Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TRICO BANCSHARES / | tcbk-20216308xk.htm |

| 8-K - 8-K - TRICO BANCSHARES / | tcbk-20210727.htm |

July 2021 Investor Presentation INVESTOR PRESENTATION Second Quarter 2021 Richard P. Smith – President & Chief Executive Officer John S. Fleshood – EVP & Chief Operating Officer Peter G. Wiese – EVP & Chief Financial Officer Exhibit 99.2

July 2021 Investor Presentation SAFE HARBOR STATEMENT The statements contained herein that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond our control. There can be no assurance that future developments affecting us will be the same as those anticipated by management. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the strength of the United States economy in general and the strength of the local economies in which we conduct operations; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market and monetary fluctuations; the impact of changes in financial services policies, laws and regulations; technological changes; weather, natural disasters and other catastrophic events that may or may not be caused by climate change and their effects on economic and business environments in which the Company operates; the continuing adverse impact on the U.S. economy, including the markets in which we operate due to the COVID-19 global pandemic, and the impact of a slowing U.S. economy and increased unemployment on the performance of our loan portfolio, the market value of our investment securities, the availability of sources of funding and the demand for our products; the costs or effects of mergers, acquisitions or dispositions we may make; the ability to execute business plans in new lending market; the future operating or financial performance of the Company, including our outlook for future growth and changes in the level of our nonperforming assets and charge-offs; the appropriateness of the allowance for credit losses, including the timing and effects of the implementation of the current expected credit losses model; any deterioration in values of California real estate, both residential and commercial; the effect of changes in accounting standards and practices; possible other-than-temporary impairment of securities held by us; changes in consumer spending, borrowing and savings habits; our ability to attract and maintain deposits and other sources of liquidity; changes in the financial performance and/or condition of our borrowers; our noninterest expense and the efficiency ratio; competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional providers including retail businesses and technology companies; the challenges of integrating and retaining key employees; the costs and effects of litigation and of unexpected or adverse outcomes in such litigation; a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber-attacks and the cost to defend against such attacks; change to U.S. tax policies, including our effective income tax rate; the effect of a fall in stock market prices on our brokerage and wealth management businesses; the discontinuation of the London Interbank Offered Rate and other reference rates; and our ability to manage the risks involved in the foregoing. Additional factors that could cause results to differ materially from those described above can be found in our Annual Report on Form 10-K for the year ended December 31, 2020, which has been filed with the Securities and Exchange Commission (the “SEC”) and are available in the “Investor Relations” section of our website, https://www.tcbk.com/investor-relations and in other documents we file with the SEC. Annualized, pro forma, projections and estimates are not forecasts and may not reflect actual results. We are under no obligation (and expressly disclaim any such obligation) to update or alter our forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. 2

July 2021 Investor Presentation AGENDA • Most Recent Quarter Recap • Company Overview • Lending Overview • Deposit Overview • Financials 3

July 2021 Investor Presentation MOST RECENT QUARTER HIGHLIGHTS 4 Consistent Profitability • Pre-tax pre-provision ROAA and ROAE were 1.94% and 16.42%, respectively, for the quarter ended June 30, 2021, and 1.76% and 14.05%, respectively, for the same quarter in the prior year. • Management remains focused on disciplined expense management with increases in the current quarter being largely correlated to, loan growth, planned merit increases and seasonal activities. Our efficiency ratio was 53.2% in the current quarter compared to 50.4% in the trailing quarter and 59.7% in the same quarter of the prior year. • Organic earning asset growth along with PPP fee accretion continues to benefit increases in interest income. Growth to Drive Results • Organic non-PPP loan growth exceeded 8% on an annualized basis for the quarter. • While the volume of loan payoffs and paydowns remain elevated, new loan production offices in San Diego, Irvine, and Pasadena are poised to drive future loan growth. The addition of new team members will further promote growth as well as portfolio diversity. • Management is actively monitoring a variety of acquisition opportunities. Net Interest Income and Margin • Net interest margin (FTE) was 3.58% for Q2 2021, compared to 3.74% for Q1 2021 and 4.10% in Q2 2020. • Yields on non-PPP loans were 4.93% for Q2 2021, compared to 5.02% for Q1 2021 and 5.23% in Q2 2020. • Growth in non-interest-bearing deposits continue to drive improved funding costs where total cost of deposits was 0.05% in Q2 2021 compared to 0.12% Q2 2020. Credit Quality • Excluding PPP, loan loss reserves were 1.83% of total loans compared to 1.87% as of March 31, 2021 and 2.07% as of December 31, 2020 . • Nearly 90% of all round one PPP loans have been forgiven by the SBA. • Year-over-year increases in risk graded credits is nearly entirely due to management’s conservative decision to downgrade all COVID deferrals, with upgrades not anticipated until such credits have returned to their scheduled payments and demonstrated at least six months of performance. Diverse Deposit Base • Non-interest-bearing deposits comprise 40.7% of total deposits, and deposits form 97.1% of total liabilities. Capital Strategies • Strength in core earnings is key to self-financed and self-funded growth. • We remain well capitalized across all regulatory capital ratios. • Consistent dividend payments with a history of increases. • Active share repurchase program with demonstrated utilization.

