Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST MIDWEST BANCORP INC | tm2117976d1_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - FIRST MIDWEST BANCORP INC | tm2117976d1_ex99-1.htm |

Exhibit 99.2

| Merger of Equals CREATING THE PREMIER MIDWEST BANKING FRANCHISE JUNE 1, 2021 |

| Disclaimer 2 Forward-Looking Statements This communication includes “f orward-looking statements” within the meaning of the Priv ate Securities Litigation Ref orm Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to First Midwest Bancorp, Inc.’s and Old National Bancorp’s belief s, goals, intentions, and expectations regarding the proposed transaction, rev enues, earnings, loan production, asset quality , and capital lev els, among other matters; our estimates of f uture costs and benef its of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; our ability to achiev e our f inancial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost sav ings, sy nergies and other anticipated benef its f rom the proposed transaction; and other statements that are not historical fa cts. Forward‐looking statements are ty pically identif ied by such words as “believ e,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “f orecast,” “project,” “should,” “will,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change ov er time. These f orward-looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. Additionally , f orward‐looking statements speak only as of the date they are made; First Midwest and Old National do not assume any duty , and do not undertake, to update such f orward‐looking statements, whether written or oral, that may be made f rom time to time, whether as a result of new inf ormation, f uture ev ents, or otherwise. Furthermore, because f orward‐looking statements are subject to assumptions and uncertainties, actual results or f uture ev ents could dif f er, possibly materially, from those indicated in such f orward-looking statements as a result of a v ariety of factors, many of which are bey ond the control of First Midwest and Old National. Such statements are based upon the current belief s and expectations of the management of First Midwest and Old National and are subject to signif icant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on f orward-looking statements. The f actors that could cause actual results to dif f er materially include the f ollowing: the occurrence of any ev ent, change or other circumstances that could giv e rise to the right of one or both of the parties to terminate the def initiv e merger agreement between First Midwest and Old National; the outcome of any legal proceedings that may be instituted against First Midwest or Old N ational; the possibility that the proposed transaction will not close when expected or at all because required regulatory , shareholder or other approvals are not receiv ed or other conditions to the closing are not satisf ied on a timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approv als may result in the imposition of conditions that could adv ersely af fect the combined company or the expected benef its of the proposed transaction); the ability of First Midwest and Old National to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could hav e adv erse ef f ects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the anticipated benef its of the proposed transaction will not be realized when expected or at all, including as a result of the impact of , or problems arising f rom, the integration of the two companies or as a result of the strength of the economy and competitiv e f actors in the areas where First Midwest and Old National do business; certain restrictions during the pendency of the proposed transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensiv e to complete than anticipated, including as a result of unexpected f actors or ev ents; div ersion of management’s attention f rom ongoing business operations and opportunities; the possibility that the parties may be unable to achiev e expected sy nergies and operating ef f iciencies in the merger within the expected timef rames or at all and to successf ully integrate First Midwest’s operations and those of Old National; such integration may be more dif f icult, time consuming or costly than expected; rev enues f ollowing the proposed transaction may be lower than expected; First Midwest’s and Old National’s success in executing their respectiv e business plans and strategies and managing the risks inv olv ed in the f oregoing; the dilution caused by Old National’s issuance of additional shares of its capital stock in connection with the proposed transaction; ef f ects of the announcement, pendency or completion of the proposed transaction on the ability of First Midwest and Old National to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; risks related to the potential impact of general economic, political and market f actors on the companies or the proposed transaction and other f actors that may af fect future results of First Midwest and Old National; uncertainty as to the extent of the duration, scope, and impacts of the COVID-19 pandemic on First Midwest, Old National and the proposed transaction; and the other f actors discussed in the “Risk Factors” and “Management’s Discussion and Analy sis of Financial Condition and Results of Operations” sections of each of First Midwest’s and Old National’s Annual Report on Form 10‐K f or the y ear ended December 31, 2020, in the “Risk Factors” and “Management’s Discussion and Analy sis of Financial Condition and Results of Operations” sections of each of First Midwest’s and Old National’s Quarterly Report on For m 10‐Q f or the quarter ended March 31, 2021, and in other reports First Midwest and Old National f ile with the U.S. Securities and Exchange Commission (the “SEC”). Unaudited Prospective Financial Information Old National and First Midwest do not, as a matter of course, publicly disclose f orecasts or internal projections as to theirf uture f inancial perf ormance, rev enues, earnings, f inancial condition or other results, giv en, among other reasons, the inherent uncertainty of the underly ing assumptions and estimates, other than, f rom time to time, certain expected f inancial results and operational metrics f or the current y ear and certain f uture y ears in their respectiv e regular earnings press releases and other inv estor material s. Howev er, Old National and First Midwest are including in this joint inv estor presentation certain unaudited prospectiv e f inancial inf ormation that was made av ailable in the course of their mutual due diligence and utilized, at their direction, in the f airness opinions rendered by their respectiv e f inancial adv isors. Neither Old National nor First Midwest endorses the prospectiv e f inancial inf ormation as necessarily predictiv e of actual f uture results. Additional Information and Where to Find It In connection with the proposed transaction, Old National will f ile a registration statement on Form S-4 with the SEC. The registration statement will include a joint proxy statement of First Midwest and Old National, which also constitutes a prospectus of Old National, that will be sent to First Midwest’s and Old National’s shareholders seeking certain approv als related to the proposed transaction. The inf ormation contained herein does not constitute an of f er to sell or a solicitation of an of f er to buy any securities or a solicitation of any v ote or approv al, nor shall there be any sale of securities in any jurisdiction in which such of f er, solicitation or sale would be unlawf ul prior to registration or qualif ication under the securities laws of any such jurisdiction. INVESTORS AND SECURITY HOLDERS OF FIRST MIDWEST AND OLD NATIONAL AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS TO BE INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONT AIN IMPORTANT INFORMATION ABOUT FIRST MIDWEST, OLD NATIONAL AND THE PROPOSED TRANSACTION. Inv estors and security holders will be able to obtain a f ree copy of the registration statement, including the joint proxy statement/prospectus, as well as other relev ant documents f iled with the SEC containing inf ormation about First Midwest and Old National, without charge, at the SEC’s website (http://www.sec.gov ). Copies of documents f iled with the SEC by First Midwest will be made av ailable f ree of charge in the “Inv estor Relations” section of First Midwest’s website, https://f irstmidwest.com/, under the heading “SEC Filings.” Copies of documents f iled with the SEC by Old National will be made av ailable f ree of charge in the “Inv estor Relations” section of Old National’s website, https://www.oldnational.com/, under the heading “Financial Inf ormation.” Participants in Solicitation First Midwest, Old National, and certain of their respectiv e directors and executiv e of ficers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Inf ormation regarding First Midwest’s directors and executiv e of ficers is av ailable in its def initiv e proxy statement, which was f iled with the SEC on April 13, 2021, and certain other documents f iled by First Midwest with the SEC. Inf ormation regarding Old National’s directors and executiv e of f icers is av ailable in its def initiv e proxy statement, which was f iled with the SEC on March 8, 2021, and certain other documents f iled by Old National with the SEC. Other inf ormation regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relev ant materials to be f iled with the SEC. Free copies of these documents, when av ailable, may be obtained as described in the preceding paragraph. |

| Non-GAAP Financial Measures 3 Non-GAAP Financial Measures In addition to results presented in accordance with GAAP, this presentation contains certain non-GAAP financial measures. A reconciliation of tangible book value and other ratios is included on page 25. Old National and First Midwest believe that providing certain non-GAAP financial measures provides investors with information useful in understanding performance trends and financial position. Old National and First Midwest use these measures for internal planning and forecasting purposes. Old National, First Midwest, and their respective securities analysts, investors and other interested parties, also use these measures to review peer company operating performance. Old National and First Midwest believe that this presentation and discussion, together with the accompanying reconciliations, provides an understanding of factors and trends affecting Old Nat ional’s and First Midwest’s businesses and allows investor to view performance in a manner similar to management. These non-GAAP measures should not be considered a substitute for GAAP basis measures and results, and investors are strongly encourag ed to review the consolidated financial statements in their entirety and not to rely on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. |

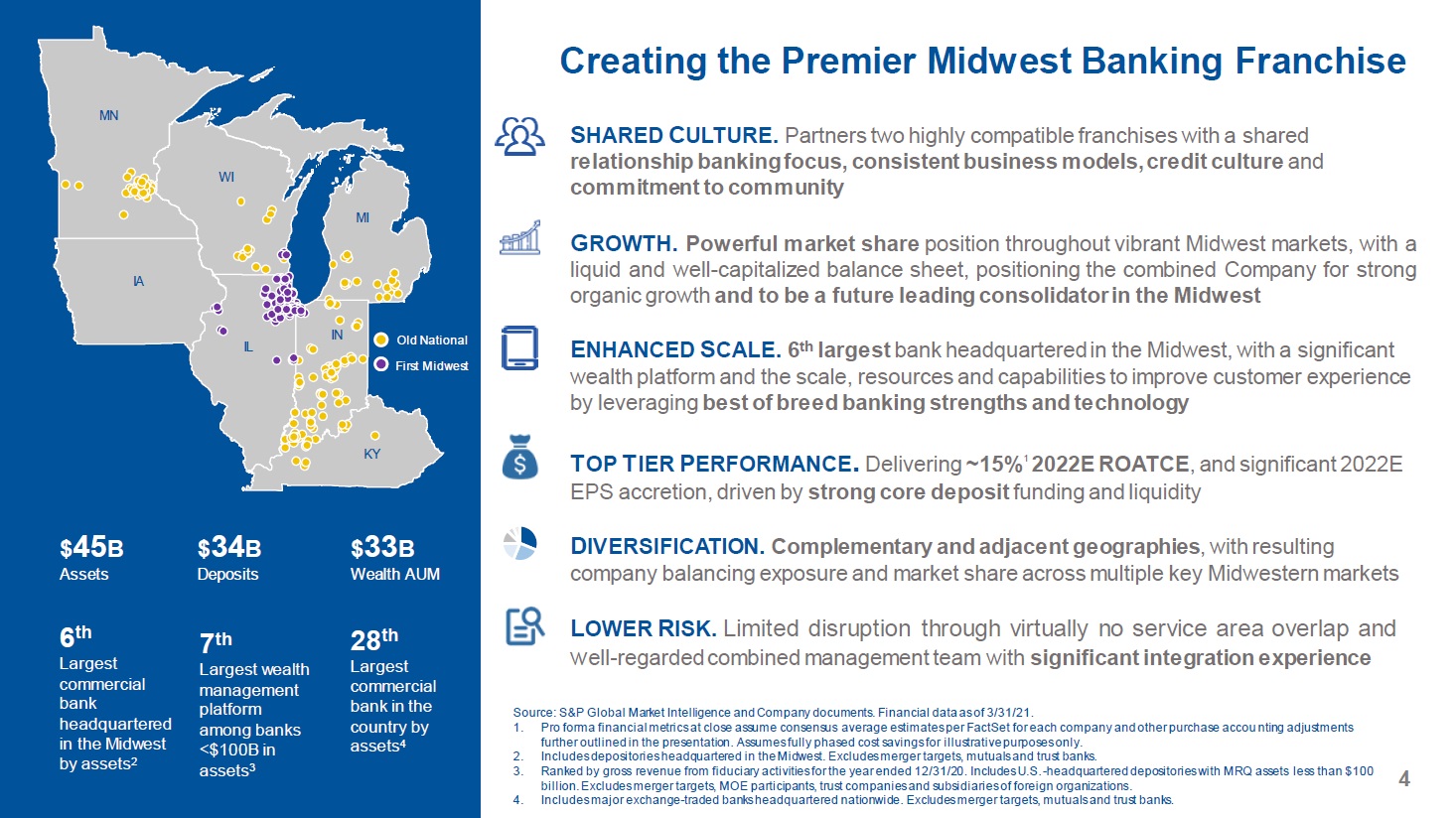

| Creating the Premier Midwest Banking Franchise SHARED CULTURE. Partners two highly compatible franchises with a shared relationship banking focus, consistent business models, credit culture and commitment to community GROWTH. Powerful market share position throughout vibrant Midwest markets, with a liquid and well-capitalized balance sheet, positioning the combined Company for strong organic growth and to be a future leading consolidator in the Midwest ENHANCED SCALE. 6th largest bank headquartered in the Midwest, with a significant wealth platform and the scale, resources and capabilities to improve customer experience by leveraging best of breed banking strengths and technology TOP TIER PERFORMANCE. Delivering ~15%1 2022E ROATCE, and significant 2022E EPS accretion, driven by strong core deposit funding and liquidity DIVERSIFICATION. Complementary and adjacent geographies, with resulting company balancing exposure and market share across multiple key Midwestern markets LOWER RISK. Limited disruption through virtually no service area overlap and well-regarded combined management team with significant integration experience Source: SP Global Market Intelligence and Company documents. Financial data as of 3/31/21. 1. Pro forma financial metrics at close assume consensus average estimates per FactSet for each company and other purchase accou nting adjustments further outlined in the presentation. Assumes fully phased cost savings for illustrative purposes only. 2. Includes depositories headquartered in the Midwest. Excludes merger targets, mutuals and trust banks. 3. Ranked by gross revenue from fiduciary activities for the year ended 12/31/20. Includes U.S. -headquartered depositories with MRQ assets less than $100 4 billion. Excludes merger targets, MOE participants, trust companies and subsidiaries of foreign organizaions. 4. Includes major exchange-traded banks headquartered nationwide. Excludes merger targets, mutuals and trust banks. |

