Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Sunstone Hotel Investors, Inc. | sho-20210422xex99d1.htm |

| EX-3.2 - EX-3.2 - Sunstone Hotel Investors, Inc. | sho-20210422xex3d2.htm |

| EX-3.1 - EX-3.1 - Sunstone Hotel Investors, Inc. | sho-20210422xex3d1.htm |

| 8-K - 8-K - Sunstone Hotel Investors, Inc. | sho-20210422x8k.htm |

Exhibit 99.2

| April 2021 Montage Healdsburg Acquisition |

| One of the Newest and Finest Luxury Resorts |

| Located in One of the World’s Most Sought-After Destinations |

| Long-Term Relevant Real Estate® |

| Transaction Overview 5 Opportunistic Acquisition of Long-Term Relevant Real Estate® • Investment: Sunstone has acquired the fee-simple interest in the recently opened Montage Healdsburg, a 130-room luxury resort in Northern California’s world-renowned wine region for $265 million. • Property: The expansive resort sits across 117 secluded acres and is adjacent to 40 premium home sites being developed as part of Montage Residences Healdsburg(1). The destination resort has abundant amenities, including a vineyard, multiple restaurants, a full-service spa, numerous recreational activities and substantial purpose-built meeting space. • Off-Market Transaction: The off-market acquisition is the result of a long-standing relationship with the seller, an affiliate of Ohana Real Estate Investors (“Ohana” or the “Seller”) who will continue to own and be responsible for the development and sales of Montage Residences Healdsburg. • Compelling Valuation: Sunstone is acquiring Montage Healdsburg at a discount to what it would cost to develop today. The resort is expected to generate a 6% to 7% net operating income yield upon stabilization of the hotel and inclusive of the expected earnings contribution from the residential rental program. • Funding: The purchase price was funded with $199 million of existing cash and the direct issuance of $66 million of attractively structured Series G preferred equity to the Seller. The dividend on the Series G preferred equity will initially be based on the hotel’s net operating income and is tied to the completion of Montage Residences Healdsburg. The Series G preferred equity is callable at liquidation value, at Sunstone’s election, at any time. 1. Montage Residences Healdsburg are not included as part of the resort acquisition but are eligible for participation in the resort’s residential rental program. |

