Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Booz Allen Hamilton Holding Corp | tm2114914d1_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Booz Allen Hamilton Holding Corp | tm2114914d1_ex2-1.htm |

| 8-K - FORM 8-K - Booz Allen Hamilton Holding Corp | tm2114914d1_8k.htm |

Exhibit 99.2

Booz Allen Hamilton to Acquire Liberty IT Solutions, LLC May 4, 2021

2 DISCLAIMER Forward Looking Safe Harbor Statement Certain statements contained in this presentation and in related comments by our management include “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward - looking statements include information concerning Booz Allen’s pr eliminary financial results, financial outlook and guidance, including forecasted revenue, Diluted EPS, Adjusted Diluted EPS, free cash flow, future quarterly divid end s, and future improvements in operating margins, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward - looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “ou tlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe tha t the expectations reflected in the forward - looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward - looking statements relate to future events or our future financial performance and involve known and unknown risks , uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, l eve ls of activity, performance or achievements expressed or implied by these forward - looking statements. A number of important factors could cause actual results to differ mat erially from those contained in or implied by these forward - looking statements, including those factors discussed in our filings with the Securities and Exchange C ommission (SEC), including our Annual Report on Form 10 - K for the fiscal year ended March 31, 2020, which can be found at the SEC’s website at www.sec.gov . All forward - looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All suc h s tatements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise. Note Regarding Non - GAAP Financial Data Information Booz Allen discloses in the following information Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted E BIT DA, Adjusted EBITDA Margin on Revenue, Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses, Adjusted Net Income, Adjusted Diluted EPS, and Free Ca sh Flow which are not recognized measurements under GAAP, and when analyzing Booz Allen’s performance or liquidity as applicable, investors should (i) evaluat e e ach adjustment in our reconciliation of revenue to Revenue, Excluding Billable Expenses, operating income to Adjusted Operating Income, net income to Adjusted EBI TDA , Adjusted EBITDA Margin on Revenue, Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses, Adjusted Net Income and Adjusted Diluted Earnings Pe r S hare, and net cash provided by operating activities to Free Cash Flow, and the explanatory footnotes regarding those adjustments, each as defined under GAAP , ( ii) use Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted EBITDA Margin on Revenue Ex clu ding Billable Expenses, Adjusted Net Income, and Adjusted Diluted EPS in addition to, and not as an alternative to revenue, operating income, net inc ome or diluted EPS as measures of operating results, and (iii) use Free Cash Flow in addition to and not as an alternative to net cash provided by operating ac tiv ities as a measure of liquidity, each as defined under GAAP. The Financial Appendix includes a reconciliation of Revenue, Excluding Billable Expenses, Adjusted Opera tin g Income, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted EBITDA Margin on Revenue, Excluding Billable Expenses, Adjusted Net Income, Adjusted Dilut ed EPS, and Free Cash Flow to the most directly comparable financial measure calculated and presented in accordance with GAAP. Booz Allen presents these suppl eme ntal performance measures because it believes that these measures provide investors and securities analysts with important supplemental information wit h w hich to evaluate Booz Allen’s performance, long term earnings potential, or liquidity, as applicable and to enable them to assess Booz Allen’s performance on the same basis as management. These supplemental performance and liquidity measurements may vary from and may not be comparable to similarly titled measures by o the r companies in Booz Allen’s industry. Projecting future stock price, equity grants and dividends to be declared would be necessary to accurately calculat e t he difference between Adjusted Diluted EPS and GAAP EPS as a result of the effects of the two - class method and related possible dilution used in the calculation of EPS . Consequently, any attempt to disclose such reconciliation would imply a degree of precision that could be confusing or misleading to investors. We expect the varia bil ity of the above charges to have an unpredictable, and potentially significant, impact on our future GAAP financial results. For the same reason, a reconciliatio n o f Adjusted EBITDA Margin on Revenue guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward - looking basis due to our inability to predict specific quantifications of the amounts that would be required to reconcile such measures.

