Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - POPULAR, INC. | d20394dex991.htm |

| 8-K - FORM 8-K - POPULAR, INC. | d20394d8k.htm |

INVESTOR PRESENTATION First Quarter 2021 Exhibit 99.2

Cautionary Note Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance, are based on the current expectations of Popular, Inc.’s (the “Corporation”) management and, by their nature, involve risks, uncertainties, estimates and assumptions. Potential factors, some of which are beyond the Corporation’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. Such factors include, but are not limited to, the scope and duration of the COVID-19 pandemic (including the appearance of new strains of the virus), actions taken by governmental authorities in response thereto, and the direct and indirect impact of the pandemic on the Corporation, our customers, service providers and third parties. Information on the risks and important factors that could affect the Corporation’s future results and financial condition is included in our Annual Report on Form 10-K for the year ended December 31, 2020 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 to be filed with the Securities and Exchange Commission. Our filings are available on the Corporation’s website (www.popular.com) and on the Securities and Exchange Commission website (www.sec.gov). The Corporation assumes no obligation to update or revise any forward-looking statements which speak as of their respective dates.

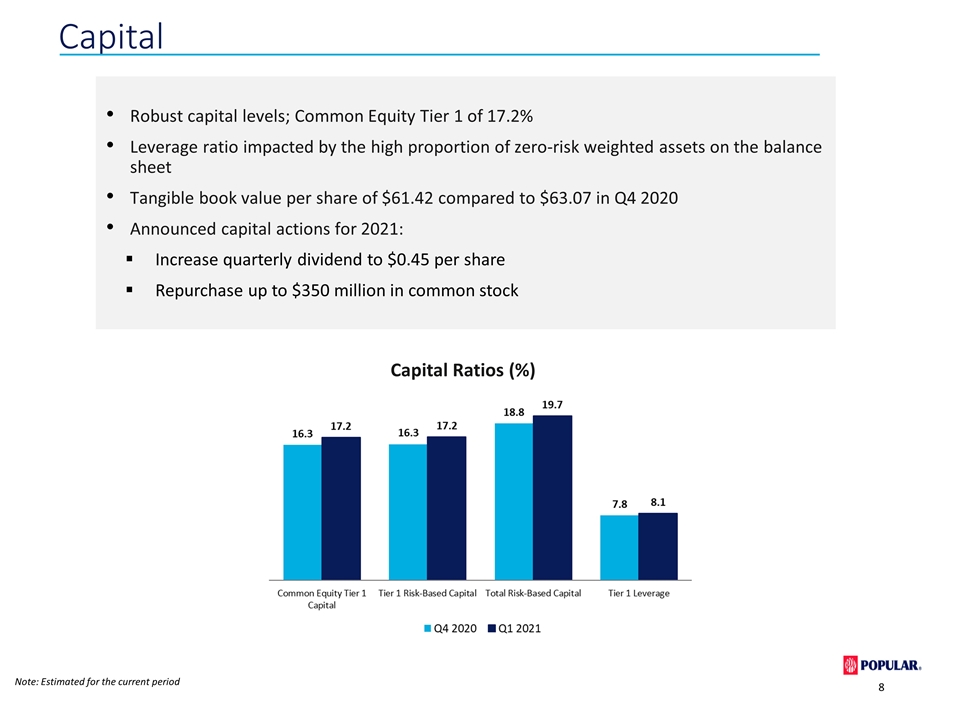

NPLs decreased $40 million QoQ; ratio at 2.4% NCO ratio decreased to 0.29% from 0.58% the previous quarter ACL to loans held-in-portfolio of 2.75% compared to 3.05% in Q4 2020 Credit Metrics Net income of $263 million Net interest margin: Popular, Inc. 3.07%, BPPR 3.10% Provision for credit losses resulted in a benefit of $82 million Earnings Robust capital; Common Equity Tier 1 Capital ratio of 17.2% Tangible book value per share of $61.42 compared to $63.07 in Q4 2020 Announced capital actions for 2021: Increase quarterly dividend to $0.45 per share Repurchase up to $350 million in common stock Capital Q1 2021 Highlights

