Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - KOHLS Corp | kss-ex322_9.htm |

| EX-32.1 - EX-32.1 - KOHLS Corp | kss-ex321_8.htm |

| EX-31.2 - EX-31.2 - KOHLS Corp | kss-ex312_6.htm |

| EX-31.1 - EX-31.1 - KOHLS Corp | kss-ex311_7.htm |

| EX-10.3 - EX-10.3 - KOHLS Corp | kss-ex103_11.htm |

| EX-10.2 - EX-10.2 - KOHLS Corp | kss-ex102_12.htm |

| 10-Q - 10-Q - KOHLS Corp | kss-10q_20210501.htm |

Exhibit 10.4

PERFORMANCE SHARE UNIT AGREEMENT

|

Executive |

Employee ID |

Grant Date |

Target Number of Performance Share Units |

RECITALS:

The Compensation Committee of the Board of Directors (the "Committee") has determined to award to the Executive Performance Share Units, subject to the restrictions contained herein, pursuant to the Company's 2017 Long-Term Compensation Plan (the "Plan"). All terms used herein and not otherwise defined shall have the same meaning as set forth in the Plan.

NOW, THEREFORE, for good and valuable consideration, including the mutual promises set forth in this agreement and the benefits that the Company expects to derive in connection with the services to be hereafter rendered to it or its subsidiaries by the Executive, the Company and the Executive hereby agree as follows:

ARTICLE I

Defined Terms

1.1Determination Date. The Determination Date shall mean the date on which the Committee determines and certifies, following the applicable Performance Period, whether and to what extent the Performance Goals set forth on Exhibit A have been attained; provided, however, that the Determination Date with respect to the applicable Performance Period shall be no later than April 15 of the calendar year following the end of such Performance Period.

1.2Payment Date. The Payment Date shall mean the date the Committee determines that the shares payable upon achievement of the Performance Goals set forth in Exhibit A shall be paid, which date shall be within thirty (30) business days following the Determination Date.

1.3Performance Share Unit. Performance Share Unit shall mean a nonvoting unit of measurement which is deemed for bookkeeping purposes to be the equivalent to one outstanding share of Common Stock (a “Share”) solely for purposes of the Plan and this Agreement. The Performance Share Units shall be used solely as a device for the determination of the payment to be made to Executive if such Performance Share Units become payable pursuant to section 2.2 below. The Performance Share Units shall not be treated as property or as a trust fund of any kind. Each Performance Share Unit granted hereunder is intended to qualify as a Performance Share expressed in terms of Common Stock, as authorized under Section 12 of the Plan.

1.4Retirement. Retirement shall mean the termination of Executive’s employment for any reason other than by the Company for Cause or due to death or Disability, but only to the extent such termination occurs after the Executive is Retirement Eligible and only to the extent such termination occurs on or following the one-year anniversary of the Grant Date.

1.5Retirement Eligible. Retirement Eligible shall mean the Executive has reached age sixty (60) and has been employed with the Company for a continuous period of at least five (5) years.

ARTICLE II

Performance Share Units

2.1Award of Performance Share Units. The Company-hereby grants to the Executive an award of Performance Share Units listed above under the heading "Target Number of Performance Share Units" (the "Performance Share Units"), subject to the restrictions contained herein and the provisions of the Plan.

2.2Performance-Based Right to Payment.

(a) The number of Shares that shall be issued pursuant to the Performance Share Units shall be determined based on the Company's achievement of Performance Goals as set forth on Exhibit A. On the Determination Date, the Committee in its sole discretion shall determine and certify whether and to what extent the Performance Goals as set forth on Exhibit A have been attained. The payment of Shares with respect to Executive's Performance Share Units is contingent on the attainment of the Performance Goals as set forth on Exhibit A. Accordingly, Executive will not become entitled to payment with respect to the Performance Share Units subject to this Agreement unless and until the Committee determines that the Performance Goals set forth on Exhibit A have been attained. Upon such determination by the Committee and subject to the provisions of the Plan and this Agreement, Executive shall be entitled to payment of that portion of the Performance Share Units as corresponds to the Performance Goals attained (as determined by the Committee in its sole discretion) as set forth on Exhibit A. Furthermore, except as otherwise set forth in Section 2.3, in order to be entitled to payment with respect to any Performance Share Units, Executive must be employed by the Company through the end of the Performance Period.

