Attached files

1 Investor Presentation July 20, 2021

2 Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of such words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “guidance,” “target,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken, occur or be achieved. The forward-looking statements include statements about the expected benefits of the (i) acquisition (the “Tracker Acquisition”) of certain assets from Tracker Resource Development III, LLC (“Tracker”) and Sequel Energy Group, LLC (“Sequel”) and (ii) the acquisition of working interests in the Eagle Ford in May 2021 and June 2021 (collectively, the “Eagle Ford Acquisition” and with the Tracker Acquisition, the “Acquisitions”) by Earthstone Energy, Inc. (“Earthstone” or the “Company”) and its stockholders, the expected future reserves, production, financial position, business strategy, revenues, earnings, costs, capital expenditures and debt levels of the Company, and plans and objectives of management for future operations. Forward-looking statements are based on current expectations and assumptions and analyses made by Earthstone and its management in light of experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: Earthstone’s ability to integrate the assets acquired in the Acquisitions and achieve anticipated benefits from them; risks relating to any unforeseen liabilities of Earthstone or the assets acquired in the Acquisitions; declines in oil, natural gas liquids or natural gas prices; the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment write-downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base under the Company’s credit facility; Earthstone’s ability to generate sufficient cash flows from operations to fund all or portions of its future capital expenditures budget; Earthstone’s ability to obtain external capital to finance exploration and development operations and acquisitions; the ability to successfully complete any potential asset dispositions and the risks related thereto; the impacts of hedging on results of operations; uninsured or underinsured losses resulting from oil and natural gas operations; Earthstone’s ability to replace oil and natural gas reserves; any loss of senior management or technical personnel; and the direct and indirect impact on most or all of the foregoing on the evolving COVID-19 pandemic. Earthstone’s annual report on Form 10-K and as amended by Form 10-K/A for the year ended December 31, 2020, recent quarterly reports on Form 10-Q, recent current reports on Form 8-K, and other Securities and Exchange Commission (“SEC”) filings discuss some of the important risk factors identified that may affect Earthstone’s business, results of operations, and financial condition. Earthstone undertakes no obligation to revise or update publicly any forward-looking statements except as required by law. This presentation contains Earthstone’s 2021 production, capital expenditure and operating expense guidance. The actual levels of production, capital expenditures and operating expenses may be higher or lower than these estimates due to, among other things, uncertainty in drilling schedules, oil and natural gas prices, changes in market demand for hydrocarbons and unanticipated delays in production. These estimates are based on numerous assumptions. All or any of these assumptions may not prove to be accurate, which could result in actual results differing materially from estimates. No assurance can be made that any new wells will produce in line with historical performance, or that existing wells will continue to produce in line with Earthstone’s expectations. Earthstone’s ability to fund its 2021 and future capital budgets is subject to numerous risks and uncertainties, including volatility in commodity prices and the potential for unanticipated increases in costs associated with drilling, production and transportation. For additional discussion of the factors that may cause us not to achieve our production estimates, see Earthstone’s filings with the SEC, including its 2020 Form 10-K (as amended), subsequent Form 10-Qs and Form 8-Ks. Earthstone does not undertake any obligation to release publicly the results of any future revisions it may make to this prospective data or to update the data to reflect events or circumstances after the date of this presentation. Therefore, you are cautioned not to place undue reliance on the information in this presentation. Industry and Market Data This presentation has been prepared by Earthstone and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Although Earthstone believes these third-party sources are reliable as of their respective dates, Earthstone has not independently verified the accuracy or completeness of this information. Some data are also based on Earthstone’s good faith estimates, which are derived from its review of internal sources as well as the third-party sources described above. Estimated Ultimate Recovery and Locations Management’s use of the term estimated ultimate recovery (“EUR”) in this presentation describes estimates of potentially recoverable hydrocarbons that the SEC rules prohibit from being included in filings with the SEC. These are more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized, particularly in areas or zones where there has been limited or no drilling history. We include EUR to demonstrate what we believe to be the potential for future drilling and production by Earthstone. Actual quantities that may be ultimately recovered may differ substantially from estimates. Factors affecting ultimate recovery include the scope of the operators' ongoing drilling programs, which will be directly affected by the availability of capital, drilling and production costs, availability of drilling services and equipment, drilling results, lease expirations, transportation constraints, regulatory approvals and other factors, and actual drilling results, including geological and mechanical factors affecting recovery rates. Estimates of potential resources may also change significantly as the development of the properties underlying Earthstone's mineral interests provides additional data. This presentation also contains Earthstone’s internal estimates of its potential drilling locations, which may prove to be incorrect in a number of material ways. The actual number of locations that may be drilled may differ substantially from estimates.

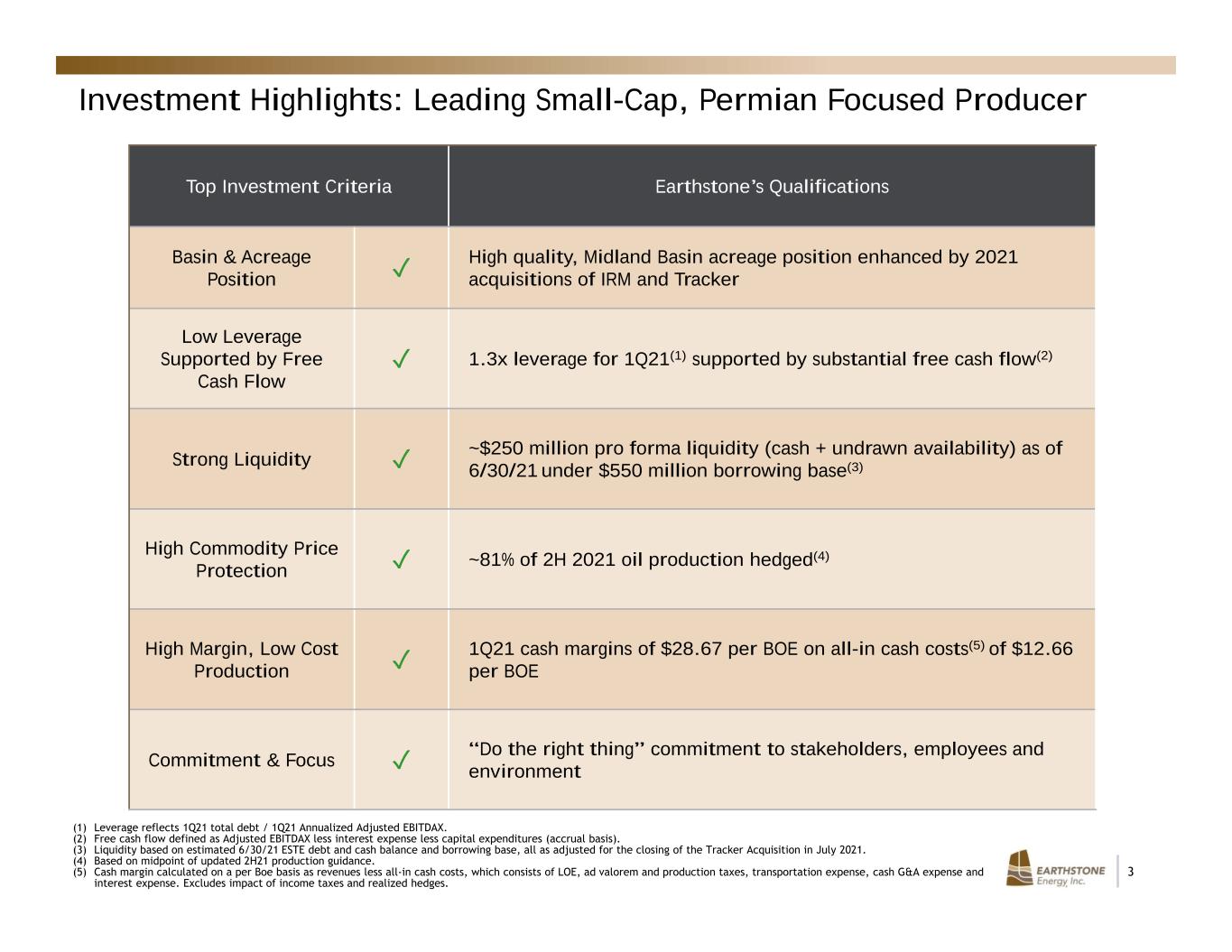

3 Investment Highlights: Leading Small-Cap, Permian Focused Producer Top Investment Criteria Earthstone’s Qualifications Basin & Acreage Position ✓ High quality, Midland Basin acreage position enhanced by 2021 acquisitions of IRM and Tracker Low Leverage Supported by Free Cash Flow ✓ 1.3x leverage for 1Q21(1) supported by substantial free cash flow(2) Strong Liquidity ✓ ~$250 million pro forma liquidity (cash + undrawn availability) as of 6/30/21 under $550 million borrowing base(3) High Commodity Price Protection ✓ ~81% of 2H 2021 oil production hedged(4) High Margin, Low Cost Production ✓ 1Q21 cash margins of $28.67 per BOE on all-in cash costs(5) of $12.66 per BOE Commitment & Focus ✓ “Do the right thing” commitment to stakeholders, employees and environment (1) Leverage reflects 1Q21 total debt / 1Q21 Annualized Adjusted EBITDAX. (2) Free cash flow defined as Adjusted EBITDAX less interest expense less capital expenditures (accrual basis). (3) Liquidity based on estimated 6/30/21 ESTE debt and cash balance and borrowing base, all as adjusted for the closing of the Tracker Acquisition in July 2021. (4) Based on midpoint of updated 2H21 production guidance. (5) Cash margin calculated on a per Boe basis as revenues less all-in cash costs, which consists of LOE, ad valorem and production taxes, transportation expense, cash G&A expense and interest expense. Excludes impact of income taxes and realized hedges.

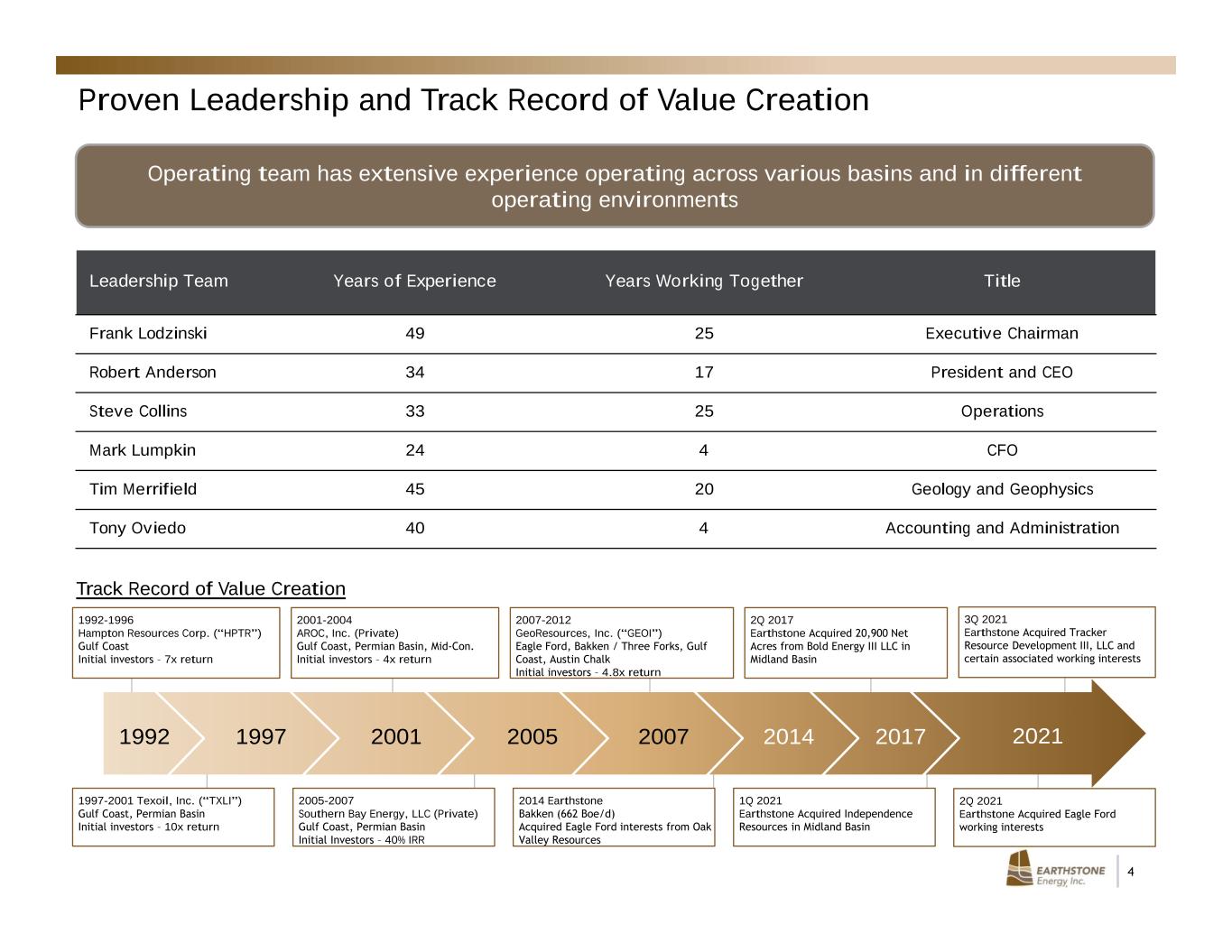

4 Proven Leadership and Track Record of Value Creation Operating team has extensive experience operating across various basins and in different operating environments Track Record of Value Creation 2007 2014 2017200520011992 1997 1992-1996 Hampton Resources Corp. (“HPTR”) Gulf Coast Initial investors – 7x return 2Q 2017 Earthstone Acquired 20,900 Net Acres from Bold Energy III LLC in Midland Basin 2005-2007 Southern Bay Energy, LLC (Private) Gulf Coast, Permian Basin Initial Investors – 40% IRR 2014 Earthstone Bakken (662 Boe/d) Acquired Eagle Ford interests from Oak Valley Resources 1997-2001 Texoil, Inc. (“TXLI”) Gulf Coast, Permian Basin Initial investors – 10x return 2001-2004 AROC, Inc. (Private) Gulf Coast, Permian Basin, Mid-Con. Initial investors – 4x return 2007-2012 GeoResources, Inc. (“GEOI”) Eagle Ford, Bakken / Three Forks, Gulf Coast, Austin Chalk Initial investors – 4.8x return 2021 Leadership Team Years of Experience Years Working Together Title Frank Lodzinski 49 25 Executive Chairman Robert Anderson 34 17 President and CEO Steve Collins 33 25 Operations Mark Lumpkin 24 4 CFO Tim Merrifield 45 20 Geology and Geophysics Tony Oviedo 40 4 Accounting and Administration 1Q 2021 Earthstone Acquired Independence Resources in Midland Basin 3Q 2021 Earthstone Acquired Tracker Resource Development III, LLC and certain associated working interests 2Q 2021 Earthstone Acquired Eagle Ford working interests