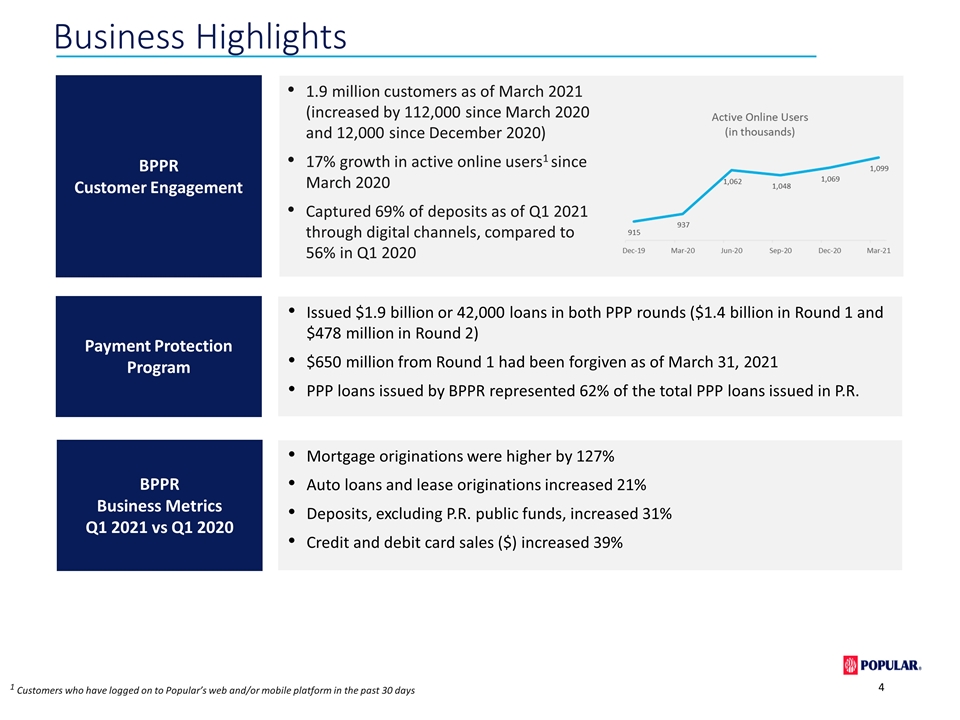

Business Highlights BPPR Customer Engagement BPPR Business Metrics Q1 2021 vs Q1 2020 Issued $1.9 billion or 42,000 loans in both PPP rounds ($1.4 billion in Round 1 and $478 million in Round 2) $650 million from Round 1 had been forgiven as of March 31, 2021 PPP loans issued by BPPR represented 62% of the total PPP loans issued in P.R. Mortgage originations were higher by 127% Auto loans and lease originations increased 21% Deposits, excluding P.R. public funds, increased 31% Credit and debit card sales ($) increased 39% Payment Protection Program 1.9 million customers as of March 2021 (increased by 112,000 since March 2020 and 12,000 since December 2020) 17% growth in active online users1 since March 2020 Captured 69% of deposits as of Q1 2021 through digital channels, compared to 56% in Q1 2020 1 Customers who have logged on to Popular’s web and/or mobile platform in the past 30 days

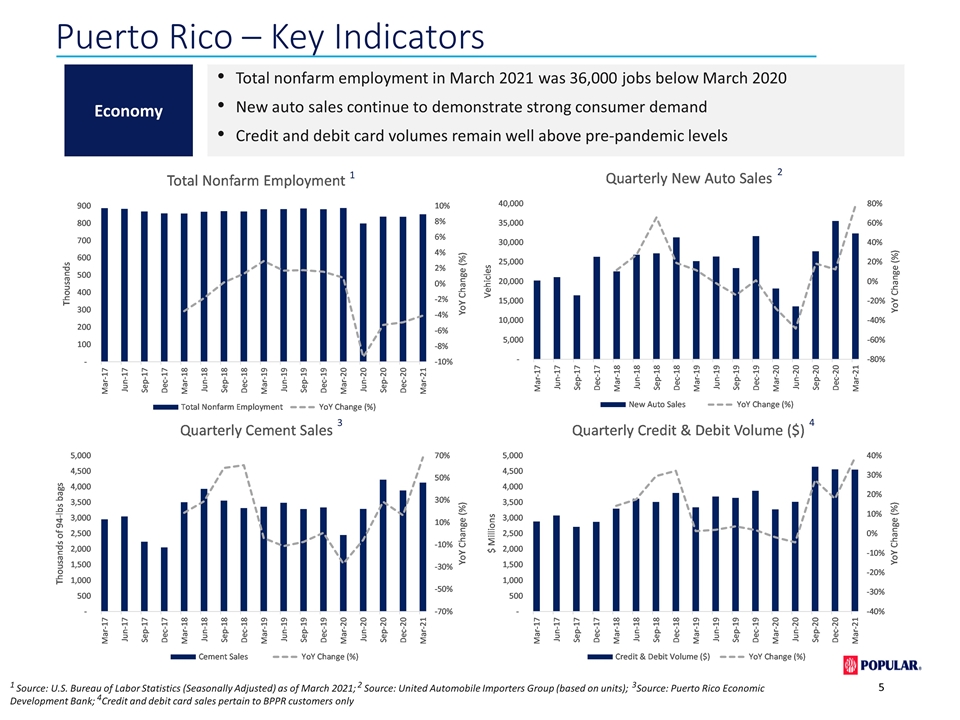

Puerto Rico – Key Indicators Economy 1 Source: U.S. Bureau of Labor Statistics (Seasonally Adjusted) as of March 2021; 2 Source: United Automobile Importers Group (based on units); 3Source: Puerto Rico Economic Development Bank; 4Credit and debit card sales pertain to BPPR customers only Total nonfarm employment in March 2021 was 36,000 jobs below March 2020 New auto sales continue to demonstrate strong consumer demand Credit and debit card volumes remain well above pre-pandemic levels 1 2 3 4

