Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BENCHMARK ELECTRONICS INC | bhe-ex991_6.htm |

| 8-K - 8-K - BENCHMARK ELECTRONICS INC | bhe-8k_20210428.htm |

Benchmark Electronics Q1-21 Earnings Results April 28, 2021

Forward-Looking Statements This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act). These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts and may include words such as “anticipate,” “believe,” “intend,” “plan,” “project,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” “will,” “could,” “predict,” and similar expressions or the negative or other variations thereof. In particular, statements, express or implied, concerning future operating results, our ability to generate sales, income or cash flow, the anticipated impact of the COVID-19 pandemic, the outlook and guidance for second quarter 2021 results, our anticipated plans and responses to the COVID-19 pandemic, our expected revenue mix, our business strategy and strategic initiatives, our repurchases of shares of our common stock and our intentions concerning the payment of dividends, among others, are forward-looking statements. Although we believe these statements are based upon reasonable assumptions, they involve risks, uncertainties and assumptions that are beyond our ability to control or predict, relating to operations, markets and the business environment generally, including those discussed under Part I, Item 1A of the company's Annual Report on Form 10-K for the year ended December 31, 2020 and in any of our subsequent reports filed with the Securities and Exchange Commission (SEC). In particular, these statements also depend on the duration, severity and evolution of the COVID-19 pandemic and related risks, including government and other third-party responses to it and the consequences for the global economy, our business and the businesses of our suppliers and customers, as well as our ability (or inability) to execute on our plans to respond to the COVID-19 pandemic. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes, including the future results of our operations, may vary materially from those indicated. Undue reliance should not be placed on any forward-looking statements. Forward-looking statements are not guarantees of performance. All forward-looking statements included in this document are based upon information available to us as of the date of this document, and we assume no obligation to update. Non-GAAP Financial Information This document includes certain financial measures that exclude items and therefore are not in accordance with U.S. generally accepted accounting principles (“GAAP”). A detailed reconciliation between GAAP results and results excluding special items (“non-GAAP”) is included in the Appendix of this document. In situations where a non-GAAP reconciliation has not been provided, the company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management discloses non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made.