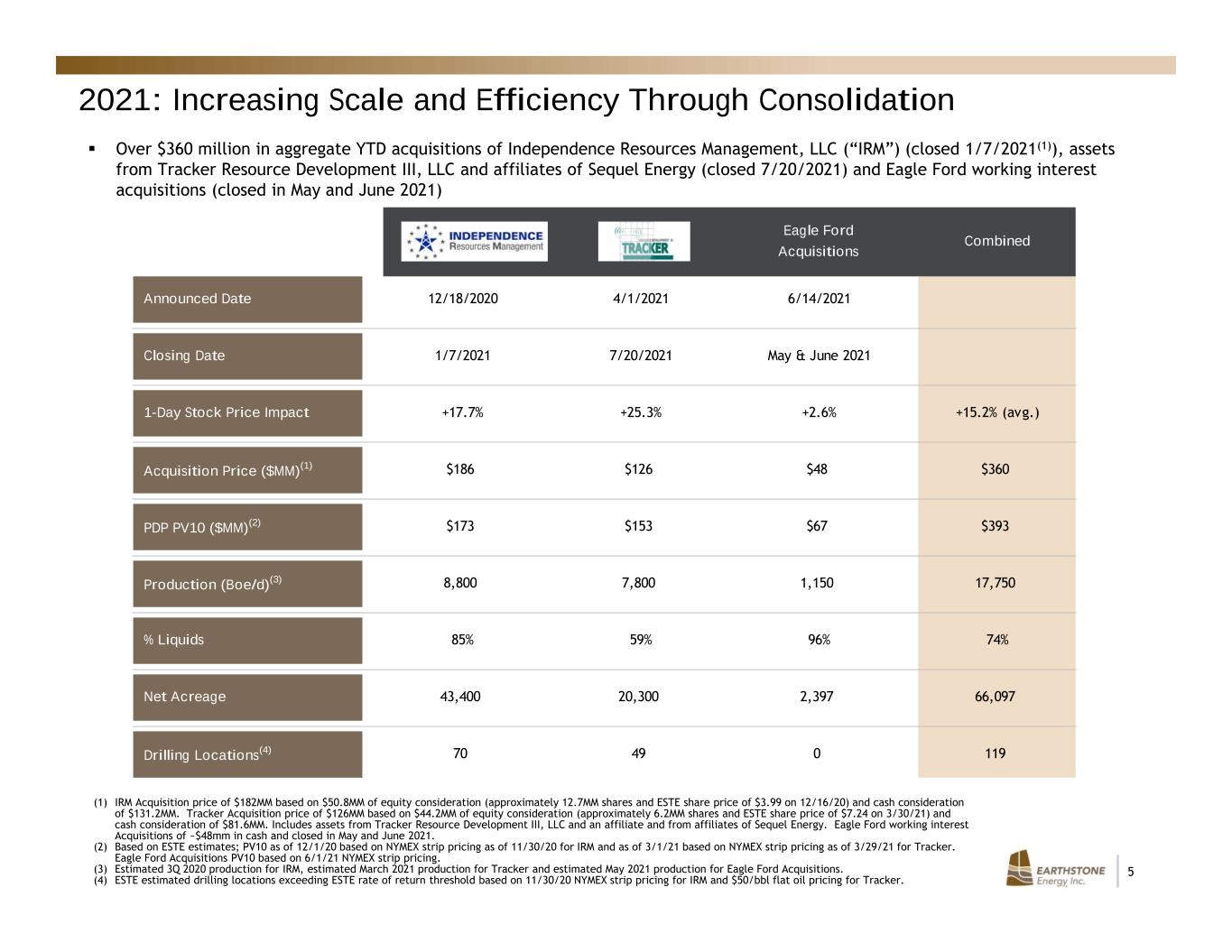

5 IRM Tracker Eagle Ford Acquisitions Combined Announced Date 12/18/2020 4/1/2021 6/14/2021 Closing Date 1/7/2021 7/20/2021 May & June 2021 1-Day Stock Price Impact +17.7% +25.3% +2.6% +15.2% (avg.) Acquisition Price ($MM)(1) $186 $126 $48 $360 PDP PV10 ($MM)(2) $173 $153 $67 $393 Production (Boe/d)(3) 8,800 7,800 1,150 17,750 % Liquids 85% 59% 96% 74% Net Acreage 43,400 20,300 2,397 66,097 Drilling Locations(4) 70 49 0 119 Over $360 million in aggregate YTD acquisitions of Independence Resources Management, LLC (“IRM”) (closed 1/7/2021(1)), assets from Tracker Resource Development III, LLC and affiliates of Sequel Energy (closed 7/20/2021) and Eagle Ford working interest acquisitions (closed in May and June 2021) (1) IRM Acquisition price of $182MM based on $50.8MM of equity consideration (approximately 12.7MM shares and ESTE share price of $3.99 on 12/16/20) and cash consideration of $131.2MM. Tracker Acquisition price of $126MM based on $44.2MM of equity consideration (approximately 6.2MM shares and ESTE share price of $7.24 on 3/30/21) and cash consideration of $81.6MM. Includes assets from Tracker Resource Development III, LLC and an affiliate and from affiliates of Sequel Energy. Eagle Ford working interest Acquisitions of ~$48mm in cash and closed in May and June 2021. (2) Based on ESTE estimates; PV10 as of 12/1/20 based on NYMEX strip pricing as of 11/30/20 for IRM and as of 3/1/21 based on NYMEX strip pricing as of 3/29/21 for Tracker. Eagle Ford Acquisitions PV10 based on 6/1/21 NYMEX strip pricing. (3) Estimated 3Q 2020 production for IRM, estimated March 2021 production for Tracker and estimated May 2021 production for Eagle Ford Acquisitions. (4) ESTE estimated drilling locations exceeding ESTE rate of return threshold based on 11/30/20 NYMEX strip pricing for IRM and $50/bbl flat oil pricing for Tracker. 2021: Increasing Scale and Efficiency Through Consolidation

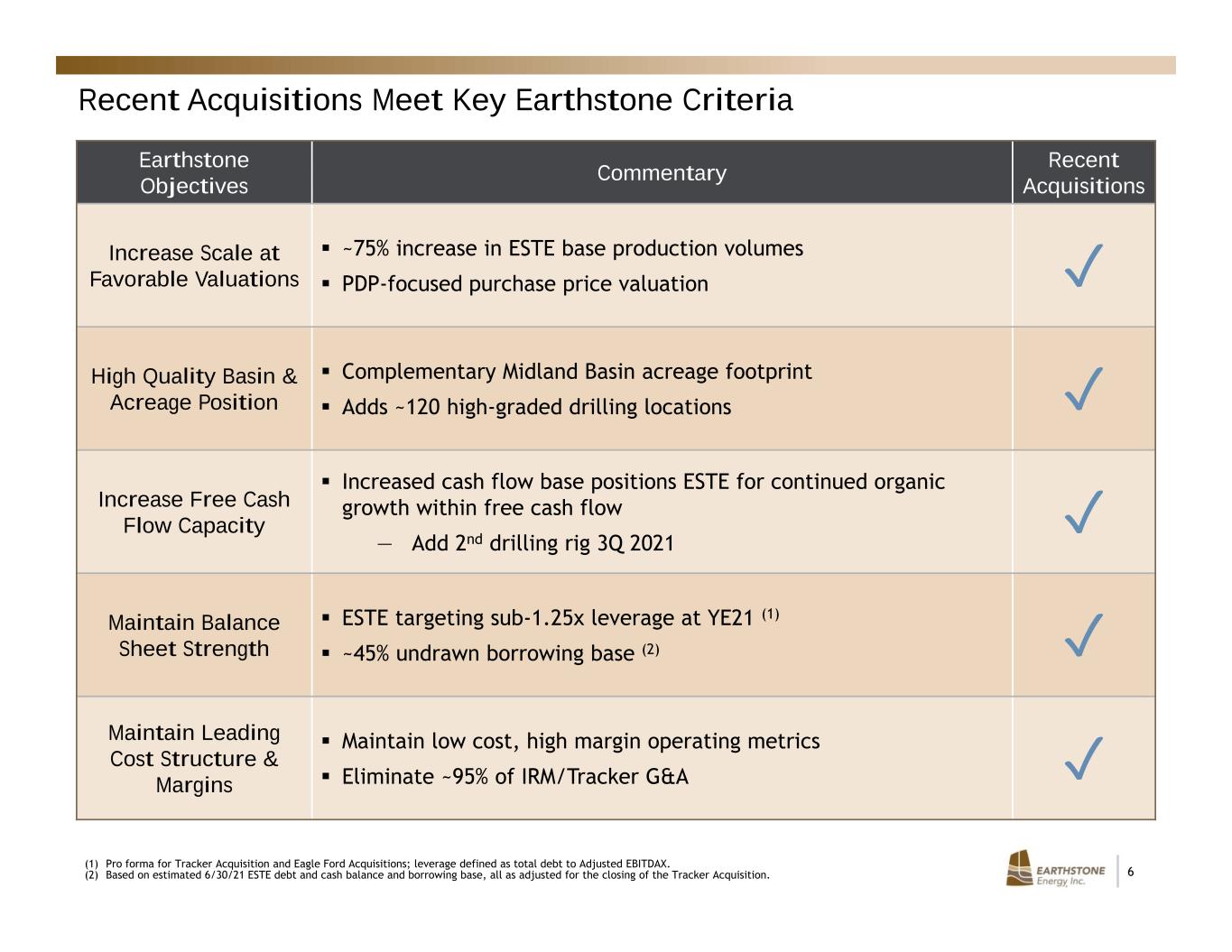

6 Recent Acquisitions Meet Key Earthstone Criteria Earthstone Objectives Commentary Recent Acquisitions Increase Scale at Favorable Valuations ~75% increase in ESTE base production volumes PDP-focused purchase price valuation ✓ High Quality Basin & Acreage Position Complementary Midland Basin acreage footprint Adds ~120 high-graded drilling locations ✓ Increase Free Cash Flow Capacity Increased cash flow base positions ESTE for continued organic growth within free cash flow — Add 2nd drilling rig 3Q 2021 ✓ Maintain Balance Sheet Strength ESTE targeting sub-1.25x leverage at YE21 (1) ~45% undrawn borrowing base (2) ✓ Maintain Leading Cost Structure & Margins Maintain low cost, high margin operating metrics Eliminate ~95% of IRM/Tracker G&A ✓ (1) Pro forma for Tracker Acquisition and Eagle Ford Acquisitions; leverage defined as total debt to Adjusted EBITDAX. (2) Based on estimated 6/30/21 ESTE debt and cash balance and borrowing base, all as adjusted for the closing of the Tracker Acquisition.

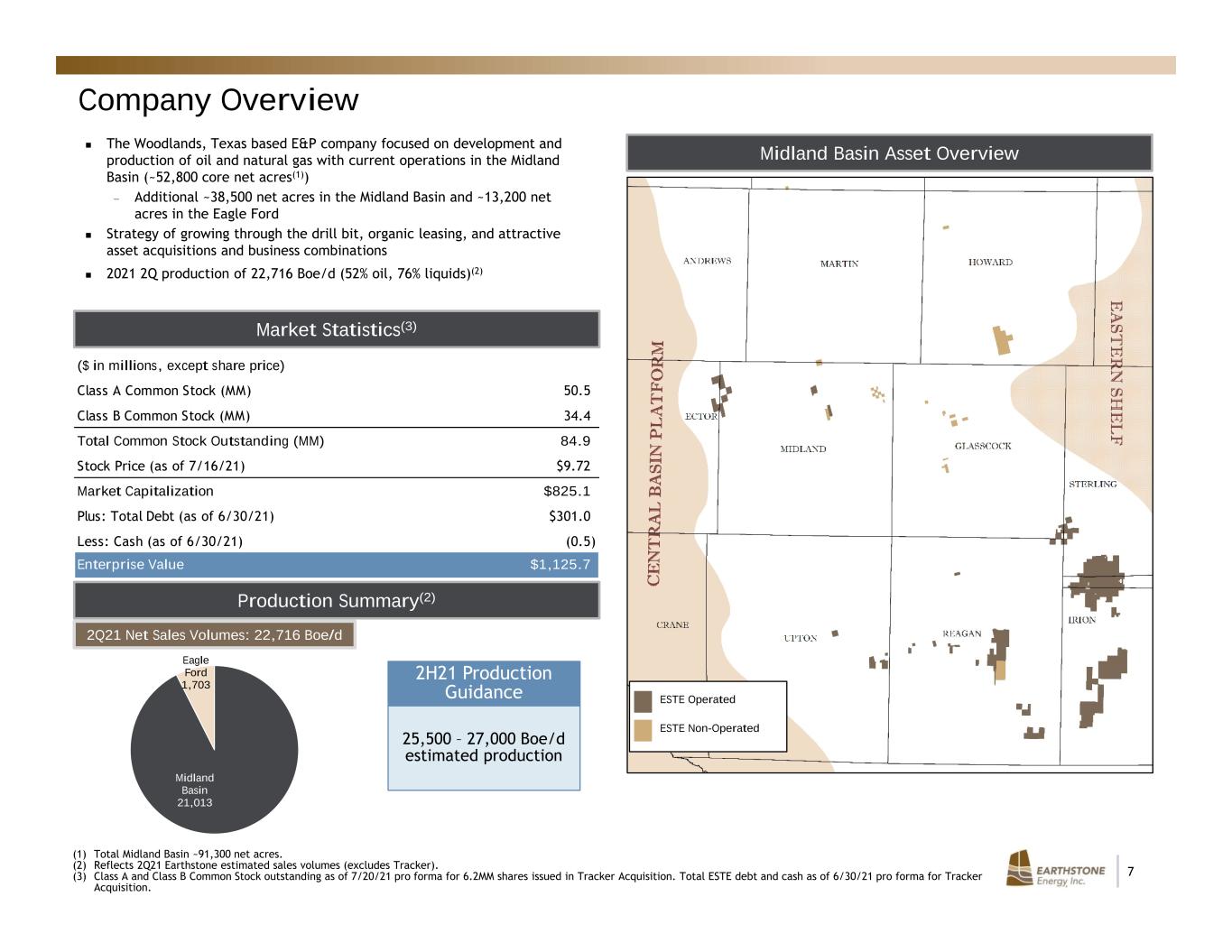

7 Midland Basin 21,013 Eagle Ford 1,703 Company Overview Midland Basin Asset Overview The Woodlands, Texas based E&P company focused on development and production of oil and natural gas with current operations in the Midland Basin (~52,800 core net acres(1)) — Additional ~38,500 net acres in the Midland Basin and ~13,200 net acres in the Eagle Ford Strategy of growing through the drill bit, organic leasing, and attractive asset acquisitions and business combinations 2021 2Q production of 22,716 Boe/d (52% oil, 76% liquids)(2) Market Statistics(3) (1) Total Midland Basin ~91,300 net acres. (2) Reflects 2Q21 Earthstone estimated sales volumes (excludes Tracker). (3) Class A and Class B Common Stock outstanding as of 7/20/21 pro forma for 6.2MM shares issued in Tracker Acquisition. Total ESTE debt and cash as of 6/30/21 pro forma for Tracker Acquisition. Production Summary(2) 2Q21 Net Sales Volumes: 22,716 Boe/d ESTE Operated ESTE Non-Operated 25,500 – 27,000 Boe/d estimated production 2H21 Production Guidance ($ in millions, except share price) Class A Common Stock (MM) 50.5 Class B Common Stock (MM) 34.4 Total Common Stock Outstanding (MM) 84.9 Stock Price (as of 7/16/21) $9.72 Market Capitalization $825.1 Plus: Total Debt (as of 6/30/21) $301.0 Less: Cash (as of 6/30/21) (0.5) Enterprise Value $1,125.7