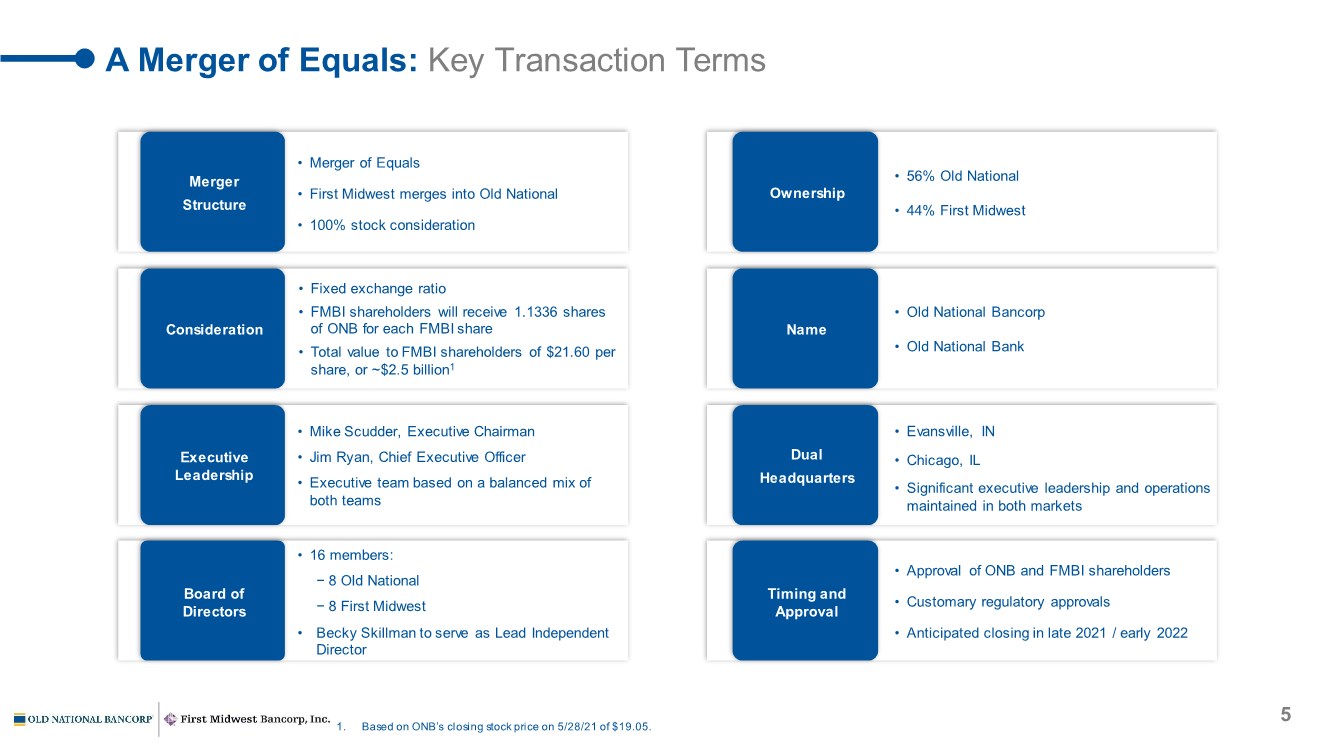

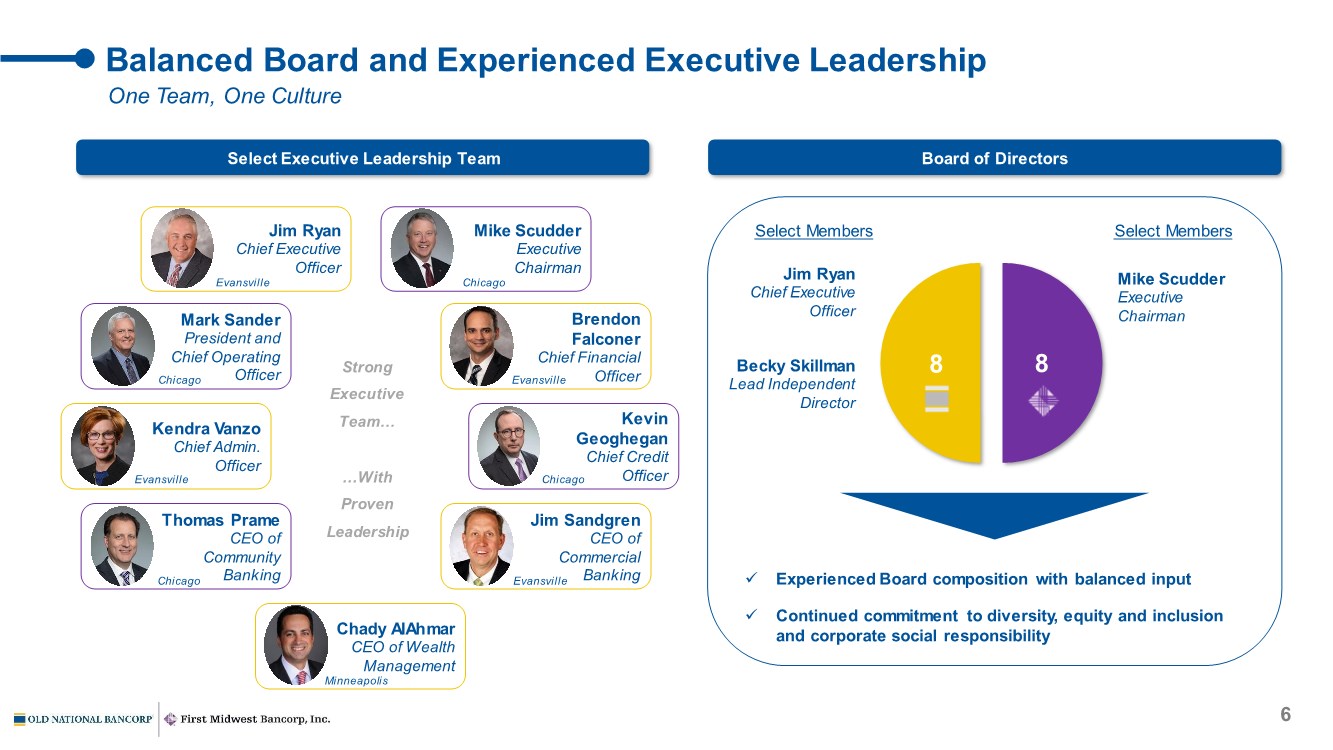

| A Merger of Equals: Key Transaction Terms • Merger of Equals • First Midwest merges into Old National • 100% stock consideration • Mike Scudder, Executive Chairman • Jim Ryan, Chief Executive Officer • Executive team based on a balanced mix of both teams • 16 members: − 8 Old National − 8 First Midwest • Becky Skillman to serve as Lead Independent Director • 56% Old National • 44% First Midwest • Evansville, IN • Chicago, IL • Significant executive leadership and operations maintained in both markets • Approval of ONB and FMBI shareholders • Customary regulatory approvals • Anticipated closing in late 2021 / early 2022 • Old National Bancorp • Old National Bank • Fixed exchange ratio • FMBI shareholders will receive 1.1336 shares of ONB for each FMBI share • Total value to FMBI shareholders of $21.60 per share, or ~$2.5 billion1 Merger Structure Ownership Consideration Name Executive Leadership Dual Headquarters Board of Directors Timing and Approval 5 1. Based on ONB’s closing stock price on 5/28/21 of $19.05. |

| Jim Ryan Chief Executive Officer Mike Scudder Executive Chairman Chady AlAhmar CEO of Wealth Management Balanced Board and Experienced Executive Leadership Select Executive Leadership Team Board of Directors 8 8 Select Members Select Members Experienced Board composition with balanced input Continued commitment to diversity, equity and inclusion and corporate social responsibility Jim Ryan Chief Executive Officer Mike Scudder Executive Chairman Becky Skillman Lead Independent Director 6 Brendon Falconer Chief Financial Officer Jim Sandgren CEO of Commercial Banking Kevin Geoghegan Chief Credit Officer Kendra Vanzo Chief Admin. Officer Strong Executive Team… …With Proven Leadership One Team, One Culture Mark Sander President and Chief Operating Officer Thomas Prame CEO of Community Banking Evansville Evansville Evansville Evansville Chicago Chicago Chicago Chicago Minneapolis |

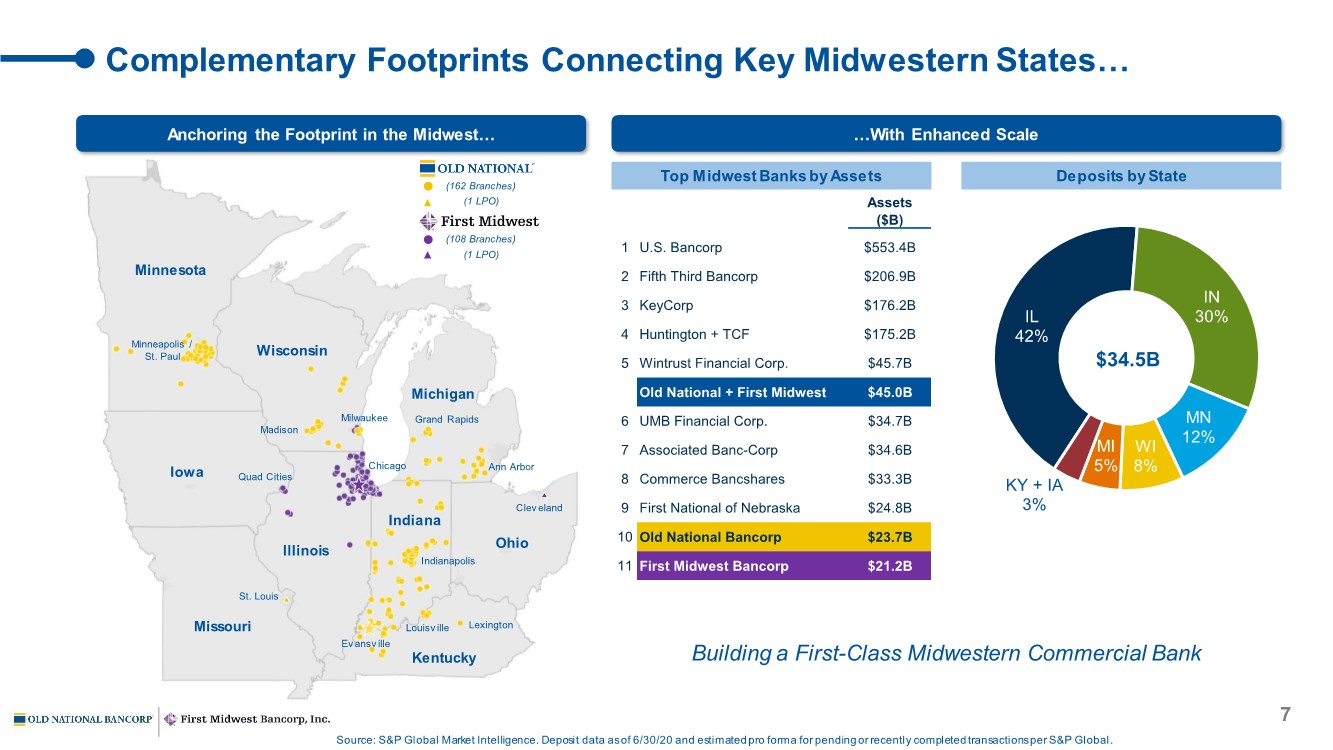

| IL 42% IN 30% MN 12% WI 8% MI 5% KY + IA 3% 7 Complementary Footprints Connecting Key Midwestern States… Anchoring the Footprint in the Midwest… …With Enhanced Scale Deposits by State Top Midwest Banks by Assets Assets ($B) 1 U.S. Bancorp $553.4B 2 Fifth Third Bancorp $206.9B 3 KeyCorp $176.2B 4 Huntington + TCF $175.2B 5 Wintrust Financial Corp. $45.7B Old National + First Midwest $45.0B 6 UMB Financial Corp. $34.7B 7 Associated Banc-Corp $34.6B 8 Commerce Bancshares $33.3B 9 First National of Nebraska $24.8B 10 Old National Bancorp $23.7B 11 First Midwest Bancorp $21.2B Source: S&P Global Market Intelligence. Deposit data as of 6/30/20 and estimated pro forma for pending or recently completed transactions per S&P Global. $34.5B Building a First-Class Midwestern Commercial Bank Minnesota Iowa Wisconsin Illinois Kentucky Indiana Michigan Minneapolis / St. Paul Milwaukee Chicago Madison Grand Rapids Indianapolis Louisv ille Ev ansv ille Missouri St. Louis Lexington Quad Cities Ann Arbor (162 Branches) (108 Branches) (1 LPO) (1 LPO) Clev eland Ohio |