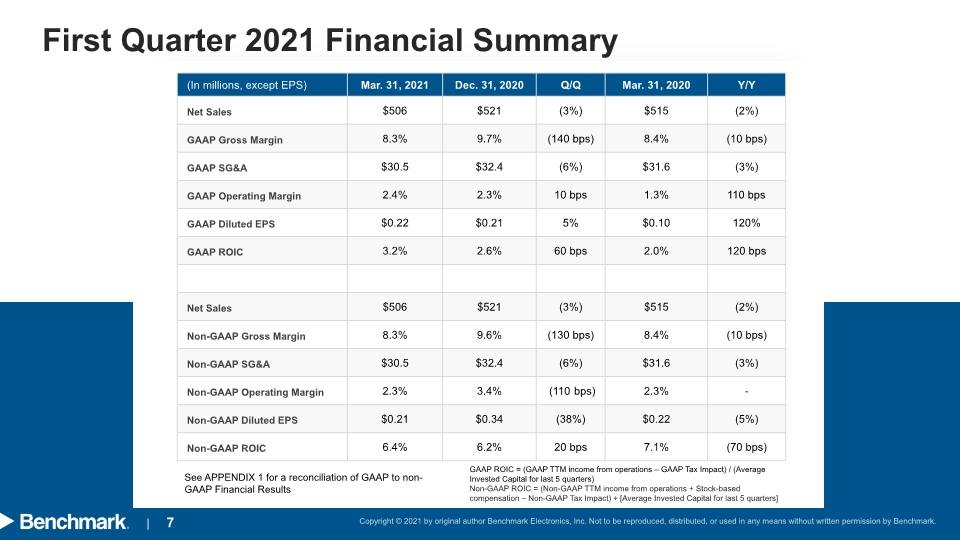

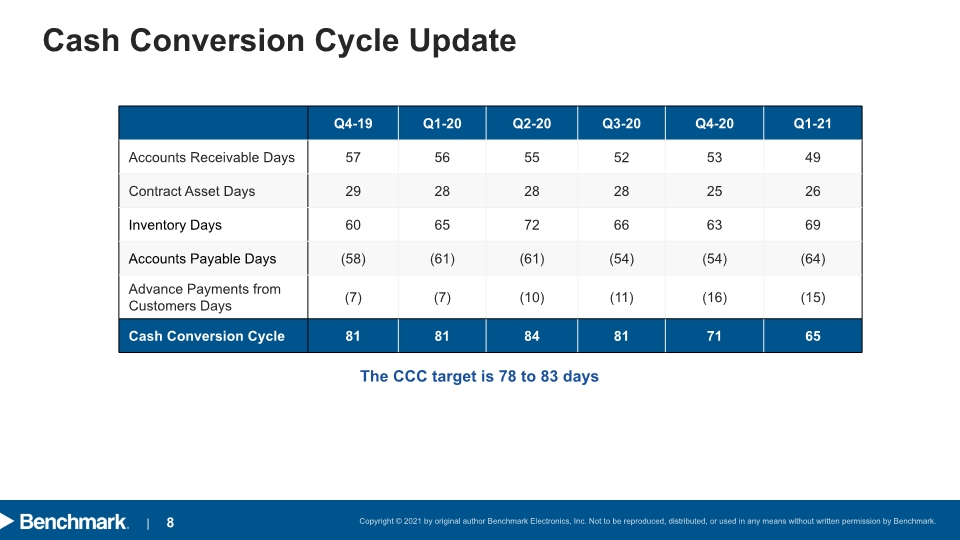

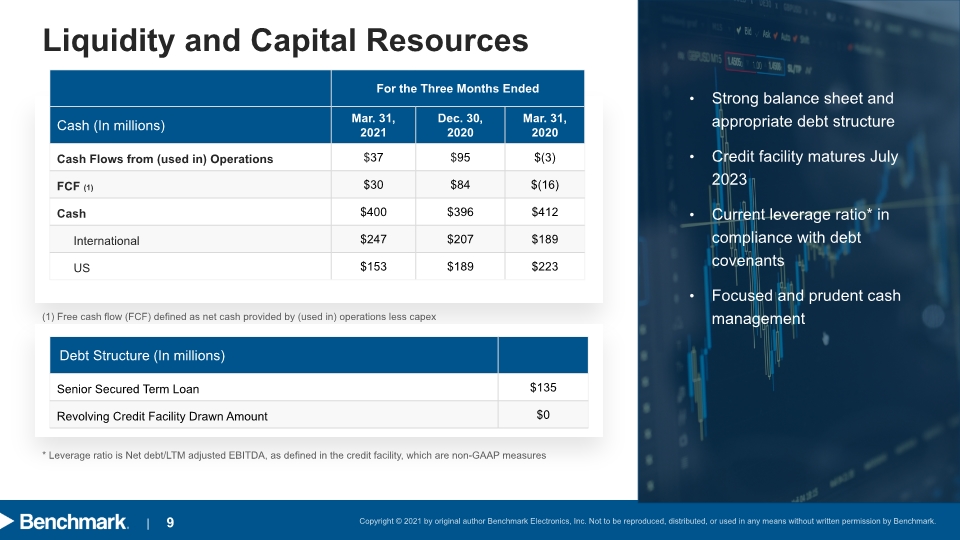

Q1-21 Overview Achieved revenue of $506 million Realized Non-GAAP gross margin of 8.3% and Non-GAAP operating margin of 2.3% Overcame intermittent facility disruptions due to COVID through the quarter Non-GAAP earnings per share of $0.21 Operating and free cash flow of $37 million and $30 million respectively Cash conversion cycle of 65 days

