Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Altabancorp | alta-8k_20210428.htm |

| EX-99.1 - EX-99.1 - Altabancorp | alta-ex991_6.htm |

Investor Presentation First Quarter 2021 April 28, 2021 Len Williams, President and Chief Executive Officer Mark Olson, EVP and Chief Financial Officer Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, including, but not limited to: The duration and impact of the COVID-19 pandemic; Changes in general economic conditions, either nationally or in our market areas; Adequacy of allowance for credit losses and estimation of current expected credit losses; Sufficiency of capital; Impact of changes in overall interest rate environment and other market risks; Fluctuations in demand for loans and other financial services in our market areas; Changes in legislative or regulatory requirements or the results of regulatory examinations; Stability of funding sources and continued availability of borrowings; Changes in accounting policies and practices and the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; and These and other risks as may be detailed from time to time in our filings with the Securities and Exchange Commission. The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to the Company. The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. These risks could cause our actual results in 2020 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us, and could negatively affect the Company’s operating results, financial condition and stock price performance. Confidential Page 2

About AltabancorpTM Nasdaq: ALTA Over 100+ years operating history Largest community bank in Utah Only public community bank in Utah Vision: to be the best bank for your business Provide highly personalized service to small and medium-sized businesses and to individuals 25 full-service branches from Preston, Idaho to St. George, Utah Focus on construction lending with business verticals in homebuilder finance and investor real estate Commercial banking centers focused on C&I lending Total assets $3.5 billion Confidential Page 3

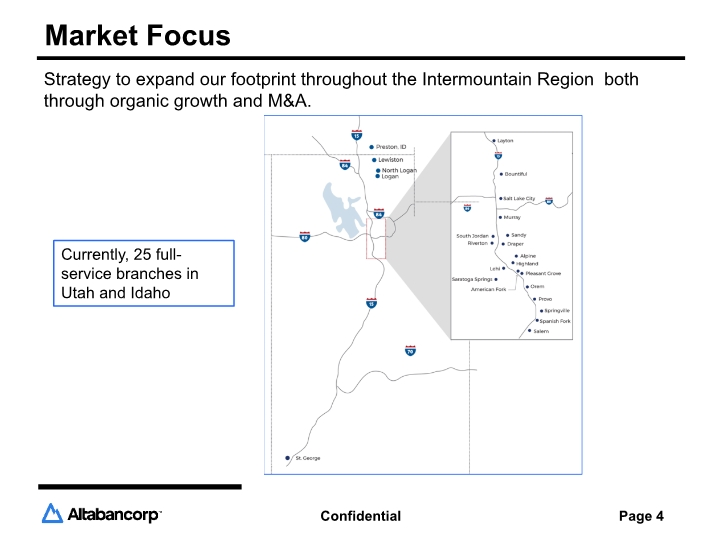

Market Focus Confidential Page 4 Strategy to expand our footprint throughout the Intermountain Region both through organic growth and M&A. Currently, 25 full- service branches in Utah and Idaho

Rebranding of Company Confidential Page 5 Nasdaq: ALTA

Business Model Customers — Small to medium sized regional businesses, and moderate to high net worth individuals; Market Niches — Real estate construction, land acquisition and development, commercial real estate, commercial & industrial, equipment leasing, and residential real estate; Loan Products — Commercial and consumer construction, commercial real estate, commercial & industrial, multifamily, single family, home equity lines, and other consumer loans; Customer Interaction — Community relationships, local decision-making, market specialists, full-service branch locations, and regional advisory boards; and Community Service — Active involvement in communities, service hours, and community charity contributions and sponsorships. Confidential Page 6

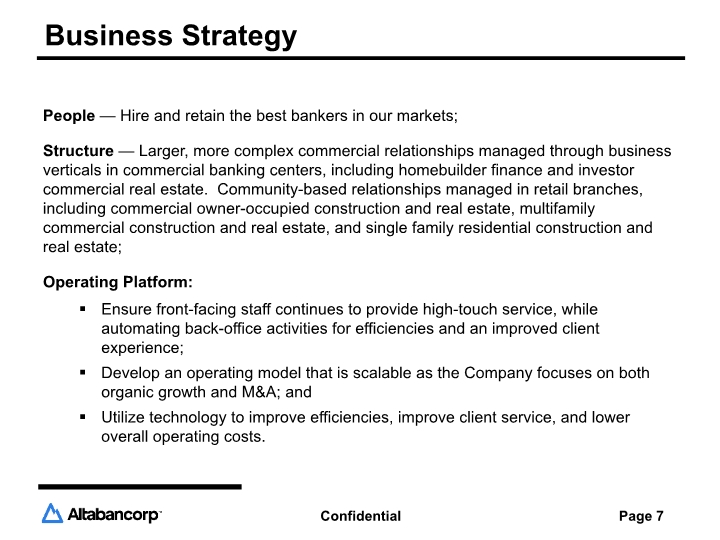

Business Strategy People — Hire and retain the best bankers in our markets; Structure — Larger, more complex commercial relationships managed through business verticals in commercial banking centers, including homebuilder finance and investor commercial real estate. Community-based relationships managed in retail branches, including commercial owner-occupied construction and real estate, multifamily commercial construction and real estate, and single family residential construction and real estate; Operating Platform: Ensure front-facing staff continues to provide high-touch service, while automating back-office activities for efficiencies and an improved client experience; Develop an operating model that is scalable as the Company focuses on both organic growth and M&A; and Utilize technology to improve efficiencies, improve client service, and lower overall operating costs. Confidential Page 7

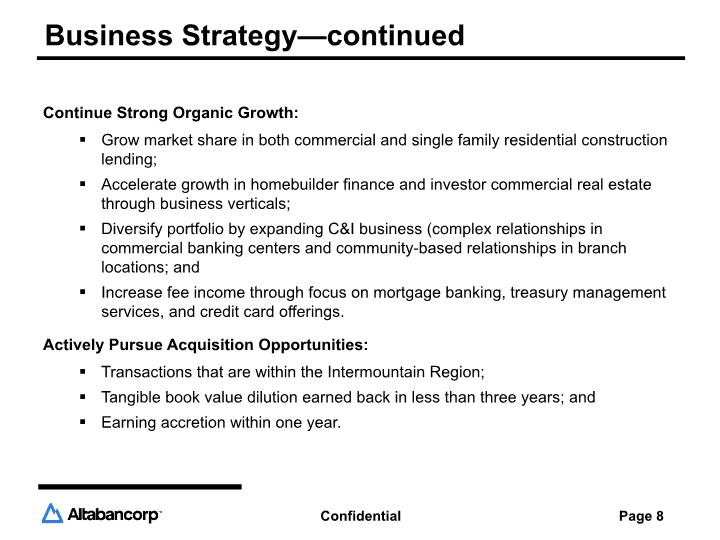

Business Strategy—continued Continue Strong Organic Growth: Grow market share in both commercial and single family residential construction lending; Accelerate growth in homebuilder finance and investor commercial real estate through business verticals; Diversify portfolio by expanding C&I business (complex relationships in commercial banking centers and community-based relationships in branch locations; and Increase fee income through focus on mortgage banking, treasury management services, and credit card offerings. Actively Pursue Acquisition Opportunities: Transactions that are within the Intermountain Region; Tangible book value dilution earned back in less than three years; and Earning accretion within one year. Confidential Page 8

