Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Weber Inc. | d39834dex232.htm |

| EX-23.1 - EX-23.1 - Weber Inc. | d39834dex231.htm |

| EX-21 - EX-21 - Weber Inc. | d39834dex21.htm |

| EX-10.23 - EX-10.23 - Weber Inc. | d39834dex1023.htm |

| EX-10.15 - EX-10.15 - Weber Inc. | d39834dex1015.htm |

| EX-10.14 - EX-10.14 - Weber Inc. | d39834dex1014.htm |

| EX-10.13 - EX-10.13 - Weber Inc. | d39834dex1013.htm |

| EX-10.12 - EX-10.12 - Weber Inc. | d39834dex1012.htm |

| EX-10.11 - EX-10.11 - Weber Inc. | d39834dex1011.htm |

| EX-5.1 - EX-5.1 - Weber Inc. | d39834dex51.htm |

| EX-1.1 - EX-1.1 - Weber Inc. | d39834dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 27, 2021.

Registration No. 333-257824

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Weber Inc.

(Exact Name of Registrant as Specified in Its Charter)

| DELAWARE | 3630 | 61-1999408 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1415 S. Roselle Road

Palatine, Illinois 60067

(847) 934-5700

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Chris M. Scherzinger Chief Executive Officer 1415 S. Roselle Road

Palatine, Illinois 60067 (847) 934-5700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Michael Kaplan Pedro J. Bermeo Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Richard A. Fenyes Joshua Ford Bonnie |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☐ | |

| Emerging growth company ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title Of Each Class Of Securities To Be Registered |

Amount to be registered(1) |

Proposed Maximum offering price per share(2) |

Proposed Offering Price(2) |

Amount Of Registration Fee(3) | ||||

| Class A common stock, par value $0.001 per share |

53,906,250 |

$17.00 | $916,406,250 |

$99,980 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes additional shares of Class A common stock that the underwriters have the option to purchase. See “Underwriting.” |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933. |

| (3) | Of this amount, $10,910 was previously paid in connection with the initial filing of this Registration Statement on July 12, 2021. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated July 27, 2021

Preliminary Prospectus

46,875,000 shares

Class A Common Stock

Weber Inc.

Weber Inc. is offering 46,875,000 shares of its Class A common stock. This is our initial public offering and no public market exists for our Class A common stock. We anticipate that the initial public offering price of our Class A common stock will be between $15.00 and $17.00 per share.

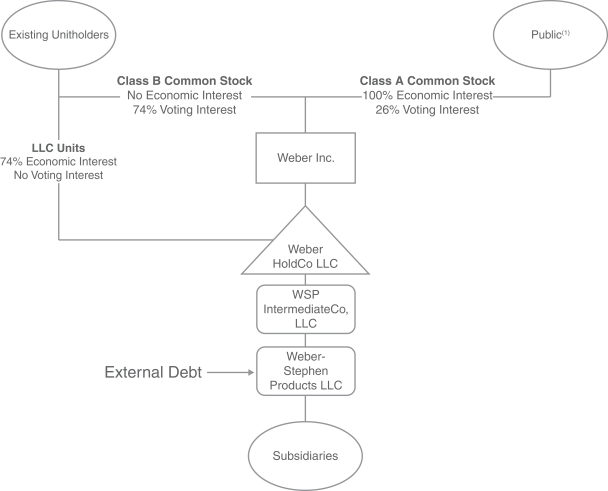

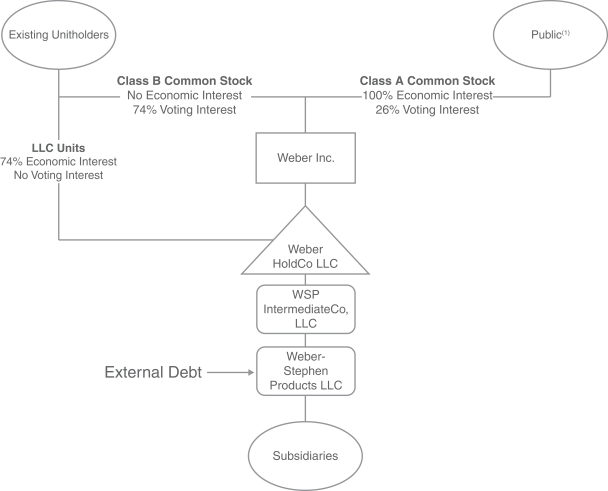

Upon completion of this offering, we will have two classes of common stock: Class A common stock and Class B common stock. The Class A common stock offered hereby will have one vote per share and economic rights and the Class B common stock will have one vote per share but no economic rights. Upon completion of this offering, the Pre-IPO LLC Members (as defined herein), including entities controlled by BDT Capital Partners, LLC, our sponsor, and certain members of management, will hold shares of Class B common stock that will entitle them to 74% of the combined voting power of our common stock (or 71% if the underwriters exercise their option to purchase additional shares of Class A common stock in full). In addition, entities controlled by BDT Capital Partners, LLC will be able to control any action requiring the general approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws and the approval of any merger or sale of the Company or substantially all of our assets. As a result, we will be a “controlled company” within the meaning of the New York Stock Exchange (“NYSE”) rules. See “Management—Board Structure—Controlled Company Exception.”

We are a holding company, and immediately after the consummation of the Reorganization Transactions (as defined herein) and this offering our principal asset will be our ownership interests in Weber HoldCo LLC. As the sole managing member of Weber HoldCo LLC, we will operate and control all of the business and affairs of Weber HoldCo LLC and, through Weber HoldCo LLC and its subsidiaries, conduct our business. See “Organizational Structure.”

We will use all of the net proceeds we receive from this offering (i) to purchase new membership interests of Weber HoldCo LLC, which we refer to as “LLC Units,” from Weber HoldCo LLC, (ii) to purchase LLC Units from certain Pre-IPO LLC Members and (iii) to repurchase a portion of our Class A common stock received by the Blocker equityholders (as defined below) in connection with the Reorganization Transactions, in each case at a price per LLC Unit and share of Class A common stock, as applicable, equal to the initial public offering price of our Class A common stock minus underwriting discounts. We will cause Weber HoldCo LLC to use the proceeds from the sale of LLC Units to Weber Inc.: (i) to pay fees and expenses in connection with this offering and the Reorganization Transactions; (ii) to repay a portion of the outstanding borrowings under our Secured Credit Facility (as defined herein) and (iii) for general corporate purposes. See “Use of Proceeds.” Weber HoldCo LLC will not receive any proceeds from purchase of LLC Units from certain Pre-IPO LLC Members by us or the repurchase of shares of Class A common stock by us.

We have applied to list our Class A common stock on the NYSE under the symbol “WEBR.”

Investing in our Class A common stock involves risk. See “Risk Factors” beginning on page 37.

Neither the Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to us before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of compensation to be paid to the underwriters. |

We have granted the underwriters the option to purchase an additional 7,031,250 shares of Class A common stock from us at the initial public offering price less the underwriting discount within 30 days of the date of this prospectus.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2021 through the book-entry facilities of The Depository Trust Company.

| Goldman Sachs & Co. LLC | BofA Securities | J.P. Morgan |

| BMO Capital Markets | Citigroup | UBS Investment Bank | Wells Fargo Securities | KeyBanc Capital Markets | ||||

| Academy Securities | Cabrera Capital Markets LLC | Siebert Williams Shank | Telsey Advisory Group |

The date of this prospectus is , 2021.

Table of Contents

| Page | ||||

| 1 | ||||

| 37 | ||||

| 79 | ||||

| 80 | ||||

| 86 | ||||

| 88 | ||||

| 89 | ||||

| Unaudited Pro Forma Condensed Consolidated Financial Information |

91 | |||

| 102 | ||||

| 104 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

107 | |||

| 142 | ||||

| 144 | ||||

| 167 | ||||

| 174 | ||||

| 197 | ||||

| 206 | ||||

| 209 | ||||

| Material U.S. Federal Tax Considerations for Non-U.S. Holders of Common Stock |

217 | |||

| 220 | ||||

| 222 | ||||

| 229 | ||||

| 229 | ||||

| 230 | ||||

| F-1 | ||||

In this prospectus, unless the context otherwise requires, “Weber,” the “Company,” “we,” “us” and “our” refer (i) prior to the consummation of the reorganization transactions described under “Organizational Structure—The Reorganization Transactions,” to Weber-Stephen Products LLC and its subsidiaries and (ii) after the reorganization transactions described under “Organizational Structure—The Reorganization Transactions,” to Weber Inc., Weber HoldCo LLC, Weber-Stephen Products LLC and their subsidiaries. “Fiscal year” refers to the year ended September 30 of a particular year. Unless otherwise stated or the context otherwise requires, all information in this prospectus reflects the consummation of the Reorganization Transactions.