8 Earthstone Overview

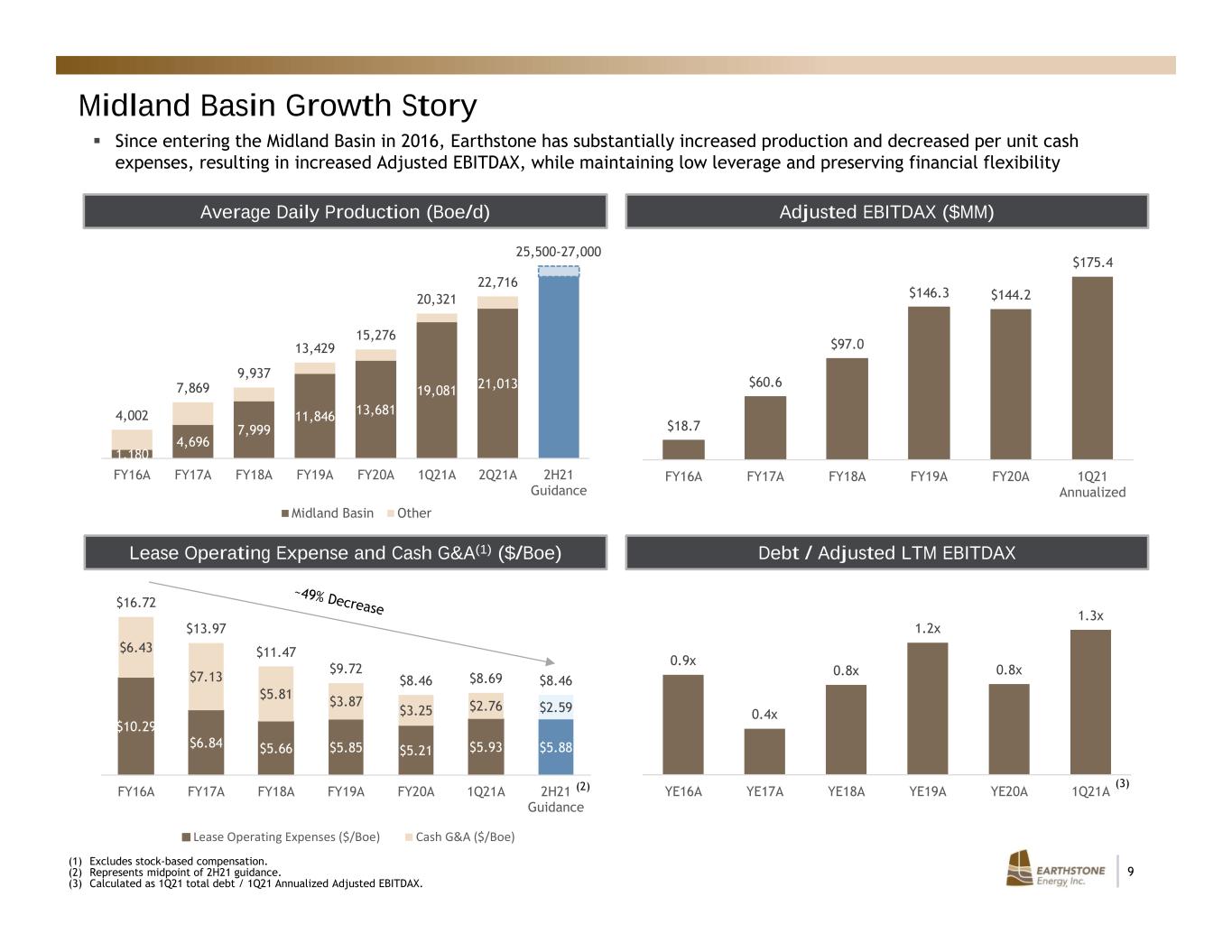

9 (1) Excludes stock-based compensation. (2) Represents midpoint of 2H21 guidance. (3) Calculated as 1Q21 total debt / 1Q21 Annualized Adjusted EBITDAX. Average Daily Production (Boe/d) Adjusted EBITDAX ($MM) Lease Operating Expense and Cash G&A(1) ($/Boe) Debt / Adjusted LTM EBITDAX Since entering the Midland Basin in 2016, Earthstone has substantially increased production and decreased per unit cash expenses, resulting in increased Adjusted EBITDAX, while maintaining low leverage and preserving financial flexibility Midland Basin Growth Story $18.7 $60.6 $97.0 $146.3 $144.2 $175.4 FY16A FY17A FY18A FY19A FY20A 1Q21 Annualized 0.9x 0.4x 0.8x 1.2x 0.8x 1.3x YE16A YE17A YE18A YE19A YE20A 1Q21A (3)(2) 1,180 4,696 7,999 11,846 13,681 19,081 21,013 4,002 7,869 9,937 13,429 15,276 20,321 22,716 25,500-27,000 FY16A FY17A FY18A FY19A FY20A 1Q21A 2Q21A 2H21 Guidance Midland Basin Other $10.29 $6.84 $5.66 $5.85 $5.21 $5.93 $5.88 $6.43 $7.13 $5.81 $3.87 $3.25 $2.76 $2.59 $16.72 $13.97 $11.47 $9.72 $8.46 $8.69 $8.46 FY16A FY17A FY18A FY19A FY20A 1Q21A 2H21 Guidance Lease Operating Expenses ($/Boe) Cash G&A ($/Boe)

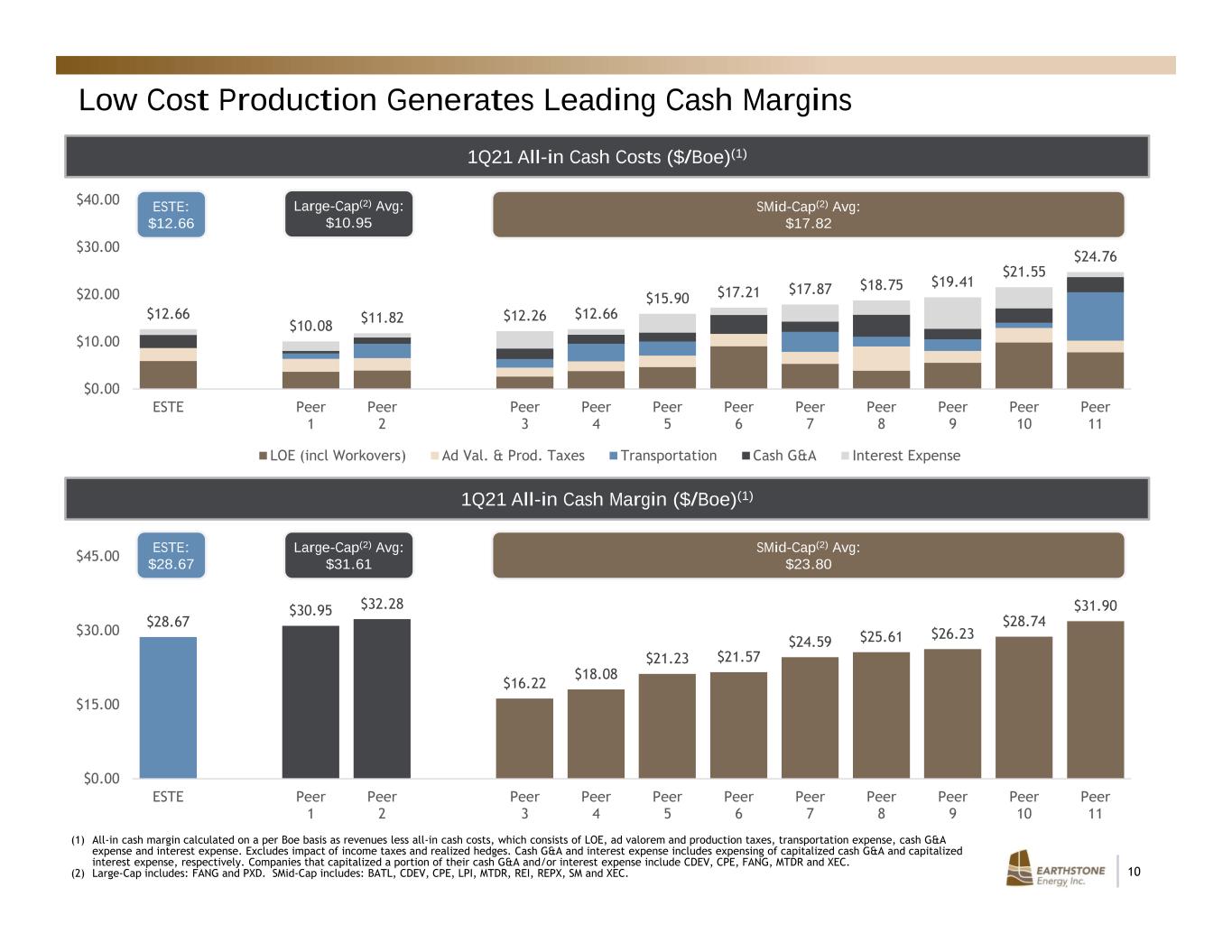

10 1Q21 All-in Cash Margin ($/Boe)(1) (1) All-in cash margin calculated on a per Boe basis as revenues less all-in cash costs, which consists of LOE, ad valorem and production taxes, transportation expense, cash G&A expense and interest expense. Excludes impact of income taxes and realized hedges. Cash G&A and interest expense includes expensing of capitalized cash G&A and capitalized interest expense, respectively. Companies that capitalized a portion of their cash G&A and/or interest expense include CDEV, CPE, FANG, MTDR and XEC. (2) Large-Cap includes: FANG and PXD. SMid-Cap includes: BATL, CDEV, CPE, LPI, MTDR, REI, REPX, SM and XEC. Large-Cap(2) Avg: $10.95 SMid-Cap(2) Avg: $17.82 ESTE: $12.66 Low Cost Production Generates Leading Cash Margins 1Q21 All-in Cash Costs ($/Boe)(1) Large-Cap(2) Avg: $31.61 SMid-Cap(2) Avg: $23.80 ESTE: $28.67 $12.66 $10.08 $11.82 $12.26 $12.66 $15.90 $17.21 $17.87 $18.75 $19.41 $21.55 $24.76 $0.00 $10.00 $20.00 $30.00 $40.00 ESTE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 LOE (incl Workovers) Ad Val. & Prod. Taxes Transportation Cash G&A Interest Expense $28.67 $30.95 $32.28 $16.22 $18.08 $21.23 $21.57 $24.59 $25.61 $26.23 $28.74 $31.90 $0.00 $15.00 $30.00 $45.00 ESTE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11

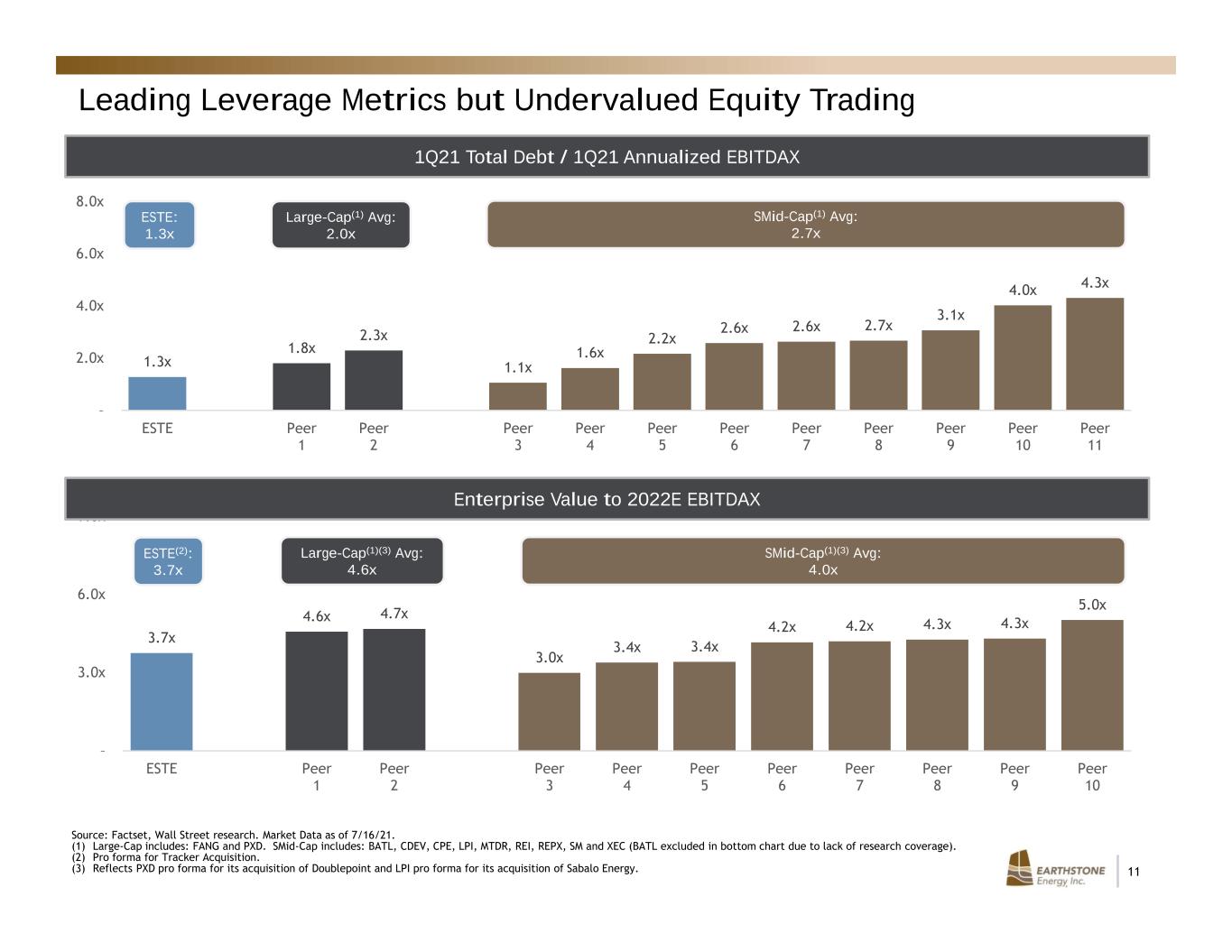

11 3.7x 4.6x 4.7x 3.0x 3.4x 3.4x 4.2x 4.2x 4.3x 4.3x 5.0x – 3.0x 6.0x 9.0x ESTE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 1.3x 1.8x 2.3x 1.1x 1.6x 2.2x 2.6x 2.6x 2.7x 3.1x 4.0x 4.3x – 2.0x 4.0x 6.0x 8.0x ESTE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Leading Leverage Metrics but Undervalued Equity Trading 1Q21 Total Debt / 1Q21 Annualized EBITDAX Large-Cap(1) Avg: 2.0x SMid-Cap(1) Avg: 2.7x ESTE: 1.3x Enterprise Value to 2022E EBITDAX Large-Cap(1)(3) Avg: 4.6x SMid-Cap(1)(3) Avg: 4.0x ESTE(2): 3.7x Source: Factset, Wall Street research. Market Data as of 7/16/21. (1) Large-Cap includes: FANG and PXD. SMid-Cap includes: BATL, CDEV, CPE, LPI, MTDR, REI, REPX, SM and XEC (BATL excluded in bottom chart due to lack of research coverage). (2) Pro forma for Tracker Acquisition. (3) Reflects PXD pro forma for its acquisition of Doublepoint and LPI pro forma for its acquisition of Sabalo Energy.