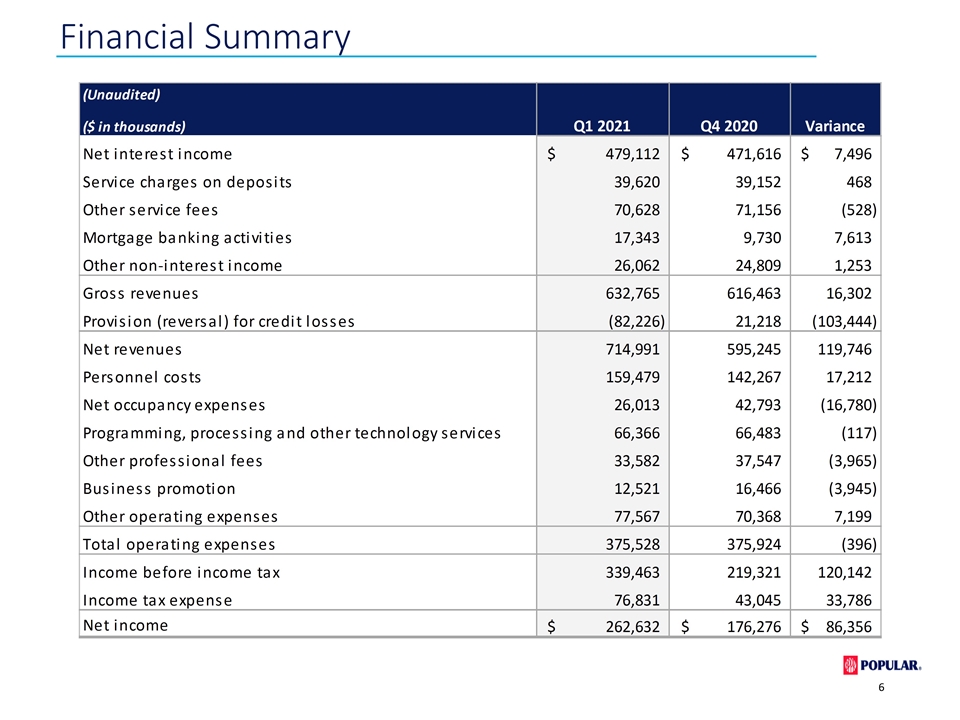

Financial Summary 6

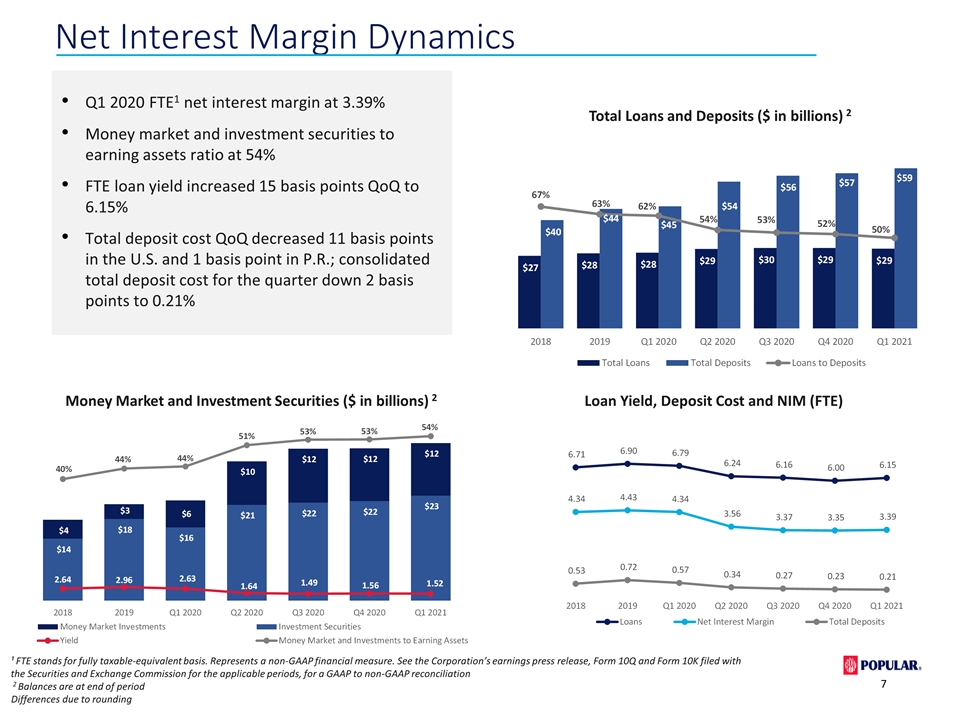

Net Interest Margin Dynamics Q1 2020 FTE1 net interest margin at 3.39% Money market and investment securities to earning assets ratio at 54% FTE loan yield increased 15 basis points QoQ to 6.15% Total deposit cost QoQ decreased 11 basis points in the U.S. and 1 basis point in P.R.; consolidated total deposit cost for the quarter down 2 basis points to 0.21% Loan Yield, Deposit Cost and NIM (FTE) Total Loans and Deposits ($ in billions) 2 Money Market and Investment Securities ($ in billions) 2 ¹ FTE stands for fully taxable-equivalent basis. Represents a non-GAAP financial measure. See the Corporation’s earnings press release, Form 10Q and Form 10K filed with the Securities and Exchange Commission for the applicable periods, for a GAAP to non-GAAP reconciliation 2 Balances are at end of period Differences due to rounding

Capital Robust capital levels; Common Equity Tier 1 of 17.2% Leverage ratio impacted by the high proportion of zero-risk weighted assets on the balance sheet Tangible book value per share of $61.42 compared to $63.07 in Q4 2020 Announced capital actions for 2021: Increase quarterly dividend to $0.45 per share Repurchase up to $350 million in common stock Capital Ratios (%) Note: Estimated for the current period