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We are offering to sell, and seeking offers to buy, shares of Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of Class A common stock. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

i

Table of Contents

Market and Industry Data

This prospectus includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys, including (i) Frost & Sullivan: Grill Market Study, an independent third-party market study we commissioned in May 2021, (ii) MetrixLab; Brand Health & Habits Study and (iii) Hunter PR’s Food Study Special Report, filings of public companies in our industry and internal company surveys. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein.

This prospectus includes references to our Net Promoter Score (NPS). A Net Promoter Score is a metric used for measuring consumer satisfaction and loyalty. We calculate our Net Promoter Score annually through an outside agency by asking a sample of consumers the following question: “How likely are you to recommend the Weber brand to a friend or colleague?” Consumers are then given a scale from 0 (labeled as “Not at all likely to recommend”) to 10 (labeled as “Extremely Likely to recommend”). Consumers rating us 6 or below are considered “Detractors”, 7 or 8 are considered “Passives”, and 9 or 10 are considered “Promoters”. To calculate our Net Promoter Score, we subtract the total percentage of Detractors from the total percentage of Promoters. For example, if 50% of overall respondents were Promoters and 10% were Detractors, our Net Promoter Score would be 40. Net Promoter Scores can range from -100 to 100. The Net Promoter Score gives no weight to consumers who decline to answer the survey question, and is asked among current grill owners about the grill brand they use most often. This method is substantially consistent with how other businesses and industries typically calculate their Net Promoter Score. Our Net Promoter Scores disclosed in this

prospectus were derived from sample sizes of 159 consumers in the U.S., 142 consumers in Germany and 266 consumers in Australia.

The sources of certain statistical data, estimates, and forecasts contained in this prospectus are provided below:

| • | United Nations |

| • | OECD (HM1-5-Housing-stock-by-dwelling-type) |

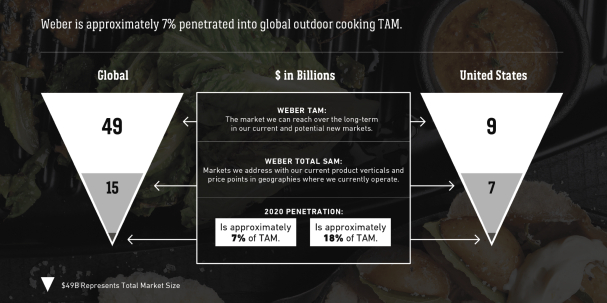

Statistics and estimates related to our Total Addressable Market, or TAM, and Serviceable Addressable Market, or SAM, are based on internal reports conducted with the assistance of our third-party marketing partner, Frost & Sullivan, Inc. In order to determine our TAM and SAM, we conducted a multi-regional survey of 4,089 consumers living in the United States, Canada, France, Germany, Australia, Argentina, Mexico and Brazil, surveying a minimum of 500 respondents per country.

Consumer responses to the survey, combined with external research, were used as the basis for determining our TAM and SAM by weighing such responses to population censuses based on poverty rate, dwelling type, grill ownership, and consumer spend for fuel and accessories. To calculate our TAM, we identified the total number of relevant households (excluding households in poverty and households without outdoor space) in 117 countries. Multiplying an annual grill spend by the targeted grill owner households, we then calculated the total grill TAM. To calculate the TAM for fuel and accessories, we considered an income level-dependent percentage of grill spend. Adding total global TAM for grills, fuel and accessories resulted in the total global TAM.

ii

Table of Contents

In lieu of the top-down approach taken for TAM estimates, for SAM we estimated unit market share and price points for major players in the grill market in Weber’s top five countries (United States, Canada, France, Germany and Australia). To calculate the fuel costs, we considered the total number of relevant households multiplied by total spend by fuel for each specific fuel type. We then considered the total grill SAM and multiplied by 25% to calculate the total accessories spend. Adding total grill, fuel and accessories costs resulted in total SAM for the five countries noted above. We then assumed the percentage for which the top five countries accounted to find the global SAM.

Trademarks, Trade Names and Service Marks

This prospectus contains references to a number of trademarks, trade names and service marks which include our registered trademarks or service marks, such as “Weber,” “Weber Connect,” “Weber Grill Academy,” “Summit,” “SmokeFire,” “Pulse” and “Genesis,” or trademarks, trade names or service marks for which we have pending applications or common law rights. This prospectus also contains trademarks, trade names, and service marks of third parties which, to our knowledge, are the property of their respective holders. Solely for convenience, (i) references in this prospectus to trademark(s) shall also include service mark(s) and (ii) the trademarks, trade names and service marks referred to in this prospectus may appear without the TM and ® symbols, but the absence of such symbols is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to such trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Non-GAAP Financial Measures

We provide supplemental non-GAAP financial measures that our management utilizes to evaluate our ongoing financial performance and provide additional insight to investors as supplemental information to our U.S. GAAP (as defined below) results. The use of non-GAAP financial information should not be considered as an alternative to, or more meaningful than, the comparable U.S. GAAP measures. In addition, because our non-GAAP measures are not determined in accordance with U.S. GAAP, it is susceptible to differing calculations, and not all comparable or peer companies may calculate their non-GAAP measures in the same manner. As a result, the non-GAAP financial measures presented in this prospectus may not be directly comparable to similarly titled measures presented by other companies.

We refer in this prospectus to the following non-GAAP financial measures:

| • | Adjusted income from operations; |

| • | Adjusted net income; |

| • | EBITDA; and |

| • | Adjusted EBITDA. |

These non-GAAP financial measures are not prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). They are supplemental financial measures of our performance only, and should not be considered substitutes for net income, income from operations or any other measure derived in accordance with U.S. GAAP.

As used in this prospectus, these non-GAAP financial measures have the following meanings:

| • | Adjusted income from operations is income from operations adjusted for non-cash stock compensation / Management Incentive Plan (“LTIP”) and profits interest expense, business transformation costs, operational transformation costs, impairment costs, debt refinancing and |

iii

Table of Contents

| IPO costs, COVID-19 costs, foreign currency (loss) gain, and gain on disposal of assets. Adjusted income from operations excludes loss from early extinguishment of debt, interest expense, net, income taxes and loss (gain) from investments in unconsolidated affiliates; |

| • | Adjusted net income is net income adjusted for non-cash stock compensation / LTIP and profits interest expense, business transformation costs, operational transformation costs, impairment costs, debt refinancing and IPO costs, COVID-19 costs, loss from early extinguishment of debt, and gain on disposal of assets held for sale, net of the tax impact of such adjustments; |

| • | EBITDA is net income before interest expense, net, income taxes, and depreciation and amortization; and |

| • | Adjusted EBITDA is net income before interest expense, net, income taxes, depreciation and amortization, adjusted for non-cash stock compensation / LTIP and profits interest expense, business transformation costs, operational transformation costs, impairment costs, debt refinancing and IPO costs, COVID-19 operational costs, loss from early extinguishment of debt, and gain on disposal of assets held for sale. |

Adjusted income from operations and adjusted net income are key metrics used by management and our board of directors to assess our financial performance. We use adjusted income from operations and adjusted net income as indicators of the productivity, profitability and performance of our business and our ability to manage expenses, after adjusting for certain one-time expenses. For a reconciliation of adjusted income from operations to income from operations and adjusted net income to net income, see “Prospectus Summary—Summary Historical and Unaudited Pro Forma Condensed Consolidated Financial Data.”

EBITDA and adjusted EBITDA are key metrics used by management and our board of directors to assess our financial performance. We use EBITDA and adjusted EBITDA to supplement U.S. GAAP measures of performance to evaluate the effectiveness of our business strategies, to make budgeting decisions, and to compare our performance against that of other companies using similar measures.

