Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST MERCHANTS CORP | frme-20210726.htm |

INVESTOR UPDATE Second Quarter 2021

Forward Looking Statement This presentation contains forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, would”, “should”, “could”, “might”, “can”, “may”, or similar expressions. These forward-looking statements include, but are not limited to, statements relating to First Merchants’ goals, intentions and expectations; statements regarding the First Merchants’ business plan and growth strategies; statements regarding the asset quality of First Merchants’ loan and investment portfolios; and estimates of First Merchants’ risks and future costs and benefits. These forward-looking statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-looking statements, including, among other things: possible changes in economic and business conditions; the existence or exacerbation of general geopolitical instability and uncertainty; the effects of a pandemic or other unforeseeable event; the ability of First Merchants to integrate recent acquisitions and attract new customers; possible changes in monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like First Merchants’ affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; changes in market, economic, operational, liquidity, credit and interest rate risks associated with the First Merchants’ business; and other risks and factors identified in each of First Merchants’ filings with the Securities and Exchange Commission. First Merchants undertakes no obligation to update any forward-looking statement, whether written or oral, relating to the matters discussed in this presentation or press release. In addition, the company’s past results of operations do not necessarily indicate its anticipated future results. NON-GAAP FINANCIAL MEASURES These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, First Merchants Corporation has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

Executive Management Team 3 Mark Hardwick Chief Executive Officer Mark K. Hardwick currently serves as the Chief Executive Officer of First Merchants Corporation and First Merchants Bank. Mark joined First Merchants in November of 1997 as Corporate Controller and was promoted to Chief Financial Officer in April of 2002. In 2016, Mark’s title expanded to include Chief Operating Officer, overseeing the leadership responsibilities for finance, operations, technology, risk, legal, and facilities for the corporation. Prior to joining First Merchants Corporation, Mark served as a senior accountant with BKD, LLP in Indianapolis. Mark is a graduate of Ball State University with a Master of Business Administration and Bachelor’s degree in Accounting. He is also a certified public accountant and a graduate of the Stonier School of Banking. FMB: 24 Yrs Banking: 24 Yrs FMB: 6 Yrs Banking: 18 Yrs Michele Kawiecki Chief Financial Officer Michele Kawiecki currently serves as Executive Vice President and Chief Financial Officer for First Merchants Corporation and First Merchants Bank. Michele joined First Merchants in 2015 as Director of Finance. Prior to joining First Merchants, Michele spent 12 years with UMB Financial Corporation in Kansas City, Missouri having served as Senior Vice President of Capital Management and Assistant Treasurer; Director of Corporate Development and the Enterprise Project Management Office; and Chief Risk Officer. Prior to UMB, she worked for PriceWaterhouseCoopers LLP as an Audit Manager. Michele earned both a Master of Science in Accounting and an Executive Master of Business Administration from the University of Missouri-Kansas City and a Bachelor’s degree in Accounting from Dakota Wesleyan University. FMB: 13 Yrs Banking: 33 Yrs Mike Stewart President Mike Stewart currently serves as President for First Merchants Corporation and First Merchants Bank overseeing the Commercial, Private Wealth, and Consumer Lines of Business for the Bank. Mike joined the bank in 2008 as Chief Banking Officer. Prior to joining First Merchants, Mike spent 18 years with National City Bank having served as Chief Credit Officer of the Indiana Bank. Mike has a Master of Business Administration from Butler University and a Bachelor’s degree in Finance from Millikin University. FMB: 13 Yrs Banking: 32 Yrs John Martin Chief Credit Officer John Martin currently serves as Executive Vice President and Chief Credit Officer of First Merchants Corporation overseeing the Commercial, Small Business and Consumer Credit functions, as well as the Mortgage Line of Business. Prior to joining First Merchants, John spent 18 years with National City Bank in various sales and senior credit roles. John is a graduate of Indiana University where he earned a Bachelor of Arts in Economics. He also holds a Master of Business Administration in Finance from Case Western Reserve University.

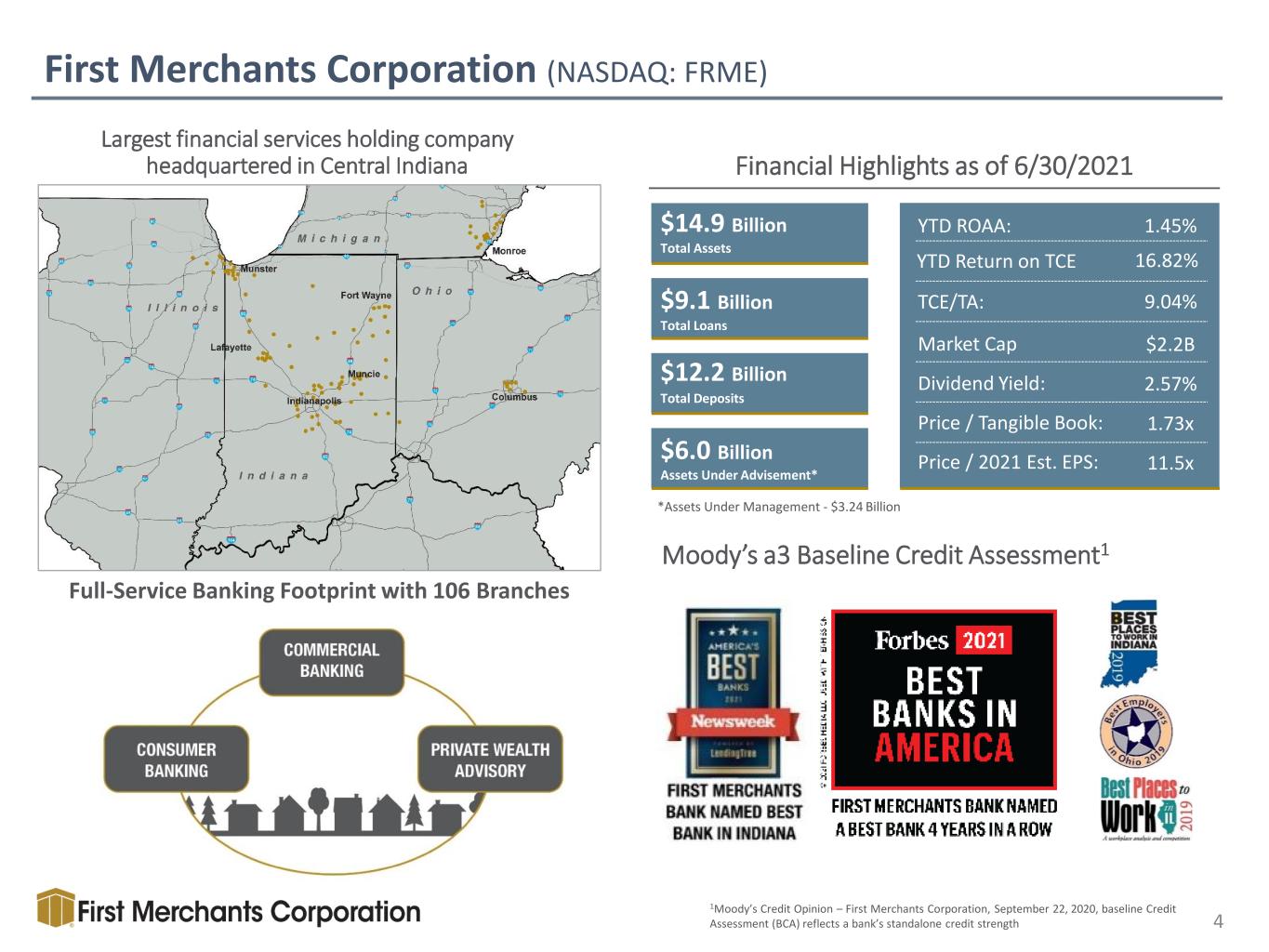

First Merchants Corporation (NASDAQ: FRME) Financial Highlights as of 6/30/2021 $14.9 Billion $9.1 Billion $12.2 Billion $6.0 Billion Assets Under Advisement* Total Assets Total Loans Total Deposits TCE/TA: YTD Return on TCE YTD ROAA: Dividend Yield: Price / Tangible Book: Price / 2021 Est. EPS: 1.45% 9.04% 16.82% 2.57% 1.73x 11.5x Moody’s a3 Baseline Credit Assessment1 Market Cap $2.2B Largest financial services holding company headquartered in Central Indiana Full-Service Banking Footprint with 106 Branches 4 *Assets Under Management - $3.24 Billion 1Moody’s Credit Opinion – First Merchants Corporation, September 22, 2020, baseline Credit Assessment (BCA) reflects a bank’s standalone credit strength

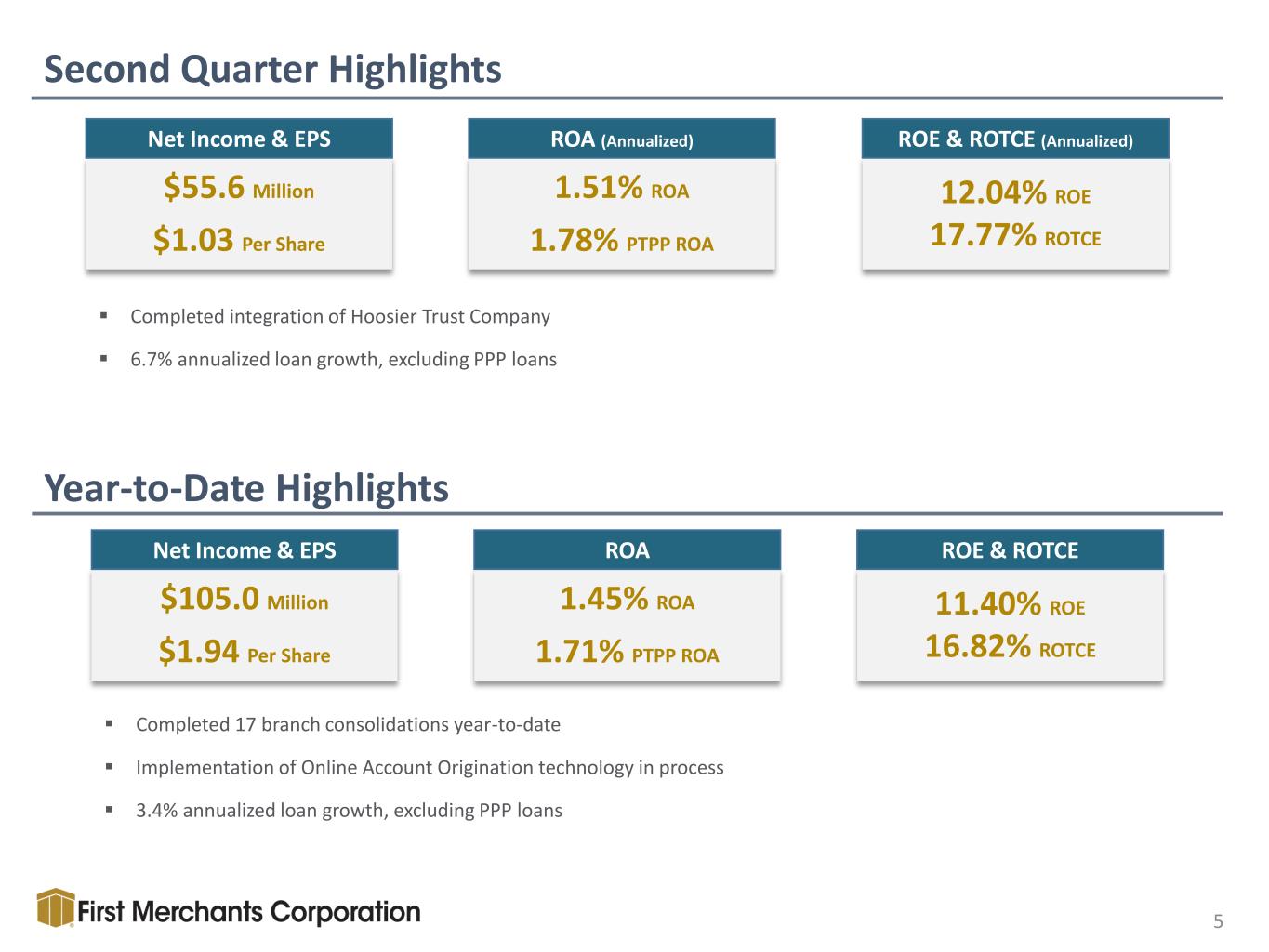

Second Quarter Highlights 5 Year-to-Date Highlights 1.45% ROA 1.71% PTPP ROA ROA $105.0 Million $1.94 Per Share Net Income & EPS 11.40% ROE 16.82% ROTCE ROE & ROTCE Completed integration of Hoosier Trust Company 6.7% annualized loan growth, excluding PPP loans 12.04% ROE 17.77% ROTCE ROE & ROTCE (Annualized) $55.6 Million $1.03 Per Share Net Income & EPS 1.51% ROA 1.78% PTPP ROA ROA (Annualized) Completed 17 branch consolidations year-to-date Implementation of Online Account Origination technology in process 3.4% annualized loan growth, excluding PPP loans