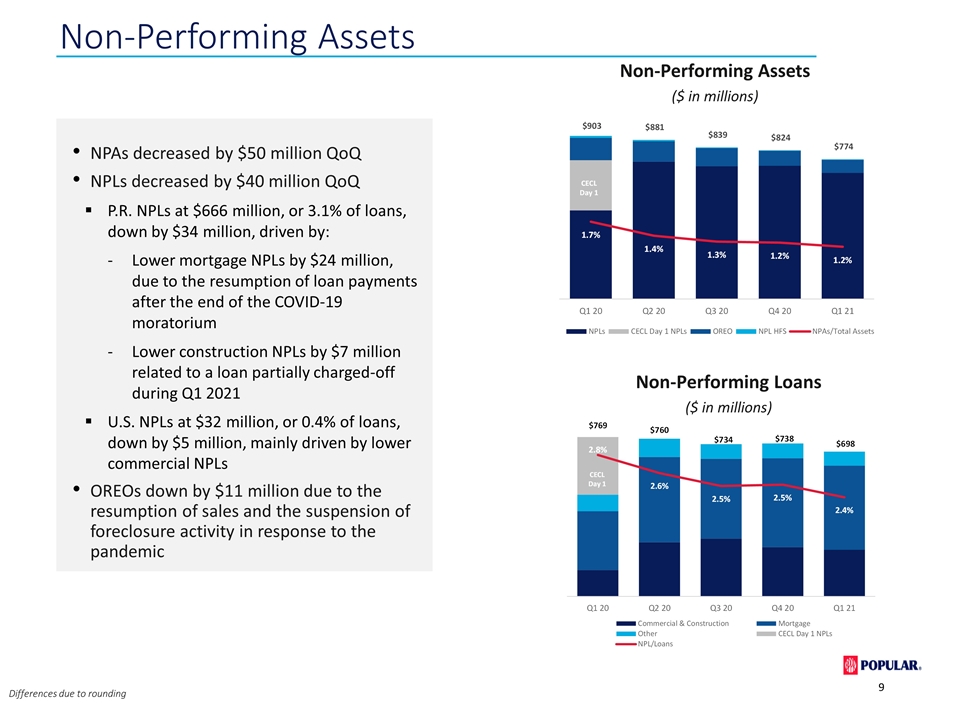

Non-Performing Assets ($ in millions) Non-Performing Assets NPAs decreased by $50 million QoQ NPLs decreased by $40 million QoQ P.R. NPLs at $666 million, or 3.1% of loans, down by $34 million, driven by: Lower mortgage NPLs by $24 million, due to the resumption of loan payments after the end of the COVID-19 moratorium Lower construction NPLs by $7 million related to a loan partially charged-off during Q1 2021 U.S. NPLs at $32 million, or 0.4% of loans, down by $5 million, mainly driven by lower commercial NPLs OREOs down by $11 million due to the resumption of sales and the suspension of foreclosure activity in response to the pandemic Differences due to rounding Non-Performing Loans ($ in millions)

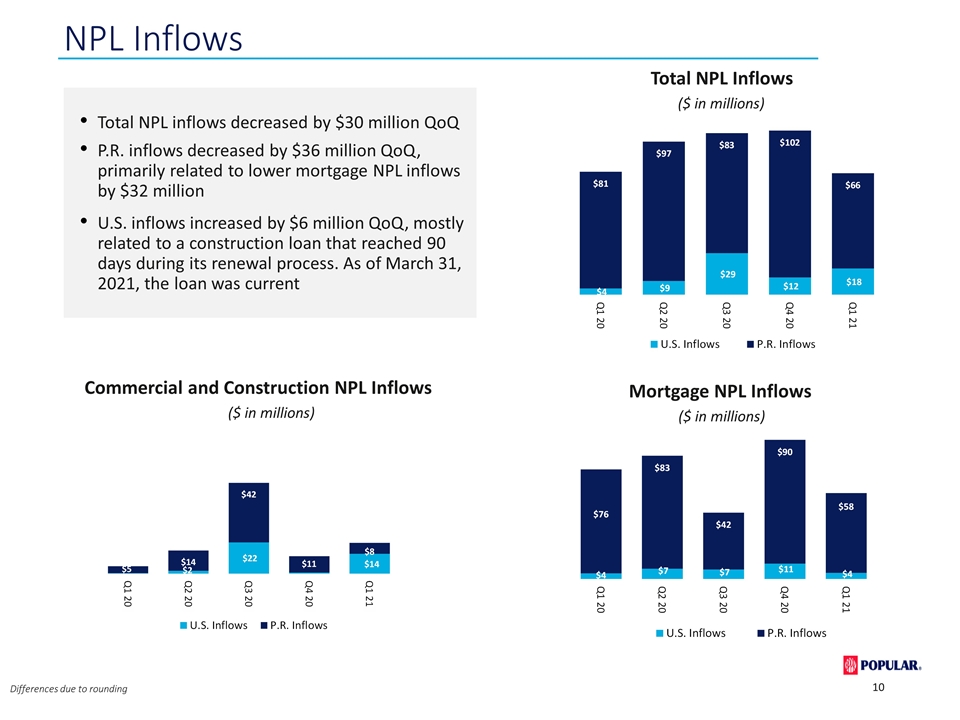

NPL Inflows Total NPL Inflows ($ in millions) Mortgage NPL Inflows ($ in millions) Commercial and Construction NPL Inflows ($ in millions) Differences due to rounding Total NPL inflows decreased by $30 million QoQ P.R. inflows decreased by $36 million QoQ, primarily related to lower mortgage NPL inflows by $32 million U.S. inflows increased by $6 million QoQ, mostly related to a construction loan that reached 90 days during its renewal process. As of March 31, 2021, the loan was current

