Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIFTH THIRD BANCORP | fitb-20210616.htm |

1 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Morgan Stanley 2021 US Financials, Payments & CRE Conference Greg D. Carmichael Chairman & Chief Executive Officer June 16, 2021

2 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Cautionary statement This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance, capital actions or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our filings with the U.S. Securities and Exchange Commission (“SEC”). When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) effects of the global COVID-19 pandemic; (2) deteriorating credit quality; (3) loan concentration by location or industry of borrowers or collateral; (4) problems encountered by other financial institutions; (5) inadequate sources of funding or liquidity; (6) unfavorable actions of rating agencies; (7) inability to maintain or grow deposits; (8) limitations on the ability to receive dividends from subsidiaries; (9) cyber-security risks; (10) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (11) failures by third-party service providers; (12) inability to manage strategic initiatives and/or organizational changes; (13) inability to implement technology system enhancements; (14) failure of internal controls and other risk management systems; (15) losses related to fraud, theft, misappropriation or violence; (16) inability to attract and retain skilled personnel; (17) adverse impacts of government regulation; (18) governmental or regulatory changes or other actions; (19) failures to meet applicable capital requirements; (20) regulatory objections to Fif th Third’s capital plan; (21) regulation of Fifth Third’s derivatives activities; (22) deposit insurance premiums; (23) assessments for the orderly liquidation fund; (24) replacement of LIBOR; (25) weakness in the national or local economies; (26) global political and economic uncertainty or negative actions; (27) changes in interest rates; (28) changes and trends in capital markets; (29) fluctuation of Fifth Third’s stock price; (30) volatility in mortgage banking revenue; (31) litigation, investigations, and enforcement proceedings by governmental authorities; (32) breaches of contractual covenants, representations and warranties; (33) competition and changes in the financial services industry; (34) changing retail distribution strategies, customer preferences and behavior; (35) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisit ions; (36) potential dilution from future acquisitions; (37) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (38) results of investments or acquired entities; (39) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (40) inaccuracies or other failures from the use of models; (41) effects of critical accounting policies and judgments or the use of inaccurate estimates; (42) weather-related events, other natural disasters, or health emergencies (including pandemics); (43) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity; and (44) changes in law or requirements imposed by Fifth Third’s regulators impacting our capital actions, including dividend payments and stock repurchases. You should refer to our periodic reports filed with the SEC for further information or other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. We provide a discussion of non-GAAP measures and reconciliations to the most directly comparable GAAP measures in later slides in this presentation, as well as on page 25-27 of our 1Q21 earnings release. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Bancorp’s control or cannot be reasonably predicted. For the same reasons, the Bancorp’s management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

3 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Living our purpose guided by our vision and values Our Vision Be the One Bank people most value and trust Our Core Values Our Purpose To improve the lives of our customers and the well-being of our communities Work as One Bank Take Accountability Be Respectful Act with Integrity Our purpose, vision, and core values support our commitment to generating sustainable value for stakeholders

4 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Committed to generating sustainable value Environmental, Social, and Governance (ESG) actions and impact Actions Impact $41.6BN Delivered against 2016 $32BN community commitment1 $18 Minimum wage per hour (since 2019) $2.8BN commitment To accelerate racial equity, equality and inclusion 6 goals by 2025 To support inclusion and diversity within workforce and for its diverse suppliers 2.6M+ People educated through our L.I.F.E. programs2 200,000 Hours community service3 59% Women in workforce; 33% Board gender diversity Carbon neutral In 2020 for our operations, including scopes 1, 2 and 3 (business travel) First regional U.S. bank to achieve neutrality $5.4BN In lending and financing to renewable energy projects towards our $8BN sustainable financing goal by 20254 ESG Committee Established in 2020, reports to Nominating & Corporate Governance Committee World’s Most Ethical Companies Recognized by Ethisphere in 2021 Most Responsible Companies Recognized by Newsweek in 2020 America’s Best Large Employers Recognized by Forbes in 2021 Diversity Best Practices Inclusion Index Company in 2020 Outstanding Rating on our most recent CRA exam 100% Score Human Rights Campaign Corporate Equality Index for sixth consecutive year A- Leadership Band 2019 & 2020 CDP surveys Green Power Leadership 2020 award from Environmental Protection Agency Winning “W” Company Recognized by 2020 Women on Boards (2020WOB) 1Since 2016-2020; 2Since 2004; 32019-2020; 4Since 2012

5 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved FY15 1Q21 LTM Commercial banking Deposit service W&AM Card & processing Leasing Mortgage Other Delivering on our financial commitments 1 Differentiating our brand and customer experience 2 Optimizing the balance sheet 3 Driving fee income growth 4 Strategic expense management 2016 long-term commitments Select proof points • Reduced Commercial loans and leases by $7BN due to risk/return profile • De-emphasized CRE • Exited businesses and focused on clients with resilient and diversified businesses • Early-cycle hedging and investment portfolio management which provides long-term NIM protection • Grew and diversified fee revenue to offset rate headwinds • Expanded fee-based capabilities to support commercial verticals through strategic partnerships and acquisitions (incl. H2C, Coker, Bellwether, etc.) • Emphasis on organic growth in capital markets fees supporting commercial verticals • Grew and diversified recurring Wealth & Asset Management fees • Branch network optimization • Completed several waves of staffing and vendor optimization • Lean process automation and re-engineering underway through 2022 • Ongoing business rationalization • Corporate real estate rationalization Outcomes • Momentum Banking • Enhanced mobile app and credit card offering (“Cash/Back”) • Better client experience and enhanced innovative Treasury Management offerings (incl. Expert AP/AR) • Digital availability of core deposit products with world class account opening process FY15 1Q21 LTM ✓ Greenwich middle market customer experience winner ✓ Most credit quality metrics at or better than peer median ✓ Well-positioned for peer-leading PPNR growth ✓ Historically low charge-offs in 1Q21 ✓ Adjusted ROTCE and ROA improved from bottom third among peers to now top third Core Noninterest Income Core Efficiency Ratio 5% 2% 3% 0.5% Fifth Third checking household growth 2016 – Apr’21 CAGR (ex. MB) Southeast Midwest Total FITB US Average (Census Bureau 2016-2020)

