Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ACI WORLDWIDE, INC. | aciw-20210506ex_991.htm |

| 8-K - 8-K - ACI WORLDWIDE, INC. | aciw-20210506.htm |

Q1 2021 EARNINGS PRESENTATION ACI WORLDWIDE May 6, 2021 Exhibit 99.2

2 Private Securities Litigation Reform Act of 1995 Safe Harbor for Forward-Looking Statements This presentation contains forward- looking statements based on current expectations that involve a number of risks and uncertainties. The forward- looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. A discussion of these forward-looking statements and risk factors that may affect them is set forth at the end of this presentation. The Company assumes no obligation to update any forward-looking statement in this presentation, except as required by law.

Quarter in Review Odilon Almeida President and Chief Executive Officer 3

Three-Pillar Strategy for the New ACI 4 • Q1 was a strong quarter, despite COVID-19-related headwinds • Revenues and EBITDA above guidance • New Three-Pillar strategy generating results • Well positioned to accelerate revenue growth in the second half of 2021 Drive organic growth through operational discipline and a strong sales culture FIT FOR GROWTH Focus R&D on growth-rich solutions supported by innovation FOCUSED ON GROWTH Accretive M&A to drive additional growth and value creation STEP CHANGE VALUE CREATION

Financial Review Scott Behrens Chief Financial Officer 5

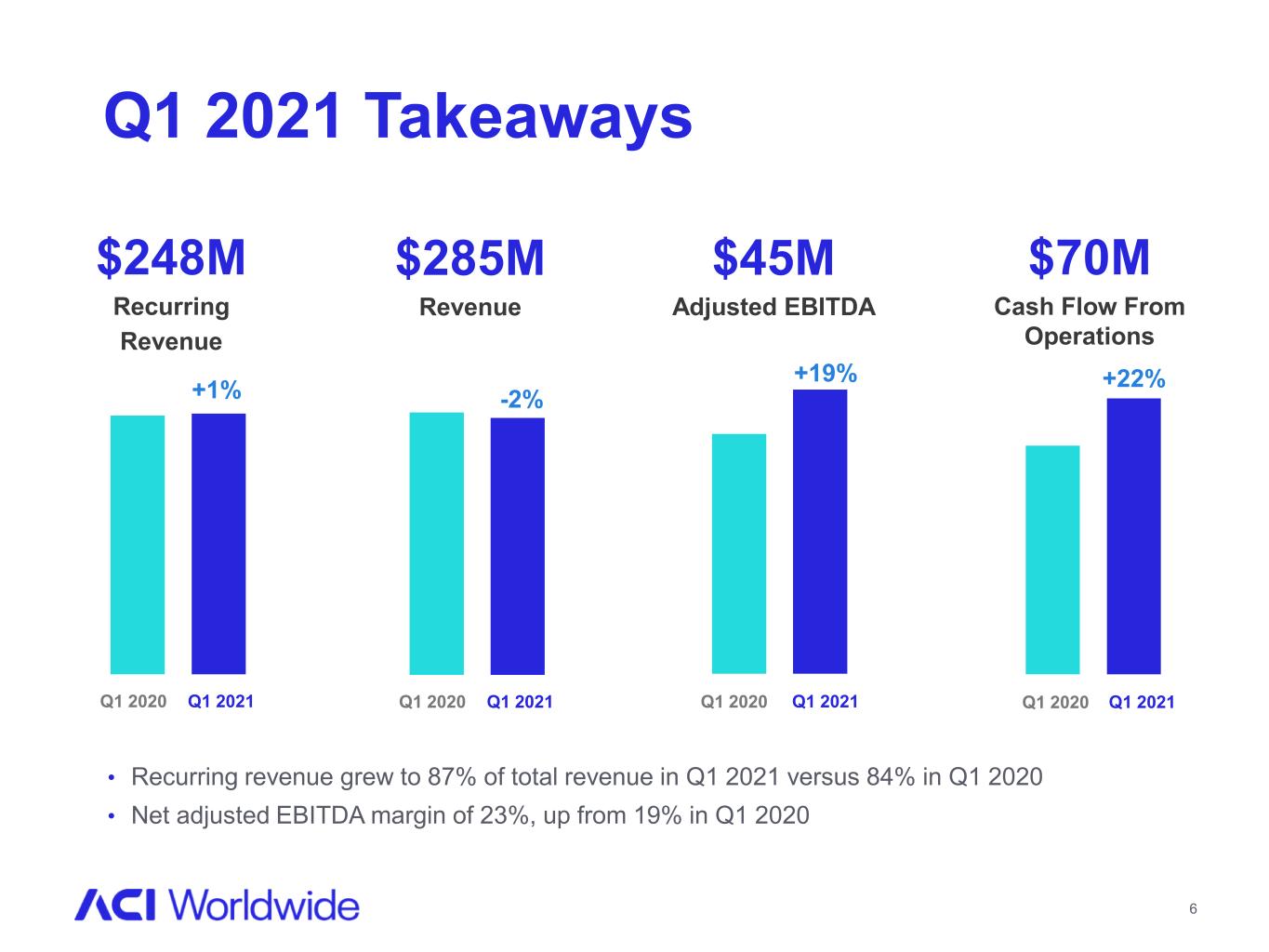

• Recurring revenue grew to 87% of total revenue in Q1 2021 versus 84% in Q1 2020 • Net adjusted EBITDA margin of 23%, up from 19% in Q1 2020 6 Q1 2021 Takeaways $70M Cash Flow From Operations $45M Adjusted EBITDA +22% Q1 2020 Q1 2021 +19% Q1 2020 Q1 2021 -2% $285M Revenue Q1 2020 Q1 2021 +1% $248M Recurring Revenue Q1 2020 Q1 2021

