Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Great Western Bancorp, Inc. | gwb-20210331xerxex991.htm |

| 8-K - 8-K - Great Western Bancorp, Inc. | gwb-20210429.htm |

Investor Presentation | March 31, 2021

KEY DEVELOPMENTS 2 Bolster Credit Risk Management • Nonaccrual and classified loans reduced further • Loans on deferral decreased to 0.24% of total loans excluding PPP loans • Ag industry outlook is favorable across key sectors Measured Actions • Prudent NIM management through reduced funding cost and PPP contribution • Strong capital generation and improved ratios • ACL ratio is 3.50% of total loans excluding PPP loans Organizational Alignment for Increased Specialization • Launched small business platform • Launched the #beU campaign as we advance Diversity, Equity and Inclusion

EARNINGS OVERVIEW 3 1QFY21 2QFY21 Net Interest Income-GAAP $107.9 $102.9 Noninterest Income (excl FVO Credit Adj) $15.8 $17.1 Noninterest Expense $57.4 $59.1 PTPP 1 $66.3 $60.9 Provision for (recapture of) Credit Losses $11.9 $(5.0) FVO Credit Adj $(1.7) $0.0 Tax $11.4 $14.6 Net Income $41.3 $51.3 Strong quarter of net income supported by lower credit costs and good PTPP results • Net interest income benefited from higher PPP income and prudent funding cost management helping to counter the impact from reduced loan volume • Noninterest income lift from a positive derivative credit adjustment, with core noninterest income benefiting from strong mortgage originations • Expenses continued to track below normal with minimal OREO cost and a reduction in FDIC insurance premium • Provision recapture driven by reduced loans and net impact from economic forecasts • PTPP1 decreased $5.4 million from the prior quarter primarily due to lower NII and increased $14.6 million year on year primarily due to lower expenses • Near term focus continues to center on asset quality, loan production and spread income Pre-tax Pre-provision Income¹ (PTPP) $46.3 $52.5 $51.8 $66.3 $60.9 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21 1 See Non-GAAP table in appendix for reconciliation

NIM Analysis 3.52% (0.16)% (0.10)% (0.07)% 0.17% 0.04% 3.40% 3.63% 3.51% NIM (FTE) Adjusted NIM (FTE)¹ 1Q FY 21 Inc rea se d L iqu idit y Lo an s Le ss No na ccr ua l R ec ov eri es PP P Fu nd ing 2Q FY 21 Net Interest Income ($MM) and NIM $426.6 $425.6 $103.5 $107.9 $107.5 $109.5 $104.4 3.74% 3.59% 3.59% 3.57% 3.51% 3.63% 3.51% 3.74% 3.51% 3.55% 3.47% 3.40% 3.52% 3.40% Net Interest Income (FTE) NIM (FTE) Adjusted NIM (FTE)¹ FY19 FY20 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21 NET INTEREST INCOME 4 • Net interest income was $104.4 million for the quarter, a decrease of $5.1 million; adjusted net interest income1 was $101.3 million, a decrease of $4.8 million ◦ Loan interest reflects a $2.2 million decrease in nonaccrual interest recoveries, a $4.4 million decrease driven by lower loan volumes, and a $4.7 million decrease due to lower day count and other loan fees, all partially offset with a net $4.2 million increase in PPP interest and fee income ◦ Interest expense lower by $1.6 million driven by a $0.7 million decrease in time deposit interest and $0.8 million decrease in interest-bearing deposits • Net interest margin was 3.51%, a 12 basis point decrease from 3.63%; adjusted net interest margin1 was 3.40%, also a 12 basis point decrease from 3.52% ◦ Excluding the impact of accelerated PPP fee income and one-off interest recoveries and accretion, underlying NIM was 3.18% 1 Non-GAAP measures, see appendix for reconciliations. NOTE: All references to net interest income and net interest margin are presented on a fully-tax equivalent basis unless otherwise noted.

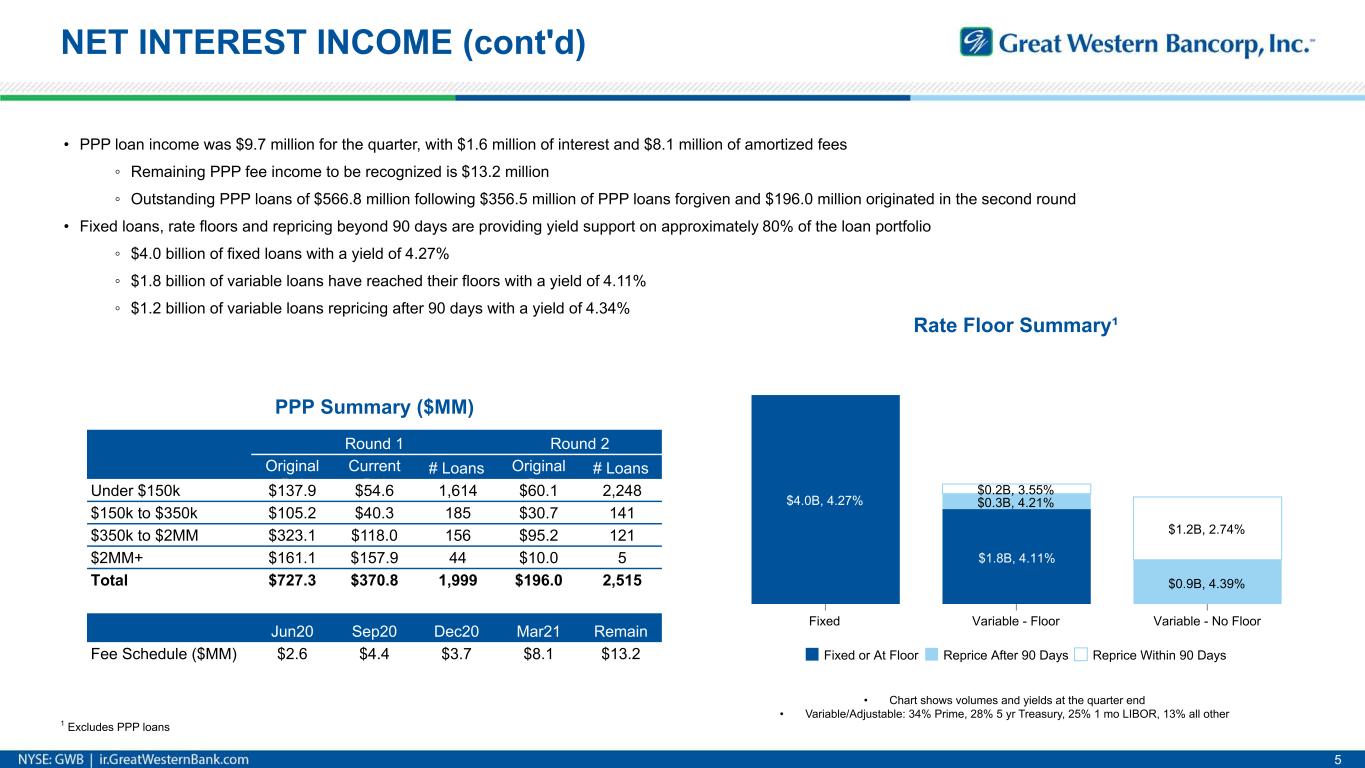

NET INTEREST INCOME (cont'd) 5 • PPP loan income was $9.7 million for the quarter, with $1.6 million of interest and $8.1 million of amortized fees ◦ Remaining PPP fee income to be recognized is $13.2 million ◦ Outstanding PPP loans of $566.8 million following $356.5 million of PPP loans forgiven and $196.0 million originated in the second round • Fixed loans, rate floors and repricing beyond 90 days are providing yield support on approximately 80% of the loan portfolio ◦ $4.0 billion of fixed loans with a yield of 4.27% ◦ $1.8 billion of variable loans have reached their floors with a yield of 4.11% ◦ $1.2 billion of variable loans repricing after 90 days with a yield of 4.34% Rate Floor Summary¹ $4.0B, 4.27% $1.8B, 4.11% $0.3B, 4.21% $0.9B, 4.39% $0.2B, 3.55% $1.2B, 2.74% Fixed or At Floor Reprice After 90 Days Reprice Within 90 Days Fixed Variable - Floor Variable - No Floor • Chart shows volumes and yields at the quarter end • Variable/Adjustable: 34% Prime, 28% 5 yr Treasury, 25% 1 mo LIBOR, 13% all other PPP Summary ($MM) Round 1 Round 2 Original Bal Current Bal # Loans Original Bal # Loans Under $150k $137.9 $54.6 1,614 $60.1 2,248 $150k to $350k $105.2 $40.3 185 $30.7 141 $350k to $2MM $323.1 $118.0 156 $95.2 121 $2MM+ $161.1 $157.9 44 $10.0 5 Total $727.3 $370.8 1,999 $196.0 2,515 Jun20 Sep20 Dec20 Mar21 Remain Fee Schedule ($MM) $2.6 $4.4 $3.7 $8.1 $13.2 1 Excludes PPP loans

