Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - VICI PROPERTIES INC. | viciq12021earningsrelease.htm |

| 8-K - 8-K - VICI PROPERTIES INC. | vici-20210429.htm |

VICI Q1 2021 Supplemental Financial & Operating Data Oh I SUP P L EMENTAL F I NANCI AL & OP ERAT I NG DATA F I R S T Q U A R T E R E N D E D M A R C H 3 1 , 2 0 2 1 Exhibit 99.2

VICI Q1 2021 Supplemental Financial & Operating Data 2 Disclaimers Forward Looking Statements Certain statements in this presentation and that may be made in meetings are forward-looking statements. Forward-looking statements are based on VICI Properties Inc.’s (“VICI or the “Company”) current plans, expectations and projections about future events and are not guarantees of future performance. These statements can be identified by the fact that they do not relate to strictly historical and current facts and by the use of the words such as "expects", "plans", "opportunities" and similar words and variations thereof. Although the Company believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, its actual results, performance and achievements could differ materially from those expressed in or by the forward-looking statements and may be affected by a variety of risks and other factors including, among others: the impact of changes in general economic conditions, including low consumer confidence, unemployment levels and depressed real estate prices resulting from the severity and duration of any downturn in the U.S. or global economy (including stemming from the COVID-19 pandemic and changes in economic conditions as a result of the COVID-19 pandemic); the Company’s dependence on subsidiaries of Caesars Entertainment, Inc. (“Caesars”), Penn National Gaming, Inc. (“Penn”), Seminole Hard Rock Entertainment, Inc. (“Hard Rock”), Century Casinos, Inc. (“Century Casinos”) and Rock Ohio Ventures LLC (“JACK Entertainment”) as tenants of our properties and Caesars, Penn, Hard Rock, Century Casinos and JACK Entertainment or certain of their respective subsidiaries as guarantors of the lease payments and the negative consequences any material adverse effect on their respective businesses could have on the Company; risks that the Company’s pending transactions, including the pending acquisition of land and real estate assets of the Venetian Resort Las Vegas and Sands Expo & Convention Center (the “Venetian Resort”), may not be consummated on the terms or timeframes contemplated, or at all; risks regarding the ability of the parties to the Company’s pending transactions to satisfy the conditions set forth in the definitive transaction documents, including the ability to receive, or delays in obtaining, the governmental and regulatory approvals and consents required to consummate the pending transactions, or other delays or impediments to completing the transactions; risks regarding the ability of the applicable parties to obtain the financing necessary to complete the pending transactions on the terms expected or at all; risks that the Company may not achieve the benefits contemplated by its pending and recently completed transactions and acquisitions of real estate assets; the possibility that the Company identifies significant environmental, tax, legal or other issues that materially and adversely impact the value of assets acquired or secured as collateral (or other benefits it expects to receive) in any of its pending or recently completed transactions; and the effects of the Company’s recently completed and pending transactions on it, including the future impact on the Company’s financial condition, financial and operating results, cash flows, strategy and plans. Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the impact of the COVID-19 pandemic on our and our tenants’ financial condition, results of operations, cash flows and performance. The extent to which the COVID-19 pandemic continues to adversely affect our tenants, and ultimately impacts our business and financial condition, will largely depend on future developments that are highly uncertain and cannot be predicted with confidence, including the impact of the actions taken to contain the pandemic or mitigate its impact, the availability, distribution, public acceptance and efficacy of one or more approved vaccines, the direct and indirect economic effects of the pandemic and containment measures on our tenants, including various state governments and/or regulatory authorities issuing directives, mandates, orders or similar actions restricting freedom of movement and business operations, such as travel restrictions, border closures, business closures, limitations on public gatherings, quarantines and “shelter-at-home” orders that have resulted and may in the future result in the temporary closure of our tenants’ operations at our properties, the ability of our tenants to successfully operate their businesses following the reopening of their respective facilities, including the costs of complying with regulatory requirements necessary to keep the facilities open, including compliance with restrictions and reduced capacity requirements, the need to close any of the facilities after reopening as a result of the COVID-19 pandemic, and the effects of the negotiated capital expenditure reductions and other amendments to the lease agreements that we agreed to with certain of our tenants in response to the COVID-19 pandemic. Each of the foregoing could have a material adverse effect on our tenants’ ability to satisfy their obligations under their leases with us, including their continued ability to pay rent in a timely manner, or at all, and/or to fund capital expenditures or make other payments required under their leases. In addition, changes and instability in global, national and regional economic activity and financial markets as a result of the COVID-19 pandemic have negatively impacted consumer discretionary spending and travel and may continue to do so, which could have a material adverse effect on our tenants’ businesses. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10‐K for the year ended December 31, 2020, Quarterly Reports on Form 10-Q and the Company’s other filings with the U.S. Securities and Exchange Commission (“SEC”). The Company does not undertake any obligation to update or revise any forward‐looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Caesars, Penn, Hard Rock, Century Casinos and JACK Entertainment Information The Company makes no representation as to the accuracy or completeness of the information regarding Caesars, Penn, Hard Rock, Century Casinos and JACK Entertainment included in this presentation. The historical audited and unaudited financial statements of Caesars, as the parent and guarantor of CEOC, LLC (“CEOC”), the Company's significant lessee, have been filed with the SEC. Certain financial and other information for Caesars, Penn, Hard Rock, Century and JACK Entertainment included in this presentation have been derived from their respective filings, if and as applicable, and other publicly available presentations and press releases. While we believe this information to be reliable, we have not independently investigated or verified such data. Market and Industry Data This presentation contains estimates and information concerning the Company's industry, including market position, rent growth and rent coverage of the Company's peers, that are based on industry publications, reports and peer company public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the "Risk Factors" section of the Company's public filings with the SEC. Non‐GAAP Financial Measures This presentation includes reference to Funds From Operations (“FFO”), FFO per share, Adjusted Funds From Operations (“AFFO”), AFFO per share, and Adjusted EBITDA, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non-GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). We believe FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA provide a meaningful perspective of the underlying operating performance of our business. For additional information regarding these non-GAAP financial measures see “Definitions of Non-GAAP Financial Measures” included in the Appendix at the end of this presentation. Financial Data Financial information provided herein is as of March 31, 2021 unless otherwise indicated.

VICI Q1 2021 Supplemental Financial & Operating Data Corporate Overview About VICI Properties (NYSE: VICI) Senior Management Edward Pitoniak John Payne David Kieske Samantha Gallagher Gabriel Wasserman Chief Executive Officer & Director President & Chief Operating Officer EVP, Chief Financial Officer EVP, General Counsel & Secretary Chief Accounting Officer VICI Properties Inc. (“VICI Properties” or the “Company”) is an experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including the world- renowned Caesars Palace. VICI Properties’ national, geographically diverse portfolio consists of 28 gaming facilities comprising 47 million square feet and features approximately 17,800 hotel rooms and more than 200 restaurants, bars, nightclubs and sportsbooks. Its properties are leased to industry leading gaming and hospitality operators, including Caesars Entertainment, Inc., Century Casinos, Inc., Hard Rock International Inc., JACK Entertainment LLC and Penn National Gaming, Inc. VICI Properties also has an investment in the Chelsea Piers, New York facility and owns four championship golf courses and 34 acres of undeveloped land adjacent to the Las Vegas Strip. VICI Properties aims to deliver sustained income and value growth through its strategy of creating the highest quality and most productive experiential asset portfolio in American real estate investment management. Covering Equity Analysts Covering High Yield Analysts Firm BofA Merrill Lynch Deutsche Bank Goldman Sachs J.P. Morgan Analyst James Kayler Luis Chinchilla Komal Patel Michael Pace Phone (646) 855‐9223 (212) 250-9980 (212) 357‐9774 (212) 270‐6530 Email James.f.kayler@baml.com Luis.chinchilla@db.com Komal.patel@gs.com Michael.pace@jpmorgan.com Firm BofA Merrill Lynch Citi Deutsche Bank Evercore ISI Goldman Sachs Green Street Advisors Jefferies J.P. Morgan Keybanc Ladenburg Thalmann & Co. Loop Capital Macquarie Capital Morgan Stanley Raymond James Robert W. Baird Scotiabank SMBC Nikko Securities Stifel Nicolaus Truist Securities Union Gaming Wells Fargo Analyst Shaun Kelley Smedes Rose Carlo Santarelli Rich Hightower Stephen Grambling Spenser Allaway David Katz Anthony Paolone Todd Thomas John Massocca Daniel Adam Jordan Bender Thomas Allen RJ Milligan Wesley Golladay Greg McGinniss Richard Anderson Simon Yarmak Barry Jonas John DeCree Todd Stender Email Shaun.kelley@baml.com Smedes.rose@citi.com Carlo.santarelli@db.com Rich.hightower@evercoreisi.com Stephen.grambling@gs.com Sallaway@greenstreetadvisors.com Dkatz@jefferies.com Anthony.paolone@jpmorgan.com Tthomas@key.com Jmassocca@ladenburg.com Daniel.adam@loopcapital.com Jordan.bender@macquarie.com Thomas.allen@morganstanley.com Rjmilligan@raymondjames.com Wgolladay@rwbaird.com Greg.mcginniss@scotiabank.com Randerson@smbcnikko-si.com Yarmaks@stifel.com Barry.jonas@truist.com John.decree@uniongaming.com Todd.stender@wellsfargo.com Phone (646) 855‐1005 (212) 816-6243 (212) 250‐5815 (212) 752-0886 (212) 902‐7832 (949) 640-8780 (212) 323-3355 (212) 622-6682 (917) 368-2286 (212) 409-2543 (212) 823-1312 (212) 231-6558 (212) 761‐3356 (727) 567-2585 (216) 737-7510 (212) 225-6906 (646) 521-2351 (443) 224‐1345 (212) 590-0998 (702) 691‐3213 (562) 637-1371 Contact Information Board of Directors Independent James Abrahamson Diana Cantor Monica Douglas Elizabeth Holland Craig Macnab Edward Pitoniak Michael Rumbolz Director, Chairman of the Board Director, Audit Committee Chair Director Director, Nominating & Governance Committee Chair Director, Compensation Committee Chair Chief Executive Officer & Director Director 3 Corporate Headquarters VICI Properties Inc. 535 Madison Ave., 20th Fl New York, NY 10022 (646) 949‐4631 Transfer Agent Computershare 7530 Lucerne Drive, Suite 305 Cleveland, OH 44130 (800) 962‐4284 www.computershare.com Investor Relations investors@viciproperties.com Public Markets Detail Ticker: VICI Exchange: NYSE Public Relations pr@viciproperties.com Website www.viciproperties.com ✓ ✓ ✓ ✓ ✓ ✓

VICI Q1 2021 Supplemental Financial & Operating Data Table of Contents Consolidated Balance Sheets 6-7 Consolidated Statements of Operations 8-9 Non‐GAAP Financial Measures 10-11 2021 Guidance 15 Properties Breakdown 18-19 Summary of Current Lease Terms 20-21 Recent Activity 22-23 Definitions of Non-GAAP Financial Measures 25 5 Portfolio Overview 17 4 Revenue Detail 12-13 Portfolio & Financial Overview Capitalization 16 Embedded Growth Pipeline 24 Current Annualized Contractual Rent and Income from Mortgage Loans 14

