Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CA Healthcare Acquisition Corp. | tm2122372d1_8k.htm |

Exhibit 99.1

Transforming Community - Based Healthcare Analyst Day July 16, 2021 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

2 This presentation (together with oral statements made in connection herewith, this “Presentation”) is provided for informatio nal purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential b us iness combination between LumiraDx Limited (“LumiraDx”) and CA Healthcare Acquisition Corp. (“CAH”) and related transactions (the “Proposed Business Combination”) and for no other purpose. By accepting this Pres ent ation, you acknowledge and agree that you will not distribute, disclose or use such information in any way detrimental to Lum ira Dx or CAH. No representations or warranties, express or implied are given in, or in respect of, this Presentation. You are also being ad vis ed that the United States securities laws restrict persons with material non - public information about a company obtained directl y or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purch ase or sell such securities on the basis of such information. To the fullest extent permitted by law, in no circumstances will CA H, LumiraDx or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arisi ng from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinio ns communicated in relation thereto or otherwise arising in connection therewith. In addition, this Presentation does not purpor t t o be all - inclusive or to contain all of the information that may be required to make a full analysis of LumiraDx or the Proposed Busi ness Combination. Viewers of this Presentation should each make their own evaluation of LumiraDx and of the relevance and ade qua cy of the information and should make such other investigations as they deem necessary. Nothing herein should be construed as legal, financial, tax or other advice. You should consult your own advisers concerning any legal, financial, tax or other considerations concerning the opportunity described herein. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. The Proposed Business Combination will be submitted to the stockholders of CAH for their consideration and approval at a spec ial meeting of stockholders. LumiraDx filed a registration statement on Form F - 4 (the “Registration Statement”) with the SEC on Ju ly 7, 2021 (File No. 333 - 257745), which includes preliminary and definitive proxy statements and be distributed to holders of CAH’s common stock in connection with CAH’s solicitation for proxies for the vote by CAH’s stockholders in connect ion with the Proposed Business Combination and other matters as described in the Registration Statement, as well as the prospectu s relating to the offer of the securities to the issued to CAH’s shareholders in connection with the completion of the business combination. After the Registration Statement has been declared effective, CAH will mail a definitive proxy statemen t a nd other relevant documents to its stockholders as of the record date established for voting on the Proposed Business Combina tio n. CAH’s stockholders and other interested parties are advised to read, once available, the preliminary proxy statement and any amendments thereto and, once available, the definitive proxy statement / prospectus, in connection with CAH’s solicit ati on of proxies for its special meeting of stockholders to be held to approve, among other things, the Proposed Business Combin ati on, because these documents will contain important information about CAH, LumiraDx and the Proposed Business Combination. Stockholders may also obtain a copy of the preliminary or definitive proxy statement / prospectus, once availabl e, as well as other documents filed with the SEC regarding the Proposed Business Combination and other documents filed with the SEC by CAH, without charge, at the SEC’s website located at www.sec.gov or by directing a request to 99 Summer Street, Suite 200, Boston, MA 02110, Attention: Larry Neiterman (larry@cahcspac.com). This Presentation does not constitute a solicitation of any proxy. PARTICIPANTS IN THE SOLICITATION CAH and its directors and executive officers and other persons may be deemed to be participants in the solicitations of proxi es from CAH’s stockholders in respect of the Proposed Business Combination and the other matters set forth in the definitive pro xy statement / prospectus. Information regarding CAH’s directors and executive officers is available under the heading “Management” in CAH’s final prospectus dated January 26, 2021. Additional information regarding the participants in the proxy so licitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement / prospectus relating to the Proposed Business Combination when it becomes available. Stockholders, potential investors and other interested persons should read the proxy statement / prospectus carefully when it becomes avail abl e. NO OFFER OR SOLICITATION This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or o the r specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other sp ecific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or quali fic ation under the securities laws of any such jurisdiction. Any offering of securities (the “Securities”) will not be registered under the Secu rit ies Act of 1933, as amended (the “Securities Act”), and will be offered as a private placement to a limited number of institu tio nal “accredited investors” as defined in Rule 501(a)(1), (2), (3) or (7) under the Securities Act and “Institutional Accounts ” a s defined in FINRA Rule 4512(c). Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt fr om the registration requirements of the Securities Act. Investors should consult with their counsel as to the applicable requ ire ments for a purchaser to avail itself of any exemption under the Securities Act. The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued. Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time. Neither LumiraDx nor CAH is making an o ffe r of the Securities in any jurisdiction where the offer is not permitted. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESE NTA TION IS TRUTHFUL OR COMPLETE. FORWARD - LOOKING STATEMENTS All statements other than statements of historical facts contained in this Presentation are forward - looking statements. Forward - looking statements may generally be identified by the use of words such as “believe,” “may,” “will,” “estimate,” “continue,” “an ticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “fut ure ,” “outlook,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward - looking statements include, but are not limited to, statements regarding estimates and forecas ts of other financial and performance metrics, projections of market opportunity and market share. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of LumiraDx’s and CAH’s management and are not predictions of actual performance. These forward - looking statements are provided for illustrat ive purposes only and are not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to p red ict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond th e c ontrol of LumiraDx and CAH. These forward - looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; risks relating to the unc ertainty of the projected financial information with respect to LumiraDx; the inability of the parties to successfully or tim ely consummate the Proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the Proposed Business Combination or the expec ted benefits of the Proposed Business Combination or that the approval of the stockholders of CAH or LumiraDx is not obtained; th e failure to realize the anticipated benefits of the Proposed Business Combination; risks relating to the uncertainty of the projected financial information with respect to LumiraDx; risks related to the rollout of LumiraDx’s business and the timing of expected business milestones; the effects of competition on LumiraDx’s future business; the amount of redemption requests made by CAH’s public stockholders; the ability of CAH or LumiraDx to issue e quity or equity - linked securities or obtain debt financing in connection with the Proposed Business Combination or in the future and those factors discussed in CAH’s final pr osp ectus dated January 26, 2021 and any Quarterly Report on Form 10 - Q, in each case, under the heading “Risk Factors,” and other do cuments of CAH or LumiraDx filed, or to be filed, with the SEC. If any of these risks materialize or CAH’s or LumiraDx’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statement s. There may be additional risks that neither CAH nor LumiraDx presently know or that CAH and LumiraDx currently believe are imm aterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect CAH’s and LumiraDx’s expectations, plans or forecasts of future events and views as of the date of this Presentation. CAH and LumiraDx anticipate th at subsequent events and developments will cause CAH’s and LumiraDx’s assessments to change. However, while CAH and LumiraDx may elect to update these forward - looking statements at some point in the future, CAH and LumiraDx specifically disclaim any obligation to do so. These forward - looking st atements should not be relied upon as representing CAH’s and LumiraDx’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon t he forward - looking statements. Neither LumiraDx, CAH, nor any of their respective affiliates have any obligation to update this Presentation. INDUSTRY AND MARKET DATA This presentation includes statistical and other industry and market data that we obtained from industry publications and res ear ch, surveys and studies conducted by third parties as well as our own estimates of potential market opportunities. Industry p ubl ications and third - party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. CAH and Lum ira Dx believe that these third - party sources and estimates are reliable, but have not independently verified them. LumiraDx’s estimates of the potential market opportunities for its Platform include several key assumptions based on industry knowledge, industry publications, third - party research and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While LumiraDx and CAH believe that their own internal assumptions are reasonabl e, no independent source has verified such assumptions. The industry in which LumiraDx operates is subject to a high degree of uncertainty and risk due to a variety of important factors that could cause results to differ materially from those ex pressed in the estimates made by third parties and by LumiraDx or CAH. USE OF PROJECTIONS This Presentation contains projected financial information with respect to LumiraDx, including, but not limited to, estimated re sults for fiscal year 2021. Such projected financial information constitutes forward - looking information, and is for illustrativ e purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimate s underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant busi nes s, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those co nta ined in the prospective financial information. See “Forward - Looking Statements” paragraph above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclus ion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Neither CAH’s nor LumiraDx’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordi ngl y, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Pre sentation. FINANCIAL INFORMATION; NON - GAAP FINANCIAL MEASURES Some of the financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X pr omulgated under the Securities Act. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement/prospectus or registration statement to be filed by CAH with the SEC. Some of the financial information and data contained in this Presentation, have not been prepared in accordance with United S tat es generally accepted accounting principles (“GAAP”). CAH and LumiraDx believe these non - GAAP measures of financial results prov ide useful information to management and investors regarding certain financial and business trends relating to LumiraDx’s financial condition and results of operations. LumiraDx’s management uses these non - GAAP measures for trend analyses, for purposes of determining management incentive compensation and f or budgeting and planning purposes. CAH and LumiraDx believe that the use of these non - GAAP financial measures provides an addit ional tool for investors to use in evaluating projected operating results and trends in and in comparing LumiraDx’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors. The pr incipal limitation of these non - GAAP financial measures is that they are subject to inherent limitations as they reflect the exe rcise of judgments by management about which expense and income are excluded or included in determining these non - GAAP financial measures. TRADEMARKS AND TRADE NAMES LumiraDx and CAH own or have rights to various trademarks, service marks and trade names that they use in connection with the op eration of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third pa rti es, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with LumiraDx or CAH, or an endorsement or sponsorship by or of LumiraDx or CAH. Solely for convenience, the trademarks, service marks and trade names re fer red to in this Presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that LumiraDx or CAH will not assert, to the fullest extent under applicable law, their rights or the r igh t of the applicable licensor to these trademarks, service marks and trade names. Disclaimer Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

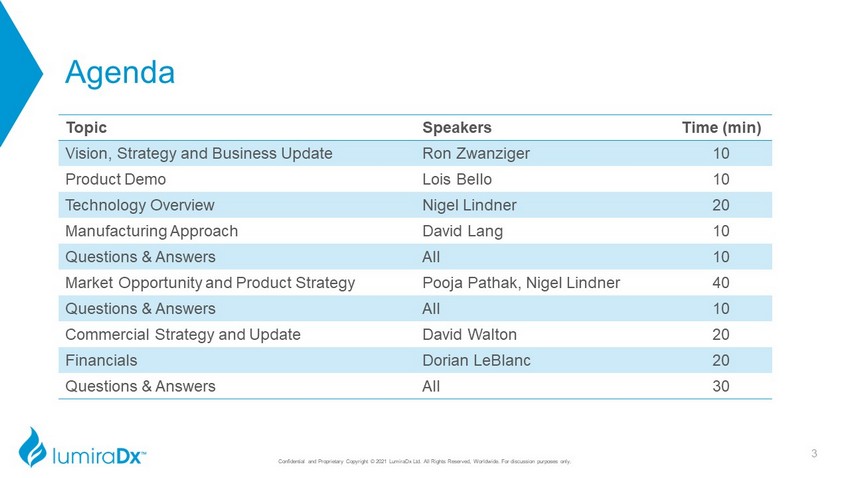

Agenda Topic Speakers Time (min) Vision, Strategy and Business Update Ron Zwanziger 10 Product Demo Lois Bello 10 Technology Overview Nigel Lindner 20 Manufacturing Approach David Lang 10 Questions & Answers All 10 Market Opportunity and Product Strategy Pooja Pathak, Nigel Lindner 40 Questions & Answers All 10 Commercial Strategy and Update David Walton 20 Financials Dorian LeBlanc 20 Questions & Answers All 30 3 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Introduction To The LumiraDx Presentation Team Dorian LeBlanc, C.P.A. CFO and Vice President, Global Operations Veronique Ameye Executive Vice President and General Counsel Nigel Lindner, Ph.D. Chief Innovation Officer Pooja Pathak Chief Product Officer Ron Zwanziger CEO, Co - Founder, Chairman and Director David Lang Senior Vice President, Strip Manufacturing & Innovation David Walton, D.M.S. Chief Commercial Officer Lois Bello, R & D Director 4 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

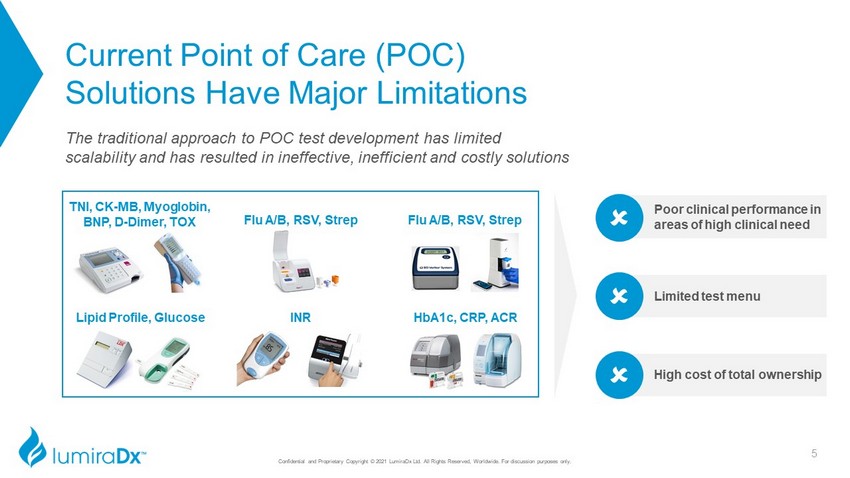

Current Point of Care (POC) Solutions Have Major Limitations The traditional approach to POC test development has limited scalability and has resulted in ineffective, inefficient and costly solutions Poor clinical performance in areas of high clinical need Limited test menu High cost of total ownership Flu A/B, RSV, Strep Lipid Profile, Glucose HbA1c, CRP, ACR TNI, CK - MB, Myoglobin, BNP, D - Dimer, TOX Flu A/B, RSV, Strep INR 5 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

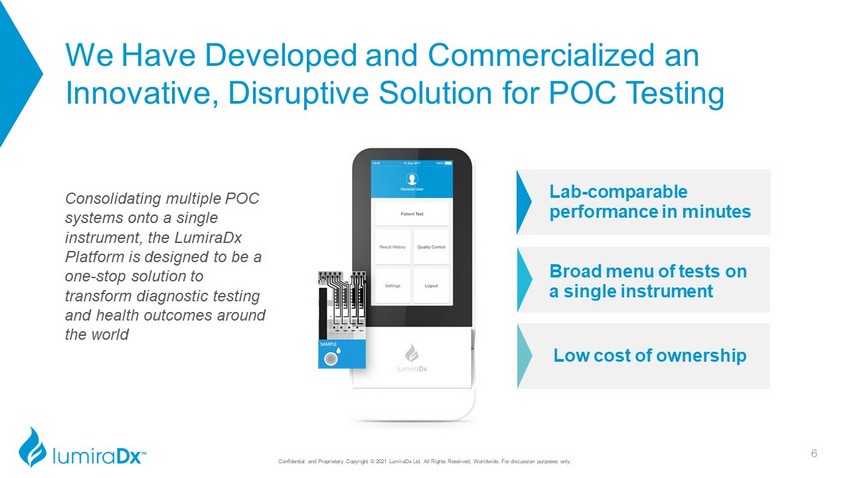

We Have Developed and Commercialized an Innovative, Disruptive Solution for POC Testing Consolidating multiple POC systems onto a single instrument, the LumiraDx Platform is designed to be a one - stop solution to transform diagnostic testing and health outcomes around the world Lab - comparable performance in minutes Broad menu of tests on a single instrument Low cost of ownership 6 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

