Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bank7 Corp. | brhc10023759_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Bank7 Corp. | brhc10023759_ex99-1.htm |

Exhibit 99.2

BSVN Q1 2021EARNINGS RELEASEApril 29, 2021

1 BSVN – A Strong Value Proposition / 1Q Overview Company Highlights Positioned in a dynamic market,

with a commercial banking emphasis that delivers services via a branch-lite model.Experienced and talented bankers focused on high-touch personalized service.Highly disciplined credit culture that adheres to a robust risk management framework

resulting in excellent credit quality and a history of low loan losses.Shareholder alignment due to 71.5% insider ownership with zero insider sales. Healthy Capital and Notable Book Value Compounder The Company began paying quarterly cash

dividends in 3Q 2019 and has since paid out dividends totaling $10.8 million. In addition, we repurchased $9.0 million of our shares in 2020.Despite our robust dividend, stock buyback activity and strong organic growth, we have strong capital

ratios – CET1 of 14.09% and total RBC of 15.34%.Since YE 2018, our tangible book value per share has increased 43% and, including dividends, the total absolute return to shareholders exceeds 56%.(1) Superior Core Earnings Even with the

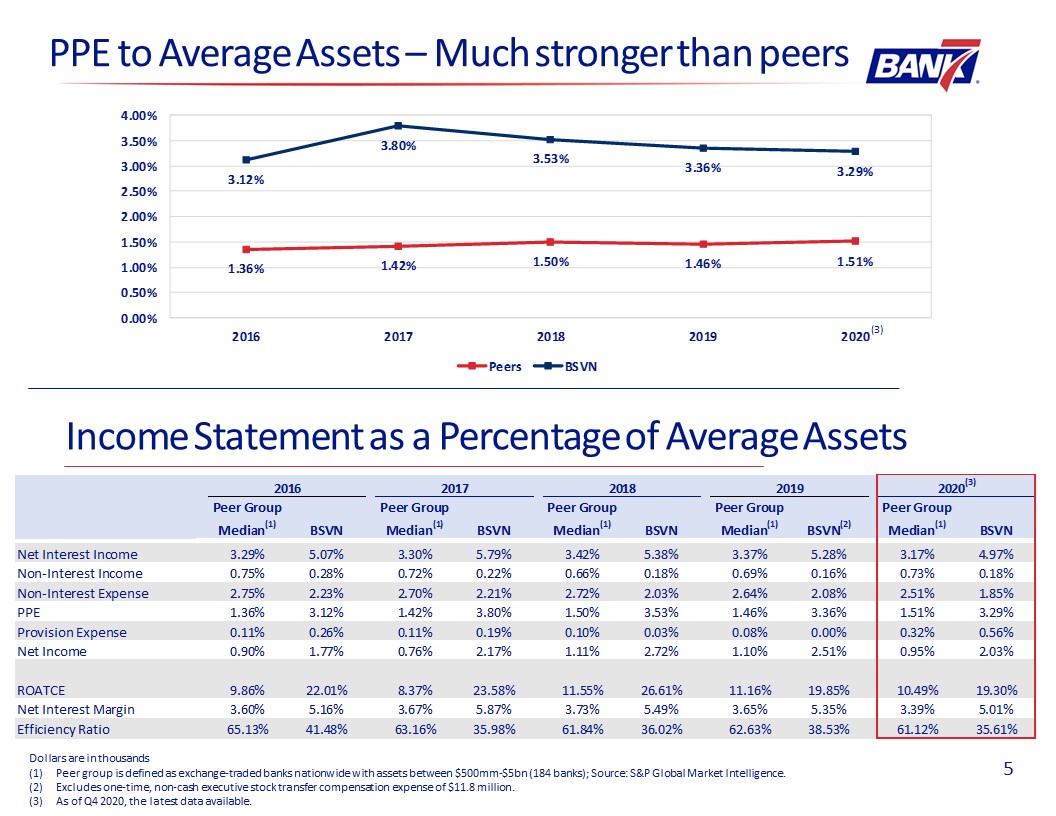

challenging yield curve environment, we have consistently produced exceptional PPE.(2)PPE strength is far greater than peers: 3.29% PPE to average assets vs. peer average of 1.51%.(3) All data as of March 31, 2021, unless indicated

otherwise.See full calculation on slide 3.Pre-tax pre-provision earnings (PPE) is a non-GAAP financial measure, see Appendix for reconciliation to the most comparable GAAP measure for this metric.As of 4Q 2020, the latest figures available.