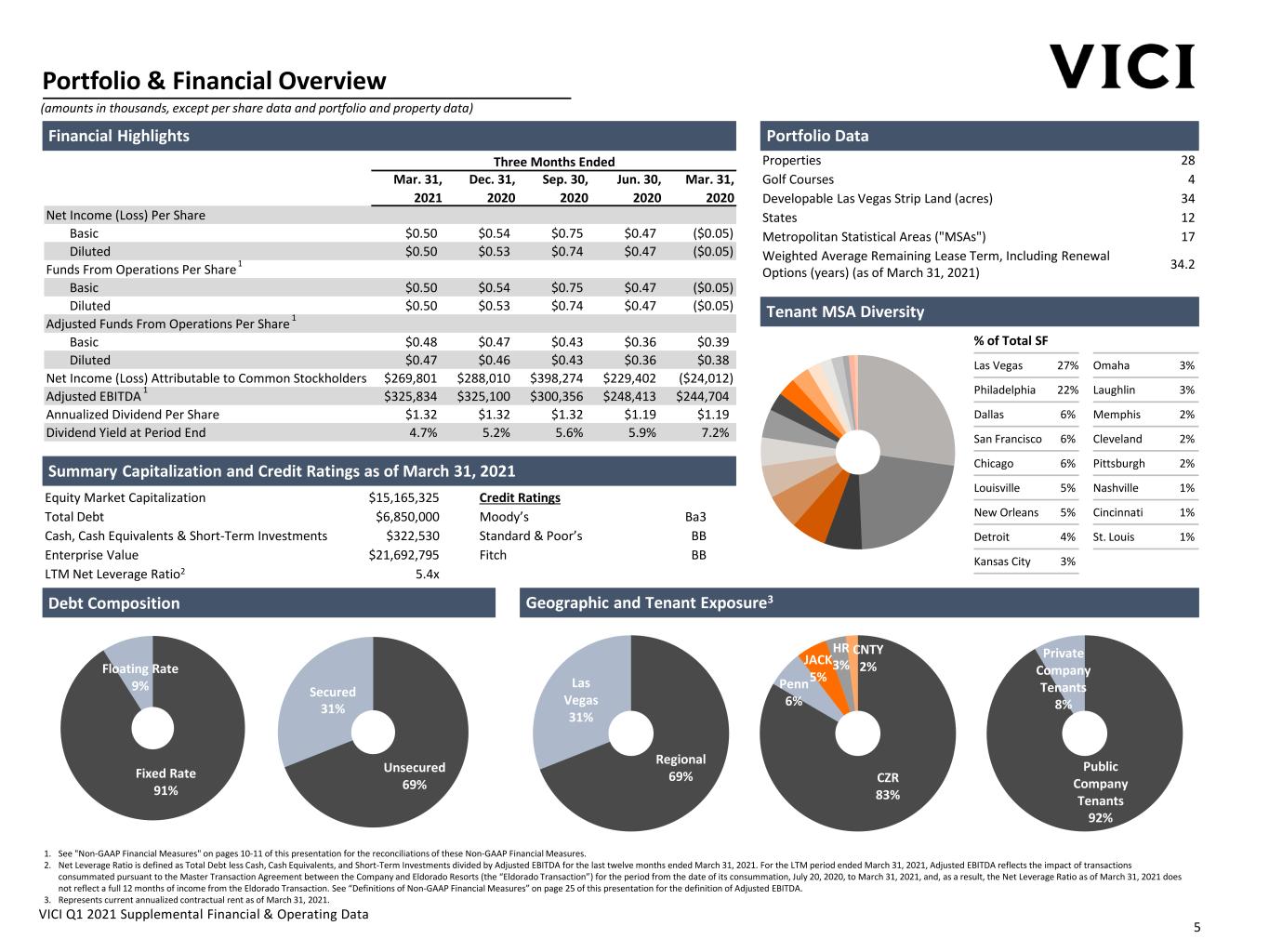

VICI Q1 2021 Supplemental Financial & Operating Data Three Months Ended Mar. 31, 2021 Dec. 31, 2020 Sep. 30, 2020 Jun. 30, 2020 Mar. 31, 2020 Net Income (Loss) Per Share Basic $0.50 $0.54 $0.75 $0.47 ($0.05) Diluted $0.50 $0.53 $0.74 $0.47 ($0.05) Funds From Operations Per Share Basic $0.50 $0.54 $0.75 $0.47 ($0.05) Diluted $0.50 $0.53 $0.74 $0.47 ($0.05) Adjusted Funds From Operations Per Share Basic $0.48 $0.47 $0.43 $0.36 $0.39 Diluted $0.47 $0.46 $0.43 $0.36 $0.38 Net Income (Loss) Attributable to Common Stockholders $269,801 $288,010 $398,274 $229,402 ($24,012) Adjusted EBITDA $325,834 $325,100 $300,356 $248,413 $244,704 Annualized Dividend Per Share $1.32 $1.32 $1.32 $1.19 $1.19 Dividend Yield at Period End 4.7% 5.2% 5.6% 5.9% 7.2% Equity Market Capitalization $15,165,325 Total Debt $6,850,000 Cash, Cash Equivalents & Short-Term Investments $322,530 Enterprise Value $21,692,795 LTM Net Leverage Ratio2 5.4x Portfolio & Financial Overview (amounts in thousands, except per share data and portfolio and property data) Properties 28 Golf Courses 4 Developable Las Vegas Strip Land (acres) 34 States 12 Metropolitan Statistical Areas ("MSAs") 17 Weighted Average Remaining Lease Term, Including Renewal Options (years) (as of March 31, 2021) 34.2 Financial Highlights Tenant MSA Diversity 1. See "Non‐GAAP Financial Measures" on pages 10-11 of this presentation for the reconciliations of these Non‐GAAP Financial Measures. 2. Net Leverage Ratio is defined as Total Debt less Cash, Cash Equivalents, and Short-Term Investments divided by Adjusted EBITDA for the last twelve months ended March 31, 2021. For the LTM period ended March 31, 2021, Adjusted EBITDA reflects the impact of transactions consummated pursuant to the Master Transaction Agreement between the Company and Eldorado Resorts (the “Eldorado Transaction”) for the period from the date of its consummation, July 20, 2020, to March 31, 2021, and, as a result, the Net Leverage Ratio as of March 31, 2021 does not reflect a full 12 months of income from the Eldorado Transaction. See “Definitions of Non-GAAP Financial Measures” on page 25 of this presentation for the definition of Adjusted EBITDA. 3. Represents current annualized contractual rent as of March 31, 2021. Portfolio Data Debt Composition Fixed Rate 91% Floating Rate 9% Unsecured 69% Las Vegas 27% Philadelphia 22% Dallas 6% San Francisco 6% Chicago 6% Louisville 5% New Orleans 5% Detroit 4% Kansas City 3% Omaha 3% Laughlin 3% Memphis 2% Cleveland 2% Pittsburgh 2% Nashville 1% Cincinnati 1% St. Louis 1% Secured 31% Geographic and Tenant Exposure3 Credit Ratings Moody’s Ba3 Standard & Poor’s BB Fitch BB Regional 69% Las Vegas 31% % of Total SF 1 1 1 CZR 83% Penn 6% JACK 5% HR 3% CNTY 2% Public Company Tenants 92% Private Company Tenants 8% Summary Capitalization and Credit Ratings as of March 31, 2021 5

VICI Q1 2021 Supplemental Financial & Operating Data March 31, 2021 December 31, 2020 Assets Real estate portfolio: Investments in leases - sales-type, net 13,054,135$ 13,027,644$ Investments in leases - financing receivables, net 2,628,422 2,618,562 Investments in loans, net 515,251 536,721 Land 158,046 158,190 Cash and cash equivalents 322,530 315,993 Short-term investments — 19,973 Other assets 406,617 386,530 Total assets 17,085,001$ 17,063,613$ Liabilities Debt, net 6,769,211$ 6,765,532$ Accrued interest 47,075 46,422 Deferred financing liability 73,600 73,600 Deferred revenue 493 93,659 Dividends payable 177,089 176,992 Other liabilities 417,841 413,663 Total liabilities 7,485,309 7,569,868 Stockholders' equity 5,370 5,367 — — Additional paid-in capital 9,364,294 9,363,539 Accumulated other comprehensive loss (80,143) (92,521) Retained earnings 232,038 139,454 Total VICI stockholders' equity 9,521,559 9,415,839 Non-controlling interests 78,133 77,906 Total stockholders' equity 9,599,692 9,493,745 Total liabilities and stockholders' equity 17,085,001$ 17,063,613$ Common stock, $0.01 par value, 950,000,000 and 700,000,000 shares authorized and 537,015,753 and 536,669,722 shares issued and outstanding at March 31, 2021 and December 31, 2020, respectively Preferred stock, $0.01 par value, 50,000,000 shares authorized and no shares outstanding at March 31, 2021 and December 31, 2020 Consolidated Balance Sheets (amounts in thousands, except share and per share data) 6

VICI Q1 2021 Supplemental Financial & Operating Data March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Assets Real estate portfolio: Investments in leases - sales-type and direct financing, net 13,054,135$ 13,027,644$ 13,009,966$ 10,372,656$ Investments in leases - operating — — — 1,086,658 Investments in leases - financing receivables, net 2,628,422 2,618,562 2,600,228 812,636 Investments in loans, net 515,251 536,721 533,713 49,876 Land 158,046 158,190 158,190 94,711 Cash and cash equivalents 322,530 315,993 144,057 1,680,536 Restricted cash — — — 2,000,000 Short-term investments — 19,973 19,973 — Other assets 406,617 386,530 385,703 180,561 Total assets 17,085,001$ 17,063,613$ 16,851,830$ 16,277,634$ Liabilities Debt, net 6,769,211$ 6,765,532$ 6,761,832$ 6,758,132$ Accrued interest 47,075 46,422 47,106 48,828 Deferred financing liability 73,600 73,600 73,600 73,600 Deferred revenue 493 93,659 309 358 Dividends payable 177,089 176,992 176,982 158,659 Other liabilities 417,841 413,663 422,462 163,646 Total liabilities 7,485,309 7,569,868 7,482,291 7,203,223 Stockholders' equity Common stock 5,370 5,367 5,367 5,337 Preferred stock — — — — Additional paid-in capital 9,364,294 9,363,539 9,361,526 9,296,511 Accumulated other comprehensive loss (80,143) (92,521) (104,258) (117,265) Retained earnings (deficit) 232,038 139,454 29,338 (191,835) Total VICI stockholders' equity 9,521,559 9,415,839 9,291,973 8,992,748 Non-controlling interests 78,133 77,906 77,566 81,663 Total stockholders' equity 9,599,692 9,493,745 9,369,539 9,074,411 Total liabilities and stockholders' equity 17,085,001$ 17,063,613$ 16,851,830$ 16,277,634$ Consolidated Balance Sheets – Quarterly (amounts in thousands, except share and per share data) 7