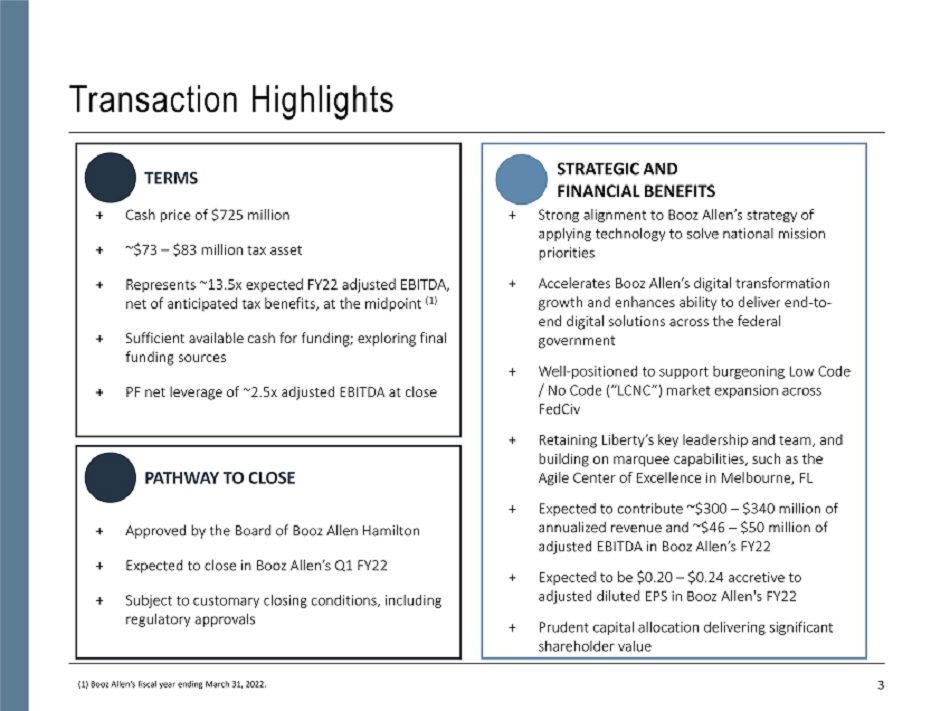

3 Transaction Highlights TERMS + Cash price of $725 million + ~$73 – $83 million tax asset + Represents ~13.5x expected FY22 adjusted EBITDA, net of anticipated tax benefits, at the midpoint (1) + Sufficient available cash for funding; exploring final funding sources + PF net leverage of ~2.5x adjusted EBITDA at close PATHWAY TO CLOSE + Strong alignment to Booz Allen’s strategy of applying technology to solve national mission priorities + Accelerates Booz Allen’s digital transformation growth and enhances ability to deliver end - to - end digital solutions across the federal government + Well - positioned to support burgeoning Low Code / No Code (“LCNC”) market expansion across FedCiv + Retaining key Liberty's leadership and team, and building on marquee capabilities, such as the Agile Center of Excellence in Melbourne, FL + Expected to contribute ~$300 – $340 million of annualized revenue and ~$46 – $50 million of adjusted EBITDA in Booz Allen’s FY22 + Expected to be $0.20 – $0.24 accretive to adjusted diluted EPS in Booz Allen's FY22 + Prudent capital allocation delivering significant shareholder value + Approved by the Board of Booz Allen Hamilton + Expected to close in Booz Allen’s Q1 FY22 + Subject to customary closing conditions, including regulatory approvals STRATEGIC AND FINANCIAL BENEFITS (1) Booz Allen's fiscal year ending March 31, 2022.

