Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HUNTINGTON INGALLS INDUSTRIES, INC. | d183414dex991.htm |

| 8-K - 8-K - HUNTINGTON INGALLS INDUSTRIES, INC. | d183414d8k.htm |

Huntington Ingalls Industries to Acquire Alion Science and Technology July 6, 2021 Mike Petters President and Chief Executive Officer Tom Stiehle Executive Vice President and Chief Financial Officer Exhibit 99.2

Forward-Looking Statements HUNTINGTON INGALLS INDUSTRIES Statements in this presentation regarding our proposed acquisition of Alion Science & Technology (the “transaction”), the expected time for completing the transaction, the expected benefits and synergies of the transaction, including the effect of the transaction on revenue, EBITDA margin and free cash flow, future opportunities for the combined company and any other statements about management’s future expectations, beliefs, goals, plans or prospects, other than statements of historical fact, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are only predictions based on current assumptions and expectations. Forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those expressed in these statements. Factors that may cause such differences include: the risk that the conditions to the closing of the transaction, including receipt of required regulatory approvals, are not satisfied; our ability to realize the anticipated synergies, growth prospects and other benefits of the transaction, including the risk that the anticipated benefits from the transaction may not be realized within the expected time period or at all; competition from larger or more established companies in the relevant markets; our ability to retain and hire key personnel; challenges, risks and costs associated with integrating the operations of Alion; changes in government and customer priorities and requirements (including government budgetary constraints, shifts in defense spending, and changes in customer short-range and long-range plans); and other risk factors discussed in our filings with the U.S. Securities and Exchange Commission. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business, and we undertake no obligation to update any forward-looking statements. You should not place undue reliance on any forward-looking statements that we may make. This presentation also contains non-GAAP financial measures. Non-GAAP financial measures should not be construed as being more important than comparable GAAP measures.

Strategic Acquisition Enhances Technical Solutions HUNTINGTON INGALLS INDUSTRIES Alion Provides Capabilities and Customer Access to Drive Accelerated Growth in Strategic Target Markets Alion significantly expands HII ability to support U.S. Navy and DoD customers in their most critical national security missions Enhanced high-end capabilities are complementary to existing HII work and provide critical mass in targeted markets C5ISR, Military Training & Simulation, Next Generation Technology & Solutions Broad customer and contract access with minimal overlap Franchise positions with diverse customers Significant value-creating revenue synergy opportunity Immediately enhances Technical Solutions potential topline growth rate Expected to be cash flow accretive in 2022 Expected to be GAAP EPS neutral in 2022, accretive in 2023