| 8 …Operating in Dynamic Markets Source: S&P Global Market Intelligence, Bureau of Labor Statistics, Indianapolis Chamber of Commerce, Madison Chamber of Commerce, Louisville Visitor Center and Grand Rapids Office of Tourism. Note: Deposit data pro forma for pending acquisitions; data as of 6/30/20. St. Louis, MO (1 Loan Production Office) Minneapolis, MN ($3.6B Dep. / #8 Rank) 3.7M $274B (GDP) #1 50% Fortune 500 companies per capita faster projected pop. grow th vs. national average 2.8M $173B (GDP) #4 largest MSA in the Midw est 8 Fortune 500 companies Chicago, IL ($13.9B Dep. / #10 Rank) 9.4M $709B (GDP) #1 354k MSA by pop. and GDP in the Midw est (#3 in USA by GDP) businesses in MSA Milwaukee, WI ($1.3B Dep. / #9 Rank) 1.6M $107B (GDP) #1 #9 largest city in Wisconsin deposit market share rank Grand Rapids, MI ($367M Dep. / #14 Rank) 1.1M $63B (GDP) Top 10 emerging cities by Global Trade Magazine $2B+ invested in dow ntow n Grand Rapid’s Medical Mile since 2000 Madison, WI ($0.8B Dep. / #10 Rank) 819k $52B (GDP) 50% of population under 30 #2 largest city in Wisconsin Indianapolis, IN ($1.4B Dep. / #13 Rank) 2.1M $145B (GDP) 28M annual visitors from conferences and sporting events 3 Fortune 500 companies Louisville, KY ($302M Dep. / #16 Rank) 1.3M $74B (GDP) #1 largest city in Kentucky >16M annual visitors from conferences or events Evansville, IN ($3.0B Dep. / #1 Rank) 315k $19B (GDP) #3 largest city in Indiana #1 deposit market share rank |

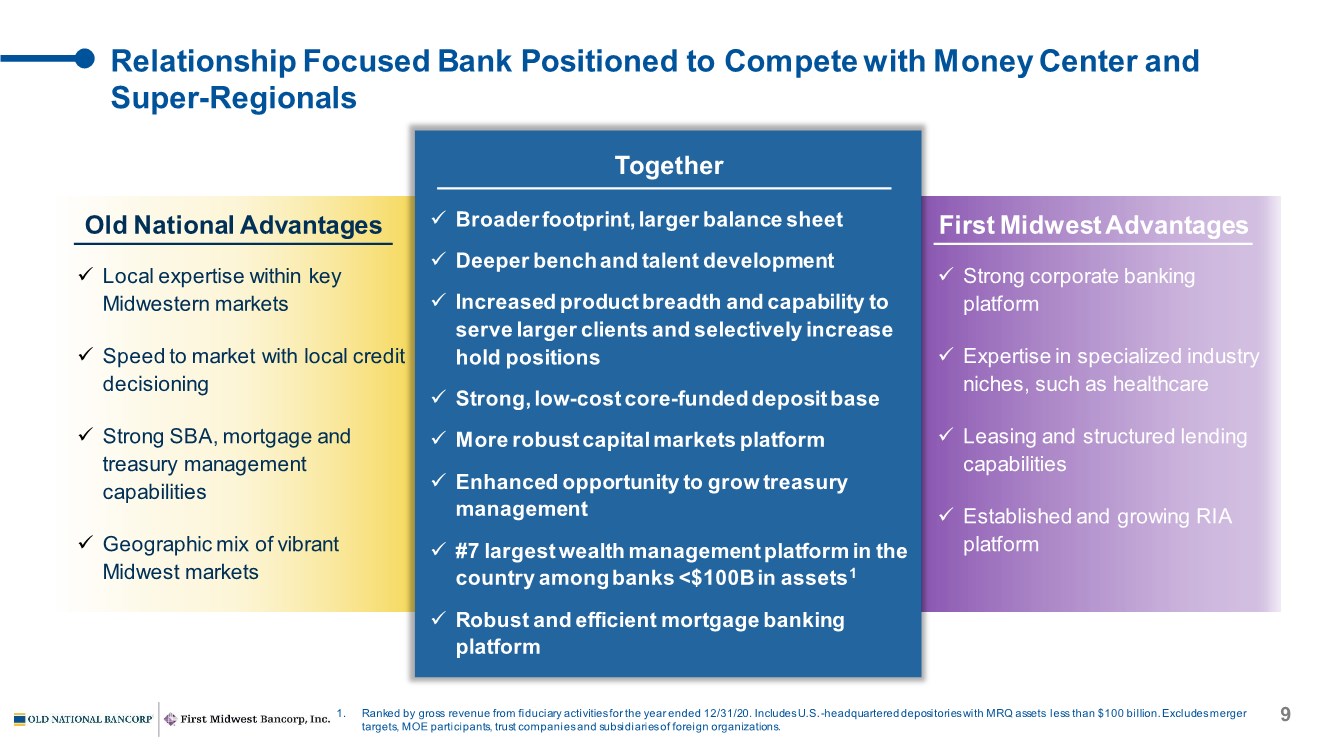

| Strong corporate banking platform Expertise in specialized industry niches, such as healthcare Leasing and structured lending capabilities Established and growing RIA platform Local expertise within key Midwestern markets Speed to market with local credit decisioning Strong SBA, mortgage and treasury management capabilities Geographic mix of vibrant Midwest markets Old National Advantages Relationship Focused Bank Positioned to Compete with Money Center and Super-Regionals First Midwest Advantages Broader footprint, larger balance sheet Deeper bench and talent development Increased product breadth and capability to serve larger clients and selectively increase hold positions Strong, low-cost core-funded deposit base More robust capital markets platform Enhanced opportunity to grow treasury management #7 largest wealth management platform in the country among banks <$100B in assets1 Robust and efficient mortgage banking platform Together 9 1. Ranked by gross revenue from fiduciary activities for the year ended 12/31/20. Includes U.S.-headquartered depositories with MRQ assets less than $100 billion. Excludes merger targets, MOE participants, trust companies and subsidiaries of foreign organizations. |

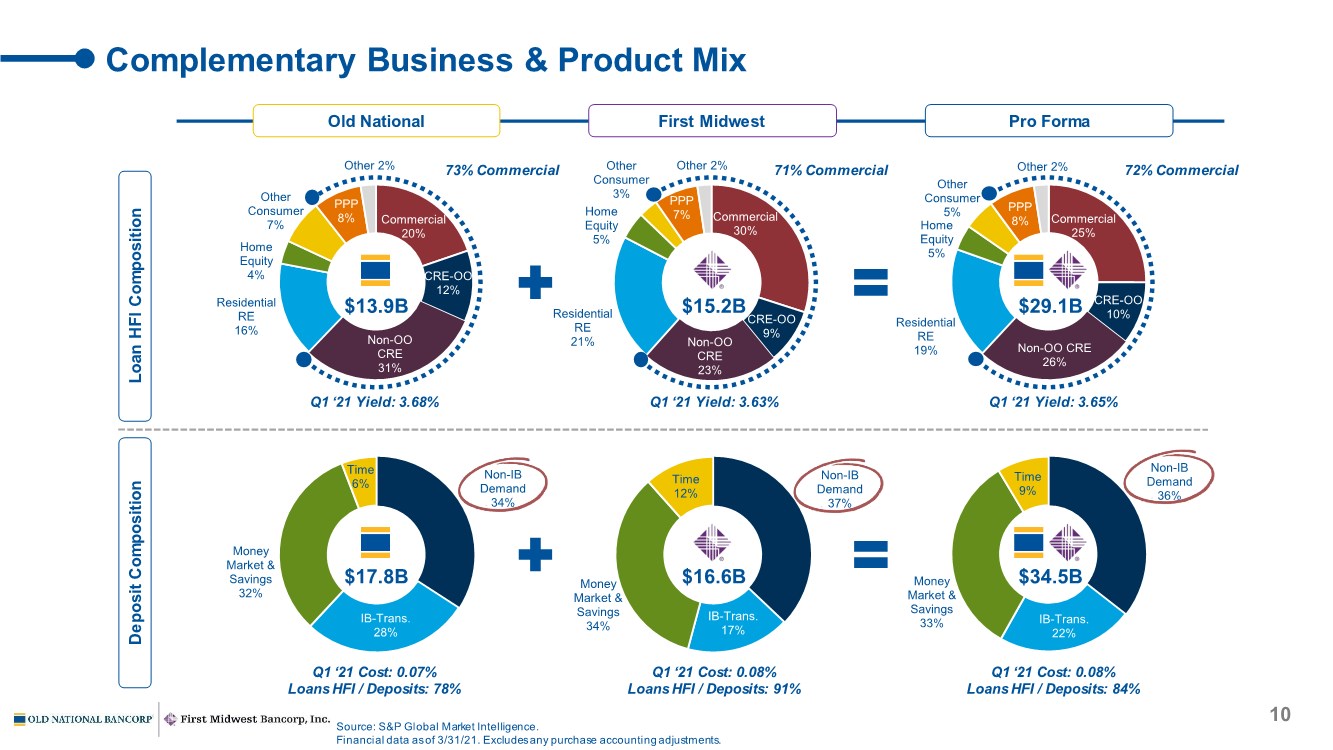

| Commercial 20% CRE-OO 12% Non-OO CRE 31% Residential RE 16% Home Equity 4% Other Consumer 7% PPP 8% Other 2% Non-IB Demand 36% IB-Trans. 22% Money Market & Savings 33% Time 9% 10 Complementary Business & Product Mix Non-IB Demand 37% IB-Trans. 17% Money Market & Savings 34% Time 12% Non-IB Demand 34% IB-Trans. 28% Money Market & Savings 32% Time 6% $17.8B Q1 ‘21 Cost: 0.07% Loans HFI / Deposits: 78% Q1 ‘21 Cost: 0.08% Loans HFI / Deposits: 91% Deposit Composition $16.6B $34.5B Q1 ‘21 Cost: 0.08% Loans HFI / Deposits: 84% Source: S&P Global Market Intelligence. Financial data as of 3/31/21. Excludes any purchase accounting adjustments. Loan HFI Composition Commercial 30% CRE-OO 9% Non-OO CRE 23% Residential RE 21% Home Equity 5% Other Consumer 3% PPP 7% Other 2% Commercial 25% CRE-OO 10% Non-OO CRE 26% Residential RE 19% Home Equity 5% Other Consumer 5% PPP 8% Other 2% $13.9B Q1 ‘21 Yield: 3.68% Q1 ‘21 Yield: 3.63% $15.2B $29.1B Q1 ‘21 Yield: 3.65% Old National First Midwest Pro Forma 73% Commercial 71% Commercial 72% Commercial |