VICI Q1 2021 Supplemental Financial & Operating Data Impact to net income related to non-cash change in allowance for credit losses - CECL 4,380$ (149,508)$ Per share impact related to non-cash change in allowance for credit losses - CECL Basic 0.01$ (0.32)$ Diluted 0.01$ (0.32)$ 2021 2020 Revenues Income from sales-type and direct financing leases 290,146$ 224,252$ Income from operating leases — 10,913 Income from lease financing receivables and loans 70,377 12,843 Other income 6,974 693 Golf revenues 6,813 6,300 Revenues 374,310 255,001 Operating expenses General and administrative 8,085 7,015 Depreciation 792 867 Other expenses 6,974 703 Golf expenses 4,506 4,370 Change in allowance for credit losses (4,380) 149,508 Transaction and acquisition expenses 8,721 4,517 Total operating expenses 24,698 166,980 Interest expense (77,048) (76,093) Interest income 19 5,520 Loss from extinguishment of debt — (39,059) Income (loss) before income taxes 272,583 (21,611) Income tax expense (484) (454) Net income (loss) 272,099 (22,065) Less: Net income attributable to non-controlling interest (2,298) (1,947) Net income (loss) attributable to common stockholders 269,801$ (24,012)$ Net income per common share Basic 0.50$ (0.05)$ Diluted 0.50$ (0.05)$ Weighted average number of shares of common stock outstanding Basic 536,480,505 465,177,425 Diluted 544,801,802 465,177,425 Three Months Ended March 31, Consolidated Statements of Operations (amounts in thousands, except share and per share data) 1. Refer to Note 5 – Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 for further details. 2. For the calculation of diluted net (loss) income per common share for the quarter ending March 31, 2020, the diluted weighted average number of shares of common stock outstanding is equal to the basic weighted average number of shares of common stock outstanding. Refer to page 10 for further details. 8 1 2 1

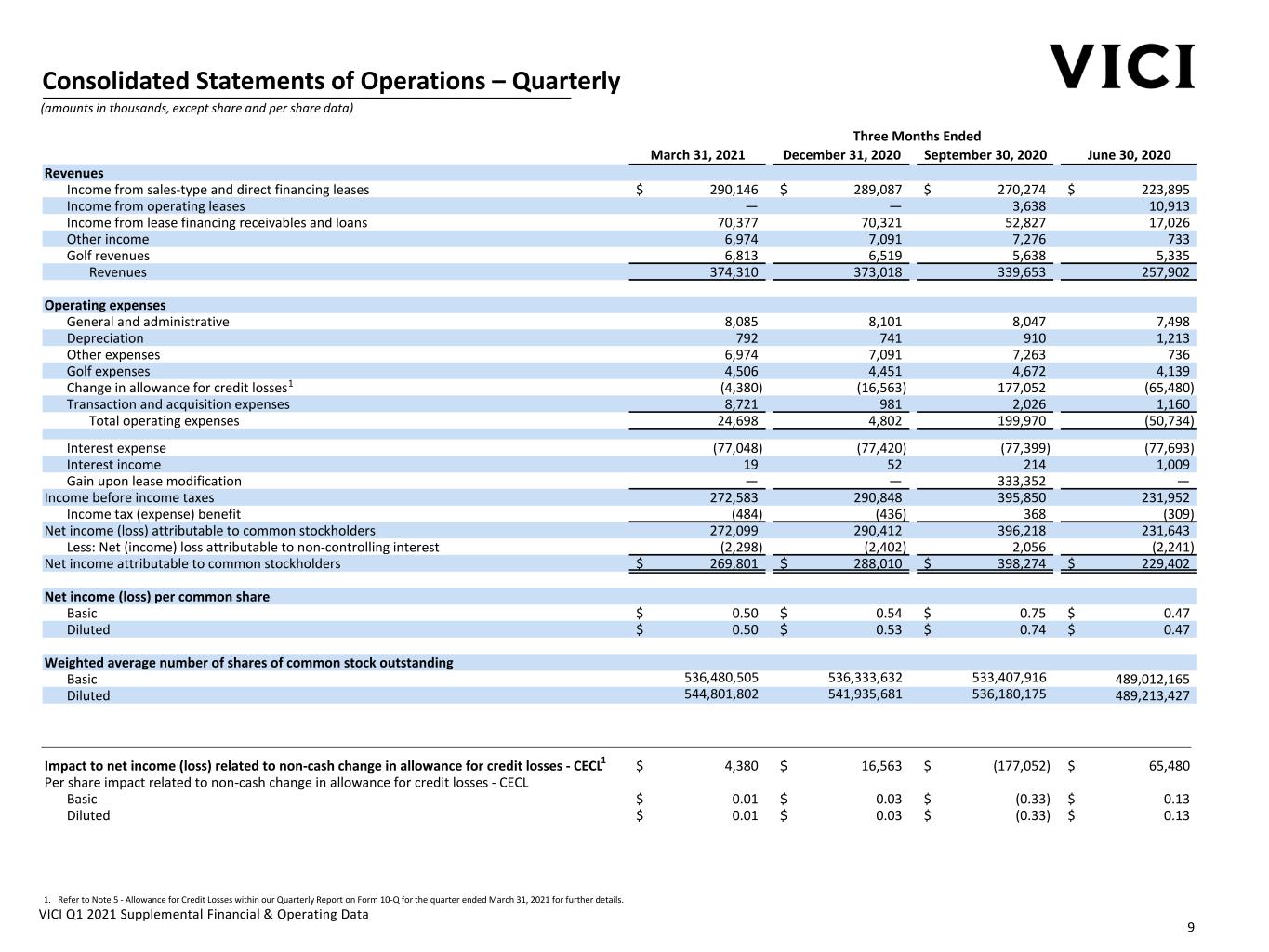

VICI Q1 2021 Supplemental Financial & Operating Data Impact to net income (loss) related to non-cash change in allowance for credit losses - CECL 4,380$ 16,563$ (177,052)$ 65,480$ Per share impact related to non-cash change in allowance for credit losses - CECL Basic 0.01$ 0.03$ (0.33)$ 0.13$ Diluted 0.01$ 0.03$ (0.33)$ 0.13$ Three Months Ended March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Revenues Income from sales-type and direct financing leases 290,146$ 289,087$ 270,274$ 223,895$ Income from operating leases — — 3,638 10,913 Income from lease financing receivables and loans 70,377 70,321 52,827 17,026 Other income 6,974 7,091 7,276 733 Golf revenues 6,813 6,519 5,638 5,335 Revenues 374,310 373,018 339,653 257,902 Operating expenses General and administrative 8,085 8,101 8,047 7,498 Depreciation 792 741 910 1,213 Other expenses 6,974 7,091 7,263 736 Golf expenses 4,506 4,451 4,672 4,139 Change in allowance for credit losses (4,380) (16,563) 177,052 (65,480) Transaction and acquisition expenses 8,721 981 2,026 1,160 Total operating expenses 24,698 4,802 199,970 (50,734) Interest expense (77,048) (77,420) (77,399) (77,693) Interest income 19 52 214 1,009 Gain upon lease modification — — 333,352 — Income before income taxes 272,583 290,848 395,850 231,952 Income tax (expense) benefit (484) (436) 368 (309) Net income (loss) attributable to common stockholders 272,099 290,412 396,218 231,643 Less: Net (income) loss attributable to non-controlling interest (2,298) (2,402) 2,056 (2,241) Net income attributable to common stockholders 269,801$ 288,010$ 398,274$ 229,402$ Net income (loss) per common share Basic 0.50$ 0.54$ 0.75$ 0.47$ Diluted 0.50$ 0.53$ 0.74$ 0.47$ Weighted average number of shares of common stock outstanding Basic 536,480,505 536,333,632 533,407,916 489,012,165 Diluted 544,801,802 541,935,681 536,180,175 489,213,427 Consolidated Statements of Operations – Quarterly (amounts in thousands, except share and per share data) 1 1. Refer to Note 5 - Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 for further details. 1 9

VICI Q1 2021 Supplemental Financial & Operating Data 2021 2020 Net income (loss) attributable to common stockholders 269,801$ (24,012)$ Real estate depreciation — — Funds From Operations (FFO) 1 269,801 (24,012) Non-cash leasing and financing adjustments (27,852) 3,267 Non-cash change in allowance for credit losses (4,380) 149,508 Non-cash stock-based compensation 2,277 1,350 Transaction and acquisition expenses 8,721 4,517 Amortization of debt issuance costs and original issue discount 6,691 6,299 Other depreciation 760 843 Capital expenditures (1,233) (762) Loss on extinguishment of debt — 39,059 Non-cash adjustments attributable to non-controlling interests 227 (93) Adjusted Funds From Operations (AFFO) 1 255,012 179,976 Interest expense, net 70,338 64,274 Income tax expense 484 454 Adjusted EBITDA 1 325,834$ 244,704$ Net income (loss) per common share Basic 0.50$ (0.05)$ Diluted 0.50$ (0.05)$ FFO per common share Basic 0.50$ (0.05)$ Diluted 0.50$ (0.05)$ AFFO per common share Basic 0.48$ 0.39$ Diluted 0.47$ 0.38$ Weighted average number of shares of common stock outstanding Basic 536,480,505 465,177,425 Diluted 2 544,801,802 465,177,425 Three Months Ended March 31, Non‐GAAP Financial Measures 1. See definitions of Non-GAAP Financial Measures on page 25 of this presentation. 2. For the three months ended March 31, 2020, the diluted weighted average number of shares of common stock outstanding in relation to AFFO is adjusted to include the dilutive effect, using the treasury stock method, of the assumed conversion of our restricted stock in the amount of 83,367 shares and the assumed settlement of our forward sale agreements in the amount of 10,291,832 shares to a total diluted share number of 475,552,624. For the three months ended March 31, 2020, such amounts have been excluded from the diluted weighted average number of shares of common stock in relation to net (loss) income and FFO as these were in loss positions and the effect of inclusion would have been anti-dilutive. (amounts in thousands, except share and per share data) 10

