Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - RMR Mortgage Trust | tm2114185d1_ex10-2.htm |

| EX-99.1 - EXHIBIT 99.1 - RMR Mortgage Trust | tm2114185d1_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - RMR Mortgage Trust | tm2114185d1_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - RMR Mortgage Trust | tm2114185d1_ex2-1.htm |

| 8-K - FORM 8-K - RMR Mortgage Trust | tm2114185d1_8k.htm |

Exhibit 99.2

| RMR Mortgage Trust to merge with Tremont Mortgage Trust April 26, 2021 |

| 2 Confidential DISCLAIMERS DISCLAIMER This investor presentation is for informational purposes only and is subject to change. The information contained herein does not purport to be all-inclusive. The data contained herein is derived from various internal sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modeling or any other information contained herein. WARNING REGARDING FORWARD-LOOKING STATEMENTS This presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever RMR Mortgage Trust (“RMRM”) or Tremont Mortgage Trust (“TRMT”) uses words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, they are making forward-looking statements. These forward-looking statements are based upon RMRM’s and TRMT’s present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by RMRM’s and TRMT’s forward‐looking statements as a result of various factors. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond RMRM’s and TRMT’s control. For example: • RMRM and TRMT have entered into a definitive agreement to merge. The merger is expected to close in the third quarter of 2021, subject to the satisfaction or waiver of closing conditions, including the receipt of the requisite approvals by RMRM and TRMT shareholders. RMRM and TRMT cannot be sure that these conditions will be satisfied or waived. Accordingly, the merger may not close by the end of the third quarter of 2021 or at all, or the terms contemplated by the merger agreement may change. • RMRM and TRMT expect to realize a number of benefits from the merger, including enhanced scale, earnings accretion, an expanded capital base, improved access to capital markets, increased portfolio diversification, greater market visibility and a seamless integration. These expectations are contingent upon the consummation of the merger and may not be realized as currently expected or at all. The information contained in RMRM’s “Summary of Principal Risk Factors” included in its Current Report on Form 8-K filed on March 24, 2021, and the information contained in TRMT’s filings with the Securities and Exchange Commission, or the SEC, including under “Risk Factors” in TRMT’s periodic reports or incorporated therein, identifies other important factors that could cause RMRM’s and TRMT’s actual results to differ materially from those stated in or implied by RMRM’s and TRMT’s forward-looking statements. RMRM’s and TRMT’s filings with the SEC are available on the SEC’s website at www.sec.gov. You should not place undue reliance upon forward-looking statements. Except as required by law, neither RMRM nor TRMT intends to update or change any forward-looking statements as a result of new information, future events or otherwise. PRO FORMA FINANCIAL INFORMATION This presentation contains unaudited pro forma financial information related to the transactions discussed herein. The unaudited pro forma financial information reflect the impact of the transactions discussed herein on RMRM’s and TRMT’s consolidated financial statements. The unaudited pro forma financial information is based on the historical financial statements and accounting records of RMRM and TRMT, giving effect to the transactions discussed herein, related reclassifications and pro forma adjustments as described herein. The unaudited pro forma financial information is not necessarily indicative of RMRM’s and TRMT’s expected financial position or results of operations for any future period, including following the merger, if completed. Differences could result from numerous factors, including future changes in RMRM’s and TRMT’s portfolio of investments, capital structure, changes in interest rates and for other reasons. The unaudited pro forma financial information is provided for informational purposes only. Actual future results are likely to be different from amounts presented in the unaudited pro forma condensed consolidated financial statements and such differences could be significant. |

| 3 Confidential DISCLAIMERS DISCLAIMER ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION AND WHERE TO FIND IT In connection with the merger and other transactions discussed in this presentation, RMRM expects to file with the SEC a registration statement on Form S-4 containing a joint proxy statement/prospectus and other documents with respect to the merger and other transactions with respect to both RMRM and TRMT. This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) IF AND WHEN THEY BECOME AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. After the registration statement for the merger has been declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to the RMRM and TRMT shareholders. Investors will be able to obtain a free copy of documents filed with the SEC at the SEC’s website at www.sec.gov. In addition, investors may obtain free copies of RMRM’s filings with the SEC from RMRM’s website at www.rmrmortgagetrust.com and free copies of TRMT’s filings with the SEC from TRMT’s website at www.trmtreit.com. PARTICIPANTS IN THE SOLICITATION RELATING TO THE MERGER RMRM, TRMT and their respective trustees and executive officers and Tremont Realty Advisors LLC, The RMR Group LLC, The RMR Group Inc. and certain of their directors, officers and employees may be deemed to be participants in the solicitation of proxies from the stockholders of RMRM and TRMT in respect of the proposed merger. Information regarding RMRM's trustees and executive officers can be found in RMRM's definitive proxy statement filed with the SEC on March 24, 2021. Information regarding TRMT's trustees and executive officers can be found in TRMT's definitive proxy statement filed with the SEC on March 25, 2021. Additional information regarding the interests of such potential participants will be included in the joint proxy statement/prospectus and other relevant documents filed with the SEC in connection with the proposed merger if and when they become available. These documents are available free of charge on the SEC's website and from RMRM or TRMT, as applicable, using the sources indicated above. |