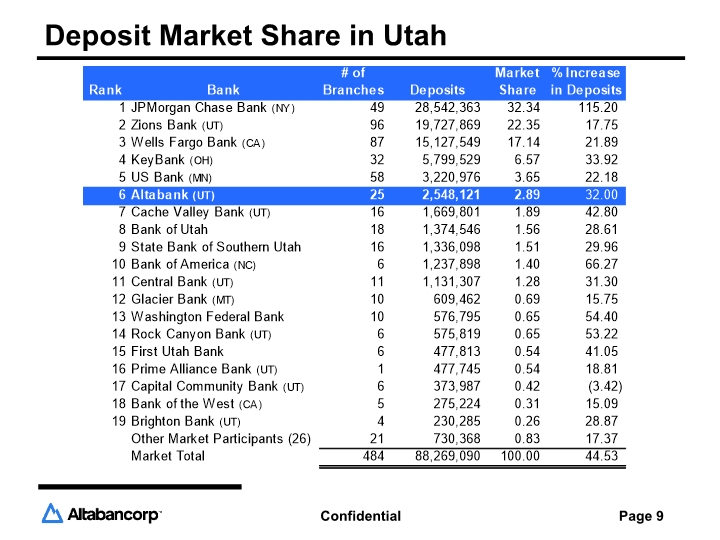

Deposit Market Share in Utah Confidential Page 9

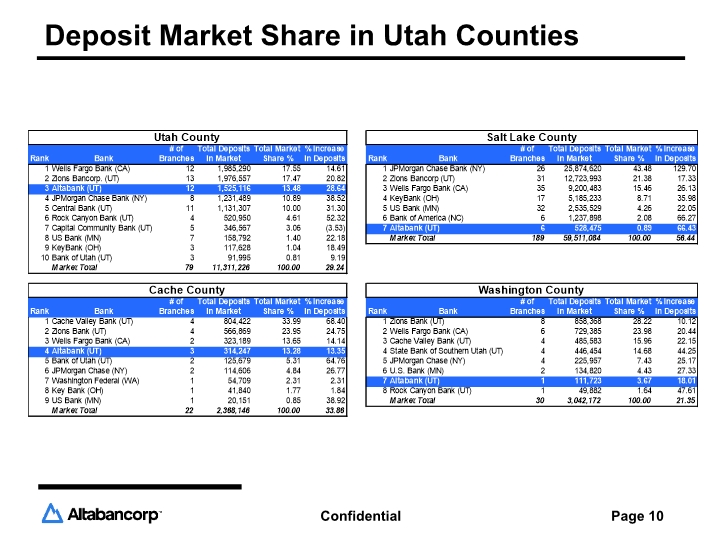

Deposit Market Share in Utah Counties Confidential Page 10

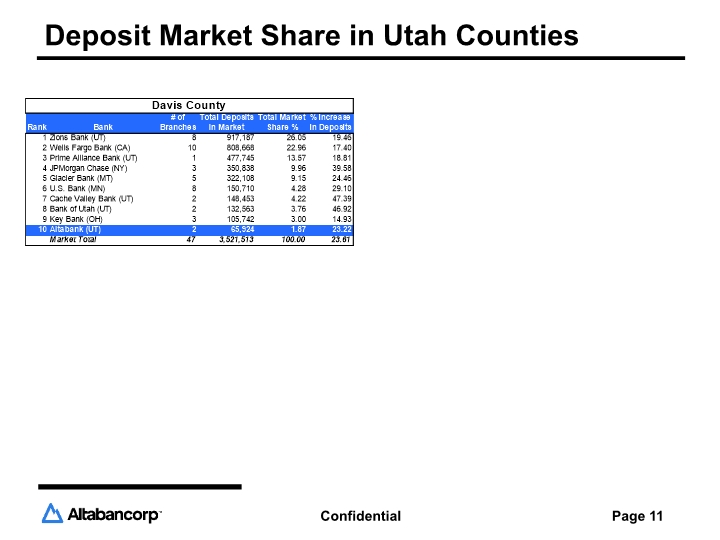

Deposit Market Share in Utah Counties Confidential Page 11 Davis County table

COVID-19 Operational Response and Preparedness Page 12

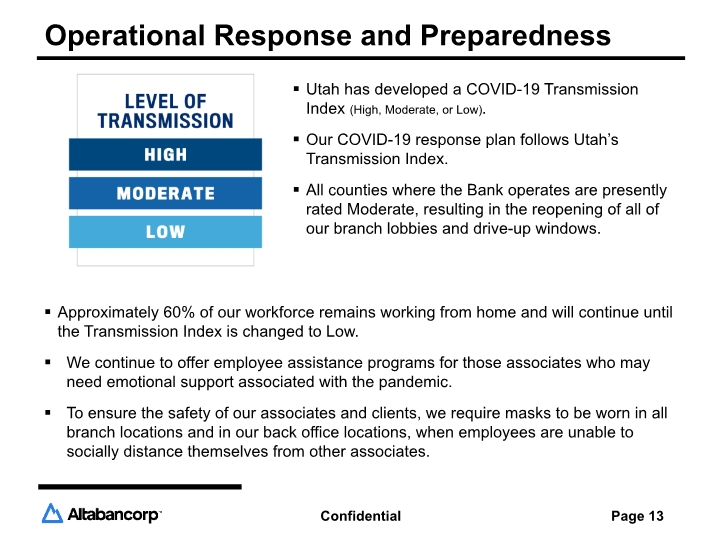

Operational Response and Preparedness Utah has developed a COVID-19 Transmission Index (High, Moderate, or Low). Our COVID-19 response plan follows Utah’s Transmission Index. All counties where the Bank operates are presently rated Moderate, resulting in the reopening of all of our branch lobbies and drive-up windows. Confidential Page 13 Approximately 60% of our workforce remains working from home and will continue until the Transmission Index is changed to Low. We continue to offer employee assistance programs for those associates who may need emotional support associated with the pandemic. To ensure the safety of our associates and clients, we require masks to be worn in all branch locations and in our back office locations, when employees are unable to socially distance themselves from other associates.