Our use of the terms adjusted income from operations, adjusted net income, EBITDA and adjusted EBITDA may vary from the use of similar terms by other companies in our industry and accordingly may not be comparable to similarly titled measures used by other companies.

The non-GAAP financial measures used in this prospectus have not been reviewed or audited by our or any independent registered public accounting firm.

Adjusted income from operations, adjusted net income, EBITDA and adjusted EBITDA have important limitations as analytical tools. For example:

| • | All metrics do not reflect changes in, or cash requirements for, our working capital; |

| • | Adjusted income from operations, adjusted net income and adjusted EBITDA do not reflect the impact of certain expenses, including cash charges, resulting from matters we consider not to be indicative of our core operations, and do not reflect stock-based compensation expense and other non-cash charges or awards under our Management Incentive Compensation Plan, which have historically settled in cash but will be restructured to settle in stock of Weber Inc. in connection with this offering; |

| • | Adjusted net income, EBITDA and adjusted EBITDA exclude certain tax payments that may represent a reduction in cash available to us; and |

| • | EBITDA and adjusted EBITDA do not account for any cash capital expenditure requirements for the assets being depreciated and amortized that may have to be replaced in the future, nor do they reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt. |

iv

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, including the sections titled “Risk factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus, before deciding whether to purchase shares of our Class A common stock.

Our Mission and Purpose

Our mission at Weber is to lead the outdoor cooking industry by innovating breakthrough new products and services that enhance our global consumers’ grilling experiences. Our purpose is to ignite inspiration and discovery through everything we do, at every touchpoint with our consumers. Grilling is about making delicious food, bringing people together and creating memories. Weber is an experience, a passion, a way of life and a journey to discover what grilling can be.

Who We Are

We are the leading outdoor cooking company with the strongest and most trusted brand in the global outdoor cooking market. Our founder George Stephen, Sr., established the outdoor cooking category when he invented the original charcoal grill nearly 70 years ago. In the decades since, we have built a loyal and global following of both grilling enthusiasts and barbeque professionals in backyards all around the world. We have continuously disrupted and led the outdoor cooking category, through a comprehensive and expanding product portfolio including traditional charcoal grills, gas grills, smokers, pellet and electric grills, and recently our cutting-edge Weber Connect™ technology-enabled grills. We believe we offer the most complete outdoor cooking portfolio globally, with our full range of premium products sold in 78 countries in fiscal 2020.

We believe Weber is the only outdoor cooking brand with global scale and a vertically integrated manufacturing platform. Our track record of premium product innovation and the strength of our brand has led to a market-leading share of 23% in the U.S. and 24% globally in 2020, according to Frost & Sullivan. We are leaders in the largest and most attractive markets in outdoor cooking, including the U.S., Germany, Australia, Canada and France. Beyond these markets, we estimate that we have either the number one or number two brand position in each of the key geographies we serve.

We have spent decades building brand affinity and awareness by teaching people how to grill the “Weber Way.” By consistently delivering high-performing, differentiated products and best-in-class customer service, we have built a global community of passionate brand loyalists who value our innovation, uncompromising quality and performance. Over the years, families have passed down their affinity for Weber from one generation to the next, forging a deep emotional connection between consumers and our brand. We continue to deepen our relationship with our consumers by bringing innovation to our grill and accessory portfolio, introducing breakthrough connected products, expanding into new categories, and providing engaging brand experiences.

Product Innovation and Technology

Weber has developed one of the most technologically advanced outdoor cooking portfolios in the industry, and maintains a diverse product portfolio across fuel types, pricing tiers, and a wide range of

1

Table of Contents

accessories, consumables and services. We consistently maintain an uncompromising commitment to exceptional quality and innovative ways to cook outdoors. Accelerated technology adoption in and around the home and new home buying occasions create opportunities to further integrate our brand into the daily lives of our consumers.

With the 2020 introduction of our connected grilling platform, Weber Connect™, we continue to be at the forefront of innovation in the outdoor cooking industry. Weber Connect brings together cutting-edge grilling technology, a mobile app and a cloud-based infrastructure on a single interconnected platform. We believe that our connected products make grilling the perfect meal simple with our smartphone-enabled, step-by-step cooking experience. The Weber Connect platform is powered by June OS, our award-winning smart cooking software solution developed by June Life. In 2018, we made a minority investment in June Life and entered into a license and development agreement. In January 2021, we acquired the company in full to further enhance our leadership position in connected outdoor cooking.

2

Table of Contents

Our current product portfolio includes:

3

Table of Contents

Omni-Channel Strategy

We bring our products to market through a diverse and powerful omni-channel network comprised of wholesale, direct-to-consumer (“DTC”) and e-commerce channels. Our wholesale channel is made up of 4,710 retailers with 31,690 physical locations. We work with leading global, regional and large multi-national retailers such as Costco Wholesale, The Home Depot, Lowe’s Companies, and Walmart Inc., as well as European retailers including Bauhaus and OBI. Independent and Specialty retailers comprise an important part of our channel mix by serving consumers who seek more education, a broader assortment of products and higher service. We believe our broad global brick-and-mortar retail presence reinforces our brand leadership. Our commitment to our retailers is evidenced by the numerous awards that we have won for our category leadership, service excellence and new product innovation. Most recently, in 2020, we were recognized as Supplier of the Year at leading retailers such as Ace Hardware and The Home Depot Canada.

Our DTC approach includes both a digital platform (Weber.com) and brick-and-mortar locations (a majority are independently operated Weber branded retail stores and Weber Grill Academy™ experience centers). Our DTC initiatives have led to a compounded annual revenue growth rate of 47% in our DTC business since 2018. Weber.com has been the fastest growing channel across our omni-channel network with a compounded annual revenue growth rate of 135% since 2018. Internationally, we have 170 Weber branded retail stores and Weber Grill Academy sites (161 independently operated, 9 Weber-operated) making us the only outdoor cooking brand with a global network of experiential retail environments. Our Weber branded retail stores and Weber Grill Academy sites represent a significant component of our international sales channels. At most of our Weber Grill Academy sites, we offer world-class instruction by Grill Masters with culinary expertise who help our consumers improve their cooking skills and better engage with our products. Our Weber branded stores and Weber Grill Academy sites offer unique branded experiences and consumer engagement that strengthen the consumers’ connection with the Weber brand. We believe that the physical experience of our branded retail stores and the global scale of our network would be difficult to replicate by competitors in the outdoor cooking market.

4

Table of Contents

With our e-commerce and digital initiatives, we have been the leaders in shifting outdoor cooking purchases to online. Our e-commerce channel is made up of the online platforms of our global, regional, and multi-national retailers such as Costco Wholesale, The Home Depot, Lowe’s, Walmart, Bauhaus and OBI, as well as digitally native retailers such as Amazon and Wayfair. We believe our online share in the U.S. in fiscal year 2020 was two times greater than that of our nearest competitor, including our revenues through Weber.com and our e-commerce partners. On Amazon, we are the number one outdoor cooking brand, and according to Weber management estimates, we captured 29% market share in the outdoor cooking category sold online in the U.S. in 2020.

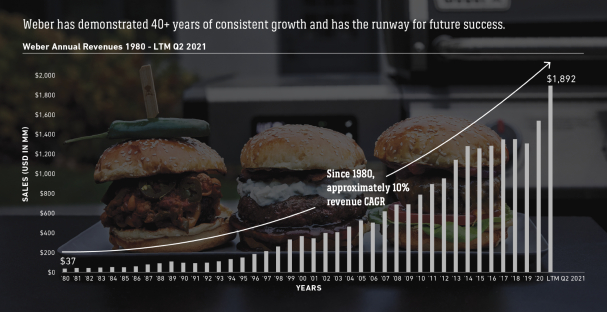

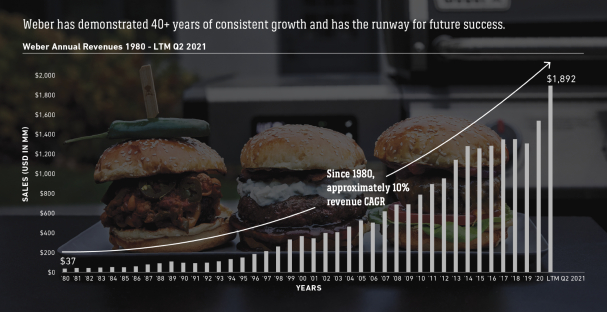

Long-Term Track Record of Performance

We have experienced growth in various economic environments and have benefited from lasting consumer shifts in behavior towards outdoor cooking, which is evidenced by our 10% revenue CAGR

5

Table of Contents

from 1980 to 2021. Our track record of growth is driven by our iconic brand, massive installed base of loyal enthusiasts, and approximately 26% of our revenues being comprised of accessories and consumables all of which support a predictable, recurring revenue model. More recently, our significant investments in Weber Connect, Weber.com, and the ongoing consumer shifts towards backyard and outdoor leisure have further enhanced our growth profile. We expect these consumer shifts to continue in the future.