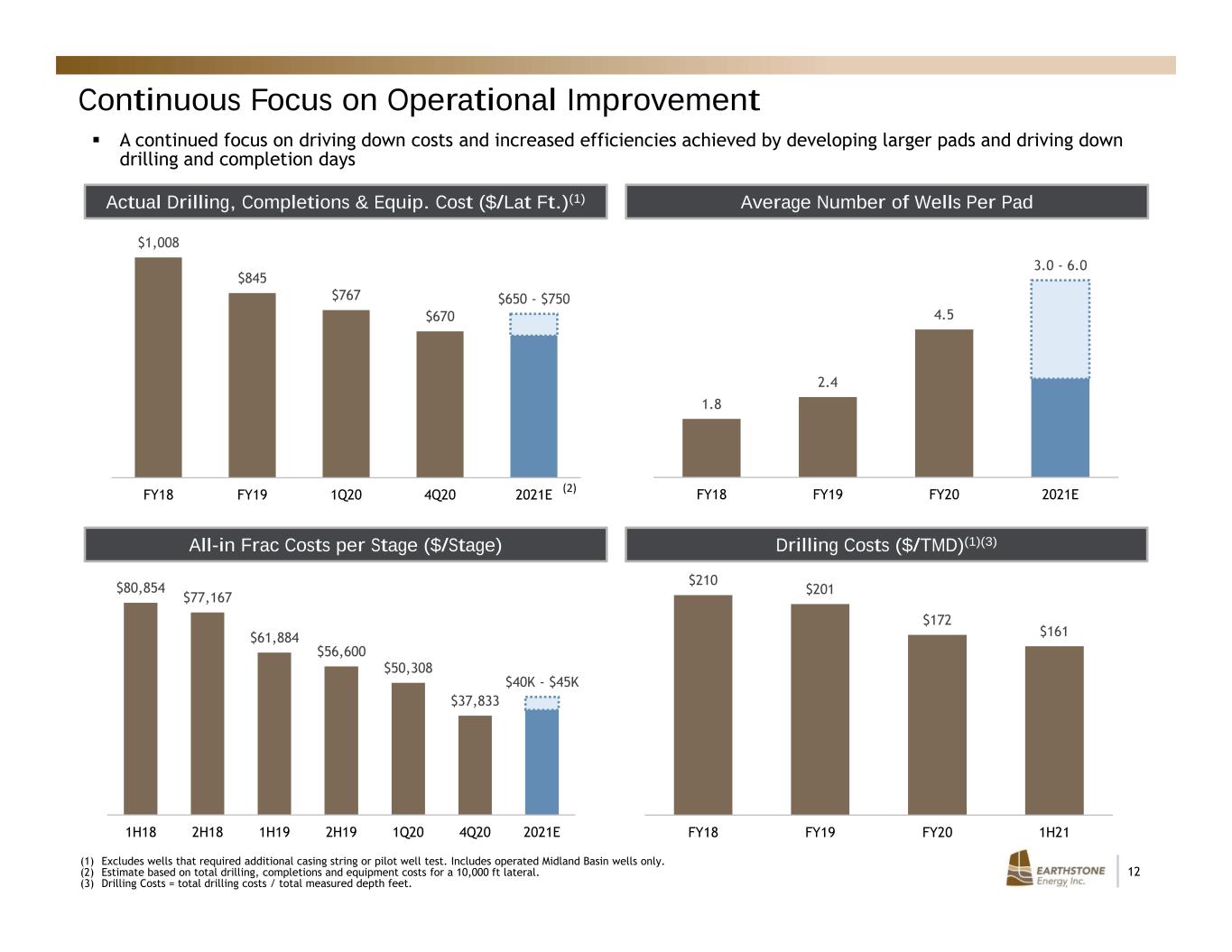

12 $80,854 $77,167 $61,884 $56,600 $50,308 $37,833 $40K - $45K 1H18 2H18 1H19 2H19 1Q20 4Q20 2021E Drilling Costs ($/TMD)(1)(3) Average Number of Wells Per Pad A continued focus on driving down costs and increased efficiencies achieved by developing larger pads and driving down drilling and completion days (1) Excludes wells that required additional casing string or pilot well test. Includes operated Midland Basin wells only. (2) Estimate based on total drilling, completions and equipment costs for a 10,000 ft lateral. (3) Drilling Costs = total drilling costs / total measured depth feet. Continuous Focus on Operational Improvement Actual Drilling, Completions & Equip. Cost ($/Lat Ft.)(1) All-in Frac Costs per Stage ($/Stage) (2) $1,008 $845 $767 $670 $650 - $750 FY18 FY19 1Q20 4Q20 2021E 1.8 2.4 4.5 3.0 - 6.0 FY18 FY19 FY20 2021E $210 $201 $172 $161 FY18 FY19 FY20 1H21

13 Installation of Vapor Recovery Units (“VRUs”) in conjunction with tank battery construction minimizes air emissions Target Zero Flaring: Connect natural gas pipelines ahead of flowback and first production negates need for flaring Leak Detection & Repair (“LDAR”) program since 2019 to further minimize air emissions Target >60% of 2021 oil production in Midland Basin on pipeline. Increased from 14% to 43% in 2020 Plan for 100% of water disposal on pipeline in the Midland Basin to reduce truck hauls, which, in turn, reduces CO2 emissions Highly Focused Environmental Stewardship Earthstone is an Environmental Partnership Program Participant Key Environmental Priorities Focus on Responsible Operatorship

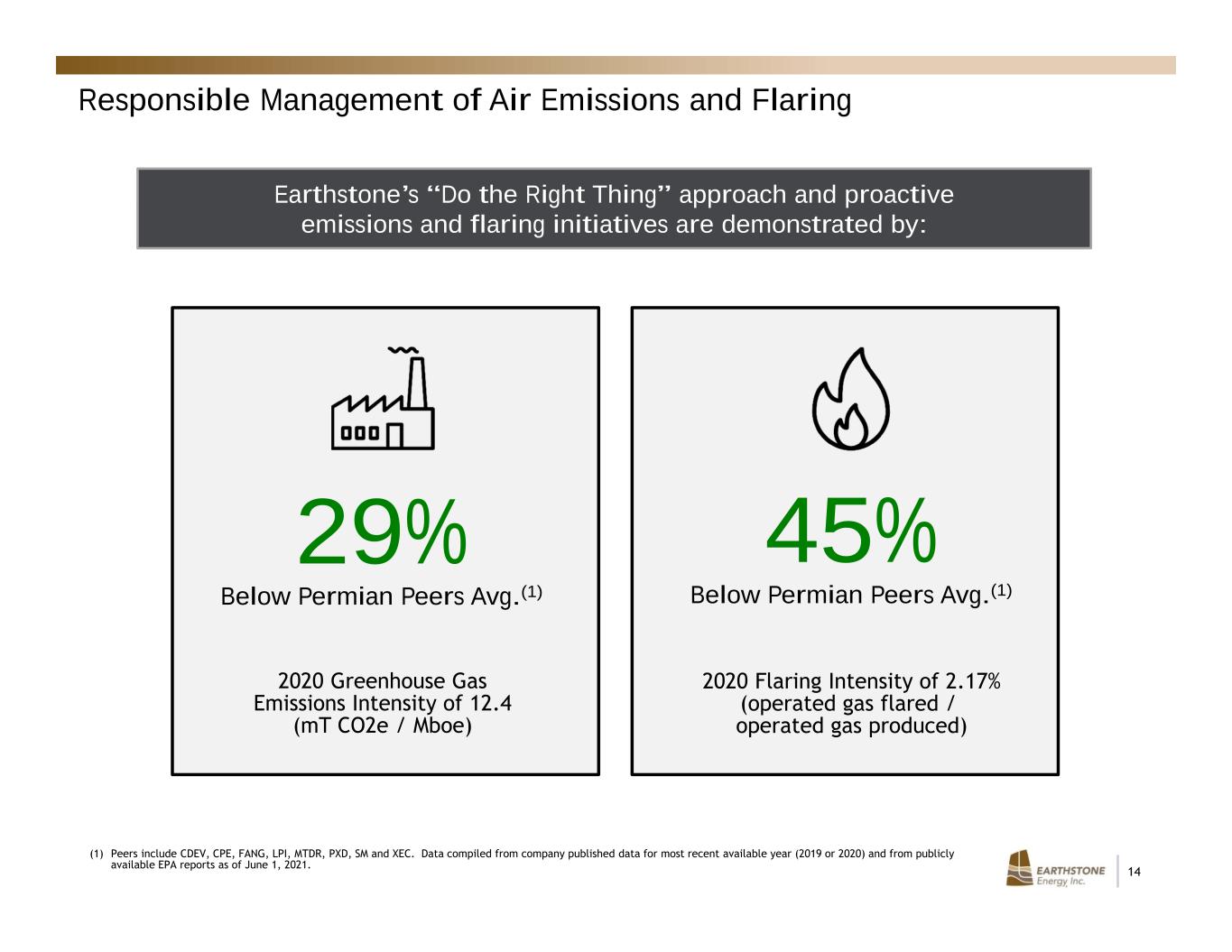

14 Responsible Management of Air Emissions and Flaring (1) Peers include CDEV, CPE, FANG, LPI, MTDR, PXD, SM and XEC. Data compiled from company published data for most recent available year (2019 or 2020) and from publicly available EPA reports as of June 1, 2021. 2020 Greenhouse Gas Emissions Intensity of 12.4 (mT CO2e / Mboe) 29% Below Permian Peers Avg.(1) 45% Below Permian Peers Avg.(1) 2020 Flaring Intensity of 2.17% (operated gas flared / operated gas produced) Earthstone’s “Do the Right Thing” approach and proactive emissions and flaring initiatives are demonstrated by:

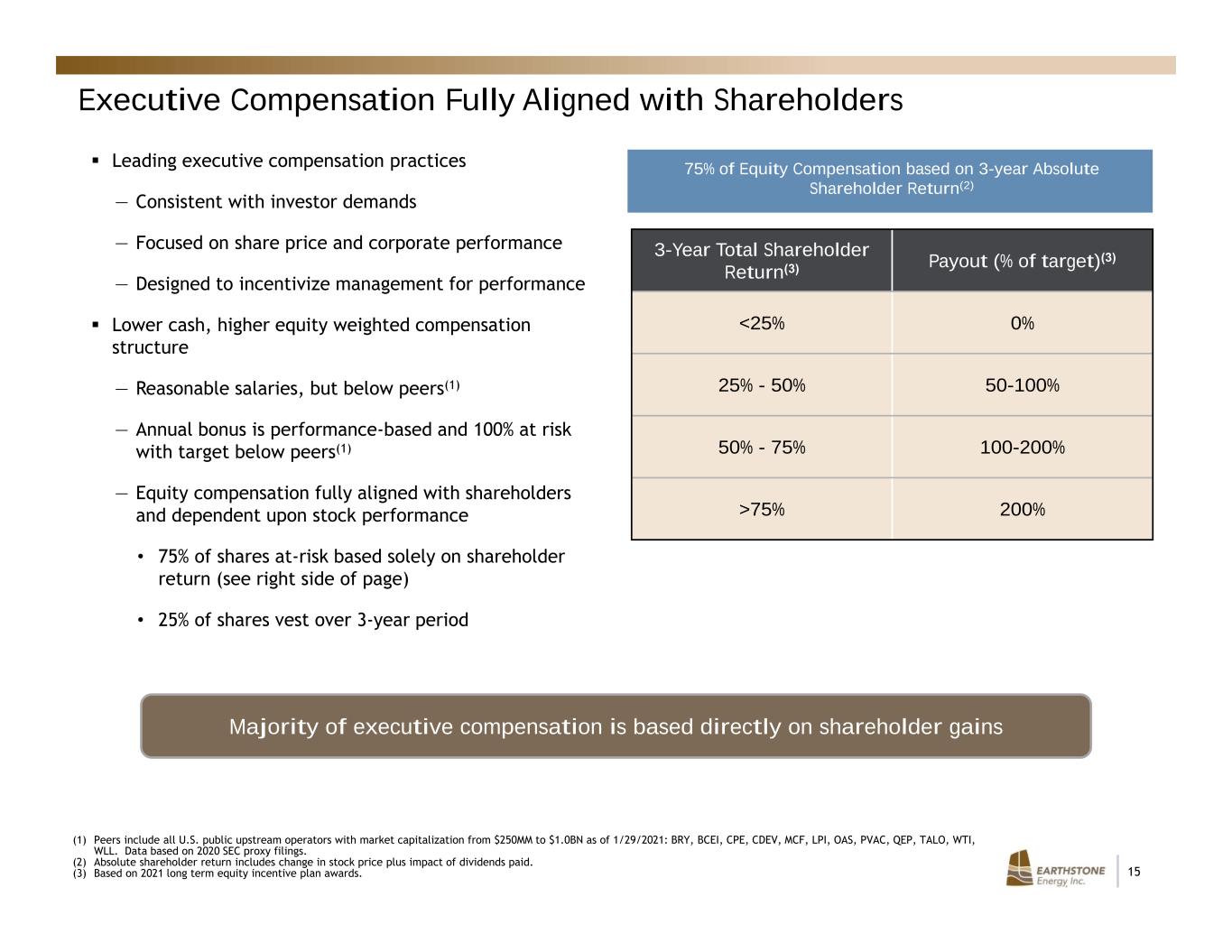

15 Executive Compensation Fully Aligned with Shareholders (1) Peers include all U.S. public upstream operators with market capitalization from $250MM to $1.0BN as of 1/29/2021: BRY, BCEI, CPE, CDEV, MCF, LPI, OAS, PVAC, QEP, TALO, WTI, WLL. Data based on 2020 SEC proxy filings. (2) Absolute shareholder return includes change in stock price plus impact of dividends paid. (3) Based on 2021 long term equity incentive plan awards. 3-Year Total Shareholder Return(3) Payout (% of target)(3) <25% 0% 25% - 50% 50-100% 50% - 75% 100-200% >75% 200% 75% of Equity Compensation based on 3-year Absolute Shareholder Return(2) Leading executive compensation practices ― Consistent with investor demands ― Focused on share price and corporate performance ― Designed to incentivize management for performance Lower cash, higher equity weighted compensation structure ― Reasonable salaries, but below peers(1) ― Annual bonus is performance-based and 100% at risk with target below peers(1) ― Equity compensation fully aligned with shareholders and dependent upon stock performance • 75% of shares at-risk based solely on shareholder return (see right side of page) • 25% of shares vest over 3-year period Majority of executive compensation is based directly on shareholder gains

