Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended April 30, 2021

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-54546

AMERI METRO, INC.

(Exact name of registrant as specified in its charter)

Delaware |

| 45-1877342 |

(State or other jurisdiction of incorporation or organization) |

| (IRS Employer Identification No.) |

|

|

|

2575 Eastern Blvd. Suite 211 York, Pennsylvania |

|

17402 |

(Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code: (717) 434-0668

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

[ ] Yes [X] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ] Yes [X] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] | Accelerated filer [ ] |

Non-accelerated filer [ X ] | Smaller reporting company [ X ] |

Emerging growth company [ ] | |

1

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

Indicate the number of shares outstanding of each of the registrant’s classes of preferred stock and common stock as of the latest practicable date.

Class | Outstanding at June 14, 2021 |

|

|

Preferred Stock, par value $0.00001 | 1,800,000 shares |

Class A Common Stock, par value $0.000001 | 1,684,000 shares |

Class B Common Stock, par value $0.000001 | 4,289,637,844 shares |

Class C Common Stock, par value $0.000001 | 191,051,320 shares |

Class D Common Stock, par value $0.000001 | 114,000,000 shares |

2

AMERI METRO, INC.

TABLE OF CONTENTS

April 30, 2021

INDEX

| Page | |

PART I – FINANCIAL INFORMATION |

| |

|

|

|

Item 1. | Condensed Consolidated Financial Statements (unaudited) |

|

|

|

|

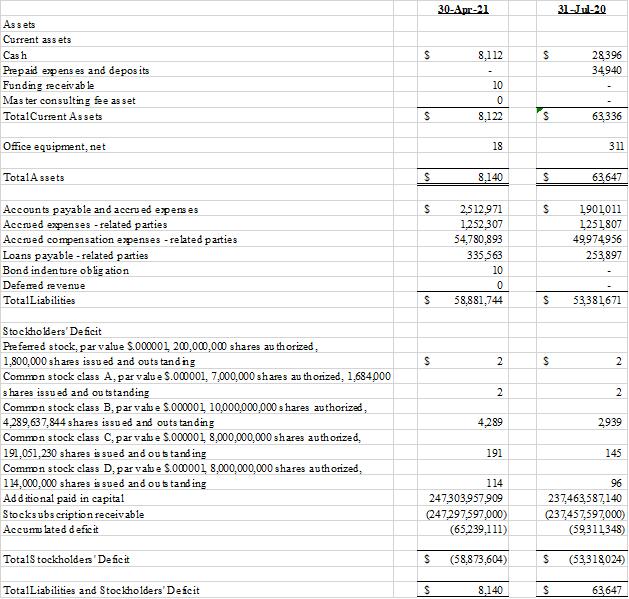

| Condensed Consolidated Balance Sheets as of April 30, 2021 and July 31, 2020 (audited) | F-1 |

|

|

|

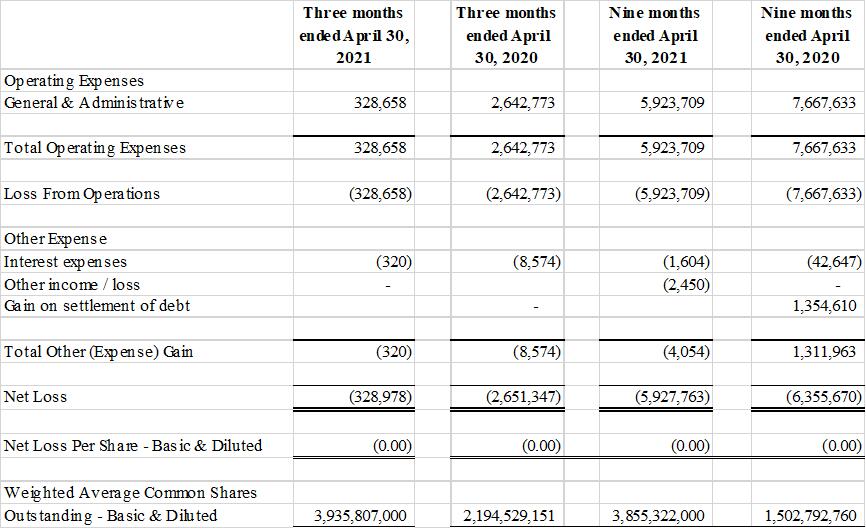

| Condensed Consolidated Statements of Operations for the Three and Nine Months ended April 30, 2021 and 2020 (unaudited) |

F-2 |

|

|

|

| Condensed Consolidated Statements of Stockholders’ Deficit for the Nine Months ended April 30, 2021 and 2020 (unaudited) |

F-3 |

|

|

|

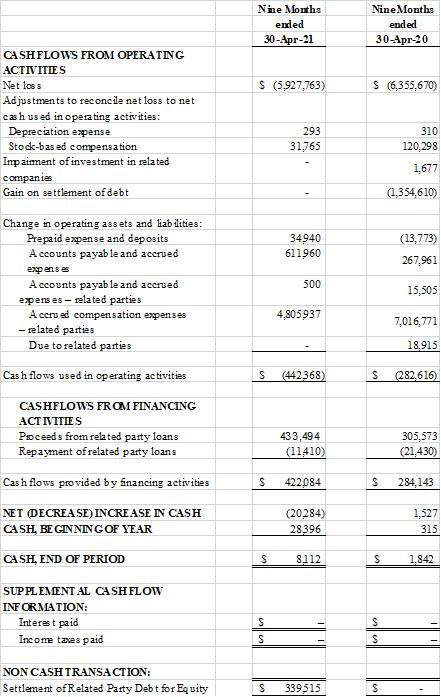

| Condensed Consolidated Statements of Cash Flows for the Nine Months ended April 30, 2021 and 2020 (unaudited) |

F-4 |

|

|

|

| Notes to Condensed Consolidated Financial Statements (unaudited) | F-5 |

|

|

|

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 14 |

|

|

|

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 19 |

|

|

|

Item 4. | Controls and Procedures | 19 |

|

|

|

PART II – OTHER INFORMATION | ||

|

|

|

Item 1. | Legal Proceedings | 19 |

|

|

|

Item 1A. | Risk Factors | 19 |

|

|

|

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 20 |

|

|

|

Item 3. | Defaults Upon Senior Securities | 20 |

|

|

|

Item 4. | Mine Safety Disclosures | 20 |

|

|

|

Item 5. | Other Information | 20 |

|

|

|

Item 6. | Exhibits | 20 |

|

|

|

Signatures |

| 21 |

3

AMERI METRO, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

See accompanying notes to condensed consolidated financial statements (unaudited).

F-1

AMERI METRO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

See accompanying notes to condensed consolidated financial statements (unaudited).

