Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Accel Entertainment, Inc. | acel-20210602.htm |

Investor Day June 2021

Important Information Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this presentation are forward-looking statements, including, but not limited to, statements regarding our strategy, prospects, plans, objectives, future operations, future revenue and earnings, projected margins and expenses, markets for our services, potential acquisitions or strategic alliances, financial position, and liquidity and anticipated cash needs and availability. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: the existing and potential future adverse impact of the COVID-19 pandemic on Accel Entertainment, Inc.’s (the “Company” or “Accel”) business, operations and financial condition, including as a result the suspensions of all video gaming terminal operations by the Illinois Gaming Board between March 16, 2020 and June 30, 2020 and between November 19, 2020 and January 23, 2021, which suspensions could be reinstated; Accel’s ability to operate in existing markets or expand into new jurisdictions; Accel’s ability to manage its growth effectively; Accel’s ability to offer new and innovative products and services that fulfill the needs of licensed establishment partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming terminals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by the slow growth in demand for VGTs and by the slow growth of new gaming jurisdictions; Accel’s heavy dependency on its ability to win, maintain and renew contracts with licensed establishment partners; unfavorable economic conditions or decreased discretionary spending due to other factors such as epidemics or other public health issues (including COVID-19), terrorist activity or threat thereof, civil unrest or other economic or political uncertainties, that could adversely affect Accel’s business, results of operations, cash flows and financial conditions and other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission ("SEC"). Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this presentation are based on our current expectations and beliefs concerning future developments and their potential effects on the Accel. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the sections entitled “Risk Factors” in the Quarterly Reports on Form 10-Q and in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. Except as required by law, we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that any projected results expressed in this presentation or future quarterly reports, press releases or company statements will not be realized. In addition, the inclusion of any statement in this presentation does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors.” These and other factors could cause our results to differ materially from those expressed in this presentation. Industry and Market Data Unless otherwise indicated, information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity, and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our services. This information includes a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the Quarterly Reports on Form 10-Q and in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. 2

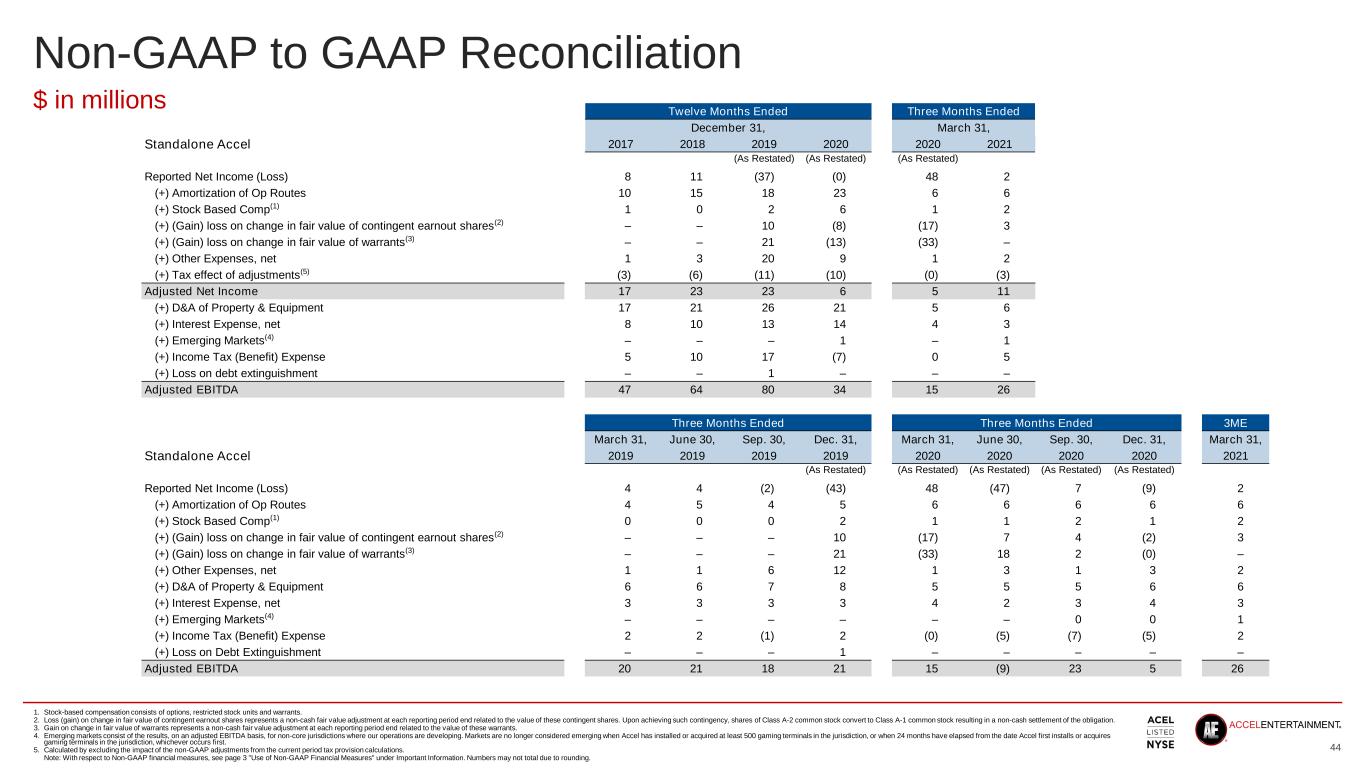

Important Information Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including Adjusted EBITDA. Adjusted EBITDA is defined as net (loss) income plus amortization of route and customer acquisition costs and location contracts acquired; change in fair value of contingent earnout shares; change in fair value of warrants; stock-based compensation expense; other expenses, net; tax effect of adjustments; depreciation and amortization of property and equipment; emerging markets; interest expense; and provision for income taxes. Management believes that these non-GAAP measures of financial results enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitate company-to-company and period-to period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items or represent certain nonrecurring items that are unrelated to core performance. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance and to evaluate Accel’s ability to fund capital expenditures, service debt obligations and meet working capital requirements. See the slide entitled “Non-GAAP to GAAP Reconciliation” on page 44 for additional information. Restatement of Prior Period Financial Statements The restatement reflects adjustments to correct an error related to the accounting treatment of certain earn out arrangements and the public and private placement warrants (the “warrants”) issued in connection with the 2019 business combination with TPG Pace Holdings Corp., a special purpose acquisition company, that were previously presented as equity. Because the number of Class A-1 common stock (the “contingent earnout shares”) the holder is entitled to under the agreement are dependent, in part, upon the occurrence of a change of control, which is not an input to the fair value of a fixed for fixed contract on equity shares, the Company determined that the contingent earnout share obligation should be presented as a liability and marked to fair value each period, not equity-classified as previously presented. The Company also concluded that Class A-2 common stock issued in the transaction does not represent an increase in equity due to the fact that such shares are not entitled to dividends, voting rights, or a stake in the Company in the case of liquidation. The contingent earnout liability does not constitute indebtedness of the Company and will only be satisfied, if earned, by settlement in the Company’s Class A-1 common stock in a non-cash transaction. The existence of contingent earnout shares occurred as a result of the Company’s merger and reverse recapitalization occurring on November 20, 2019 and did not impact any reporting periods prior to the merger and reverse recapitalization transaction. The Company also corrected certain classification errors impacting amusement revenue, ATM fees and other revenue, and cost of revenue that were previously presented net instead of gross, and certain revenue share expenses that were previously presented in general and administrative instead of cost of revenue. There is no impact to net income (loss) as a result of these reclassifications. A provision in the Company's agreement for its public warrants related to certain tender or exchange offers precludes the warrants from being accounted for as components of equity as contemplated in ASC 815-40, and, as such, the warrants should be recorded as liabilities on the consolidated balance sheets. Likewise, the provisions of the private placement warrants can change based on who is the holder of the warrant. This is a settlement adjustment provision which is based on the identity of the holder, which is not an adjustment in a fixed-for-fixed contract. Therefore, these provisions preclude equity classification and the private placement warrants should be recorded as liabilities on the consolidated balance sheets. The warrants were measured at fair value at inception (on the date of the reverse recapitalization) and at each subsequent reporting date. Accordingly, the contingent earnout and warrants are now reflected as a liability at fair value on the Company's consolidated balance sheets, and the change in the fair value of such liabilities in each period are recognized as a gain or loss in the Company's consolidated statements of operations and comprehensive (loss) income. 3

Agenda Operational Excellence Illinois Other States Century Gaming Georgia Introduction 4

Michael Marino Chief Commercial Officer As Chief Commercial Officer, Michael leads the company’s strategic development with a focus on partnerships, marketing, and player rewards 4 years management consulting and nearly 8 years of gaming experience working in various roles at Caesars Entertainment Most recently served as SVP of Marketing and Chief Experience Officer where he managed the end-to-end customer journey including Total Rewards BS (Computer Science) and MBA from University of Virginia 5