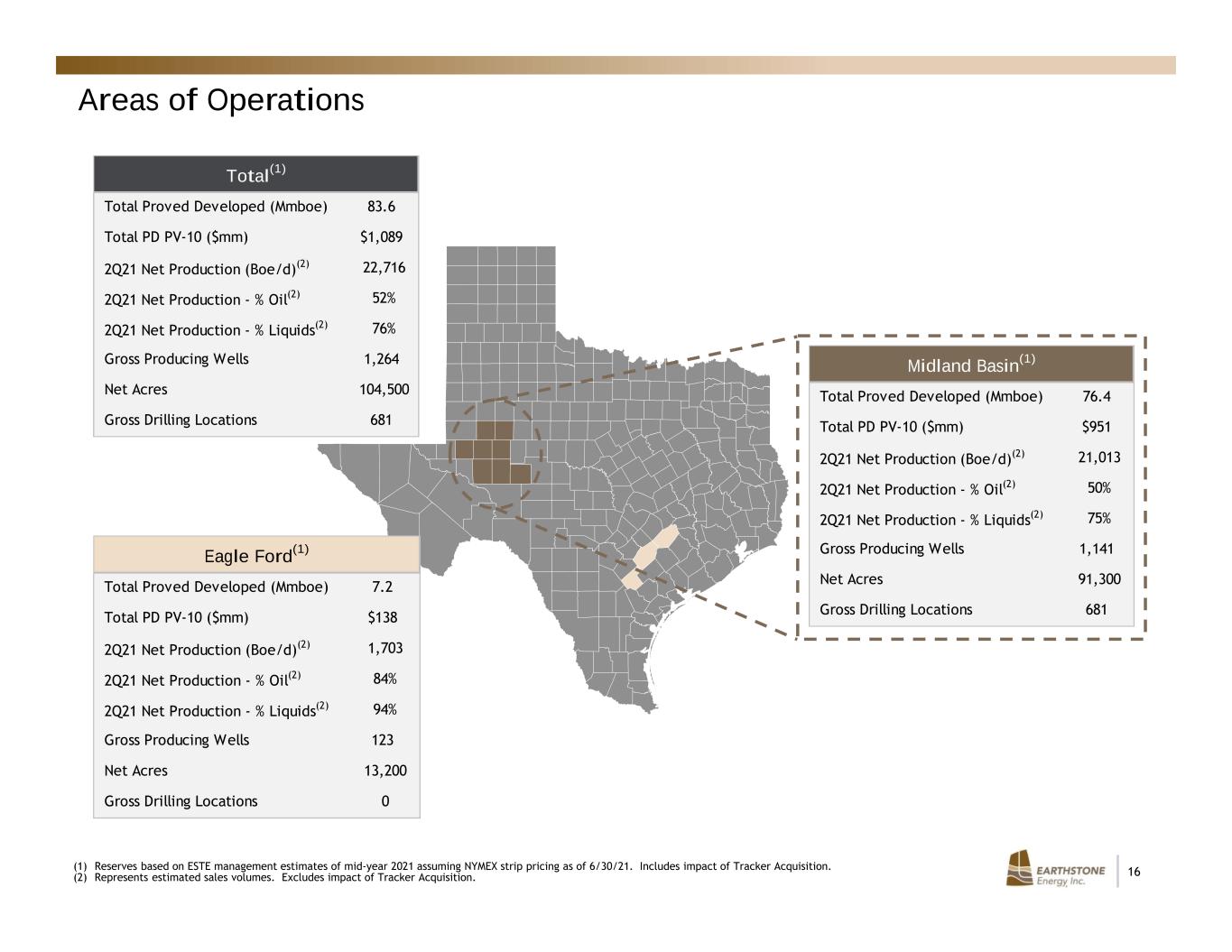

16 Areas of Operations (1) Reserves based on ESTE management estimates of mid-year 2021 assuming NYMEX strip pricing as of 6/30/21. Includes impact of Tracker Acquisition. (2) Represents estimated sales volumes. Excludes impact of Tracker Acquisition. Total(1) Total Proved Developed (Mmboe) 83.6 Total PD PV-10 ($mm) $1,089 2Q21 Net Production (Boe/d)(2) 22,716 2Q21 Net Production - % Oil(2) 52% 2Q21 Net Production - % Liquids(2) 76% Gross Producing Wells 1,264 Net Acres 104,500 Gross Drilling Locations 681 Eagle Ford(1) Total Proved Developed (Mmboe) 7.2 Total PD PV-10 ($mm) $138 2Q21 Net Production (Boe/d)(2) 1,703 2Q21 Net Production - % Oil(2) 84% 2Q21 Net Production - % Liquids(2) 94% Gross Producing Wells 123 Net Acres 13,200 Gross Drilling Locations 0 Midland Basin(1) Total Proved Developed (Mmboe) 76.4 Total PD PV-10 ($mm) $951 2Q21 Net Production (Boe/d)(2) 21,013 2Q21 Net Production - % Oil(2) 50% 2Q21 Net Production - % Liquids(2) 75% Gross Producing Wells 1,141 Net Acres 91,300 Gross Drilling Locations 681

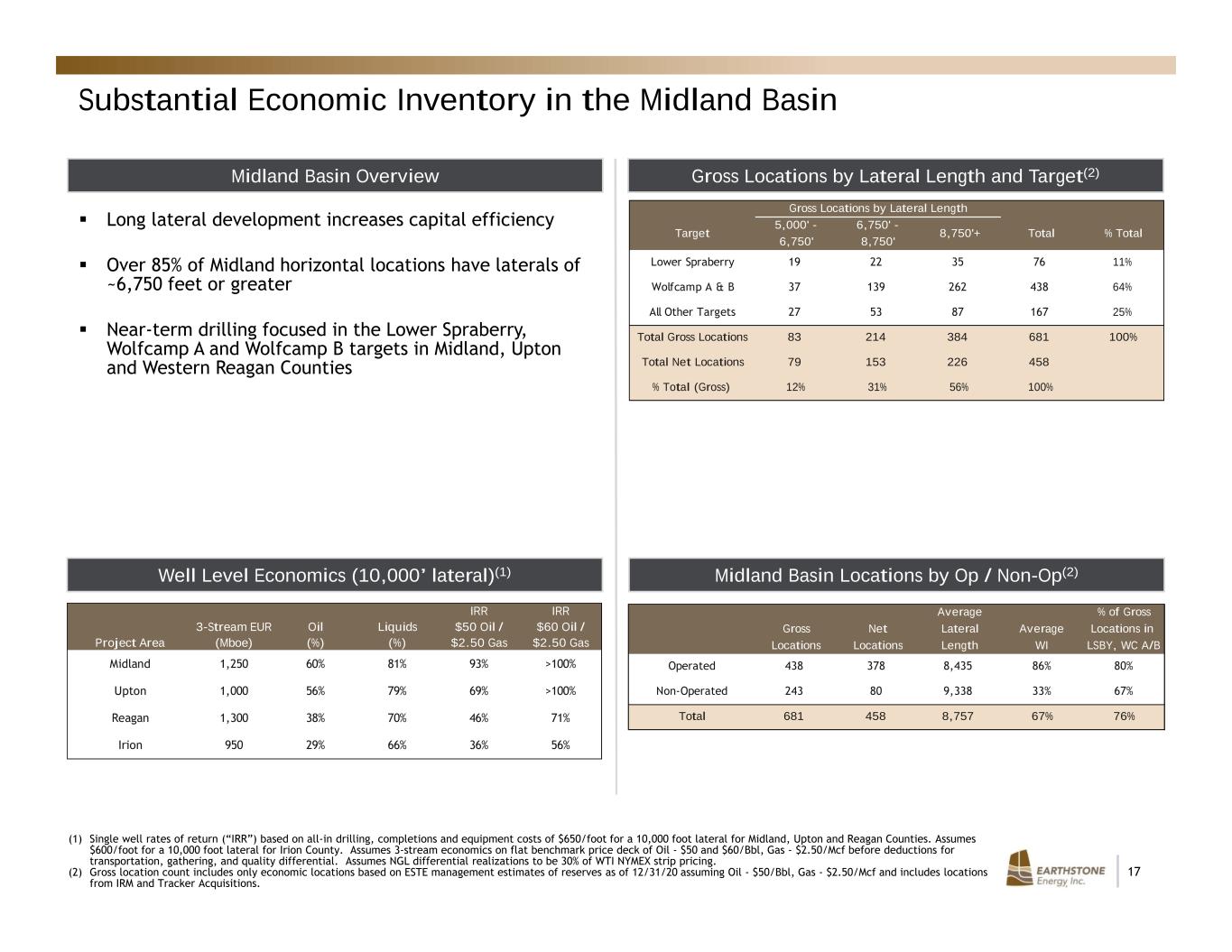

17 Gross Locations by Lateral Length and Target(2) Long lateral development increases capital efficiency Over 85% of Midland horizontal locations have laterals of ~6,750 feet or greater Near-term drilling focused in the Lower Spraberry, Wolfcamp A and Wolfcamp B targets in Midland, Upton and Western Reagan Counties Midland Basin Overview Substantial Economic Inventory in the Midland Basin Midland Basin Locations by Op / Non-Op(2)Well Level Economics (10,000’ lateral)(1) (1) Single well rates of return (“IRR”) based on all-in drilling, completions and equipment costs of $650/foot for a 10,000 foot lateral for Midland, Upton and Reagan Counties. Assumes $600/foot for a 10,000 foot lateral for Irion County. Assumes 3-stream economics on flat benchmark price deck of Oil - $50 and $60/Bbl, Gas - $2.50/Mcf before deductions for transportation, gathering, and quality differential. Assumes NGL differential realizations to be 30% of WTI NYMEX strip pricing. (2) Gross location count includes only economic locations based on ESTE management estimates of reserves as of 12/31/20 assuming Oil - $50/Bbl, Gas - $2.50/Mcf and includes locations from IRM and Tracker Acquisitions. IRR IRR 3-Stream EUR Oil Liquids $50 Oil / $60 Oil / Project Area (Mboe) (%) (%) $2.50 Gas $2.50 Gas Midland 1,250 60% 81% 93% >100% Upton 1,000 56% 79% 69% >100% Reagan 1,300 38% 70% 46% 71% Irion 950 29% 66% 36% 56% Gross Locations by Lateral Length Target 5,000' - 6,750' 6,750' - 8,750' 8,750'+ Total % Total Lower Spraberry 19 22 35 76 11% Wolfcamp A & B 37 139 262 438 64% All Other Targets 27 53 87 167 25% Total Gross Locations 83 214 384 681 100% Total Net Locations 79 153 226 458 % Total (Gross) 12% 31% 56% 100% Average % of Gross Gross Net Lateral Average Locations in Locations Locations Length WI LSBY, WC A/B Operated 438 378 8,435 86% 80% Non-Operated 243 80 9,338 33% 67% Total 681 458 8,757 67% 76%

