Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KITE REALTY GROUP TRUST | krg-20210429.htm |

Number of Operating Retail Properties Total Retail GLA (SF) Operating Retail Portfolio Percent Leased Annualized Base Rent (ABR) Per SF % of ABR from assets with a grocery component Equity Market Cap1 Enterprise Value1 Net Debt to EBITDA2 Moody’s / S&P Ratings Note: Unless otherwise indicated, the source of all Company data is publicly available information that has been furnished or filed with the Securities and Exchange Commission as of March 31, 2021. 1. As of 04/28/2021. 2. Reflects as if ground lease portfolio was sold at the beginning of the 1st quarter. 3. Peers include REG, RPAI, BRX, RPT, SITC, ROIC, US and KIM, subsequent to the merger with WRI. 4. Definition per Green Street Advisors. • Only open-air retail REIT focused on Southern and Western US (aka “Warmer & Cheaper”) - 78% of ABR from Warmer & Cheaper markets - Closest peer3 has less than 50% from similar markets • Southern and Western US will continue to benefit from current and projected demographic trends • High-quality portfolio with diverse tenant base • Strong balance sheet with over $600 million of available liquidity • Experienced, disciplined team focused on operational excellence and value creation • Community-oriented shopping centers with 58% of ABR from community centers4 • Pandemic dislocation = growth opportunity

Note: Portfolio stats are based on the retail operating portfolio. 1. Sources: PopStats, demographic stats are based on a 3-mile radius. ABR PSF Average Population1 Average # of Households1 Average HH Income1 % of College Graduates1 % of ABR with Grocer % of ABR in Top 50 MSAs Las Vegas Indianapolis New York Raleigh Dallas / Ft. Worth Houston Naples Fort Lauderdale Oklahoma City Salt Lake City Charlotte Miami Port St. Lucie Orlando Tampa

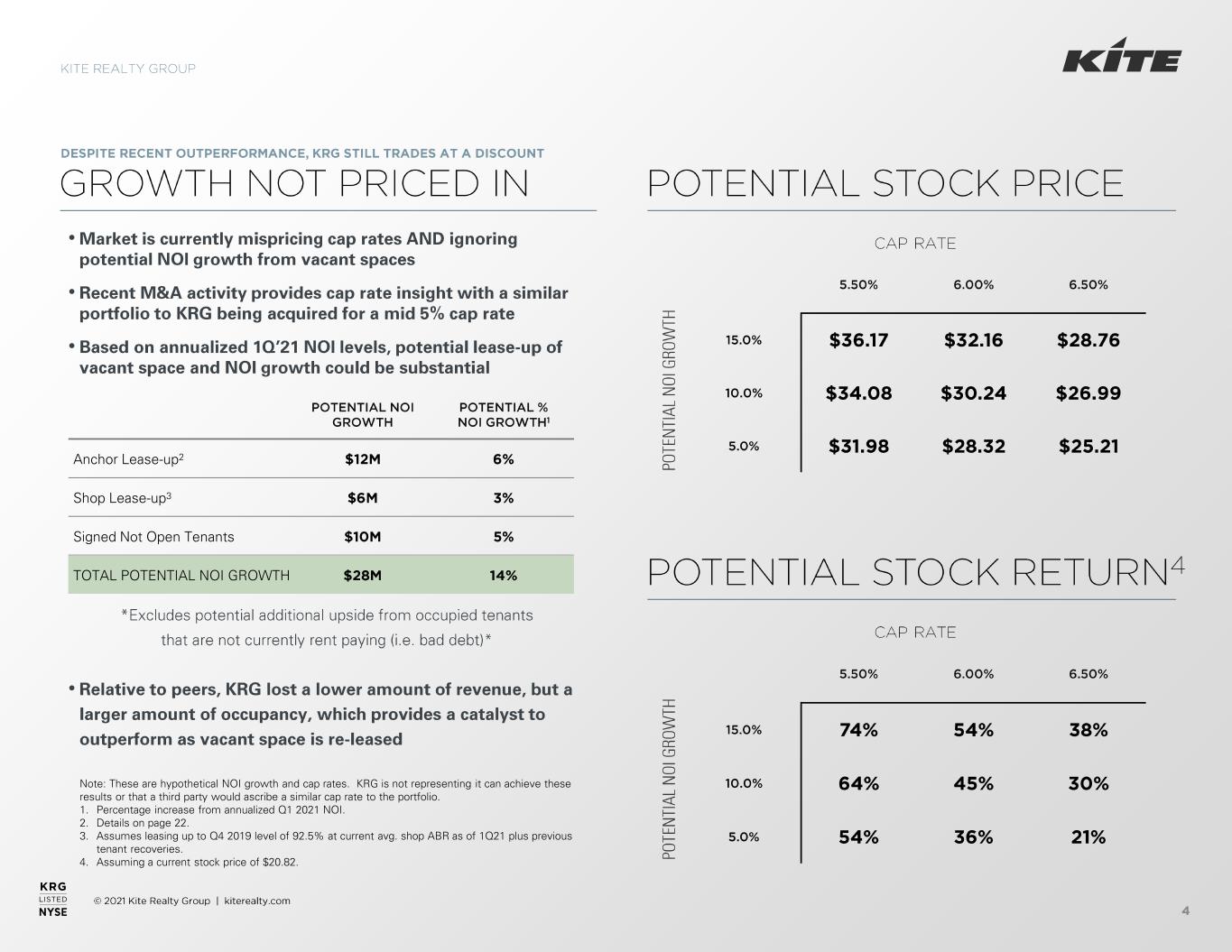

Note: These are hypothetical NOI growth and cap rates. KRG is not representing it can achieve these results or that a third party would ascribe a similar cap rate to the portfolio. 1. Percentage increase from annualized Q1 2021 NOI. 2. Details on page 22. 3. Assumes leasing up to Q4 2019 level of 92.5% at current avg. shop ABR as of 1Q21 plus previous tenant recoveries. 4. Assuming a current stock price of $20.82. • • • • Anchor Lease-up2 Shop Lease-up3 Signed Not Open Tenants TOTAL POTENTIAL NOI GROWTH

