Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Hudson Global, Inc. | investorpresentation.htm |

| 8-K - 8-K - Hudson Global, Inc. | hson-20210615.htm |

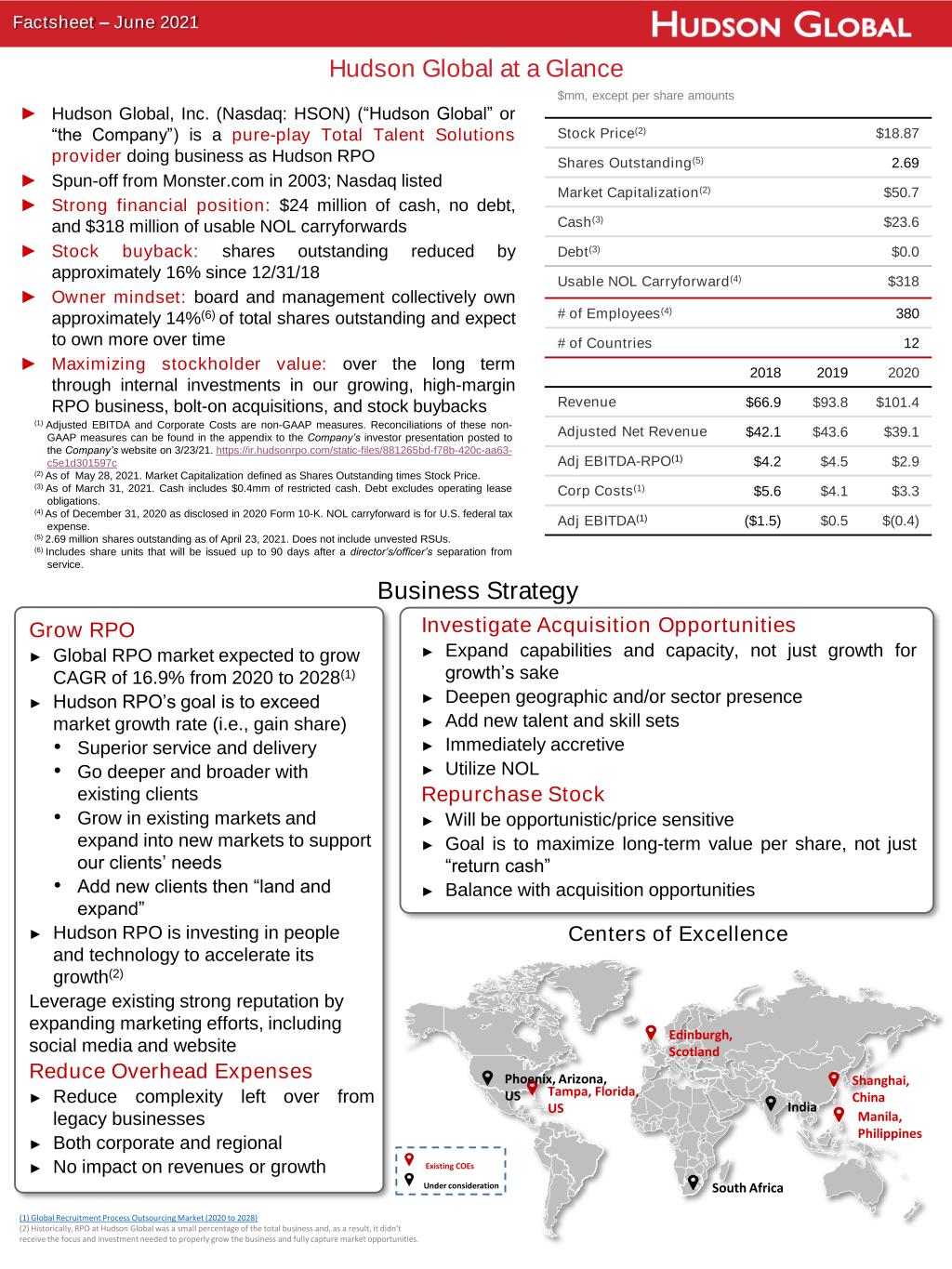

Hudson Global at a Glance Factsheet – June 2021 ► Hudson Global, Inc. (Nasdaq: HSON) (“Hudson Global” or “the Company”) is a pure-play Total Talent Solutions provider doing business as Hudson RPO ► Spun-off from Monster.com in 2003; Nasdaq listed ► Strong financial position: $24 million of cash, no debt, and $318 million of usable NOL carryforwards ► Stock buyback: shares outstanding reduced by approximately 16% since 12/31/18 ► Owner mindset: board and management collectively own approximately 14%(6) of total shares outstanding and expect to own more over time ► Maximizing stockholder value: over the long term through internal investments in our growing, high-margin RPO business, bolt-on acquisitions, and stock buybacks $mm, except per share amounts Stock Price(2) $18.87 Shares Outstanding(5) 2.69 Market Capitalization(2) $50.7 Cash(3) $23.6 Debt(3) $0.0 Usable NOL Carryforward(4) $318 2018 2019 2020 Revenue $66.9 $93.8 $101.4 Adjusted Net Revenue $42.1 $43.6 $39.1 Adj EBITDA-RPO(1) $4.2 $4.5 $2.9 Corp Costs(1) $5.6 $4.1 $3.3 Adj EBITDA(1) ($1.5) $0.5 $(0.4) # of Employees(4) 380 # of Countries 12 (1) Adjusted EBITDA and Corporate Costs are non-GAAP measures. Reconciliations of these non- GAAP measures can be found in the appendix to the Company’s investor presentation posted to the Company’s website on 3/23/21. https://ir.hudsonrpo.com/static-files/881265bd-f78b-420c-aa63- c5e1d301597c (2) As of May 28, 2021. Market Capitalization defined as Shares Outstanding times Stock Price. (3) As of March 31, 2021. Cash includes $0.4mm of restricted cash. Debt excludes operating lease obligations. (4) As of December 31, 