18 Financial Overview

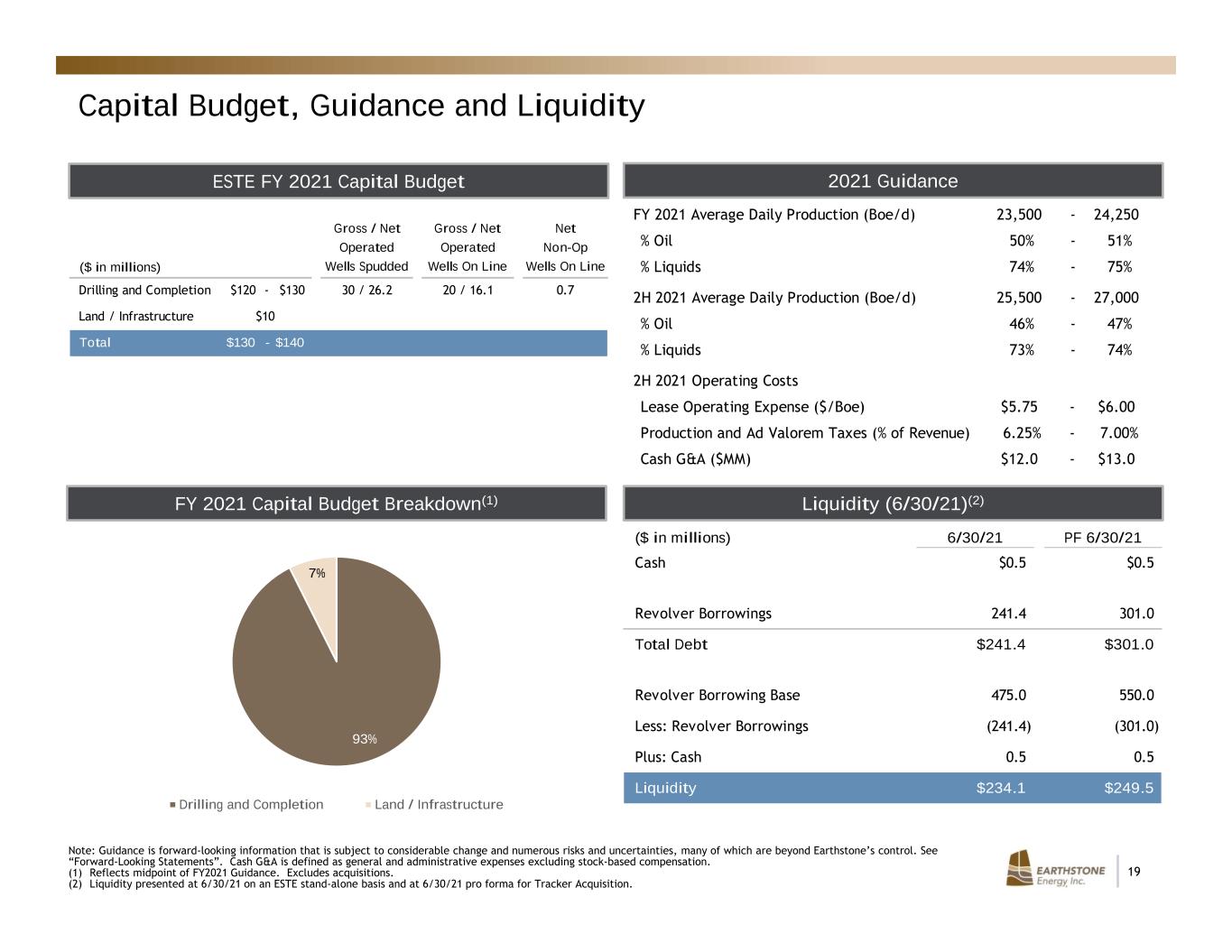

19 Capital Budget, Guidance and Liquidity ESTE FY 2021 Capital Budget Liquidity (6/30/21)(2) 2021 Guidance FY 2021 Capital Budget Breakdown(1) Note: Guidance is forward-looking information that is subject to considerable change and numerous risks and uncertainties, many of which are beyond Earthstone’s control. See “Forward-Looking Statements”. Cash G&A is defined as general and administrative expenses excluding stock-based compensation. (1) Reflects midpoint of FY2021 Guidance. Excludes acquisitions. (2) Liquidity presented at 6/30/21 on an ESTE stand-alone basis and at 6/30/21 pro forma for Tracker Acquisition. ($ in millions) Gross / Net Operated Wells Spudded Gross / Net Operated Wells On Line Net Non-Op Wells On Line Drilling and Completion $120 - $130 30 / 26.2 20 / 16.1 0.7 Land / Infrastructure $10 Total $130 - $140 93% 7% Drilling and Completion Land / Infrastructure ($ in millions) 6/30/21 PF 6/30/21 Cash $0.5 $0.5 Revolver Borrowings 241.4 301.0 Total Debt $241.4 $301.0 Revolver Borrowing Base 475.0 550.0 Less: Revolver Borrowings (241.4) (301.0) Plus: Cash 0.5 0.5 Liquidity $234.1 $249.5 FY 2021 Average Daily Production (Boe/d) 23,500 - 24,250 % Oil 50% - 51% % Liquids 74% - 75% 2H 2021 Average Daily Production (Boe/d) 25,500 - 27,000 % Oil 46% - 47% % Liquids 73% - 74% 2H 2021 Operating Costs Lease Operating Expense ($/Boe) $5.75 - $6.00 Production and Ad Valorem Taxes (% of Revenue) 6.25% - 7.00% Cash G&A ($MM) $12.0 - $13.0

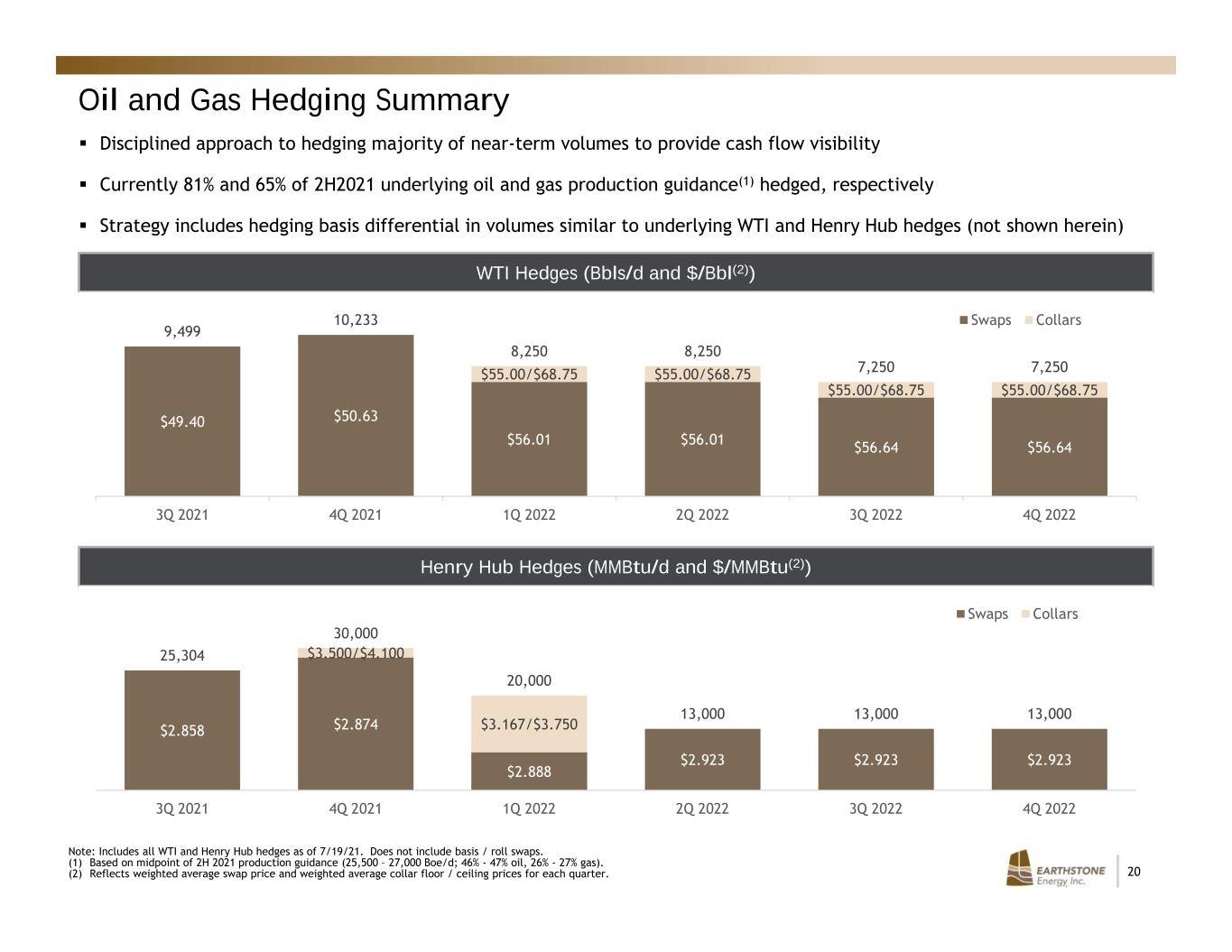

20 Oil and Gas Hedging Summary WTI Hedges (Bbls/d and $/Bbl(2)) Henry Hub Hedges (MMBtu/d and $/MMBtu(2)) Note: Includes all WTI and Henry Hub hedges as of 7/19/21. Does not include basis / roll swaps. (1) Based on midpoint of 2H 2021 production guidance (25,500 – 27,000 Boe/d; 46% - 47% oil, 26% - 27% gas). (2) Reflects weighted average swap price and weighted average collar floor / ceiling prices for each quarter. Disciplined approach to hedging majority of near-term volumes to provide cash flow visibility Currently 81% and 65% of 2H2021 underlying oil and gas production guidance(1) hedged, respectively Strategy includes hedging basis differential in volumes similar to underlying WTI and Henry Hub hedges (not shown herein) $2.858 $2.874 $2.888 $2.923 $2.923 $2.923 $3.500/$4.100 $3.167/$3.750 25,304 30,000 20,000 13,000 13,000 13,000 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 4Q 2022 Swaps Collars $49.40 $50.63 $56.01 $56.01 $56.64 $56.64 $55.00/$68.75 $55.00/$68.75 $55.00/$68.75 $55.00/$68.75 9,499 10,233 8,250 8,250 7,250 7,250 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 4Q 2022 Swaps Collars

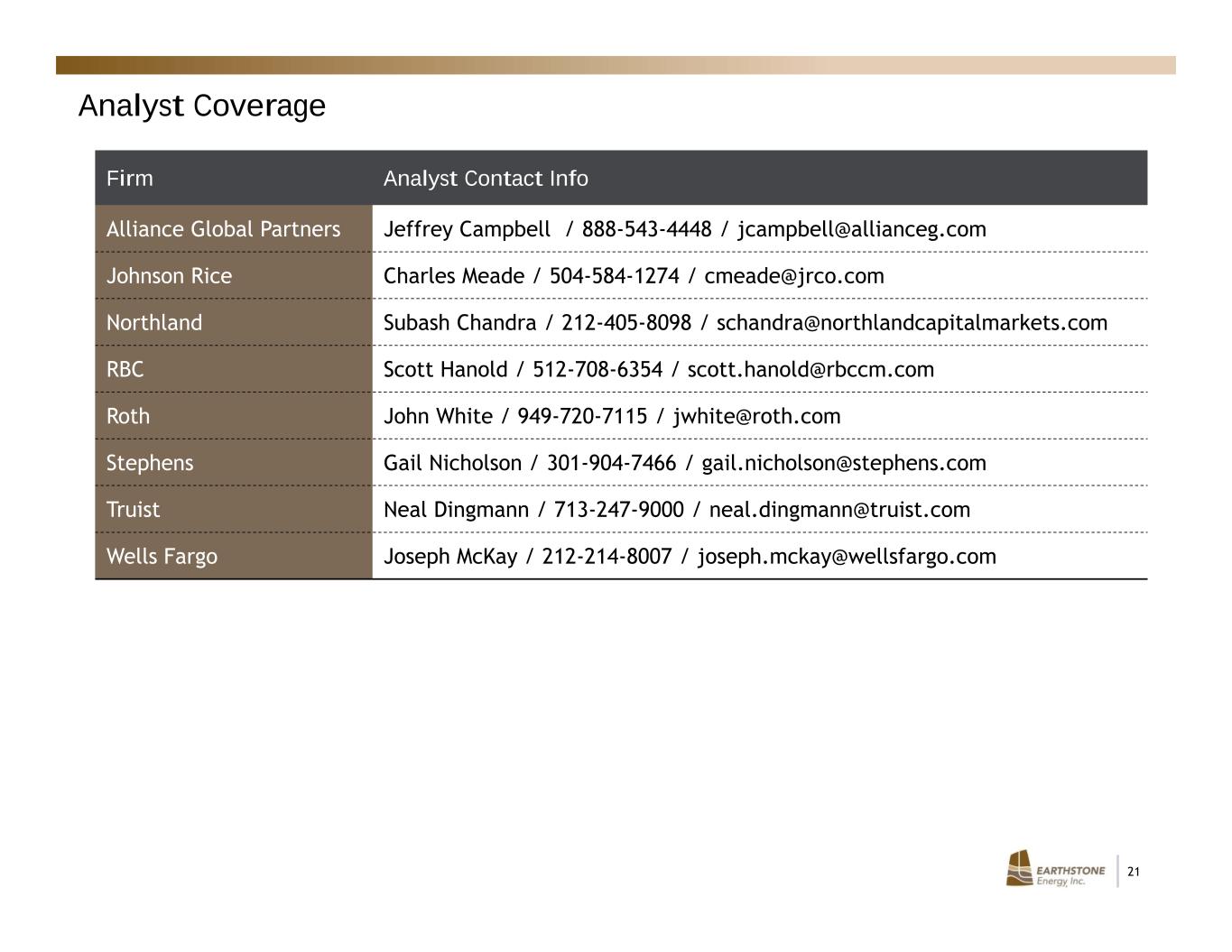

21 Analyst Coverage Firm Analyst Contact Info Alliance Global Partners Jeffrey Campbell / 888-543-4448 / jcampbell@allianceg.com Johnson Rice Charles Meade / 504-584-1274 / cmeade@jrco.com Northland Subash Chandra / 212-405-8098 / schandra@northlandcapitalmarkets.com RBC Scott Hanold / 512-708-6354 / scott.hanold@rbccm.com Roth John White / 949-720-7115 / jwhite@roth.com Stephens Gail Nicholson / 301-904-7466 / gail.nicholson@stephens.com Truist Neal Dingmann / 713-247-9000 / neal.dingmann@truist.com Wells Fargo Joseph McKay / 212-214-8007 / joseph.mckay@wellsfargo.com

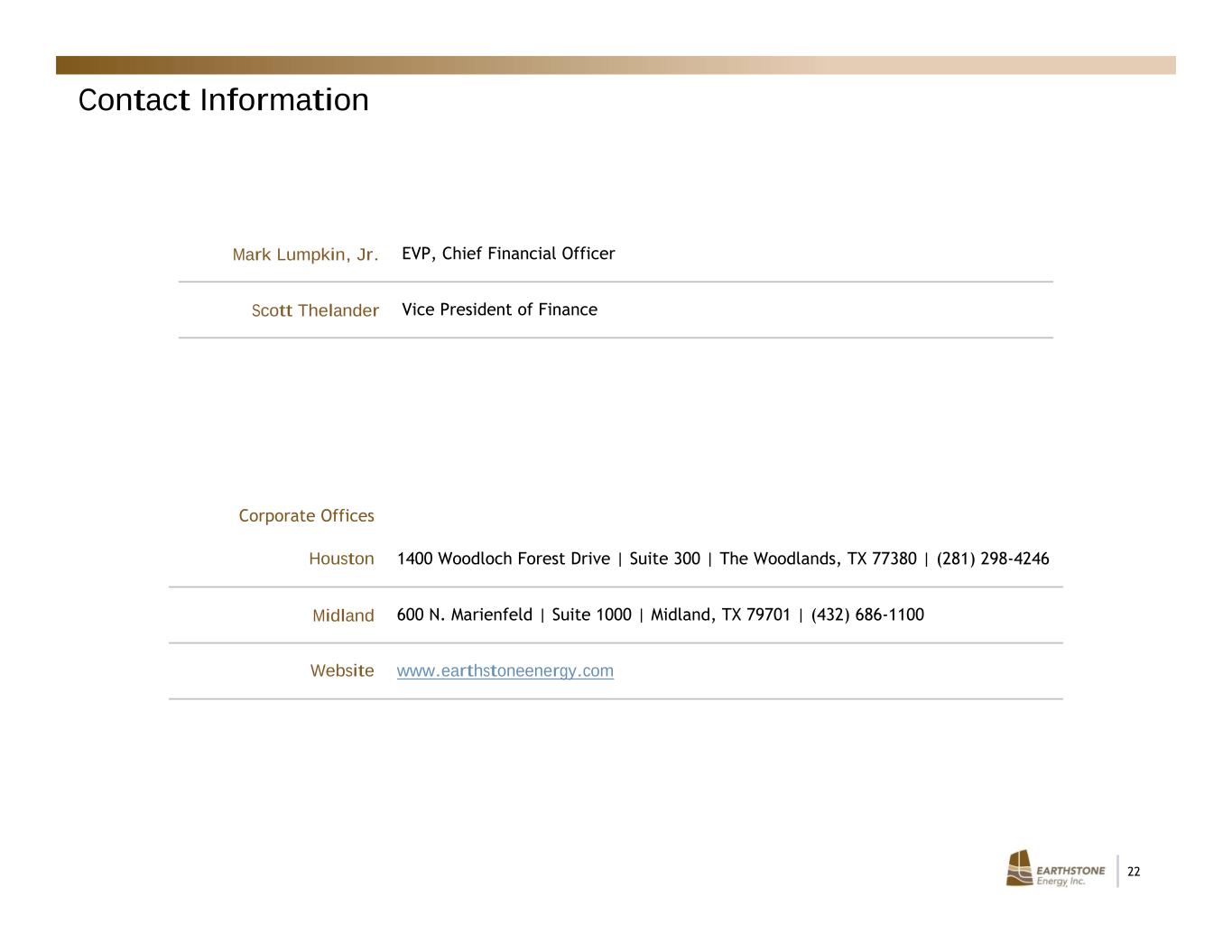

22 Mark Lumpkin, Jr. EVP, Chief Financial Officer Scott Thelander Vice President of Finance Corporate Offices Houston 1400 Woodloch Forest Drive | Suite 300 | The Woodlands, TX 77380 | (281) 298-4246 Midland 600 N. Marienfeld | Suite 1000 | Midland, TX 79701 | (432) 686-1100 Website www.earthstoneenergy.com Contact Information