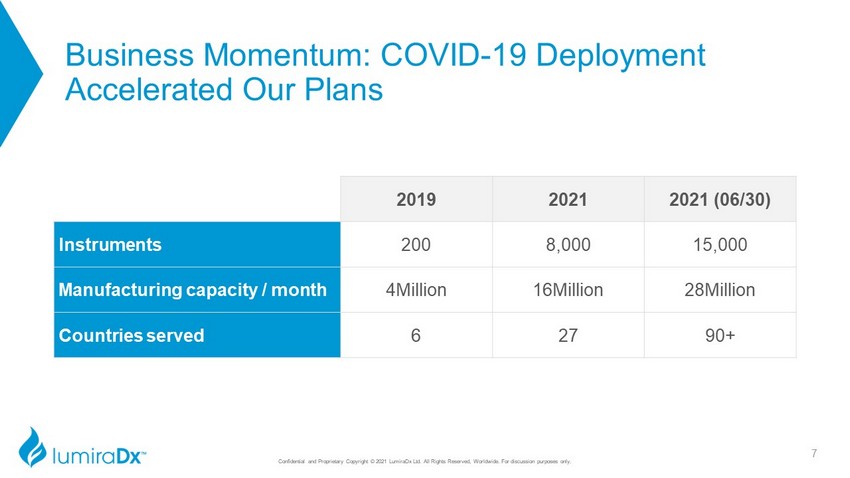

Business Momentum: COVID - 19 Deployment Accelerated Our Plans 7 2019 2021 2021 (06/30) Instruments 200 8,000 15,000 Manufacturing capacity / month 4Million 16Million 28Million Countries served 6 27 90+ Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

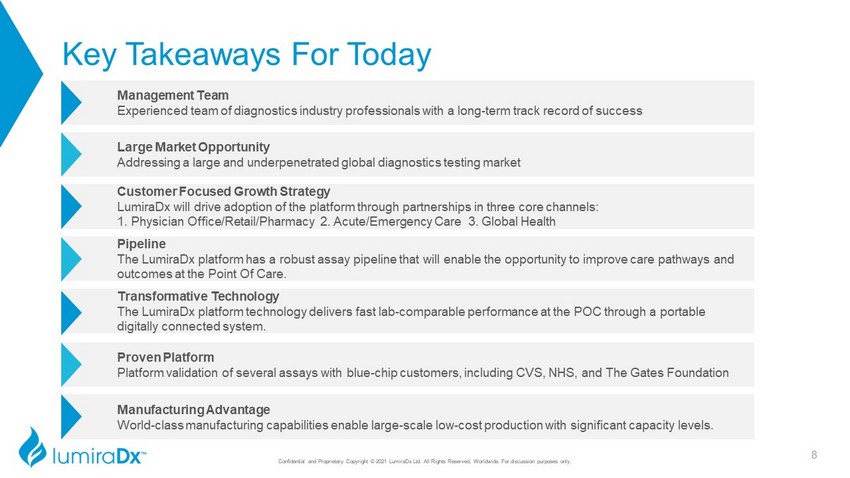

Key Takeaways For Today Management Team Experienced team of diagnostics industry professionals with a long - term track record of success Transformative Technology The LumiraDx platform technology delivers fast lab - comparable performance at the POC through a portable digitally connected system. Manufacturing Advantage World - class manufacturing capabilities enable large - scale low - cost production with significant capacity levels. Customer Focused Growth Strategy LumiraDx will drive adoption of the platform through partnerships in three core channels: 1. Physician Office/Retail/Pharmacy 2. Acute/Emergency Care 3. Global Health Large Market Opportunity Addressing a large and underpenetrated global diagnostics testing market Proven Platform Platform validation of several assays with blue - chip customers, including CVS, NHS, and The Gates Foundation Pipeline The LumiraDx platform has a robust assay pipeline that will enable the opportunity to improve care pathways and outcomes at the Point Of Care. 8 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Demo 9 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Technology Overview 10 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Key Takeaways Requirements of a successful POC diagnostics platform Lab comparable performance, differentiated versus legacy lateral flow technology Simple, versatile and scalable strip design enabling broad test menu at low cost World - Class Technology Platform Nigel Lindner, Ph.D. Chief Innovation Officer 11 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

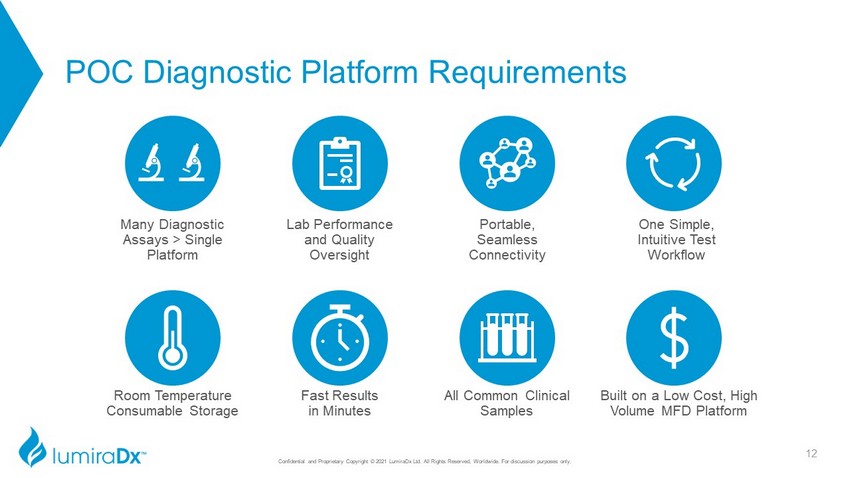

POC Diagnostic Platform Requirements Portable, Seamless Connectivity Lab Performance and Quality Oversight Many Diagnostic Assays > Single Platform One Simple, Intuitive Test Workflow Fast Results in Min utes Room Temperature Consumable Storage All Common Clinical Samples Built on a Low Cost, High Volume MFD Platform 12 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

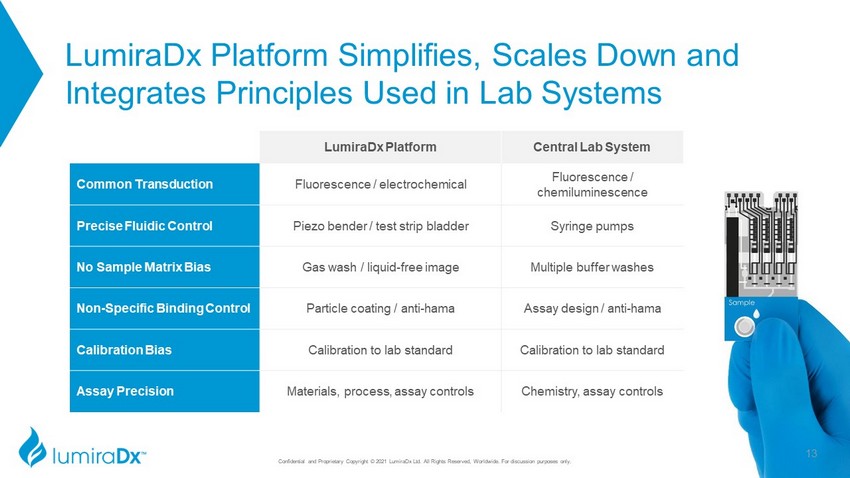

LumiraDx Platform Simplifies, Scales Down and Integrates Principles Used in Lab Systems LumiraDx Platform Central Lab System Common Transduction Fluorescence / electrochemical Fluorescence / chemiluminescence Precise Fluidic Control Piezo bender / test strip bladder Syringe pumps No Sample Matrix Bias Gas wash / liquid - free image Multiple buffer washes Non - Specific Binding Control Particle coating / anti - hama Assay design / anti - hama Calibration Bias Calibration to lab standard Calibration to lab standard Assay Precision Materials, process, assay controls Chemistry, assay controls 13 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

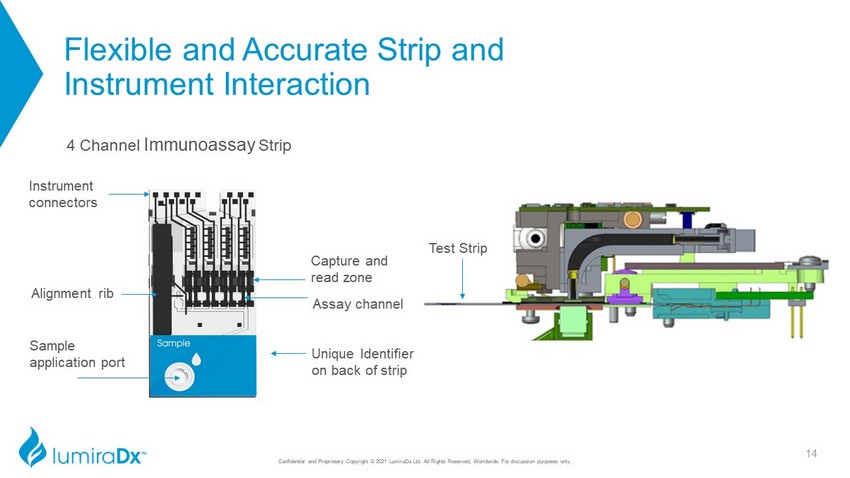

Flexible and Accurate Strip and Instrument Interaction 4 Channel Immunoassay Strip Test Strip Instrument connectors Sample application port Alignment rib Capture and read zone Assay channel Unique Identifier on back of strip 14 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

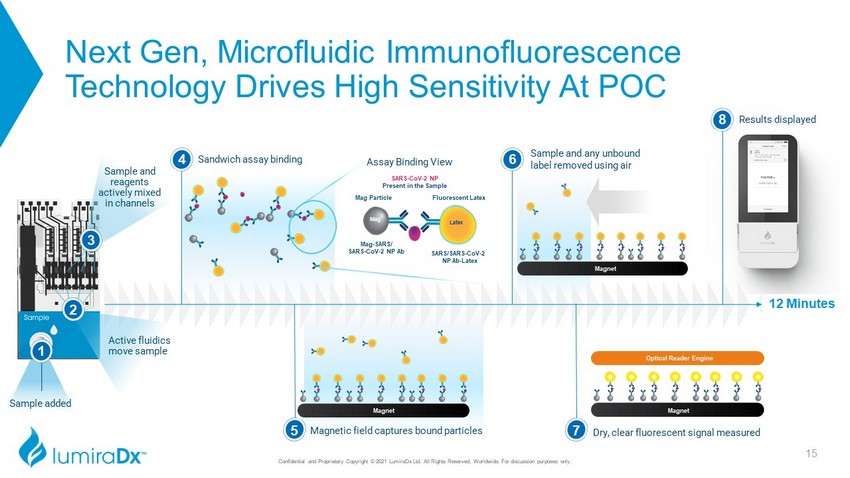

Sample added 1 Next Gen, Microfluidic Immunofluorescence Technology Drives High Sensitivity At POC Sample and reagents actively mixed in channels 3 12 Minutes 4 Sandwich assay binding 2 SARS - CoV - 2 NP Present in the Sample Fluorescent Latex Latex Mag Mag Particle SARS/SARS - CoV - 2 NP Ab - Latex Mag - SARS/ SARS - CoV - 2 NP Ab Assay Binding View Magnet Magnetic field captures bound particles 5 Sample and any unbound label removed using air 6 Active fluidics move sample Dry, clear fluorescent signal measured 7 Magnet Optical Reader Engine Magnet 8 Results displayed 15 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

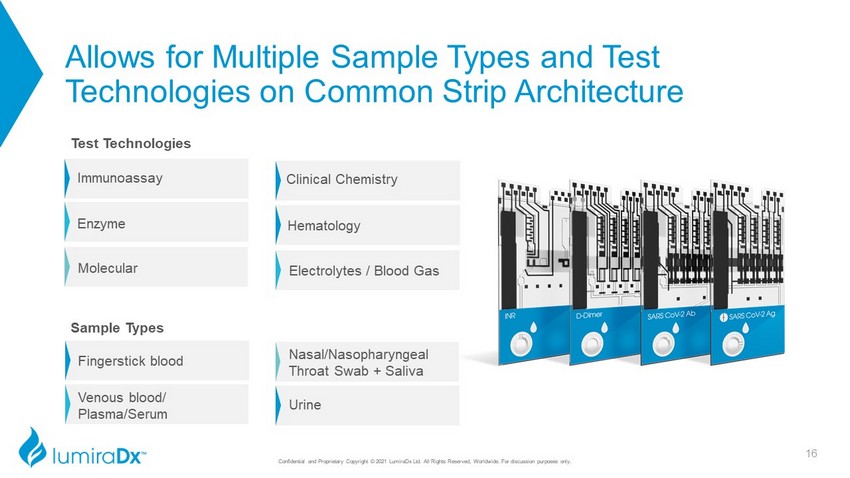

Allows for Multiple Sample Types and Test Technologies on Common Strip Architecture Immunoassay Enzyme Molecular 16 Electrolytes / Blood Gas Clinical Chemistry Hematology Fingerstick blood Venous blood/ Plasma/Serum Nasal/Nasopharyngeal Throat Swab + Saliva Urine Test Technologies Sample Types Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