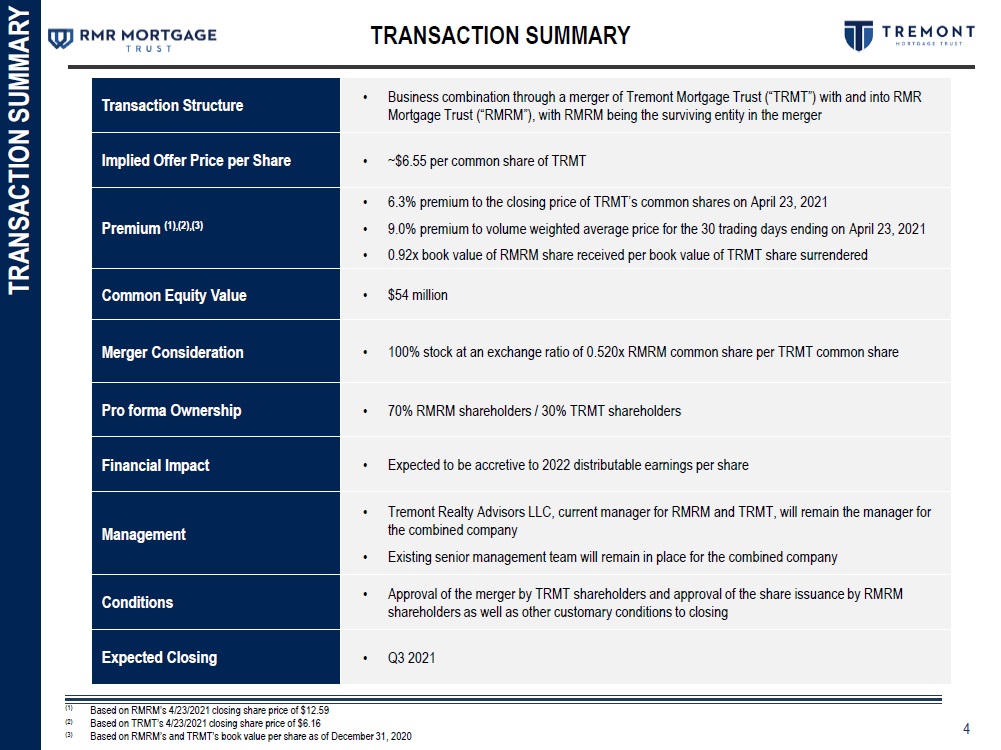

| 4 Confidential TRANSACTION SUMMARY TRANSACTION SUMMARY Transaction Structure • Business combination through a merger of Tremont Mortgage Trust (“TRMT”) with and into RMR Mortgage Trust (“RMRM”), with RMRM being the surviving entity in the merger Implied Offer Price per Share • ~$6.55 per common share of TRMT Premium (1),(2),(3) • 6.3% premium to the closing price of TRMT’s common shares • 9.0% premium to the 30-day volume weighted average price • 0.92x book value of RMRM share received per book value of TRMT share surrendered Common Equity Value • $54 million Merger Consideration • 100% stock at an exchange ratio of 0.520x RMRM common share per TRMT common share Pro forma Ownership • 70% RMRM shareholders / 30% TRMT shareholders Financial Impact • Expected to be accretive to 2022 distributable earnings per share Management • Tremont Realty Advisors LLC, current manager for RMRM and TRMT, will remain the manager for the combined company • Existing senior management team will remain in place for the combined company Conditions • Approval of the merger by TRMT shareholders and approval of the share issuance by RMRM shareholders as well as other customary conditions to closing Expected Closing • Q3 2021 (1) Based on RMRM’s 4/23/2021 closing share price of $12.59 (2) Based on TRMT’s 4/23/2021 closing share price of $6.16 (3) Based on RMRM’s and TRMT’s book value per share as of December 31, 2020 |