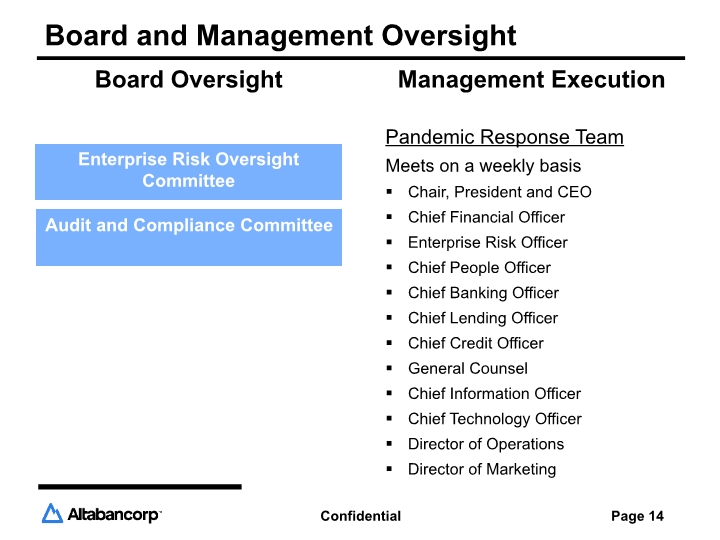

Board and Management Oversight Board Oversight Confidential Page 14 Management Execution Pandemic Response Team Meets on a weekly basis Chair, President and CEO Chief Financial Officer Enterprise Risk Officer Chief People Officer Chief Banking Officer Chief Lending Officer Chief Credit Officer General Counsel Chief Information Officer Chief Technology Officer Director of Operations Director of Marketing Enterprise Risk Oversight Committee Audit and Compliance Committee Audit and Compliance Committee

Relief Programs to Support Clients and Communities Page 15

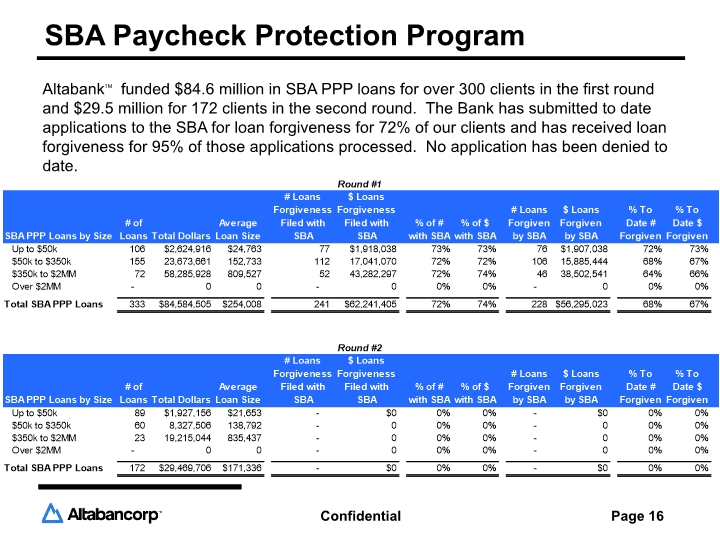

SBA Paycheck Protection Program AltabankTM funded $84.6 million in SBA PPP loans for over 300 clients in the first round and $29.5 million for 172 clients in the second round. The Bank has submitted to date applications to the SBA for loan forgiveness for 72% of our clients and has received loan forgiveness for 95% of those applications processed. No application has been denied to date. Confidential Page 16

Relief Programs—Payment Deferrals AltabankTM offered temporary loan payment relief to 445 businesses(1) and 108 individuals(2) totaling approximately $345 million or 20% of the loan portfolio. To date, 99% of the borrowers have reached the expiration of their deferment period. As of Q1-21, the Bank has entered into additional loan payment deferment agreements with 4 borrowers. The Bank requires a full re-underwriting of the credit to re-defer a loan. As of Q1-21, 3 borrowers are past due on their loan payments after the deferment. Since these loans were performing loans that were current on their payments prior to the COVID-19 pandemic, these modified loans are not considered to be troubled debt restructurings pursuant to applicable accounting and regulatory guidance. (1)—20 businesses waived their deferment agreement after execution. (2)—3 individuals waived their deferment agreement after execution. Confidential Page 17

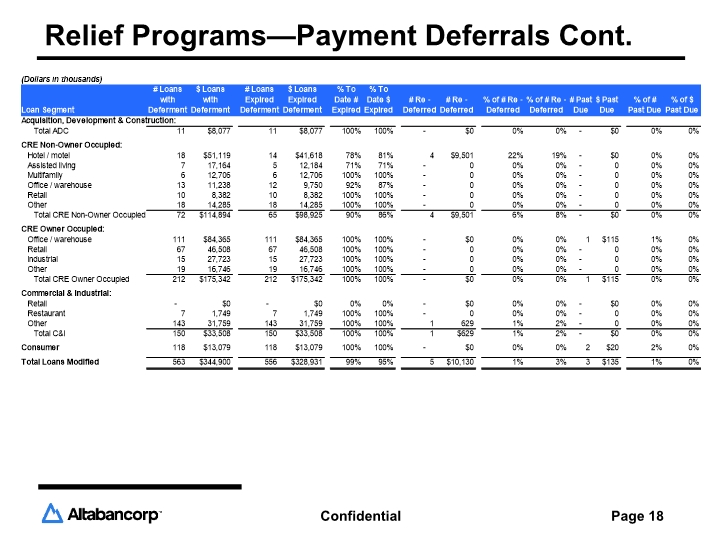

Relief Programs—Payment Deferrals Cont. Confidential Page 18

Economic Trends Page 19

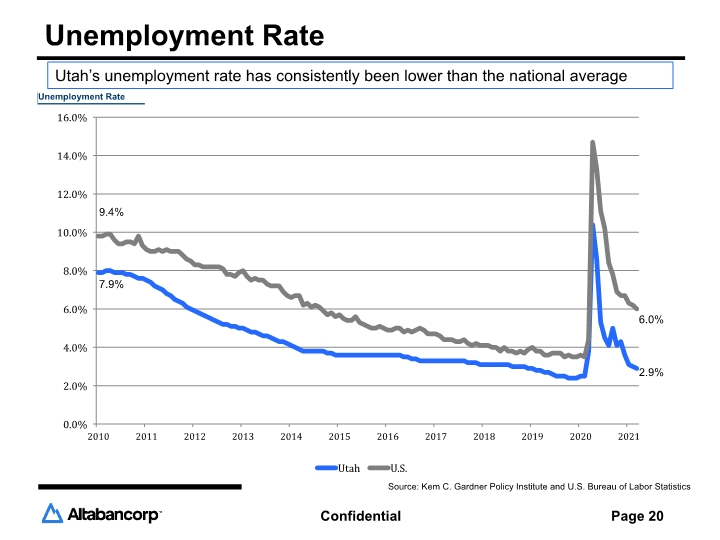

Unemployment Rate Confidential Page 20 Unemployment Rate 2.9% 7.9% 9.4% Source: Kem C. Gardner Policy Institute and U.S. Bureau of Labor Statistics Utah’s unemployment rate has consistently been lower than the national average Chart