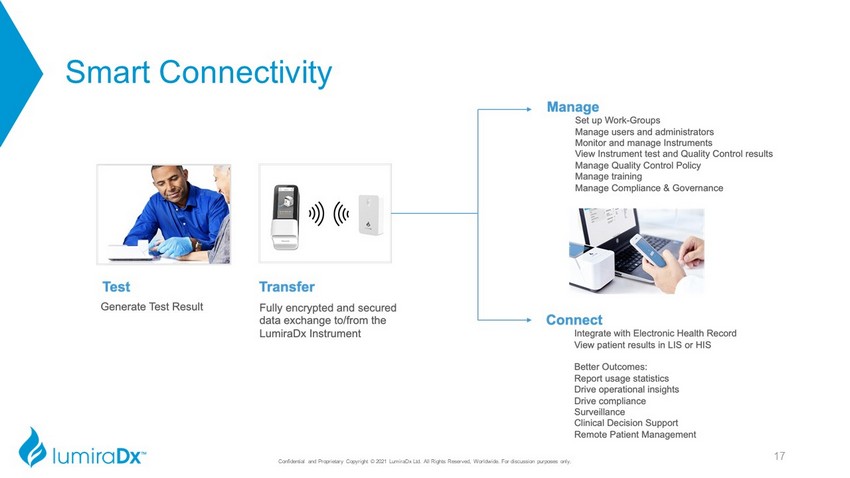

Smart Connectivity Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 17

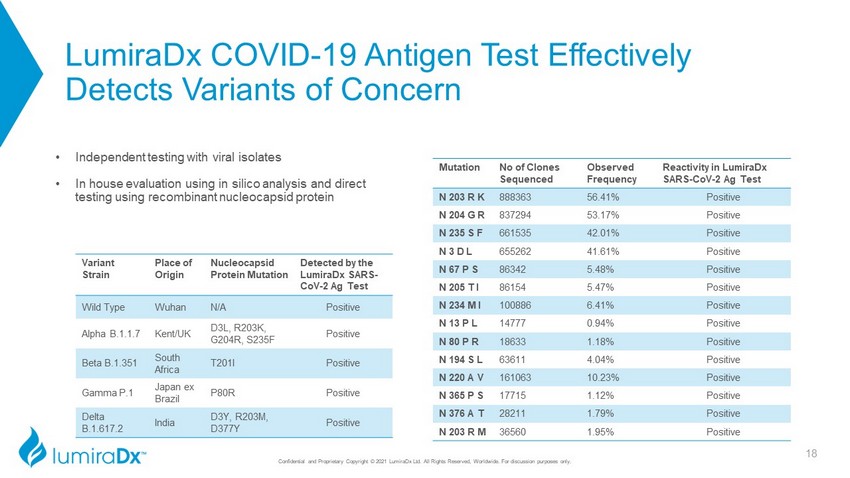

LumiraDx COVID - 19 Antigen Test Effectively Detects Variants of Concern Mutation No of Clones Sequenced Observed Frequency Reactivity in LumiraDx SARS - CoV - 2 Ag Test N 203 R K 888363 56.41% Positive N 204 G R 837294 53.17% Positive N 235 S F 661535 42.01% Positive N 3 D L 655262 41.61% Positive N 67 P S 86342 5.48% Positive N 205 T I 86154 5.47% Positive N 234 M I 100886 6.41% Positive N 13 P L 14777 0 . 94 % Positive N 80 P R 18633 1 . 18 % Positive N 194 S L 63611 4 . 04 % Positive N 220 A V 161063 10 . 23 % Positive N 365 P S 17715 1 . 12 % Positive N 376 A T 28211 1 . 79 % Positive N 203 R M 36560 1 . 95 % Positive Variant Strain Place of Origin Nucleocapsid Protein Mutation Detected by the LumiraDx SARS - CoV - 2 Ag Test Wild Type Wuhan N/A Positive Alpha B.1.1.7 Kent/UK D3L, R203K, G204R, S235F Positive Beta B.1.351 South Africa T201I Positive Gamma P.1 Japan ex Brazil P80R Positive Delta B.1.617.2 India D3Y, R203M, D377Y Positive • Independent testing with viral isolates • In house evaluation using in silico analysis and direct testing using recombinant nucleocapsid protein 18 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Manufacturing Video 19 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Question & Answer Session 20 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Market Opportunity and Product Strategy 21 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Defining the Path to Capturing and Growing POC Market Share Nigel Lindner, Ph.D. Chief Innovation Officer Pooja Pathak Chief Product Officer Key Takeaways A large and underpenetrated testing market represents a significant opportunity for LumiraDx Partnerships and execution across three core market segments will drive our success A robust near - term and long - term pipeline of strong performing assays will serve unmet clinical needs 22 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

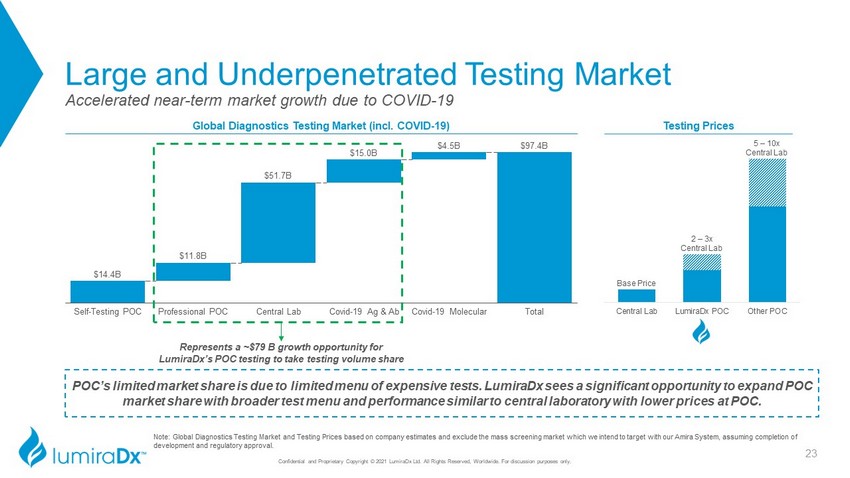

$14.4B $97.4B $11.8B $51.7B $15.0B $4.5B Self - Testing POC Covid - 19 Ag & Ab Professional POC Central Lab Covid - 19 Molecular Total Central Lab LumiraDx POC Other POC Large and Underpenetrated Testing Market Note: Global Diagnostics Testing Market and Testing Prices based on company estimates and exclude the mass screening market w hic h we intend to target with our Amira System, assuming completion of development and regulatory approval. Global Diagnostics Testing Market (incl. COVID - 19) Accelerated near - term market growth due to COVID - 19 POC’s limited market share is due to limited menu of expensive tests. LumiraDx sees a significant opportunity to expand POC market share with broader test menu and performance similar to central laboratory with lower prices at POC. Testing Prices Base Price 2 – 3x Central Lab 5 – 10x Central Lab Represents a ~$79 B growth opportunity for LumiraDx’s POC testing to take testing volume share Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 23

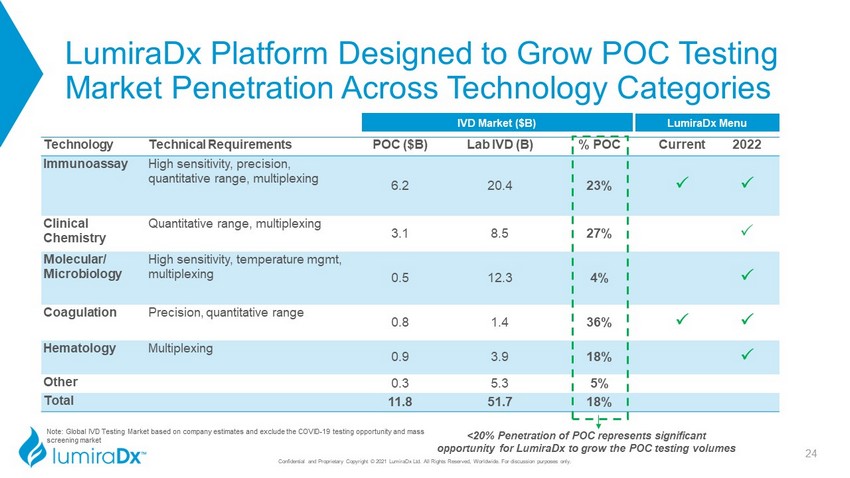

LumiraDx Platform Designed to Grow POC Testing Market Penetration Across Technology Categories Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. Technology Technical Requirements POC ($B) Lab IVD (B) % POC Current 2022 Immunoassay High sensitivity, precision, quantitative range, multiplexing 6.2 20.4 23% P P Clinical Chemistry Quantitative range, multiplexing 3.1 8.5 27% P Molecular/ Microbiology High sensitivity, temperature mgmt, multiplexing 0.5 12.3 4% P Coagulation Precision, quantitative range 0.8 1.4 36% P P Hematology Multiplexing 0.9 3.9 18% P Other 0.3 5.3 5% Total 11.8 51.7 18% <20% Penetration of POC represents significant opportunity for LumiraDx to grow the POC testing volumes IVD Market ($B) LumiraDx Menu 24 Note: Global IVD Testing Market based on company estimates and exclude the COVID - 19 testing opportunity and mass screening market

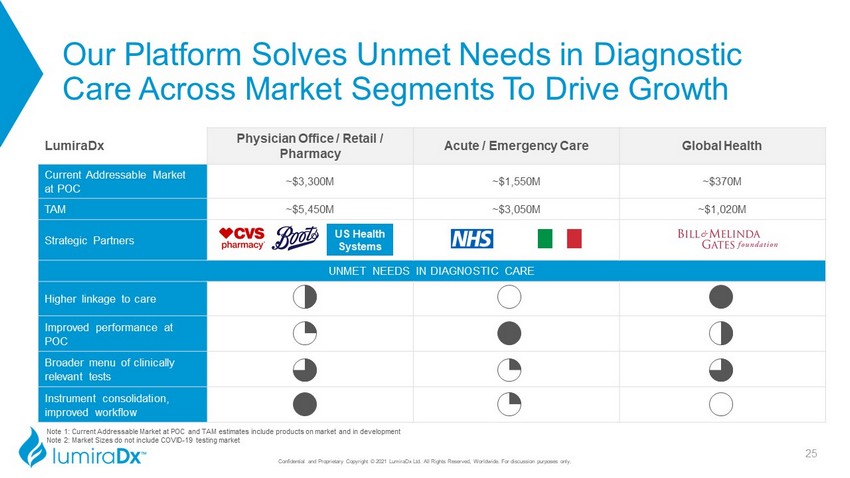

Our Platform Solves Unmet Needs in Diagnostic Care Across Market Segments To Drive Growth LumiraDx Physician Office / Retail / Pharmacy Acute / Emergency Care Global Health Current Addressable Market at POC ~$3,300M ~$1,550M ~$370M TAM ~$5,450M ~$3,050M ~$1,020M Strategic Partners UNMET NEEDS IN DIAGNOSTIC CARE Higher linkage to care 22 0 4 Improved performance at POC 1 4 2 Broader menu of clinically relevant tests 3 1 3 Instrument consolidation, improved workflow 4 1 0 25 US Health Systems Note 1: Current Addressable Market at POC and TAM estimates include products on market and in development Note 2: Market Sizes do not include COVID - 19 testing market Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

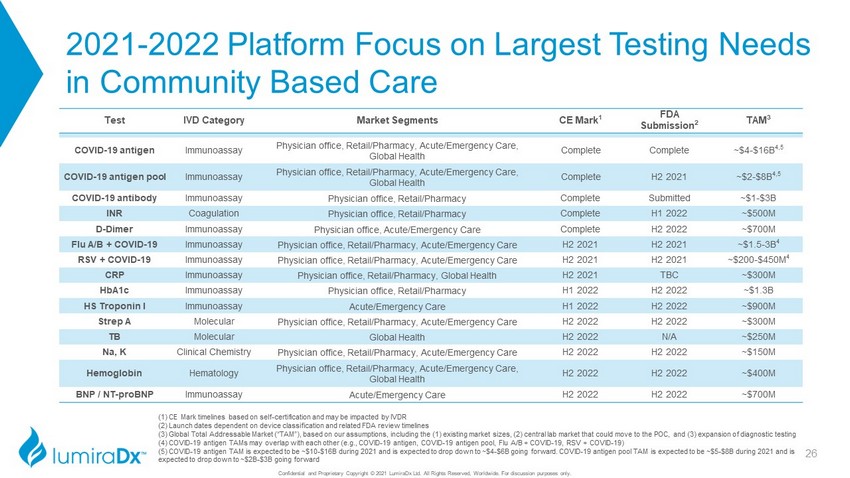

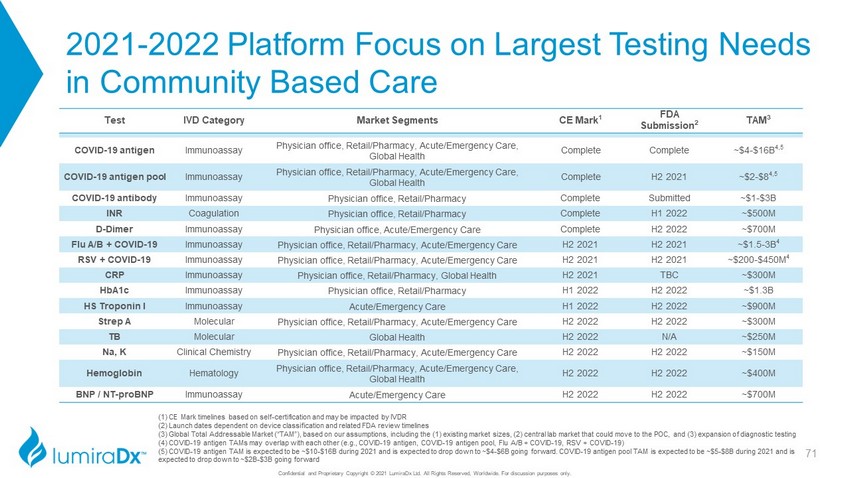

2021 - 2022 Platform Focus on Largest Testing Needs in Community Based Care Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. Test IVD Category Market Segments CE Mark 1 FDA Submission 2 TAM 3 COVID - 19 antigen Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health Complete Complete ~$4 - $16B 4,5 COVID - 19 antigen pool Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health Complete H2 2021 ~$2 - $8B 4,5 COVID - 19 antibody Immunoassay Physician office, Retail/Pharmacy Complete Submitted ~$1 - $3B INR Coagulation Physician office, Retail/Pharmacy Complete H1 2022 ~$500M D - Dimer Immunoassay Physician office, Acute/Emergency Care Complete H2 2022 ~$700M Flu A/B + COVID - 19 Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2021 H2 2021 ~$1.5 - 3B 4 RSV + COVID - 19 Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2021 H2 2021 ~$200 - $450M 4 CRP Immunoassay Physician office, Retail/Pharmacy, Global Health H2 2021 TBC ~$300M HbA1c Immunoassay Physician office, Retail/Pharmacy H1 2022 H2 2022 ~$1.3B HS Troponin I Immunoassay Acute/Emergency Care H1 2022 H2 2022 ~$900M Strep A Molecular Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2022 H2 2022 ~$300M TB Molecular Global Health H2 2022 N/A ~$250M Na, K Clinical Chemistry Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2022 H2 2022 ~$150M Hemoglobin Hematology Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health H2 2022 H2 2022 ~$400M BNP / NT - proBNP Immunoassay Acute/Emergency Care H2 2022 H2 2022 ~$700M (1) CE Mark timelines based on self - certification and may be impacted by IVDR (2) Launch dates dependent on device classification and related FDA review timelines (3) Global Total Addressable Market (“TAM”), based on our assumptions, including the (1) existing market sizes, (2) central l ab market that could move to the POC, and (3) expansion of diagnostic testing (4) COVID - 19 antigen TAMs may overlap with each other (e.g., COVID - 19 antigen, COVID - 19 antigen pool, Flu A/B + COVID - 19, RSV + COVID - 19) (5) COVID - 19 antigen TAM is expected to be ~$10 - $16B during 2021 and is expected to drop down to ~$4 - $6B going forward. COVID - 19 antigen pool TAM is expected to be ~$5 - $8B during 2021 and is expected to drop down to ~$2B - $3B going forward 26

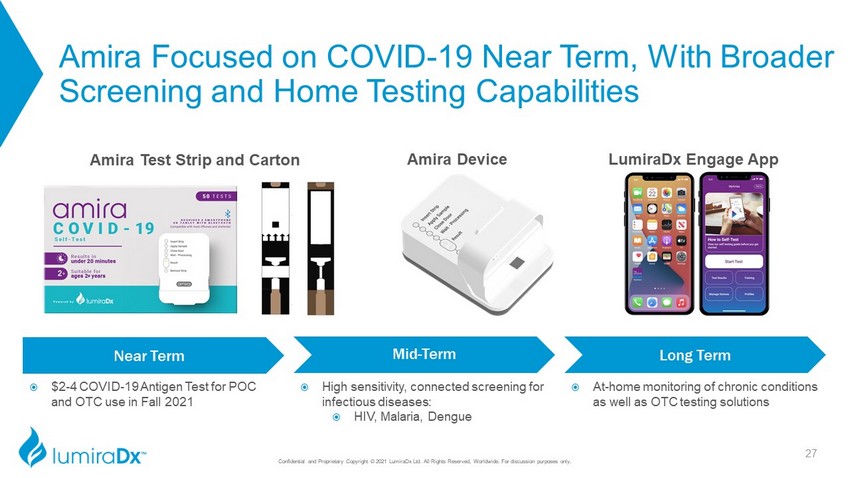

Amira Focused on COVID - 19 Near Term, With Broader Screening and Home Testing Capabilities Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. Amira Test Strip and Carton LumiraDx Engage App Amira Device Near Term Mid - Term Long Term High sensitivity, connected screening for infectious diseases: HIV, Malaria , Dengue At - home monitoring of chronic conditions as well as OTC testing solutions $2 - 4 COVID - 19 Antigen Test for POC and OTC use in Fall 2021 27

