standard. The inclusion of advertising contributions in 2020 revenue was responsible for two percentage points of the CAGR from 2015 to 2020. |

| (2) | Acquisition Adjusted EBITDA for 2020 includes the impact of all businesses acquired in 2020 as if such acquisitions had been completed on the first day of our 2020 fiscal year. |

| (3) | We have not yet completed our financial statement review procedures for the six months ended June 26, 2021; such preliminary financial and other data for this period has been prepared by, and is the responsibility of, management based on currently available information. See “Basis of Presentation.” |

| * | These metrics for fiscal 2015 represent pro forma revenue, pro forma net income, pro forma Adjusted Net Income, and pro forma Adjusted EBITDA after giving effect to the acquisition of Driven Holdings LLC by the Company on April 17, 2015, as if it occurred at the beginning of our 2015 fiscal year. See “Summary Historical Consolidated Financial and Other Data” for further discussion and a reconciliation of 2015 pro forma net income, pro forma Adjusted Net Income, and pro forma Adjusted EBITDA. |

Our financial performance and business model are highly resilient across economic cycles, as demonstrated by twelve consecutive years of positive same store sales growth through 2019, including growth through the Great Recession, and positive same store sales growth in the first and second quarters of 2021. In addition, our highly-franchised business model generates consistent, recurring revenue and significant and predictable free cash flow, and we are insulated from the operating cost variability of our franchised locations. The operating costs of franchised locations are borne by the franchisees themselves, and our international locations outside North America utilize an independent operator model whereby a third-party is responsible for site-level labor and receives commissions based on a percent of site revenue from car washes.

OUR OPPORTUNITY: THE LARGE, RECESSION-RESISTANT AND HIGHLY FRAGMENTED AUTOMOTIVE SERVICES INDUSTRY WITH LONG-TERM GROWTH TRENDS

The highly-fragmented U.S. automotive care industry, estimated to be a $300+ billion market in 2019, provides critical needs-based services and replacement components, accessories, and equipment to vehicle owners after initial sale. The core of the industry is a large and growing car parc of more than 275 million vehicles in operation (“VIO”), with an average vehicle age of 12 years. Our VIO sweet spot for repairs and maintenance is the population of vehicles 6 years or older that are outside of manufacturers’ warranty periods and represent the majority of the car parc. This expanding pool of older vehicles consistently requires a variety of

3

Table of Contents

on-going services to remain operable. As a result, the industry has experienced stable and predictable long-term growth trends driven by non-discretionary and non-cyclical demand from end customers who need their vehicles every day. While the industry experienced a 5% decline in 2020 due to the coronavirus pandemic, miles driven in the United States have significantly increased in the first six months of 2021 relative to 2020.

The U.S. automotive care industry has a long track record of consistent growth, having grown at a 3% CAGR from 2007 to 2019, and a 4% CAGR from 2014 to 2019. We believe numerous secular tailwinds will continue to drive predictable long-term industry growth. The addressable market of vehicles in operation is projected to grow along with the average vehicle age, all of which increase the needs for vehicle maintenance and repair. Increasing vehicle complexity is driving higher cost of repairs and greater consumer reliance on “do-it-for-me” (“DIFM”) service providers with specialized knowledge, tools and equipment. These trends continue to drive an increased need for professional DIFM services, premiumization of certain products such as higher-cost motor oils to sustain performance, and increasing average repair order.

In addition to the benefits of the growing car parc and shift in consumer preference towards DIFM, the car wash industry also uniquely benefits from the affordability and frequency-of-use of the services provided. Since our acquisition of ICWG in August 2020, Driven Brands operates in the automated segment of the car wash industry, which accounts for approximately 70% of the total U.S. car wash industry, and which has grown at a 5.2% CAGR in the U.S. between 2015 and 2020, outpacing the 2.5% CAGR of the overall U.S. car wash industry over the same timeframe. Driven Brands’ express-style conveyer car wash services provide a very quick and convenient experience relative to other non-automated car wash services, such as handwashing, and ensures a safe and comfortable experience as the consumer remains in their vehicle during the wash.

