Attached files

Table of Contents

As filed with the Securities and Exchange Commission on July 7, 2021.

Registration No. 333-257193

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

F45 Training Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7997 | 38-3978689 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

F45 Training Holdings Inc.

801 Barton Springs Road, 9th Floor

Austin, Texas 78704

(737) 787-1955

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Adam J. Gilchrist

President and Chief Executive Officer

F45 Training Holdings Inc.

801 Barton Springs Road, 9th Floor

Austin, Texas 78704

(737) 787-1955

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Peter W. Wardle | Tad J. Freese | |

| Daniela L. Stolman | Brian D. Paulson | |

| Gibson, Dunn & Crutcher LLP | Latham & Watkins LLP | |

| 333 South Grand Avenue | 140 Scott Drive | |

| Los Angeles, CA 90071 | Menlo Park, CA 94025 | |

| (213) 229-7000 | (650) 328-4600 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

| Non-accelerated filer | ☑ | Smaller reporting company | ☑ | |||||

| Emerging growth company | ☑ | |||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Common Stock, $0.00005 par value per share |

23,359,375 | $17.00 | $397,109,375 |

$43,325(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 3,046,875 shares that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | Of this amount, $10,910 has previously been paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 7, 2021

PRELIMINARY PROSPECTUS

20,312,500 Shares

F45 Training Holdings Inc.

Common Stock

This is the initial public offering of shares of common stock of F45 Training Holdings Inc.

We are offering 18,750,000 shares of our common stock. The selling stockholder identified in this prospectus, is offering 1,562,500 shares of common stock. We will not receive any proceeds from the sale of common stock being sold by the selling stockholder.

Prior to this offering, there has been no public market for our common stock. The initial public offering price is expected to be between $15.00 and $17.00 per share. We have applied to list our common stock on the New York Stock Exchange under the symbol “FXLV.”

We are an “emerging growth company” and a “smaller reporting company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced disclosure requirements for this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company and Smaller Reporting Company.”

Our current major stockholders, including certain of our directors and officers, who will beneficially own approximately 72.4% of our outstanding common stock after this offering (or approximately 69.3% if the underwriters exercise in full their option to purchase additional shares of common stock), will be able to control or substantially influence corporate decisions following this offering.

One or more funds affiliated with Caledonia have indicated an interest in purchasing an aggregate of up to $100.0 million in shares of our common stock in this offering at the initial public offering price. Because this indication of interest is not a binding agreement or commitment to purchase, one or more funds affiliated with Caledonia could determine to purchase more, less or no shares in this offering or the underwriters could determine to sell more, less or no shares to one or more funds affiliated with Caledonia. The underwriters will receive the same discount on any of our shares of common stock purchased by one or more funds affiliated with Caledonia as they will from any other shares of common stock sold to the public in this offering.

Investing in our common stock involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 24 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholder |

$ | $ | ||||||

| (1) | See “Underwriting (Conflicts of Interest)” beginning on page 176 for additional disclosure regarding underwriting discounts and commissions and estimated offering expenses. |

We have granted to the underwriters an option to purchase up to 625,000 additional shares of common stock and the selling stockholder has granted the underwriters an option to purchase up to 2,421,875 shares of common stock, in each case at the initial public offering price, less the underwriting discounts and commissions, solely to cover overallotments.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2021.

| Goldman Sachs & Co. LLC | J.P. Morgan | |

| Baird | Cowen | Guggenheim Securities | Macquarie Capital | Roth Capital Partners |

Prospectus dated , 2021.

Table of Contents

TEAM TRAINING LIFE CHANGING

Table of Contents

OUR MISSION IMPROVE PEOPLE’S LIVES WITH THE WORLD’S BEST FUNCTIONAL WORKOUT

Table of Contents

“I fell in love with the energy. I fell in love with the sense of community.” Mark Wahlberg

Table of Contents

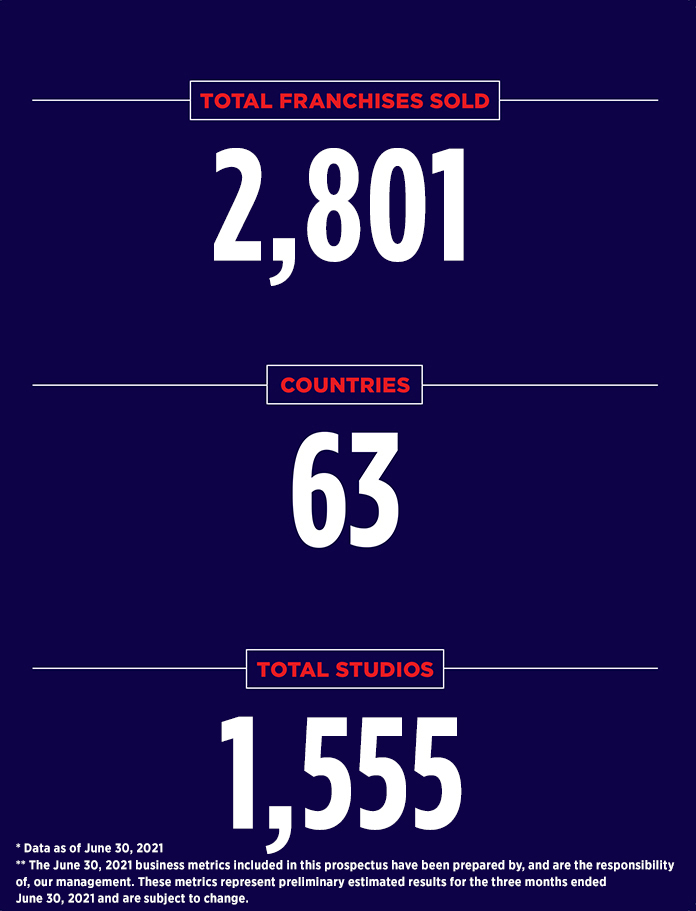

TOTAL FRANCHISES SOLD 2,801 COUNTRIES 63 TOTAL STUDIOS 1,555 * Data as of June 30, 2021 **The June 30, 2021 business metrics included in this prospectus have been prepared by, and are the responsibility of, our management. These metrics represent preliminary estimated results for the three months ended June 30, 2021 and are subject to change.