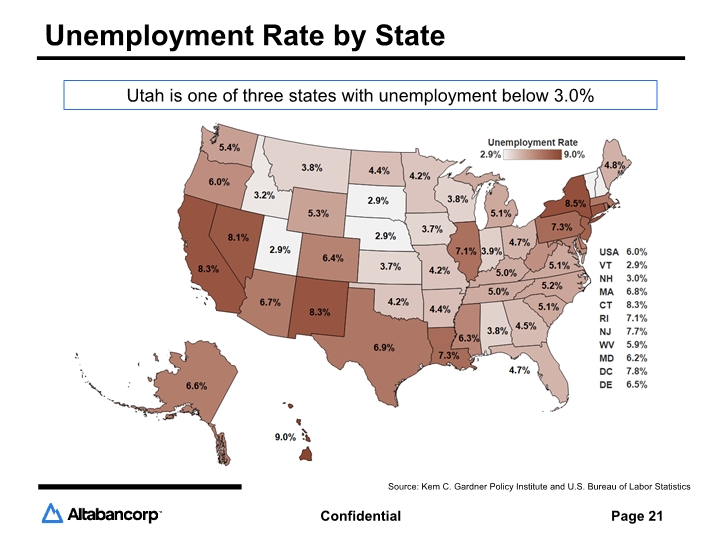

Unemployment Rate by State Confidential Page 21 Source: Kem C. Gardner Policy Institute and U.S. Bureau of Labor Statistics Utah is one of three states with unemployment below 3.0% Map

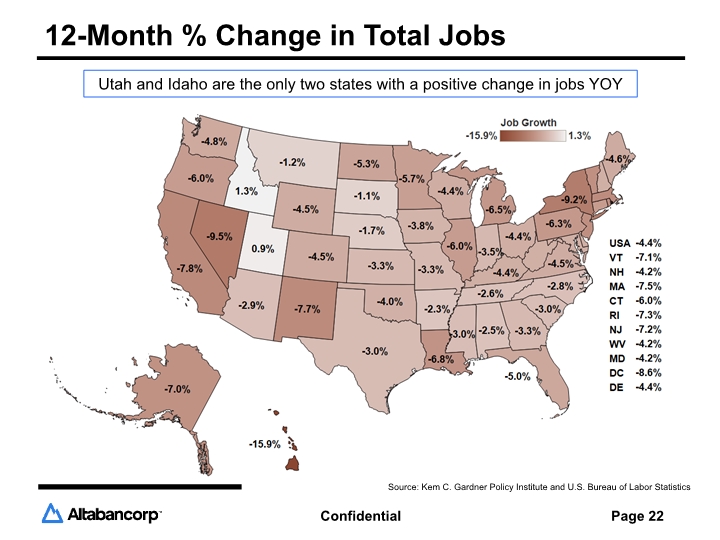

12-Month % Change in Total Jobs Confidential Page 22 Source: Kem C. Gardner Policy Institute and U.S. Bureau of Labor Statistics Utah and Idaho are the only two states with a positive change in jobs YOY Map

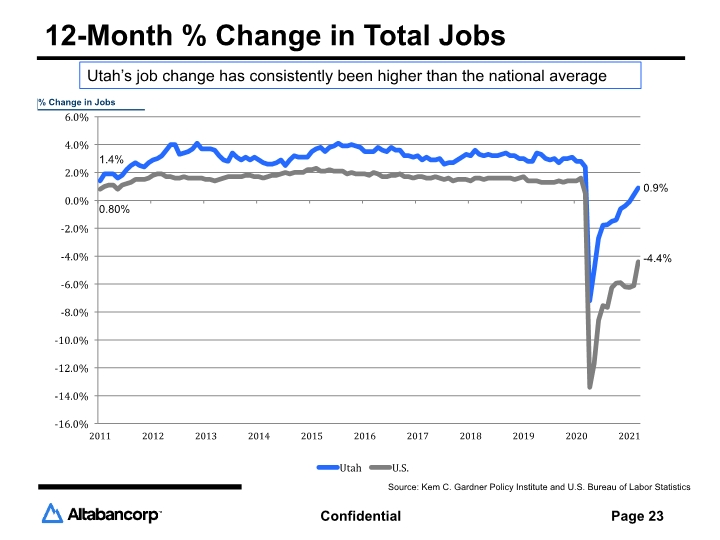

12-Month % Change in Total Jobs Confidential Page 23 % Change in Jobs -4.4% 1.4% 0.80% Source: Kem C. Gardner Policy Institute and U.S. Bureau of Labor Statistics Utah’s job change has consistently been higher than the national average Line Chart

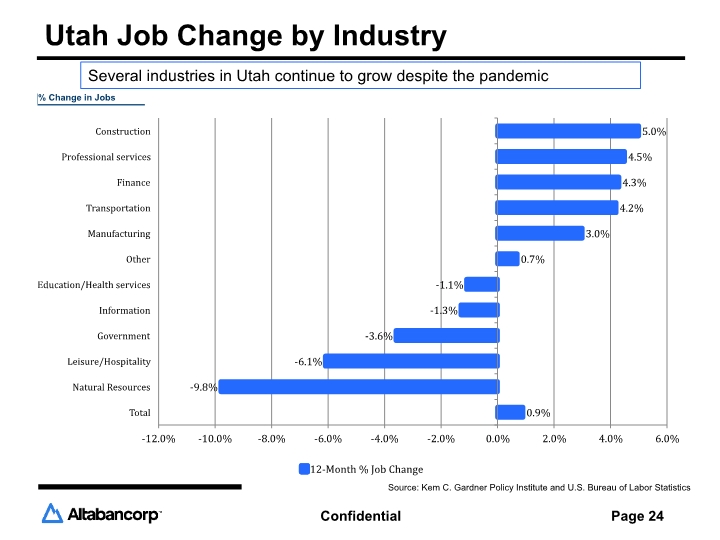

Utah Job Change by Industry Confidential Page 24 % Change in Jobs Source: Kem C. Gardner Policy Institute and U.S. Bureau of Labor Statistics Several industries in Utah continue to grow despite the pandemic Bar chart

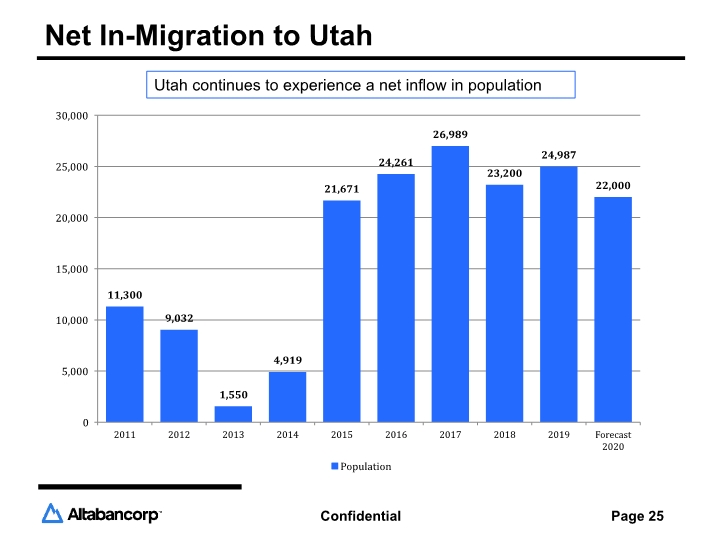

Net In-Migration to Utah Confidential Page 25 Utah continues to experience a net inflow in population Bar chart