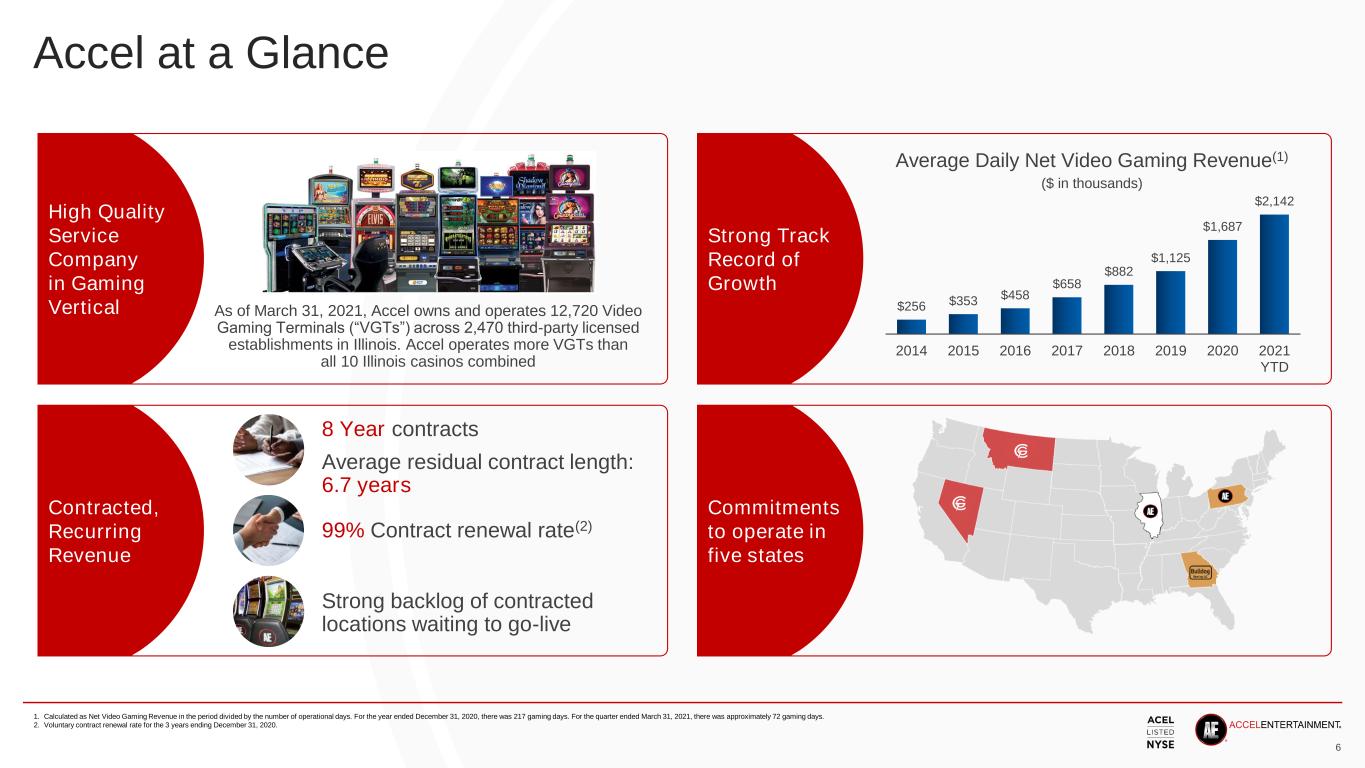

Accel at a Glance 1. Calculated as Net Video Gaming Revenue in the period divided by the number of operational days. For the year ended December 31, 2020, there was 217 gaming days. For the quarter ended March 31, 2021, there was approximately 72 gaming days. 2. Voluntary contract renewal rate for the 3 years ending December 31, 2020. Strong Track Record of Growth Commitments to operate in five states As of March 31, 2021, Accel owns and operates 12,720 Video Gaming Terminals (“VGTs”) across 2,470 third-party licensed establishments in Illinois. Accel operates more VGTs than all 10 Illinois casinos combined Average Daily Net Video Gaming Revenue(1) ($ in thousands) $256 $353 $458 $658 $882 $1,125 $1,687 $2,142 2014 2015 2016 2017 2018 2019 2020 2021 YTD 8 Year contracts Average residual contract length: 6.7 years 99% Contract renewal rate(2) Strong backlog of contracted locations waiting to go-live High Quality Service Company in Gaming Vertical Contracted, Recurring Revenue 6

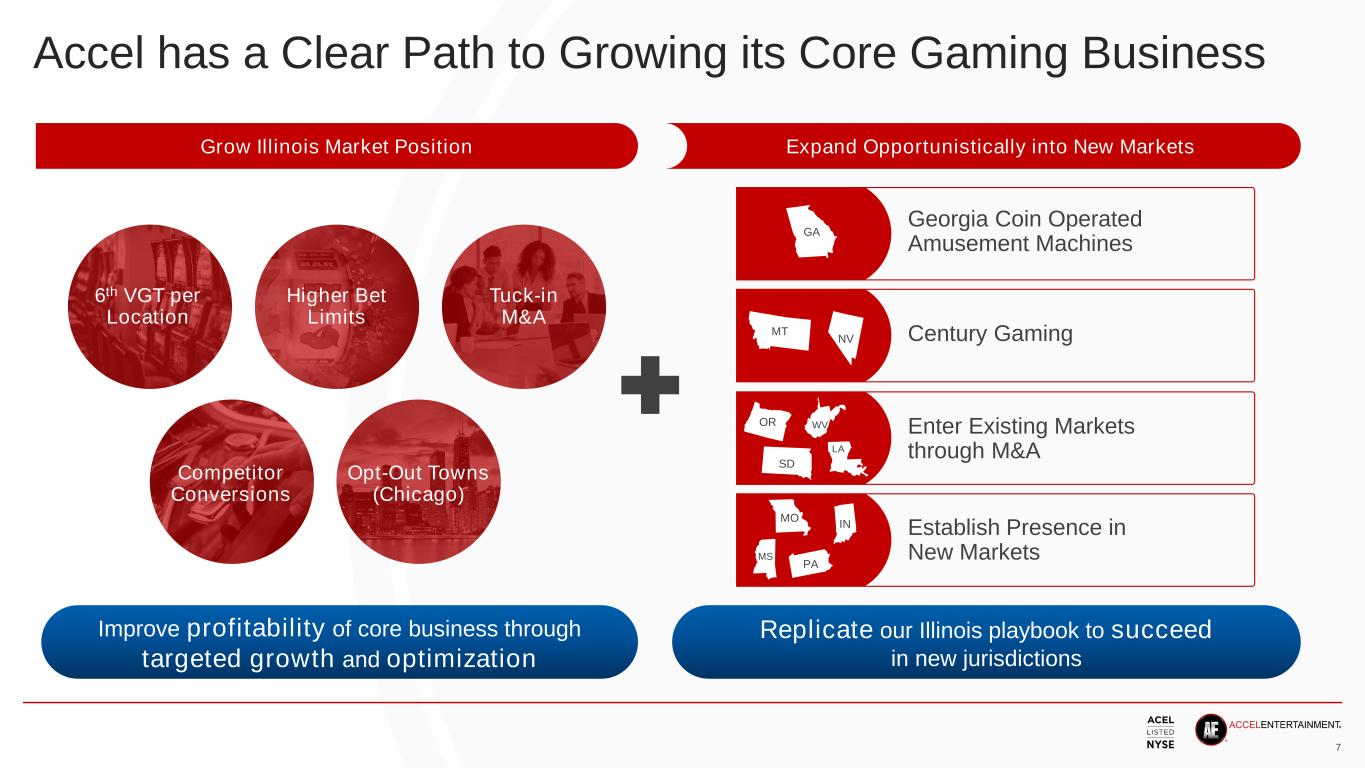

Accel has a Clear Path to Growing its Core Gaming Business Grow Illinois Market Position Expand Opportunistically into New Markets Improve profitability of core business through targeted growth and optimization Replicate our Illinois playbook to succeed in new jurisdictions Higher Bet Limits Opt-Out Towns (Chicago) Competitor Conversions Tuck-in M&A GA MT NV OR SD WV LA MO IN PA MS Georgia Coin Operated Amusement Machines Century Gaming Enter Existing Markets through M&A Establish Presence in New Markets 7 6th VGT per Location

Most Experienced Management Team Executives Andy Rubenstein President, CEO & Director Derek Harmer General Counsel & Chief Compliance Officer • Chairman and CEO, responsible for overall business operations • Prior to Accel, Andy was the owner and operator of the largest liquor store chain in central Illinois by revenue after starting his career at Arthur Andersen Consulting • Vast experience of successfully introducing progressive retail and customer service strategies • BA (Economics) and MA (International Finance & Economics) from Brandeis University • Practiced law for 22 years → 19 years in the gaming industry • Currently serves as the Secretary of the Illinois Gaming Machine Operators Association • Previously worked at Stadium Technology, Progressive Gaming International, and WMS Gaming • Former Deputy Attorney General on Nevada Gaming Control Board and Gaming Commission • BA (Criminal Justice) from University of Illinois at Chicago; JD from Drake University School Mike Pappas EVP of Business Development & Government Relations • Over 40 years of route gaming / amusements experience • Managing Member of Fair Share Gaming, LLC and Fair Share Amusements (acquired by Accel in 2017) • Serves on the board of the Illinois Gaming Machine Operators Association • B.S. (Accounting) from University of Illinois at Chicago Brian Carroll Chief Financial Officer • Oversees financial reporting, treasury, count room processing, route collections, and security • Previously an executive and consultant at various companies focused on M&A / restructurings • Appointed by a federal judge to serve as a Special Master in the Southern District of Ohio Federal Court mediating complex financial litigation • CPA, BA (Finance) from Loyola U.; MBA. (Accounting) from DePaul Univ.; JD UIC School of Law Mark Phelan Chief Revenue Officer/GM, Georgia • Chief Revenue Officer since 2017, responsible for all sales efforts and development of new markets, and leads Accel's efforts to grow the Class B market within Georgia • Previously worked in a variety of finance related positions, most notably as the Portfolio Manager of SFG Asset Advisors (a large single family office) and as a Managing Director in the Convertible Bond Group at Piper Jaffray & Co. • BA, MA and MBA from the University of Chicago 8 Mathew Ellis SVP of Corporate Strategy • Focuses on Investor Relations, M&A, Finance, and Analytics • Previously the VP of Finance for Transworld Systems • Began his career as an Auditor at Deloitte • CPA, B.A. (Economics) and Masters of Accounting from University of Michigan

Agenda Georgia Illinois Other States Century Gaming Operational Excellence Introduction 9

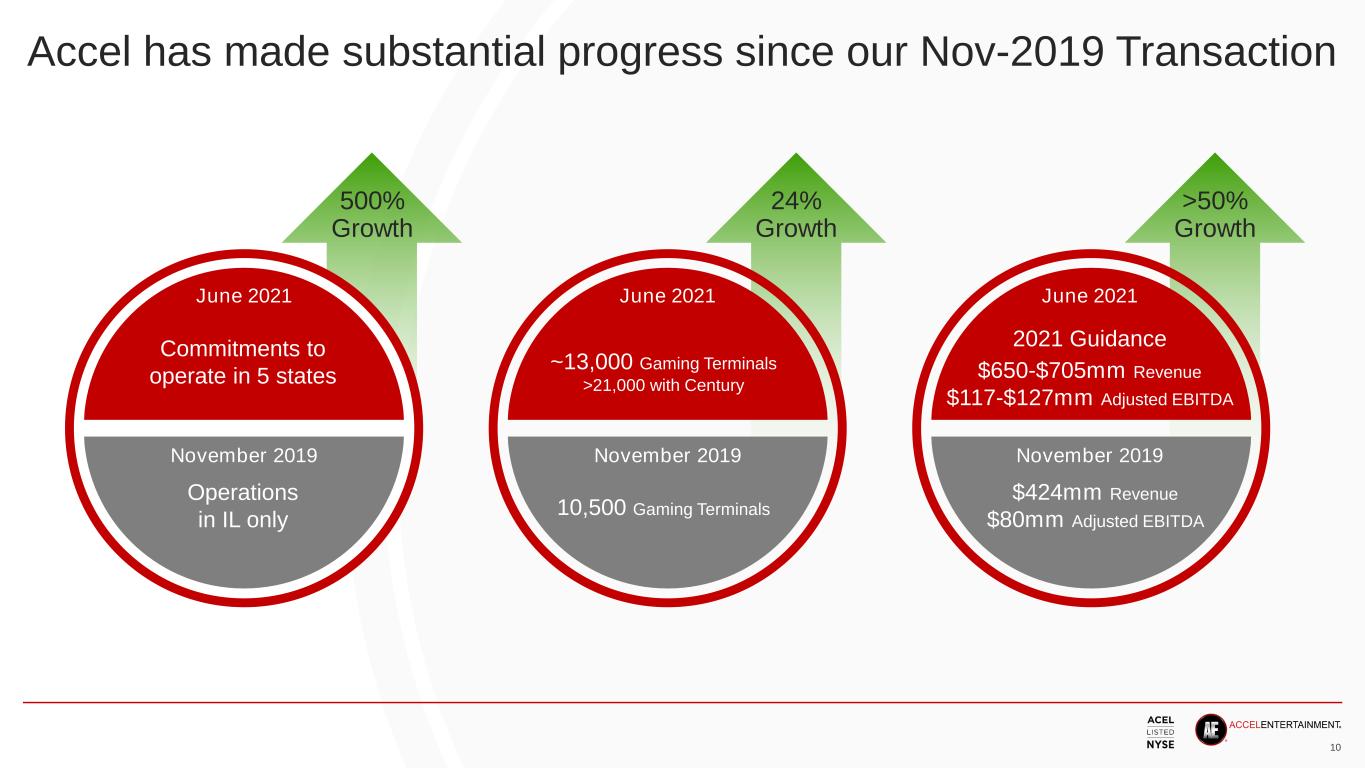

Accel has made substantial progress since our Nov-2019 Transaction November 2019 June 2021 $424mm Revenue $80mm Adjusted EBITDA November 2019 June 2021 10,500 Gaming Terminals November 2019 June 2021 Operations in IL only 500% Growth 24% Growth >50% Growth 2021 Guidance $650-$705mm Revenue $117-$127mm Adjusted EBITDA ~13,000 Gaming Terminals >21,000 with Century Commitments to operate in 5 states 10