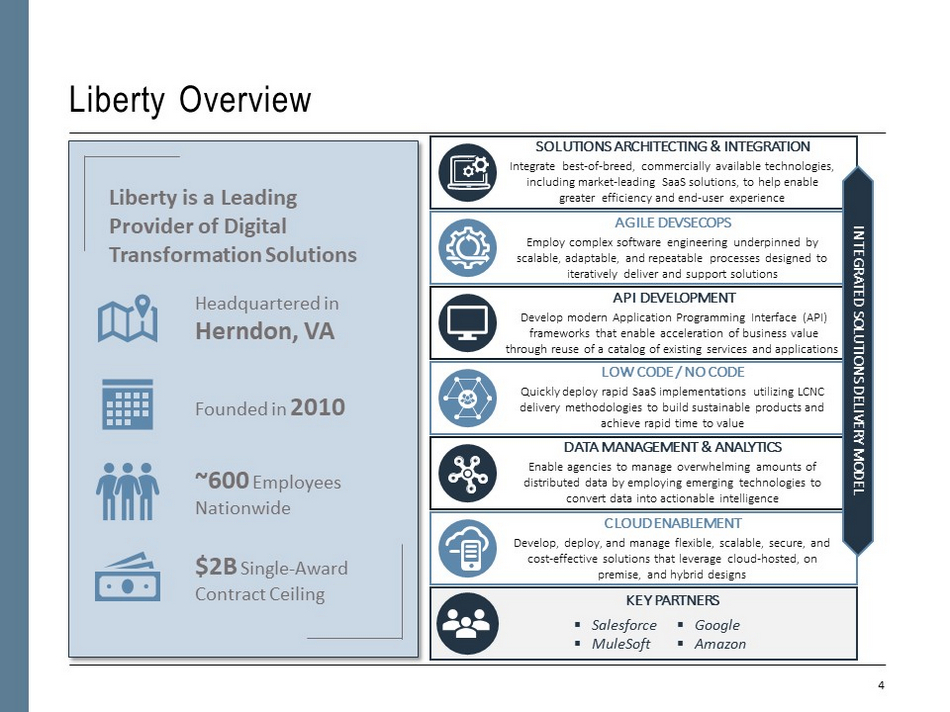

4 Liberty Overview API DEVELOPMENT Develop modern Application Programming Interface (API) frameworks that enable acceleration of business value through reuse of a catalog of existing services and applications AGILE DEVSECOPS Employ complex software engineering underpinned by scalable, adaptable, and repeatable processes designed to iteratively deliver and support solutions CLOUD ENABLEMENT Develop, deploy, and manage flexible, scalable, secure, and cost - effective solutions that leverage cloud - hosted, on premise, and hybrid designs LOW CODE / NO CODE Quickly deploy rapid SaaS implementations utilizing LCNC delivery methodologies to build sustainable products and achieve rapid time to value DATA MANAGEMENT & ANALYTICS Enable agencies to manage overwhelming amounts of distributed data by employing emerging technologies to convert data into actionable intelligence SOLUTIONS ARCHITECTING & INTEGRATION Integrate best - of - breed, commercially available technologies, including market - leading SaaS solutions, to help enable greater efficiency and end - user experience INTEGRATED SOLUTIONS DELIVERY MODEL Liberty is a Leading Provider of Digital Transformation Solutions Headquartered in Herndon, VA Founded in 2010 ~600 Employees Nationwide $2B Single - Award Contract Ceiling KEY PARTNERS ▪ Salesforce ▪ MuleSoft ▪ Google ▪ Amazon