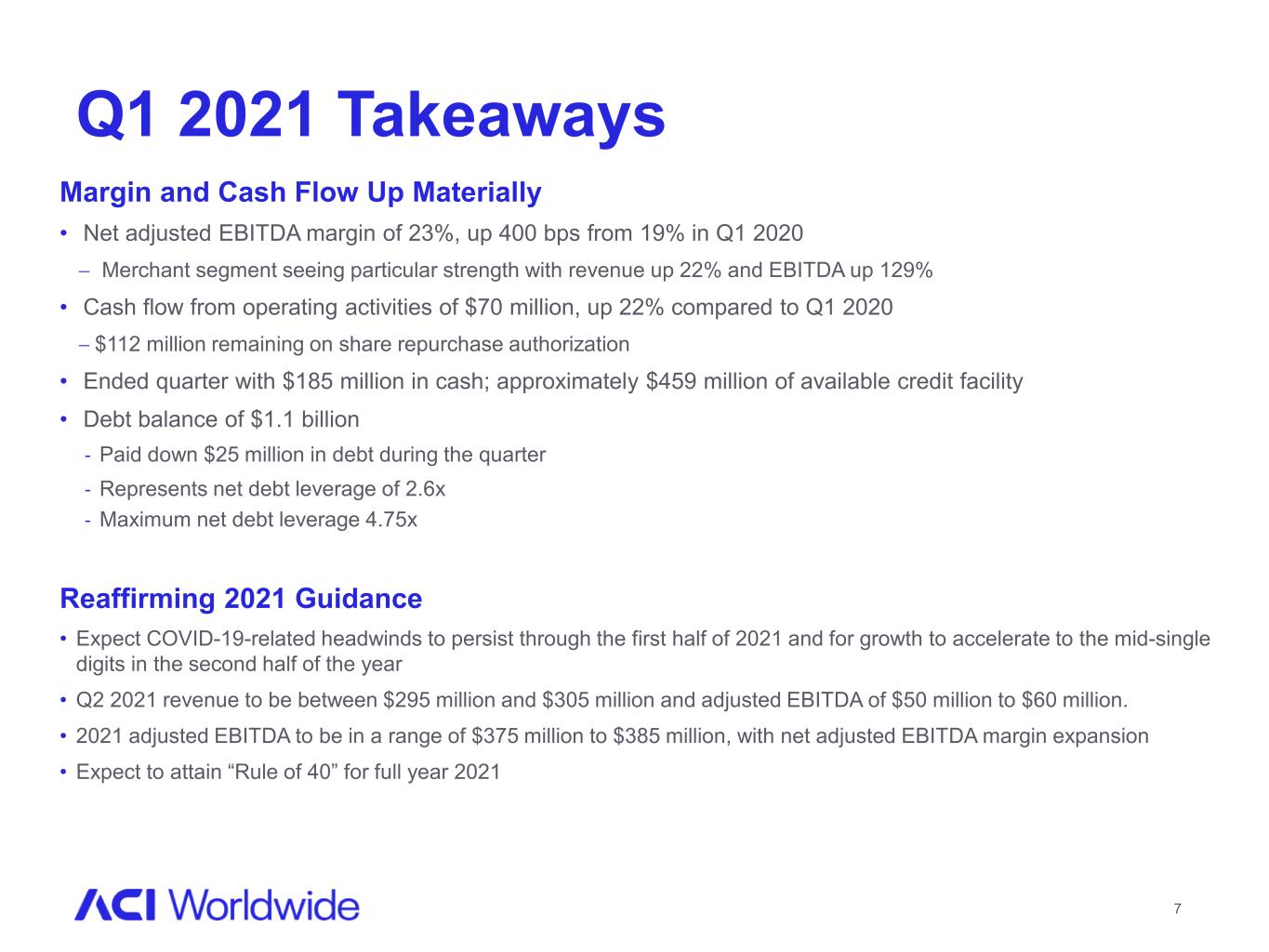

Margin and Cash Flow Up Materially • Net adjusted EBITDA margin of 23%, up 400 bps from 19% in Q1 2020 − Merchant segment seeing particular strength with revenue up 22% and EBITDA up 129% • Cash flow from operating activities of $70 million, up 22% compared to Q1 2020 − $112 million remaining on share repurchase authorization • Ended quarter with $185 million in cash; approximately $459 million of available credit facility • Debt balance of $1.1 billion - Paid down $25 million in debt during the quarter - Represents net debt leverage of 2.6x - Maximum net debt leverage 4.75x Reaffirming 2021 Guidance • Expect COVID-19-related headwinds to persist through the first half of 2021 and for growth to accelerate to the mid-single digits in the second half of the year • Q2 2021 revenue to be between $295 million and $305 million and adjusted EBITDA of $50 million to $60 million. • 2021 adjusted EBITDA to be in a range of $375 million to $385 million, with net adjusted EBITDA margin expansion • Expect to attain “Rule of 40” for full year 2021 7 Q1 2021 Takeaways