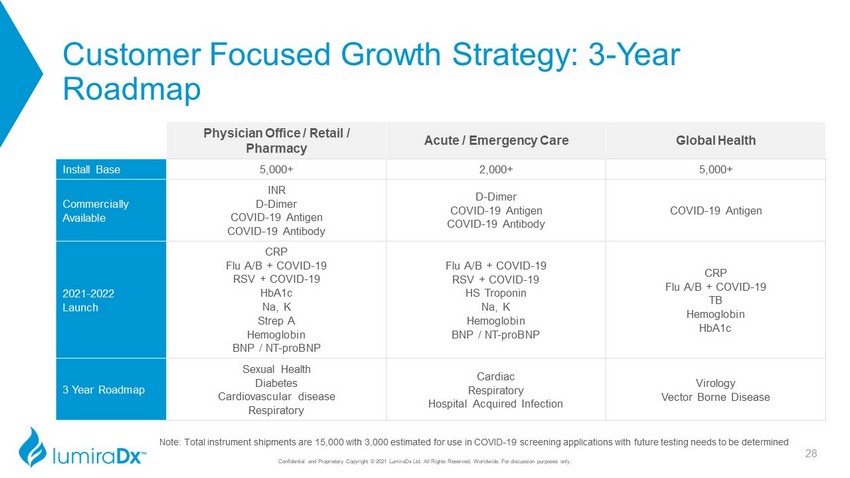

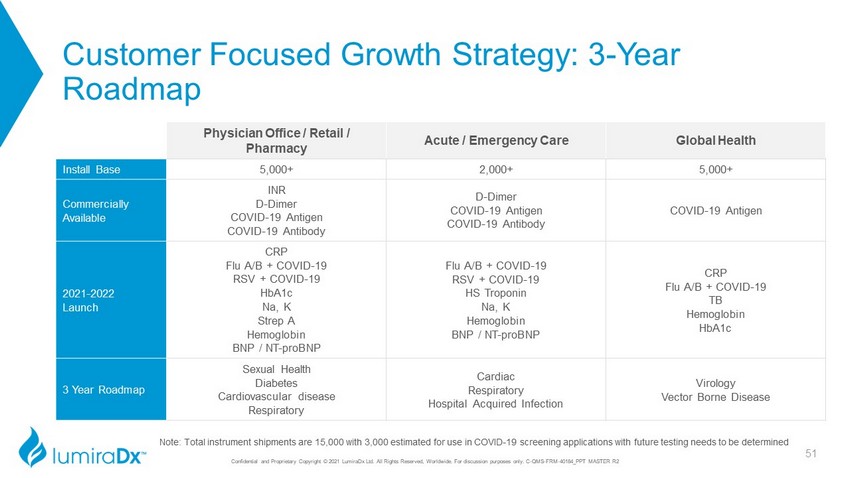

Customer Focused Growth Strategy: 3 - Year Roadmap Physician Office / Retail / Pharmacy Acute / Emergency Care Global Health Install Base 5,000+ 2,000+ 5,000+ Commercially Available INR D - Dimer COVID - 19 Antigen COVID - 19 Antibody D - Dimer COVID - 19 Antigen COVID - 19 Antibody COVID - 19 Antigen 2021 - 2022 Launch CRP Flu A/B + COVID - 19 RSV + COVID - 19 HbA1c Na, K Strep A Hemoglobin BNP / NT - proBNP Flu A/B + COVID - 19 RSV + COVID - 19 HS Troponin Na, K Hemoglobin BNP / NT - proBNP CRP Flu A/B + COVID - 19 TB Hemoglobin HbA1c 3 Year Roadmap Sexual Health Diabetes Cardiovascular disease Respiratory Cardiac Respiratory Hospital Acquired Infection Virology Vector Borne Disease Note: Total instrument shipments are 15,000 with 3,000 estimated for use in COVID - 19 screening applications with future testing needs to be determined 28 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Physician Office / Retail / Pharmacy / Urgent Care Market Opportunity and Product Strategy 29 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

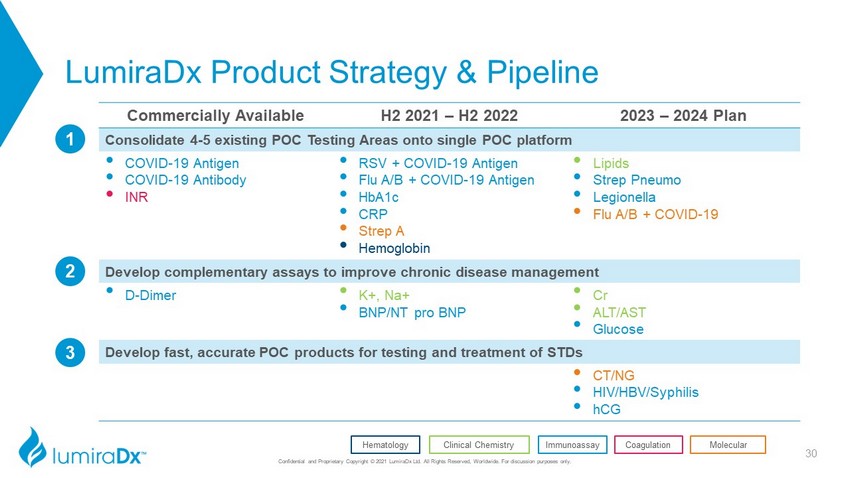

LumiraDx Product Strategy & Pipeline Commercially Available H2 2021 – H2 2022 2023 – 2024 Plan Consolidate 4 - 5 existing POC Testing Areas onto single POC platform • COVID - 19 Antigen • COVID - 19 Antibody • INR • RSV + COVID - 19 Antigen • Flu A/B + COVID - 19 Antigen • HbA1c • CRP • Strep A • Hemoglobin • Lipids • Strep Pneumo • Legionella • Flu A/B + COVID - 19 Develop complementary assays to improve chronic disease management • D - Dimer • K+, Na+ • BNP/NT pro BNP • Cr • ALT/AST • Glucose Develop fast, accurate POC products for testing and treatment of STDs • CT/NG • HIV/HBV/Syphilis • hCG 3 2 1 Coagulation Clinical Chemistry Hematology Immunoassay Molecular 30 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

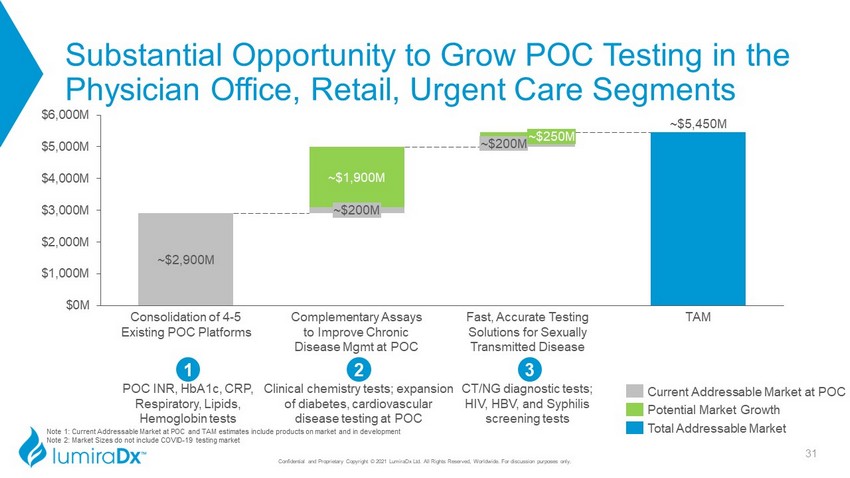

~$2,900M ~$5,450M ~$1,900M $0M $1,000M $2,000M $3,000M $4,000M $5,000M $6,000M ~$200M ~$200M Consolidation of 4 - 5 Existing POC Platforms Complementary Assays to Improve Chronic Disease Mgmt at POC ~$250M TAM Fast, Accurate Testing Solutions for Sexually Transmitted Disease Substantial Opportunity to Grow POC Testing in the Physician Office, Retail, Urgent Care Segments Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 3 CT/NG diagnostic tests; HIV, HBV, and Syphilis screening tests POC INR, HbA1c, CRP, Respiratory, Lipids, Hemoglobin tests 1 2 Clinical chemistry tests; expansion of diabetes, cardiovascular disease testing at POC Current Addressable Market at POC Potential Market Growth Total Addressable Market 31 Note 1: Current Addressable Market at POC and TAM estimates include products on market and in development Note 2: Market Sizes do not include COVID - 19 testing market

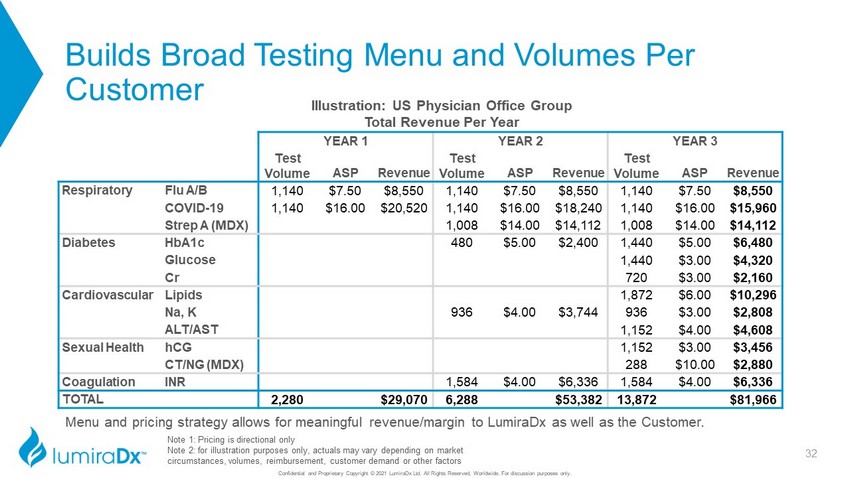

Builds Broad Testing Menu and Volumes Per Customer Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. Illustration: US Physician Office Group Total Revenue Per Year YEAR 1 YEAR 2 YEAR 3 Test Volume ASP Revenue Test Volume ASP Revenue Test Volume ASP Revenue Respiratory Flu A/B 1,140 $7.50 $8,550 1,140 $7.50 $8,550 1,140 $7.50 $8,550 COVID - 19 1,140 $16.00 $20,520 1,140 $16.00 $18,240 1,140 $16.00 $15,960 Strep A (MDX) 1,008 $14.00 $14,112 1,008 $14.00 $14,112 Diabetes HbA1c 480 $5.00 $2,400 1,440 $5.00 $6,480 Glucose 1,440 $3.00 $4,320 Cr 720 $3.00 $2,160 Cardiovascular Lipids 1,872 $6.00 $10,296 Na, K 936 $4.00 $3,744 936 $3.00 $2,808 ALT/AST 1,152 $4.00 $4,608 Sexual Health hCG 1,152 $3.00 $3,456 CT/NG (MDX) 288 $10.00 $2,880 Coagulation INR 1,584 $4.00 $6,336 1,584 $4.00 $6,336 TOTAL 2,280 $29,070 6,288 $53,382 13,872 $81,966 32 Note 1: Pricing is directional only Note 2: for illustration purposes only, actuals may vary depending on market circumstances, volumes, reimbursement, customer demand or other factors Menu and pricing strategy allows for meaningful revenue/margin to LumiraDx as well as the Customer.

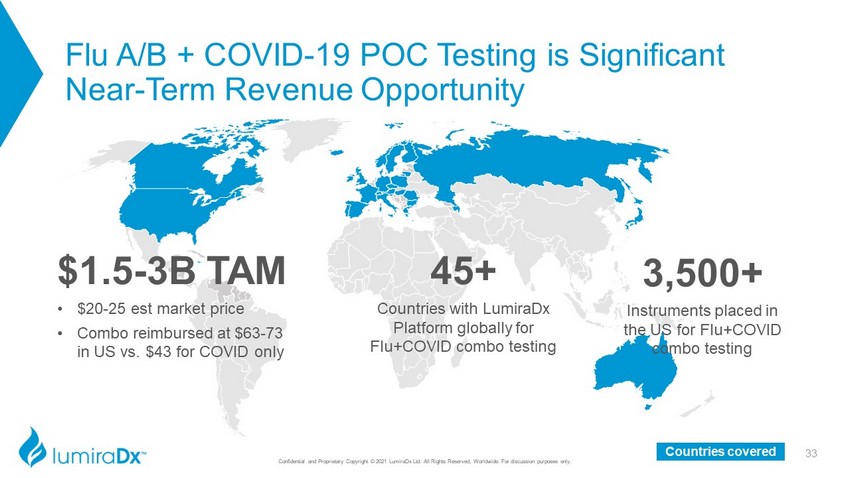

Flu A/B + COVID - 19 POC Testing is Significant Near - Term Revenue Opportunity 33 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. $1.5 - 3B TAM • $20 - 25 est market price • Combo reimbursed at $63 - 73 in US vs. $43 for COVID only 45+ Countries with LumiraDx Platform globally for Flu+COVID combo testing 3,500+ Instruments placed in the US for Flu+COVID combo testing Countries covered

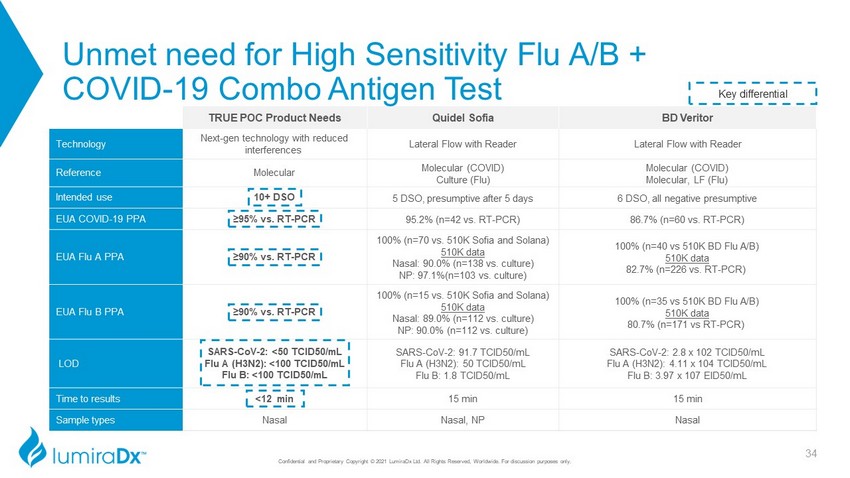

Unmet need for High Sensitivity Flu A/B + COVID - 19 Combo Antigen Test TRUE POC Product Needs Quidel Sofia BD Veritor Technology Next - gen technology with reduced interferences Lateral Flow with Reader Lateral Flow with Reader Reference Molecular Molecular (COVID) Culture (Flu) Molecular (COVID) Molecular, LF (Flu) Intended use 10+ DSO 5 DSO, presumptive after 5 days 6 DSO, all negative presumptive EUA COVID - 19 PPA ≥95% vs. RT - PCR 95.2% (n=42 vs. RT - PCR) 86.7% (n=60 vs. RT - PCR) EUA Flu A PPA ≥90% vs. RT - PCR 100% (n=70 vs. 510K Sofia and Solana) 510K data Nasal: 90.0% (n=138 vs. culture) NP: 97.1%(n=103 vs. culture) 100% (n=40 vs 510K BD Flu A/B) 510K data 82.7% (n=226 vs. RT - PCR) EUA Flu B PPA ≥90% vs. RT - PCR 100% (n=15 vs. 510K Sofia and Solana) 510K data Nasal: 89.0% (n=112 vs. culture) NP: 90.0% (n=112 vs. culture) 100% (n=35 vs 510K BD Flu A/B) 510K data 80.7% (n=171 vs RT - PCR) LOD SARS - CoV - 2: < 50 TCID50/mL Flu A (H3N2): <100 TCID50/mL Flu B: <100 TCID50/mL SARS - CoV - 2: 91.7 TCID50/mL Flu A (H3N2): 50 TCID50/mL Flu B: 1.8 TCID50/mL SARS - CoV - 2: 2.8 x 102 TCID50/mL Flu A (H3N2): 4.11 x 104 TCID50/mL Flu B: 3.97 x 107 EID50/mL Time to results <12 min 15 min 15 min Sample types Nasal Nasal, NP Nasal Key differential 34 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