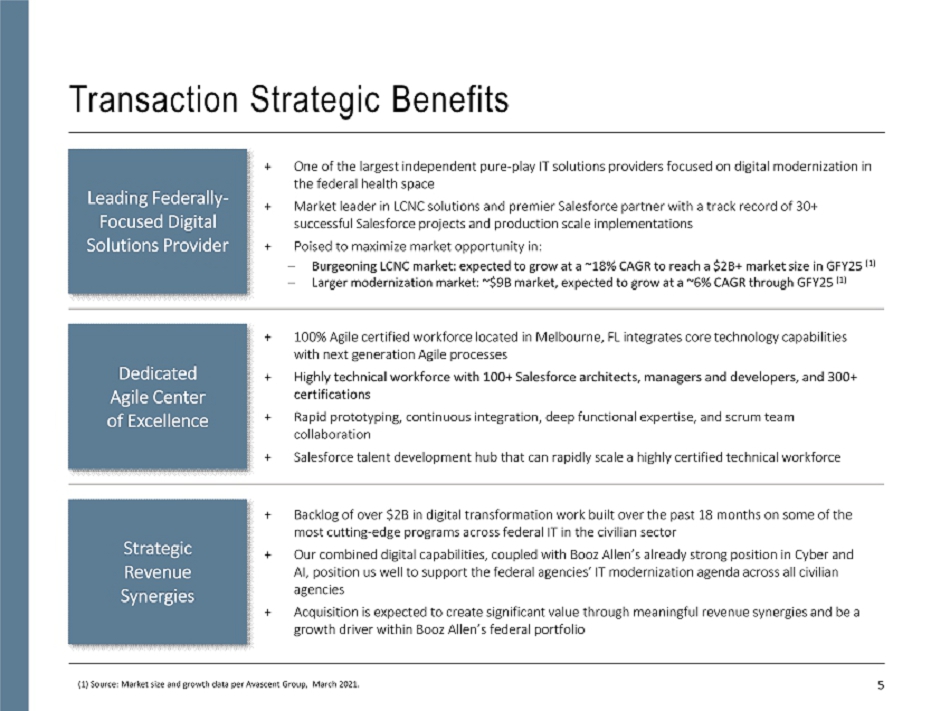

5 Transaction Strategic Benefits Leading Federally - Focused Digital Solutions Provider Strategic Revenue Synergies Dedicated Agile Center of Excellence + One of the largest independent pure - play IT solutions providers focused on digital modernization, across the entire federal health space + Market leader in LCNC solutions and premier Salesforce partner with a track record of 30+ successful Salesforce projects and production scale implementations + Poised to maximize market opportunity in: – Burgeoning LCNC market: expected to grow at a ~18% CAGR to reach a $2B+ market size in GFY25 (1) – Larger modernization market: ~$9B market, expected to grow at a ~6% CAGR through GFY25 (1) + Backlog of over $2B in digital transformation work built over the past 18 months on some of the most cutting - edge programs across federal IT in the civilian sector + Our combined digital capabilities, coupled with Booz Allen’s already strong position in Cyber and AI, position us well to support the Administration’s IT modernization agenda across all civilian agencies + Acquisition is expected to create significant value through meaningful revenue synergies and be a growth driver within Booz Allen’s federal and civil portfolio + 100% Agile certified workforce located in Melbourne, FL integrates core technology capabilities with next generation Agile processes + Highly technical workforce with 100+ Salesforce architects, managers and developers, and 300+ certifications + Rapid prototyping, continuous integration, deep functional expertise, and scrum team collaboration + Salesforce talent development hub that can rapidly scale a highly certified technical workforce (1) Source: Market size and growth data per Avascent Group, March 2021.

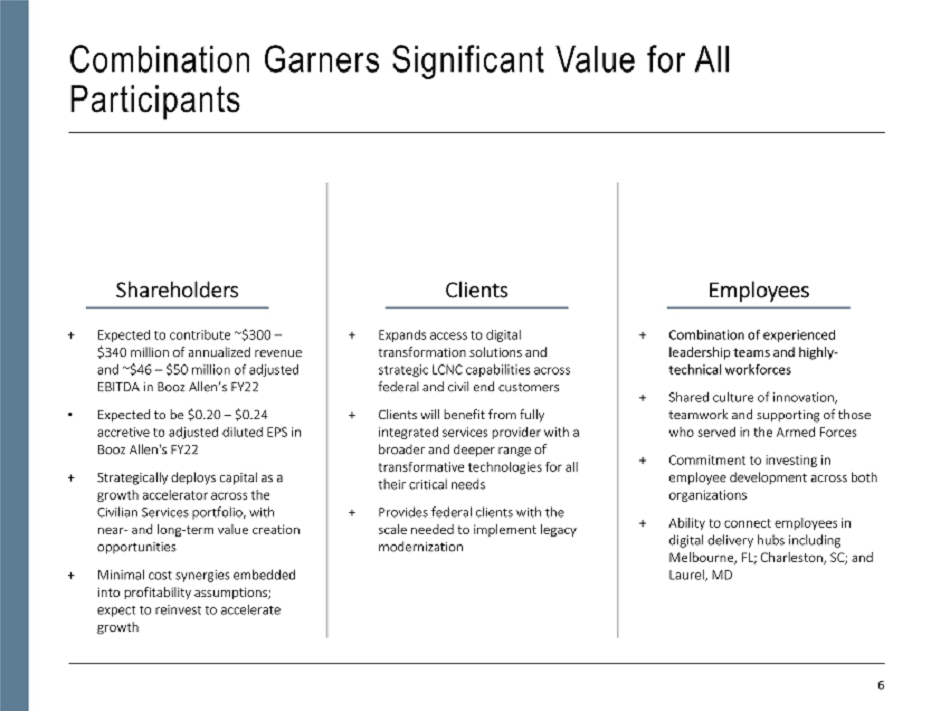

6 Combination Garners Significant Value for All Participants + Expected to contribute ~$300 – $340 million of annualized revenue and ~$46 – $50 million of adjusted EBITDA in Booz Allen’s FY22 • Expected to be $0.20 – $0.24 accretive to adjusted diluted EPS in Booz Allen's FY22 + Strategically deploys capital for a growth accelerator across the Civilian Services portfolio, with near and long - term value creation opportunities + Minimal cost synergies embedded into transaction expectations + Combination of experienced leadership teams and highly - technical work forces + Shared culture of innovation, teamwork and supporting of those who served in the armed forces + Commitment to investing in employee development across both organizations + Ability to connect employees in digital delivery hubs including Melbourne, FL; Charleston, SC; and Laurel, MD + Expands access to digital transformation solutions and strategic LCNC capabilities across federal and civil end customers + Customers will benefit from fully integrated services provider with a broader and deeper range of transformative technologies for all their critical needs + Provides federal clients with the scale needed to implement legacy modernization Shareholders Customers Employees

