Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - C. H. ROBINSON WORLDWIDE, INC. | ex991earningsreleaseq20630.htm |

| 8-K - 8-K - C. H. ROBINSON WORLDWIDE, INC. | chrw-20210727.htm |

1 Q2 2021 July 27, 2021 Earnings Presentation Bob Biesterfeld, CEO Mike Zechmeister, CFO Chuck Ives, Director of IR

2 Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to such factors as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; competition and growth rates within the third party logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; changes in relationships with existing contracted truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; our ability to successfully integrate the operations of acquired companies with our historic operations; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with operations outside of the United States; risks associated with the potential impact of changes in government regulations; risks associated with the produce industry, including food safety and contamination issues; fuel price increases or decreases, or fuel shortages; cyber-security related risks; the impact of war on the economy; changes to our capital structure; risks related to the elimination of LIBOR; changes due to catastrophic events including pandemics such as COVID-19; and other risks and uncertainties detailed in our Annual and Quarterly Reports.

3 ▪ Record quarter for Total Volumes, Revenues, Adjusted Gross Profit ("AGP") & Operating Income(1) ▪ Largest service lines delivered both year-over-year and sequential growth in total volumes, revenues & AGP ▪ Year-over-year volume growth in NAST Truckload & higher AGP/load ▪ Robust growth in Global Forwarding in a capacity- constrained environment ▪ Arun Rajan joining the company as Chief Product Officer to drive the next generation of innovation Q2 2021 Key Highlights (1) Adjusted gross profit is a non-GAAP financial measure. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers.

4

5 Technology Advancements & Transformation Efforts Providing Meaningful Efficiencies Beginning of Increased Tech Investment Beginning of Increased Tech Investment

6 Results Q2 2021 ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Three Months Ended June 30 Six Months Ended June 30 $ in thousands, except per share amounts 2021 2020 % CHANGE 2021 2020 % CHANGE Total Revenues $5,532,726 $3,627,846 52.5 % $10,336,595 $7,432,854 39.1 % Total Adjusted Gross Profits(1) $749,176 $614,453 21.9 % $1,451,556 $1,182,406 22.8 % Adjusted Gross Profit Margin % 13.5 % 16.9 % (340 bps) 14.0 % 15.9 % (190 bps) Personnel Expenses $362,901 $300,483 20.8 % $723,736 $630,703 14.8 % Selling, General, and Admin $125,671 $125,183 0.4 % $243,887 $253,476 (3.8) % Income from Operations $260,604 $188,787 38.0 % $483,933 $298,227 62.3 % Adjusted Operating Margin % 34.8 % 30.7 % 410 bps 33.3 % 25.2 % 810 bps Depreciation and Amortization $22,937 $25,758 (11.0) % $46,215 $50,151 (7.8) % Net Income $193,789 $143,939 34.6 % $367,094 $222,085 65.3 % Earnings Per Share (Diluted) $1.44 $1.06 35.8 % $2.71 $1.64 65.2 % Average Headcount 15,405 15,294 0.7 % 15,233 15,338 (0.7) % • Increase in adjusted gross profits driven primarily by higher volume in our ocean, truckload, less than truckload ("LTL") and air service lines and higher profit per shipment in ocean and truckload service lines • Increase in personnel expenses driven primarily by higher incentive compensation costs that are aligned with our expected 2021 results and the impact of short-term, pandemic-driven, cost reductions in Q2 of 2020 (1) Adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers.

7 Q2 2021 Cash Flow and Capital Distribution • $297.8 million decrease in cash flow driven primarily by an outsized improvement in operating working capital in second quarter of 2020 • $16.3 million in capital expenditures • Expect 2021 capital expenditures to be $55-65 million Cash Flow from Operations Capital Distribution • $204.8 million returned to shareholders • $69.7 million in cash dividends • $135.1 million in share repurchases ◦ 1,385,735 shares repurchased at an average price of $97.47 per share Q2 2020 Q2 2021 Q2 2020 Q2 2021 $149.3M $447.1M (67%) $68.4M $204.8M 199% Cash Dividends Share Repurchases