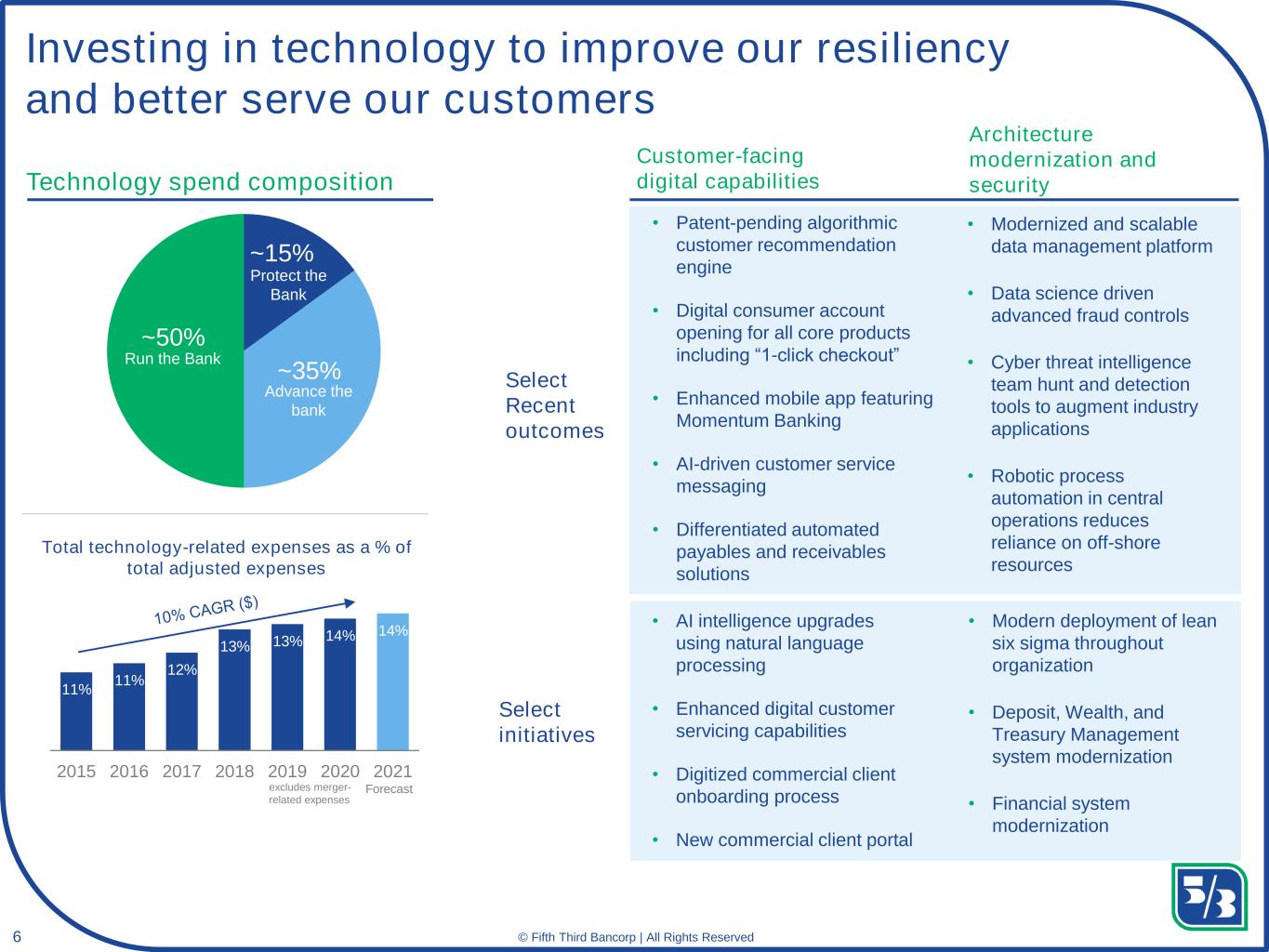

6 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Investing in technology to improve our resiliency and better serve our customers Select initiatives Select Recent outcomes Customer-facing digital capabilitiesTechnology spend composition Run the Bank Advance the bank Protect the Bank ~35% ~15% ~50% Total technology-related expenses as a % of total adjusted expenses 11% 11% 12% 13% 13% 14% 14% 2015 2016 2017 2018 2019 2020 2021 excludes merger- related expenses Forecast Architecture modernization and security • Patent-pending algorithmic customer recommendation engine • Digital consumer account opening for all core products including “1-click checkout” • Enhanced mobile app featuring Momentum Banking • AI-driven customer service messaging • Differentiated automated payables and receivables solutions • AI intelligence upgrades using natural language processing • Enhanced digital customer servicing capabilities • Digitized commercial client onboarding process • New commercial client portal • Modernized and scalable data management platform • Data science driven advanced fraud controls • Cyber threat intelligence team hunt and detection tools to augment industry applications • Robotic process automation in central operations reduces reliance on off-shore resources • Modern deployment of lean six sigma throughout organization • Deposit, Wealth, and Treasury Management system modernization • Financial system modernization

