Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - RENASANT CORP | exhibit991_rnstx1q2021earn.htm |

| 8-K - 8-K - RENASANT CORP | rnst-20210427.htm |

First Quarter 2021 Earnings Call

2 Forward-Looking Statements This presentation may contain various statements about Renasant Corporation (“Renasant,” “we,” “our,” or “us”) that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “projects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “possible,” “may increase,” “may fluctuate,” “will likely result,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would” and “could,” are generally forward-looking in nature and not historical facts. Forward-looking statements include information about our future financial performance, business strategy, projected plans and objectives and are based on the current beliefs and expectations of management. We believe these forward-looking statements are reasonable, but they are all inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions about future business strategies and decisions that are subject to change. Actual results may differ from those indicated or implied in the forward-looking statements; such differences may be material. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date they are made. Currently, the most important factor that could cause Renasant’s actual results to differ materially from those in forward-looking statements is the continued impact of the COVID-19 pandemic and related governmental measures to respond to the pandemic on the U.S. economy and the economies of the markets in which we operate and our participation in government programs related to the pandemic. In this presentation, we have addressed the historical impact of the pandemic on our operations and set forth certain expectations regarding the COVID-19 pandemic’s future impact on our business, financial condition, results of operations, liquidity, asset quality, capital, cash flows and prospects. We believe these statements about future events and conditions in light of the COVID-19 pandemic are reasonable, but these statements are based on assumptions regarding, among other things, how long the pandemic will continue, the pace at which the COVID-19 vaccine can be distributed and administered to residents of the markets we serve and the United States generally, the duration, extent and effectiveness of the governmental measures implemented to contain the pandemic and ameliorate its impact on businesses and individuals throughout the United States, and the impact of the pandemic and the government’s virus containment measures on national and local economies, all of which are out of our control. If the assumptions underlying these statements about future events prove to be incorrect, Renasant’s business, financial condition, results of operations, liquidity, asset quality, capital, cash flows and prospects may be materially different from what is presented in our forward-looking statements. Important factors other than the COVID-19 pandemic currently known to us that could cause actual results to differ materially from those in forward-looking statements include the following: (i) our ability to efficiently integrate acquisitions into operations, retain the customers of these businesses, grow the acquired operations and realize the cost savings expected from an acquisition to the extent and in the timeframe management anticipated; (ii) the effect of economic conditions and interest rates on a national, regional or international basis; (iii) timing and success of the implementation of changes in operations to achieve enhanced earnings or effect cost savings; (iv) competitive pressures in the consumer finance, commercial finance, insurance, financial services, asset management, retail banking, mortgage lending and auto lending industries; (v) the financial resources of, and products available from, competitors; (vi) changes in laws and regulations as well as changes in accounting standards; (vii) changes in policy by regulatory agencies; (viii) changes in the securities and foreign exchange markets; (ix) our potential growth, including our entrance or expansion into new markets, and the need for sufficient capital to support that growth; (x) changes in the quality or composition of our loan or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers; (xi) an insufficient allowance for credit losses as a result of inaccurate assumptions; (xii) general economic, market or business conditions, including the impact of inflation; (xiii) changes in demand for loan products and financial services; (xiv) concentration of credit exposure; (xv) changes or the lack of changes in interest rates, yield curves and interest rate spread relationships; (xvi) increased cybersecurity risk, including potential network breaches, business disruptions or financial losses; (xvii) civil unrest, natural disasters, epidemics and other catastrophic events in our geographic area; (xviii) the impact, extent and timing of technological changes; and (xix) other circumstances, many of which are beyond our control. The COVID-19 pandemic has exacerbated, and is likely to continue to exacerbate, the impact of any of these factors on us. Management believes that the assumptions underlying our forward-looking statements are reasonable, but any of the assumptions could prove to be inaccurate. Investors are urged to carefully consider the risks described in Renasant’s filings with the Securities and Exchange Commission (“SEC”) from time to time, which are available at www.renasant.com and the SEC’s website at www.sec.gov. We undertake no obligation, and specifically disclaim any obligation, to update or revise our forward-looking statements, whether as a result of new information or to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by federal securities laws.

