Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - GENTHERM Inc | thrm-ex991_153.htm |

| 8-K - Q1 2021 GENTHERM FORM 8-K EARNINGS RELEASE - GENTHERM Inc | thrm-8k_20210429.htm |

2021 First Quarter Results Gentherm, Inc. April 29, 2021 Exhibit 99.2

Forward-Looking Statement Except for historical information contained herein, statements in this presentation are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent Gentherm Incorporated's goals, beliefs, plans and expectations about its prospects for the future and other future events. The forward-looking statements included in this presentation are made as of the date hereof or as of the date specified herein and are based on management's reasonable expectations and beliefs. Such statements are subject to a number of important assumptions, risks, uncertainties and other factors that may cause actual results or performance to differ materially from that described in or indicated by the forward-looking statements. Those risks include, but are not limited to, risks that: the COVID-19 pandemic and its direct and indirect adverse impacts on the automobile and medical industries and global economy, which had, and may continue to have, an adverse effect on, among other things, the Company’s results of operations, financial condition, cash flows, liquidity, business operations and stock price; borrowing availability under the Company’s revolving credit facility, the loss of any key suppliers, or any material delays in the supply chain of the Company or the ORMs and Tier 1s supplied by the Company, including resulting from a shortage of key components (such as semiconductors); the Company’s failure to be in compliance with covenants under its debt agreements, which could result in the amounts outstanding thereunder being accelerated and becoming immediately due and payable; the Company’s ability to obtain additional financing by accessing the capital markets, which may not be available on acceptable terms or at all; the macroeconomic environment, including its impact on the automotive industry, which is cyclical; any significant declines or slower growth than anticipated in light vehicle production; market acceptance of the Company’s existing or new products, and new or improved competing products developed by competitors with greater resources; shifting customer preferences, including due to the evolving use of automobiles and technology; the Company’s ability to project future sales volumes, based on which the Company manages its business; reductions in new business awards, which were limited in 2020, and may continue to be limited, due to COVID-19 and related uncertainties; the Company’s ability to convert new business awards into product revenues; the loss or insolvency of any of the Company’s key customers; the impact of price downs in the ordinary course, or additional increased pricing pressures from the Company’s customers; the feasibility of Company’s development of new products on a timely, cost effective basis, or at all; security breaches and other disruptions to the Company’s IT systems; work stoppages impacting the Company, its suppliers or customers; changes in free trade agreements or the implementation of additional tariffs, and the Company’s ability to pass-through tariff costs; unfavorable changes to currency exchange rates; the Company’s ability to protect its intellectual property in certain jurisdictions; the Company’s ability to effectively implement ongoing restructuring and other cost-savings measures or realize the full amount of estimated savings; and compliance with, and increased costs related to, domestic and international regulations. The foregoing risks should be read in conjunction with the Company's filings with the Securities and Exchange Commission (the “SEC”), including “Risk Factors”, in its most recent Annual Report on Form 10-K and subsequent SEC filings, for a discussion of these and other risks and uncertainties. In addition, the business outlook discussed in this presentation does not include the potential impact of any business combinations, acquisitions, divestitures, strategic investments and other significant transactions that may be completed after the date hereof, each of which may present material risks to the Company’s future business and financial results. Except as required by law, the Company expressly disclaims any obligation or undertaking to update any forward-looking statements to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. 2

Use of Non-GAAP Financial Measures* In addition to the results reported herein in accordance with GAAP, the Company has provided here or elsewhere Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EPS, Free Cash Flow, Net Debt and Revenue excluding the impact of foreign currency translation, each a non-GAAP financial measure. See the Company’s earnings release dated April 29, 2021 for the definitions of each non-GAAP financial measure, information regarding why the Company utilizes such non-GAAP measures as supplemental measures of performance or liquidity, and their limitations. * See Appendix for certain reconciliations of GAAP to non-GAAP historical financial measures 3

Automotive 1Q 2021 Highlights 4 Continued strong execution in Automotive 10 Vehicle launches with 8 OEMs Multiple CCS® product launches Acura MDX Jeep Grand Cherokee Kia Sportage Stellantis DS9 VW CrossBlue / Tiguan Advanced ClimateSense™ development projects Further confirmation of energy savings Enhancing human-based Thermal Comfort Measurement Model

New Automotive Business Awards 5 Strong win rate and continued momentum in new business awards $400M in awards across 10 OEMs in 1Q 2021 Multiple CCS® awards Hyundai Kia Toyota Volkswagen 10 Steering Wheel Heater awards across 8 OEMs Air-cooling Battery Thermal Management awards with Hyundai and Kia Power Seat Electronics Award with Shanghai General Motors Steering Wheel Heater and Seat Heater awards with Rivian and one of the largest EV manufacturers

Medical 1Q 2021 Highlights 6 Continued market challenges due to COVID-19 Continued hospital access restrictions and cancelled elective procedures Recovering Blanketrol® demand Strong interest from Ambulatory Surgery Centers for ASTOPAD™ Continued innovation leveraging thermophysiology synergies between Medical and Automotive