6 NONINTEREST INCOME • Noninterest income was $17.2 million for the quarter, including $18.1 million of core noninterest income (compared to $19.4 million prior quarter) and a $2.3 million favorable derivative credit adjustment (CVA/DVA), offset by $3.2 million of derivative interest expense • The decrease in core revenue was driven by a $1.0 million decrease in service charges from decreased overdraft activity and a seasonal decrease in crop insurance revenue, along with a $0.4 million decrease in mortgage banking revenue related to seasonality, partially offset by an increase from added bank owned life insurance income Noninterest Income ($MM) $62.9 $63.1 $14.6 $14.1 $17.2 $18.1 $17.1 $5.8 $3.4 $0.4 $1.6 $0.1 $1.3 $1.0 $(0.2) $7.9 $7.9 $0.2 $(7.8) $(74.3) $(15.1) $(27.4) $(29.2) $(5.5) $(0.9) Noninterest Income excl FV Adj & Deriv Int Swap Sales G/L on Securities FV Adj & Deriv Int FY19 FY20 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21 1 Service charges, wealth management, mortgage, swap sales and other Noninterest Income Profile ($MM) $17.2 $18.1 $(3.2) $2.3 nominal nominal Q2 Core Noninterest Income¹ Derivative Interest CVA/DVA FVO Credit Adjustments Gain on Securities Q2 Total Noninterest Income

Provision for Credit Losses ($MM) $40.9 $118.4 $71.8 $21.6 $16.9 $11.9 $58.7 $12.1 $(5.0) $59.7 $59.7 Provision for Credit Losses Incremental Environmental Overlay for COVID-19 FY19 FY20 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21 7 EXPENSES & PROVISION • Total noninterest expense was $59.1 million for the quarter, an increase of $1.7 million from the prior quarter ◦ Increase driven by a $1.6 million increase in salaries and benefits due to annual merit increases and accrued incentives, a $0.3 million increase in data processing costs due to various software maintenance and upgrades, a $0.4 million increase in consulting costs to support strategic initiatives and a $0.3 million increase in seasonal grounds maintenance ◦ These were partially offset by a $0.4 million decrease in other real estate owned operating costs and a $0.5 million decrease in FDIC insurance premiums • Provision for credit losses on loans resulted in a $5.0 million net recapture for the quarter, compared to an $11.9 million provision in the prior quarter Noninterest Expense ($MM) $265.0 $66.1 $224.9 $67.0 $74.9 $57.4 $59.1 $742.4 $742.4 Noninterest Expense (excl Goodwill & Intangible Impairment) Goodwill & Intangible Impairment FY19 FY20 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21

ACL & CREDIT COVERAGE 8 • The ACL (CECL adopted October 1, 2020), was $296.0 million as of March 31, 2021, a decrease of $12.8 million from $308.8 million as of December 31, 2020 • The ratio of ACL to total loans was 3.28% as of March 31, 2021, an increase from 3.24% as of December 31, 2020 • $27.4 million of the adjustment for fair value option loans relates to credit risk, which is 4.82% of the fair value option loans and 0.30% of total loans • Economic Factors: Oxford GDP and Unemployment and related qualitative adjustments ◦ Improvement in unemployment forecasts • Portfolio Changes: changes in loan volumes, mix, and age, along with credit quality, and charge-off activity ◦ Lower loan volumes CECL Waterfall ($MM) $149.9 $177.3 $(18.8) $0.4 $(8.9) $(3.9) $30.5 $327.2 $308.8 $296.0 $30.5 $27.5 $27.4 ACL³ (ALLL on Sep 30) FV Adjustment September 30 Day 1 Adjustment October 1 Economic Factors Portfolio Changes December 31 Economic Factors Portfolio Changes March 31 2019 2020 QE Mar21 QE Jun21 QE Sep21 QE Dec21 2022 GDP1 2.2 -3.5 6.6 11.5 7.9 2.8 3 Unemployment1 3.7 8.1 6.2 5.8 5.2 4.6 4.4 Total Credit Coverage2 = 3.61% Excluding PPP2 = 3.86% 1 Source: Oxford Economics - Annual Percentage Change 2 Total Credit Coverage is ACL, FV Adjustment and Unfunded Commitment Reserve 3 ACL excludes Unfunded Commitment Reserve; Oct 1 = $2.4 million, Dec 31 = $2.3 million, Mar 31 = $2.3 million 4 FV adjustment reflects effective coverage on the loan portfolio accounted for at fair value 4

CAPITAL 9 • All regulatory capital ratios improved over the prior quarter, and all remain above regulatory minimums to be considered "well capitalized" ◦ Total capital ratio of 15.1%, up from 14.3% ◦ Tier 1 capital ratio of 13.5%, up from 12.7% ◦ Common equity tier 1 capital ratio of 12.8%, up from 12.0% ◦ Tier 1 leverage ratio of 10.0%, up from 9.7% • On April 29, 2021, the Company's Board of Directors declared a dividend of $0.01 per common share, payable on May 28, 2021 to stockholders of record as of close of business on May 14, 2021 Capital Trend 11.4% 12.0% 11.7% 11.8% 12.7% 13.5%12.5% 13.0% 12.7% 13.3% 14.3% 15.1% 9.2% 9.6% 9.6% 9.2% 8.3% 8.4% Tier 1 Capital Total Capital TCE / TA¹ FY17 FY18 FY19 FY20 1QFY21 2QFY21 1 Non-GAAP measures, see appendix for reconciliations Capital Ratio Summary 10.0% 8.0% 6.5% 5.0% 5.1% 5.5% 6.3% 5.0% 15.1% 13.5% 12.8% 10.0% 8.4% Well-Capitalized Difference to Well-Capitalized Total Capital Tier 1 Capital CET1 Leverage Ratio TCE Ratio¹