Peer group is defined as 184 exchange-traded banks nationwide with assets between $500 million and $5 billion. Source: S&P Global Market Intelligence. Strong PPE is one of the foundations of our company – PPE totaled $8.1 million for the

quarter, compared to $7.4 million for 1Q 2020, an increase of 9.4%. TBV totaled $12.18 per share, an increase of $0.49, or 4.2%, from year-end. EPS for the quarter was $0.56, an increase of $0.04, or 7.7%, from 4Q 2020.

2 Outstanding Book Value Appreciation Tangible Book Value Per Share Between 2018 and 1Q 2021,

tangible book value per share CAGR of 17.4%.Over this same period, we have increased tangible book value per share by 43.49%.When including the cash dividends, BSVN has produced a 56.68% overall return over the same period. Dollars are in

thousands, except for per share data CAGR since 2018 = 17.4%

2.51% Pro Forma Pro Forma A Continuation of BSVN Performance Return on Average Assets

(1)(2) Return on Average Tangible Common Equity (1) (2) Dollars are in millionsFinancial data is as of or for the twelve months ended December 31 of each respective year and as of and for the three months ended March 31, 2021.Profitability

metrics are tax-adjusted as if the Company were a C Corporation at the estimated tax rates for the respective periods. Pro Forma YTD ROAA, ROATCE and efficiency ratio are non-GAAP financial measures, see slide 14 for reconciliation to the

most comparable GAAP measures for these metrics. Efficiency Ratio(2) Even with the additional ALLL build and a challenging rate environment, we continue to produce strong annualized ROAA and ROATCE: 2.11% and 19.29% for Q1 2021,

respectively. Industry-leading efficiency ratio. 3 5-year average: 2.25% 5-year average: 22.3% 38.3% 20.9% Pro Forma

Dollars are in millions. Financial data is as of or for the twelve months ended December 31 of each

respective year and as of and for the three months ended March 31, 2020 and 2021.Pro Forma noninterest expense to average assets is a non-GAAP financial measure. See slide 14 for reconciliation to their most comparable GAAP measure.Pro Forma

2019 PPE is a non-GAAP financial measure which adds back the one-time, extraordinary compensation expense related to the non-cash executive stock transaction that took place during the period. See Pro Forma Net Income reconciliation table for

detailed calculation of this measure. 9.4% increase YoY Strong PPE and Organic Growth PPE(2) Total Assets 4 $26.8 Pro Forma A history of strong organic growth.Our high level of PPE is achieved in part because of our strategy of

having fewer, but better FTEs, who excel at providing services and solutions utilizing our enhanced technology and processes, delivered through our branch-lite model. Leveraging Our Employee Base(1) 3.56%Actual Pro Forma CAGR Since

2016: 13.4%

5 Income Statement as a Percentage of Average Assets Dollars are in thousandsPeer group is defined as

exchange-traded banks nationwide with assets between $500mm-$5bn (184 banks); Source: S&P Global Market Intelligence.Excludes one-time, non-cash executive stock transfer compensation expense of $11.8 million.As of Q4 2020, the latest data

available. PPE to Average Assets – Much stronger than peers (3)