Our Recent Financial Performance

Our compelling financial profile is characterized by stable revenue growth, solid profitability and consistent high cash flow generation.

Comparing our six months ended March 31, 2021 with six months ended March 31, 2020, we achieved the following results:

| • | Increase in revenue from $596.4 million to $963.3 million, representing year-over-year growth of 62%; |

| • | Increase in income from operations from $56.4 million to $120.9 million, representing year-over-year growth of 114%; |

| • | Increase in net income from $23.6 million to $73.8 million, representing year-over-year growth of 213%; |

| • | Increase in adjusted income from operations from $58.3 million to $161.1 million, representing year-over-year growth of 176%; |

| • | Increase in adjusted net income from $30.6 million to $111.1 million, representing year-over-year growth of 263%; |

| • | Increase in EBITDA from $69.0 million to $141.3 million, representing year-over-year growth of 105%; and |

6

Table of Contents

| • | Increase in Adjusted EBITDA from $77.0 million to $186.9 million, representing year-over-year growth of 143%. |

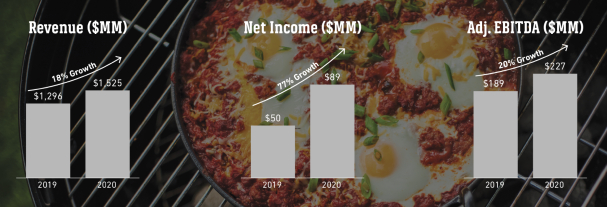

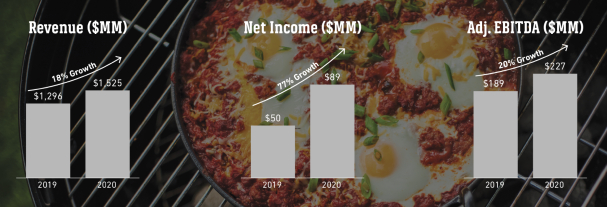

Comparing our fiscal year 2020 with fiscal year 2019, we achieved the following results:

| • | Increase in revenue from $1,296.2 million to $1,525.3 million, representing year-over-year growth of 18%; |

| • | Increase in income from operations from $106.9 million to $151.5 million, representing year-over-year growth of 42%; |

| • | Increase in net income from $50.1 million to $88.9 million, representing year-over-year growth of 77%; |

| • | Increase in adjusted income from operations from $143.8 million to $189.0 million, representing year-over-year growth of 31%; |

| • | Increase in adjusted net income from $77.9 million to $126.0 million, representing year-over-year growth of 62%; |

| • | Increase in EBITDA from $154.0 million to $184.1 million, representing year-over-year growth of 20%; and |

| • | Increase in Adjusted EBITDA from $189.1 million to $226.7 million, representing year-over-year growth of 20%. |

| ||||||

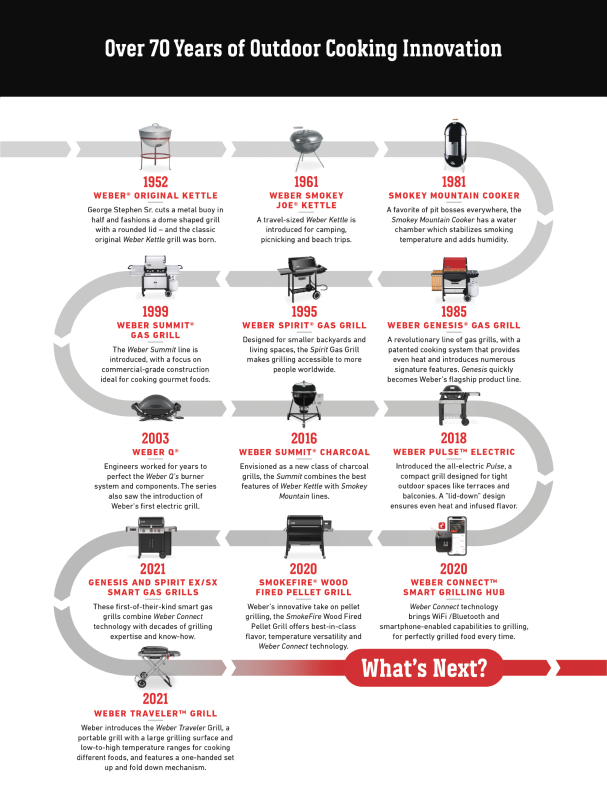

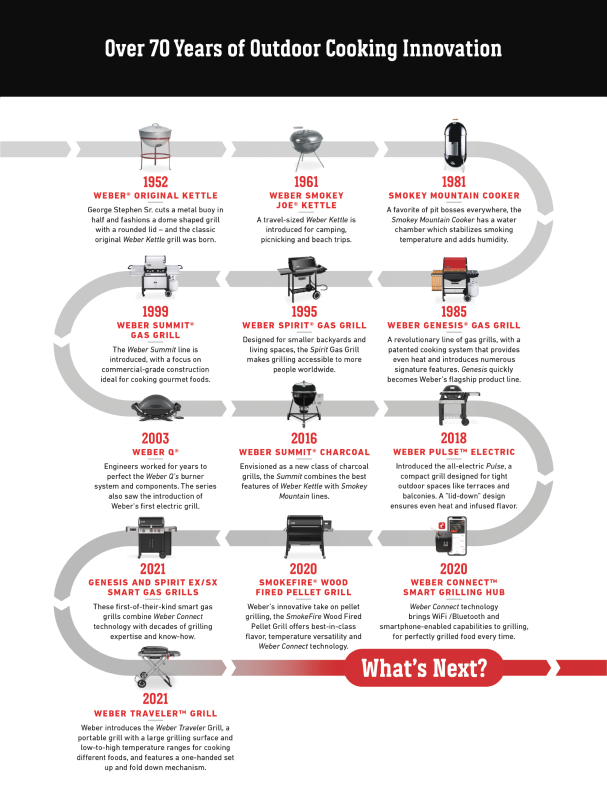

Our History and Legacy of Innovation

We believe that our track record of innovation and category leadership is unparalleled in the outdoor cooking industry. The Weber journey began in 1952, when our founder George Stephen invented covered charcoal cooking with the iconic Weber Kettle grill. In the 1980s, we used the same ingenuity and unwavering approach to product quality and innovation to develop our Genesis gas grill, and again quickly became the market leader in the new category. In the 2000s, we disrupted the grilling market for the third time with the portable Weber Q grill and redefined mobility for millions of outdoor cooking enthusiasts. Recently, we introduced the SmokeFire wood pellet grill, the Pulse electric grill and the Weber Traveler gas grill, fueling additional expansion and leadership globally into these subcategories.

Today, we continue to disrupt the grilling category through our innovations with Weber Connect, which will further enhance the consumer experience, while staying true to our steadfast commitment to delivering premium products. We believe that the connected capabilities offered by our technology-enabled products will enable a closer relationship with our consumers and usher in a new generation of enthusiasts who will join our global community of Weber loyalists.