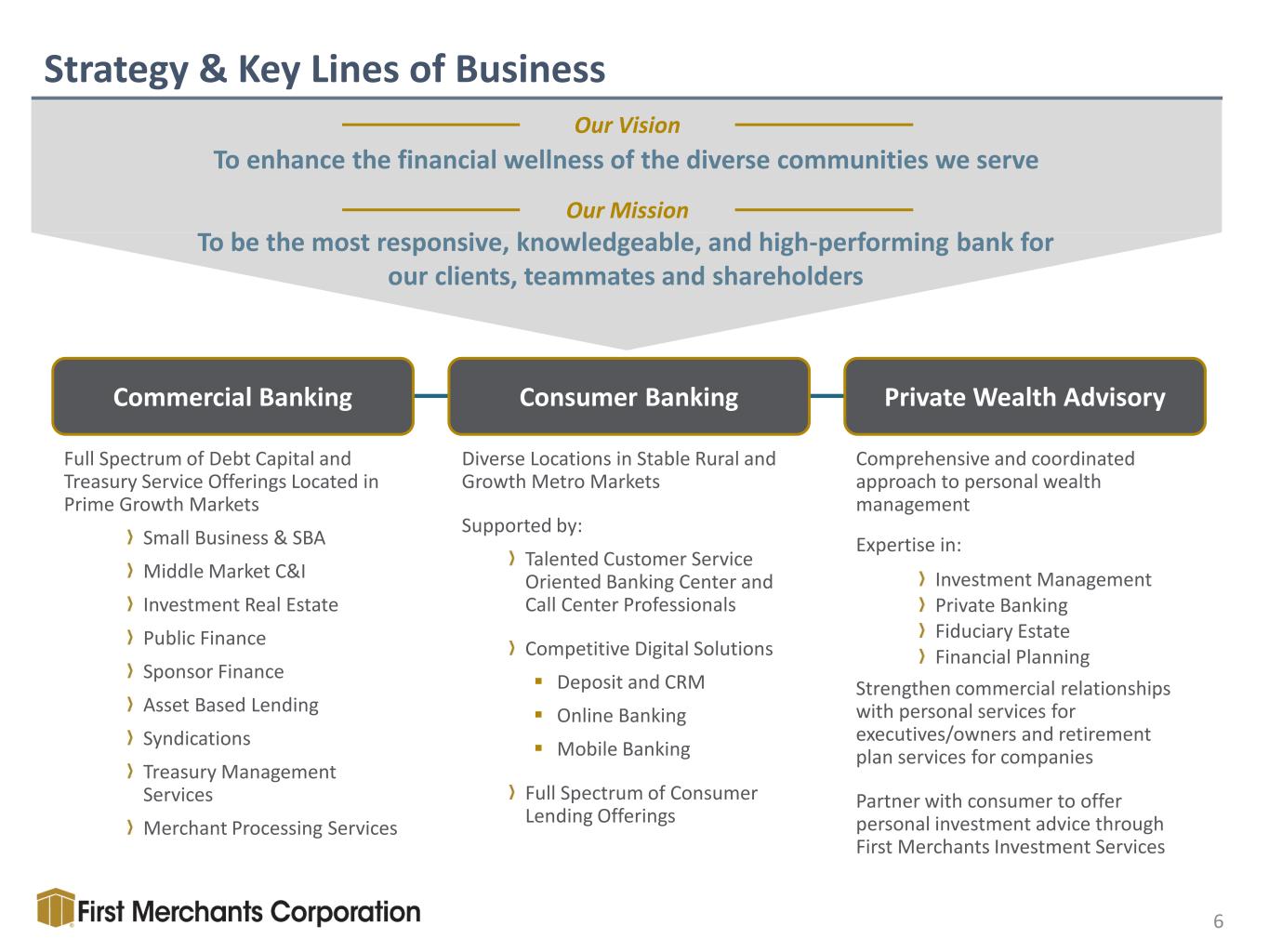

Strategy & Key Lines of Business 6 Consumer BankingCommercial Banking Private Wealth Advisory Full Spectrum of Debt Capital and Treasury Service Offerings Located in Prime Growth Markets Small Business & SBA Middle Market C&I Investment Real Estate Public Finance Sponsor Finance Asset Based Lending Syndications Treasury Management Services Merchant Processing Services Diverse Locations in Stable Rural and Growth Metro Markets Supported by: Talented Customer Service Oriented Banking Center and Call Center Professionals Competitive Digital Solutions Deposit and CRM Online Banking Mobile Banking Full Spectrum of Consumer Lending Offerings Comprehensive and coordinated approach to personal wealth management Expertise in: Investment Management Private Banking Fiduciary Estate Financial Planning Strengthen commercial relationships with personal services for executives/owners and retirement plan services for companies Partner with consumer to offer personal investment advice through First Merchants Investment Services Our Vision To enhance the financial wellness of the diverse communities we serve To be the most responsive, knowledgeable, and high-performing bank for our clients, teammates and shareholders Our Mission

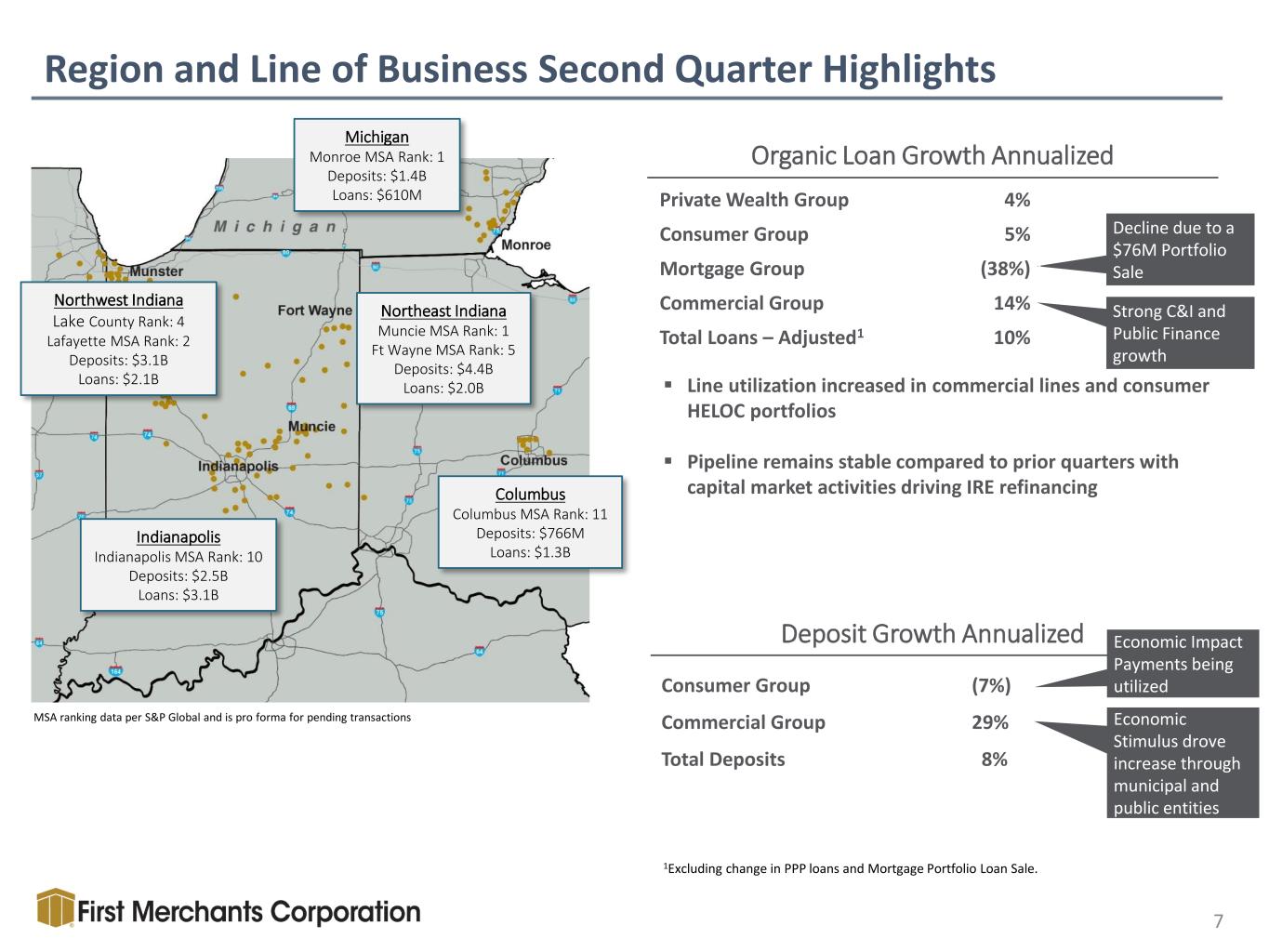

Deposit Growth Annualized Consumer Group (7%) Commercial Group 29% Total Deposits 8% Region and Line of Business Second Quarter Highlights 7 Indianapolis Indianapolis MSA Rank: 10 Deposits: $2.5B Loans: $3.1B Columbus Columbus MSA Rank: 11 Deposits: $766M Loans: $1.3B Northwest Indiana Lake County Rank: 4 Lafayette MSA Rank: 2 Deposits: $3.1B Loans: $2.1B Northeast Indiana Muncie MSA Rank: 1 Ft Wayne MSA Rank: 5 Deposits: $4.4B Loans: $2.0B Michigan Monroe MSA Rank: 1 Deposits: $1.4B Loans: $610M MSA ranking data per S&P Global and is pro forma for pending transactions Decline due to a $76M Portfolio Sale Organic Loan Growth Annualized Line utilization increased in commercial lines and consumer HELOC portfolios Pipeline remains stable compared to prior quarters with capital market activities driving IRE refinancing Private Wealth Group 4% Consumer Group 5% Mortgage Group (38%) Commercial Group 14% Total Loans – Adjusted1 10% Economic Impact Payments being utilized Economic Stimulus drove increase through municipal and public entities Strong C&I and Public Finance growth 1Excluding change in PPP loans and Mortgage Portfolio Loan Sale.