(b) On the Payment Date, the Company shall deliver to Executive a number of Shares (either by delivering one or more certificates for such shares or by entering such shares in book entry form, as determined by the Company in its sole discretion) equal to the number of Performance Share Units subject to this award that are payable pursuant to the achievement of the Performance Goals set forth on Exhibit A.

2.3Forfeiture of Performance Share Units Upon Termination of Employment. Notwithstanding any provision in any employment agreement or executive compensation agreement between the Executive and the Company to the contrary, upon Executive's termination of employment prior to the end of the Performance Period, all rights with respect to any unpaid Performance Share Units awarded pursuant to this Agreement shall immediately terminate, and Executive will not be entitled to any payments or benefits with respect thereto; provided, however, that in the event of Executive’s termination of employment by reason of Retirement or Disability prior to the end of the Performance Period, Executive or Executive’s personal representative, as the case may be, shall be entitled to receive, on the Payment Date, Performance Share Units awarded pursuant to this Agreement that would have been paid had Executive remained employed until the end of the Performance Period. In the event of Executive’s termination of employment by reason of Retirement or Disability prior to the end of the Performance Period, if delivery of the Shares to the Executive on the Payment Date would cause the Executive to be subject to a penalty under Section 409A of the Internal Revenue Code because Executive is a “specified employee” within the meaning of Section 409A(a)(2)(B)(i), the delivery of the Shares will be delayed until a date which is the first business day after the six (6) months after Executive’s termination of employment. Notwithstanding the foregoing to the contrary, in the event of Executive’s termination of employment by reason of death prior to the end of the Performance Period, Executive’s beneficiary shall be entitled to receive, as soon as administratively possible, the number of Performance Share Units listed at the top of this Agreement under the “Target Number of Performance Share Units.”

2

2.4Change of Control. In the event of a Change of Control, the Performance Share Units shall be subject to the provisions set forth in Paragraph 19 of the Plan, provided, however, any references to "cause" and "good reason" used in Paragraph 19 of the Plan shall be interpreted by applying the definitions of "cause" and "good reason" contained in an employment agreement or executive compensation agreement between the Executive and the Company in effect as of the Grant Date, if any. For the avoidance of doubt, for purposes of Paragraph 19 of the Plan only, the time-based vesting criteria to which this Award is subject to is a requirement for the Executive to continue employment until the end of the Performance Period.

2.5Prohibition Against Transfer. The Performance Share Units may not be transferred, assigned, pledged or hypothecated in any way (whether by operation of law or otherwise) by the Executive, or be subject to execution, attachment or similar process. Any transfer in violation of this Section 2.5 shall be void and of no further effect.

ARTICLE III

Miscellaneous

3.1Provisions of the Plan Control. This Agreement shall be governed by the provisions of the Plan, the terms and conditions of which are incorporated herein by reference. The Plan empowers the Committee to make interpretations, rules and regulations thereunder, and, in general, provides that determinations of such Committee with respect to the Plan shall be binding upon the Executive. A copy of the Plan will be delivered to the Executive upon reasonable request.

3.2No Rights as Shareholder. Executive shall not have any right to exercise the rights or privileges of a shareholder with respect to any Performance Share Units or Shares distributable with respect to any Performance Share Units until such Shares are distributed.

3.3Dividend Equivalents. On the Payment Date (or earlier date of payment in the event of the Executive’s termination of employment by reason of death prior to the end of the Performance Period), in addition to the Shares deliverable under Section 2.2 above, the Company shall issue the Executive or Executive’s beneficiary that number of Shares equal to the Dividend Equivalent Amount. The Dividend Equivalent Amount shall be calculated as of the Payment Date, pursuant to this Section 3.3. In calculating the Dividend Equivalent Amount, the Company shall determine the number of Shares that would have been payable to the Executive if the total number of Performance Share Units earned under Section 2.2 had been outstanding as Shares from the Grant Date until the Payment Date (or earlier date of payment in the event of the Executive’s termination of employment by reason of death prior to the end of the Performance Period) and in lieu of any regular cash dividends, on the declared payment date of each regular cash dividend otherwise payable on such Shares (“Dividend Date”), the Company had issued Executive a number of additional Shares with a Dividend Date Market Value equal to: (i) the per-share dollar amount of the declared dividend multiplied by (ii) the number of Performance Share Units earned under Section 2.2 above plus the number of Shares deemed issued hereunder as dividend equivalents as of the declared record date for the dividend. For purposes of calculating the “Dividend Date Market Value” in the preceding sentence, the Company shall use the closing price of a share of the Company’s Common Stock on the New York Stock Exchange on the Dividend Date. Shares issued hereunder shall be issued in fractional shares.