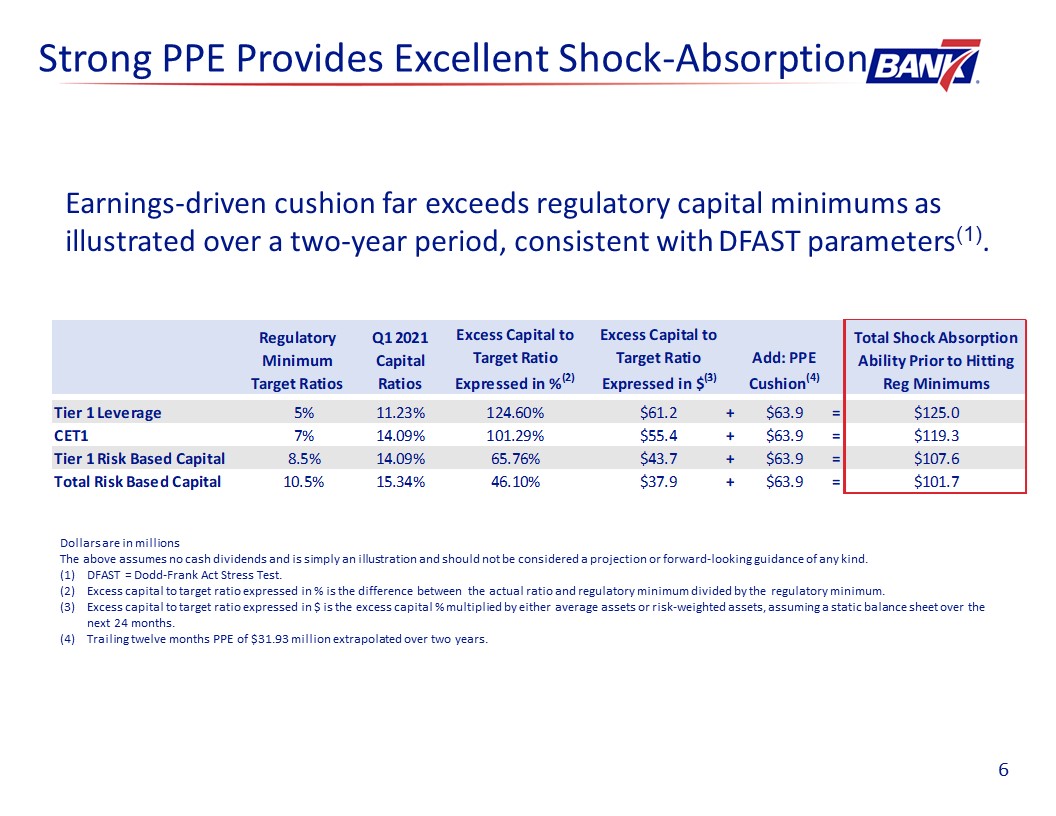

6 Earnings-driven cushion far exceeds regulatory capital minimums as illustrated over a two-year

period, consistent with DFAST parameters(1). Dollars are in millionsThe above assumes no cash dividends and is simply an illustration and should not be considered a projection or forward-looking guidance of any kind. DFAST = Dodd-Frank Act

Stress Test.Excess capital to target ratio expressed in % is the difference between the actual ratio and regulatory minimum divided by the regulatory minimum.Excess capital to target ratio expressed in $ is the excess capital % multiplied by

either average assets or risk-weighted assets, assuming a static balance sheet over the next 24 months. Trailing twelve months PPE of $31.93 million extrapolated over two years. Strong PPE Provides Excellent Shock-Absorption

