Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED STATES STEEL CORP | x-20210430.htm |

First Quarter 2021 Earnings Call April 30, 2021 David Burritt President and Chief Executive Officer Christie Breves Senior Vice President and Chief Financial Officer Rich Fruehauf Senior Vice President, Chief Strategy and Sustainability Officer Kevin Lewis Vice President, Investor Relations and Corporate FP&A

2 Forward-looking statements These slides are being provided to assist readers in understanding the results of operations, financial condition and cash flows of United States Steel Corporation as of and for the first quarter of 2021. They should be read in conjunction with the consolidated financial statements and Notes to the Consolidated Financial Statements contained in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. This presentation contains information that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “will,” "may" and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume changes, share of sales and earnings per share changes, anticipated cost savings, potential capital and operational cash improvements, anticipated disruptions to our operations and industry due to the COVID-19 pandemic, changes in global supply and demand conditions and prices for our products, international trade duties and other aspects of international trade policy, the integration of Big River Steel in our existing business, business strategies related to the combined business and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, the risks and uncertainties described in this report and in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020, our Quarterly Reports on Form 10-Q and those described from time to time in our future reports filed with the Securities and Exchange Commission. References to (i) "U. S. Steel," "the Company," "we," "us," and "our" refer to United States Steel Corporation and its consolidated subsidiaries unless otherwise indicated by the context and (ii) “Big River Steel” refer to Big River Steel Holdings LLC and its direct and indirect subsidiaries unless otherwise indicated by the context.

3 We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share, earnings (loss) before interest, income taxes, depreciation and amortization (EBITDA) and adjusted EBITDA, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA, considered along with net earnings (loss), is a relevant indicator of trends relating to our operating performance and provides management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share are non-GAAP measures that exclude the effects of items that include: debt extinguishment, Big River Steel - inventory step-up amortization, Big River Steel - unrealized losses, Big River Steel - acquisition costs, restructuring and other charges, gain on previously held investment in Big River Steel, asset impairment charge, gain on previously held investment in UPI and Big River Steel options and forward adjustments (Adjustment Items). Adjusted EBITDA is also a non- GAAP measure that excludes the effects of certain Adjustment Items. We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA to enhance the understanding of our ongoing operating performance and established trends affecting our core operations, by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA provides insight into management’s view and assessment of the Company’s ongoing operating performance, because management does not consider the adjusting items when evaluating the Company’s financial performance. Adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA should not be considered a substitute for net earnings (loss), earnings (loss) per diluted share or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies. A condensed consolidated statement of operations (unaudited), condensed consolidated cash flow statement (unaudited), condensed consolidated balance sheet (unaudited) and preliminary supplemental statistics (unaudited) for U. S. Steel are attached. Explanation of use of non-GAAP measures

4 Business update What you will hear on today’s call: OPTIMISM OPTIONALITY OPPORTUNITY ‘Stronger for longer’ steel market Big River Steel creating value Industry-leading sustainability announcements

Stronger for longer steel market Informing our perspective 5 Healthy Customer Order Book Supportive Steelmaking Costs Low Steel Supply Chain Inventories Continued confidence in strong demand and market fundamentals Elevated steelmaking input costs for blast furnaces and EAFs Restocking period needed to replenish customer inventories

6 6 Big River Steel creating value Well-timed acquisition of Big River Steel 32% EBITDA margin Continued margin expansion from Phase 2 expansion Strong per ton profitability reflects a highly variable cost structure $362 EBITDA per ton Well-timed acquisition of the remaining stake in Big River Steel $967 Average selling price per ton Increased spot market exposure from Phase 2 expansion Note: Big River Steel statistics calculated based off their January 15 – March 31 contribution, as reflected in the Mini Mill segment.

Big River Steel creating value Outperforming the competition Efficiencies from Phase 2 expansion delivering strong margin performance 32% 19% 22% 1Q 2021 EBITDA margin % 7 Mini mill competitor #1 Mini mill competitor #2 Note: Big River Steel statistics calculated based off their January 15 – March 31 contribution, as reflected in the Mini Mill segment. Mini mill competitor data is based on enterprise-level adjusted EBITDA from company filings.