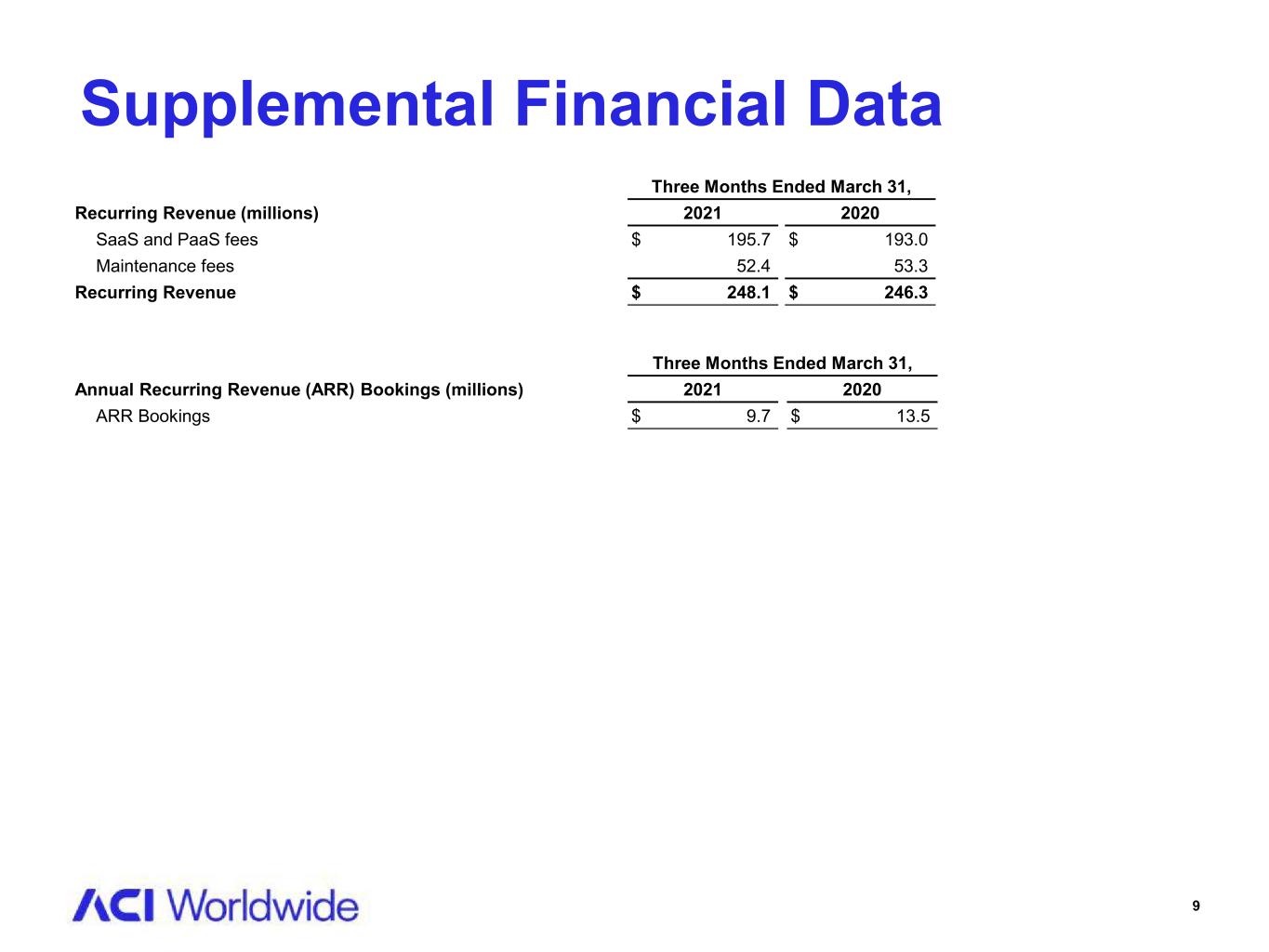

9 Three Months Ended March 31, Recurring Revenue (millions) 2021 2020 SaaS and PaaS fees $ 195.7 $ 193.0 Maintenance fees 52.4 53.3 Recurring Revenue $ 248.1 $ 246.3 Three Months Ended March 31, Annual Recurring Revenue (ARR) Bookings (millions) 2021 2020 ARR Bookings $ 9.7 $ 13.5 Supplemental Financial Data