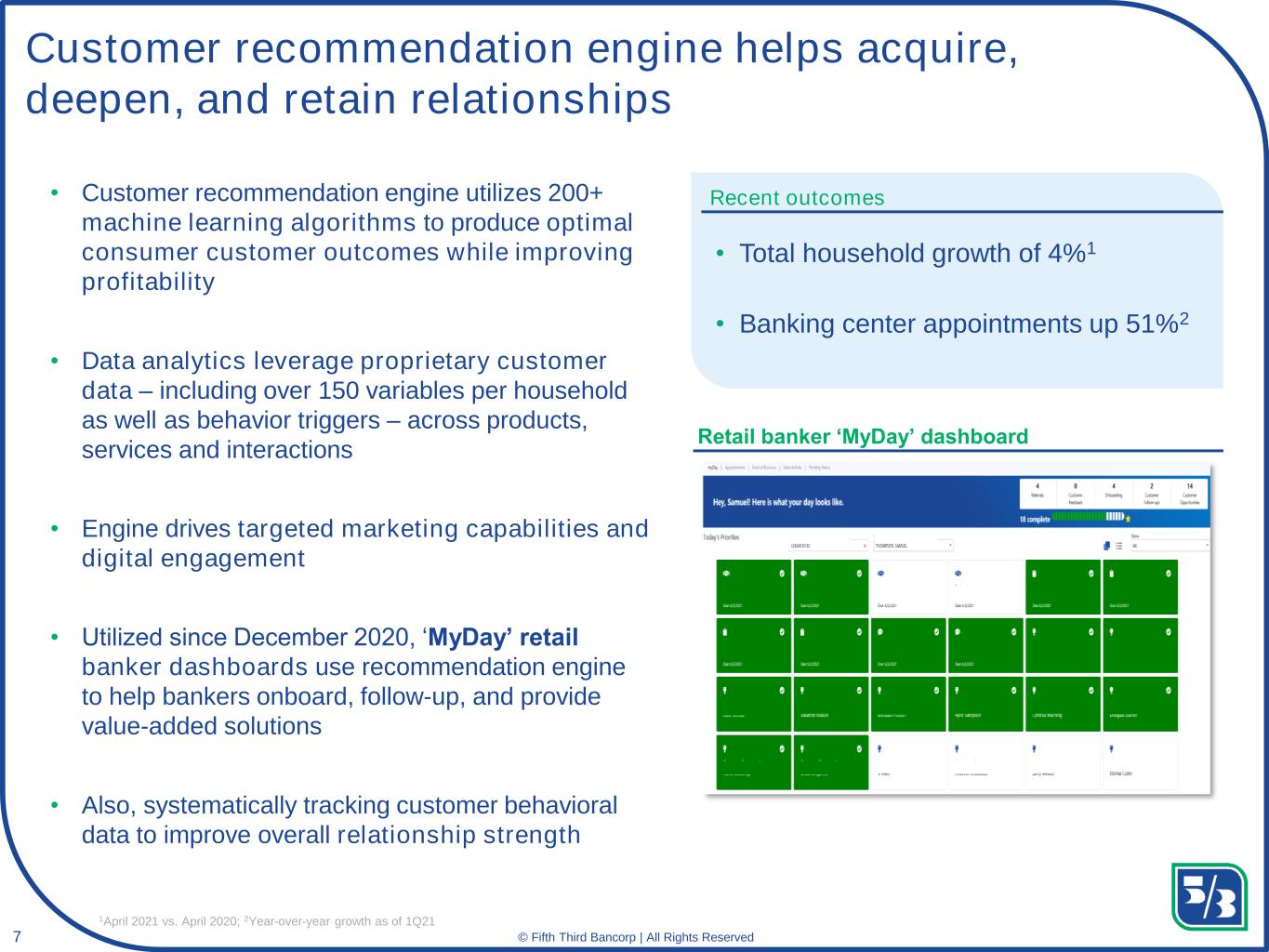

7 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved • Customer recommendation engine utilizes 200+ machine learning algorithms to produce optimal consumer customer outcomes while improving profitability • Data analytics leverage proprietary customer data – including over 150 variables per household as well as behavior triggers – across products, services and interactions • Engine drives targeted marketing capabilities and digital engagement • Utilized since December 2020, ‘MyDay’ retail banker dashboards use recommendation engine to help bankers onboard, follow-up, and provide value-added solutions • Also, systematically tracking customer behavioral data to improve overall relationship strength Customer recommendation engine helps acquire, deepen, and retain relationships Retail banker ‘MyDay’ dashboard • Total household growth of 4%1 • Banking center appointments up 51%2 Recent outcomes 1April 2021 vs. April 2020; 2Year-over-year growth as of 1Q21