7

Table of Contents

8

Table of Contents

Highly Experienced and Visionary Management Team

To achieve our goals and meet our growth initiatives, we have assembled a management team that combines world-class brand expertise and advanced technological capabilities. In mid-2018, Chris Scherzinger joined as Chief Executive Officer, after spending the prior decade in a number of group CEO roles in the largest operating divisions at Jarden Corporation and Newell Brands. Prior to joining Newell/Jarden, Mr. Scherzinger held global marketing leadership and brand management and operational roles at Johnson & Johnson, Procter & Gamble and General Electric. In 2018, Bill Horton also joined as Chief Financial Officer, having also previously served as group CFO for a number of business units within Jarden Corporation and Newell Brands from 2009 to 2018. Prior to his time with Newell/Jarden, Mr. Horton spent 12 years in a number of leadership roles with Procter & Gamble, and served in the United States Air Force for five years. During their time at Jarden Corporation and Newell Brands, Scherzinger and Horton partnered for four years as group CEO and CFO of Jarden’s largest operating segment. Our management team has a proven track record of building brands, leading market innovation, expanding distribution, driving best-in-class operations and delivering consistently strong financial results.

Our Competitive Strengths

We believe that the following competitive strengths are key drivers of our past and future success.

Iconic Global Brand and Market Leader

For nearly 70 years, the Weber brand has defined the outdoor cooking category by enriching the experience of grilling consumers around the world. Based on internal management estimates and in coordination with Frost & Sullivan, we believe revenue in our top five markets to be up to three times that of the next leading competitor. We are the most recommended brand in the outdoor cooking industry by consumers, according to MetrixLab, with total brand awareness of 87% in the United States, 86% in Germany, 89% in Australia, 74% in Canada, and 76% in France, the five largest grilling markets in the world. Our consumers often share a deep emotional connection with our iconic brand that is passed down from one generation to the next. 41% of consumers indicated Weber as the U.S. brand they are most likely to purchase next relative to only 18% and 2% for our next closest competitors, according to a 2020 MetrixLab Brand Health & Habits Survey. We are the only global manufacturer and distributor in the outdoor cooking industry with leading market share in nearly every product sub-category across geographies. The leadership of our global brand is demonstrated by holding the number one brand position in grilling, in the United States, Germany, Australia, France and Canada with 23%, 44%, 30%, 26% and 24% market share respectively, and 24% globally, according to Frost & Sullivan. In addition, we have the number one brand position in gas grilling across these five markets and the number one brand position in charcoal grilling in the United States and Australia, according to Frost & Sullivan. Gas and charcoal grill types continue to be preferred by consumers, with 51% of survey respondents indicating they are most likely to purchase a gas grill next and 26% indicating charcoal grills, relative to only 3% for pellet grills, according to a 2020 MetrixLab Brand Health & Habits Survey. Our brand leadership is further emphasized by our 22 global points of distribution through wholesale and direct retail channels across 78 countries.

Massive Community of Loyal Weber Enthusiasts

Since 1952, we have cultivated deep bonds with generations of Weber owners and their families, as evidenced by our massive installed base of 30 million Weber grills in the U.S. and 50 million Weber grills globally. Our installed base coupled with impressive net promoter scores of 62 in the U.S., 65 in

9

Table of Contents

Germany and 52 in Australia, as of 2020, enable a powerful recurring revenue model through repeat grill sales, and branded accessories and consumables purchases. Our installed base continues to grow as we expand in international markets, where we combine what consumers love about their local grilling traditions with the magic of the Weber grilling experience. Our marketing strategies and recent investments in Weber.com continue to grow our massive community of Weber enthusiasts, with 65 million site visits in 2020 globally, representing an increase of 83% compared to 2019. Alongside this growth in Weber.com, we are rapidly building database marketing initiatives to further enhance our consumer relationships and maximize purchase frequency.

Leader in Product Development with Exceptional Quality

Disruptive innovation has been part of the Weber culture since the introduction of the iconic Weber Kettle grill in 1952. Today we continue our legacy of innovation with our SmokeFire wood pellet grills, Pulse electric grills, and our Weber Connect platform. We believe that the Weber Connect platform has set the standard for connected grilling, as evidenced by the recent Consumer Electronics Show Award for best Connected-Home Product in 2020, and represents the future of our industry. We believe that our acquisition of June Life provides us with industry-leading in-house software engineering talent that will help drive continued innovation for years to come.

Throughout the decades, we have maintained an uncompromising approach to exceptional quality and performance. We believe this has allowed us to expand from our roots in charcoal grills to a diverse portfolio across price points and fuel types, including gas grills, electric grills, smokers, pellet grills and accessories, consumables and services. We pride ourselves on bringing our commitment to quality and performance standards in each new category we enter. Weber is also recognized for developing and utilizing industry-leading features in the grilling category, such as Flavorizer bars (for even heating) and porcelain-enameled coating (for withstanding the high-heat applications). We employ an in-house team of engineers and designers to develop our products to ensure they meet our high standards of performance and quality. We also employ a best-in-class customer service organization that fuels brand satisfaction and loyalty.

Diversified Global Revenue Base and Broad Network of Distribution Partners in Each Region

The iconic nature of our global brand enables us to sell in 78 countries across six continents. In 2020, approximately 58% of our revenue was generated in the Americas, 35% in Europe, Middle East and Africa (“EMEA”) and 7% in Asia-Pacific (“APAC”). We distribute our products through a diverse and powerful omni-channel platform, consisting of our wholesale, DTC and e-commerce channels. Across our distribution network, we believe Weber is the outdoor cooking brand that reinforces our distribution partners’ presence in the grilling category. In our wholesale channel, we work with leading global retailers including Ace Hardware and Costco Wholesale across the Americas, Europe and Asia. Our wholesale business also spans large international retail partners such as The Home Depot, Lowes Companies and Walmart Inc. across the U.S., Canada and Mexico, as well as Bauhaus and OBI in Europe. According to management estimates, at Ace Hardware, The Home Depot and Lowes, we represented 52%, 39%, and 32% dollar share of each retailer’s grilling category respectively in 2020. Across other regions, we distribute our products through a global network of independent and specialty dealers. Our DTC channel provides an unparalleled customer experience at Weber.com and our independently operated Weber branded retail stores and Weber Grill Academy sites. Weber.com features our complete product assortment and exclusive online offerings so consumers are able to compare products, read reviews and transact in a virtual environment. To complement our online presence, we operate a network of 170 Weber branded retail stores globally, which are strategically located in markets where we are leading consumer shifts to popularize the

10

Table of Contents

outdoor cooking industry. To further enhance our online presence, we offer our products on the online platforms of our retailer partners and digitally native retailers such as Amazon.com, where we are the number one outdoor cooking brand in the U.S. and capture 29% of the outdoor grill category.

U.S.-Led, Global Manufacturing Footprint and World-Class Supply Chain

We are a vertically integrated manufacturer and the only major outdoor cooking company that maintains a significant U.S.-based manufacturing footprint that is complemented by other manufacturing capabilities throughout the world. We operate three manufacturing facilities in Illinois with core competencies in metal fabrication, welding, deep drawn stamping and porcelain-enameled coatings. In 2018, our U.S. operations were consolidated into our Huntley facility where approximately 55% of our global grill demand is currently produced. In addition, Weber maintains trusted relationships of more than 15 years with three major grill manufacturers in China and Taiwan to provide flexibility to produce some of our grills, which provides redundant manufacturing of key product lines. We have a long-standing history with a diversified set of suppliers who send components to our U.S. manufacturing facilities as well as our China manufacturing partners. Our 22 global distribution facilities serve 78 countries and have capabilities including truckload shipping to our customers and parcel service to support our growing DTC business. Our U.S.-led, diversified global manufacturing and distribution footprint provides Weber with a significant competitive advantage, allowing for a balanced combination of quality, speed and agility in response to customer demand locally and globally. We believe our diversified manufacturing platform also enables us to better manage potential supply chain disruptions and navigate changes in tariff policies more effectively than our competitors.

In 2020, we expanded our “Make Where We Sell” philosophy, and continued growth in the EMEA region drove the decision to commission a manufacturing plant in Europe and break ground on a new facility in Zabrze, Poland. This new location will manufacture and distribute key product lines for the EMEA market and is expected to open for operation in the fourth quarter of fiscal year 2021. The strategic location of this facility will facilitate reduced labor and transportation costs, resulting in positive improvements to our operating margin. The breadth and depth of our supply chain initiatives have been, and will continue to be, a key business focus and source of strong cash flow generation.

