Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Columbia Financial, Inc. | tm2120065d1_ex99-2.htm |

| EX-2.1 - EXHIBIT 2.1 - Columbia Financial, Inc. | tm2120065d1_ex2-1.htm |

| 8-K - FORM 8-K - Columbia Financial, Inc. | tm2120065d1_8k.htm |

Exhibit 99.1

NASDAQ: CLBK June 17, 2021

2 SAFE HARBOR STATEMENT THIS PRESENTATION CONTAINS FORWARD - LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 REGARDING COLUMBIA FINANCIAL INC . ’S EXPECTATIONS OR PREDICTIONS OF FUTURE FINANCIAL OR BUSINESS PERFORMANCE OR CONDITIONS . FORWARD - LOOKING STATEMENTS ARE TYPICALLY IDENTIFIED BY WORDS SUCH AS “BELIEVE,” “EXPECT,” “ANTICIPATE,” “INTEND,” “TARGET,” “ESTIMATE,” “CONTINUE,” “POSITIONS,” “PROSPECTS” OR “POTENTIAL,” BY FUTURE CONDITIONAL VERBS SUCH AS “WILL,” “WOULD,” “SHOULD,” “COULD,” “MAY,” OR BY VARIATIONS OF SUCH WORDS OR BY SIMILAR EXPRESSIONS . THESE FORWARD - LOOKING STATEMENTS ARE SUBJECT TO NUMEROUS ASSUMPTIONS, RISKS AND UNCERTAINTIES, WHICH CHANGE OVER TIME . ACTUAL RESULTS MAY DIFFER MATERIALLY FROM CURRENT PROJECTIONS . ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE SET FORTH IN THE FORWARD - LOOKING STATEMENTS AS A RESULT OF NUMEROUS FACTORS . THE FOLLOWING FACTORS, AMONG OTHERS, COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE ANTICIPATED RESULTS EXPRESSED IN THE FORWARD - LOOKING STATEMENTS : (I) THE BUSINESSES OF COLUMBIA AND FREEHOLD MAY NOT BE COMBINED SUCCESSFULLY, OR SUCH COMBINATION MAY TAKE LONGER THAN EXPECTED ; (II) THE COST SAVINGS FROM THE MERGER MAY NOT BE FULLY REALIZED OR MAY TAKE LONGER THAN EXPECTED TO BE REALIZED ; (III) OPERATING COSTS, CUSTOMER LOSS AND BUSINESS DISRUPTION FOLLOWING THE MERGER MAY BE GREATER THAN EXPECTED ; (IV) GOVERNMENTAL APPROVALS OF THE MERGER MAY NOT BE OBTAINED, OR ADVERSE REGULATORY CONDITIONS MAY BE IMPOSED IN CONNECTION WITH GOVERNMENTAL APPROVALS OF THE MERGER OR OTHERWISE ; (V) THE INTEREST RATE ENVIRONMENT MAY FURTHER COMPRESS MARGINS AND ADVERSELY AFFECT NET INTEREST INCOME ; (VI) THE RISKS ASSOCIATED WITH CONTINUED DIVERSIFICATION OF ASSETS AND ADVERSE CHANGES TO CREDIT QUALITY ; CHANGES IN LEGISLATION, REGULATIONS AND POLICIES ; AND THE EFFECT OF THE COVID - 19 PANDEMIC, INCLUDING ON THE CREDIT QUALITY AND BUSINESS OPERATIONS OF COLUMBIA AND FREEHOLD, AS WELL AS ITS IMPACT ON GENERAL ECONOMIC AND FINANCIAL MARKET CONDITIONS . ADDITIONAL FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED IN THE FORWARD - LOOKING STATEMENTS ARE DISCUSSED IN COLUMBIA’S REPORTS (SUCH AS THE ANNUAL REPORT ON FORM 10 - K, QUARTERLY REPORTS ON FORM 10 - Q, AND CURRENT REPORTS ON FORM 8 - K) FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) AND AVAILABLE AT THE SEC’S INTERNET WEBSITE (WWW . SEC . GOV) . ALL SUBSEQUENT WRITTEN AND ORAL FORWARD - LOOKING STATEMENTS CONCERNING THE PROPOSED TRANSACTION OR OTHER MATTERS ATTRIBUTABLE TO COLUMBIA AND FREEHOLD OR ANY PERSON ACTING ON THEIR BEHALF ARE EXPRESSLY QUALIFIED IN THEIR ENTIRETY BY THE CAUTIONARY STATEMENTS ABOVE . EXCEPT AS REQUIRED BY LAW, COLUMBIA AND FREEHOLD DO NOT UNDERTAKE ANY OBLIGATION TO UPDATE ANY FORWARD - LOOKING STATEMENT TO REFLECT CIRCUMSTANCES OR EVENTS THAT OCCUR AFTER THE DATE THE FORWARD - LOOKING STATEMENT IS MADE . THIS PRESENTATION ALSO INCLUDES INTERIM AND UNAUDITED FINANCIAL INFORMATION THAT IS SUBJECT TO FURTHER REVIEW BY COLUMBIA FINANCIAL’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM .

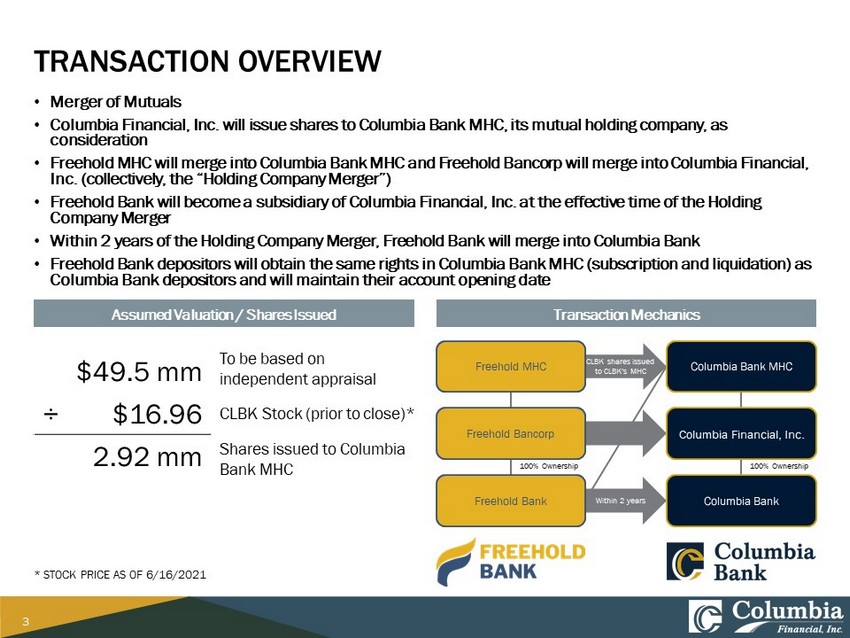

3 CLBK shares issued to CLBK’s MHC Within 2 years TRANSACTION OVERVIEW Assumed Valuation / Shares Issued Transaction Mechanics $49.5 mm To be based on independent appraisal ÷ $16.96 CLBK Stock (prior to close)* 2.92 mm Shares issued to Columbia Bank MHC Freehold MHC Freehold Bancorp Freehold Bank 100% Ownership Columbia Bank MHC Columbia Financial, Inc. Columbia Bank 100% Ownership * STOCK PRICE AS OF 6/16/2021 • Merger of Mutuals • Columbia Financial, Inc. will issue shares to Columbia Bank MHC, its mutual holding company, as consideration • Freehold MHC will merge into Columbia Bank MHC and Freehold Bancorp will merge into Columbia Financial, Inc. (collectively, the “Holding Company Merger”) • Freehold Bank will become a subsidiary of Columbia Financial, Inc. at the effective time of the Holding Company Merger • Within 2 years of the Holding Company Merger, Freehold Bank will merge into Columbia Bank • Freehold Bank depositors will obtain the same rights in Columbia Bank MHC (subscription and liquidation) as Columbia Bank depositors and will maintain their account opening date