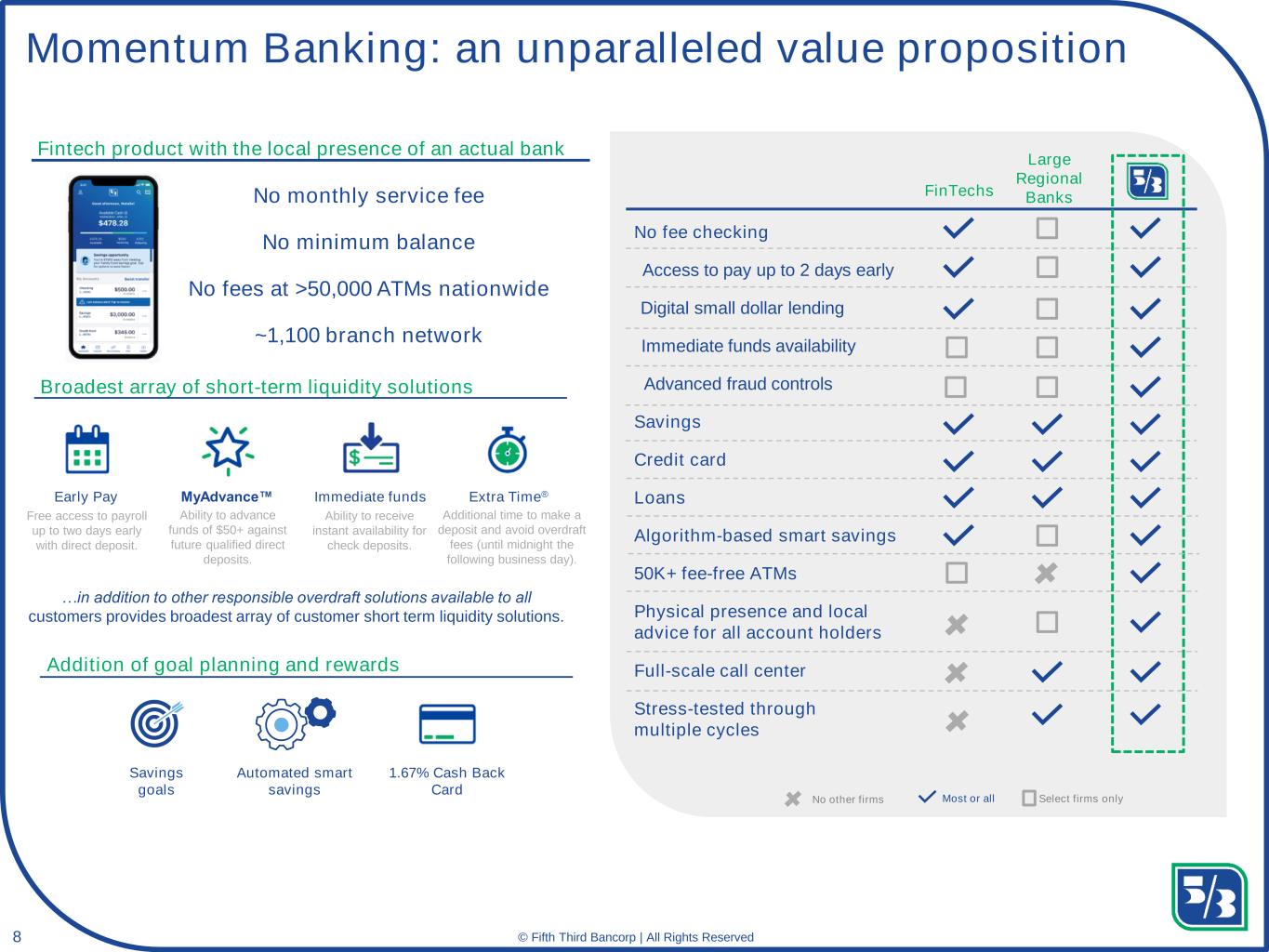

8 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved 1.67% Cash Back Card Savings goals Automated smart savings Momentum Banking: an unparalleled value proposition Fintech product with the local presence of an actual bank Early Pay Extra Time®MyAdvance™ Immediate funds Broadest array of short-term liquidity solutions Addition of goal planning and rewards No fee checking Savings Credit card Digital small dollar lending Loans 50K+ fee-free ATMs Large Regional Banks FinTechsNo monthly service fee No minimum balance No fees at >50,000 ATMs nationwide ~1,100 branch network Access to pay up to 2 days early Physical presence and local advice for all account holders Full-scale call center Algorithm-based smart savings Immediate funds availability Stress-tested through multiple cycles …in addition to other responsible overdraft solutions available to all customers provides broadest array of customer short term liquidity solutions. Free access to payroll up to two days early with direct deposit. Ability to advance funds of $50+ against future qualified direct deposits. Ability to receive instant availability for check deposits. Additional time to make a deposit and avoid overdraft fees (until midnight the following business day). Most or all Select firms only Advanced fraud controls No other firms

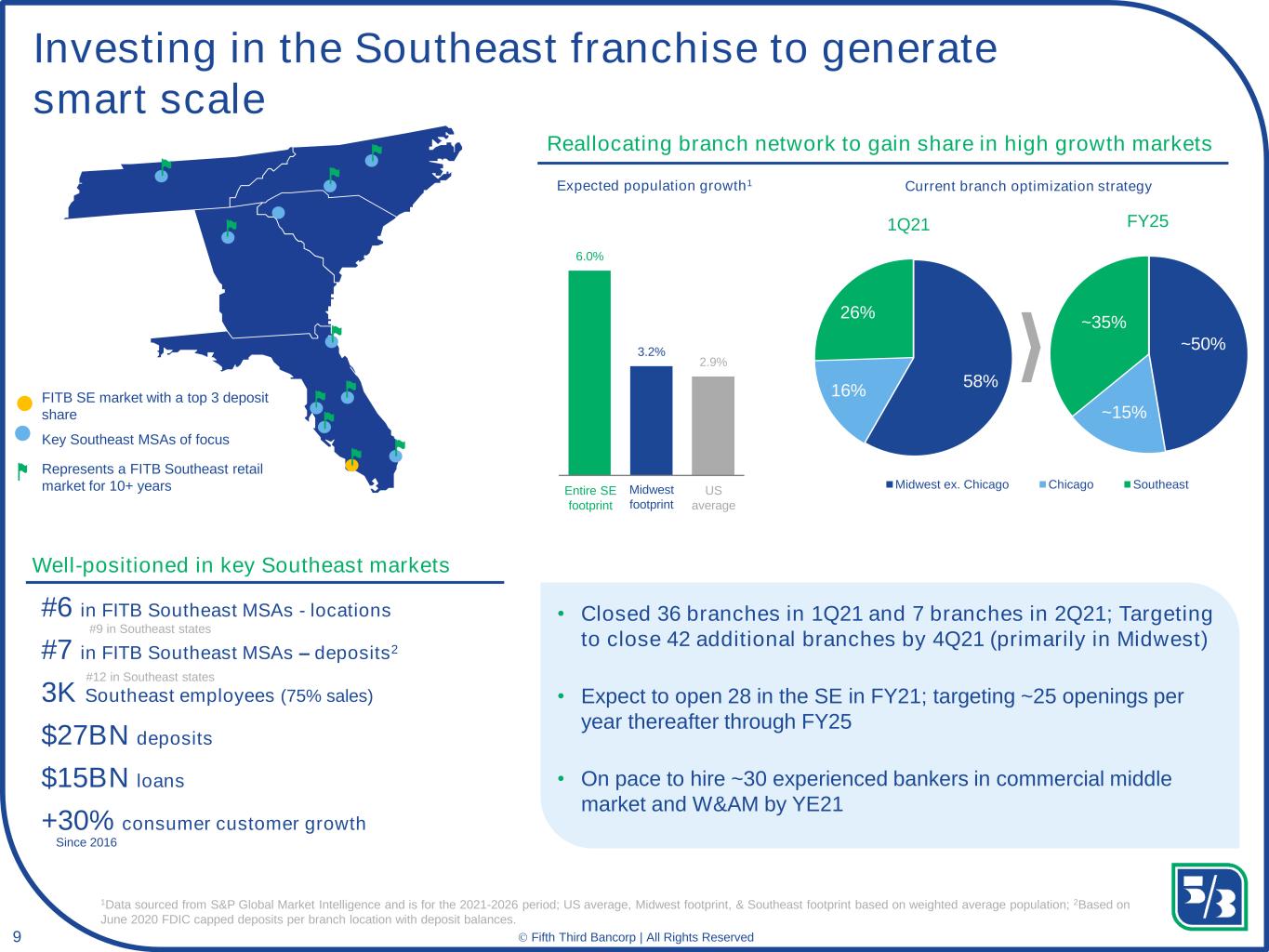

9 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved 58% 16% 26% Midwest ex. Chicago Chicago Southeast Investing in the Southeast franchise to generate smart scale FITB SE market with a top 3 deposit share Key Southeast MSAs of focus Represents a FITB Southeast retail market for 10+ years Well-positioned in key Southeast markets • Closed 36 branches in 1Q21 and 7 branches in 2Q21; Targeting to close 42 additional branches by 4Q21 (primarily in Midwest) • Expect to open 28 in the SE in FY21; targeting ~25 openings per year thereafter through FY25 • On pace to hire ~30 experienced bankers in commercial middle market and W&AM by YE21 #6 in FITB Southeast MSAs - locations #7 in FITB Southeast MSAs – deposits2 3K Southeast employees (75% sales) $27BN deposits $15BN loans +30% consumer customer growth 1Data sourced from S&P Global Market Intelligence and is for the 2021-2026 period; US average, Midwest footprint, & Southeast footprint based on weighted average population; 2Based on June 2020 FDIC capped deposits per branch location with deposit balances. #9 in Southeast states #12 in Southeast states Reallocating branch network to gain share in high growth markets Since 2016 6.0% 3.2% 2.9% Expected population growth1 US average Entire SE footprint Midwest footprint Current branch optimization strategy 1Q21 FY25 ~50% ~35% ~15%