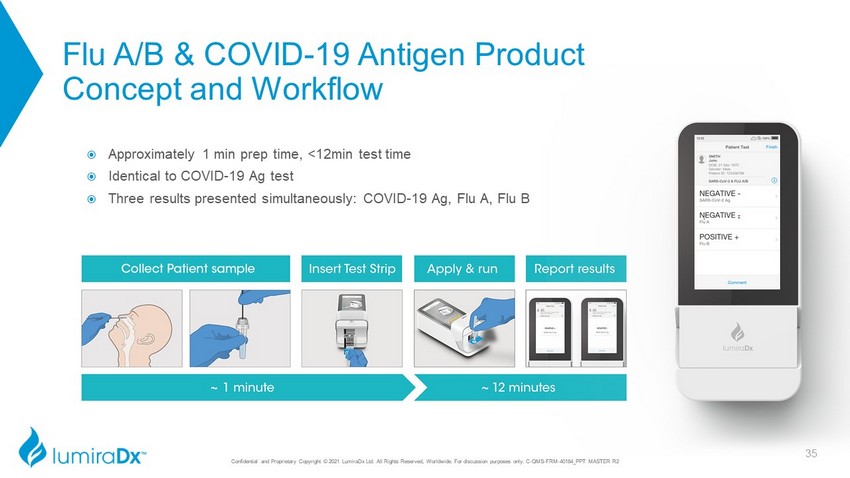

Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. C - QMS - FRM - 40184_PPT MASTER R2 Flu A/B & COVID - 19 Antigen Product Concept and Workflow Approximately 1 min prep time, <12min test time Identical to COVID - 19 Ag test Three results presented simultaneously: COVID - 19 Ag, Flu A, Flu B 35

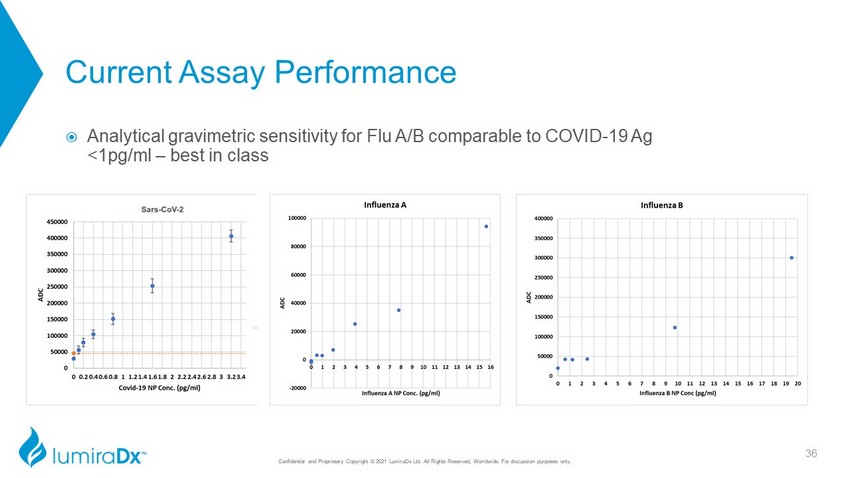

Current Assay Performance Analytical gravimetric sensitivity for Flu A/B comparable to COVID - 19 Ag <1pg/ml – best in class 36 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. CC

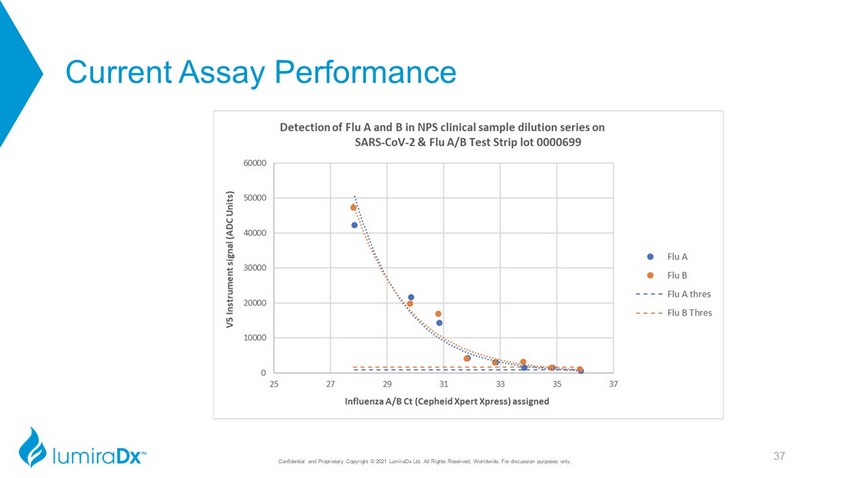

Current Assay Performance Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 37

Acute Care / Hospital Emergency Department Market Opportunity and Product Strategy 38 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

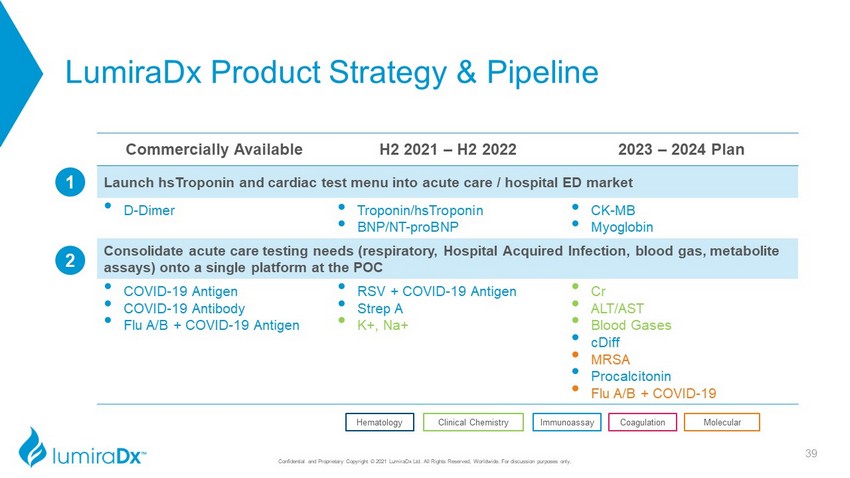

LumiraDx Product Strategy & Pipeline Commercially Available H2 2021 – H2 2022 2023 – 2024 Plan Launch hsTroponin and cardiac test menu into acute care / hospital ED market • D - Dimer • Troponin/hsTroponin • BNP/NT - proBNP • CK - MB • Myoglobin Consolidate acute care testing needs (respiratory, Hospital Acquired Infection, blood gas, metabolite assays) onto a single platform at the POC • COVID - 19 Antigen • COVID - 19 Antibody • Flu A/B + COVID - 19 Antigen • RSV + COVID - 19 Antigen • Strep A • K+, Na+ • Cr • ALT/AST • Blood Gases • cDiff • MRSA • Procalcitonin • Flu A/B + COVID - 19 Coagulation Clinical Chemistry Hematology Immunoassay Molecular 2 1 39 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

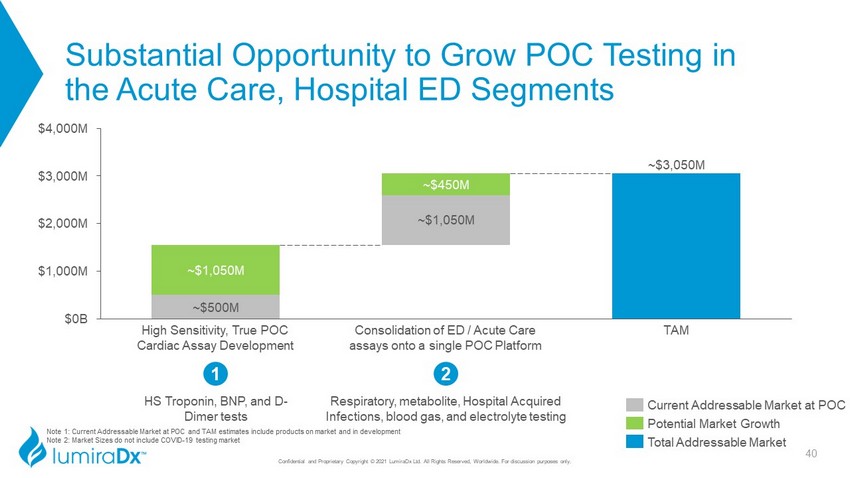

Note 1: Current Addressable Market at POC and TAM estimates include products on market and in development Note 2: Market Sizes do not include COVID - 19 testing market ~$500M ~$3,050M ~$1,050M ~$1,050M ~$450M $2,000M $0B $1,000M $3,000M $4,000M TAM High Sensitivity, True POC Cardiac Assay Development Consolidation of ED / Acute Care assays onto a single POC Platform Substantial Opportunity to Grow POC Testing in the Acute Care, Hospital ED Segments Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. HS Troponin, BNP, and D - Dimer tests 1 2 Respiratory, metabolite, Hospital Acquired Infections, blood gas, and electrolyte testing Current Addressable Market at POC Potential Market Growth Total Addressable Market 40

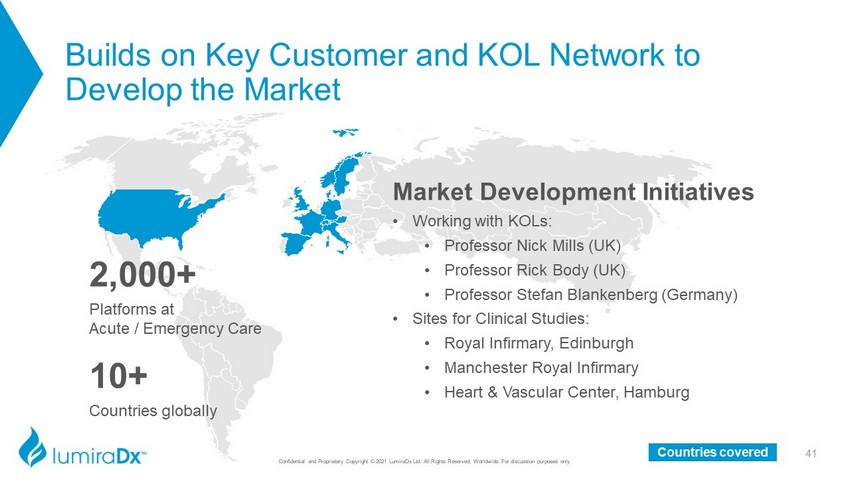

Builds on Key Customer and KOL Network to Develop the Market Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 41 Countries covered Market Development Initiatives • Working with KOLs: • Professor Nick Mills (UK) • Professor Rick Body (UK) • Professor Stefan Blankenberg (Germany) • Sites for Clinical Studies: • Royal Infirmary, Edinburgh • Manchester Royal Infirmary • Heart & Vascular Center, Hamburg 2,000+ Platforms at Acute / Emergency Care 10 + Countries globally

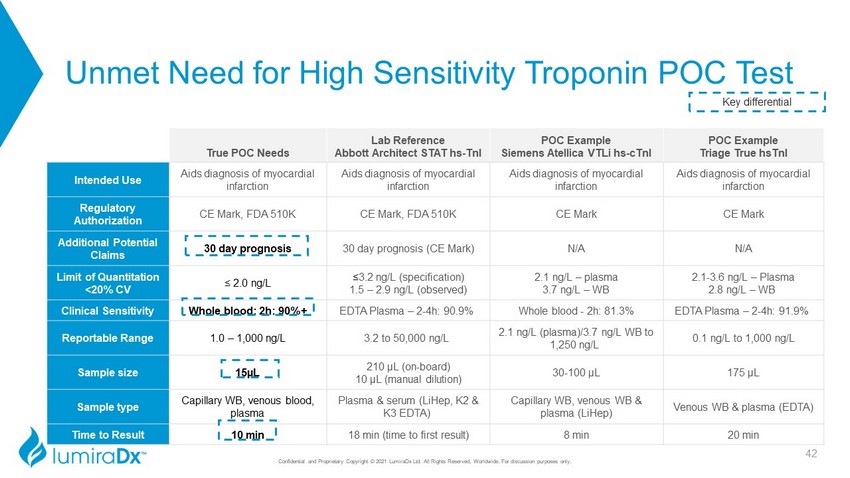

Unmet Need for High Sensitivity Troponin POC Test Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. True POC Needs Lab Reference Abbott Architect STAT hs - TnI POC Example Siemens Atellica VTLi hs - cTnI POC Example Triage True hsTnI Intended Use Aids diagnosis of myocardial infarction Aids diagnosis of myocardial infarction Aids diagnosis of myocardial infarction Aids diagnosis of myocardial infarction Regulatory Authorization CE Mark, FDA 510K CE Mark, FDA 510K CE Mark CE Mark Additional Potential Claims 30 day prognosis 30 day prognosis (CE Mark) N/A N/A Limit of Quantitation <20% CV ≤ 2.0 ng/L ≤ 3.2 ng/L (specification) 1.5 – 2.9 ng/L (observed) 2.1 ng/L – plasma 3.7 ng/L – WB 2.1 - 3.6 ng/L – Plasma 2.8 ng/L – WB Clinical Sensitivity Whole blood: 2h: 90%+ EDTA Plasma – 2 - 4h: 90.9% Whole blood - 2h: 81.3% EDTA Plasma – 2 - 4h: 91.9% Reportable Range 1.0 – 1,000 ng/L 3.2 to 50,000 ng/L 2.1 ng/L (plasma)/3.7 ng/L WB to 1,250 ng/L 0.1 ng/L to 1,000 ng/L Sample size 15µL 210 µL (on - board) 10 µL (manual dilution) 30 - 100 µL 175 µL Sample type Capillary WB, venous blood, plasma Plasma & serum (LiHep, K2 & K3 EDTA) Capillary WB, venous WB & plasma ( LiHep ) Venous WB & plasma (EDTA) Time to Result 10 min 18 min (time to first result) 8 min 20 min Key differential 42