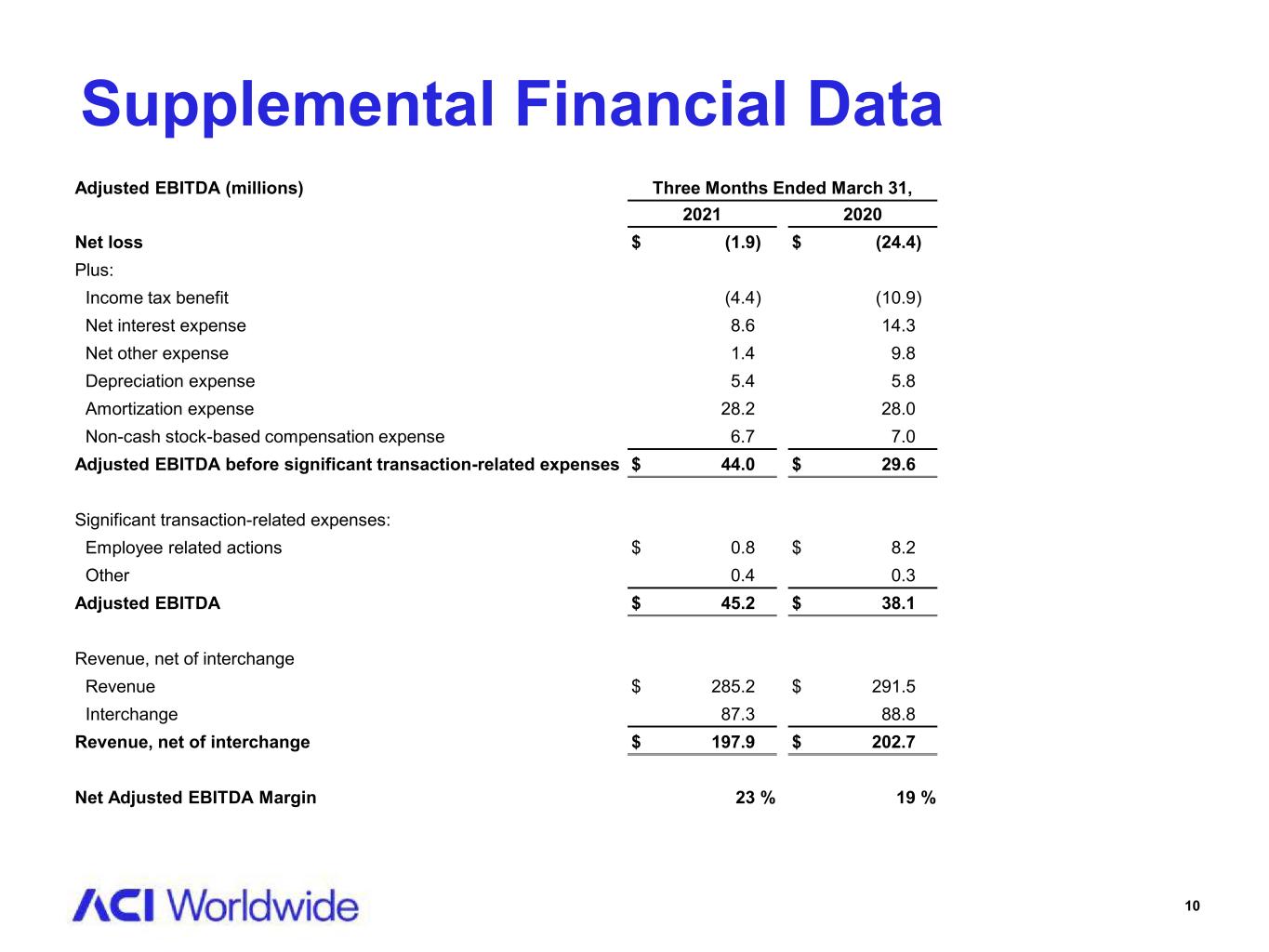

10 Supplemental Financial Data Adjusted EBITDA (millions) Three Months Ended March 31, 2021 2020 Net loss $ (1.9) $ (24.4) Plus: Income tax benefit (4.4) (10.9) Net interest expense 8.6 14.3 Net other expense 1.4 9.8 Depreciation expense 5.4 5.8 Amortization expense 28.2 28.0 Non-cash stock-based compensation expense 6.7 7.0 Adjusted EBITDA before significant transaction-related expenses $ 44.0 $ 29.6 Significant transaction-related expenses: Employee related actions $ 0.8 $ 8.2 Other 0.4 0.3 Adjusted EBITDA $ 45.2 $ 38.1 Revenue, net of interchange Revenue $ 285.2 $ 291.5 Interchange 87.3 88.8 Revenue, net of interchange $ 197.9 $ 202.7 Net Adjusted EBITDA Margin 23 % 19 %

