Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Stagwell Inc | tm2122204d1_8k.htm |

Exhibit 99.1

July 2021

Cautionary Statement Regarding Forward - Looking Statements This communication may contain certain forward - looking statements (collectively, “forward - looking statements”) within the meanin g of Section 27A of the U.S. Securities Act of 1933, as amended and Section 21E of the U.S. Exchange Act and the United States Private Securities Litigation Reform Act of 1995, as amended, and “forward - looking informatio n” under applicable Canadian securities laws. Statements in this document that are not historical facts, including statements about MDC’s or Stagwell’s beliefs and expectations and recent business and economic tr end s, constitute forward - looking statements. Words such as “estimate,” “project,” “target,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “should,” “would,” “may,” “foresee,” “plan,” “wi ll, ” “guidance,” “look,” “outlook,” “future,” “assume,” “forecast,” “focus,” “continue,” or the negative of such terms or other variations thereof and terms of similar substance used in connection with any discussion of current plans, est ima tes and projections are subject to change based on a number of factors, including those outlined in this section. Such forward - looking statements may include, but are not limited to, statements related to: future financial pe rformance and the future prospects of the respective businesses and operations of MDC, Stagwell and the combined company; information concerning the Proposed Transaction; the anticipated benefits of the Proposed Transacti on; the likelihood of the Proposed Transaction being completed; the anticipated outcome of the Proposed Transaction; the tax impact of the Proposed Transaction on MDC and shareholders of MDC; the timing of the shareh old er meeting to approve the Proposed Transaction (the “Special Meeting”); the shareholder approvals required for the Proposed Transaction; regulatory and stock exchange approval of the Proposed Transaction; and the tim ing of the implementation of the Proposed Transaction. A number of important factors could cause actual results to differ materially from those contained in any forward - looking statement, including the risks identified in our filings with the SEC. These forward - looking statements are subject to various risks and uncertainties, many of which are outside MDC’s control. Import ant factors that could cause actual results and expectations to differ materially from those indicated by such forward - looking statements include, without limitation, the risks and uncertainties set forth under the sectio n entitled “Risk Factors” in the registration statement on Form S - 4 filed on February 8, 2021, and as amended on March 29, 2021, April 21, 2021 and April 30, 2021 (the “Form S - 4”), under the section entitled “Risk Factors” in the proxy statement/prospectus on Form 424B3 filed on May 10, 2021 as supplemented by the Supplement to the Proxy Statement/Prospectus on Form 8 - K filed by MDC with the SEC on 7/12/2021 (together with the Form S - 4, the “Proxy Statement/Prospectus”) and under the caption “Risk Factors” in MDC’s Annual Report on Form 10 - K for the year - ended December 31, 2020 under Item 1A. These and other risk factors include, but are not limite d to, the following: an inability to realize expected benefits of the Proposed Transaction or the occurrence of difficulties in connection with th e P roposed Transaction; adverse tax consequences in connection with the Proposed Transaction for MDC, its operations and its shareholders, that may d iff er from the expectations of MDC or Stagwell, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on MDC’s determination of va lue and computations of its tax attributes may result in increased tax costs; the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Proposed Tran sac tion; the impact of uncertainty associated with the Proposed Transaction on MDC’s and Stagwell’s respective businesses; direct or indirect costs associated with the Proposed Transaction, which could be greater than expected; the risk that a condition to completion of the Proposed Transaction may not be satisfied and the Proposed Transaction may not be completed; and the risk of parties challenging the Proposed Transaction or the impact of the Proposed Transaction on MDC’s debt arrangements . You can obtain copies of MDC’s filings under its profile on SEDAR at www.sedar.com, its profile on the SEC’s website at www.s ec. gov or its website at www.mdc - partners.com. MDC does not undertake any obligation to update any forward - looking statements as a result of new information, future developments or otherwise, except as expressly requ ired by law. All forward - looking statements in this communication are qualified in their entirety by this cautionary statement. No Offer or Solicitation This communication does not constitute an offer to buy or exchange, or the solicitation of an offer to sell or exchange, any sec urities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This co mmu nication is not a substitute for any prospectus, proxy statement or any other document that MDC or New MDC may file with the SEC in connection with the Proposed Transaction. No money, securities or other consideration is bei ng solicited, and, if sent in response to the information contained herein, will not be accepted. No offering of securities shall be made except by means of a prospectus meeting the requirements of the U.S. Securities Act o f 1 933, as amended. The Proposed Transaction and distribution of this document may be restricted by law in certain jurisdictions and persons into whose possession any document or other information referred to herein should in form themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. No offering of securities will be ma de directly or indirectly, in or into any jurisdiction where to do so would be inconsistent with the laws of such jurisdiction. FORWARD LOOKING INFORMATION & OTHER INFORMATION

2 Executive Summary Rationale Transaction Affords MDC Shareholders the Best Opportunity for Value Creation Through a Meaningful Stake in a Well Positioned Company ▪ MDC shareholders will have a meaningful ownership stake in a scaled company that is well positioned in the fastest - growing digital marketing and advertising sectors ▪ Combined Company will have lower leverage, more financial flexibility, and greater scale than standalone MDC ▪ Opportunities for cost savings and revenue synergies The Transaction and Its Terms Are the Result of a Rigorous Process by the Independent Special Committee ▪ Transaction follows a robust, independent process ▪ The MDC Special Committee achieved a significant increase in pro forma ownership for MDC shareholders from the initial Stagwell offer of 18.5%, as Stagwell raised its offer seven times to ~31% ▪ No interlopers have emerged since the transaction was first publicly proposed by Stagwell in June 2020, despite ample opportunity to do so ▪ Stagwell communicated its June 14, 2021, revised offer was “best and final ”; the Special Committee achieved one final increase even after Stagwell’s last “best and final” offer The Transaction Incorporates Key Minority Shareholder & Corporate Governance Protections ▪ Pro forma Board will be strong and independent, with three current independent MDC directors, three independent directors designated by Stagwell and one additional independent director to be mutually agreed upon ▪ Minority shareholders will have meaningful influence over the composition of the entire Board going forward ▪ Seven of nine directors to be independent and key committees to consist solely of independent directors The Transaction Creates Significant Value for MDC Shareholders ▪ The MDC Board, on the Special Committee’s recommendation, determined the deal is in the best interest of MDC shareholders and recommended shareholders to vote to approve the transaction ▪ The Special Committee and its advisors conducted extensive diligence into both businesses and concluded that the economic split reflected fairly the contributions of each party The Transaction Received Positive Market Reaction as Demonstrated by Share Price Appreciation ▪ Market has reacted favourably with shareholder returns of 357 % since Stagwell’s initial June 2020 proposal ▪ Opportunity for further upside from greater trading liquidity in the stock and increased coverage from sell - side analysts 1 2 3 4 5 STRICTLY CONFIDENTIAL