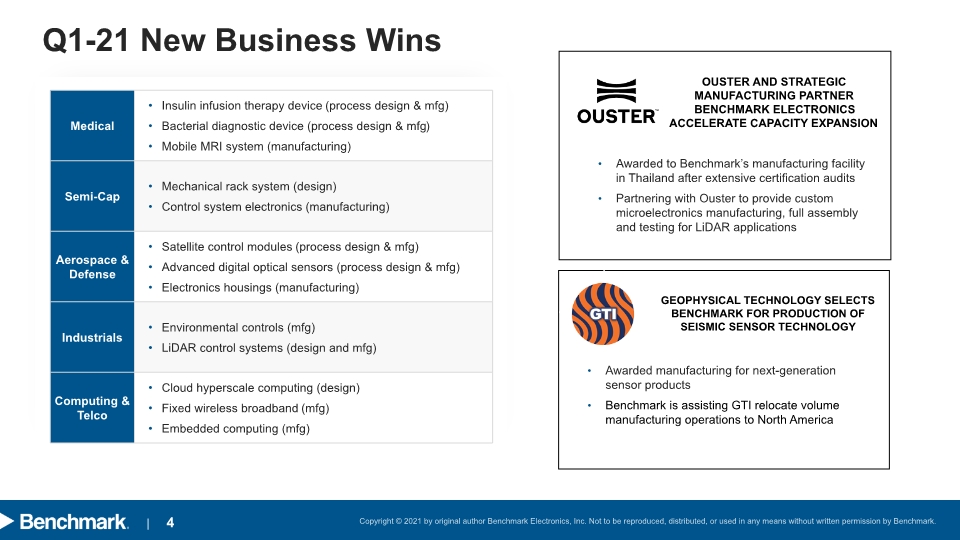

Q1-21 New Business Wins Awarded to Benchmark’s manufacturing facility in Thailand after extensive certification audits Partnering with Ouster to provide custom microelectronics manufacturing, full assembly and testing for LiDAR applications Awarded manufacturing for next-generation sensor products Benchmark is assisting GTI relocate volume manufacturing operations to North America Ouster and strategic manufacturing partner Benchmark Electronics accelerate capacity expansion GEOPHYSICAL TECHNOLOGY SELECTS benchmark FOR PRODUCTION OF SEISMIC SENSOR TECHNOLOGY

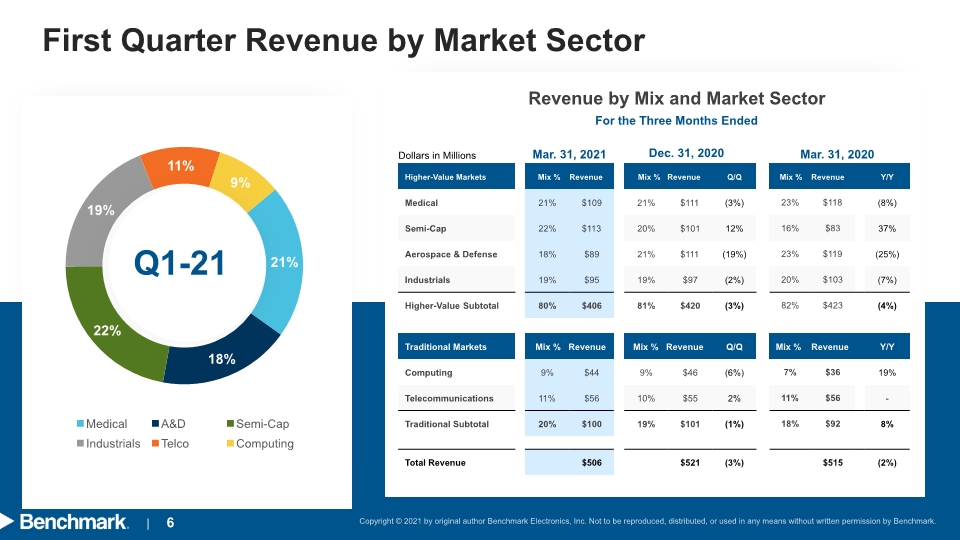

First Quarter Revenue by Market Sector Q1-21 Mar. 31, 2021 Revenue by Mix and Market Sector Dec. 31, 2020 Mar. 31, 2020 For the Three Months Ended Dollars in Millions

First Quarter 2021 Financial Summary See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) / (Average Invested Capital for last 5 quarters) Non-GAAP ROIC = (Non-GAAP TTM income from operations + Stock-based compensation – Non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters]