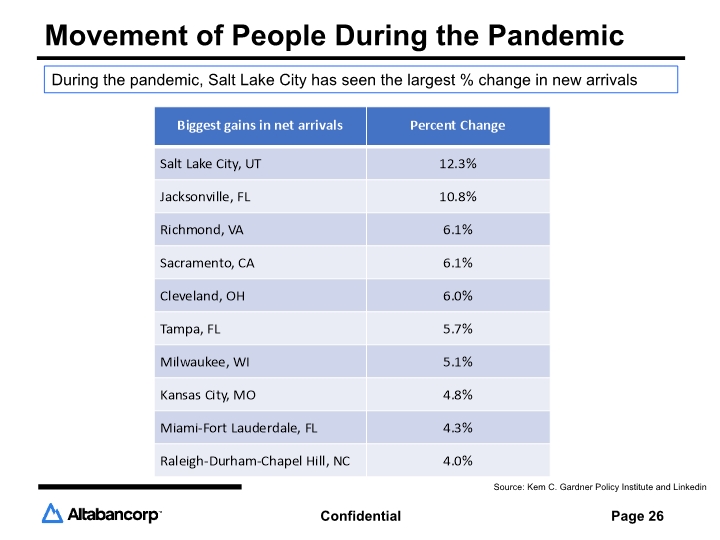

Movement of People During the Pandemic Confidential Page 26 Source: Kem C. Gardner Policy Institute and Linkedin During the pandemic, Salt Lake City has seen the largest % change in new arrivals

Asset Quality Trends Page 27

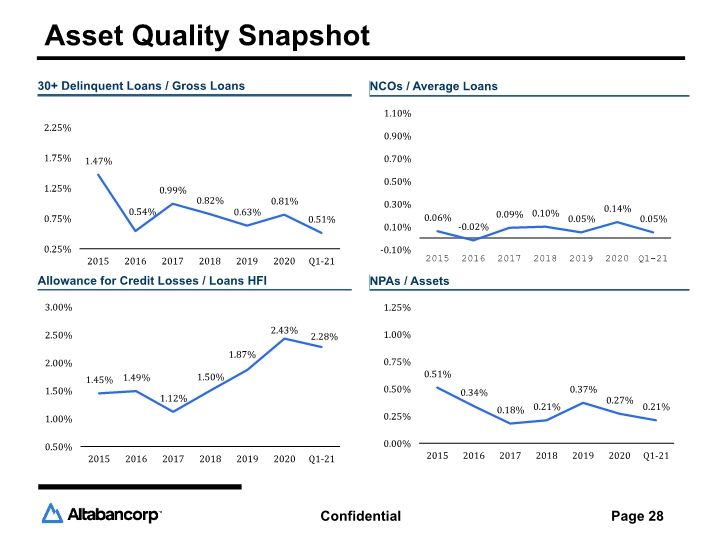

Asset Quality Snapshot Confidential Page 28 30+ Delinquent Loans / Gross Loans NCOs / Average Loans Allowance for Credit Losses / Loans HFI NPAs / Assets Line Chart

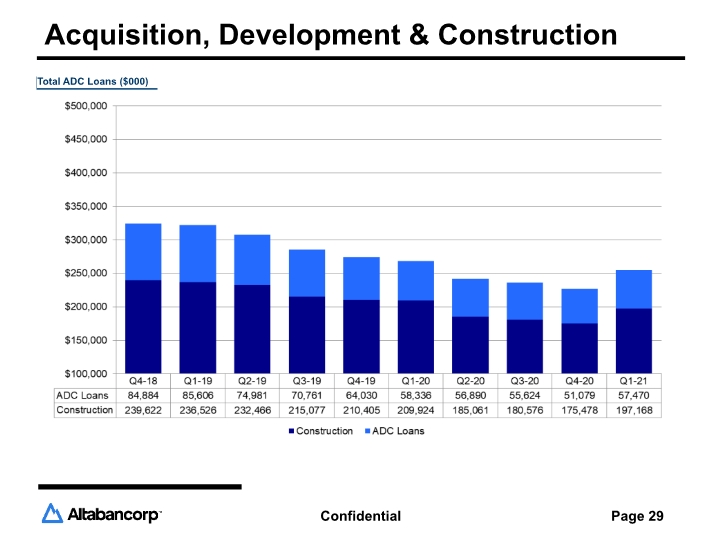

Acquisition, Development & Construction Confidential Page 29 Total ADC Loans ($000) Bar Chart Bar chart

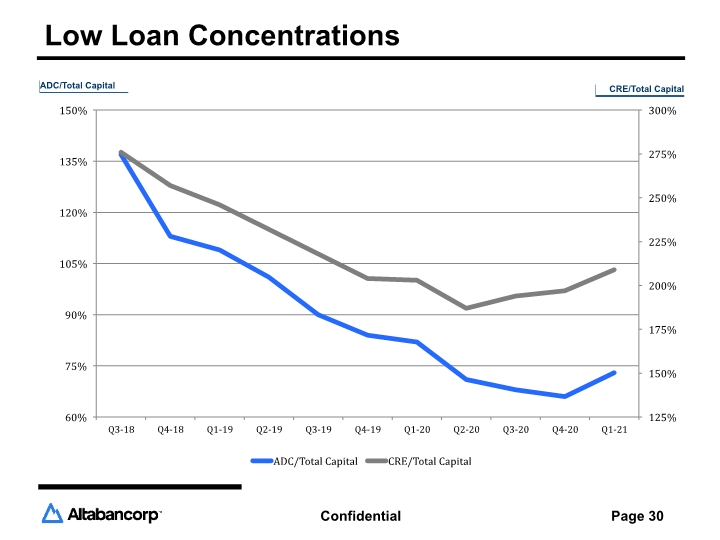

Low Loan Concentrations Confidential Page 30 ADC/Total Capital CRE/Total Capital Line chart