3 $0 $5 $10 $15 $20 Jul-16 Jul-17 Jul-18 Jul-19 Jul-20 Jul-21 $5.25 Overview of MDC KEY STATISTICS Unaffected Current Market Value ($M) $87 $427 Enterprise Value ($M) $1,201 $1,541 2020A GAAP Revenue $1,199 2020A Net Revenue $1,023 2020A Adjusted EBITDA $177 % Margin (based on Net Revenue) 17% 2020 REVENUE BREAKDOWN BY SEGMENT 2 2020 REVENUE BREAKDOWN BY GEOGRAPHY 1 ▪ MDC Partners is a global marketing and communications network ▪ Headquarters in New York, with offices in Washington D.C., Toronto and London ▪ Provides marketing, advertising, public relations, branding, digital, social, event marketing and other business solutions to over 1,700 clients worldwide through its network of agencies ▪ MDC leverages its range of services in an integrated manner, offering strategic, creative and innovative solutions that are technologically forward and media - agnostic ▪ MDC maintains a majority or 100% ownership position in substantially all of its partner firms, with management of the partner firms owning the remaining equity 5 - YEAR STOCK PRICE STRICTLY CONFIDENTIAL Source: Company filings including the definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus o n F orm 8 - K filed by MDC with the SEC on 7/12/2021 and MDC's Form 10 - K, CapitalIQ as of 7/9/2021 Note: Unaffected share price data as of 6/25/2020. Current share price data as of 7/9/2021. 1. MDC Partners 2020 10 - K 2. Digital includes Instrument, Y Media Labs, Gale and Kenna. Media includes MDC Media Partners and Varick Media. PR includes Hunter, HL Group, Kwittken , Veritas, Relevent , 6degrees and Allison. Advertising includes 72andSunny, Crispin, Laird, Anomaly, Concentric, Mono, Doner , Union, Yamamoto, F&B, Colle McVoy , Vitro Robertson and Hello Design. Other includes Redscout , Team, Bruce Mau and Northstar . Prior to Stagwell’s offer, stock price was down 94% Since Stagwell’s initial offer, stock price has appreciated 357% US 80.0% Canada 6.8% Other 13.1% Advertising 55% DIGITAL SERVICES 14 % Media 7 % Other 7 % Marketing Comm. / PR 16% Research 1 %

4 Overview of The Stagwell Group KEY STATISTICS 2020 Net Revenue ($M) $ 656 2020 Adjusted EBITDA ($M) $ 148 % Margin (based on Net Revenue) 23% 2020 NET REVENUE BY SEGMENT ▪ Stagwell Group is a digital - first, technology - enabled and fully - integrated marketing consultancy ▪ Network consists of 20 leading brands providing digital transformation and performance marketing, research and insights, marketing communications and digital content solutions to some of the world’s foremost companies across major verticals ▪ Founded in 2015 by Mark Penn, former Chief Strategy Officer of Microsoft, CEO of Burson - Marsteller, and founder of Penn and Schoen, with more than 45 years of successful operating experience and industry expertise ▪ Backed by experienced technology and financial investors, including Steve Ballmer, co - founder of the Ballmer Group and former CEO of Microsoft ▪ Owns approximately 19.9% of the issued and outstanding Class A subordinate voting shares of MDC Partners, as calculated on an as - converted basis STRICTLY CONFIDENTIAL Advertising 1 % DIGITAL SERVICES 68 % Other 7 % Marketing Comm. / PR 16% Research 12 % Source: Stagwell Group Q4 2020 Investor Presentation 1. Digital includes Code & Theory, Scout, StagTech , ForwardPMX , MMI, Multiview and Targeted Victory. PR includes SKDK, Reputation Defender and WyeComm . Advertising includes Observatory. Research includes all Research & Insights agencies. Other includes Ink.