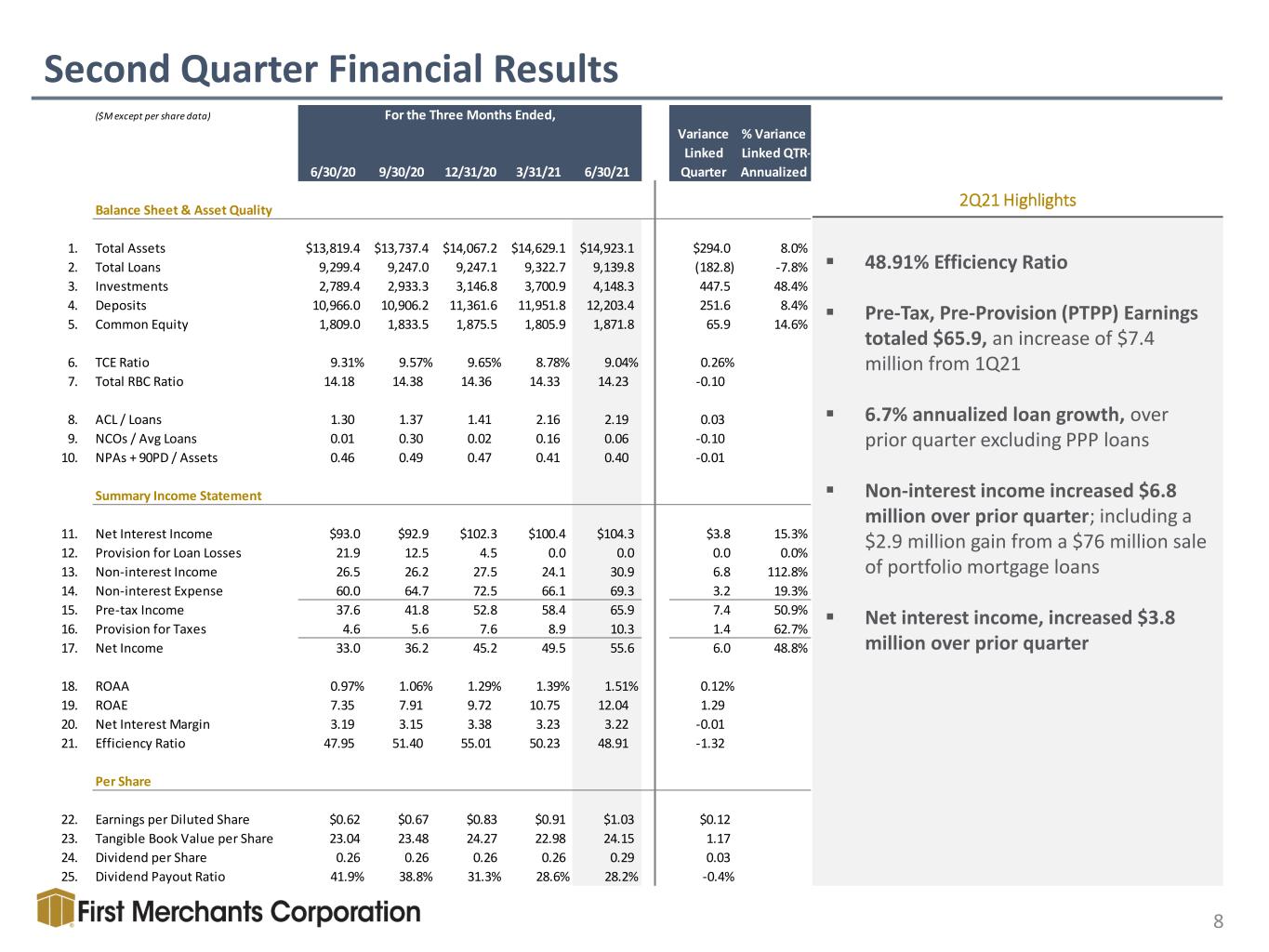

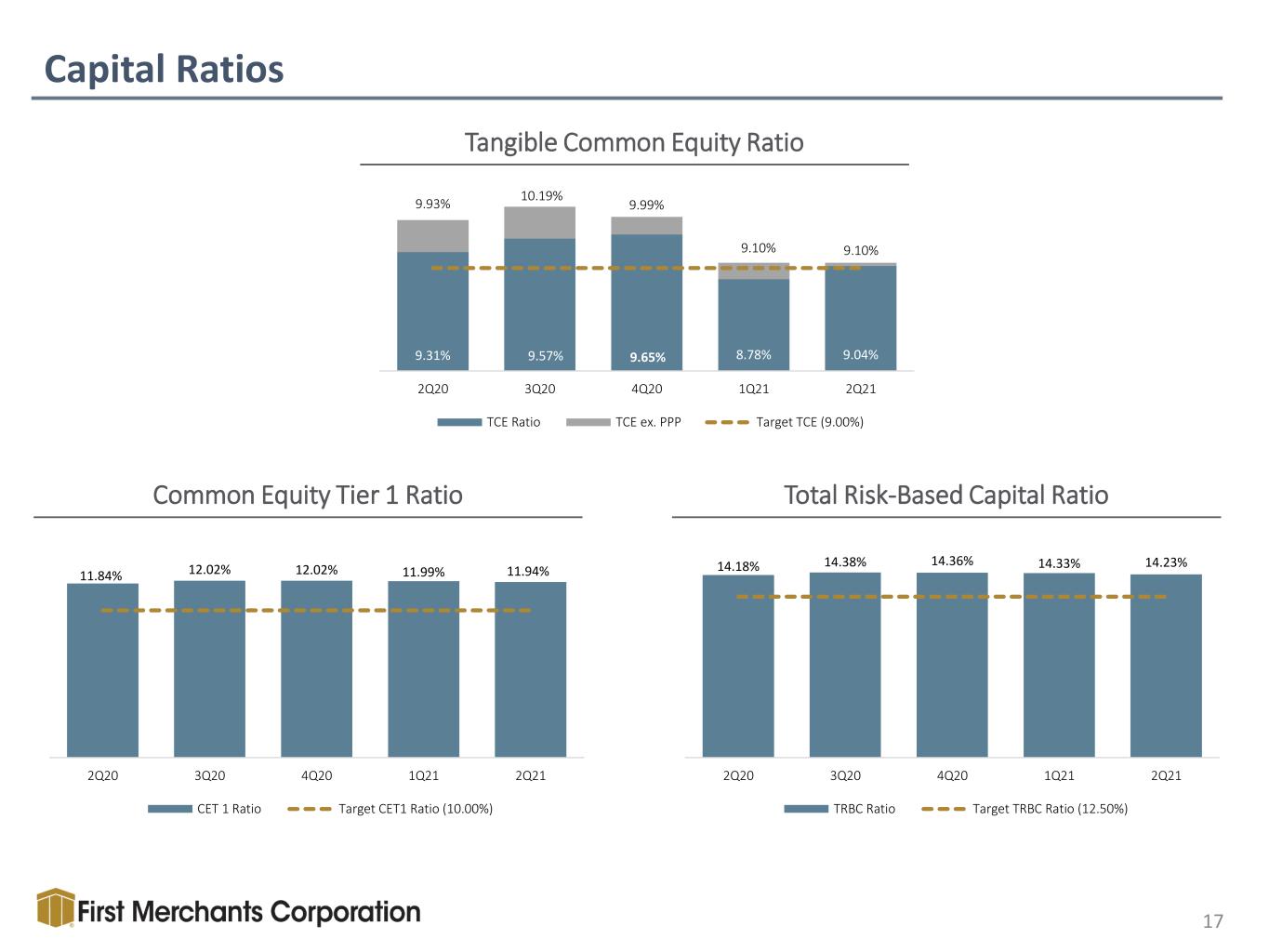

Second Quarter Financial Results 8 48.91% Efficiency Ratio Pre-Tax, Pre-Provision (PTPP) Earnings totaled $65.9, an increase of $7.4 million from 1Q21 6.7% annualized loan growth, over prior quarter excluding PPP loans Non-interest income increased $6.8 million over prior quarter; including a $2.9 million gain from a $76 million sale of portfolio mortgage loans Net interest income, increased $3.8 million over prior quarter 2Q21 Highlights ($M except per share data) 6/30/20 9/30/20 12/31/20 3/31/21 6/30/21 Variance Linked Quarter % Variance Linked QTR- Annualized Balance Sheet & Asset Quality 1. Total Assets $13,819.4 $13,737.4 $14,067.2 $14,629.1 $14,923.1 $294.0 8.0% 2. Total Loans 9,299.4 9,247.0 9,247.1 9,322.7 9,139.8 (182.8) -7.8% 3. Investments 2,789.4 2,933.3 3,146.8 3,700.9 4,148.3 447.5 48.4% 4. Deposits 10,966.0 10,906.2 11,361.6 11,951.8 12,203.4 251.6 8.4% 5. Common Equity 1,809.0 1,833.5 1,875.5 1,805.9 1,871.8 65.9 14.6% 6. TCE Ratio 9.31% 9.57% 9.65% 8.78% 9.04% 0.26% 7. Total RBC Ratio 14.18 14.38 14.36 14.33 14.23 -0.10 8. ACL / Loans 1.30 1.37 1.41 2.16 2.19 0.03 9. NCOs / Avg Loans 0.01 0.30 0.02 0.16 0.06 -0.10 10. NPAs + 90PD / Assets 0.46 0.49 0.47 0.41 0.40 -0.01 Summary Income Statement 11. Net Interest Income $93.0 $92.9 $102.3 $100.4 $104.3 $3.8 15.3% 12. Provision for Loan Losses 21.9 12.5 4.5 0.0 0.0 0.0 0.0% 13. Non-interest Income 26.5 26.2 27.5 24.1 30.9 6.8 112.8% 14. Non-interest Expense 60.0 64.7 72.5 66.1 69.3 3.2 19.3% 15. Pre-tax Income 37.6 41.8 52.8 58.4 65.9 7.4 50.9% 16. Provision for Taxes 4.6 5.6 7.6 8.9 10.3 1.4 62.7% 17. Net Income 33.0 36.2 45.2 49.5 55.6 6.0 48.8% 18. ROAA 0.97% 1.06% 1.29% 1.39% 1.51% 0.12% 19. ROAE 7.35 7.91 9.72 10.75 12.04 1.29 20. Net Interest Margin 3.19 3.15 3.38 3.23 3.22 -0.01 21. Efficiency Ratio 47.95 51.40 55.01 50.23 48.91 -1.32 Per Share 22. Earnings per Diluted Share $0.62 $0.67 $0.83 $0.91 $1.03 $0.12 23. Tangible Book Value per Share 23.04 23.48 24.27 22.98 24.15 1.17 24. Dividend per Share 0.26 0.26 0.26 0.26 0.29 0.03 25. Dividend Payout Ratio 41.9% 38.8% 31.3% 28.6% 28.2% -0.4% For the Three Months Ended,

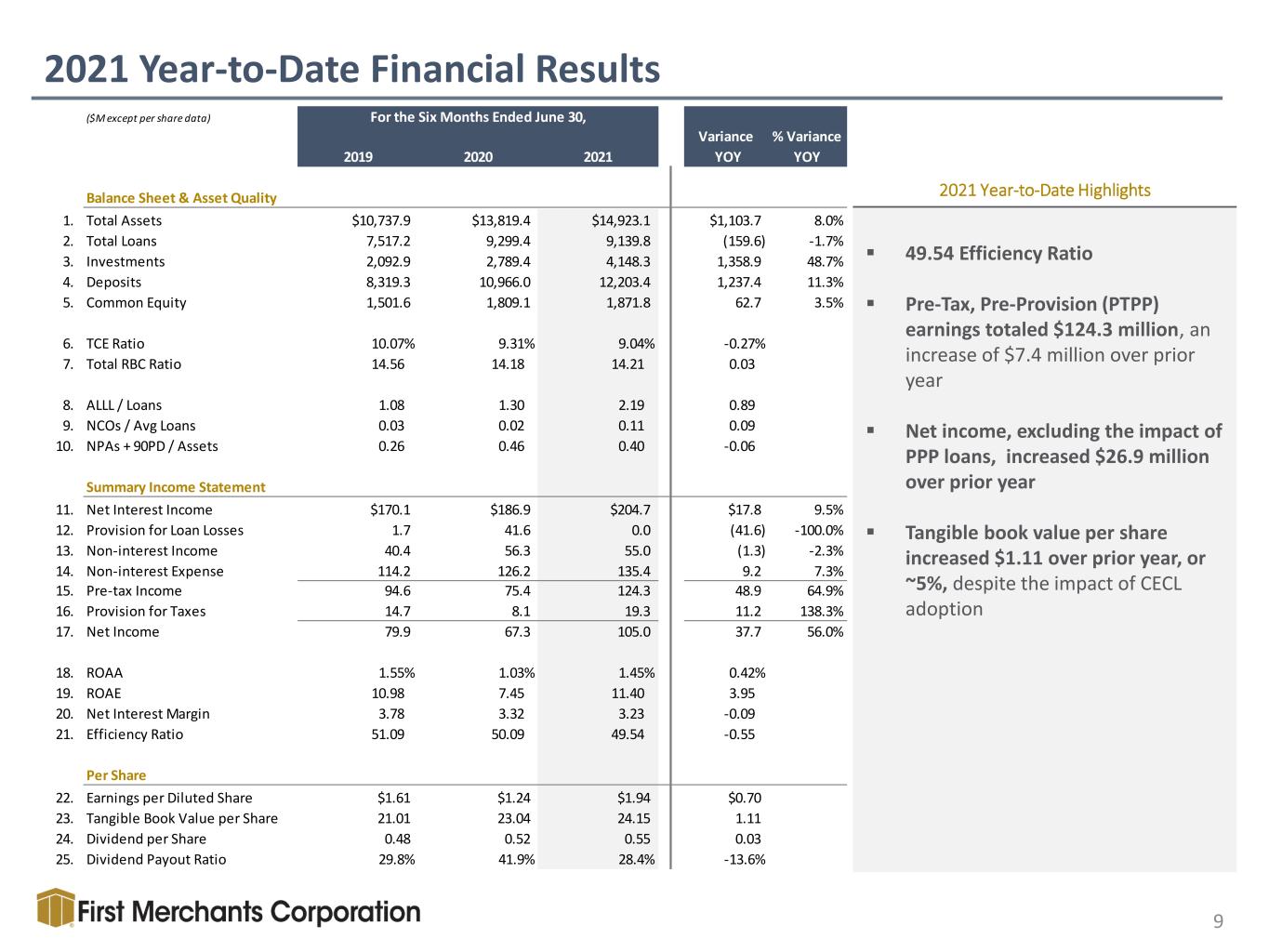

2021 Year-to-Date Financial Results 9 2021 Year-to-Date Highlights 49.54 Efficiency Ratio Pre-Tax, Pre-Provision (PTPP) earnings totaled $124.3 million, an increase of $7.4 million over prior year Net income, excluding the impact of PPP loans, increased $26.9 million over prior year Tangible book value per share increased $1.11 over prior year, or ~5%, despite the impact of CECL adoption ($M except per share data) 2019 2020 2021 Variance YOY % Variance YOY Balance Sheet & Asset Quality 1. Total Assets $10,737.9 $13,819.4 $14,923.1 $1,103.7 8.0% 2. Total Loans 7,517.2 9,299.4 9,139.8 (159.6) -1.7% 3. Investments 2,092.9 2,789.4 4,148.3 1,358.9 48.7% 4. Deposits 8,319.3 10,966.0 12,203.4 1,237.4 11.3% 5. Common Equity 1,501.6 1,809.1 1,871.8 62.7 3.5% 6. TCE Ratio 10.07% 9.31% 9.04% -0.27% 7. Total RBC Ratio 14.56 14.18 14.21 0.03 8. ALLL / Loans 1.08 1.30 2.19 0.89 9. NCOs / Avg Loans 0.03 0.02 0.11 0.09 10. NPAs + 90PD / Assets 0.26 0.46 0.40 -0.06 Summary Income Statement 11. Net Interest Income $170.1 $186.9 $204.7 $17.8 9.5% 12. Provision for Loan Losses 1.7 41.6 0.0 (41.6) -100.0% 13. Non-interest Income 40.4 56.3 55.0 (1.3) -2.3% 14. Non-interest Expense 114.2 126.2 135.4 9.2 7.3% 15. Pre-tax Income 94.6 75.4 124.3 48.9 64.9% 16. Provision for Taxes 14.7 8.1 19.3 11.2 138.3% 17. Net Income 79.9 67.3 105.0 37.7 56.0% 18. ROAA 1.55% 1.03% 1.45% 0.42% 19. ROAE 10.98 7.45 11.40 3.95 20. Net Interest Margin 3.78 3.32 3.23 -0.09 21. Efficiency Ratio 51.09 50.09 49.54 -0.55 Per Share 22. Earnings per Diluted Share $1.61 $1.24 $1.94 $0.70 23. Tangible Book Value per Share 21.01 23.04 24.15 1.11 24. Dividend per Share 0.48 0.52 0.55 0.03 25. Dividend Payout Ratio 29.8% 41.9% 28.4% -13.6% For the Six Months Ended June 30,

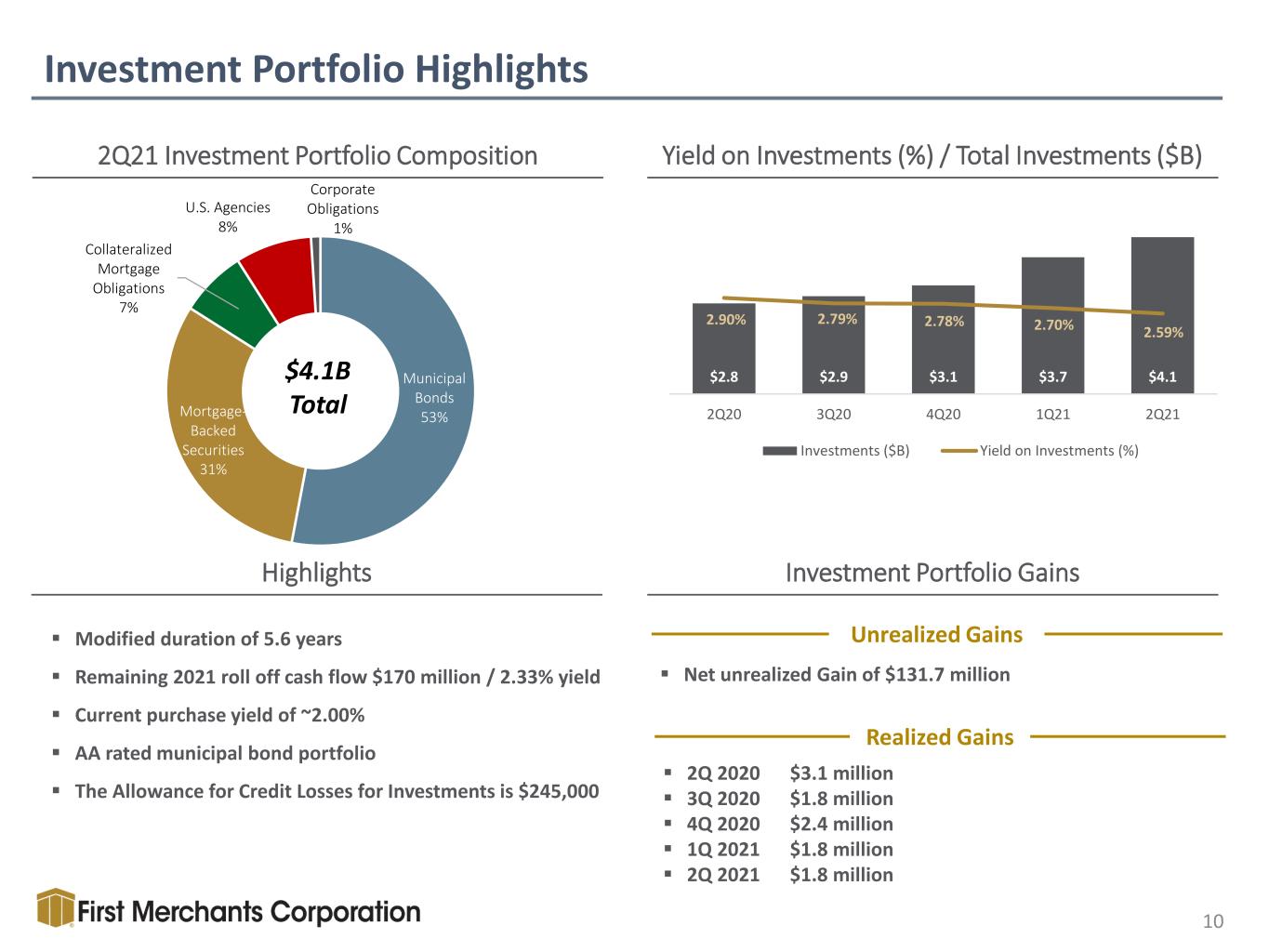

Net unrealized Gain of $131.7 million Investment Portfolio Highlights 10 2Q21 Investment Portfolio Composition Yield on Investments (%) / Total Investments ($B) $4.1B Total Investment Portfolio GainsHighlights Realized Gains 2Q 2020 $3.1 million 3Q 2020 $1.8 million 4Q 2020 $2.4 million 1Q 2021 $1.8 million 2Q 2021 $1.8 million Unrealized Gains Modified duration of 5.6 years Remaining 2021 roll off cash flow $170 million / 2.33% yield Current purchase yield of ~2.00% AA rated municipal bond portfolio The Allowance for Credit Losses for Investments is $245,000 Municipal Bonds 53%Mortgage- Backed Securities 31% Collateralized Mortgage Obligations 7% U.S. Agencies 8% Corporate Obligations 1% $2.8 $2.9 $3.1 $3.7 $4.1 2.90% 2.79% 2.78% 2.70% 2.59% 2Q20 3Q20 4Q20 1Q21 2Q21 Investments ($B) Yield on Investments (%)