July 2021 Investor Presentation COMPANY OVERVIEW 5

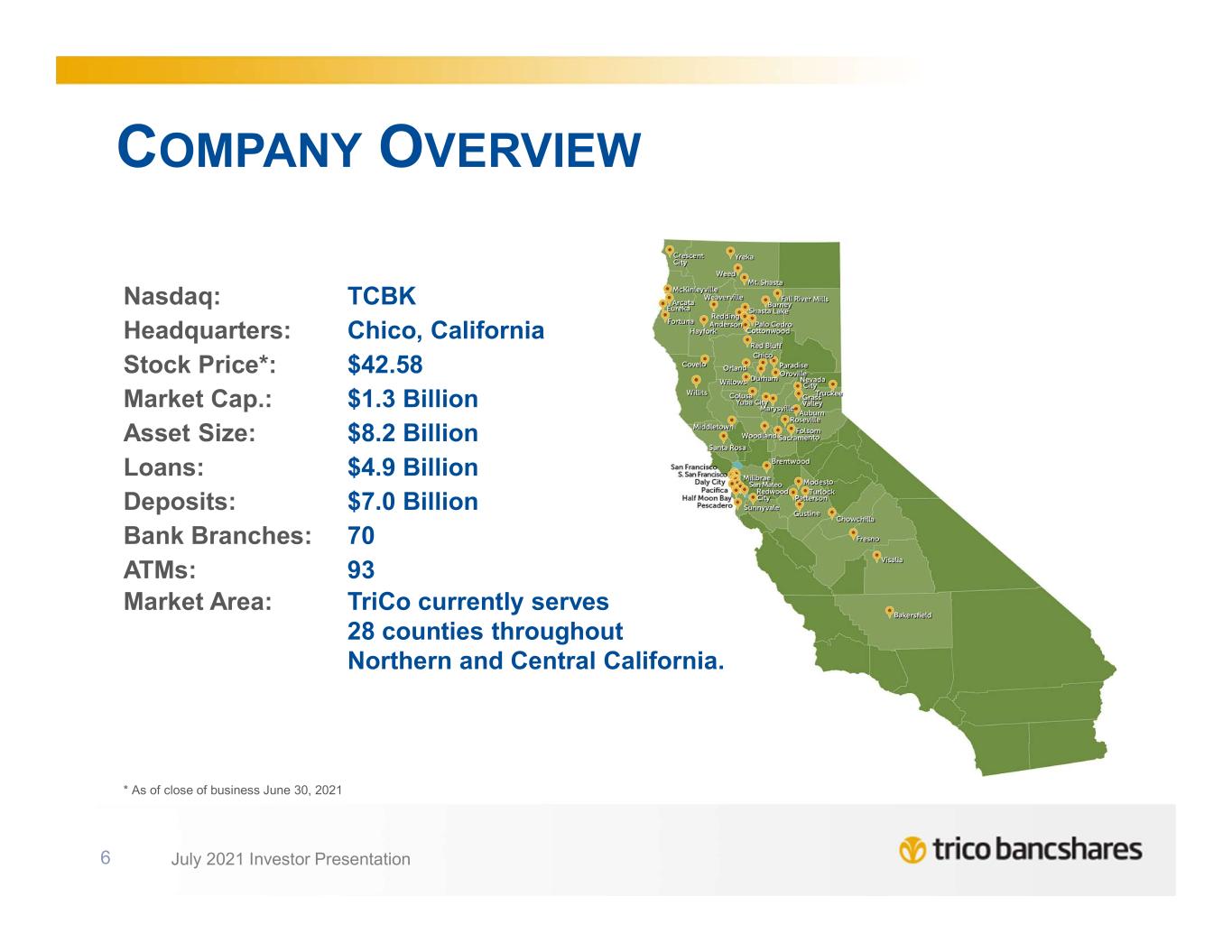

July 2021 Investor Presentation COMPANY OVERVIEW Nasdaq: TCBK Headquarters: Chico, California Stock Price*: $42.58 Market Cap.: $1.3 Billion Asset Size: $8.2 Billion Loans: $4.9 Billion Deposits: $7.0 Billion Bank Branches: 70 ATMs: 93 Market Area: TriCo currently serves 28 counties throughout Northern and Central California. 6 * As of close of business June 30, 2021

July 2021 Investor Presentation EXECUTIVE TEAM 7 Rick Smith President & CEO TriCo since 1993 John Fleshood EVP Chief Operating Officer TriCo since 2016 Dan Bailey EVP Chief Banking Officer TriCo since 2007 Craig Carney EVP Chief Credit Officer TriCo since 1996 Peter Wiese EVP Chief Financial Officer TriCo since 2018 Judi Giem SVP Chief HR Officer TriCo since 2020 Greg Gehlmann SVP General Counsel TriCo since 2017

July 2021 Investor Presentation POSITIVE EARNINGS TRACK RECORD 8 * Impact of the Tax Cut and Jobs Act results in adjusted quarterly diluted EPS of $0.45. Q3'17 Q4'17 * Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Net Income ($MM) $11.9 $3.0 $13.9 $15.0 $16.2 $23.2 $22.7 $23.1 $23.4 $22.9 $16.1 $7.4 $17.6 $23.6 $33.6 $28.4 Qtrly Diluted EPS $0.51 $0.13 $0.60 $0.65 $0.53 $0.76 $0.74 $0.75 $0.76 $0.75 $0.53 $0.25 $0.59 $0.79 $1.13 $0.95 Adj EPS $0.51 $0.45 $0.60 $0.65 $0.53 $0.76 $0.74 $0.75 $0.76 $0.75 $0.53 $0.25 $0.59 $0.79 $1.13 $0.95 $0.00 $0.40 $0.80 $1.20 $0 $4 $8 $12 $16 $20 $24 $28 $32 $36 Q tr ly E P S ( di lu te d ) E a rn in gs ( in M ill io ns )

July 2021 Investor Presentation SHAREHOLDER RETURNS 9 Dividends per Share: 11.5% CAGR* Dividends as % of Earnings Return on Avg. Shareholder Equity Diluted EPS * CAGR based upon 2015 full year to 2021 annualized; all figures through 6/30/2021. $0.11 $0.15 $0.15 $0.17 $0.19 $0.22 $0.25 $0.13 $0.15 $0.17 $0.17 $0.19 $0.22 $0.25 $0.13 $0.15 $0.17 $0.17 $0.22 $0.22 $0.15 $0.15 $0.17 $0.19 $0.22 $0.22 $0.52 $0.60 $0.66 $0.70 $0.82 $0.88 $1.00 2015 2016 2017 2018 2019 2020 2021 Q1 Q2 Q3 Q4 10.04% 9.47% 8.10% 10.75% 10.49% 7.18% 13.16% 2015 2016 2017 2018 2019 2020 2021 $0.36 $0.46 $0.52 $0.60 $0.74 $0.53 $1.13 $0.49 $0.41 $0.58 $0.65 $0.75 $0.25 $0.95 $0.55 $0.53 $0.51 $0.53 $0.76 $0.59 $0.50 $0.54 $0.76 $0.75 $0.79 $1.91 $1.94 $1.74 $2.54 $3.00 $2.16 2015 2016 2017 2018 2019 2020 2021 Q1 Q2 Q3 Q4 31% 31% 37% 27% 27% 41% 24% 2015 2016 2017 2018 2019 2020 2021