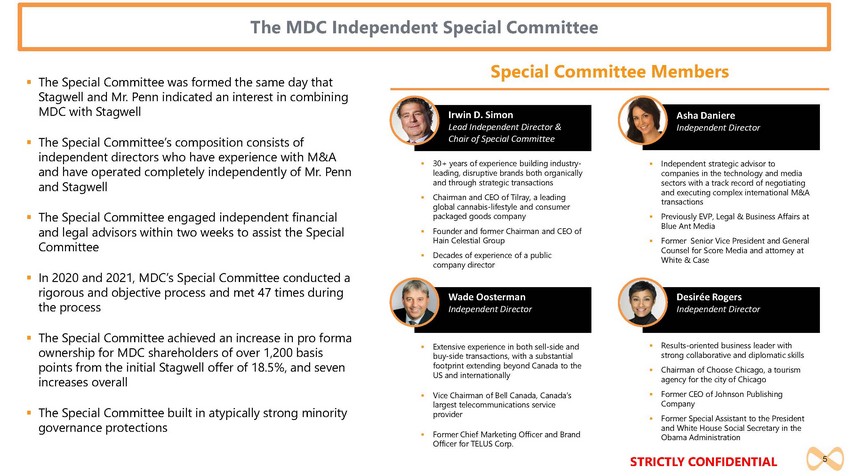

5 The MDC Independent Special Committee ▪ The Special Committee was formed the same day that Stagwell and Mr. Penn indicated an interest in combining MDC with Stagwell ▪ The Special Committee’s composition consists of independent directors who have experience with M&A and have operated completely independently of Mr. Penn and Stagwell ▪ The Special Committee engaged independent financial and legal advisors within two weeks to assist the Special Committee ▪ In 2020 and 2021, MDC’s Special Committee conducted a rigorous and objective process and met 47 times during the process ▪ The Special Committee achieved an increase in pro forma ownership for MDC shareholders of over 1,200 basis points from the initial Stagwell offer of 18.5 %, and seven increases overall ▪ The Special Committee built in atypically strong minority governance protections Special Committee Members Irwin D. Simon Lead Independent Director & Chair of Special Committee Desirée Rogers Independent Director Wade Oosterman Independent Director Asha Daniere Independent Director ▪ 30+ years of experience building industry - leading, disruptive brands both organically and through strategic transactions ▪ Chairman and CEO of Tilray, a leading global cannabis - lifestyle and consumer packaged goods company ▪ Founder and former Chairman and CEO of Hain Celestial Group ▪ Decades of experience of a public company director ▪ Results - oriented business leader with strong collaborative and diplomatic skills ▪ Chairman of Choose Chicago, a tourism agency for the city of Chicago ▪ Former CEO of Johnson Publishing Company ▪ Former Special Assistant to the President and White House Social Secretary in the Obama Administration ▪ Extensive experience in both sell - side and buy - side transactions, with a substantial footprint extending beyond Canada to the US and internationally ▪ Vice Chairman of Bell Canada, Canada’s largest telecommunications service provider ▪ Former Chief Marketing Officer and Brand Officer for TELUS Corp. ▪ Independent strategic advisor to companies in the technology and media sectors with a track record of negotiating and executing complex international M&A transactions ▪ Previously EVP, Legal & Business Affairs at Blue Ant Media ▪ Former Senior Vice President and General Counsel for Score Media and attorney at White & Case STRICTLY CONFIDENTIAL

5.00 4.00 3.08 4.35 5.0 6 Timeline of Key Events September 20, 2018 MDC announces process to evaluate strategic alternatives 2018 2019 2020 2021 March 15, 2019 Stagwell invests $100M in MDC and Mark Penn is named CEO. Stagwell was the only bidder out of 34 parties as the stock traded at 52 - week lows near $2.00 July 22, 2020 Special Committee’s legal advisor receives a draft term sheet with the initial Stagwell proposal, which proposed 18.5% post - transaction ownership for MDC shareholders June 25, 2020 Stagwell publicly proposes possible combination of Stagwell and MDC; proposes post - transaction ownership for MDC shareholders to 18.5% ( MDC stock trading at $1.15); Special Committee is empaneled to evaluate and negotiate Stagwell’s proposal March 9, 2021 Stagwell releases first earnings report, MDC stock rises to 52 - week highs above $4.00 December 21, 2020 Transaction Agreement is executed and delivered, and the transaction is announced publicly via a press release October 3, 2020 The Special Committee formally requests that Stagwell increase the post - transaction ownership for MDC shareholders to 26.0% ; Stagwell agrees June 14, 2021 Special Committee receives and evaluates a revised offer from Stagwell, which proposes to increase post - transaction ownership for MDC shareholders to approximately 30% June 12, 2021 MDC stock reaches 52 - week highs of $5.65 in anticipation of the deal June 7, 2021 MDC announces Stagwell’s Board designees and governance enhancements designed to ensure minority shareholders of the combined company have meaningful representation July 9, 2021 Stagwell and MDC announce an amended transaction agreement that increases post - transaction ownership for MDC shareholders to approximately 31% STRICTLY CONFIDENTIAL AF4

7 Transaction Overview Terms ▪ All - stock transaction in which MDC will issue to Stagwell equity interests equivalent to 180 million common equity interests in exchange for Stagwell’s operating businesses 1 Pro Forma Ownership ▪ Pre - Transaction holders of MDC Class A and Class B shares will receive approximately 31% of the common equity of the combined company and Stagwell will receive share consideration equal to approximately 69% of the common equity of the combined company Pro Forma Business Overview ▪ Combined company would have over 8,600 employees across 23 countries ▪ High - growth digital offerings would almost triple to 38% of the combined business ▪ Complementary offerings have the potential to deliver 5%+ annual organic revenue growth Pro Forma Management ▪ Mark Penn, current CEO and Chairman of MDC and Managing Partner of Stagwell, will continue as CEO and Chairman of the combined company ▪ Management of the combined company will consist of existing executives from MDC and Stagwell Board of Directors And Governance ▪ Pro forma Board of Directors will consist of nine members, seven of whom will be independent ▪ Audit , Compensation and Nominating & Corporate Governance committees to consist of independent directors ▪ Nominating & Corporate Governance Committee being comprised of two of the continuing MDC independent directors and one other independent director ▪ Protections for public shareholders include a requirement that any director that receives more “withheld” votes than “for” votes from public shareholders in an uncontested election must tender his or her resignation Voting Agreements ▪ Stagwell , Goldman Sachs and their respective affiliates have agreed to vote for the transaction Shareholder Vote & Closing ▪ Subject to approval of 1) 66 2/3% of all votes cast and 2) a majority of unaffiliated shareholders (“majority of the minority” vote) ▪ Special Meeting expected to be held 7/26 and targeting closing in the second half of calendar year 2021 STRICTLY CONFIDENTIAL 1. As part of the transaction, the Series 4 Preferred Shares and Series 6 Preferred Shares will reduce accretion to 0% per annum fo r one year; Stagwell will also contribute an incremental $25M of net debt

8 Indaba’s Ill - Founded Opposition Puts Great Transaction at Risk ▪ Despite extensive negotiations with Stagwell by the independent Special Committee, Indaba has expressed disappointment in the transaction economics and governance structure ▪ Indaba’s opposition is bereft of a recognition that MDC shareholders are gaining the high - growth, high - margin businesses of Stag well , which are valued higher than MDC on a trading multiples basis ▪ Indaba’s valuation work relies entirely on comparing today’s stock price a theoretical per - share price developed by a financial advisor to the Special Committee, but does not ever account for the overhang on the stock caused by Indaba’s very own opposition (and threat to deal completion, which would leave MDC over - levered and without a growth engine), nor to the lack of liquidity or research analyst coverage ▪ An appropriate analysis of the relative contributions of MDC and Stagwell to the new company demonstrates the equity stake of MDC shareholders in the combined business (approximately 31%) fairly accounts for MDC’s contributions to the business (See Section 4) ▪ Indaba’s complaints about governance are equally unfounded ▪ The Special Committee negotiated for atypically strong minority shareholder protections , including the right for the public shareholders to reject any or all of the directors (other than any director then serving as CEO) through a modified majority - voting governance structure (See Section 3 ) ▪ The Nominating and Governance Committee will be predominantly comprised of preexisting independent MDC directors and Audit and Compensation Committee will be comprised solely of independent directors to ensure independence from Stagwell (See Section 3) ▪ This transaction is the best opportunity for MDC shareholders to own a meaningful stake in a scaled company with significant participation in the fas tes t growing segments of the advertising and marketing business ▪ MDC has transparently released all relevant information and data , including the Moelis & Company LLC fairness opinion via the Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus on Form 8 - K filed by MDC with the SEC on 7/12/2021 STRICTLY CONFIDENTIAL