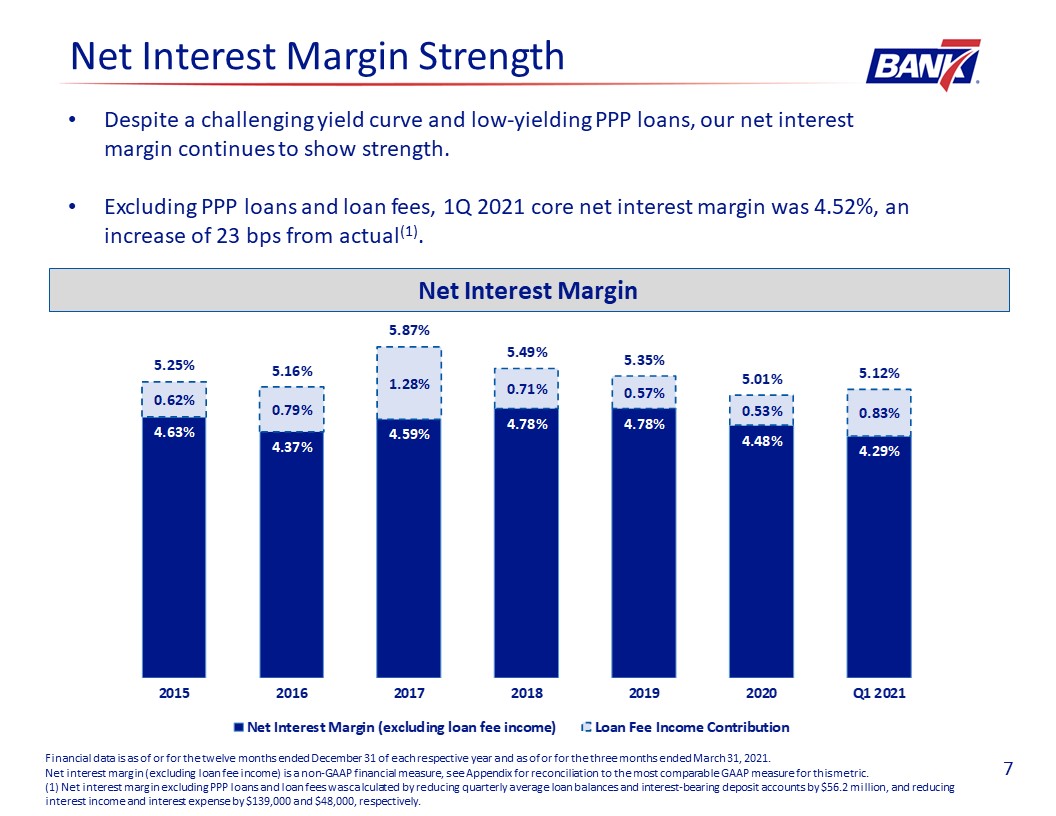

Net Interest Margin Strength Financial data is as of or for the twelve months ended December 31 of

each respective year and as of or for the three months ended March 31, 2021.Net interest margin (excluding loan fee income) is a non-GAAP financial measure, see Appendix for reconciliation to the most comparable GAAP measure for this

metric.(1) Net interest margin excluding PPP loans and loan fees was calculated by reducing quarterly average loan balances and interest-bearing deposit accounts by $56.2 million, and reducing interest income and interest expense by $139,000

and $48,000, respectively. Net Interest Margin Despite a challenging yield curve and low-yielding PPP loans, our net interest margin continues to show strength.Excluding PPP loans and loan fees, 1Q 2021 core net interest margin was 4.52%,

an increase of 23 bps from actual(1). 7

ALLL increased by $1.23 million, or 12.7%, during 1Q 2021 and finished the quarter at 1.36% of total

loans, up from 1.22% at year end 2020.(1)Reduction of energy loan portfolio; down from 18.6% of total loans at YE 2017 to 10.8% of total loans at 1Q 2021.Full effect of the pandemic related downturn continues to become more clear and

management remains confident that the overall cycle NCOs will be within historical trends. 8 Allowance for Loan Losses to Total Loans Asset Quality Net Charge-Offs to Average Loans Financial data is as of or for the twelve months ended

December 31 of each respective year and as of or for the three months ended March 31, 2021. (1) “Total Loans” excludes $44.9 and $64.7 in PPP loans for 2020 and 1Q 2021, respectively. With PPP loans included, ratio is 1.15% and 1.26%,

respectively. (1) Energy Portfolio as a % of Total Loans (1)

Hospitality Loan Portfolio Detail as of 1Q 21 9 Blue collar portfolio that is well-protected by the

“cycle-down” effect of a recession. Experienced owner/operators with decades of history that spans multiple recessions. Average occupancy for March 2021 within the portfolio was 70% compared to 32% for March 2020. Average Daily Rate for March

2021 was $65 compared to $50 for March 2020. Diversified exposure to many reputable brands. Dollars are in millions. Hotel Portfolio Exposure by Class Hotel Portfolio Exposure by Flag

10 Hospitality Loan Portfolio Detail Equity advantage – average loan per room is $45,500 vs.

estimated replacement cost in excess of $115,000 per room.Consistent underwriting fundamentals with disciplined equity requirements, minimum debt coverage ratio hurdles, personal recourse, and rapid amortization. Portfolio Metrics – 38

Operating Properties Dollars are in millions except per room data. Data as of March 31, 2021. Concentrated in “Drive-To” markets in Texas with no exposure to “Gateway” cities.No exposure to towns or cities that are heavily dependent on the

energy space.