Overview Note: Financial data as of March 31, 2021 (1) Total revenue is calculated as net interest income plus noninterest income. Company Snapshot Loans and Deposits by State Assets: $15.6 billion Loans: 10.7 Deposits: 12.7 Equity: 2.2 3 MS 24% AL 20% FL 5% GA 33% TN 18% Loans MS 38% AL 12%FL 3% GA 34% TN 13% Deposits 67%3% 28% 2% YTD Total Revenue(1) Community Bank Wealth Management Mortgage Insurance

55 20 65 10 65 75 20 95 95 85 77 95 81 7524 40 59 40 FLORIDA Jackson Mobile Knoxville Chattanooga Greensboro Raleigh Columbia Nashville Winston-Salem Montgomery Birmingham Columbus Charlotte Jacksonville Memphis Orlando Huntsville Tallahassee Atlanta Wilmington Charleston Savannah Tupelo Greenville MISSISSIPPI ALABAMA TENNESSEE GEORGIA SOUTH CAROLINA NORTH CAROLINA ARKANSAS LOUISIANA Branch (162) Loan Production Office (7) Mortgage (21) Insurance (8) Financial Services (2) 4 Renasant Footprint Note: The map reflects the closure of 6 Renasant branches in April 2021.

First Quarter Highlights 5 • Net income of $57.91 million and diluted EPS of $1.02 • Mortgage banking income was $50.73 million, inclusive of a $13.56 million MSR valuation adjustment • Allowance for credit losses to total loans, excluding Paycheck Protection Program (“PPP”) loans, decreased to 1.76%(1) • Net charge-offs were $3.04 million and the ratio of nonperforming loans to total loans (excluding PPP loans) was 0.57% • Loans, excluding PPP loans, grew nominally quarter over quarter, at an annualized growth rate of 0.93% • Deposits increased $678 million quarter over quarter and noninterest-bearing deposits now represent 32.47% of total deposits (1) Allowance to total loans (excluding PPP loans) is a non-GAAP financial measure. See slide 35 in the appendix for a reconciliation of this non-GAAP financial measure to GAAP.

Financial Condition

Total Assets 7 Note: Dollars in millions $13,901 $14,897 $14,809 $14,930 $15,623 $10 ,000 $11 ,000 $12 ,000 $13 ,000 $14 ,000 $15 ,000 $16 ,000 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021