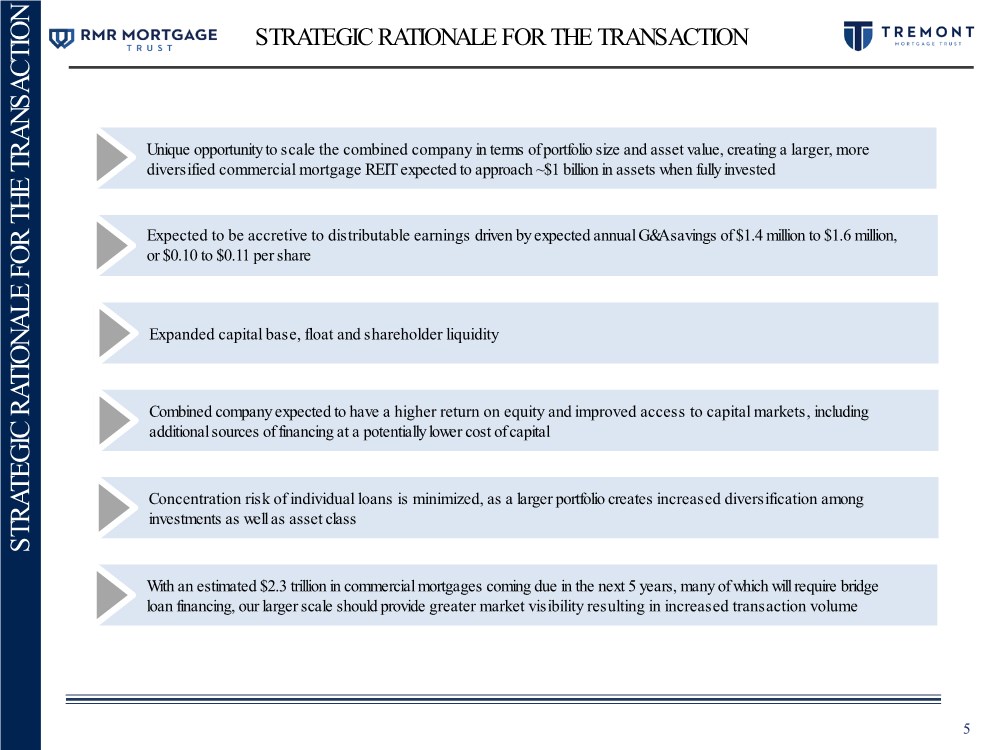

| 5 Confidential STRATEGIC RATIONALE FOR THE TRANSACTION STRATEGIC RATIONALE FOR THE TRANSACTION Concentration risk of individual loans is minimized, as a larger portfolio creates increased diversification among investments as well as asset class With an estimated $2.3 trillion in commercial mortgages coming due in the next 5 years, many of which will require bridge loan financing, our larger scale should provide greater market visibility resulting in increased transaction volume Combined company expected to have a higher return on equity and improved access to capital markets, including additional sources of financing at a potentially lower cost of capital Expected to be accretive to distributable earnings driven by expected annual G&A savings of $1.4 million to $1.6 million, or $0.10 to $0.11 per share Unique opportunity to scale the combined company in terms of portfolio size and asset value, creating a larger, more diversified commercial mortgage REIT expected to approach ~$1 billion in assets when fully invested Expanded capital base, float and shareholder liquidity |