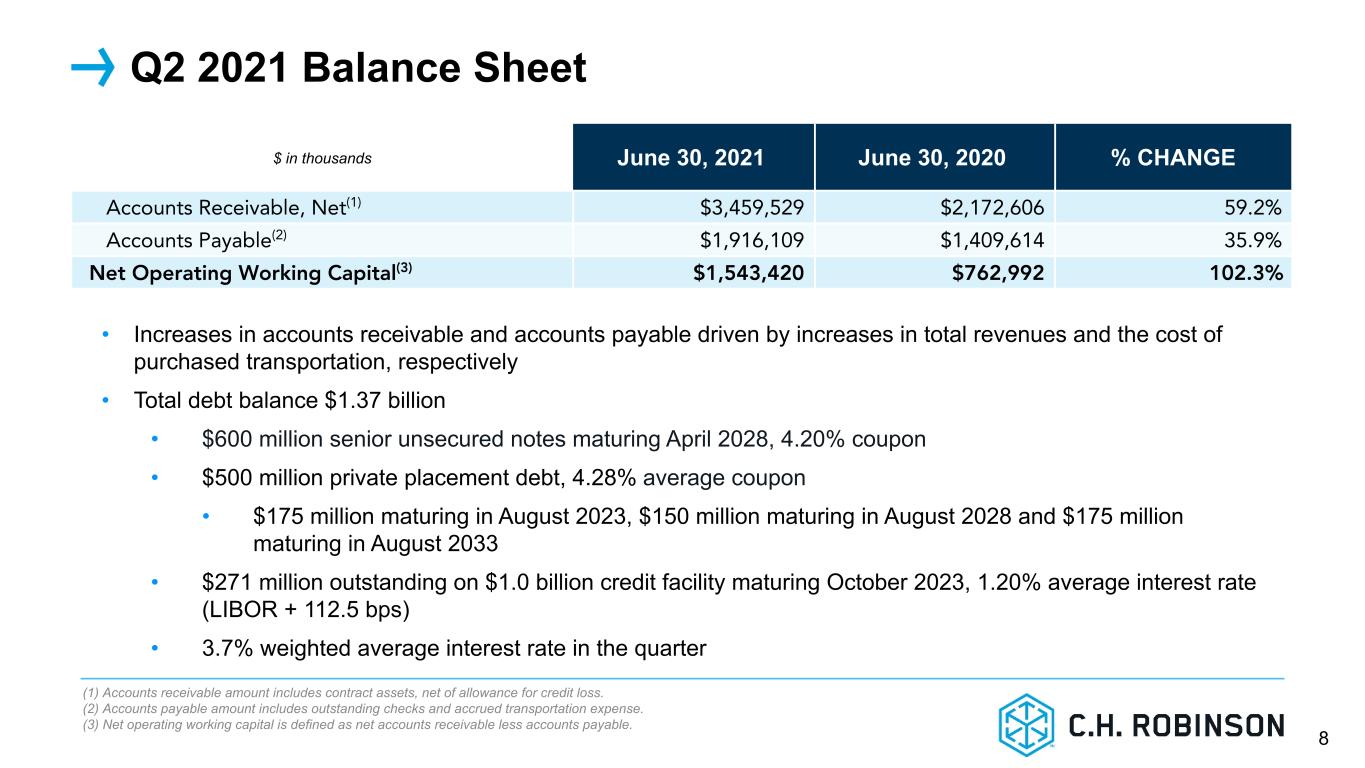

8 Q2 2021 Balance Sheet ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor $ in thousands June 30, 2021 June 30, 2020 % CHANGE Accounts Receivable, Net(1) $3,459,529 $2,172,606 59.2% Accounts Payable(2) $1,916,109 $1,409,614 35.9% Net Operating Working Capital(3) $1,543,420 $762,992 102.3% • Increases in accounts receivable and accounts payable driven by increases in total revenues and the cost of purchased transportation, respectively • Total debt balance $1.37 billion • $600 million senior unsecured notes maturing April 2028, 4.20% coupon • $500 million private placement debt, 4.28% average coupon • $175 million maturing in August 2023, $150 million maturing in August 2028 and $175 million maturing in August 2033 • $271 million outstanding on $1.0 billion credit facility maturing October 2023, 1.20% average interest rate (LIBOR + 112.5 bps) • 3.7% weighted average interest rate in the quarter (1) Accounts receivable amount includes contract assets, net of allowance for credit loss. (2) Accounts payable amount includes outstanding checks and accrued transportation expense. (3) Net operating working capital is defined as net accounts receivable less accounts payable.