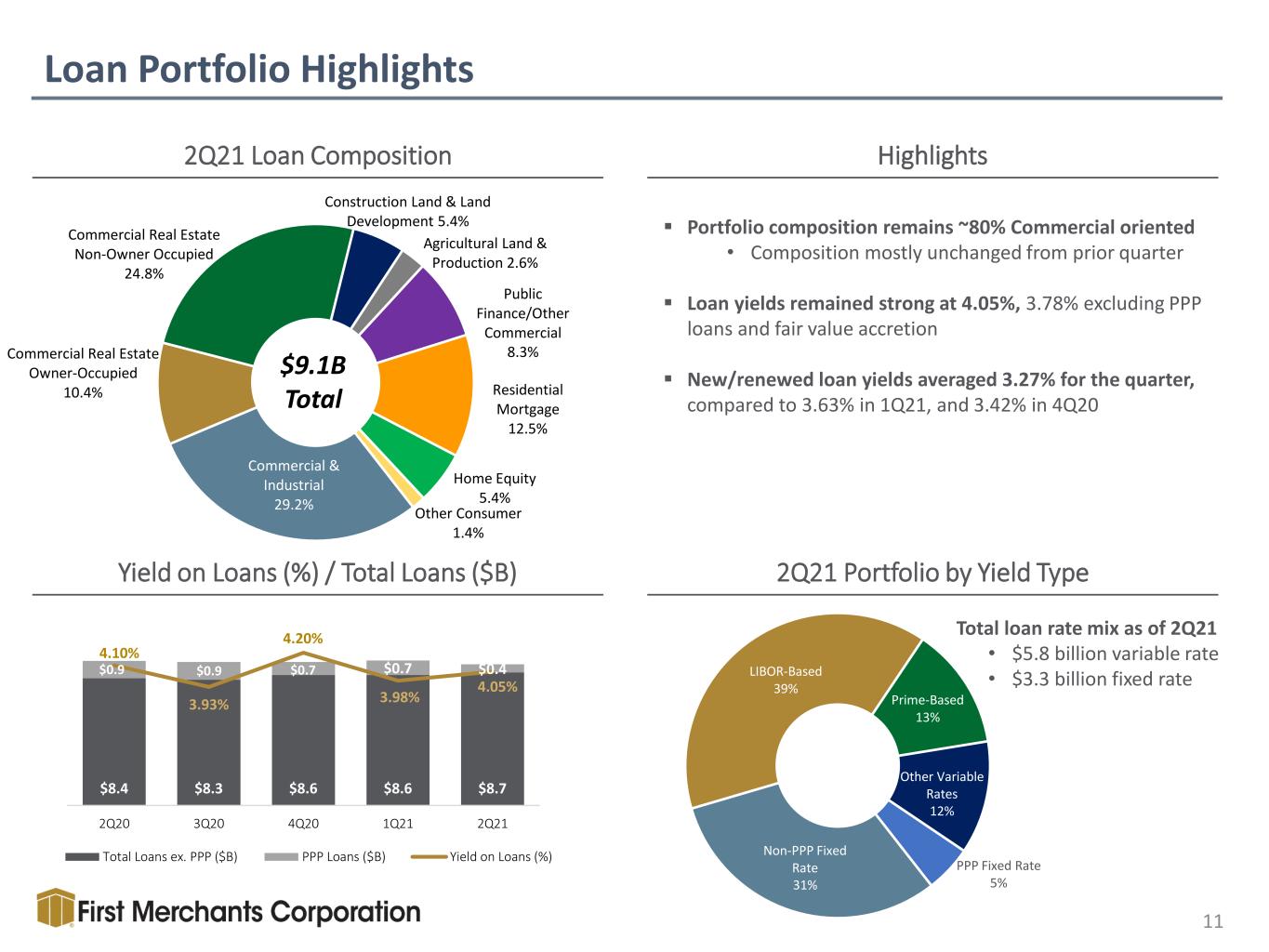

Commercial & Industrial 29.2% Commercial Real Estate Owner-Occupied 10.4% Commercial Real Estate Non-Owner Occupied 24.8% Construction Land & Land Development 5.4% Agricultural Land & Production 2.6% Public Finance/Other Commercial 8.3% Residential Mortgage 12.5% Home Equity 5.4% Other Consumer 1.4% Loan Portfolio Highlights 11 2Q21 Loan Composition Yield on Loans (%) / Total Loans ($B) $9.1B Total 2Q21 Portfolio by Yield Type Highlights Total loan rate mix as of 2Q21 • $5.8 billion variable rate • $3.3 billion fixed rate $0.9 Portfolio composition remains ~80% Commercial oriented • Composition mostly unchanged from prior quarter Loan yields remained strong at 4.05%, 3.78% excluding PPP loans and fair value accretion New/renewed loan yields averaged 3.27% for the quarter, compared to 3.63% in 1Q21, and 3.42% in 4Q20 $0.9$0.9 Non-PPP Fixed Rate 31% LIBOR-Based 39% Prime-Based 13% Other Variable Rates 12% PPP Fixed Rate 5% $8.4 $8.3 $8.6 $8.6 $8.7 $0.7 $0.4 4.10% 3.93% 4.20% 3.98% 4.05% 2Q20 3Q20 4Q20 1Q21 2Q21 Total Loans ex. PPP ($B) PPP Loans ($B) Yield on Loans (%) $0.7$0.9 $0.9

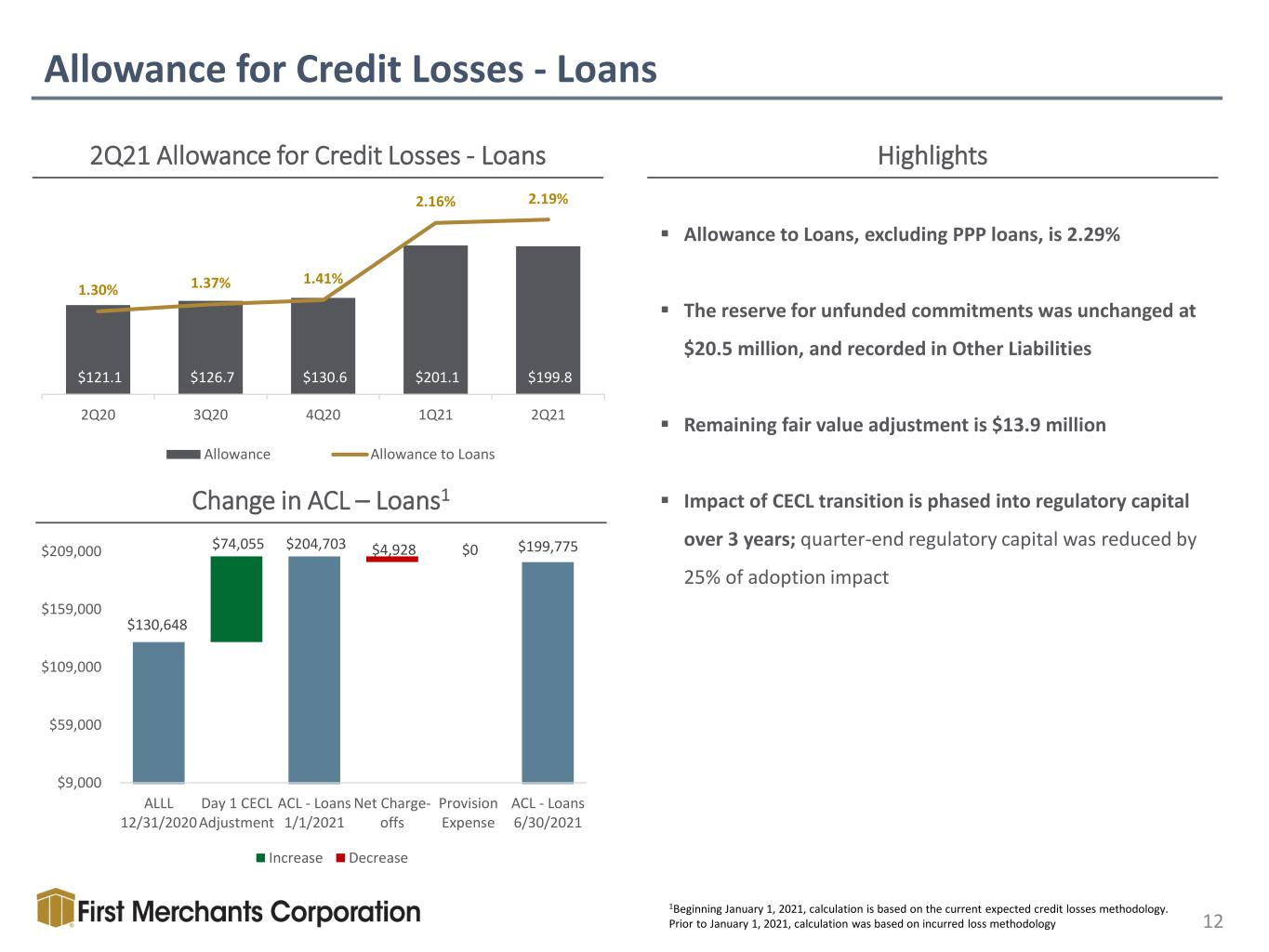

$130,648 $204,703 $199,775 $74,055 $0 $4,928 $9,000 $59,000 $109,000 $159,000 $209,000 ALLL 12/31/2020 Day 1 CECL Adjustment ACL - Loans 1/1/2021 Net Charge- offs Provision Expense ACL - Loans 6/30/2021 Increase Decrease Allowance for Credit Losses - Loans 12 2Q21 Allowance for Credit Losses - Loans Change in ACL – Loans1 Highlights Allowance to Loans, excluding PPP loans, is 2.29% The reserve for unfunded commitments was unchanged at $20.5 million, and recorded in Other Liabilities Remaining fair value adjustment is $13.9 million Impact of CECL transition is phased into regulatory capital over 3 years; quarter-end regulatory capital was reduced by 25% of adoption impact 1Beginning January 1, 2021, calculation is based on the current expected credit losses methodology. Prior to January 1, 2021, calculation was based on incurred loss methodology $121.1 $126.7 $130.6 $201.1 $199.8 1.30% 1.37% 1.41% 2.16% 2.19% 2Q20 3Q20 4Q20 1Q21 2Q21 Allowance Allowance to Loans

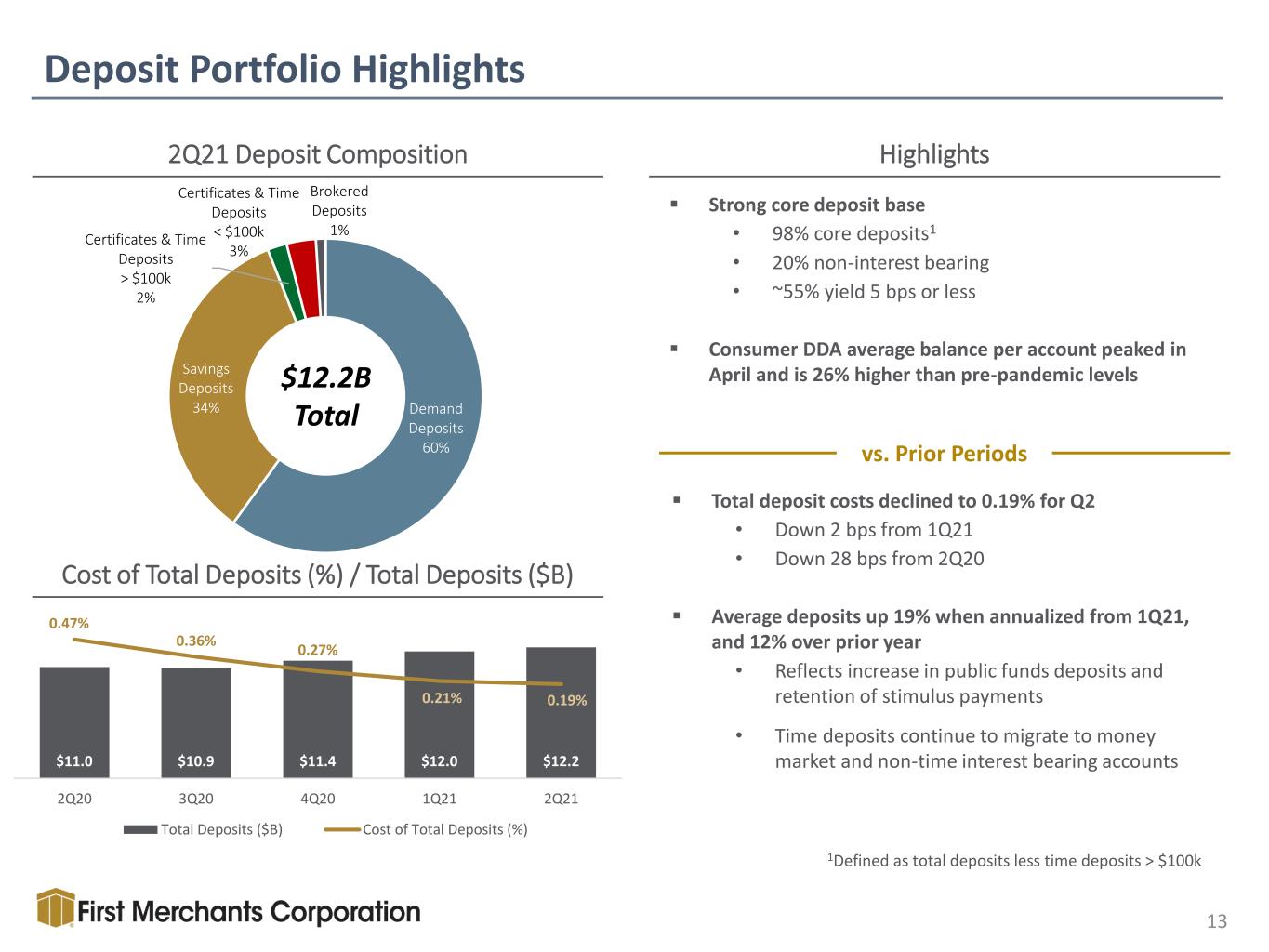

Demand Deposits 60% Savings Deposits 34% Certificates & Time Deposits > $100k 2% Certificates & Time Deposits < $100k 3% Brokered Deposits 1% 13 2Q21 Deposit Composition Highlights $12.2B Total 1Defined as total deposits less time deposits > $100k vs. Prior Periods Cost of Total Deposits (%) / Total Deposits ($B) Deposit Portfolio Highlights Strong core deposit base • 98% core deposits1 • 20% non-interest bearing • ~55% yield 5 bps or less Consumer DDA average balance per account peaked in April and is 26% higher than pre-pandemic levels Total deposit costs declined to 0.19% for Q2 • Down 2 bps from 1Q21 • Down 28 bps from 2Q20 Average deposits up 19% when annualized from 1Q21, and 12% over prior year • Reflects increase in public funds deposits and retention of stimulus payments • Time deposits continue to migrate to money market and non-time interest bearing accounts$11.0 $10.9 $11.4 $12.0 $12.2 0.47% 0.36% 0.27% 0.21% 0.19% 2Q20 3Q20 4Q20 1Q21 2Q21 Total Deposits ($B) Cost of Total Deposits (%)