NAREIT FFO impacted $0.2M from 2020 Collection Impact Negatively impacted by COVID-19 Strong leasing volume continues Negatively impacted by COVID-19 Sector-leading collection % throughout the pandemic 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q211Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21

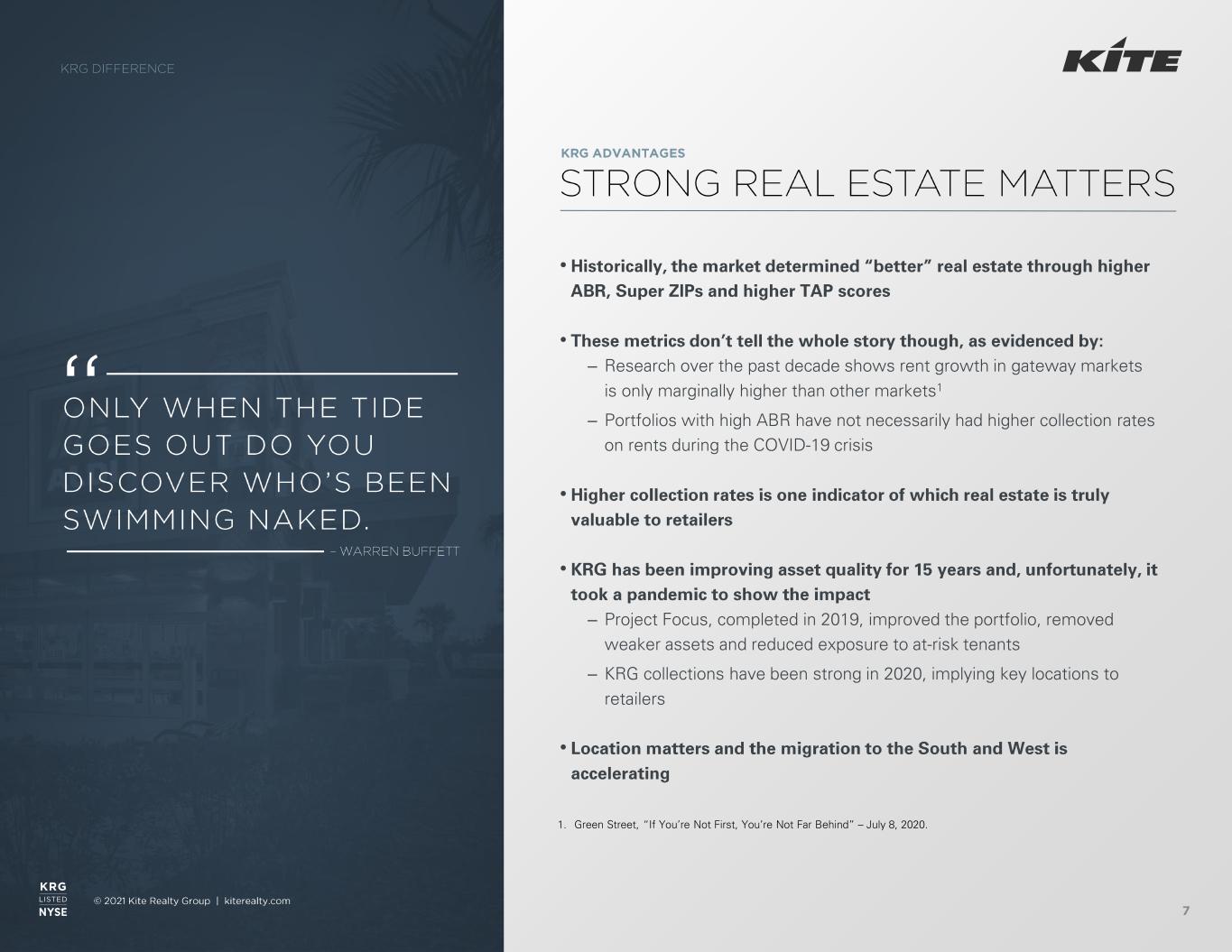

• • – Research over the past decade shows rent growth in gateway markets is only marginally higher than other markets1 – Portfolios with high ABR have not necessarily had higher collection rates on rents during the COVID-19 crisis • • – Project Focus, completed in 2019, improved the portfolio, removed weaker assets and reduced exposure to at-risk tenants – KRG collections have been strong in 2020, implying key locations to retailers • 1. Green Street, “If You’re Not First, You’re Not Far Behind” – July 8, 2020.

# of Operating Retail Properties # of States # of Markets South and West ABR Top Region (% of ABR) Top State (% of ABR) Top MSA (% of ABR) ABR Top Tenant (% of ABR) Net-debt-to-EBITDA Note: Based on retail operating portfolio in supplemental disclosures for YE 2004, 2015, and Q1 2021. 1. Reflects as if ground lease portfolio was sold at the beginning of the 1st quarter.

1. Per Green Street Advisors. 2. Based on ABR. Remaining 6% of portfolio are Lifestyle Centers or other assets. • • • • – Average Population: 76,300 – Average Household Income: $101,200 – Est. Annual 5-year Population Growth: 1.4%

• • # of leases signed Leased SF signed Year-over-year % change1 Blended GAAP Spread 1. Year-over-year leasing statistics have been adjusted for sold assets in 2019.