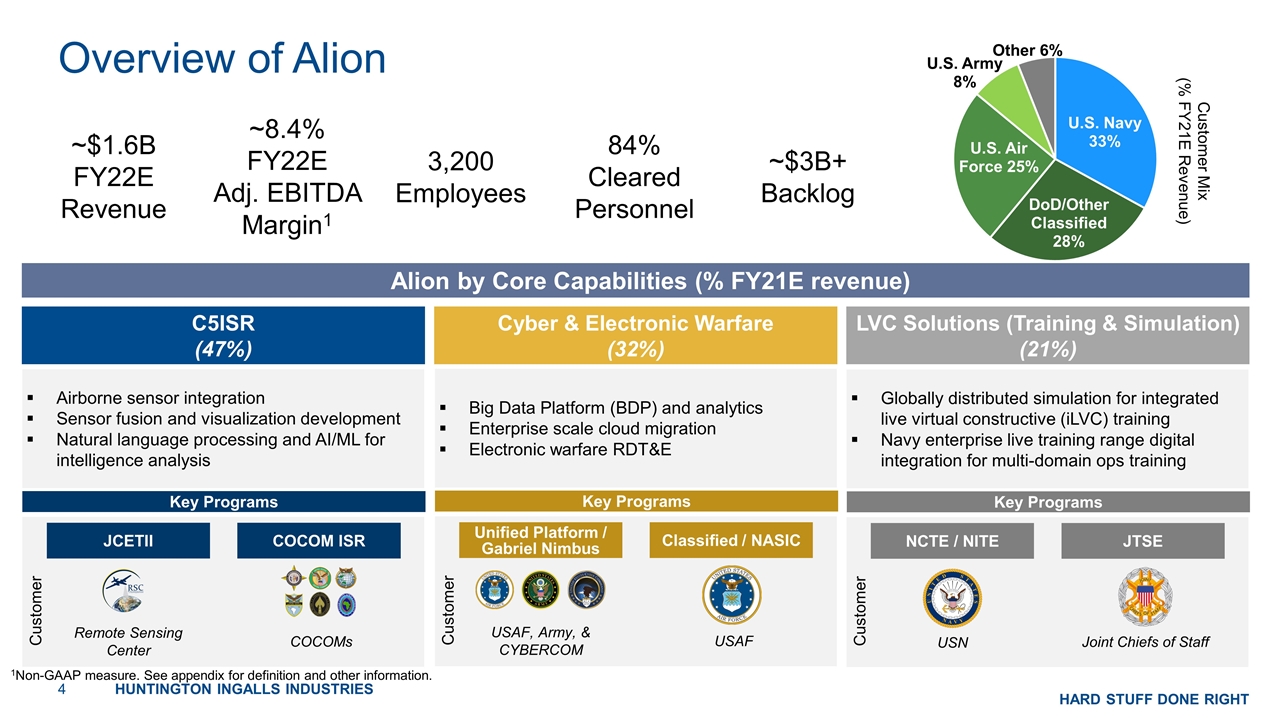

Overview of Alion HUNTINGTON INGALLS INDUSTRIES ~$1.6B FY22E Revenue ~8.4% FY22E Adj. EBITDA Margin1 ~$3B+ Backlog 3,200 Employees 84% Cleared Personnel Airborne sensor integration Sensor fusion and visualization development Natural language processing and AI/ML for intelligence analysis C5ISR (47%) Cyber & Electronic Warfare (32%) LVC Solutions (Training & Simulation) (21%) Alion by Core Capabilities (% FY21E revenue) Customer JCETII COCOM ISR Remote Sensing Center COCOMs Key Programs Big Data Platform (BDP) and analytics Enterprise scale cloud migration Electronic warfare RDT&E Customer Unified Platform / Gabriel Nimbus Classified / NASIC USAF, Army, & CYBERCOM USAF Key Programs Globally distributed simulation for integrated live virtual constructive (iLVC) training Navy enterprise live training range digital integration for multi-domain ops training Customer NCTE / NITE JTSE USN Joint Chiefs of Staff Key Programs Customer Mix (% FY21E Revenue) 1Non-GAAP measure. See appendix for definition and other information.