All of these secular tailwinds play to Driven Brands’ advantage as the largest automotive services platform in North America. We believe that as a large, scaled chain, Driven Brands will continue to gain market share from independent market participants due to our ability to invest in the required technology, infrastructure, and equipment to service more complex cars, as well as preferences from insurance carriers and fleet operators to work with nationally scaled and recognized chains with broad geographic coverage, extensive service offerings, strong operating metrics and centralized billing services. In addition to services that are essential for vehicles to remain operable, including collision, oil change and repairs, we also provide services through our car wash segment that make consumers feel great about maintaining their vehicles, with a highly convenient, safe and affordable experience.

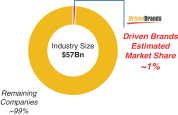

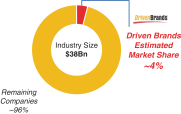

The automotive services industry is highly fragmented, comprised primarily of regional and locally owned and operated independent shops, and offers a significant consolidation opportunity across our segments.

| U.S. Addressable Market for Driven Brands’ Three Largest Segments(1)

|

| Maintenance(1)(2)

|

Car Wash(1)(2)(3)

|

Paint, Collision and Glass(2)(4)

| ||

|

|

| ||

| Highly fragmented industry with top 10 companies representing ~15% of market share(2)(3) | Highly fragmented conveyer car wash industry with top 10 companies representing ~5% market share(2)(3)(4) | Highly fragmented industry with top 5 companies representing ~15% of market share(3)(5) | ||

4

Table of Contents

| (1) | Industry size information is based on 2019 management estimates using internal knowledge in addition to information derived from third party sources. See “Industry and Market Data.” |

| (2) | Percentage of market share based on aggregate store count. |

| (3) | Based on management estimates using internal knowledge in addition to information derived from third party sources. See “Industry and Market Data.” |

| (4) | $9 billion car wash market size represents total car wash industry. Market share figures are based on the share of conveyor car wash location count only rather than share of total car wash industry. |

| (5) | Percentage of market share based on aggregate store count, except for the glass repair component of the Paint, Collision & Glass segment, which is based on revenue. |

OUR COMPETITIVE STRENGTHS AND STRATEGIC DIFFERENTIATION

We believe the following strengths differentiate us from our competitors and enable us to profitably grow our leading market position and drive our continued success.

We Provide an Extensive Suite of Services Retail and Commercial Customers Consistently Need

We believe Driven Brands is the only automotive services platform of scale providing an extensive suite of services to its customers. Our diversified platform is uniquely capable of offering a compelling and convenient service proposition to our customers by providing a wide breadth of services for all vehicle types and across multiple service categories including paint, collision, glass, repair, oil change, maintenance and car wash. Our diverse offerings span a wide range of price points and most of our services are non-discretionary and essential to the customer in any economic environment. Our network generated approximately $904 million in revenue from approximately $3.4 billion in system-wide sales in 2020 and an estimated $704 million in revenue from approximately $2.2 billion in system-wide sales in the six months ended June 26, 2021. Including ICWG for the full 2020 fiscal year, our network would have serviced 50 million vehicles across a diverse mix of customers, with approximately 50% of our system-wide sales coming from retail customers and approximately 50% coming from commercial customers such as fleet operators and insurance carriers. For our commercial customers, we offer a compelling value proposition by providing a “one-stop-shop” for their many automotive service needs through our global footprint of more than 4,300 locations offering an extensive range of complementary and needs-based services.