9 • 55% / 45% truckload contractual to transactional volume mix compared to 65% / 35% in Q2 last year • Average routing guide depth of 1.7 in Managed Services business vs. 1.2 in Q2 last year Truckload Price and Cost Change(1)(2)(3) Yo Y % C ha ng e in P ric e an d C os t 2013 2014 2015 2016 2017 2018 2019 2020 2021 -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% YoY Price Change YoY Cost Change Truckload Q2 Volume(2)(4) +6.0% Pricing(1)(2)(3) +42.0% Cost(1)(2)(3) +47.5% Adjusted Gross Profit(4) +13.6% (1) Price and cost change represents YoY change for North America truckload shipments across all segments. (2) Growth rates are rounded to the nearest 0.5 percent. (3) Pricing and cost measures exclude fuel surcharges and costs. (4) Truckload volume and adjusted gross profit growth represents YoY change for NAST truckload.

10 Q2 2021 NAST Results by Service Truckload, LTL and Other ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Adjusted Gross Profits(1) ($ in thousands) Three Months Ended June 30 2021 2020 % Change Truckload $286,574 $252,165 13.6 % LTL $128,155 $105,428 21.6 % Other $21,867 $21,963 (0.4) % Total Adjusted Gross Profits $436,596 $379,556 15.0 % Adjusted Gross Profit Margin % 12.2 % 15.3 % (310 bps) • Truckload volume up 6.0% and LTL volume up 23.5%(2) • Truckload AGP per load increased 7.0% due to an increased mix of transactional volume and higher AGP per load on transactional volume(2) • 290,000 fully automated truckload bookings • Added 6,900 new carriers in the quarter (1) Adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. (2) Growth rates are rounded to the nearest 0.5 percent.

11 Q2 2021 NAST Operating Income • Improved operating income due to 15.0% increase in AGP • Operating expenses increased 17.6%, primarily due to higher incentive compensation and the impact of short- term, pandemic-driven, cost reductions in Q2 of 2020 • Average headcount decreased 5.5% Operating Income Adjusted Operating Margin % Q2 2020 Q2 2021 (150 bps) 10.4% $136.8M $151.1M 36.1% 34.6% Q2 2020 Q2 2021

