Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - CAVCO INDUSTRIES INC. | cvco-2021726xex992.pdf |

| EX-99.1 - EX-99.1 - CAVCO INDUSTRIES INC. | cvco-2021726xex991.htm |

| EX-10.1 - APA - CAVCO INDUSTRIES INC. | cvco-2021726xex101.htm |

| 8-K - 8-K - CAVCO INDUSTRIES INC. | cvco-20210723.htm |

Cavco Industries, Inc. Nasdaq: CVCO A C Q U I S I T I O N O F T H E C O M M O D O R E C O R P O R A T I O N P R E S E N T A T I O N J U L Y 2 0 2 1 investor.cavco.com FACTORY-BUILT HOUSING SOLUTIONS

2 • 3,700 homes (6,600 modules) shipped in LTM March 2021 • 6 manufacturing facilities • 2 wholly owned retail stores • 1,210 employees • More than doubles Cavco’s Modular capacity • The Commodore Corporation (“Commodore”) is the largest private, independent provider of manufactured and modular housing in the US • Comprehensive product offering ranging from standard HUD manufactured homes to customized modular houses across 30 states • Fiscal Year 2020 revenue comprised of 41% manufactured homes and 59% modular homes The Commodore Corporation Company Overview Overview of Facilities Key Statistics Clarion Colony MidCountry Goshen Pennwest R-Anell Location Shippenville, PA Shippenville, PA Dorchester, WI Goshen, IN Emlenton, PA Crouse, NC Product Description Entry-level manufactured housing Entry-level manufactured housing Manufactured homes designed for manufacturing efficiency with upscale features Semi-customizable modular homes Highly customizable modular homes Moderately customizable modular homes Product Breakdown (Manufactured / Modular) 89% / 11% 87% / 13% 80% / 20% 10% / 90% 0% / 100% 0% / 100% Note: Last 12 months (“LTM”).

3 Operational Excellence across a Variety of Products • Very strong engineering organization with demonstrated innovation capability • Integrated design and engineering system enabling: • Fast design cycle time • Efficient customization • Implemented manufacturing technologies that have resulted in quality, throughput, and cost improvements Proven Track Record of Innovation V a lu e P re m iu m Brands cover attractive range of price point and product combinations Semi Full Customization A ff o rd a b il it y

4 Transaction Summary • Purchase includes: • 6 manufacturing facilities • A commercial loan portfolio of more than $25mm in outstanding principal • 2 retail locations • Fully funded with cash from Cavco balance sheet • Expected close in the 3rd fiscal quarter of 2022 Note: Dollars in millions. (1) Includes pension withdrawal liability, capital lease liabilities, and estimated customer deposits as of March 27, 2021. Purchase Price Summary Total Transaction Value $153 Less: Other Adjustments (1) (16) Transaction Enterprise Value $137 Sources & Uses Cash From Cavco Balance Sheet $140 Total Sources $140 Purchase of Commodore $137 Transaction Fees 3 Total Uses $140

5 • Ideal geographic addition to Cavco’s footprint with strong operations in the Northeast/Midwest/Mid-Atlantic markets which provide a platform for future growth • Strong and experienced management team that has implemented manufacturing innovations with reapplication potential across Cavco’s operations • Potential for cost and revenue synergies • Strategic deployment of cash while maintaining a strong liquidity position • Significantly accretive transaction on both an earnings and cash flow from operations basis at an attractive price based on industry benchmarks Transaction Rationale

6 Pro Forma Manufacturing Locations • Fills out a missing piece in the Cavco geographic footprint with a respected franchise in the Northeast United States Standalone Pro Forma LTM Revenue by Geography Commodore Facilities (6) Cavco Facilities (19) Commodore HQ Cavco HQ Note: Excludes Cavco’s idled facility in Lexington, MS. Southwest 38% South 29% West 21% Midwest 12% Southwest 29% South 27% West 16% Midwest 16% Northeast 12%

7 • Ideal geographic addition to Cavco’s footprint with strong operations in the Northeast/Midwest/Mid-Atlantic markets which provide a platform for future growth • Strong and experienced management team that has implemented manufacturing innovations with reapplication potential across Cavco’s operations • Potential for cost and revenue synergies • Strategic deployment of cash while maintaining a strong liquidity position • Significantly accretive transaction on both an earnings and cash flow from operations basis at an attractive price based on industry benchmarks Transaction Rationale

8 • Ideal geographic addition to Cavco’s footprint with strong operations in the Northeast/Midwest/Mid-Atlantic markets which provide a platform for future growth • Strong and experienced management team that has implemented manufacturing innovations with reapplication potential across Cavco’s operations • Potential for cost and revenue synergies • Strategic deployment of cash while maintaining a strong liquidity position • Significantly accretive transaction on both an earnings and cash flow from operations basis at an attractive price based on industry benchmarks Transaction Rationale