Table of Contents

FUNCTIONAL 45

Table of Contents

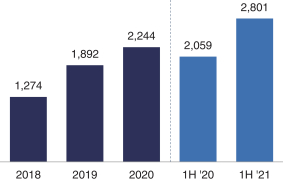

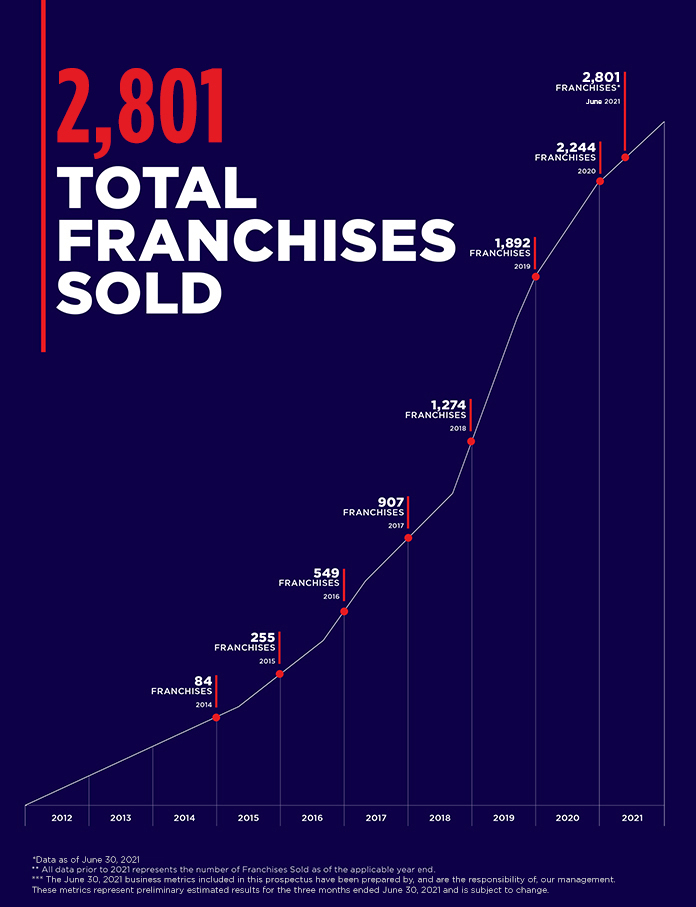

2,801 TOTAL FRANCHISES SOLD 84 FRANCHISES 2014 255 FRANCHISES 2015 549 FRANCHISES 2016 907 FRANCHISES 2017 1,274, FRANCHISES 2018 1,892 FRANCHISES 2019 2,244 FRANCHISES 2020, TOTAL FRANCHISES SOLD 2,247 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 255 FRANCHISES 2015 2017 907 FRANCHISES 2018 1,274 FRANCHISES 2019 1,892 FRANCHISES 2020 2,244 FRANCHISES March 2021 2,247 FRANCHISES 84 FRANCHISES 2014 2016 549 FRANCHISES ** All data prior to 2021 represents the number of Franchises Sold as of the applicable year end. *Data as of June 30, 2021 **The June 30, 2021 business metrics included in this prospectus have been prepared by, and are the responsibility of, our management. These metrics represent preliminary estimated results for the three months ended June 30, 2021 and is subject to change.

Table of Contents

| Page | ||||

| ii | ||||

| 1 | ||||

| 24 | ||||

| 65 | ||||

| 67 | ||||

| 69 | ||||

| 70 | ||||

| 72 | ||||

| 74 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

77 | |||

| 109 | ||||

| 130 | ||||

| 142 | ||||

| 150 | ||||

| 161 | ||||

| 164 | ||||

| 169 | ||||

| 171 | ||||

| 176 | ||||

| 183 | ||||

| 183 | ||||

| 183 | ||||

| F-1 | ||||

Neither we, the selling stockholder nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus we have prepared. We, the selling stockholder and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the selling stockholder are offering to sell, and seeking offers to buy, shares of common stock only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock.

For investors outside the United States: Neither we, the selling stockholder nor the underwriters have done anything that would permit this offering or the possession or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus outside the United States.

i

Table of Contents

Industry, Market and Other Data

This prospectus contains estimates, projections and other information concerning our industry, our business, our franchises and the markets for our products and services. Some data and statistical information are based on independent reports from third parties, including the International Health, Racquet & Sports Club Association, or IHRSA, and a member survey with 4,184 respondents that we conducted in October 2017.

Some data and other information related to our franchisees, including estimated initial investment, EBITDA margins and average unit volumes, are based on internal estimates and calculations that are derived from research we conducted. In order to determine certain franchise and studio-level information, we conducted a survey of our franchisees, or the Franchise Survey, in July 2019, which only reflects data from prior to the outbreak of COVID-19. This survey was provided to the franchisees of all studios at the time that the survey was conducted and generated responses from franchisees representing approximately 57% of studios across our global network of studios. In generating the data, estimates and calculations derived from the information provided by these respondents, we excluded certain responses that were incomplete or that we determined to be significant outliers. As a result, while we believe that the data and other information related to our franchisees presented in this prospectus are accurate and reliable, such data and other information are based on responses provided by a limited respondent pool, which may not represent the broader network of franchisees, and that have not been independently verified by us or any independent sources. Such data also does not reflect any impacts on our business or franchisees from COVID-19 or otherwise after July 2019.

We believe the information described in the paragraphs above to be accurate as of the date of this prospectus. However, this information generally involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such information, estimates or projections. Industry publications and other reports we have obtained from independent parties generally state that the data contained in these publications or other reports have been obtained in good faith or from sources considered to be reliable, but they do not guarantee the accuracy or completeness of such data. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in the sections titled “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the projections and estimates made by the independent third parties and us.

Trademarks, Trade Names and Service Marks

This prospectus includes some of our trademarks, trade names and service marks, including F45, F45 Training and the names of certain of our workouts and products. Each one of these trademarks, trade names or service marks is either our registered trademark, a trademark for which we have a pending application, a trade name or service mark for which we claim common law rights or a registered trademark or application for registration which we have been authorized by a third party to use.

Solely for convenience, the trademarks, service marks and trade names included in this prospectus are without the ®, ™ or other applicable symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

ii

Table of Contents

Certain Definitions

As used in this prospectus, unless otherwise noted or the context otherwise requires:

| • | “we,” “our,” “us,” “F45” and the “Company” refer to (i) for the period prior to the MWIG Transaction, the business of F45 Aus and (ii) for the period after the completion of the MWIG Transaction, the business of F45 Training Holdings, in each case together with its consolidated subsidiaries; |

| • | “F45 Aus” refers to F45 Aus Hold Co Pty Ltd, an Australia proprietary limited company; |

| • | “F45 Training Holdings” refers to F45 Training Holdings Inc., a Delaware corporation; |

| • | “MWIG” refers to a special purpose private investment fund vehicle led by FOD Capital LLC, a family office investment fund, and Mark Wahlberg; |

| • | “MWIG Transaction” refers to the series of transactions effectuated on March 15, 2019, pursuant to which MWIG acquired a minority interest in us; |

| • | “our convertible notes” refers to the $100.0 million aggregate principal amount of convertible notes issued by us pursuant to the Convertible Credit Agreement, dated as of October 6, 2020; and |

| • | “our convertible preferred stock” refers to our outstanding shares of convertible preferred stock, par value $0.0001 per share, held by MWIG. |

Non-GAAP Financial Information

Certain financial measures presented in this prospectus, such as EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are not recognized under U.S. generally accepted accounting principles, or GAAP. We define these terms as follows:

| • | “EBITDA” means, for any reporting period, net income before interest, taxes, depreciation and amortization. |

| • | “Adjusted EBITDA” means, for any reporting period, net income before interest, taxes, depreciation and amortization and adjusted to exclude the impact of sales tax liability, transaction expenses, certain legal costs and settlements, forgiveness of loans to directors and relocation costs as well as certain other items identified as affecting comparability, when applicable. |

| • | “Adjusted EBITDA margin” means, for any reporting period, Adjusted EBITDA, divided by revenue. |

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin have been included in this prospectus because they are important metrics used by management as one of the means by which it assesses our financial performance. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are also frequently used by analysts, investors and other interested parties to evaluate companies in our industry. These measures, when used in conjunction with related GAAP financial measures, provide investors with an additional financial analytical framework that may be useful in assessing our company and its results of operations.

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are supplemental measures of financial performance that are not required by, or presented in accordance with, GAAP. These non-GAAP metrics have certain limitations and should not be considered as alternatives to financial measures prepared in accordance with GAAP, such as net income, or as measures of financial performance or

iii

Table of Contents

any other performance measure derived in accordance with GAAP or as measures of liquidity. These measures also should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items for which these non-GAAP measures make adjustments. Management compensates for these limitations by using EBITDA, Adjusted EBITDA and Adjusted EBITDA margin as supplemental financial metrics and in conjunction with our results prepared in accordance with GAAP. Other companies, including other companies in our industry, may not use such measures or may calculate one or more of the measures differently than as presented in this prospectus, limiting their usefulness as a comparative measure.