1. Credit rating from S&P as of April 15, 2021. 1 Publix Supermarkets, Inc. 2 The TJX Companies, Inc. 3 PetSmart, Inc. 4 Ross Stores, Inc. 5 Dick’s Sporting Goods, Inc. 6 Nordstrom Rack 7 Michaels Stores, Inc. 8 Burlington Stores, Inc. 9 National Amusements 10 Old Navy / Athleta Grocery / Drug Office / Communication Pet Stores Medical Hardware / Auto Banks Quick Service Restaurants Full Service Restaurants Soft Goods Discount Retailers Personal Service Fitness Sporting Goods Theaters Other Non-essential Professional Service

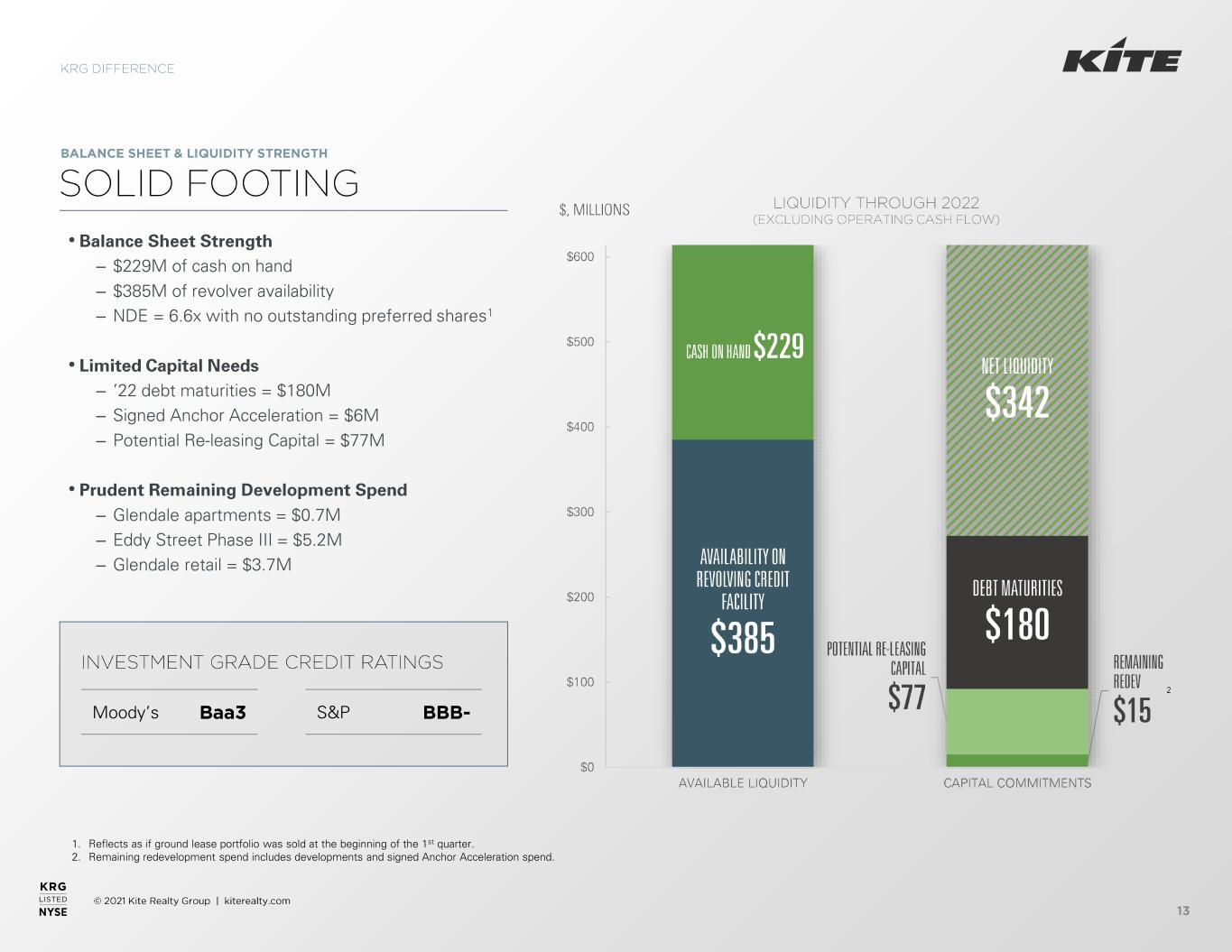

1. Reflects as if ground lease portfolio was sold at the beginning of the 1st quarter. 2. Remaining redevelopment spend includes developments and signed Anchor Acceleration spend. • – $229M of cash on hand – $385M of revolver availability – NDE = 6.6x with no outstanding preferred shares1 • – ’22 debt maturities = $180M – Signed Anchor Acceleration = $6M – Potential Re-leasing Capital = $77M • – Glendale apartments = $0.7M – Eddy Street Phase III = $5.2M – Glendale retail = $3.7M Moody’s S&P