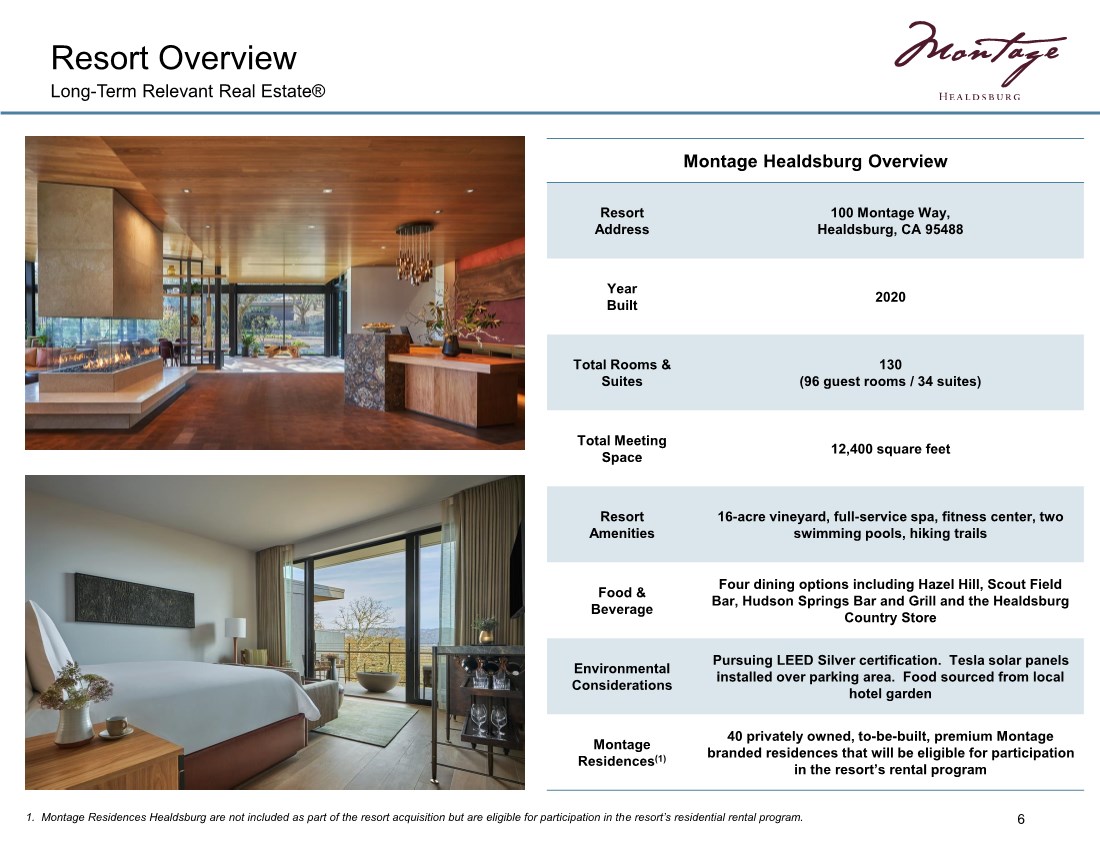

| Resort Overview 6 Long-Term Relevant Real Estate® Montage Healdsburg Overview Resort Address 100 Montage Way, Healdsburg, CA 95488 Year Built 2020 Total Rooms & Suites 130 (96 guest rooms / 34 suites) Total Meeting Space 12,400 square feet Resort Amenities 16-acre vineyard, full-service spa, fitness center, two swimming pools, hiking trails Food & Beverage Four dining options including Hazel Hill, Scout Field Bar, Hudson Springs Bar and Grill and the Healdsburg Country Store Environmental Considerations Pursuing LEED Silver certification. Tesla solar panels installed over parking area. Food sourced from local hotel garden Montage Residences(1) 40 privately owned, to-be-built, premium Montage branded residences that will be eligible for participation in the resort’s rental program 1. Montage Residences Healdsburg are not included as part of the resort acquisition but are eligible for participation in the resort’s residential rental program. |

| Destination Overview 7 Easily Accessible, Ideal Location to Enjoy All That Wine Country Has to Offer • Nestled along the Russian River, Healdsburg combines small-town charm, stunning vistas, and award-winning wines with a picturesque town plaza lined with shops, tasting rooms, art galleries, bars and Michelin-starred restaurants. • Healdsburg’s ideal location provides for a secluded and serene retreat while still being close to the world- renowned wineries in both Napa and Sonoma counties with easy access to hiking, biking and other outdoor activities for which the area is famous. • Highly accessible location benefits from substantial drive- to demand given its proximity to the San Francisco Bay Area’s affluent population and concentrations of industry- leading companies. • Located only a short drive from Sonoma County Airport, the closest and most convenient airport to wine country. • Direct flights from Los Angeles, Orange County, Burbank, San Diego, Phoenix, Denver, Dallas, Portland, Seattle and San Francisco. • Passenger traffic increased at a 17% compounded annual rate from 2015 to 2019. • $31 million terminal improvement project is underway to modernize amenities and better handle increasing passenger volumes. |

| $200 $450 $700 $950 $1,200 2012 2013 2014 2015 2016 2017 2018 2019 US Luxury Average Wine Country Luxury Luxury Resort Market Overview 8 Established, Year-Round Market with Significant Rate Premium Luxury Hotel Average Daily Rates Luxury hotels in wine country command average daily rates far in excess of the national average for luxury hotels in other parts of the country. Our underwriting assumes room rates already achieved in the market. Source: STR. |

| Transaction Rationale 9 Compelling and Well Structured Investment Opportunity • Pricing reflects a discount to current replacement cost. Development costs today would be meaningfully higher than the actual development costs given recent construction cost inflation. • Projected 6% to 7% net operating income yield upon stabilization of the hotel and inclusive of the anticipated earnings contribution from the residential rental program. • Issuing preferred equity directly to the Seller not only preserves a portion of our existing liquidity, but also further aligns the interests of the Seller with the success of the hotel and the completion of Montage Residences Healdsburg. The Series G preferred equity is callable at liquidation value, at Sunstone’s election, at any time. |