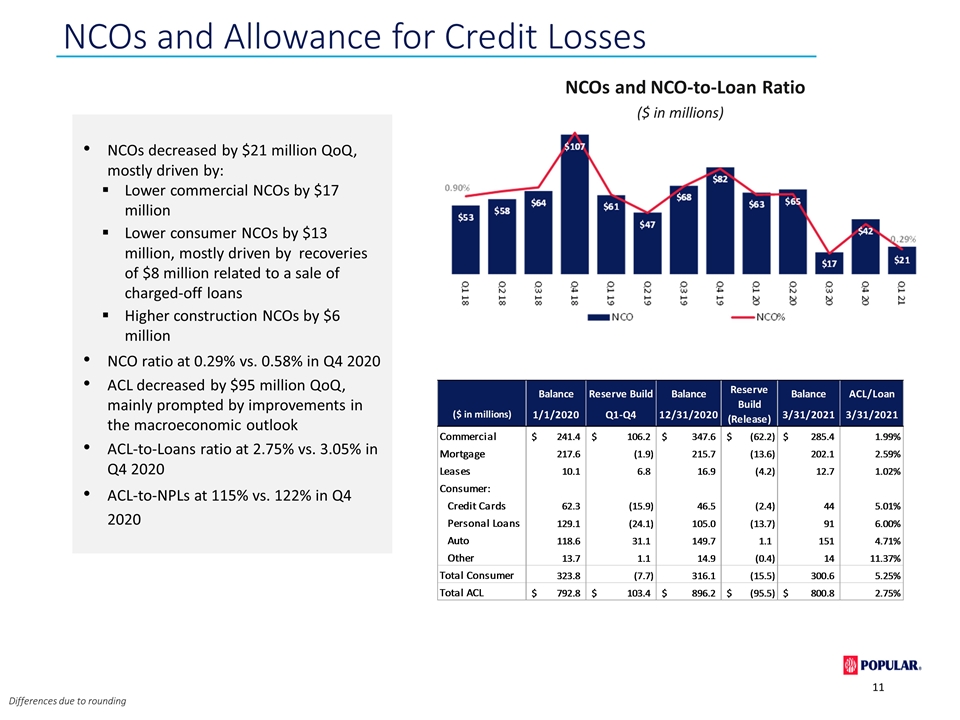

NCOs and NCO-to-Loan Ratio ($ in millions) NCOs and Allowance for Credit Losses Differences due to rounding NCOs decreased by $21 million QoQ, mostly driven by: Lower commercial NCOs by $17 million Lower consumer NCOs by $13 million, mostly driven by recoveries of $8 million related to a sale of charged-off loans Higher construction NCOs by $6 million NCO ratio at 0.29% vs. 0.58% in Q4 2020 ACL decreased by $95 million QoQ, mainly prompted by improvements in the macroeconomic outlook ACL-to-Loans ratio at 2.75% vs. 3.05% in Q4 2020 ACL-to-NPLs at 115% vs. 122% in Q4 2020 1