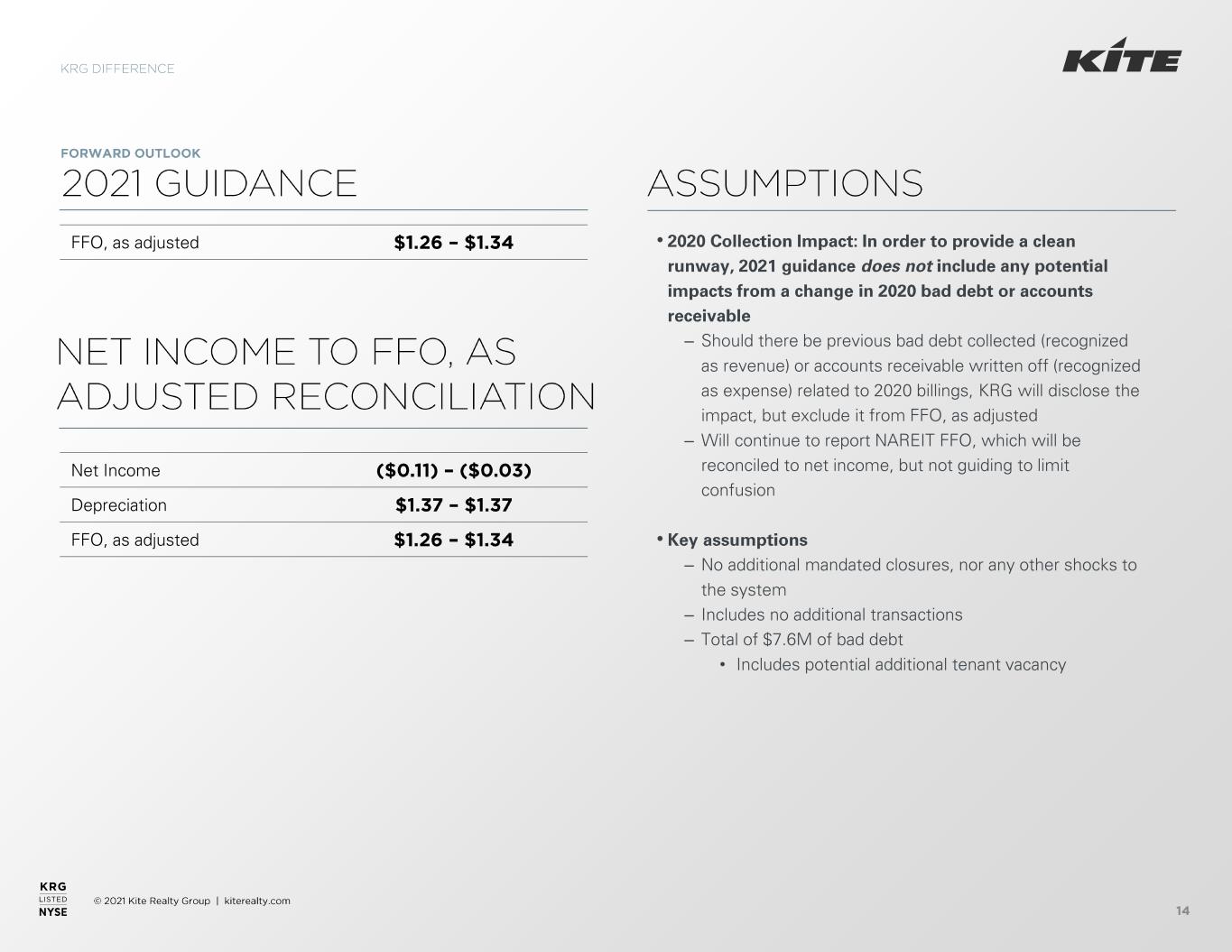

• – Should there be previous bad debt collected (recognized as revenue) or accounts receivable written off (recognized as expense) related to 2020 billings, KRG will disclose the impact, but exclude it from FFO, as adjusted – Will continue to report NAREIT FFO, which will be reconciled to net income, but not guiding to limit confusion • – No additional mandated closures, nor any other shocks to the system – Includes no additional transactions – Total of $7.6M of bad debt • Includes potential additional tenant vacancy FFO, as adjusted Net Income Depreciation FFO, as adjusted

• – Created an ESG Task Force – Publicly disclosed KRG’s ESG policy – Published an ESG brochure highlighting key stats and initiatives for each category – Filed inaugural GRESB report – Planted 5,100 trees in partnership with One Tree Planted and donating 51 additional trees in KRG’s local communities – Signed 62k sf leases containing green lease language as recognized by Green Lease Leaders • – Enabled work-from-home capabilities across the organization and focused on bringing employees back to the office at their own pace to ensure health and safety – Issued 27 loans for $2.2 million in the KRG Small Business Lending Program for our tenants – Discussed local and federal aid packages with Congressmen and Senators to ensure at-risk tenants have the necessary needs to survive this crisis

• – Convertible debt issuance proceeds will be used to fund 2022 maturities • – Leasing of pandemic dislocation is already under way • – BOPIS and curbside pick-up are here to stay and will continue to drive brick-and-mortar sales – Will benefit from expected tenant demand for open-air space • – Pursuing select redevelopments that will deliver appropriate risk- adjusted returns