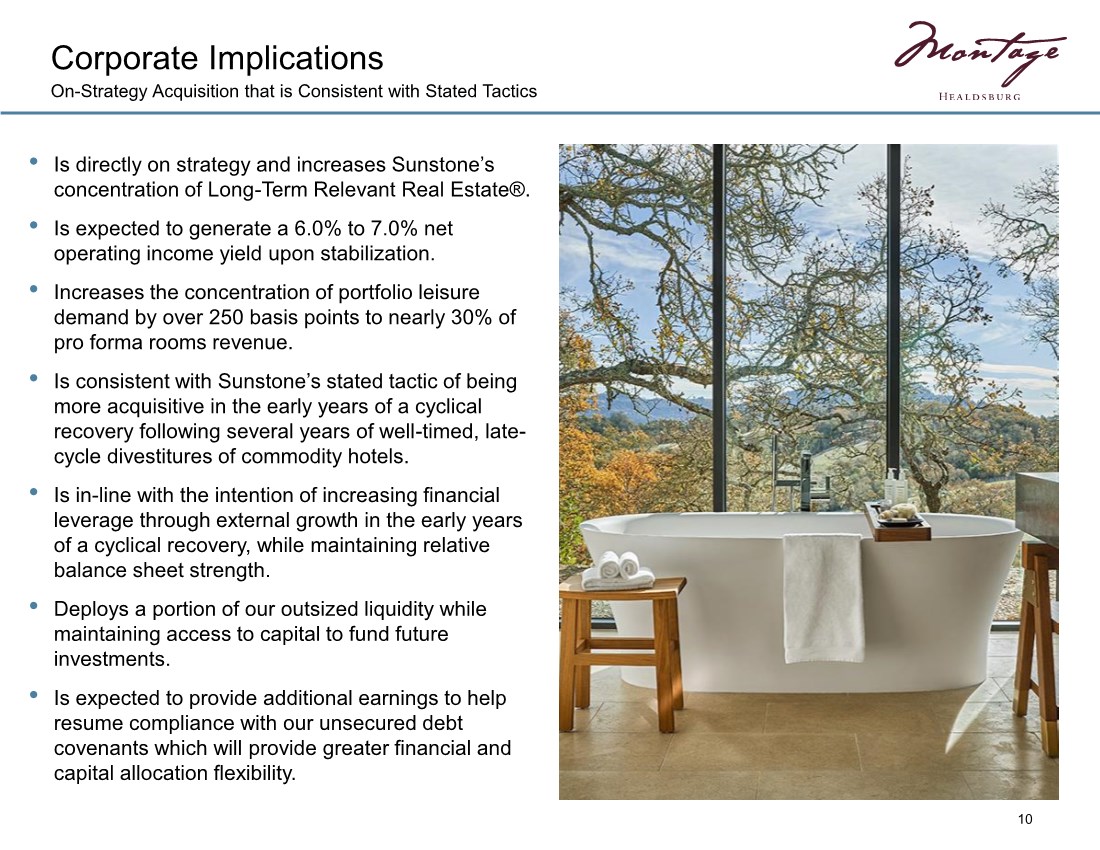

| Corporate Implications 10 On-Strategy Acquisition that is Consistent with Stated Tactics • Is directly on strategy and increases Sunstone’s concentration of Long-Term Relevant Real Estate®. • Is expected to generate a 6.0% to 7.0% net operating income yield upon stabilization. • Increases the concentration of portfolio leisure demand by over 250 basis points to nearly 30% of pro forma rooms revenue. • Is consistent with Sunstone’s stated tactic of being more acquisitive in the early years of a cyclical recovery following several years of well-timed, late- cycle divestitures of commodity hotels. • Is in-line with the intention of increasing financial leverage through external growth in the early years of a cyclical recovery, while maintaining relative balance sheet strength. • Deploys a portion of our outsized liquidity while maintaining access to capital to fund future investments. • Is expected to provide additional earnings to help resume compliance with our unsecured debt covenants which will provide greater financial and capital allocation flexibility. |