Financial Performance Page 31

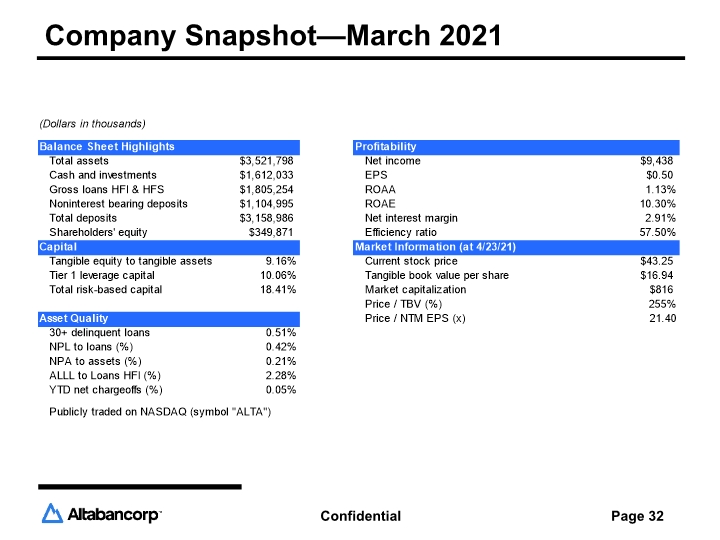

Company Snapshot—March 2021 Confidential Page 32

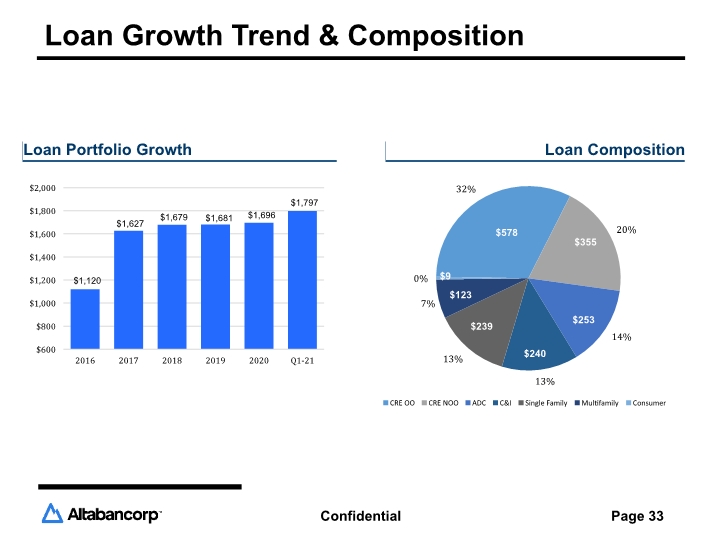

Loan Growth Trend & Composition Confidential Page 33 Loan Portfolio Growth $1,797 $1,120 $1,627 $1,679 Loan Composition $1,696 $253 $1,681 Bar chart pie Chart

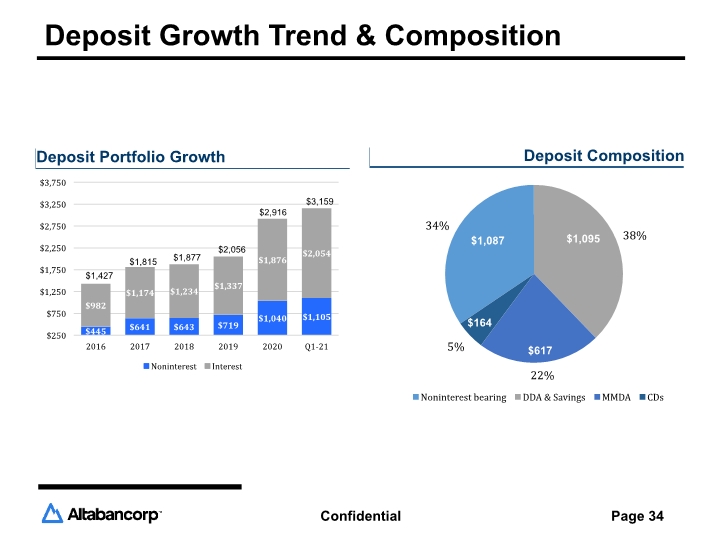

Deposit Growth Trend & Composition Confidential Page 34 Deposit Portfolio Growth $3,159 $1,427 $1,815 $2,056 Deposit Composition $1,877 $2,916 Bar chart Pie chart

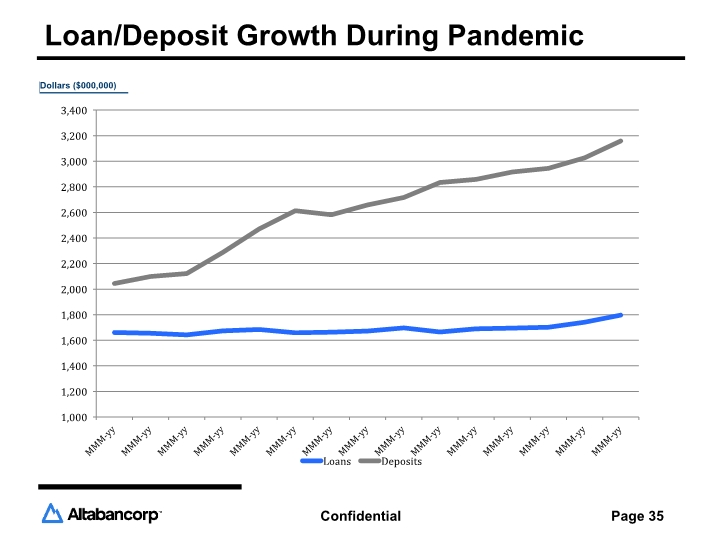

Loan/Deposit Growth During Pandemic Confidential Page 35 Dollars ($000,000) Line chart

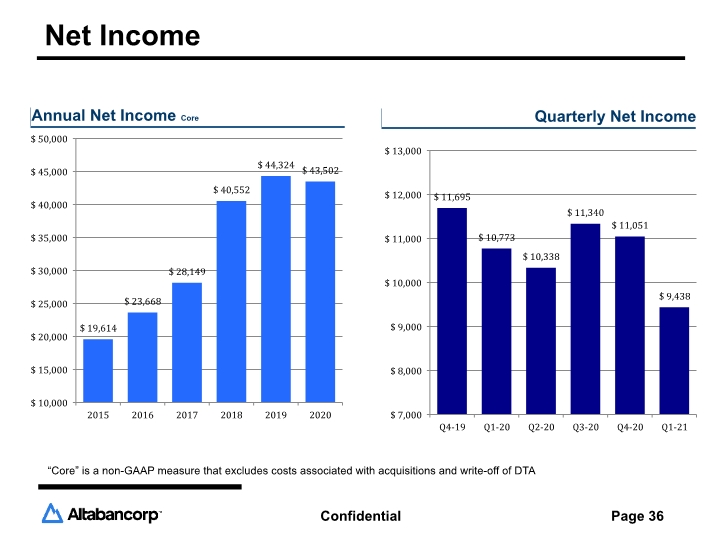

Net Income Confidential Page 36 Annual Net Income Core Quarterly Net Income “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA Bar chart

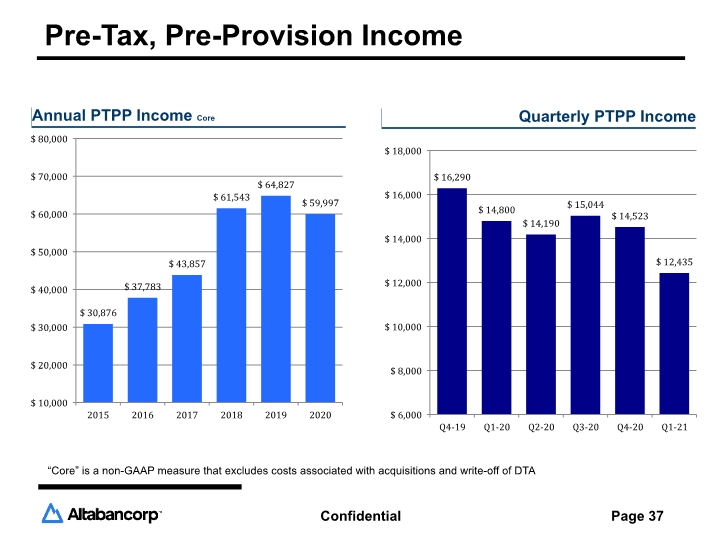

Pre-Tax, Pre-Provision Income Confidential Page 37 Annual PTPP Income Core Quarterly PTPP Income “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA Bar chart