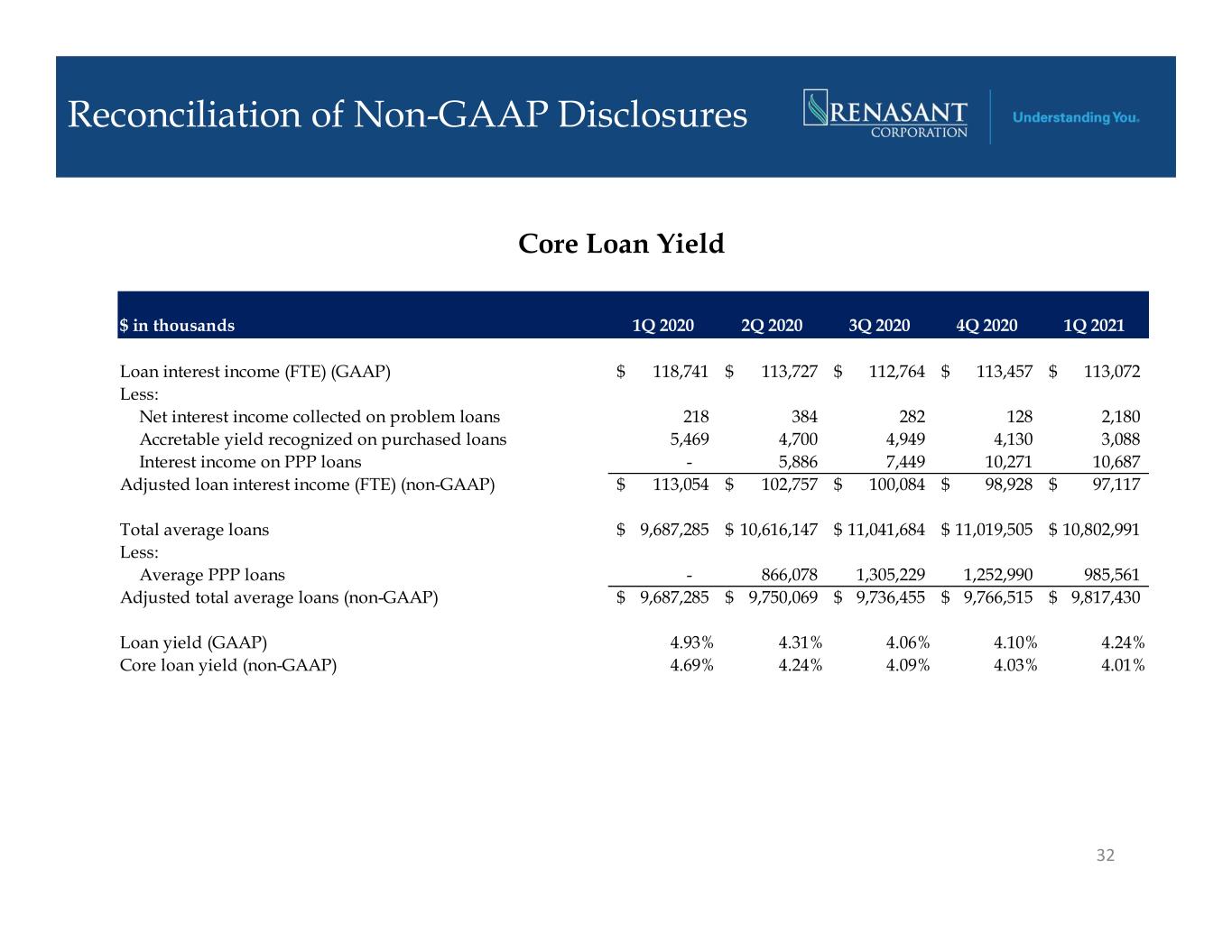

Loans and Yields 8Note: Dollars in millions * Other loans are comprised of installment loans to individuals and lease financing, which both have historically constituted less than 5% of the total loan portfolio. ** Core Loan Yield is a non-GAAP financial measure. See slide 32 in the appendix for a description of the exclusions and a reconciliation of this non-GAAP financial measure to GAAP. $9,769 $10,997 $11,085 $10,933 $10,688 4.93% 4.31% 4.06% 4.10% 4.24%4.69% 4.24% 4.09% 4.03% 4.01% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 1-4 Family Mortgage Commercial Mortgage Construction Other* C&I PPP Loan Yield Core Loan Yield**

Deposit Mix and Pricing 9 Note: Dollars in millions $10,412 $11,846 $11,934 $12,059 $12,737 0.72% 0.49% 0.40% 0.33% 0.27% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Noninterest-bearing Interest-bearing Savings Time Cost of deposits