| April 2021 Sunstone Operations Update |

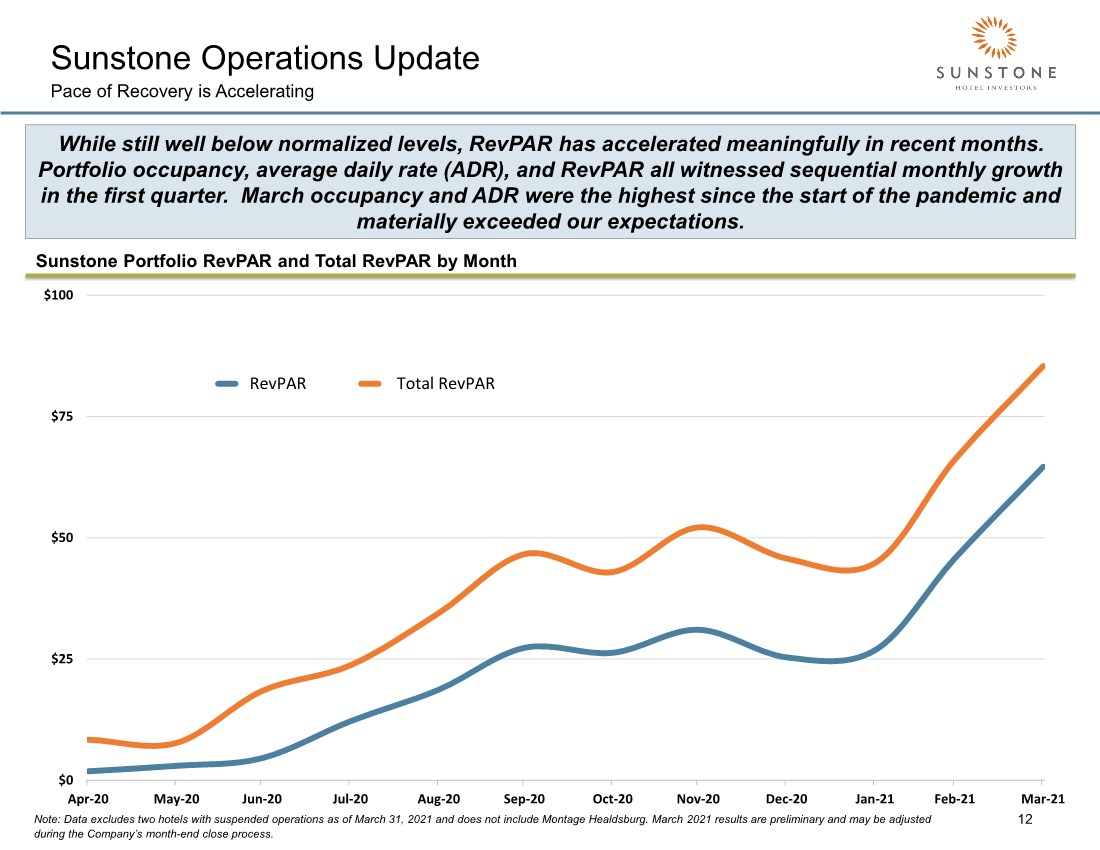

| Sunstone Operations Update 12 Pace of Recovery is Accelerating Sunstone Portfolio RevPAR and Total RevPAR by Month While still well below normalized levels, RevPAR has accelerated meaningfully in recent months. Portfolio occupancy, average daily rate (ADR), and RevPAR all witnessed sequential monthly growth in the first quarter. March occupancy and ADR were the highest since the start of the pandemic and materially exceeded our expectations. Note: Data excludes two hotels with suspended operations as of March 31, 2021 and does not include Montage Healdsburg. March 2021 results are preliminary and may be adjusted during the Company’s month-end close process. $0 $25 $50 $75 $100 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 RevPAR Total RevPAR |