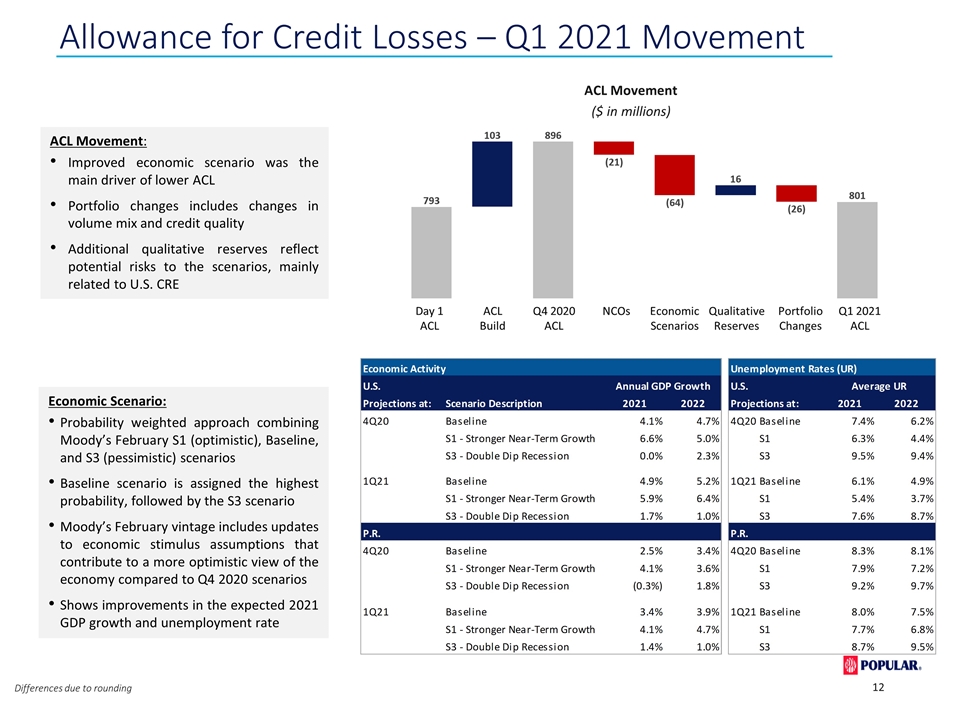

Allowance for Credit Losses – Q1 2021 Movement Differences due to rounding ACL Movement: Improved economic scenario was the main driver of lower ACL Portfolio changes includes changes in volume mix and credit quality Additional qualitative reserves reflect potential risks to the scenarios, mainly related to U.S. CRE Economic Scenario: Probability weighted approach combining Moody’s February S1 (optimistic), Baseline, and S3 (pessimistic) scenarios Baseline scenario is assigned the highest probability, followed by the S3 scenario Moody’s February vintage includes updates to economic stimulus assumptions that contribute to a more optimistic view of the economy compared to Q4 2020 scenarios Shows improvements in the expected 2021 GDP growth and unemployment rate ACL Movement ($ in millions)

Driving Value Capital Announced capital actions for 2021: Increase quarterly dividend to $0.45 per share Repurchase up to $350 million in common stock Franchise Additional Value Investments in Evertec and Banco BHD León Leading market position in Puerto Rico Well positioned to take advantage of economic recovery Focus on customer service supported by broad branch network Differentiated digital offering for retail and commercial customers Diversified fee income driven by unmatched product breadth and depth Strong risk-adjusted loan margins driven by a well-diversified portfolio Substantial liquidity with low deposit beta Mainland U.S. banking operation provides geographic diversification Commercial led strategy focused on small and medium-sized businesses Branch footprint in South Florida and New York Metro National niche banking focus in homeowners’ associations, healthcare and non-profit organizations

INVESTOR PRESENTATION Appendix First Quarter 2021

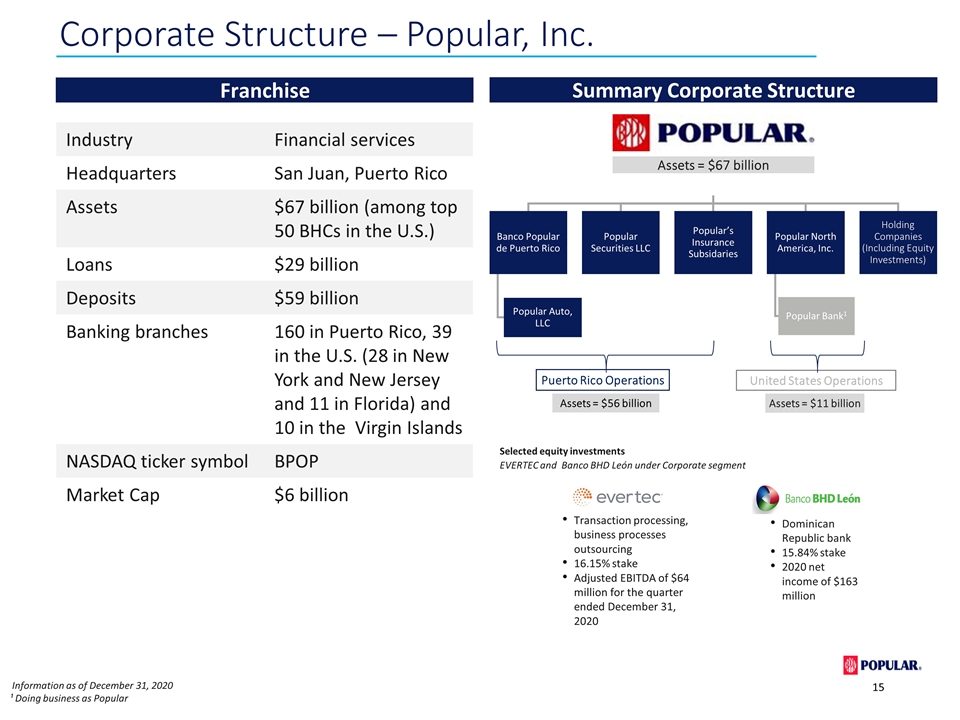

Franchise Summary Corporate Structure Assets = $56 billion Assets = $11 billion Puerto Rico Operations United States Operations Assets = $67 billion Information as of December 31, 2020 ¹ Doing business as Popular Selected equity investments EVERTEC and Banco BHD León under Corporate segment Transaction processing, business processes outsourcing 16.15% stake Adjusted EBITDA of $64 million for the quarter ended December 31, 2020 Dominican Republic bank 15.84% stake 2020 net income of $163 million Industry Financial services Headquarters San Juan, Puerto Rico Assets $67 billion (among top 50 BHCs in the U.S.) Loans $29 billion Deposits $59 billion Banking branches 160 in Puerto Rico, 39 in the U.S. (28 in New York and New Jersey and 11 in Florida) and 10 in the Virgin Islands NASDAQ ticker symbol BPOP Market Cap $6 billion Corporate Structure – Popular, Inc. Banco Popular de Puerto Rico Popular’s Insurance Subsidaries Popular North America, Inc. Popular Securities LLC Holding Companies (Including Equity Investments) Popular Bank 1 Popular Auto, LLC