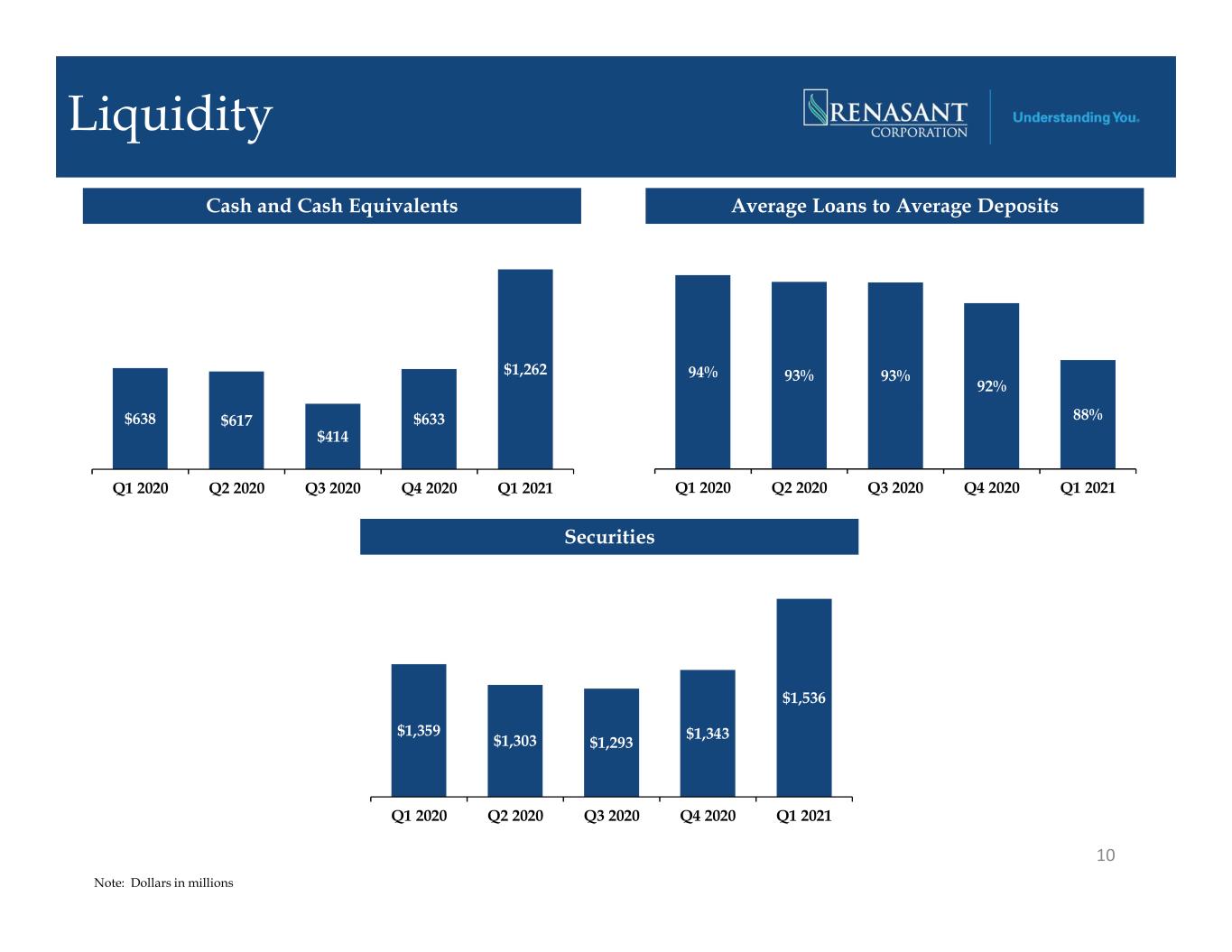

Liquidity 10 Note: Dollars in millions $638 $617 $414 $633 $1,262 $0 $20 0 $40 0 $60 0 $80 0 $1,0 00 $1,2 00 $1,4 00 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Cash and Cash Equivalents $1,359 $1,303 $1,293 $1,343 $1,536 $1,0 00 $1,1 00 $1,2 00 $1,3 00 $1,4 00 $1,5 00 $1,6 00 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Securities 94% 93% 93% 92% 88% $1 $1 $1 $1 $1 $1 $1 $1 $1 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Average Loans to Average Deposits

Capital Position 11 Tier 1 $1,353 Tier 2 $348 Regulatory Capital as of March 31, 2021 • $50 million stock repurchase program in effect until October 2021. • Consistent dividend payment history; including through the 2008 financial crisis and the pandemic. • Callable subordinated debt in 2021: • July 2021 - $15 million 6.50% fixed-to-floating rate subordinated notes • September 2021 - $60 million 5.00% fixed-to- floating rate subordinated notes Capital Highlights Subordinated Notes $212 ACL $136 Trust Preferred $107 Common Equity Tier 1 $1,246 1 Note: Dollars in millions

Strong Capital Position 12 * Tangible Common Equity is a non-GAAP financial measure. See slide 34 in the appendix for a description of the exclusions and a reconciliation of this non- GAAP financial measure to GAAP. Ratio 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Minimum to be Well Capitalized Tangible Common Equity* 8.48% 7.97% 8.19% 8.33% 8.23% N/A Leverage 9.90 9.12 9.17 9.37 9.49 5.00% Tier 1 Risk Based 11.63 11.69 11.79 11.91 12.00 8.00 Total Risk Based 13.44 13.72 14.89 15.07 15.09 10.00 Tier 1 Common Equity 10.63 10.69 10.80 10.93 11.05 6.50 PPP impact as of March 31, 2021: Tangible common equity* 51 bps Leverage ratio 70 bps Capital Ratios

Asset Quality

2.33% 0.00% 1.00% 2.00% 3.00% 4.00% $- $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Classified Loans/Total Loans(1) Classified Loans % of Total Loans, excl. PPP ($ in thousands) 0.22% 0.00% 0.50% 1.00% 1.50% 2.00% $- $25,000 $50,000 $75,000 $100,000 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Loans 30-89 Days Past Due/ Total Loans(1) 30-89 DPD % of Total Loans, excl. PPP ($ in thousands) Asset Quality 14(1) The ratio of loans 30-89 days past due to total loans (excluding PPP loans) and the ratio of classified loans to total loans (excluding PPP loans) are non-GAAP financial measures. See slide 35 in the appendix for a reconciliation of these non-GAAP financial measures to GAAP.

0.42% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% $- $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 NPAs/Total Assets(1) Nonperforming loans OREO % of Assets ($ in thousands) 0.13% 0.00% 0.10% 0.20% 0.30% 0.40% $- $5,000 $10,000 $15,000 $20,000 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Net Charge-offs/Average Loans(1) Net charge-offs % of Avg Loans ($ in thousands) Asset Quality 15(1) Nonperforming assets to total assets (excluding PPP loans) and net charge-offs to average loans (excluding PPP loans) are non-GAAP financial measures. See slide 36 in the appendix for a reconciliation of these non-GAAP financial measures to GAAP.