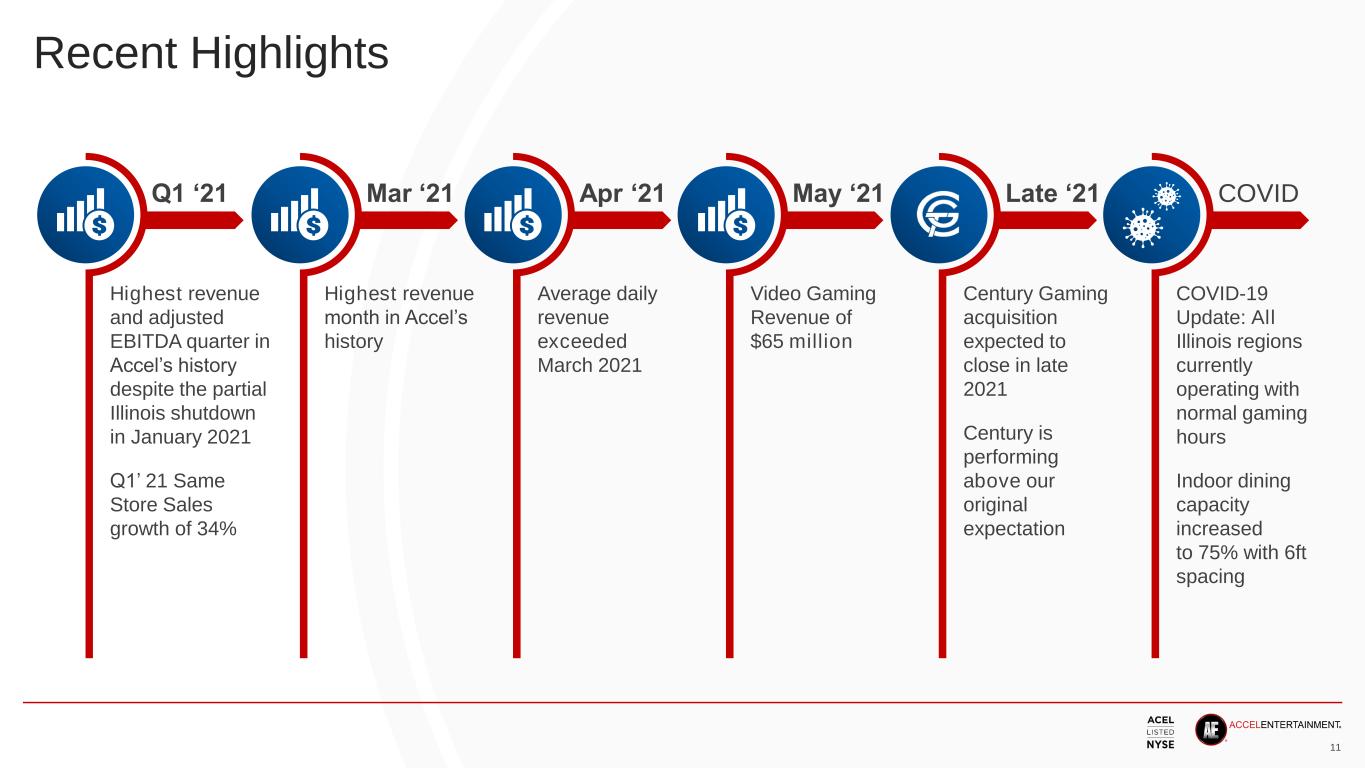

Recent Highlights Q1 ‘21 Highest revenue and adjusted EBITDA quarter in Accel’s history despite the partial Illinois shutdown in January 2021 Q1’ 21 Same Store Sales growth of 34% Mar ‘21 Highest revenue month in Accel’s history Apr ‘21 Average daily revenue exceeded March 2021 May ‘21 Video Gaming Revenue of $65 million Late ‘21 Century Gaming acquisition expected to close in late 2021 Century is performing above our original expectation COVID COVID-19 Update: All Illinois regions currently operating with normal gaming hours Indoor dining capacity increased to 75% with 6ft spacing 11

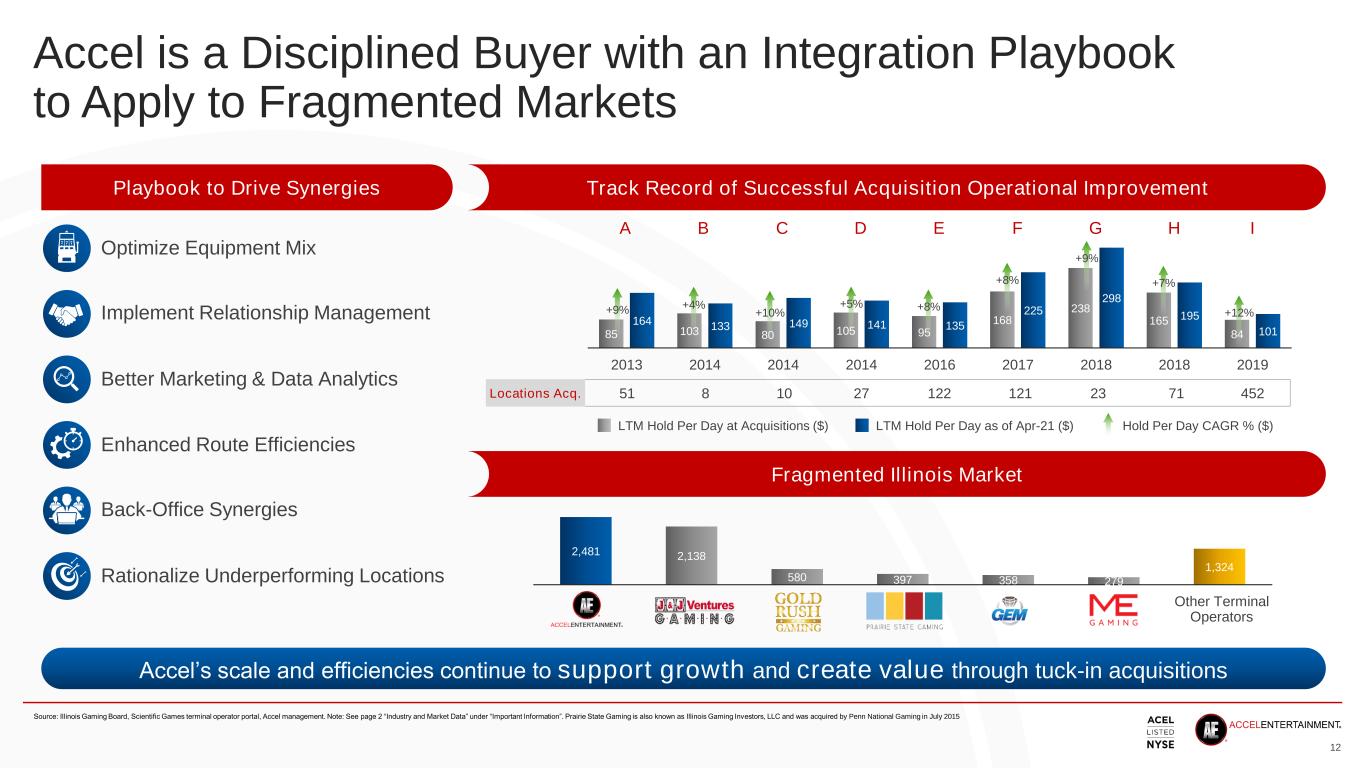

2,481 2,138 580 397 358 279 1,324 Accel is a Disciplined Buyer with an Integration Playbook to Apply to Fragmented Markets Source: Illinois Gaming Board, Scientific Games terminal operator portal, Accel management. Note: See page 2 “Industry and Market Data” under “Important Information”. Prairie State Gaming is also known as Illinois Gaming Investors, LLC and was acquired by Penn National Gaming in July 2015 Accel’s scale and efficiencies continue to support growth and create value through tuck-in acquisitions Optimize Equipment Mix Implement Relationship Management Better Marketing & Data Analytics Enhanced Route Efficiencies Back-Office Synergies Rationalize Underperforming Locations 85 103 80 105 95 168 238 165 84 164 133 149 141 135 225 298 195 101 2013 2014 2014 2014 2016 2017 2018 2018 2019 +9% +4% +10% +5% +8% +8% +9% +7% +12% LTM Hold Per Day at Acquisitions ($) LTM Hold Per Day as of Apr-21 ($) Hold Per Day CAGR % ($) 51Locations Acq. 8 10 27 122 121 23 71 452 Playbook to Drive Synergies Fragmented Illinois Market GA IHE FC DB Other Terminal Operators Track Record of Successful Acquisition Operational Improvement 12

Agenda Operational Excellence Illinois Other States Century Gaming Georgia Introduction 13

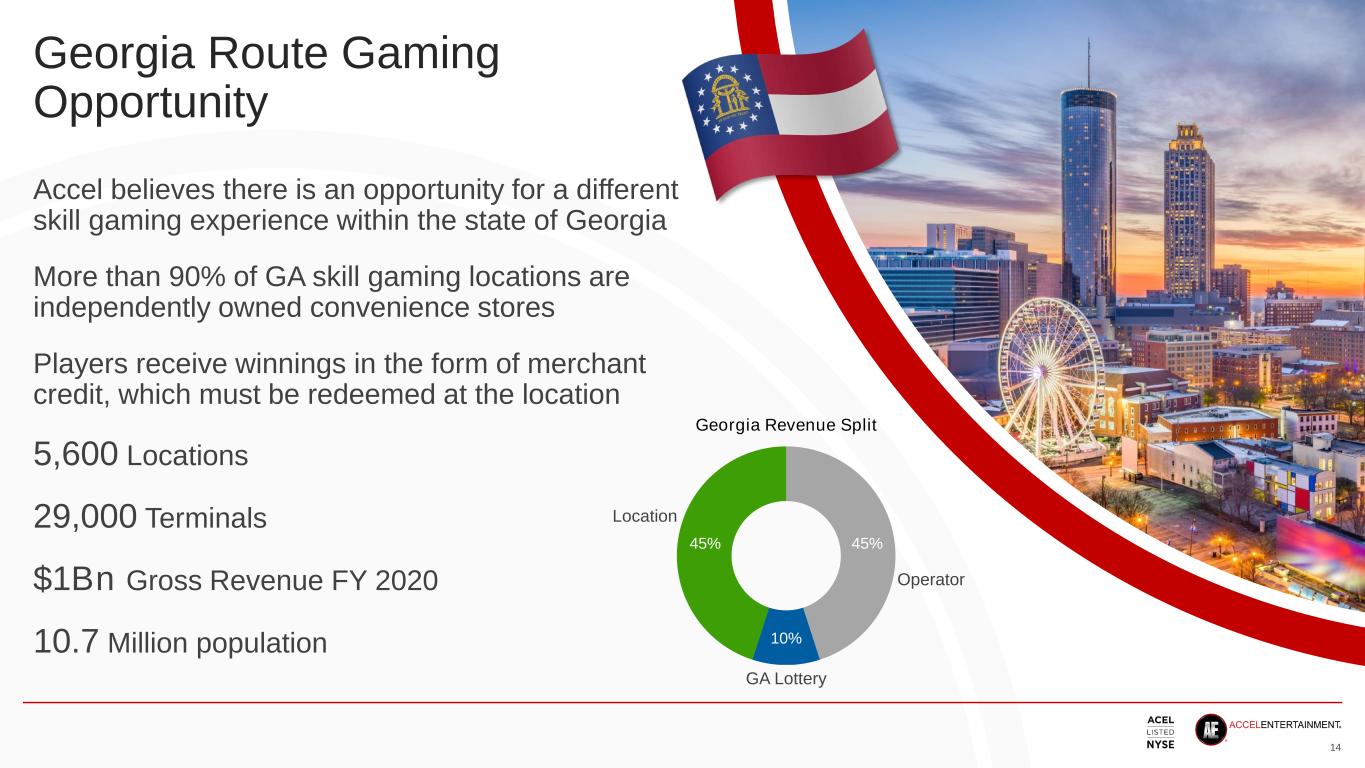

45% 10% 45% Georgia Route Gaming Opportunity Accel believes there is an opportunity for a different skill gaming experience within the state of Georgia More than 90% of GA skill gaming locations are independently owned convenience stores Players receive winnings in the form of merchant credit, which must be redeemed at the location 5,600 Locations 29,000 Terminals $1Bn Gross Revenue FY 2020 10.7 Million population Location Operator GA Lottery 14 Georgia Revenue Split