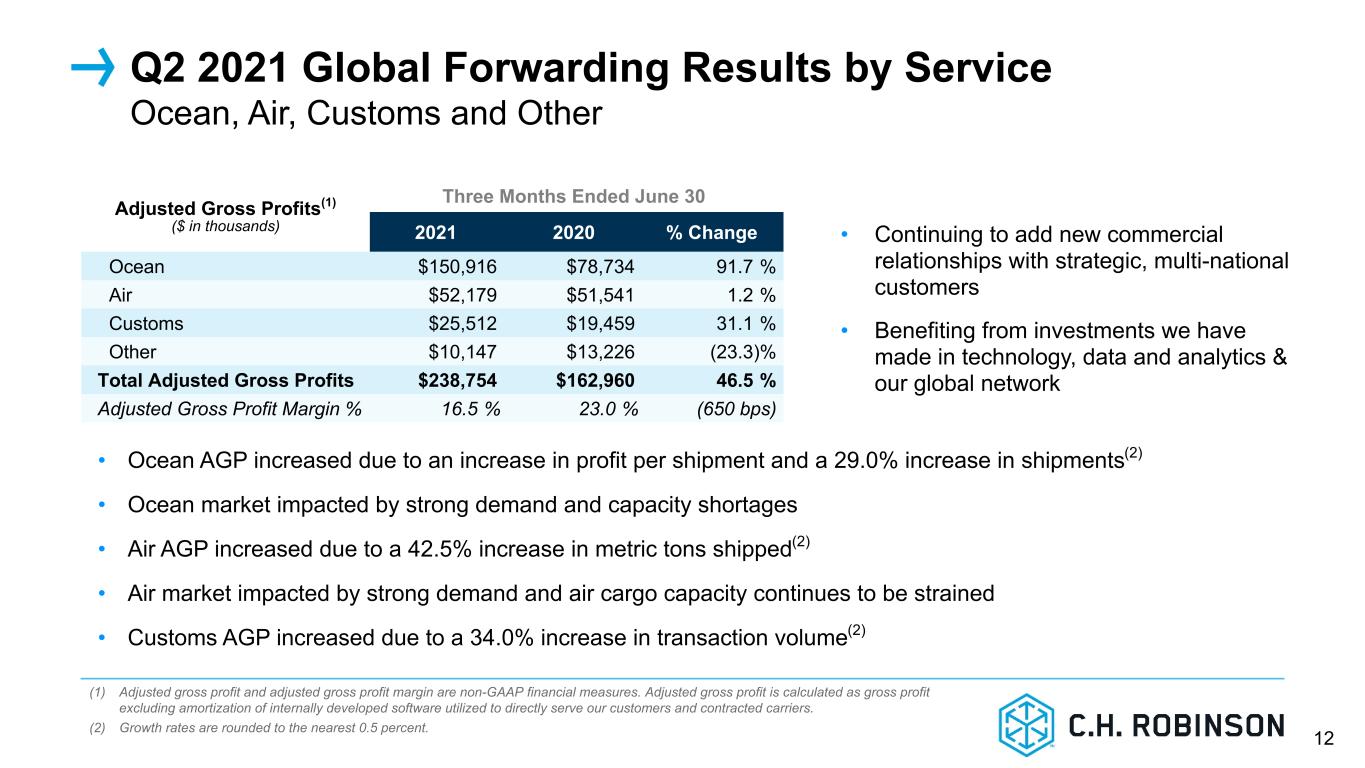

12 ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Q2 2021 Global Forwarding Results by Service Ocean, Air, Customs and Other Adjusted Gross Profits(1) ($ in thousands) Three Months Ended June 30 2021 2020 % Change Ocean $150,916 $78,734 91.7 % Air $52,179 $51,541 1.2 % Customs $25,512 $19,459 31.1 % Other $10,147 $13,226 (23.3) % Total Adjusted Gross Profits $238,754 $162,960 46.5 % Adjusted Gross Profit Margin % 16.5 % 23.0 % (650 bps) • Continuing to add new commercial relationships with strategic, multi-national customers • Benefiting from investments we have made in technology, data and analytics & our global network (1) Adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. (2) Growth rates are rounded to the nearest 0.5 percent. • Ocean AGP increased due to an increase in profit per shipment and a 29.0% increase in shipments(2) • Ocean market impacted by strong demand and capacity shortages • Air AGP increased due to a 42.5% increase in metric tons shipped(2) • Air market impacted by strong demand and air cargo capacity continues to be strained • Customs AGP increased due to a 34.0% increase in transaction volume(2)

13 Q2 2021 Global Forwarding Operating Income • Improved operating income due to 46.5% increase in AGP • Operating expenses increased 25.3%, primarily due to higher salaries, technology and incentive compensation expenses, partially offset by lower amortization • 3.9% increase in average headcount and 5.4% increase in full-time equivalents Operating Income Adjusted Operating Margin % Q2 2020 Q2 2021 36.1% 45.3%920 bps Q2 2020 Q2 2021 $58.8M $108.2M 84.1%

14 Q2 2021 All Other and Corporate Results Robinson Fresh, Managed Services and Other Surface Transportation ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Adjusted Gross Profits(1) ($ in thousands) Three Months Ended June 30 2021 2020 % Change Robinson Fresh $29,940 $30,202 (0.9)% Managed Services $26,234 $23,503 11.6% Other Surface Transportation $17,652 $18,232 (3.2)% Total $73,826 $71,937 2.6% Robinson Fresh • Decline in profit per case partially offset by an 8.0% increase in case volume(2) • Operating income up 5.3%, due to a 2.9% reduction in operating expenses, and operating margin up 150 bps Managed Services • 18.5% increase in transaction volume and 44.0% increase in total freight under management(2) • Operating income up 19.9% and operating margin up 130 bps Other Surface Transportation • 5.2% decline in Europe truckload AGP, due to higher AGP margin in 2020 caused by COVID lockdowns in Europe (1) Adjusted gross profit is a non-GAAP financial measure. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. (2) Growth rates are rounded to the nearest 0.5 percent.