Cash Conversion Cycle Update The CCC target is 78 to 83 days

Liquidity and Capital Resources (1) Free cash flow (FCF) defined as net cash provided by (used in) operations less capex * Leverage ratio is Net debt/LTM adjusted EBITDA, as defined in the credit facility, which are non-GAAP measures Strong balance sheet and appropriate debt structure Credit facility matures July 2023 Current leverage ratio* in compliance with debt covenants Focused and prudent cash management

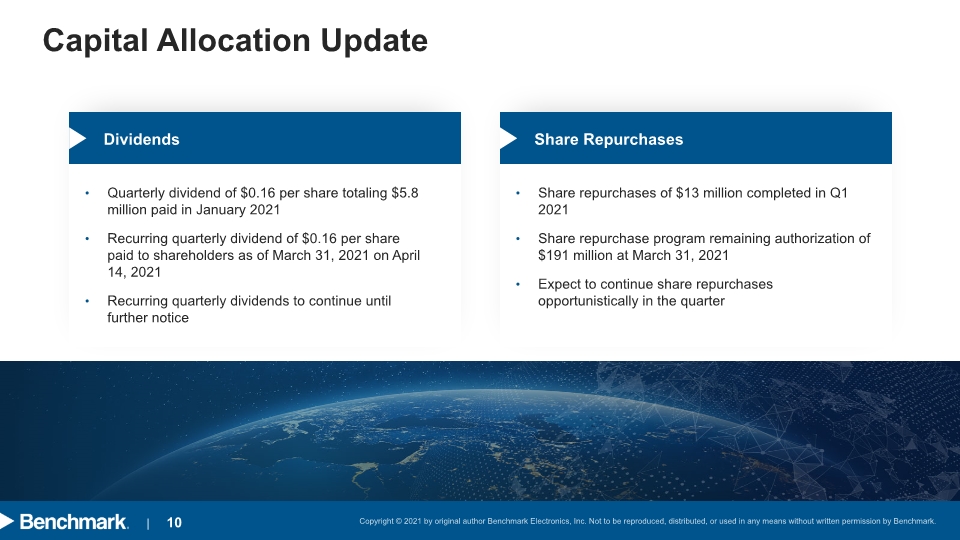

Capital Allocation Update Dividends Quarterly dividend of $0.16 per share totaling $5.8 million paid in January 2021 Recurring quarterly dividend of $0.16 per share paid to shareholders as of March 31, 2021 on April 14, 2021 Recurring quarterly dividends to continue until further notice Share Repurchases Share repurchases of $13 million completed in Q1 2021 Share repurchase program remaining authorization of $191 million at March 31, 2021 Expect to continue share repurchases opportunistically in the quarter

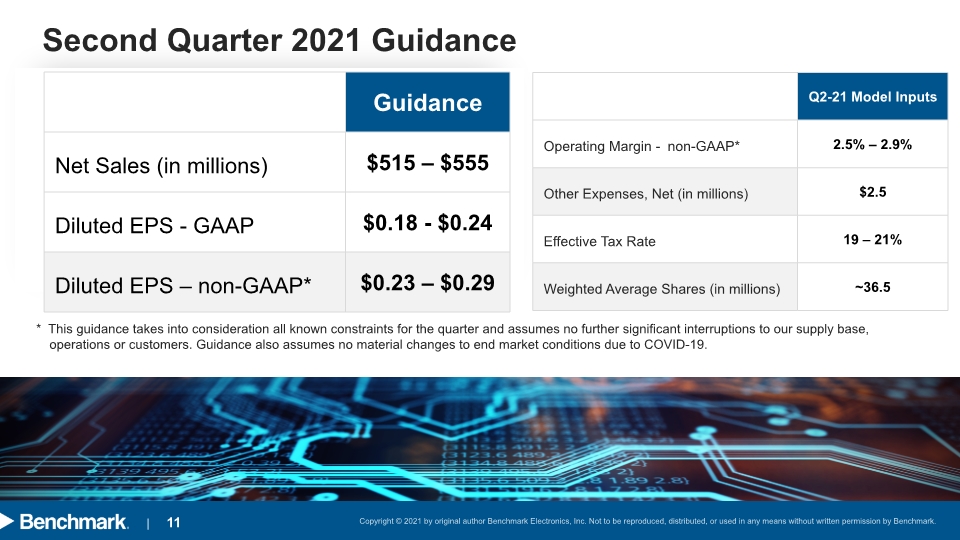

Second Quarter 2021 Guidance * This guidance takes into consideration all known constraints for the quarter and assumes no further significant interruptions to our supply base, operations or customers. Guidance also assumes no material changes to end market conditions due to COVID-19.