9 • Ideal geographic addition to Cavco’s footprint with strong operations in the Northeast/Midwest/Mid-Atlantic markets which provide a platform for future growth • Strong and experienced management team that has implemented manufacturing innovations with reapplication potential across Cavco’s operations • Potential for cost and revenue synergies • Strategic deployment of cash while maintaining a strong liquidity position • Significantly accretive transaction on both an earnings and cash flow from operations basis at an attractive price based on industry benchmarks Transaction Rationale

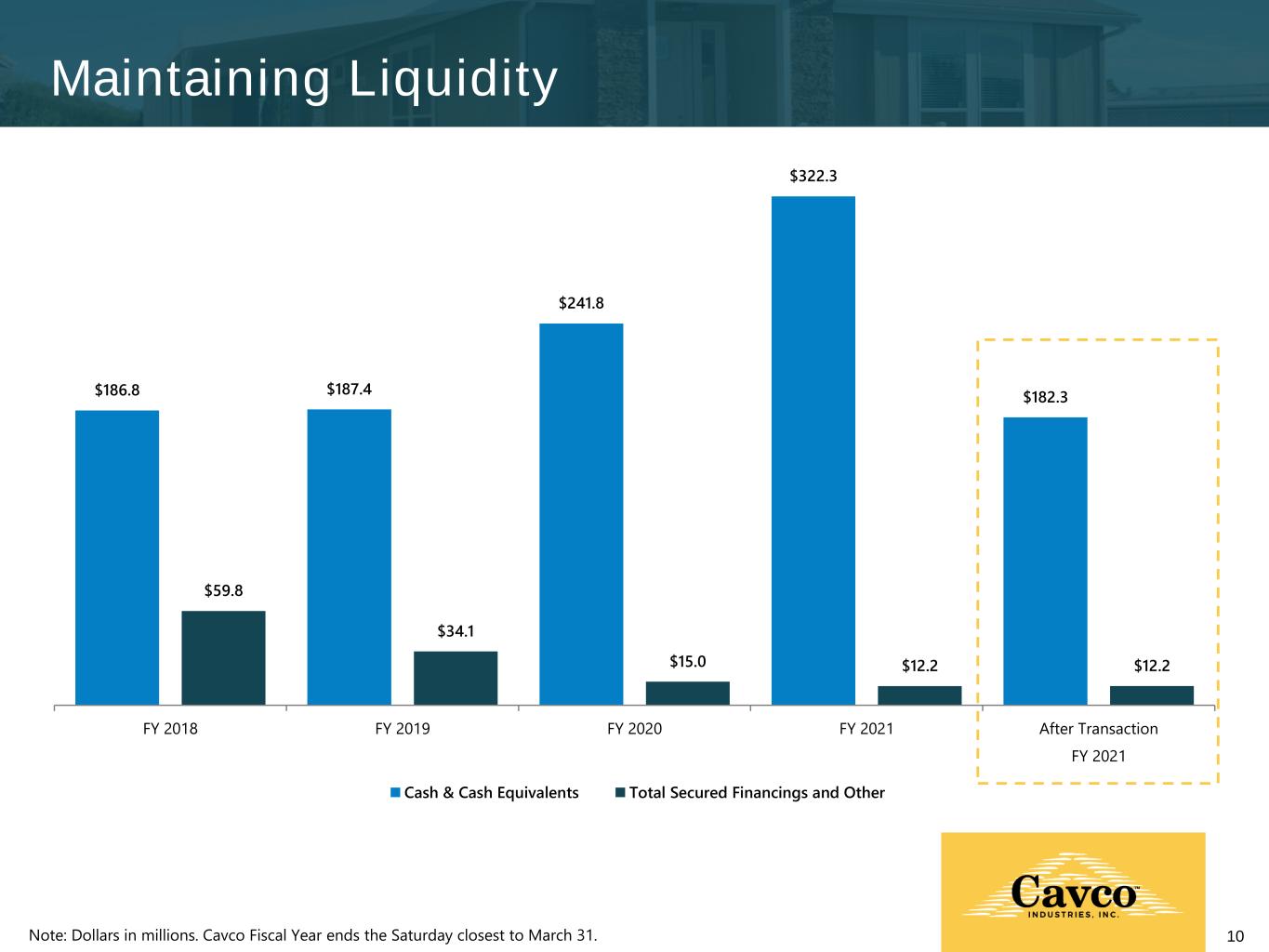

10 Maintaining Liquidity Note: Dollars in millions. Cavco Fiscal Year ends the Saturday closest to March 31. $186.8 $187.4 $241.8 $322.3 $182.3 $59.8 $34.1 $15.0 $12.2 $12.2 FY 2018 FY 2019 FY 2020 FY 2021 After Transaction FY 2021 Cash & Cash Equivalents Total Secured Financings and Other

11 • Ideal geographic addition to Cavco’s footprint with strong operations in the Northeast/Midwest/Mid-Atlantic markets which provide a platform for future growth • Strong and experienced management team that has implemented manufacturing innovations with reapplication potential across Cavco’s operations • Potential for cost and revenue synergies • Strategic deployment of cash while maintaining a strong liquidity position • Significantly accretive transaction on both an earnings and cash flow from operations basis at an attractive price based on industry benchmarks Transaction Rationale