5.00 4.00 3.08 4.35 5.0 1 Transaction Affords MDC Shareholders the Best Opportunity for Value Creation Through a Meaningful Stake in a Well Positioned Company STRICTLY CONFIDENTIAL

10 Strategic and Business Benefits of the Transaction Rationale Enhanced Market Position ▪ Greater scale with significant capabilities and participation in fastest growing segments of the marketing and advertising bu sin ess ▪ Targeting 5%+ of annual organic revenue growth ▪ Almost tripling high - growth digital offerings, with 38% of business in digital services Lower Pro Forma Leverage ▪ Enhanced capital structure, decreasing net leverage ratio 1 from 3.9x on a standalone basis to 3.0x on a pro forma basis, after giving full effect to run - rate operational synergies ▪ Over $200m of pro forma cash generation in 2021 , providing ample liquidity for reducing balance sheet liabilities and investing in growth Enhanced Scale ▪ Combination creates a media and data operation managing $4.4 billion in media spend, bringing added scale and sophistication, wi th a global reach across 23 countries ▪ Combined company will offer a significantly expanded suite of high - growth digital services compared to MDC as a standalone entit y ▪ New revenue streams from expanded digital and technology products based on AI, proprietary data and insights Cost Savings and Synergies ▪ Run - rate savings of ~$30 million from operational synergies over time Improved Public Company Profile ▪ Increased market cap, scale, and prominence of the combined company may attract more trading volume, research analyst coverag e a nd Wall Street sponsorship 1 STRICTLY CONFIDENTIAL Source: Company filings 1. Net leverage calculation excludes issued but undrawn letters of credit of $19.2M as of 3/31/21. Includes $20M Drawn Revolver, $870M of Senior Notes less $113M of Cash. Excludes Deferred Acquisition Costs and Minority Investments.

11 Greater contribution from high - growth digital services revenue (% 2020 Net Revenue) Advertising 55% DIGITAL SERVICES 14 % Media 7 % Other 7 % Advertising 31% Marketing Comm. / PR 16% DIGITAL SERVICES 38% Media 5% Other 4% Research 6 % Marketing Comm. / PR 16% (% 2020 PF Net Revenue ) The Combination is Transformative to MDC’s Business Mix 1 Note: Does not reflect MDC or Stagwell reported segments. Stagwell includes digital media and fundraising assets in Digital S erv ices; MDC includes digital media assets in Media . STRICTLY CONFIDENTIAL Research 1 %

12 The Proposed Transaction materially improves MDC’s growth rate and margin profile, while adding significant scale The Combination is Transformative to MDC’s Financial Profile 1 NET REVENUE¹ EBITDA ’20 - ’25 CAGR (15.3%) 10.9% 3.5% 5.6% (11.8%) 14.6% 5.3% 10.8% +520bps MDC Standalone PF MDC Net Revenue Growth (%) ’20 - ’25 CAGR 17.4% 18.6% 20.0% 8.5% 18.2% 19.8% 20.9% 10.6% 18.2% 19.2% 22.2% 12.0% +340bps MDC Standalone PF MDC – Polit. Average 1 EBITDA Margin (%) PF MDC – Polit. Average (Incl. Synergies) 1,2 $1,019 $1,130 $1,336 $1,637 $1,877 $2,366 2020A 2021E 2025E Current MDC PF MDC - Polit. Average² $177 $210 $267 $299 $372 $495 $299 $360 $525 2020A 2021E 2025E Current MDC PF MDC - Polit. Average² PF MDC - Polit. Average - Incl. Synergies²,³ Source: Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus on Form 8 - K filed b y MDC with the SEC on 7/12/2021 Note: Standalone MDC EBITDA based on MDC Partners EBITDA, PF MDC EBITDA based on MDC Partners EBITDA plus Stagwell political ave rage EBITDA plus cost synergies (excluding costs to achieve). Excludes potential revenue synergies and impact of minority interest 1. MDC GAAP Revenue converted to Net Revenue at illustrative 85% factor 2. Political Avg. Net Revenue & EBITDA calculated assuming 2 - year averages for SKDK and Targeted Victory, other agencies calcula ted using current year 3. Cost synergies and cost to achieve per Stagwell management and MDC Disinterested Senior Executives STRICTLY CONFIDENTIAL

13 Combination with Stagwell materially reduces leverage; limited optionality for MDC to meaningfully reduce leverage on a stand alo ne basis The Combination is Transformative to MDC’s Credit Profile 1 SYNERGY IMPACT 3.3x 3.0x $ in millions LTM as of: 3/31/21 3/31/21 Pro Forma at Closing Revenue $1,179 1 $885 $2,064 Adj. EBITDA (Incl. Synergies) $201 2 $145 $346 ($376) Net Debt (Excluding DAC and Minority Investments) $777 4 $134 5 $1,137 6 TRANSACTION REDUCES LEVERAGE BY ~1X k Source : Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus on Form 8 - K filed b y MDC with the SEC on 7/12/2021, MDC Q1 2021 10 - Q, Stagwell Q1 2021 Investor Presentation Note : Assumes ~$30 million of cost savings. Does not include costs to achieve. Synergies expected to be fully realized by year 3. 1. Unless otherwise noted, MDC figures for revenue as reported and does not adjust for divestitures. 2. MDC Covenant EBITDA. 3. Net leverage calculation excludes issued but undrawn letters of credit of $ 19.2M and includes all $113M of cash on balance sheet as of 3/31/21. 4. Includes $20M Drawn Revolver, $870M of Senior Notes less $113M of Cash. Excludes Deferred Acquisition Costs and Minority I nve stments. 5. Includes $188M of RCF, less $54M of Cash. Excludes Deferred Acquisition Costs and Minority Investments. 6. Includes ~$50M of illustrative transaction fees & expenses, $25M of Subordinated Notes, and Pro Forma Stagwell Net Debt of $2 85M at closing. Excludes Deferred Acquisition Costs and Minority Investments. 3.9x ³ 3.0x 3.3x STRICTLY CONFIDENTIAL