F-2

AMERI METRO, INC.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE NINE MONTHS ENDED APRIL 30, 2021 AND 2020

(Unaudited)

| Preferred Stock | Common Stock Class A | Common Stock Class B | Common Stock Class C | Common Stock Class D | Additional Paid in | Stock Subscription | Accumulated |

| ||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Capital | Receivable | Deficit | Total | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Balance, August 1, 2019 | 1,800,000 | $ 2 | 1,600,000 | $ 2 | 1,062,522,134 | $ 1,063 | 48,000,000 | $ 48 | 48,000,000 | $ 48 | $ 1,589,157,814 | $ (1,583,597,000) | $ (50,225,784) | $ (44,663,807) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Stock-based compensation | – | – | – | – | 480,000,000 | 480 | – | – | – | – | 119,818 | – | – | 119,818 | |

Shares issued for option exercise | - | - | - | - | 303,600,000 | 303 | - | - | - | - | 228,673,999,697 | (228,673,999,697) | - | - | |

Shares issued for amended opportunity license agreement | - | - | - | - | 3,475,248 | 3 | - | - | - | - | 866 | - | - | 869 | |

Stock options issued for debt settlement | - | - | - | - | - | - | 14,769,480 | 15 | - | - | 3,677 | - | (3,692) | - | |

Shares issued for investment in related entity | - | - | - | - | - | - | 3,230,520 | 3 | - | - | 805 | - | - | 808 | |

Shares re-issued for deposit | - | - | - | - | 11,292,240 | 11 | - | - | - | - | (11) | - | - | - | |

Stock Dividend | - | - | - | - | 1,065,879,277 | 1,068 | - | - | - | - | 477,463 |

| (465,229) | 13,300 | |

Net loss | – | – | – | – | – | – | – | – | – | – | – | – | (6,355,670) | (6,355,670) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Balance, April 30, 2020 | 1,800,000 | $ 2 | 1,600,000 | $ 2 | 2,926,768,899 | $ 2,926 | 66,000,000 | $ 66 | 48,000,000 | $ 48 | $230,263,760,129 | $ (230,257,597,000) | $ (57,050,375) | $ (50,884,202) | |

| Preferred Stock | Common Stock Class A | Common Stock Class B | Common Stock Class C | Common Stock Class D | Additional Paid in | Stock Subscription | Accumulated |

| ||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Capital | Receivable | Deficit | Total | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Balance, August 1, 2020 | 1,800,000 | $ 2 | 1,684,000 | $ 2 | 2,939,018,899 | $ 2,939 | 145,045,680 | $ 145 | 96,000,000 | $ 96 | $237,463,587,140 | $ (237,457,597,000) | $ (59,311,348) | $ (53,318,024) | |

Opening Equity AJE |

|

|

|

|

|

|

|

|

|

| 905 |

|

| 905 | |

Stock-based compensation | – | – | – | – | – | – | – | – | – | – | 106 | – | – | 106 | |

Issuance of Class B shares at par | - | - | - | - | 1,348,218,945 | 1,348 | - | - | - | - | (1,348) | - | - | - | |

Issuance of Class C shares at par | - | - | - |

| - | - | 23,000,000 | 23 | - | - | (23) | - | - | - | |

Issuance of Class C shares at par | - | - | - | - | - | - | 23,000,000 | 23 | - | - | (23) | - | -- | - | |

Issuance of Class D shares at par | - | - | - | - | - | - | - | - | 18,000,000 | 18 | (18) | - | - | - | |

Shares issued to officers for cash | - | - |

| - | 2,400,000 | 2 | - | - | - | - | 9,839,999,998 | (9,840,000,000) | - | - | |

Conversion of shares for debt | - | - | - | - | - | - | 5,640 | - | - | - | 339,515 | - | - | 339,515 | |

Stock Options Issued | - | - | - | - | - | - | - | - | - | - | 31,658 | - | - | 31,658 | |

Net Loss | – | – | – | – | – | – | – | – | – | – | – | – | (5,927,763) | (5,927,763) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Balance, April 30, 2021 | 1,800,000 | $ 2 | 1,684,000 | $ 2 | 4,289,637,844 | $ 4,289 | 191,051,320 | $ 191 | 114,000,000 | $ 114 | $247,303,597,908 | $ (247,297,597,000) | $ (65,239,111) | $ (58,873,604) | |

See accompanying notes to condensed consolidated financial statements (unaudited).

F-3

AMERI METRO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

See accompanying notes to condensed consolidated financial statements (unaudited).

F-4

AMERI METRO, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

April 30, 2021 and 2020

(Unaudited)

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Ameri Metro, Inc. (“Ameri Metro”, “our” and the “Company”) was formed to engage primarily in high-speed rail for passenger and freight transportation and related transportation projects. The Company initially intends to develop a Midwest high-speed rail system for passengers and freight.

The Company’s activities are subject to significant risks and uncertainties including failure to secure additional funding to properly execute our business plan.

The following transactions changed the corporate operating structure of the Company during the nine months ended April 30, 2021:

On February 18, 2020, the Company issued 3,230,520 shares of Class C common stock to acquire 2% of Susquehanna Mortgage Bankers Corp. (formerly Global Infrastructure SP Bankers). On April 28, 2020, by consent of the Company’s Board of directors, the Company agree to issue 23,000,000 shares of Original Class C common stock to acquire an additional 23% in Susquehanna Mortgage Bankers Corp. The intent is to become a licensed Commercial & Residential lender, an entity supervised by the State banking commission. Once licensed, it will then apply for a Fintech mortgage lender with the U.S. Office of Currency Control to become a licensed lender under the U.S. Federal Reserve system. On September 18, 2020, the Company issued 23,000,000 shares of Original Class C common stock to Susquehanna Mortgage Bankers.

On April 28, 2020, by consent of the Company’s Board of directors, the Company agreed to issue 23,000,000 shares of the Original Class C common stock to acquire 25% ownership interest in Ann Charles International Airport. The Company is the developer of this project. On September 18, 2020, the Company issued 23,000,000 shares of Original Class C common stock to Ann Charles International Airport.

On September 18, 2020, the CEO of the Company transferred 102,600,000 shares of Class B common stock from his personal holdings to 20 related entities in which the Company holds a 25% ownership interest in 19 of the 20 related entities and 10% interest in one of the related entities.

On September 18, 2020, the Company reserved 400,000,000 Class B shares of common stock in the name of the Ameri Metro, Inc. Trust, for the purpose of any future purchases of commodities, supplies, equipment and other tangible items for current and future projects. The shares are being administered by the HSRF Statutory Trust on behalf of the Company and will be issued out of trust when the Company deems it appropriate to issue Class B shares of common stock for these purchases.

As a result of the previous transactions, the Company has a 25% participating profits interest in nineteen related entities and a 10% participating profit in one other entity. These entities have not commenced substantial operations or revenue producing activities.

On December 8, 2020, Atlantic Energy & Utility Products, Inc. a related party of the Company, entered into an agreement with Bayelsa Oil Company Limited to extract 70 million barrels of oil from the OPL 240 asset. The related entity and Bayelsa Oil Company Limited will create a joint venture to raise approximately $300.55MM to further develop the OPL 240 asset. Ameri Metro, Inc. holds a 25% non-controlling interest in Atlantic Energy & Utility Products, Inc.