The non-GAAP information in this prospectus should be read in conjunction with our audited annual financial statements and the related notes included elsewhere in this prospectus. For a reconciliation of the most directly comparable GAAP measures, see “Prospectus Summary—Summary Historical Combined and Consolidated Financial and Other Data.”

Additional Financial Metrics and Other Data

| • | “Average Unit Volume” or “AUV” means average studio-level revenue generated by a group of studios during a particular period of time. Due to the relatively young age of our studio base, we believe it is appropriate to assess AUV for studios that have been open for the full period for which AUV is calculated. We define a cohort as a group of studios that opened during the same full year and are also open and operational during the six months ended June 30, 2021. |

| • | “Cash-on-cash returns” means studio-level EBITDA over initial investment. |

| • | “Initial Studio Openings” means the number of studios that were determined to be first opened during such period. We classify an Initial Studio Opening to occur in the first month in which the studio first generates monthly revenue of at least $4,500. Initial Studio Openings are not adjusted downward for studios that were temporarily closed due to the COVID-19 pandemic or otherwise. |

| • | “Members” refers to the number of paying members who were billed $20 or more in membership fees in a given month. |

| • | “New Franchises Sold” means, for any specific period, the number of franchises sold during such period using the methodology set forth below for “Total Franchises Sold.” |

| • | “Open Studios” means the number of studios that were open for business as of a certain date. A studio may be classified as an Open Studio regardless of whether or not it generated minimum monthly revenue of $4,500. During the COVID-19 pandemic, a significant portion of our network was forced to temporarily close, which reduced the number of Open Studios. As studios re-open in accordance with state and local regulations, they are reflected in the Open Studios figures. |

| • | “Same store sales” means, for any reporting period, studio-level revenue generated by a comparable base of franchise studios, which we define as open studios that have been operating for more than 16 months. |

| • | “System-wide Sales” are defined as all payments made to our studios and includes payment for classes, apparel and other sales for a given period. We track System-wide Sales as an indication of the strength of our franchisee network. |

| • | “Total Franchises Sold” represents, as of any specified date, (i) the total number of signed franchise agreements in place as of such date for which an establishment fee has been paid and (ii) the total number of franchises committed in a multi-studio agreement in place as of such date for which an upfront payment has been made, in each case that have not been terminated. Each new franchise is included in the number of Total Franchises Sold from the date on which such franchise first satisfies the condition in clause (i) or (ii) above, as applicable. Total Franchises Sold includes franchise arrangements in all stages of development after signing a franchise agreement, and includes franchises with open studios. Franchises are removed from Total Franchises Sold upon termination of the franchise agreement. |

iv

Table of Contents

| • | “Total Studios” as of any specified date, means the total cumulative Initial Studio Openings as of that date less cumulative permanent studio closures as of that date. Total Studios are not adjusted downward for studios that were temporarily closed due to the COVID-19 pandemic or otherwise. |

| • | “Visits” means the number of registered individual workouts for any specified period. A workout is registered when the consumer checks into a class. |

v

Table of Contents

The following is a summary of material information discussed in this prospectus. This summary is not complete and does not contain all the information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes thereto included elsewhere in this prospectus, before making an investment decision to purchase shares of our common stock. Some of the statements in this summary constitute forward-looking statements. See “Special Note Regarding Forward-Looking Statements.”

Overview

We are F45 Training, one of the fastest growing fitness franchisors in the United States based on number of franchises sold in the United States, focused on creating a leading global fitness training and lifestyle brand. We offer consumers functional 45-minute workouts that are effective, fun and community-driven. Our workouts combine elements of high-intensity interval, circuit and functional training to offer consumers what we believe is the world’s best functional training workout. We deliver our workouts primarily through our digitally-connected global network of studios, and we have built a differentiated, technology-enabled platform that allows us to create and distribute workouts to our global franchisee base. Our platform enables the rapid scalability of our model and helps to promote the success of our franchisees. We offer consumers a continuously evolving fitness program in which virtually no two workouts are ever the same. Our vast and growing library of functional training movements allows us to vary workout programs to keep consumers engaged with fresh content, stay at the forefront of consumer trends and drive maximum individual results, while helping our members achieve their fitness goals.

We were founded in 2013 in Sydney, Australia. Our CEO and co-founder Adam Gilchrist recognized an opportunity to leverage technology to offer consumers an effective, multi-disciplinary and community-driven workout that serves as an affordable alternative to one-on-one personal training and repetitive, single-discipline studio classes. Soon after the first F45 Training studio opened in Paddington, Australia, our founders focused on using technology to streamline and standardize the F45 Training experience in order to franchise the business. We quickly expanded, initially selling franchises to members of the original studio, after which viral word-of-mouth marketing led to rapid growth, and we opened nearly 200 studios over the following 30 months. In less than eight years, we have scaled our global footprint to 2,801 Total Franchises Sold in 63 countries, including 1,555 Total Studios, of which 1,415 had re-opened following temporary closures related to the COVID-19 pandemic, as of June 30, 2021.

Our in-studio experience utilizes our proprietary technologies: our fitness programming algorithm and our patented technology-enabled delivery platform. Our fitness programming algorithm leverages a rich content database of over 3,900 unique functional training movements to offer new workouts each day. Our content delivery platform allows us to standardize the F45 Training experience across our global footprint and broadcast content, including workout instructions and timing, directly to our in-studio F45TVs and speaker systems. Our in-studio experience is further enhanced by trainers who provide guidance on proper form and movement, as well as motivate our members and foster a positive sense of community. We believe our approach helps to provide a consistent and high-quality fitness experience across our network of studios, keeping members highly engaged and helping them to achieve and sustain their fitness goals.

1

Table of Contents

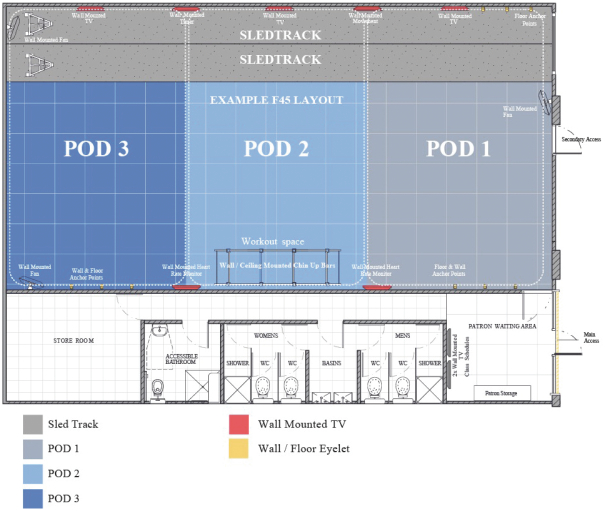

We operate a nearly 100% franchise model that offers compelling economics to us and our franchisees. We believe our franchisees generally benefit from a relatively low initial investment and low four-wall operating expenses, which in turn can generate strong returns on franchisee investments. The optimized box layout of our studios, which requires as little as approximately 1,600 square feet of training area, contributes to the relatively low initial investment and operating costs of our franchisees, and allows our studios to be located in a wide array of attractive prospective retail locations. We believe this flexibility will enable us to capitalize on our estimated long-term global opportunity of over 23,000 studios. Based on the Franchise Survey conducted prior to the COVID-19 pandemic, we estimate that a typical F45 Training franchise in a normalized operating environment requires an aggregate initial investment of approximately $315,000 and, in its third year of operation can produce average EBITDA margins in excess of 30% and average cash-on-cash returns in excess of 33%.