Platform of Highly Recognized and Long-Standing Brands

We are the largest diversified automotive services platform in North America, and our brands have been providing quality services to retail and commercial customers around the world for over 350 years combined. We believe that the longevity and awareness of our brands, tenure of our franchisees, and the quality and value of our offerings resonate deeply with our customers. Maaco and Meineke have been operating since 1972 and are two of the most recognizable brands in the industry. In addition, Take 5 has been operating since 1984, and CARSTAR has been in operation since 1989. Our brands are supported by highly qualified Driven Brands field operations team members who provide training and operational expertise to our franchisees and company-operated and independently-operated locations to help them deliver best-in-class customer service and drive strong financial performance. Additionally, our brands are supplemented by our continuous brand investment, with more than $1 billion having been spent on marketing over our 49 year history. Our deep and ongoing investment in training, operations and marketing has enabled our brands to stay highly relevant in the evolving marketplace and has helped position our locations as the “go to” destination for our retail and commercial customers’ automotive service needs.

5

Table of Contents

Powerful Shared Services and Data Analytics Engine

We have proactively built and invested in our shared services and data analytics capabilities, which are an integral component of Driven Brands and provide us with a significant competitive advantage and deep defensive moat against our peers. Our platform of centralized marketing support, consumer insights, procurement, training, new store development, finance, technology and fleet services provides significant benefits across the system by driving cost savings, incremental revenue, and sharing of best practices and capabilities across brands. We believe our shared services platform provides each brand with more resources and produces better results than any individual brand could achieve on its own. In addition, we believe the scale provided by our platform increases engagement with third parties and improves our ability to attract and retain employees, franchisees, and customers. We have used our strength and scale to create procurement programs that provide franchisees with lower pricing on supplies than they could otherwise achieve on their own. Our shared services are enhanced by our data analytics engine, which is powered by internally collected data from consumers, their vehicles and services that are provided to us at each transaction and further enriched by third-party data. This powerful data gathering capability results in more than 40 million data elements collected each month and a growing data repository with approximately 18 billion unique elements, which we use throughout our platform for improving our marketing and customer prospecting capabilities, measuring location performance, enhancing store-level operations, and optimizing our real estate site selection. As we grow organically and through acquisition, we believe the power of our shared services and data analytics will grow and will continue to be a key differentiator for our business through strengthening economies of scale, enhanced and accelerated data collection, and continued roll-out of best practices, ultimately driving attractive growth and profitability in our overall business.

Highly Franchised and Independently-Operated Business Model with Attractive Company-operated Unit Economics

We believe our operating model incorporates the best financial attributes of franchised, independently-operated and company-operated businesses. Driven Brands benefits from recurring cash flow streams generated by our highly franchised and independently-operated unit composition as well as the high-growth and high-margin characteristics of our company-operated units. Across all of our brands, our locations generate attractive and consistent cash-on-cash returns and strong brand loyalty from our customers.

Our asset-light business, combined with the geographic and service category diversification of our locations, results in high operating margins and highly stable cash flow generation for Driven Brands that has been consistent throughout economic cycles. Our diverse base of more than 1,900 franchisees has an average tenure with Driven Brands of approximately 14 years, and our franchisees typically work at the locations they operate and are highly engaged with their employees and customers. Our brands have attractive unit level economics, and our franchisees earn strong cash-on-cash returns, averaging 67% at CARSTAR, 50% at Meineke, 48% at Maaco, and 44% at Take 5. Outside of North America, we operate an independent operator model across our more than 730 car wash locations, whereby a third-party is responsible for site-level labor and receives commissions based on a percent of site revenue from car washes. As of June 26, 2021, 82% of our locations were either franchised or independently-operated (and such locations contributed to 26% of total revenue and 82% of total system-wide sales in the six months ended June 26, 2021).

We also benefit from highly-attractive unit economics at our company-operated stores, primarily within our Take 5 brand and our domestic car wash business. Given the high growth and margins at these locations, our invested capital has yielded very strong cash-on-cash returns and expanding our company-operated unit count continues to be an attractive aspect of our growth strategy. The combination of our asset-light franchised units with our attractive and high-growth company-operated locations provides Driven Brands with a compelling mix that result in durable operating margins, a highly attractive growth profile and recurring free cash flow generation.