On February 8, 2021, the Ameri Metro Inc Board of Directors voted to proceed with the creation of a wholly-owned subsidiary "Africa High Speed Rail and Infrastructure Development Co." for projects located on the African continent. The wholly-owned subsidiary will also apply for listing on the Nigerian Stock Exchange (NSE) in the near future.

On February 10, 2021, the Board of Directors approved the transfer of Global Infrastructure and Development Company in the UK as a wholly owned subsidiary of the Company.

F-5

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information, the instructions to Form 10-Q and Article 8 of Regulation S-X, and should be read in conjunction with the audited consolidated financial statements and notes thereto contained in the Company’s consolidated financial statements filed with the Securities and Exchange Commission (“SEC”) on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for the unaudited interim condensed consolidated financial statements to be not misleading have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. The unaudited interim condensed consolidated statements do not include all of the information and notes required by U.S. GAAP for complete financial statements. Notes to the consolidated financial statements which would substantially duplicate the disclosure contained in the audited consolidated financial statements for the most recent fiscal year 2020 as reported in Form 10-K, have been omitted.

Principles of Consolidation

The consolidated financial statements present the financial position, results of operations and cash flows for Ameri Metro and its wholly-owned subsidiaries, Global Transportation & Infrastructure, Inc. (“GTI”); Africa High Speed Rail and Infrastructure Development Co. and Global Infrastructure and Development Company. Intercompany transactions and balances have been eliminated in consolidation.

The financial position, results of operations and cash flows as of, and for the period reported include the results of operations for Ameri Metro and its subsidiaries.

Participating Profits Interest

As at April 30, 2021, the Company has a 25% participating profits interest in nineteen related entities and a 10% participating profit in one other entity. The remaining participating profits interest (and 100% voting control) is owned by the Company’s majority shareholder. These entities have had no operations, assets, or liabilities, and as of April 30, 2021, the Company’s participating profits interest in these companies was $0.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the year. Management bases its estimates on historical experience and on other assumptions considered to be reasonable under the circumstances. However, actual results may differ from the estimates.

Revenue Recognition

We will recognize revenue from contracts with customers in accordance with Financial Accounting Standards Board (“FASB”) ASC Topic 606, “Revenue from Contracts with Customers” (“ASC 606”). We recognize our contracts in our financial statements upon determining that it creates enforceable rights and obligations and the funding to complete our projects are probable.

The Company will recognize revenue based on the following agreements for each project:

Master Consulting Agreement Exhibit 10.24: The Company shall be compensated for arranging financing and developing the sponsorship mechanism for the Project by a specific fee equal to one and one half percent (1.5%) of the face amount of the each master trust indenture. All fees are deemed earned upon delivery of each master trust indenture documents and or recordation of same in any public record. However, the Company has conservatively determined under ASC 606 that the revenues will not be recognized until the cash from the bond indentures is received and is ready to be transferred to the sponsor projects.

Master Agreement for Construction Exhibit 10.15: The Company will earn cost plus forty percent (40%), plus two percent (2%) over the adjustment for the increase in inflation. Construction contract is based upon 97% of the face amount of each Master Trust Indenture over course of construction period. The Company will also receive three percent (3%) of the face amount of the contract upon the bond funding for the initial phase of the project; and a subsequent payment of an additional two percent (2%) of the face amount of the contract upon mobilization of the project. These percentages shall apply to the first phase and to all subsequent phases of the project.

The cost plus forty percent, plus the 2% inflation adjustment will be recognized over the expected term of the contract on a percentage of completion basis.

The 3% will be recognized at the time of the bond funding as the Company has no other performance obligations.

The 2% mobilization fee will be recognized at that time the project is mobilized.

F-6

The Company will also generate revenues through Susquehanna Mortgage Bankers and Penn Insurance Services. The Company currently has no activity related to these two entities. The revenues will be recorded based on the Master Consulting Agreement of 1.5%, Credit Enhancement Fees of 3.0%, Financial Guarantee Fees of 3%, Lender Fee of 1.5%, Origination / Underwriting Fee of 1.5% and Service Fees of 0.5%. All of the fees will be recognized once all services have been completed.

The Company has submitted $44.5 Billion shovel ready projects to a large financial institution for funding. They expect that these projects will be financed over the next twelve months, which will allow management to commence the projects and recognize revenue.

Income (Loss) Per Share

Basic loss per share is calculated by dividing the Company’s net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing the Company’s net income available to common shareholders by the diluted weighted average number of shares outstanding during the period. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. Due to loss for the period ended April 30, 2021 and 2020, the outstanding options are anti-dilutive. As a result, the computations of net loss per common shares is the same for both basic and fully diluted common stock. Potentially dilutive securities, which includes 23,630,000 stock options as at April 30, 2021, have been excluded from the computation of diluted net loss per share because the effect of their inclusion would have been antidilutive.

Recent Accounting Pronouncements

In December 2019, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2019-12, “Simplifying the Accounting for Income Taxes”. The pronouncement simplifies the accounting for income taxes by removing certain exceptions to the general principles in ASC Topic 740, “Income Taxes”. The pronouncement also improves consistent application of and simplifies GAAP for other areas of Topic 740 by clarifying and amending existing guidance. ASU 2019-12 will be effective for us beginning in the first quarter of fiscal 2021, with early adoption permitted. We have evaluated the impact of the new FASB standard and determine that it will not have a material impact on our consolidated financial statements.

NOTE 2 – GOING CONCERN

These unaudited condensed consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has not generated any revenues since inception, management’s business strategy involves commencing of various economic development projects and closing of acquisitions that are expected to be profitable subject to the availability of financing to make these projects and acquisitions commercially successful. As at April 30, 2020, the Company has a working capital deficit of approximately $58.874 million and has accumulated losses of $65,239,111 since inception. The ability of the Company to continue as a going concern is dependent on our ability to generate cash from the sale of its common stock and/or obtaining debt financing and attaining future profitable operations.

Management’s plans include selling its equity securities and obtaining debt financing to fund its capital requirement and on-going operations; however, there can be no assurance the Company will be successful in these efforts. These factors create substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustment that might be necessary if the Company is unable to continue as a going concern.

NOTE 3 – ACCRUED COMPENSATION AND ACCRUED EXPENSES – RELATED PARTIES

As of April 30, 2021, $56,033,200 (July 31, 2020 - $51,226,763) is accrued in relation to various employment agreements, directorship agreements and audit committee agreements.

NOTE 4 – LOANS PAYABLE – RELATED PARTY

As of April 30, 2021, $335,562 (July 31, 2020 - $253,897) is due to the majority shareholder as he paid expenses on behalf of the Company. The amount is unsecured, bears interest at 1% per annum and is due on demand.