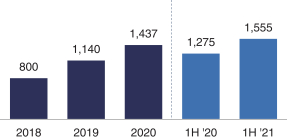

We believe our franchise model is attractive due to its potential for asset-light growth, strong profitability and robust cash flow generation, and has helped to facilitate our rapid growth and strong financial performance prior to the COVID-19 pandemic. Despite challenges posed by the COVID-19 pandemic, we grew our footprint and experienced minimal permanent closures during 2020, which we believe underscores the resilience of our business model. Between 2018 and 2020 we grew our Total Franchises Sold at the annual rate of 33% and our Total Studios at the rate of 34%. From June 30, 2020 to June 30, 2021, our Total Franchises Sold increased by 36% and our Total Studios increased by 22%.

| Total Franchises Sold (as of period end)

|

Total Studios (as of period end)1 | |

|

|

|

| ¹ | Due to the lead time associated with opening a new studio after a franchise is sold, Total Franchises Sold is always greater than Total Studios as of a certain date. Of our 1,555 Total Studios as of June 30, 2021, we had 1,415 Open Studios, which are studios that were open for business. |

Impact of the COVID-19 Pandemic

The COVID-19 pandemic, related shelter-in-place restrictions and other containment efforts have had and continue to have a significant impact on the gym and fitness industry generally, as well as our business, financial condition and results of our operations. Following the outbreak of the pandemic and at its initial peak, nearly all of our studios temporarily closed pursuant to local, state and federal mandates and guidelines.

2

Table of Contents

Over the course of the pandemic, we developed new programs to support our franchisee network and maintain member engagement. In order to support franchisees, we launched several programs, including training seminars on government assistance, promotional offerings, support with rent deferrals, franchise fee relief and assistance with reopening plans. To maintain member engagement, we launched the F45 AtHome Challenge and helped franchisees develop live-streaming options. We also released a digital platform in response to temporary studio closures called F45 AtHome Workouts. This platform provides members with the ability to access part of F45’s library of fitness and wellness offerings, and allows users to maintain their engagement with F45 at home during temporary studio closures. These strategies proved to be successful in driving engagement with, and retention of, our members during the pandemic, but we do not currently expect to further develop or focus on our at home offering as our studios continue to re-open in full. As of June 30, 2021, our total membership stood at 13% higher compared to December 31, 2019, while 9% of our network remained temporarily closed.

As businesses have been allowed to re-open in certain jurisdictions pursuant to local and state mandates, we have worked closely with our franchisees in helping to re-open their studios subject to certain indoor capacity and other restrictions, including company-implemented health and safety policies. We have also been providing additional operating guidance to our franchisees by assisting with modifications to studio layouts and workouts to accommodate proper social distancing.

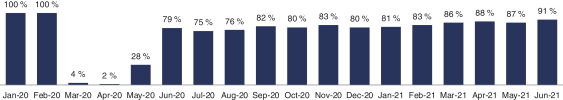

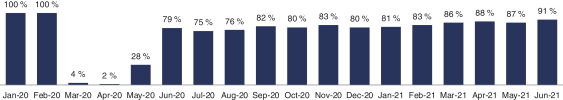

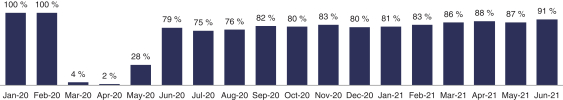

As of June 30, 2021, we had approximately 1,415 Open Studios, which represented 91% of our Total Studios. The remaining 9% of our Total Studios are generally located in regions that continue to face restrictions, which we expect to be lifted over time. The following chart illustrates the number of Open Studios as a percentage of Total Studios at the end of each month for the 18 months ended June 30, 2021.

Open Studios as a Percentage of Total Studios for the 18 Months Ended June 30, 2021

We have found that, on average, studios that have re-opened following temporary closure quickly return close to pre-pandemic levels on a weekly revenue basis, and eventually exceed pre-pandemic levels on the same basis. As of June 30, 2021, the median weekly revenue of the 618 studios that have been re-opened the longest since temporary closure exceeded pre-pandemic levels.

We believe our performance over the course of the pandemic has underscored the resilience of our business model. While our revenues decreased to $82.3 million for the year ended December 31, 2020 compared to $92.7 million for the year ended December 31, 2019 due to the pandemic, between February 1, 2020 and June 30, 2021, only 19 studios permanently closed due to financial hardship or otherwise, which represents approximately 1% of our Total Studios as of June 30, 2021. Additionally, only approximately 9% of our Total Backlog Studios, which is the difference between the Total Franchises Sold and Total Studios, terminated franchise agreements during that same period. These metrics compare favorably to the estimated 15% of all U.S. health clubs that had permanently closed as of September 30, 2020, according to IHRSA, as well as the estimated 25% that were expected to permanently close by the end of 2020.

3

Table of Contents

Despite challenges posed by the COVID-19 pandemic such as temporary closure of our studios, we successfully continued to sell new franchises and open new studios during 2020. Of the 909 New Franchises Sold during the 18 months ended June 30, 2021, 253 were sold as part of a limited-time promotional offer made exclusively to existing franchisees. The following tables illustrate the number of New Franchises Sold and Initial Studio Openings during the 18 months ended June 30, 2021.

| Monthly Total Franchises Sold for the 18 Months Ended June 30, 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JAN | FEB | MAR | APR | MAY | JUNE | JULY | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | APR | MAY | JUN | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Franchises Sold, beginning of period |

1,892 | 1,922 | 1,947 | 1,959 | 1,961 | 1,997 | 2,059 | 2,113 | 2,160 | 2,214 | 2,227 | 2,242 | 2,244 | 2,247 | 2,255 | 2,247 | 2,340 | 2,487 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Franchises Sold, net¹ |

30 | 25 | 12 | 2 | 36 | 62 | 54 | 47 | 54 | 13 | 15 | 2 | 3 | 8 | (8 | ) | 93 | 147 | 314 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Franchises Sold, end of period |

1,922 | 1,947 | 1,959 | 1,961 | 1,997 | 2,059 | 2,113 | 2,160 | 2,214 | 2,227 | 2,242 | 2,244 | 2,247 | 2,255 | 2,247 | 2,340 | 2,487 | 2,801 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Monthly Total Studios for the 18 Months Ended June 30, 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JAN | FEB | MAR | APR | MAY | JUNE | JULY | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | APR | MAY | JUN | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Studios, beginning of period |

1,140 | 1,186 | 1,224 | 1,242 | 1,241 | 1,249 | 1,275 | 1,300 | 1,337 | 1,376 | 1,404 | 1,422 | 1,437 | 1,452 | 1,463 | 1,487 | 1,515 | 1,539 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Initial Studio Openings, net¹ |

46 | 38 | 18 | (1 | ) | 8 | 26 | 25 | 37 | 39 | 28 | 18 | 15 | 15 | 11 | 24 | 28 | 24 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Studios, end of period |

1,186 | 1,224 | 1,242 | 1,241 | 1,249 | 1,275 | 1,300 | 1,337 | 1,376 | 1,404 | 1,422 | 1,437 | 1,452 | 1,463 | 1,487 | 1,515 | 1,539 | 1,555 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ¹ | New Franchises Sold and Initial Studio Openings shown net of 112 franchise terminations and 19 permanent studio closures that occurred during the 18 months ended June 30, 2021. For June 2021, New Franchises Sold includes 300 franchises sold pursuant to a long-term multi-unit studio development agreement with Club Franchise Group LLC. See “Certain Relationships and Related Party Transactions - Franchise Relationships.” |

There have been frequent changes and variation in local and state regulation of the health club industry, and many local and state jurisdictions have returned to shelter in place restrictions after allowing for health club re-openings. While we are optimistic about our ability to continue to effectively manage through the COVID-19 pandemic, we are unable to predict the duration or future impact of the pandemic on our business, financial condition and results of operations. For additional information on the impact of COVID-19 on our business, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—COVID-19 Impact.”