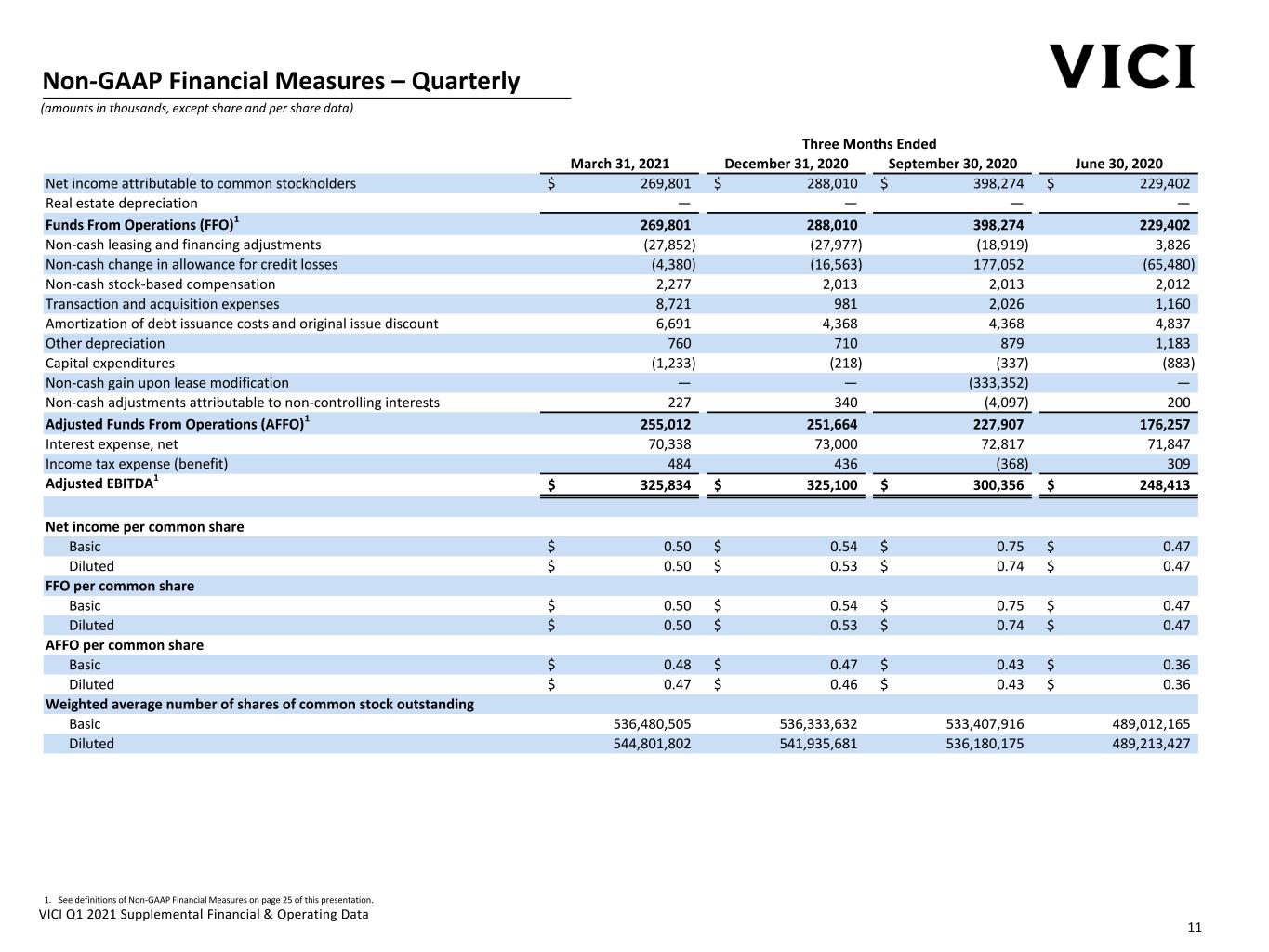

VICI Q1 2021 Supplemental Financial & Operating Data Three Months Ended March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Net income attributable to common stockholders 269,801$ 288,010$ 398,274$ 229,402$ Real estate depreciation — — — — Funds From Operations (FFO) 1 269,801 288,010 398,274 229,402 Non-cash leasing and financing adjustments (27,852) (27,977) (18,919) 3,826 Non-cash change in allowance for credit losses (4,380) (16,563) 177,052 (65,480) Non-cash stock-based compensation 2,277 2,013 2,013 2,012 Transaction and acquisition expenses 8,721 981 2,026 1,160 Amortization of debt issuance costs and original issue discount 6,691 4,368 4,368 4,837 Other depreciation 760 710 879 1,183 Capital expenditures (1,233) (218) (337) (883) Non-cash gain upon lease modification — — (333,352) — Non-cash adjustments attributable to non-controlling interests 227 340 (4,097) 200 Adjusted Funds From Operations (AFFO) 1 255,012 251,664 227,907 176,257 Interest expense, net 70,338 73,000 72,817 71,847 Income tax expense (benefit) 484 436 (368) 309 Adjusted EBITDA 1 325,834$ 325,100$ 300,356$ 248,413$ Net income per common share Basic 0.50$ 0.54$ 0.75$ 0.47$ Diluted 0.50$ 0.53$ 0.74$ 0.47$ FFO per common share Basic 0.50$ 0.54$ 0.75$ 0.47$ Diluted 0.50$ 0.53$ 0.74$ 0.47$ AFFO per common share Basic 0.48$ 0.47$ 0.43$ 0.36$ Diluted 0.47$ 0.46$ 0.43$ 0.36$ Weighted average number of shares of common stock outstanding Basic 536,480,505 536,333,632 533,407,916 489,012,165 Diluted 544,801,802 541,935,681 536,180,175 489,213,427 1. See definitions of Non-GAAP Financial Measures on page 25 of this presentation. Non‐GAAP Financial Measures – Quarterly (amounts in thousands, except share and per share data) 11

VICI Q1 2021 Supplemental Financial & Operating Data 2021 2020 Contractual revenue from sales-type and direct financing leases Caesars Las Vegas Master Lease 100,652$ 63,312$ Caesars Regional Master Lease & Joliet Lease (excluding Harrah's NOLA, AC, and Laughlin) 129,040 127,133 Margaritaville Lease 5,872 5,857 Greektown Lease 13,889 13,889 Hard Rock Lease 10,848 10,688 Century Master Lease 6,313 6,250 Income from sales-type and direct financing leases non-cash adjustment 23,532 (2,877) Income from sales-type and direct financing leases 290,146 224,252 Contractual revenue from operating leases Land component of Caesars Palace — 10,913 Income from operating leases — 10,913 Contractual revenue from lease financing receivables JACK Entertainment Master Lease 16,470 12,397 Harrah's NOLA, AC, and Laughlin 39,077 — Income from lease financing receivables non-cash adjustment 4,345 (377) Income from lease financing receivables 59,892 12,020 Contractual interest income JACK Entertainment Loan 1,634 836 Caesars Forum Convention Center Loan 7,700 — Chelsea Piers Loan 1,176 — Income from loans non-cash adjustment (25) (13) Income from loans 10,485 823 Income from lease financing receivables and loans 70,377 12,843 Other income 6,974 693 Golf revenues 6,813 6,300 Total revenues 374,310$ 255,001$ Three Months Ended March 31, Revenue Detail 1. Amounts represent non-cash adjustments to recognize revenue on an effective interest basis in accordance with GAAP. (amounts in thousands, except share and per share data) 1 1 1 12

VICI Q1 2021 Supplemental Financial & Operating Data Three Months Ended March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Contractual revenue from sales-type and direct financing leases Caesars Las Vegas Master Lease 100,652$ 100,052$ 90,181$ 63,312$ Caesars Regional Master Lease & Joliet Lease (excluding Harrah's NOLA, AC, and Laughlin) 129,040 128,405 127,133 127,134 Margaritaville Lease 5,872 5,886 5,886 5,886 Greektown Lease 13,889 13,889 13,889 13,889 Hard Rock Lease 10,848 10,848 10,687 10,687 Century Master Lease 6,313 6,250 6,250 6,250 Income from sales-type and direct financing leases non-cash adjustment 23,532 23,757 16,248 (3,263) Income from sales-type and direct financing leases 290,146 289,087 270,274 223,895 Contractual revenue from operating leases Land component of Caesars Palace — — 3,638 10,913 Income from operating leases — — 3,638 10,913 Contractual revenue from lease financing receivables JACK Entertainment Master Lease 16,470 16,470 16,470 16,470 Harrah's NOLA, AC, and Laughlin 39,077 38,884 30,635 - Income from lease financing receivables non-cash adjustment 4,345 4,247 2,694 (546) Income from lease financing receivables 59,892 59,601 49,799 15,924 Contractual interest income JACK Entertainment Loan 1,633 1,663 1,547 1,119 Caesars Forum Convention Center Loan 7,700 7,871 1,112 — Chelsea Piers Loan 1,176 1,213 392 — Income from loans non-cash adjustment (24) (27) (23) (17) Income from loans 10,485 10,720 3,028 1,102 Income from lease financing receivables and loans 70,377 70,321 52,827 17,026 Other income 6,974 7,091 7,276 733 Golf revenues 6,813 6,519 5,638 5,335 Total revenues 374,310$ 373,018$ 339,653$ 257,902$ Revenue Detail – Quarterly (amounts in thousands, except share and per share data) 1. Amounts represent non-cash adjustments to recognize revenue on an effective interest basis in accordance with GAAP. 1 1 1 13