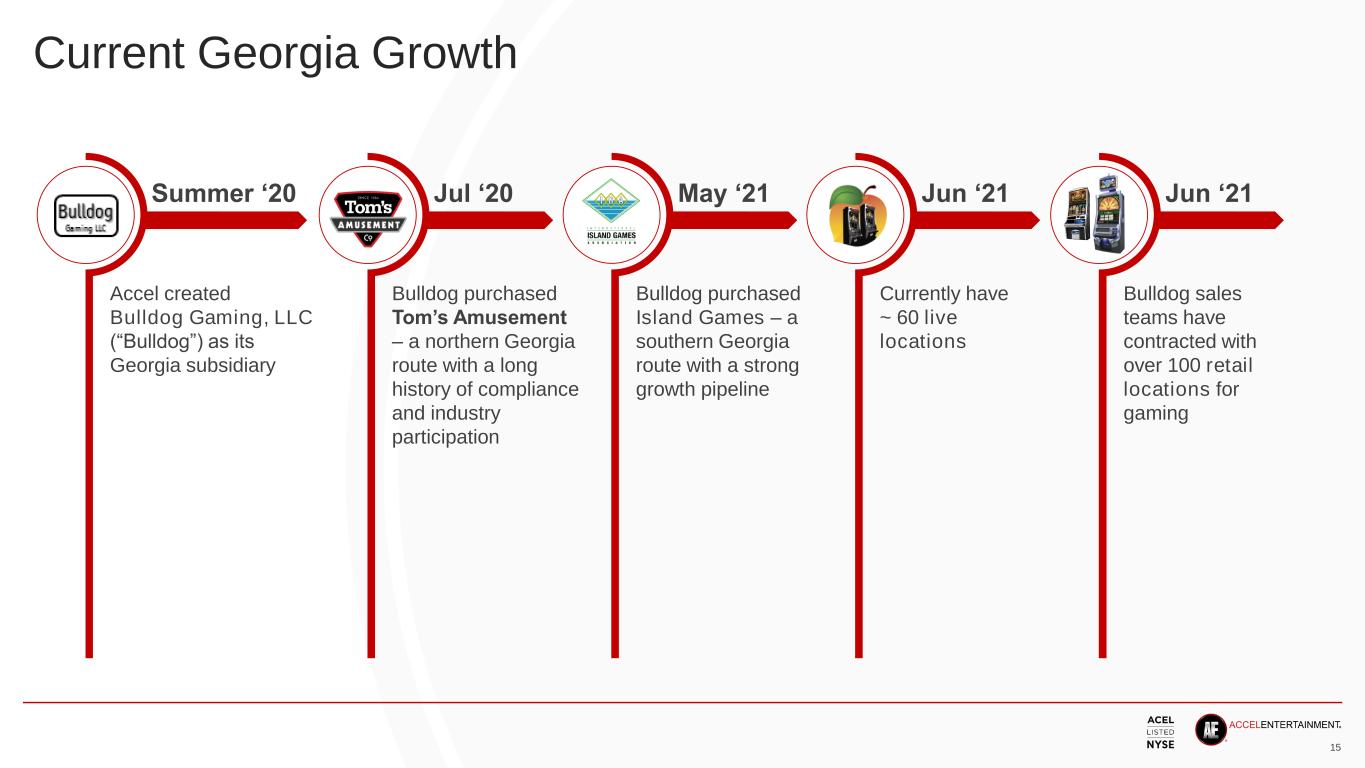

Current Georgia Growth Summer ‘20 Accel created Bulldog Gaming, LLC (“Bulldog”) as its Georgia subsidiary Jul ‘20 Bulldog purchased Tom’s Amusement – a northern Georgia route with a long history of compliance and industry participation May ‘21 Bulldog purchased Island Games – a southern Georgia route with a strong growth pipeline Jun ‘21 Currently have ~ 60 live locations Jun ‘21 Bulldog sales teams have contracted with over 100 retail locations for gaming 15

Agenda Century Gaming Georgia Operational Excellence Illinois Other States Introduction 16 Note: Accel’s proposed acquisition of Century is subject to the satisfaction of customary closing conditions, including regu latory approvals from applicable gaming authorities, and there can be no assurance that the transaction will be consummated. Certain statements regarding the proposed acquisition are forward-looking in nature, including statements regarding the expected timing of the closing of the acquisition; the ability of the parties to complete the acquisition considering the various closing conditions; the expected benefits of the acquisition; and any assumptions underlying any of the foregoing (see “Important Information—Forward Looking Statements”).

Steve Arntzen President and CEO, Century Gaming, Inc. President and CEO since 2010 Co-Founded CGI in 1989 Gaming Career Began in Montana in 1987 Became President of 30 Unit Regional Franchised Pizza Chain in 1980 BS Finance w/ High Honors – University of Montana 1977 Active on several boards, including the Gaming Industry Association of Montana and the Montana Chamber of Commerce 17

Century at a Glance Montana Headquarters in Billings Ten Customer Service Centers across Montana Nevada Headquarters in Las Vegas Additional Customer Service Centers in Reno and Elko Class III Video Gaming Machine (“VGM”) Developer and Manufacturer 18

Montana Route Largest VGM operator in Montana 610 Locations (~40% of Market) 5,907 VGM’s (~40% of Market) $1,369 Average VGM Handle(1) per day $86 Average VGM Win(2) per day 15% State Gaming Tax Rate 109 Employees Vending splits with locations are individually negotiated contracts 1. Handle defined as defined as the total dollar amount wagered on a VGM 2. Win is equal to the amount wagered less the amount won 19

Nevada Route Second largest VGM operator in Nevada 399 Locations 2,462 VGM’s $2,444 Average VGM Handle(1) per day $139 Average VGM Win(2) per day 135 Employees State and Local Government share is based on Fixed License Fees Vending splits with locations are individually negotiated contracts 1. Handle defined as defined as the total dollar amount wagered on a VGM 2. Win is equal to the amount wagered less the amount won 20

Gamblers Bonus – Player Rewards 127,000 current players in database in Nevada Individualized Player Accounts that are accessible in any Gamblers Bonus location in Nevada Unique, cardless login Over $1B in logged-in play annually Over $1.25M paid annually in Proprietary Four of a Kind Bingo Awards 21

Grand Vision Gaming Century owns Grand Vision Gaming, a VGM manufacturer licensed to sell in MT, SD, WV, LA, and OK − GVG is also the developer of “Power Vision” software exclusive to Century VGM’s in Nevada. (Century locations experience a 17% win increase when adding “Power Vision” VGMs into the game mix.) 8,988 GVG manufactured devices on location across the US today 92 Proprietary game titles, 34 licensed game titles developed 41 Employees 22

Century Strategy Mix Century’s efficiencies with Accel’s growth playbook to create the best-in-class VGM operator Century has been capital constrained (heavy legacy debt load) − As a positive result, operations are efficient and stream-lined Combine the best practices of both companies The Accel/Century combination allows for some very exciting opportunities − Route territory expansion, technology background and experience, VGM manufacturing 23

Agenda Georgia Illinois Other States Introduction Century Gaming Operational Excellence 24

Ryan Hammer President of Gaming Operations As president of Gaming Operations, Ryan leads the company’s video gaming business More than 16 years of gaming experience working in various roles at Caesars Entertainment Most recently served as Senior Vice President & General Manager, where he oversaw operations at Bally’s, Paris, and Planet Hollywood BS (Finance) from Southern Illinois University; MBA and JD from Indiana University 25

Operational Approach Expand the business cycle through Relationship Management − 70 professionals on the ground to drive same store sales − Creative incentive structure to retain and extend partner agreements − Utilization of Salesforce and other tools to allocate resources appropriately Devote substantial resources to our Sales organization − Motivating incentive structure to attract quality partners − Deep support team in-house to manage sales cycle − Utilization of sales agents to expand reach Pursue growth at partner locations through product, service and analytical rigor View each and every location as a business partner 26

Agenda Georgia Other States Introduction Century Gaming Operational Excellence Illinois 27