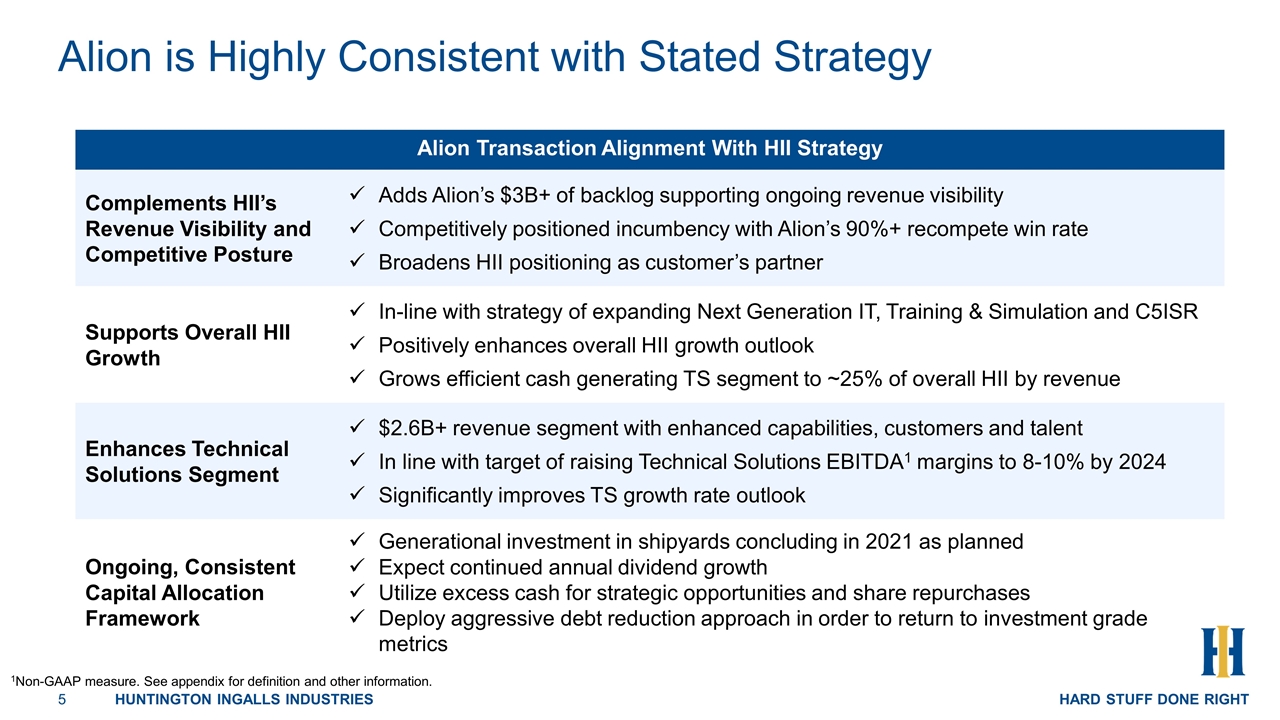

Alion is Highly Consistent with Stated Strategy HUNTINGTON INGALLS INDUSTRIES Alion Transaction Alignment With HII Strategy Complements HII’s Revenue Visibility and Competitive Posture Adds Alion’s $3B+ of backlog supporting ongoing revenue visibility Competitively positioned incumbency with Alion’s 90%+ recompete win rate Broadens HII positioning as customer’s partner Supports Overall HII Growth In-line with strategy of expanding Next Generation IT, Training & Simulation and C5ISR Positively enhances overall HII growth outlook Grows efficient cash generating TS segment to ~25% of overall HII by revenue Enhances Technical Solutions Segment $2.6B+ revenue segment with enhanced capabilities, customers and talent In line with target of raising Technical Solutions EBITDA1 margins to 8-10% by 2024 Significantly improves TS growth rate outlook Ongoing, Consistent Capital Allocation Framework Generational investment in shipyards concluding in 2021 as planned Expect continued annual dividend growth Utilize excess cash for strategic opportunities and share repurchases Deploy aggressive debt reduction approach in order to return to investment grade metrics 1Non-GAAP measure. See appendix for definition and other information.