2021 Revenue Trends and Key Initiatives Jeff Benck - CEO

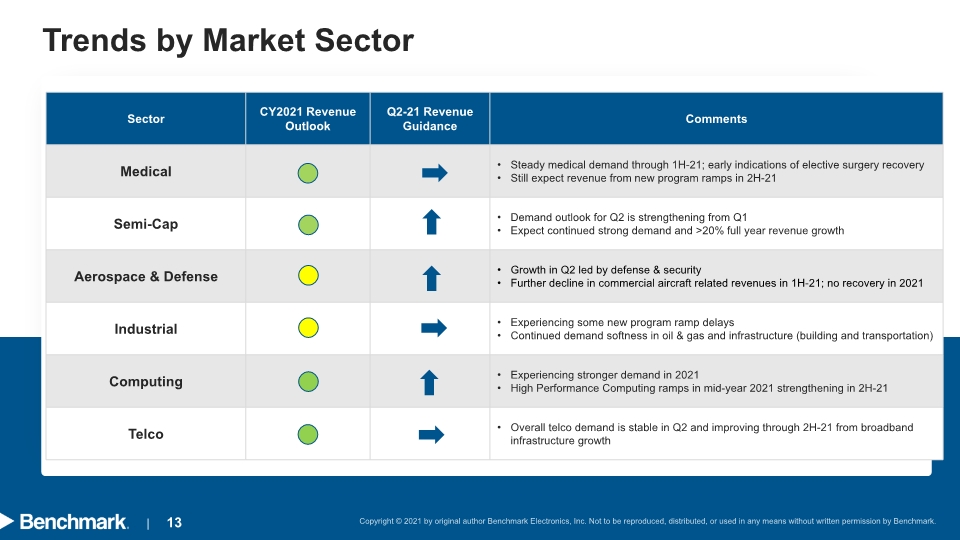

Trends by Market Sector

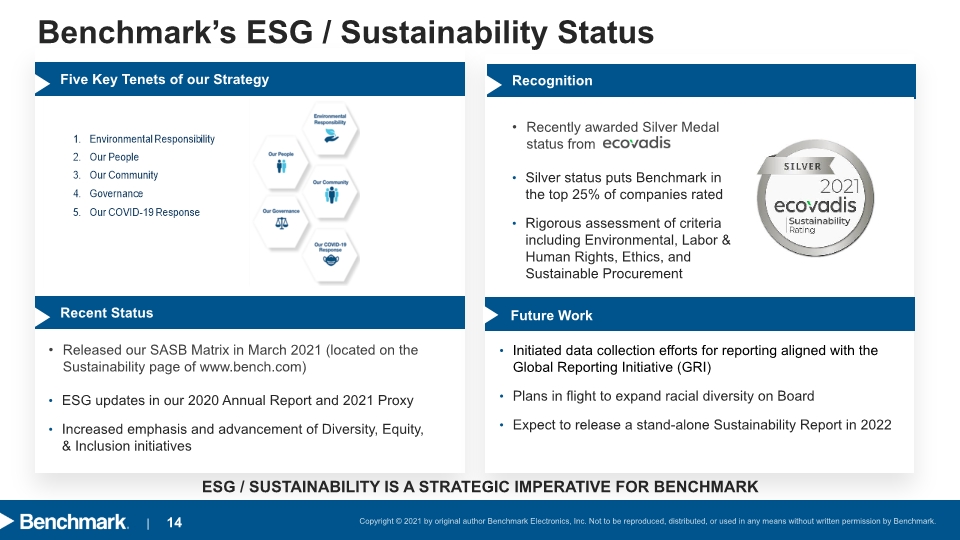

Benchmark’s ESG / Sustainability Status Released our SASB Matrix in March 2021 (located on the Sustainability page of www.bench.com) ESG updates in our 2020 Annual Report and 2021 Proxy Increased emphasis and advancement of Diversity, Equity, & Inclusion initiatives ESG / SUSTAINABILITY IS A STRATEGIC IMPERATIVE FOR BENCHMARK Five Key Tenets of our Strategy Recent Status Next Steps Initiated data collection efforts for reporting aligned with the Global Reporting