Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CF BANKSHARES INC. | cfbk-20210602x8k.htm |

Exhibit 99

CF Bankshares Inc. Annual Stockholders Meeting Wednesday June 2, 2021 Columbus Cleveland Cincinnati Fairlawn Indianapolis

FORWARD LOOKING STATEMENTS Comments made in this presentation include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in good faith by us. Forward-looking statements include but are not limited to:(1)projections of revenues, income or loss, earnings or loss per common share, capital structure and other financial items;(2)plans and objectives of the management or Boards of Directors of CF Bankshares Inc.(the “Holding Company”)or CFBank, National Association(“CFBank”);(3)statements regarding future events, actions or economic performance; and(4)statements of assumptions underlying such statements. Words such s"estimate,""strategy,""may,""believe,""anticipate,""expect,""predict,""will,""intend,""plan,""targeted,"and the negative of these terms, or similar expressions, are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Various risks and uncertainties may cause actual results to differ materially from those indicated by our forward-looking statements. For factors that could cause actual resultsto differ fro m our forward-looking statements, please refer to the “Risk Factors” in the Company’s Annual Report on Form 10-K,Quarterly Reports on Form 10-Q and other reports filed with the SEC.

1stQuarter 2021 Highlights.Net income Increased 220%vs. Q1 2020 to $6.4 million. Earnings per share increased to $0.96/share, an increase of 220%vs. Q1 2020.ROA of 1.70%; ROE of 22.73%..Net interest margin increased 21bpsvs. Q4 2020.Book Value per common share increased $0.76(5%) to $17.55per share. .Net interest income increased by 57% vs. Q1 2020.Assets topped $1.6 billion at March 31, 2021.Q1 loan growth 8%; NIB deposits grew 9%.

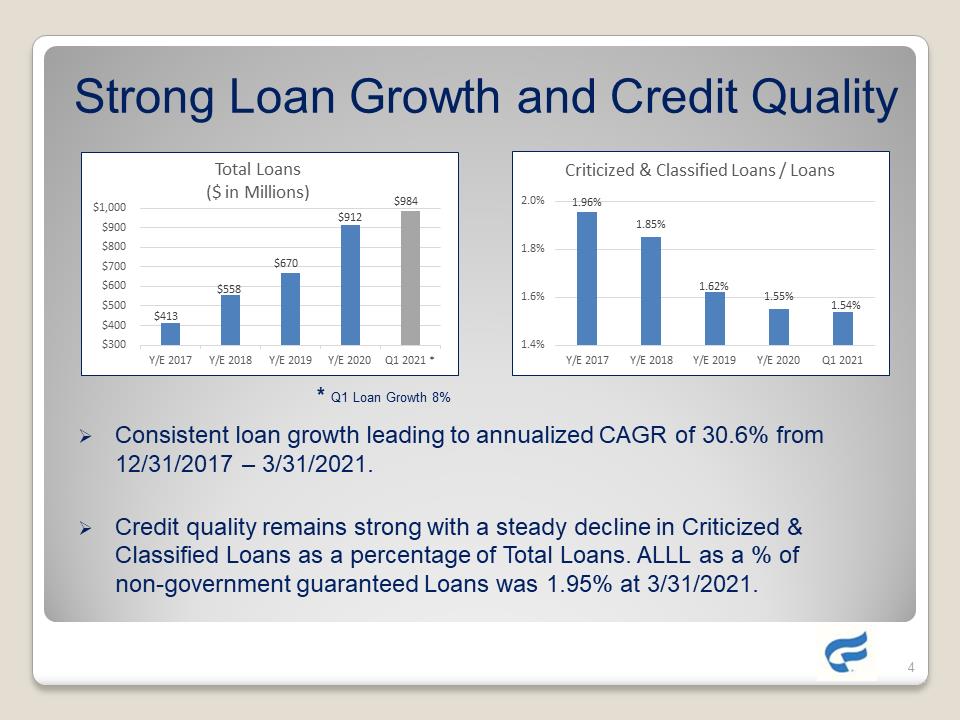

Strong Loan Growth and Credit Quality. Consistent loan growth leading to annualized CAGR of 30.6% from 12/31/2017 –3/31/2021.Credit quality remains strong with a steady decline in Criticized & Classified Loans as a percentage of Total Loans. ALLL as a % of non-government guaranteed Loans was 1.95% at 3/31/2021.$413 $558 $670 $912 $984 $300 $400 $500 $600 $700 $800 $900 $1,000Y/E 2017Y/E 2018Y/E 2019Y/E 2020Q1 2021 *Total Loans($ in Millions) 1.96% 1.85% 1.62% 1.55% 1.54% 1.4% 1.6% 1.8% 2.0% Y/E 2017 Y/E 2018 Y/E 2019 Y/E 2020 Q1 2021 Criticized & Classified Loans / Loans* Q1 Loan Growth 8%