F-7

Details of transactions between the Company and related parties are disclosed below:

|

| April 30, |

|

| April 30, |

|

|

| 2021 |

|

| 2020 |

|

|

| $ |

|

| $ |

|

The following balances were carried out with related parties: |

|

|

|

|

|

|

Officer payroll |

| 3,381,765 |

|

| 5,103,385 |

|

Director fees |

| 975,000 |

|

| 1,462,747 |

|

Audit committee fees |

| 180,000 |

|

| 270,000 |

|

NOTE 5 – CAPITAL STOCK

On September 18, 2020, the Company issued the 23,000,000 shares of Original Class C common stock to Susquehanna Mortgage Bankers Corp. (formerly Global Infrastructure SP Bankers).

On September 18, 2020, the Company issued the 23,000,000 shares of Original Class C common stock to Ann Charles International Airport.

On September 18, 2020, the CEO of the Company transferred 102,600,000 shares of Class B common stock from his personal holdings to 20 related entities in which the Company holds a 25% ownership interest in 19 of the 20 related entities and 10% interest in one of the related entities.

On September 18, 2020, the Company reserved 400,000,000 Class B shares of common stock in the name of the Ameri Metro, Inc. Trust, for the purpose of any future purchases of commodities, supplies, equipment and other tangible items for current and future projects. The shares are being administered by the HSRF Statutory Trust on behalf of the Company and will be issued out of trust when the Company deems it appropriate to issue Class B shares of common stock for these purchases.

On September 18, 2020, the Company issued 2,400,000 shares of Class B common stock at $4,100 per share from the 2015 Equity Incentive Plan reserved shares to 12 directors and officers of the Company, of which $9,840,000,000 proceeds is recorded as stock subscription receivable.

On October 1, 2018, the Company issued 18,000,000 each of Class C and Class D shares of common stock in the name of Ameri Metro, Inc. The shares are being administered by HSRF Statutory Trust and reserved on behalf of the shareholders for future dividend disbursement.

On November 5, 2018, the Company issued 2,000,000 shares of Class B common stock with a fair value of $500 to two officers and directors of the Company for services pursuant to directorship agreements dated August 30, 2018. The shares were issued from the 2015 Equity Incentive Plan reserved shares. The shares vest 285,714 per year for seven years. As of the year ended July 31, 2020, the shares were fully vested.

On December 28, 2020, the majority shareholder converted approximately $339,000 in debt owed to one of his related companies for a fixed conversion price of $60 which provided him with 5,640 Class C shares.

NOTE 6 – STOCK OPTIONS

On March 8, 2016, the Company adopted a stock option plan named 2015 Equity Incentive Plan, the purpose of which is to help the Company secure and retain the services of employees, directors and consultants, provide incentives to exert maximum efforts for the success of the Company and any affiliate and provide a means by which the eligible recipients may benefit from increases in value of the common stock.

During the three months ended April 30, 2021 and 2020, the Company recorded stock-based compensation of $31,658 and $65 on the consolidated statement of operations for all stock based compensation.

During the nine months ended April 30, 2021 and 2020, the Company recorded stock-based compensation of $31,765 and $65 on the consolidated statement of operations for all stock based compensation.

On June 12, 2019, the Company amended Equity Incentive Plans, Subscription Agreements and Equity Agreements so that options issued after June 12, 2019 would have a strike price equal to the market price at that grant date.

F-8

A summary of the Company’s stock option activity is as follow:

| Number of Options | Weighted Average Exercise Price $ | Weighted Average Remaining Contractual Term | Aggregate Intrinsic Value $ |

|

|

|

|

|

Outstanding, July 31, 2020 | 10,890,000 | 435.75 | 19.65 | – |

|

|

|

|

|

Granted | 12,740,000 | 435.75 | 30 | – |

Exercised | – | – | – | – |

|

|

|

|

|

Outstanding, April 30, 2021 | 23,630,000 | 435.75 | 25.23 | – |

Exercisable, April 30, 2021 | 21,630,000 | 435.75 | 25.23 | – |

The fair value of each option granted was estimated on the date of grant using the Black-Scholes option pricing model with the following weighted average assumptions:

| Nine Months Ended April 30, 2021 | Nine Months Ended April 30, 2020 |

Expected dividend yield | 0% | 0% |

Expected volatility | 150% | 150% |

Expected life (in years) | 30 | 30 |

Risk-free interest rate | 1.84% | 1.82% |

|

|

|

The options issued to officers and directors have an indefinite life. The Company has adjusted the expected life of the options to 30 years in the current quarter.

All Officer and Director Stock Options and Share Based Compensation are fully vested.

At April 30, 2021, there was $- of unrecognized compensation costs related to non-vested stock-based compensation arrangements granted under the Plan. There was nil intrinsic value associated with the outstanding stock options at April 30, 2021.

NOTE 7 – COMMITMENTS AND CONTINGENCIES

Related and Non-related Party Agreements

The Company has entered into agreements with related and non-related parties for identified projects. As of April 30, 2021 and through May 14, 2021, the Company has no commitments or obligations under these agreements due to lack of financing which is in process. The Company will be committed to perform agreed upon services once the financings are completed. The Company has completed most of the feasibility studies for each project.

On June 25, 2019, the Company amended the Opportunity License Agreements it entered with 16 related entities. The amendment clarifies ownership, voting rights, and distribution of profits for the Company and the Company founder. The amendment also provides that the Company will purchase non-controlling interest of each of the sixteen entities and the Portus de Jewel project. On June 29, 2019, the Company issued 33,931,475 shares of Class B common stock from the 2015 Incentive Plan which equal to 25% of the Founder’s shares in 15 of the 16 entities and 20,000,000 shares of Class B common stock from the 2015 Incentive Plan which equal to 10% of the Founder’s shares in the Portus de Jewel project. During the year ended July 31, 2019, the Company recorded an impairment of $8,483 and opportunity license fees of $5,000 which are included in general and administrative expense.

Employee Agreements

The Company has entered into material agreements with its Officers and Directors for more information on these contracts please see the Company’s July 31, 2020 Form 10-K.

The Company has entered into an employment agreement with the Chief Operations Officer of the Company with an effective date of August 30, 2018. The term of the employment agreement is three years, with an annual base salary of $425,000. Effective September 1, 2019, the Chief Operations Officer’s annual base salary is increased to $500,000.

The Company has entered into an employment agreement with the Chief Financial Officer of the Company with an effective date of August 30, 2018. The term of the employment agreement is three years, with an annual base salary of $375,000. Effective September 1, 2019, the Chief Financial Officer’s annual base salary is increased to $500,000.

F-9

As of April 30, 2021 and July 31, 2020, total accrued compensation expenses to related parties related to the above employment agreements were $54,780,893 and $49,974,956, respectively. As of April 30, 2021 and July 31, 2020, the Company has accrued payroll taxes of $1,533,141 and $1,401,084, respectively, related to the accrued compensation expenses. The board of directors have stopped accruing compensation for officers and directors as of February 1, 2021.

Operating Lease

On April 30, 2014, the Company terminated its existing office space lease, and entered into a new month-to-month rent agreement for office space. The new agreement which commenced on November 1, 2015, calls for monthly rent payments of $1,440. The terminated lease agreement has not been resolved as to payment of existing amounts due or as to any early termination fees. According to the lease agreement, the Company’s unpaid rental balance shall bear interest until paid at a rate equal to the prime rate of interest charged by the M&T Bank, plus 2 percent. Late payment charge is $25 per day beginning with the first day following the due date. As of April 30, 2021, and July 31, 2020, the Company recorded accrued interest and late fee of $170,060 and $163,389, respectively.