1.76% 0.00% 0.50% 1.00% 1.50% 2.00% $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Allowance/Total Loans Allowance % of Total Loans, excl. PPP ($ in thousands) 309% 0% 100% 200% 300% 400% 500% $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Allowance/Nonperforming Loans Allowance % of Total NPLs ($ in thousands) • Loan purchase discount of $22.8 million (23 bps of total loans excluding PPP loans) remaining as of March 31, 2021. • 1.99% total loss absorption capacity (total allowance plus loan purchase discount remaining) as of March 31, 2021 excluding PPP loans. Asset Quality 16* Allowance to total loans excluding PPP is a non-GAAP financial measure. See slide 35 in the appendix for a reconciliation of this non-GAAP financial measure to GAAP.

ACL Summary ($ in thousands) ACL ACL as a % of Loans ACL ACL as a % of Loans SBA Paycheck Protection Program - - - - Commercial, Financial, Agricultural 39,031$ 2.77 37,592$ 2.71 Lease Financing Receivables 1,624 2.14 1,546 2.05 Real Estate - 1-4 Family Mortgage 32,165 1.19 31,694 1.18 Real Estate - Commercial Mortgage 76,127 1.67 76,225 1.68 Real Estate - Construction 16,047 1.87 14,977 1.57 Installment loans to individuals 11,150 5.32 11,072 6.40 Allowance for Credit Losses on Loans 176,144 1.61 173,106 1.62 Allowance for Credit Losses on Deferred Interest 1,500 1,375 Reserve for Unfunded Commitments 20,535 20,535 Total Allowance for Credit Losses 198,179$ 195,016$ ACL on Total Loans excluding PPP loans* 1.80 1.76 3/31/202112/31/2020 17* Allowance to total loans (excluding PPP loans) is a non-GAAP financial measure. See slide 35 in the appendix for a reconciliation of this non-GAAP financial measure to GAAP.

Profitability

Net Income & Adjusted Pre-Provision Net Revenue* 19 $2.0 $20.1 $30.0 $31.5 $57.9 $45.0 $65.6 $63.2 $57.4 $62.3 1.34% 1.79% 1.68% 1.53% 1.66% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2018 2019 Net Income PPNR (Non-GAAP) PPNR/Avg Assets (Non-GAAP)Adj. PPNR (non-GAAP) Adj. PPNR /Avg. Assets (non-GAAP) Note: Dollars in millions *Adjusted Pre-Provision Net Revenue and Adjusted Pre-Provision Net Revenue/Average Assets are non GAAP financial measures. See slides 27 and 28 in the appendix for a description of the exclusions and a reconciliation of these non-GAAP financial measures to GAAP.

Diluted Earnings per Share and Diluted Earnings per Share Adjusted* 20 $.04 $.36 $.53 $.56 $1.02 $.20 $.52 $.53 $.68 $.85 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 EPS (GAAP) EPS Adjusted (non-GAAP)* * Diluted earnings per share (adjusted) is a non-GAAP financial measure. See slide 29 in the appendix for a description of exclusions and a reconciliation of this non-GAAP financial measure to GAAP.

Profitability Ratios 21 0.38% 3.85% 5.63% 5.88% 10.81% 4.41% 11.01% 10.81% 13.52% 16.68% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 ROE (GAAP) ROTCE (Adjusted) (non-GAAP)* * ROAA (Adjusted) and ROTCE (Adjusted) are non-GAAP financial measures. See slides 28 and 30 in the appendix for a description of the exclusions and a reconciliation of these non-GAAP financial measures to GAAP. 0.06% 0.55% 0.80% 0.84% 1.54% 0.33% 0.80% 0.79% 1.02% 1.29% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 ROAA (GAAP) ROAA (Adjusted) (non-GAAP)* Return on Average Equity (ROE)Return on Average Assets (ROAA)

Core Net Interest Income (FTE) & Core Net Interest Margin* 22 $108.3 $107.5 $107.9 $110.0 $111.3 3.75% 3.38% 3.29% 3.35% 3.37% 3.56% 3.26% 3.23% 3.22% 3.12% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Core NII (FTE)(Non-GAAP)* Non-Core NII NIM Core NIM (Non-GAAP)* Note: Dollars in millions *Core Net Interest Income (FTE) and Core Net Interest Margin are non-GAAP financial measures. See slide 31 in the appendix for a description of exclusions and a reconciliation of these non-GAAP financial measures to GAAP.