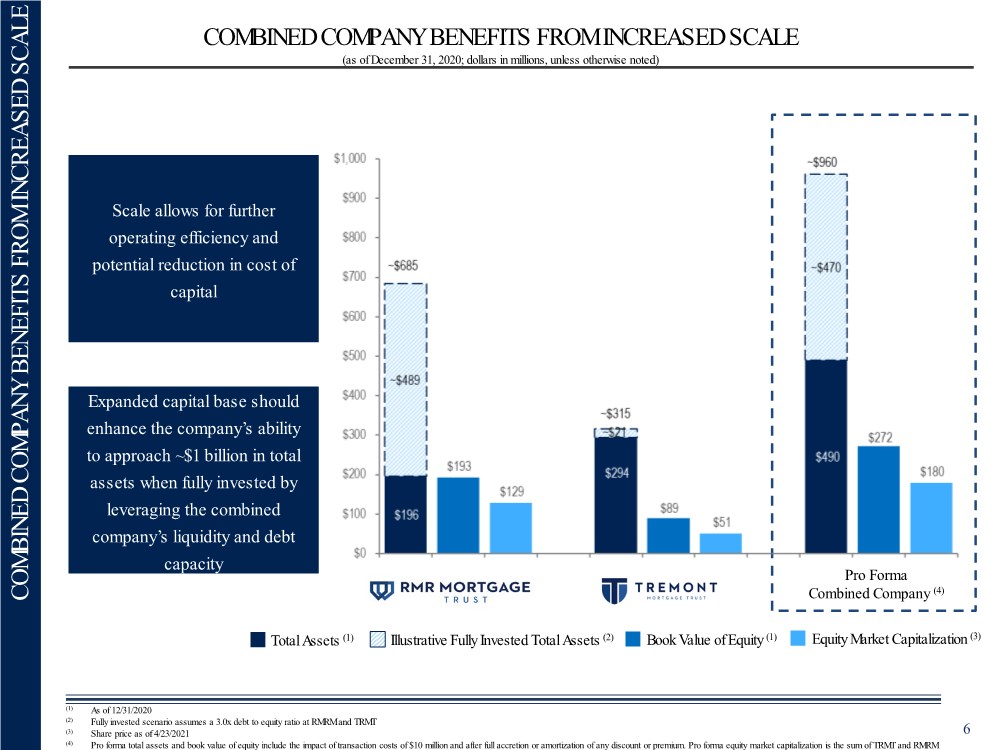

| 6 Confidential COMBINED COMPANY BENEFITS FROM INCREASED SCALE COMBINED COMPANY BENEFITS FROM INCREASED SCALE Scale allows for further operating efficiency and potential reduction in cost of capital Expanded capital base should enhance the company’s ability to approach ~$1 billion in total assets when fully invested by leveraging the combined company’s liquidity and debt capacity RMRM TRMT Pro Forma Combined Company (4) Total Assets (1) Book Value of Equity (1) Equity Market Capitalization (3) (1) As of 12/31/2020 (2) Fully invested scenario assumes a 3.0x debt to equity ratio at RMRM and TRMT (3) Share price as of 4/23/2021 (4) Pro forma total assets and book value of equity include the impact of transaction costs of $10 million and after full accretion or amortization of any discount or premium. Pro forma equity market capitalization is the sum of TRMT and RMRM (as of December 31, 2020; dollars in millions, unless otherwise noted) Illustrative Fully Invested Total Assets (2) |