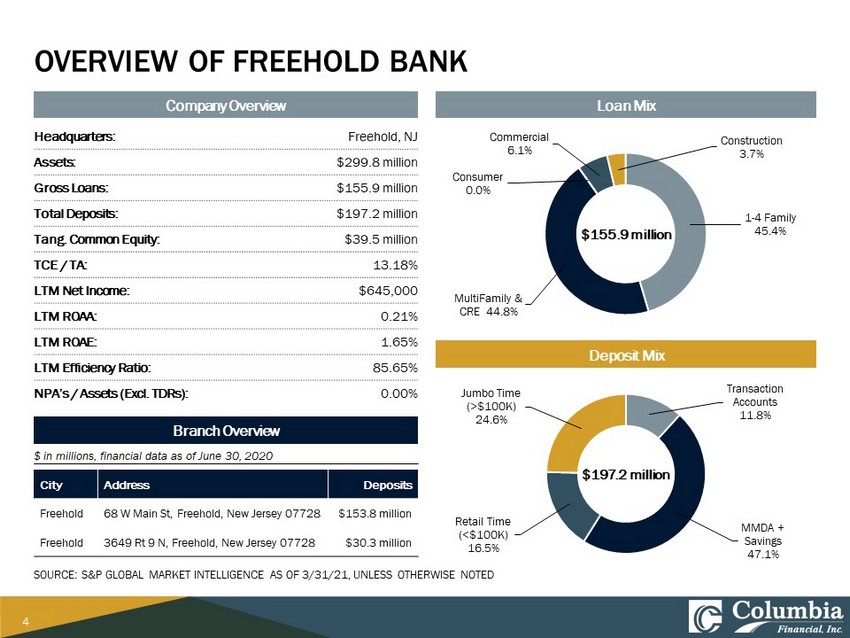

4 SOURCE: S&P GLOBAL MARKET INTELLIGENCE AS OF 3/31/21, UNLESS OTH ERWISE NOTED OVERVIEW OF FREEHOLD BANK Company Overview Headquarters: Freehold, NJ Assets: $299.8 million Gross Loans: $155.9 million Total Deposits: $197.2 million Tang. Common Equity: $39.5 million TCE / TA: 13.18% LTM Net Income: $645,000 LTM ROAA: 0.21% LTM ROAE: 1.65% LTM Efficiency Ratio: 85.65% NPA’s / Assets (Excl. TDRs): 0.00% Branch Overview City Address Deposits Freehold 68 W Main St, Freehold, New Jersey 07728 $153.8 million Freehold 3649 Rt 9 N, Freehold, New Jersey 07728 $30.3 million Loan Mix Deposit Mix $ in millions, financial data as of June 30, 2020 Transaction Accounts 11.8% MMDA + Savings 47.1% Retail Time (<$100K) 16.5% Jumbo Time (>$100K) 24.6% 1 - 4 Family 45.4% MultiFamily & CRE 44.8% Consumer 0.0% Commercial 6.1% Construction 3.7% $155.9 million $197.2 million

5 2020 Rank Institution Branches Deposits in Market ($000) Market Share (%) 1 The Toronto-Dominion Bank 17 4,572,486 15.59 2 Wells Fargo & Company 28 4,093,240 13.96 3 Bank of America Corporation 17 3,701,967 12.62 4 Banco Santander, S.A. 24 3,105,857 10.59 5 JPMorgan Chase & Co. 20 2,369,283 8.08 6 Investors Bancorp, Inc. 12 1,960,334 6.68 7 The PNC Financial Services Group, Inc. 22 1,944,412 6.63 8 OceanFirst Financial Corp. 17 1,687,132 5.75 9 MB Mutual Holding Company 9 1,032,778 3.52 10 Valley National Bancorp 11 853,178 2.91 11 Kearny Financial Corp. 10 767,719 2.62 12 Provident Financial Services, Inc. 8 590,882 2.01 Pro Forma 5 466,933 1.59 13 M&T Bank Corporation 5 432,596 1.48 14 Amboy Bancorporation 11 346,100 1.18 15 New York Community Bancorp, Inc. 6 324,811 1.11 16 Columbia Financial, Inc. 3 282,810 0.96 17 1st Constitution Bancorp 8 258,127 0.88 18 Capital One Financial Corporation 1 219,727 0.75 19 First Commerce Bank 2 204,664 0.70 20 Fulton Financial Corporation 3 200,925 0.69 21 Freehold MHC 2 184,123 0.63 22 Brunswick Bancorp 1 70,269 0.24 23 BCB Bancorp, Inc. 1 61,798 0.21 24 ConnectOne Bancorp, Inc. 1 60,050 0.20 Total for Institutions in Market 239 29,325,268 100% SOURCE: S&P GLOBAL MARKET INTELLIGENCE; DEPOSIT DATA AS OF 6/30/ 20 EXPANDS FRANCHISE IN ATTRACTIVE MARKETS Columbia Financial Inc. (CLBK) Freehold Bank Pro Forma Map Deposit Market Share – Monmouth County Current Projected % Change Demographic Metric 2021 2026 2021 - 2026 Total Population 616,422 611,882 (0.74) Median Age 43.8 44.6 1.83 Total Households 231,486 230,565 (0.40) Average Household Income ($) 150,264 164,872 9.72 Median Household Income ($) 107,218 117,901 9.96 Per Capita Income ($) 57,044 62,773 10.04