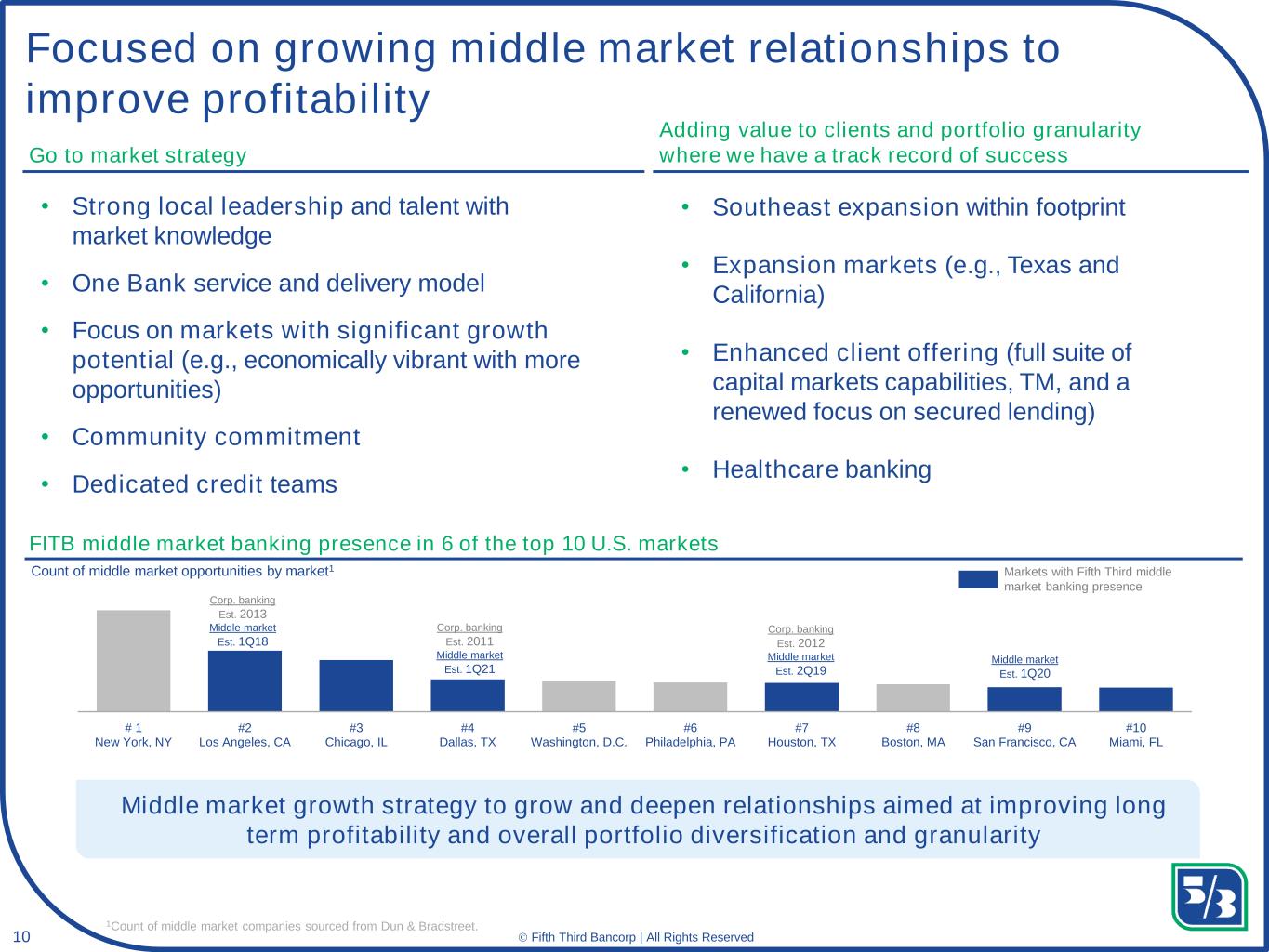

10 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved # 1 New York, NY #2 Los Angeles, CA #3 Chicago, IL #4 Dallas, TX #5 Washington, D.C. #6 Philadelphia, PA #7 Houston, TX #8 Boston, MA #9 San Francisco, CA #10 Miami, FL Corp. banking Est. 2013 Middle market Est. 1Q18 Focused on growing middle market relationships to improve profitability Go to market strategy • Strong local leadership and talent with market knowledge • One Bank service and delivery model • Focus on markets with significant growth potential (e.g., economically vibrant with more opportunities) • Community commitment • Dedicated credit teams • Southeast expansion within footprint • Expansion markets (e.g., Texas and California) • Enhanced client offering (full suite of capital markets capabilities, TM, and a renewed focus on secured lending) • Healthcare banking Adding value to clients and portfolio granularity where we have a track record of success Middle market growth strategy to grow and deepen relationships aimed at improving long term profitability and overall portfolio diversification and granularity FITB middle market banking presence in 6 of the top 10 U.S. markets Count of middle market opportunities by market1 Markets with Fifth Third middle market banking presence 1Count of middle market companies sourced from Dun & Bradstreet. Corp. banking Est. 2011 Middle market Est. 1Q21 Corp. banking Est. 2012 Middle market Est. 2Q19 Middle market Est. 1Q20