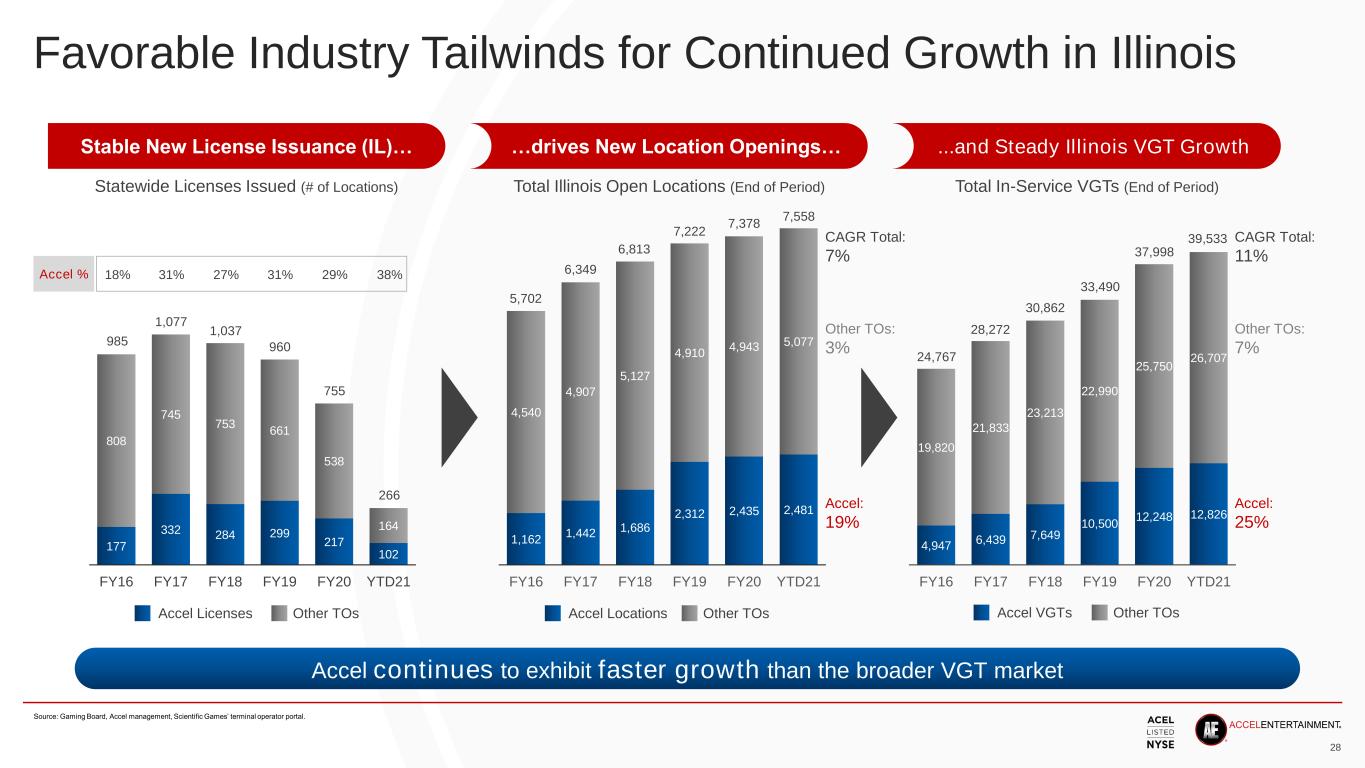

Favorable Industry Tailwinds for Continued Growth in Illinois Source: Gaming Board, Accel management, Scientific Games’ terminal operator portal. 177 332 284 299 217 102 808 745 753 661 538 164 FY16 FY17 FY18 FY19 FY20 YTD21 ...and Steady Illinois VGT Growth 985 1,077 1,037 960 755 266 18% 31% 27% 31% 29% 38%Accel % Accel Licenses Other TOs Accel Locations Other TOs Accel VGTs Other TOs Statewide Licenses Issued (# of Locations) Total In-Service VGTs (End of Period) Accel: 19% Other TOs: 3% Accel: 25% Other TOs: 7% CAGR Total: 7% CAGR Total: 11% Accel continues to exhibit faster growth than the broader VGT market Stable New License Issuance (IL)… 28 1,162 1,442 1,686 2,312 2,435 2,481 4,540 4,907 5,127 4,910 4,943 5,077 FY16 FY17 FY18 FY19 FY20 YTD21 4,947 6,439 7,649 10,500 12,248 12,826 19,820 21,833 23,213 22,990 25,750 26,707 FY16 FY17 FY18 FY19 FY20 YTD21 24,767 28,272 30,862 33,490 37,998 39,533 …drives New Location Openings… 6,813 7,222 Total Illinois Open Locations (End of Period) 7,378 7,558 5,702 6,349

Estimated Video Gaming Opportunity in Illinois 1. Based on retailer liquor license data from the Illinois Liquor Control Commission 2. Population counts from latest U.S. Census Bureau estimates. Slots counts based on state gaming boards’ annual reports as of FY 2020. Illinois data as of end of April 2021 based on Illinois Gaming Board monthly video gaming reports 9.4 4.3 2.6 23 33 62 93 154 Addressable Today Locations (k) Implied Add’l IL VGTs at Each State Density (k)Potentially Addressable VGTs (k) 16.9 21.2 23.8 39 62 73 101 132 194 7.5 Live Establishments Currently Addressable In Chicago In Other Opt-Out Municipalities Illinois (Current) Iowa Nevada South Dakota MontanaIllinois (Higher Density) +125% +183% +217%Vs. IL Current +57% +85% +157% +236% +393%Vs. IL Current Avg. Pop/VGT 207 176 127 97 66 Based on Establishments that Currently Have Liquor Licenses(1) 326 Based on Density of Comparable Video Gaming States(2) Illinois Video Gaming Total Addressable Market (“TAM”): $4+bn 29

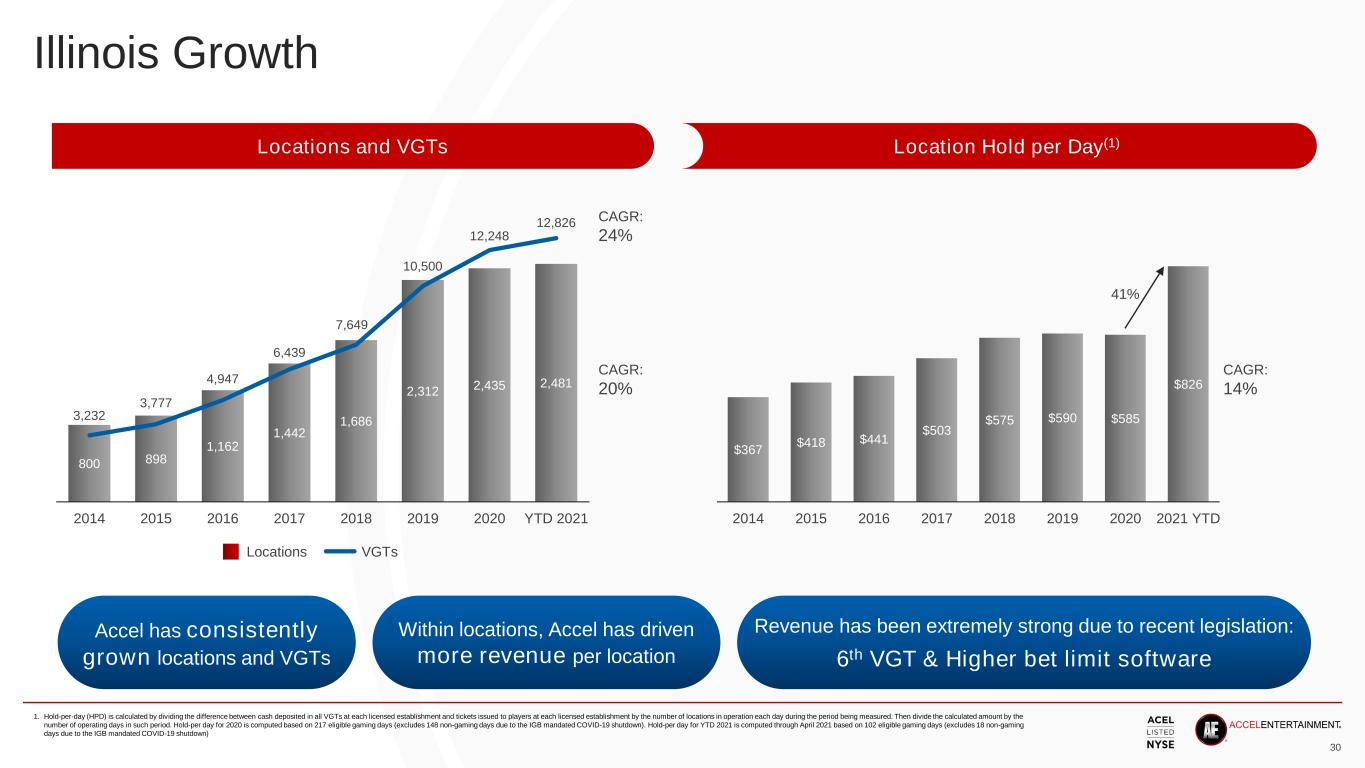

Illinois Growth Locations and VGTs $367 $418 $441 $503 $575 $590 $585 $826 2014 2015 2016 2017 2018 2019 2020 2021 YTD 800 898 1,162 1,442 1,686 2,312 2,435 2,481 3,232 3,777 4,947 6,439 7,649 10,500 12,248 12,826 0 500 1000 1500 2000 2500 3000 0 2000 4000 6000 8000 10000 12000 14000 2014 2015 2016 2017 2018 2019 2020 YTD 2021 CAGR: 20% CAGR: 24% CAGR: 14% 41% Locations VGTs Accel has consistently grown locations and VGTs Within locations, Accel has driven more revenue per location Revenue has been extremely strong due to recent legislation: 6th VGT & Higher bet limit software Location Hold per Day(1) 30 1. Hold-per-day (HPD) is calculated by dividing the difference between cash deposited in all VGTs at each licensed establishment and tickets issued to players at each licensed establishment by the number of locations in operation each day during the period being measured. Then divide the calculated amount by the number of operating days in such period. Hold-per day for 2020 is computed based on 217 eligible gaming days (excludes 148 non-gaming days due to the IGB mandated COVID-19 shutdown). Hold-per day for YTD 2021 is computed through April 2021 based on 102 eligible gaming days (excludes 18 non-gaming days due to the IGB mandated COVID-19 shutdown)

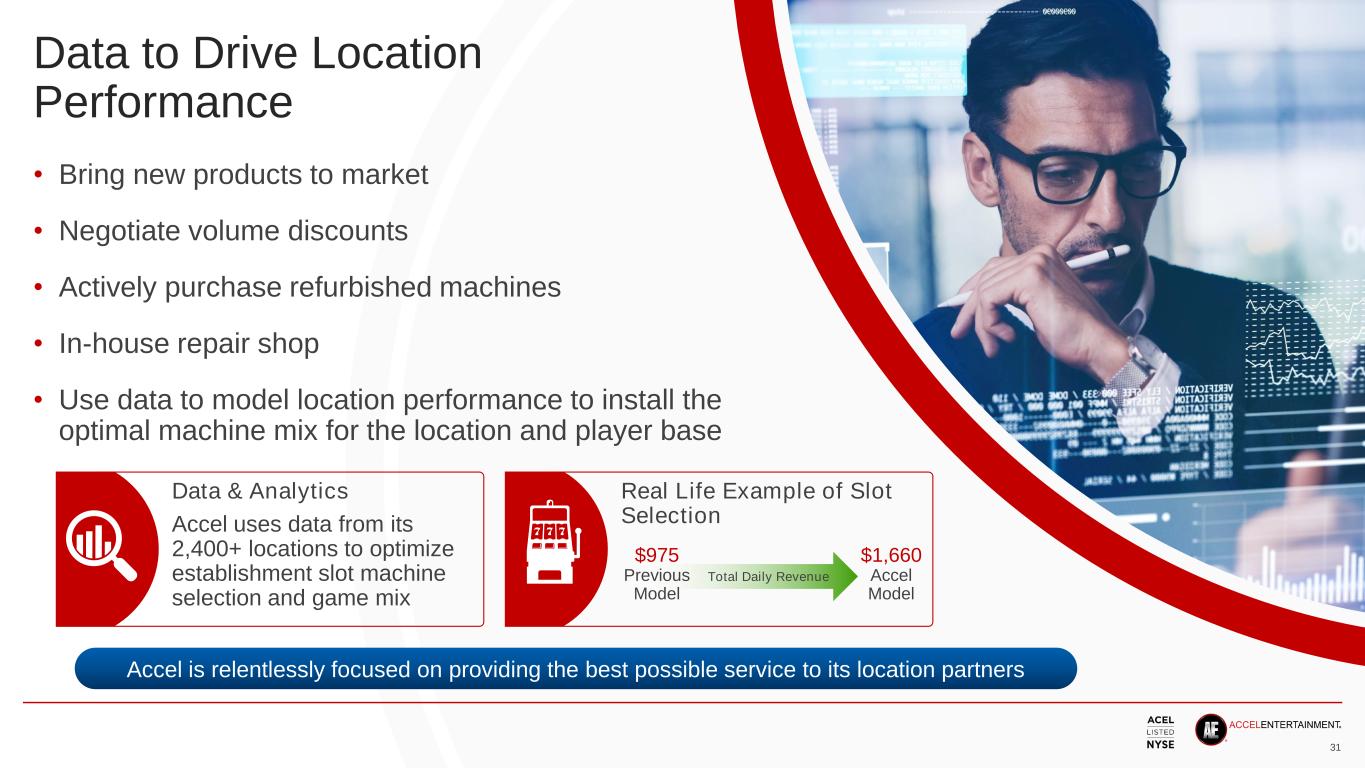

Data to Drive Location Performance Accel is relentlessly focused on providing the best possible service to its location partners • Bring new products to market • Negotiate volume discounts • Actively purchase refurbished machines • In-house repair shop • Use data to model location performance to install the optimal machine mix for the location and player base Data & Analytics Accel uses data from its 2,400+ locations to optimize establishment slot machine selection and game mix Real Life Example of Slot Selection $975 Previous Model $1,660 Accel Model Total Daily Revenue 31