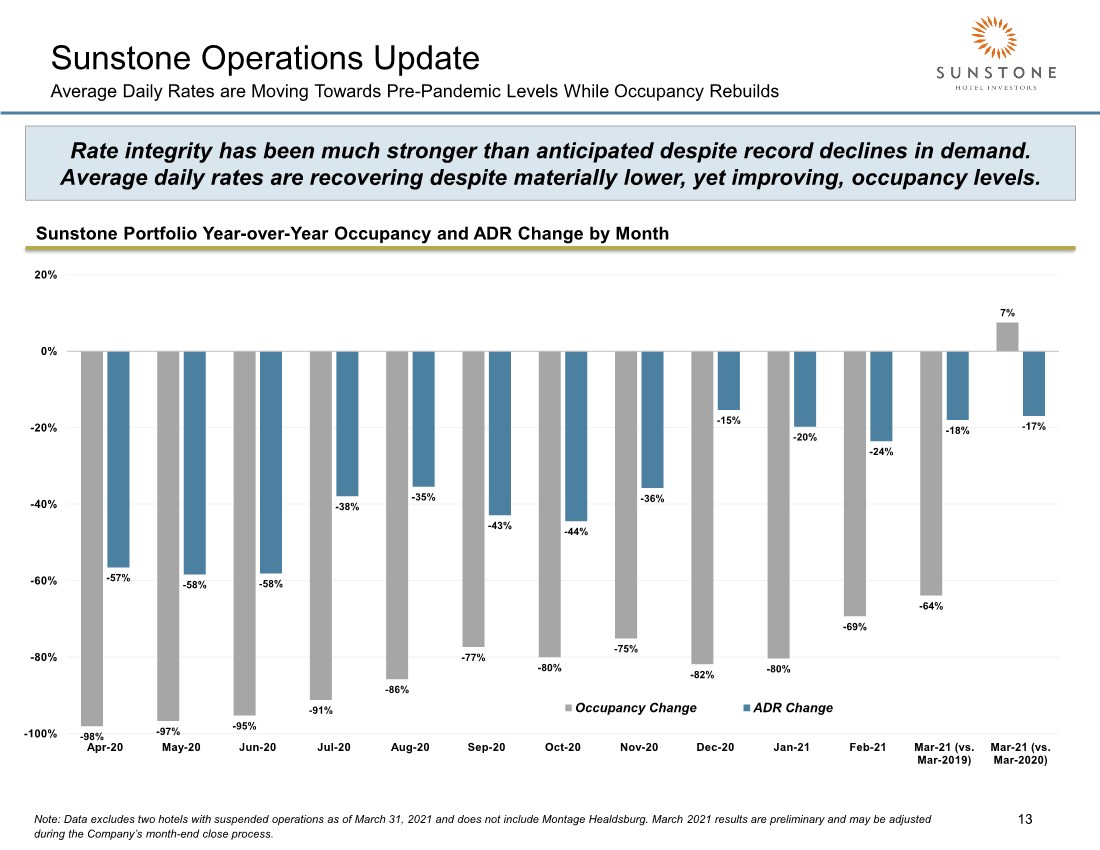

| Sunstone Operations Update 13 Average Daily Rates are Moving Towards Pre-Pandemic Levels While Occupancy Rebuilds Rate integrity has been much stronger than anticipated despite record declines in demand. Average daily rates are recovering despite materially lower, yet improving, occupancy levels. Sunstone Portfolio Year-over-Year Occupancy and ADR Change by Month -98% -97% -95% -91% -86% -77% -80% -75% -82% -80% -69% -64% 7% -57% -58% -58% -38% -35% -43% -44% -36% -15% -20% -24% -18% -17% -100% -80% -60% -40% -20% 0% 20% Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 (vs. Mar-2019) Mar-21 (vs. Mar-2020) Occupancy Change ADR Change Note: Data excludes two hotels with suspended operations as of March 31, 2021 and does not include Montage Healdsburg. March 2021 results are preliminary and may be adjusted during the Company’s month-end close process. |