12 0.5x 7.4x $19.1 EV / LTM Net Revenue EV / Adjusted EBITDA EV / Facility Enterprise Value Multiples Note: Dollars in millions. Commodore Fiscal Year ends in September. LTM figures as of March 2021. (1) Enterprise Value (“EV”) calculated as Total Transaction Value of $153mm less pension withdrawal and capital lease liabilities and adding back customer deposits. (2) Commodore Adjusted EBITDA of $18.7mm represents Normalized Adjusted EBITDA. See page 14 for more detail. (3) Enterprise Value used in EV / Facility calculation excludes $25mm commercial loan portfolio. Commodore LTM Net Revenue $258.0 Adjusted EBITDA (2) $18.7 # of Facilities 6 (1) (2)(1) (1) (3)

Appendix

14 Non-GAAP Reconciliation Note: Dollars in millions. Commodore Fiscal Years 2019 and 2020 ended September 28, 2019 and September 26, 2020 respectively. Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) and Adjusted EBITDA are metrics not calculated in accordance with Generally Accepted Accounting Principles in the U.S. (“GAAP”). Management believes EBITDA and Adjusted EBITDA are useful because they provide additional tools to compare business performance across companies and periods and are commonly used by financial analysts in evaluating operating performance. (1) Normalized Adjusted EBITDA represents the average of FY 2019 and FY 2020 Adjusted EBITDA. Commodore FY 2019 FY 2020 Net Income $13.4 $12.8 Interest Expense 1.1 0.8 Income Tax Expense 0.1 0.1 Depreciation & Amortization 2.2 2.2 EBITDA $16.8 $15.9 Quality of Earnings Adjustments 1.8 3.0 Adjusted EBITDA $18.6 $18.9 Normalized Adjusted EBITDA (1) $18.7

15 Certain statements contained in this release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. In general, all statements that are not historical in nature are forward-looking. Forward-looking statements are typically included, for example, in discussions regarding the manufactured housing and site-built housing industries; our financial performance and operating results; and the expected effect of certain risks and uncertainties on our business, financial condition and results of operations. All forward- looking statements are subject to risks and uncertainties, many of which are beyond our control. As a result, our actual results or performance may differ materially from anticipated results or performance. Factors that could cause such differences to occur include, but are not limited to: the impact of local or national emergencies including the COVID-19 pandemic, including such impacts from state and federal regulatory action that restricts our ability to operate our business in the ordinary course and impacts on (i) customer demand and the availability of financing for our products, (ii) our supply chain and the availability of raw materials for the manufacture of our products, (iii) the availability of labor and the health and safety of our workforce and (iv) our liquidity and access to the capital markets; our ability to successfully integrate past acquisitions or future acquisitions and the ability to attain the anticipated benefits of such acquisitions; the risk that any past or future acquisition may adversely impact our liquidity; involvement in vertically integrated lines of business, including manufactured housing consumer finance, commercial finance and insurance; information technology failures or cyber incidents; curtailment of available financing from home-only lenders; availability of wholesale financing and limited floor plan lenders; our participation in certain wholesale and retail financing programs for the purchase of our products by industry distributors and consumers, which may expose us to additional risk of credit loss; significant warranty and construction defect claims; our contingent repurchase obligations related to wholesale financing; market forces and housing demand fluctuations; net losses were incurred in certain prior periods and our ability to generate income in the future; a write-off of all or part of our goodwill; the cyclical and seasonal nature of our business; limitations on our ability to raise capital; competition; our ability to maintain relationships with independent distributors; our business and operations being concentrated in certain geographic regions; labor shortages and the pricing and availability of raw materials; unfavorable zoning ordinances; loss of any of our executive officers; organizational document provisions delaying or making a change in control more difficult; volatility of stock price; general deterioration in economic conditions and turmoil in the credit markets; governmental and regulatory disruption, including federal government shutdowns; extensive regulation affecting manufactured housing; potential financial impact on the Company from the subpoenas we received from the SEC and its ongoing investigation, including the risk of potential litigation or regulatory action, and costs and expenses arising from the SEC subpoenas and investigation and the events described in or covered by the SEC subpoenas and investigation, which include the Company's indemnification obligations and insurance costs regarding such matters, and potential reputational damage that the Company may suffer; and losses not covered by our director and officer insurance, which may be large, adversely impacting financial performance; together with all of the other risks described in our filings with the SEC. Readers are specifically referred to the Risk Factors described in Item 1A of the 2021 Form 10-K, as may be amended from time to time, which identify important risks that could cause actual results to differ from those contained in the forward-looking statements. Cavco expressly disclaims any obligation to update any forward-looking statements contained in this release, whether as a result of new information, future events or otherwise. Investors should not place undue reliance on any such forward-looking statements. Forward Looking Statements