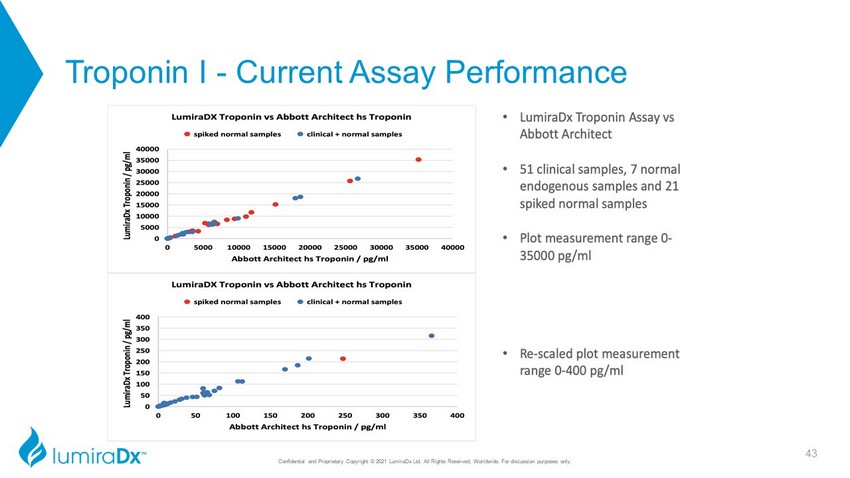

Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 43 Troponin I - Current Assay Performance

Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. Global Health Market Opportunity and Product Strategy 44

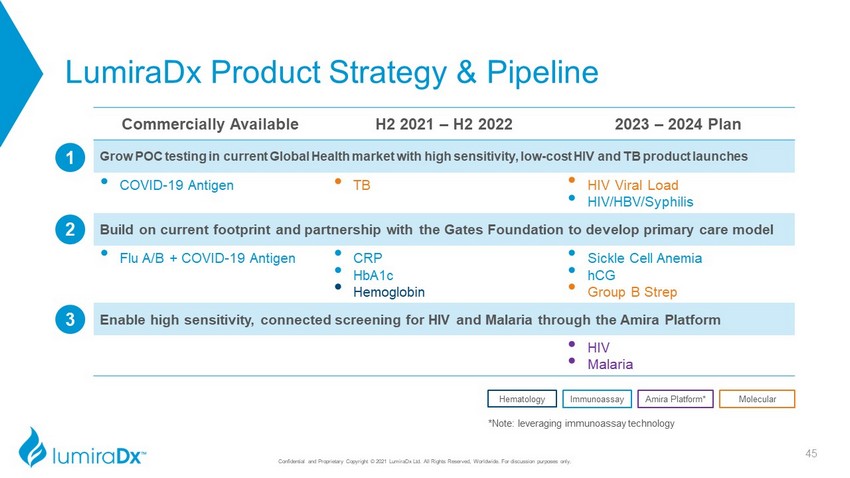

LumiraDx Product Strategy & Pipeline Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. *Note: leveraging immunoassay technology Commercially Available H2 2021 – H2 2022 2023 – 2024 Plan Grow POC testing in current Global Health market with high sensitivity, low - cost HIV and TB product launches • COVID - 19 Antigen • TB • HIV Viral Load • HIV/HBV/Syphilis Build on current footprint and partnership with the Gates Foundation to develop primary care model • Flu A/B + COVID - 19 Antigen • CRP • HbA1c • Hemoglobin • Sickle Cell Anemia • hCG • Group B Strep Enable high sensitivity, connected screening for HIV and Malaria through the Amira Platform • HIV • Malaria 3 Molecular Amira Platform* Immunoassay Hematology 2 1 45

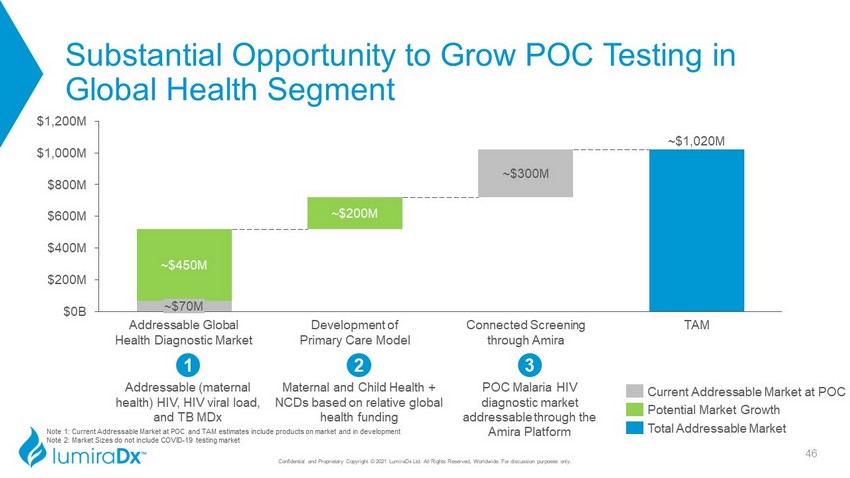

Note 1: Current Addressable Market at POC and TAM estimates include products on market and in development Note 2: Market Sizes do not include COVID - 19 testing market Substantial Opportunity to Grow POC Testing in Global Health Segment Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 3 POC Malaria HIV diagnostic market addressable through the Amira Platform Addressable (maternal health) HIV, HIV viral load, and TB MDx 1 2 Maternal and Child Health + NCDs based on relative global health funding ~$1,020M ~$450M ~$200M ~$300M $0B $200M $400M $600M $1,000M $800M $1,200M ~$70M Addressable Global Health Diagnostic Market Development of Primary Care Model Connected Screening through Amira TAM Total Addressable Market Current Addressable Market at POC Potential Market Growth 46

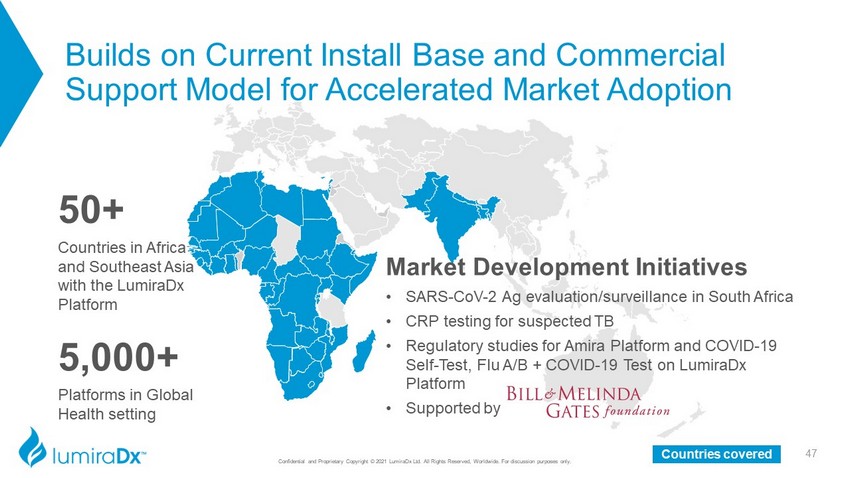

Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 5,000+ Platforms in Global Health setting Market Development Initiatives • SARS - CoV - 2 Ag evaluation/surveillance in South Africa • CRP testing for suspected TB • Regulatory studies for Amira Platform and COVID - 19 Self - Test, Flu A/B + COVID - 19 Test on LumiraDx Platform • Supported by 50 + Countries in Africa and Southeast Asia with the LumiraDx Platform 47 Countries covered Builds on Current Install Base and Commercial Support Model for Accelerated Market Adoption

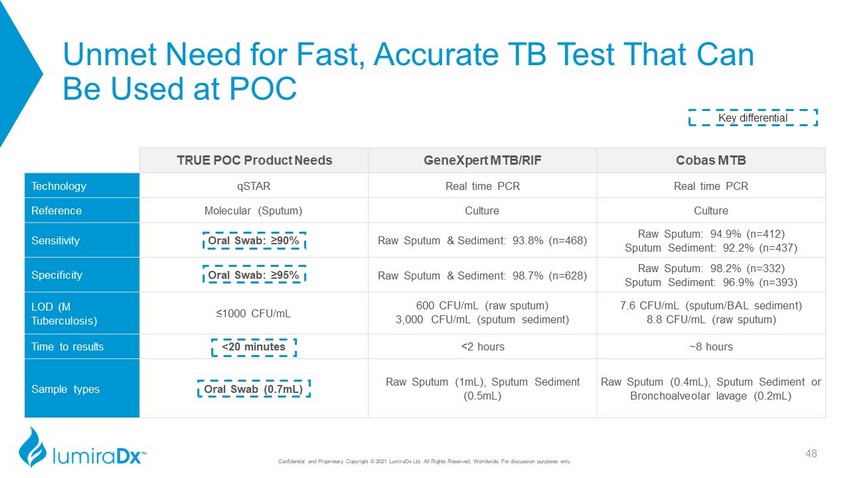

Unmet Need for Fast, Accurate TB Test That Can Be Used at POC TRUE POC Product Needs GeneXpert MTB/RIF Cobas MTB Technology qSTAR Real time PCR Real time PCR Reference Molecular (Sputum) Culture Culture Sensitivity Oral Swab: ≥90% Raw Sputum & Sediment: 93.8% (n=468) Raw Sputum: 94.9% (n=412) Sputum Sediment: 92.2% (n=437) Specificity Oral Swab: ≥95% Raw Sputum & Sediment: 98.7% (n=628) Raw Sputum: 98.2% (n=332) Sputum Sediment: 96.9% (n=393) LOD (M Tuberculosis) ≤1000 CFU/mL 600 CFU/mL (raw sputum) 3,000 CFU/mL (sputum sediment) 7.6 CFU/mL (sputum/BAL sediment) 8.8 CFU/mL (raw sputum) Time to results <20 minutes <2 hours ~8 hours Sample types Oral Swab (0.7mL) Raw Sputum (1mL), Sputum Sediment (0.5mL) Raw Sputum (0.4mL), Sputum Sediment or Bronchoalveolar lavage (0.2mL) Key differential 48 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

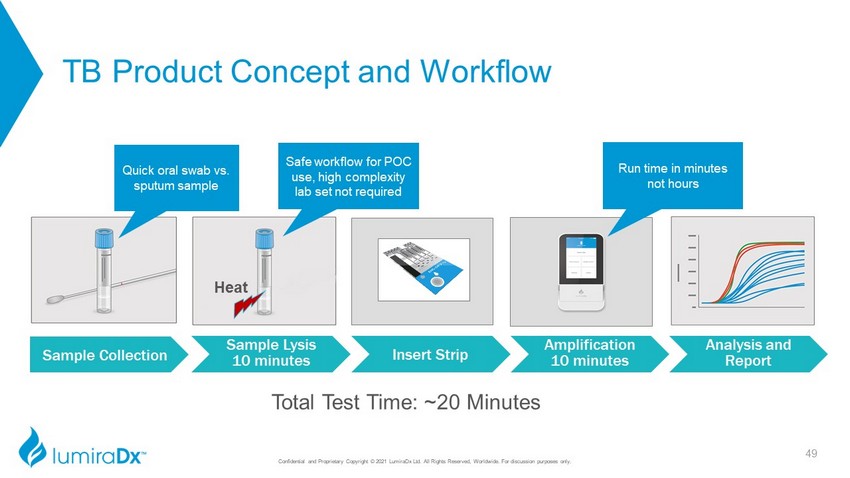

TB Product Concept and Workflow Heat Sample Collection Sample Lysis 10 minutes Insert Strip Amplification 10 minutes Analysis and Report Total Test Time: ~20 Minutes Quick oral swab vs. sputum sample Safe workflow for POC use, high complexity lab set not required Run time in minutes not hours 49 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

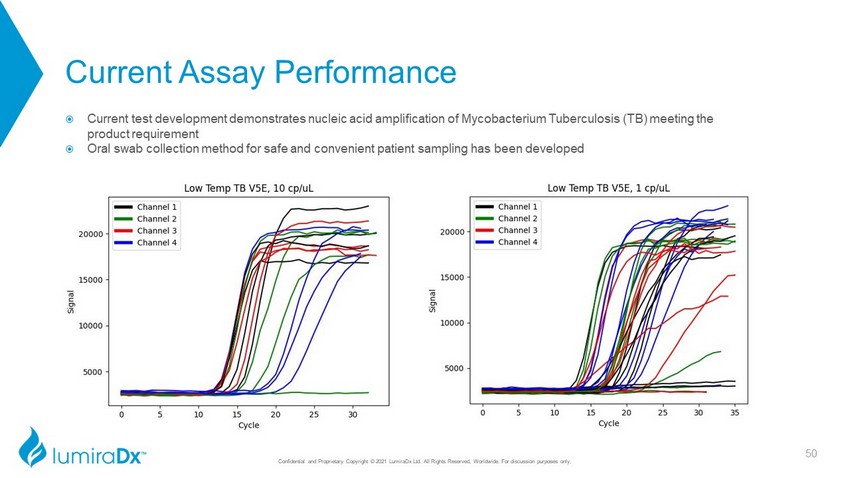

Current Assay Performance Current test development demonstrates nucleic acid amplification of Mycobacterium Tuberculosis (TB) meeting the product requirement Oral swab collection method for safe and convenient patient sampling has been developed 50 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. C - QMS - FRM - 40184_PPT MASTER R2 Customer Focused Growth Strategy: 3 - Year Roadmap Physician Office / Retail / Pharmacy Acute / Emergency Care Global Health Install Base 5,000+ 2,000+ 5,000+ Commercially Available INR D - Dimer COVID - 19 Antigen COVID - 19 Antibody D - Dimer COVID - 19 Antigen COVID - 19 Antibody COVID - 19 Antigen 2021 - 2022 Launch CRP Flu A/B + COVID - 19 RSV + COVID - 19 HbA1c Na, K Strep A Hemoglobin BNP / NT - proBNP Flu A/B + COVID - 19 RSV + COVID - 19 HS Troponin Na, K Hemoglobin BNP / NT - proBNP CRP Flu A/B + COVID - 19 TB Hemoglobin HbA1c 3 Year Roadmap Sexual Health Diabetes Cardiovascular disease Respiratory Cardiac Respiratory Hospital Acquired Infection Virology Vector Borne Disease Note: Total instrument shipments are 15,000 with 3,000 estimated for use in COVID - 19 screening applications with future testing needs to be determined 51

Question & Answer Session 52 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Commercial Strategy and Update 53 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Enabling A Global Growth Strategy David Walton, D.M.S. Chief Commercial Officer We are a global company with employees, partners, and customers located around the world Delivering a superior value proposition to customers versus the current options on the market Case studies of successful partnerships with global commercial and government organizations Key Takeaways 54 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