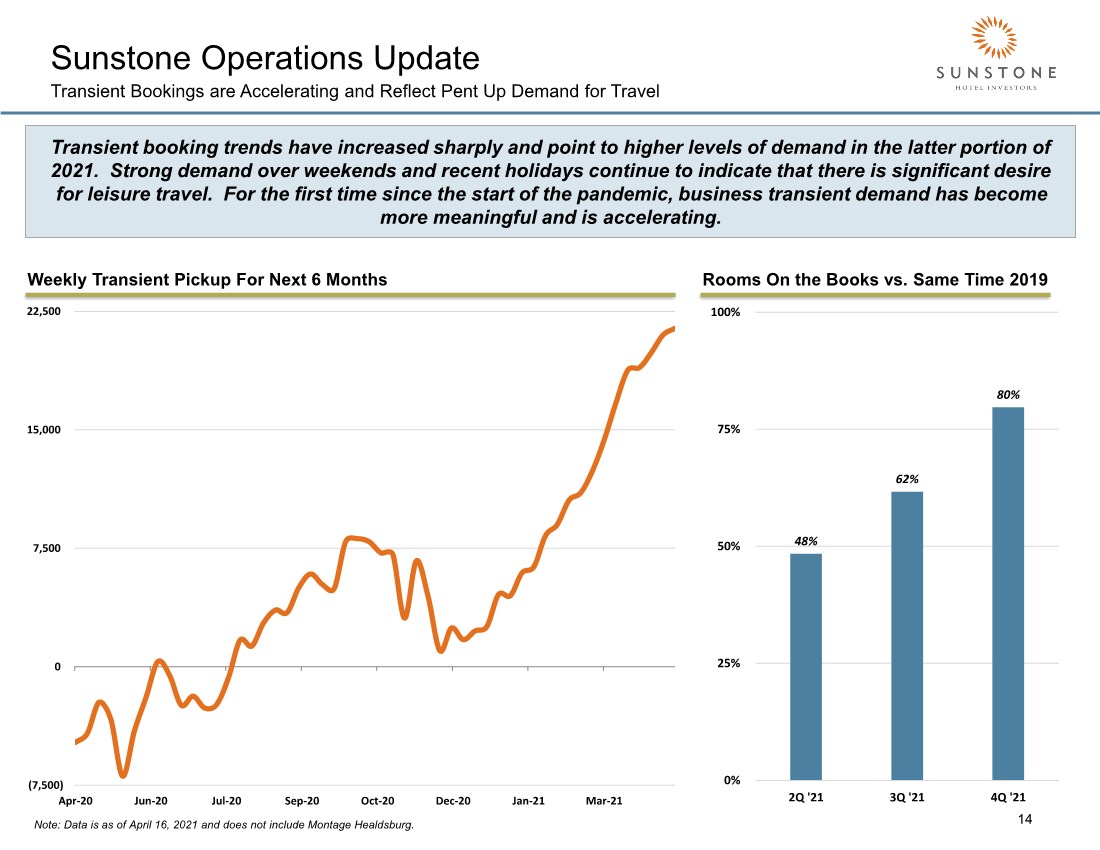

| Sunstone Operations Update 14 Transient Bookings are Accelerating and Reflect Pent Up Demand for Travel Weekly Transient Pickup For Next 6 Months Transient booking trends have increased sharply and point to higher levels of demand in the latter portion of 2021. Strong demand over weekends and recent holidays continue to indicate that there is significant desire for leisure travel. For the first time since the start of the pandemic, business transient demand has become more meaningful and is accelerating. Note: Data is as of April 16, 2021 and does not include Montage Healdsburg. Rooms On the Books vs. Same Time 2019 (7,500) 0 7,500 15,000 22,500 Apr-20 Jun-20 Jul-20 Sep-20 Oct-20 Dec-20 Jan-21 Mar-21 48% 62% 80% 0% 25% 50% 75% 100% 2Q '21 3Q '21 4Q '21 |