14 Cost Synergies Create Value for Shareholders 1 Corporate 9% T&E 5% Shared Services 16% Media 32% Production 10% Research 12% Real Estate 9% Other 1 7% Annualized Cost Synergies ~55% Expected To Be Realized by Year 1 ~90% Expected To Be Realized by Year 2 100% Expected To Be Realized by Year 3 $30 MILLION ~ Run - rate cost savings of ~$30 million from operational efficiencies and integrated services over time Note: Estimates do not include cost to achieve. 1. Includes consolidation of IT staff, decrease in third party spend on employee benefits and consolidation of translation se rvi ces. STRICTLY CONFIDENTIAL

5.00 4.00 3.08 4.35 5.0 The Transaction and Its Terms Are the Result of a Rigorous Process by the Independent Special Committee 2 STRICTLY CONFIDENTIAL

16 ▪ MDC’s 2018 - 2019 process was led by an experienced and independent board that conducted a rigorous process ─ 34 parties were contacted as part of the process resulting in only 1 actionable proposal , from Stagwell, culminating in its investment in the company ▪ In 2020 and 2021, MDC’s Special Committee conducted a rigorous and objective process and met 47 times ─ With the guidance of its independent financial advisor, the MDC Special Committee negotiated extensively with Stagwell ─ The MDC Special Committee achieved an increase in pro forma ownership of over 67% from the initial Stagwell offer of 18.5% for MDC shareholders, as Stagwell raised its offer seven times ─ Independent directors unanimously approved transaction ▪ Since the public disclosure of Stagwell’s proposal in June 2020, potential interlopers have had over a year to express interest in a transaction and no interlopers emerged either during the 6 - month period before signing or thereafter during the window - shop period ─ Press releases outlining Stagwell’s proposals were made public on June 25, 2020 and October 6, 2020, and there was no inbound interest from any parties following either announcement ▪ After transaction announcement in December, the Special Committee canvassed the MDC shareholders ─ Despite strong economic participation by MDC shareholders in the combined company, some shareholders expressed a desire for a gr eater stake ▪ The Special Committee worked to get Stagwell to agree to a revised transaction ─ Even after Stagwell communicated that its June 14 revised offer was “best and final,” the Special Committee achieved one final increase ─ The transaction economics reflect an improvement of over 1,200 basis points from Stagwell’s original offer ▪ The Special Committee renewed its diligence of Stagwell and received advice from its independent financial advisor in light of the revised economic outlook ▪ The deal is in the best interests of MDC shareholders , in the view of the Special Committee, and should be supported by shareholders MDC Conducted a Rigorous, Objective and Competitive Process 2 STRICTLY CONFIDENTIAL

17 The Special Committee Worked to Get Stagwell to Raise its Offer Seven Times 2 Evolution of Split Negotiations to Achieve Best Outcome Source: Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus on Form 8 - K filed by MDC with the SEC on 7/12/2021 Date 6/25/2020 9/25/2020 10/2/2020 10/6/2020 12/21/2020 6/6/2021 6/14/2021 7/8/2021 Equity Interests to Stagwell (MM) 335.50 216.25 196.25 185.00 180.00 STRICTLY CONFIDENTIAL 18.5% 25.0% 25.75% 26.0% ~26.5% ~29% ~30% ~31% Initial Offer Revised Offer #1 Revised Offer #2 Revised Offer #3 Transaction Ownership Per December 21, 2020 Transaction Agreement Revised Offer #4 Revised Offer #5 Revised Offer #6

5.00 4.00 3.08 4.35 5.0 The Transaction Incorporates Key Minority Shareholder & Corporate Governance Protections 3 STRICTLY CONFIDENTIAL

19 Transaction Includes Key Minority Shareholder & Corporate Governance Protections Transaction Agreement includes minority protections and many corporate governance protections: ▪ Strong and independent Board : ─ Three individuals who currently serve as MDC independent directors will serve as directors on the Board of Directors of the C omb ined Company ─ Seven of the nine members of the Board of Directors of the Combined Company will be independent during the Post - Closing Governance Period ─ An affiliate of Goldman Sachs will have the right to nominate one director to serve on the Combined Company Board ▪ Continuing Independent Directors will Comprise Majority of Nominating and Corporate Governance Committees: During the Post - Closing Governance Period, the Combined Company’s Audit, Compensation and Nominating & Corporate Governance Committees will be comprised exclusively of the Independent Directors and the Nominating & Corporate Governance Committees will be comprised of two of the three Continuing Independent Directors and one additional independent director ▪ Minority Shareholders Have Significant Input on the Board: During the Resignation Requirement Period, any director (including Stagwell’s designees) who receives more “withhold” votes than “for” votes from the minority shareholders (i.e., shareholders other than Stagwell and its affilia tes ) in an uncontested election must tender his or her resignation to the Board of Directors ▪ Restrictions on Related Party Transactions: During the Restricted Period, the Combined Company will be prohibited from entering into certain related party transactions without the approval of a majority of the independent directors serving on the Combined Company Board ▪ “Majority of the Minority” Voting Rights: During the Restricted Period, the Combined Company’s bylaws (in addition to the Transaction Agreement) will further generally prohibit the Combined Company from entering into any proposed business combinations involving Stagwell or its affil iat es without: ─ (A) the approval of the Combined Company stockholders representing a “majority of the minority” of the voting power of the Co mbi ned Company, and ─ (B) the creation of a special committee of independent directors with authority similar to that of the MDC Special Committee ▪ Stagwell Lock - Up: Following the Combination, there will be a 6 - month lock - up period before Stagwell’s membership interests in OpCo are exchangeabl e for Class A Common Shares or cash 3 STRICTLY CONFIDENTIAL Note: Definitions of “Post - Closing Governance Period,” “Resignation Requirement Period,” and “Restricted Period” set forth in a nnex.