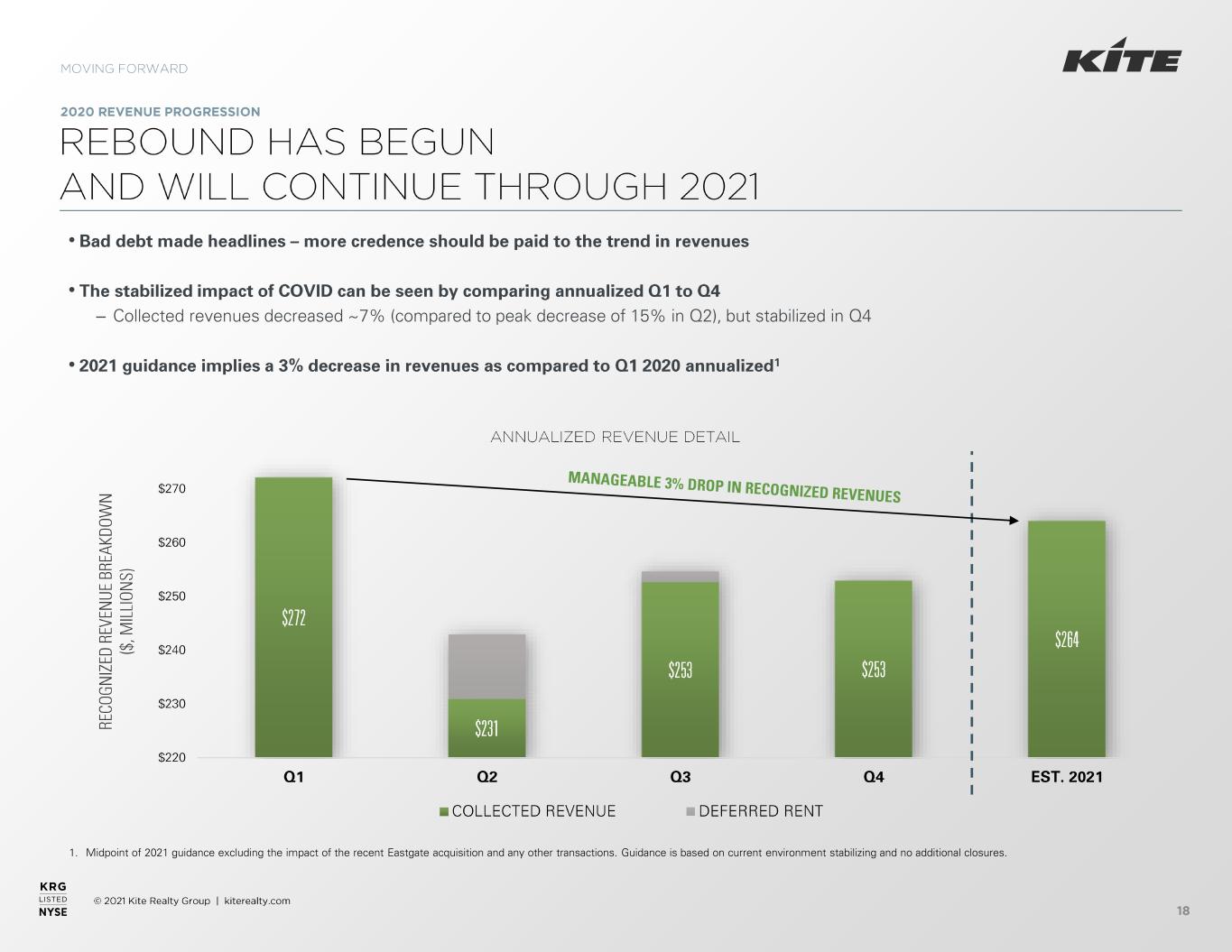

• • – Collected revenues decreased ~7% (compared to peak decrease of 15% in Q2), but stabilized in Q4 • 1. Midpoint of 2021 guidance excluding the impact of the recent Eastgate acquisition and any other transactions. Guidance is based on current environment stabilizing and no additional closures.

Note: Represents KRG’s retail operating portfolio as of March 31, 2021. 1. Includes 16 of 22 leases. 81.0% 83.0% 85.0% 87.0% 89.0% 91.0% 93.0% KRG REG WRI RPAI KIM RPT FRT SITC BRX UE AKR # of Leases Signed # of Different Tenants Signed Square Feet of New Leases Total Expected Cost Return on Capital Comparable Cash Lease Spread1 Comparable GAAP Lease Spread1 Source: Company filings. • • • – Over 85% of the bankruptcy dislocation, shown on the next slide, has been addressed or is in discussions • – The Big Box Surge success demonstrates a track record of turning disruption into an opportunity – Details on the current opportunity and progress to date are the following pages

1 Guitar Center 2 Francesca’s 3 Rubio’s Restaurant 4 New York Sports Club 5 Stein Mart 6 It’s Sugar 7 Ruby Tuesday 8 Ascena 9 Tailored Brands 10 24 Hour Fitness 11 GNC 12 Tuesday Morning 13 J Crew 14 Hair Cuttery 15 Earth Fare 16 Pier 1 Imports 17 AC Moore 18 Bar Louie 19 Destination Maternity 1. KRG’s exposure in number of locations and percentage of ABR shown prior to when the tenant filed bankruptcy. 2. Includes spaces assumed by tenants coming out of bankruptcy and spaces with an executed lease.