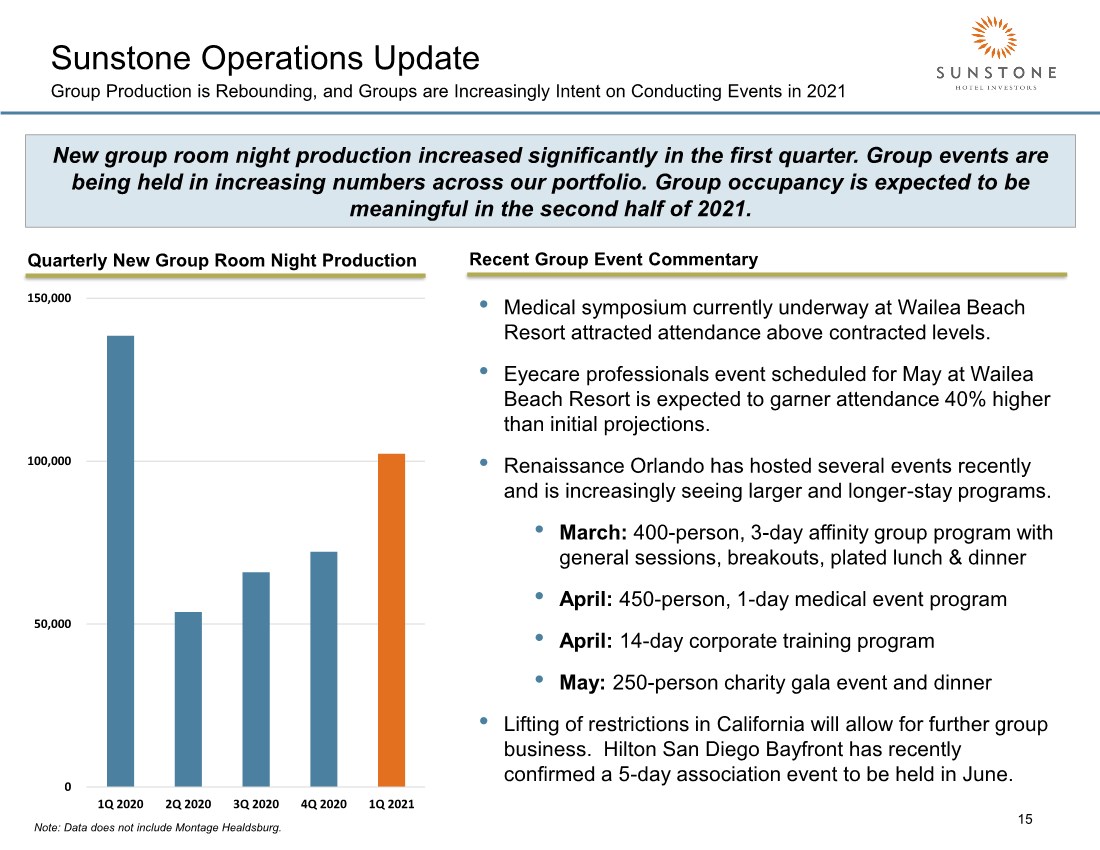

| Sunstone Operations Update 15 Group Production is Rebounding, and Groups are Increasingly Intent on Conducting Events in 2021 Quarterly New Group Room Night Production New group room night production increased significantly in the first quarter. Group events are being held in increasing numbers across our portfolio. Group occupancy is expected to be meaningful in the second half of 2021. Recent Group Event Commentary Note: Data does not include Montage Healdsburg. • Medical symposium currently underway at Wailea Beach Resort attracted attendance above contracted levels. • Eyecare professionals event scheduled for May at Wailea Beach Resort is expected to garner attendance 40% higher than initial projections. • Renaissance Orlando has hosted several events recently and is increasingly seeing larger and longer-stay programs. • March: 400-person, 3-day affinity group program with general sessions, breakouts, plated lunch & dinner • April: 450-person, 1-day medical event program • April: 14-day corporate training program • May: 250-person charity gala event and dinner • Lifting of restrictions in California will allow for further group business. Hilton San Diego Bayfront has recently confirmed a 5-day association event to be held in June. 0 50,000 100,000 150,000 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 |