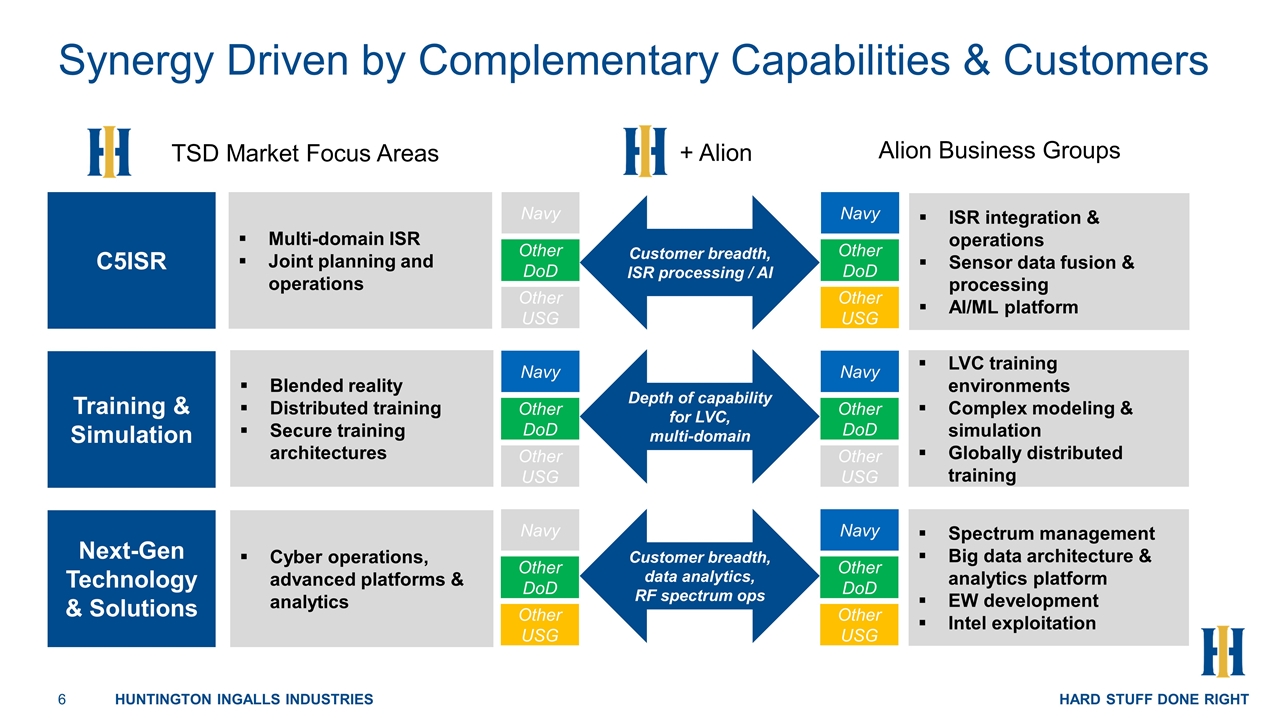

Synergy Driven by Complementary Capabilities & Customers HUNTINGTON INGALLS INDUSTRIES Alion Business Groups + Alion TSD Market Focus Areas C5ISR Next-Gen Technology & Solutions Training & Simulation Multi-domain ISR Joint planning and operations ISR integration & operations Sensor data fusion & processing AI/ML platform Blended reality Distributed training Secure training architectures Spectrum management Big data architecture & analytics platform EW development Intel exploitation Cyber operations, advanced platforms & analytics LVC training environments Complex modeling & simulation Globally distributed training Navy Other DoD Other USG Navy Other DoD Other USG Navy Other DoD Other USG Navy Other DoD Other USG Navy Other DoD Other USG Navy Other DoD Other USG Customer breadth, ISR processing / AI Depth of capability for LVC, multi-domain Customer breadth, data analytics, RF spectrum ops