Exceptional Financial Profile Through Business Cycles

Weber has a long track record of strong growth and resilient financial performance, through periods of varying macro-economic cycles. Our growth has been broad-based across product categories and geographies. Weber benefits from countercyclical trends associated with “eat at home” categories, where challenging economic periods lead families to cook and spend more time at home. However, Weber also thrives in strong economic times when disposable income and investments in and around the home and backyard are strong. Our business maintains a strong margin profile driven by our consistent premium pricing strategy, global scale, vertically integrated manufacturing capabilities, operational productivity programs and commitment to value-added product innovations. We are well positioned to continue to execute on our operational excellence initiatives, including our new manufacturing and distribution facility in Poland. Our resilient growth, margin improvement and efficient capital intensity all contribute to our strong free cash flow. Our strong free cash flow profile allows for significant capital allocation flexibility, enabling long-term shareholder value creation through multiple operating and financial strategies.

Highly Experienced and Visionary Management Team

We believe our management team, led by CEO Chris Scherzinger and CFO Bill Horton, is among the most experienced in the industry, representing decades of leading global consumer brands. We

11

Table of Contents

have built a broad executive leadership team with extensive brand building experience from companies such as Amazon, Bosch, Danaher, Dyson, General Motors, Royal Dutch Shell, Unilever, Whirlpool and more. In addition, with our recent acquisition of June, we have acquired software and hardware engineering talent from Apple, Google, Lyft, Microsoft, SpaceX, Tesla and other leading technology companies. Our management team is uniquely capable of executing upon our strategic vision and successfully continuing to create long-term shareholder value by scaling our business, leading innovation, expanding distribution, and managing expansive global operations.

12

Table of Contents

Our Growth Strategy

13

Table of Contents

We intend to build on our competitive strengths and deliver sustainable growth by executing on the following strategies:

Introduce New and Disruptive Products

We have a proven track record of consistently expanding our product portfolio to meet the evolving needs of our consumers. Our culture of innovation and strong manufacturing capabilities allow us to introduce disruptive and differentiated new products. Our success is evidenced by our diverse product portfolio and recent launches across technology, grilling, accessories, consumables and services including:

| • | Grilling Innovations — Historically, we have captured share in the outdoor cooking market by launching grill products that have revolutionized our consumer’s grilling experience. Our legacy of innovation started over 70 years ago when we invented the iconic Weber Kettle and transformed the charcoal grilling market. Since then, we have introduced the Genesis gas grill, the portable Weber Q grill, and the Pulse electric grill. In 2020, we launched the SmokeFire wood pellet grill to capitalize on demand in the fast-growing pellet grill sub-category. We believe the SmokeFire wood pellet grill will have a similar impact on the pellet industry as our iconic grills have had historically in their respective categories. We also have a long track record of success refreshing products in existing categories, which allows customers to upgrade while staying loyal to the Weber brand. |

| • | Weber Connect™ — In 2020, we introduced our new connected device platform, Weber Connect powered by June OS. This Consumer Electronics Show award-winning precision grilling technology was first made available as the stand-alone Smart Grilling Hub, and as an integrated feature in our SmokeFire wood pellet grill. Today, Weber Connect is also available in our Genesis / Spirit gas grill and Pulse electric grill. We intend to make Weber Connect available in our charcoal grills and smokers in the future. Weber Connect is an integral part of our connected product pipeline of cutting-edge, technology-enabled grills and devices that will enhance the grilling experience for consumers. |

| • | Accessories, Consumables and Services — Over the past 70 years, we have consistently developed and launched Weber branded outdoor cooking accessories and consumables to complement our core offering and provide a predictable, recurring revenue stream. These product offerings help ensure that Weber’s iconic brand stays at the forefront of all facets of the outdoor cooking experience while also providing attractive margins. We have developed a robust product pipeline that includes tools and cookware, cleaning supplies, multiple fuel types, gear, carts and covers, among others. Innovation in our growing accessory and consumables business will continue to create higher transaction frequency and drive increased consumer loyalty. We also intend to expand our service offerings to capitalize on our best-in-class customer service organization and the global footprint of our Weber branded retail stores and Weber Grill Academy sites to capture new revenue streams. |

As we have done throughout our history, we have identified opportunities for new product introductions in existing and new categories. We will continue to leverage our extensive experience and deep expertise to continue to regularly introduce new products that differentiate us from our competition and accelerate our growth.

14

Table of Contents

Accelerate Direct-to-Consumer and E-Commerce Revenue

Our DTC and e-commerce channels represented 20% of our revenue in 2020 and have grown 31% annually since 2018. Our DTC channel includes Weber.com, our independently operated Weber branded retail locations and Weber Grill Academy sites. Within our DTC channel, Weber.com has experienced explosive growth achieving a 135% CAGR from 2018 to 2020. Weber.com is a strategic focus as we believe consumers enjoy engaging directly with our brand through this channel. Due to our efforts, visits to Weber.com have expanded rapidly as evidenced by the 65 million global site visits we achieved in 2020, representing an increase of 83% compared to 2019. We also have long-standing relationships with the largest e-commerce players in our industry, including Amazon, HomeDepot.com and Lowes.com, and have experienced significant growth in this channel over the last several years. Our network of 170 Weber branded retail locations deliver an immersive brand experience for consumers as well as engagement with culinary grilling experts and knowledgeable staff. We believe there is a significant opportunity to increase DTC revenue by accelerating site visits and engagement of Weber.com and partnering with our retailers to launch additional Weber branded retail locations and Weber Grill Academy sites in attractive geographies throughout the world. We also expect purchasing to continue to migrate online providing positive tailwinds for our e-commerce channel.

Expand Customer Base and Consumer Revenue Streams

In the last three years, Weber has added more than $200 million from new retail customers that did not distribute our brand prior to 2018. We have also demonstrated the ability to add new consumers: over the past three years, we have added nearly 12 million Weber Grill households in our top five markets, an increase of 22%. We have invested significantly in all facets of marketing to fuel this growth. From 2018 to 2020, we increased our advertising and marketing spending by 14%. In addition, we have bolstered our consumer insights, analytics and marketing team, hiring over 40 new positions in the last 12 months, to strengthen our marketing organization and build broader capabilities. In addition to adding new consumers, we believe we have a sizable opportunity to optimize direct engagement with our existing consumer base and create new sources of revenue. We currently maintain a database of millions of registered consumers; that base, supplemented with new data from sources like Weber.com and our connected products, gives us the ability to personalize marketing, promotional offers and programs to drive increased consumer loyalty. This will open up new revenue streams like incremental accessory sales and new customized subscription services.

Expand and Deepen Our Presence in Emerging Geographies

We believe we have the opportunity to continue to expand into additional growing international markets. We intend to focus on the most attractive markets in Asia, Europe and Latin America. Within these markets, we aim to enhance the consumer outdoor cooking experience and teach millions of people how to grill the “Weber Way.” Although our top 12 developing markets currently account for approximately 10% of our revenue, we believe we can meaningfully expand this percentage in the future, to grow our customer base and drive net sales. Historically, the growth in our developing markets has been nearly two times the growth of our mature markets and we believe this pattern can be repeated as we expand in these emerging geographies and increase our global brand awareness.

Execute on Value-Enhancing Operational Initiatives

In 2018, we launched our “Fuel the Growth” initiative to improve productivity within our supply chain, focusing on “Make Where We Sell” initiatives and distribution footprint optimization projects. To date, we have achieved over $64 million in gross productivity savings which has resulted in 150 bps of margin improvement and allowed us to increase growth investments. Key ongoing drivers of our Fuel

15

Table of Contents

the Growth initiative include sourcing initiatives in Mexico, Poland and Southeast Asia, our U.S. assembly plant consolidation, our new EMEA manufacturing facility in Zabrze, Poland and our distribution network optimization initiatives. In addition, we have various ongoing continuous improvement projects within our plants and distribution centers. We believe there is a significant opportunity for us to continue to expand our margins.

Our Industry and Opportunity

We operate in the large, growing global outdoor cooking market which we believe is highly predictable, recurring and resilient. This market is comprised of outdoor products that include gas grills, charcoal grills, wood pellet grills, electric grills, smokers, grilling accessories, and solid fuel products (including charcoal briquettes, lump charcoal, pellets, and wood chips and chunks).