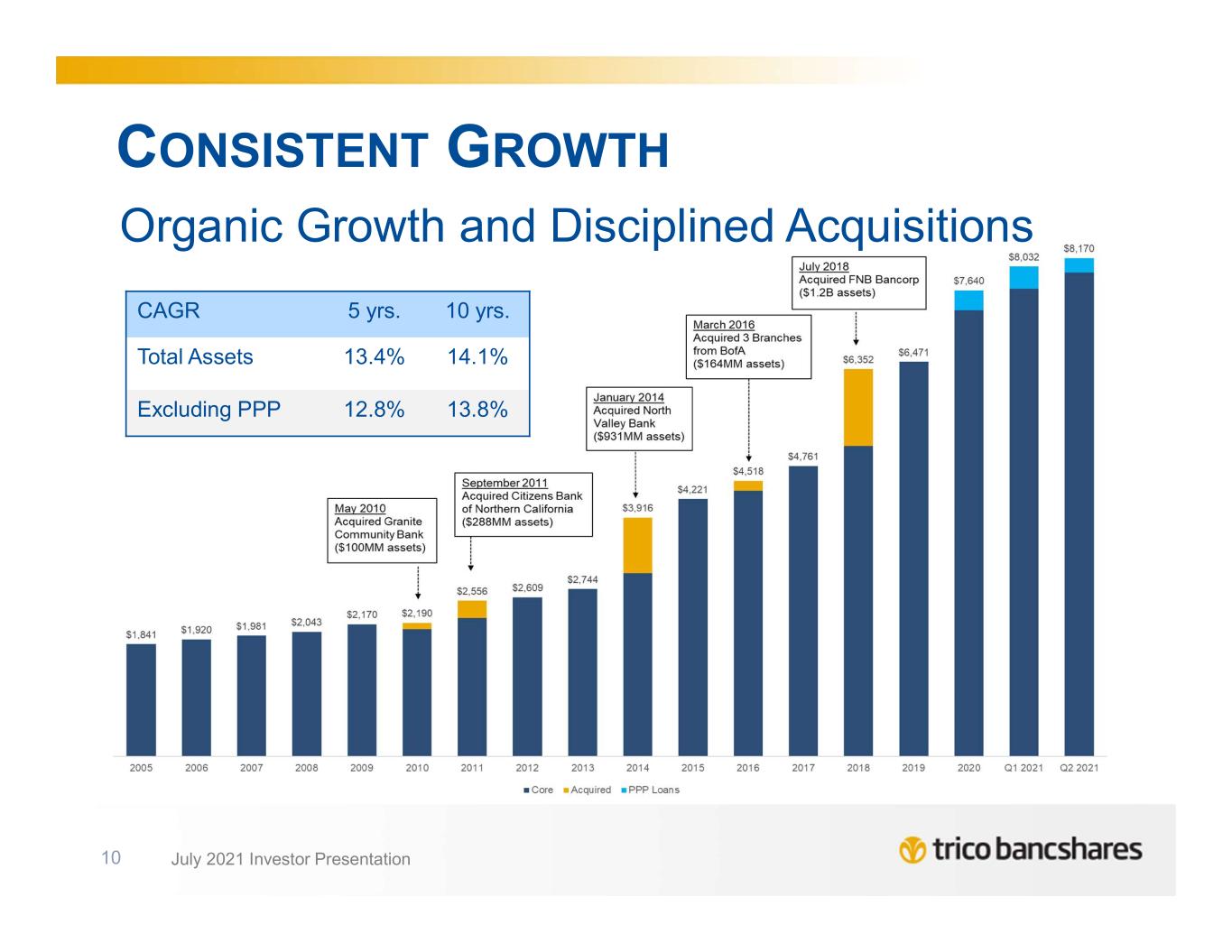

July 2021 Investor Presentation CONSISTENT GROWTH Organic Growth and Disciplined Acquisitions 10 CAGR 5 yrs. 10 yrs. Total Assets 13.4% 14.1% Excluding PPP 12.8% 13.8%

July 2021 Investor Presentation “TOP OF MIND” Executive Management Themes and Topics 11 • Lending in Low and Flat Rate Environment; Transitory Versus Longer Term Impacts of Inflation; and the Timing of Fed Tapering and its Impact on Excess Market Liquidity, Consumer Spending, and Future Deposit Flows • Fiscal Policy Changes – Tax Rates, Timing and Duration of Personal Spending and Consumption, Drivers of Small Business Growth and Competitive Pressures • Life beyond $10 Billion - Building and Growing the Bank of the Future, Including the Timing and Execution of Meaningful Acquisition and Loan Production Office Strategies • Relentless Pursuit of Greater Operational Efficiency • Maintaining Our Culture and Sense of Team…Virtually • Talent Acquisition and Proactive Succession Planning

July 2021 Investor Presentation LOANS AND CREDIT QUALITY 12

July 2021 Investor Presentation CONSISTENT LOAN GROWTH 13 • 2018 includes acquisition of FNB Bancorp (Loan Yield was 5.04%) • End of period balances are presented net of fees and include LHFS. Yields based on average balance and annualized quarterly interest income.