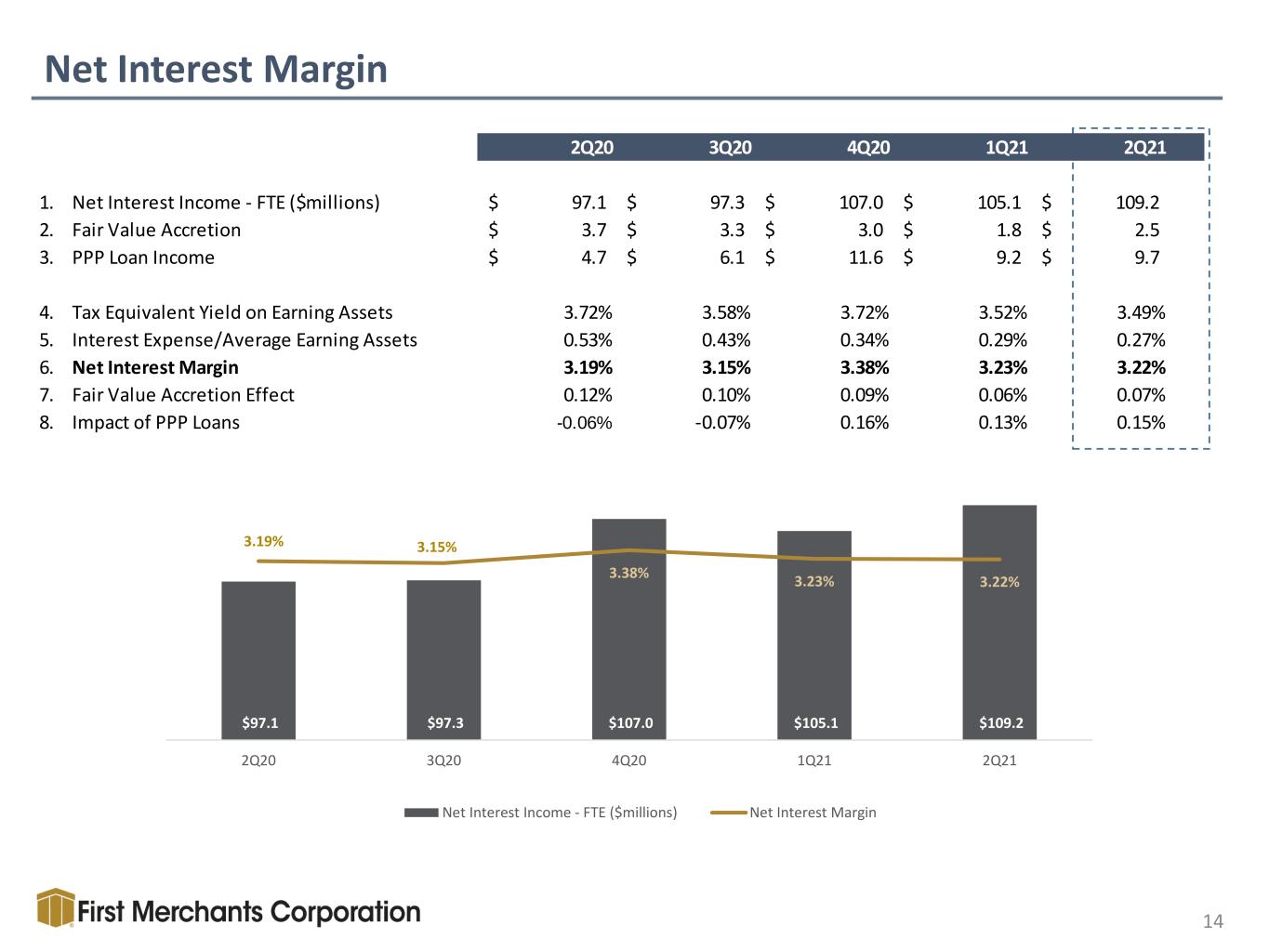

Net Interest Margin 14 $105.1$97.1 $97.3 $105.1 $107.0$97.8 2Q20 3Q20 4Q20 1Q21 2Q21 1. Net Interest Income - FTE ($millions) 97.1$ 97.3$ 107.0$ 105.1$ 109.2$ 2. Fair Value Accretion 3.7$ 3.3$ 3.0$ 1.8$ 2.5$ 3. PPP Loan Income 4.7$ 6.1$ 11.6$ 9.2$ 9.7$ 4. Tax Equivalent Yield on Earning Assets 3.72% 3.58% 3.72% 3.52% 3.49% 5. Interest Expense/Average Earning Assets 0.53% 0.43% 0.34% 0.29% 0.27% 6. Net Interest Margin 3.19% 3.15% 3.38% 3.23% 3.22% 7. Fair Value Accretion Effect 0.12% 0.10% 0.09% 0.06% 0.07% 8. Impact of PPP Loans -0.06% -0.07% 0.16% 0.13% 0.15% $97.1 $97.3 $107.0 $105.1 $109.2 3.19% 3.15% 3.38% 3.23% 3.22% 2Q20 3Q20 4Q20 1Q21 2Q21 Net Interest Income - FTE ($millions) Net Interest Margin

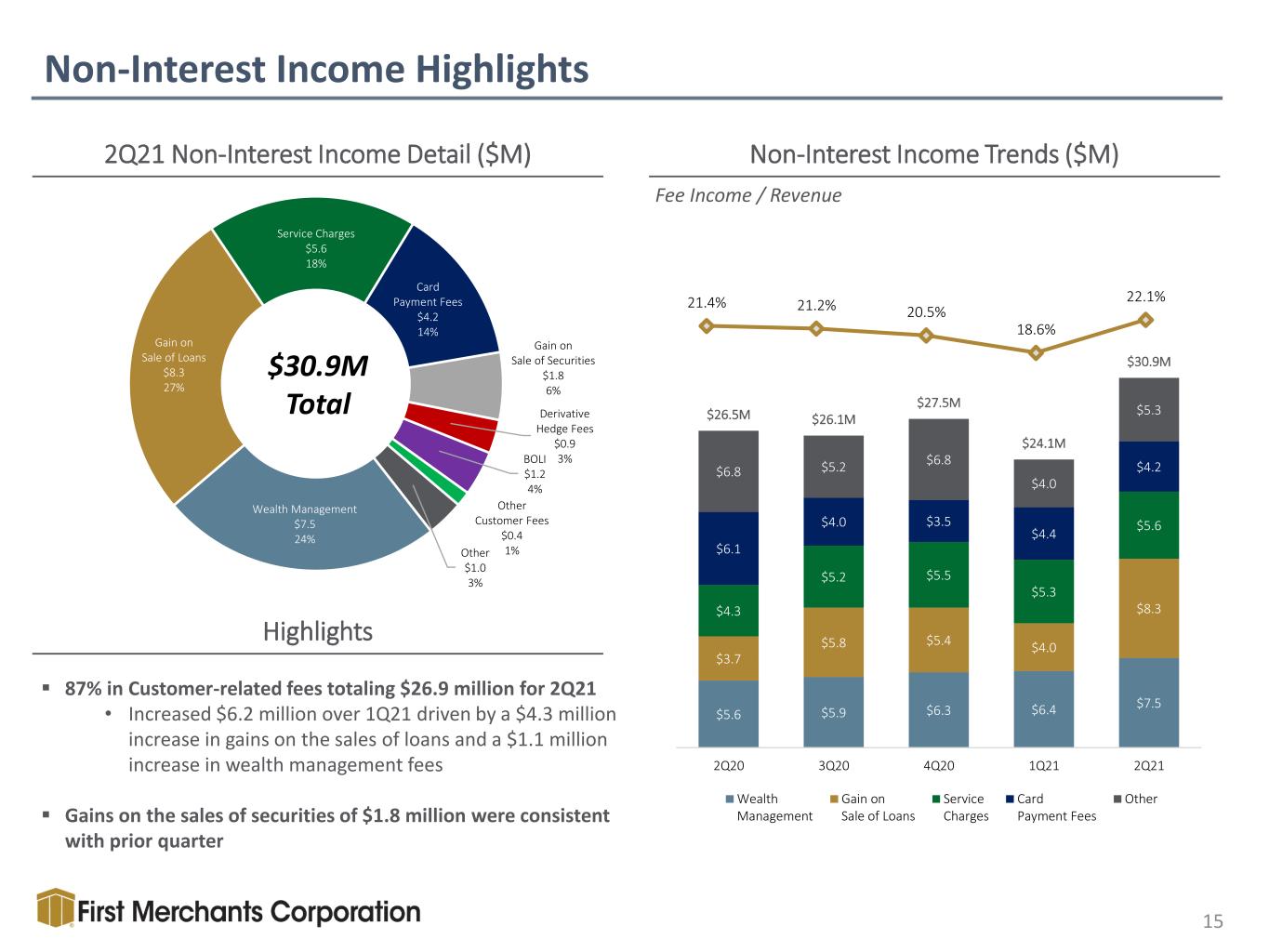

15 2Q21 Non-Interest Income Detail ($M) $30.9M Total Non-Interest Income Trends ($M) Fee Income / Revenue Non-Interest Income Highlights Highlights 87% in Customer-related fees totaling $26.9 million for 2Q21 • Increased $6.2 million over 1Q21 driven by a $4.3 million increase in gains on the sales of loans and a $1.1 million increase in wealth management fees Gains on the sales of securities of $1.8 million were consistent with prior quarter Wealth Management $7.5 24% Gain on Sale of Loans $8.3 27% Service Charges $5.6 18% Card Payment Fees $4.2 14% Gain on Sale of Securities $1.8 6% Derivative Hedge Fees $0.9 3%BOLI $1.2 4% Other Customer Fees $0.4 1%Other $1.0 3% 21.4% 21.2% 20.5% 18.6% 22.1% $5.6 $5.9 $6.3 $6.4 $7.5 $3.7 $5.8 $5.4 $4.0 $8.3 $4.3 $5.2 $5.5 $5.3 $5.6 $6.1 $4.0 $3.5 $4.4 $4.2 $6.8 $5.2 $6.8 $4.0 $5.3 $26.5M $26.1M $27.5M $24.1M $30.9M 2Q20 3Q20 4Q20 1Q21 2Q21 Wealth Management Gain on Sale of Loans Service Charges Card Payment Fees Other

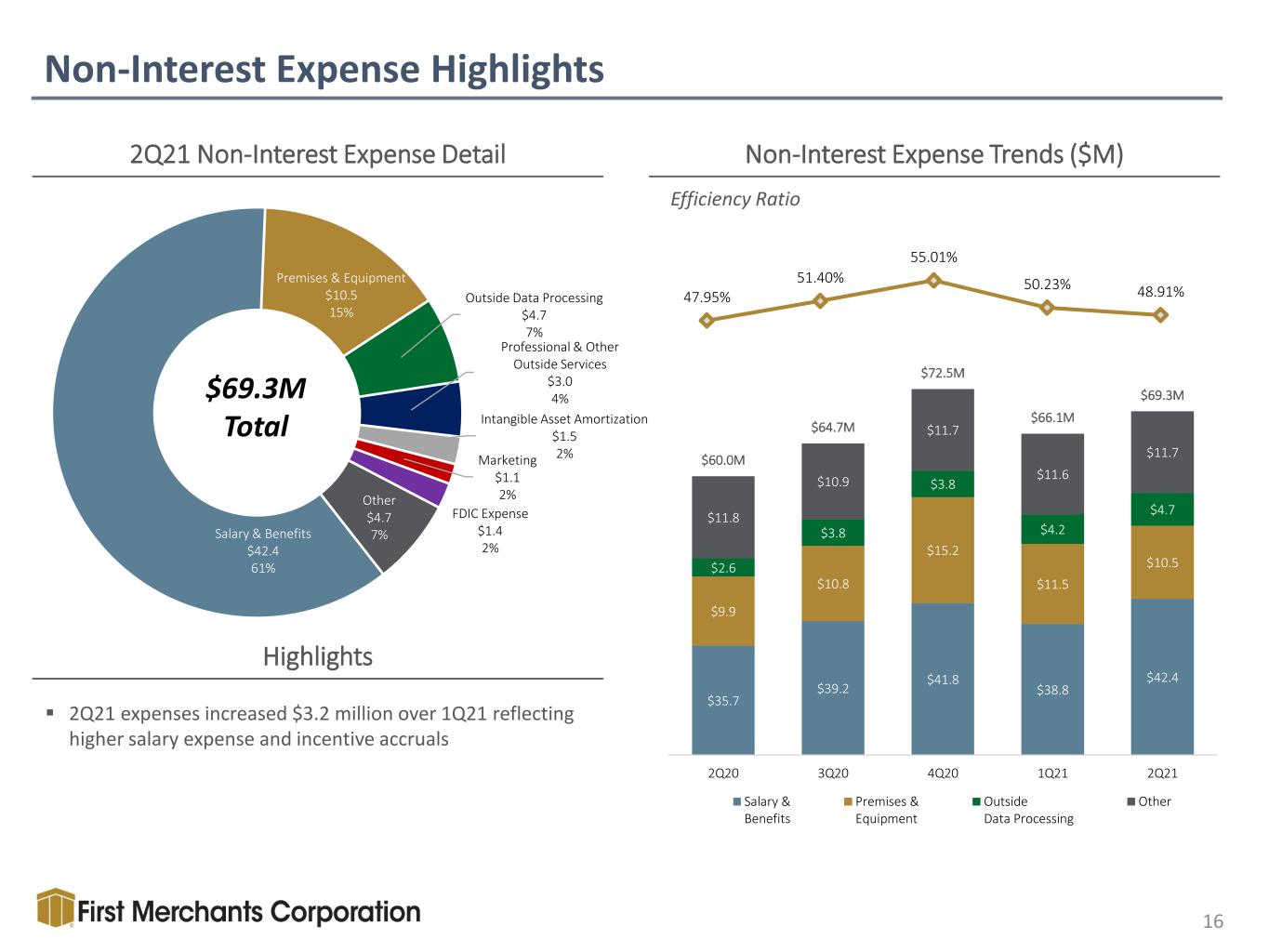

Salary & Benefits $42.4 61% Premises & Equipment $10.5 15% Outside Data Processing $4.7 7% Professional & Other Outside Services $3.0 4% Intangible Asset Amortization $1.5 2%Marketing $1.1 2% FDIC Expense $1.4 2% Other $4.7 7% 16 2Q21 Non-Interest Expense Detail $69.3M Total Non-Interest Expense Trends ($M) Efficiency Ratio Non-Interest Expense Highlights Highlights 2Q21 expenses increased $3.2 million over 1Q21 reflecting higher salary expense and incentive accruals $35.7 $39.2 $41.8 $38.8 $42.4 $9.9 $10.8 $15.2 $11.5 $10.5 $2.6 $3.8 $3.8 $4.2 $4.7 $11.8 $10.9 $11.7 $11.6 $11.7 $60.0M $64.7M $72.5M $66.1M $69.3M 2Q20 3Q20 4Q20 1Q21 2Q21 Salary & Benefits Premises & Equipment Outside Data Processing Other 47.95% 51.40% 55.01% 50.23% 48.91%

17 Tangible Common Equity Ratio Common Equity Tier 1 Ratio Total Risk-Based Capital Ratio Capital Ratios 9.31% 9.31% 9.57% 9.31% 9.31% 11.84% 12.02% 12.02% 11.99% 11.94% 2Q20 3Q20 4Q20 1Q21 2Q21 CET 1 Ratio Target CET1 Ratio (10.00%) 14.18% 14.38% 14.36% 14.33% 14.23% 2Q20 3Q20 4Q20 1Q21 2Q21 TRBC Ratio Target TRBC Ratio (12.50%) 8.78% 9.04% 9.93% 10.19% 9.99% 9.10% 9.10% 2Q20 3Q20 4Q20 1Q21 2Q21 TCE Ratio TCE ex. PPP Target TCE (9.00%) 9.65%9.57%9.31%