Note: Dollars in thousands $37,570 $64,170 $70,928 $62,864 $81,037 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Service Charges Fees and Commissions Insurance Wealth Management Mortgage Banking Securities Gains Other Noninterest Income 23 ($ in thousands) 1Q20 4Q20 1Q21 Gain on sales of loans, net 21,782$ 36,080$ 33,901$ Fees, net 2,919 5,318 4,902 Mortgage servicing income, net 405 (3,606) (1,631) MSR valuation adjustment (9,571) 1,968 13,561 Mortgage banking income, net 15,535$ 39,760$ 50,733$ Mortgage banking income 1Q20 4Q20 1Q21 Locked Volume $1.9 bill $1.4 bill $1.7 bill Wholesale % 45 41 43 Retail % 55 59 57 Purchase % 42 50 53 Refinance % 58 50 47 Mortgage production

79% 69% 65% 71% 60% 69% 61% 63% 64% 64% Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Efficiency Ratio (GAAP) Adjusted Efficiency Ratio (non-GAAP)* Efficiency Ratio 24 Note: Dollars in millions *Adjusted Efficiency Ratio is a non-GAAP financial measure. See slide 33 in the appendix for a description of exclusions and a reconciliation of this non- GAAP financial measure to GAAP.

Appendix

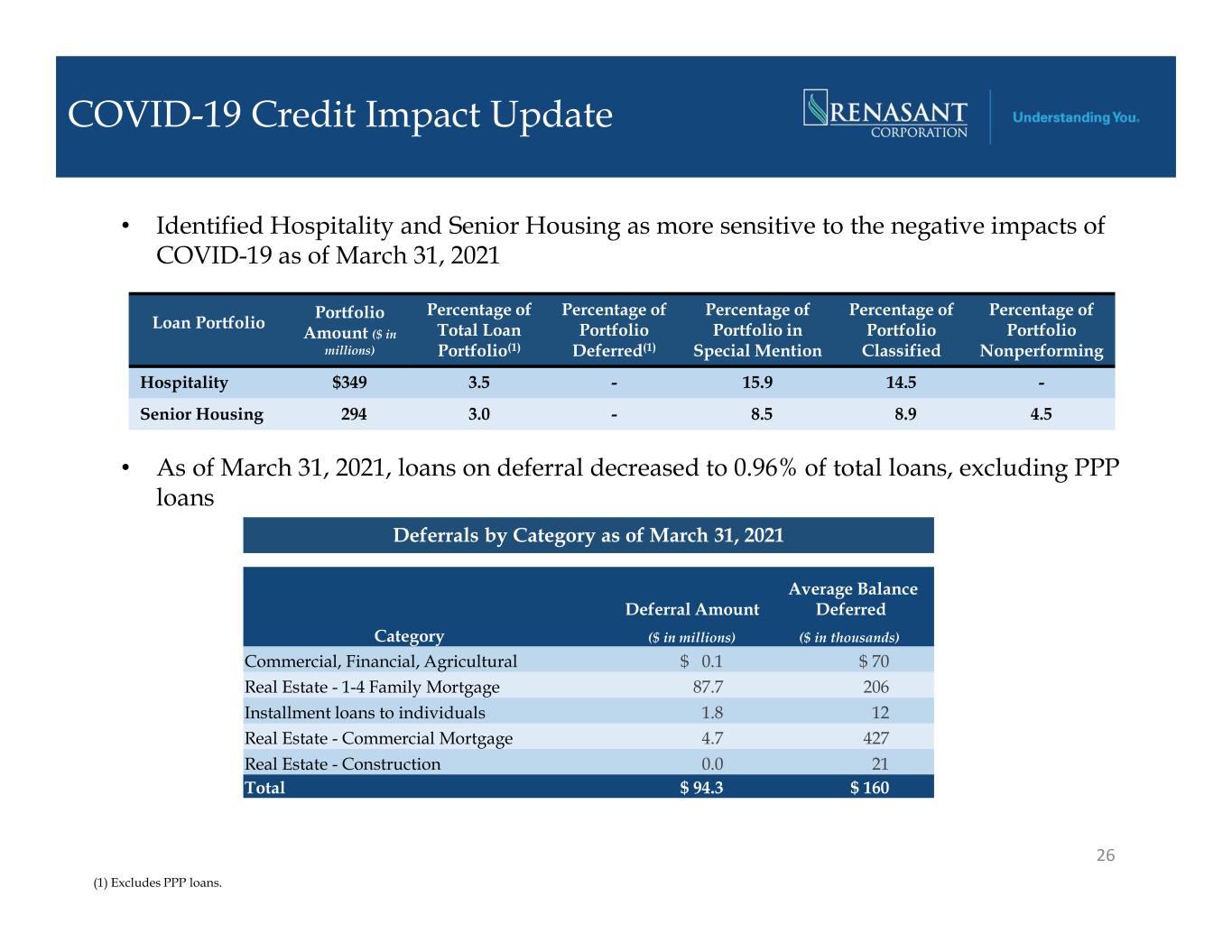

COVID-19 Credit Impact Update • As of March 31, 2021, loans on deferral decreased to 0.96% of total loans, excluding PPP loans Loan Portfolio Portfolio Amount ($ in millions) Percentage of Total Loan Portfolio(1) Percentage of Portfolio Deferred(1) Percentage of Portfolio in Special Mention Percentage of Portfolio Classified Percentage of Portfolio Nonperforming Hospitality $349 3.5 - 15.9 14.5 - Senior Housing 294 3.0 - 8.5 8.9 4.5 26 (1) Excludes PPP loans. • Identified Hospitality and Senior Housing as more sensitive to the negative impacts of COVID-19 as of March 31, 2021 Deferral Amount Average Balance Deferred Category ($ in millions) ($ in thousands) Commercial, Financial, Agricultural $ 0.1 $ 70 Real Estate - 1-4 Family Mortgage 87.7 206 Installment loans to individuals 1.8 12 Real Estate - Commercial Mortgage 4.7 427 Real Estate - Construction 0.0 21 Total $ 94.3 $ 160 Deferrals by Category as of March 31, 2021