July 2021 Investor Presentation $1,534 $660 $828 $660 $452 $325 $201 $214 $71 $1,597 $579 $577 $514 $631 $357 $279 $187 $80 CRE Non-Owner Occupied CRE-Owner Occupied Multifamily SFR 1-4 Term Commercial & Industrial SFR HELOC and Junior Liens Construction Agriculture & Farmland Auto & Other 2Q-2021 2Q-2020 DIVERSIFIED LOAN PORTFOLIO 14 Note: Dollars in millions, Net Book Value at period end, excludes LHFS; Auto & other includes Leases. Commercial & Industrial includes one Municipality Loan for $2.58 mln. CRE Non-Owner Occupied 31% CRE-Owner Occupied 13%Multifamily 17% SFR 1-4 Term 13% Commercial & Industrial 9% SFR HELOC and Junior Liens 7% Construction 4% Agriculture & Farmland 4% Auto & Other 2%

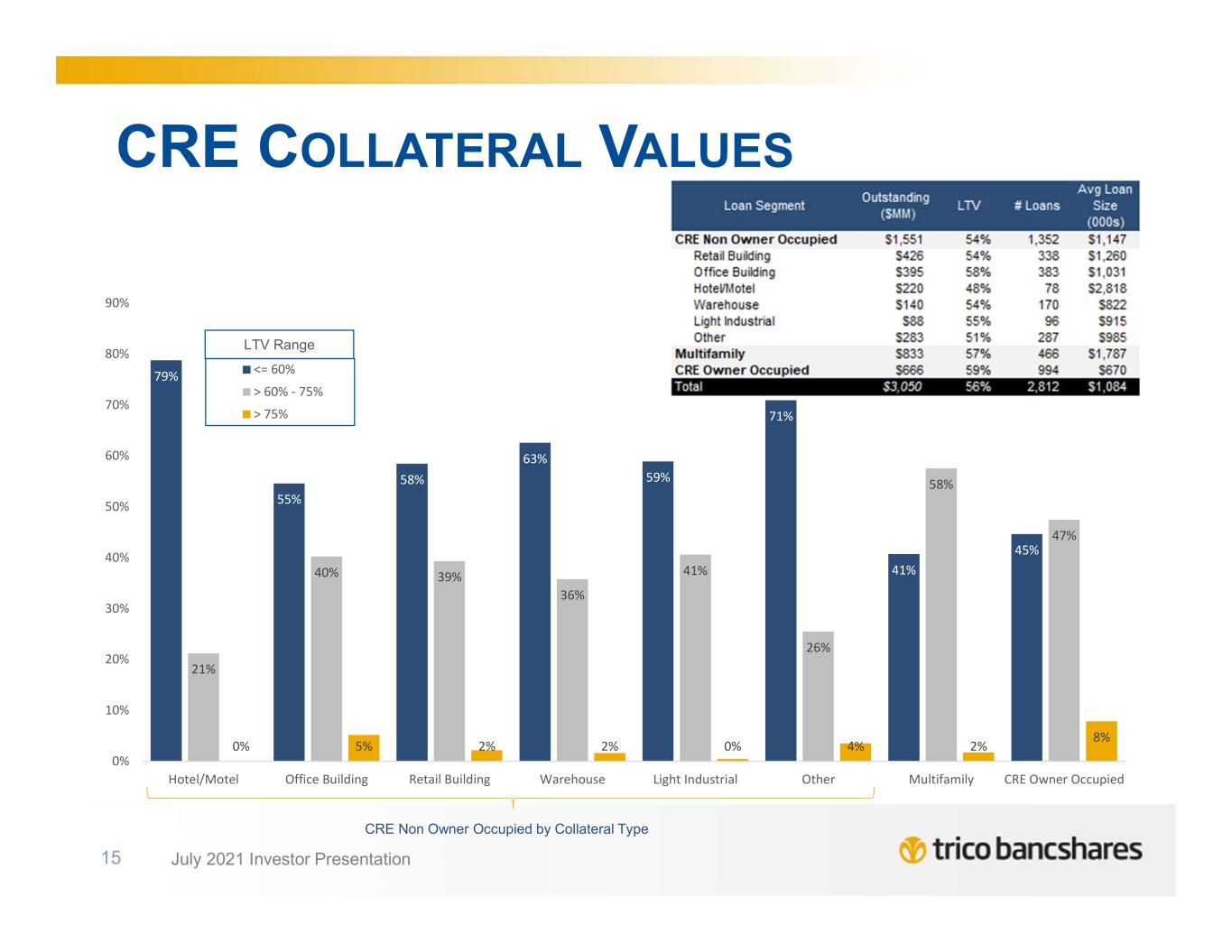

July 2021 Investor Presentation 79% 55% 58% 63% 59% 71% 41% 45% 21% 40% 39% 36% 41% 26% 58% 47% 0% 5% 2% 2% 0% 4% 2% 8% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Hotel/Motel Office Building Retail Building Warehouse Light Industrial Other Multifamily CRE Owner Occupied <= 60% > 60% - 75% > 75% CRE COLLATERAL VALUES 15 LTV Range CRE Non Owner Occupied by Collateral Type

July 2021 Investor Presentation HELOCs – by vintage, with weighted avg. coupon UNFUNDED LOAN COMMITMENTS 16 Outstanding Principal and Commitments exclude unearned fees and discounts/premiums, Leases, DDA Overdraft, and Credit Cards C&I includes PPP loans for $249 million in Outstanding Principal. $1,551 $1,616 $833 $581 $322 $354 $457 $645 $666 $588 $662 $521 $203 $282 $215 $188 $68 $79 $119 $99 $43 $31 $513 $550 $365 $265 $30 $22 $2 $203 $224 $66 $63 $9 $56 2Q-2021 2Q-2020 2Q-2021 2Q-2020 2Q-2021 2Q-2020 2Q-2021 2Q-2020 2Q-2021 2Q-2020 2Q-2021 2Q-2020 2Q-2021 2Q-2020 2Q-2021 2Q-2020 2Q-2021 2Q-2020 CRE Non-Owner Occupied Multifamily SFR HELOC and Junior Liens Commercial & Industrial CRE-Owner Occupied SFR 1-4 Term Construction Agriculture & Farmland Auto & Other Outstanding Principal ($MM) Unfunded Commitment ($MM)