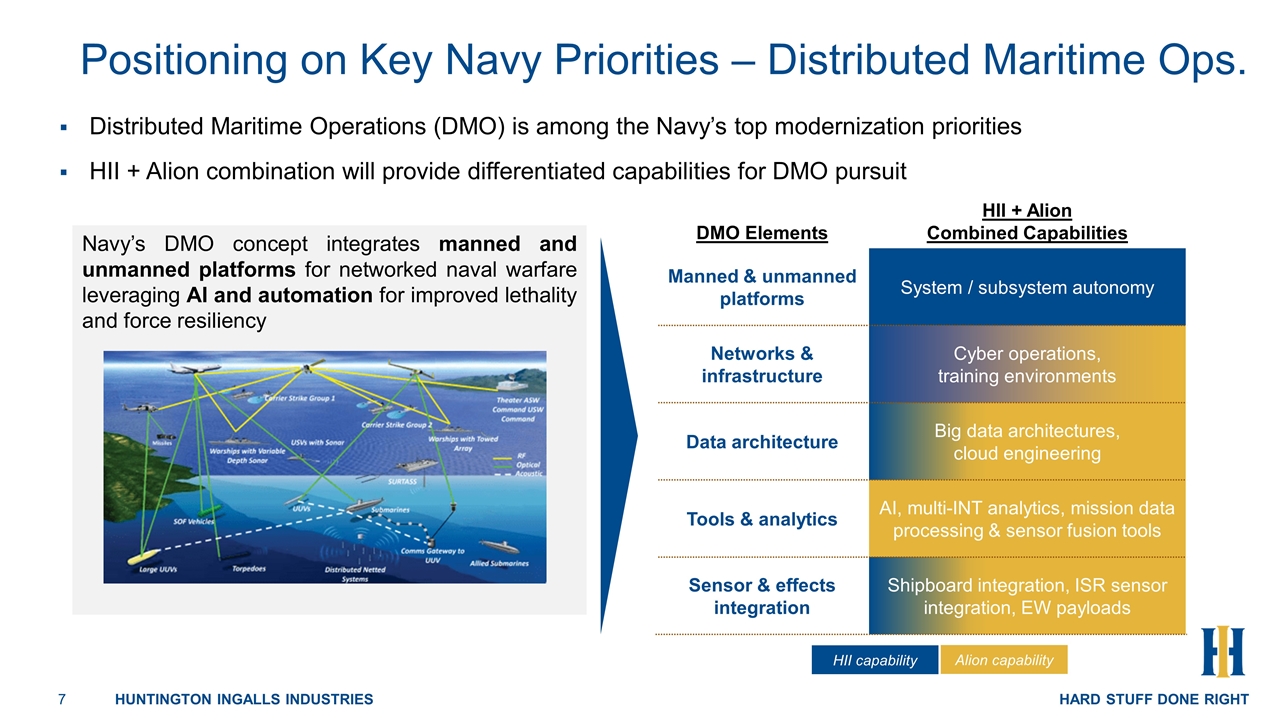

Positioning on Key Navy Priorities – Distributed Maritime Ops. HUNTINGTON INGALLS INDUSTRIES Navy’s DMO concept integrates manned and unmanned platforms for networked naval warfare leveraging AI and automation for improved lethality and force resiliency DMO Elements HII + Alion Combined Capabilities Manned & unmanned platforms System / subsystem autonomy Networks & infrastructure Cyber operations, training environments Data architecture Big data architectures, cloud engineering Tools & analytics AI, multi-INT analytics, mission data processing & sensor fusion tools Sensor & effects integration Shipboard integration, ISR sensor integration, EW payloads Distributed Maritime Operations (DMO) is among the Navy’s top modernization priorities HII + Alion combination will provide differentiated capabilities for DMO pursuit HII capability Alion capability