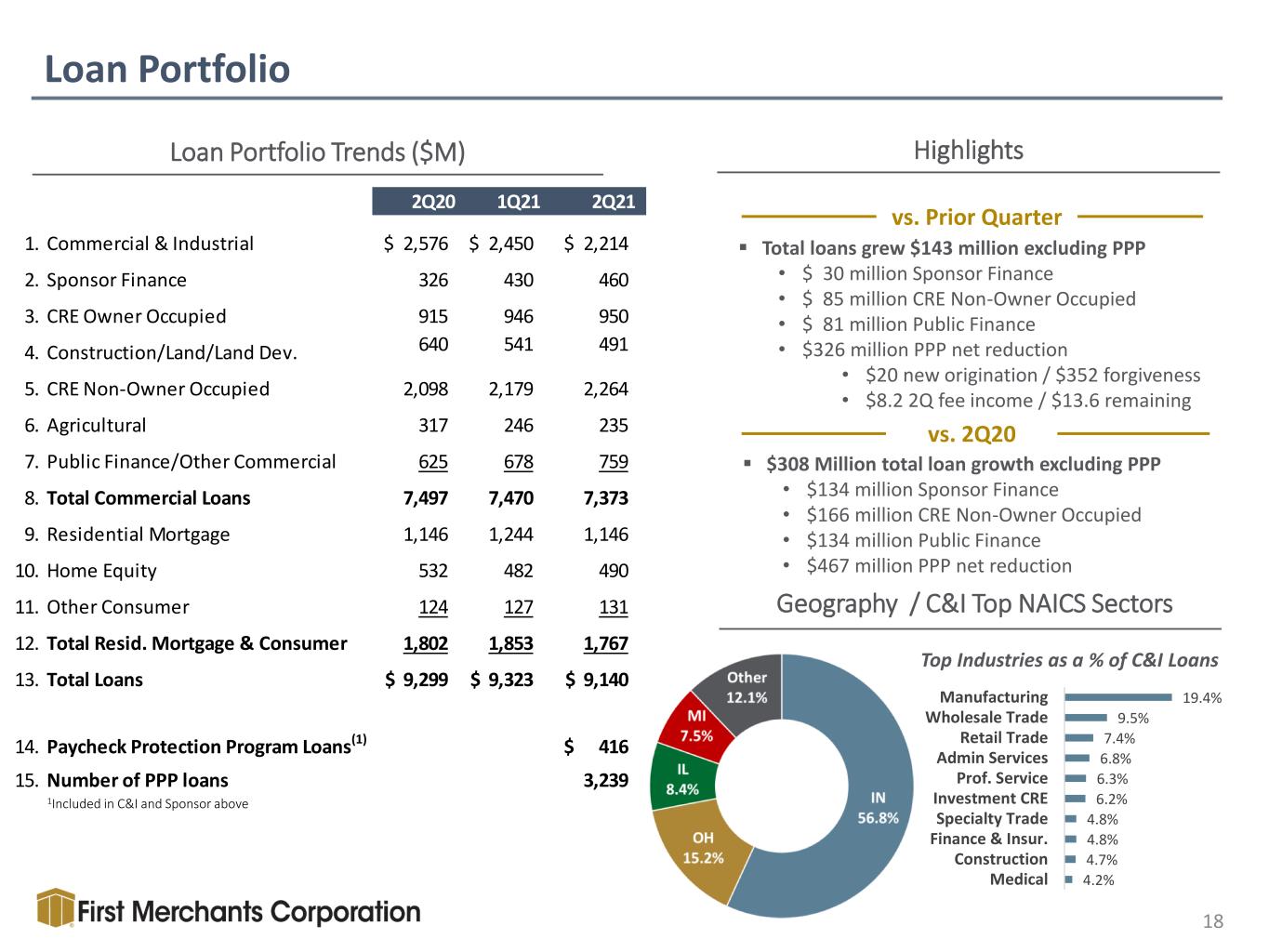

19.4% 9.5% 7.4% 6.8% 6.3% 6.2% 4.8% 4.8% 4.7% 4.2% Manufacturing Wholesale Trade Retail Trade Admin Services Prof. Service Investment CRE Specialty Trade Finance & Insur. Construction Medical Total loans grew $143 million excluding PPP • $ 30 million Sponsor Finance • $ 85 million CRE Non-Owner Occupied • $ 81 million Public Finance • $326 million PPP net reduction • $20 new origination / $352 forgiveness • $8.2 2Q fee income / $13.6 remaining Loan Portfolio 18 Highlights vs. Prior Quarter vs. 2Q20 $308 Million total loan growth excluding PPP • $134 million Sponsor Finance • $166 million CRE Non-Owner Occupied • $134 million Public Finance • $467 million PPP net reduction Geography / C&I Top NAICS Sectors 1Included in C&I and Sponsor above Loan Portfolio Trends ($M) Top Industries as a % of C&I Loans 2Q20 1Q21 2Q21 1. Commercial & Industrial 2,576$ 2,450$ 2,214$ 2. Sponsor Finance 326 430 460 3. CRE Owner Occupied 915 946 950 4. Construction/Land/Land Dev. 640 541 491 5. CRE Non-Owner Occupied 2,098 2,179 2,264 6. Agricultural 317 246 235 7. Public Finance/Other Commercial 625 678 759 8. Total Commercial Loans 7,497 7,470 7,373 9. Residential Mortgage 1,146 1,244 1,146 10. Home Equity 532 482 490 11. Other Consumer 124 127 131 12. Total Resid. Mortgage & Consumer 1,802 1,853 1,767 13. Total Loans 9,299$ 9,323$ 9,140$ 14. Paycheck Protection Program Loans(1) 416$ 15. Number of PPP loans 3,239

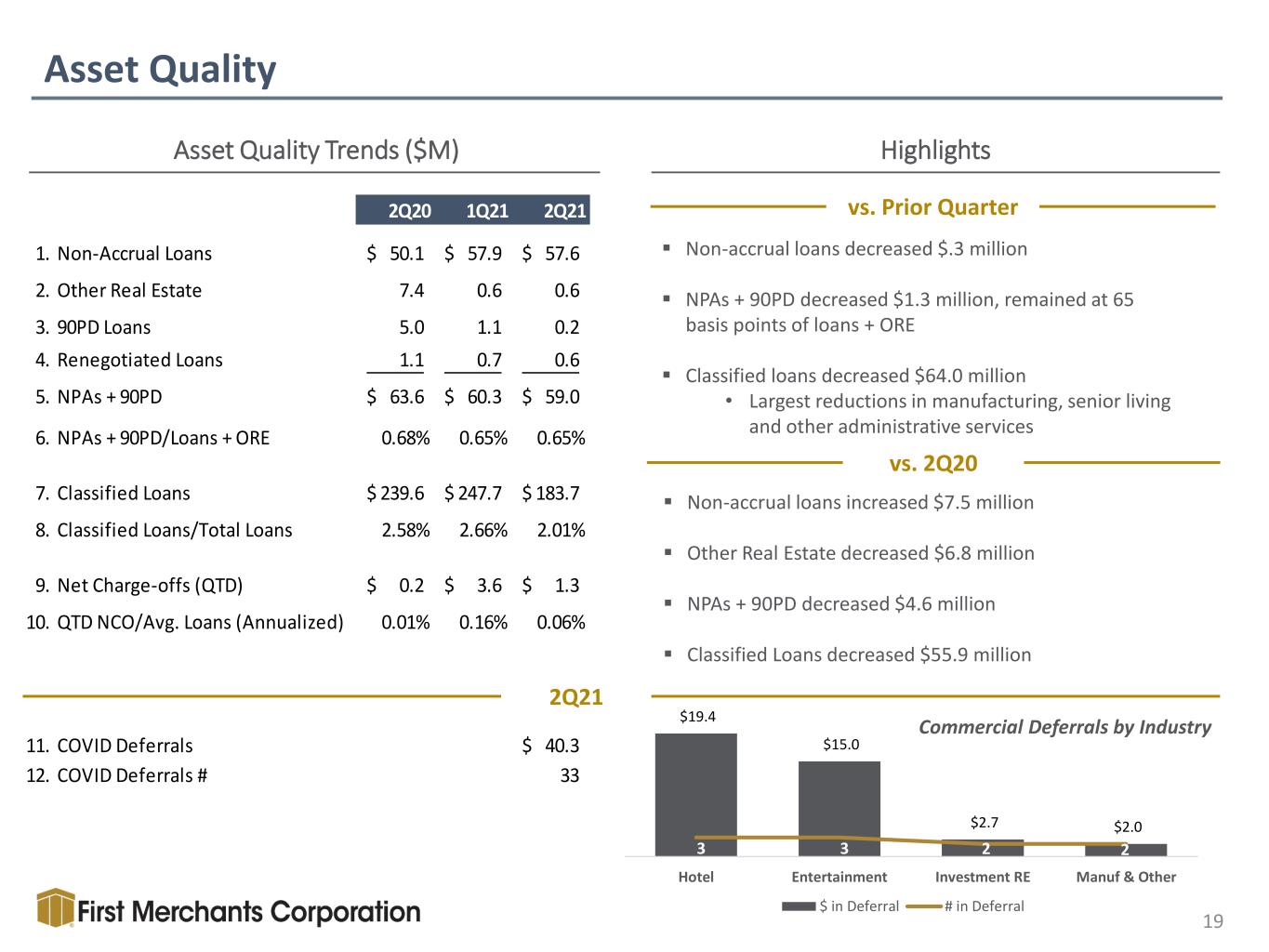

$19.4 $15.0 $2.7 $2.0 3 3 2 2 Hotel Entertainment Investment RE Manuf & Other $ in Deferral # in Deferral Asset Quality 19 Asset Quality Trends ($M) Highlights vs. Prior Quarter vs. 2Q20 Non-accrual loans decreased $.3 million NPAs + 90PD decreased $1.3 million, remained at 65 basis points of loans + ORE Classified loans decreased $64.0 million • Largest reductions in manufacturing, senior living and other administrative services Non-accrual loans increased $7.5 million Other Real Estate decreased $6.8 million NPAs + 90PD decreased $4.6 million Classified Loans decreased $55.9 million Commercial Deferrals by Industry 2Q21 2Q20 1Q21 2Q21 1. Non-Accrual Loans 50.1$ 57.9$ 57.6$ 2. Other Real Estate 7.4 0.6 0.6 3. 90PD Loans 5.0 1.1 0.2 4. Renegotiated Loans 1.1 0.7 0.6 5. NPAs + 90PD 63.6$ 60.3$ 59.0$ 6. NPAs + 90PD/Loans + ORE 0.68% 0.65% 0.65% 7. Classified Loans 239.6$ 247.7$ 183.7$ 8. Classified Loans/Total Loans 2.58% 2.66% 2.01% 9. Net Charge-offs (QTD) 0.2$ 3.6$ 1.3$ 10. QTD NCO/Avg. Loans (Annualized) 0.01% 0.16% 0.06% 11. COVID Deferrals 40.3$ 12. COVID Deferrals # 33

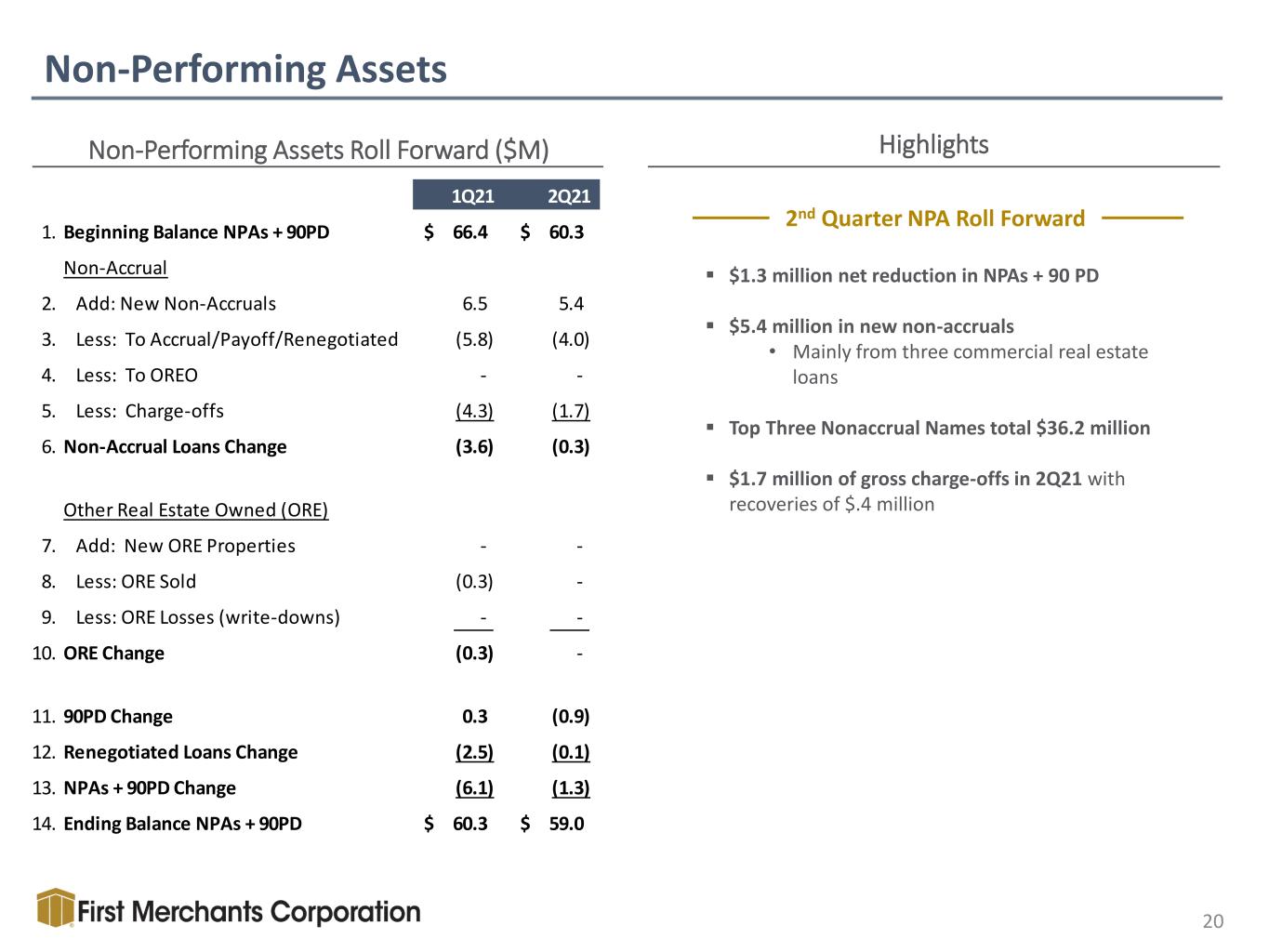

$1.3 million net reduction in NPAs + 90 PD $5.4 million in new non-accruals • Mainly from three commercial real estate loans Top Three Nonaccrual Names total $36.2 million $1.7 million of gross charge-offs in 2Q21 with recoveries of $.4 million Non-Performing Assets 20 Highlights 2nd Quarter NPA Roll Forward Non-Performing Assets Roll Forward ($M) 1Q21 2Q21 1. Beginning Balance NPAs + 90PD 66.4$ 60.3$ Non-Accrual 2. Add: New Non-Accruals 6.5 5.4 3. Less: To Accrual/Payoff/Renegotiated (5.8) (4.0) 4. Less: To OREO - - 5. Less: Charge-offs (4.3) (1.7) 6. Non-Accrual Loans Change (3.6) (0.3) Other Real Estate Owned (ORE) 7. Add: New ORE Properties - - 8. Less: ORE Sold (0.3) - 9. Less: ORE Losses (write-downs) - - 10. ORE Change (0.3) - 11. 90PD Change 0.3 (0.9) 12. Renegotiated Loans Change (2.5) (0.1) 13. NPAs + 90PD Change (6.1) (1.3) 14. Ending Balance NPAs + 90PD 60.3$ 59.0$