The Three Pillars of F45 Training

Our differentiated approach to fitness is firmly rooted in the three pillars of our DNA: Innovation, Motivation and Results.

Innovation: at the core of everything we do. We are dedicated to driving new innovations that will continue to elevate the F45 Training experience and further our position as a global fitness training and lifestyle brand. We are able to distinguish ourselves from competitors through such innovations as:

| • | Technology-Enabled Centralized Delivery Platform: Our technology-enabled centralized delivery platform distributes daily workout content via in-studio F45TVs that display proper |

4

Table of Contents

| exercise form, timing and sequencing, driving consistency and efficiency across our global network of studios. In-studio trainers coach members throughout their workout and adjust movements to suit individual levels of experience, strength and flexibility; |

| • | Proprietary Fitness Programming Algorithm: Our fitness programming algorithm configures movements from our vast content library into new workout plans based on various criteria, including duration, target muscle group, equipment type and aerobic versus anaerobic focus, among others, ensuring that virtually no two workouts are ever the same; and |

| • | Curated High-Quality Workout Plans: Our curated workout plans are subject to a rigorous in-house quality control process and are designed to sequence movements in what we believe to be a safe, effective manner. This quality control process is led by our centralized F45 Athletics Department, which consists of training professionals, athletes and sports scientists. |

Motivation: the key to creating a community and sanctuary. We believe the foundation for any effective fitness program is motivation. We motivate our members through a combination of positivity, inclusivity and teamwork, which encourages our members to view each studio as a sanctuary and is driven by:

| • | Positive Trainers: Our in-studio trainers are responsible for fostering a positive environment for all members before, during and after workouts, and we specifically instruct them to drive positivity, inclusivity and teamwork; |

| • | “No Mirrors, No Microphones, No Egos”: Our studios are deliberately free of mirrors and microphones, which mitigates the appearance-related pressures and trainer intimidation that are associated with many fitness alternatives. Our goal is to emphasize our members’ achievements in completing our workouts; and |

| • | Community: Our positive, inclusive philosophy permeates the studio and creates a genuine sense of camaraderie, team-building and community amongst our members. |

Results: supported by the sustainability of our workouts over time. We strive to help our members achieve and maintain results by focusing on creating a sustainable fitness program. Our fitness programming algorithm offers new workouts each day and is specifically designed to encourage members to visit studios multiple times per week over the course of their long-term fitness journey. We believe we offer members a winning formula to achieve long-term results, driven by:

| • | Total Body Workout: Our fitness programming algorithm offers a total body workout that combines cardiovascular and strength modalities to deliver comprehensive results; |

| • | Safety: We believe our emphasis on functional training movements and relatively low weight resistance helps to mitigate the risk of injury, thereby enabling our members to push themselves and maximize individual performance without compromising their safety; and |

| • | Frequency: The curation, style and cadence of workouts, combined with the use of low weight resistance, allows for members to visit as frequently as their schedules permit. Workouts alternate between cardiovascular and strength modalities from day to day, which alternates the impact on the body. |

Our Competitive Strengths

We believe there are several competitive strengths that form the foundation of our strategy and are key differentiating factors of our business.

5

Table of Contents

The Next Generation Global Fitness Training and Lifestyle Brand Striving to Deliver the Best Functional Training Workout

Over the last eight years, we have focused on leveraging our approach to fitness to develop a global brand that is viewed as the gold standard in functional fitness. We strive to offer our members the best functional training workout in each F45 Training studio on a daily basis. Our differentiated, technology-driven approach, including our proprietary fitness programming algorithm’s database of over 3,900 unique functional training movements, helps us to design workouts that are fun, challenging, safe, dynamic and sustainable for members to attend day after day and week after week. The versatility of our workouts resonates with both women and men, and across a broad range of fitness levels.

Innovative and Differentiated Technology-Enabled Delivery Platform Driving Quality and Consistency within Each Studio

A critical component to the success of our business is our patented technology that provides us with the ability to remotely manage each in-studio experience across our global network of 1,555 Total Studios as of June 30, 2021 from a centralized hub at F45 Training headquarters. We have built an automated, centralized delivery platform that gives us the ability to control the delivery and timing of our workout content through our F45TVs in each of our studios. Our centralized delivery platform enables a seamless F45 Training experience on a consistent basis at scale across a broad geographic footprint. In response to temporary studio closures due to the COVID-19 pandemic, we were able to leverage our technology platform and create a home digital product called F45 AtHome Workouts. This offering provides users with the ability to access part of our library of fitness and wellness offerings from remote or outdoor locations, and allows users to maintain their engagement with F45 during temporary studio closures. In addition, as our studios have re-opened, our adaptable workout model has enabled us to modify workouts so they can be completed in socially distanced setting and with minimal equipment requirements.

Highly Scalable Commercial Delivery and Franchise Development Model

Our differentiated approach, including our fitness programming algorithm and our proprietary technology-enabled delivery platform, plays an integral role in the scalability of our business. By integrating technology into the workout experience, we have been able to develop a franchise model that is highly replicable for both new and existing franchisees across multiple geographies. In addition, our purpose-built studio design, which utilizes an open floor plan and modest physical footprint (as little as 1,600 square feet of training area), can be built within a wide array of attractive prospective retail locations. We have also substantially simplified the pre-opening process by providing franchisees with a comprehensive studio opening pack, which we call a World Pack, that includes the key items needed to operate the studio, including fitness equipment, technology, AV equipment and more. Our World Pack has resulted in a streamlined pre-opening process for our franchisees.

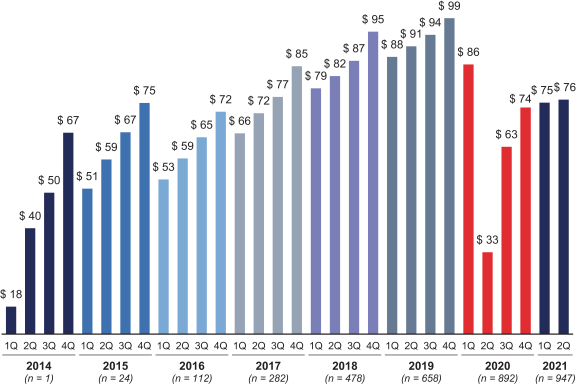

Compelling Franchisee Studio Economics

We believe we offer a compelling business opportunity for franchisees to generate strong returns driven by a relatively low initial investment combined with healthy AUV and low four-wall operating expenses. Prior to the COVID-19 pandemic and based on data collected through our booking systems and the Franchise Survey, we estimate that in a normalized operating environment, a typical F45 Training franchise requires an aggregate initial investment of approximately $315,000 and, in its third year of operation can produce an AUV of approximately $354,000, average EBITDA margins in excess of 30% and average cash-on-cash returns in excess of 33%.

6

Table of Contents

Across the F45 network, we believe that many studios that have re-opened following the onset of the COVID-19 pandemic have demonstrated the ability to ramp up AUV levels. Further, we believe that many studios that have re-opened following the onset of COVID-19 have been able to return to or lower their pre COVID-19 operating costs. During the six months ended June 30, 2021, studios that were open for the full period experienced an AUV increase of approximately 27% compared to the same period in 2020.