Legal Proceedings

On September 14, 2017, the Company received a letter from Zimmerman & Associates, on behalf of J. Harold Hatchett, III and Ronald Silberstein, claiming breach of contract, wrongful termination, and wrongful violations of the Business Corporations Act, and knowingly inaccurate SEC Reporting against the Company and the board of directors. The Company plans to work amicably to come to a settlement. As of April 30, 2021 and July 31, 2020, the Company has accrued $1,263,870 and $1,295,120 in salaries for each of J. Harold Hatchett III and Ronald Silberstein, respectively for each period.

The Company received a lawsuit on June 13, 2017 by Estate of Robert A. Berry Esq. (decedent, Oct 22, 2015), plaintiff (the “Plaintiff Estate”). The Plaintiff Estate asserted a claim for $50,000 and 11,000 common class “B” shares of the Company relating to shares and accrued stipend beginning 2015. The Company, in 2015, had previously booked the liability of $50,000 without interest accruing and issued the 11,000 shares of common class “B” stock of the Company to decedent Robert A. Berry Esq. The Company anticipates paying the $50,000 when our capital raise is completed.

NOTE 8 – INCOME TAXES

At April 30, 2021 and July 31, 2020, the Company’s deferred tax assets consisted of principally net operating loss carry forwards. The material reconciling items between the tax benefit computed at the statutory rate and the actual benefit recognized in the financial statements consisted of accrued expenses and the change in the valuation allowance during the applicable period. The Company has recorded a 100% valuation allowance as management is uncertain that the Company will realize the deferred tax assets.

The Company has filed its federal and state tax returns for the year ended July 31, 2020 and has filed its federal and state tax returns for the year ended July 31, 2019. The Net operating losses (“NOLs”) for these years will not be available to reduce future taxable income until the returns are filed. Assuming these returns are filed, as of April 30, 2021, the Company had approximately $10.9 million of federal and state net operating losses that may be available to offset future taxable income. The net operating loss carryforwards will begin to expire in 2021 unless utilized.

The tax years 2013 to 2020 remain open to examination by the major taxing jurisdictions to which the Company is subject.

NOTE 9 – SUBSEQUENT EVENTS

We have evaluated subsequent events through June 14, 2021, the date on which the accompanying condensed consolidated financial statements were available to be issued. Based upon its evaluation, management has determined that no subsequent events have occurred that would require recognition in the accompanying condensed consolidated financial statements or disclosures in the notes thereto, except as follows:

To mitigate the impact of novel coronavirus 2019 (“COVID-19”), we have taken measures to promote the safety and security of our employees while complying with various government mandates, including work-from-home arrangements and social-distancing initiatives to reduce the transmission of COVID-19.

The COVID-19 pandemic has had a negative impact on our results of operations and financial performance for the first of 2020, and we expect it will continue to have a negative impact on our revenue, earnings and cash flows into 2021. Accordingly, current results and financial condition discussed herein may not be indicative of future operating results and trends.

F-10

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s discussion and analysis of results of operations and financial condition (“MD&A”) is a supplement to the accompanying unaudited consolidated financial statements and provides additional information on the Company’s businesses, current developments, financial condition, cash flows and results of operations. The following discussion should be read in conjunction with our unaudited consolidated financial statements and notes thereto included elsewhere in this Quarterly Report on Form 10-Q (this “Quarterly Report”) and with our Annual Report on Form 10-K for the fiscal year ended July 31, 2020.

Forward-Looking Statements

Except for the historical information contained herein, this Quarterly Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements involve risks and uncertainties, including, among other things, statements concerning: our business strategy; liquidity and capital expenditures; future sources of revenues and anticipated costs and expenses; and trends in industry activity generally. Such forward-looking statements include, among others, those statements including the words such as "may," "will," "should," "expect," "plan," "could," "anticipate," "intend," "believe," "estimate," "predict," "potential," "goal," or similar language or by discussions of our outlook, plans, goals, strategy or intentions.

Our actual results may differ significantly from those projected in the forward-looking statements. These statements are only predictions and involve known and unknown risks, and uncertainties, that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, we cannot guarantee future results, levels of activity, performance or achievements.

The forward-looking statements we make in this Quarterly Report are based on management’s current views and assumptions regarding future events and speak only as of the date of this report. We assume no obligation to update any of these forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements, except as required by applicable law, including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission.

BUSINESS

The Business

Ameri Metro, Inc. (“Ameri Metro” and the “Company”) is multifaceted emerging growth critical infrastructure and economic development company. The Company under the master construction agreement with related and non-related parties has over $510 Billion (USA) in construction contracts and or agreement/MOUs to construct projects, for various governments and states throughout the United States of America and Africa. Under an agreement with Bayelsa Oil Company (a State-owned company), the Company’s related entity holds rights to extract 70 million barrels of oil.

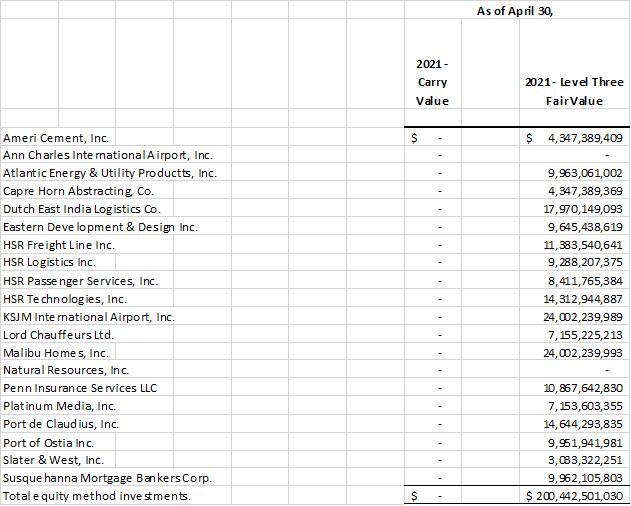

The Company and the 20 related entities were formed to engage primarily in High-Speed Rail for passenger, freight transportation, and ancillary infrastructure projects such as inland ports, deep water sea ports, airports, airline, toll roads, toll bridges, energy, utilities, power grid, telecommunications, technologies, housing, insurance services, media, and as mortgage banker for infrastructure projects and related transportation projects. Management has completed a third party valuation of the 20 entities which was based on projected discounted net income (Level 3). The resulting Level Three fair value is provided later in this section and totals $200,442,501,030. Management has not recorded the fair value in the financial statements.