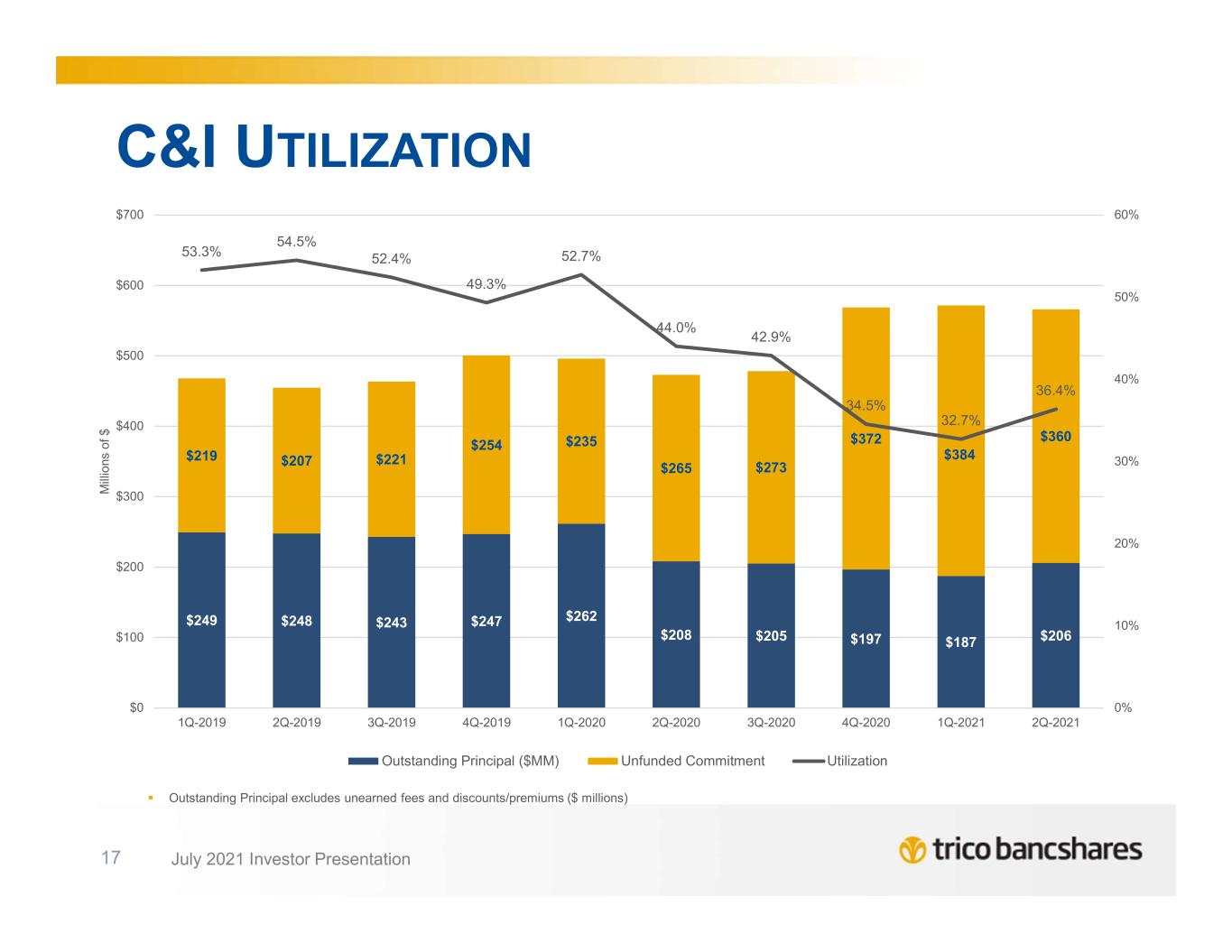

July 2021 Investor Presentation C&I UTILIZATION 17 Outstanding Principal excludes unearned fees and discounts/premiums ($ millions) $249 $248 $243 $247 $262 $208 $205 $197 $187 $206 $219 $207 $221 $254 $235 $265 $273 $372 $384 $360 53.3% 54.5% 52.4% 49.3% 52.7% 44.0% 42.9% 34.5% 32.7% 36.4% 0% 10% 20% 30% 40% 50% 60% $0 $100 $200 $300 $400 $500 $600 $700 1Q-2019 2Q-2019 3Q-2019 4Q-2019 1Q-2020 2Q-2020 3Q-2020 4Q-2020 1Q-2021 2Q-2021 M ill io ns o f $ Outstanding Principal ($MM) Unfunded Commitment Utilization

July 2021 Investor Presentation LOAN YIELD COMPOSITION 18 Dollars in millions, Wtd Avg Rate (weighted average rate) as of 06/30/2021 and based upon outstanding principal; excludes unearned fees and accretion/amortization therein • Variable rate loans at their floor as a percentage of total variable loans has risen marginally since the Q4-2020 total of 88% to 89% in Q2-2021. • The most prominent index for the variable portfolio is 5 Year Treasury CMT Fixed 35% Variable At Floor 58% Variable Above Floor 6% Variable No … Fixed vs. Variable, Total Loans (ex-PPP)

July 2021 Investor Presentation ALLOWANCE FOR CREDIT LOSSES 19 Drivers of Change under CECL Change in reserve for all collectively and individually analyzed loans rated criticized or worse California Unemployment remains the largest driver of qualitative factors As quantitative reserve rates continue to recede through continued recoveries and immaterial losses, Q factor observations support reserve retention Total reserve increase of $0.121 million Q2 2021 Includes volume and mix change due to originations, draws, pay downs, and payoffs While non-PPP volumes increased, construction-to- perm completed RE loans drove lower reserve rates in the period Gross charge offs $387 thousand Gross recoveries $653 thousand 1.73% of Total Loans 1.87% Excluding PPP 1.74% of Total Loans 1.83% Excluding PPP