8 8 Industry-leading sustainability announcements Differentiated product offering 1 Compared to the traditional, integrated steelmaking process. up to 75% reduction in CO2 emissions1 Our most advanced high-strength steels … MADE SUSTAINABLY WORLD-CLASS finishing assets BEST … for our customers … for the planet

9 9 Industry-leading sustainability announcements Differentiated sustainability proposition Only LEED® certified steel mill in the United States Helping customers meet their own decarbonization goals Only North American-based steel company to join ResponsibleSteel1 Reinforces commitment to our 2050 goal Low GHG-emission steelmaking Sustainable steel solutions Committed to sustainability Builds on our existing goal to reduce global GHG emissions intensity by 20% by 20302 2050 Net-zero target 1 ResponsibleSteel is the industry’s first global multi-stakeholder standard and certification initiative. 2 Versus a 2018 baseline.

10 10 Reevaluating capital allocation through the following lenses: Mon Valley Works remains a critical asset: ➢ Sustainability ➢ Value creation ➢ Lower capital / carbon intensity ➢ Low-cost steelmaking ➢ Advantaged logistics and energy costs ➢ Serves strategic end-markets Canceling the Mon Valley project Note: Mon Valley Endless Casting and Rolling and Cogeneration project.

Strengthened balance sheet Restored financial flexibility Restored secured debt capacity and removed secured notes limitations2 Extended maturity profile with 2029 senior unsecured notes Reduced annual run-rate interest expense by ~$100M1 ~$1.2B debt reduction in 1Q 20211 ✓ ✓ ✓ ✓ 11 1 Excluding the impact of the Big River Steel debt assumed in connection with the acquisition. Face value of debt excludes accounting impacts of unamortized discounts and issuance costs. 2 Secured debt capacity for U. S. Steel Corp. as issuer. Informs our capital allocation priorities moving forward

• Total first quarter adjusted EBITDA1 of $551 million, ahead of our guidance on March 12 • Ending liquidity of ~$2.9 billion • Cash and cash equivalents of ~$0.8 billion • Acquired technologically advanced Big River Steel without increasing pension/OPEB liabilities • Record setting Flat-rolled and Mini Mill EBITDA margin performance expected in the second quarter $50 $266 1Q 20214Q 2020 Flat-rolled Segment EBITDA1 $ Millions EBITDA1 Margin: 3% 11% U. S. Steel Europe Segment EBITDA1 $ Millions EBITDA1 Margin: 11% 16% Tubular Segment EBITDA1 $ Millions EBITDA1 Margin: (20%) (12%) 12 1 Earnings before interest, income taxes, depreciation and amortization. Note: For reconciliation of non-GAAP amounts see Appendix. Strong start to 2021 Financial highlights ($21) ($17) 4Q 2020 1Q 2021 $61 $130 4Q 2020 1Q 2021 $162 1Q 2021 Mini-Mill Segment EBITDA1 $ Millions EBITDA1 Margin: 32%

Recap • ‘Stronger for longer’ steel market • Big River Steel creating value • Industry-leading sustainability announcements 13