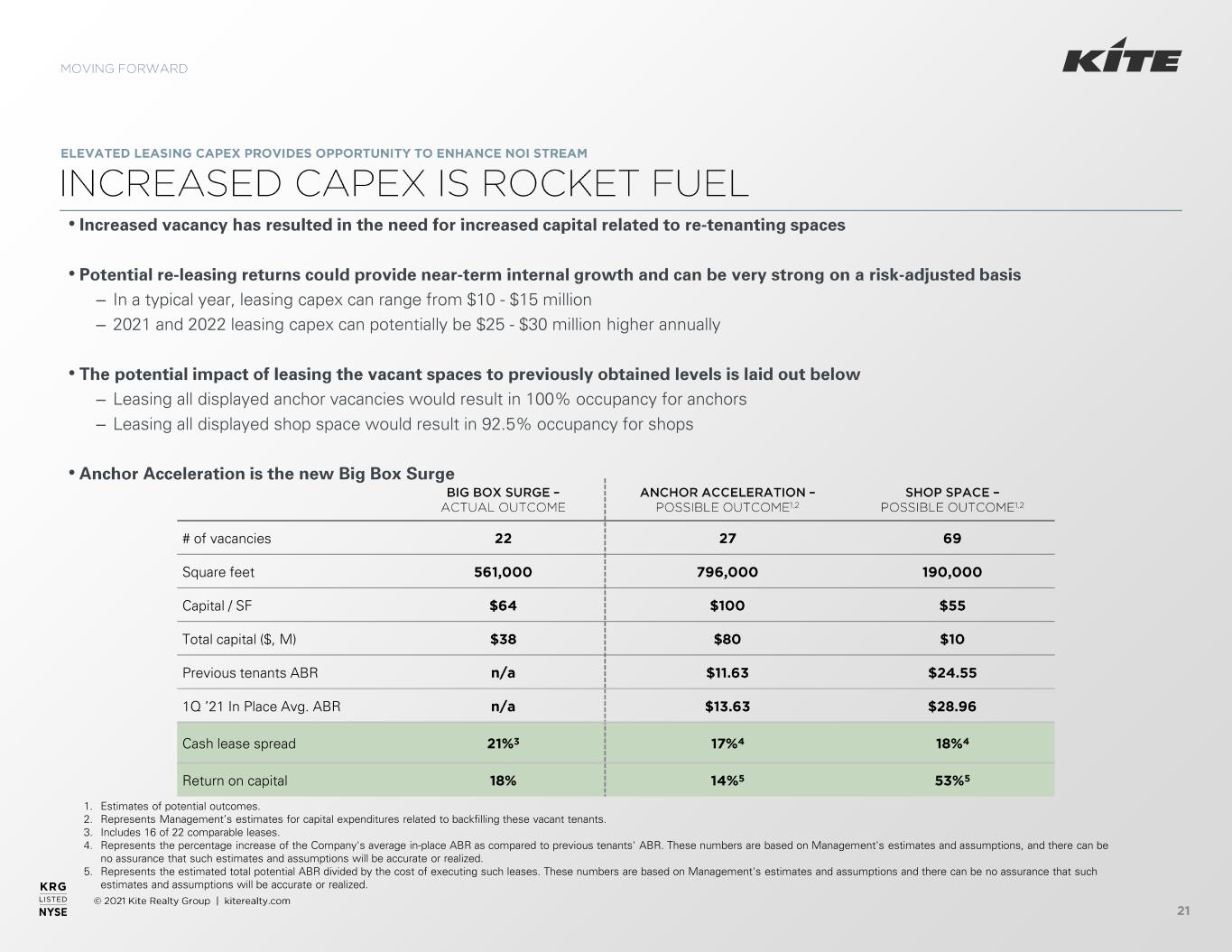

1. Estimates of potential outcomes. 2. Represents Management’s estimates for capital expenditures related to backfilling these vacant tenants. 3. Includes 16 of 22 comparable leases. 4. Represents the percentage increase of the Company's average in-place ABR as compared to previous tenants' ABR. These numbers are based on Management's estimates and assumptions, and there can be no assurance that such estimates and assumptions will be accurate or realized. 5. Represents the estimated total potential ABR divided by the cost of executing such leases. These numbers are based on Management's estimates and assumptions and there can be no assurance that such estimates and assumptions will be accurate or realized. • • – In a typical year, leasing capex can range from $10 - $15 million – 2021 and 2022 leasing capex can potentially be $25 - $30 million higher annually • – Leasing all displayed anchor vacancies would result in 100% occupancy for anchors – Leasing all displayed shop space would result in 92.5% occupancy for shops • # of vacancies Square feet Capital / SF Total capital ($, M) Previous tenants ABR 1Q ’21 In Place Avg. ABR Cash lease spread Return on capital

1. Estimate of potential outcomes of remaining project Anchor Acceleration vacancy. 2. New ABR is actual for Signed Not Open and average in place ABR for anchor tenants in the KRG portfolio as of 1Q’21. 3. Represents the percentage increase of the Company's average in-place ABR as compared to previous tenants' ABR. These numbers are based on Management's estimates and assumptions, and there can be no assurance that such estimates and assumptions will be accurate or realized. 4. Represents the estimated total potential ABR divided by the cost of executing such leases. These numbers are based on Management's estimates and assumptions and there can be no assurance that such estimates and assumptions will be accurate or realized. 5. Assumes weighted average NNN revenue from previously occupied spaces. • • Count Square feet Capital / SF Total capital ($, M) Previous tenants ABR Estimated New ABR2 Cash lease spread Return on capital New NOI incl. NNN ($, M) FFO / Share

• • Cost KRG Ownership % KRG Capital Required Est. Project Cash Yield Est. Incremental NOI @ share Expected Stabilization Date

• • Cost KRG Ownership % KRG Capital Required Est. Project Cash Yield Est. Incremental NOI @ share Expected Stabilization Date

• • Cost KRG Ownership % KRG Capital Required Est. Project Cash Yield Est. Incremental NOI @ share Expected Stabilization Date

• • – Florida had the largest AGI increase (20.3%) and Nevada had the third largest increase (15.7%) – New Jersey, Connecticut, New York and Illinois were 4 of the bottom 5 in terms of AGI reduction • – States listed in the bottom 10 were New Jersey, Illinois, New York, Connecticut and California • – U-Haul one-way rates out of CA are multiples of rates into California, highlighting the spike in moves – COVID could accelerate past and projected migration patterns towards warmer and cheaper states1 Sources: US Census Bureau, Wirepoints.org, United Van Lines, 2019 National Movers Study 1. Bloomberg: “New Yorkers Flee to Florida and Texas as Mobility Surges”

Source: Smart Asset 2021 Cost of Living Calculator 1. Discretionary income is net of tax burden, housing and food costs. • • Income Discretionary Income1 Income Discretionary Income1

Florida Texas North Carolina Indiana Nevada South West Midwest Northeast Source: Synergos Technologies. Pre pandemic analysis.

Curbside pickup at ~3,750 locations and same-day delivery from ~3,000 stores Greater than 60% of online orders fulfilled through a store in 2020 Greater than 80% of online orders are ready for store pickup in less than 30 minutes Plan to grow current store base of ~1,000 stores to 2,500 stores Expanded to 2,223 Pickup locations and 2,472 Delivery locations, covering over 98% of Kroger households Source: Each such company’s most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q. 1) WSJ Article: “Amazon, Walmart Tell Customers to Skip Returns of Unwanted Items” • Drive-up pick up has increased 500% year-over-year Comp sales were up 28.6% in 4Q Curbside and BOPIS sales growth greater than 350% in 2020. Enabled BOPIS and curbside pickup at all locations in 2020 Physical stores fulfilled 43% of all digital sales in 2020

• • • – Other property types operating costs can range from $20 - $70 psf – Shopping center operating costs can range from $5 - $10 psf • – Lower operating costs equate to retailer savings • • • • – 30% lower gross rent charges – Sales expected increase to $1.27M from $977k in other location

44% of ABR is deemed essential 41% of ABR service-oriented tenants offer necessary daily trips post-COVID 15% of ABR from primarily full-service restaurants creates additional traffic Essential shadow anchors Target and Bank of America drive daily trips Sufficient access points to the shopping center to ensure quick and convenient trips