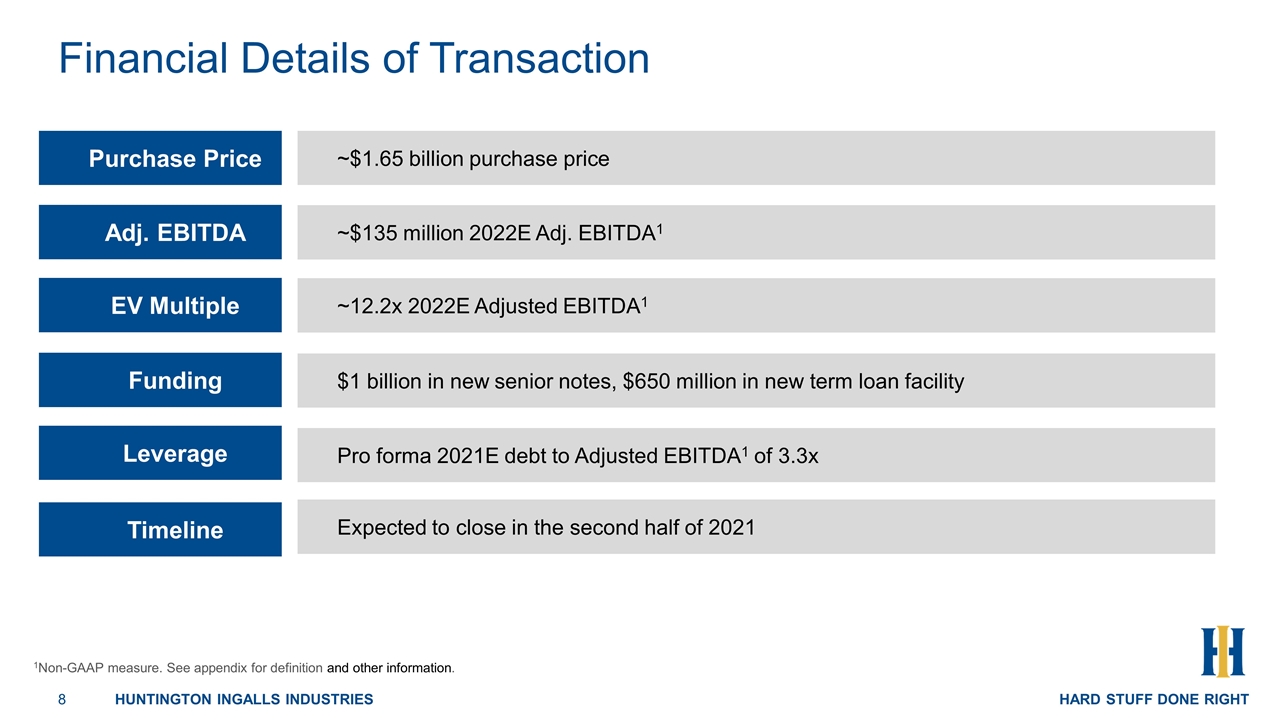

Financial Details of Transaction HUNTINGTON INGALLS INDUSTRIES 1Non-GAAP measure. See appendix for definition and other information. Purchase Price Funding Leverage EV Multiple Timeline ~$1.65 billion purchase price ~12.2x 2022E Adjusted EBITDA1 $1 billion in new senior notes, $650 million in new term loan facility Pro forma 2021E debt to Adjusted EBITDA1 of 3.3x Expected to close in the second half of 2021 Adj. EBITDA ~$135 million 2022E Adj. EBITDA1