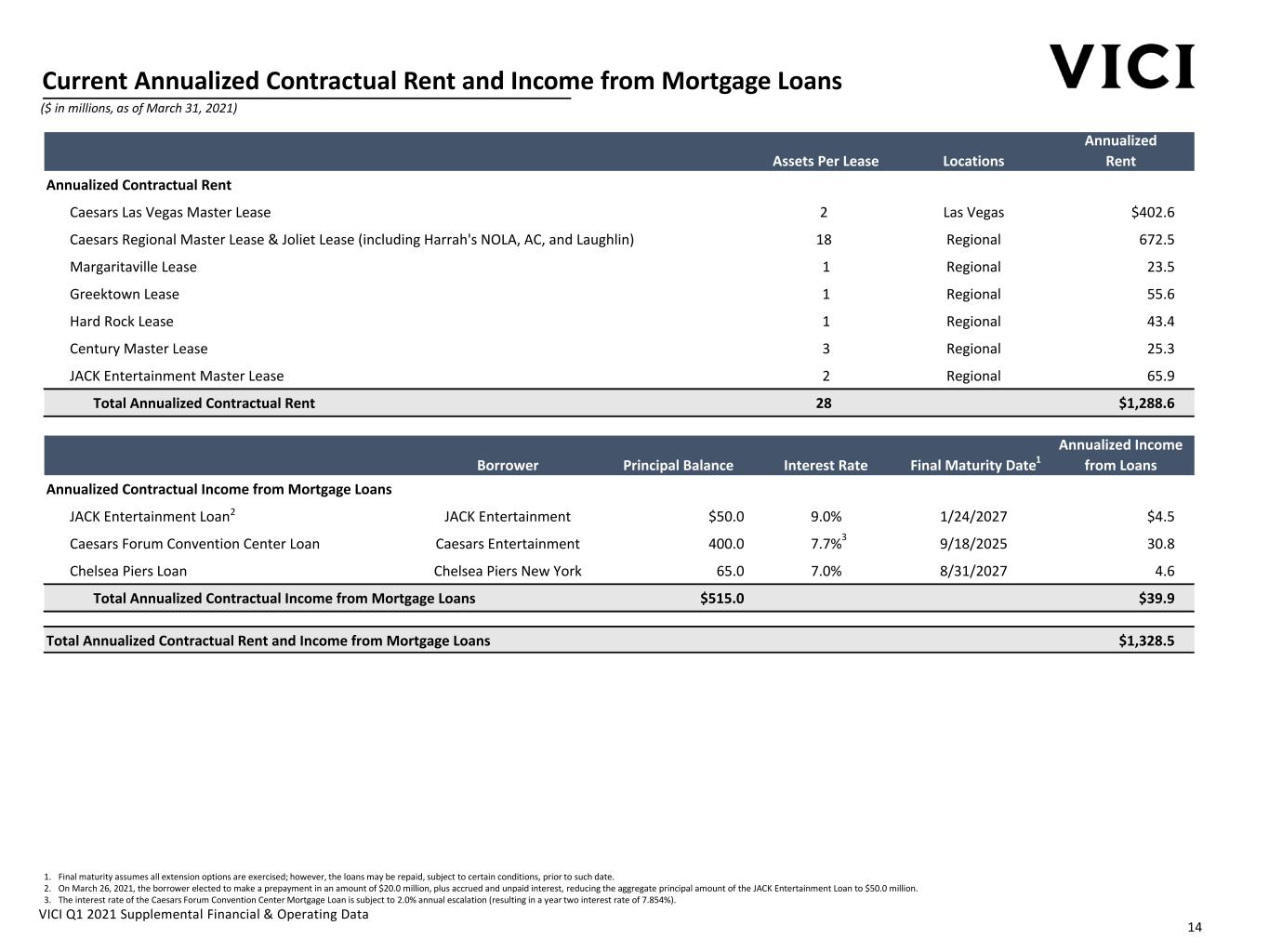

VICI Q1 2021 Supplemental Financial & Operating Data Assets Per Lease Locations Annualized Rent Annualized Contractual Rent Caesars Las Vegas Master Lease 2 Las Vegas $402.6 Caesars Regional Master Lease & Joliet Lease (including Harrah's NOLA, AC, and Laughlin) 18 Regional 672.5 Margaritaville Lease 1 Regional 23.5 Greektown Lease 1 Regional 55.6 Hard Rock Lease 1 Regional 43.4 Century Master Lease 3 Regional 25.3 JACK Entertainment Master Lease 2 Regional 65.9 Total Annualized Contractual Rent 28 $1,288.6 Borrower Principal Balance Interest Rate Final Maturity Date Annualized Income from Loans Annualized Contractual Income from Mortgage Loans JACK Entertainment Loan JACK Entertainment $50.0 9.0% 1/24/2027 $4.5 Caesars Forum Convention Center Loan Caesars Entertainment 400.0 7.7% 9/18/2025 30.8 Chelsea Piers Loan Chelsea Piers New York 65.0 7.0% 8/31/2027 4.6 Total Annualized Contractual Income from Mortgage Loans $515.0 $39.9 Total Annualized Contractual Rent and Income from Mortgage Loans $1,328.5 Current Annualized Contractual Rent and Income from Mortgage Loans ($ in millions, as of March 31, 2021) 1. Final maturity assumes all extension options are exercised; however, the loans may be repaid, subject to certain conditions, prior to such date. 2. On March 26, 2021, the borrower elected to make a prepayment in an amount of $20.0 million, plus accrued and unpaid interest, reducing the aggregate principal amount of the JACK Entertainment Loan to $50.0 million. 3. The interest rate of the Caesars Forum Convention Center Mortgage Loan is subject to 2.0% annual escalation (resulting in a year two interest rate of 7.854%). 3 1 14 2

VICI Q1 2021 Supplemental Financial & Operating Data 2021 Guidance The Company is reaffirming AFFO guidance for the full year 2021. The Company estimates AFFO for the year ending December 31, 2021 will be between $1,010.0 million and $1,035.0 million, or between $1.82 and $1.87 per diluted share. These per share estimates reflect the dilutive impact of the pending 26,900,000 shares related to the June 2020 Forward Sale Agreement, assuming settlement and the issuance of such shares on December 17, 2021, the maturity date of the June 2020 Forward Sale Agreement (as amended), and the dilutive effect prior to the expected settlement date as calculated under the treasury stock method, as well as the dilutive effect of the pending 69,000,000 shares related to the March 2021 Forward Sale Agreements as calculated under the treasury stock method. These estimates do not include the impact on operating results from any pending or possible future acquisitions or dispositions, capital markets activity, or other non-recurring transactions. The following is a summary of the Company’s full-year 2021 guidance: In determining Adjusted Funds from Operations (“AFFO”), the Company adjusts for certain items that are otherwise included in determining net income attributable to common stockholders, the most comparable GAAP financial measure. For more information, see “Non-GAAP Financial Measures.” The Company is unable to provide a reconciliation of its stated AFFO guidance to net income attributable to common stockholders because it is unable to predict with reasonable certainty the amount of the change in non-cash allowance for credit losses under ASU No. 2016-13 - Financial Instruments—Credit Losses (Topic 326) (“ASC 326”) for a future period. The non-cash change in allowance for credit losses under ASC 326 with respect to a future period is dependent upon future events that are entirely outside of the Company's control and may not be reliably predicted, including its tenants’ respective financial performance, fluctuations in the trading price of their common stock, credit ratings and outlook (each to the extent applicable), as well as broader macroeconomic performance. Based on past results, the impact of these adjustments could be material, individually or in the aggregate, to the Company's reported GAAP results. The estimates set forth above reflect management’s view of current and future market conditions, including assumptions with respect to the earnings impact of the events referenced in this release. The estimates set forth above may be subject to fluctuations as a result of several factors and there can be no assurance that the Company’s actual results will not differ materially from the estimates set forth above. ($ in millions, except per share data) 15 2021 Guidance For the Year Ending December 31, 2021: Low High Estimated Adjusted Funds From Operations (AFFO) $1,010.0 $1,035.0 Estimated Adjusted Funds From Operations (AFFO) per diluted share $1.82 $1.87 Estimated Weighted Average Share Count at Year End (in millions) 554.6 554.6

VICI Q1 2021 Supplemental Financial & Operating Data 1. Commitment fees (0.375%-0.500% depending on leverage) on the undrawn portion of the Revolving Credit Facility are paid quarterly. 2. On April 24, 2018, VICI swapped $1.5 billion of variable rate debt at a fixed rate of 2.8297%. The interest rate swap agreements each have an effective date of May 22, 2018 and a termination date of April 22, 2023. 3. The Term Loan B Facility requires scheduled quarterly payments in amounts equal to 0.25% of the original principal amount adjusted for prepayments permitted pursuant to the Credit Agreement dated December 22, 2017. 4. Based on one month LIBOR of 0.11% as of March 31, 2021. Includes impact of interest rate swaps. Debt Maturity Date Interest Rate Interest Frequency Credit Rating Moody’s/S&P/Fitch Balance as of March 31, 2021 % of Total Prepayment Option Years to Maturity VICI PropCo Senior Secured Credit Facilities Revolving Credit Facility 5/15/2024 L+2.00% Monthly1 - 0% ‐ 3.1 years Term Loan B Facility 12/22/2024 L+1.75%2 Monthly3 Ba2 / BBB- / BBB- 2,100,000 31% Par 3.7 years Senior Unsecured Notes Due 2025 2/15/2025 3.50% Semi-Annually Ba3 / BB / BB 750,000 11% NC 2 3.9 years Senior Unsecured Notes Due 2026 12/1/2026 4.25% Semi‐Annually Ba3 / BB / BB 1,250,000 18% NC 3 5.7 years Senior Unsecured Notes Due 2027 2/15/2027 3.75% Semi-Annually Ba3 / BB / BB 750,000 11% NC 3 5.9 years Senior Unsecured Notes Due 2029 12/1/2029 4.63% Semi‐Annually Ba3 / BB / BB 1,000,000 15% NC 5 8.7 years Senior Unsecured Notes Due 2030 8/15/2030 4.13% Semi-Annually Ba3 / BB / BB 1,000,000 15% NC 5 9.4 years Total Debt 4.01%4 $6,850,000 100% 5.9 years Fixed Rate $6,250,000 91% Variable Rate $600,000 9% Equity Shares Outstanding as of 3/31/2021 537,015,753 Share Price as of 3/31/2021 $28.24 Equity Market Capitalization $15,165,325 Enterprise Value Total Debt plus Equity Market Capitalization $22,015,325 Less: Cash, Cash Equivalents & Short Term Investments 322,530 Total Enterprise Value $21,692,795 Total Liquidity Revolving Credit Facility Capacity (Undrawn as of 3/31/2021) $1,000,000 Outstanding Equity Forwards (Equity Issuance Price as of 3/31/2021) 2,450,010 Cash, Cash Equivalents & Short Term Investments 322,530 Total Liquidity $3,772,540 Capitalization ($ in thousands, except share and per share data) 16