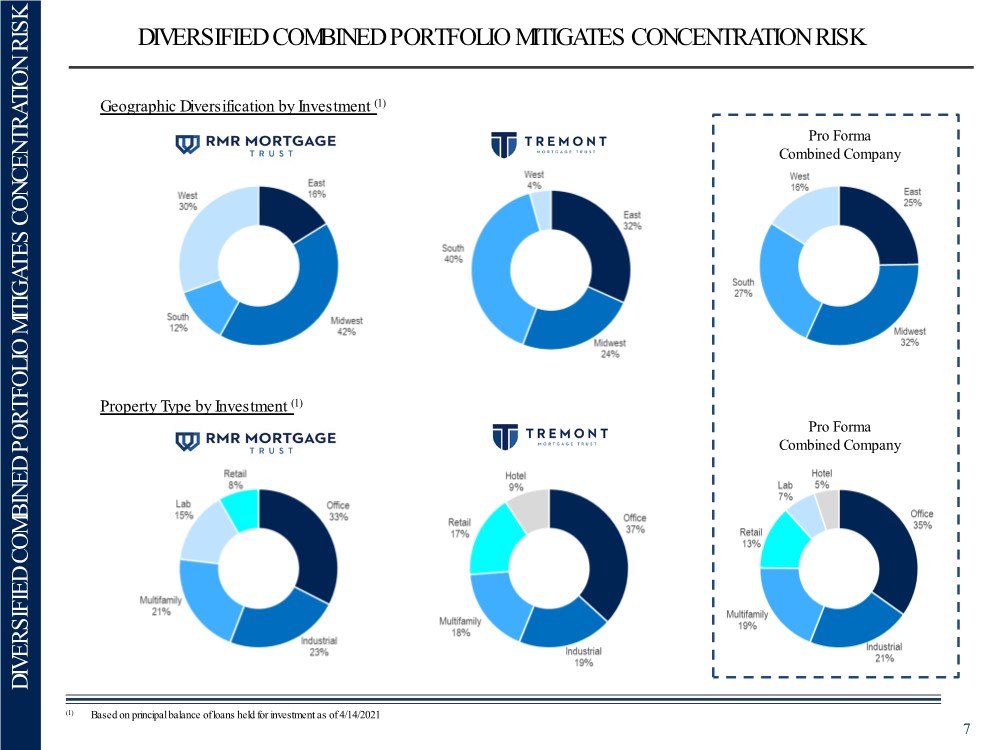

| 7 Confidential DIVERSIFIED COMBINED PORTFOLIO MITIGATES CONCENTRATION RISK DIVERSIFIED COMBINED PORTFOLIO MITIGATES CONCENTRATION RISK Geographic Diversification by Investment (1) Property Type by Investment (1) Pro Forma Combined Company TRMT Pro Forma Combined Company (1) Based on principal balance of loans held for investment as of 4/14/2021 |

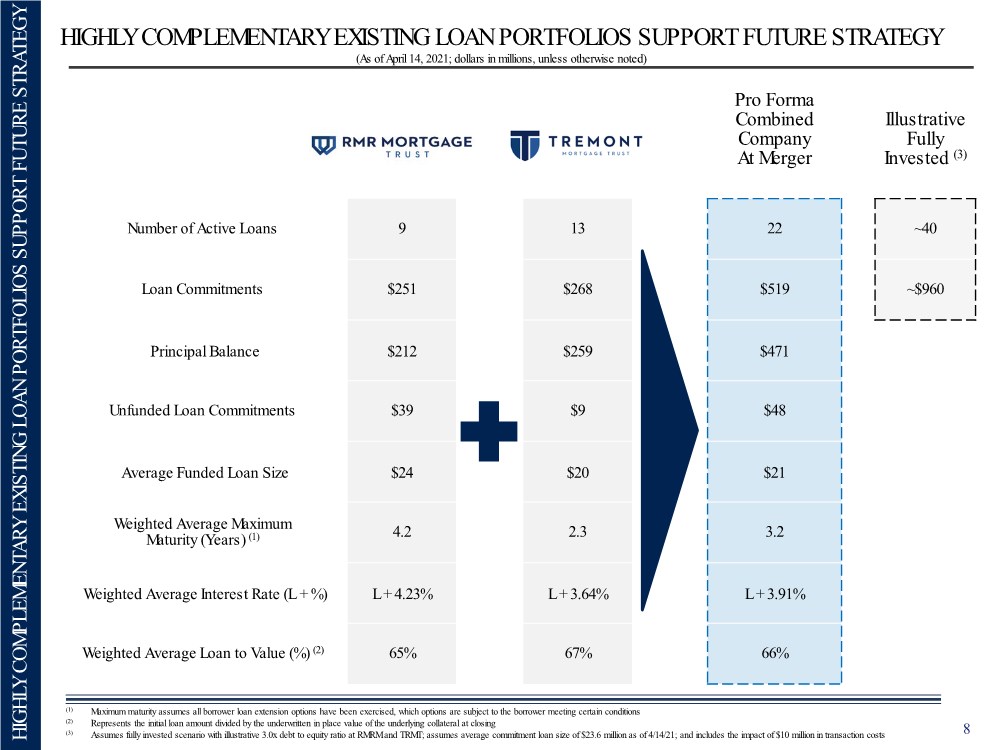

| 8 Confidential HIGHLY COMPLEMENTARY EXISTING LOAN PORTFOLIOS SUPPORT FUTURE STRATEGY HIGHLY COMPLEMENTARY EXISTING LOAN PORTFOLIOS SUPPORT FUTURE STRATEGY Pro Forma Combined Company At Merger Illustrative Fully Invested (3) Number of Active Loans 9 13 22 ~40 Loan Commitments $251 $268 $519 ~$960 Principal Balance $212 $259 $471 Unfunded Loan Commitments $39 $9 $48 Average Funded Loan Size $24 $20 $21 Weighted Average Maximum Maturity (Years) (1) 4.2 2.3 3.2 Weighted Average Interest Rate (L + %) L + 4.23% L + 3.64% L + 3.91% Weighted Average Loan to Value (%) (2) 65% 67% 66% (As of April 14, 2021; dollars in millions, unless otherwise noted) (1) Maximum maturity assumes all borrower loan extension options have been exercised, which options are subject to the borrower meeting certain conditions (2) Represents the initial loan amount divided by the underwritten in place value of the underlying collateral at closing (3) Assumes fully invested scenario with illustrative 3.0x debt to equity ratio at RMRM and TRMT; assumes average commitment loan size of $23.6 million as of 4/14/21; and includes the impact of $10 million in transaction costs |