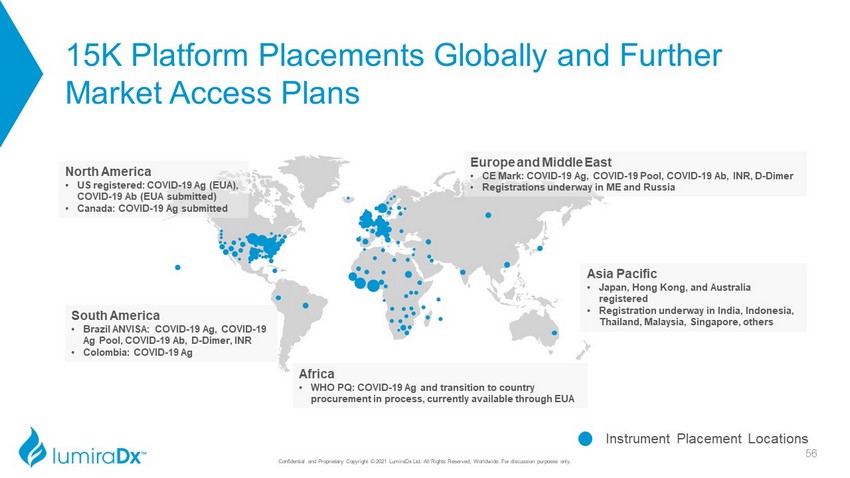

Direct (Current) Direct (Planned) Global Commercial Footprint • >1,550 employees, of which >200 are commercial employees located in 27 countries • Direct sales operations in Western Europe, USA, Japan, Colombia, Brazil, India and Africa • Distribution in another >30 countries. Total reach >90 countries • Over time, plan to operate with a direct commercial presence in each of the largest diagnostics markets, including China, South Korea, Southeast Asia and Latin America to ensure broad access of our Platform globally 55 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

15K Platform Placements Globally and Further Market Access Plans Instrument Placement Locations North America • US registered: COVID - 19 Ag (EUA), COVID - 19 Ab (EUA submitted) • Canada: COVID - 19 Ag submitted Europe and Middle East • CE Mark: COVID - 19 Ag, COVID - 19 Pool, COVID - 19 Ab, INR, D - Dimer • Registrations underway in ME and Russia Africa • WHO PQ: COVID - 19 Ag and transition to country procurement in process, currently available through EUA South America • Brazil ANVISA: COVID - 19 Ag, COVID - 19 Ag Pool, COVID - 19 Ab, D - Dimer, INR • Colombia: COVID - 19 Ag Asia Pacific • Japan, Hong Kong, and Australia registered • Registration underway in India, Indonesia, Thailand, Malaysia, Singapore, others 56 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

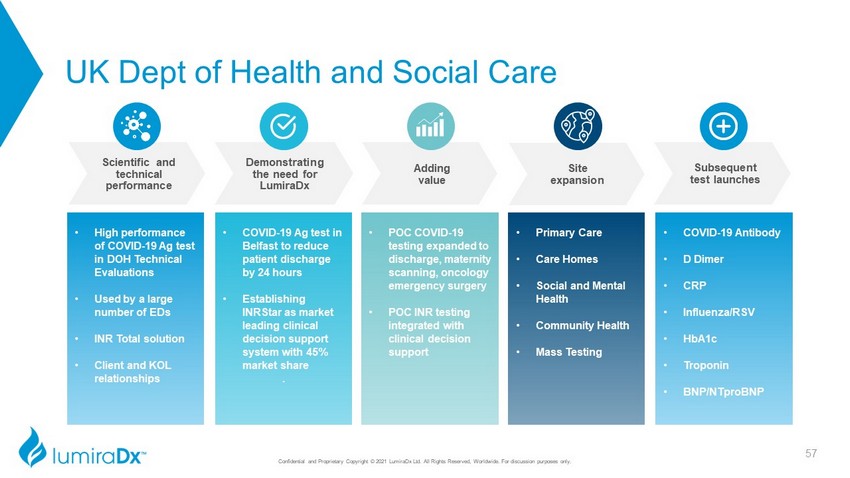

UK Dept of Health and Social Care Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. • High performance of COVID - 19 Ag test in DOH Technical Evaluations • Used by a large number of EDs • INR Total solution • Client and KOL relationships • COVID - 19 Ag test in Belfast to reduce patient discharge by 24 hours • Establishing INRStar as market leading clinical decision support system with 45% market share . • POC COVID - 19 testing expanded to discharge, maternity scanning, oncology emergency surgery • POC INR testing integrated with clinical decision support • Primary Care • Care Homes • Social and Mental Health • Community Health • Mass Testing • COVID - 19 Antibody • D Dimer • CRP • Influenza/RSV • HbA1c • Troponin • BNP/ NTproBNP Site expansion Subsequent test launches Adding value Demonstrating the need for LumiraDx Scientific and technical performance 57

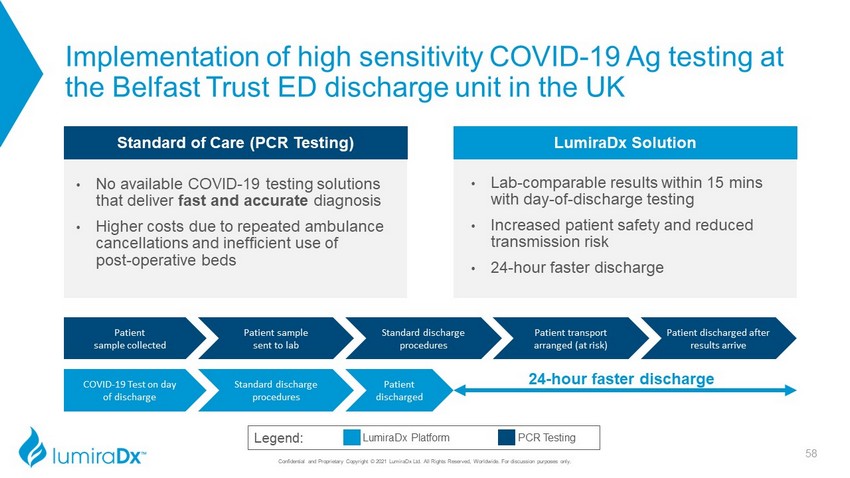

Implementation of high sensitivity COVID - 19 Ag testing at the Belfast Trust ED discharge unit in the UK Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. Legend: PCR Testing LumiraDx Platform Standard discharge procedures Patient discharged after results arrive Patient sample collected Patient sample sent to lab Patient transport arranged (at risk) COVID - 19 Test on day of discharge Standard discharge procedures Patient discharged 24 - hour faster discharge LumiraDx Solution • Lab - comparable results within 15 mins with day - of - discharge testing • Increased patient safety and reduced transmission risk • 24 - hour faster discharge Standard of Care (PCR Testing) • No available COVID - 19 testing solutions that deliver fast and accurate diagnosis • Higher costs due to repeated ambulance cancellations and inefficient use of post - operative beds 58

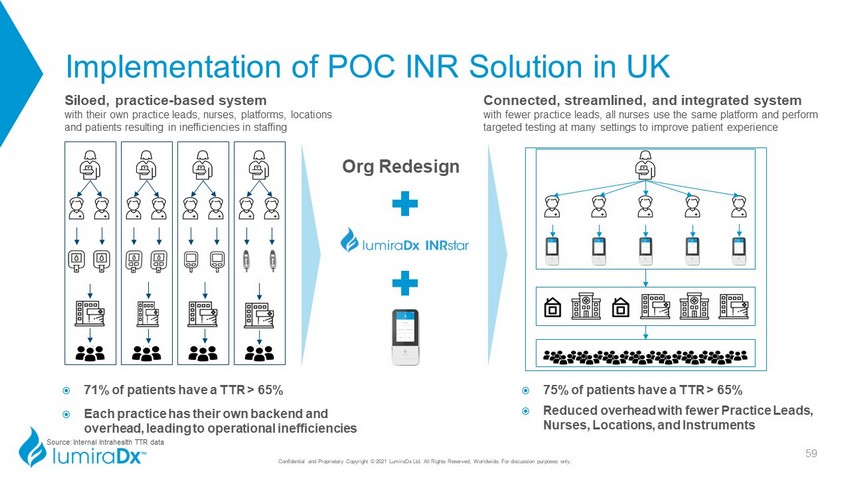

Implementation of POC INR Solution in UK Connected, streamlined, and integrated system with fewer practice leads, all nurses use the same platform and perform targeted testing at many settings to improve patient experience Siloed, practice - based system with their own practice leads, nurses, platforms, locations and patients resulting in inefficiencies in staffing 71% of patients have a TTR > 65% Each practice has their own backend and overhead, leading to operational inefficiencies 75% of patients have a TTR > 65% Reduced overhead with fewer Practice Leads, Nurses, Locations, and Instruments Org Redesign 59 Source: Internal Intrahealth TTR data Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

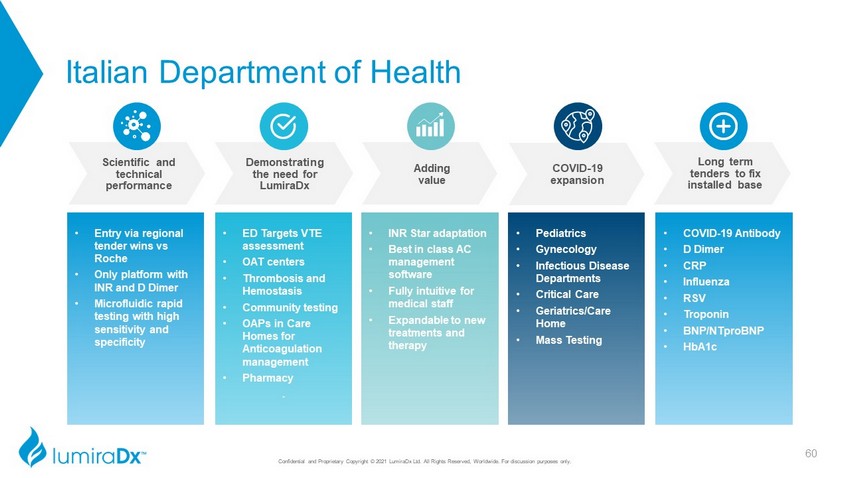

Italian Department of Health Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. • Entry via regional tender wins vs Roche • Only platform with INR and D Dimer • Microfluidic rapid testing with high sensitivity and specificity • ED Targets VTE assessment • OAT centers • Thrombosis and Hemostasis • Community testing • OAPs in Care Homes for Anticoagulation management • Pharmacy . • INR Star adaptation • Best in class AC management software • Fully intuitive for medical staff • Expandable to new treatments and therapy • Pediatrics • Gynecology • Infectious Disease Departments • Critical Care • Geriatrics/Care Home • Mass Testing • COVID - 19 Antibody • D Dimer • CRP • Influenza • RSV • Troponin • BNP/ NTproBNP • HbA1c COVID - 19 expansion Long term tenders to fix installed base Adding value Demonstrating the need for LumiraDx Scientific and technical performance 60

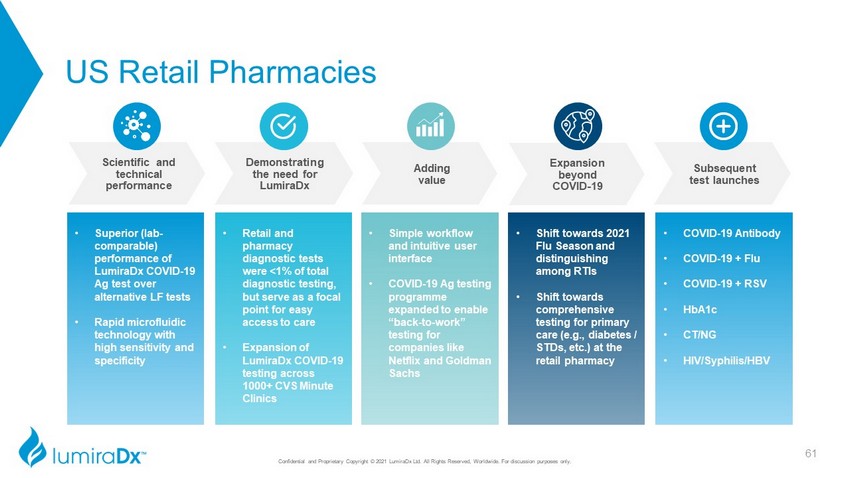

US Retail Pharmacies Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. • Superior (lab - comparable) performance of LumiraDx COVID - 19 Ag test over alternative LF tests • Rapid microfluidic technology with high sensitivity and specificity • Retail and pharmacy diagnostic tests were <1% of total diagnostic testing, but serve as a focal point for easy access to care • Expansion of LumiraDx COVID - 19 testing across 1000+ CVS Minute Clinics • Simple workflow and intuitive user interface • COVID - 19 Ag testing programme expanded to enable “back - to - work” testing for companies like Netflix and Goldman Sachs • Shift towards 2021 Flu Season and distinguishing among RTIs • Shift towards comprehensive testing for primary care (e.g., diabetes / STDs, etc.) at the retail pharmacy • COVID - 19 Antibody • COVID - 19 + Flu • COVID - 19 + RSV • HbA1c • CT/NG • HIV/Syphilis/HBV Expansion beyond COVID - 19 Subsequent test launches Adding value Demonstrating the need for LumiraDx Scientific and technical performance 61

Helping Re - Open the Economy with High Sensitivity, Connected COVID - 19 Testing PCR too slow and expensive, lateral flow too insensitive Governments and organisers define how to move forward with major events LumiraDx Ag test has high sensitivity and can be used online to get test results in less than 15 minutes to entrants ONE Stop IT solution provides different options to get spectators into stadia or festivals. Can include ticket, testing certificate for entrance, antibody tests and vaccination certificate in the future via one app. No hands and no data problems. Turnover significant in 2 months with high potential which could include Influenza and COVID antibody 62 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Financials 63 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.