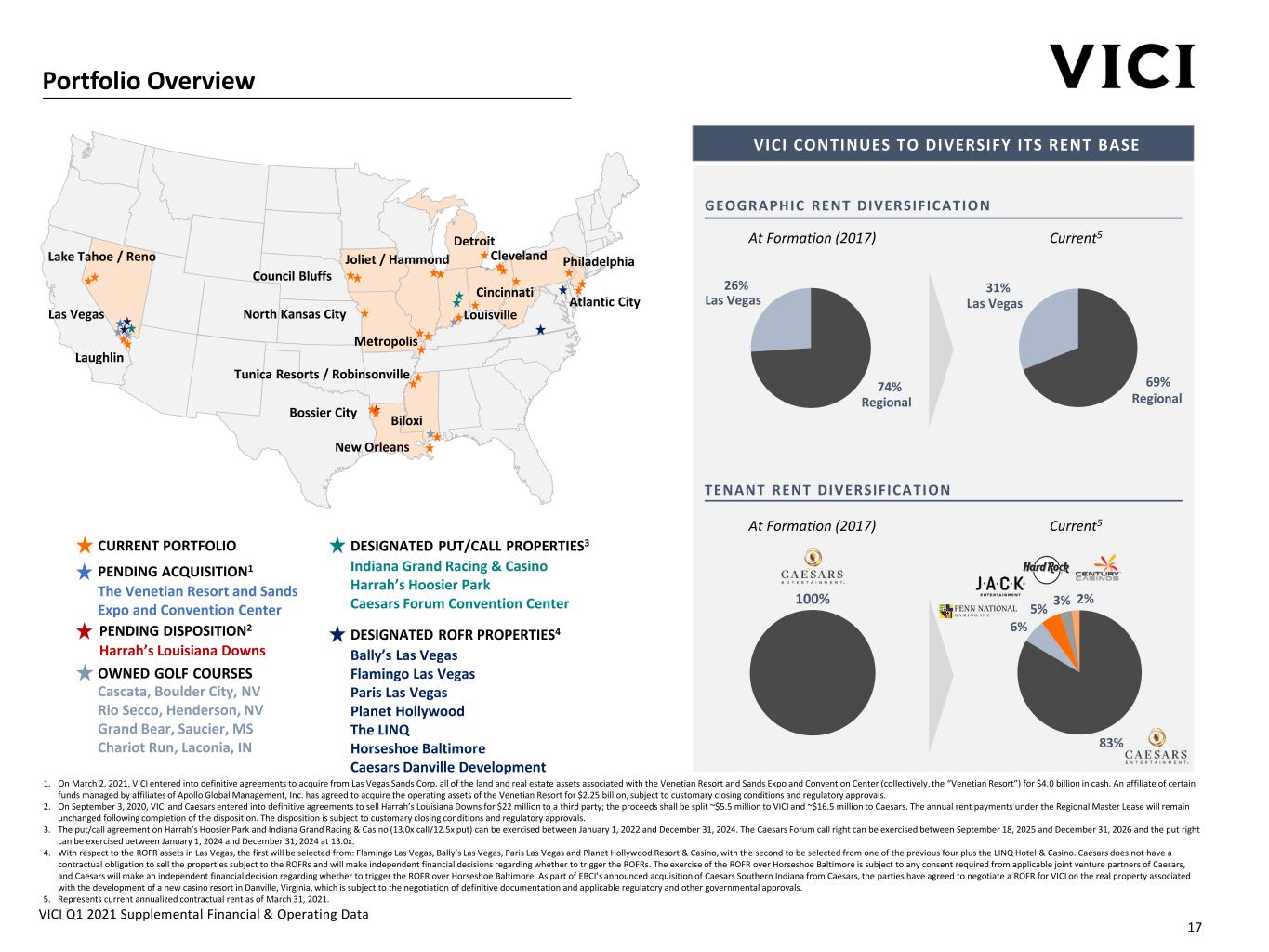

VICI Q1 2021 Supplemental Financial & Operating Data Portfolio Overview 1. On March 2, 2021, VICI entered into definitive agreements to acquire from Las Vegas Sands Corp. all of the land and real estate assets associated with the Venetian Resort and Sands Expo and Convention Center (collectively, the “Venetian Resort”) for $4.0 billion in cash. An affiliate of certain funds managed by affiliates of Apollo Global Management, Inc. has agreed to acquire the operating assets of the Venetian Resort for $2.25 billion, subject to customary closing conditions and regulatory approvals. 2. On September 3, 2020, VICI and Caesars entered into definitive agreements to sell Harrah’s Louisiana Downs for $22 million to a third party; the proceeds shall be split ~$5.5 million to VICI and ~$16.5 million to Caesars. The annual rent payments under the Regional Master Lease will remain unchanged following completion of the disposition. The disposition is subject to customary closing conditions and regulatory approvals. 3. The put/call agreement on Harrah’s Hoosier Park and Indiana Grand Racing & Casino (13.0x call/12.5x put) can be exercised between January 1, 2022 and December 31, 2024. The Caesars Forum call right can be exercised between September 18, 2025 and December 31, 2026 and the put right can be exercised between January 1, 2024 and December 31, 2024 at 13.0x. 4. With respect to the ROFR assets in Las Vegas, the first will be selected from: Flamingo Las Vegas, Bally’s Las Vegas, Paris Las Vegas and Planet Hollywood Resort & Casino, with the second to be selected from one of the previous four plus the LINQ Hotel & Casino. Caesars does not have a contractual obligation to sell the properties subject to the ROFRs and will make independent financial decisions regarding whether to trigger the ROFRs. The exercise of the ROFR over Horseshoe Baltimore is subject to any consent required from applicable joint venture partners of Caesars, and Caesars will make an independent financial decision regarding whether to trigger the ROFR over Horseshoe Baltimore. As part of EBCI’s announced acquisition of Caesars Southern Indiana from Caesars, the parties have agreed to negotiate a ROFR for VICI on the real property associated with the development of a new casino resort in Danville, Virginia, which is subject to the negotiation of definitive documentation and applicable regulatory and other governmental approvals. 5. Represents current annualized contractual rent as of March 31, 2021. CURRENT PORTFOLIO DESIGNATED PUT/CALL PROPERTIES3 Indiana Grand Racing & Casino Harrah’s Hoosier Park Caesars Forum Convention Center DESIGNATED ROFR PROPERTIES4 Bally’s Las Vegas Flamingo Las Vegas Paris Las Vegas Planet Hollywood The LINQ Horseshoe Baltimore Caesars Danville Development OWNED GOLF COURSES Cascata, Boulder City, NV Rio Secco, Henderson, NV Grand Bear, Saucier, MS Chariot Run, Laconia, IN PENDING DISPOSITION2 Harrah’s Louisiana Downs 83% 6% 5% 3% 2%100% 74% 26% Regional 69% 31% Las Vegas Regional Las Vegas TENANT RENT DIVERSIFICATION GEOGRAPHIC RENT DIVERSIFICATION At Formation (2017) Current5 At Formation (2017) Current5 VICI CONTINUES TO DIVERSIFY ITS RENT BASE 17 PENDING ACQUISITION1 The Venetian Resort and Sands Expo and Convention Center North Kansas City Tunica Resorts / Robinsonville Bossier City Las Vegas Lake Tahoe / Reno Council Bluffs Joliet / Hammond Metropolis Detroit New Orleans Laughlin Biloxi Philadelphia Atlantic City Louisville Cincinnati Cleveland

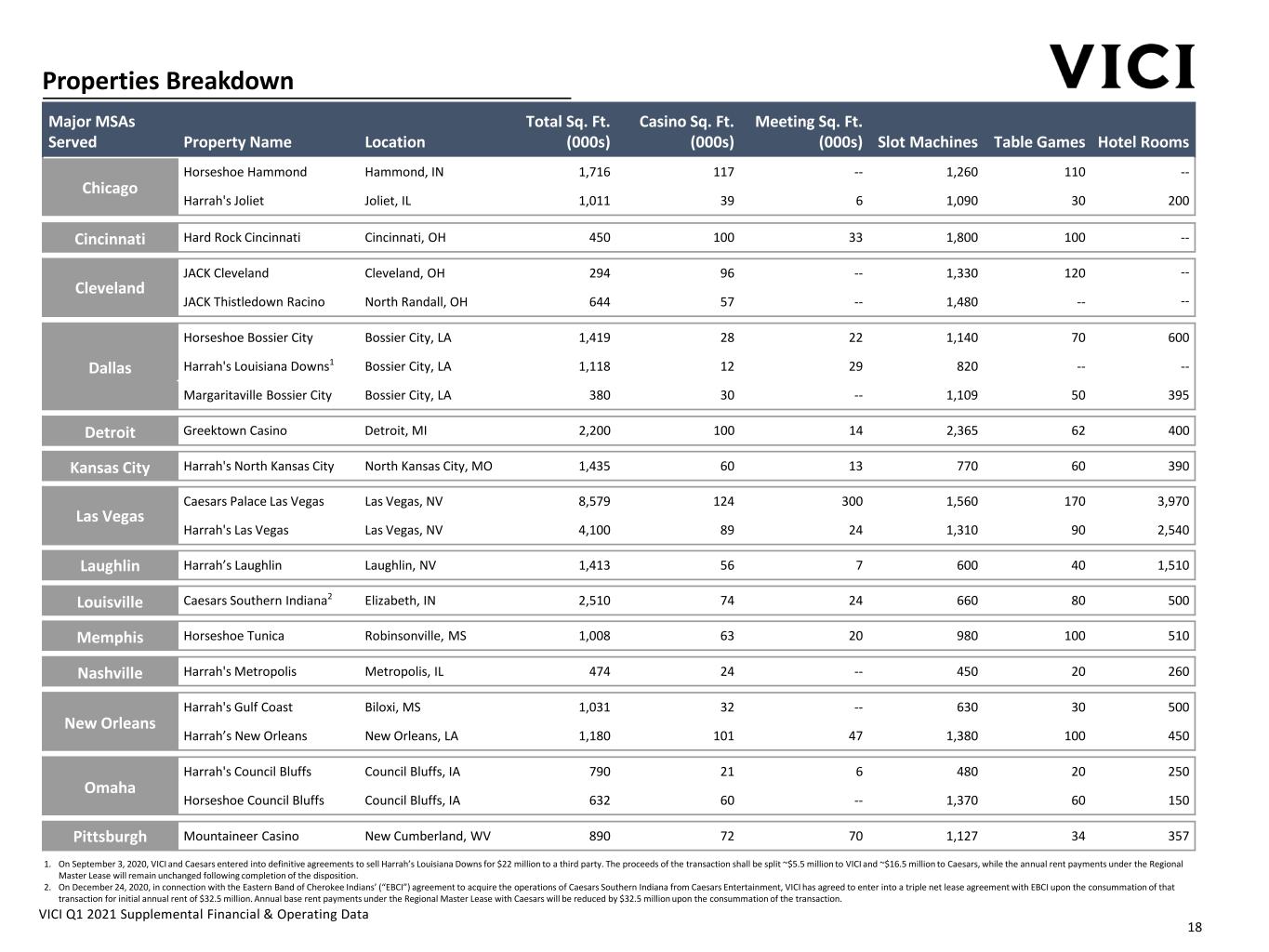

VICI Q1 2021 Supplemental Financial & Operating Data Properties Breakdown 1. On September 3, 2020, VICI and Caesars entered into definitive agreements to sell Harrah’s Louisiana Downs for $22 million to a third party. The proceeds of the transaction shall be split ~$5.5 million to VICI and ~$16.5 million to Caesars, while the annual rent payments under the Regional Master Lease will remain unchanged following completion of the disposition. 2. On December 24, 2020, in connection with the Eastern Band of Cherokee Indians’ (“EBCI”) agreement to acquire the operations of Caesars Southern Indiana from Caesars Entertainment, VICI has agreed to enter into a triple net lease agreement with EBCI upon the consummation of that transaction for initial annual rent of $32.5 million. Annual base rent payments under the Regional Master Lease with Caesars will be reduced by $32.5 million upon the consummation of the transaction. Major MSAs Served Property Name Location Total Sq. Ft. (000s) Casino Sq. Ft. (000s) Meeting Sq. Ft. (000s) Slot Machines Table Games Hotel Rooms Chicago Horseshoe Hammond Hammond, IN 1,716 117 -- 1,260 110 -- Harrah's Joliet Joliet, IL 1,011 39 6 1,090 30 200 Cincinnati Hard Rock Cincinnati Cincinnati, OH 450 100 33 1,800 100 -- Cleveland JACK Cleveland Cleveland, OH 294 96 -- 1,330 120 -- JACK Thistledown Racino North Randall, OH 644 57 -- 1,480 -- -- Dallas Horseshoe Bossier City Bossier City, LA 1,419 28 22 1,140 70 600 Harrah's Louisiana Downs1 Bossier City, LA 1,118 12 29 820 -- -- Margaritaville Bossier City Bossier City, LA 380 30 -- 1,109 50 395 Detroit Greektown Casino Detroit, MI 2,200 100 14 2,365 62 400 Kansas City Harrah's North Kansas City North Kansas City, MO 1,435 60 13 770 60 390 Las Vegas Caesars Palace Las Vegas Las Vegas, NV 8,579 124 300 1,560 170 3,970 Harrah's Las Vegas Las Vegas, NV 4,100 89 24 1,310 90 2,540 Laughlin Harrah’s Laughlin Laughlin, NV 1,413 56 7 600 40 1,510 Louisville Caesars Southern Indiana 2 Elizabeth, IN 2,510 74 24 660 80 500 Memphis Horseshoe Tunica Robinsonville, MS 1,008 63 20 980 100 510 Nashville Harrah's Metropolis Metropolis, IL 474 24 -- 450 20 260 New Orleans Harrah's Gulf Coast Biloxi, MS 1,031 32 -- 630 30 500 Harrah’s New Orleans New Orleans, LA 1,180 101 47 1,380 100 450 Omaha Harrah's Council Bluffs Council Bluffs, IA 790 21 6 480 20 250 Horseshoe Council Bluffs Council Bluffs, IA 632 60 -- 1,370 60 150 Pittsburgh Mountaineer Casino New Cumberland, WV 890 72 70 1,127 34 357 18