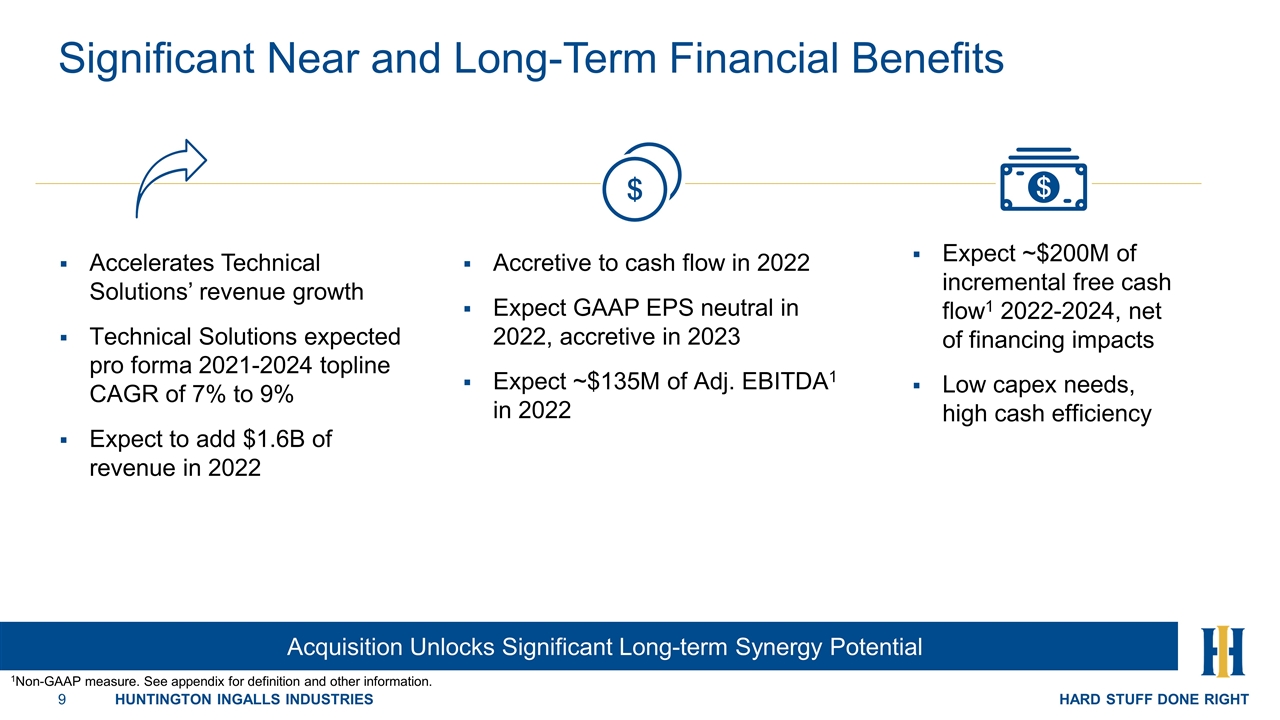

Significant Near and Long-Term Financial Benefits HUNTINGTON INGALLS INDUSTRIES Acquisition Unlocks Significant Long-term Synergy Potential Accelerates Technical Solutions’ revenue growth Technical Solutions expected pro forma 2021-2024 topline CAGR of 7% to 9% Expect to add $1.6B of revenue in 2022 Accretive to cash flow in 2022 Expect GAAP EPS neutral in 2022, accretive in 2023 Expect ~$135M of Adj. EBITDA1 in 2022 Expect ~$200M of incremental free cash flow1 2022-2024, net of financing impacts Low capex needs, high cash efficiency 1Non-GAAP measure. See appendix for definition and other information.