July 2021 Investor Presentation ALLOWANCE FOR CREDIT LOSSES 20 Allocation of Allowance by Segment

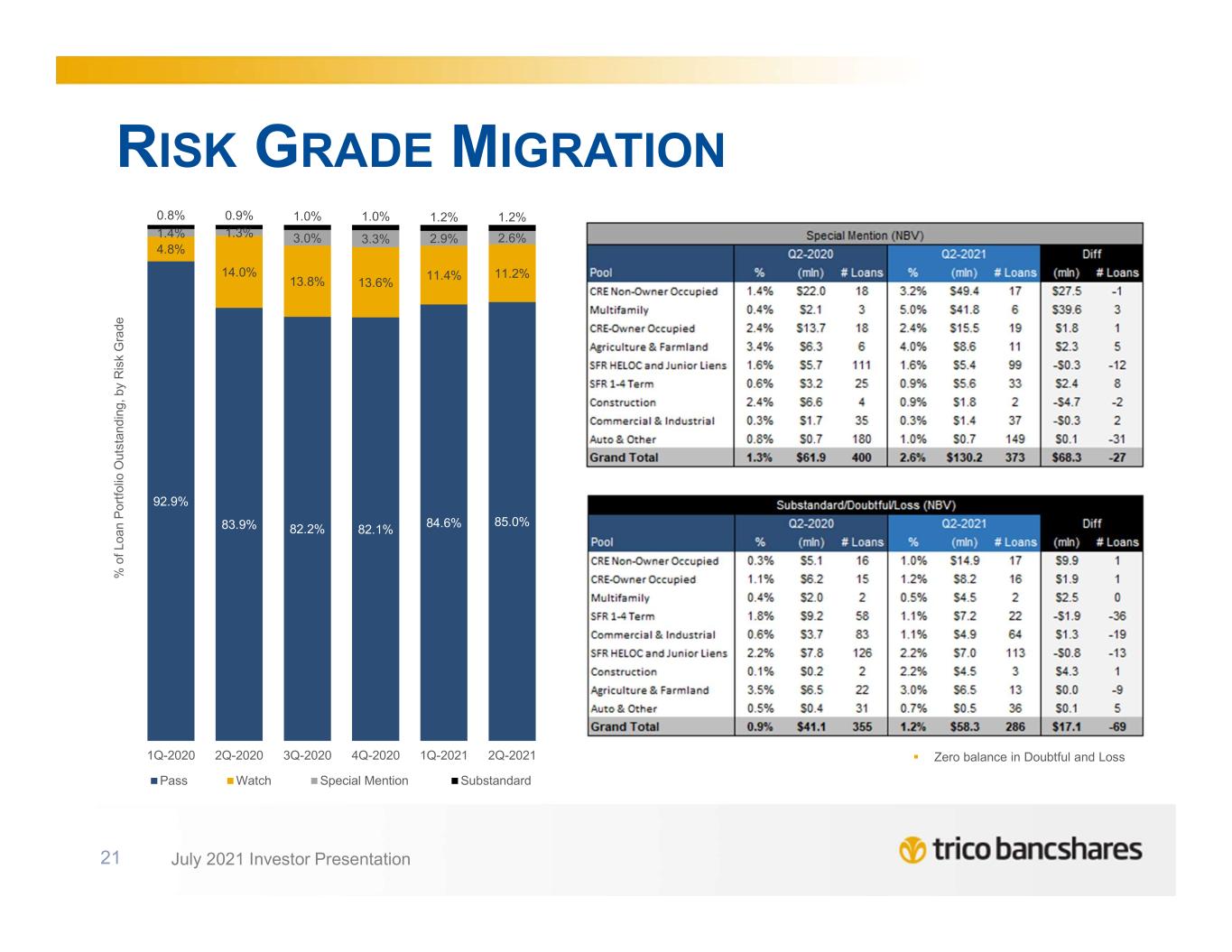

July 2021 Investor Presentation RISK GRADE MIGRATION 21 Zero balance in Doubtful and Loss 85.0%84.6%82.1%82.2%83.9% 92.9% 11.2%11.4% 13.6%13.8% 14.0% 4.8% 2.6%2.9%3.3%3.0%1.3%1.4% 1.2%1.2%1.0%1.0%0.9%0.8% 2Q-20211Q-20214Q-20203Q-20202Q-20201Q-2020 % o f L oa n P or tf ol io O ut st an d in g, b y R is k G ra de Pass Watch Special Mention Substandard

July 2021 Investor Presentation ASSET QUALITY 22 Peer group consists of 99 closest peers in terms of asset size, range $4.1-11.5 Billion source: BankRegData.com NPA and NPL ratios displayed are net of guarantees Coverage Ratio: Allowance as % of Non-Performing Loans NPAs have remained below peers while loss coverage has expanded, first with the adoption of CECL, then through the on-going concerns of the pandemic; resulting in an increase in the coverage ratio of non- performing loans. 0.54% 0.45% 0.45% 0.32% 0.35% 0.30% 0.28% 0.30% 0.31% 0.33% 0.39% 0.39% 0.43% 0.77% 0.64% 0.58% 0.59% 0.61% 0.54% 0.47% 0.73% 0.53% 0.58% 0.75% 0.73% 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 TCBK PeersNon-Performing Assets as a % of Total Assets 118% 120% 124% 174% 159% 180% 193% 343% 385% 395% 342% 297% 263% 1 2 9 % 1 2 5 % 1 3 4 % 1 3 1 % 1 2 9 % 1 4 5 % 1 5 6 % 1 3 9 % 2 0 2 % 1 9 1 % 1 7 9 % 1 8 7 % 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 TCBK Peers