Accel is a Distributed Gaming Leader for Player Marketing AE Player Rewards Partnerships Multi-channel Marketing Sweepstakes In-Location Content Screens AE.Bet Accel gave away more than $1mm to players Accel branded free to play sports betting app Accel scale enables appealing partnerships for players Launched March 1st Loyalty program designed to drive repeat play Mobile app 32

Accel will Deepen our Relationships with Players to Drive Greater Loyalty Accel will continue to deepen relationship with players through partnerships… …and Player RewardsAccel has the primary relationship with players Grow with Consumer and their Preferences Sports Betting iGaming Regional & Destination Gaming Vacation Gaming (Resorts/Cruises) Convenience and Frequency in Gaming Less More Secondary relationship iGaming Destination Casino Regional Casino Primary relationship VGTs 33

Agenda Georgia Introduction Century Gaming Operational Excellence Illinois Other States 34

Additional Growth Momentum building for route gaming across the country Missouri Legislation Senate Bill 98 and House Bills 915 and 1014 would have allowed gaming terminals and sports betting in certain areas of Missouri. Bars would have been allowed to operate 5 VGTs per location, while truck- stops and fraternal organizations would have been allowed 10 VGTs per location On April 27th, Senate Bill 98 was debated on the Senate floor and defeated by a narrow margin Virginia Legislation Skill games expected to be banned in July 2021 – first step to legalize regulated gaming Legislative study and hearings expected to occur before the 2022 session Pennsylvania Expansion On November 28th, Accel received its four-year Terminal Operator License in Pennsylvania The PA Legislature is expected to reintroduce legislation to expand video gaming to bars, taverns, veteran, fraternal, and other establishments in Pennsylvania during the current session Louisiana, West Virginia, South Dakota, & Oregon Other states with regulated distributed gaming Accel is evaluating each state for financially attractive entry 35

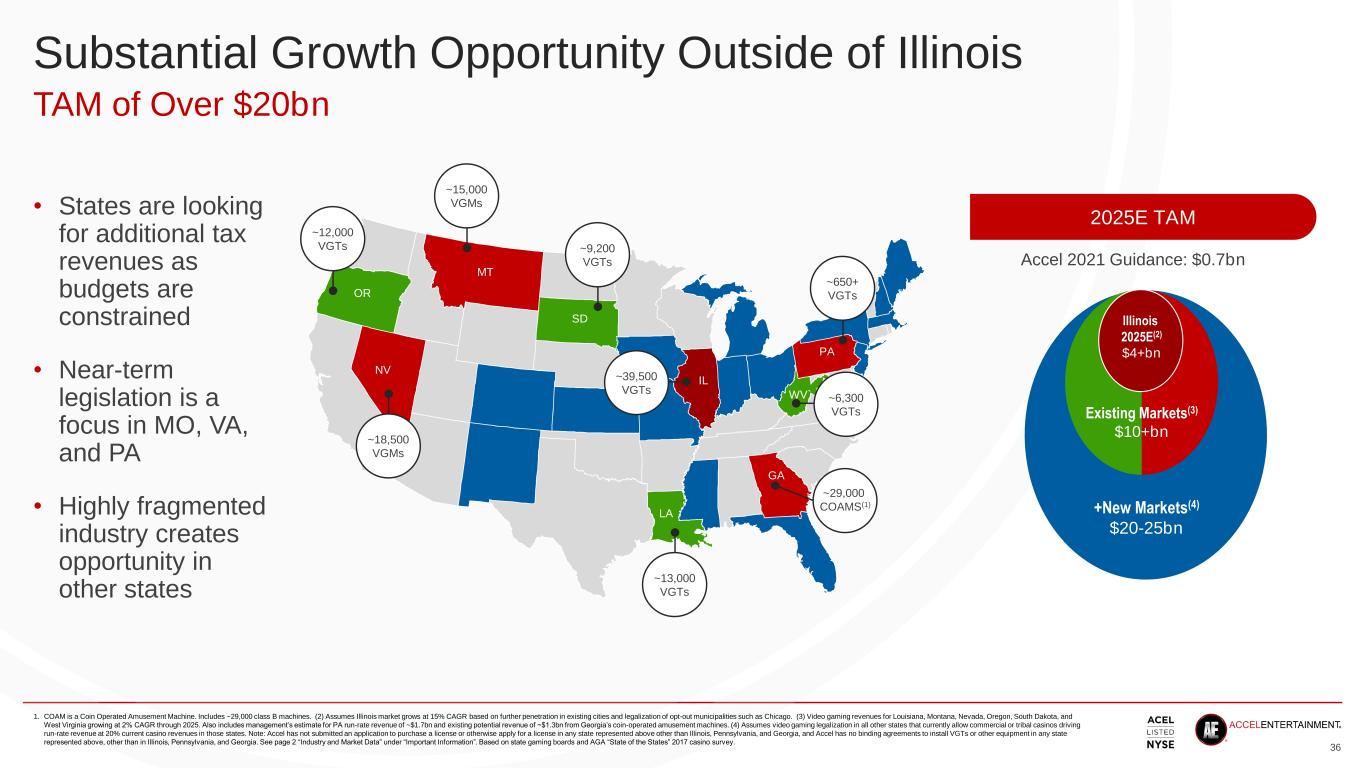

+New Markets(4) $20-25bn Existing Markets(3) $10+bn Substantial Growth Opportunity Outside of Illinois 1. COAM is a Coin Operated Amusement Machine. Includes ~29,000 class B machines. (2) Assumes Illinois market grows at 15% CAGR based on further penetration in existing cities and legalization of opt-out municipalities such as Chicago. (3) Video gaming revenues for Louisiana, Montana, Nevada, Oregon, South Dakota, and West Virginia growing at 2% CAGR through 2025. Also includes management’s estimate for PA run-rate revenue of ~$1.7bn and existing potential revenue of ~$1.3bn from Georgia’s coin-operated amusement machines. (4) Assumes video gaming legalization in all other states that currently allow commercial or tribal casinos driving run-rate revenue at 20% current casino revenues in those states. Note: Accel has not submitted an application to purchase a license or otherwise apply for a license in any state represented above other than Illinois, Pennsylvania, and Georgia, and Accel has no binding agreements to install VGTs or other equipment in any state represented above, other than in Illinois, Pennsylvania, and Georgia. See page 2 “Industry and Market Data” under “Important Information”. Based on state gaming boards and AGA “State of the States” 2017 casino survey. TAM of Over $20bn • States are looking for additional tax revenues as budgets are constrained • Near-term legislation is a focus in MO, VA, and PA • Highly fragmented industry creates opportunity in other states 2025E TAM Accel 2021 Guidance: $0.7bn Illinois 2025E(2) $4+bn 36 ~12,000 VGTs ~15,000 VGMs ~9,200 VGTs ~18,500 VGMs ~13,000 VGTs ~6,300 VGTs ~650+ VGTs ~39,500 VGTs OR NV MT SD IL LA WV` PA GA ~29,000 COAMS(1)

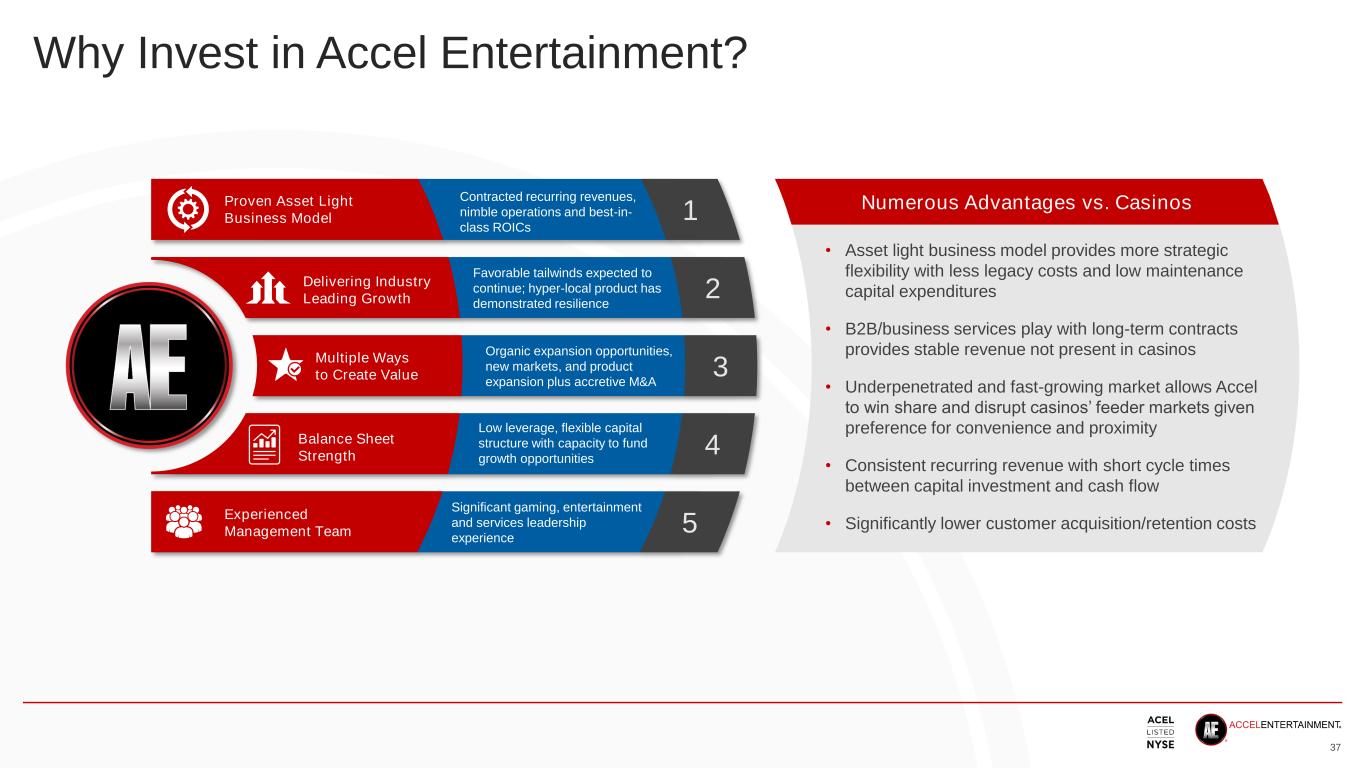

Why Invest in Accel Entertainment? 1 2 3 4 5 Proven Asset Light Business Model Delivering Industry Leading Growth Organic expansion opportunities, new markets, and product expansion plus accretive M&A Multiple Ways to Create Value Balance Sheet Strength Experienced Management Team Favorable tailwinds expected to continue; hyper-local product has demonstrated resilience Contracted recurring revenues, nimble operations and best-in- class ROICs Low leverage, flexible capital structure with capacity to fund growth opportunities Significant gaming, entertainment and services leadership experience Numerous Advantages vs. Casinos • Asset light business model provides more strategic flexibility with less legacy costs and low maintenance capital expenditures • B2B/business services play with long-term contracts provides stable revenue not present in casinos • Underpenetrated and fast-growing market allows Accel to win share and disrupt casinos’ feeder markets given preference for convenience and proximity • Consistent recurring revenue with short cycle times between capital investment and cash flow • Significantly lower customer acquisition/retention costs 37