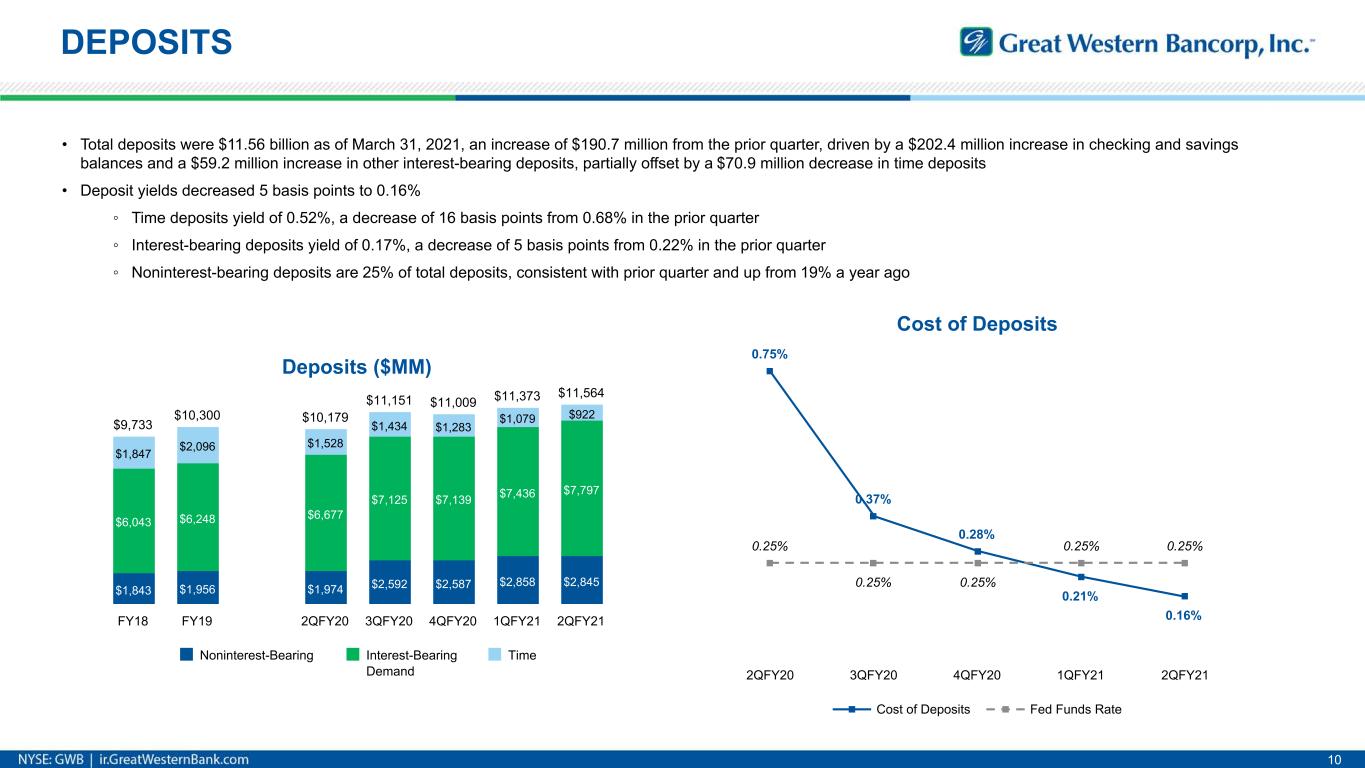

DEPOSITS 10 • Total deposits were $11.56 billion as of March 31, 2021, an increase of $190.7 million from the prior quarter, driven by a $202.4 million increase in checking and savings balances and a $59.2 million increase in other interest-bearing deposits, partially offset by a $70.9 million decrease in time deposits • Deposit yields decreased 5 basis points to 0.16% ◦ Time deposits yield of 0.52%, a decrease of 16 basis points from 0.68% in the prior quarter ◦ Interest-bearing deposits yield of 0.17%, a decrease of 5 basis points from 0.22% in the prior quarter ◦ Noninterest-bearing deposits are 25% of total deposits, consistent with prior quarter and up from 19% a year ago Deposits ($MM) $1,843 $1,956 $1,974 $2,592 $2,587 $2,858 $2,845 $6,043 $6,248 $6,677 $7,125 $7,139 $7,436 $7,797 $1,847 $2,096 $1,528 $1,434 $1,283 $1,079 $922$9,733 $10,300 $10,179 $11,151 $11,009 $11,373 $11,564 Noninterest-Bearing Interest-Bearing Demand Time FY18 FY19 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21 Cost of Deposits 0.75% 0.37% 0.28% 0.21% 0.16% 0.25% 0.25% 0.25% 0.25% 0.25% Cost of Deposits Fed Funds Rate 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21

Loan Portfolio - Key Segments² Agriculture $1.5B Accommodation³ $0.9BHealthCare $0.9B Retail Trade $0.5B Construction $0.4B Prof, Scien, Tech Oth Services $0.4B Manufacturing $0.3B Wholesale Trade $0.3B Finance and Insurance $0.2B Other C&I (incl PPP) $0.3B Other CRE-Owner Occupied $0.5B Other CRE-Non Owner Occupied $1.1B Multifamily & Lessors of Resi RE $0.8B Consumer, Mortgage & Other $0.7B LOAN OVERVIEW 11 • Total loans outstanding were $9.01 billion as of March 31, 2021, a decrease of $506.5 million from the prior quarter • The decrease in loans during the quarter was driven by a $132.7 million net decrease in PPP loans, a number of paydowns in nonaccrual and criticized loans, an increase in commercial loans sold to the secondary market activity and a number of paydowns across commercial, ag and consumer driven by property sales and excess liquidity 2 Segment classifications utilize NAICS codes and in some cases combine C&I, CRE and Residential categories 3 Hotel and Casino Hotel Total Loans¹ ($MM) $9,633 $9,385 $8,819 $8,444 $723 $727 $699 $567 $9,446 $9,733 $9,717 $10,356 $10,112 $9,518 $9,011 PPP Loans Non-PPP Loans FY18 FY19 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21 1 Beginning in the first quarter of fiscal year 2021, loan segments are presented based on amortized cost, which includes unpaid principal balance, unamortized discount on acquired loans, and unearned net deferred fees and costs, as a part of the adoption of CECL.

CREDIT OVERVIEW 12 Loan Deferral Summary1 3QFY20 4QFY20 1QFY21 2QFY21 Segments Balance ($MM) % of Segment Loans Balance ($MM) % of Segment Loans Balance ($MM) % of Segment Loans Balance ($MM) % of Segment Loans Accommodation (Hotel and Casino Hotel) $861 72% $111 9% $69 7% $5 1% Arts Entertainment and Recreation $79 61% $3 3% $8 7% — — Food & Drink $68 41% $4 3% $5 5% $1 1% Transportation and Warehousing $41 20% $1 1% $0 0% — — Retail Trade $93 19% $14 3% — — — — Real Estate and Rental and Leasing $359 14% $19 1% $11 1% $11 1% Other Services (except Public Administration) $22 13% $2 1% $2 2% — — Manufacturing $25 7% $14 4% $1 0% — — Wholesale Trade $19 6% $1 0% $0 0% — — Health Care and Social Assistance $63 6% $1 0% $9 1% $0 0% Agriculture Forestry Fishing and Hunting $19 1% $2 0% — — — — Other $45 2% $11 1% $8 0% $3 0% Total $1,694 $183 $113 $20 % of Total Loans excl PPP 17.7% 1.98% 1.29% 0.24% 1 Effective dates are July 20, 2020; October 22, 2020; January 16, 2021; April 16, 2021, respectively Key Credit Outcomes: • Continued derisking of portfolio with $7.9 million reduction in nonaccrual loans and $43.0 million reduction in classified loans • Net charge-offs were $7.8 million; excluding the impact from a hotel loan sale, net charge-offs were $2.5 million, or 0.11% of total loans annualized • Loans on deferral have reduced to $19.7 million with majority paying interest only • Hotel loans are $497.9 million pass-rated and $285.2 million criticized as we transition from winter slowdown to spring uptick in tourism • Ag sector continues to strengthen, which is helping reduce credit risk and support growth prospects for the industry

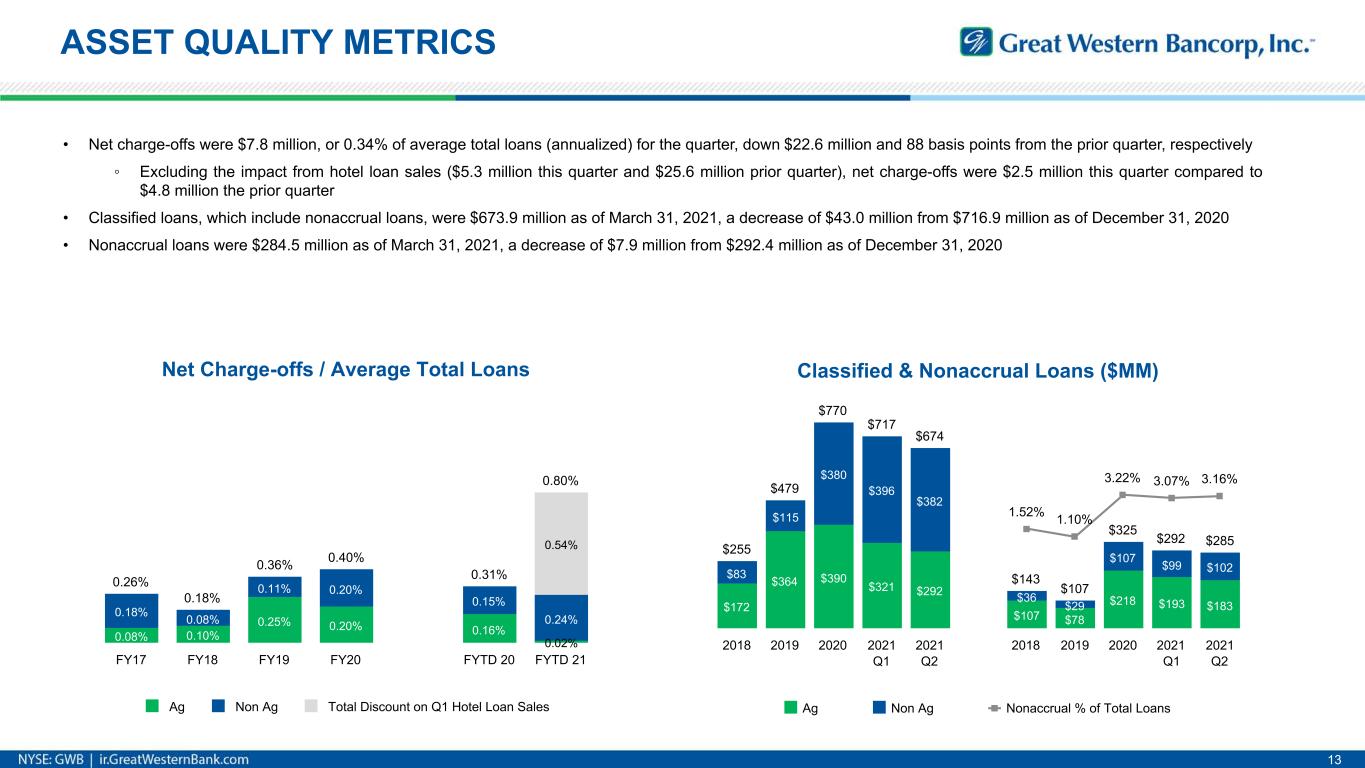

Net Charge-offs / Average Total Loans 0.08% 0.10% 0.25% 0.20% 0.16% 0.02% 0.18% 0.08% 0.11% 0.20% 0.15% 0.24% 0.54% 0.26% 0.18% 0.36% 0.40% 0.31% 0.80% Ag Non Ag Total Discount on Q1 Hotel Loan Sales FY17 FY18 FY19 FY20 FYTD 20 FYTD 21 ASSET QUALITY METRICS 13 • Net charge-offs were $7.8 million, or 0.34% of average total loans (annualized) for the quarter, down $22.6 million and 88 basis points from the prior quarter, respectively ◦ Excluding the impact from hotel loan sales ($5.3 million this quarter and $25.6 million prior quarter), net charge-offs were $2.5 million this quarter compared to $4.8 million the prior quarter • Classified loans, which include nonaccrual loans, were $673.9 million as of March 31, 2021, a decrease of $43.0 million from $716.9 million as of December 31, 2020 • Nonaccrual loans were $284.5 million as of March 31, 2021, a decrease of $7.9 million from $292.4 million as of December 31, 2020 Classified & Nonaccrual Loans ($MM) $172 $364 $390 $321 $292 $107 $78 $218 $193 $183 $83 $115 $380 $396 $382 $36 $29 $107 $99 $102 $255 $479 $770 $717 $674 $143 $107 $325 $292 $285 1.52% 1.10% 3.22% 3.07% 3.16% Ag Non Ag Nonaccrual % of Total Loans 2018 2019 2020 2021 Q1 2021 Q2 2018 2019 2020 2021 Q1 2021 Q2