3

3.4Taxes. The Company may require payment of or withhold any income or employment tax which it believes is payable as a result of the grant or vesting of the Performance Share Units or the payment of Shares in connection therewith, and the Company may defer making delivery with respect to the Shares until arrangements satisfactory to the Company have been made with regard to any such withholding obligation. In accordance with the Plan, the Company may withhold shares of Common Stock to satisfy such withholding obligations.

3.5No Employment Rights. The award of the Performance Share Units pursuant to this Agreement shall not give the Executive any right to remain employed by the Company or any affiliate thereof.

3.6Notices. Any notice to be given to the Company under the terms of this Agreement shall be given in writing to the Company in care of its General Counsel at Kohl's Department Stores, Inc., N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin, 53051. Any notice to be given to the Executive may be addressed to him/her at the address as it appears on the payroll records of the Company or any subsidiary thereof. Any such notice shall be deemed to have been duly given if and when actually received by the party to whom it is addressed, as evidenced by a written receipt to that effect.

3.7Governing Law. This Agreement and all questions arising hereunder or in connection herewith shall be determined in accordance with the laws of the State of Wisconsin without giving effect to its conflicts of law provisions.

3.8Suspension or Termination of Award; Clawback. Executive acknowledges that this Agreement is subject to Section 23 of the Plan, including, but not limited to, the forfeiture of the Award in the event that Executive makes an unauthorized disclosure of any Company trade secret or confidential information or breaches any non-competition agreement.

3.9Award Acceptance. This Award shall not be effective unless the Executive electronically consents to this Agreement via an online platform, access to which will be provided by the Company, indicating the Executive’s acceptance of the terms and conditions of this Agreement. By electronically consenting to this Agreement via the online platform, the Executive acknowledges and agrees to the terms and conditions of this Agreement and the Plan.

[Signatures on Following Page]

4

IN WITNESS WHEREOF, the parties have caused this Agreement to be effective as of the date first written above.

|

|

KOHL’s CORPORATION |

||

|

|

|

|

|

|

|

By: |

|

|

|

|

Michelle Gass |

||

|

|

Chief Executive Officer |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Executive |

||

5

EXHIBIT A

TO PERFORMANCE SHARE AGREEMENT

PERFORMANCE GOALS

[To be updated by Kohl’s for fiscal 2021 awards]

Payment of Shares with respect to the Target number of Performance Share Units granted in the Performance Share Agreement is contingent on the attainment of the Performance Goals listed below for the Performance Period. The Committee shall retain the right to determine the calculation of the Performance Goals in the Committee’s reasonable discretion, and subject further to the discretion of the Committee to reduce the number of Performance Share Units actually earned.

Performance Period: January 31, 2021 through February 3, 2024

Performance Metrics:

|

|

(a) |

40% of the Shares are earned based on Cumulative Net Sales during the Performance Period |

|

Cumulative Net Sales for Performance Period |

Percentage of Target Number of Performance Share Units Earned |

|

Less than 94% of Financial Plan for Cumulative Net Sales |

0% |

|

94% of Financial Plan for Cumulative Net Sales |

50% |

|

Financial Plan for Cumulative Net Sales |

100% |

|

103% of Financial Plan for Cumulative Net Sales |

200% |

|

|

(b) |

30% of the Shares are earned based on Cumulative Operating Margin Percent during the Performance Period |

|

Cumulative Operating Margin Percent for Performance Period |

Percentage of Target Number of Performance Share Units Earned |

|

Less than 80% of Financial Plan for Cumulative Operating Margin Percent |

0% |

|

80% of Financial Plan for Cumulative Operating Margin Percent |

50% |

|

Financial Plan for Cumulative Operating Margin Percent |

100% |

|

115% of Financial Plan for Cumulative Operating Margin Percent |

200% |

|

|

(c) |

30% of the Shares are earned based on Cumulative Operating Cash Flow during the Performance Period |