11 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Appendix

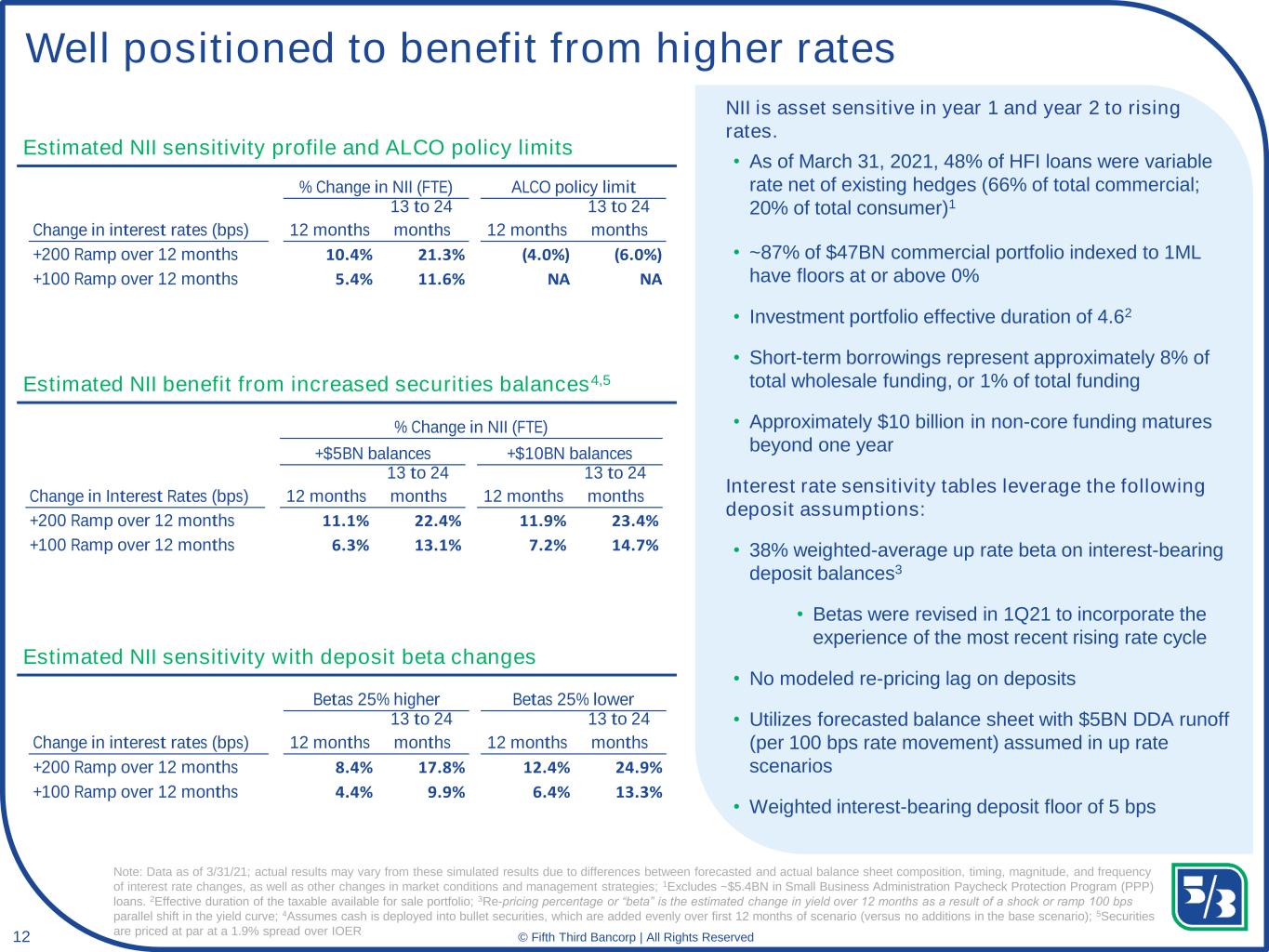

12 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Well positioned to benefit from higher rates Estimated NII sensitivity profile and ALCO policy limits Estimated NII sensitivity with deposit beta changes Estimated NII benefit from increased securities balances4,5 NII is asset sensitive in year 1 and year 2 to rising rates. • As of March 31, 2021, 48% of HFI loans were variable rate net of existing hedges (66% of total commercial; 20% of total consumer)1 • ~87% of $47BN commercial portfolio indexed to 1ML have floors at or above 0% • Investment portfolio effective duration of 4.62 • Short-term borrowings represent approximately 8% of total wholesale funding, or 1% of total funding • Approximately $10 billion in non-core funding matures beyond one year Interest rate sensitivity tables leverage the following deposit assumptions: • 38% weighted-average up rate beta on interest-bearing deposit balances3 • Betas were revised in 1Q21 to incorporate the experience of the most recent rising rate cycle • No modeled re-pricing lag on deposits • Utilizes forecasted balance sheet with $5BN DDA runoff (per 100 bps rate movement) assumed in up rate scenarios • Weighted interest-bearing deposit floor of 5 bps Note: Data as of 3/31/21; actual results may vary from these simulated results due to differences between forecasted and actual balance sheet composition, timing, magnitude, and frequency of interest rate changes, as well as other changes in market conditions and management strategies; 1Excludes ~$5.4BN in Small Business Administration Paycheck Protection Program (PPP) loans. 2Effective duration of the taxable available for sale portfolio; 3Re-pricing percentage or “beta” is the estimated change in yield over 12 months as a result of a shock or ramp 100 bps parallel shift in the yield curve; 4Assumes cash is deployed into bullet securities, which are added evenly over first 12 months of scenario (versus no additions in the base scenario); 5Securities are priced at par at a 1.9% spread over IOER ALCO policy limit Change in interest rates (bps) 12 months 13 to 24 months 12 months 13 to 24 months +200 Ramp over 12 months 10.4% 21.3% (4.0%) (6.0%) +100 Ramp over 12 months 5.4% 11.6% NA NA % Change in NII (FTE) Betas 25% higher Betas 25% lower Change in interest rates (bps) 12 months 13 to 24 months 12 months 13 to 24 months +200 Ramp over 12 months 8.4% 17.8% 12.4% 24.9% +100 Ramp over 12 months 4.4% 9.9% 6.4% 13.3% % Change in NII (FTE) +$5BN balances +$10BN balances Change in Interest Rates (bps) 12 months 13 to 24 months 12 months 13 to 24 months +200 Ramp over 12 months 11.1% 22.4% 11.9% 23.4% +100 Ramp over 12 months 6.3% 13.1% 7.2% 14.7%