KEY LOAN SEGMENTS 14 Midwest, 51% Western, 37% Hotel & Casino Hotel Balances by State ($MM) IA $189 SD $131 NE $75 MN $43 Other $39 CO $179 AZ $166 Non-Footprint² $116 1 Consists of 108 PPP loans, most of which are related to non-PPP relationships reflected in the chart 2 Includes AK $22, CA $19, FL $19, among others, and mostly relates to experienced in-footprint customers • Accommodation portfolio comprised of $783.7 million in hotels (excl casino hotels), $115.1 million of casino hotels, and $40.0 million of PPP loans across both segments • 88% of the accommodation balance is concentrated within the bank's footprint • Diversified across more than 100 cities with largest balances in Colorado Springs, CO; Rapid City, SD; Des Moines, IA; Sioux Falls, SD; and Omaha, NE, and casino hotels located in rural IA and MN • LTV of approximately 64% for accommodation relationships over $1 million (78% of balance) • 87% of hotel (excl casino hotels) relationships over $1 million are flagged (83% of balance) Risk Rating excl PPP ($MM) $579 $498 $118 $115 $120 $150 $123 $136 Pass Special Mention Classified Dec Hotels Mar Hotels Dec Casino Hotels Mar Casino Hotels Balances ($MM) and Counts by Relationship Size 126 29 17 7$36 $178 $199 $250 $156$4 $18 $22 $75 Hotels Casino Hotels PPP¹ 0-5MM 5-10MM 10-25MM 25MM+ NOTE: Accommodation portfolio and consists of hotels (excl casino hotels) and casino hotels segmented by NAICS. Chart values exclude $0.6 million of balances with NAICS of hotel (excl casino hotels) that do not have a commercial classification.

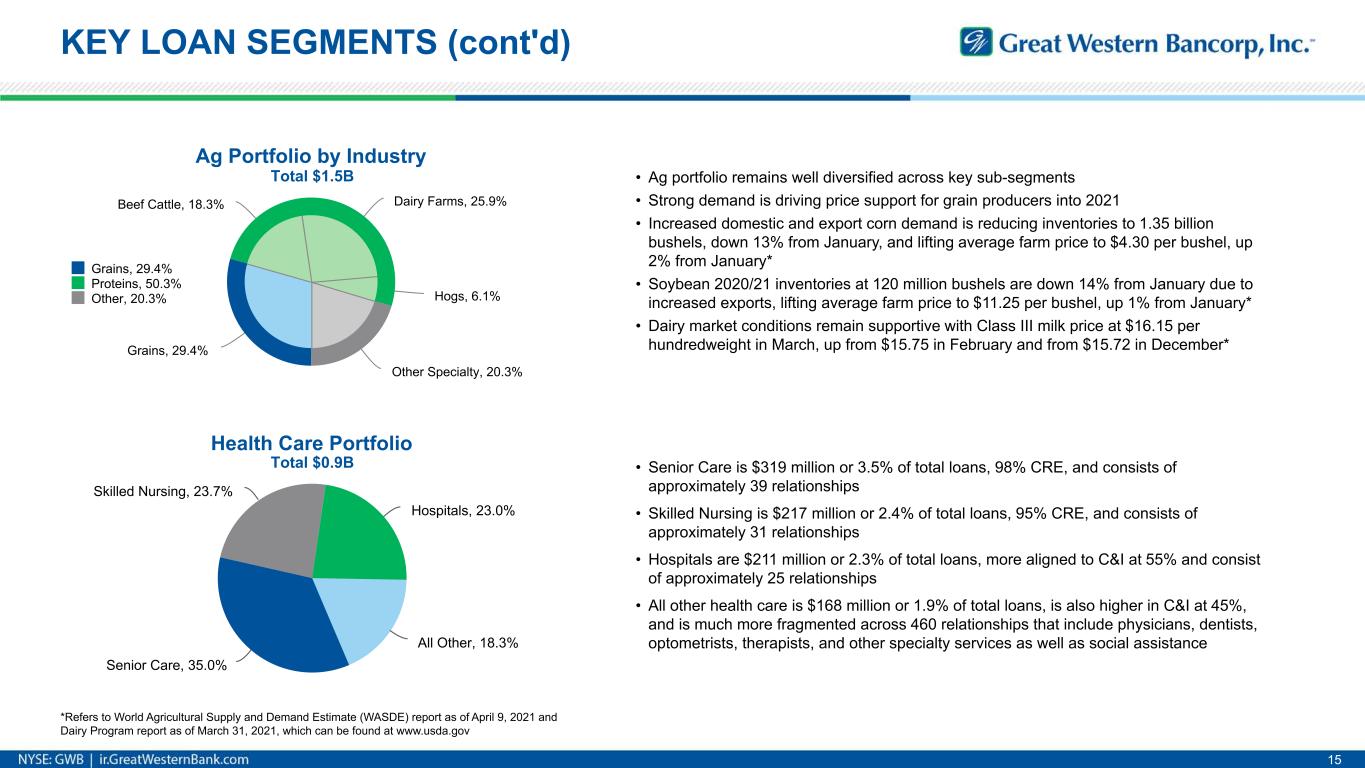

Ag Portfolio by Industry Grains, 29.4% Beef Cattle, 18.3% Dairy Farms, 25.9% Hogs, 6.1% Other Specialty, 20.3% Grains, 29.4% Proteins, 50.3% Other, 20.3% KEY LOAN SEGMENTS (cont'd) 15 Health Care Portfolio Senior Care, 35.0% Skilled Nursing, 23.7% Hospitals, 23.0% All Other, 18.3% • Senior Care is $319 million or 3.5% of total loans, 98% CRE, and consists of approximately 39 relationships • Skilled Nursing is $217 million or 2.4% of total loans, 95% CRE, and consists of approximately 31 relationships • Hospitals are $211 million or 2.3% of total loans, more aligned to C&I at 55% and consist of approximately 25 relationships • All other health care is $168 million or 1.9% of total loans, is also higher in C&I at 45%, and is much more fragmented across 460 relationships that include physicians, dentists, optometrists, therapists, and other specialty services as well as social assistance • Ag portfolio remains well diversified across key sub-segments • Strong demand is driving price support for grain producers into 2021 • Increased domestic and export corn demand is reducing inventories to 1.35 billion bushels, down 13% from January, and lifting average farm price to $4.30 per bushel, up 2% from January* • Soybean 2020/21 inventories at 120 million bushels are down 14% from January due to increased exports, lifting average farm price to $11.25 per bushel, up 1% from January* • Dairy market conditions remain supportive with Class III milk price at $16.15 per hundredweight in March, up from $15.75 in February and from $15.72 in December* *Refers to World Agricultural Supply and Demand Estimate (WASDE) report as of April 9, 2021 and Dairy Program report as of March 31, 2021, which can be found at www.usda.gov Total $1.5B Total $0.9B

Forward Looking Statements: This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements about Great Western Bancorp, Inc.’s expectations, beliefs, plans, strategies, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “views,” “intends” and similar words or phrases. In particular, the statements included in this press release concerning Great Western Bancorp, Inc.’s expected performance and strategy, strategies for managing troubled loans, the impact on the business arising from the COVID-19 pandemic and the interest rate environment are not historical facts and are forward-looking. Accordingly, the forward-looking statements in this press release are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in the sections titled “Item 1A. Risk Factors” and "Cautionary Note Regarding Forward-Looking Statements" in Great Western Bancorp, Inc.’s Annual Report on Form 10-K for the most recently ended fiscal year, Form 10-Q for the quarter ended December 31, 2020 and in other periodic filings with the Securities and Exchange Commission. Further, any forward-looking statement speaks only as of the date on which it is made, and Great Western Bancorp, Inc. undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Non-GAAP Financial Measures: This presentation contains non-GAAP measures which our management relies on in making financial and operational decisions about our business and which exclude certain items that we do not consider reflective of our business performance. We believe that the presentation of these measures provides investors with greater transparency and supplemental data relating to our financial condition and results of operations. These non-GAAP measures should be considered in context with our GAAP results. A reconciliation of these non-GAAP measures appears in our earnings release dated April 29, 2021 and in Appendix 1 to this presentation. Our earnings release and this presentation are available in the Investor Relations section of our website at www.greatwesternbank.com. Our earnings release and this presentation are also available as part of our Current Report on Form 8-K filed with the Securities and Exchange Commission on April 29, 2021. Explanatory Note: In this presentation, all financial information presented refers to the financial results of Great Western Bancorp, Inc. combined with those of its predecessor, Great Western Bancorporation, Inc. Also note loan balance information is presented using unpaid principal balances (UPB) unless otherwise noted. DISCLOSURES 16