Dollars are in millions Energy Portfolio Potential Exposure 11

Appendix 12

13 Bank7 Corp. Financials Net income and earnings per share are tax-adjusted as if the Company were a

C Corporation at the estimated tax rates for the respective periods. EPS calculation is based on diluted shares. Combined federal and state effective tax rates for the three months ended March 31, 2020 and 2021 was 25.3%. Represents a

non-GAAP financial measure. See non-GAAP reconciliations table for reconciliation to most comparable GAAP measure for this metric. All pro forma amounts relate to the one-time, non-cash executive stock transfer which occurred in September

2019. These amounts remove the compensation expense and related tax impact from net income. See detail and reconciliation on slide 18 of this presentation.

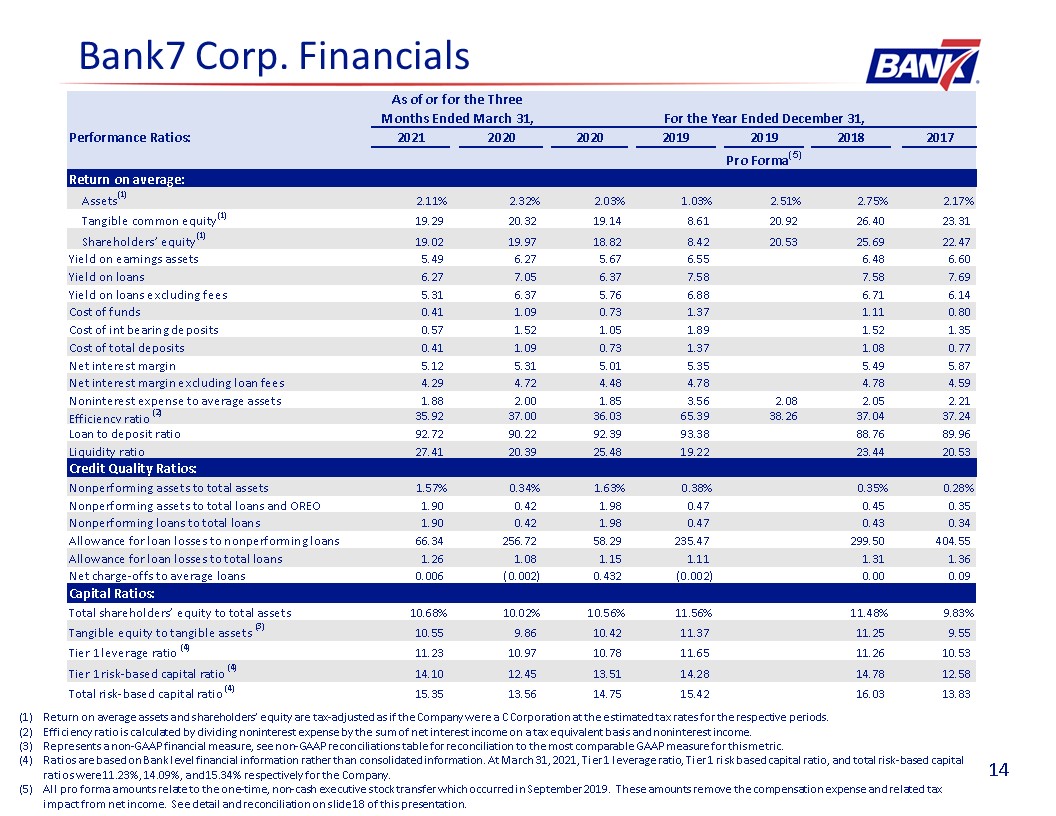

0 Bank7 Corp. Financials Return on average assets and shareholders’ equity are tax-adjusted as if the

Company were a C Corporation at the estimated tax rates for the respective periods.Efficiency ratio is calculated by dividing noninterest expense by the sum of net interest income on a tax equivalent basis and noninterest income. Represents

a non-GAAP financial measure, see non-GAAP reconciliations table for reconciliation to the most comparable GAAP measure for this metric. Ratios are based on Bank level financial information rather than consolidated information. At March 31,

2021, Tier 1 leverage ratio, Tier 1 risk based capital ratio, and total risk-based capital ratios were 11.23%, 14.09%, and 15.34% respectively for the Company.All pro forma amounts relate to the one-time, non-cash executive stock transfer

which occurred in September 2019. These amounts remove the compensation expense and related tax impact from net income. See detail and reconciliation on slide 18 of this presentation.