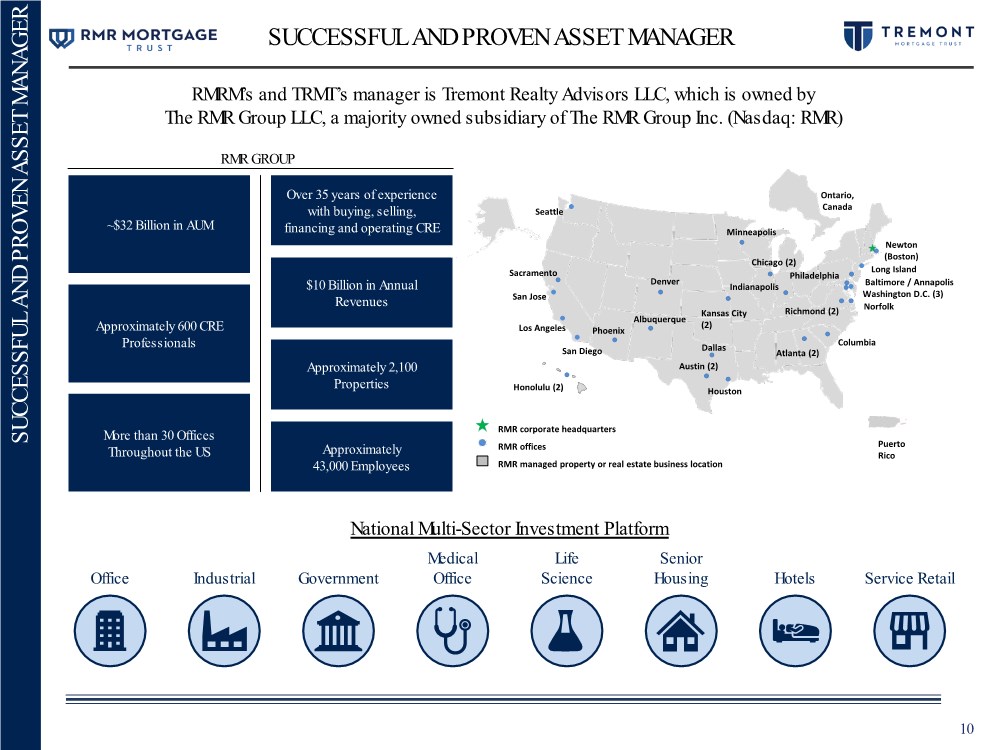

| 10 Confidential SUCCESSFUL AND PROVEN ASSET MANAGER SUCCESSFUL AND PROVEN ASSET MANAGER RMRM’s and TRMT’s manager is Tremont Realty Advisors LLC, which is owned by The RMR Group LLC, a majority owned subsidiary of The RMR Group Inc. (Nasdaq: RMR) National Multi-Sector Investment Platform ~$32 Billion in AUM Approximately 600 CRE Professionals More than 30 Offices Throughout the US Over 35 years of experience with buying, selling, financing and operating CRE $10 Billion in Annual Revenues Approximately 2,100 Properties Approximately 43,000 Employees Life Science Hotels Government Medical Office Industrial Senior Housing Service Retail Office Long Island Newton (Boston) Los Angeles San Diego Baltimore / Annapolis Honolulu (2) Washington D.C. (3) Albuquerque Austin (2) Minneapolis Chicago (2) Atlanta (2) Indianapolis Columbia Phoenix Denver Dallas Kansas City (2) Philadelphia Sacramento Houston Richmond (2) Seattle San Jose Ontario, Canada RMR corporate headquarters RMR offices RMR managed property or real estate business location Puerto Rico Norfolk RMR GROUP |

| 11 Confidential Expanded capital base, float and shareholder liquidity with capacity to utilize additional leverage Accretive to distributable earnings with potential to realize meaningful G&A savings Combined company well positioned to approach ~$1 billion in assets when fully invested The transaction will create immediate, well- diversified scale in terms of portfolio size and asset value TRANSACTION HIGHLIGHTS TRANSACTION HIGHLIGHTS Larger, More Diversified Commercial Mortgage REIT Earnings Accretion Strong Growth Momentum to Attain Meaningful Scale Financial Strength |