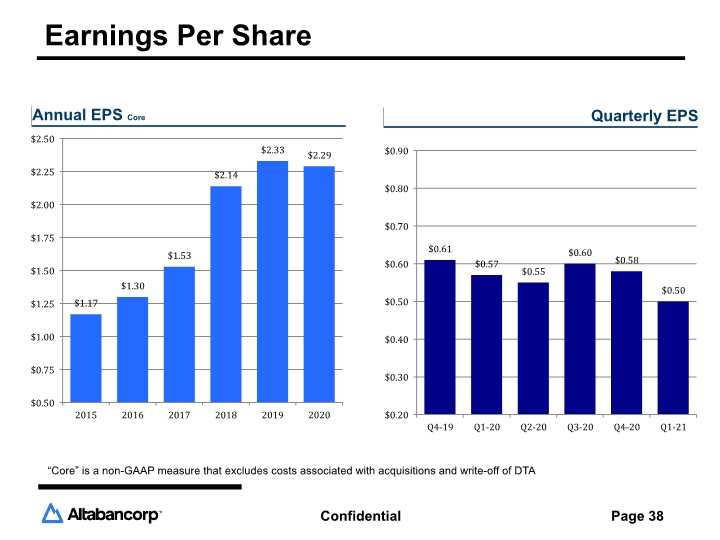

Earnings Per Share Confidential Page 38 Annual EPS Core Quarterly EPS “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA Bar chart

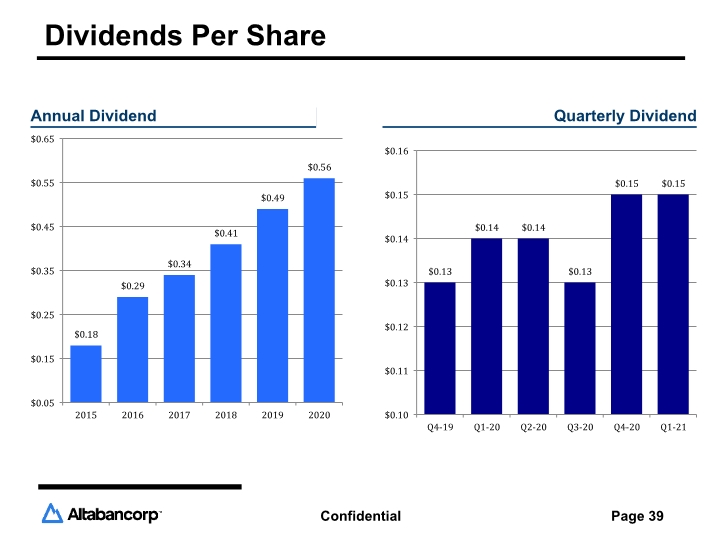

Dividends Per Share Confidential Page 39 Annual Dividend Quarterly Dividend Bar chart

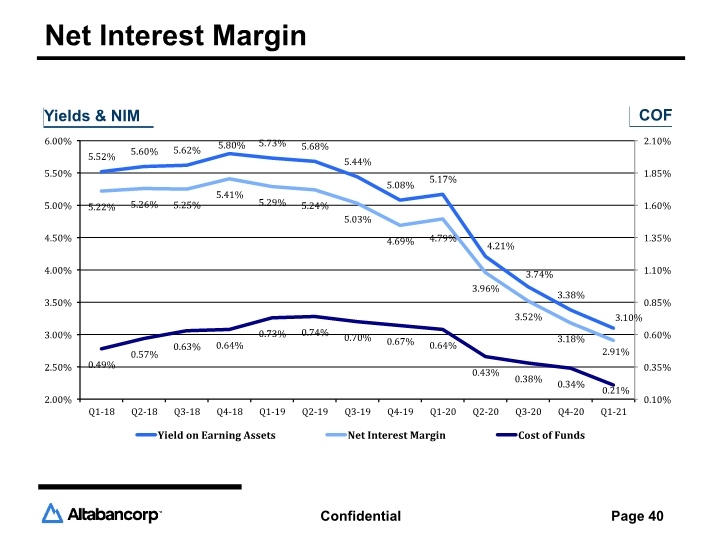

Net Interest Margin Confidential Page 40 Yields & NIM COF Line chart

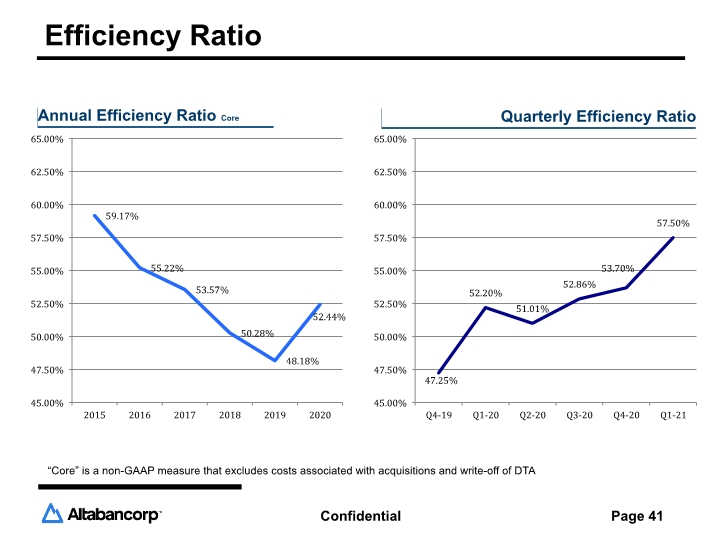

Efficiency Ratio Confidential Page 41 Annual Efficiency Ratio Core Quarterly Efficiency Ratio “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA Line chart

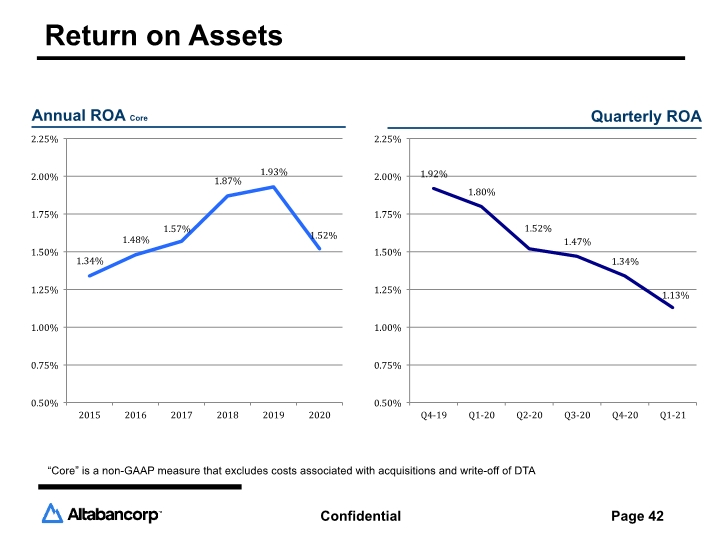

Return on Assets Confidential Page 42 Annual ROA Core Quarterly ROA “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA Line Chart