6

Table of Contents

Proven Ability to Drive and Integrate Highly Accretive M&A

The execution of successful mergers and acquisitions is a core competency of the Driven Brands platform. We have invested in and built out a dedicated team and supporting infrastructure and processes to systematically source, perform due diligence on, acquire and integrate locations. Since 2015, we have completed more than 70 acquisitions. Notably, in August 2020 we acquired ICWG, the world’s largest car wash company by location count with more than 900 locations across 14 countries. Our expansion into the car wash segment has been further complemented by the tuck-in acquisitions of more than 60 additional car wash sites since the acquisition of ICWG. Additionally, we have grown our collision service offerings through the acquisitions of CARSTAR in 2015, ABRA in 2019 and Fix Auto USA in 2020, and we have also expanded into adjacent, complementary service offerings, including oil change services through our acquisition of Take 5 in 2016 and glass services in 2019. Since our initial public offering in January 2021, we have completed 21 tuck-in acquisitions, adding more than 50 stores, including the addition of 18 car wash sites in July 2021 through our acquisition of Frank’s Car Wash Express.

Our acquisition strategy is enhanced by information and data provided by our platform. 1-800-Radiator, for instance, is a very powerful identifier of prospective acquisition targets through its broad customer base of approximately 100,000 automotive shops. Once a company has been acquired, we leverage our shared services to enable the acquired business to benefit from our powerful procurement programs, data analytics capabilities, and training services. Every acquisition has been integrated into Driven Brands on plan and has demonstrated improved performance by being a part of our platform rather than operating as an independent company. We also seek to acquire businesses that make the rest of our platform and team stronger, including capabilities that can be extended to our existing brands, enhance our capture of data or strengthen our commercial customer base. Our track-record of highly-accretive acquisitions, with acquired companies benefiting from rapid growth and immediate synergies, will continue to be a significant part of the growth story for Driven Brands given the expected consolidation in the highly fragmented automotive services industry.

Deep Bench of Talent Poised to Capitalize on Attractive Growth Opportunity

Driven Brands is led by a best-in-class management team with experience managing many multi-billion dollar franchise and automotive service organizations. Our strategic vision is set by our CEO Jonathan Fitzpatrick, who previously served as the Chief Brand and Operations Officer of Burger King, and since joining Driven Brands in 2012, has led our transformation into an industry leading platform. Our highly experienced management team has previously held senior positions at large franchisors, including Burger King and Wendy’s and other global corporations, including Bank of America, General Electric, Lowe’s, Motorola, and United Parcel Service. Our success, growth and platform allow us to continue to attract and retain exceptional talent.

THE STRATEGIES THAT WILL CONTINUE OUR TRACK RECORD OF GROWTH

We expect to drive continued growth and strong financial performance by executing on the following strategies:

Grow Our Brands with New Locations

We have a proven track record of unit growth, having grown our store count at a CAGR of 13% between 2015 and 2020, and we believe our competitive strengths provide us with a solid financial and operational foundation to continue growing our footprint. Based on an extensive internal analysis, we believe we have enormous whitespace, with more than 12,000 potential locations across North America within our existing service categories.

Our franchise growth is driven both by new store openings as well as through conversions of independent market participants that do not have the benefits of our scaled platform. Our attractive unit economics, national

7

Table of Contents

brand recognition, strong insurance and fleet customer relationships and beneficial shared services capabilities provide highly compelling economic benefits for our franchisees resulting in a strong desire to join and stay within our network. We have agreements to open more than 750 new franchised units as of June 26, 2021, which provides us with visibility into future franchise unit growth.

Additionally, we continue to expand our company-operated Take 5 footprint, primarily in Southern U.S. markets, and our domestic company-operated car wash business, both through new greenfield openings as well as tuck-in acquisitions and conversions. Both the oil change and car wash markets in North America are highly fragmented, providing significant runway for continued growth. The success of our company-operated locations is supported by our deep data analytics capabilities that use proprietary algorithms and insights that enable us to identify optimal real estate and make informed site selection decisions. With low net start-up costs and strong sales ramp, company-operated locations provide highly attractive returns, and we believe there is ample whitespace in existing and adjacent markets for continued unit growth.