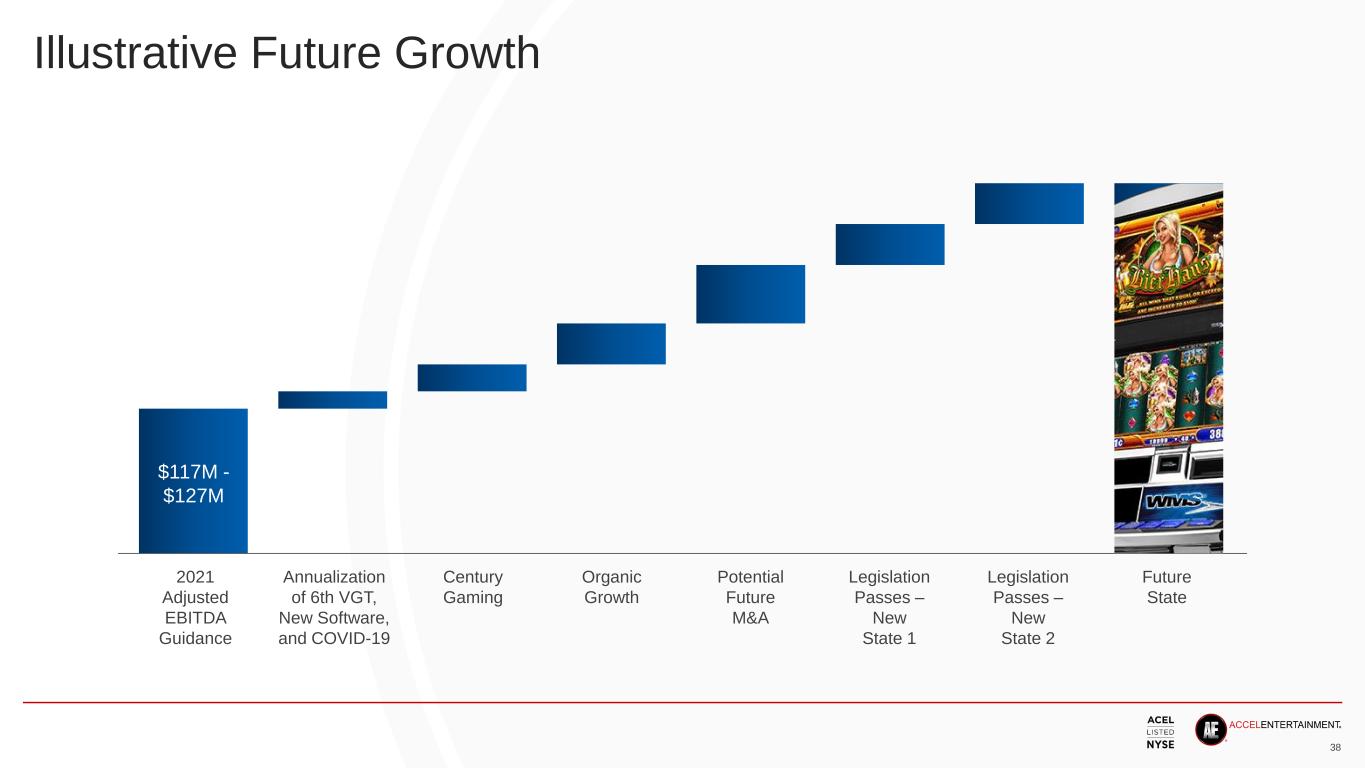

Illustrative Future Growth 38 2021 Adjusted EBITDA Guidance Annualization of 6th VGT, New Software, and COVID-19 Century Gaming Organic Growth Potential Future M&A Legislation Passes – New State 1 Legislation Passes – New State 2 Future State $117M - $127M

Q&A 39

Appendix 40

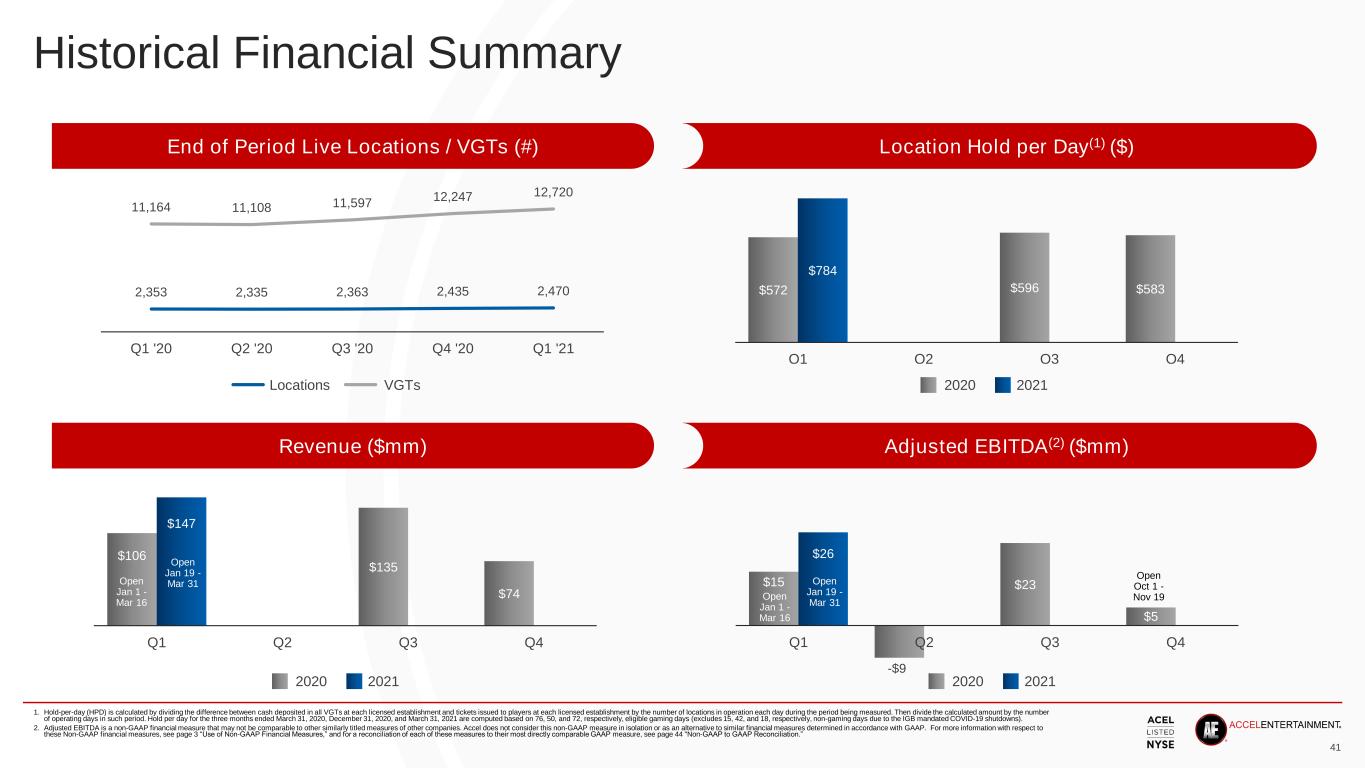

Historical Financial Summary 1. Hold-per-day (HPD) is calculated by dividing the difference between cash deposited in all VGTs at each licensed establishment and tickets issued to players at each licensed establishment by the number of locations in operation each day during the period being measured. Then divide the calculated amount by the number of operating days in such period. Hold per day for the three months ended March 31, 2020, December 31, 2020, and March 31, 2021 are computed based on 76, 50, and 72, respectively, eligible gaming days (excludes 15, 42, and 18, respectively, non-gaming days due to the IGB mandated COVID-19 shutdowns). 2. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to these Non-GAAP financial measures, see page 3 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 44 "Non-GAAP to GAAP Reconciliation.” End of Period Live Locations / VGTs (#) Location Hold per Day(1) ($) $572 $596 $583 $784 Q1 Q2 Q3 Q4 11,164 11,108 11,597 12,247 12,720 2,353 2,335 2,363 2,435 2,470 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 2020 2021VGTsLocations Revenue ($mm) Adjusted EBITDA(2) ($mm) $15 $23 $5 $26 Q1 Q2 Q3 Q4 2020 2021 $106 $135 $74 $147 Q1 Q2 Q3 Q4 2020 2021 -$9 Open Jan 1 – Mar. 16 Open Jan 1 - Mar 16 Open Jan 19 - Mar 31 Open Jan 1 - Mar 16 Open Jan 19 - Mar 31 Open Oct 1 - Nov 19 41