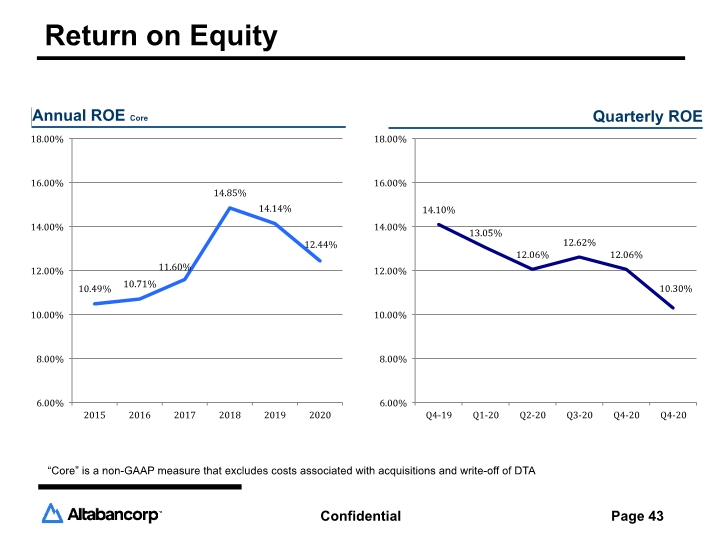

Return on Equity Confidential Page 43 Annual ROE Core Quarterly ROE “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA

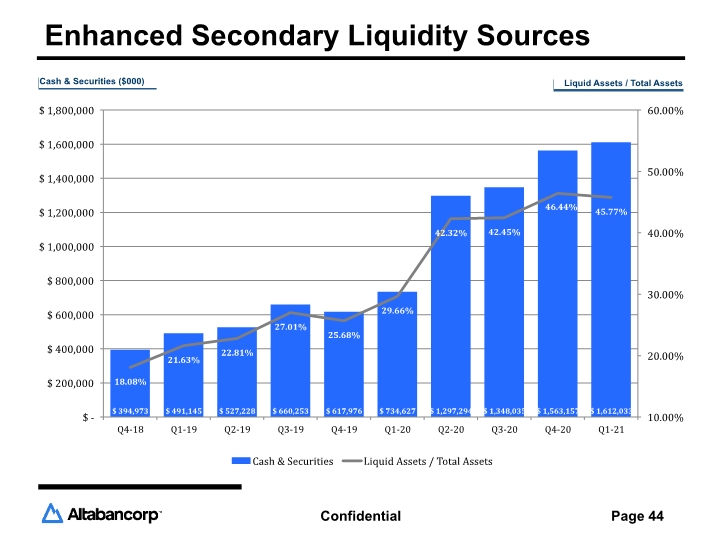

Enhanced Secondary Liquidity Sources Confidential Page 44 Cash & Securities ($000) Liquid Assets / Total Assets

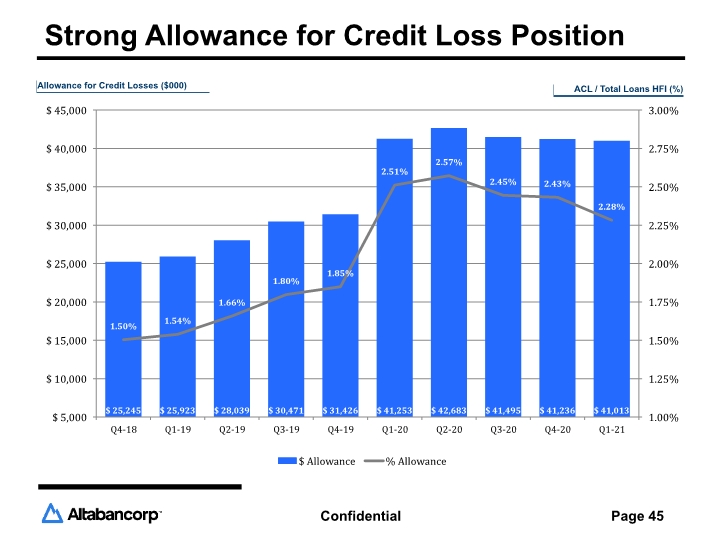

Strong Allowance for Credit Loss Position Confidential Page 45 Allowance for Credit Losses ($000) ACL / Total Loans HFI (%) Bar chart

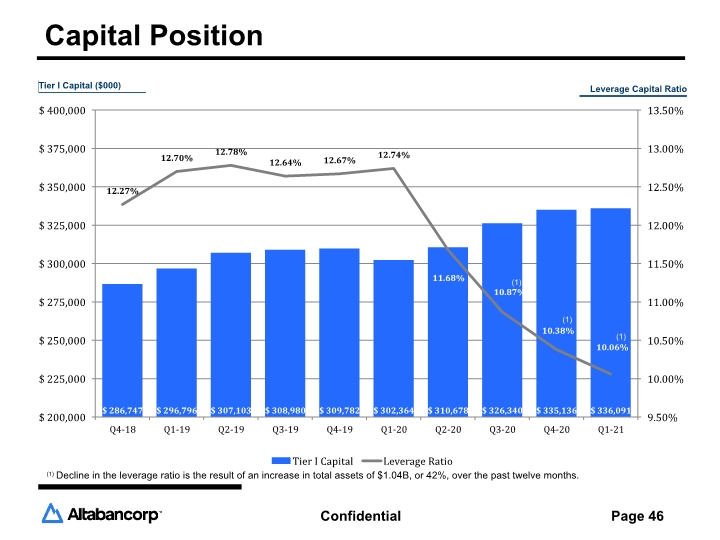

Capital Position Confidential Page 46 Tier I Capital ($000) Leverage Capital Ratio (1) Decline in the leverage ratio is the result of an increase in total assets of $1.04B, or 42%, over the past twelve months. (1) (1) (1) Bar chart

Summary Effective rollout of pandemic business continuity plan with primary focus to protect our associates and provide financial relief to clients; Actively engaged to provide financial relief to clients through internal relief programs and the SBA’s Paycheck Protection Program; Fortified balance sheet with strong capital, higher allowance for credit losses, reduced loan concentrations, and strong liquidity position will mitigate negative effects related to COVID-19 pandemic; The Utah economy has consistently performed better than most states and the nation as a whole. Early trends indicate that Utah is recovering more quickly than most states and the nation as a whole; and With business strategic initiatives in the commercial lending area substantially completed, excess liquidity, and the strong Utah economy, the Company expects significant loan growth for the foreseeable future. Confidential Page 47

Altabancorp logo