Appendix 1 Supplemental Data

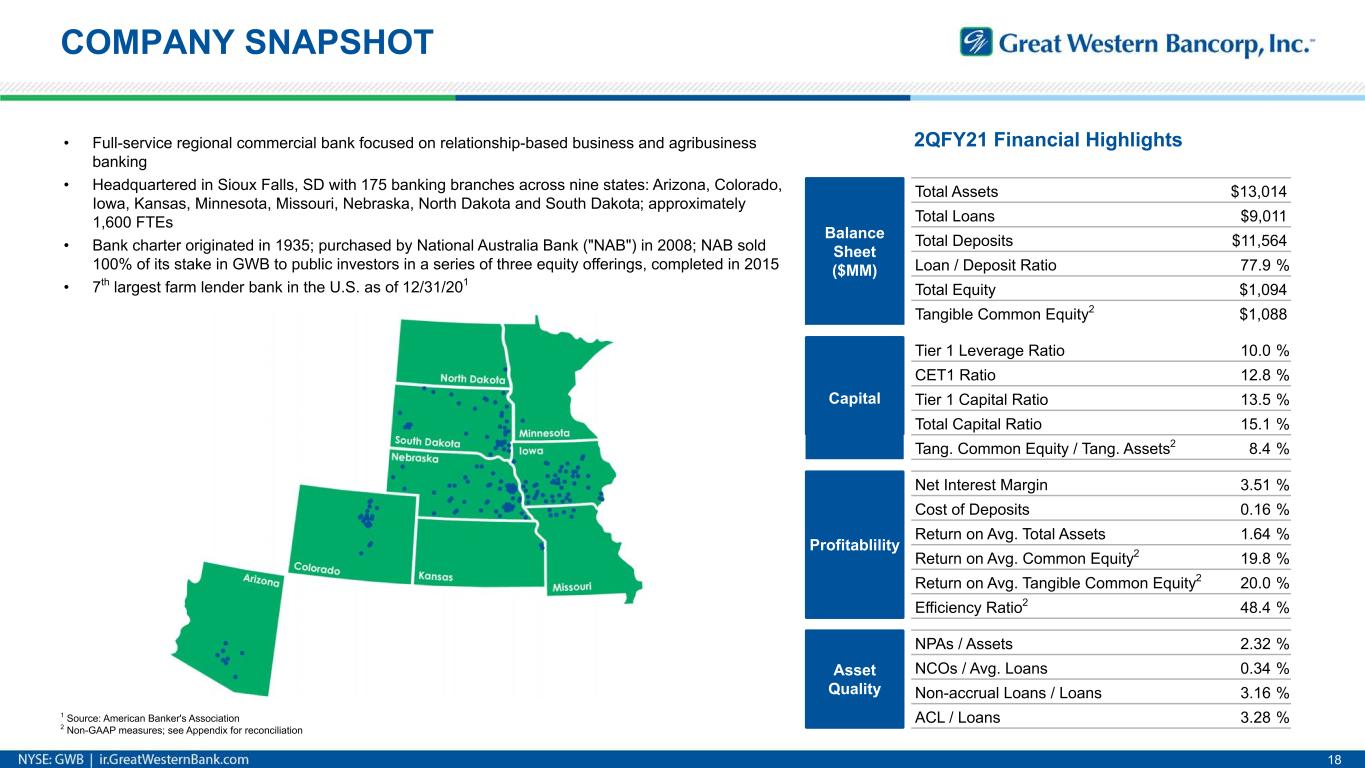

Footprint 18 COMPANY SNAPSHOT • Full-service regional commercial bank focused on relationship-based business and agribusiness banking • Headquartered in Sioux Falls, SD with 175 banking branches across nine states: Arizona, Colorado, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota; approximately 1,600 FTEs • Bank charter originated in 1935; purchased by National Australia Bank ("NAB") in 2008; NAB sold 100% of its stake in GWB to public investors in a series of three equity offerings, completed in 2015 • 7th largest farm lender bank in the U.S. as of 12/31/201 2QFY21 Financial Highlights Balance Sheet ($MM) Total Assets $13,014 Total Loans $9,011 Total Deposits $11,564 Loan / Deposit Ratio 77.9 % Total Equity $1,094 Tangible Common Equity2 $1,088 Capital Tier 1 Leverage Ratio 10.0 % CET1 Ratio 12.8 % Tier 1 Capital Ratio 13.5 % Total Capital Ratio 15.1 % Tang. Common Equity / Tang. Assets2 8.4 % Profitablility Net Interest Margin 3.51 % Cost of Deposits 0.16 % Return on Avg. Total Assets 1.64 % Return on Avg. Common Equity2 19.8 % Return on Avg. Tangible Common Equity2 20.0 % Efficiency Ratio2 48.4 % Asset Quality NPAs / Assets 2.32 % NCOs / Avg. Loans 0.34 % Non-accrual Loans / Loans 3.16 % ACL / Loans 3.28 %1 Source: American Banker's Association 2 Non-GAAP measures; see Appendix for reconciliation