|

| Forward-Looking Statements This presentation contains forward-looking statements within the meaning of federal securities laws and regulations. These forward-looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and other similar terms and phrases, including opinions, references to assumptions and forecasts of future results. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from those anticipated at the time the forward-looking statements are made. These risks include, but are not limited to: the impact the COVID-19 pandemic has on the Company’s business and the economy, as well as the response of governments and the Company to the pandemic, and how quickly and successfully effective vaccines and therapies are distributed and administered; increased risks related to employee matters, including increased employment litigation and claims for severance or other benefits tied to termination or furloughs as a result of temporary hotel suspensions or reduced hotel operations due to COVID-19; general economic and business conditions, including a U.S. recession, trade conflicts and tariffs, regional or global economic slowdowns and any type of flu or disease-related pandemic that impacts travel or the ability to travel, including the COVID-19 pandemic; the need for business-related travel, including the increased use of business-related technology; rising hotel operating costs due to labor costs, workers’ compensation and health-care related costs, utility costs, property and liability insurance costs, unanticipated costs such as acts of nature and their consequences and other costs that may not be offset by increased room rates; the ground, building or airspace leases for three of the hotels the Company has interests in as of the date of this presentation; the need for renovations, repositionings and other capital expenditures for the Company’s hotels; the impact, including any delays, of renovations and repositionings on hotel operations; new hotel supply, or alternative lodging options such as timeshare, vacation rentals or sharing services such as Airbnb, in the Company’s markets, which could harm its occupancy levels and revenue at its hotels; competition from hotels not owned by the Company; relationships with, and the requirements, performance and reputation of, the managers of the Company’s hotels; relationships with, and the requirements and reputation of, the Company’s franchisors and hotel brands; the Company’s hotels may become impaired, or its hotels which have previously become impaired may become further impaired in the future, which may adversely affect its financial condition and results of operations; competition for the acquisition of hotels, and the Company’s ability to complete acquisitions and dispositions; performance of hotels after they are acquired; changes in the Company’s business strategy or acquisition or disposition plans; the Company’s level of debt, including secured, unsecured, fixed and variable rate debt; financial and other covenants in the Company’s debt and preferred stock; the impact on the Company’s business of potential defaults by the Company on its debt agreements or leases; volatility in the capital markets and the effect on lodging demand or the Company’s ability to obtain capital on favorable terms or at all; the Company’s need to operate as a REIT and comply with other applicable laws and regulations, including new laws, interpretations or court decisions that may change the federal or state tax laws or the federal or state income tax consequences of the Company’s qualification as a REIT; potential adverse tax consequences in the event that the Company’s operating leases with its taxable REIT subsidiaries are not held to have been made on an arm’s-length basis; system security risks, data protection breaches, cyber-attacks, including those impacting the Company’s hotel managers or other third parties, and systems integration issues; other events beyond the Company’s control, including climate change, natural disasters, terrorist attacks or civil unrest; and other risks and uncertainties associated with the Company’s business described in its filings with the Securities and Exchange Commission. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. All forward-looking information provided herein is as of the date of this presentation, and the Company undertakes no obligation to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations. This presentation should be read together with the consolidated financial statements and notes thereto included in our most recent reports on Form 10-K and Form 10-Q. Copies of these reports are available on our website at www.sunstonehotels.com and through the SEC’s Electronic Data Gathering Analysis and Retrieval System (“EDGAR”) at www.sec.gov. 17 |