Continue to Drive Same Store Sales Growth

We have demonstrated an ability to drive attractive organic growth with twelve consecutive years of positive same store sales growth through 2019 and positive same store sales growth in the first and second quarters of 2021. We believe that we are well positioned to continue benefiting from this momentum by executing on the following growth levers:

| • | Continued Commercial Partnership Expansion: We are proactively growing our commercial partnerships and winning new customers by being a highly convenient and cost effective “one-stop-shop” service provider that caters to the extensive suite of automotive service needs for fleet operators and insurance carriers. These customers want to work with nationally scaled and recognized chains with broad geographic coverage, extensive service offerings, strong operating metrics and centralized billing services. We have a growing team dedicated to expanding partnerships with existing commercial customers as well as attracting new national and local customers. |

| • | Continued Growth of Subscription Car Wash Revenue Model: In 2017, ICWG introduced a subscription membership program across its domestic car wash stores, and revenue from this subscription program has grown to 42% of domestic car wash revenue in 2020 and 47% of domestic car wash for the quarter ended June 26, 2021. In addition to fostering strong customer loyalty to our stores, we believe the subscription program also generates predictable and recurring revenue and provides incremental data and customer insights, further strengthening our data analytics capabilities. We believe there is significant opportunity to continue to grow our subscription program. |

| • | Leverage Data Analytics to Optimize Marketing, Product Offerings and Pricing: We have large, dedicated brand marketing funds supported by contributions from our franchisees, and in 2020 we collected and spent approximately $84 million for marketing across our brands. Insights from our data analytics engine enhance our marketing and promotional strategy to drive growth in unit-level performance. For instance, our proprietary data algorithms help optimize lead generation and conversion through personalized, targeted, and timely marketing promotions that provide customers with the optimal offer at the right time. In addition, our data provides insights that are enabling us to identify and roll out new product offerings, improve menu design and optimize pricing structure across our brands. Use cases like these are regularly tested, refined and deployed across our network to drive store performance. |

| • | Benefit from Industry Tailwinds: The U.S. automotive care industry has a long track record of consistent growth, having grown at a 3% CAGR from 2007 to 2019, and a 4% CAGR from 2014 to 2019. We believe that the industry has significant tailwinds that will drive continued growth, including a large and expanding pool of older cars, increasing long-term miles driven trends, a growing need for DIFM services, and increasing average repair order due to more technology and premiumization in vehicles. |

8

Table of Contents

Enhance Margins through Procurement Initiatives and Strengthening Platform Services

In addition to topline growth, Driven Brands has also been able to leverage the strength of the platform to enhance margins for franchised, independently-operated and company-operated locations through the following levers:

| • | Leverage Shared Services and Platform Scale: We expect to continue to benefit from margin improvements associated with our increasing scale and the growing efficiency of our platform. As a result of the investments we have made, we believe our shared services provide substantial operating leverage and are capable of supporting a much larger business than we are today. Driven Brands has also been increasing margins through technology advancements to enhance in-store operations and deploy best-practice training initiatives across the portfolio. |

| • | Utilize Purchasing Strength from Procurement Programs: Driven Brands currently provides franchisees, independently-operated and company-operated locations with lower pricing on supplies than they could otherwise achieve on their own, thereby augmenting the value proposition to new and existing franchisees as well as the earnings of our independently-operated and company-operated locations. Our procurement programs provide us with recurring revenue via supplier rebates and product margin. As we continue to grow organically and through acquisition, we believe we are well-positioned to continue driving lower procurement pricing and more benefits to our overall system. |

We plan to continue to invest in these capabilities that enhance the power of our platform and believe that these platform benefits will continue to provide strong tailwinds to our profits, as well as the profits of our franchisees going forward.