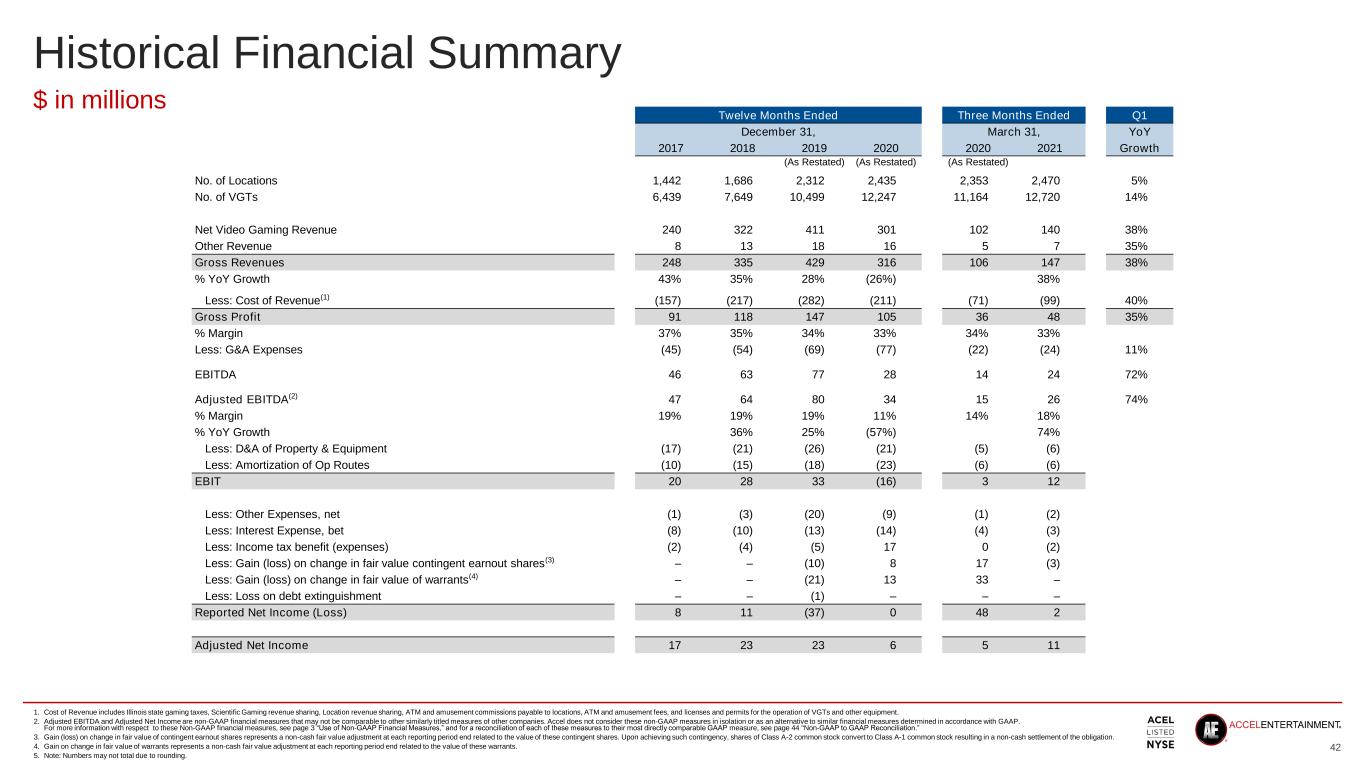

Historical Financial Summary 42 $ in millions Twelve Months Ended Three Months Ended Q1 December 31, March 31, YoY 2017 2018 2019 2020 2020 2021 Growth (As Restated) (As Restated) (As Restated) No. of Locations 1,442 1,686 2,312 2,435 2,353 2,470 5% No. of VGTs 6,439 7,649 10,499 12,247 11,164 12,720 14% Net Video Gaming Revenue 240 322 411 301 102 140 38% Other Revenue 8 13 18 16 5 7 35% Gross Revenues 248 335 429 316 106 147 38% % YoY Growth 43% 35% 28% (26%) 38% Less: Cost of Revenue(1) (157) (217) (282) (211) (71) (99) 40% Gross Profit 91 118 147 105 36 48 35% % Margin 37% 35% 34% 33% 34% 33% Less: G&A Expenses (45) (54) (69) (77) (22) (24) 11% EBITDA 46 63 77 28 14 24 72% Adjusted EBITDA(2) 47 64 80 34 15 26 74% % Margin 19% 19% 19% 11% 14% 18% % YoY Growth 36% 25% (57%) 74% Less: D&A of Property & Equipment (17) (21) (26) (21) (5) (6) Less: Amortization of Op Routes (10) (15) (18) (23) (6) (6) EBIT 20 28 33 (16) 3 12 Less: Other Expenses, net (1) (3) (20) (9) (1) (2) Less: Interest Expense, bet (8) (10) (13) (14) (4) (3) Less: Income tax benefit (expenses) (2) (4) (5) 17 0 (2) Less: Gain (loss) on change in fair value contingent earnout shares(3) – – (10) 8 17 (3) Less: Gain (loss) on change in fair value of warrants(4) – – (21) 13 33 – Less: Loss on debt extinguishment – – (1) – – – Reported Net Income (Loss) 8 11 (37) 0 48 2 Adjusted Net Income 17 23 23 6 5 11 1. Cost of Revenue includes Illinois state gaming taxes, Scientific Gaming revenue sharing, Location revenue sharing, ATM and amusement commissions payable to locations, ATM and amusement fees, and licenses and permits for the operation of VGTs and other equipment. 2. Adjusted EBITDA and Adjusted Net Income are non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to these Non-GAAP financial measures, see page 3 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 44 "Non-GAAP to GAAP Reconciliation.” 3. Gain (loss) on change in fair value of contingent earnout shares represents a non-cash fair value adjustment at each reporting period end related to the value of these contingent shares. Upon achieving such contingency, shares of Class A-2 common stock convert to Class A-1 common stock resulting in a non-cash settlement of the obligation. 4. Gain on change in fair value of warrants represents a non-cash fair value adjustment at each reporting period end related to the value of these warrants. 5. Note: Numbers may not total due to rounding.

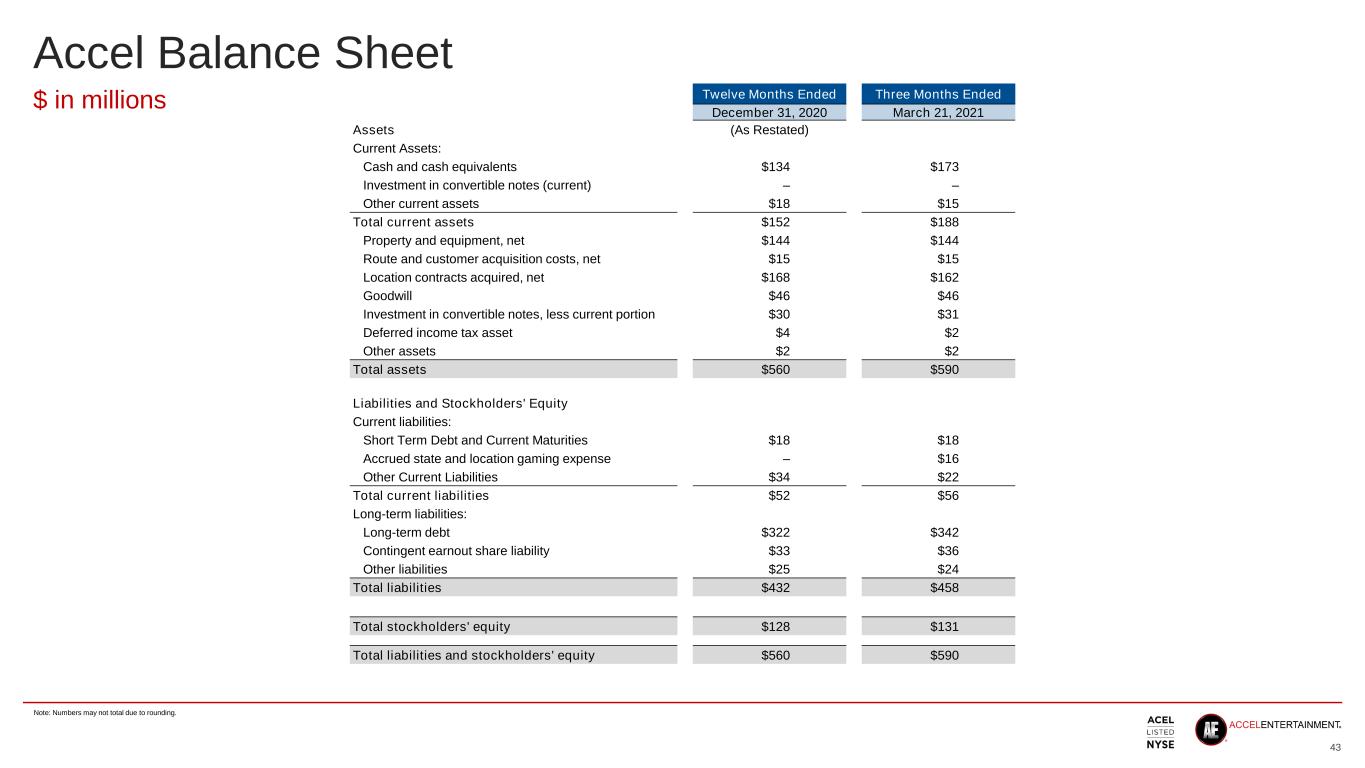

Accel Balance Sheet 43 Note: Numbers may not total due to rounding. Twelve Months Ended Three Months Ended December 31, 2020 March 21, 2021 Assets (As Restated) Current Assets: Cash and cash equivalents $134 $173 Investment in convertible notes (current) – – Other current assets $18 $15 Total current assets $152 $188 Property and equipment, net $144 $144 Route and customer acquisition costs, net $15 $15 Location contracts acquired, net $168 $162 Goodwill $46 $46 Investment in convertible notes, less current portion $30 $31 Deferred income tax asset $4 $2 Other assets $2 $2 Total assets $560 $590 Liabilities and Stockholders' Equity Current liabilities: Short Term Debt and Current Maturities $18 $18 Accrued state and location gaming expense – $16 Other Current Liabilities $34 $22 Total current liabilities $52 $56 Long-term liabilities: Long-term debt $322 $342 Contingent earnout share liability $33 $36 Other liabilities $25 $24 Total liabilities $432 $458 Total stockholders' equity $128 $131 Total liabilities and stockholders' equity $560 $590 $ in millions

Non-GAAP to GAAP Reconciliation 44 Twelve Months Ended Three Months Ended December 31, March 31, Standalone Accel 2017 2018 2019 2020 2020 2021 (As Restated) (As Restated) (As Restated) Reported Net Income (Loss) 8 11 (37) (0) 48 2 (+) Amortization of Op Routes 10 15 18 23 6 6 (+) Stock Based Comp(1) 1 0 2 6 1 2 (+) (Gain) loss on change in fair value of contingent earnout shares(2) – – 10 (8) (17) 3 (+) (Gain) loss on change in fair value of warrants(3) – – 21 (13) (33) – (+) Other Expenses, net 1 3 20 9 1 2 (+) Tax effect of adjustments(5) (3) (6) (11) (10) (0) (3) Adjusted Net Income 17 23 23 6 5 11 (+) D&A of Property & Equipment 17 21 26 21 5 6 (+) Interest Expense, net 8 10 13 14 4 3 (+) Emerging Markets(4) – – – 1 – 1 (+) Income Tax (Benefit) Expense 5 10 17 (7) 0 5 (+) Loss on debt extinguishment – – 1 – – – Adjusted EBITDA 47 64 80 34 15 26 Three Months Ended Three Months Ended 3ME March 31, June 30, Sep. 30, Dec. 31, March 31, June 30, Sep. 30, Dec. 31, March 31, Standalone Accel 2019 2019 2019 2019 2020 2020 2020 2020 2021 (As Restated) (As Restated) (As Restated) (As Restated) (As Restated) Reported Net Income (Loss) 4 4 (2) (43) 48 (47) 7 (9) 2 (+) Amortization of Op Routes 4 5 4 5 6 6 6 6 6 (+) Stock Based Comp(1) 0 0 0 2 1 1 2 1 2 (+) (Gain) loss on change in fair value of contingent earnout shares(2) – – – 10 (17) 7 4 (2) 3 (+) (Gain) loss on change in fair value of warrants(3) – – – 21 (33) 18 2 (0) – (+) Other Expenses, net 1 1 6 12 1 3 1 3 2 (+) D&A of Property & Equipment 6 6 7 8 5 5 5 6 6 (+) Interest Expense, net 3 3 3 3 4 2 3 4 3 (+) Emerging Markets(4) – – – – – – 0 0 1 (+) Income Tax (Benefit) Expense 2 2 (1) 2 (0) (5) (7) (5) 2 (+) Loss on Debt Extinguishment – – – 1 – – – – – Adjusted EBITDA 20 21 18 21 15 (9) 23 5 26 1. Stock-based compensation consists of options, restricted stock units and warrants. 2. Loss (gain) on change in fair value of contingent earnout shares represents a non-cash fair value adjustment at each reporting period end related to the value of these contingent shares. Upon achieving such contingency, shares of Class A-2 common stock convert to Class A-1 common stock resulting in a non-cash settlement of the obligation. 3. Gain on change in fair value of warrants represents a non-cash fair value adjustment at each reporting period end related to the value of these warrants. 4. Emerging markets consist of the results, on an adjusted EBITDA basis, for non-core jurisdictions where our operations are developing. Markets are no longer considered emerging when Accel has installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date Accel first installs or acquires gaming terminals in the jurisdiction, whichever occurs first. 5. Calculated by excluding the impact of the non-GAAP adjustments from the current period tax provision calculations. Note: With respect to Non-GAAP financial measures, see page 3 "Use of Non-GAAP Financial Measures" under Important Information. Numbers may not total due to rounding. $ in millions