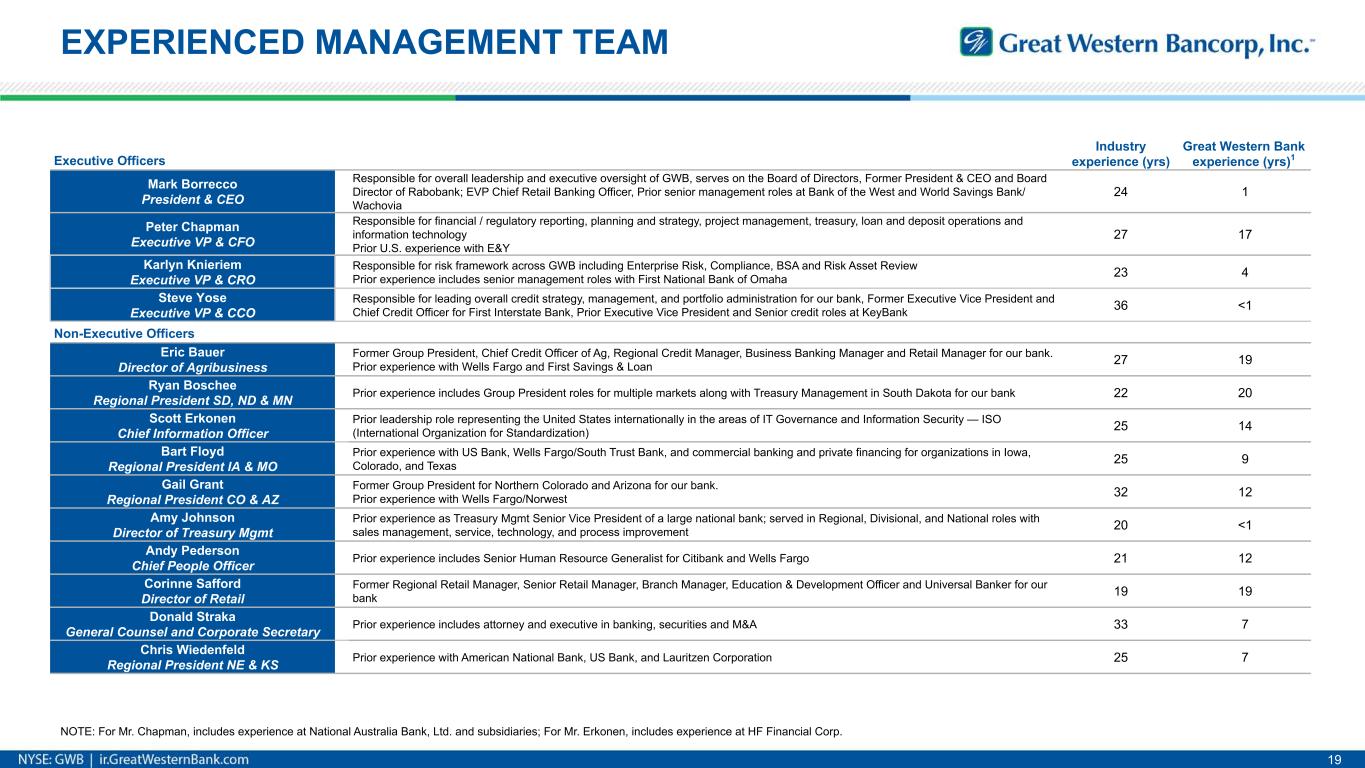

EXPERIENCED MANAGEMENT TEAM 19 Executive Officers x x Industry experience (yrs) Great Western Bank experience (yrs)1 Mark Borrecco President & CEO x Responsible for overall leadership and executive oversight of GWB, serves on the Board of Directors, Former President & CEO and Board Director of Rabobank; EVP Chief Retail Banking Officer, Prior senior management roles at Bank of the West and World Savings Bank/ Wachovia 24 1 Peter Chapman Executive VP & CFO x Responsible for financial / regulatory reporting, planning and strategy, project management, treasury, loan and deposit operations and information technology Prior U.S. experience with E&Y 27 17 Karlyn Knieriem Executive VP & CRO x Responsible for risk framework across GWB including Enterprise Risk, Compliance, BSA and Risk Asset Review Prior experience includes senior management roles with First National Bank of Omaha 23 4 Steve Yose Executive VP & CCO Responsible for leading overall credit strategy, management, and portfolio administration for our bank, Former Executive Vice President and Chief Credit Officer for First Interstate Bank, Prior Executive Vice President and Senior credit roles at KeyBank 36 <1 Non-Executive Officers x x x x Eric Bauer Director of Agribusiness x Former Group President, Chief Credit Officer of Ag, Regional Credit Manager, Business Banking Manager and Retail Manager for our bank. Prior experience with Wells Fargo and First Savings & Loan 27 19 Ryan Boschee Regional President SD, ND & MN x Prior experience includes Group President roles for multiple markets along with Treasury Management in South Dakota for our bank 22 20 Scott Erkonen Chief Information Officer x Prior leadership role representing the United States internationally in the areas of IT Governance and Information Security — ISO (International Organization for Standardization) 25 14 Bart Floyd Regional President IA & MO x Prior experience with US Bank, Wells Fargo/South Trust Bank, and commercial banking and private financing for organizations in Iowa, Colorado, and Texas 25 9 Gail Grant Regional President CO & AZ x Former Group President for Northern Colorado and Arizona for our bank. Prior experience with Wells Fargo/Norwest 32 12 Amy Johnson Director of Treasury Mgmt Prior experience as Treasury Mgmt Senior Vice President of a large national bank; served in Regional, Divisional, and National roles with sales management, service, technology, and process improvement 20 <1 Andy Pederson Chief People Officer x Prior experience includes Senior Human Resource Generalist for Citibank and Wells Fargo 21 12 Corinne Safford Director of Retail x Former Regional Retail Manager, Senior Retail Manager, Branch Manager, Education & Development Officer and Universal Banker for our bank 19 19 Donald Straka General Counsel and Corporate Secretary x Prior experience includes attorney and executive in banking, securities and M&A 33 7 Chris Wiedenfeld Regional President NE & KS x Prior experience with American National Bank, US Bank, and Lauritzen Corporation 25 7 NOTE: For Mr. Chapman, includes experience at National Australia Bank, Ltd. and subsidiaries; For Mr. Erkonen, includes experience at HF Financial Corp.

March 2021 75.4% $6,792 22.1% $1,989 2.5% $230 PORTFOLIO FOOTPRINT September 2016 $4,304 50.0% 49.0% $4,217 $84 1.0% March 2021 50.5% $5,839 48.2% $5,574 1.3% $151 1 Metro markets generally include MSAs with >100K populations 20 September 2016 66.9% $5,810 32.4% $2,815 0.7% $58 Ag Loan Geography South Dakota / Minnesota / North Dakota, 24.2% Colorado, 7.1% Iowa / Missouri, 17.6% Nebraska / Kansas, 6.5% Arizona, 39.8% Specialized Assets, 4.0% Other, 0.8% Non Ag Loan Geography South Dakota / Minnesota / North Dakota, 20.6% Colorado, 13.5% Iowa / Missouri, 26.3% Nebraska / Kansas, 21.1% Arizona, 9.9% Specialized Assets, 4.4% Other, 4.2% Loans - Metro vs Rural Deposits - Metro vs Rural Metro Rural Corporate

COMMERCIAL LOANS 21 Commercial Segments1 Balance ($MM) % of Total Loans Real Estate & Leasing Lessors of Non Residential RE $1,215 13.4 % Lessors of Residential RE/Oth $284 3.2 % Accommodation & Food/Drink Hotel (excl Casino Hotels) $819 9.1 % Food/Drink $170 1.9 % Casino Hotels $119 1.3 % Other Accommodation $9 0.1 % Health Care & Social Assistance Senior Care $319 3.5 % Skilled Nursing $217 2.4 % Hospitals $211 2.3 % Health Services $168 1.9 % Retail Trade Motor Vehicle & Parts Dealers $144 1.6 % Convenience Stores $112 1.2 % Other Retail Trade $201 2.2 % Construction $429 4.8 % Prof, Scien, Tech Oth Services $376 4.2 % Manufacturing $347 3.9 % Wholesale Trade $309 3.4 % Finance and Insurance $189 2.1 % Transportation & Warehousing $155 1.7 % Arts Entertainment and Recreation $123 1.4 % Other $189 2.1 % Total $6,105 67.7 % • Real Estate & Leasing ◦ Major property types are 24% multifamily residential, 21% office buildings, 8% warehouses & manufacturing, 10% retail stores and 11% retail strip malls • Accommodation & Food/Drink ▪ See Key Loan Segments slides for additional details • Health Care & Social Assistance ▪ See Key Loan Segments slides for additional details • Retail Trade ◦ Largely comprised of automobile and other motorized vehicle dealers (32%), convenience stores (25%) and various other segments like furniture stores, building materials, and other retailers (43%) • Construction ◦ Diversified mix with 39% in various specialty contractors, 19% in civil engineering and construction, and 42% in building construction • Manufacturing ◦ Top 3 categories in cement & mineral-based, food and metal fabrication 1 Reflects C&I, CRE and C&D and certain Multifamily loans utilizing NAICS classifications

MORE ON HOTELS 22 Hotel Balances vs Commitments ($MM) $864 $74 $884 $110 $10 Drawn Committed Operating Under Construction Not Started Customer Tenure ($MM) Commitment Outstanding Bal FY14 & Prior FY15 FY16 FY17 FY18 FY19 FY20 $0 $50 $100 $150 $200 $250 $300 $350 • Minimal line commitment exposure with 88% of balances and commitments operational, 11% under construction, and 1% committed and not started • Portfolio consists of relationships with medium to long tenure • 85% of the total commitments is term debt and 15% is lines of credit • 87% of hotel (excl casino hotels) relationships over $1 million are flagged (83% of balance) Franchise Flag Profile (Commitments $MM) Best Western $22 Choice Hotels $19 Hilton $122 Hyatt $23 IHG $168Mariott $91 Other $3 Radisson $11 Wyndham $103 Casino Hotels $119 Boutique, Resort & Other $112 Flagged Not Flagged Casino Hotels