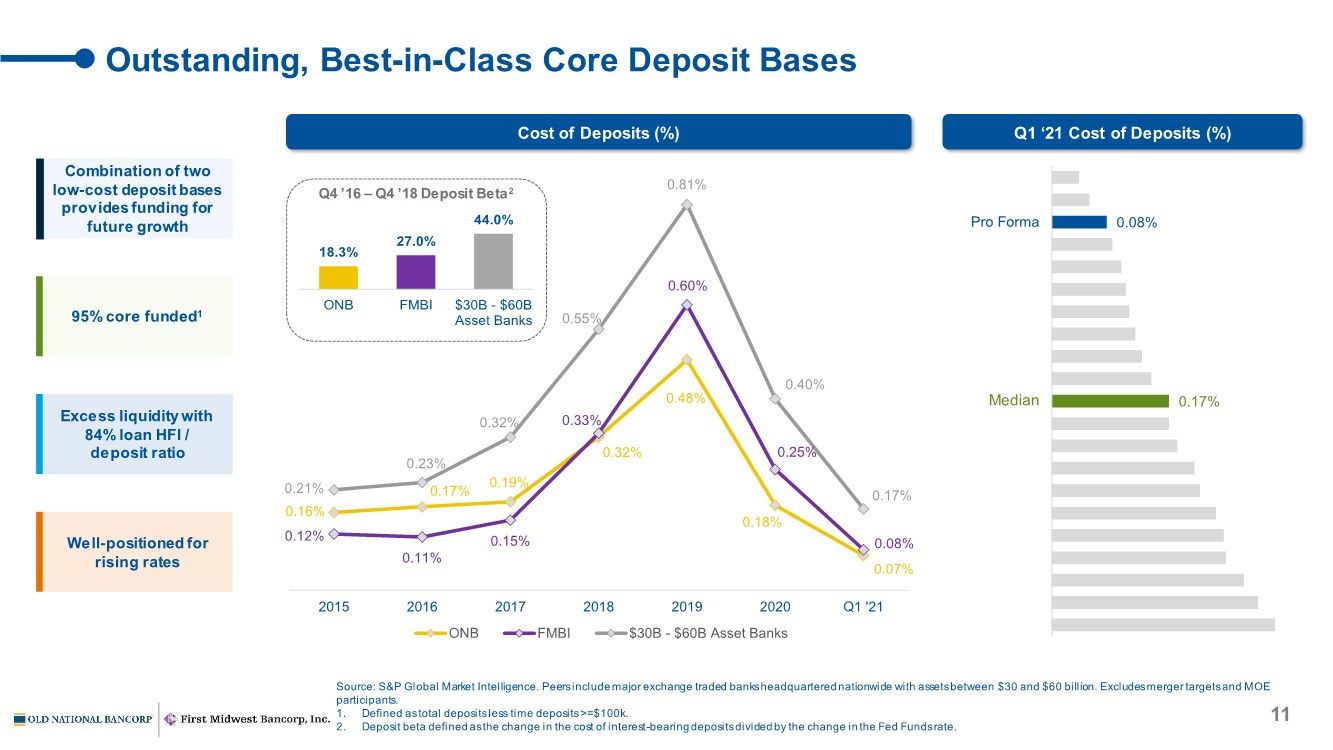

| 0.16% 0.17% 0.19% 0.32% 0.48% 0.18% 0.07% 0.12% 0.11% 0.15% 0.33% 0.60% 0.25% 0.08% 0.21% 0.23% 0.32% 0.55% 0.81% 0.40% 0.17% 2015 2016 2017 2018 2019 2020 Q1 '21 ONB FMBI $30B - $60B Asset Banks 11 Outstanding, Best-in-Class Core Deposit Bases 0.17% 0.08% Pro Forma Median Source: S&P Global Market Intelligence. Peers include major exchange traded banks headquartered nationwide with assets between $30 and $60 billion. Excludes merger targets and MOE participants. 1. Defined as total deposits less time deposits >=$100k. 2. Deposit beta defined as the change in the cost of interest-bearing deposits divided by the change in the Fed Funds rate. Q4 ’16 – Q4 ’18 Deposit Beta2 18.3% 27.0% 44.0% ONB FMBI $30B - $60B Asset Banks 95% core funded1 Well-positioned for rising rates Combination of two low-cost deposit bases provides funding for future growth Excess liquidity with 84% loan HFI / deposit ratio Cost of Deposits (%) Q1 ‘21 Cost of Deposits (%) |

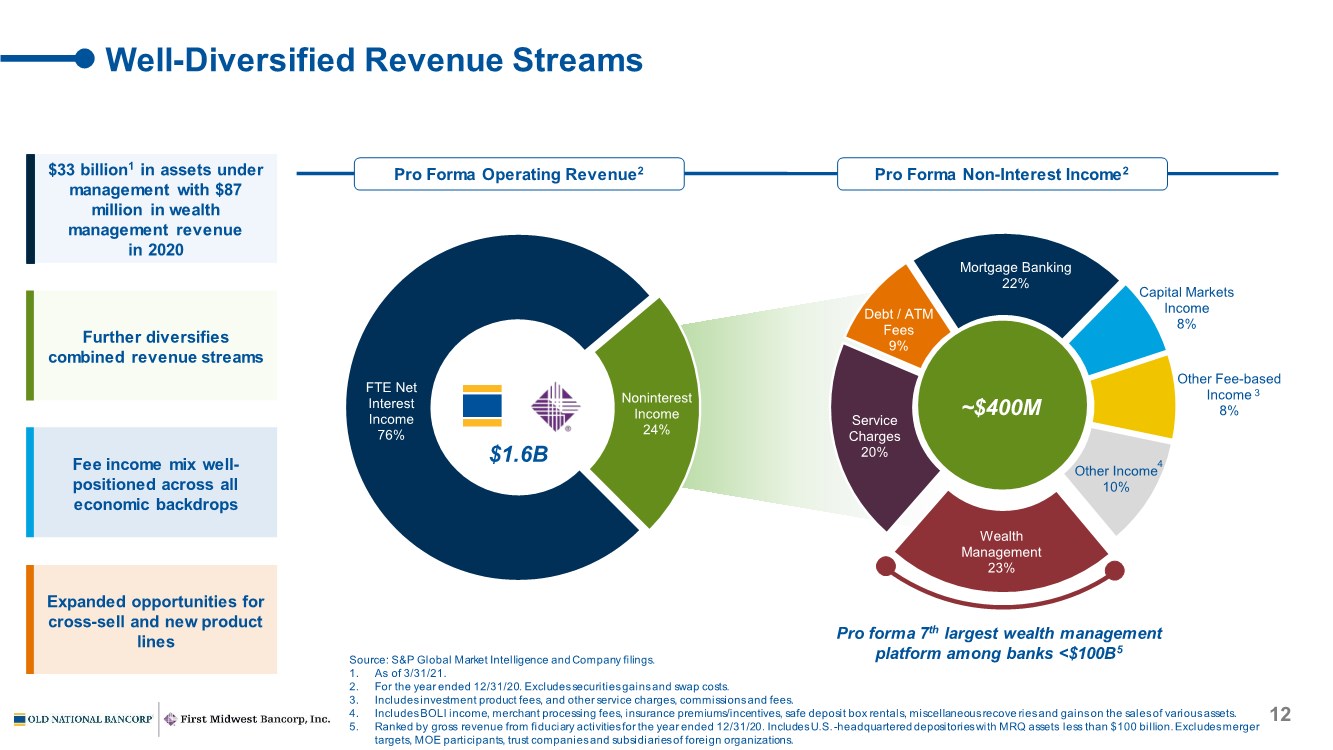

| 12 Source: S&P Global Market Intelligence and Company filings. 1. As of 3/31/21. 2. For the year ended 12/31/20. Excludes securities gains and swap costs. 3. Includes investment product fees, and other service charges, commissions and fees. 4. Includes BOLI income, merchant processing fees, insurance premiums/incentives, safe deposit box rentals, miscellaneous recove ries and gains on the sales of various assets. 5. Ranked by gross revenue from fiduciary activities for the year ended 12/31/20. Includes U.S.-headquartered depositories with MRQ assets less than $100 billion. Excludes merger targets, MOE participants, trust companies and subsidiaries of foreign organizations. FTE Net Interest Income 76% Noninterest Income 24% Wealth Management 23% Service Charges 20% Debt / ATM Fees 9% Mortgage Banking 22% Capital Markets Income 8% Other Fee-based Income 8% Other Income 10% $1.6B Well-Diversified Revenue Streams ~$400M Pro Forma Operating Revenue2 Pro Forma Non-Interest Income2 Further diversifies combined revenue streams Expanded opportunities for cross-sell and new product lines $33 billion1 in assets under management with $87 million in wealth management revenue in 2020 Fee income mix well- positioned across all economic backdrops Pro forma 7th largest wealth management platform among banks <$100B5 3 4 |

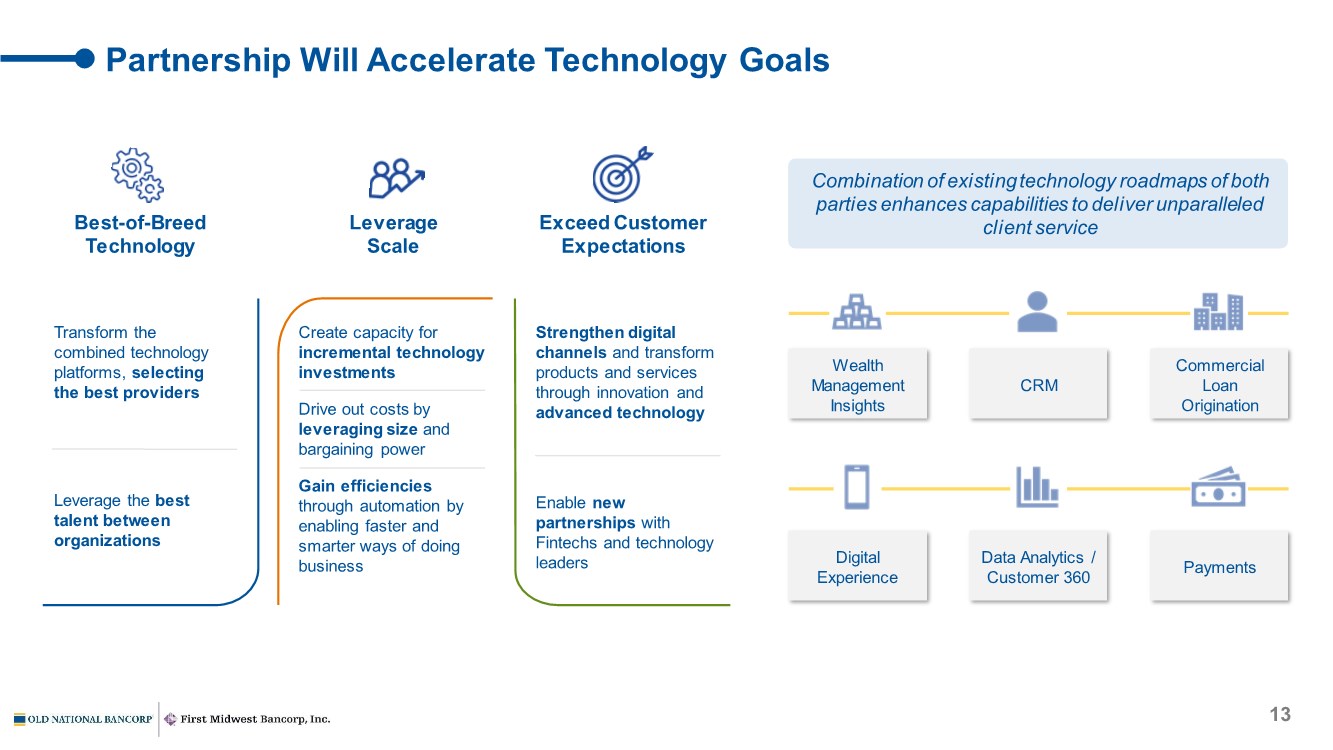

| Wealth Management Insights 13 Partnership Will Accelerate Technology Goals Best-of-Breed Technology Leverage Scale Create capacity for incremental technology investments Drive out costs by leveraging size and bargaining power Gain efficiencies through automation by enabling faster and smarter ways of doing business Exceed Customer Expectations Strengthen digital channels and transform products and services through innovation and advanced technology Enable new partnerships with Fintechs and technology leaders Transform the combined technology platforms, selecting the best providers Leverage the best talent between organizations Combination of existing technology roadmaps of both parties enhances capabilities to deliver unparalleled client service CRM Commercial Loan Origination Digital Experience Data Analytics / Customer 360 Payments |