15 Appendix

16 Q2 2021 Transportation Results(1) Three Months Ended June 30 Six Months Ended June 30 Transportation ($ in thousands) 2021 2020 % Change 2021 2020 % Change Total Revenues $5,240,448 $3,348,611 56.5% $9,800,675 $6,890,729 42.2% Total Adjusted Gross Profits(2) $721,143 $586,021 23.1% $1,400,085 $1,128,026 24.1% Adjusted Gross Profit Margin % 13.8% 17.5% (370 bps) 14.3% 16.4% (210 bps) Transportation Adjusted Gross Profit Margin % 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 16.9% 16.3% 15.3% 16.8% 19.7% 17.3% 16.4% 18.6% 15.3% 14.9% Q2 14.9% 15.4% 16.0% 17.5% 19.3% 16.2% 16.2% 18.3% 17.5% 13.8% Q3 15.6% 15.0% 16.2% 18.4% 17.6% 16.4% 16.6% 16.9% 14.4% Q4 15.8% 15.1% 15.9% 19.0% 17.2% 16.6% 17.7% 15.6% 14.3% Total 15.8% 15.4% 15.9% 17.9% 18.4% 16.6% 16.7% 17.3% 15.3% (1) Includes results across all segments. (2) Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

17 Q2 2021 NAST Results Three Months Ended June 30 Six Months Ended June 30 $ in thousands 2021 2020 % Change 2021 2020 % Change Total Revenues $3,585,481 $2,475,292 44.9% $6,796,904 $5,299,037 28.3% Total Adjusted Gross Profits(1) $436,596 $379,556 15.0% $857,704 $752,334 14.0% Adjusted Gross Profit Margin % 12.2% 15.3% (310 bps) 12.6% 14.2% (160 bps) Income from Operations $151,092 $136,846 10.4% $287,876 $235,372 22.3% Adjusted Operating Margin % 34.6% 36.1% (150 bps) 33.6% 31.3% 230 bps Depreciation and Amortization $6,534 $7,201 (9.3%) $13,159 $12,455 5.7% Total Assets $3,278,540 $2,793,290 17.4% $3,278,540 $2,793,290 17.4% Average Headcount 6,580 6,960 (5.5%) 6,578 6,981 (5.8%) (1) Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

