Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - LANTRONIX INC | lantronix_ex9901.htm |

| EX-10.2 - SECOND LIEN COMMITMENT LETTER - LANTRONIX INC | lantronix_ex1002.htm |

| EX-10.1 - FIRST LIEN COMMITMENT LETTER - LANTRONIX INC | lantronix_ex1001.htm |

| EX-2.1 - SECURITIES PURCHASE AGREEMENT - LANTRONIX INC | lantronix_ex0201.htm |

| 8-K - FORM 8-K - LANTRONIX INC | lantronix_8k.htm |

Exhibit 99.2

1 www.lantronix.com

2 Lantronix to Acquire Transition Networks, Net2Edge from Communications System, Inc. Bringing scale, efficiencies, and accretion to turnkey IoT solutions providers www.lantronix.com 2 RA4

2 This presentation contains forward - looking statements, including statements concerning our business and product development plan s and strategies, the perceived benefits of our products and corporate acquisitions, and our future growth and financial performance. Any statement r elating to our plans, goals, expectations or any future event should be considered a forward - looking statement. While we have based our forward - looking state ments on our current assumptions and expectations, forward - looking statements are not guarantee of future performance and are subject to substantial risks and uncertainties. As a result, our actual results could differ materially from those indicated in our forward - looking statements, and you should not re ly on any of these forward - looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in th e f orward - looking statements include the impact of the COVID - 19 pandemic; volatility in global economic conditions; product development and marketing risks; risks re lated to manufacturing and international operations; difficulties associated with our suppliers, distributors or resellers; intense competition in our i ndu stry; changes in applicable U.S. and foreign government laws, regulations, and tariffs; risks associated with acquisitions, divestitures, mergers, or joint ventur es; intellectual property and cybersecurity risks; the outcome of legal proceedings; and other risks and uncertainties described in “Risk Factors” in our Annual Report o n F orm 10 - K filed with the Securities and Exchange Commission, or SEC, as well as in our other filings with the SEC. In addition, new risks emerge from time - to - time a nd we cannot predict all future risks or assess the impact of all risks to our business. Our forward - looking statements are based on our view as of the date the y are made. Except as required by law, we expressly disclaim any intent or obligation to update any forward - looking statements after the date hereof because of ne w information, future events or otherwise. This presentation references certain non - GAAP financial measures, including non - GAAP net income (loss). A reconciliation of the non - GAAP financial measures to the corresponding GAAP financial measures, along with important information regarding our disclosure of the non - GAAP financia ls, is provided in Appendix A. FORWARD LOOKING STATEMENTS

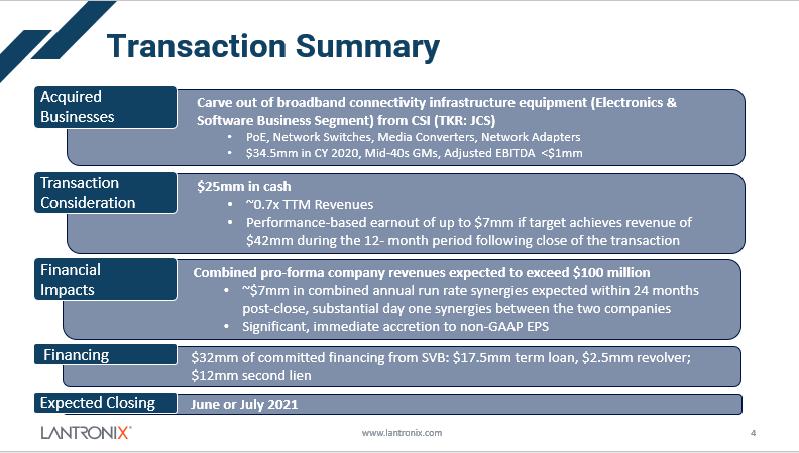

4 www.lantronix.com Transaction Summary Carve out of broadband connectivity infrastructure equipment (Electronics & Software Business Segment) from CSI (TKR: JCS) • PoE, Network Switches, Media Converters, Network Adapters • $34.5mm in CY 2020, Mid - 40s GMs, Adjusted EBITDA <$1mm $25mm in cash • ~0.7x TTM Revenues • Performance - based earnout of up to $7mm if target achieves revenue of $42mm during the 12 - month period following close of the transaction Transaction Consideration Acquired Businesses Combined pro - forma company revenues expected to exceed $100 million • ~$7mm in combined annual run rate synergies expected within 24 months post - close, substantial day one synergies between the two companies • Significant, immediate accretion to non - GAAP EPS Financial Impacts $32mm of committed financing from SVB: $17.5mm term loan, $2.5mm revolver; $12mm second lien June or July 2021 Financing Expected Closing