The Company, and its wholly owned subsidiaries, plan to use Private Public Partnerships (“PPP”) for funding of infrastructure projects and transportation projects. The Company is a conduit to provide general contracting services for infrastructure projects and transportation projects. As a conduit we identify infrastructure projects for both private and public end users. The Company will bring together private and public entities, the end users, including the affiliate entities to organize the revenue bond offering, which will be the private debt vehicle to build the infrastructure project for the end user. The Company’s ultimate role is providing general contracting services and construction management services for the private and public entities. The Company was incorporated in the State of Delaware and merged with Ameri Metro 2010 on June 12, 2012.

In the United States, the Company via its related entities, initially intends to develop a Midwest high-speed rail system for passengers and freight. These initial planned activities are “ATFI Roadway” and “Port Trajan”, a northeast freight corridor.

In Africa, the Company has a binding memorandum of understanding to develop a high-speed rail system for passengers and freight, and an agreement to extract 70 million barrels of oil.

14

Since its incorporation, the Company has developed its business plan, appointed officers and directors, engaged initial project consultants, and had meetings with certain agencies and groups related to potential future projects as disclosed in the “Current Potential Projects” section of the Company’s July 31, 2020 Form 10-K.

The Company Founder and CEO Shah Mathias, has organized and established three related non-profit corporations and is an independent consultant of a fourth non-profit (ATFI) for the purpose of funding current potential projects of the Company identified by Transportation Economics Management Systems (TEMS). TEMS, a transportation/rail/sea vessel consulting firm working for and with the Company has completed preliminary studies on behalf of the end user, both public and private. The Company can introduce related and non-related entities to the four non-profit entities for the purpose of funding projects they have.

These are the four Non-Profit entities with the ability to officiate Master Bond Indentures when sponsored by a state end user:

1.Alabama Toll Facilities, Inc. (ATFI) (A Non-Related Party)

2.Hi Speed Rail Facilities, Inc. (HSRF) (A Related Party)

3.Hi Speed Rail Facilities Provider, Inc. (HSFP) (A Related Party)

4.Global Infrastructure Finance & Development Authority (GIFDA) (A Related Party)

The four non–profit related entities will play a vital role in financing. The non-profits statutes provide a vehicle to issue bonds and help secure infrastructure projects. The non-profit entities have the discretion to turn over the infrastructure projects to the state, or the governing body after it has successfully developed and paid for the potential projects. The Company will then be able to consult the end users, related and non-related entities, and non-profits (who will sponsor bond offerings to fund the projects) and to contract with one or more of the largest construction firms in the United States who will carry out the actual construction management.

Participating Profits Interest

As at April 30, 2021, the Company has a 25% participating profits interest in nineteen related entities and a 10% participating profit in one other entity. The remaining 75% participating profits interest (and 100% voting control) is owned by the Company’s majority shareholder. These entities have had no operations, assets, or liabilities, and as of April 30, 2021, the Company’s participating profits interest in these companies was $0.

On June 25, 2019, the Company amended the Opportunity License Agreements it entered with 16 related entities (Ameri Cement, Inc., Atlantic Energy & Utility Products, Inc., Cape Horn Abstracting Co., Eastern Development & Design Inc., HSR Freight Line Inc., HSR Logistics Inc., HSR Passenger Services, Inc., HSR Technologies, Inc., KSJM International Airport, Inc., Lord Chauffeurs Ltd., Malibu Homes Inc., Penn Insurance Services LLC, Platinum Media, Inc., Port de Claudius, Inc., Port of Ostia Inc., and Slater & West, Inc.). The amendment clarifies ownership, voting rights, and distribution of profits for the Company and the Company’s Chief Executive Officer. The amendment also provides that the Company will purchase non-controlling interest of each of the sixteen entities and the Portus de Jewel project. On June 29, 2019, the Company issued 33,931,475 shares of Class B common stock to acquire 25% ownership interest in 15 of the 16 entities. On January 13, 2020, the Company issued 3,475,248 shares of Class B common stock to acquire 25% ownership interest in 1 of the 16 entities.

On February 20, 2020, the Company issued 3,230,520 shares of Original Class C common stock to acquire 2% ownership interest in a related entity, Susquehanna Mortgage Bankers Corp (“Susquehanna”). On September 18, 2020, the Company issued 23,000,000 shares of Original Class C common stock to acquire an additional 23% ownership interest in Susquehanna.

On July 1, 2020, the Company issued 250,000 shares of Class B common stock to acquire 25% ownership interest in a related entity, Natural Resources Inc.

On July 31, 2020, the Company amended the Opportunity License Agreement it entered on June 25, 2019 for the acquisition of 10% participating profit interest in the Portus de Jewel project. Pursuant to the amendment, the consideration of 20,000,000 shares of Class B common stock also includes the acquisition of 10% of Dutch East India Logistics, Co, the developer of the Portus de Jewel project.

On June 20, 2020, the Company’s largest stockholder created Ann Charles International Airport, Inc. and transferred 25% of the equity to the Company.

On September 18, 2020, the CEO of the Company transferred 102,600,000 shares of Class B common stock from his personal holdings to 20 related entities in which the Company holds a 25% ownership interest in 19 of the 20 related entities and 10% interest in one of the related entities.

15

On September 18, 2020, the Company reserved 400,000,000 Class B shares of common stock in the name of the Ameri Metro, Inc. Trust, for the purpose of any future purchases of commodities, supplies, equipment and other tangible items for current and future projects. The shares are being administered by the HSRF Statutory Trust on behalf of the Company and will be issued out of trust when the Company deems it appropriate to issue Class B shares of common stock for these purchases.

As a result of the previous transactions, the Company has a 25% participating profits interest in nineteen related entities and a 10% participating profit in one other entity. These entities have not commenced substantial operations or revenue producing activities.

On December 8, 2020, Atlantic Energy & Utility Products, Inc. a related party of the Company, entered into an agreement with Bayelsa Oil Company Limited to extract 70 million barrels of oil from the OPL 240 asset. The related entity and Bayelsa Oil Company Limited will create a joint venture to raise approximately $300.55MM to further develop the OPL 240 asset. Ameri Metro, Inc. holds a 25% non-controlling interest in Atlantic Energy & Utility Products, Inc.

On February 8, 2021, the Ameri Metro Inc Board of Directors voted to proceed with the creation of a wholly-owned subsidiary "Africa High Speed Rail and Infrastructure Development Co." for projects located on the African continent. The wholly-owned subsidiary will also apply for listing on the Nigerian Stock Exchange (NSE) in the near future.

On February 10, 2021, the Board of Directors approved the transfer of Global Infrastructure and Development Company in the UK as a wholly owned subsidiary of the Company.

The Company determined that it has the ability to exercise significant influence over the operating and financial policies of the related entities and therefore the investments will be accounted for under the equity method of accounting once full operations of the entities commence.