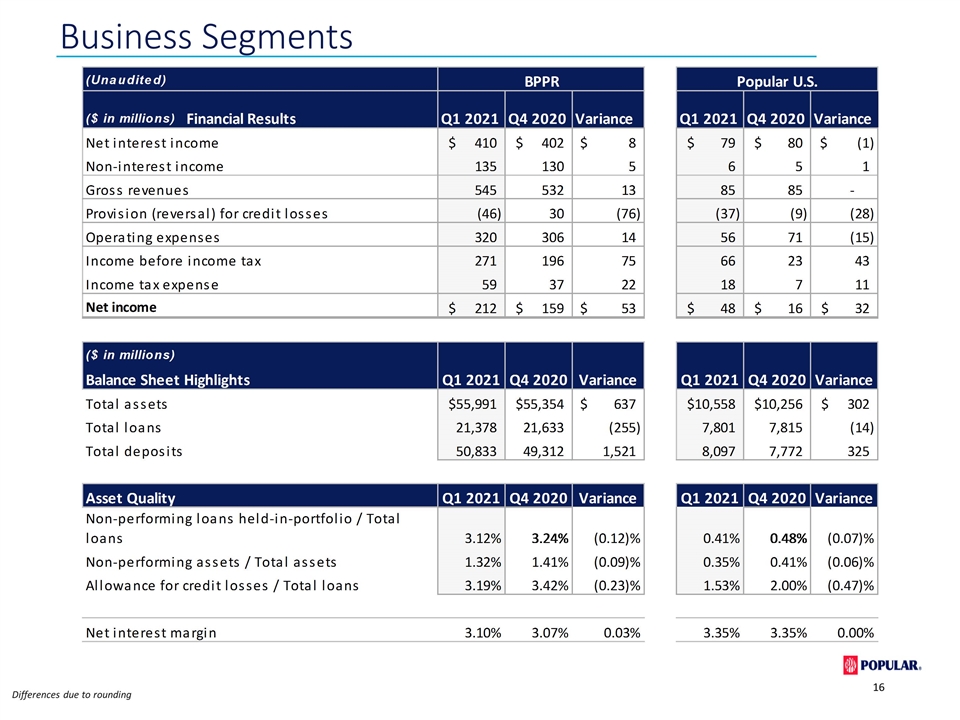

Differences due to rounding Business Segments

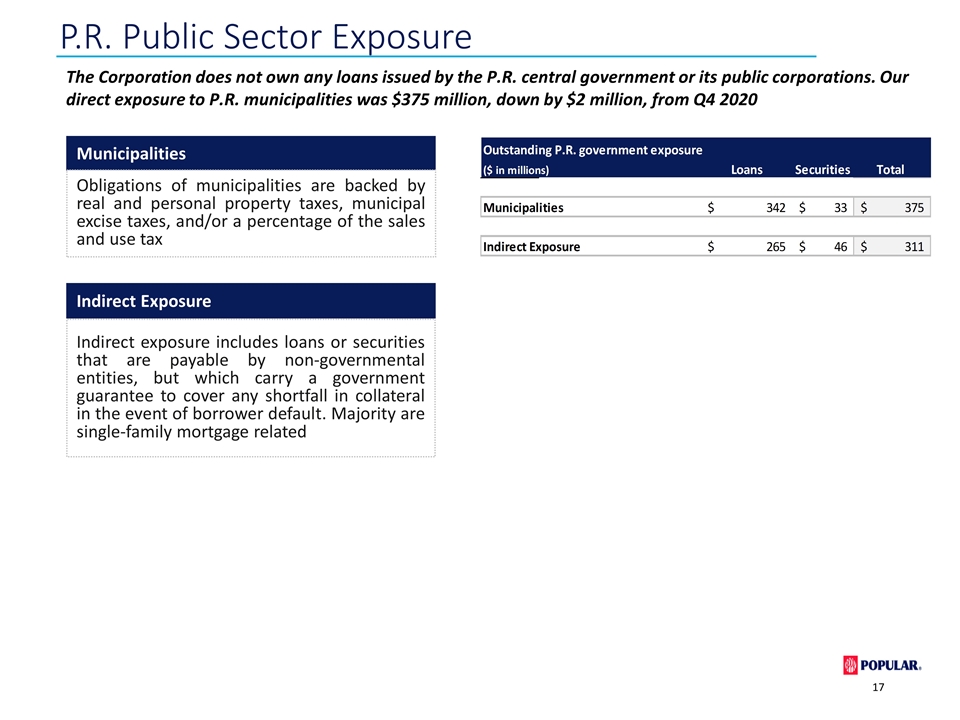

Municipalities Obligations of municipalities are backed by real and personal property taxes, municipal excise taxes, and/or a percentage of the sales and use tax Indirect exposure includes loans or securities that are payable by non-governmental entities, but which carry a government guarantee to cover any shortfall in collateral in the event of borrower default. Majority are single-family mortgage related Indirect Exposure The Corporation does not own any loans issued by the P.R. central government or its public corporations. Our direct exposure to P.R. municipalities was $375 million, down by $2 million, from Q4 2020 P.R. Public Sector Exposure