Attractive Financial Forecast Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. C - QMS - FRM - 40184_PPT MASTER R2 Dorian LeBlanc, C.P.A. CFO and Vice President, Global Operations Key Takeaways Transformative LumiraDx Platform with menu expansion will drive rapid revenue growth Large TAMs in multiple segments for multiple tests High volume, very low cost manufacturing drives strong margins 64

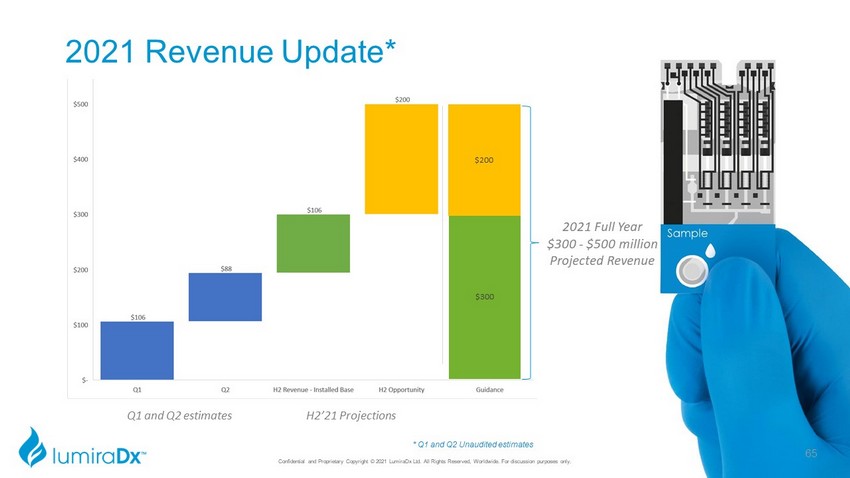

2021 Revenue Update* Q1 and Q2 estimates 2021 Full Year $300 - $500 million Projected Revenue H2’21 Projections * Q1 and Q2 Unaudited estimates $300 $200 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 65

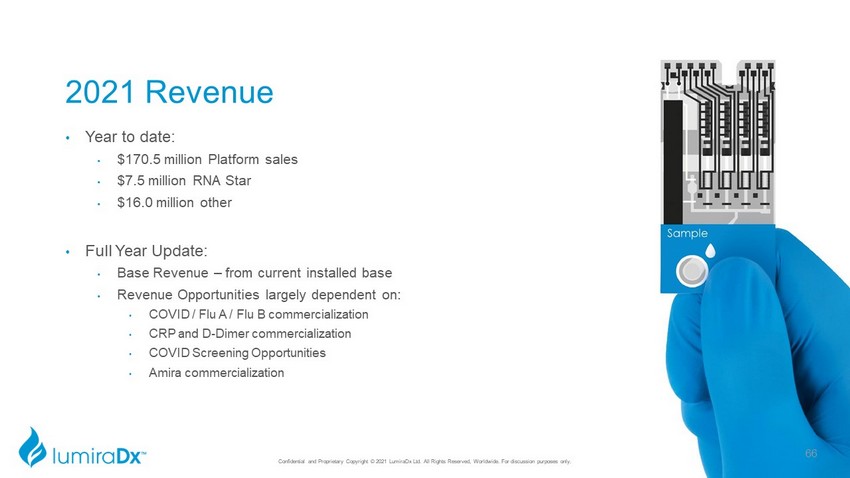

2021 Revenue • Year to date: • $170.5 million Platform sales • $7.5 million RNA Star • $16.0 million other • Full Year Update: • Base Revenue – from current installed base • Revenue Opportunities largely dependent on: • COVID / Flu A / Flu B commercialization • CRP and D - Dimer commercialization • COVID Screening Opportunities • Amira commercialization Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 66

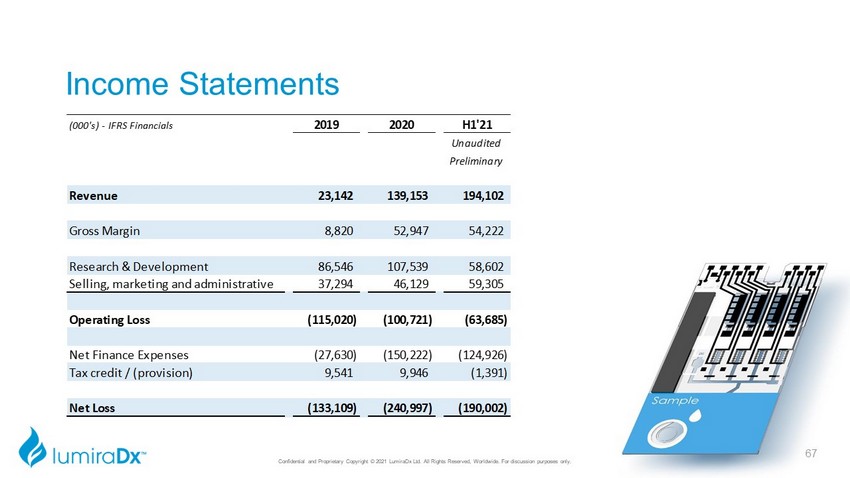

Income Statements (000's) - IFRS Financials 2019 2020 H1'21 Unaudited Preliminary Revenue 23,142 139,153 194,102 Gross Margin 8,820 52,947 54,222 Research & Development 86,546 107,539 58,602 Selling, marketing and administrative 37,294 46,129 59,305 Operating Loss (115,020) (100,721) (63,685) Net Finance Expenses (27,630) (150,222) (124,926) Tax credit / (provision) 9,541 9,946 (1,391) Net Loss (133,109) (240,997) (190,002) Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 67

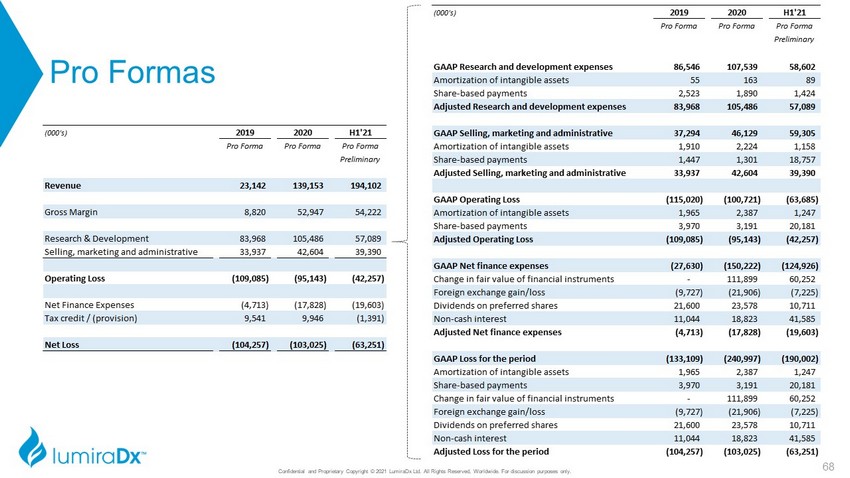

Pro Formas (000's) 2019 2020 H1'21 Pro Forma Pro Forma Pro Forma Preliminary Revenue 23,142 139,153 194,102 Gross Margin 8,820 52,947 54,222 Research & Development 83,968 105,486 57,089 Selling, marketing and administrative 33,937 42,604 39,390 Operating Loss (109,085) (95,143) (42,257) Net Finance Expenses (4,713) (17,828) (19,603) Tax credit / (provision) 9,541 9,946 (1,391) Net Loss (104,257) (103,025) (63,251) (000's) 2019 2020 H1'21 Pro Forma Pro Forma Pro Forma Preliminary GAAP Research and development expenses 86,546 107,539 58,602 Amortization of intangible assets 55 163 89 Share-based payments 2,523 1,890 1,424 Adjusted Research and development expenses 83,968 105,486 57,089 GAAP Selling, marketing and administrative 37,294 46,129 59,305 Amortization of intangible assets 1,910 2,224 1,158 Share-based payments 1,447 1,301 18,757 Adjusted Selling, marketing and administrative 33,937 42,604 39,390 GAAP Operating Loss (115,020) (100,721) (63,685) Amortization of intangible assets 1,965 2,387 1,247 Share-based payments 3,970 3,191 20,181 Adjusted Operating Loss (109,085) (95,143) (42,257) GAAP Net finance expenses (27,630) (150,222) (124,926) Change in fair value of financial instruments - 111,899 60,252 Foreign exchange gain/loss (9,727) (21,906) (7,225) Dividends on preferred shares 21,600 23,578 10,711 Non-cash interest 11,044 18,823 41,585 Adjusted Net finance expenses (4,713) (17,828) (19,603) GAAP Loss for the period (133,109) (240,997) (190,002) Amortization of intangible assets 1,965 2,387 1,247 Share-based payments 3,970 3,191 20,181 Change in fair value of financial instruments - 111,899 60,252 Foreign exchange gain/loss (9,727) (21,906) (7,225) Dividends on preferred shares 21,600 23,578 10,711 Non-cash interest 11,044 18,823 41,585 Adjusted Loss for the period (104,257) (103,025) (63,251) Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 68

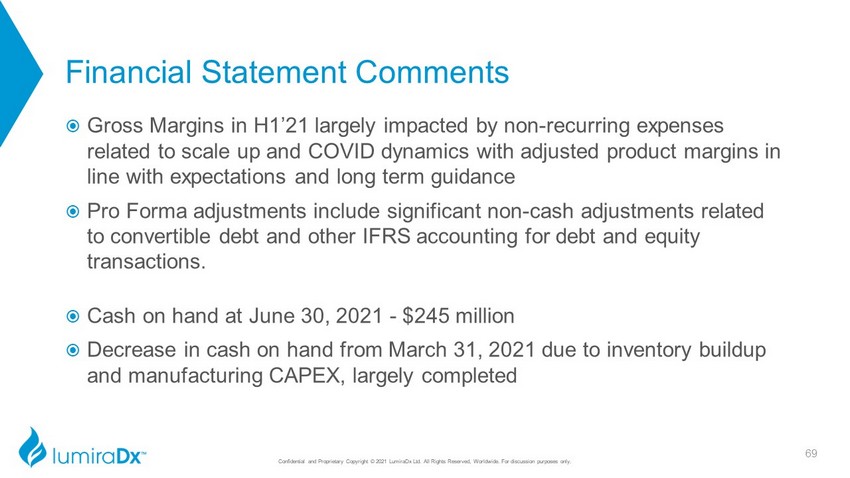

Financial Statement Comments Gross Margins in H1’21 largely impacted by non - recurring expenses related to scale up and COVID dynamics with adjusted product margins in line with expectations and long term guidance Pro Forma adjustments include significant non - cash adjustments related to convertible debt and other IFRS accounting for debt and equity transactions. Cash on hand at June 30, 2021 - $245 million Decrease in cash on hand from March 31, 2021 due to inventory buildup and manufacturing CAPEX, largely completed Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 69

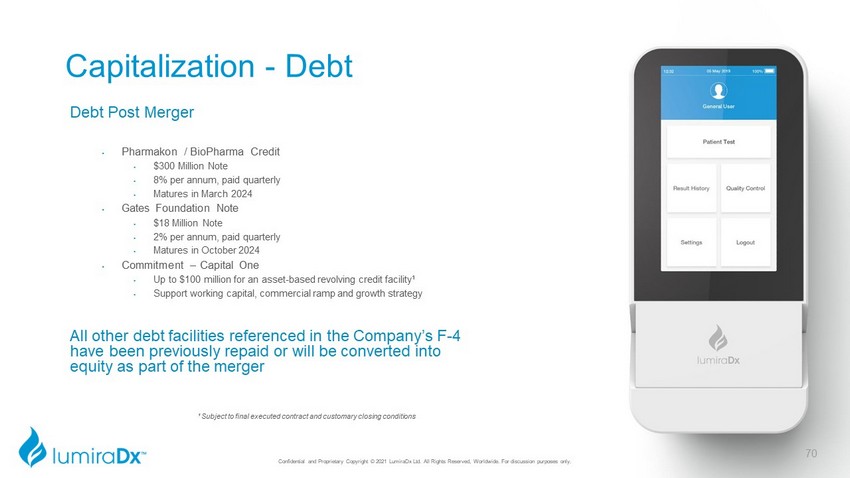

Capitalization - Debt Debt Post Merger • Pharmakon / BioPharma Credit • $300 Million Note • 8% per annum, paid quarterly • Matures in March 2024 • Gates Foundation Note • $18 Million Note • 2% per annum, paid quarterly • Matures in October 2024 • Commitment – Capital One • Up to $100 million for an asset - based revolving credit facility¹ • Support working capital, commercial ramp and growth strategy All other debt facilities referenced in the Company’s F - 4 have been previously repaid or will be converted into equity as part of the merger ¹ Subject to final executed contract and customary closing conditions Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 70

2021 - 2022 Platform Focus on Largest Testing Needs in Community Based Care Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. Test IVD Category Market Segments CE Mark 1 FDA Submission 2 TAM 3 COVID - 19 antigen Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health Complete Complete ~$4 - $16B 4,5 COVID - 19 antigen pool Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health Complete H2 2021 ~$2 - $8 4,5 COVID - 19 antibody Immunoassay Physician office, Retail/Pharmacy Complete Submitted ~$1 - $3B INR Coagulation Physician office, Retail/Pharmacy Complete H1 2022 ~$500M D - Dimer Immunoassay Physician office, Acute/Emergency Care Complete H2 2022 ~$700M Flu A/B + COVID - 19 Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2021 H2 2021 ~$1.5 - 3B 4 RSV + COVID - 19 Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2021 H2 2021 ~$200 - $450M 4 CRP Immunoassay Physician office, Retail/Pharmacy, Global Health H2 2021 TBC ~$300M HbA1c Immunoassay Physician office, Retail/Pharmacy H1 2022 H2 2022 ~$1.3B HS Troponin I Immunoassay Acute/Emergency Care H1 2022 H2 2022 ~$900M Strep A Molecular Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2022 H2 2022 ~$300M TB Molecular Global Health H2 2022 N/A ~$250M Na, K Clinical Chemistry Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2022 H2 2022 ~$150M Hemoglobin Hematology Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health H2 2022 H2 2022 ~$400M BNP / NT - proBNP Immunoassay Acute/Emergency Care H2 2022 H2 2022 ~$700M (1) CE Mark timelines based on self - certification and may be impacted by IVDR (2) Launch dates dependent on device classification and related FDA review timelines (3) Global Total Addressable Market (“TAM”), based on our assumptions, including the (1) existing market sizes, (2) central l ab market that could move to the POC, and (3) expansion of diagnostic testing (4) COVID - 19 antigen TAMs may overlap with each other (e.g., COVID - 19 antigen, COVID - 19 antigen pool, Flu A/B + COVID - 19, RSV + COVID - 19) (5) COVID - 19 antigen TAM is expected to be ~$10 - $16B during 2021 and is expected to drop down to ~$4 - $6B going forward. COVID - 19 antigen pool TAM is expected to be ~$5 - $8B during 2021 and is expected to drop down to ~$2B - $3B going forward 71

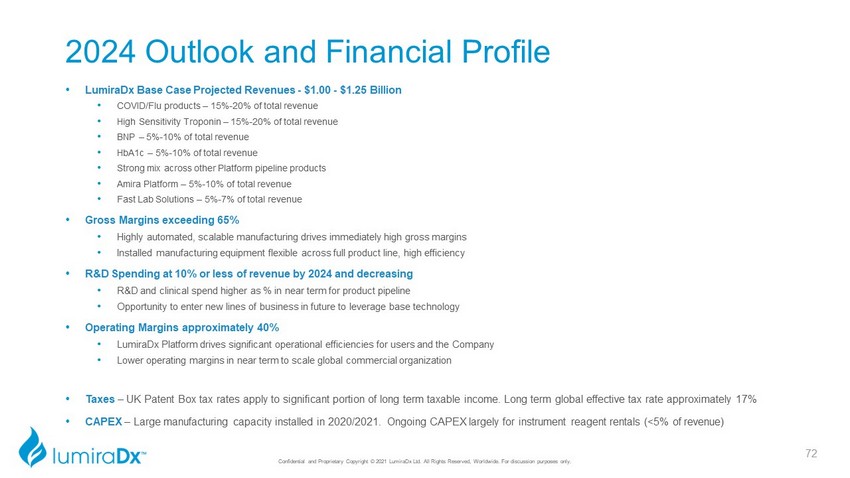

2024 Outlook and Financial Profile • LumiraDx Base Case Projected Revenues - $1.00 - $1.25 Billion • COVID/Flu products – 15% - 20% of total revenue • High Sensitivity Troponin – 15% - 20% of total revenue • BNP – 5% - 10% of total revenue • HbA1c – 5% - 10% of total revenue • Strong mix across other Platform pipeline products • Amira Platform – 5% - 10% of total revenue • Fast Lab Solutions – 5% - 7% of total revenue • Gross Margins exceeding 65% • Highly automated, scalable manufacturing drives immediately high gross margins • Installed manufacturing equipment flexible across full product line, high efficiency • R&D Spending at 10% or less of revenue by 2024 and decreasing • R&D and clinical spend higher as % in near term for product pipeline • Opportunity to enter new lines of business in future to leverage base technology • Operating Margins approximately 40% • LumiraDx Platform drives significant operational efficiencies for users and the Company • Lower operating margins in near term to scale global commercial organization • Taxes – UK Patent Box tax rates apply to significant portion of long term taxable income. Long term global effective tax rate approxi m ately 17% • CAPEX – Large manufacturing capacity installed in 2020/2021. Ongoing CAPEX largely for instrument reagent rentals (<5% of revenue) Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only. 72

Question & Answer Session 73 Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.