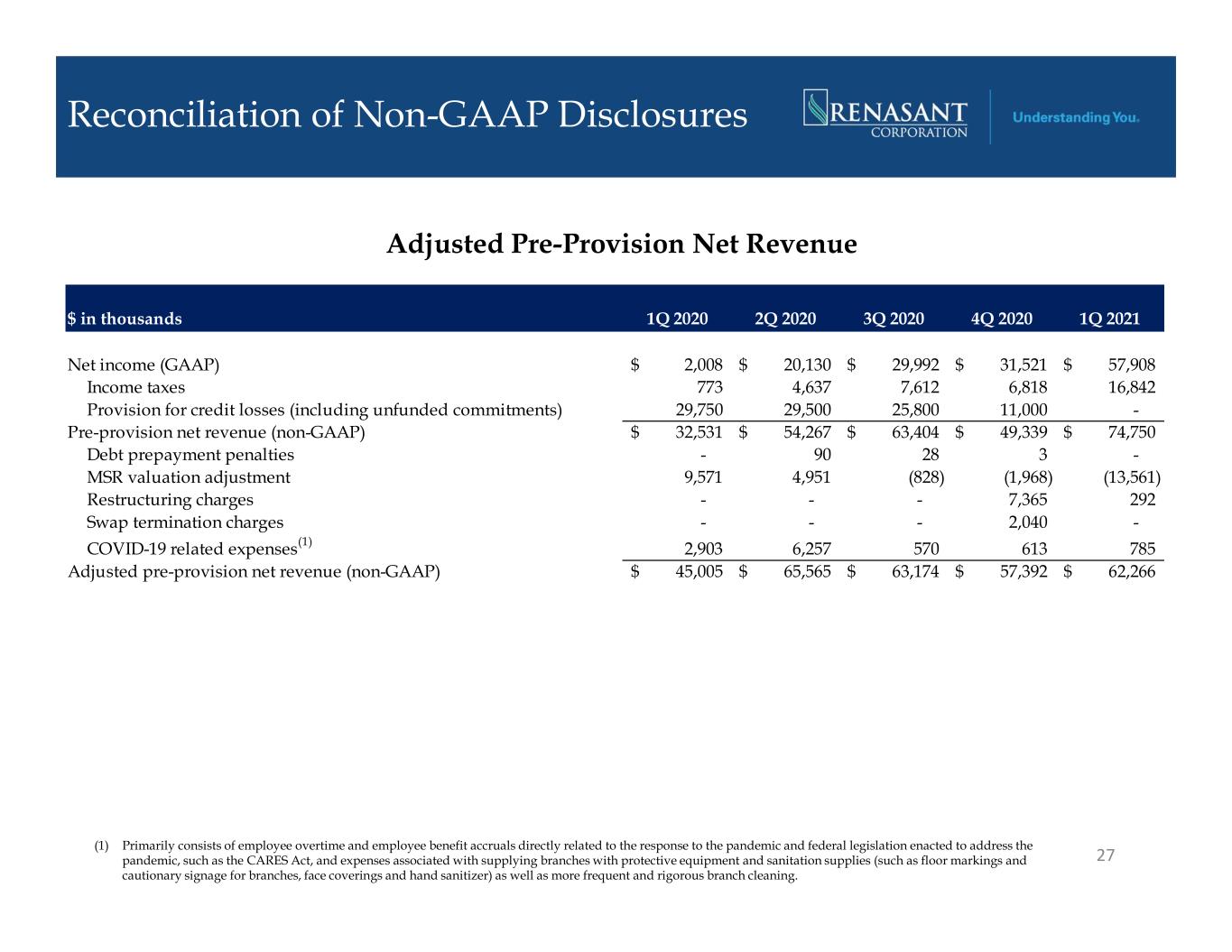

Reconciliation of Non-GAAP Disclosures Adjusted Pre-Provision Net Revenue 27 $ in thousands 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Net income (GAAP) 2,008$ 20,130$ 29,992$ 31,521$ 57,908$ Income taxes 773 4,637 7,612 6,818 16,842 Provision for credit losses (including unfunded commitments) 29,750 29,500 25,800 11,000 - Pre-provision net revenue (non-GAAP) 32,531$ 54,267$ 63,404$ 49,339$ 74,750$ Debt prepayment penalties - 90 28 3 - MSR valuation adjustment 9,571 4,951 (828) (1,968) (13,561) Restructuring charges - - - 7,365 292 Swap termination charges - - - 2,040 - COVID-19 related expenses(1) 2,903 6,257 570 613 785 Adjusted pre-provision net revenue (non-GAAP) 45,005$ 65,565$ 63,174$ 57,392$ 62,266$ (1) Primarily consists of employee overtime and employee benefit accruals directly related to the response to the pandemic and federal legislation enacted to address the pandemic, such as the CARES Act, and expenses associated with supplying branches with protective equipment and sanitation supplies (such as floor markings and cautionary signage for branches, face coverings and hand sanitizer) as well as more frequent and rigorous branch cleaning.

Reconciliation of Non-GAAP Disclosures Adjusted Pre-Provision Net Revenue/Average Assets 28 $ in thousands 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Net income (GAAP) 2,008$ 20,130$ 29,992$ 31,521$ 57,908$ Debt prepayment penalties - 90 28 3 - MSR valuation adjustment 9,571 4,951 (828) (1,968) (13,561) Restructuring