Pursue Accretive Acquisitions in Existing and New Service Categories

We believe that we are optimally positioned to continue our long and successful track record of acquisitions, both in our existing service categories as well as into new, complementary ones, and we also maintain an actionable pipeline of M&A opportunities. Since 2015, we have completed more than 70 acquisitions, and since 2019, the Company expanded into both car wash and glass services, which has provided us with new organic and acquisition growth opportunities in two highly fragmented service categories. In addition, the evolving vehicle technology landscape provides numerous opportunities for Driven Brands to leverage its scale and core competencies to continue to expand our market share. We plan to capitalize on the highly fragmented nature of the automotive services industry by continuing to execute on accretive acquisitions using our proven acquisition strategy and playbook.

RECENT DEVELOPMENTS

Certain Financial Results for the Six Months Ended June 26, 2021

Set forth below are certain preliminary estimates of our results of operations for the six months ended June 26, 2021 as compared to our historical results of operations for the six months ended June 27, 2020. The following information is based on our internal management accounts and reporting as of and for the six months ended June 26, 2021, as compared to our reviewed results for, or financial metrics derived from, the six months ended June 27, 2020. We have not yet completed our financial statement review procedures for the six months ended June 26, 2021 and the foregoing preliminary financial and other data for this period has been prepared by, and is the responsibility of, management based on currently available information. The preliminary results of operations are subject to revision as we prepare our financial statements and disclosure for the six months ended June 26, 2021, and such revisions may be significant. In connection with our quarterly closing and review process for the fiscal quarter with our independent auditors, we may identify items that would require us to make adjustments to the preliminary results of operations set forth above. As a result, the final results and other disclosures for the six months ended June 26, 2021 may differ materially from this preliminary data. This preliminary financial data should not be viewed as a substitute for all financial statements prepared in accordance with U.S. GAAP. Our consolidated financial statements for the six months ended June 26, 2021 will not be available until after this offering is consummated, and consequently, will not be available to you prior to investing in this offering. Grant Thornton LLP has not audited, reviewed, compiled or performed any procedures with respect to the following preliminary financial results. Accordingly, Grant Thornton LLP does not express an opinion or any other form of assurance with respect thereto. For additional information, see “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors.”

9

Table of Contents

The following are our preliminary estimated financial results for the six months ended June 26, 2021 and financial results for the six months ended June 27, 2020:

| Six Months Ended | ||||||||

| (in thousands) | June 26, 2021 | June 27, 2020 | ||||||

| Preliminary financial results: |

||||||||

| Revenue |

$ | 704,247 | $ | 347,930 | ||||

| Net income (loss) |

15,235 | (856 | ) | |||||

| Adjusted Net Income |

72,358 | 19,562 | ||||||

| Adjusted EBITDA |

178,772 | 70,569 | ||||||

The following are our preliminary estimated key performance indicators and financial results by segment for the six months ended June 26, 2021 and key performance indicators and financial results by segment for the six months ended June 27, 2020:

| Six Months Ended | ||||||||

| (in thousands, except store count or as otherwise noted) | June 26, 2021 | June 27, 2020 | ||||||

| System-wide Sales |

||||||||

| Maintenance |

$ | 599,111 | $ | 447,618 | ||||

| Car Wash |

235,295 | — | ||||||

| Paint, Collision & Glass |

1,140,011 | 892,832 | ||||||

| Platform Services |

186,830 | 142,445 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 2,161,247 | $ | 1,482,895 | ||||