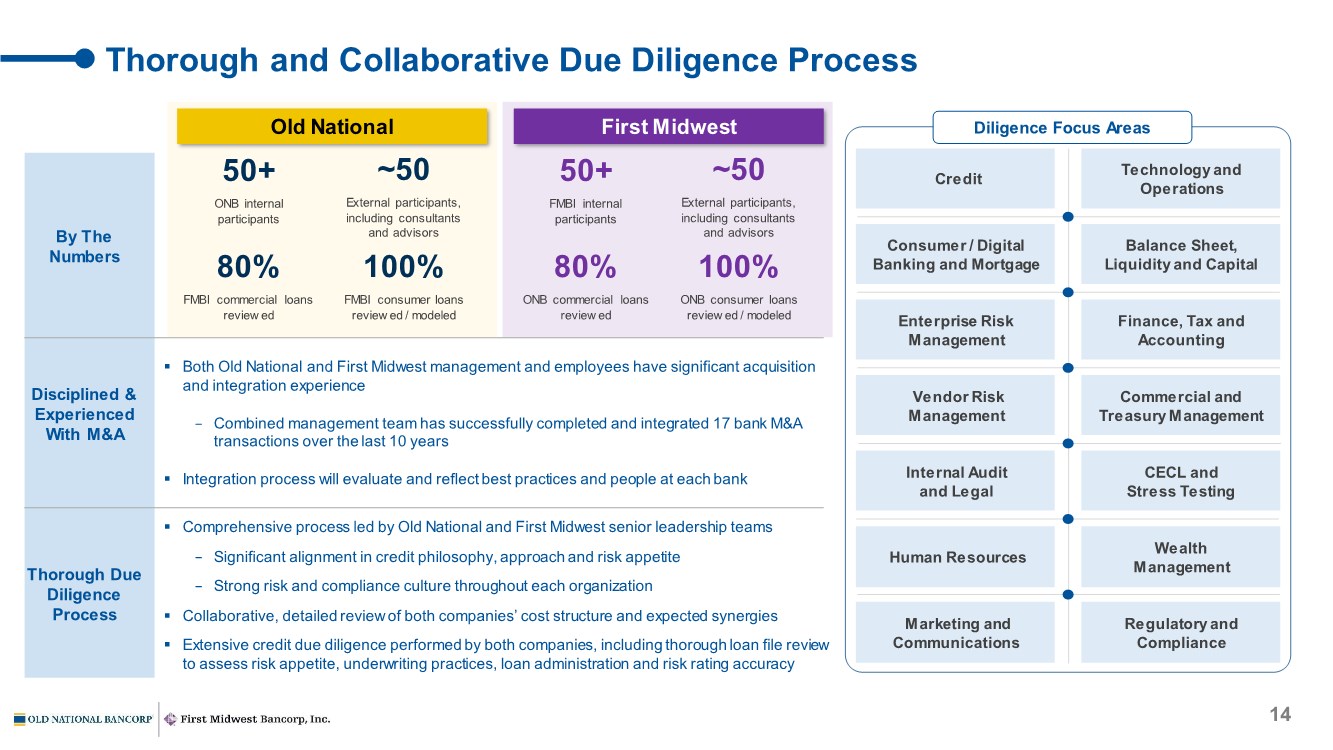

| 14 Thorough and Collaborative Due Diligence Process By The Numbers Disciplined & Experienced With M&A Thorough Due Diligence Process Credit Technology and Operations Consumer / Digital Banking and Mortgage Balance Sheet, Liquidity and Capital Enterprise Risk Management Finance, Tax and Accounting Vendor Risk Management Commercial and Treasury Management Internal Audit and Legal CECL and Stress Testing Human Resources Wealth Management Marketing and Communications Regulatory and Compliance Old National First Midwest 50+ ONB internal participants 80% FMBI commercial loans review ed 100% FMBI consumer loans review ed / modeled 80% ONB commercial loans review ed 100% ONB consumer loans review ed / modeled Diligence Focus Areas ~50 External participants, including consultants and advisors 50+ FMBI internal participants ~50 External participants, including consultants and advisors . Both Old National and First Midwest management and employees have significant acquisition and integration experience − Combined management team has successfully completed and integrated 17 bank M&A transactions over the last 10 years . Integration process will evaluate and reflect best practices and people at each bank . Comprehensive process led by Old National and First Midwest senior leadership teams − Significant alignment in credit philosophy, approach and risk appetite − Strong risk and compliance culture throughout each organization . Collaborative, detailed review of both companies’ cost structure and expected synergies . Extensive credit due diligence performed by both companies, including thorough loan file review to assess risk appetite, underwriting practices, loan administration and risk rating accuracy |

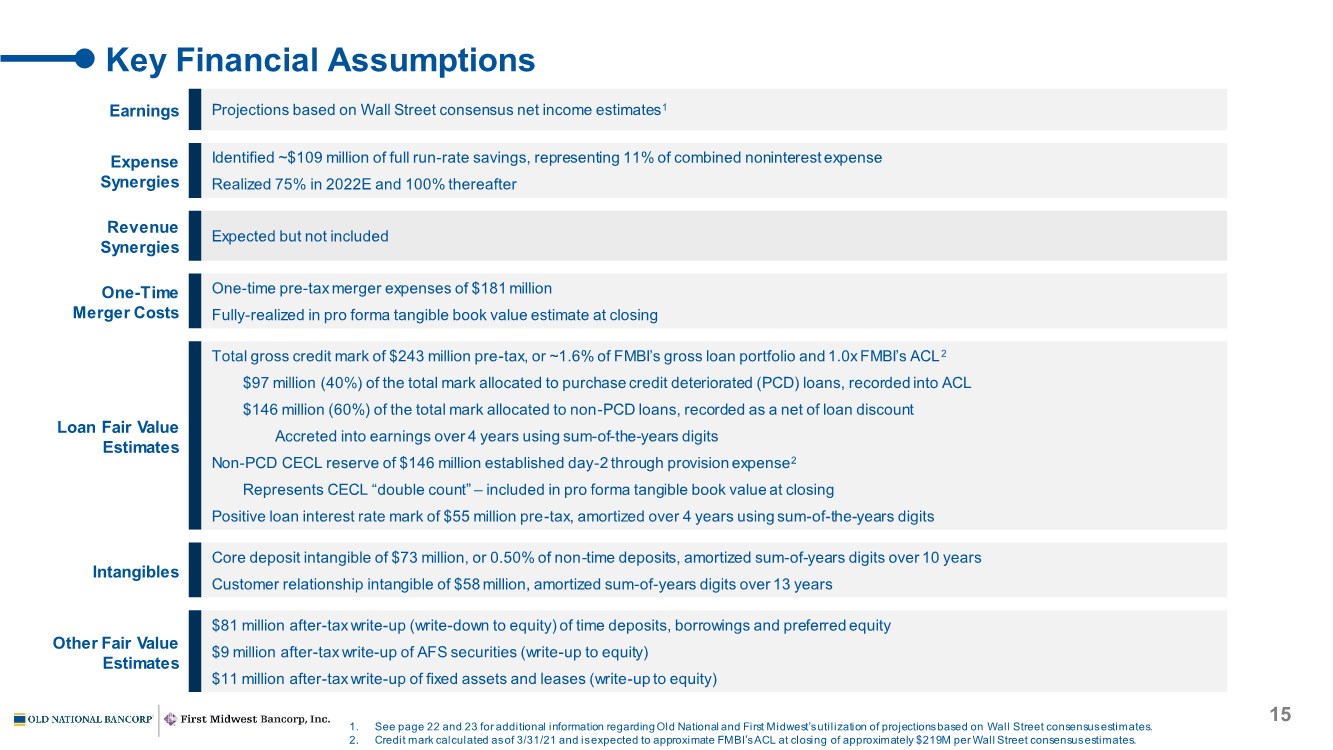

| 15 Key Financial Assumptions Earnings Projections based on Wall Street consensus net income estimates1 Expense Synergies Identified ~$109 million of full run-rate savings, representing 11% of combined noninterest expense Realized 75% in 2022E and 100% thereafter Revenue Synergies Expected but not included One-Time Merger Costs One-time pre-taxmerger expenses of $181 million Fully-realized in pro forma tangible book value estimate at closing Loan Fair Value Estimates Total gross credit mark of $243 million pre-tax, or ~1.6% of FMBI’s gross loan portfolio and 1.0x FMBI’s ACL2 $97 million (40%) of the total mark allocated to purchase credit deteriorated (PCD) loans, recorded into ACL $146 million (60%) of the total mark allocated to non-PCD loans, recorded as a net of loan discount Accreted into earnings over 4 years using sum-of-the-years digits Non-PCD CECL reserve of $146 million established day-2 through provision expense2 Represents CECL “double count” – included in pro forma tangible book value at closing Positive loan interest rate mark of $55 million pre-tax, amortized over 4 years using sum-of-the-years digits Intangibles Core deposit intangible of $73 million, or 0.50% of non-time deposits, amortized sum-of-years digits over 10 years Customer relationship intangible of $58 million, amortized sum-of-years digits over 13 years Other Fair Value Estimates $81 million after-tax write-up (write-down to equity) of time deposits, borrowings and preferred equity $9 million after-tax write-up of AFS securities (write-up to equity) $11 million after-tax write-up of fixed assets and leases (write-up to equity) 1. See page 22 and 23 for additional information regarding Old National and First Midwest’s utilization of projections based on Wall Street consensus estimates. 2. Credit mark calculated as of 3/31/21 and is expected to approximate FMBI’s ACL at closing of approximately $219M per Wall Street consensus estimates. |

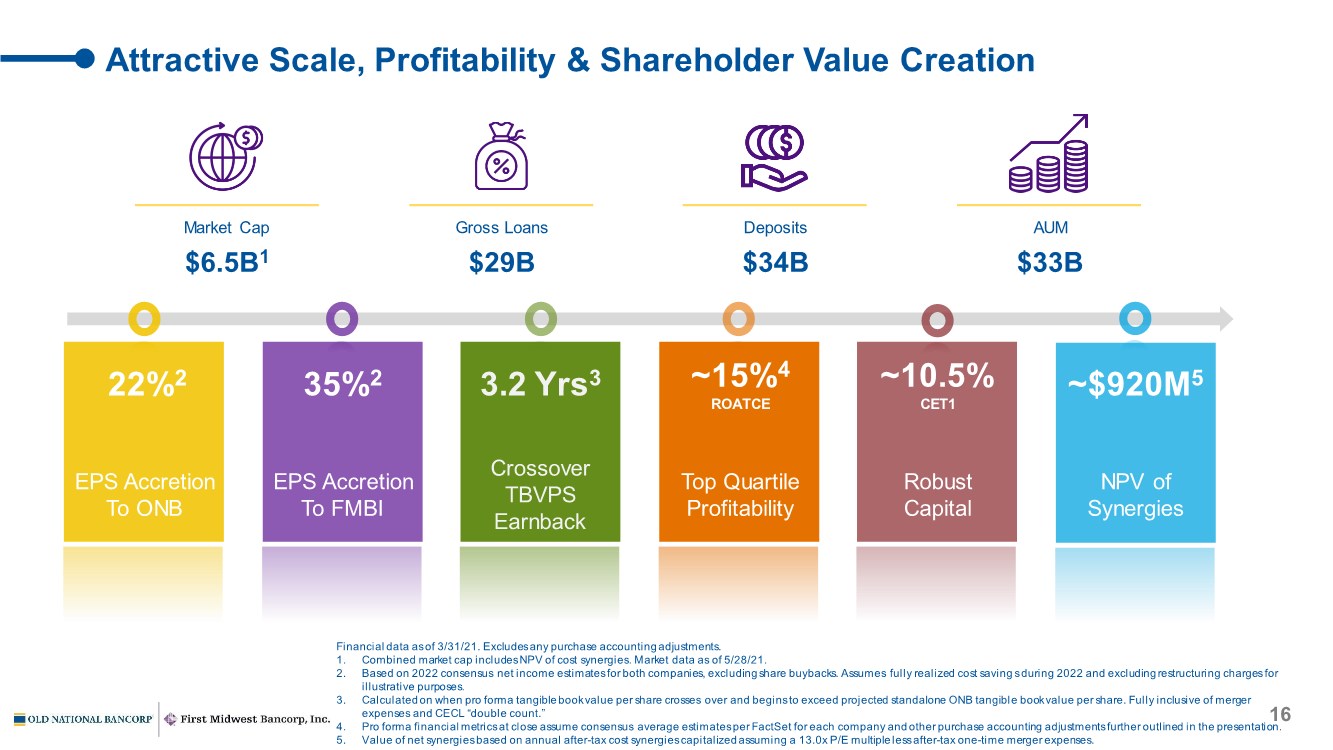

| 16 Attractive Scale, Profitability & Shareholder Value Creation Financial data as of 3/31/21. Excludes any purchase accounting adjustments. 1. Combined market cap includes NPV of cost synergies. Market data as of 5/28/21. 2. Based on 2022 consensus net income estimates for both companies, excluding share buybacks. Assumes fully realized cost saving s during 2022 and excluding restructuring charges for illustrative purposes. 3. Calculated on when pro forma tangible book value per share crosses over and begins to exceed projected standalone ONB tangible book value per share. Fully inclusive of merger expenses and CECL “double count.” 4. Pro forma financial metrics at close assume consensus average estimates per FactSet for each company and other purchase accounting adjustments further outlined in the presentation. 5. Value of net synergies based on annual after-tax cost synergies capitalized assuming a 13.0x P/E multiple less after-tax one-time merger expenses. EPS Accretion To ONB Crossover TBVPS Earnback EPS Accretion To FMBI Top Quartile Profitability Robust Capital Market Cap $6.5B1 Gross Loans $29B Deposits $34B AUM $33B 22%2 35%2 3.2 Yrs3 ~15%4 ROATCE ~10.5% CET1 NPV of Synergies ~$920M5 |