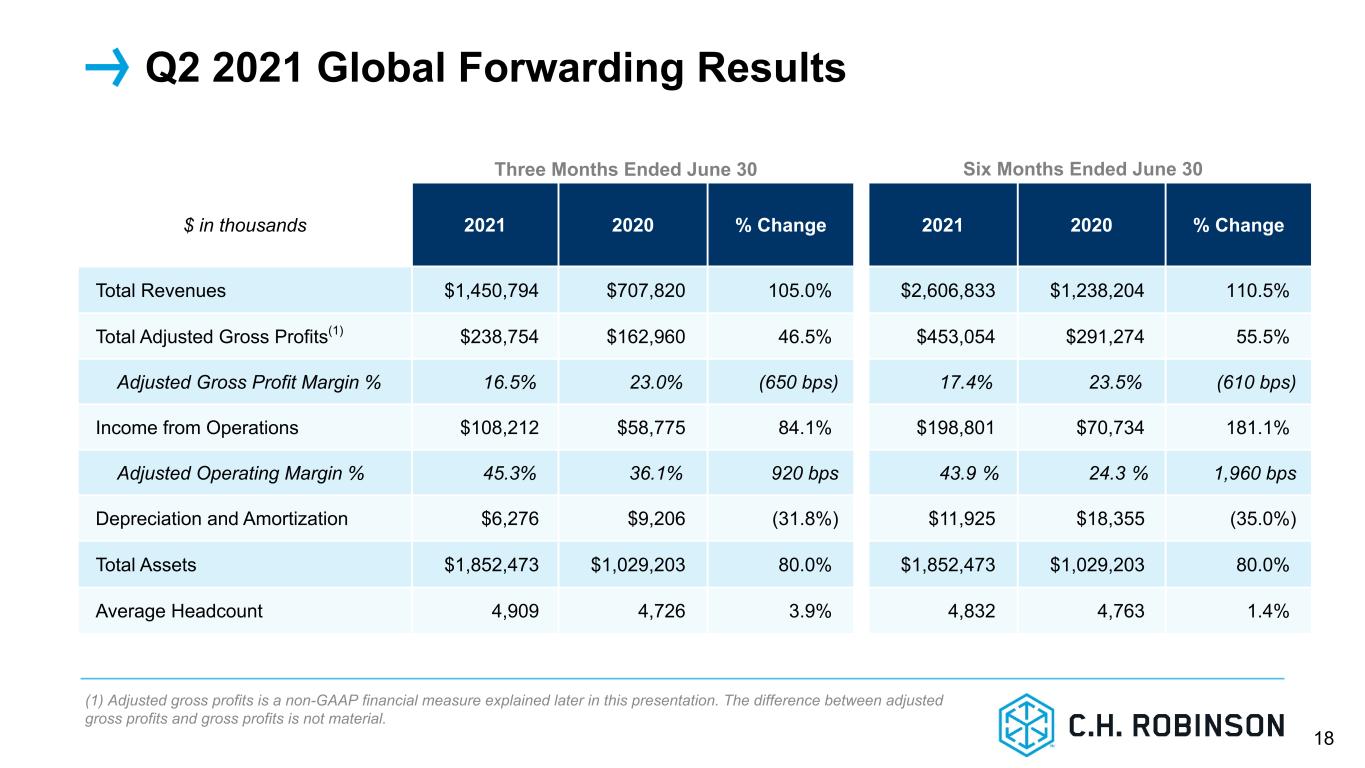

18 Q2 2021 Global Forwarding Results Three Months Ended June 30 Six Months Ended June 30 $ in thousands 2021 2020 % Change 2021 2020 % Change Total Revenues $1,450,794 $707,820 105.0% $2,606,833 $1,238,204 110.5% Total Adjusted Gross Profits(1) $238,754 $162,960 46.5% $453,054 $291,274 55.5% Adjusted Gross Profit Margin % 16.5% 23.0% (650 bps) 17.4% 23.5% (610 bps) Income from Operations $108,212 $58,775 84.1% $198,801 $70,734 181.1% Adjusted Operating Margin % 45.3% 36.1% 920 bps 43.9 % 24.3 % 1,960 bps Depreciation and Amortization $6,276 $9,206 (31.8%) $11,925 $18,355 (35.0%) Total Assets $1,852,473 $1,029,203 80.0% $1,852,473 $1,029,203 80.0% Average Headcount 4,909 4,726 3.9% 4,832 4,763 1.4% (1) Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

19 Q2 2021 All Other and Corporate Results Three Months Ended June 30 Six Months Ended June 30 $ in thousands 2021 2020 % Change 2021 2020 % Change Total Revenues $496,451 $444,734 11.6% $932,858 $895,613 4.2% Total Adjusted Gross Profits(1) $73,826 $71,937 2.6% $140,798 $138,798 1.4% Income from Operations $1,300 ($6,834) NM ($2,744) ($7,879) NM Depreciation and Amortization $10,127 $9,351 8.3% $21,131 $19,341 9.3% Total Assets $775,551 $1,003,196 (22.7%) $775,551 $1,003,196 (22.7%) Average Headcount 3,916 3,608 8.5% 3,823 3,594 6.4% (1) Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

20 Non-GAAP Reconciliations Three Months Ended June 30 Six Months Ended June 30 2021 2020 2021 2020 Revenues: Transportation $ 5,240,448 $ 3,348,611 $ 9,800,675 $ 6,890,729 Sourcing 292,278 279,235 535,920 542,125 Total Revenues 5,532,726 3,627,846 10,336,595 7,432,854 Costs and expenses: Purchased transportation and related services 4,519,305 2,762,590 8,400,590 5,762,703 Purchased products sourced for resale 264,245 250,803 484,449 487,745 Direct internally developed software amortization 4,802 3,991 9,449 7,736 Total direct costs 4,788,352 3,017,384 8,894,488 6,258,184 Gross profit & Gross profit margin 744,374 13.5 % 610,462 16.8 % 1,442,107 14.0 % 1,174,670 15.8 % Plus: Direct internally developed software amortization 4,802 3,991 9,449 7,736 Adjusted gross profit / Adjusted gross profit margin 749,176 13.5 % 614,453 16.9 % 1,451,556 14.0 % 1,182,406 15.9 % Our adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. Adjusted gross profit margin is calculated as adjusted gross profit divided by total revenues. We believe adjusted gross profit and adjusted gross profit margin are useful measures of our ability to source, add value, and sell services and products that are provided by third parties, and we consider adjusted gross profit to be a primary performance measurement. The reconciliation of gross profit to adjusted gross profit and gross profit margin to adjusted gross profit margin are presented below (in thousands):