16

The following table details the carrying value of the Company’s respective equity method investments. Management has completed a third party valuation of the 20 entities which was based on projected discounted net income (Level 3). The resulting Level Three fair value is provided below and totals $200,442,501,030. Management believes that future discounted net income will approximate its future net discounted cash flows. Additionally, any material changes to critical valuation inputs and future net income (or cash flows) can materially change the fair value of the equity investments. Management has not recorded the fair value in the financial statements:

Results of Operations

Significant Risks and Uncertainties

On January 30, 2020, the World Health Organization declared the novel coronavirus 2019 (“COVID-19”) outbreak to constitute a “Public Health Emergency of International Concern.” The COVID-19 outbreak is disrupting supply chains and affecting production and sales across a range of industries. On March 11, 2020, the World Health Organization declared COVID-19 a pandemic, and on March 13, 2020, the United States declared a national emergency with respect to COVID-19. The outbreak of COVID-19 has severely impacted global economic activity and caused significant volatility and negative pressure in financial markets. The global impact of the outbreak has been rapidly evolving and many countries, including the United States, have reacted by instituting quarantines, mandating business and school closures and restricting travel. The extent of the impact of COVID-19 on our operational and financial performance will depend on certain developments, including the duration and spread of the outbreak, impact on our customers, employees and vendors all of which are uncertain and cannot be predicted. At this point, the extent to which COVID-19 may impact our financial condition or results of operations is uncertain.

17

To mitigate the impact of COVID-19, we have taken measures to promote the safety and security of our employees while complying with various government mandates, including work-from-home arrangements and social-distancing initiatives to reduce the transmission of COVID-19.

The COVID-19 pandemic has had a negative impact on our results of operations and financial performance for the third quarter of 2021, and we expect it will continue to have a negative impact on our revenue, earnings and cash flows in the fourth quarter of 2021. Accordingly, current results and financial condition discussed herein may not be indicative of future operating results and trends. See the Risk Factors included in our Annual report on Form 10-K for the year ended July 31, 2020 as filed with the Securities and Exchange Commission as well as the additional Risk Factor included in Part II—Item 1A of this quarterly report regarding the impacts of the COVID-19 outbreak.

Comparison of the Nine Months Ended April 30, 2021 and 2020.

The Company did not earn revenues for the nine months ending April 30, 2021 and 2020. For the nine months ended April 30, 2021 and 2020, the Company had total operating expenses of $5,923,709 and $7,667,663, respectively and net losses of $5,927,763 and $6,355,670, respectively. The decrease in operating expenses resulted primarily from reductions in officer and director compensation by approximately $2,347,000.

Comparison of the Three Months Ended April 30, 2021 and 2020.

The Company did not earn revenues for the three months ending April 30, 2021 and 2020. For the three months ended April 30, 2020 and 2020, the Company had total operating expenses of $328,658 and $2,642,773, respectively and net losses of $328,978 and $2,651,347, respectively. The decrease in operating expenses resulted primarily from reductions in officer and director compensation by approximately $2,347,000.

Liquidity and Capital Resources

Our cash, current assets, total assets, current liabilities and total liabilities as of April 30, 2021 and July 31, 2020 were as follows:

| April 30, 2021 | July 31, 2020 |

Cash | $ 8,112 | $ 28,396 |

Total current assets | 8,122 | 63,336 |

Total assets | 8,140 | 63,647 |

Total current liabilities | $ 58,881,744 | $ 53,381,671 |

|

|

|

Cash Requirements

We had $8,112 in cash as of April 30, 2021. Our cash used in operations for the nine months ended April 30, 2021 was $442,368 and through April 30, 2020 was $282,616. We had a net loss of $5,927,763 for the nine months ended April 30, 2021 compared to April 30, 2020 of $6,355,670. We had an accumulated deficit of $65,239,111 as of April 30, 2021 compared to $57,050,375 at April 30, 2020. Our cash on hand is not sufficient to cover our monthly expenses and we continue to seek financing in the form of debt or stock sales to finance our operations. There can be no assurance the Company will be successful in these efforts.

Sources and Uses of Cash

Operations

For the nine months ended April 30, 2021, our net cash used in operating activities was $442,368 which consisted primarily of our net loss of $5,927,763, offset on the deferral of officer and director salary, increase in professional fees, state taxes and offset by reversal of share based compensation.

Financing

For the nine months ended April 30, 2021, our net cash provided by financing activities was $422,084, which consisted primarily of proceeds from related party loans.

Off-Balance Sheet Arrangements

As of April 30, 2021, we had no off-balance sheet arrangements.

18

Item 3. Quantitative and Qualitative Disclosures About Market Risk. - Not applicable.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Our management has evaluated, under the supervision and with the participation of our principal executive and principal financial officers, the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934 (the “Exchange Act”). Based on that evaluation, our principal executive and principal financial officers concluded that, as of the end of the period covered by this report, our disclosure controls and procedures were effective in ensuring that information required to be disclosed in our Exchange Act reports is (1) recorded, processed, summarized and reported in a timely manner, and (2) accumulated and communicated to our management, including our principal executive and financial officers, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

On September 14, 2017, the Company received a letter from Zimmerman & Associates, on behalf of J. Harold Hatchett, III and Ronald Silberstein, claiming breach of contract, wrongful termination, and wrongful violations of the Business Corporations Act, and knowingly inaccurate SEC Reporting against the Company and the board of directors. The Company plans to work amicably to come to a settlement. As of April 30, 2021 and 2020, the Company has accrued $1,263,870 and $1,295,120 in salaries for J. Harold Hatchett III and Ronald Silberstein, respectively.

The Company received lawsuit on June 13, 2017 by Estate of Robert A. Berry Esq. (decedent, Oct 22, 2015), plaintiff (the “Plaintiff Estate”). The Plaintiff Estate asserted a claim for $50,000 and 11,000 common class “B” shares of the Company relating to shares and accrued stipend beginning 2015. The Company, in 2015, had previously booked the liability of $50,000 without interest accruing and issued the 11,000 shares of common class “B” stock of the Company to decedent Robert A. Berry Esq. the Company anticipates paying the $50,000 when we complete our capital raise.

Item 1A. Risk Factors.

The discussion of our business and operations should be read together with the risk factor set forth below and the risk factors contained in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2020, which describe various risks and uncertainties to which we are or may become subject. These risks and uncertainties have the potential to affect our business, financial condition, results of operations, cash flows, strategies or prospects in a material and adverse manner. Other than the additional risk factor set forth below, as of April 30, 2021, there have been no material changes to the risk factors set forth in our Annual Report on Form 10-K for the year ended July 31, 2020.

The COVID-19 pandemic has negatively impacted the global economy, disrupted global supply chains, impacted the operations of our business partners and negatively impacted our operations and financial results.

The COVID-19 outbreak has negatively impacted the global economy, disrupted global supply chains, constrained workforce participation due to travel restrictions and quarantine orders, disrupted logistics and distribution systems, and created significant volatility and disruption of financial markets. As a result, this pandemic has negatively impacted our operations and those of our customers and suppliers, and heightened the risks of customer bankruptcies, customer delayed payments, restrictions on access to financial markets and other risk factors described in our Annual Report. While we have not yet experienced any material disruption to our supply chain and our headquarters and main distribution warehouse remains operational under business continuity plans, we have experienced increased logistics costs, lower product demand, longer lead times, and shipping delays. To mitigate the impact of COVID-19, we have implemented business continuity plans, with a focus on employee safety and mitigation of business disruptions. As the scope and duration of the COVID-19 outbreak is unknown and the extent of its economic impact continues to evolve globally, there is significant uncertainty related to the ultimate impact that it will have on our business, our employees, results of operations and financial condition.