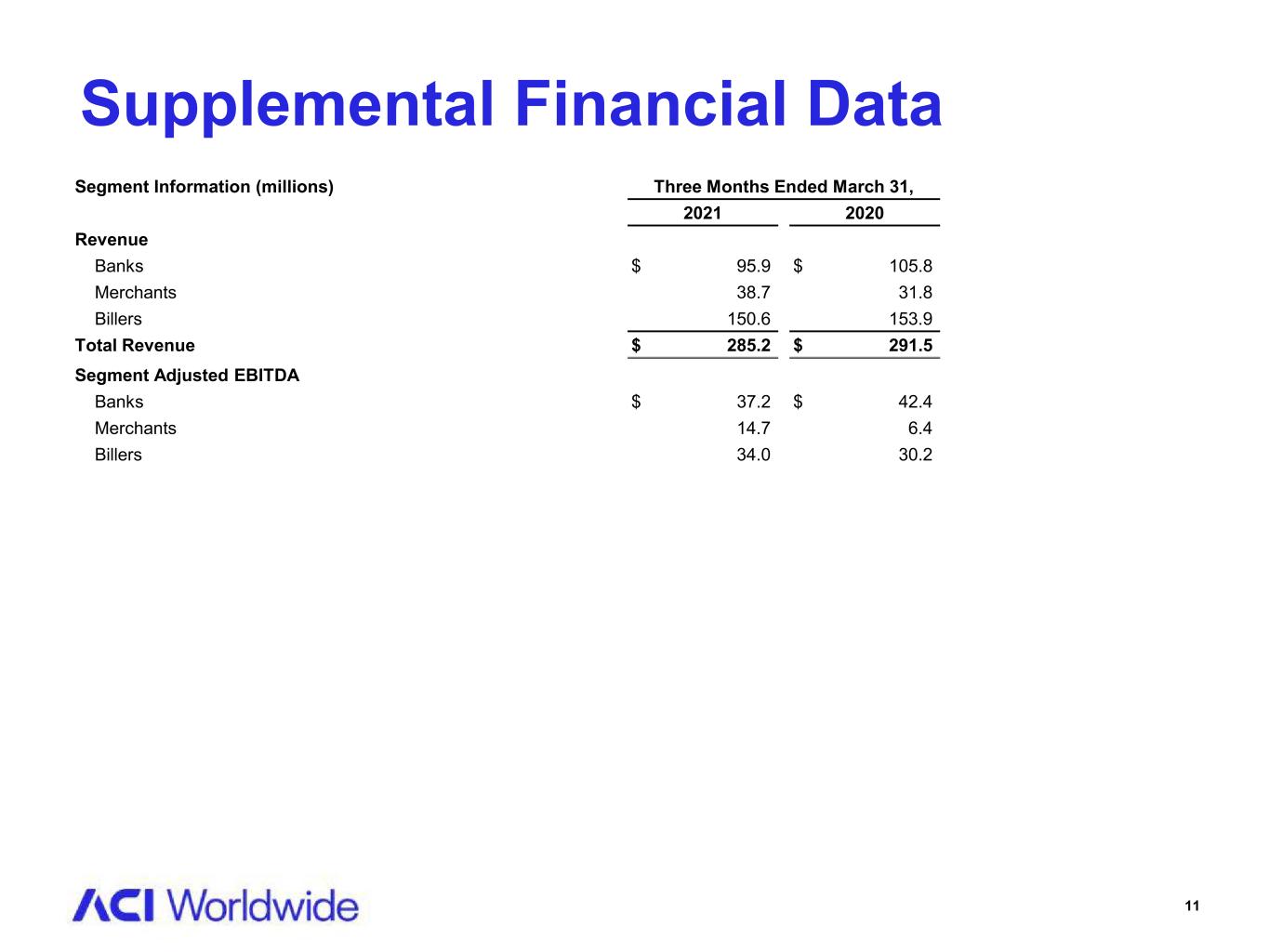

11 Segment Information (millions) Three Months Ended March 31, 2021 2020 Revenue Banks $ 95.9 $ 105.8 Merchants 38.7 31.8 Billers 150.6 153.9 Total Revenue $ 285.2 $ 291.5 Segment Adjusted EBITDA Banks $ 37.2 $ 42.4 Merchants 14.7 6.4 Billers 34.0 30.2 Supplemental Financial Data