July 2021 Investor Presentation DEPOSITS 23

July 2021 Investor Presentation DEPOSITS: STRENGTH IN FUNDING 24 Total Deposits = $6.99 billion 98.4% of Total Liabilities Liability Mix 06/30/2021 Peer group consists of 99 closest peers in terms of asset size, range $4.7-11.5 Billion; source: BankRegData.com Net Loans includes LHFS and Allowance for Credit Loss; Core Deposits = Total Deposits less CDs > 250k 7 6 .8 7 9 .1 8 0 .7 7 6 .3 7 5 .5 7 8 .1 8 0 .6 8 1 .6 8 1 .6 7 6 .9 7 5 .9 7 2 .7 7 1 .8 7 0 .2 0 20 40 60 80 100 120 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 Loans to Core Deposits TCBK Peers 3 3 .6 3 3 .6 3 2 .8 3 2 .4 3 3 .3 3 3 .6 3 4 .1 3 4 .9 3 9 .8 3 9 .7 3 9 .7 4 0 .3 4 0 .7 0 10 20 30 40 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 Non Interest-bearing Deposits as % of Total Deposits TCBK Peers Non Interest- bearing Demand Deposits, 39.5% Interest-bearing Demand & Savings Deposits, 53.1% Time Deposits, 4.5% Borrowings & Subordinated Debt, 1.4% Other liabilities, 1.6%

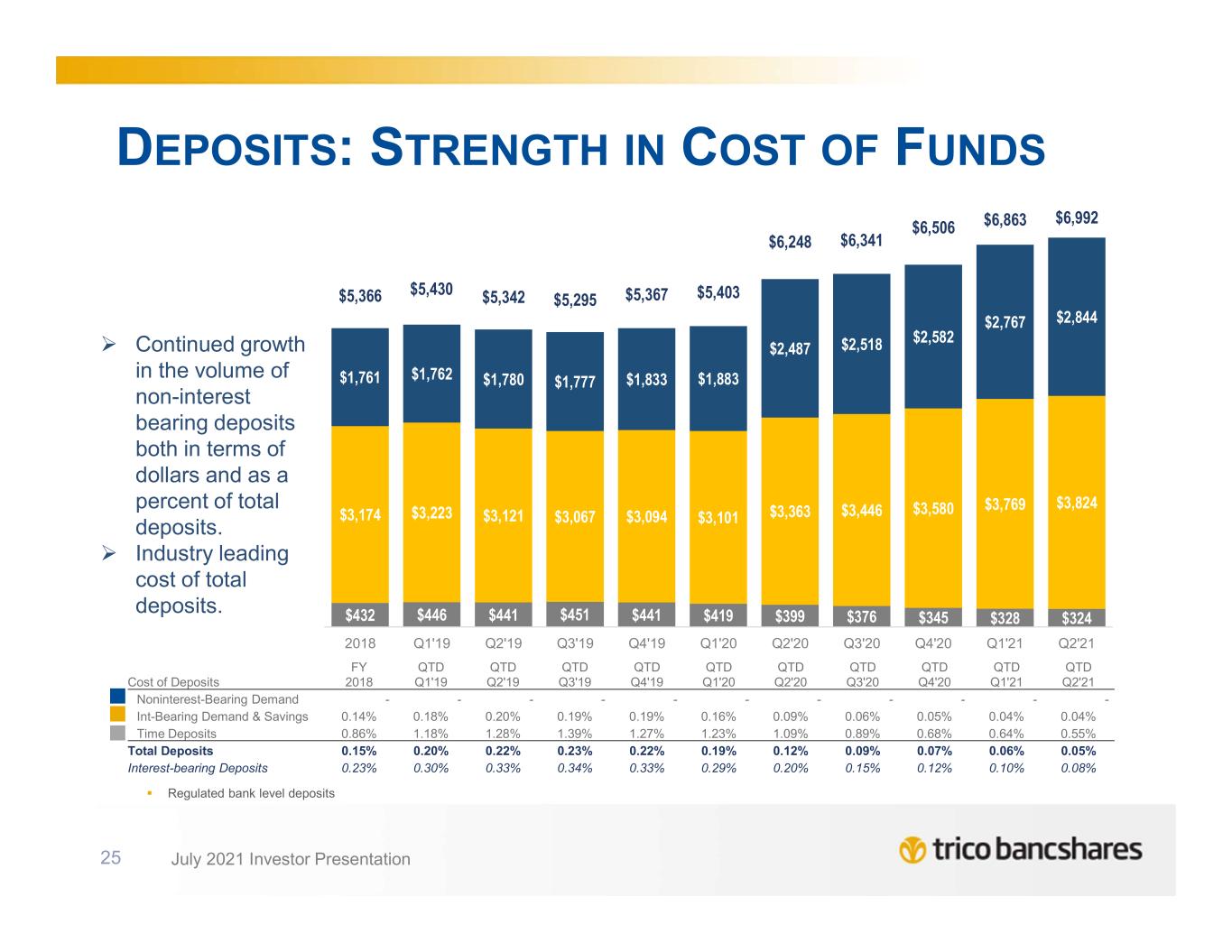

July 2021 Investor Presentation $432 $446 $441 $451 $441 $419 $399 $376 $345 $328 $324 $3,174 $3,223 $3,121 $3,067 $3,094 $3,101 $3,363 $3,446 $3,580 $3,769 $3,824 $1,761 $1,762 $1,780 $1,777 $1,833 $1,883 $2,487 $2,518 $2,582 $2,767 $2,844 $5,366 $5,430 $5,342 $5,295 $5,367 $5,403 $6,248 $6,341 $6,506 $6,863 $6,992 2018 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 DEPOSITS: STRENGTH IN COST OF FUNDS 25 Continued growth in the volume of non-interest bearing deposits both in terms of dollars and as a percent of total deposits. Industry leading cost of total deposits. Regulated bank level deposits Cost of Deposits FY 2018 QTD Q1'19 QTD Q2'19 QTD Q3'19 QTD Q4'19 QTD Q1'20 QTD Q2'20 QTD Q3'20 QTD Q4'20 QTD Q1'21 QTD Q2'21 Noninterest-Bearing Demand - - - - - - - - - - - Int-Bearing Demand & Savings 0.14% 0.18% 0.20% 0.19% 0.19% 0.16% 0.09% 0.06% 0.05% 0.04% 0.04% Time Deposits 0.86% 1.18% 1.28% 1.39% 1.27% 1.23% 1.09% 0.89% 0.68% 0.64% 0.55% Total Deposits 0.15% 0.20% 0.22% 0.23% 0.22% 0.19% 0.12% 0.09% 0.07% 0.06% 0.05% Interest-bearing Deposits 0.23% 0.30% 0.33% 0.34% 0.33% 0.29% 0.20% 0.15% 0.12% 0.10% 0.08%