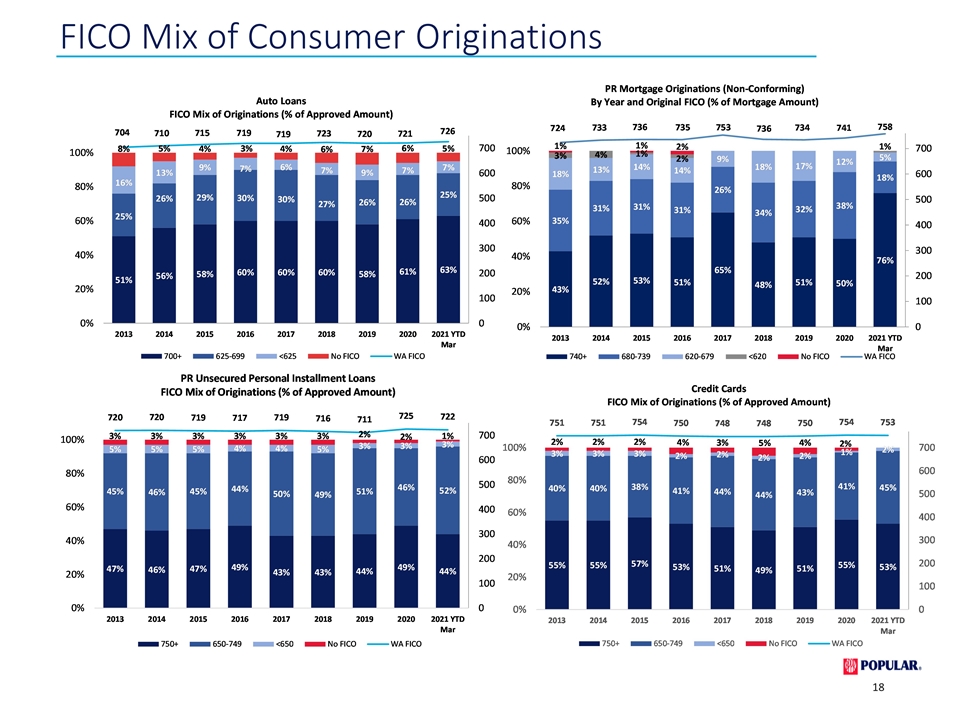

FICO Mix of Consumer Originations

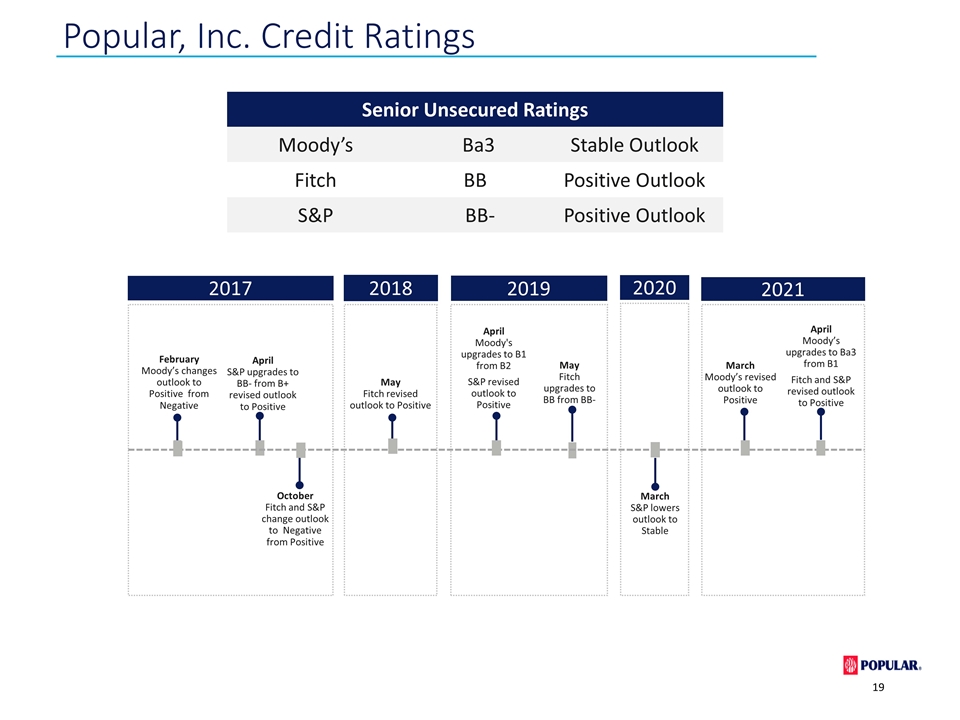

Popular, Inc. Credit Ratings Senior Unsecured Ratings Moody’s Ba3 Stable Outlook Fitch BB Positive Outlook S&P BB- Positive Outlook February Moody’s changes outlook to Positive from Negative April S&P upgrades to BB- from B+ revised outlook to Positive 2017 October Fitch and S&P change outlook to Negative from Positive 2018 May Fitch revised outlook to Positive 2019 April Moody's upgrades to B1 from B2 S&P revised outlook to Positive May Fitch upgrades to BB from BB- 2020 March S&P lowers outlook to Stable 2021 March Moody’s revised outlook to Positive April Moody’s upgrades to Ba3 from B1 Fitch and S&P revised outlook to Positive

INVESTOR PRESENTATION First Quarter 2021