2020 as disclosed in 2020 Form 10-K. NOL carryforward is for U.S. federal tax expense. (5) 2.69 million shares outstanding as of April 23, 2021. Does not include unvested RSUs. (6) Includes share units that will be issued up to 90 days after a director’s/officer’s separation from service. Grow RPO ► Global RPO market expected to grow CAGR of 16.9% from 2020 to 2028(1) ► Hudson RPO’s goal is to exceed market growth rate (i.e., gain share) • Superior service and delivery • Go deeper and broader with existing clients • Grow in existing markets and expand into new markets to support our clients’ needs • Add new clients then “land and expand” ► Hudson RPO is investing in people and technology to accelerate its growth(2) Leverage existing strong reputation by expanding marketing efforts, including social media and website Reduce Overhead Expenses ► Reduce complexity left over from legacy businesses ► Both corporate and regional ► No impact on revenues or growth Investigate Acquisition Opportunities ► Expand capabilities and capacity, not just growth for growth’s sake ► Deepen geographic and/or sector presence ► Add new talent and skill sets ► Immediately accretive ► Utilize NOL Repurchase Stock ► Will be opportunistic/price sensitive ► Goal is to maximize long-term value per share, not just “return cash” ► Balance with acquisition opportunities (1) Global Recruitment Process Outsourcing Market (2020 to 2028) (2) Historically, RPO at Hudson Global was a small percentage of the total business and, as a result, it didn’t receive the focus and investment needed to properly grow the business and fully capture market opportunities. Business Strategy Manila, Philippines Shanghai, China Edinburgh, Scotland Tampa, Florida, US Phoenix, Arizona, US India South Africa Existing COEs Under consideration Centers of Excellence