• Forward-Looking Statements • This supplemental information package, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements. • Currently, one of the most significant factors that could cause actual outcomes to differ materially from the forward-looking statements is the potential adverse effect of the current pandemic of the novel coronavirus (“COVID-19”), including possible resurgences and mutations, on the financial condition, result of operations, cash flows and per formance of the Company and its tenants, the real estate market and the global economy and financial markets. The effects of COVID-19 have caused and may continue to cause many of the Company’s tenants to close stores, reduce hours or significantly limit service, making it difficult for them to meet their obligations, and therefore has and will continue to impact us significantly for the foreseeable future. COVID-19 has impacted the Company significantly, and the extent to which it will continue to impact the Company and its tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the speed and effectiveness of vaccine and treatment developments and distribution pipeline, the actions taken to contain the pandemic or mitigate its impact, and the d irect and indirect economic effects of the pandemic and containment measure, and possible short-term and long-term effects of the pandemic on consumer behavior, among others. • Additional risks, uncertainties and other factors that might cause such differences, some of which could be material, include but are not limited to: • National and local economic, business, real estate and other market conditions, particularly in connection with low or negative growth in the U.S. economy as well as economic uncertainty; • Financing risks, including the availability of, and costs associated with, sources of liquidity; • Our ability to refinance, or extend the maturity dates of, our indebtedness; • The level and volatility of interest rates; • the financial stability of tenants, including their ability to pay rent or request rent concessions and the risk of tenant insolvency and bankruptcy; • the competitive environment in which the Company operates, including potential oversupplies of and reduction in demand for rental space; • acquisition, disposition, development and joint venture risks; • property ownership and management risks, including the relative illiquidity of real estate investments, periodic costs to repair, renovate and re-lease spaces, operating costs and expenses, vacancies or the inability to rent space on favorable terms or at all; • our ability to maintain our status as a real estate investment trust for U.S. federal income tax purposes; • potential environmental and other liabilities; • impairment in the value of real estate property the Company owns; • the attractiveness of our properties to tenants, the actual and perceived impact of e-commerce on the value of shopping center assets and changing demographics and customer traffic patterns; • risks related to the geographical concentration of our properties in Florida, Indiana, Texas, North Carolina and Nevada; • Civil unrest, acts of terrorism or war, acts of God, climate change, epidemics, pandemics (including COVID-19), natural disasters and severe weather conditions such as hurricanes, tropical storms, tornadoes, earthquakes, droughts, floods and fires, including such events or conditions that may result in underinsured or uninsured losses or other increased costs and expenses; • Changes in laws and government regulations including governmental orders affecting the use of our properties or the ability of our tenants to operate, and the costs of complying with such changed laws and government regulations; • Possible short-term or long-term changes in consumer behavior due to COVID-19 and the fear of future pandemics; • Insurance costs and coverage; • Risks associated with cybersecurity attacks and the loss of confidential information and other business disruptions; • Other factors affecting the real estate industry generally; and • Other risks identified in reports the Company files with the Securities and Exchange Commission (“the SEC”) or in other documents that it publicly disseminates, including, in particular, the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and in our quarterly reports on Form 10-Q. • The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. • This Investor Update also includes certain forward-looking non-GAAP information. Due to the high variability and difficulty in making accurate forecasts and projections of some of the other information excluded from these estimates, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financials measures without unreasonable efforts.

NET OPERATING INCOME AND SAME PROPERTY NET OPERATING INCOME The Company uses property net operating income (“NOI”), a non-GAAP financial measure, to evaluate the performance of our properties. The Company defines NOI as income from our real estate, including lease termination fees received from tenants, less our property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions and certain corporate level expenses. The Company believes that NOI is helpful to investors as a measure of our operating performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as depreciation and amortization, interest expense, and impairment, if any. The Company uses same property NOI ("Same Property NOI"), a non-GAAP financial measure, to evaluate the performance of our properties. Same Property NOI excludes properties that have not been owned for the full period presented. It also excludes net gains from outlot sales, straight-line rent revenue, lease termination income in excess of lost rent, amortization of lease intangibles and significant prior period expense recoveries and adjustments, if any. When the Company receives payments in excess of any accounts receivable in exchange for terminating a lease, Same Property NOI will include such excess payments as monthly rent until the earlier of the following: the expiration of 12 months or the start date of a replacement tenant. The Company believes that Same Property NOI is helpful to investors as a measure of our operating performance because it includes only the NOI of properties that have been owned and fully operational for the full quarters presented. The Company believes such presentation eliminates disparities in net income due to the acquisition or disposition of properties during the particular periods presented and thus provides a more consistent comparison of our properties. Same Property NOI includes the results of properties that have been owned for the entire current and prior year reporting periods. NOI and Same Property NOI should not, however, be considered as alternatives to net income (calculated in accordance with GAAP) as indicators of our financial performance. Our computation of NOI and Same Property NOI may differ from the methodology used by other REITs, and therefore may not be comparable to such other REITs. When evaluating the properties that are included in the same property pool, the Company has established specific criteria for determining the inclusion of properties acquired or those recently under development. An acquired property is included in the same property pool when there is a full quarter of operations in both years subsequent to the acquisition date. Development and redevelopment properties are included in the same property pool four full quarters after the properties have been transferred to the operating portfolio. A redevelopment property is first excluded from the same property pool when the execution of a redevelopment plan is likely and the Company a) begins recapturing space from tenants or b) the contemplated plan significantly impacts the operations of the property. For the quarter ended December 31, 2020, the Company excluded three redevelopment properties from the same property pool that met these criteria and were owned in both comparable periods. In addition, the Company excluded two recently acquired properties from the same property pool.