|

Cumulative Operating Cash Flow for Performance Period |

Percentage of Target Number of Performance Share Units Earned |

|

Less than 80% of Financial Plan for Cumulative Operating Cash Flow |

0% |

|

80% of Financial Plan for Cumulative Operating Cash Flow |

50% |

|

Financial Plan for Cumulative Operating Cash Flow |

100% |

|

115% of Financial Plan for Cumulative Operating Cash Flow |

200% |

|

|

(d) |

If the Company’s Net Sales, Operating Margin Percent, or Operating Cash Flow performance results fall between any of the specified levels in subparagraphs (a), (b), or (c) above, (e.g., between 94% and Financial Plan for Net Sales), the actual number of Performance Share Units which shall be earned shall be determined based on a straight-line, mathematical interpolation between the applicable percentages set forth above, rounded up to the nearest whole share. |

6

|

|

(e) |

If Threshold levels of Net Sales, Operating Margin Percent or Operating Cash Flow are not achieved during the Performance Period, a Threshold (minimum) level Peer Performance Index payout will be made if the Company beats the respective Peer Performance Index comparing the Company’s performance with respect to net sales and/or net income to that of a weighted average of the Company’s Core Peer Group during the Performance Period. Calculations with respect to the Company’s performance relative to the Core Peer Group shall be made by the Company and certified by the Company’s Board of Directors’ Compensation Committee, in the Compensation Committee’s sole discretion. |

Performance Period Relative Total Shareholder Return Modifier

If any Performance Share Units are earned based on the above criteria, the number of Performance Share Units earned will be modified up or down as follows based on Kohl’s Relative Total Shareholder Return against the TSR Peer Group during the Performance Period:

|

Kohl’s TSR as a Percentile of Total Shareholder Return for Peer Group |

Award Modified |

|

< 25th Percentile |

Down 25% |

|

25th Percentile to 75th Percentile |

No Modification |

|

> 75th Percentile |

Up 25% |

For purposes of the charts above:

“Financial Plan” shall mean the Company’s 2021 – 2023 Financial Plan, as reviewed by the Compensation Committee in the first quarter of fiscal 2021.

“Cumulative Net Sales” shall mean the three-year total of the net sales of the Company as reported in the Company’s 10-K for the applicable fiscal years, adjusted in the Committee’s reasonable discretion to exclude the effects of: extraordinary items, discontinued operations, restructurings, acquisitions or divestitures of any division, business segment, subsidiary or affiliate, acquisition or divestiture of assets that are significant otherwise than in the ordinary course of business, other unusual or non-recurring items, and the cumulative effect of accounting changes, as determined in the Committee’s reasonable discretion.

“Cumulative Operating Margin Percent” shall mean the three-year total of the “operating income” divided by the “total revenue” of the company for the applicable fiscal years, expressed as a percentage. For purposes of this calculation “operating income” and “total revenue” are defined as the operating income and total revenue, respectively, of the Company as reported in the Company’s 10-K for the applicable fiscal years, adjusted in the Committee’s reasonable discretion to exclude the effects of: extraordinary items, discontinued operations, restructurings, acquisitions or divestitures of any division, business segment, subsidiary or affiliate, acquisition or divestiture of assets that are significant otherwise than in the ordinary course of business, other unusual or non-recurring items, and the cumulative effect of accounting changes, as determined in the Committee’s reasonable discretion.

“Cumulative Operating Cash Flow” shall mean the three-year total of the net cash provided by operating activities of the Company as reported in the Company’s 10-K for the applicable fiscal years, adjusted in the Committee’s reasonable discretion to exclude the effects of: extraordinary

7

items, discontinued operations, restructurings, acquisitions or divestitures of any division, business segment, subsidiary or affiliate, acquisition or divestiture of assets that are significant otherwise than in the ordinary course of business, other unusual or non-recurring items, and the cumulative effect of accounting changes, as determined in the Committee’s reasonable discretion.

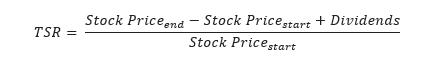

“TSR” shall mean the “total shareholder return” to the company’s shareholders over the applicable Performance Period, calculated by a third party expert using the following formula:

“Stock Pricestart” shall mean the average closing price of a share of the respective company's common stock for the 20 trading days prior to the start of the Performance Period on which shares of such company's common stock were traded, as reported in The Wall Street Journal or such other source as the Committee deems reliable.