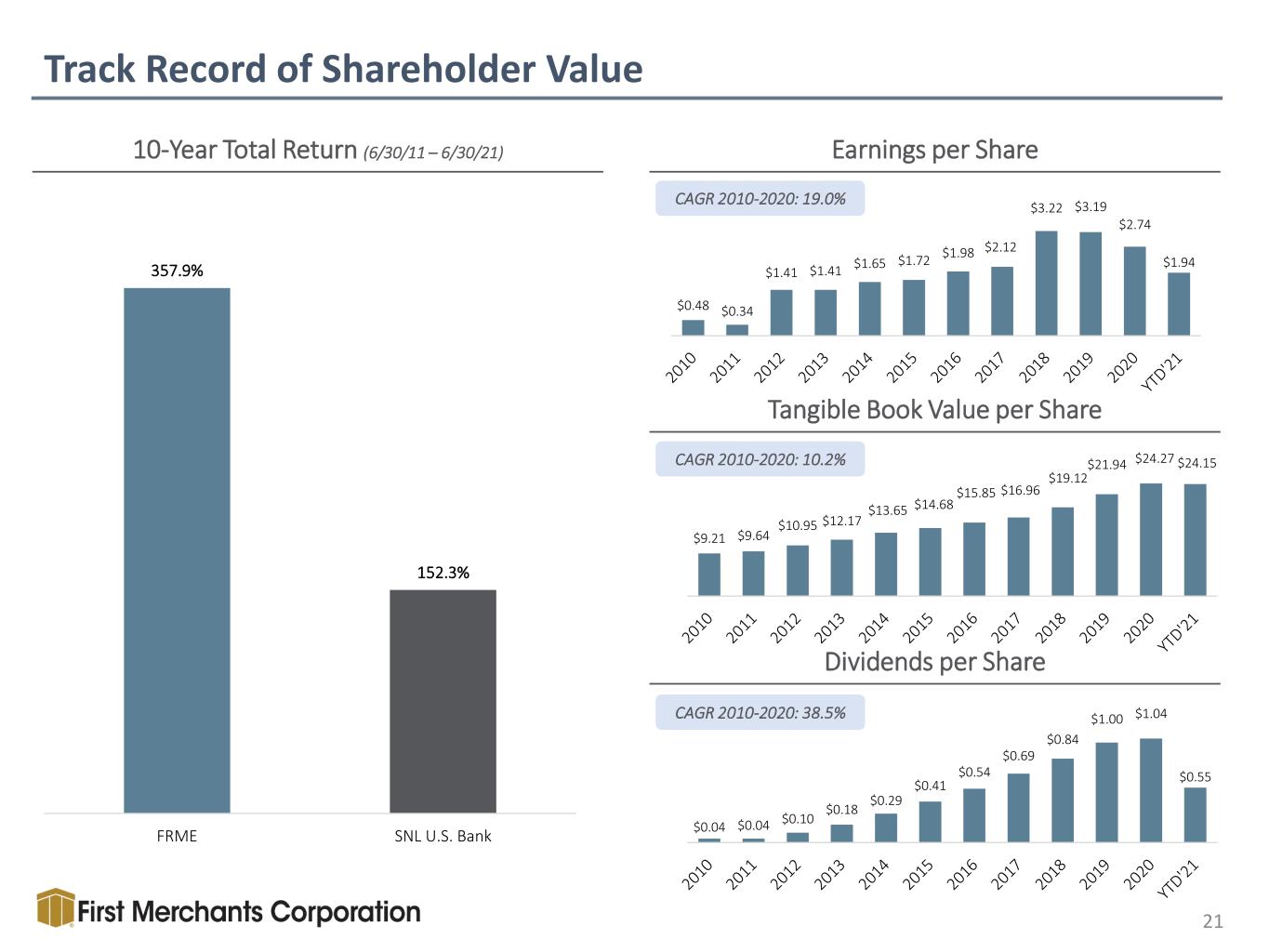

Track Record of Shareholder Value 21 10-Year Total Return (6/30/11 – 6/30/21) Earnings per Share Tangible Book Value per Share Dividends per Share CAGR 2010-2020: 19.0% CAGR 2010-2020: 10.2% CAGR 2010-2020: 38.5% $0.48 $0.34 $1.41 $1.41 $1.65 $1.72 $1.98 $2.12 $3.22 $3.19 $2.74 $1.94 $9.21 $9.64 $10.95 $12.17 $13.65 $14.68 $15.85 $16.96 $19.12 $21.94 $24.27 $24.15 $0.04 $0.04 $0.10 $0.18 $0.29 $0.41 $0.54 $0.69 $0.84 $1.00 $1.04 $0.55 357.9% 152.3% FRME SNL U.S. Bank

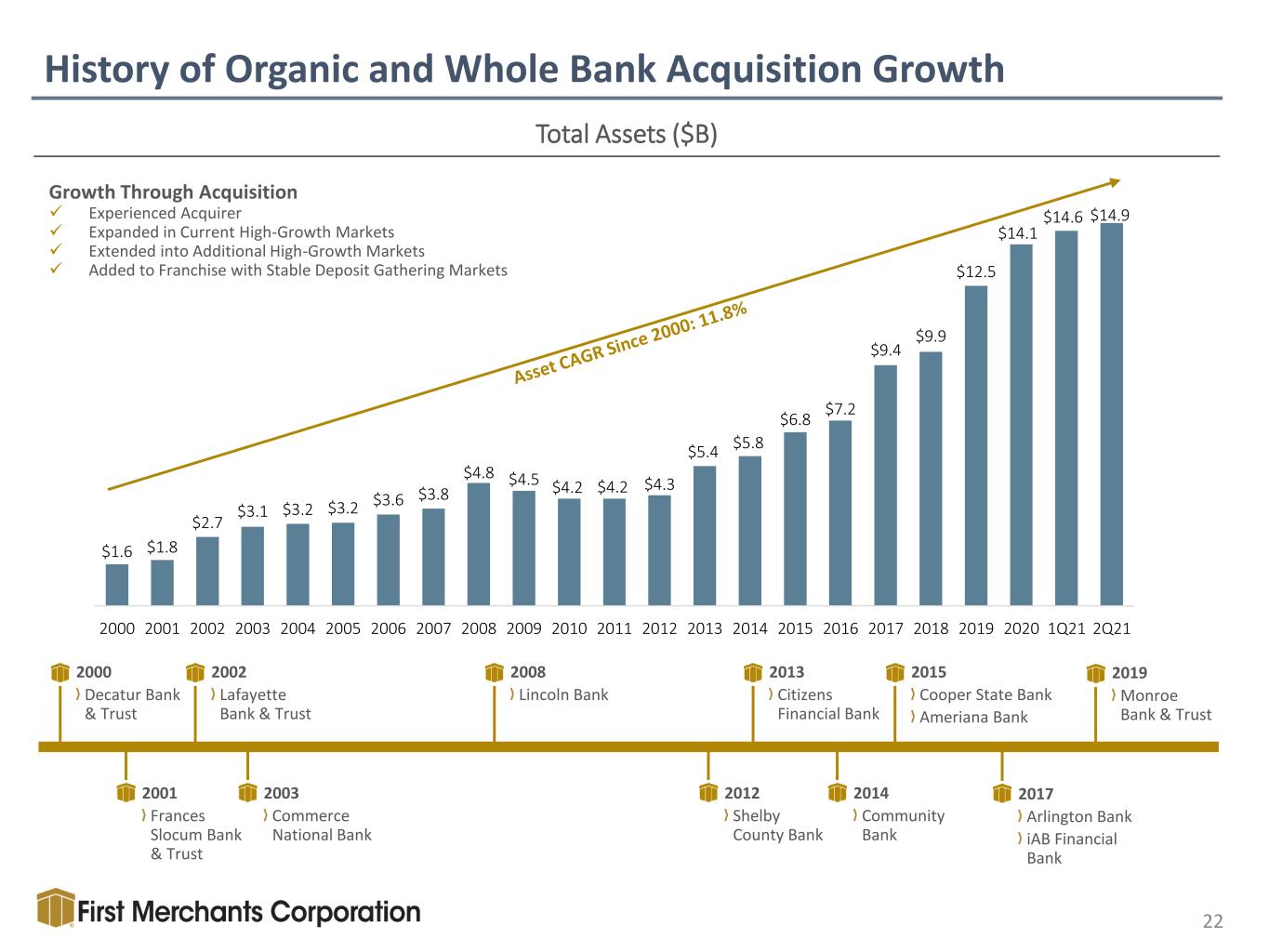

$1.6 $1.8 $2.7 $3.1 $3.2 $3.2 $3.6 $3.8 $4.8 $4.5 $4.2 $4.2 $4.3 $5.4 $5.8 $6.8 $7.2 $9.4 $9.9 $12.5 $14.1 $14.6 $14.9 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 1Q21 2Q21 History of Organic and Whole Bank Acquisition Growth 22 Total Assets ($B) Growth Through Acquisition Experienced Acquirer Expanded in Current High-Growth Markets Extended into Additional High-Growth Markets Added to Franchise with Stable Deposit Gathering Markets 2000 Decatur Bank & Trust 2001 Frances Slocum Bank & Trust 2002 Lafayette Bank & Trust 2003 Commerce National Bank 2008 Lincoln Bank 2012 Shelby County Bank 2013 Citizens Financial Bank 2014 Community Bank 2015 Cooper State Bank Ameriana Bank 2017 Arlington Bank iAB Financial Bank 2019 Monroe Bank & Trust

Vision for the Future 23 People: Enhance our culture through the power of collaboration, accountability and effective teams Source, recruit, onboard and engage a diverse and inclusive workforce with a commitment to career pathing and market level compensation Communicate our Corporate Social Responsibility strategy and success Uphold a corporate governance system inclusive of enterprise risk management to ensure safety, soundness and sustainability Ensure that acquisitions continue as a core competency Implement organic revenue-generating disciplines that attracts new business, delivers the whole bank and achieves industry leading levels of retention Commit to the digital transformation of the bank across all lines of business to enhance and automate the client experience Broaden our revenue streams across various lines of businesses, products, clients and geographies Maintain top-quartile financial performance while investing in all parts of the business Manage & cultivate a changing shareholder base Process: Customer: Financial:

24 APPENDIX

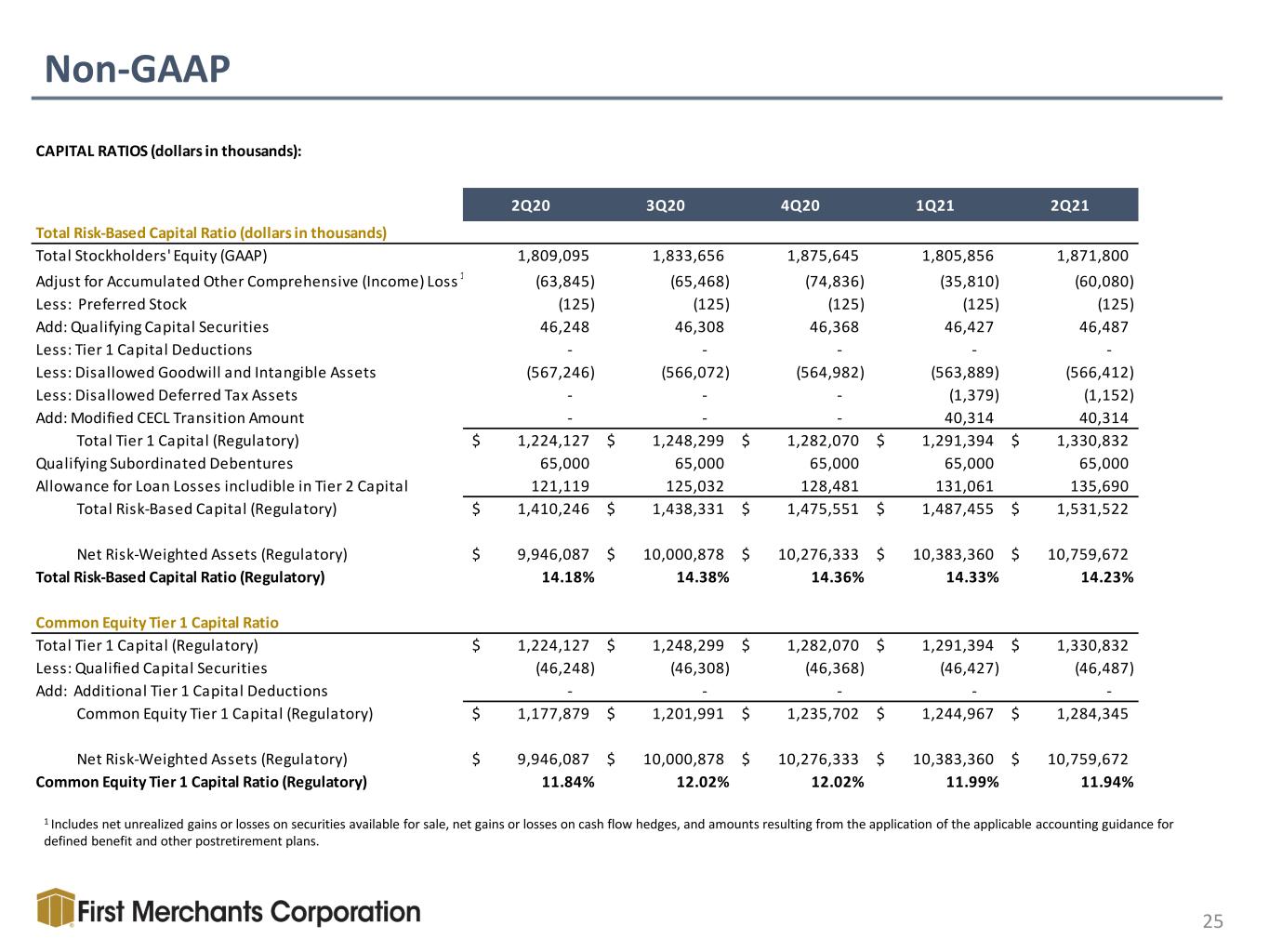

Non-GAAP 25 1 Includes net unrealized gains or losses on securities available for sale, net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance for defined benefit and other postretirement plans. CAPITAL RATIOS (dollars in thousands): 2Q20 3Q20 4Q20 1Q21 2Q21 Total Risk-Based Capital Ratio (dollars in thousands) Total Stockholders' Equity (GAAP) 1,809,095 1,833,656 1,875,645 1,805,856 1,871,800 Adjust for Accumulated Other Comprehensive (Income) Loss 1 (63,845) (65,468) (74,836) (35,810) (60,080) Less: Preferred Stock (125) (125) (125) (125) (125) Add: Qualifying Capital Securities 46,248 46,308 46,368 46,427 46,487 Less: Tier 1 Capital Deductions - - - - - Less: Disallowed Goodwill and Intangible Assets (567,246) (566,072) (564,982) (563,889) (566,412) Less: Disallowed Deferred Tax Assets - - - (1,379) (1,152) Add: Modified CECL Transition Amount - - - 40,314 40,314 Total Tier 1 Capital (Regulatory) 1,224,127$ 1,248,299$ 1,282,070$ 1,291,394$ 1,330,832$ Qualifying Subordinated Debentures 65,000 65,000 65,000 65,000 65,000 Allowance for Loan Losses includible in Tier 2 Capital 121,119 125,032 128,481 131,061 135,690 Total Risk-Based Capital (Regulatory) 1,410,246$ 1,438,331$ 1,475,551$ 1,487,455$ 1,531,522$ Net Risk-Weighted Assets (Regulatory) 9,946,087$ 10,000,878$ 10,276,333$ 10,383,360$ 10,759,672$ Total Risk-Based Capital Ratio (Regulatory) 14.18% 14.38% 14.36% 14.33% 14.23% Common Equity Tier 1 Capital Ratio Total Tier 1 Capital (Regulatory) 1,224,127$ 1,248,299$ 1,282,070$ 1,291,394$ 1,330,832$ Less: Qualified Capital Securities (46,248) (46,308) (46,368) (46,427) (46,487) Add: Additional Tier 1 Capital Deductions - - - - - Common Equity Tier 1 Capital (Regulatory) 1,177,879$ 1,201,991$ 1,235,702$ 1,244,967$ 1,284,345$ Net Risk-Weighted Assets (Regulatory) 9,946,087$ 10,000,878$ 10,276,333$ 10,383,360$ 10,759,672$ Common Equity Tier 1 Capital Ratio (Regulatory) 11.84% 12.02% 12.02% 11.99% 11.94%