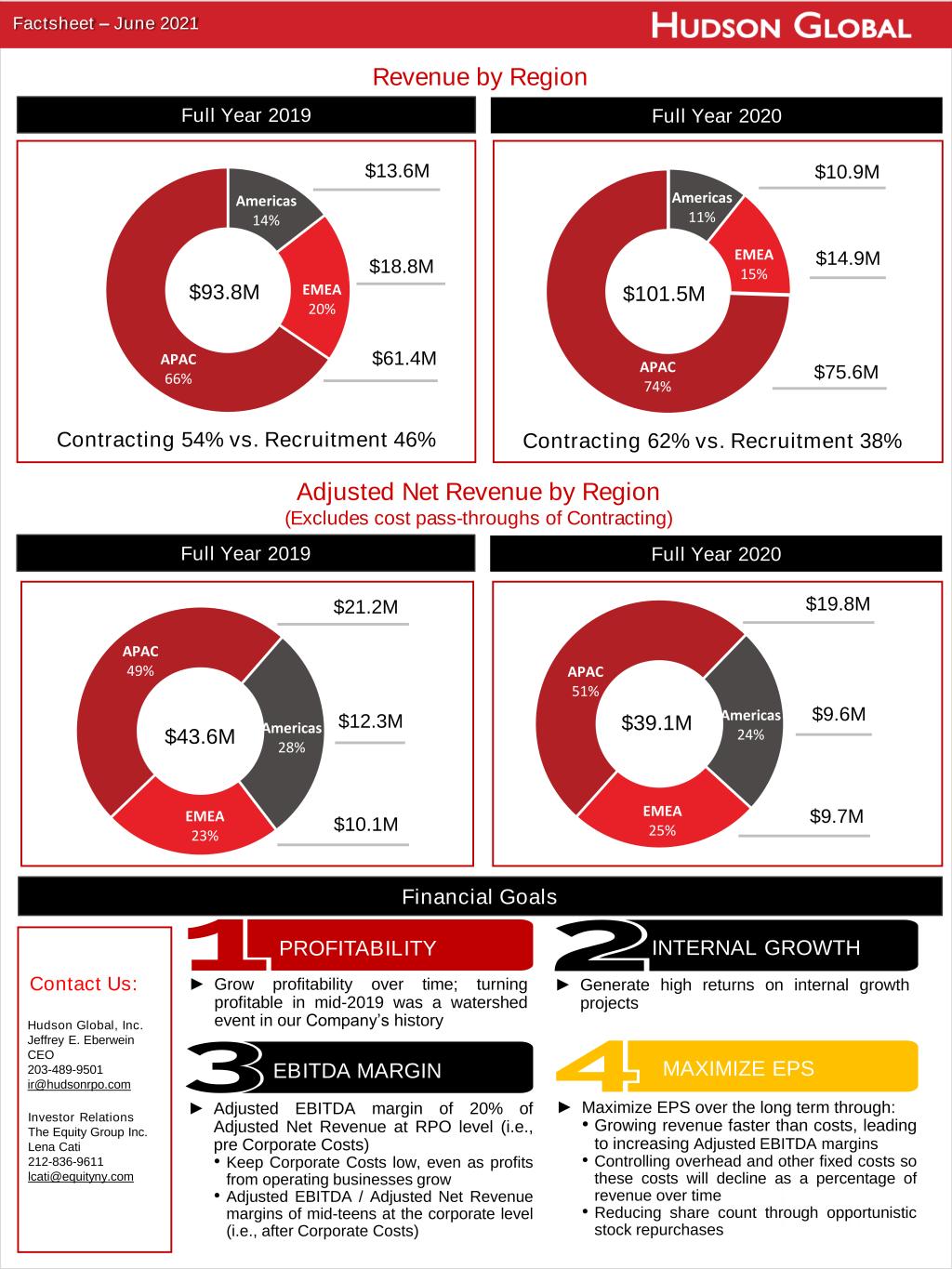

Revenue by Region Investor Relations The Equity Group Inc. Lena Cati 212-836-9611 lcati@equityny.com Hudson Global, Inc. Jeffrey E. Eberwein CEO 203-489-9501 ir@hudsonrpo.com Contact Us: Factsheet – June 2021 Full Year 2019 Full Year 2020 Americas 11% EMEA 15% APAC 74% $101.5M $10.9M $14.9M $75.6M Americas 24% EMEA 25% APAC 51% $39.1M $19.8M $9.6M $9.7M Americas 28% EMEA 23% APAC 49% $43.6M $21.2M $12.3M $10.1M Adjusted Net Revenue by Region (Excludes cost pass-throughs of Contracting) Contracting 62% vs. Recruitment 38% Americas 14% EMEA 20% APAC 66% $93.8M $13.6M $18.8M $61.4M Contracting 54% vs. Recruitment 46% Full Year 2019 Full Year 2020 PROFITABILITY INTERNAL GROWTH MAXIMIZE EPSEBITDA MARGIN ► Grow profitability over time; turning profitable in mid-2019 was a watershed event in our Company’s history ► Generate high returns on internal growth projects ► Adjusted EBITDA margin of 20% of Adjusted Net Revenue at RPO level (i.e., pre Corporate Costs) • Keep Corporate Costs low, even as profits from operating businesses grow • Adjusted EBITDA / Adjusted Net Revenue margins of mid-teens at the corporate level (i.e., after Corporate Costs) ► Maximize EPS over the long term through: • Growing revenue faster than costs, leading to increasing Adjusted EBITDA margins • Controlling overhead and other fixed costs so these costs will decline as a percentage of revenue over time • Reducing share count through opportunistic stock repurchases Financial Goals