“Stock Priceend” shall mean the average closing price of a share of the respective company's common stock for the 20 trading days prior to the end of the Performance Period on which shares of such company's common stock were traded, as reported in The Wall Street Journal or such other source as the Committee deems reliable.

“Dividends” shall mean the sum of (a) all dividends paid with respect to one share of the respective company's common stock during the Performance Period, as reported in the company's public filings with the SEC, and (b) the yield on such dividends, assuming reinvestment of each dividend in the company's common stock on the applicable ex-dividend date, using the closing price of a share of the company's common stock on such ex-dividend date, as reported in The Wall Street Journal or such other source as the Committee deems reliable.

“TSR Peer Group” shall include the following companies:

|

Abercrombie & Fitch (ANF) |

|

Children’s Place (PLCE) |

|

L Brands (LB) |

|

American Eagle Outfitters (AEO) |

|

Dick’s Sporting Goods (DKS) |

|

Macy’s (M) |

|

Bed Bath & Beyond (BBBY) |

|

Dillard’s (DDS) |

|

Nordstrom (JWN) |

|

|

Designer Brands (DBI) |

|

PVH Corp (PVH) |

|

|

Best Buy (BBY) |

|

Express (EXPR) |

|

Ross Stores (ROST) |

|

|

Foot Locker (FL) |

|

Target (TGT) |

|

|

Carter’s (CRI) |

|

Gap (GPS) |

|

TJX Companies (TJX) |

|

Chico’s FAS (CHS) |

|

Home Depot (HD) |

|

|

8

The Peer Companies shall be modified in the following events:

|

|

1) |

In the event of a merger, acquisition or business combination transaction of a Peer Company with or by another Peer Company, the surviving entity shall remain a Peer Company. |

|

|

|

2) |

In the event of a merger of a Peer Company with an entity that is not a Peer Company, or the acquisition or business combination transaction by or with a Peer Company, or with an entity that is not a Peer Company, in each case where the Peer Company is the surviving entity and remains publicly traded, the surviving entity shall remain a Peer Company. |

|

|

|

3) |

In the event of a merger or acquisition or business combination transaction of a Peer Company by or with an entity that is not a Peer Company, a “going private” transaction involving a Peer Company or the liquidation of a Peer Company, where the Peer Company is not the surviving entity or is otherwise no longer publicly traded, the company shall no longer be a Peer Company. |

|

|

|

4) |

In the event of a bankruptcy of a Peer Company, such company shall remain a Peer Company. |

|

|

|

5) |

In any other circumstance that the Committee determines such modification to be appropriate, in the Committee’s reasonable discretion. |

|

“Relative TSR” shall mean Kohl’s TSR compared to the total shareholder returns of the TSR Peer Group companies. Relative TSR will be determined by ranking the company and the peer companies from highest to lowest according to their respective TSRs. After this ranking, the percentile performance of the Company relative to the peer companies will be determined as follows:

P = 1 – [(R - 1) / (N – 1)]

Where: “P” represents the percentile performance which will be rounded up, if necessary, to the nearest whole percentile.

“N” represents the remaining number of peer companies, plus the Company.

“R” represents Company’s ranking among the peer companies.

Example: If there are 29 remaining companies, and the Company is ranked 10th, the performance would be at the 68th percentile: .68 = 1 – ((10 - 1)/(29 – 1)).

9

“Core Peer Group” shall mean the following companies, each of whose performance shall be weighted in calculating the Peer Performance Index for sales and net income according to the percentage below:

|

|

Macy’s, (M) |

20% |

|

|

Gap. (GPS) |

15% |

|

|

Bed Bath & Beyond (BBBY) |

10% |

|

|

Dick’s Sporting Goods (DKS) |

10% |

|

|

L Brands (LB) |

10% |

|

|

Nordstrom (JWN) |

10% |

|

|

Ross Stores (ROST) |

10% |

|

|

TJX Companies (TJX) |

10% |

|

|

Foot Locker (FL) |

5% |

To the extent that either (a) any of the member companies of the Core Peer Group do not publicly report financial metrics for the Performance Period, or (b) any of the member companies of the Core Peer Group merges or combines with any other person or entity with revenues in excess of 10% of such member company’s revenues, then such member company shall be removed from the Core Peer Group and the weighting of the performance of the remaining companies in the Core Peer Group shall be adjusted proportionately in order to calculate the Peer Performance Index.

10