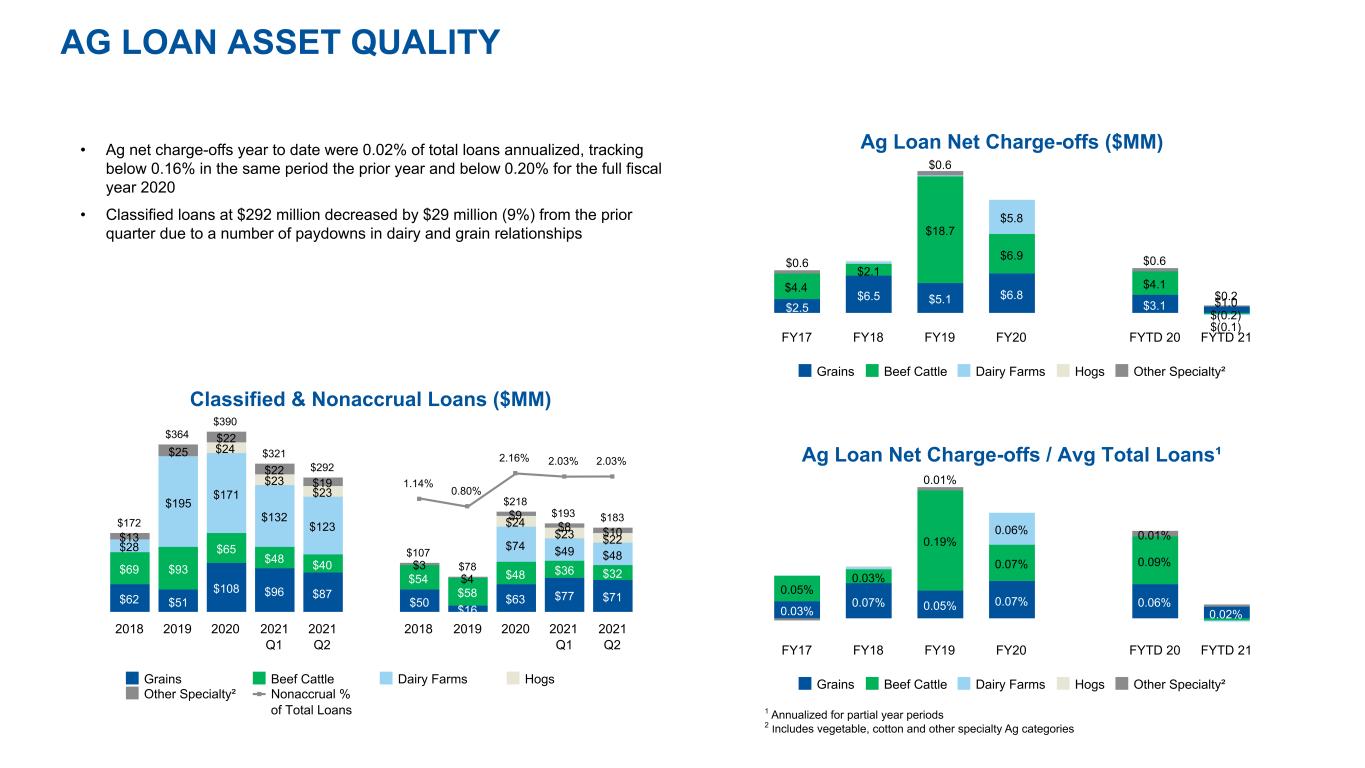

Ag Loan Net Charge-offs / Avg Total Loans¹ 0.03% 0.07% 0.05% 0.07% 0.06% 0.02% 0.05% 0.03% 0.19% 0.07% 0.09% 0.06% 0.01% 0.01% Grains Beef Cattle Dairy Farms Hogs Other Specialty² FY17 FY18 FY19 FY20 FYTD 20 FYTD 21 AG LOAN ASSET QUALITY 23 Classified & Nonaccrual Loans ($MM) $62 $51 $108 $96 $87 $50 $16 $63 $77 $71 $69 $93 $65 $48 $40 $54 $58 $48 $36 $32 $28 $195 $171 $132 $123 $74 $49 $48 $24 $23 $23 $24 $23 $22$13 $25 $22 $22 $19 $3 $4 $9 $8 $10 $172 $364 $390 $321 $292 $107 $78 $218 $193 $183 1.14% 0.80% 2.16% 2.03% 2.03% Grains Beef Cattle Dairy Farms Hogs Other Specialty² Nonaccrual % of Total Loans 2018 2019 2020 2021 Q1 2021 Q2 2018 2019 2020 2021 Q1 2021 Q2 1 Annualized for partial year periods 2 Includes vegetable, cotton and other specialty Ag categories • Ag net charge-offs year to date were 0.02% of total loans annualized, tracking below 0.16% in the same period the prior year and below 0.20% for the full fiscal year 2020 • Classified loans at $292 million decreased by $29 million (9%) from the prior quarter due to a number of paydowns in dairy and grain relationships Ag Loan Net Charge-offs ($MM) $2.5 $6.5 $5.1 $6.8 $3.1 $1.0 $4.4 $2.1 $18.7 $6.9 $4.1 $(0.2) $5.8 $(0.1) $0.6 $0.6 $0.6 $0.2 Grains Beef Cattle Dairy Farms Hogs Other Specialty² FY17 FY18 FY19 FY20 FYTD 20 FYTD 21

INVESTMENTS & BORROWINGS 24 • Investment portfolio weighted average life of 4.2 years as of March 31, 2021 and yield of 1.56% for the quarter ended March 31, 2021, a decrease of 13 basis points compared to the prior quarter • Spot yield on the portfolio at March 31, 2021 was 1.60% • Borrowings portfolio yield of 2.24% for the quarter ended March 31, 2021, an increase of 5 basis points compared to the prior quarter Investment Portfolio US Treasury, 4.3% SBA, 10.6% GNMA, 16.5% Agency CMBS, 18.2% Agency RMBS / CMOs, 47.2% State, 2.2% Agency, 1.0% Other, 0.0% Borrowings & Weighted Average Cost FHLB & Other Borrowings, 2.85% WA Cost Securities sold under agreements to repurchase, 0.08% WA Cost Subordinated debentures and subordinated notes payable, 2.95% WA Cost Total $0.3BTotal $2.3B

LIQUIDITY & INTEREST RATE SENSITIVITY 25 Rate Term 13.6% 7.9% 20.5% 30.0% 19.5% 49.1% 11.7% 11.3% 11.7% 12.2% 0.1% 0.1% 1.2% 1.2% 5.9% 0.2% 0.3% 0.1% 3.4% Fixed Swapped to Variable Adjustable <3m 3m- 12m 12m- 3y 3y-5y 5y+ <3m 3m- 12m 12m- 3y 3y-5y 5y+ Sensitivity Modeling Immediate Gradual -100 bps +100 bps +200 bps +300 bps +400 bps -5.00% 0.00% 5.00% 10.00% 15.00% Additional Sources of Bank Funding Type Amount Outstanding ($MM) Available ($MM) Cash and Unencumbered Securities $2,437 FHLB, Notes Payable $120 $1,825 FHLB Fed Funds Advance $0 FRB Discount Window $0 $939 Unsecured Federal Funds $0 $125 Total $120 $5,326 Holding Company Detail Type Amount Outstanding ($MM) Available ($MM) Cash and Due from Banks $32 Subordinated Debt $35 Trust Preferred $74 Total $109 $32

Net Cash Income by State¹ ($B) 5.5 5.4 4.1 3.8 3.3 3.0 11.8 5.9 3.1 7.4 3.5 3.1 GWB Footprint² GWB Adjacent All Other States CA TX IL IA NE SD MN IN ND WI WA MO FARM INCOME 26 • 2020 net cash income is estimated to be $136 billion, a 25% increase from 2019, driven by a 5% increase in crop receipts offset by a 5% decrease in animal receipts, $24 billion increase in direct government payments, and a small decrease in total production costs • 2021 net cash income is projected to be $128 billion, down 6% from a record level in 2020 with increased commodity prices offset by reduction in government payments combined with a 3% increase in production costs • Farm income by state was well-balanced with 29% in our footprint, 29% adjacent to our footprint, and 42% non-adjacent • Average profits in each of the key sectors are forecasted to increase in 2021, aside from dairy coming off a record year in 2020 to a level more consistent with the 5 year average Source: USDA/ERS Farm Income and Wealth Statistics as of February 5, 2021 1 Data through 2019 2 KS = $2.7M, AZ = $2.0M, CO = $1.9M US Net Cash Income ($B) 57 62 51 72 84 87 68 77 85 74 96 123 135 136 131 107 96 101 103 109 136 128 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 F 20 21 F Avg Net Cash Income per Farm by Sector 23,700 193,000 243,300 421,400 98,400 2016 2017 2018 2019 2020F 2021F Cattle Corn Dairy Hogs Soybeans 29.3% 28.9% 41.8%

FARM BALANCE SHEETS 27 Debt to Equity 19.4% 28.5% 18.5% 17.4% 15.8% 13.9% 14.7% 14.1% 16.1% Equity Debt Debt/equity ratio 1980 1985 1990 1995 2000 2005 2010 2015 2020F $0B $500B $1,000B $1,500B $2,000B $2,500B $3,000B $3,500B $4,000B Debt Service Ratios 37% 38% 24% 24% 25% 23% 25% 24% 24% Non RE Debt RE Debt Debt Service Ratio 1980 1985 1990 1995 2000 2005 2010 2015 2020F $0B $100B $200B $300B $400B $500B $600B Land Value Index 19 50 19 55 19 60 19 65 19 70 19 75 19 80 19 85 19 90 19 95 20 00 20 05 20 10 20 15 20 20 —% 50% 100% 150% 200% 250% 300% 350% 400% 450% • Land values remain firm following a 3% increase from 2017-2020 despite a decrease in general commodity prices • Farm debt to equity remains low relative to historic levels; 2020 increased slightly to 16% and is forecasted to be flat at 16% in 2021 ◦ 2020 estimated industry equity increased 1% and is forecasted to increase 2% to 2.7 trillion in 2021 ◦ 2020 estimated industry debt increased 3% and is forecasted to increase 2% to 442 billion in 2021 • The industry debt service ratio, which measures how much production income is committed to debt servicing, remains in line with recent years and is forecasted to be 25% for 2021 Source: USDA/ERS Farm Income and Wealth Statistics as of February 5, 2021 Source: 2020 Iowa State University Farmland Value Survey

PEER GROUP 28 • BancorpSouth Bank • Fulton Financial Corporation • Banner Corporation • Glacier Bancorp, Inc. • Berkshire Hills Bancorp, Inc. • Heartland Financial USA, Inc. • Columbia Banking System, Inc. • Old National Bancorp • Community Bank System, Inc. • Renasant Corporation • Customers Bancorp, Inc. • Trustmark Corporation • CVB Financial Corp. • UMB Financial Corporation • First BanCorp. • United Bankshares, Inc. • First Midwest Bancorp, Inc. • United Community Banks, Inc.