15 Non-GAAP Reconciliations

Loan Portfolio Distribution Dollars are in millions. Data as of March 31, 2021. Gross Loan Portfolio

Composition by Purpose Type 16

Deposit Composition Historical Deposit Growth Compound Annual Growth Rate = 12.9% Deposit

Composition as of March 31, 2021 85.4% of our loan customers also had a deposit relationship with us as of March 31, 2021.Core Deposits(1)Total organic core deposit growth YOY was $99.1M, or 13.1%. Core deposits totaled $856.8 million as of

March 31, 2021 compared to $757.7 million as of March 31, 2020. Dollars are in millions.Financial data is as of or for the twelve months ended December 31 of each respective year and as of or for the three months ended March 31, 2021.(1) We

define core deposits as deposits obtained directly from the depositor and exclude deposits obtained from listing services and brokered deposits that are obtained through an intermediary. Commentary 17

18 2019 Pro Forma Net Income Reconciliation On September 5, 2019, our largest shareholders, the

Haines Family Trusts, contributed approximately 6.5% of their shares (656,925 shares) to the Company. Subsequently, the Company immediately issued those shares to certain executive officers, which was charged as compensation expense of $11.8

million, including payroll taxes, through the income statement of the Company. Additionally, at the discretion of the employees receiving shares to assist in paying tax withholdings, 149,425 shares were withheld and subsequently canceled,

resulting in a charge to retained earnings of $2.6 million.

19 Legal Information and Disclaimer This presentation and oral statements made regarding the subject

of this presentation contain forward-looking statements. These forward-looking statements are subject to significant uncertainties because they are based upon: the amount and timing of future changes in interest rates, market behavior, and

other economic conditions; future laws, regulations, and accounting principles; changes in regulatory standards and examination policies, and a variety of other matters. These other matters include, among other things, the impact of COVID-19

on the United States economy and our operations, the direct and indirect effect of economic conditions on interest rates, credit quality, loan demand, liquidity, and monetary and supervisory policies of banking regulators. These

forward-looking statements reflect Bank7 Corp.’s current views with respect to, among other things, future events and Bank7 Corp.’s financial performance. Any statements about Bank7 Corp.’s expectations, beliefs, plans, predictions,

forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,”

“can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Any or all of the forward-looking statements in (or conveyed orally

regarding) this presentation may turn out to be inaccurate. The inclusion of or reference to forward-looking information in this presentation should not be regarded as a representation by Bank7 Corp. or any other person that the future plans,

estimates or expectations contemplated by Bank7 Corp. will be achieved. Bank7 Corp. has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that Bank7 Corp.

believes may affect its financial condition, results of operations, business strategy and financial needs. Bank7 Corp.’s actual results could differ materially from those anticipated in such forward-looking statements as a result of risks,

uncertainties and assumptions that are difficult to predict. If one or more events related to these or other risks or uncertainties materialize, or if Bank7 Corp.’s underlying assumptions prove to be incorrect, actual results may differ

materially from what Bank7 Corp. anticipates. You are cautioned not to place undue reliance on forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made and Bank7 Corp. undertakes no

obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as may be required by law. All

forward-looking statements herein are qualified by these cautionary statements. Within this presentation, we reference certain market, industry and demographic data, forecasts and other statistical information. We have obtained this data,

forecasts and information from various independent, third party industry sources and publications. Nothing in the data, forecasts or information used or derived from third party sources should be construed as advice. Some data and other

information are also based on our good faith estimates, which are derived from our review of industry publications and surveys and independent sources. We believe that these sources and estimates are reliable, but have not independently

verified them. Statements as to our market position are based on market data currently available to us. Although we are not aware of any misstatements regarding the economic, employment, industry and other market data presented herein, these

estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. This presentation includes certain non-GAAP financial measures, including pro forma net income, tax-adjusted net income, tax-adjusted

earnings per share, tax-adjusted return on average assets and tax-adjusted return on average shareholders’ equity. These non-GAAP financial measures and any other non-GAAP financial measures that we discuss in this presentation should not be

considered in isolation, and should be considered as additions to, and not substitutes for or superior to, measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of these

non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the

usefulness of Bank7 Corp.’s non-GAAP financial measures as tools for comparison. See the table on Slides 14, 15 and 19 of this presentation for a reconciliation of the non-GAAP financial measures used in (or conveyed orally during) this

presentation to their most directly comparable GAAP financial measures.