5.00 4.00 3.08 4.35 5.0 The Transaction Creates Significant Value for MDC Shareholders 4 STRICTLY CONFIDENTIAL

21 Summary of Value Approach 4 ▪ The Special Committee sought to understand relative valuations of MDC and Stagwell ─ An all - stock transaction must be evaluated on a relative Basis; relative value implies fair equity splits ─ The Special Committee considered the relative value calculated using a number of traditional value methodologies ▪ Additionally , the Special Committee also evaluated the transaction on a Has/Gets basis ─ What is the incremental value that will be created (through synergies, lower cost of capital, etc.) for shareholders by virtue of the transaction ▪ On July 8, 2021, Moelis & Company LLC (“Moelis”) delivered a fairness opinion to the MDC Special Committee that, as of that date an d subject to the assumptions, limitations and qualifications stated in such opinion, the Post - Transaction Ownership Percentage (31 %) of the Combined Company to be held by the holders of MDC Canada Common Shares upon completion of the Proposed Transactions was fair to the holders of MDC Canada Co mmon Shares (other than the Interested Shareholders). ─ The full text of Moelis’ written opinion can be found in the Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus on Form 8 - K filed by MDC with the SEC on 7/12/2021. STRICTLY CONFIDENTIAL

22 20.9% 20.8% 38.7% 39.0% 0.0% 25.0% 50.0% 2022E 2021E Implied Relative Contribution of MDC and Stagwell Based on Benchmarking to Peers 4 Source: CapitalIQ as of 7/9/2021, Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the P roxy Statement/Prospectus on Form 8 - K filed by MDC with the SEC on 7/12/2021 Note: Uses Low - High / High - Low ownership range implied by low end of Existing MDC Canada Common Shares and high end of Stagwell valuation, and vice versa; Does not give effect to the conversion of Series 4 and Series 6 Preferred Shares . EV/EBITDA multiples based on EBITDA less stock based compensation (“SBC”). STRICTLY CONFIDENTIAL ▪ 2021E Adj. EBITDA Multiple ─ MDC: 7.5x – 9.5x ─ Stagwell: 9.5x – 11.5x MDC Canada Common Shares Ownership: ~31% ▪ The lower end of MDC’s multiple range is informed by MDC’s current trading levels (7.8x 2021E EBITDA and 7.1x 2022E EBITDA) ▪ The higher end of MDC’s multiple range is informed by management's long - term growth forecast being generally in - line with Omnicom and IPG and justifies a multiple range in - line with peers ▪ Stagwell is valued at a two - turn premium to MDC’s multiples due to Stagwell’s greater concentration in higher growth digital, political and research agencies (please refer to the following pages for benchmarking analysis) ▪ On a relative contributions analysis, MDC is contributing between ~21% and ~39% of the equity value of the combined company and is receiving ~31% of the common equity ownership ▪ 2022E Adj. EBITDA Multiple ─ MDC: 7.0x – 9.0x ─ Stagwell: 9.0x – 11.0x Based on market prices, MDC is combining with Stagwell’s businesses at an attractive implied valuation

23 ▪ 52 - week Trading Range : Prior to Stagwell’s initial proposal on June 25, 2020, MDC traded in a 52 - week range of $1.01 - $ 3.43 per share. Since then MDC has traded up to $6.37 and is trading at $5.25 as of July 9, 2021 ▪ Implied Value of Stagwell Based on MDC Current Trading Value : Based on the current trading price of MDC, the implied multiple of Stagwell is attractive ▪ Benchmarking vs. Selected Publicly Traded Companies : Stagwell compares favorably to the selected publicly traded companies on both growth and margins ▪ Liquidity: MDC’s trading volume had been declining for years prior to the announcement of Stagwell’s initial proposal, reaching a low of just $0.5M per day; value traded has improved materially since ▪ Visibility: MDC did not qualify for inclusion in the Russell 2000 in 2020 and lacks sell - side research coverage ▪ Leverage: MDC’s leverage on a standalone basis is higher than its peers, making continued growth through acquisitions difficult ▪ Pro Forma Financial Profile : On a pro forma basis, MDC will have a leading growth and margin profile Other Markers the Special Committee Considered 4 STRICTLY CONFIDENTIAL

24 ($ in millions, except per share values) MDC Share Price $5.25 (✕) Shares Issued to Stagwell 180.0 Implied Stagwell Equity Value $945 (+) Stagwell Net Debt¹ $313 Implied Stagwell TEV $1,258 TEV / 2021E Pol. Avg. EBITDA 7.7x TEV / 2022E Pol. Avg. EBITDA 6.9x 2021E EBITDA Margin² 16.6% 2021E Net EBITDA Margin³ 21.8% 2021E - 2023E Revenue Growth 8.4% Implied Value of Stagwell Based on MDC Market Prices 4 Source: CapitalIQ as of 7/9/2021, Company projections as disclosed in the definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus on Form 8 - K filed by MDC with the SEC on 7/12/2021 Note: Based on MDC Disinterested Senior Executives projections for MDC, Updated Revised Stagwell Forecast political average figures for Stagwell. EV/EBITDA multiples based on EBITDA less SBC. 1. MDC Net Debt includes $20M Revolving Credit Facility, $870M Senior Unsecured Notes, $131M Series 6 Preferred, $59M Series 4 P ref erred, $11M Equity Investments, $65M Noncontrolling Interest, $93M Deferred Acquisition Consideration and $113M Cash & Equivalents as of 3/31/2021; Stagwell Net Debt includes $285M Closing Net Debt, $2 5M Deferred Acquisition Consideration and $3M of Adjustments as of 3/31/2021; excludes transaction pro forma adjustments 2. EBITDA margin for Stagwell based on implied GAAP revenue from pro forma company guidance 3. Based on 2021E Political Average Based on market prices, MDC is combining with Stagwell’s businesses at an attractive implied valuation STRICTLY CONFIDENTIAL MDC Partners Stagwell ▪ The implied EBITDA multiples in the transaction are essentially in line - between MDC and Stagwell ▪ Yet, Stagwell has higher margins and has had (and is projecting) significantly stronger topline growth than MDC ▪ Stagwell also has a greater portion of its revenue and EBITDA from digital segments and other attractive, high - growth services ▪ Stagwell has less leverage and more financial flexibility than MDC ($ in millions, except per share values) MDC Share Price $5.25 (✕) Fully Diluted Shares Outstanding 81.4 MDC Equity Value $427 (+) MDC Net Debt¹ $1,114 MDC TEV $1,541 TEV / 2021E EBITDA 7.8x TEV / 2022E EBITDA 7.1x 2021E EBITDA Margin 15.8% 2021E Net EBITDA Margin 18.6% 2021E - 2023E Revenue Growth 5.0%