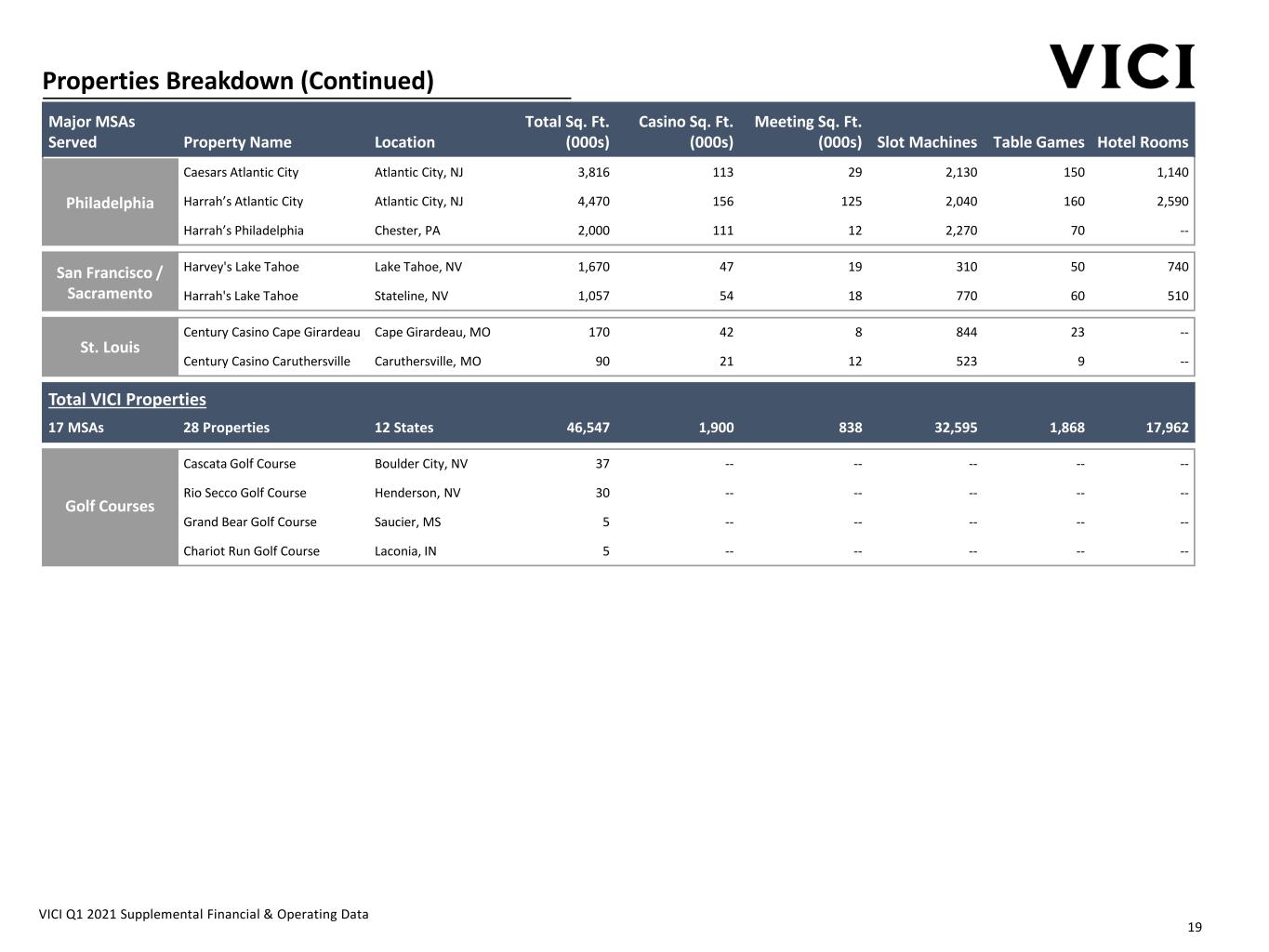

VICI Q1 2021 Supplemental Financial & Operating Data Properties Breakdown (Continued) Major MSAs Served Property Name Location Total Sq. Ft. (000s) Casino Sq. Ft. (000s) Meeting Sq. Ft. (000s) Slot Machines Table Games Hotel Rooms Philadelphia Caesars Atlantic City Atlantic City, NJ 3,816 113 29 2,130 150 1,140 Harrah’s Atlantic City Atlantic City, NJ 4,470 156 125 2,040 160 2,590 Harrah’s Philadelphia Chester, PA 2,000 111 12 2,270 70 -- San Francisco / Sacramento Harvey's Lake Tahoe Lake Tahoe, NV 1,670 47 19 310 50 740 Harrah's Lake Tahoe Stateline, NV 1,057 54 18 770 60 510 St. Louis Century Casino Cape Girardeau Cape Girardeau, MO 170 42 8 844 23 -- Century Casino Caruthersville Caruthersville, MO 90 21 12 523 9 -- Total VICI Properties 17 MSAs 28 Properties 12 States 46,547 1,900 838 32,595 1,868 17,962 Golf Courses Cascata Golf Course Boulder City, NV 37 -- -- -- -- -- Rio Secco Golf Course Henderson, NV 30 -- -- -- -- -- Grand Bear Golf Course Saucier, MS 5 -- -- -- -- -- Chariot Run Golf Course Laconia, IN 5 -- -- -- -- -- 19

VICI Q1 2021 Supplemental Financial & Operating Data Summary of Current Lease Terms 1. Regional Master Lease consists of 17 Caesars properties leased from VICI and the Las Vegas Master Lease consists of Caesars Palace Las Vegas and Harrah’s Las Vegas. 2. Cash rent amounts are presented prior to accounting for the portion of rent payable to the 20% JV partner at Harrah’s Joliet. After adjusting for the portion of rent payable to the 20% JV partner, Current Annual Cash Rent is $664.2 million. 3. Rent adjustments in the Regional Master Lease and Las Vegas Master Lease occur in lease years based on a lease commencement date of October 6, 2017. 4. Upon the consummation of the Eldorado Transaction, the Caesars Lease Agreements were extended such that each lease has a full 15-year initial lease term from the date of consummation. Regional Master Lease and Joliet Lease1 Las Vegas Master Lease1 Margaritaville Bossier City Lease Greektown Lease Tenant Caesars Entertainment Caesars Entertainment Penn National Gaming Penn National Gaming Current Annual Cash Rent $672.5 Million2 $402.6 Million $23.5 Million $55.6 Million Current Lease Year Nov. 1, 2020 – Oct. 31, 2021 Lease Year 4 Nov. 1, 2020 – Oct. 31, 2021 Lease Year 4 Feb. 1, 2021 – Jan. 31, 2022 Lease Year 3 June 1, 2020 – May 31, 2021 Lease Year 2 Annual Escalator 1.5% in years 2-5 >2% / change in CPI thereafter, subject to 2% floor >2% / change in CPI, subject to 2% floor 2% for Building Base Rent ($17.2 Million) 2% for Building Base Rent ($42.8 Million) Coverage Floor None None Net Revenue to Rent Ratio: 6.1x beginning in year 2 Net Revenue to Rent Ratio to be mutually agreed upon prior to the commencement of lease year 4 Rent Adjustment3 Year 8: 70% Base / 30% Variable Year 11 & 16: 80% Base / 20% Variable Year 8, 11 & 16: 80% Base / 20% Variable Percentage (Variable) Rent adjusts every 2 years beginning in year 3 Percentage (Variable) Rent adjusts every 2 years beginning in year 3 Variable Rent Adjustment Mechanic3 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 0-2 Year 11: Avg. of years 8-10 less avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 8-10 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 0-2 Year 11: Avg. of years 8-10 less avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 8-10 4% of the average net revenues for trailing 2-year period less threshold amount 4% of the average net revenues for trailing 2-year period less threshold amount Term 18-year initial term with four 5-year renewal options4 15-year initial term with four 5-year renewal options Guarantor Caesars Entertainment, Inc. Caesars Entertainment, Inc. Penn National Gaming Penn National Gaming Capex $405.2mm (together with CPLV) required over rolling 3-year period at $114.5mm minimum per year ($311mm allocated to regional assets, $84mm allocated to CPLV, and $10.2mm allocated by the tenant) CPLV: $84mm (included in the $405.2mm required under Regional Master Lease) over rolling 3-year period HLV: $171mm between 2017 and 2021; Capex at 1% of net revenue thereafter Minimum 1% of Net Revenue based on a four-year average Minimum 1% of Net Revenue based on a four-year average 20