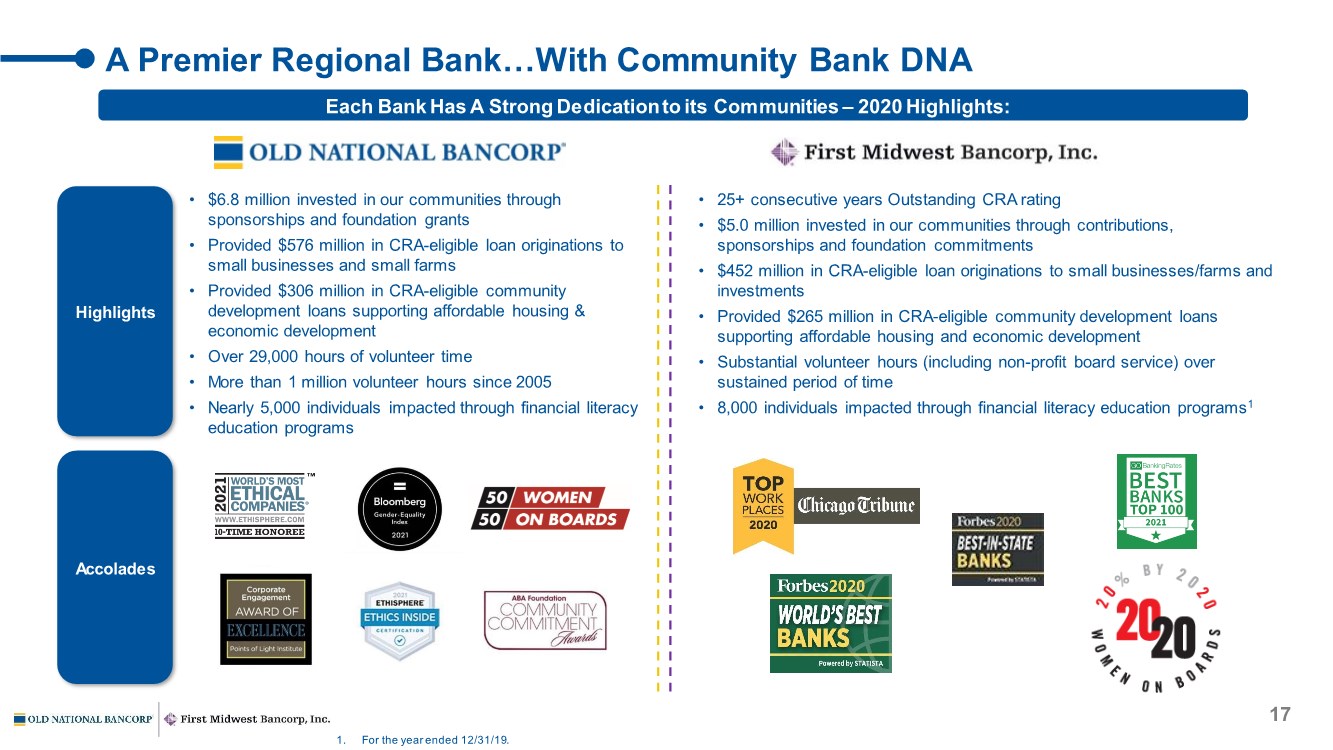

| 17 A Premier Regional Bank…With Community Bank DNA • 25+ consecutive years Outstanding CRA rating • $5.0 million invested in our communities through contributions, sponsorships and foundation commitments • $452 million in CRA-eligible loan originations to small businesses/farms and investments • Provided $265 million in CRA-eligible community development loans supporting affordable housing and economic development • Substantial volunteer hours (including non-profit board service) over sustained period of time • 8,000 individuals impacted through financial literacy education programs1 Each Bank Has A Strong Dedication to its Communities – 2020 Highlights: Highlights Accolades • $6.8 million invested in our communities through sponsorships and foundation grants • Provided $576 million in CRA-eligible loan originations to small businesses and small farms • Provided $306 million in CRA-eligible community development loans supporting affordable housing & economic development • Over 29,000 hours of volunteer time • More than 1 million volunteer hours since 2005 • Nearly 5,000 individuals impacted through financial literacy education programs 1. For the year ended 12/31/19. |

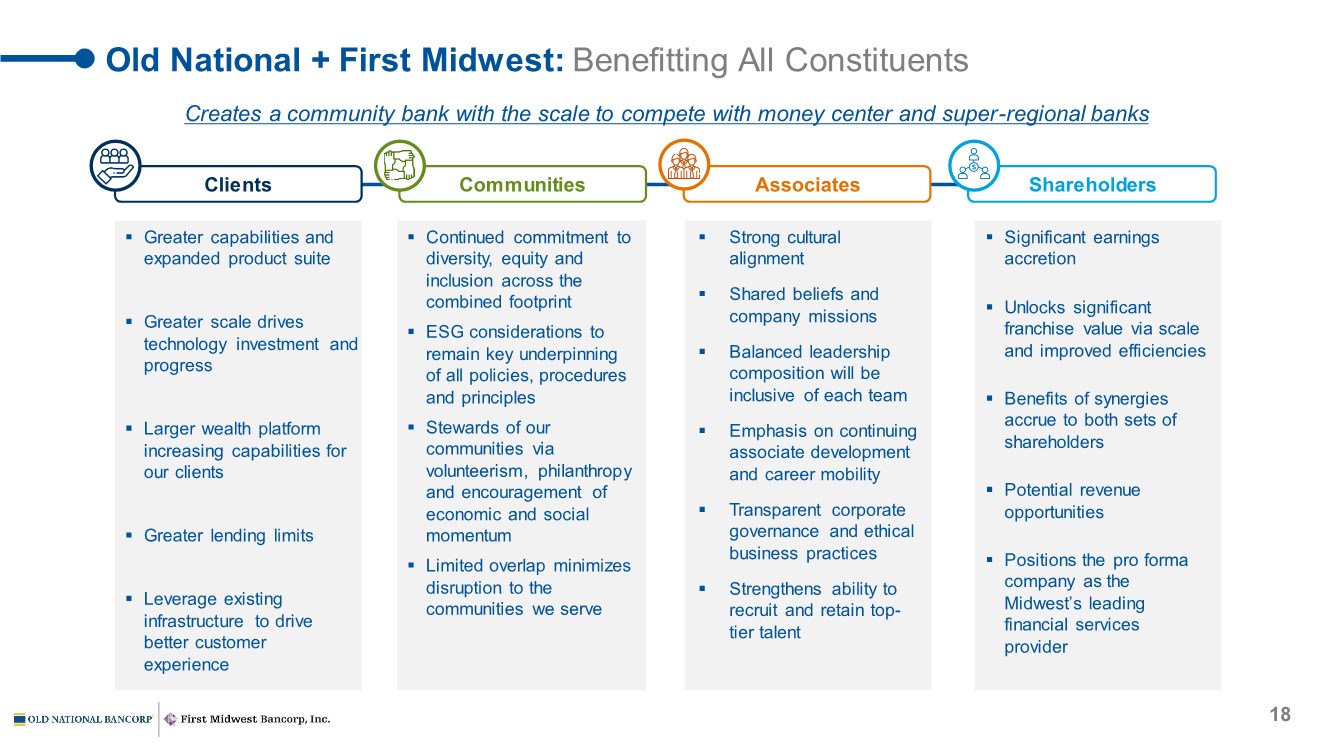

| Old National + First Midwest: Benefitting All Constituents Clients Communities Associates . Greater capabilities and expanded product suite . Greater scale drives technology investment and progress . Larger wealth platform increasing capabilities for our clients . Greater lending limits . Leverage existing infrastructure to drive better customer experience . Continued commitment to diversity, equity and inclusion across the combined footprint . ESG considerations to remain key underpinning of all policies, procedures and principles . Stewards of our communities via volunteerism, philanthropy and encouragement of economic and social momentum . Limited overlap minimizes disruption to the communities we serve . Strong cultural alignment . Shared beliefs and company missions . Balanced leadership composition will be inclusive of each team . Emphasis on continuing associate development and career mobility . Transparent corporate governance and ethical business practices . Strengthens ability to recruit and retain top- tier talent 18 Shareholders . Significant earnings accretion . Unlocks significant franchise value via scale and improved efficiencies . Benefits of synergies accrue to both sets of shareholders . Potential revenue opportunities . Positions the pro forma company as the Midwest’s leading financial services provider Creates a community bank with the scale to compete with money center and super-regional banks |

| 19 Appendix |

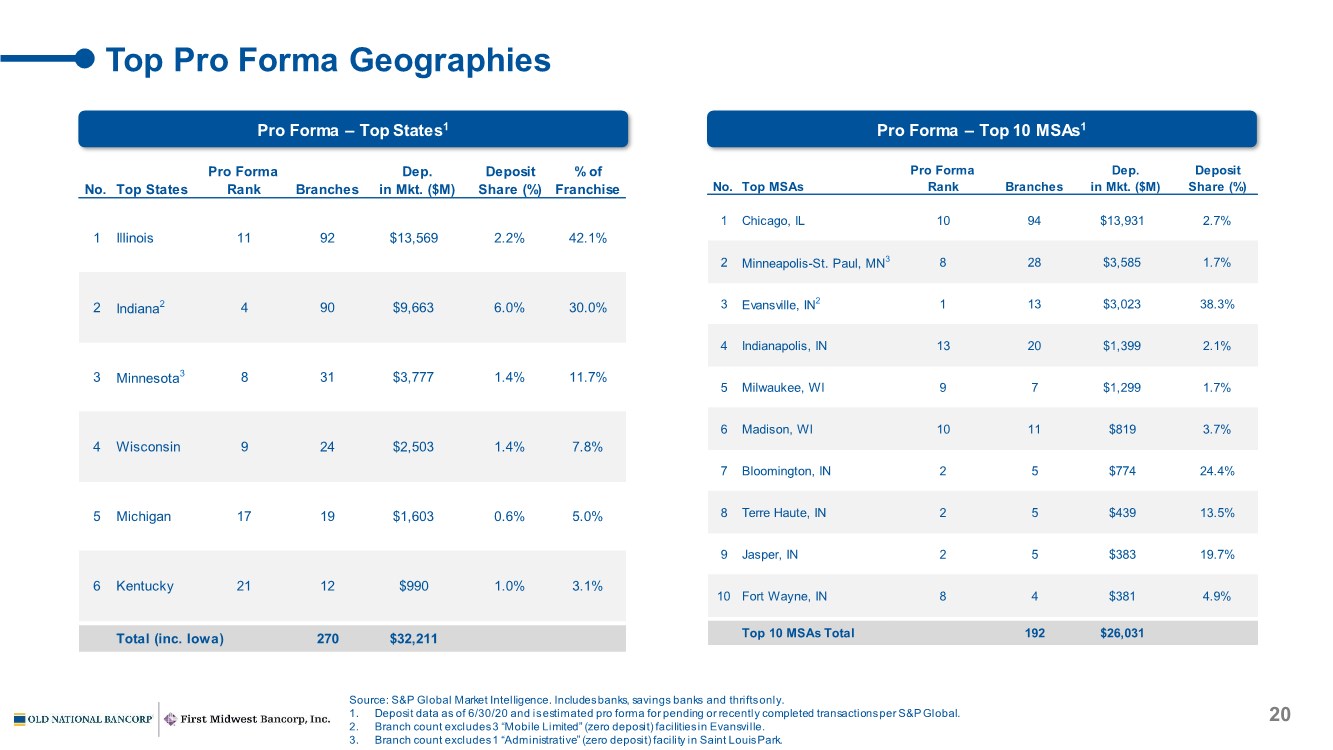

| 20 Top Pro Forma Geographies Pro Forma – Top States1 Pro Forma – Top 10 MSAs1 No. Top States Pro Forma Rank Branches Dep. in Mkt. ($M) Deposit Share (%) % of Franchise 1 Illinois 11 92 $13,569 2.2% 42.1% 2 Indiana2 4 90 $9,663 6.0% 30.0% 3 Minnesota3 8 31 $3,777 1.4% 11.7% 4 Wisconsin 9 24 $2,503 1.4% 7.8% 5 Michigan 17 19 $1,603 0.6% 5.0% 6 Kentucky 21 12 $990 1.0% 3.1% Total (inc. Iowa) 270 $32,211 No. Top MSAs Pro Forma Rank Branches Dep. in Mkt. ($M) Deposit Share (%) 1 Chicago, IL 10 94 $13,931 2.7% 2 Minneapolis-St. Paul, MN3 8 28 $3,585 1.7% 3 Evansville, IN2 1 13 $3,023 38.3% 4 Indianapolis, IN 13 20 $1,399 2.1% 5 Milwaukee, WI 9 7 $1,299 1.7% 6 Madison, WI 10 11 $819 3.7% 7 Bloomington, IN 2 5 $774 24.4% 8 Terre Haute, IN 2 5 $439 13.5% 9 Jasper, IN 2 5 $383 19.7% 10 Fort Wayne, IN 8 4 $381 4.9% Top 10 MSAs Total 192 $26,031 Source: S&P Global Market Intelligence. Includes banks, savings banks and thrifts only. 1. Deposit data as of 6/30/20 and is estimated pro forma for pending or recently completed transactions per S&P Global. 2. Branch count excludes 3 “Mobile Limited” (zero deposit) facilities in Evansville. 3. Branch count excludes 1 “Administrative” (zero deposit) facility in Saint Louis Park. |