25 15.8% 16.6% 18.6% 21.8% 21.8% 18.2% 16.3% 16.2% 16.0% 23.7% 19.2% (6.9%) (6.9%) 1.9% 2.8% 6.3% (1.8%) (2.4%) 35.2% N/A (13.9%) 29.1% (4.8%) (6.3%) (7.3%) (11.1%) (11.1%) 20.1% (3.4%) Q1 2020A Stagwell Compares Favorably When Benchmarked to Peers 4 Stagwell Experiencing High Levels of Growth Compared to Peers Combining with Stagwell’s Businesses is Accretive to MDC’s Margin Source: Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus on Form 8 - K filed by MDC with the SEC on 7/12/2021, Capital IQ as of 7/9/2021 Note: Based on MDC Disinterested Senior Executives projections for MDC, Updated Revised Stagwell Forecast political average figures for Stagwell as presented in Exhibit 99.2 to Form 8 - K and Thomson research estimates for other companies 1. EBITDA margin for Stagwell based on implied GAAP revenue from pro forma company guidance 2021E EBITDA Margin Organic Growth (2020 and Most Recent Quarter) STRICTLY CONFIDENTIAL 1 Net Margin

26 5.0% 8.4% 4.7% 4.5% 3.9% 3.3% 2.5% 22.5% 7.9% Stagwell Compares Favorably When Benchmarked to Peers ( cont.d ) 4 Combination with Stagwell’s Businesses Improves MDC Growth Trajectory to Align with More Digitally - Focused Agencies Source: Capital IQ as of 7/9/2021, Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus on Fo rm 8 - K filed by MDC with the SEC on 7/12/2021 Note: Based on MDC Disinterested Senior Executives projections for MDC, Updated Revised Stagwell Forecast political average figures for Stagwell as presented in Exhibit 99.2 to Form 8 - K and Thomson research estimates for other companies 1. 2021E revenue represents consensus estimates does not reflect pro forma adjustments for their various acquisitions during yea r 1 2021E – 2023E Revenue Growth STRICTLY CONFIDENTIAL

27 Selected Publicly Traded Marketing Services Companies Data 4 Source: Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospectus on Form 8 - K filed by MDC with the SEC on 7/12/2021, Capital IQ as of 7/9/2021 Note: EV/EBITDA multiples based on EBITDA less SBC. 1. LTM figures represent 2020 results 2. Represents unaffected share price data (6/25/2020) 3. LTM figures as of 1/31/2021 4. Revenue growth and EBITDA margin shown on a political average basis; 5. EBITDA margin based on GAAP revenue 6. EBITDA margin based on net revenue STRICTLY CONFIDENTIAL ($ in millions) Share Price Market Enterprise TEV / EBITDA Organic Growth Revenue Growth 2021E EBITDA Company 7/9/2021 Cap Value 2021E 2022E Q1 2020A 21E - '23E 22E - '23E Margin Ad Agency Holding Companies Omnicom $80.05 $17,503 $19,062 8.4x 8.0x (1.8%) (11.1%) 3.3% 3.3% 16.0% WPP¹ 13.38 16,110 17,675 7.3x 6.7x 6.3% (7.3%) 3.9% 3.7% 16.2% Publicis¹ 63.07 15,752 18,022 6.7x 6.5x 2.8% (6.3%) 2.5% 2.0% 21.8% Dentsu 36.30 10,222 10,611 7.2x 6.1x (2.4%) (11.1%) 4.5% 4.4% 16.3% IPG 33.08 13,425 15,136 9.6x 9.2x 1.9% (4.8%) 4.7% 6.1% 18.2% Mean 7.9x 7.3x 1.4% (8.1%) 3.8% 3.9% 17.7% Median 7.3x 6.7x 1.9% (7.3%) 3.9% 3.7% 16.3% MDC Partners (Unaffected)² 1.15 87 1,201 6.1x 5.5x (6.9%) (13.9%) 5.0% 3.5% 15.8% / 18.6% MDC Partners (Current) 5.25 427 1,541 7.8x 7.1x (6.9%) (13.9%) 5.0% 3.5% 15.8% / 18.6% Other Marketing Services Companies S4 Capital¹ $9.06 $5,145 $5,169 32.4x 25.5x 35.2% 20.1% 22.5% 21.8% 19.2% Next Fifteen³ 12.86 1,253 1,306 12.6x 11.4x N/A (3.4%) 7.9% 7.7% 23.7% Implied Value of Stagwell Based on MDC Market Prices Stagwell 4 $945 $1,258 7.7x 6.9x (6.9%) 29.1% 8.4% 7.5% 16.6% / 21.8% 5 5 5 6 6 6 Based on market prices, MDC is combining with Stagwell’s businesses at an attractive implied valuation

28 Transaction Represents Significant Premiums of Over 350% to Unaffected 4 STRICTLY CONFIDENTIAL Source: Capital IQ as of 7/9/2021 MDC Has Seen Greater Share Price Appreciation Than Its Peers Since Original Stagwell Letter on June 25, 2020 357% 52% 57% 92% 57% 101% 157% 141% 144% 30% 19% 28% 23% 38% 29% 85% Since Unaffected (6/25/2020) Since Annoucement (12/18/2020) Total Share Price Return

5.00 4.00 3.08 4.35 5.0 The Transaction Received Positive Market Reaction as Demonstrated by Share Price Appreciation 5 STRICTLY CONFIDENTIAL