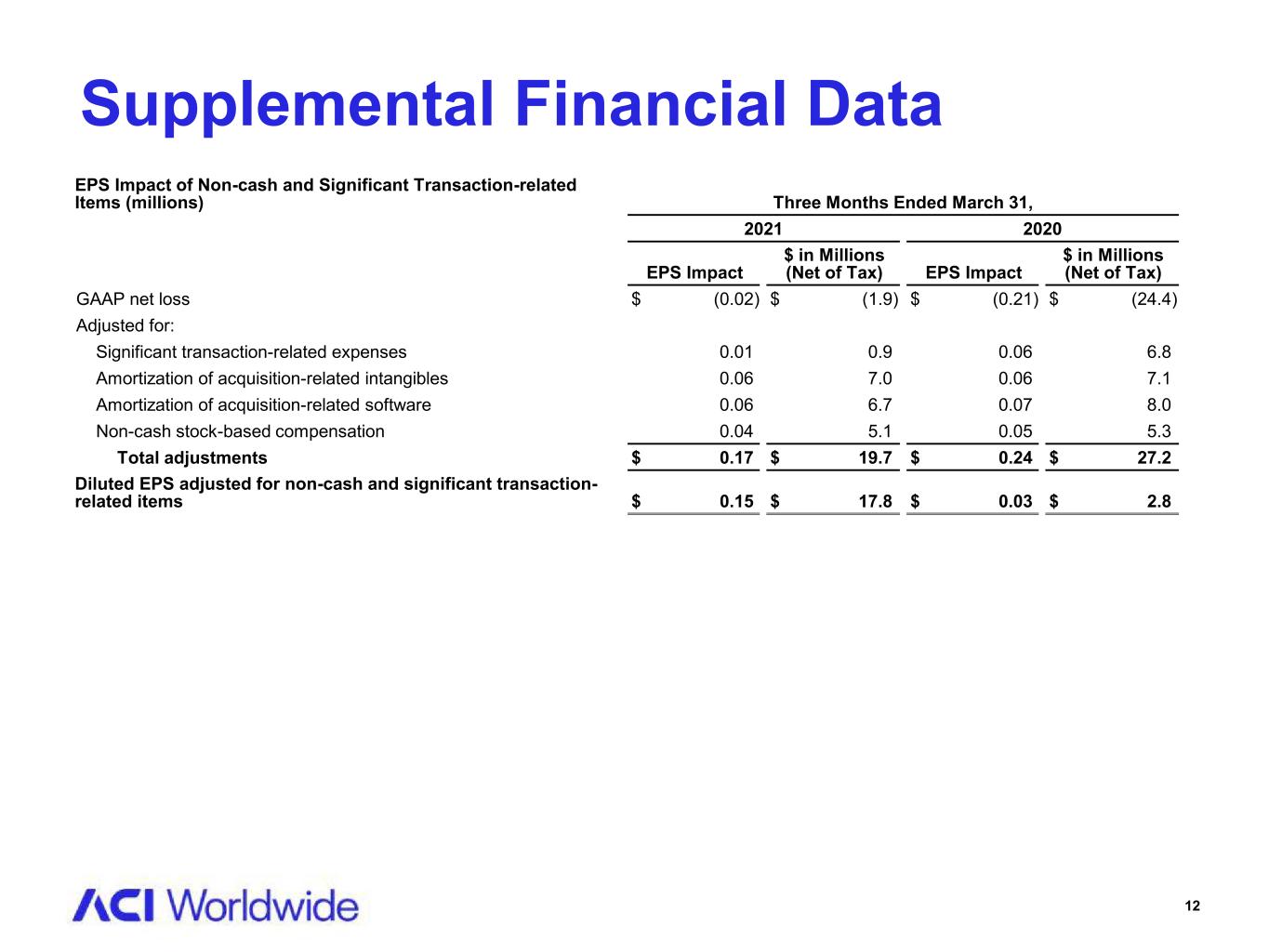

12 EPS Impact of Non-cash and Significant Transaction-related Items (millions) Three Months Ended March 31, 2021 2020 EPS Impact $ in Millions (Net of Tax) EPS Impact $ in Millions (Net of Tax) GAAP net loss $ (0.02) $ (1.9) $ (0.21) $ (24.4) Adjusted for: Significant transaction-related expenses 0.01 0.9 0.06 6.8 Amortization of acquisition-related intangibles 0.06 7.0 0.06 7.1 Amortization of acquisition-related software 0.06 6.7 0.07 8.0 Non-cash stock-based compensation 0.04 5.1 0.05 5.3 Total adjustments $ 0.17 $ 19.7 $ 0.24 $ 27.2 Diluted EPS adjusted for non-cash and significant transaction- related items $ 0.15 $ 17.8 $ 0.03 $ 2.8 Supplemental Financial Data