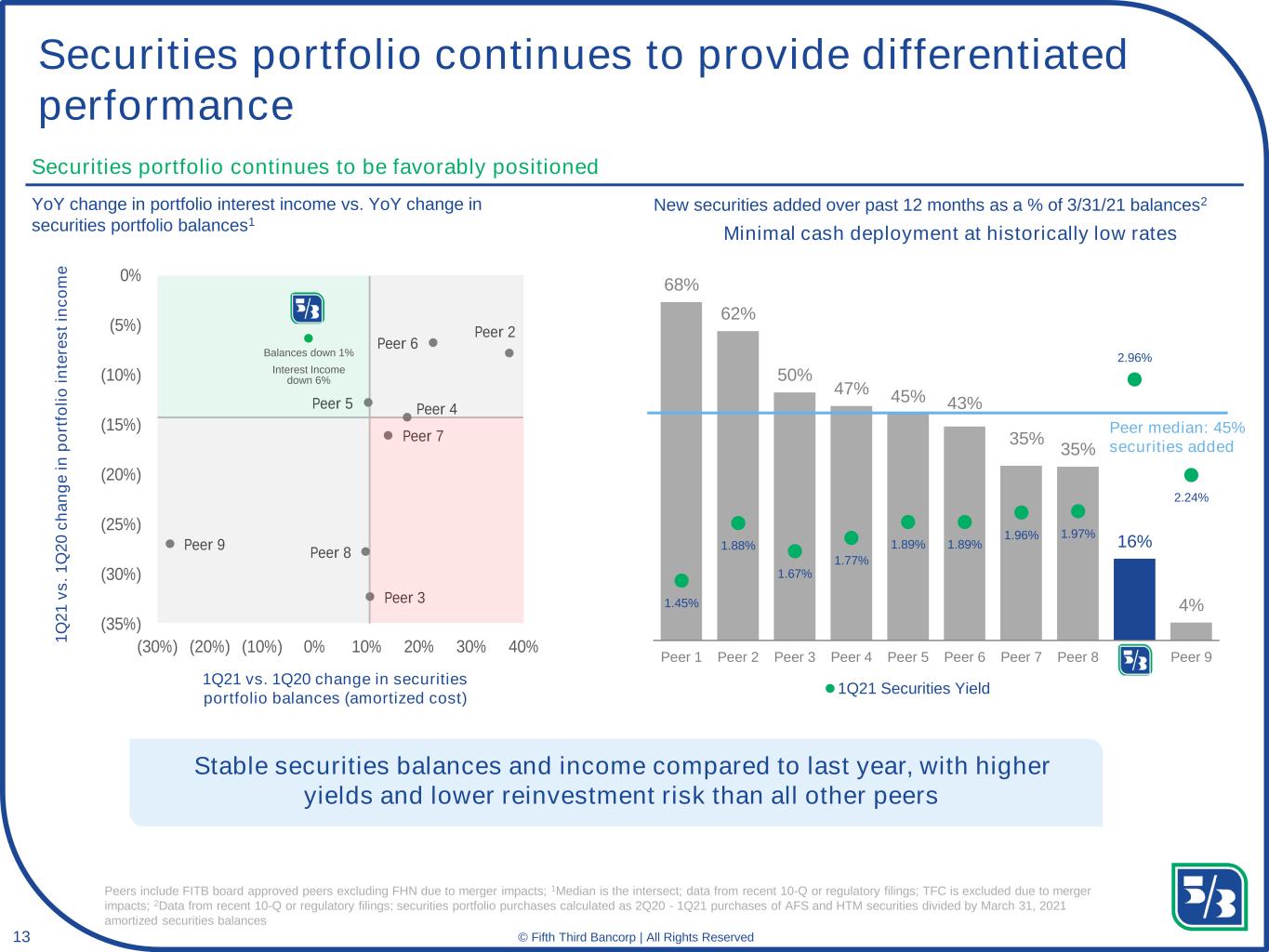

13 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Peer 6 Peer 7 Peer 2 Peer 4 Peer 3 Peer 8 Peer 5 Peer 9 (35%) (30%) (25%) (20%) (15%) (10%) (5%) 0% (30%) (20%) (10%) 0% 10% 20% 30% 40% Securities portfolio continues to provide differentiated performance 68% 62% 50% 47% 45% 43% 35% 35% 16% 4%1.45% 1.88% 1.67% 1.77% 1.89% 1.89% 1.96% 1.97% 2.96% 2.24% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 x Peer 9 1Q21 Securities Yield Peers include FITB board approved peers excluding FHN due to merger impacts; 1Median is the intersect; data from recent 10-Q or regulatory filings; TFC is excluded due to merger impacts; 2Data from recent 10-Q or regulatory filings; securities portfolio purchases calculated as 2Q20 - 1Q21 purchases of AFS and HTM securities divided by March 31, 2021 amortized securities balances New securities added over past 12 months as a % of 3/31/21 balances2YoY change in portfolio interest income vs. YoY change in securities portfolio balances1 1Q21 vs. 1Q20 change in securities portfolio balances (amortized cost) 1 Q 2 1 v s . 1 Q 2 0 c h a n g e i n p o rt fo li o i n te re s t in c o m e Securities portfolio continues to be favorably positioned Stable securities balances and income compared to last year, with higher yields and lower reinvestment risk than all other peers Balances down 1% Interest Income down 6% Minimal cash deployment at historically low rates Peer median: 45% securities added