30 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 Jun-20 Aug-20 Nov-20 Jan-21 Apr-21 Jul-21 $5.25 ▪ Meaningful upside exists – We believe the current share price does not reflect the full upside potential from the transaction ─ The current price is depressed as a result of perceived transaction uncertainty ─ Significant additional upside exists from achieving the combined company’s financial forecast ─ No equity research coverage as a resource for investors MDC Stock Price Reflects Broad Support for the Transaction A D B ▪ June 25, 2020 : Stagwell submits initial proposal to acquire MDC. One - Day Stock Price Reaction: +78% ▪ October 6, 2020 : Stagwell publishes press release noting a tentative agreement was settled upon at 26% ownership for MDC. One - Day Stock Price Reaction: +14% ▪ December 21, 2020 : MDC and Stagwell announce a transaction at 26% ownership for MDC. One - Day Stock Price Reaction: +15% ▪ March 9, 2021 : Stagwell reports FY 2020 earnings. One - Day Stock Price Reaction: +10% ▪ May 5, 2021 : MDC Stagwell report Q1 2021 earnings. One - Day Stock Price Reaction: +9% ▪ June 6, 2021 : Stagwell presents revised offer for 196.250mm shares. One - Day Stock Price Reaction: +3% ▪ June 14, 2021 : Stagwell presents revised offer for 185.000mm shares. One - Day Stock Price Reaction: +1 % ▪ July 9, 2021 : Amendment No. 2 filed, revised offer for 180.000mm shares One - Day Stock Price Reaction: +1 % A B C C D Market has reacted favorably to every deal announcement; MDC has delivered shareholder returns of 142% over the last year and 357% since June 25 announcement E E 5 F F Source: Definitive Proxy Statement/Prospectus on Form 424B3 as supplemented by the Supplement to the Proxy Statement/Prospect us on Form 8 - K filed by MDC with the SEC on 7/12/2021, CapitalIQ as of 7/9/2021 G G STRICTLY CONFIDENTIAL H H

31 50.0 75.0 100.0 125.0 - 5.0% 10.0% 15.0% 20.0% 25.0% Jul-19 Nov-19 Apr-20 Sep-20 Feb-21 Jul-21 Yield Price 5.9% 101.3 Transaction has Reduced Uncertainty and Reduced MDC Borrowing Costs ▪ Before Stagwell’s initial proposal in June 2020, MDC’s debt was yielding over 10% and spiked to over 20% in March 2020; curre nt debt yield is 5.9% MDC’s notes were trading at distressed levels (~$0.60 - 0.70 range in March/April 2020) within the last two years We believe this indicates that the debt capital markets view the transaction favorably A A “…we could raise our ratings on MDC by one notch at the close of its merger with Stagwell because we expect the combined company's pro forma leverage could decline to the low - 4x area under the proposed deal terms.” – S&P Global Ratings Report, Mar 25, 2021 Source: Bloomberg as of 7/9/2021 5 STRICTLY CONFIDENTIAL Average Before 3/11/2020 3-Month 6-Month 12-Month Current Yield 9.8% 9.5% 9.8% 5.9% Price 91.4 91.9 90.4 101.3

32 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 Jan-17 Jul-17 Feb-18 Sep-18 Apr-19 Oct-19 May-20 Dec-20 Jul-21 30 - Day Average Daily Volume x Closing Price ($ in 000s) Pro Forma Increase in Market Cap May Boost MDC’s Trading Liquidity Daily trading value (i.e. dollar volume) has rarely exceeded $1 million since early 2019, leading to significant barriers to entry for institutional investors. Jan 1, 2017 – Jun 25, 2020 90% decline in daily trading value from beginning of 2017 through first announcement of potential merger Jun 25, 2020 Announcement of possible combination of Stagwell and MDC Dec 22, 2020 – July 9, 2021 1,359% increase following signing of the deal Source: Capital IQ as of 7/9/2021 5 STRICTLY CONFIDENTIAL

5.00 4.00 3.08 4.35 5.0 Appendix: Response to Investor Questions and Other Information STRICTLY CONFIDENTIAL

34 Indaba’s Opposition to the Deal Is Based on Faulty Arguments Questions/Concerns Summary of Responses Valuation ▪ MDC is not being valued fairly in the transaction ▪ In a stock merger involving two strategic entities, a relative contributions analysis is the appropriate measure of fairness ▪ The parties’ equity contribution to the new entity in line with their share of the pro forma equity ownership ▪ MDC is “buying” Stagwell at a low multiple ▪ Indaba has not provided a single analysis to show that its 35% split to MDC is appropriate or should be acceptable to Stagwell Control Premium ▪ Does the proposed transaction reflect a control premium for MDC shareholders? ▪ MDC has historically traded at a discount and is now trading in line with peers ▪ The transaction - impacted current share price represents a ~350% premium to the unaffected share price Conflicts ▪ Mark Penn is “rooting” for Stagwell ▪ MDC’s independent Special Committee was created to address conflicts of interest and conducted a rigorous process ▪ The Special Committee negotiated at arm’s length from Mr. Penn to ensure MDC shareholders received the best deal possible and extracted substantial concessions from Stagwell relative to Stagwell’s original proposal ▪ The Special Committee was able to get Stagwell to increase its offer seven times and the final transaction terms represent a ~67% increase over Stagwell’s initial offer Shareholder Reception ▪ The deal has been poorly received by shareholders ▪ The stock has rallied on the news of the deal and its appreciation has far outpaced the peers and the market 1 2 3 4 STRICTLY CONFIDENTIAL

35 Series 6 Preferred Shares Voting Rights STRICTLY CONFIDENTIAL ▪ Holders of the Series 6 shares will be granted a one - time, increased - voting right, only with respect to the Up - C reorganization merger and no other matters ▪ Granting such voting right is necessary to achieve the optimal timeline for the transaction and dispense with the convening of an additional meeting of the MDC shareholders following MDC’s redomiciliation to Delaware that would otherwise be triggered solely to approve the Up - C reorganization merger, which shouldn’t be necessary given the vote MDC shareholders will already have on the transaction and benefits of the Up - C structure ▪ Effecting such merger is necessary in order to put in place the Up - C structure of the combined company, which is expected to produce benefits for the combined company, including the right to receive 15% of the tax benefits under the tax receivables agreement ▪ Following the consummation of the Up - C reorganization merger, the Series 6 shares will not have any further voting rights, except as required by Delaware law

36 Certain Defined Terms STRICTLY CONFIDENTIAL The following capitalized terms have the meanings set forth below: ▪ “ Post - Closing Governance Period ” means the period, commencing at the closing of the transaction and continuing until such time as Stagwell and its affiliates collectively beneficially own 10% or less of the then - issued and outstanding outstanding voting securities of the Combined Company. ▪ “ Resignation Requirement Period ” means any period during which Stagwell and its affiliates collectively beneficially own 30% or more of the then - issued and outstanding voting securities of the Combined Company ▪ “ Restricted Period ” means the any period during which Stagwell and its affiliates collectively beneficially own more than 10% of the Combined Company’s then - issued and outstanding voting securities, (y) Stagwell has nominated directors constituting a majority of the Board, or (z) Stagwell has the contractual right to appoint a majority of the Board