According to MetrixLab the installed base of U.S. grills is nearly 70 million units representing 56% penetration of U.S. households. We estimate that more than 30 million of these grills are Weber grills, based on MetrixLab, and are being replaced at a rate of over 2 million units per year. While we benefit from growth from our installed base, our business is not dependent on replacements. We will continue to grow based on the increasing number of first-time grill buyers; consumers purchasing second grills with a different fuel type; heightened demand for specialty grills such as smokers, pellet grills, electric grills and kamado grills; and additional revenue streams including accessories, consumables and grill services. We expect the outdoor cooking market will continue to benefit from increased investment in and around the home as well as macro consumer trends in at home food consumption, culinary exploration and health and wellness.

We believe that several fundamental shifts in consumer behavior are providing positive tailwinds for our industry, including the increasing adoption of outdoor lifestyles and rising focus on health and wellness. More than half (54%) of consumers report cooking more in 2020 and 52% of people cited health as one of their top reasons for cooking at home based on a survey from Hunter PR. The COVID-19 pandemic accelerated certain trends that benefited our industry, and, according to a 2020 survey of grill owners, 85% of grillers globally expect to grill as often or more often after the pandemic than they did before the pandemic. We believe that the grill represents the center of any outdoor lifestyle and our industry will see continued resiliency through the business cycle and growth driven by increasing demand for outdoor spaces.

We consider our market opportunity in terms of TAM, which is the revenue opportunity from the number of total households that we believe are able to own a grill and could be interested in purchasing a new one in current geographies where Weber operates and in potential markets. We define the SAM as the revenue opportunity from the total number of households that purchased a grill in a given year in markets where Weber currently operates.

According to Frost & Sullivan, our TAM is estimated at $49 billion globally and $9 billion in the United States and our SAM is estimated at $15 billion globally and $7 billion in the United States From 2015 to 2020, our SAM grew at a 3.0% CAGR and is projected to grow at a 4.5% CAGR from 2020 to 2025. We expect to grow both TAM and SAM as we expand beyond our current geographies and grow SAM as we introduce new products in our existing verticals and add new verticals to our product portfolio in geographies where we currently operate. As of 2020, we are approximately 7% penetrated in our global TAM and 18% penetrated in our U.S. TAM. For additional discussion of the methodology used to determine our TAM and SAM, see the section entitled “Market and Industry Data.”

16

Table of Contents

Recent Developments

Preliminary Estimated Financial Data

Set forth below are preliminary estimates of certain of our consolidated financial data as of and for the three months ended June 30, 2021 and actual consolidated financial data as of September 30, 2020. Our consolidated financial statements as of and for the three months ended June 30, 2021 are not yet available and are subject to completion of our financial closing procedures. The following information reflects our preliminary estimates based on currently available information and is subject to change. We have provided ranges, rather than specific amounts, for the preliminary estimated results described below primarily because we are still in the process of finalizing our financial and operating results as of and for the three months ended June 30, 2021 and, as a result, our final reported results may vary materially from the preliminary estimates. The preliminary estimated financial data set forth below have been prepared by, and are the responsibility of, our management. Our auditors have not audited, reviewed, compiled or applied agreed-upon procedures with respect to the preliminary estimated financial data. Accordingly, our auditors do not express an opinion or any other form of assurance with respect thereto. Our preliminary estimated results also include non-GAAP financial measures. Neither such measures nor our estimates of GAAP results should be viewed as a substitute for interim financial statements prepared in accordance with GAAP. You should not place undue reliance on the preliminary estimates, and the preliminary estimates are not necessarily indicative of the results to be expected in the future. The preliminary estimates should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Special Note Regarding Forward-Looking Statements,” “Risk Factors” and the consolidated financial statements and related notes thereto included elsewhere in this prospectus.

| For the Three Months Ended June 30, 2021 |

||||||||

| (Dollars in thousands) | Low | High | ||||||

| (unaudited) | ||||||||

| Net sales |

$ | 662,178 | $ | 675,556 | ||||

| Net income |

$ | 27,631 | $ | 49,287 | ||||

| Adjusted EBITDA(1) |

$ | 130,255 | $ | 140,044 | ||||

17

Table of Contents

| As of | ||||||||

| September 30, 2020 |

June 30, 2021 |

|||||||

| Cash and cash equivalents |

$ | 123,792 | $ | 146,469 | ||||

| Long-term debt (including the current portion thereof and net of unamortized debt issuance costs of $4,341 and $23,002, respectively) |

$ | 611,909 | $ | 1,220,748 | ||||

| (1) | We define Adjusted EBITDA as net income before interest expense, net, income taxes, depreciation and amortization, adjusted for non-cash stock compensation / LTIP and profits interest expense, business transformation costs, operational transformation costs, impairment costs, debt refinancing and IPO costs, COVID-19 operational costs, loss from early extinguishment of debt, and gain on disposal of assets held for sale. |

The following table reconciles net income to Adjusted EBITDA for the period presented.

| For the Three Months Ended June 30, 2021 |

||||||||

| (Dollars in thousands) | Low | High | ||||||

| Net income |

$ | 27,631 | $ | 49,287 | ||||

| Adjustments: |

||||||||

| Interest expense, net |

18,534 | 17,534 | ||||||

| Income tax expense |

(14,597 | ) | (13,207 | ) | ||||

| Depreciation and amortization |

12,628 | 11,425 | ||||||

| Non-cash stock compensation / LTIP and profits interest costs |

65,323 | 56,776 | ||||||

| Business transformation costs |

5,933 | 4,933 | ||||||

| Operational transformation costs |

5,527 | 4,527 | ||||||

| Impairment costs |

— | — | ||||||

| Debt refinancing and IPO costs |

9,204 | 8,704 | ||||||

| COVID-19 costs |

72 | 65 | ||||||

| Loss from early extinguishment of debt |

— | — | ||||||

| Gain on disposal of assets held for sale |

— | — | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 130,255 | $ | 140,044 | ||||

|

|

|

|

|

|||||

April Transactions

In April 2021, Weber-Stephen Products, LLC consummated a series of equity repurchase agreements to repurchase common units held by WSP Investment LLC, an entity held by the Stephen family, for an aggregate amount of approximately $189 million, and additionally issued a special distribution to its equityholders in an aggregate amount of approximately $261 million (collectively, the “April Transactions”). Weber financed the April Transactions using cash on hand and approximately $170 million of borrowings under the revolving facility of our Secured Credit Facility. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

As of June 30, 2021, we had fully repaid the $170 million of borrowings used to finance the April Transactions and, accordingly, as of June 30, 2021, we had no outstanding borrowings other than approximately $6.4 million in undrawn letters of credit, or approximately $293.6 million of available

18

Table of Contents

capacity, under the revolving facility of our Secured Credit Facility and approximately $146.5 million of cash on hand. For more information regarding the effect of the April Transactions as well as our subsequent repayment of indebtedness, see “Unaudited Pro Forma Condensed Consolidated Financial Information.”

R. McDonald Acquisition

Also in April 2021, Weber-Stephen Products, LLC acquired substantially all of the assets of R. McDonald Co. Pty. Ltd., a sales and marketing company headquartered in Australia, for approximately $29 million in cash and $14 million in equity. As part of the acquisition, the Company reacquired R. McDonald’s exclusive rights to sell and market Weber products in Australia and New Zealand. See note 17 to our unaudited consolidated financial statements for the six months ended March 31, 2021 included elsewhere in this prospectus.

Risk Factors

Participating in this offering involves substantial risk. Our ability to execute our strategies also is subject to certain risks. The risks described under the heading “Risk Factors” immediately following this summary may cause us not to realize the full benefits of our competitive strengths or may cause us to be unable to successfully execute all or part of our strategies. Some of the more significant challenges and risks we face include the following:

| • | maintaining and strengthening our brand to generate and maintain ongoing demand for our products; |

| • | our ability to execute our business objectives and growth strategies successfully, including our efforts to expand into new markets, or sustain our growth; |

| • | the high degree of competition in the markets in which we operate; |

| • | the impacts of both extreme weather events and unusual or poor weather patterns; |

| • | seasonal and quarterly variations in our operating results; |

| • | the sensitivity of our operating results to general economic conditions and levels of consumer discretionary spending; |

| • | our reliance on information technology systems and proprietary software; |

| • | our exposure to numerous international business risks due to our reliance on foreign suppliers and our global presence in international markets; |

| • | our reliance on our own internal network of manufacturing and distribution facilities, including a small number of key geographical locations that constitute our principal manufacturing and distribution centers; |

| • | disruptions in our supply chain and manufacturing and distribution channels; |

| • | the impacts of tariffs and exchange rate fluctuations; |

| • | fluctuations in the cost and availability of raw materials, equipment, labor, and transportation; and |

| • | a significant portion of our sales are to large, multi-national retail partners and our business could be harmed if these retail partners cease to carry our current products, choose not to carry new products that we develop or cease operations altogether. |

Before you invest in our Class A common stock, you should carefully consider all the information in this prospectus, including matters set forth under the heading “Risk Factors.”