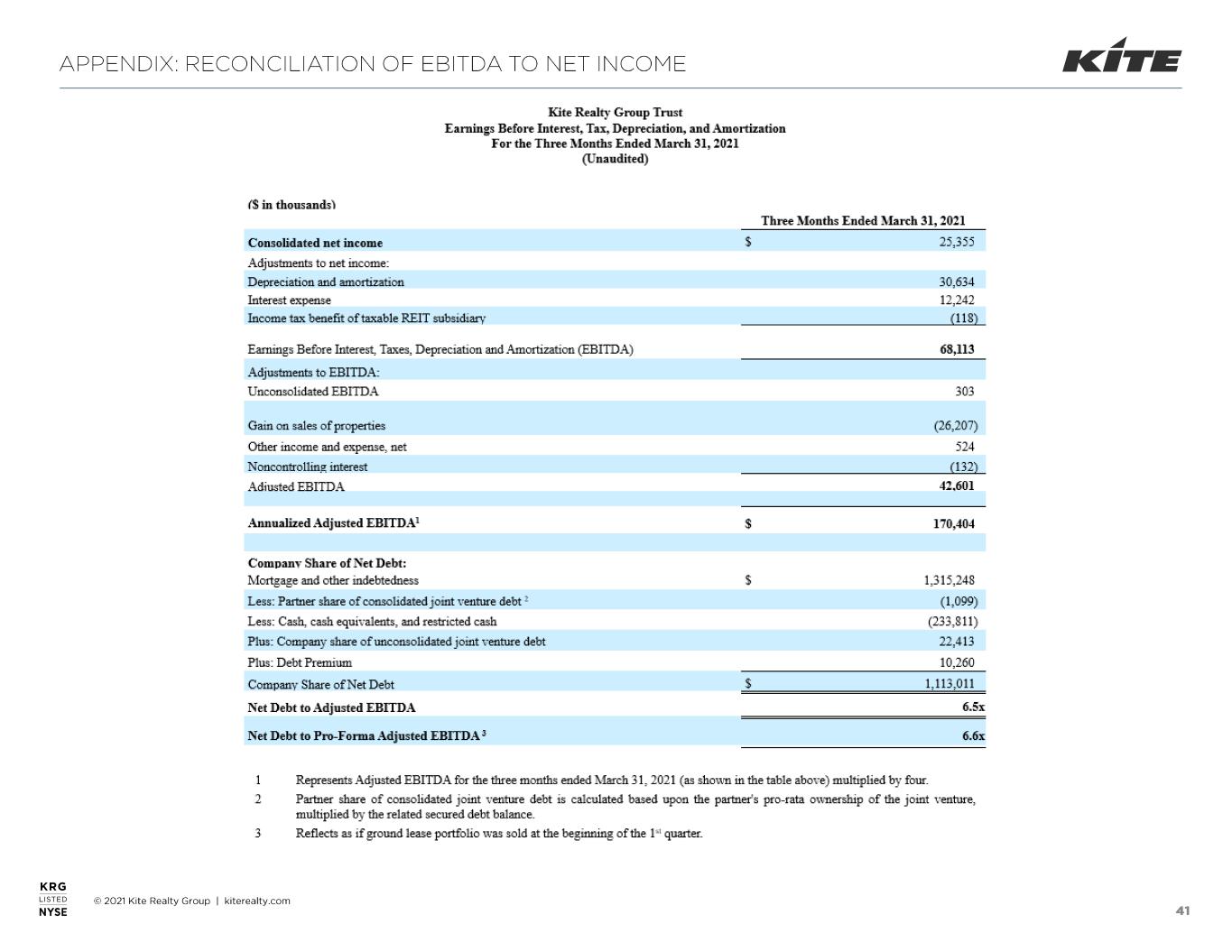

EBITDA The Company defines EBITDA, a non-GAAP financial measure, as net income before depreciation and amortization, interest expense and income tax expense of taxable REIT subsidiary. For informational purposes, the Company has also provided Adjusted EBITDA, which the Company defines as EBITDA less (i) EBITDA from unconsolidated entities, (ii) gains on sales of operating properties or impairment charges, (iii) other income and expense, (iv) noncontrolling interest EBITDA and (v) other non-recurring activity or items impacting comparability from period to period. Annualized Adjusted EBITDA is Adjusted EBITDA for the most recent quarter multiplied by four. Net Debt to Adjusted EBITDA is the Company's share of net debt divided by Annualized Adjusted EBITDA. EBITDA, Adjusted EBITDA, Annualized Adjusted EBITDA and Net Debt to Adjusted EBITDA, as calculated by us, are not comparable to EBITDA and EBITDA-related measures reported by other REITs that do not define EBITDA and EBITDA-related measures exactly as we do. EBITDA, Adjusted EBITDA and Annualized Adjusted EBITDA do not represent cash generated from operating activities in accordance with GAAP, and should not be considered alternatives to net income as an indicator of performance or as alternatives to cash flows from operating activities as an indicator of liquidity. Considering the nature of our business as a real estate owner and operator, the Company believes that EBITDA, Adjusted EBITDA and the ratio of Net Debt to Adjusted EBITDA are helpful to investors in measuring our operational performance because they exclude various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. For informational purposes, the Company has also provided Annualized Adjusted EBITDA, adjusted as described above. The Company believes this supplemental information provides a meaningful measure of our operating performance. The Company believes presenting EBITDA and the related measures in this manner allows investors and other interested parties to form a more meaningful assessment of our operating results. FUNDS FROM OPERATIONS Funds from Operations (FFO) is a widely used performance measure for real estate companies and is provided here as a supplemental measure of operating performance. The Company calculates FFO, a non-GAAP financial measure, in accordance with the best practices described in the April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts ("NAREIT"), as restated in 2018. The NAREIT white paper defines FFO as net income (calculated in accordance with GAAP), excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. Considering the nature of our business as a real estate owner and operator, the Company believes that FFO is helpful to investors in measuring our operational performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. FFO excludes the gain on the sale of the ground lease portfolio as this sale was part of our capital strategy distinct from our ongoing operating strategy of selling individual land parcels from time to time. FFO (a) should not be considered as an alternative to net income (calculated in accordance with GAAP) for the purpose of measuring our financial performance, (b) is not an alternative to cash flow from operating activities (calculated in accordance with GAAP) as a measure of our liquidity, and (c) is not indicative of funds available to satisfy our cash needs, including our ability to make distributions. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. A reconciliation of net income (calculated in accordance with GAAP) to FFO is included elsewhere in this Financial Supplement. From time to time, the Company may report or provide guidance with respect to “FFO as adjusted” which starts with FFO, as def ined by NAREIT, and then removes the impact of certain non-recurring and non-operating transactions or other items the Company does not consider to be representative of its core operating results including without limitation, gains or losses associated with the early extinguishment of debt, gains or losses associated with litigation involving the Company that is not in the normal course of business, the impact on earnings from executive separation, the excess of redemption value over carrying value of preferred stock redemption, and the impact of 2020 bad debt on 2020 accounts receivable (“2020 Collection Impact”) which are not otherwise ad justed in the Company’s calculation of FFO.