Predictable, Asset-Light Model Driving Rapid Growth

As a franchisor, we have employed an economic model that, other than due to the unprecedented global shutdown of our network due to the COVID-19 pandemic, has been predictable, asset light and cash flow generative and has enabled us to open new studios at an accelerated pace versus the owner-operator model that is common in the studio fitness landscape. For the majority of franchises that we sell, we receive an upfront payment from the franchisee, which varies by geography. Once a new studio has opened, we receive contractual, recurring franchise fee revenue streams that provide us with a high degree of revenue visibility. During the most challenging months of the COVID-19 pandemic, we offered franchisees temporary relief from contractual franchise fees. As our network of total studios grows, we expect recurring revenue as a percentage of total revenue to increase.

Given our model is nearly 100% franchised, we have also been able to maintain a strong margin profile. For the quarter ended March 31, 2021, we reported operating margin and Adjusted EBITDA margin of (16.7)% and 29.0%, respectively. For the quarter ended March 31, 2020, we reported operating margin and Adjusted EBITDA margin of 5.4% and 10.5%, respectively. For the year ended December 31, 2020, we reported operating margin and Adjusted EBITDA margin of (6.3)% and 30.9% respectively. For the year ended December 31, 2019, we reported operating margin and Adjusted EBITDA margin of (9.4)% and 33.1%, respectively.

Proven Management Team with Value-Added Investors

F45 Training is led by an experienced and passionate team dedicated to driving the continued growth of the business. Our CEO Adam Gilchrist has developed and fostered our strategic vision and culture of excellence from the very beginning. Our broader management team consists of a deep bench of experienced professionals with expertise in finance, operations, marketing and other critical areas, which we believe helps to position us to execute on our long-term strategy.

In March 2019, a group led by Mark Wahlberg and FOD Capital LLC, or FOD Capital, a family office investment fund, made a strategic minority investment in F45 Training, providing critical branding and marketing capabilities to supplement the strengths of our management team. We expect that Mr. Wahlberg’s involvement, leveraging his broad celebrity reach (with over 17 million Instagram followers) and well-known affinity for fitness, will continue to be a key differentiator in helping us to continue to drive growth.

In addition to Mr. Wahlberg, we have established relationships with Earvin “Magic” Johnson, Jr., David Beckham, Greg Norman, Cindy Crawford and other professional athletes and personalities in order to promote our products.

Our Growth Strategies

We believe there are several attractive opportunities to continue to drive the long-term growth of our business.

7

Table of Contents

Expand Studio Footprint in the United States

We believe there is a significant opportunity to meaningfully expand our franchise studio footprint in the United States. As of June 30, 2021, we had 1,379 franchises sold and 556 total studios in the United States. Prior to the COVID-19 pandemic, we had seen the pace of our U.S. growth accelerate with average net franchises sold per month increasing from 12 in 2017 to 18 in 2018 to 32 in 2019. Due to COVID-19, the average net franchises sold per month decreased in 2020 to 10. Based on current franchises sold in Australia per capita as of June 30, 2021, we believe there is long-term studio potential for us to open over 7,000 studios in the United States.

Expand Studio Footprint Throughout the Rest of the World

We believe in the proven portability of our brand and franchise model, as evidenced by our strong growth outside of our core U.S. and Australian markets. We have designed our studios to be deployed successfully in both developed and emerging markets, and to drive continued growth in both underpenetrated and new markets. As of June 30, 2021, we had 637 franchises sold outside of our core markets of the United States and Australia. Based on an extrapolation of current franchises sold in Australia per capita as of June 30, 2021, we believe there is a long-term global opportunity for over 23,000 studios, with a potential for approximately 16,000 studios outside of the U.S. market. We believe we can continue to grow our international presence through our existing franchising strategy and by opportunistically pursuing master franchising agreements to sell select territories to experienced, local partners.

Grow Same Store Sales and Transition to a Revenue-Based Franchise Fee Model

Prior to the onset of the COVID-19 pandemic, we had successfully delivered consistent positive system-wide same store sales growth for 20 consecutive quarters by driving increased brand awareness to acquire new members and increased existing member spend. We see continued opportunity to drive same store sales growth by leveraging our organic, word-of-mouth marketing and the network effect as we continue to open new studios.

Historically, our franchise agreements have generally included a fixed monthly franchise fee per studio. Since July 2019, we have transitioned our model in the United States for new franchisees to a franchise fee based on the greater of a fixed monthly franchise fee or a percentage of gross monthly studio revenue, generally 7%, which we believe will help to further align our interests with those of our franchisees while also providing us with the opportunity to increase revenue. In select markets outside of the United States and for renewals of existing franchisees in the United States, we are in the process of developing a strategy for transitioning to a similar model.

Pursue Franchise Agreements with Multi-Unit Franchise Systems

The majority of our franchisees today consist of owner-operators that manage single locations. Going forward, we intend to seek opportunities to develop multi-unit franchise systems with select financial partners. As of March 31, 2021, approximately 51% of our franchises sold were owned by multi-unit franchisees, up from approximately 41% as of December 31, 2019, which highlights the strong market demand for multi-unit franchise opportunities.

We recently entered into long-term multi-unit studio development agreements with three financial partners, including an affiliate of Kennedy Lewis Management, or KLIM, one of our principal stockholders. Pursuant to each such agreement, we have granted to the financial sponsor the right to develop, and the financial sponsor has agreed to develop, an agreed number of studios within certain territories in the United States, with one sponsor agreeing to develop at least 70 studios over a 7 year

8

Table of Contents

period, another to at least 87 studios over 6 years and the sponsor affiliated with KLIM agreeing to at least 300 studios over 36 months. In certain cases, we have also agreed to a right of first refusal in favor of the financial sponsor developer within their territories with respect to any new concepts developed by us.

Expand Into New Channels

We believe there is a significant opportunity to expand into new channels, and we are actively pursuing potential opportunities to partner with major universities, hospitality operators, corporations and military facilities. As of March 31, 2021, we had five employees on our franchise sales force devoted specifically to such pursuits. In 2016, we believe we became the first external studio fitness provider to open a studio on a major U.S. university campus through our collaboration with the University of Southern California. As of March 31, 2021, we had 29 studios located on major university campuses in the United States, including the University of Southern California, Stanford University and the University of Texas at Austin. In June 2021, we opened our first studio on a government military base at the U.S. Air Force Station in Miramar, CA.

Develop Workout Programs to Access New Target Demographics

We believe there is a significant opportunity to create workout programs that enable us to target a broader range of consumer demographic groups. In 2018, we successfully launched “Prodigy,” a training program designed to target children and young adults between the ages of 11 and 18 years. Prodigy is generally offered globally. Following an initial development period, franchisees will have the opportunity to incorporate the Prodigy program into existing studios for additional fees. We have also recently developed a new fitness concept called FS8, which we began marketing in Australia in March 2021. FS8 integrates three popular methods in the health and fitness industry, the remixing of pilates, yoga and tone, to create a new workout style. This workout style is an effective method of building lean muscle and definition. FS8 offers members a premium fitness experience through F45’s platform of training systems, the FS8tv and FS8 App, and also offers franchisees a proprietary business model and large community via the franchise network. We also have a dedicated support team to assist across all business functions. As of June 30, 2021, we had sold 106 total FS8 studios in Australia.

We also have additional concepts in development, including Malibu Crew, a functional fitness studio clubhouse targeting men over the age of 50, as well as Avalon House, a studio sanctuary for women of a similar age.

Strategically Utilize M&A to Further Grow Footprint and Attract New Members

The boutique fitness industry remains highly fragmented, which offers attractive opportunities to utilize strategic and bolt-on M&A to drive consolidation. On March 31, 2021, we entered into an agreement to purchase certain assets consisting primarily of intellectual property and customer assets in connection with the Flywheel indoor cycling studio business, which we anticipate will close concurrently with the closing of this offering. We intend to continue to opportunistically pursue acquisitions to grow our franchise network and attract new members in both new and existing markets.