Initiative (GRI) Plans in flight to expand racial diversity on Board Expect to release a stand-alone Sustainability Report in 2022 Recognition Recently awarded Silver Medal status from Silver status puts Benchmark in the top 25% of companies rated Rigorous assessment of criteria including Environmental, Labor & Human Rights, Ethics, and Sustainable Procurement Future Work

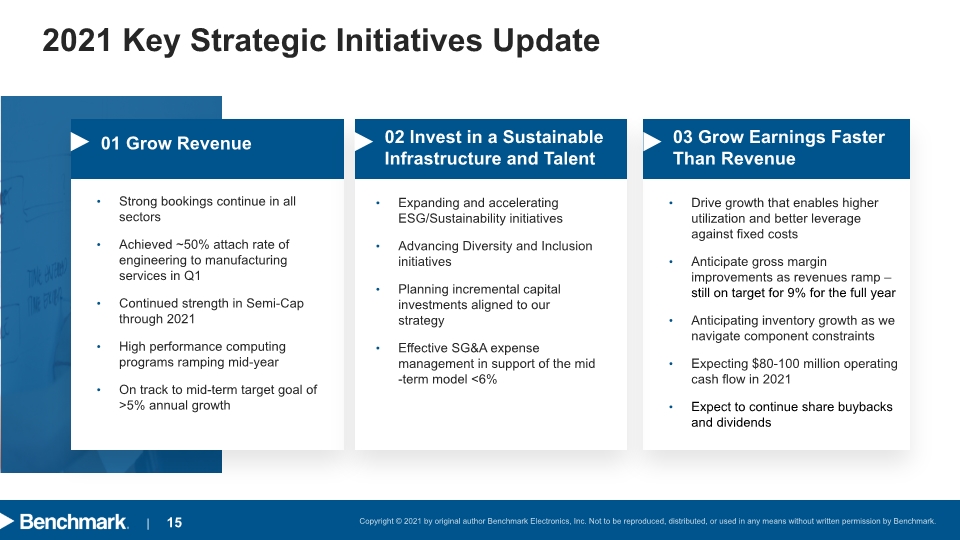

2021 Key Strategic Initiatives Update

Appendix

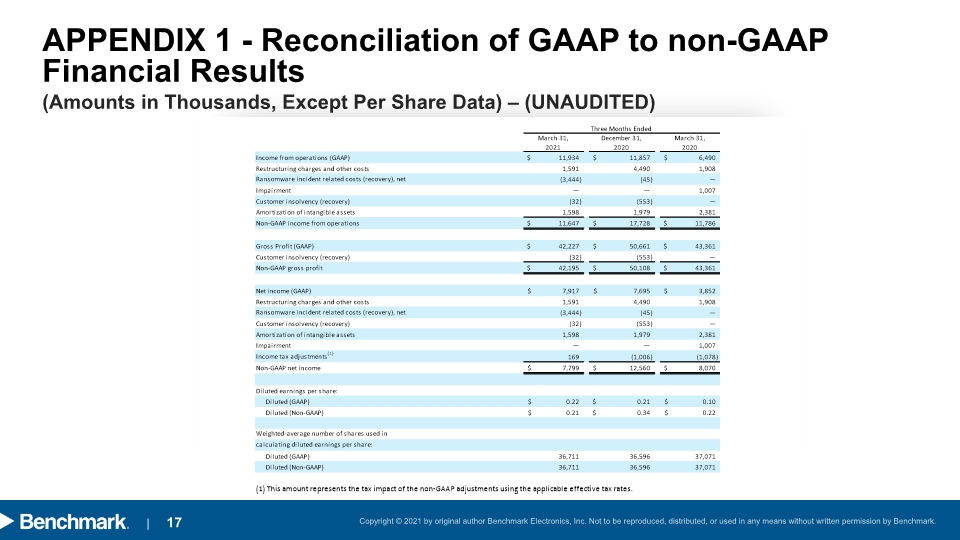

(Amounts in Thousands, Except Per Share Data) – (UNAUDITED) APPENDIX 1 - Reconciliation of GAAP to non-GAAP Financial Results