APPENDIX

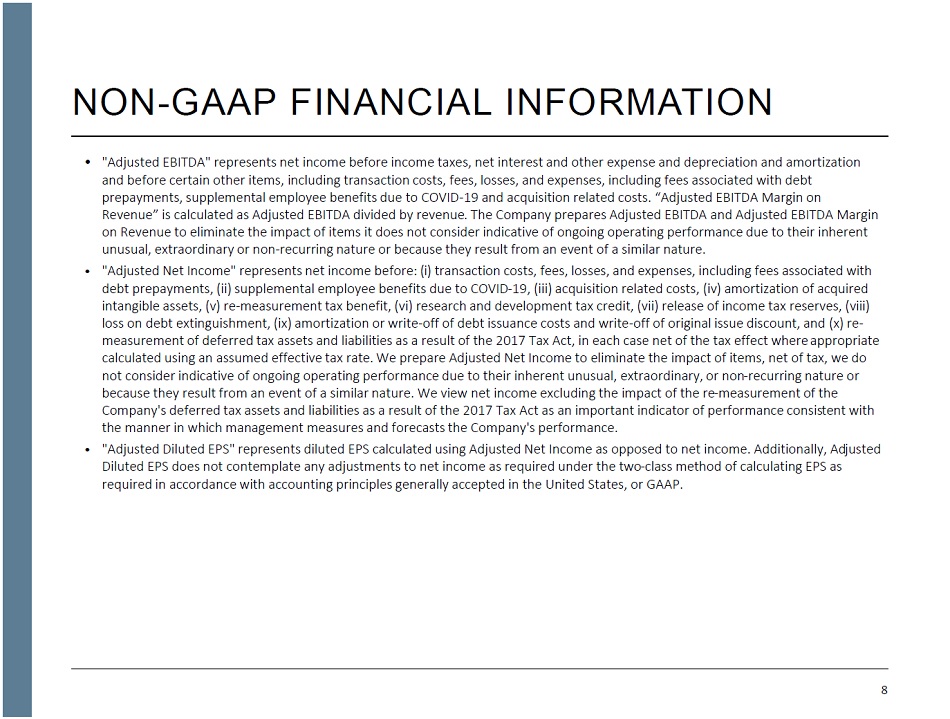

8 NON - GAAP FINANCIAL INFORMATION • "Adjusted EBITDA" represents net income before income taxes, net interest and other expense and depreciation and amortization and before certain other items, including transaction costs, fees, losses, and expenses, including fees associated with debt prepayments , supplemental employee benefits due to COVID - 19 and acquisition related costs . “Adjusted EBITDA Margin on Revenue” is calculated as Adjusted EBITDA divided by revenue . The Company prepares Adjusted EBITDA and Adjusted EBITDA Margin on Revenue to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non - recurring nature or because they result from an event of a similar nature. • "Adjusted Net Income" represents net income before: ( i ) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments, (ii) supplemental employee benefits due to COVID - 19, (iii) acquisition related costs, (i v ) amortization of acquired intangible assets, (v) re - measurement tax benefit, (vi) research and development tax credit, (v ii ) release of income tax reserves, (viii) loss on debt extinguishment, (ix) amortization or write - off of debt issuance costs and write - off of original issue discount, and (x) re - measurement of deferred tax assets and liabilities as a result of the 2017 Tax Act, in each case net of the tax effect where app ropriate calculated using an assumed effective tax rate. We prepare Adjusted Net Income to eliminate the impact of items, net of tax, we do not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary, or non - recurring nature o r because they result from an event of a similar nature. We view net income excluding the impact of the re - measurement of the Company's deferred tax assets and liabilities as a result of the 2017 Tax Act as an important indicator of performance consis ten t with the manner in which management measures and forecasts the Company's performance. • "Adjusted Diluted EPS" represents diluted EPS calculated using Adjusted Net Income as opposed to net income. Additionally, Ad jus ted Diluted EPS does not contemplate any adjustments to net income as required under the two - class method of calculating EPS as required in accordance with accounting principles generally accepted in the United States, or GAAP.