Appendix 2 Non-GAAP Measures

NON-GAAP MEASURES 30 At or for the six months ended: At or for the three months ended: March 31, 2021 March 31, 2020 March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 Adjusted net income and adjusted earnings per common share: Net income (loss) - GAAP $ 92,618 $ (697,344) $ 51,299 $ 41,319 $ 11,136 $ 5,400 $ (740,618) Add: COVID-19 related impairment of goodwill and certain intangible assets, net of tax — 713,013 — — — — 713,013 Add: COVID-19 impact on credit and other related charges, net of tax — 56,685 — — — — 56,685 Adjusted net income $ 92,618 $ 72,354 $ 51,299 $ 41,319 $ 11,136 $ 5,400 $ 29,080 Weighted average diluted common shares outstanding 55,351,871 56,141,816 55,456,399 55,247,343 55,164,548 55,145,619 55,906,002 Earnings per common share - diluted $ 1.68 $ (12.42) $ 0.93 $ 0.75 $ 0.20 $ 0.10 $ (13.25) Adjusted earnings per common share - diluted $ 1.68 $ 1.29 $ 0.93 $ 0.75 $ 0.20 $ 0.10 $ 0.52 Pre-tax pre-provision income ("PTPP"): Income (loss) before income taxes - GAAP 118,668 (722,475) 65,960 52,708 10,279 5,878 (778,348) Add: Provision for credit losses - GAAP 6,899 79,898 (5,000) 11,899 16,853 21,641 71,795 Add: Change in fair value of FVO loans and related derivatives - GAAP 1,630 12,657 (42) 1,672 24,648 25,001 10,533 Add: Goodwill impairment - GAAP — 742,352 — — — — 742,352 Pre-tax pre-provision income $ 127,197 $ 112,432 $ 60,918 $ 66,279 $ 51,780 $ 52,520 $ 46,332 Tangible net income and return on average tangible common equity: x x x x x Net income (loss) - GAAP $ 92,618 $ (697,344) $ 51,299 $ 41,319 $ 11,136 $ 5,400 $ (740,618) Add: Amortization of intangible assets and COVID-19 related impairment of goodwill and certain intangible assets, net of tax 522 713,817 261 261 261 261 713,440 Tangible net income (loss) $ 93,140 $ 16,473 $ 51,560 $ 41,580 $ 11,397 $ 5,661 $ (27,178) Average common equity $ 1,065,732 $ 1,913,277 $ 1,049,388 $ 1,082,077 $ 1,174,996 $ 1,163,724 $ 1,918,035 Less: Average goodwill and other intangible assets 5,873 744,702 5,742 6,004 6,265 6,527 741,257 Average tangible common equity $ 1,059,859 $ 1,168,575 $ 1,043,646 $ 1,076,073 $ 1,168,731 $ 1,157,197 $ 1,176,778 Return on average common equity * 17.4 % (72.9) % 19.8 % 15.2 % 3.8 % 1.9 % (155.3) % Return on average tangible common equity ** 17.6 % 2.8 % 20.0 % 15.3 % 3.9 % 2.0 % (9.3) % * Calculated as net income - GAAP divided by average common equity. Annualized for partial-year periods. ** Calculated as tangible net income divided by average tangible common equity. Annualized for partial-year periods.

NON-GAAP MEASURES 31 At or for the six months ended: At or for the three months ended: March 31, 2021 March 31, 2020 March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 Adjusted net interest income and adjusted net interest margin (fully-tax equivalent basis): Net interest income - GAAP $ 210,778 $ 207,156 $ 102,870 $ 107,908 $ 106,018 $ 106,251 $ 101,983 Add: Tax equivalent adjustment 3,175 3,037 1,577 1,598 1,508 1,601 1,514 Net interest income (FTE) 213,953 210,193 104,447 109,506 107,526 107,852 103,497 Add: Derivative interest expense (6,575) (2,141) (3,182) (3,393) (3,541) (3,040) (1,251) Adjusted net interest income (FTE) $ 207,378 $ 208,052 $ 101,265 $ 106,113 $ 103,985 $ 104,812 $ 102,246 Average interest-earning assets $ 12,019,526 $ 11,567,032 $ 12,073,497 $ 11,965,555 $ 12,184,093 $ 12,156,505 $ 11,590,453 Net interest margin (FTE) * 3.57 % 3.63 % 3.51 % 3.63 % 3.51 % 3.57 % 3.59 % Adjusted net interest margin (FTE) ** 3.46 % 3.60 % 3.40 % 3.52 % 3.40 % 3.47 % 3.55 % * Calculated as net interest income (FTE) divided by average interest earning assets. Annualized for partial-year periods. ** Calculated as adjusted net interest income (FTE) divided by average interest earning assets. Annualized for partial-year periods. Adjusted interest income and adjusted yield (fully-tax equivalent basis), on non-ASC 310-30 loans: x x x x x Interest income - GAAP $ 207,597 $ 229,679 $ 100,274 $ 107,323 $ 106,305 $ 107,725 $ 111,970 Add: Tax equivalent adjustment 3,175 3,037 1,577 1,598 1,508 1,601 1,514 Interest income (FTE) 210,772 232,716 101,851 108,921 107,813 109,326 113,484 Add: Derivative interest expense (6,575) (2,141) (3,182) (3,393) (3,541) (3,040) (1,251) Adjusted interest income (FTE) $ 204,197 $ 230,575 $ 98,669 $ 105,528 $ 104,272 $ 106,286 $ 112,233 Average non-ASC310-30 loans $ 9,291,950 $ 9,525,157 $ 9,016,221 $ 9,567,679 $ 9,977,591 $ 9,974,802 $ 9,496,153 Yield (FTE) * 4.55 % 4.89 % 4.58 % 4.52 % 4.30 % 4.41 % 4.81 % Adjusted yield (FTE) ** 4.41 % 4.84 % 4.44 % 4.38 % 4.16 % 4.29 % 4.75 % * Calculated as interest income (FTE) divided by average loans. Annualized for partial-year periods. ** Calculated as adjusted interest income (FTE) divided by average loans. Annualized for partial-year periods.

NON-GAAP MEASURES 32 At or for the six months ended: At or for the three months ended: March 31, 2021 March 31, 2020 March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 Efficiency ratio: Total revenue - GAAP $ 242,119 $ 222,806 $ 120,063 $ 122,056 $ 102,068 $ 94,568 $ 101,900 Add: Tax equivalent adjustment 3,175 3,037 1,577 1,598 1,508 1,601 1,514 Total revenue (FTE) $ 245,294 $ 225,843 $ 121,640 $ 123,654 $ 103,576 $ 96,169 $ 103,414 Noninterest expense $ 116,552 $ 865,383 $ 59,103 $ 57,449 $ 74,936 $ 67,049 $ 808,453 Less: Amortization of intangible assets and COVID-19 related impairment of goodwill and certain intangible assets 522 743,206 261 261 261 278 742,779 Tangible noninterest expense $ 116,030 $ 122,177 $ 58,842 $ 57,188 $ 74,675 $ 66,771 $ 65,674 Efficiency ratio * 47.3 % 54.1 % 48.4 % 46.2 % 72.1 % 69.4 % 63.5 % * Calculated as the ratio of tangible noninterest expense to total revenue (FTE). Tangible common equity and tangible common equity to tangible assets: x x x x x Total stockholders' equity $ 1,093,919 $ 1,153,464 $ 1,093,919 $ 1,068,501 $ 1,162,933 $ 1,160,644 $ 1,153,464 Less: Goodwill and other intangible assets 5,643 6,703 5,643 5,904 6,164 6,425 6,703 Tangible common equity $ 1,088,276 $ 1,146,761 $ 1,088,276 $ 1,062,597 $ 1,156,769 $ 1,154,219 $ 1,146,761 Total assets $ 13,013,739 $ 12,387,808 $ 13,013,739 $ 12,814,383 $ 12,604,439 $ 12,934,328 $ 12,387,808 Less: Goodwill and other intangible assets 5,643 6,703 5,643 5,904 6,164 6,425 6,703 Tangible assets $ 13,008,096 $ 12,381,105 $ 13,008,096 $ 12,808,479 $ 12,598,275 $ 12,927,903 $ 12,381,105 Tangible common equity to tangible assets 8.4 % 9.3 % 8.4 % 8.3 % 9.2 % 8.9 % 9.3 % x x x x x Tangible book value per share: x x x x x Total stockholders' equity $ 1,093,919 $ 1,153,464 $ 1,093,919 $ 1,068,501 $ 1,162,933 $ 1,160,644 $ 1,153,464 Less: Goodwill and other intangible assets 5,643 6,703 5,643 5,904 6,164 6,425 6,703 Tangible common equity $ 1,088,276 $ 1,146,761 $ 1,088,276 $ 1,062,597 $ 1,156,769 $ 1,154,219 $ 1,146,761 Common shares outstanding 55,111,403 55,013,928 55,111,403 55,105,105 55,014,189 55,014,047 55,013,928 Book value per share - GAAP $ 19.85 $ 20.97 $ 19.85 $ 19.39 $ 21.14 $ 21.10 $ 20.97 Tangible book value per share $ 19.75 $ 20.84 $ 19.75 $ 19.28 $ 21.03 $ 20.98 $ 20.84