13 To supplement our financial results presented on a GAAP basis, we use the non-GAAP measures indicated in the tables, which exclude significant transaction related expenses, as well as other significant non-cash expenses such as depreciation, amortization, and non-cash compensation, that we believe are helpful in understanding our past financial performance and our future results. The presentation of these non-GAAP financial measures should be considered in addition to our GAAP results and are not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. Management generally compensates for limitations in the use of non-GAAP financial measures by relying on comparable GAAP financial measures and providing investors with a reconciliation of non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. We believe that these non-GAAP financial measures reflect an additional way to view aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business. Certain non-GAAP measures include: • Adjusted EBITDA: net income (loss) plus income tax expense (benefit), net interest income (expense), net other income (expense), depreciation, amortization, and non-cash compensation, as well as significant transaction related expenses. Adjusted EBITDA should be considered in addition to, rather than as a substitute for, net income (loss). • Net Adjusted EBITDA Margin: Adjusted EBITDA divided by revenue net of pass through interchange revenue. Net Adjusted EBITDA Margin should be considered in addition to, rather than as a substitute for, net income (loss). • Diluted EPS adjusted for non-cash and significant transaction related items: diluted EPS plus tax effected significant transaction related items, amortization of acquired intangibles and software, and non-cash stock-based compensation. Diluted EPS adjusted for non-cash and significant transaction related items should be considered in addition to, rather than as a substitute for, diluted EPS. • Recurring Revenue: revenue from software as a service and platform service fees and maintenance fees. Recurring revenue should be considered in addition to, rather than as a substitute for, total revenue. Non-GAAP Financial Measures

14 This presentation contains forward-looking statements based on current expectations that involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and may include words or phrases such as “believes,” “will,” “expects,” “anticipates,” “intends,” and words and phrases of similar impact. The forward-looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation include, but are not limited to, statements regarding our new Three Pillar strategy generating results; our positioning to accelerate revenue growth in the second half of 2021; our expectations regarding COVID-19- related headwinds to persisting through the first half of 2021; our expectations for 2021 adjusted EBITDA; and our expectations for Q2 2021 revenue and adjusted EBITDA. All of the foregoing forward-looking statements are expressly qualified by the risk factors discussed in our filings with the Securities and Exchange Commission. Such factors include, but are not limited to, increased competition, the success of our Universal Payments strategy, demand for our products, consolidations and failures in the financial services industry, customer reluctance to switch to a new vendor, failure to obtain renewals of customer contracts or to obtain such renewals on favorable terms, delay or cancellation of customer projects or inaccurate project completion estimates, the complexity of our products and services and the risk that they may contain hidden defects or be subjected to security breaches or viruses, compliance of our products with applicable legislation, governmental regulations and industry standards, our compliance with privacy regulations, our ability to protect customer information from security breaches or attacks, our ability to adequately defend our intellectual property, exposure to credit or operating risks arising from certain payment funding methods, business interruptions or failure of our information technology and communication systems, our offshore software development activities, risks from operating internationally, including fluctuations in currency exchange rates, exposure to unknown tax liabilities, adverse changes in the global economy, worldwide events outside of our control, failure to attract and retain key personnel, litigation, future acquisitions, strategic partnerships and investments, integration of and achieving benefits from the Speedpay acquisition, impairment of our goodwill or intangible assets, restrictions and other financial covenants in our debt agreements, our existing levels of debt, replacement of LIBOR benchmark interest rate, the accuracy of management’s backlog estimates, exposure to unknown tax liabilities, the cyclical nature of our revenue and earnings and the accuracy of forecasts due to the concentration of revenue-generating activity during the final weeks of each quarter, volatility in our stock price, and the COVID-19 pandemic. For a detailed discussion of these risk factors, parties that are relying on the forward-looking statements should review our filings with the Securities and Exchange Commission, including our most recently filed Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. Forward Looking Statements