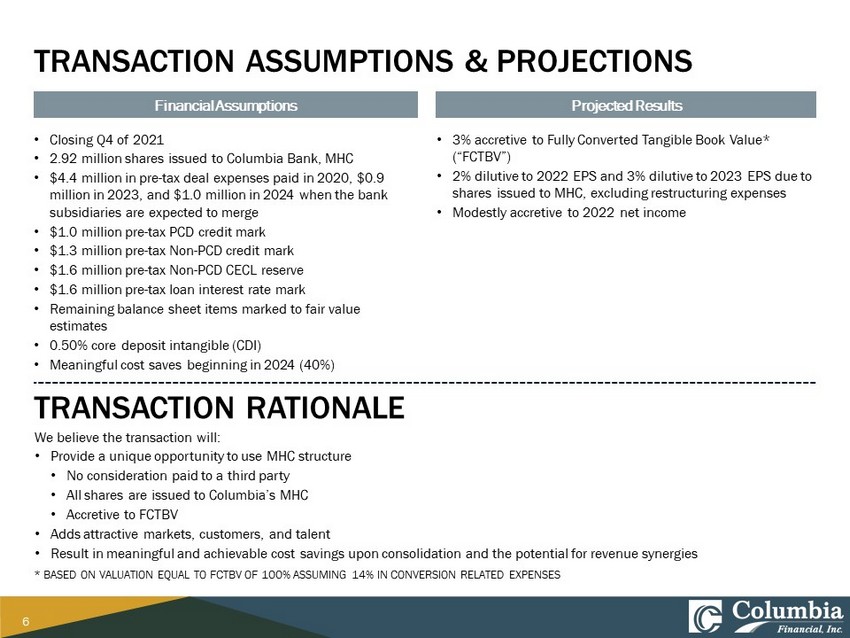

6 * BASED ON VALUATION EQUAL TO FCTBV OF 100% ASSUMING 14% IN CONV ERSION RELATED EXPENSES TRANSACTION ASSUMPTIONS & PROJECTIONS • Closing Q4 of 2021 • 2.92 million shares issued to Columbia Bank, MHC • $4.4 million in pre - tax deal expenses paid in 2020, $0.9 million in 2023, and $1.0 million in 2024 when the bank subsidiaries are expected to merge • $1.0 million pre - tax PCD credit mark • $1.3 million pre - tax Non - PCD credit mark • $1.6 million pre - tax Non - PCD CECL reserve • $1.6 million pre - tax loan interest rate mark • Remaining balance sheet items marked to fair value estimates • 0.50% core deposit intangible (CDI) • Meaningful cost saves beginning in 2024 (40%) TRANSACTION RATIONALE • 3% accretive to Fully Converted Tangible Book Value* (“FCTBV”) • 2% dilutive to 2022 EPS and 3% dilutive to 2023 EPS due to shares issued to MHC, excluding restructuring expenses • Modestly accretive to 2022 net income Financial Assumptions Projected Results We believe the transaction will: • Provide a unique opportunity to use MHC structure • No consideration paid to a third party • All shares are issued to Columbia’s MHC • Accretive to FCTBV • Adds attractive markets, customers, and talent • Result in meaningful and achievable cost savings upon consolidation and the potential for revenue synergies

7 APPENDIX: MARK TO MARKET ADJUSTMENTS

8 Pro Forma Equity In $000s unless otherwise noted Freehold Preliminary Valuation $49,500 Freehold Total Equity $39,524 Freehold Transaction Expenses, Net of Tax (1,376) Mark-to-Market Adjustments, Net of Tax 1,427 Freehold Adjusted Total Equity $39,575 Goodwill $9,925 Value of Shares Issued $49,500 Columbia Transaction Expenses, Net of Tax (2,074) Non-PCD CECL Reserve, Net of Tax (1,166) Additional Deal Expenses (2023 - 2024), Net of Tax* (1,463) Impact on Columbia's Total Equity $44,797 Goodwill (9,925) Core Deposit Intangible (581) Impact on Columbia's Tangible Common Equity $34,291 Mark-to-Market Adjustments Pre-Tax Fair Value Deferred Tax Year 1 Mark to Market Adjustments Adjustment Asset / (Liab.) Goodwill Amortization Securities Mark $201 ($50) ($151) ($562) Loan Rate Mark 1,622 (406) (1,217) (270) Non-PCD Credit Mark (1,259) 315 944 235 PCD Credit Mark (1,049) 262 787 0 Elimination of Target's ALLL 1,171 (293) (878) 0 Fixed Asset Revaluation 3,007 (752) (2,255) (76) Core Deposit Intangible 581 (145) (436) (106) Time Deposit Mark (811) 203 608 405 Borrowings Mark (1,560) 390 1,170 780 Total $1,903 ($476) ($1,427) $406 MARK TO MARKET & GOODWILL ANALYSIS NOTE: ASSUMES A CLOSING BALANCE SHEET AT 3/31/21 * ESTIMATED DEAL EXPENSES TO BE PAID WHEN THE BANK SUBSIDIARIES ARE EXPECTED TO MERGE