19

Table of Contents

Organizational Structure

Weber Inc., a Delaware corporation, was formed in April 2021 and is the issuer of the Class A common stock offered by this prospectus. We currently conduct our business through Weber-Stephen Products LLC. Following this offering, Weber Inc. will be a holding company and its sole asset will be a controlling equity interest in Weber HoldCo LLC, a Delaware limited liability company formed in April 2021; Weber-Stephen Products LLC will be a wholly owned subsidiary of Weber HoldCo LLC.

All of Weber-Stephen Products LLC’s outstanding equity interests are currently owned by the following persons and entities, to whom we refer collectively as the “Pre-IPO LLC Members:”

| • | BDT WSP Holdings, LLC, an entity controlled by BDT Capital Partners, LLC, our sponsor; |

| • | WSP Investment LLC, an entity held by the Stephen family; |

| • | Weber-Stephen Management Pool LLC, an entity held by current and former members of our management team and directors; and |

| • | certain other historical equityholders. |

In connection with this offering, we intend to enter into the following series of transactions to implement an internal reorganization, which we collectively refer to as the “Reorganization Transactions:”

| • | Weber Merger Sub, LLC, a subsidiary of Weber Inc. formed in April 2021, will merge with and into BDT WSP Blocker, LLC (“Blocker”), an entity controlled by BDT Capital Partners, LLC, our sponsor, with Blocker surviving the merger. As a result, (i) the Blocker equityholders will receive Class A common stock of Weber Inc. in exchange for their equity interests in Blocker, (ii) the nominal shares of Weber Inc. held by Weber-Stephen Products LLC will be canceled for no consideration (because Weber Inc. was originally formed as a subsidiary of Weber-Stephen Products LLC) and (iii) Weber Inc. will become wholly owned by the former Blocker equityholders; |

| • | Blocker will then merge with and into Weber Inc., with Weber Inc. surviving the merger. Weber Inc.’s certificate of incorporation will be amended to authorize the issuance of two classes of common stock: Class A common stock and Class B common stock, which we refer to collectively as our “common stock.” Each share of Class A common stock and Class B common stock will entitle its holder to one vote per share on all matters submitted to a vote of our stockholders. See “Description of Capital Stock”; |

| • | WSP Merger Sub, a subsidiary of WSP Intermediate formed in April 2021, will merge with and into Weber-Stephen Products LLC, with Weber-Stephen Products LLC surviving the merger. As a result, (i) the Pre-IPO LLC Members will receive non-voting common interest units (the “LLC Units”) in Weber HoldCo LLC in exchange for all of their equity interests in Weber-Stephen Products LLC, (ii) Weber-Stephen Management Pool LLC will receive LLC Units in exchange for all equity interest that it holds in Weber-Stephen Products LLC and profits interests (the “Profits Interests”) in Weber HoldCo LLC with terms substantially similar to the terms of the profits interests that it holds in Weber-Stephen Products LLC and (iii) Weber-Stephen Products LLC will become a wholly owned subsidiary of Weber HoldCo LLC; |

| • | the LLC Agreement of Weber HoldCo LLC will be amended and restated prior to this offering to, among other things, appoint Weber Inc. as the sole managing member of Weber HoldCo LLC; |

| • | members of the management team who indirectly hold Profits Interests through their direct interests in Weber-Stephen Management Pool LLC will be able to direct Weber-Stephen |

20

Table of Contents

| Management Pool LLC to convert those Profits Interests into a number of LLC Units based on a formula that calculates the positive difference between the then implied value of an LLC Unit and the then applicable threshold price associated with the Profits Interest; |

| • | as sole managing member of Weber HoldCo LLC, Weber Inc. will have sole authority to determine the amount and timing of distributions from Weber HoldCo LLC and offer LLC Units to future Partners, subject to any limitations set forth under the Secured Credit Facility. Because we will manage and operate the business and control the strategic decisions and day-to-day operations of Weber HoldCo LLC and will also have a substantial financial interest in Weber HoldCo LLC, we will consolidate the financial results of Weber HoldCo LLC, and a portion of our net income will be allocated to noncontrolling interest to reflect the entitlement of the Pre-IPO LLC Members to a portion of Weber HoldCo LLC’s net income. In addition, because Weber HoldCo LLC will be under the common control of BDT Capital Partners, LLC before and after the Reorganization Transactions, we will account for the Reorganization Transactions as a reorganization of entities under common control and will initially measure the interests of the Pre-IPO LLC Members in the assets and liabilities of Weber HoldCo LLC at their carrying amounts as of the date of the completion of these Reorganization Transactions; |

| • | each of the Pre-IPO LLC Members will be issued shares of our Class B common stock in an amount equal to the number of LLC Units held by each such Pre-IPO LLC Member; |

| • | under the Amended LLC Agreement, all current and future holders of LLC Units (including LLC Units issued upon conversion of Profits Interests), including the Pre-IPO LLC Members, will have the right, from and after the completion of this offering, to require Weber HoldCo LLC to redeem all or a portion of their LLC Units for, at our election, newly issued shares of Class A common stock on a one-for-one basis or a cash payment equal to the volume weighted average market price of one share of our Class A common stock for each LLC Unit redeemed (subject to customary adjustments, including for stock splits, stock dividends and reclassifications) in accordance with the terms of the Amended LLC Agreement (the “Redemption Right”). Additionally, in the event of a redemption request by a holder of LLC Units, we may, at our option, effect a direct exchange of cash or Class A common stock for LLC Units in lieu of such a redemption. A corresponding number of shares of Class B common stock will be canceled on a one-for-one basis if we, following a redemption request of a holder of LLC Units, redeem or exchange LLC Units of such holder of LLC Units pursuant to the terms of the Amended LLC Agreement. See “Certain Relationships and Related Party Transactions—Amended LLC Agreement.” Except for transfers to us pursuant to the Amended LLC Agreement or to certain permitted transferees, the holders of LLC Units are not permitted to sell, transfer or otherwise dispose of any LLC Units or shares of Class B common stock; |

| • | members of the management team who indirectly hold LLC Units (including LLC Units issued upon conversion of Profits Interests) through their direct interests in Weber-Stephen Management Pool LLC will be able to exercise the Redemption Right with respect to those LLC Units (to the extent vested) by directing Weber-Stephen Management Pool LLC to distribute those LLC Units to them (in redemption of a corresponding number of their interests in Weber-Stephen Management Pool LLC), which will then be redeemed pursuant to the Redemption Right; |

| • | Weber Inc. will enter into a Tax Receivable Agreement that will obligate us to make payments to the Pre-IPO LLC Members and any future party to the Tax Receivable Agreement generally equal to 85% of the applicable cash savings that we actually realize as a result of Weber Inc.’s allocable share of certain existing tax basis in tangible and intangible assets related to certain transactions that resulted in a step-up in Weber HoldCo LLC’s tax basis, certain tax basis |

21

Table of Contents

| adjustments resulting from the purchase of LLC Units from the Pre-IPO LLC Members in connection with or after this offering, future taxable redemptions or exchanges of LLC Units by the holders of LLC Units and from payments made under the Tax Receivable Agreement. We will retain the benefit of the remaining 15% of these tax savings; |

| • | Weber Inc. and the Pre-IPO LLC Members will enter into the Stockholders Agreement, which will, among other things, provide that, for so long as the Pre-IPO LLC Members beneficially hold at least 10% of the aggregate number of outstanding shares of our common stock, which we refer to as the “Substantial Ownership Requirement,” approval by the Pre-IPO LLC Members will be required for certain corporate actions; |

| • | Weber Inc. will issue 46,875,000 shares of Class A common stock to the public pursuant to this offering; |