23 Appendix

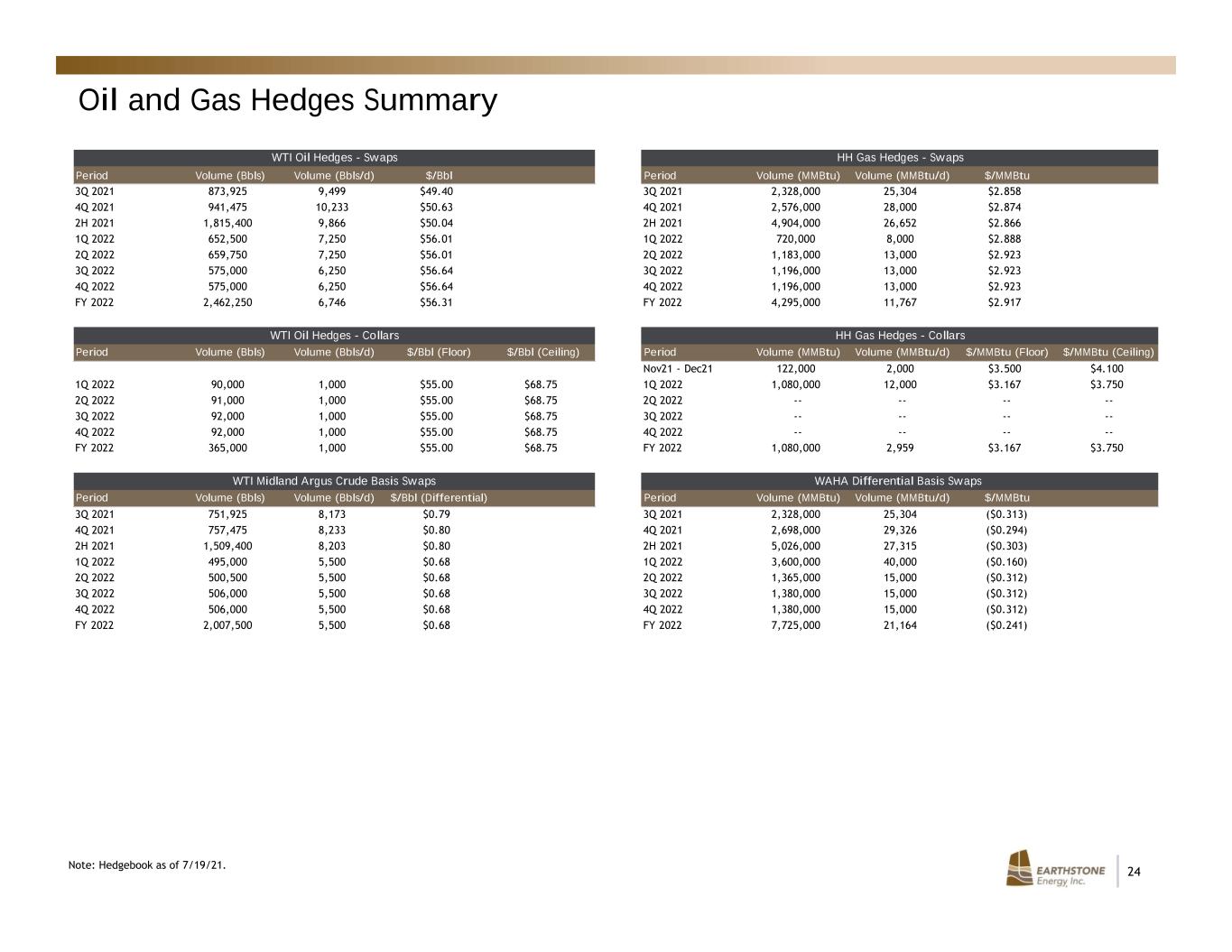

24 Oil and Gas Hedges Summary Note: Hedgebook as of 7/19/21. WTI Oil Hedges - Swaps HH Gas Hedges - Swaps Period Volume (Bbls) Volume (Bbls/d) $/Bbl Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu 3Q 2021 873,925 9,499 $49.40 3Q 2021 2,328,000 25,304 $2.858 4Q 2021 941,475 10,233 $50.63 4Q 2021 2,576,000 28,000 $2.874 2H 2021 1,815,400 9,866 $50.04 2H 2021 4,904,000 26,652 $2.866 1Q 2022 652,500 7,250 $56.01 1Q 2022 720,000 8,000 $2.888 2Q 2022 659,750 7,250 $56.01 2Q 2022 1,183,000 13,000 $2.923 3Q 2022 575,000 6,250 $56.64 3Q 2022 1,196,000 13,000 $2.923 4Q 2022 575,000 6,250 $56.64 4Q 2022 1,196,000 13,000 $2.923 FY 2022 2,462,250 6,746 $56.31 FY 2022 4,295,000 11,767 $2.917 WTI Oil Hedges - Collars HH Gas Hedges - Collars Period Volume (Bbls) Volume (Bbls/d) $/Bbl (Floor) $/Bbl (Ceiling) Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu (Floor) $/MMBtu (Ceiling) Nov21 - Dec21 122,000 2,000 $3.500 $4.100 1Q 2022 90,000 1,000 $55.00 $68.75 1Q 2022 1,080,000 12,000 $3.167 $3.750 2Q 2022 91,000 1,000 $55.00 $68.75 2Q 2022 -- -- -- -- 3Q 2022 92,000 1,000 $55.00 $68.75 3Q 2022 -- -- -- -- 4Q 2022 92,000 1,000 $55.00 $68.75 4Q 2022 -- -- -- -- FY 2022 365,000 1,000 $55.00 $68.75 FY 2022 1,080,000 2,959 $3.167 $3.750 WTI Midland Argus Crude Basis Swaps WAHA Differential Basis Swaps Period Volume (Bbls) Volume (Bbls/d) $/Bbl (Differential) Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu 3Q 2021 751,925 8,173 $0.79 3Q 2021 2,328,000 25,304 ($0.313) 4Q 2021 757,475 8,233 $0.80 4Q 2021 2,698,000 29,326 ($0.294) 2H 2021 1,509,400 8,203 $0.80 2H 2021 5,026,000 27,315 ($0.303) 1Q 2022 495,000 5,500 $0.68 1Q 2022 3,600,000 40,000 ($0.160) 2Q 2022 500,500 5,500 $0.68 2Q 2022 1,365,000 15,000 ($0.312) 3Q 2022 506,000 5,500 $0.68 3Q 2022 1,380,000 15,000 ($0.312) 4Q 2022 506,000 5,500 $0.68 4Q 2022 1,380,000 15,000 ($0.312) FY 2022 2,007,500 5,500 $0.68 FY 2022 7,725,000 21,164 ($0.241)

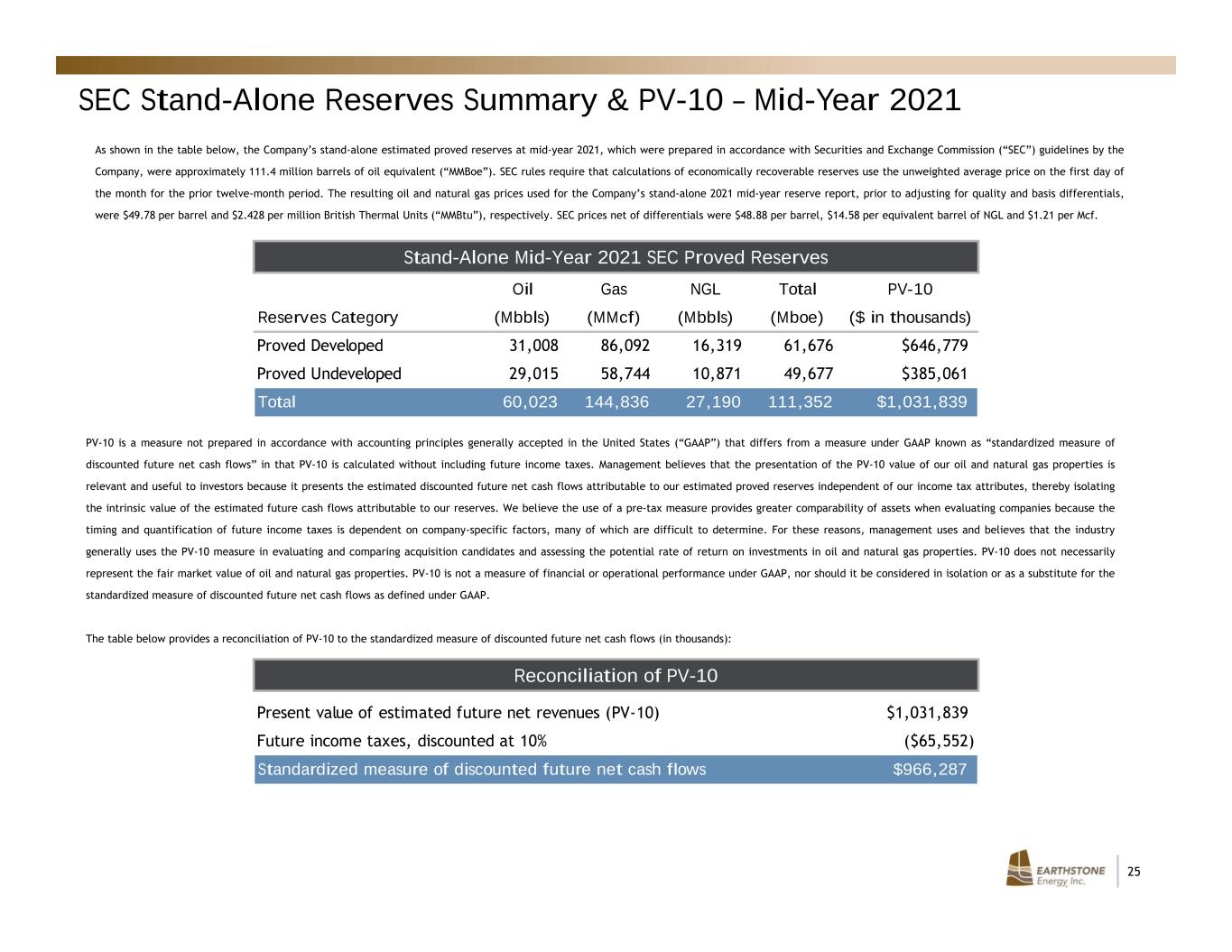

25 SEC Stand-Alone Reserves Summary & PV-10 – Mid-Year 2021 As shown in the table below, the Company’s stand-alone estimated proved reserves at mid-year 2021, which were prepared in accordance with Securities and Exchange Commission (“SEC”) guidelines by the Company, were approximately 111.4 million barrels of oil equivalent (“MMBoe”). SEC rules require that calculations of economically recoverable reserves use the unweighted average price on the first day of the month for the prior twelve-month period. The resulting oil and natural gas prices used for the Company’s stand-alone 2021 mid-year reserve report, prior to adjusting for quality and basis differentials, were $49.78 per barrel and $2.428 per million British Thermal Units (“MMBtu”), respectively. SEC prices net of differentials were $48.88 per barrel, $14.58 per equivalent barrel of NGL and $1.21 per Mcf. Stand-Alone Mid-Year 2021 SEC Proved Reserves PV-10 is a measure not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) that differs from a measure under GAAP known as “standardized measure of discounted future net cash flows” in that PV-10 is calculated without including future income taxes. Management believes that the presentation of the PV-10 value of our oil and natural gas properties is relevant and useful to investors because it presents the estimated discounted future net cash flows attributable to our estimated proved reserves independent of our income tax attributes, thereby isolating the intrinsic value of the estimated future cash flows attributable to our reserves. We believe the use of a pre-tax measure provides greater comparability of assets when evaluating companies because the timing and quantification of future income taxes is dependent on company-specific factors, many of which are difficult to determine. For these reasons, management uses and believes that the industry generally uses the PV-10 measure in evaluating and comparing acquisition candidates and assessing the potential rate of return on investments in oil and natural gas properties. PV-10 does not necessarily represent the fair market value of oil and natural gas properties. PV-10 is not a measure of financial or operational performance under GAAP, nor should it be considered in isolation or as a substitute for the standardized measure of discounted future net cash flows as defined under GAAP. The table below provides a reconciliation of PV-10 to the standardized measure of discounted future net cash flows (in thousands): Reconciliation of PV-10 Oil Gas NGL Total PV-10 Reserves Category (Mbbls) (MMcf) (Mbbls) (Mboe) ($ in thousands) Proved Developed 31,008 86,092 16,319 61,676 $646,779 Proved Undeveloped 29,015 58,744 10,871 49,677 $385,061 Total 60,023 144,836 27,190 111,352 $1,031,839 Present value of estimated future net revenues (PV-10) $1,031,839 Future income taxes, discounted at 10% ($65,552) Standardized measure of discounted future net cash flows $966,287