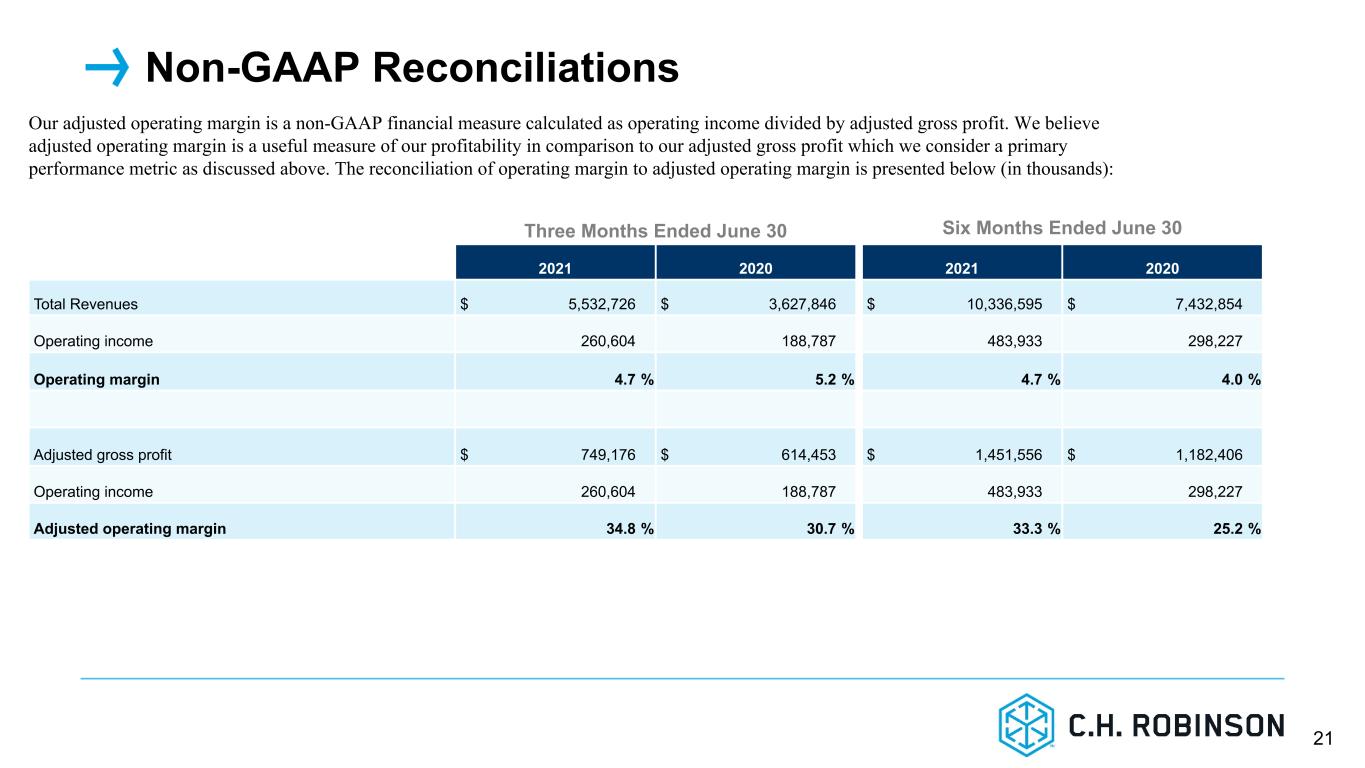

21 Non-GAAP Reconciliations Three Months Ended June 30 Six Months Ended June 30 2021 2020 2021 2020 Total Revenues $ 5,532,726 $ 3,627,846 $ 10,336,595 $ 7,432,854 Operating income 260,604 188,787 483,933 298,227 Operating margin 4.7 % 5.2 % 4.7 % 4.0 % Adjusted gross profit $ 749,176 $ 614,453 $ 1,451,556 $ 1,182,406 Operating income 260,604 188,787 483,933 298,227 Adjusted operating margin 34.8 % 30.7 % 33.3 % 25.2 % Our adjusted operating margin is a non-GAAP financial measure calculated as operating income divided by adjusted gross profit. We believe adjusted operating margin is a useful measure of our profitability in comparison to our adjusted gross profit which we consider a primary performance metric as discussed above. The reconciliation of operating margin to adjusted operating margin is presented below (in thousands):

22 Thank you