Drive Increased Member Spend Through Ancillary Product Offerings

We believe there are several opportunities by enhancing our offering of health and fitness-related products across our global network of studios. Examples of product categories include footwear and apparel, prepared meal plans, nutrition and supplements and wearables, such as the LionHeart heart rate monitor designed exclusively for F45 Training.

9

Table of Contents

Franchise Model

Franchising Strategy

We utilize an attractive franchise model that has allowed us to scale our business rapidly. As of June 30, 2021, we had a global network of 2,801 Total Franchises Sold, including 1,555 Total Studios, of which 1,415 had re-opened following one or more temporary COVID-related closures. Approximately 49% of Total Franchises Sold are owned by single-unit franchisee owners, with the other 51% owned by multi-unit franchisees. As of March 31, 2021, our largest franchisee owns 24 franchises, representing approximately 1% of our Total Franchises Sold. As we pursue opportunities to develop multi-unit franchise systems with financial partners, we expect the percentage of multi-unit franchisees to increase over time.

Attractive Franchisee Return Profile

Our franchise model has the potential to generate strong returns for franchisees as a result of a relatively low initial investment and favorable operating cost structure driven by our purpose-built studio design and proprietary technology-enabled ecosystem. We believe that our scale provides us with cost advantages that allow us to offer our equipment to our franchisees for a significantly lower cost than if they were to acquire it on their own. We recommend that our franchisees typically staff one lead trainer and at least one assistant trainer during business hours. We also provide ongoing back-office support through our customer relationship management capabilities to assist with day-to-day booking and operation of the business. We believe the modest initial investment, combined with limited staffing needs, creates the potential for strong financial performance and expands the universe of potential franchisees.

Prior to the COVID-19 pandemic and based on data collected through our booking systems and the Franchise Survey, we estimate that in a normalized operating environment, a typical F45 Training franchise requires an aggregate initial investment of approximately $315,000, which includes all of the required studio equipment contained in the World Pack, and, in its third year of operation can produce an AUV of approximately $354,000, average EBITDA margins in excess of 30% and average cash-on-cash returns in excess of 33%.

Across the F45 network, we believe that many studios that have re-opened following the onset of the COVID-19 pandemic have demonstrated the ability to ramp up AUV levels. Further, we believe that many studios that have re-opened following the onset of COVID-19 have been able to return to or lower their pre COVID-19 operating costs. During the six months ended June 30, 2021, studios that were open for the full period experienced an AUV increase of approximately 27% compared to the same period in 2020.

Summary of Risks Factors

Our business is subject to numerous risks and uncertainties, including, but not limited to, the following:

| • | COVID-19 and the related governmental restrictions have had, and are expected to continue to have, a material and adverse effect on our business, financial condition and results of operations. |

| • | If we are unable to anticipate and satisfy consumer preferences and shifting views of health and fitness and successfully develop and introduce new, innovative and updated fitness services, our business may be adversely affected. |

| • | The high level of competition in the health club and fitness industry could materially and adversely affect our business. |

| • | Our financial results are affected by the number of franchises sold and studios we open and by the operating and financial results of such studios. |

10

Table of Contents

| • | If we fail to identify, recruit and contract with qualified franchisees, our ability to open new franchised studios and increase our revenue could be materially adversely affected. |

| • | If we are unable to renew our franchise agreements with our existing franchisees, our business, results of operations and financial condition would be materially and adversely affected. |

| • | We have limited control with respect to the operations of our franchisees, which could have a negative impact on our business, and our franchisees are impacted by factors that are beyond our control. |

| • | If we fail to successfully implement our growth strategy, which includes new studio development by existing and new franchisees, our brand and ability to increase our revenue and operating profits could be materially and adversely affected. |

| • | If we and our franchisees are unable to identify and secure suitable sites for new franchise studios, our revenue growth rate and operating profits may be negatively impacted. |

| • | If we are unable to sustain pricing levels for our establishment fees, World Packs and franchise fees, our business could be adversely affected. |

| • | If our relations with existing or potential franchisees deteriorate, our business could be adversely affected. |

| • | Our business is subject to various franchise laws and regulations, and changes in such laws and regulations, or failure to comply with existing or future laws and regulations and other legal developments that impact franchising, could materially and adversely affect our business. |

| • | Our success depends substantially on the value of our brand. |

| • | Our marketing strategy relies on the use of social media platforms and any negative publicity on such social media platforms may adversely affect the public perception of our brand which in turn could have a material and adverse effect on our business, results of operations and financial condition. In addition, our use of social media platforms could subject us to fines or other penalties. |

| • | We and our franchisees may be unable to attract and retain members, which would materially and adversely affect our business, results of operations and financial condition. |

| • | We have identified three material weaknesses in our internal control over financial reporting and if our remediation of such material weaknesses is not effective, or if we fail to develop and maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable laws and regulations could be impaired. |

| • | If we fail to obtain and retain high-profile strategic partnership arrangements, or if the reputation of any of our partners is impaired, our business may suffer. |

| • | Economic, political and other risks associated with our international operations could adversely affect our profitability and international growth prospects. |

| • | Our planned growth could place strains on our management, employees, information systems and internal controls, which may materially and adversely impact our business. |

| • | Acquisitions may expose us to significant risks and additional costs. |

| • | Any inability to successfully integrate acquisitions, or realize their anticipated benefits, could have a material adverse effect on us. |

| • | We depend upon third-party licenses for the use of music to supplement our workouts and workout tutorials. An adverse change to, loss of or claim that we or our franchisees do not hold necessary licenses may have an adverse effect on our business, results of operations and financial condition. |

11

Table of Contents

| • | We require our franchisees to secure certain music licenses to use music in our studios and to supplement our workouts. Any failure to secure such licenses or comply with the terms and conditions of such licenses may lead to third party claims or lawsuits and/or have an adverse effect on our business. |

| • | Our intellectual property rights, including trademarks and trade names, may be infringed, misappropriated or challenged by others. |

| • | We and our franchisees rely heavily on information systems, and any material failure, interruption or weakness in these systems may prevent us from effectively operating our business and damage our reputation. |

| • | Our dependence on a limited number of suppliers for equipment and certain products and services could result in disruptions to our business and could materially and adversely affect our revenue and gross profit. |

| • | We may be unable to generate sufficient cash flow to satisfy our debt service obligations, which would adversely affect our results of operations and financial condition. |

| • | Our current major stockholders will continue to have significant control over us after this offering, which could limit your ability to influence the outcome of matters subject to stockholder approval, including a change of control. |

| • | We and our franchisees could be subject to claims related to health and safety risks to members that arise at our studios. |

Investing in our common stock involves substantial risk. You should carefully consider all of the information set forth in this prospectus and, in particular, the information in the section entitled “Risk Factors” beginning on page 24 of this prospectus prior to making an investment in our common stock. These risks could, among other things, prevent us from successfully executing our strategies and could have a material adverse effect on our business, results of operations and financial condition.

Our Corporate Information

We were originally incorporated in Delaware in March 2019 under the name “Flyhalf Holdings Inc.” We were formed by MWIG in connection with its acquisition of a minority interest in us, as discussed below. On March 15, 2019, in connection with the consummation of the MWIG Transaction, we changed our name to “F45 Training Holdings Inc.”

Our principal executive offices are located at 801 Barton Springs Road, 9th Floor, Austin, TX 78704 and our telephone number is (737) 787-1955. Our website address is www.f45training.com. The information contained on or accessible through our website is not part of this prospectus or the registration statement of which this prospectus forms a part, nor is it incorporated by reference herein, and potential investors should not rely on such information in making a decision to purchase our common stock in this offering.