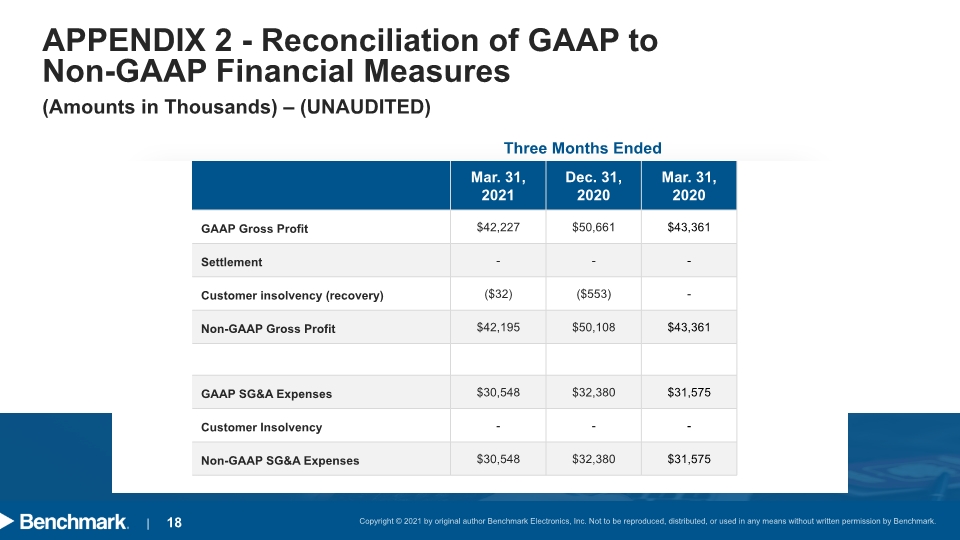

(Amounts in Thousands) – (UNAUDITED) APPENDIX 2 - Reconciliation of GAAP to Non-GAAP Financial Measures Three Months Ended

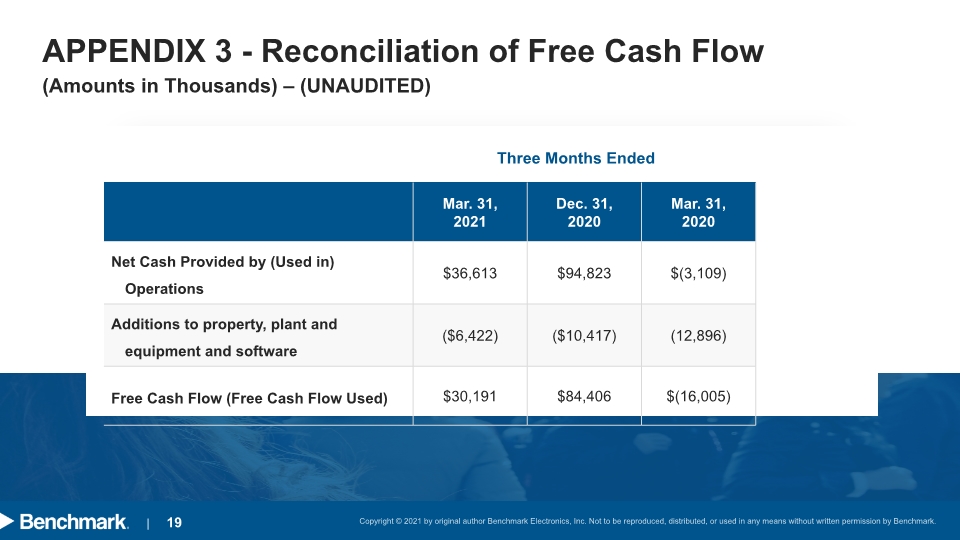

(Amounts in Thousands) – (UNAUDITED) APPENDIX 3 - Reconciliation of Free Cash Flow Three Months Ended