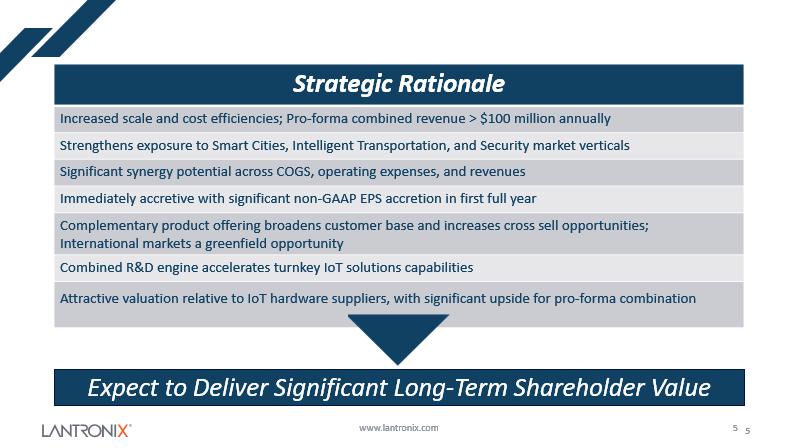

5 Strategic Rationale Increased scale and cost efficiencies; Pro - forma combined revenue > $100 million annually Strengthens exposure to Smart Cities, Intelligent Transportation, and Security market verticals Significant synergy potential across COGS, operating expenses, and revenues Immediately accretive with significant non - GAAP EPS accretion in first full year Complementary product offering broadens customer base and increases cross sell opportunities; International markets a greenfield opportunity Combined R&D engine accelerates turnkey IoT solutions capabilities Attractive valuation relative to IoT hardware suppliers, with significant upside for pro - forma combination www.lantronix.com 5 Expect to Deliver Significant Long - Term Shareholder Value

6 • Remote Management (NEM, NDM, NIM) • Datacenter / MDF • Branch Office / Unmanned Site • External IoT • Industrial Automation • Logistics • Fleet • Healthcare • Security • Embedded IoT • Edge Connectivity • Edge Computing • RF Mesh / SDRF • Network Infrastructure • Switches • Media Converters • Adapters & Optics • PoE • Segmentation • Traditional (Now) • Intelligent (Future) • Verticals • Smart Cities • Enterprise • Federal • Service Providers Complementary Products New Verticals Expertise www.lantronix.com 6

7 Product Development Leveraging Each Other’s Competencies www.lantronix.com 7 Cellular Connectivity Open Q, Computing SaaS Switching Gateways Remote Management PoE Service Providers Federal/Municipalities Smart Cities

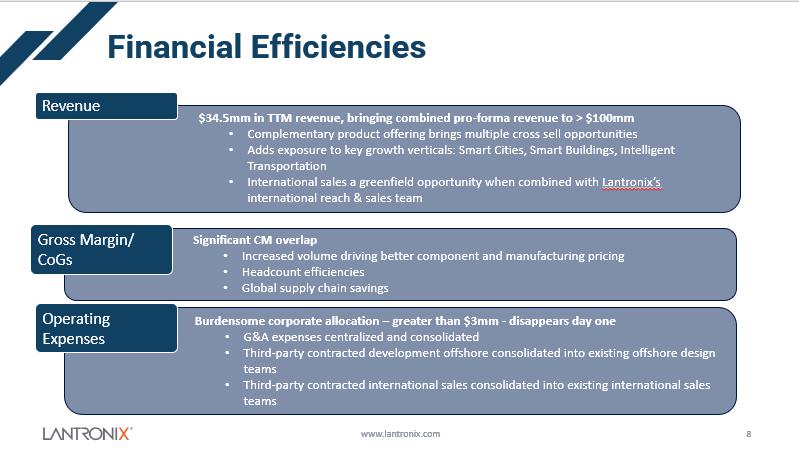

8 www.lantronix.com Financial Efficiencies $34.5mm in TTM revenue, bringing combined pro - forma revenue to > $100mm • Complementary product offering brings multiple cross sell opportunities • Adds exposure to key growth verticals: Smart Cities, Smart Buildings, Intelligent Transportation • Increased mind share/shelf space at largest common distributors • International sales a greenfield opportunity when combined with Lantronix’s international reach & sales team Significant CM overlap • Increased volume driving better component and manufacturing pricing • Headcount efficiencies • Global supply chain savings Gross Margin/ CoGs Revenue Burdensome corporate allocation – greater than $3mm - disappears day one • G&A expenses centralized and consolidated • Third - party contracted development offshore consolidated into existing offshore design teams • Third - party contracted international sales consolidated into existing international sales teams Operating Expenses PP1 RA1 RA2 PP2 RA3