Principal Stockholders

Our principal stockholders include:

| • | Adam Gilchrist (25.4% post-offering), our Co-Founder, President and Chief Executive Officer; |

| • | MWIG (28.6% post offering), a special purpose private investment fund vehicle led by FOD Capital LLC, a family office investment fund, and Mark Wahlberg, which acquired a minority investment in us in March 2019 through an acquisition of our convertible preferred stock; |

12

Table of Contents

| • | Entities affiliated with KLIM (11.4% post offering), a global investment manager; and |

| • | Funds affiliated with L1 Capital (7.1% post offering), a global investment manager. |

The beneficial ownership percentages reflected above assumes the conversion of our convertible preferred stock into 27,368,102 shares of common stock, and the conversion of our convertible notes into 14,847,066 shares of common stock.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies that are not emerging growth companies, including:

| • | presenting only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure; |

| • | reduced disclosure about our executive compensation arrangements; |

| • | exemption from the requirements to hold non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; |

| • | extended transition periods for complying with new or revised accounting standards; |

| • | exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; and |

| • | exemption from complying with any requirement that may be adopted by the Public Company Accounting Oversight Board, or the PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis). |

We may take advantage of these exemptions up until the last day of the fiscal year following the fifth anniversary of this offering or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company at the start of the first fiscal year after we have more than $1.07 billion in annual gross revenue, at the end of any fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year (and we have been a public company for at least 12 months and have filed at least one annual report on Form 10-K) or the date on which we have, during the previous three-year period, issued more than $1 billion of non-convertible debt securities. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of certain reduced reporting obligations in this prospectus. Further, pursuant to Section 107 of the JOBS Act, as an emerging growth company, we have elected to use the extended transition period for complying with new or revised accounting standards until those standards would otherwise apply to private companies.

13

Table of Contents

We are also a “smaller reporting company” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, or the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as our voting and non-voting common stock held by non-affiliates is less than $250 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and our voting and non-voting common stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock, and our financial statements may not be comparable to the financial statements of issuers who are required to comply with the effective dates for new or revised accounting standards that are applicable to public companies. See “Risk Factors—Risks Related to Our Common Stock and This Offering—We are an “emerging growth company” and a “smaller reporting company.” As a result of the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies, our common stock may be less attractive to investors.”

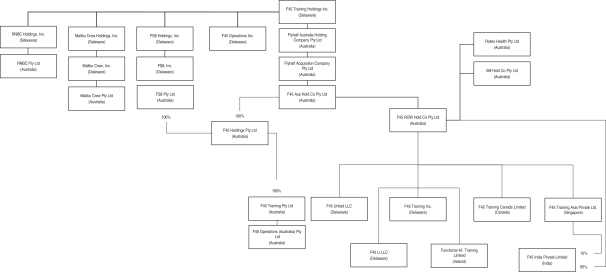

Summary Organizational Chart

The following diagram depicts our current corporate structure:

14

Table of Contents

The Offering

| Common stock offered by us |

18,750,000 shares |

| Common stock offered by the selling |

1,562,500 shares |

| Option to purchase additional shares of |

3,046,875 shares |

| Common stock to be outstanding immediately |

90,246,682 shares (or 90,871,682 shares if the underwriters exercise in full their option to purchase additional shares). |

| Indication of Interest |

One or more funds affiliated with Caledonia have indicated an interest in purchasing $100.0 million in shares of our common stock in this offering at the initial public offering price. Because this indication of interest is not a binding agreement or commitment to purchase, one or more funds affiliated with Caledonia could determine to purchase more, less or no shares in the offering or the underwriters could determine to sell more, less or no shares to one or more funds affiliated with Caledonia. The underwriters will receive the same discount on any of our shares of common stock purchased by one or more funds affiliated with Caledonia as they will from any other shares of the common stock sold in this offering. |

| Use of proceeds |

We estimate that we will receive net proceeds of approximately $275.9 million (or approximately $285.2 million if the underwriters exercise in full their option to purchase additional shares), based on an assumed initial public offering price of $16.00 per share, the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of common stock by the selling stockholder. |

| We intend to use the net proceeds we receive from this offering (i) to repay indebtedness, (ii) to pay the purchase price for our acquisition of certain assets of the Flywheel indoor cycling studio business, (iii) to pay cash bonuses to |

15

Table of Contents

certain of our employees, including certain of our executive officers, in connection with this offering, (iv) to pay expenses incurred in connection with this offering and (v) for working capital and general corporate purposes. See “Use of Proceeds.”

| Dividend policy |

We have no present intention to pay cash dividends on our common stock. Any determination to pay dividends to holders of our common stock will be at the discretion of our board of directors and will depend upon many factors, including our financial condition, results of operations, projections, liquidity, earnings, legal requirements, restrictions in our debt agreements and other factors that our board of directors deems relevant. See “Dividend Policy.” |

| Risk factors |

Investing in our common stock involves a high degree of risk. You should carefully read and consider the information set forth under “Risk Factors” beginning on page 24 and all other information in this prospectus before investing in our common stock. |

| Conflicts of Interest |

Affiliates of J.P. Morgan Securities LLC are lenders under the Term Facility and Revolving Facility. As described in the section entitled “Use of Proceeds,” a portion of the net proceeds from this offering will be used to repay borrowings under the Term Facility and Revolving Facility. Because we expect that more than 5% of the proceeds of this offering will be received by affiliates of J.P. Morgan Securities LLC, each of which is a lender under the Term Facility and Revolving Facility, this offering is being conducted in compliance with Rule 5121, as administered by the Financial Industry Regulatory Authority, or FINRA. Goldman Sachs & Co. LLC has agreed to act as the “qualified independent underwriter” with respect to this offering and has performed due diligence investigations and participated in the preparation of this registration statement. See the section entitled “Underwriting (Conflicts of Interest)—Conflicts of Interest.” |

| Listing |

We have applied to have our common stock approved for listing on the New York Stock Exchange, or the NYSE, under the symbol “FXLV.” |

16

Table of Contents

The number of shares of our common stock to be outstanding immediately after this offering is based on 90,246,682 shares of common stock outstanding as of June 30, 2021 and excludes (i) shares that will become available for future issuance under the F45 Training Holdings Inc. 2021 Equity Incentive Plan, or the 2021 Plan, upon the effectiveness of the registration statement of which this prospectus forms a part (which includes 3,590,900 shares of our common stock issuable upon the settlement of restricted stock units, or RSUs, and 263,684 shares of our common stock issuable upon the exercise of stock options to be granted in connection with this offering under the 2021 Plan to certain of our employees (including certain executive officers), with the stock options to have an exercise price per share equal to the initial public offering price in this offering and (ii) 2,738,648 RSUs, which were issued to Mr. Wahlberg pursuant to a promotional services agreement that we entered into in connection with the MWIG investment (see “Certain Relationships and Related Party Transactions—Promotional Agreement” for more details regarding the RSUs held by Mr. Wahlberg), which RSUs will vest in connection with offering, but not settle until 2022).

Except as otherwise indicated, all information in this prospectus reflects and assumes the following:

| • | an initial public offering price of $16.00 per share, the midpoint of the estimated offering price range set forth on the cover page of this prospectus; |

| • | the effectiveness of our restated certificate of incorporation and restated bylaws in connection with the completion of this offering; |

| • | the conversion of all of our outstanding shares of convertible preferred stock into an aggregate of 27,368,102 shares of common stock upon completion of this offering; |

| • | the conversion of all of our outstanding convertible notes into an aggregate of 14,847,066 shares of common stock upon completion of this offering; and |