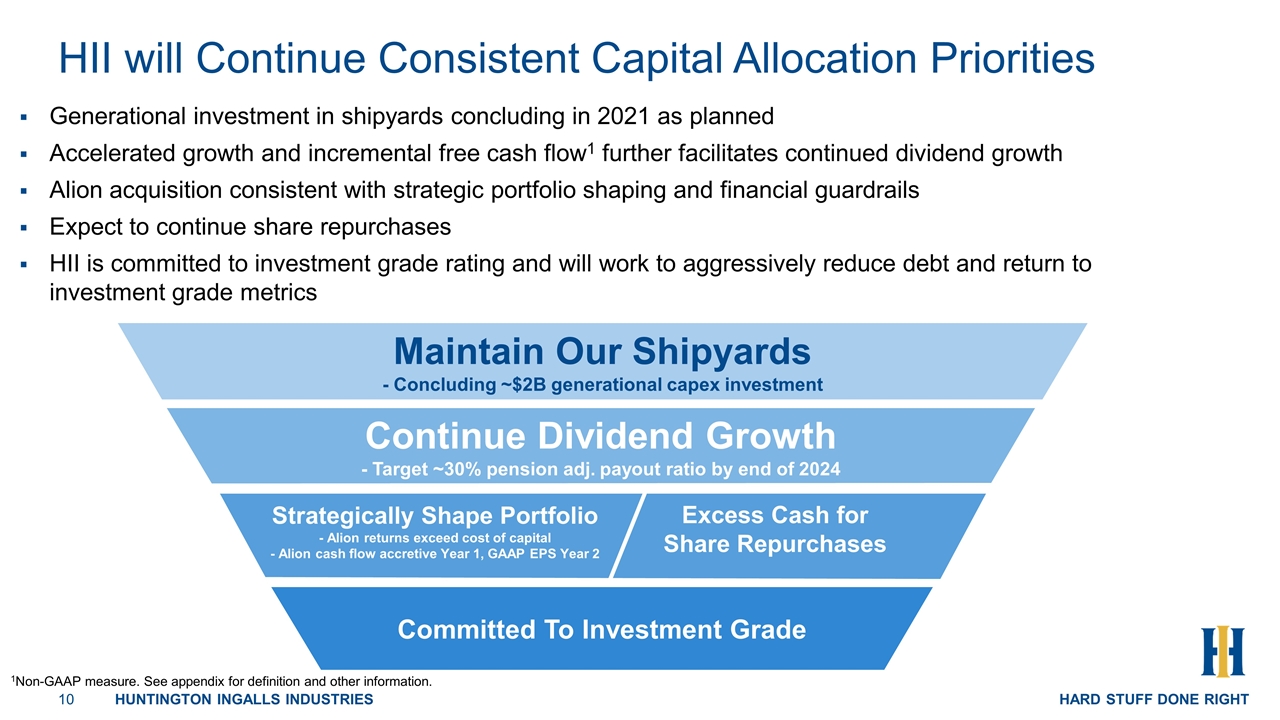

HII will Continue Consistent Capital Allocation Priorities HUNTINGTON INGALLS INDUSTRIES Generational investment in shipyards concluding in 2021 as planned Accelerated growth and incremental free cash flow1 further facilitates continued dividend growth Alion acquisition consistent with strategic portfolio shaping and financial guardrails Expect to continue share repurchases HII is committed to investment grade rating and will work to aggressively reduce debt and return to investment grade metrics Maintain Our Shipyards - Concluding ~$2B generational capex investment Continue Dividend Growth - Target ~30% pension adj. payout ratio by end of 2024 Committed To Investment Grade Strategically Shape Portfolio - Alion returns exceed cost of capital - Alion cash flow accretive Year 1, GAAP EPS Year 2 Excess Cash for Share Repurchases 1Non-GAAP measure. See appendix for definition and other information.

Key Takeaways HUNTINGTON INGALLS INDUSTRIES Alion Provides Capabilities, Customers and Talent to Drive Accelerated Growth in Strategic Target Markets Alion represents an unmatched strategic fit for HII Enhances technical capabilities and improves HII position in high-growth mission-critical security solutions Provides high-end solutions critical to multi-domain distributed operations, well aligned with future U.S. Navy and Department of Defense modernization and readiness priorities Meaningfully accelerates Technical Solutions revenue growth Expected to be significantly cash flow accretive in 2022; incremental $200M FCF1 2022-24 1Non-GAAP measure. See appendix for definition and other information.

Appendix Huntington Ingalls Industries Proprietary

Acronym list HUNTINGTON INGALLS INDUSTRIES AI/ML: Artificial Intelligence/Machine Learning C5: Command, Control, Computers, Communications and Cyber CAGR: Compound Annual Growth Rate DMO: Distributed Maritime Operations DoD: Department of Defense ELICSAR: Enterprise Logging Ingest and Cyber Situational Awareness Refinery EW: Electronic Warfare GAAP: Generally Accepted Accounting Principles ISR: Intelligence, Surveillance, and Reconnaissance JCC2: Joint Cyber Command and Control JCETII: Joint Capability Embedded Technology Insertion and Integration JTSE: Joint Training Synthetic Environment LVC: Live, Virtual, Constructive Training NASIC: National Air and Space Intelligence Center NCTE: Navy Continuous Training Environment NITE: Navy Integrated Training Environment RDT&E: Research, Development, Test & Evaluation RF: Radio Frequency

Non-GAAP Measures Definitions HUNTINGTON INGALLS INDUSTRIES We make reference to “adjusted EBITDA”, “adjusted EBITDA margin” and “free cash flow.” Adjusted EBITDA and EBITDA margin are not measures recognized under GAAP. They should be considered supplemental to and not substitutes for financial information prepared in accordance with GAAP. They may not be comparable to similarly titled measures of other companies. Free cash flow is not a measure recognized under GAAP. Free cash flow has limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, analysis of our results as reported under GAAP. We believe free cash flow is an important measure for our investors because it provides them insight into our current and period-to-period performance and our ability to generate cash from continuing operations. We also use free cash flow as a key operating metric in assessing the performance of our business and as a key performance measure in evaluating management performance and determining incentive compensation. Free cash flow may not be comparable to similarly titled measures of other companies. Reconciliations of forward-looking non-GAAP measures are not provided because we are unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the future occurrence and financial impact of certain elements of GAAP and non-GAAP measures. Adjusted EBITDA is defined as operating income before interest expense, income taxes, depreciation, and amortization Adjusted EBITDA margin is defined as operating income before interest expense, income taxes, depreciation, and amortization as a percentage of revenues. Free cash flow is defined as net cash provided by (used in) operating activities less capital expenditures net of related grant proceeds.

HUNTINGTON INGALLS INDUSTRIES