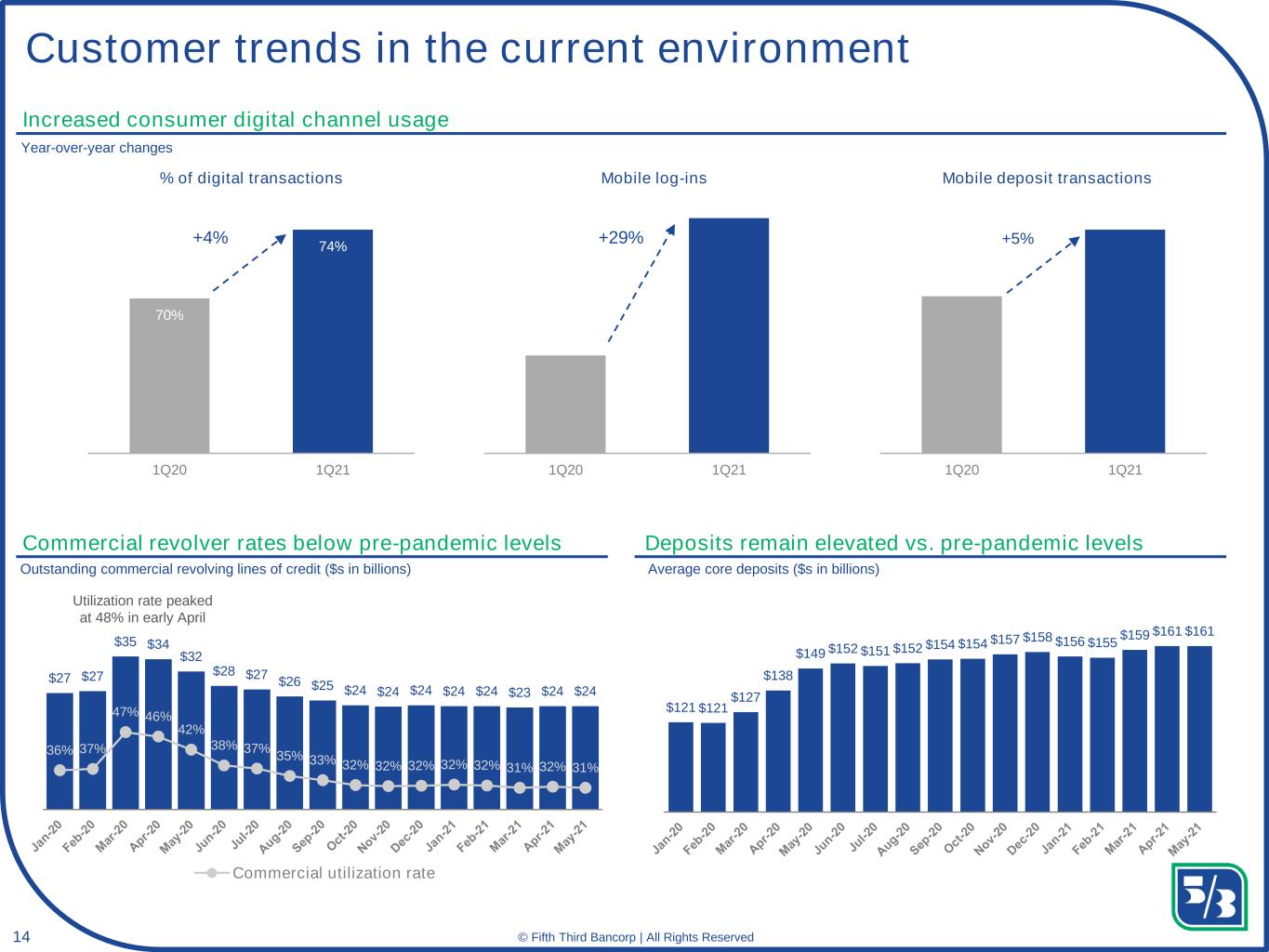

14 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved 70% 74% 1Q20 1Q21 +4% Customer trends in the current environment Deposits remain elevated vs. pre-pandemic levels $27 $27 $35 $34 $32 $28 $27 $26 $25 $24 $24 $24 $24 $24 $23 $24 $24 36% 37% 47% 46% 42% 38% 37% 35% 33% 32% 32% 32% 32% 32% 31% 32% 31% 0 5 10 15 20 25 30 35 40 Commercial utilization rate Outstanding commercial revolving lines of credit ($s in billions) Commercial revolver rates below pre-pandemic levels $121 $121 $127 $138 $149 $152 $151 $152 $154 $154 $157 $158 $156 $155 $159 $161 $161 Average core deposits ($s in billions) Increased consumer digital channel usage 1Q20 1Q21 1Q20 1Q21 % of digital transactions Mobile log-ins Mobile deposit transactions +5%+29% Year-over-year changes Utilization rate peaked at 48% in early April

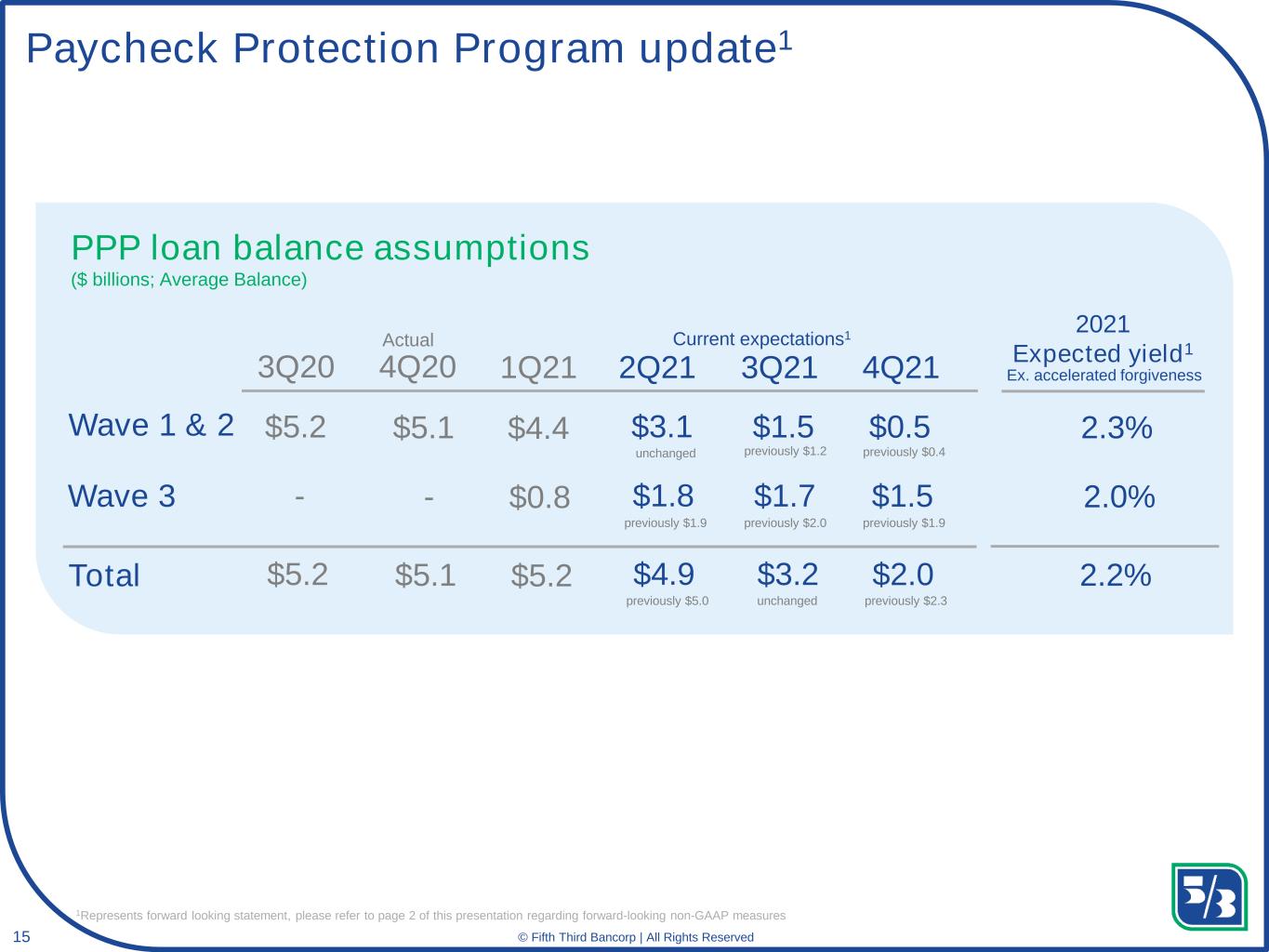

15 Classification: Internal Use© Fifth Third Banc rp | All Rights Reserved Paycheck Protection Program update1 PPP loan balance assumptions ($ billions; Average Balance) 1Q21 2Q21 3Q21 4Q21 Wave 1 & 2 Wave 3 Total 3Q20 4Q20 $5.2 $5.1 $4.4 $3.1 $1.5 $0.5 - - $0.8 $1.8 $1.7 $1.5 $5.2 $5.1 $5.2 $4.9 $3.2 $2.0 Actual Current expectations1 2021 Expected yield1 2.3% 2.0% 2.2% unchanged previously $1.2 previously $0.4 previously $1.9 previously $2.0 previously $1.9 previously $5.0 unchanged previously $2.3 Ex. accelerated forgiveness 1Represents forward looking statement, please refer to page 2 of this presentation regarding forward-looking non-GAAP measures