July 2021 Investor Presentation FINANCIALS 26

July 2021 Investor Presentation CONSISTENT OPERATING METRICS 27 Net Interest Margin (FTE) PPNR as % of Average Assets Efficiency Ratio ROAA 4.32% 4.23% 4.22% 4.30% 4.47% 3.96% 3.66% 2015 2016 2017 2018 2019 2020 Q2 2021 65.1% 68.7% 65.4% 63.7% 59.7% 58.4% 51.8% 2015 2016 2017 2018 2019 2020 Q2 2021 1.11% 1.02% 0.89% 1.24% 1.43% 0.91% 1.57% 2015 2016 2017 2018 2019 2020 Q2 2021 1.79% 1.60% 1.70% 1.73% 1.94% 1.83% 2.02% 2015 2016 2017 2018 2019 2020 Q2 2021

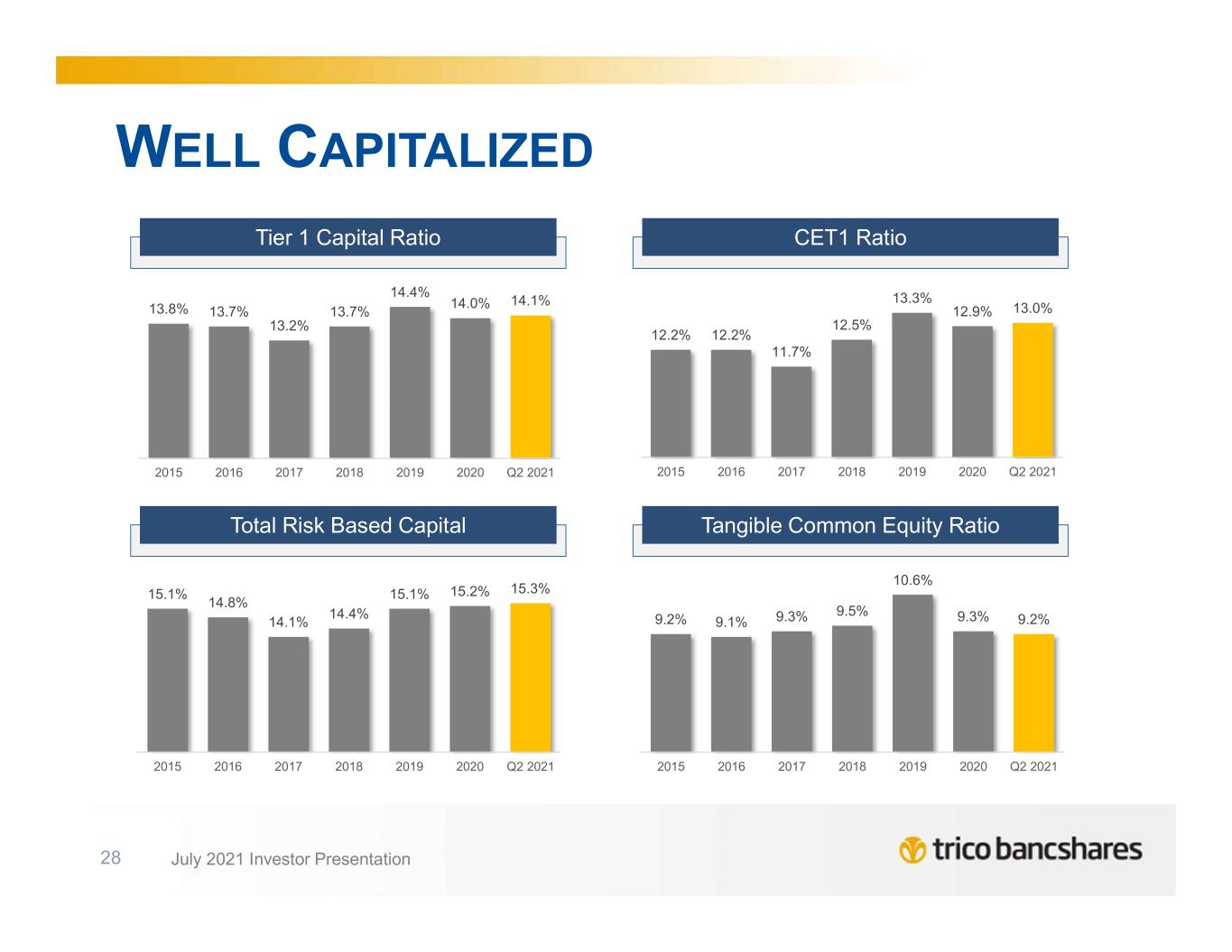

July 2021 Investor Presentation 12.2% 12.2% 11.7% 12.5% 13.3% 12.9% 13.0% 2015 2016 2017 2018 2019 2020 Q2 2021 WELL CAPITALIZED 28 Tier 1 Capital Ratio Total Risk Based Capital CET1 Ratio Tangible Common Equity Ratio 9.2% 9.1% 9.3% 9.5% 10.6% 9.3% 9.2% 2015 2016 2017 2018 2019 2020 Q2 2021 13.8% 13.7% 13.2% 13.7% 14.4% 14.0% 14.1% 2015 2016 2017 2018 2019 2020 Q2 2021 15.1% 14.8% 14.1% 14.4% 15.1% 15.2% 15.3% 2015 2016 2017 2018 2019 2020 Q2 2021

July 2021 Investor Presentation29 August 2020