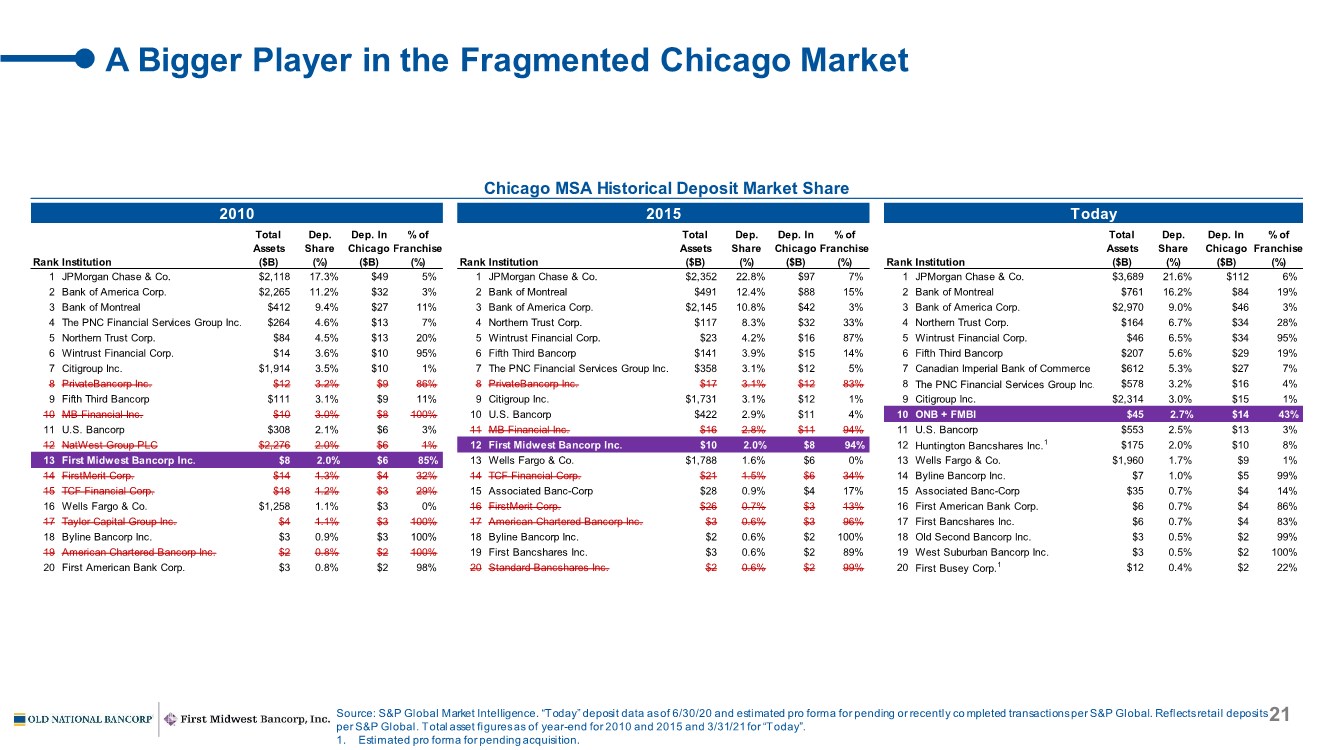

| 21 A Bigger Player in the Fragmented Chicago Market Source: S&P Global Market Intelligence. “Today” deposit data as of 6/30/20 and estimated pro forma for pending or recently co mpleted transactions per S&P Global. Reflects retail deposits per S&P Global. Total asset figures as of year-end for 2010 and 2015 and 3/31/21 for “Today”. 1. Estimated pro forma for pending acquisition. Chicago MSA Historical Deposit Market Share 2010 2015 Today Total Dep. Dep. In % of Total Dep. Dep. In % of Total Dep. Dep. In % of Assets Share Chicago Franchise Assets Share Chicago Franchise Assets Share Chicago Franchise Rank Institution ($B) (%) ($B) (%) Rank Institution ($B) (%) ($B) (%) Rank Institution ($B) (%) ($B) (%) 1 JPMorgan Chase & Co. $2,118 17.3% $49 5% 1 JPMorgan Chase & Co. $2,352 22.8% $97 7% 1 JPMorgan Chase & Co. $3,689 21.6% $112 6% 2 Bank of America Corp. $2,265 11.2% $32 3% 2 Bank of Montreal $491 12.4% $88 15% 2 Bank of Montreal $761 16.2% $84 19% 3 Bank of Montreal $412 9.4% $27 11% 3 Bank of America Corp. $2,145 10.8% $42 3% 3 Bank of America Corp. $2,970 9.0% $46 3% 4 The PNC Financial Services Group Inc. $264 4.6% $13 7% 4 Northern Trust Corp. $117 8.3% $32 33% 4 Northern Trust Corp. $164 6.7% $34 28% 5 Northern Trust Corp. $84 4.5% $13 20% 5 Wintrust Financial Corp. $23 4.2% $16 87% 5 Wintrust Financial Corp. $46 6.5% $34 95% 6 Wintrust Financial Corp. $14 3.6% $10 95% 6 Fifth Third Bancorp $141 3.9% $15 14% 6 Fifth Third Bancorp $207 5.6% $29 19% 7 Citigroup Inc. $1,914 3.5% $10 1% 7 The PNC Financial Services Group Inc. $358 3.1% $12 5% 7 Canadian Imperial Bank of Commerce $612 5.3% $27 7% 8 PrivateBancorp Inc. $12 3.2% $9 86% 8 PrivateBancorp Inc. $17 3.1% $12 83% 8 The PNC Financial Services Group Inc.1 $578 3.2% $16 4% 9 Fifth Third Bancorp $111 3.1% $9 11% 9 Citigroup Inc. $1,731 3.1% $12 1% 9 Citigroup Inc. $2,314 3.0% $15 1% 10 MB Financial Inc. $10 3.0% $8 100% 10 U.S. Bancorp $422 2.9% $11 4% 10 ONB + FMBI $45 2.7% $14 43% 11 U.S. Bancorp $308 2.1% $6 3% 11 MB Financial Inc. $16 2.8% $11 94% 11 U.S. Bancorp $553 2.5% $13 3% 12 NatWest Group PLC $2,276 2.0% $6 1% 12 First Midwest Bancorp Inc. $10 2.0% $8 94% 12 Huntington Bancshares Inc.1 $175 2.0% $10 8% 13 First Midwest Bancorp Inc. $8 2.0% $6 85% 13 Wells Fargo & Co. $1,788 1.6% $6 0% 13 Wells Fargo & Co. $1,960 1.7% $9 1% 14 FirstMerit Corp. $14 1.3% $4 32% 14 TCF Financial Corp. $21 1.5% $6 34% 14 Byline Bancorp Inc. $7 1.0% $5 99% 15 TCF Financial Corp. $18 1.2% $3 29% 15 Associated Banc-Corp $28 0.9% $4 17% 15 Associated Banc-Corp $35 0.7% $4 14% 16 Wells Fargo & Co. $1,258 1.1% $3 0% 16 FirstMerit Corp. $26 0.7% $3 13% 16 First American Bank Corp. $6 0.7% $4 86% 17 Taylor Capital Group Inc. $4 1.1% $3 100% 17 American Chartered Bancorp Inc. $3 0.6% $3 96% 17 First Bancshares Inc. $6 0.7% $4 83% 18 Byline Bancorp Inc. $3 0.9% $3 100% 18 Byline Bancorp Inc. $2 0.6% $2 100% 18 Old Second Bancorp Inc. $3 0.5% $2 99% 19 American Chartered Bancorp Inc. $2 0.8% $2 100% 19 First Bancshares Inc. $3 0.6% $2 89% 19 West Suburban Bancorp Inc. $3 0.5% $2 100% 20 First American Bank Corp. $3 0.8% $2 98% 20 Standard Bancshares Inc. $2 0.6% $2 99% 20 First Busey Corp.1 $12 0.4% $2 22% |

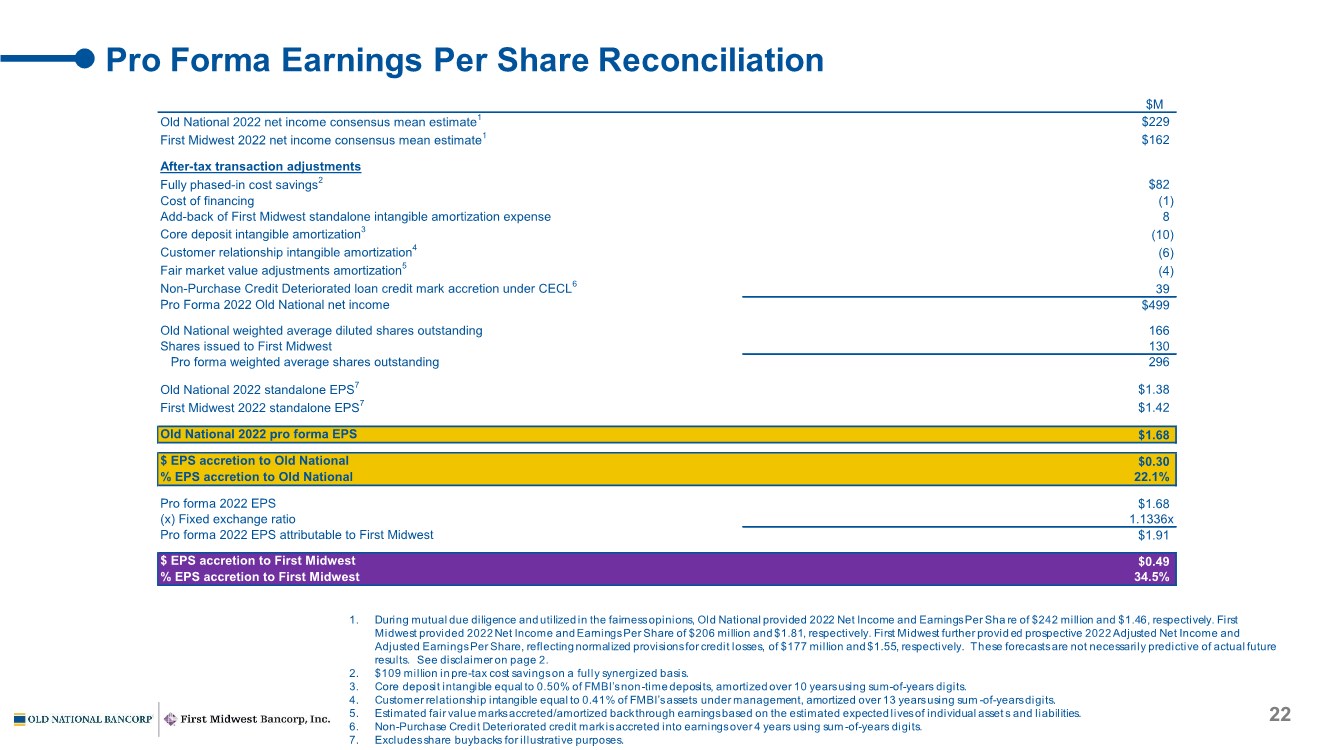

| 22 Pro Forma Earnings Per Share Reconciliation 1. During mutual due diligence and utilized in the fairness opinions, Old National provided 2022 Net Income and Earnings Per Sha re of $242 million and $1.46, respectively. First Midwest provided 2022 Net Income and Earnings Per Share of $206 million and $1.81, respectively. First Midwest further provid ed prospective 2022 Adjusted Net Income and Adjusted Earnings Per Share, reflecting normalized provisions for credit losses, of $177 million and $1.55, respectively. These forecasts are not necessarily predictive of actual future results. See disclaimer on page 2. 2. $109 million in pre-tax cost savings on a fully synergized basis. 3. Core deposit intangible equal to 0.50% of FMBI’s non-time deposits, amortized over 10 years using sum-of-years digits. 4. Customer relationship intangible equal to 0.41% of FMBI’s assets under management, amortized over 13 years using sum -of-years digits. 5. Estimated fair value marks accreted/amortized back through earnings based on the estimated expected lives of individual asset s and liabilities. 6. Non-Purchase Credit Deteriorated credit mark is accreted into earnings over 4 years using sum-of-years digits. 7. Excludes share buybacks for illustrative purposes. $M Old National 2022 net income consensus mean estimate1 $229 First Midwest 2022 net income consensus mean estimate1 $162 After-tax transaction adjustments Fully phased-in cost savings2 $82 Cost of financing (1) Add-back of First Midwest standalone intangible amortization expense 8 Core deposit intangible amortization3 (10) Customer relationship intangible amortization4 (6) Fair market value adjustments amortization5 (4) Non-Purchase Credit Deteriorated loan credit mark accretion under CECL6 39 Pro Forma 2022 Old National net income $499 Old National weighted average diluted shares outstanding 166 Shares issued to First Midwest 130 Pro forma weighted average shares outstanding 296 Old National 2022 standalone EPS7 $1.38 First Midwest 2022 standalone EPS7 $1.42 Old National 2022 pro forma EPS $1.68 $ EPS accretion to Old National $0.30 % EPS accretion to Old National 22.1% Pro forma 2022 EPS $1.68 (x) Fixed exchange ratio 1.1336x Pro forma 2022 EPS attributable to First Midwest $1.91 $ EPS accretion to First Midwest $0.49 % EPS accretion to First Midwest 34.5% |