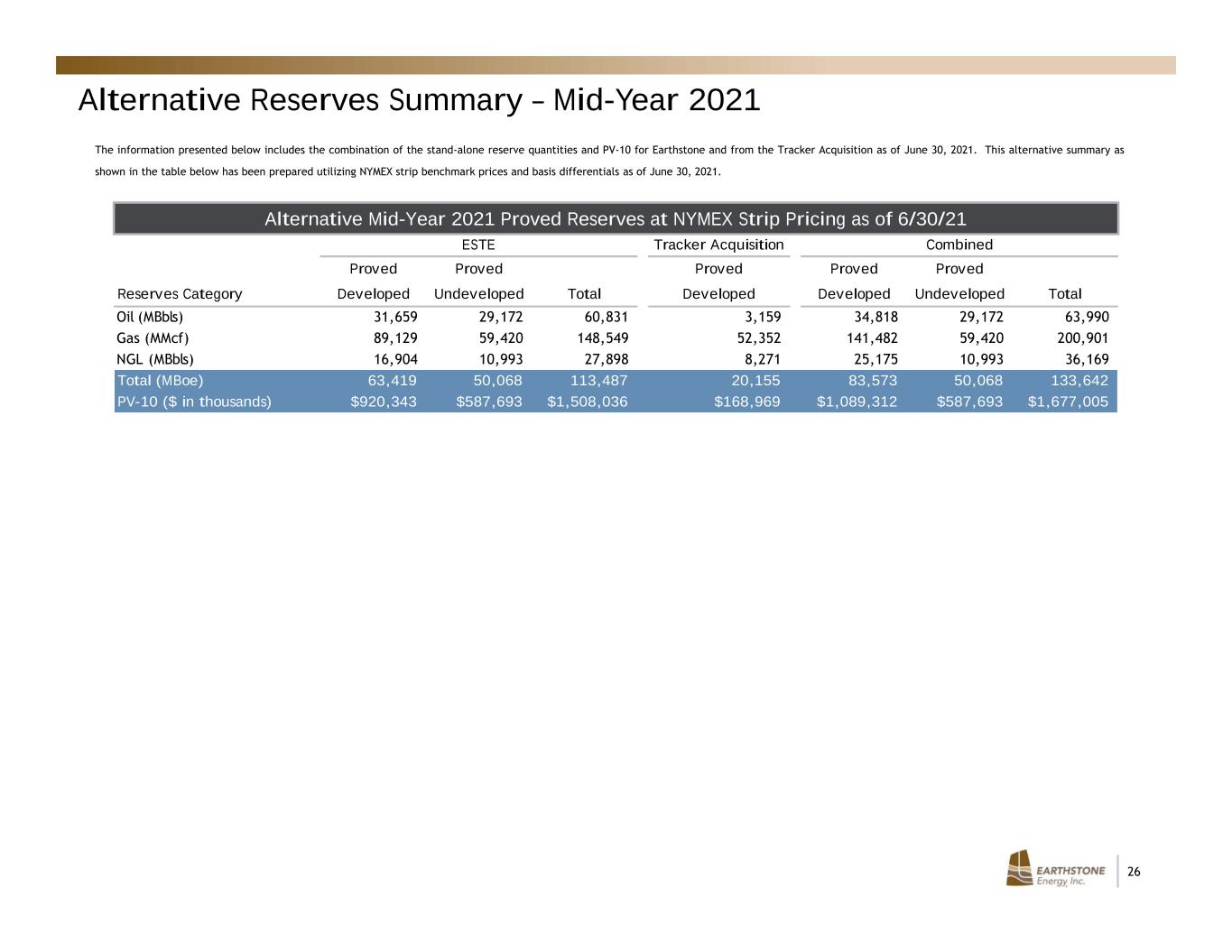

26 Alternative Reserves Summary – Mid-Year 2021 The information presented below includes the combination of the stand-alone reserve quantities and PV-10 for Earthstone and from the Tracker Acquisition as of June 30, 2021. This alternative summary as shown in the table below has been prepared utilizing NYMEX strip benchmark prices and basis differentials as of June 30, 2021. Alternative Mid-Year 2021 Proved Reserves at NYMEX Strip Pricing as of 6/30/21 ESTE Tracker Acquisition Combined Proved Proved Proved Proved Proved Reserves Category Developed Undeveloped Total Developed Developed Undeveloped Total Oil (MBbls) 31,659 29,172 60,831 3,159 34,818 29,172 63,990 Gas (MMcf) 89,129 59,420 148,549 52,352 141,482 59,420 200,901 NGL (MBbls) 16,904 10,993 27,898 8,271 25,175 10,993 36,169 Total (MBoe) 63,419 50,068 113,487 20,155 83,573 50,068 133,642 PV-10 ($ in thousands) $920,343 $587,693 $1,508,036 $168,969 $1,089,312 $587,693 $1,677,005

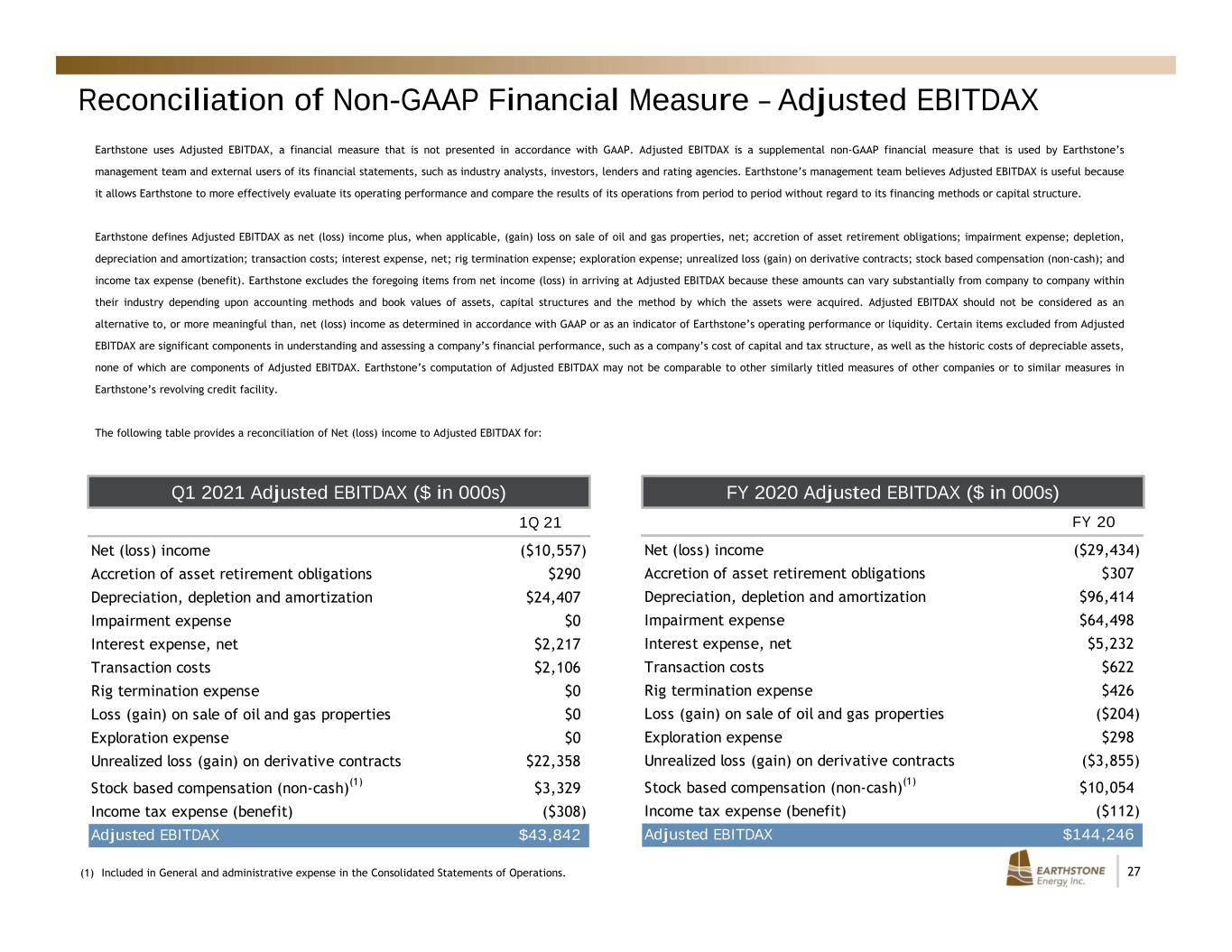

27 Reconciliation of Non-GAAP Financial Measure – Adjusted EBITDAX Earthstone uses Adjusted EBITDAX, a financial measure that is not presented in accordance with GAAP. Adjusted EBITDAX is a supplemental non-GAAP financial measure that is used by Earthstone’s management team and external users of its financial statements, such as industry analysts, investors, lenders and rating agencies. Earthstone’s management team believes Adjusted EBITDAX is useful because it allows Earthstone to more effectively evaluate its operating performance and compare the results of its operations from period to period without regard to its financing methods or capital structure. Earthstone defines Adjusted EBITDAX as net (loss) income plus, when applicable, (gain) loss on sale of oil and gas properties, net; accretion of asset retirement obligations; impairment expense; depletion, depreciation and amortization; transaction costs; interest expense, net; rig termination expense; exploration expense; unrealized loss (gain) on derivative contracts; stock based compensation (non-cash); and income tax expense (benefit). Earthstone excludes the foregoing items from net income (loss) in arriving at Adjusted EBITDAX because these amounts can vary substantially from company to company within their industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net (loss) income as determined in accordance with GAAP or as an indicator of Earthstone’s operating performance or liquidity. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDAX. Earthstone’s computation of Adjusted EBITDAX may not be comparable to other similarly titled measures of other companies or to similar measures in Earthstone’s revolving credit facility. The following table provides a reconciliation of Net (loss) income to Adjusted EBITDAX for: (1) Included in General and administrative expense in the Consolidated Statements of Operations. FY 2020 Adjusted EBITDAX ($ in 000s)Q1 2021 Adjusted EBITDAX ($ in 000s) FY 20 Net (loss) income ($29,434) Accretion of asset retirement obligations $307 Depreciation, depletion and amortization $96,414 Impairment expense $64,498 Interest expense, net $5,232 Transaction costs $622 Rig termination expense $426 Loss (gain) on sale of oil and gas properties ($204) Exploration expense $298 Unrealized loss (gain) on derivative contracts ($3,855) Stock based compensation (non-cash)(1) $10,054 Income tax expense (benefit) ($112) Adjusted EBITDAX $144,246 1Q 21 Net (loss) income ($10,557) Accretion of asset retirement obligations $290 Depreciation, depletion and amortization $24,407 Impairment expense $0 Interest expense, net $2,217 Transaction costs $2,106 Rig termination expense $0 Loss (gain) on sale of oil and gas properties $0 Exploration expense $0 Unrealized loss (gain) on derivative contracts $22,358 Stock based compensation (non-cash)(1) $3,329 Income tax expense (benefit) ($308) Adjusted EBITDAX $43,842

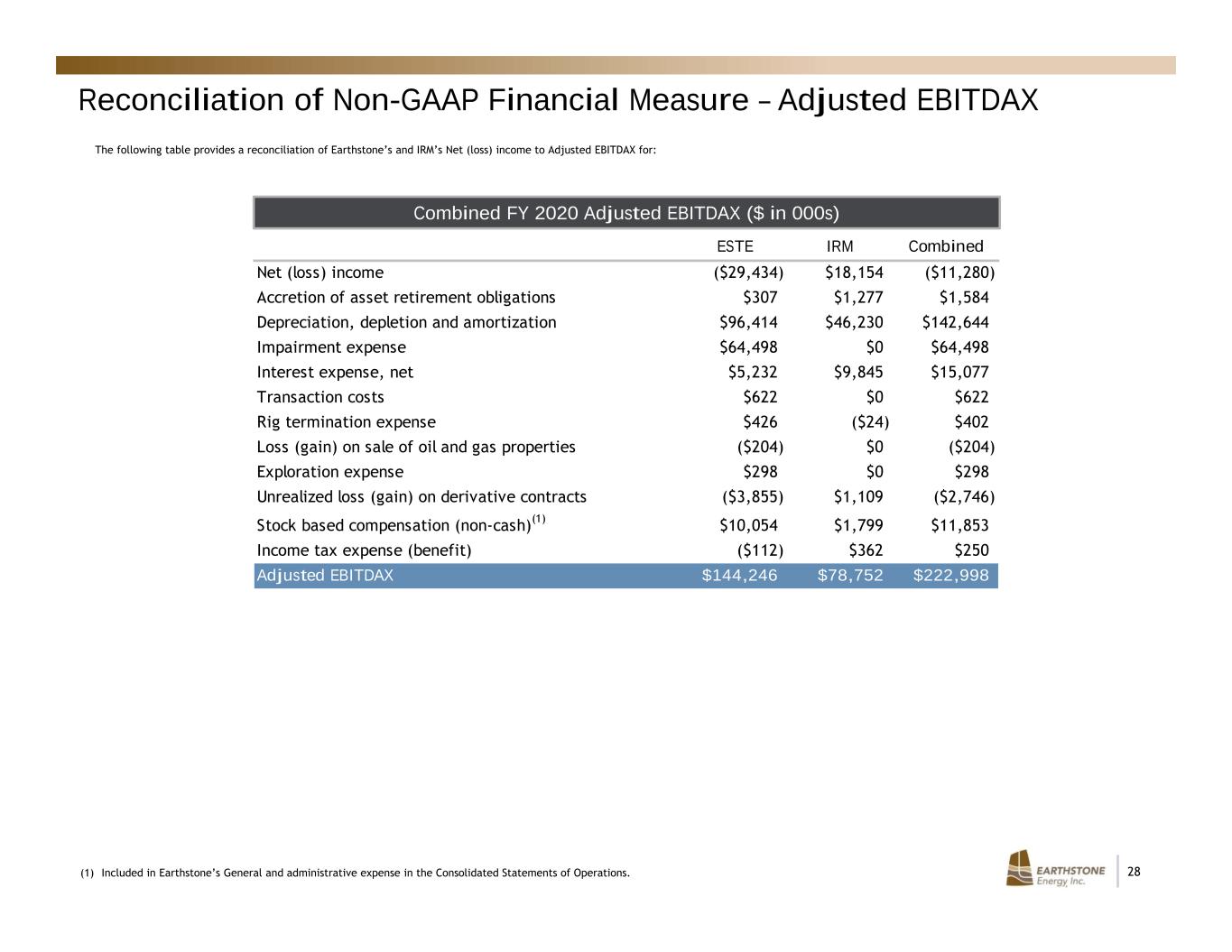

28 Reconciliation of Non-GAAP Financial Measure – Adjusted EBITDAX (1) Included in Earthstone’s General and administrative expense in the Consolidated Statements of Operations. Combined FY 2020 Adjusted EBITDAX ($ in 000s) ESTE IRM Combined Net (loss) income ($29,434) $18,154 ($11,280) Accretion of asset retirement obligations $307 $1,277 $1,584 Depreciation, depletion and amortization $96,414 $46,230 $142,644 Impairment expense $64,498 $0 $64,498 Interest expense, net $5,232 $9,845 $15,077 Transaction costs $622 $0 $622 Rig termination expense $426 ($24) $402 Loss (gain) on sale of oil and gas properties ($204) $0 ($204) Exploration expense $298 $0 $298 Unrealized loss (gain) on derivative contracts ($3,855) $1,109 ($2,746) Stock based compensation (non-cash)(1) $10,054 $1,799 $11,853 Income tax expense (benefit) ($112) $362 $250 Adjusted EBITDAX $144,246 $78,752 $222,998 The following table provides a reconciliation of Earthstone’s and IRM’s Net (loss) income to Adjusted EBITDAX for: