Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AERIE PHARMACEUTICALS INC | d181545d8k.htm |

Approaches to Europe: Strategies for Development and Differentiation David A. Hollander, MD, MBA Chief R&D Officer July 20, 2021 Exhibit 99.1

Important Information The information in this presentation does not contain all of the information that a potential investor should review before investing in Aerie shares. The descriptions of Aerie Pharmaceuticals, Inc. (the “Company” or “Aerie”) in this presentation are qualified in their entirety by reference to reports filed with the SEC. Certain information in this presentation has been obtained from outside sources or is anecdotal in nature. While such information is believed to be reliable for the purposes used herein, no representations are made as to the accuracy or completeness thereof and we take no responsibility for such information. Any discussion of the potential use or expected success of Rhopressa® (netarsudil ophthalmic solution) 0.02% or Rocklatan® (netarsudil and latanoprost ophthalmic solution) 0.02%/0.005%, with respect to foreign approval or additional indications, and our current or any future product candidates, including AR-1105, AR-13503, AR-14034, AR-6121 and AR-15512, is subject to regulatory approval. In addition, any discussion of U.S. Food and Drug Administration (“FDA”) approval of Rhopressa® or Rocklatan® does not guarantee successful commercialization of Rhopressa® or Rocklatan®. For more information on Rhopressa®, including prescribing information, refer to the full Rhopressa® product label at www.rhopressa.com. For more information on Rocklatan®, including prescribing information, refer to the full Rocklatan® product label at www.rocklatan.com. The information in this presentation is current only as of its date and may have changed or may change in the future. We undertake no obligation to update this information in light of new information, future events or otherwise. We are not making any representation or warranty that the information in this presentation is accurate or complete. This presentation shall not constitute an offer to sell, nor a solicitation of an offer to buy, any of Aerie’s securities. Certain statements in this presentation, including any guidance or timelines presented herein, are “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “will,” “should,” “would,” “could,” “believe,” “expects,” “anticipates,” “plans,” “intends,” “estimates,” “targets,” “projects,” “potential” or similar expressions are intended to identify these forward-looking statements. These statements are based on the Company’s current plans and expectations. Known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those contemplated by the statements. In evaluating these statements, you should specifically consider various factors that may cause our actual results to differ materially from any forward-looking statements. For example, uncertainties around the duration and severity of the current global COVID-19 pandemic including its possible impact on our clinical and commercial operations and our global supply chain could cause our actual results to be materially different than those expressed in our forward-looking statements. In particular, these statements include any discussion of potential commercial sales, placement or utilization of Rocklatan® or Rhopressa® in the United States or any other market. Likewise, FDA approval of Rhopressa® and Rocklatan® does not constitute approval of any future product candidates. Any top line data presented herein is preliminary and based solely on information available to us as of the date of this presentation and additional information about the results may be disclosed at any time. FDA approval of Rhopressa® and Rocklatan® also does not constitute regulatory approval of Rhopressa® or Rocklatan® in jurisdictions outside the United States and there can be no assurance that we will receive regulatory approval for Rhopressa® or Rocklatan® in jurisdictions outside the United States. In addition, any discussion in this presentation about preclinical activities or opportunities associated with our products or discussions involving the potential for our dry eye or retinal product candidates are preliminary and the outcome of any studies may not be predictive of the outcome of later trials and ultimate regulatory approval. Any future clinical trial results may not demonstrate safety and efficacy sufficient to obtain regulatory approval related to the preclinical research findings discussed in this presentation. Any statements regarding Aerie’s future liquidity, cash balances or financing transactions also constitute forward-looking statements as are discussions of the possibility of, or possible results of, any commercial transactions or collaborations. These risks and uncertainties are described more fully in the quarterly and annual reports that we file with the SEC, particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Such forward-looking statements only speak as of the date they are made. We undertake no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events or otherwise, except as otherwise required by law.

Aerie Overview Rhopressa® and Rocklatan® have not been approved by any regulatory authority other than the FDA and EMA. AR-15512, AR-1105, AR-13503, AR-14034, and AR-6121 are development stage product candidates and are not approved by any regulatory agency. Aerie IOP–Lowering Products (IP 2030+) Key Pipeline Opportunities Dry Eye AR-15512 TRPM8 agonist: Fully enrolled, Ph 2b topline expected Q3 2021 Sustained-Release Retinal Implant Platform AR-1105 (Dexamethasone): Positive Topline Ph 2 results, Ph 3 plans underway for U.S. and Europe AR-13503 SR (ROCK/PKC): First-in-human clinical study commenced Q3 2019 AR-14034 SR (Pan-VEGF inhibitor): IND-enabling preclinical studies underway; IND filing H2 2022 Anti-Inflammatory AR-6121 (ROCK inhibitor-Linked-steroid): IND-enabling preclinical studies underway; IND filing H2 2022 Rhopressa® and Rocklatan® gaining momentum in the U.S. Total prescriptions and shipments to pharmacies are achieving record levels Glaucoma Franchise Approved in Europe Globalization Plan Under Way Concluded licensing agreement with Santen for Rhopressa ® and Rocklatan®, potential collaborators pursuing European opportunity for IOP-lowering products

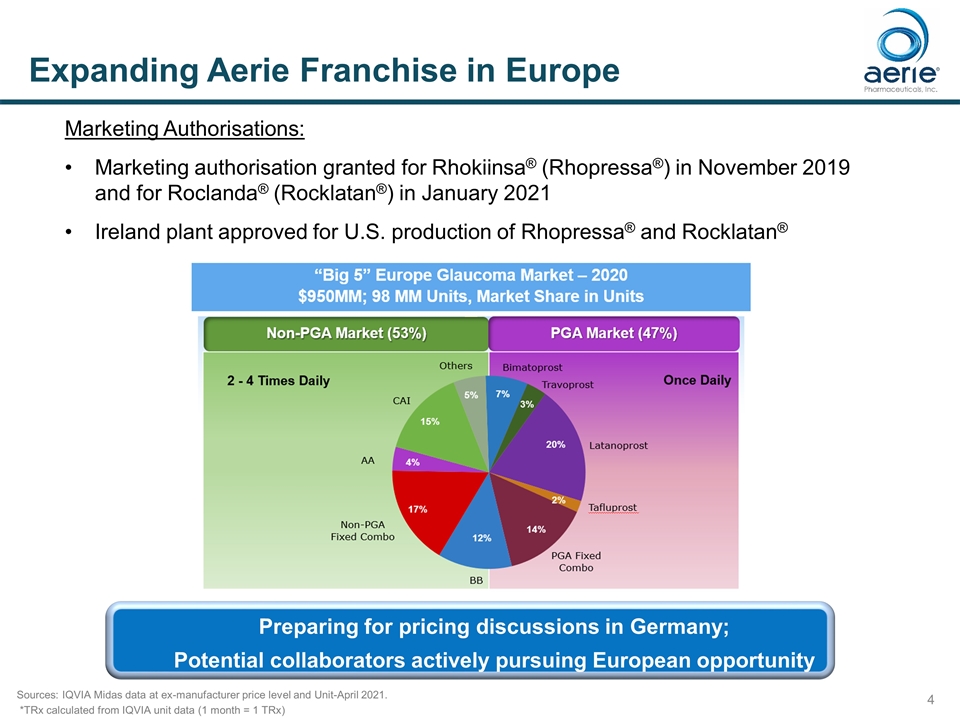

Expanding Aerie Franchise in Europe Marketing Authorisations: Marketing authorisation granted for Rhokiinsa® (Rhopressa®) in November 2019 and for Roclanda® (Rocklatan®) in January 2021 Ireland plant approved for U.S. production of Rhopressa® and Rocklatan® Sources: IQVIA Midas data at ex-manufacturer price level and Unit-April 2021. *TRx calculated from IQVIA unit data (1 month = 1 TRx) Preparing for pricing discussions in Germany; Potential collaborators actively pursuing European opportunity

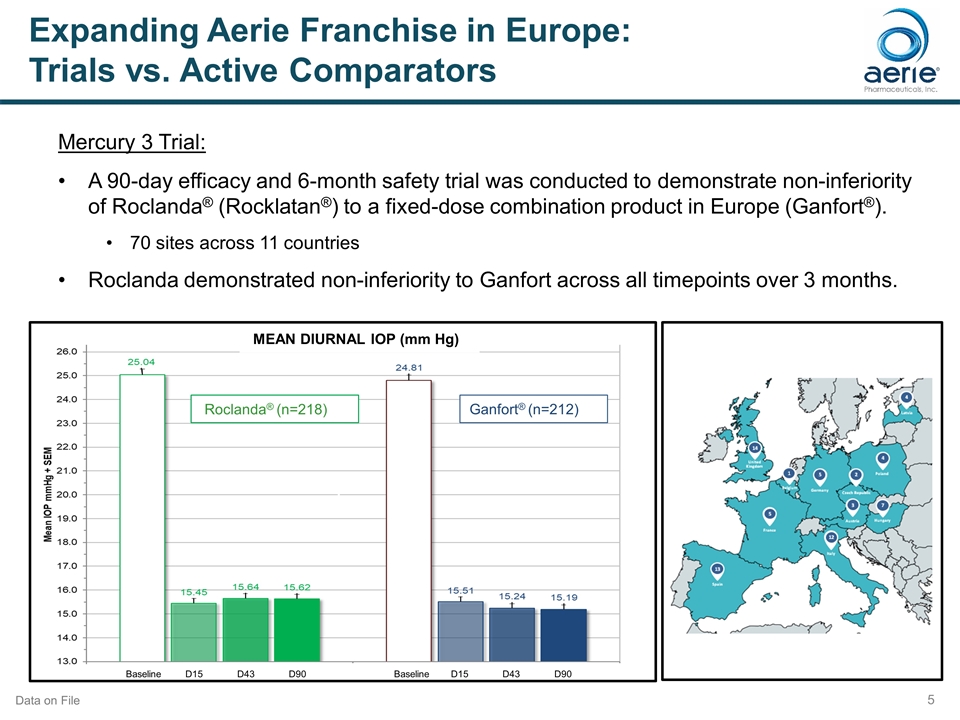

Expanding Aerie Franchise in Europe: Trials vs. Active Comparators Mercury 3 Trial: A 90-day efficacy and 6-month safety trial was conducted to demonstrate non-inferiority of Roclanda® (Rocklatan®) to a fixed-dose combination product in Europe (Ganfort®). 70 sites across 11 countries Roclanda demonstrated non-inferiority to Ganfort across all timepoints over 3 months. Baseline D15 D43 D90 Baseline D15 D43 D90 Roclanda® (n=218) Ganfort® (n=212) h MEAN DIURNAL IOP (mm Hg) Data on File

Dry Eye: Unmet Need for a Novel MOA that Addresses Symptoms and Signs of Dry Eye Pharmaceutical treatments approved today in US and Europe for chronic dry eye are anti-inflammatories, which are often associated with poor compliance secondary to delayed onset or poor tolerability. US: Ciclosporine 0.05% and Ciclosporine 0.09% (tear production), lifitegrast 5% (signs and symptoms) Europe: Ciclosporine 0.1% approved for severe keratitis which has not improved with tear substitutes Approval based on impact on signs and reduction in inflammatory markers In Europe, the use of artificial tears remains predominant treatment option for dry eye patients. Less developed Rx market than the ~$1.7 B US dry eye market Potential for dry eye approvals in Europe based on achieving statistical significance on a sign or a symptom. Considerations for European approval as well as reimbursement include head-to-head data vs. active comparators, potentially longer duration studies than US, quality of life data, real world evidence on country level A significant unmet need in both US and Europe for a novel MOA that addresses underlying etiology and relieves symptoms in addition to treating signs of dry eye. Sources: Mixture of public information, IQVIA , Market Scope and estimates – Feb 2020;

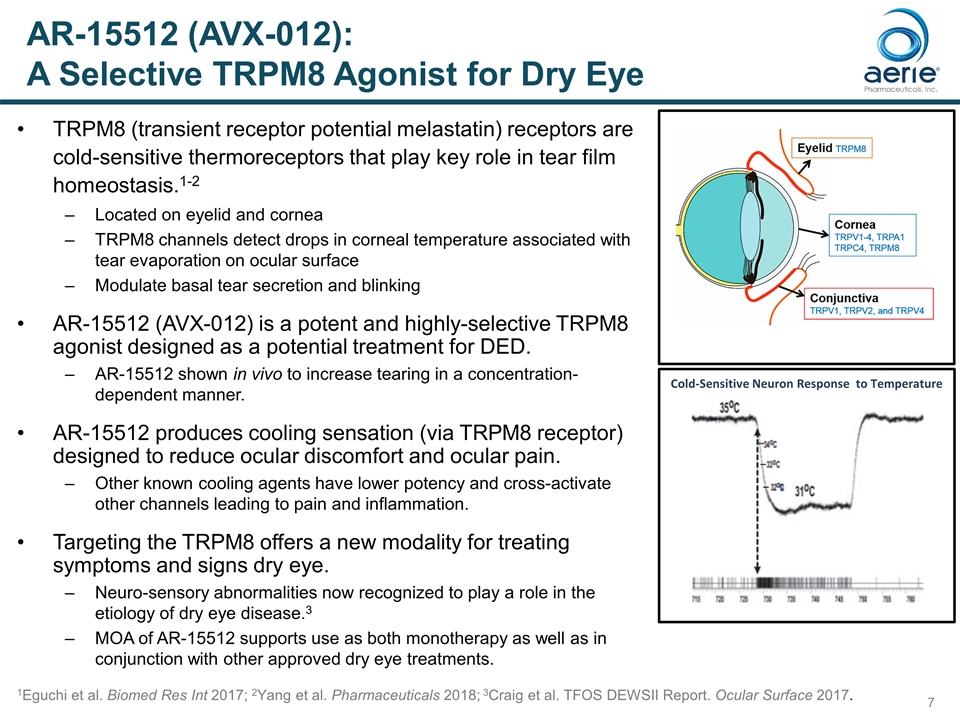

TRPM8 (transient receptor potential melastatin) receptors are cold-sensitive thermoreceptors that play key role in tear film homeostasis.1-2 Located on eyelid and cornea TRPM8 channels detect drops in corneal temperature associated with tear evaporation on ocular surface Modulate basal tear secretion and blinking AR-15512 (AVX-012) is a potent and highly-selective TRPM8 agonist designed as a potential treatment for DED. AR-15512 shown in vivo to increase tearing in a concentration-dependent manner. AR-15512 produces cooling sensation (via TRPM8 receptor) designed to reduce ocular discomfort and ocular pain. Other known cooling agents have lower potency and cross-activate other channels leading to pain and inflammation. Targeting the TRPM8 offers a new modality for treating symptoms and signs dry eye. Neuro-sensory abnormalities now recognized to play a role in the etiology of dry eye disease.3 MOA of AR-15512 supports use as both monotherapy as well as in conjunction with other approved dry eye treatments. 1Eguchi et al. Biomed Res Int 2017; 2Yang et al. Pharmaceuticals 2018; 3Craig et al. TFOS DEWSII Report. Ocular Surface 2017. Cold-Sensitive Neuron Response to Temperature AR-15512 (AVX-012): A Selective TRPM8 Agonist for Dry Eye

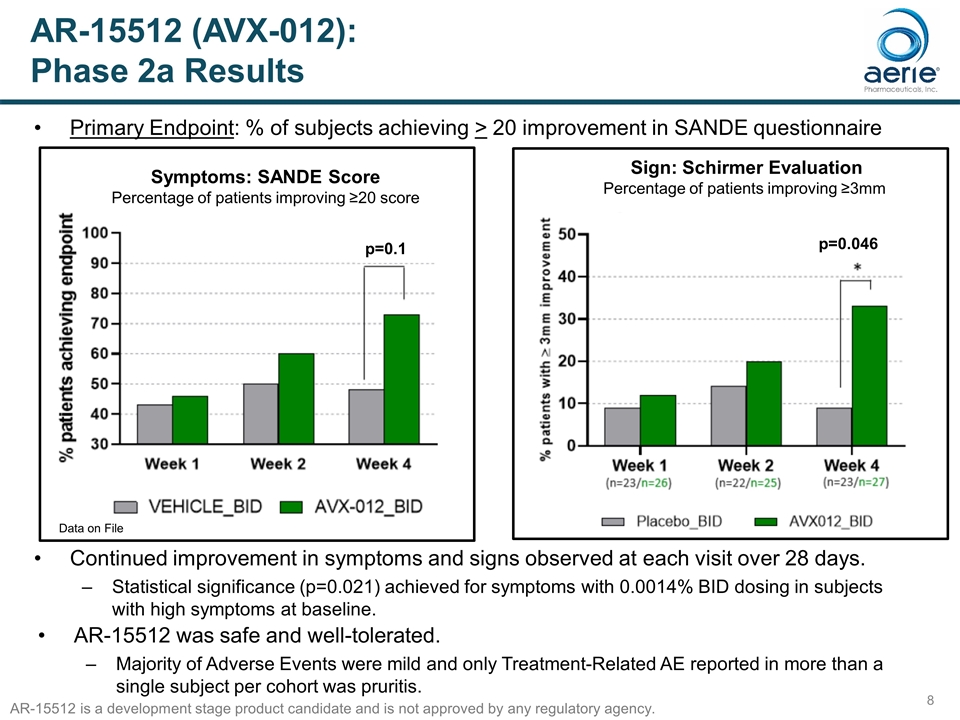

AR-15512 (AVX-012): Phase 2a Results h Symptoms: SANDE Score Percentage of patients improving ≥20 score Primary Endpoint: % of subjects achieving > 20 improvement in SANDE questionnaire Continued improvement in symptoms and signs observed at each visit over 28 days. Statistical significance (p=0.021) achieved for symptoms with 0.0014% BID dosing in subjects with high symptoms at baseline. Data on File p=0.1 Sign: Schirmer Evaluation Percentage of patients improving ≥3mm h p=0.046 AR-15512 was safe and well-tolerated. Majority of Adverse Events were mild and only Treatment-Related AE reported in more than a single subject per cohort was pruritis. AR-15512 is a development stage product candidate and is not approved by any regulatory agency.

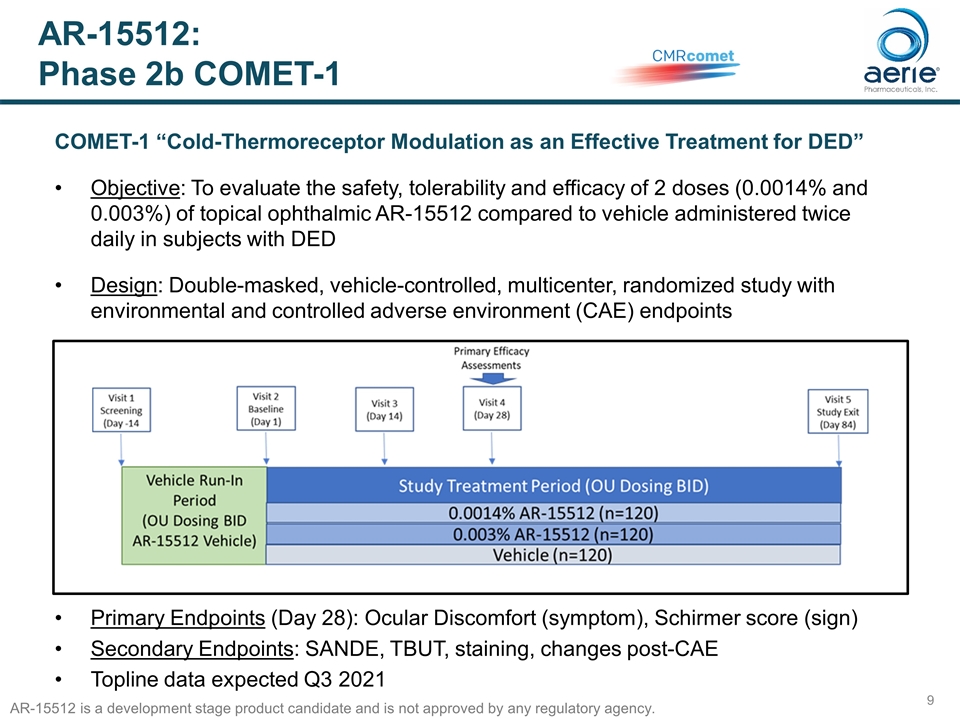

AR-15512: Phase 2b COMET-1 COMET-1 “Cold-Thermoreceptor Modulation as an Effective Treatment for DED” Objective: To evaluate the safety, tolerability and efficacy of 2 doses (0.0014% and 0.003%) of topical ophthalmic AR-15512 compared to vehicle administered twice daily in subjects with DED Design: Double-masked, vehicle-controlled, multicenter, randomized study with environmental and controlled adverse environment (CAE) endpoints Primary Endpoints (Day 28): Ocular Discomfort (symptom), Schirmer score (sign) Secondary Endpoints: SANDE, TBUT, staining, changes post-CAE Topline data expected Q3 2021 AR-15512 is a development stage product candidate and is not approved by any regulatory agency.

Aerie’s Proprietary Drug Delivery Platform for Retinal Disease – Predictable and Flexible Customizable drug elution, reproducible manufacturing Proprietary bio-erodible formulations, PRINT ® manufacturing Longer treatment duration, reduced injection frequency Enables once or twice per year IVT injections Greater diversity of drug targets via small molecule drugs Monoclonal antibodies limited to extracellular targets Potential across a broad range of molecules and a variety of polymers (or custom polymer combinations) uniquely designed to optimize delivery of the active molecule Highly predictive when translating from preclinical models to humans Efficient low-cost tool to achieve proof of concept PRINT® Platform

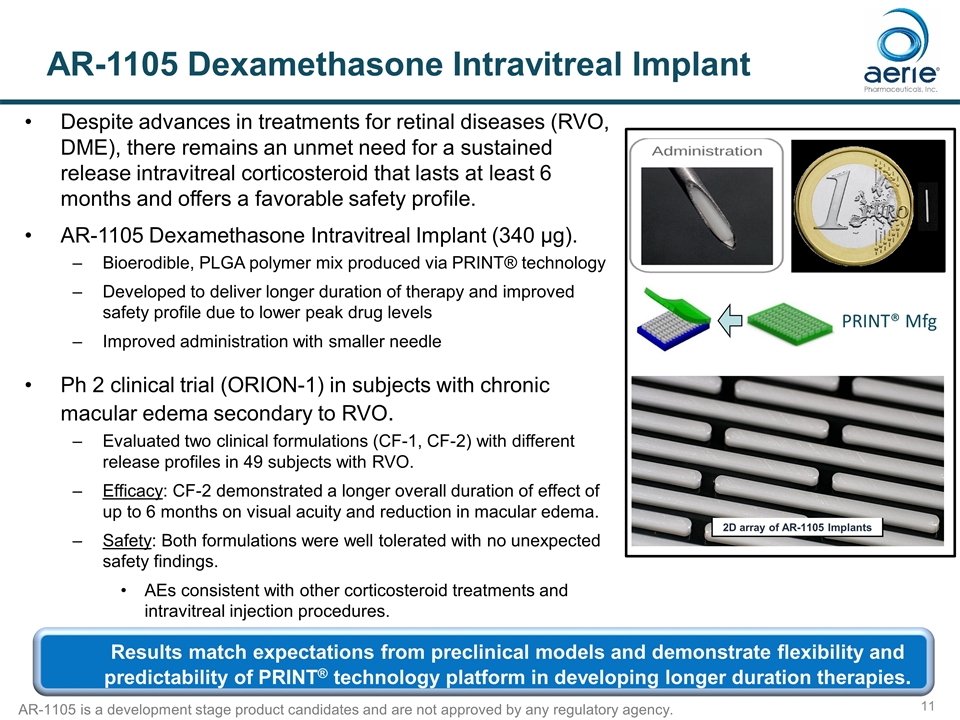

AR-1105 Dexamethasone Intravitreal Implant Despite advances in treatments for retinal diseases (RVO, DME), there remains an unmet need for a sustained release intravitreal corticosteroid that lasts at least 6 months and offers a favorable safety profile. AR-1105 Dexamethasone Intravitreal Implant (340 µg). Bioerodible, PLGA polymer mix produced via PRINT® technology Developed to deliver longer duration of therapy and improved safety profile due to lower peak drug levels Improved administration with smaller needle Ph 2 clinical trial (ORION-1) in subjects with chronic macular edema secondary to RVO. Evaluated two clinical formulations (CF-1, CF-2) with different release profiles in 49 subjects with RVO. Efficacy: CF-2 demonstrated a longer overall duration of effect of up to 6 months on visual acuity and reduction in macular edema. Safety: Both formulations were well tolerated with no unexpected safety findings. AEs consistent with other corticosteroid treatments and intravitreal injection procedures. 2D array of AR-1105 Implants PRINT® Mfg Results match expectations from preclinical models and demonstrate flexibility and predictability of PRINT® technology platform in developing longer duration therapies. AR-1105 is a development stage product candidates and are not approved by any regulatory agency.

AR-1105 Sustained Release Steroid Opportunity Prevalence of diabetes mellitus increasing and DME market is growing worldwide.1 The 6-month sustained efficacy of AR-1105 in the Ph 2 study may render this product, if approved, highly competitive in both the U.S. and European markets AR-1105 may be viewed as a more favorable treatment alternative for anti-VEGF non-responders 6-month dosing may benefit physician productivity and overall health economics Opportunity for market expansion – market currently over $100M in the U.S. and nearly $300M in Europe Aerie’s exclusive PRINT® platform may allow for low-cost production and significant pricing flexibility 1Li et al. Eur J Epidemiol 2020; 35:11-23. Positive AR-1105 P2 topline sustained efficacy data supports advancement as a potentially significant pipeline asset for Aerie, of particular value in Europe. AR-1105 is a development stage product candidates and are not approved by any regulatory agency.

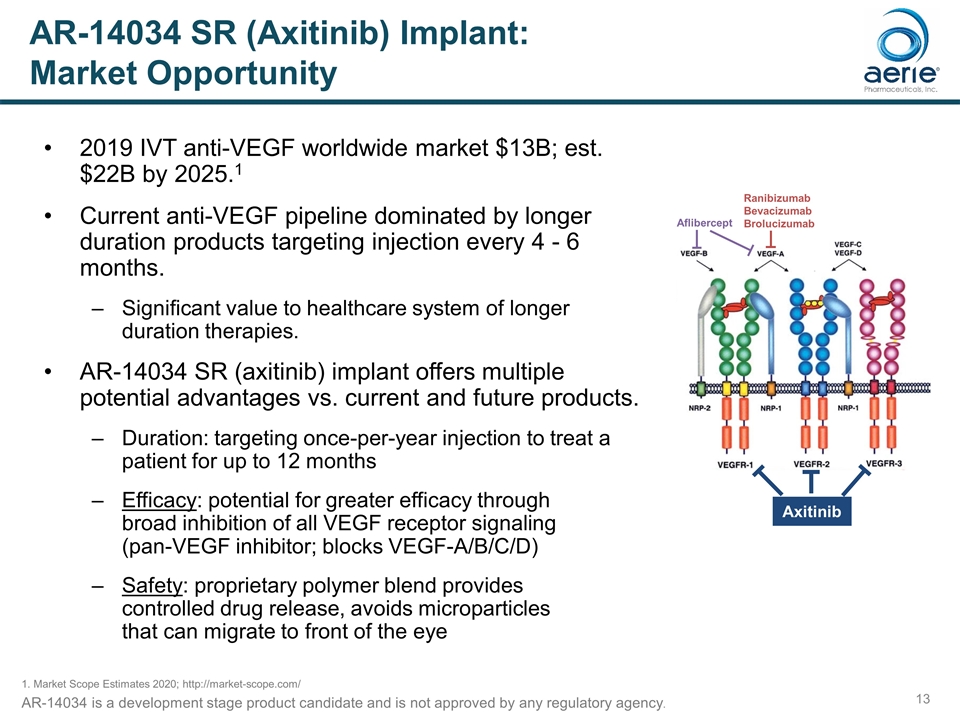

AR-14034 SR (Axitinib) Implant: Market Opportunity 1. Market Scope Estimates 2020; http://market-scope.com/ Aflibercept Ranibizumab Bevacizumab Brolucizumab Axitinib 2019 IVT anti-VEGF worldwide market $13B; est. $22B by 2025.1 Current anti-VEGF pipeline dominated by longer duration products targeting injection every 4 - 6 months. Significant value to healthcare system of longer duration therapies. AR-14034 SR (axitinib) implant offers multiple potential advantages vs. current and future products. Duration: targeting once-per-year injection to treat a patient for up to 12 months Efficacy: potential for greater efficacy through broad inhibition of all VEGF receptor signaling (pan-VEGF inhibitor; blocks VEGF-A/B/C/D) Safety: proprietary polymer blend provides controlled drug release, avoids microparticles that can migrate to front of the eye AR-14034 is a development stage product candidate and is not approved by any regulatory agency.

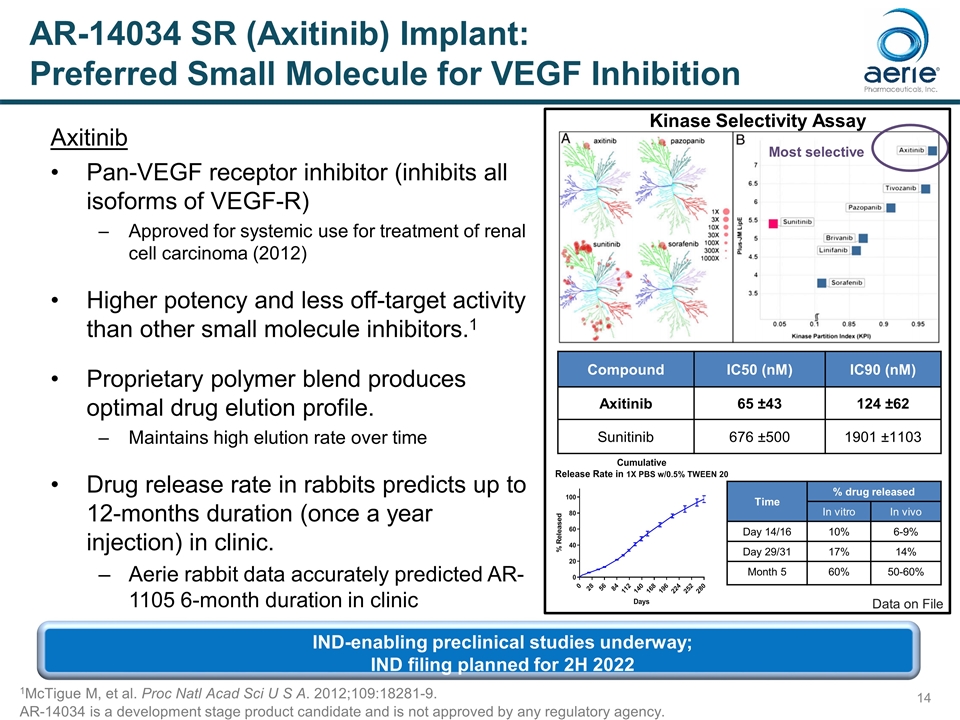

AR-14034 SR (Axitinib) Implant: Preferred Small Molecule for VEGF Inhibition Axitinib Pan-VEGF receptor inhibitor (inhibits all isoforms of VEGF-R) Approved for systemic use for treatment of renal cell carcinoma (2012) Higher potency and less off-target activity than other small molecule inhibitors.1 Proprietary polymer blend produces optimal drug elution profile. Maintains high elution rate over time Drug release rate in rabbits predicts up to 12-months duration (once a year injection) in clinic. Aerie rabbit data accurately predicted AR-1105 6-month duration in clinic 1McTigue M, et al. Proc Natl Acad Sci U S A. 2012;109:18281-9. Compound IC50 (nM) IC90 (nM) Axitinib 65 ±43 124 ±62 Sunitinib 676 ±500 1901 ±1103 Most selective Kinase Selectivity Assay Data on File AR-14034 is a development stage product candidate and is not approved by any regulatory agency. IND-enabling preclinical studies underway; IND filing planned for 2H 2022 Time % drug released In vitro In vivo Day 14/16 10% 6-9% Day 29/31 17% 14% Month 5 60% 50-60%

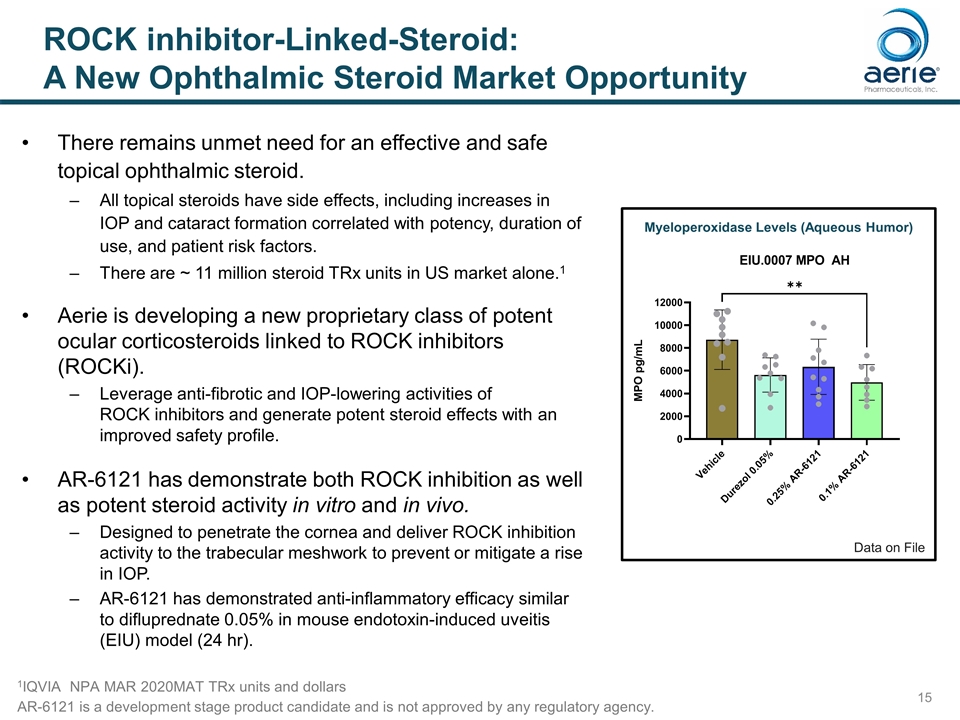

There remains unmet need for an effective and safe topical ophthalmic steroid. All topical steroids have side effects, including increases in IOP and cataract formation correlated with potency, duration of use, and patient risk factors. There are ~ 11 million steroid TRx units in US market alone.1 Aerie is developing a new proprietary class of potent ocular corticosteroids linked to ROCK inhibitors (ROCKi). Leverage anti-fibrotic and IOP-lowering activities of ROCK inhibitors and generate potent steroid effects with an improved safety profile. AR-6121 has demonstrate both ROCK inhibition as well as potent steroid activity in vitro and in vivo. Designed to penetrate the cornea and deliver ROCK inhibition activity to the trabecular meshwork to prevent or mitigate a rise in IOP. AR-6121 has demonstrated anti-inflammatory efficacy similar to difluprednate 0.05% in mouse endotoxin-induced uveitis (EIU) model (24 hr). 1IQVIA NPA MAR 2020MAT TRx units and dollars ROCK inhibitor-Linked-Steroid: A New Ophthalmic Steroid Market Opportunity Myeloperoxidase Levels (Aqueous Humor) Data on File AR-6121 is a development stage product candidate and is not approved by any regulatory agency.

Aerie Globalization Aerie continues to drive Rhopressa® and Rocklatan® volume growth in the U.S. Ireland manufacturing facility approved for U.S. production of Rhopressa® and Rocklatan® Globalization plan underway with glaucoma franchise approved in Europe. Preparing pricing discussions in Europe with long-term and comparative data. Significant interest from potential collaborators for glaucoma portfolio in Europe. Santen collaboration in Japan for glaucoma products underway and first Ph 3 trial in Japan fully-enrolled. Aerie continues to develop new products for dry eye, retinal diseases, and other potential indications to address unmet needs. AR-15512 (TRPM8 agonist) Ph 2b study for dry eye will have topline data Q3 2021 Novel MOA (different from approved anti-inflammatories) designed to produce a cooling sensation to relieve ocular discomfort and increase tear production. After positive Ph 2 results, AR-1105 (Dexamethasone Implant) under regulatory discussions with EMA and FDA for harmonized Ph 3 programs for retinal diseases. IND enabling studies underway for AR-14034 SR (Axitinib Pan-VEGF inhibitor) sustained-release implant with potential for up to 1 year of efficacy. Preclinical studies ongoing for AR-6121 (ROCK inhibitor-Linked-Steroid) for potent topical steroid which minimizes IOP-related side effects.

Thank you