|

|

|

|

|

|||||

| Store Count |

||||||||

| Maintenance |

1,485 | 1,426 | ||||||

| Car Wash |

979 | — | ||||||

| Paint, Collision & Glass |

1,655 | 1,608 | ||||||

| Platform Services |

200 | 198 | ||||||

|

|

|

|

|

|||||

| Total |

4,319 | 3,232 | ||||||

|

|

|

|

|

|||||

| Same Store Sales % |

||||||||

| Maintenance |

28.9 | % | (8.8 | %) | ||||

| Paint, Collision & Glass |

12.3 | % | (10.7 | %) | ||||

| Platform Services |

31.1 | % | (1.3 | %) | ||||

|

|

|

|

|

|||||

| Total |

19.2 | % | (8.7 | %) | ||||

|

|

|

|

|

|||||

| Revenue |

||||||||

| Maintenance |

$ | 273,160 | $ | 191,211 | ||||

| Car Wash |

238,579 | — | ||||||

| Paint, Collision & Glass |

94,466 | 74,048 | ||||||

| Platform Services |

79,437 | 66,926 | ||||||

| Corporate and Other |

18,605 | 15,745 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 704,247 | $ | 347,930 | ||||

|

|

|

|

|

|||||

| Segment Adjusted EBITDA |

||||||||

| Maintenance |

$ | 85,001 | $ | 47,805 | ||||

| Car Wash |

77,224 | — | ||||||

| Paint, Collision & Glass |

39,495 | 26,888 | ||||||

| Platform Services |

28,610 | 23,434 | ||||||

| Corporate and other |

(50,864 | ) | (25,756 | ) | ||||

| Store opening costs |

(694 | ) | (1,802 | ) | ||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 178,772 | $ | 70,569 | ||||

|

|

|

|

|

|||||

10

Table of Contents

The following table provides a reconciliation of estimated Adjusted Net Income to estimated net loss for the six months ended June 26, 2021, and Adjusted Net Income to net income (loss) for the six months ended June 27, 2020:

| Six Months Ended | ||||||||

| (in thousands) | June 26, 2021 | June 27, 2020 | ||||||

| Net income (loss) |

$ | 15,235 | $ | (856 | ) | |||

| Acquisition related costs(a) |

2,038 | 1,211 | ||||||

| Non-core items and project costs, net(b) |

2,553 | 1,764 | ||||||

| Sponsor management fees(c) |

— | 1,079 | ||||||

| Straight-line rent adjustment(d) |

5,843 | 2,639 | ||||||

| Equity-based compensation expense(e) |

2,011 | 690 | ||||||

| Foreign currency transaction loss, net(f) |

5,282 | 2,285 | ||||||

| Bad debt expense(g) |

— | 2,842 | ||||||

| Asset impairment and closed store expenses(h) |

2,692 | 6,880 | ||||||

| Loss on debt extinguishment(i) |

45,576 | — | ||||||

| Amortization related to acquired intangible assets(j) |

9,210 | 7,650 | ||||||

|

|

|

|

|

|||||

| Adjusted net income before tax impact of adjustments |

90,440 | 26,184 | ||||||

| Tax impact of adjustments(k) |

(18,082 | ) | (6,622 | ) | ||||

|

|

|

|

|

|||||

| Adjusted Net Income |

$ | 72,358 | $ | 19,562 | ||||

|

|

|

|

|

|||||

The following table provides a reconciliation of estimated Adjusted EBITDA to estimated net loss for the six months ended June 26, 2021, and Adjusted EBITDA to net income (loss) for the six months ended June 27, 2020:

| Six Months Ended | ||||||||

| (in thousands) | June 26, 2021 | June 27, 2020 | ||||||

| Net income (loss) |

$ | 15,235 | $ | (856 | ) | |||

| Income tax expense (benefit) |

12,565 | 221 | ||||||

| Interest expense, net |

34,702 | 35,379 | ||||||

| Depreciation and amortization |

50,275 | 16,435 | ||||||

|

|

|

|

|

|||||

| EBITDA |

112,777 | 51,179 | ||||||

| Acquisition related costs(a) |

2,038 | 1,211 | ||||||

| Non-core items and project costs, net(b) |

2,553 | 1,764 | ||||||

| Sponsor management fees(c) |

— | 1,079 | ||||||

| Straight-line rent adjustment(d) |

5,843 | 2,639 | ||||||

| Equity-based compensation expense(e) |

2,011 | 690 | ||||||

| Foreign currency transaction loss, net(f) |

5,282 | 2,285 | ||||||

| Bad debt expense(g) |

— | 2,842 | ||||||

| Asset impairment and closed store expenses(h) |

2,692 | 6,880 | ||||||

| Loss on debt extinguishment(i) |

45,576 | — | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 178,772 | $ | 70,569 | ||||