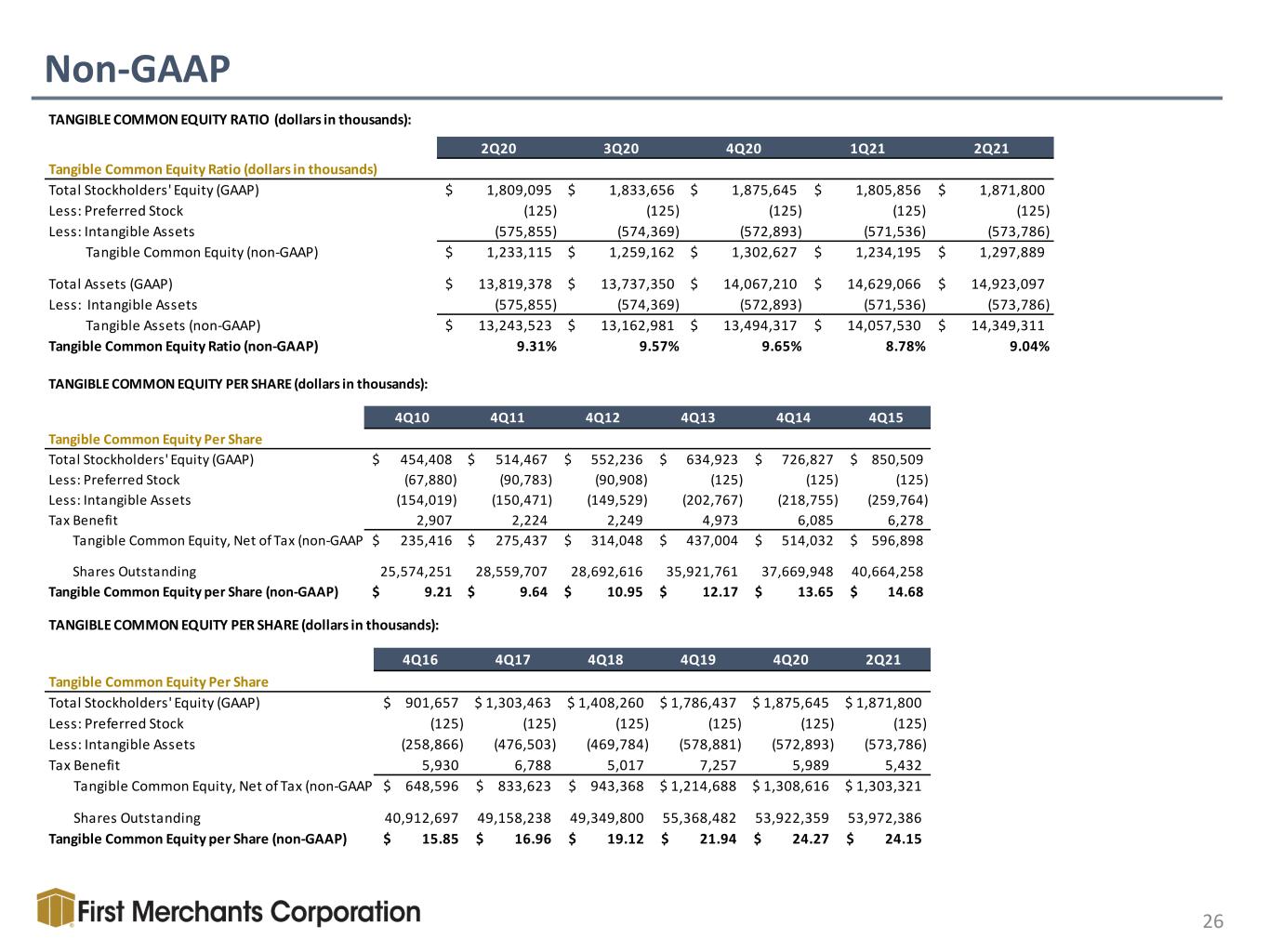

Non-GAAP 26 TANGIBLE COMMON EQUITY RATIO (dollars in thousands): 2Q20 3Q20 4Q20 1Q21 2Q21 Tangible Common Equity Ratio (dollars in thousands) Total Stockholders' Equity (GAAP) 1,809,095$ 1,833,656$ 1,875,645$ 1,805,856$ 1,871,800$ Less: Preferred Stock (125) (125) (125) (125) (125) Less: Intangible Assets (575,855) (574,369) (572,893) (571,536) (573,786) Tangible Common Equity (non-GAAP) 1,233,115$ 1,259,162$ 1,302,627$ 1,234,195$ 1,297,889$ Total Assets (GAAP) 13,819,378$ 13,737,350$ 14,067,210$ 14,629,066$ 14,923,097$ Less: Intangible Assets (575,855) (574,369) (572,893) (571,536) (573,786) Tangible Assets (non-GAAP) 13,243,523$ 13,162,981$ 13,494,317$ 14,057,530$ 14,349,311$ Tangible Common Equity Ratio (non-GAAP) 9.31% 9.57% 9.65% 8.78% 9.04% TANGIBLE COMMON EQUITY PER SHARE (dollars in thousands): 4Q10 4Q11 4Q12 4Q13 4Q14 4Q15 4Q16 4Q17 4Q18 4Q19 4Q20 2Q21 Tangible Common Equity Per Share Total Stockholders' Equity (GAAP) 454,408$ 514,467$ 552,236$ 634,923$ 726,827$ 850,509$ 901,657$ 1,303,463$ 1,408,260$ 1,786,437$ 1,875,645$ 1,871,800$ Less: Preferred Stock (67,880) (90,783) (90,908) (125) (125) (125) (125) (125) (125) (125) (125) (125) Less: Intangible Assets (154,019) (150,471) (149,529) (202,767) (218,755) (259,764) (258,866) (476,503) (469,784) (578,881) (572,893) (573,786) Tax Benefit 2,907 2,224 2,249 4,973 6,085 6,278 5,930 6,788 5,017 7,257 5,989 5,432 Tangible Common Equity, Net of Tax (non-GAAP) 235,416$ 275,437$ 314,048$ 437,004$ 514,032$ 596,898$ 648,596$ 833,623$ 943,368$ 1,214,688$ 1,308,616$ 1,303,321$ Shares Outstanding 25,574,251 28,559,707 28,692,616 35,921,761 37,669,948 40,664,258 40,912,697 49,158,238 49,349,800 55,368,482 53,922,359 53,972,386 Tangible Common Equity per Share (non-GAAP) 9.21$ 9.64$ 10.95$ 12.17$ 13.65$ 14.68$ 15.85$ 16.96$ 19.12$ 21.94$ 24.27$ 24.15$ TANGIBLE COMMON EQUITY PER SHARE (dollars in thousands): 4Q16 4Q17 4Q18 4Q19 4Q20 2Q21 Tangible Common Equity Per Share Total Stockholders' Equity (GAAP) 901,657$ 1,303,463$ 1,408,260$ 1,786,437$ 1,875,645$ 1,871,800$ Less: Preferred Stock (125) (125) (125) (125) (125) (125) Less: Intangible Assets (258,866) (476,503) (469,784) (578,881) (572,893) (573,786) Tax Benefit 5,930 6,788 5,017 7,257 5,989 5,432 Tangible Common Equity, Net of Tax (non-GAAP) 648,596$ 833,623$ 943,368$ 1,214,688$ 1,308,616$ 1,303,321$ Shares Outstanding 40,912,697 49,158,238 49,349,800 55,368,482 53,922,359 53,972,386 Tangible Common Equity per Share (non-GAAP) 15.85$ 16.96$ 19.12$ 21.94$ 24.27$ 24.15$

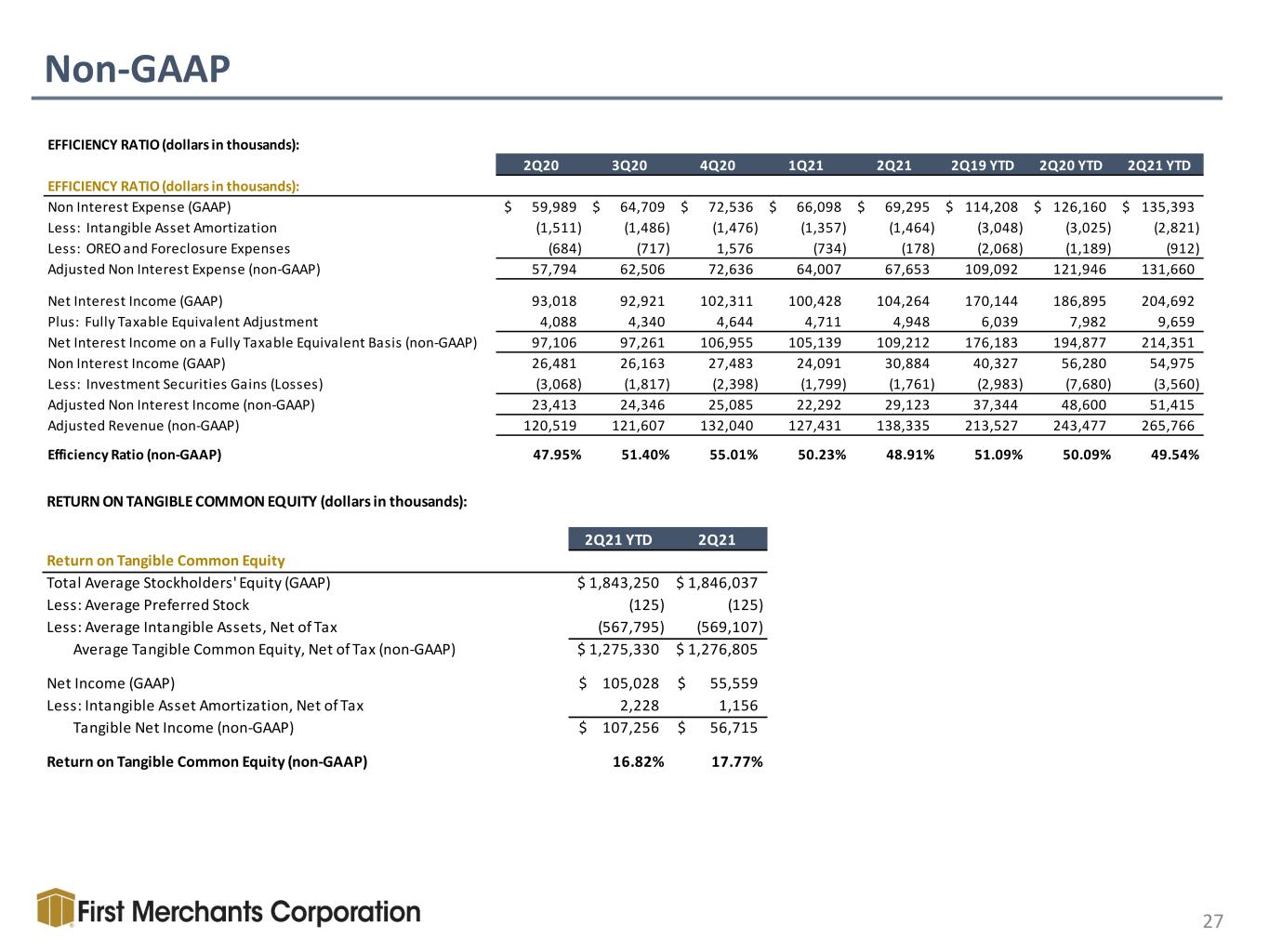

Non-GAAP 27 RETURN ON TANGIBLE COMMON EQUITY (dollars in thousands): 2Q21 YTD 2Q21 Return on Tangible Common Equity Total Average Stockholders' Equity (GAAP) 1,843,250$ 1,846,037$ Less: Average Preferred Stock (125) (125) Less: Average Intangible Assets, Net of Tax (567,795) (569,107) Average Tangible Common Equity, Net of Tax (non-GAAP) 1,275,330$ 1,276,805$ Net Income (GAAP) 105,028$ 55,559$ Less: Intangible Asset Amortization, Net of Tax 2,228 1,156 Tangible Net Income (non-GAAP) 107,256$ 56,715$ Return on Tangible Common Equity (non-GAAP) 16.82% 17.77% EFFICIENCY RATIO (dollars in thousands): 2Q20 3Q20 4Q20 1Q21 2Q21 2Q19 YTD 2Q20 YTD 2Q21 YTD EFFICIENCY RATIO (dollars in thousands): Non Interest Expense (GAAP) 59,989$ 64,709$ 72,536$ 66,098$ 69,295$ 114,208$ 126,160$ 135,393$ Less: Intangible Asset Amortization (1,511) (1,486) (1,476) (1,357) (1,464) (3,048) (3,025) (2,821) Less: OREO and Foreclosure Expenses (684) (717) 1,576 (734) (178) (2,068) (1,189) (912) Adjusted Non Interest Expense (non-GAAP) 57,794 62,506 72,636 64,007 67,653 109,092 121,946 131,660 Net Interest Income (GAAP) 93,018 92,921 102,311 100,428 104,264 170,144 186,895 204,692 Plus: Fully Taxable Equivalent Adjustment 4,088 4,340 4,644 4,711 4,948 6,039 7,982 9,659 Net Interest Income on a Fully Taxable Equivalent Basis (non-GAAP) 97,106 97,261 106,955 105,139 109,212 176,183 194,877 214,351 Non Interest Income (GAAP) 26,481 26,163 27,483 24,091 30,884 40,327 56,280 54,975 Less: Investment Securities Gains (Losses) (3,068) (1,817) (2,398) (1,799) (1,761) (2,983) (7,680) (3,560) Adjusted Non Interest Income (non-GAAP) 23,413 24,346 25,085 22,292 29,123 37,344 48,600 51,415 Adjusted Revenue (non-GAAP) 120,519 121,607 132,040 127,431 138,335 213,527 243,477 265,766 Efficiency Ratio (non-GAAP) 47.95% 51.40% 55.01% 50.23% 48.91% 51.09% 50.09% 49.54%