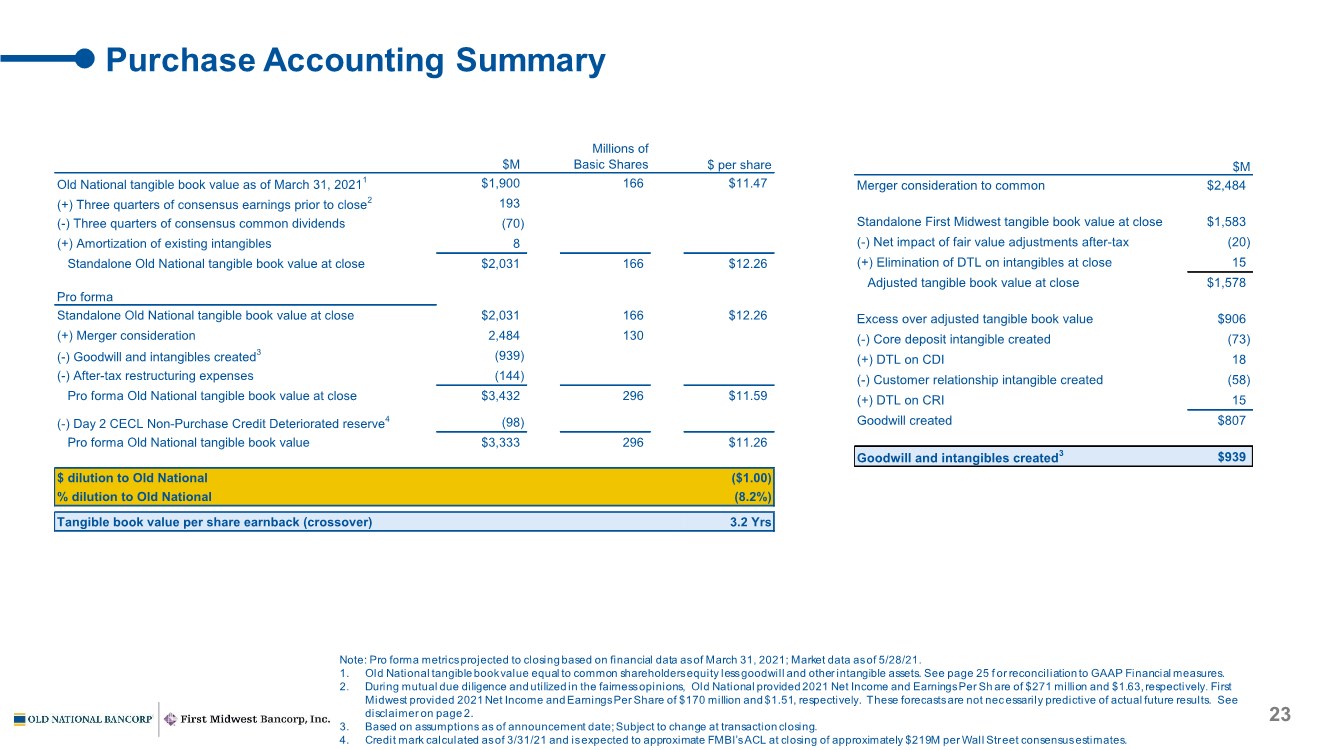

| 23 Purchase Accounting Summary Note: Pro forma metrics projected to closing based on financial data as of March 31, 2021; Market data as of 5/28/21. 1. Old National tangible book value equal to common shareholders equity less goodwill and other intangible assets. See page 25 f or reconciliation to GAAP Financial measures. 2. During mutual due diligence and utilized in the fairness opinions, Old National provided 2021 Net Income and Earnings Per Sh are of $271 million and $1.63, respectively. First Midwest provided 2021 Net Income and Earnings Per Share of $170 million and $1.51, respectively. These forecasts are not necessarily predictive of actual future results. See disclaimer on page 2. 3. Based on assumptions as of announcement date; Subject to change at transaction closing. 4. Credit mark calculated as of 3/31/21 and is expected to approximate FMBI’s ACL at closing of approximately $219M per Wall Street consensus estimates. $M) Millions of Basic Shares $ per share Old National tangible book value as of March 31, 20211 $1,900 166 $11.47 (+) Three quarters of consensus earnings prior to close2 193 (-) Three quarters of consensus common dividends (70) (+) Amortization of existing intangibles 8 Standalone Old National tangible book value at close $2,031 166 $12.26 Pro forma Standalone Old National tangible book value at close $2,031 166 $12.26 (+) Merger consideration 2,484 130 (-) Goodwill and intangibles created3 (939) (-) After-tax restructuring expenses (144) Pro forma Old National tangible book value at close $3,432 296 $11.59 (-) Day 2 CECL Non-Purchase Credit Deteriorated reserve4 (98) Pro forma Old National tangible book value $3,333 296 $11.26 $ dilution to Old National ($1.00) % dilution to Old National (8.2%) Tangible book value per share earnback (crossover) 3.2 Yrs $M Merger consideration to common $2,484 Standalone First Midwest tangible book value at close $1,583 (-) Net impact of fair value adjustments after-tax (20) (+) Elimination of DTL on intangibles at close 15 Adjusted tangible book value at close $1,578 Excess over adjusted tangible book value $906 (-) Core deposit intangible created (73) (+) DTL on CDI 18 (-) Customer relationship intangible created (58) (+) DTL on CRI 15 Goodwill created $807 Goodwill and intangibles created3 $939 |

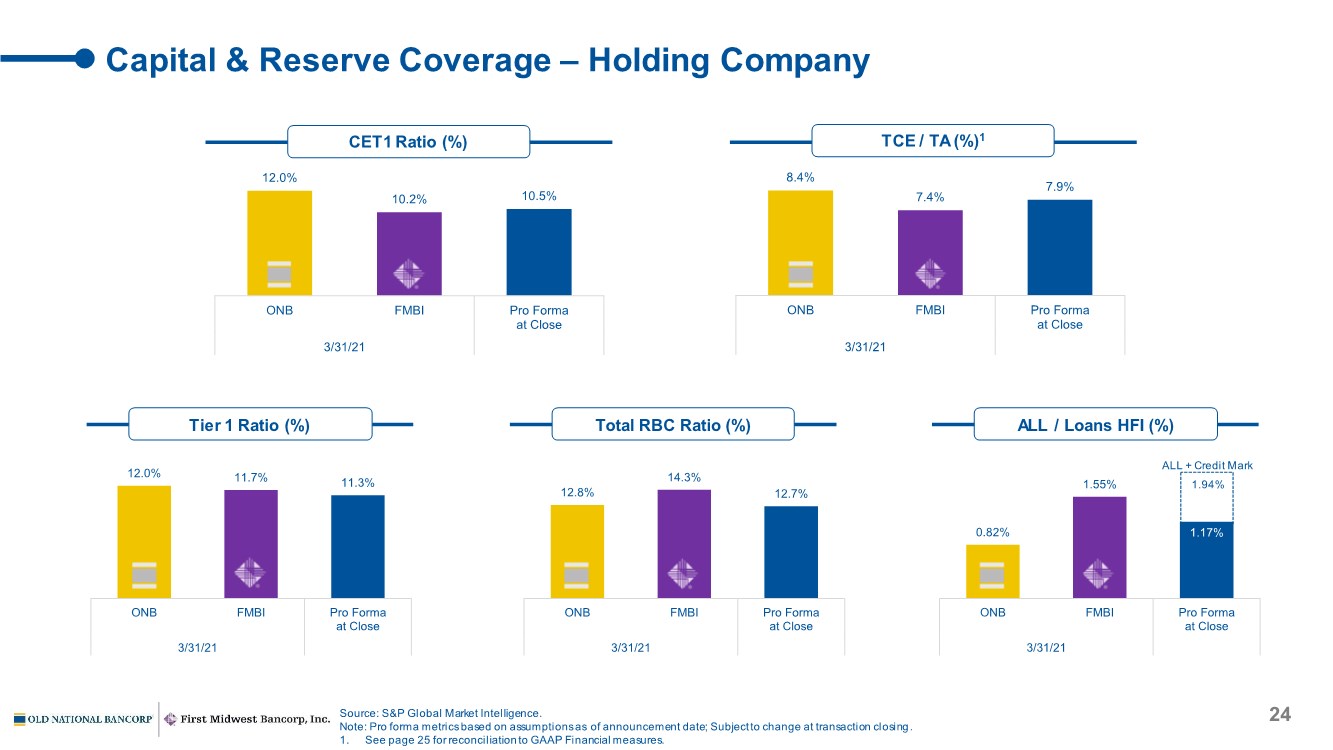

| Capital & Reserve Coverage – Holding Company Source: S&P Global Market Intelligence. Note: Pro forma metrics based on assumptions as of announcement date; Subject to change at transaction closing. 1. See page 25 for reconciliation to GAAP Financial measures. CET1 Ratio (%) TCE / TA (%)1 Tier 1 Ratio (%) Total RBC Ratio (%) ALL / Loans HFI (%) 12.0% 10.2% 10.5% ONB FMBI Pro Forma at Close 3/31/21 8.4% 7.4% 7.9% ONB FMBI Pro Forma at Close 3/31/21 12.0% 11.7% 11.3% ONB FMBI Pro Forma at Close 3/31/21 12.8% 14.3% 12.7% ONB FMBI Pro Forma at Close 3/31/21 0.82% 1.55% 1.17% ONB FMBI Pro Forma at Close 3/31/21 ALL + Credit Mark 1.94% 24 |

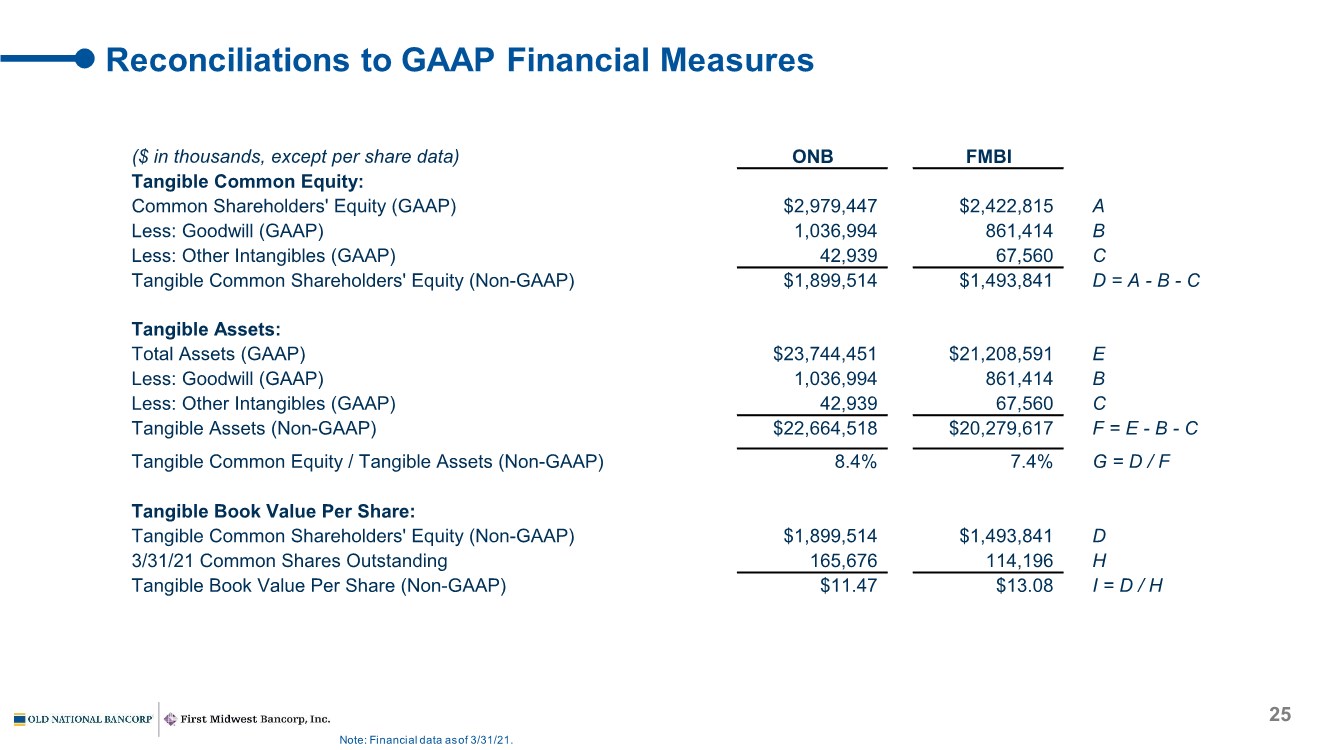

| Reconciliations to GAAP Financial Measures Note: Financial data as of 3/31/21. 25 ($ in thousands, except per share data) ONB FMBI Tangible Common Equity: Common Shareholders' Equity (GAAP) $2,979,447 $2,422,815 A Less: Goodwill (GAAP) 1,036,994 861,414 B Less: Other Intangibles (GAAP) 42,939 67,560 C Tangible Common Shareholders' Equity (Non-GAAP) $1,899,514 $1,493,841 D = A - B - C Tangible Assets: Total Assets (GAAP) $23,744,451 $21,208,591 E Less: Goodwill (GAAP) 1,036,994 861,414 B Less: Other Intangibles (GAAP) 42,939 67,560 C Tangible Assets (Non-GAAP) $22,664,518 $20,279,617 F = E - B - C Tangible Common Equity / Tangible Assets (Non-GAAP) 8.4% 7.4% G = D / F Tangible Book Value Per Share: Tangible Common Shareholders' Equity (Non-GAAP) $1,899,514 $1,493,841 D 3/31/21 Common Shares Outstanding 165,676 114,196 H Tangible Book Value Per Share (Non-GAAP) $11.47 $13.08 I = D / H |

|