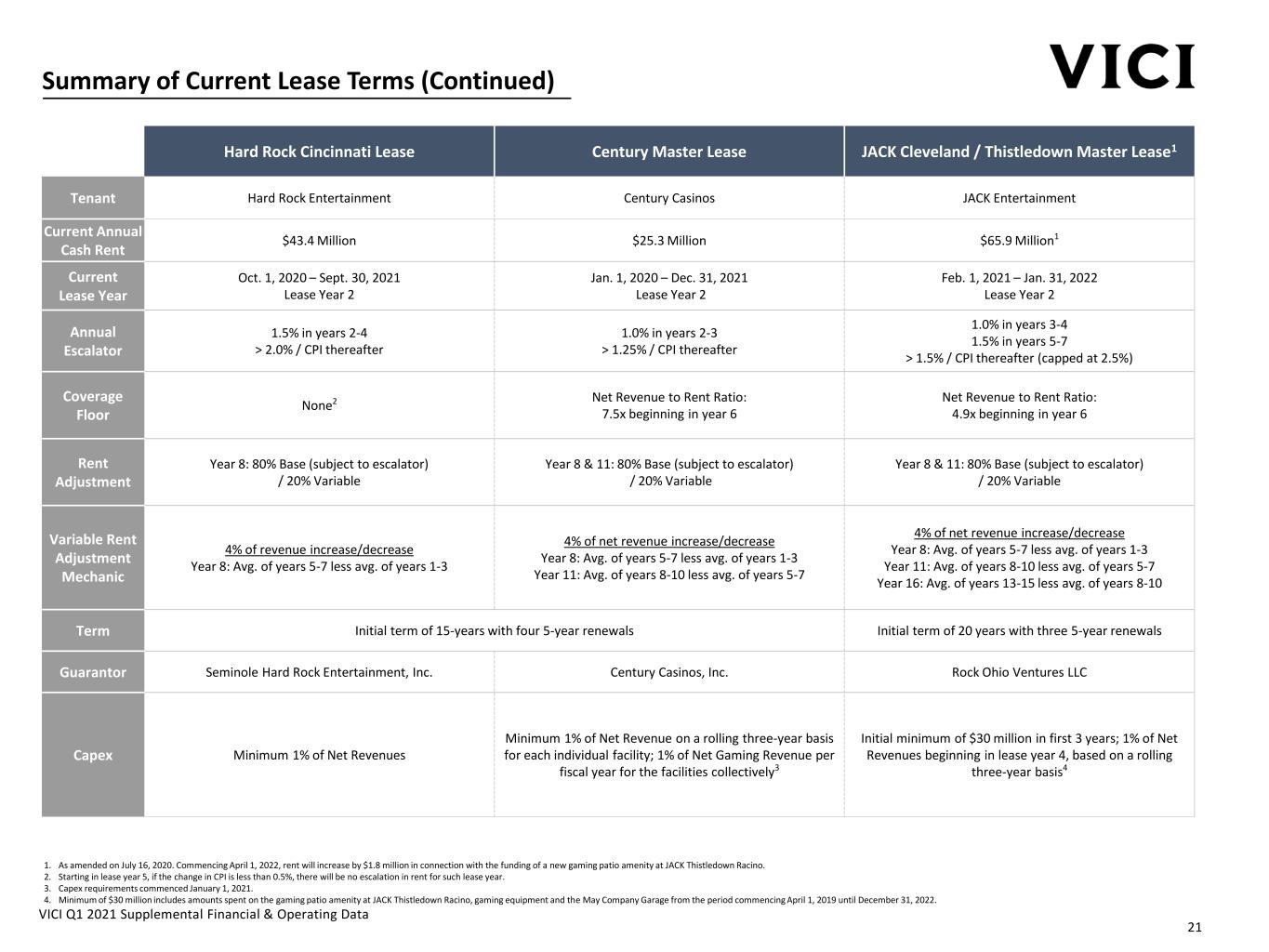

VICI Q1 2021 Supplemental Financial & Operating Data Summary of Current Lease Terms (Continued) Hard Rock Cincinnati Lease Century Master Lease JACK Cleveland / Thistledown Master Lease1 Tenant Hard Rock Entertainment Century Casinos JACK Entertainment Current Annual Cash Rent $43.4 Million $25.3 Million $65.9 Million1 Current Lease Year Oct. 1, 2020 – Sept. 30, 2021 Lease Year 2 Jan. 1, 2020 – Dec. 31, 2021 Lease Year 2 Feb. 1, 2021 – Jan. 31, 2022 Lease Year 2 Annual Escalator 1.5% in years 2-4 > 2.0% / CPI thereafter 1.0% in years 2-3 > 1.25% / CPI thereafter 1.0% in years 3-4 1.5% in years 5-7 > 1.5% / CPI thereafter (capped at 2.5%) Coverage Floor None2 Net Revenue to Rent Ratio: 7.5x beginning in year 6 Net Revenue to Rent Ratio: 4.9x beginning in year 6 Rent Adjustment Year 8: 80% Base (subject to escalator) / 20% Variable Year 8 & 11: 80% Base (subject to escalator) / 20% Variable Year 8 & 11: 80% Base (subject to escalator) / 20% Variable Variable Rent Adjustment Mechanic 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 1-3 4% of net revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 1-3 Year 11: Avg. of years 8-10 less avg. of years 5-7 4% of net revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 1-3 Year 11: Avg. of years 8-10 less avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 8-10 Term Initial term of 15-years with four 5-year renewals Initial term of 20 years with three 5-year renewals Guarantor Seminole Hard Rock Entertainment, Inc. Century Casinos, Inc. Rock Ohio Ventures LLC Capex Minimum 1% of Net Revenues Minimum 1% of Net Revenue on a rolling three-year basis for each individual facility; 1% of Net Gaming Revenue per fiscal year for the facilities collectively3 Initial minimum of $30 million in first 3 years; 1% of Net Revenues beginning in lease year 4, based on a rolling three-year basis4 1. As amended on July 16, 2020. Commencing April 1, 2022, rent will increase by $1.8 million in connection with the funding of a new gaming patio amenity at JACK Thistledown Racino. 2. Starting in lease year 5, if the change in CPI is less than 0.5%, there will be no escalation in rent for such lease year. 3. Capex requirements commenced January 1, 2021. 4. Minimum of $30 million includes amounts spent on the gaming patio amenity at JACK Thistledown Racino, gaming equipment and the May Company Garage from the period commencing April 1, 2019 until December 31, 2022. 21

VICI Q1 2021 Supplemental Financial & Operating Data Recently Announced Transaction Activity 1. On March 2, 2021, VICI entered into definitive agreements to acquire from Las Vegas Sands Corp. all of the land and real estate assets associated with the Venetian Resort for $4.0 billion in cash. An affiliate of certain funds managed by affiliates of Apollo Global Management, Inc. has agreed to acquire the operating assets of the Venetian Resort for $2.25 billion, subject to customary closing conditions and regulatory approval. 2. On December 24, 2020, VICI agreed to enter into a triple net lease agreement with EBCI with respect to the real property associated with Caesars Southern Indiana in connection with the consummation of EBCI’s agreement to acquire the operations of Caesars Southern Indiana from Caesars, subject to customary closing conditions and regulatory approval. Annual base rent payments under the Regional Master Lease with Caesars will be reduced by $32.5 million upon the consummation of the transaction. 3. On September 3, 2020, VICI and Caesars entered into definitive agreements to sell Harrah’s Louisiana Downs for $22 million to a third party. The proceeds of the transaction shall be split ~$5.5 million to VICI and ~$16.5 million to Caesars, while the annual rent payments under the Regional Master Lease will remain unchanged following completion of the disposition. The transaction remains subject to customary closing conditions and regulatory approval. ($ in millions) Property Announcement Date Status Rent Yield Purchase Price / Sale Proceeds Tenant Pending Transactions The Venetian Resort and Sands Expo and Convention Center1 (Las Vegas, NV) $250.0 6.25% $4,000.0 Expected H2 2021 Affiliates of Apollo Global Management, Inc. Harrah’s Louisiana Downs3 (Bossier City, LA) 9/3/2020 No Change to Rent under Regional Master Lease N/A ~$5.5In Progress N/A Pending Dispositions 22 3/3/2021 Caesars Southern Indiana2 (Elizabeth, IN) 12/24/2020 $32.5 N/A N/A Expected Q3 2021 Eastern Band of Cherokee Indians

VICI Q1 2021 Supplemental Financial & Operating Data Investment & Capital Markets Activities ($ in millions) Recently Completed Transactions Financing Activities Property / Loan Announcement Date Closing Date Rent / Income Multiple / Cap Rate / Yield Price / Proceeds / Loan Size Tenant / Borrower Unsecured Notes Offering of $2,500 million • On February 5, 2020, issued $750 million 5-Year Notes at 3.500%, $750 million 7-Year Notes at 3.750% and $1,000 million 10.5-Year Notes at 4.125% and redeemed in full the $498 million Second Lien Secured Notes on February 20, 2020 Repriced Term Loan B Facility to L + 1.75% • On January 24, 2020, repriced the Term Loan B Facility from L + 2.00% to L + 1.75% Inaugural Unsecured Notes Offering of $2,250 million • On November 26, 2019, issued $1,000 million 7-Year Notes at 4.250% and $1,250 million 10-Year Notes at 4.625% and prepaid the $1,550 million CPLV CMBS debt $2,001 million Follow-On Equity Offering at $29.00 per share • On March 3, 2021, offered 69.0 million shares to be issued upon settlement of the forward sale agreements $662 million Follow-On Equity Offering at $22.15 per share • On June 19, 2020, offered 29.9 million shares to be issued upon settlement of the forward sale agreement • On September 28, 2020, settled 3 million shares of the forward sale agreement Up to $750 million At-the-Market (“ATM”) Equity Program • During February 2020, issued 7.5 million shares raising net proceeds of $200 million • During Q1 2019, issued 6.1 million shares raising net proceeds of $128 million Debt Capital Markets Equity Capital Markets Harrah’s New Orleans Harrah’s Atlantic City Harrah’s Laughlin 6/24/2019 $154.0 11.8x / 8.4% $1,823.0 CPLV and HLV Lease Modifications 7/20/2020 Caesars Entertainment 6/24/2019 $98.5 14.3x / 7.0% $1,404.07/20/2020 Caesars Entertainment Caesars Forum Mortgage Loan 6/15/2020 $30.8 7.7% $400.09/18/2020 Caesars Entertainment Chelsea Piers New York - 8/31/2020 $4.6 7.0% $65.01 Chelsea Piers JACK Entertainment Loan Various $6.3 9.0% $70.02Various JACK Entertainment Recently Completed Dispositions Harrah’s Reno 1/15/2020 N/A $31.19/30/2020 N/A No Change to Rent under Regional Master Lease 1. Loan includes $65 million initial term loan and a $15 million delayed draw term loan at borrower’s option. 2. On March 26, 2021, the borrower elected to make a prepayment in an amount of $20.0 million, plus accrued and unpaid interest, reducing the aggregate principal amount of the JACK Entertainment Loan to $50.0 million. Bally’s Atlantic City 4/24/2020 No Change to Rent under Regional Master Lease N/A $19.011/18/2020 N/A JACK Cleveland Casino JACK Thistledown Racino 10/28/2019 $65.9 12.8x / 7.8% $843.31/24/2020 JACK Entertainment 23

VICI Q1 2021 Supplemental Financial & Operating Data Embedded Growth Pipeline Location / Jurisdiction LV Strip LV Strip LV Strip LV Strip LV Strip Anderson, IN Shelbyville, IN LV Strip Baltimore, MD New York, NY Danville, VA Casino Space Sq.Ft. 68,400 72,300 95,300 64,500 32,900 55,300 105,100 -- 122,000 -- -- # of Tables 70 110 100 110 60 28 61 -- 210 -- -- # of Slots 940 1,120 980 1,070 780 1,710 2,070 -- 2,200 -- -- # of Rooms 2,810 3,450 2,920 2,520 2,250 -- -- -- -- -- -- Highlights • Opportunity to expand presence on Las Vegas Strip and potential to diversify tenant base • Highly attractive Indianapolis market with the potential for growth from table games • Bolsters Las Vegas asset base with newly built, world class convention center • Furthers geographic diversification with urban core real estate • Iconic experiential asset with diverse revenue streams expands VICI’s investment universe • Geographical diversification with a new asset in a recently legalized state with limited casino licenses Terms • Two ROFRs on Las Vegas Strip assets to be sold by Caesars (whether as a “WholeCo” or “OpCo/PropCo” sale) – First asset can only be Bally's, Flamingo, Paris or Planet Hollywood – Second asset can be from the same group plus The LINQ • Terms subject to negotiation • 13.0x call / 12.5x put, commencing on Jan. 1, 2022 and expiring on Dec. 31, 2024 • 13.0x put from Jan. 1, 2024 to Dec. 31, 2024 • 13.0x call from Sept. 18, 2025 to Dec. 31, 2026 • Terms subject to negotiation • Agreement with Chelsea Piers for the life of the loan, subject to a minimum of 5 years, that could lead to a longer- term financing partnership in the future • As part of the Caesars Southern Indiana transaction, the parties have agreed to negotiate a ROFR for the real estate related to the pending development of a new casino resort in Danville Put / Call Agreements Two Las Vegas Strip ROFRs Horseshoe Baltimore ROFR1 First Asset Second Asset 1. Subject to any consent required from Caesars’ joint venture partners with respect to Horseshoe Baltimore. 2. The Danville development ROFR remains subject to negotiation of definitive documentation and applicable regulatory and other governmental approvals. Chelsea Piers New York Caesars Danville Development ROFR2 24

VICI Q1 2021 Supplemental Financial & Operating Data 25 Definitions of Non-GAAP Financial Measures FFO is a non-GAAP financial measure that is considered a supplemental measure for the real estate industry and a supplement to GAAP measures. Consistent with the definition used by The National Association of Real Estate Investment Trusts (NAREIT), we define FFO as net income (or loss) attributable to common stockholders (computed in accordance with GAAP) excluding (i) gains (or losses) from sales of certain real estate assets, (ii) depreciation and amortization related to real estate, (iii) gains and losses from change in control and (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. AFFO is a non-GAAP financial measure that we use as a supplemental operating measure to evaluate our performance. We calculate AFFO by adding or subtracting from FFO non-cash leasing and financing adjustments, non-cash change in allowance for credit losses, non-cash stock-based compensation expense, transaction costs incurred in connection with the acquisition of real estate investments, amortization of debt issuance costs and original issue discount, other non-cash interest expense, non-real estate depreciation (which is comprised of the depreciation related to our golf course operations), capital expenditures (which are comprised of additions to property, plant and equipment related to our golf course operations), impairment charges related to non-depreciable real estate, gains (or losses) on debt extinguishment, other non-recurring non-cash transactions (such as non-cash gain upon lease modification) and non-cash adjustments attributable to non-controlling interest with respect to certain of the foregoing. We calculate Adjusted EBITDA by adding or subtracting from AFFO contractual interest expense and interest income (collectively, interest expense, net) and income tax expense. These non-GAAP financial measures: (i) do not represent cash flow from operations as defined by GAAP; (ii) should not be considered as an alternative to net income as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. In addition, these measures should not be viewed as measures of liquidity, nor do they measure our ability to fund all of our cash needs, including our ability to make cash distributions to our stockholders, to fund capital improvements, or to make interest payments on our indebtedness. Investors are also cautioned that FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA, as presented, may not be comparable to similarly titled measures reported by other real estate companies, including REITs, due to the fact that not all real estate companies use the same definitions. Our presentation of these measures does not replace the presentation of our financial results in accordance with GAAP.