Q&A

Closing Remarks

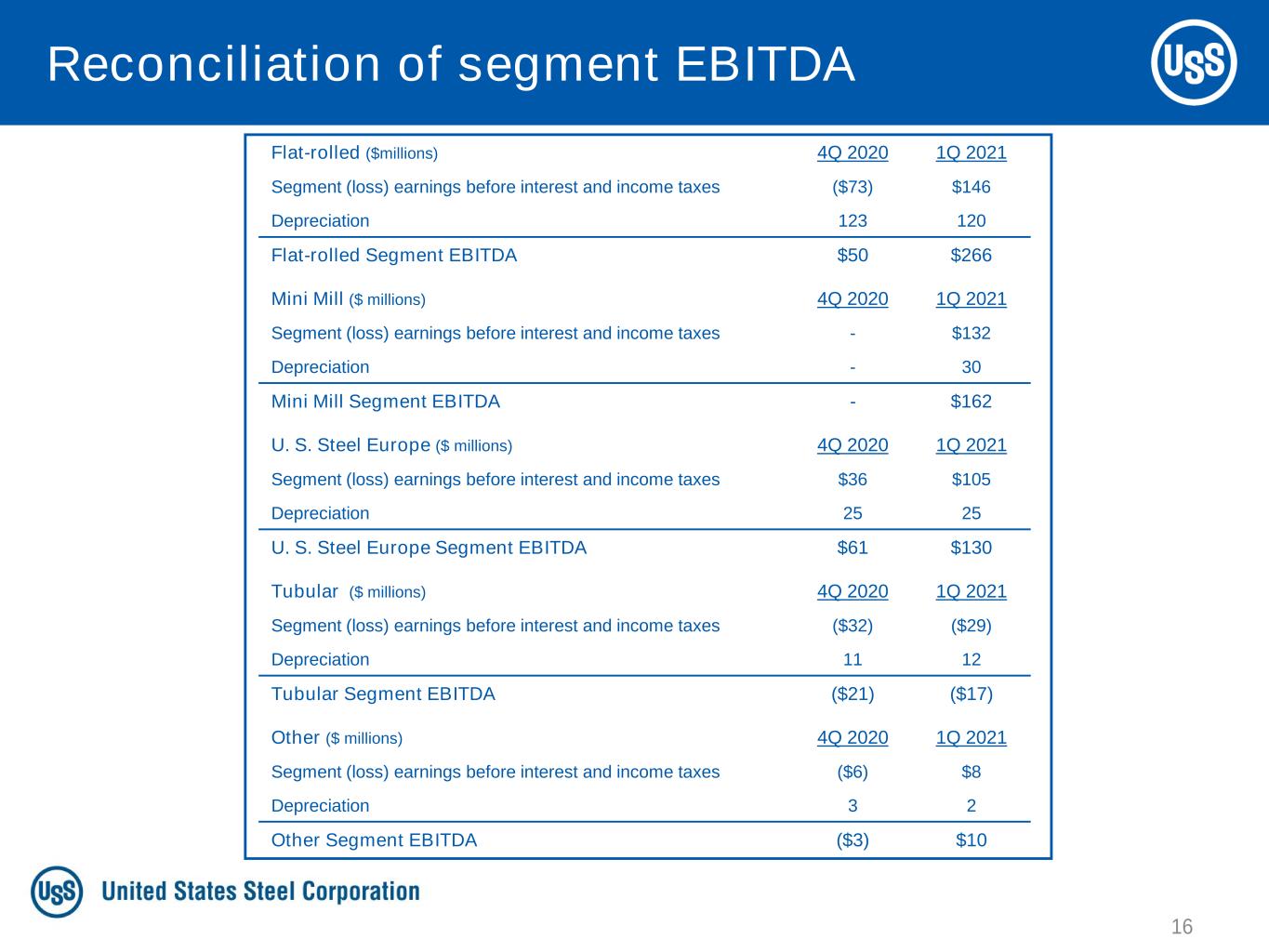

16 Reconciliation of segment EBITDA Flat-rolled ($millions) 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes ($73) $146 Depreciation 123 120 Flat-rolled Segment EBITDA $50 $266 U. S. Steel Europe ($ millions) 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes $36 $105 Depreciation 25 25 U. S. Steel Europe Segment EBITDA $61 $130 Tubular ($ millions) 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes ($32) ($29) Depreciation 11 12 Tubular Segment EBITDA ($21) ($17) Other ($ millions) 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes ($6) $8 Depreciation 3 2 Other Segment EBITDA ($3) $10 Mini Mill ($ millions) 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes - $132 Depreciation - 30 Mini Mill Segment EBITDA - $162

Reconciliation of adjusted EBITDA 17 ($ millions) 4Q 2020 1Q 2021 Reported net (loss) earnings attributable to U. S. Steel $49 $91 Income tax provision (benefit) (94) 1 Net interest and other financial costs 88 333 Reported (loss) earnings before interest and income taxes $43 $425 Depreciation, depletion and amortization expense 162 189 EBITDA $205 $614 Asset impairment charges ─ ─ Restructuring and other charges 8 6 Big River Steel inventory step-up amortization ─ 24 Big River Steel unrealized losses ─ 9 Big River Steel acquisitions costs 3 9 Big River Steel debt extinguishment charges 18 ─ Fairless property sale (145) ─ Gain on previously held investment in Big River Steel ─ (111) Gain on previously held investment in UPI ─ ─ Tubular inventory impairment ─ ─ December 24, 2018 Clairton coke making facility fire (2) ─ Adjusted EBITDA $87 $551

INVESTOR RELATIONS Kevin Lewis Vice President 412-433-6935 klewis@uss.com Eric Linn Senior Manager 412-433-2385 eplinn@uss.com www.ussteel.com