KEY STRATEGIC & BUSINESS FOCUS .Size and Scale to $2 Billion (near term objective)..Core Earnings Growth & Franchise Expansion. .Full Relationship Driven Sales approach. Emphasizing Recurring Revenue and Earnings streams..Positioning for future size & scale with $1 Billion potential in each of our 4 metro markets. Indianapolis recently became 4thMajor Metro Market. .Indianapolis market has similar business opportunities to our other metro markets.

.Earnings lift from Home Mortgage Lending (2020 was extraordinary year) enabled us to: .Grow Capital faster..Increase investment in Commercial and Retail Teams..Expand Market Presence & Footprint. .Set table for accelerated future Bank and Core Earnings growth..Proven track record of accomplishing quality growth while maintaining Strong Credit Quality. .Since 2017, CAGR in Loans was 30.6%..During 2020 (COVID period) $1 million in net charge-offs. Prior to 2020, we had 6 consecutive periods of net recoveries while successfully maintaining 20%+ loan growth.

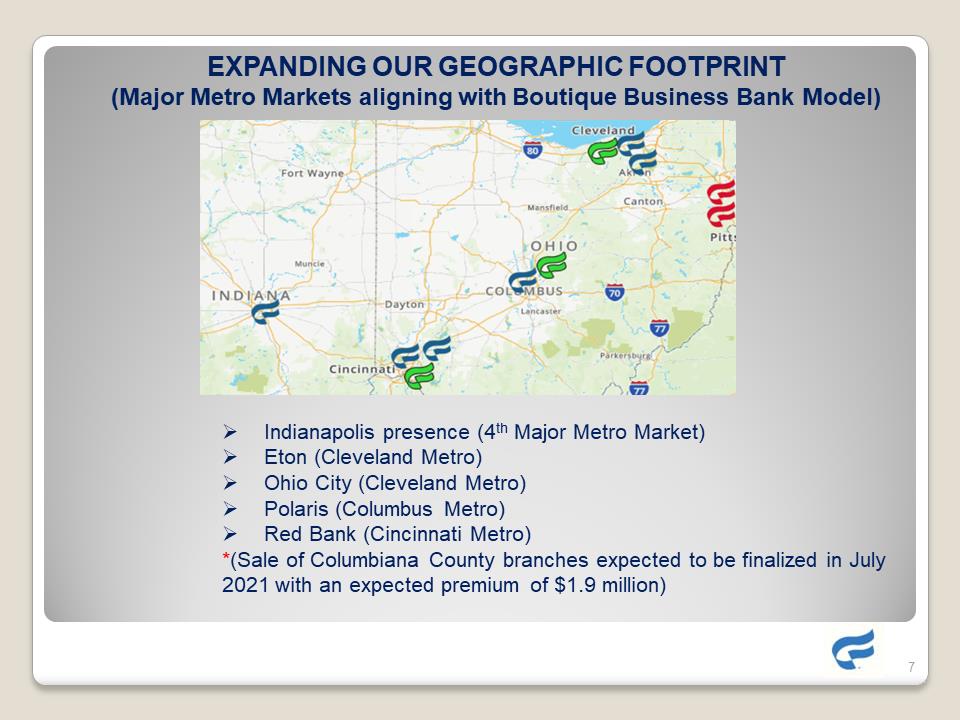

EXPANDING OUR GEOGRAPHIC FOOTPRINT(Major Metro Markets aligning with Boutique Business Bank Model).Indianapolis presence (4thMajor Metro Market).Eton (Cleveland Metro).Ohio City (Cleveland Metro).Polaris (Columbus Metro).Red Bank (Cincinnati Metro)*(Sale of Columbiana County branches expected to be finalized in July 2021 with an expected premium of $1.9 million)

Uniquely positioned Commercial Bank and Retail Franchise with presence in 4 major Metro Markets plus Mortgage Lending Operation.. Potential for significant Regional Market presence in all 4 Metro Markets. .Full Service Commercial Bank, with a successful track record of competing vs. Regional Banks.. Treasury Management capabilities support driving strong Noninterest-Bearing (NIB) Deposit growth and Fee Income opportunities. NIB Deposit CAGR of 31% since 2017..Strong Credit Quality and Effective Risk Management infrastructure.. Expanding Core Business with recurring, predictable Earnings streams .WE ARE JUST REVVING UP!CF BANKSHARES / CFBANK