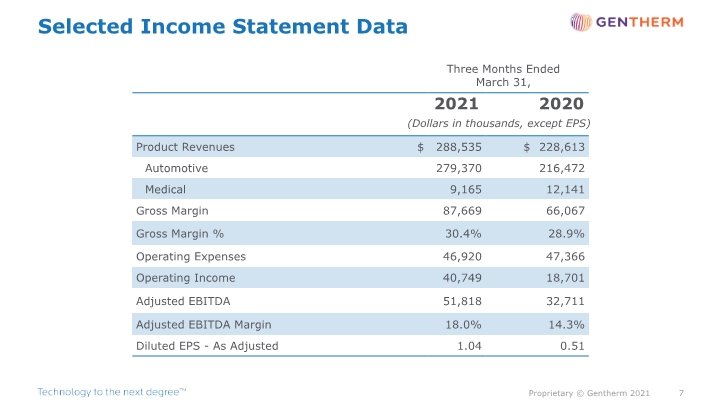

Selected Income Statement Data 7 Three Months Ended March 31, (Dollars in thousands, except EPS)

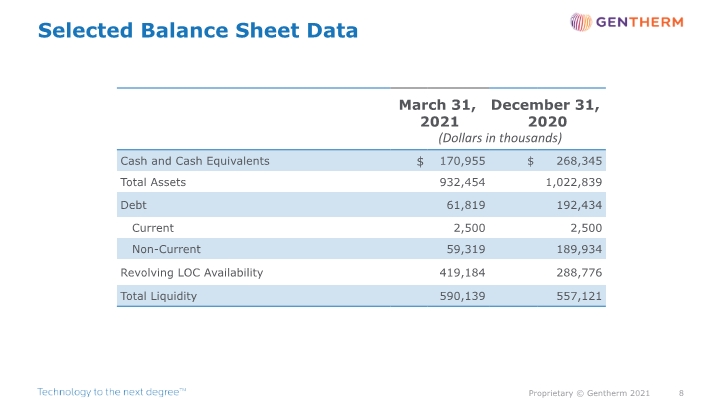

Selected Balance Sheet Data 8 (Dollars in thousands)

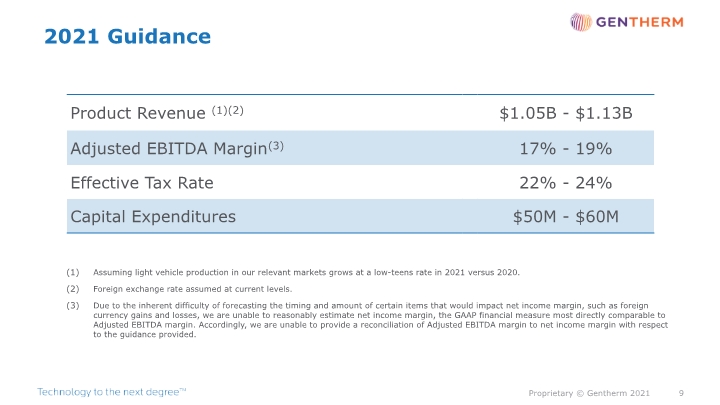

2021 Guidance Assuming light vehicle production in our relevant markets grows at a low-teens rate in 2021 versus 2020. Foreign exchange rate assumed at current levels. Due to the inherent difficulty of forecasting the timing and amount of certain items that would impact net income margin, such as foreign currency gains and losses, we are unable to reasonably estimate net income margin, the GAAP financial measure most directly comparable to Adjusted EBITDA margin. Accordingly, we are unable to provide a reconciliation of Adjusted EBITDA margin to net income margin with respect to the guidance provided. 9

Appendix 10

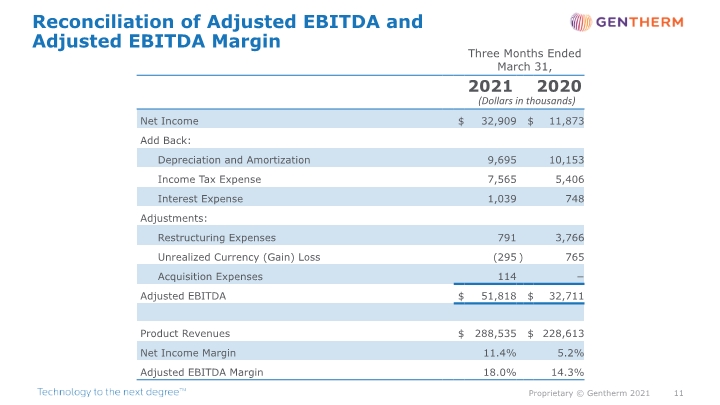

Reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin 11 Three Months Ended March 31, (Dollars in thousands)

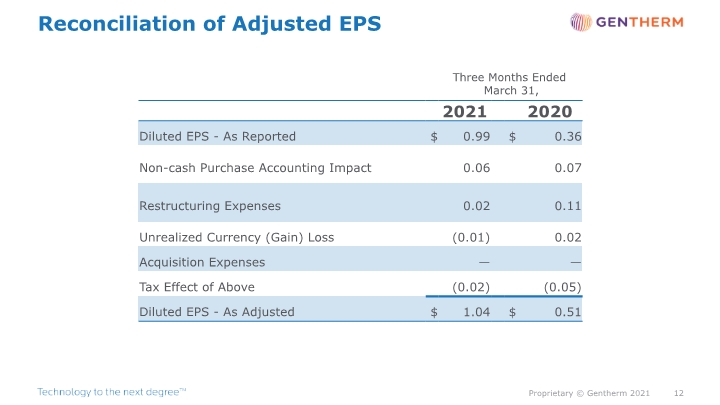

Reconciliation of Adjusted EPS 12 Three Months Ended March 31,