|

|

|

|

|

|||||

| a. | Consists of acquisition costs as reflected within the condensed consolidated statements of operations, including legal, consulting and other fees and expenses incurred in connection with acquisitions completed during the applicable period, as well as inventory rationalization expenses incurred in connection with acquisitions. We expect to incur similar costs in connection with other acquisitions in the future and, under GAAP, such costs relating to acquisitions are expensed as incurred and not capitalized. |

| b. | Consists of discrete items and project costs, including (i) third-party consulting and professional fees associated with strategic transformation initiatives and (ii) other miscellaneous expenses, including non-capitalizable expenses relating to the Company’s initial public offering and other strategic transactions. |

11

Table of Contents

| c. | Includes management fees paid to Roark. |

| d. | Consists of the non-cash portion of rent expense, which reflects the extent to which our straight-line rent expense recognized under GAAP exceeds or is less than our cash rent payments. |

| e. | Represents non-cash equity-based compensation expense. |

| f. | Represents foreign currency transaction net losses primarily related to the remeasurement of our intercompany loans. |

| g. | Represents bad debt expense related to uncollectible receivables outside of normal operations. |

| h. | Relates to the impairment of certain fixed assets and operating lease right-of-use assets related to closed locations. Also represents lease exit costs and other costs associated with stores that were closed prior to their respective lease termination dates. |

| i. | Represents the write-off of unamortized discount associated with early termination of debt. |

| j. | Consists of amortization related to acquired intangible assets as reflected within depreciation and amortization in the condensed consolidated statements of operations. |

| k. | Represents the tax impact of adjustments associated with the reconciling items between net income and Adjusted Net Income, excluding the provision for uncertain tax positions and valuation allowance for certain deferred taxes. To determine the tax impact of the deductible reconciling items, we utilized statutory income tax rates ranging from 9% to 38%, depending upon the tax attributes of each adjustment and the applicable jurisdiction. |

Year-over-year growth in consolidated revenue and Adjusted EBITDA for the six months ended June 26, 2021 was primarily the result of acquisitions, new franchise and company-operated units and strong same store sales growth. Operating expenses have increased year-over-year primarily as a result of acquisitions. Specifically, independently-operated store expenses, company-operated store expenses, and depreciation and amortization increased as a result of the growth in unit count year-over-year. However, operating expenses as a percentage of revenue are trending in line with prior quarters.

We present Adjusted EBITDA for the reason described in “Use of Non-GAAP Financial Information.”

INITIAL PUBLIC OFFERING

On January 20, 2021, we completed the initial public offering of shares of common stock. In our initial public offering, we sold 31,818,182 shares of common stock at a purchase price per share of $20.79 (the offering price per share to the public of $22.00 per share minus the underwriting discount and commissions). We used the proceeds from the initial public offering and cash on hand to repay in full certain of our outstanding indebtedness.

On February 10, 2021, the underwriters exercised their over-allotment option granted in the initial public offering, and we sold an additional 4,772,727 shares of common stock at a purchase price per share of $20.79 (the offering price per share to the public of $22.00 per share minus the underwriting discount and commissions). We used approximately $43 million of the net proceeds from this sale we received to purchase 2,067,172 shares of common stock from certain stockholders of the Company and used the remaining net proceeds for general corporate purposes.

Our Principal Stockholders, Driven Equity LLC and RC IV Cayman ICW Holdings LLC, are controlled indirect subsidiaries of Roark Capital Partners III LP (“Roark Capital Partners III”) and Roark Capital Partners IV Cayman AIV LP (“Roark Capital Partners IV”), respectively. Roark Capital Partners III and Roark

12

Table of Contents