19

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

None

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

Not applicable.

Item 6. Exhibits.

See the Exhibit Index following the signature page to this Quarterly Report on Form 10-Q for a list of exhibits filed or furnished with this report, which Exhibit Index is incorporated herein by reference.

Exhibit Index

3.1 Articles of Incorporation (filed with the Form 10 November 9, 2011)

3.2 Amended by-laws (filed as part of the Form 8-K/A filed January 18, 2013)

3.3 Cert. of Amendment Cert. of Incorporation of Ameri Metro

5.1 Opinion of Counsel on legality of securities being registered

10.1 Master Indenture Agreement of Alabama Toll Facilities, Inc. (filed with the Form 8-K January 18, 2013)

10.2 Master Indenture Agreement of Hi Speed Rail Facilities, Inc. (filed with the Form 8-K January 18, 2013)

10.3 Master Indenture Agreement of Hi Speed Rail Facilities Provider, Inc. (filed with the Form 8-K January 18, 2013)

10.4 TEMS engagement (filed as part of the Form 8-K/A filed January 18, 2013)

10.5 Alabama Indenture Agreement (filed as part of the Form 8-K/A filed January 18, 2013)

10.6 High Speed Rail Indenture Agreement (filed as part of the Form 8-K/A filed January 18, 2013)

10.7 Damar Agreement (filed as part of the Form 8-K/A filed January 18, 2013)

10.8 Agreement For Construction (filed as part of the Form 10-K/A filed November 6, 2019)

10.9 Assignment Agreement For Construction (filed as part of the Form 10-K/A filed November 6, 2019)

10.10 Payment Agreement to Penndel Land Co (filed as part of the Form 10-K/A filed November 6, 2019)

10.11 Ameri Metro Inc. / HSR Tech Inc. Licensing of Intellectual Property Agreement (filed as part of the Form 10-K/A filed November 6, 2019)

10.12 HSR Tech LOI Tech Use Agreement (filed as part of the Form 10-K/A filed November 6, 2019)

10.13 Opportunity License Agreement Entities (filed as part of the Form 10-K/A filed November 6, 2019)

10.14 Master Agreement for Construction Nonprofits (filed as part of the Form 10-K/A filed November 6, 2019)

10.15 Master Agreement for Construction Entities (filed as part of the Form 10-K/A filed November 6, 2019)

10.16 Consulting Agreement HSRFP Inc. (filed as part of the Form 10-K/A filed November 6, 2019)

10.17 Consulting Agreement HSRF Inc. (filed as part of the Form 10-K/A filed November 6, 2019)

10.18 Company Founder Emp. Agreement(filed as part of the Form 10-K/A filed November 6, 2019)

10.19 Directorship Agreement (filed as part of the Form 10-K/A filed November 6, 2019)

10.20 Letter of Intent for Port Trajan property (filed with the Registration Statement on Form S-1 filed June 13, 2013)

10.21 Port De Ostia Inc. Agreement GTI (filed as part of the Form 10-K/A filed November 6, 2019)

10.22 C-Bar Marshall Rebar Agreement (filed as part of the Form 10-K/A filed November 6, 2019)

10.23 Ameri Metro & Jewell LOI (filed as part of the Form 10-K/A filed November 6, 2019)

10.24 Master Consulting Agreement (filed as part of the Form 10-K/A filed November 6, 2019)

10.25 Master Trustee Agreement (filed as part of the Form 10-K/A filed November 6, 2019)

10.26 2015 Executive Incentive Compensation Program (filed as part of the Form 10-K/A filed November 6, 2019)

10.27 Establishing the Compensation Committee (filed as part of the Form 10-K/A filed November 6, 2019)

10.28 Amendment to Payment Agreement Penndel Land Co. (filed as part of the Form 10-K/A filed November 6, 2019)

10.29 Amendment to HSR Technologies Inc. Payment Agreement (filed as part of the Form 10-K/A filed November 6, 2019)

10.30 Amendment to Damar TruckDeck LLC Payment Agreement (filed as part of the Form 10-K/A filed November 6, 2019)

10.31 TEMS consent form letter (filed as part of the Form 10-K/A filed November 6, 2019)

20

23.2 Consent of Counsel (included in Exhibit 5.1)

31.1 CERTIFICATION PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002*

31.2 CERTIFICATION PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002*

32.1 CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002*

32.2 CERTIFICATION OF PRINCIPAL ACCOUNTING AND FINANCIAL OFFICER PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002*

99.1 ProAdvisor Valuation report, dated November 1, 2016 (filed as Exhibit 99.1 to the registration statement on Form S-1, filed on November 23, 2016, and incorporated herein by reference)

99.2 ProAdvisor consent letter (filed as Exhibit 99.2 to the registration statement on Form S-1, filed on November 23, 2016) v

99.3 June 12, 2012 Agreement and Plan of Reorganization (filed as part of the Form 8-K/A filed January 18, 2013)

99.4 Alabama Legislative Act 506 (filed as part of the Form 8-K/A filed January 18, 2013)

99.5 Form of subscription agreement for sale of the shares (filed with the Registration Statement on Form S-1 filed June 13, 2013)

99.6 Intended use of Master Trust Indentures (filed as part of the Form 10-K/A filed November 6, 2019)

99.7 Florida Alabama TPO Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.8 Alabama Toll Road Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.9 Appalachian Region Commission Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.10 Atlantic Energy & Utilities Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.11 High Speed Rail Projects Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.12 Port Freeport & Brazoria Fort Bend Rail District Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.13 High Speed Rail & Ancillary Projects Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.14 Port of Ostia Inc. @ KSJM International Airport Inc. Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.15 Portus De Jewel Mexico Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.16 KSJM International Airport Inc. Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.17 HSR Freight Line Inc. / Phila. Port Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.18 HSR Freight Line Inc. Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.19 HSR Passenger Services Inc. Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.20 HSR Technologies Inc. Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.21 Malibu Homes Inc. Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.22 Platinum Media Inc. Bond Indenture (filed as part of the Form 10-Q filed December 30, 2019)

99.23 Port De Claudius Inc. & Port Trajan of Pa. Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.24 Panama Canal – Alabama Port Partnership (filed as part of the Form 10-K/A filed November 6, 2019)

99.25 Lord Chauffeurs Inc. – Business Jet Center @ KSJM Airport Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.26 HSR Freight Line Inc. & HSR Passenger Services Coast to Coast Rail Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.27 New York – Washington Rail Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.28 Ann Charles International Cargo Airport Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.29 Texas International Trade Corridor Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

99.30 Virginia Crescent Line Rail Bond Indenture (filed as part of the Form 10-K/A filed November 6, 2019)

____________________

* Filed herewith

** To be filed

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: June 16, 2021By:/s/ Robert Choiniere

Robert Choiniere

Chief Financial Officer

21