charges - - - 7,365 292 Swap termination charges - - - 2,040 - COVID-19 related expenses(1) 2,903 6,257 570 613 785 Tax effect of adjustments noted above(2) (3,467) (2,065) 50 (1,443) 2,820 Net income with exclusions (non-GAAP) 11,015$ 29,363$ 29,812$ 38,131$ 48,244$ Adjusted pre-provision net revenue (non-GAAP)(3) 45,005$ 65,565$ 63,174$ 57,392$ 62,266$ Total average assets 13,472,550$ 14,706,027$ 14,928,159$ 14,898,055$ 15,203,691$ Return on Average Assets (GAAP) 0.06% 0.55% 0.80% 0.84% 1.54% Return on Average Assets (Adjusted) (non-GAAP) 0.33% 0.80% 0.79% 1.02% 1.29% Adjusted pre-provision net revenue/Average assets (non-GAAP) 1.34% 1.79% 1.68% 1.53% 1.66% (1) See footnote 1 on slide 27 for an explanation of the types of expenses included in the COVID-19 related expenses line item. (2) Tax effect is calculated based on the respective periods’ effective tax rate. (3) See slide 27 for reconciliation of Adjusted pre-provision net revenue.

Reconciliation of Non-GAAP Disclosures 29 Diluted Earnings Per Share $ in thousands 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Net income (GAAP) 2,008$ 20,130$ 29,992$ 31,521$ 57,908$ Debt prepayment penalties - 90 28 3 - MSR valuation adjustment 9,571 4,951 (828) (1,968) (13,561) Restructuring charges - - - 7,365 292 Swap termination charges - - - 2,040 - COVID-19 related expenses (1) 2,903 6,257 570 613 785 Tax effect of adjustments noted above (2) (3,467) (2,065) 50 (1,443) 2,820 Net income with exclusions (non-GAAP) 11,015$ 29,363$ 29,812$ 38,131$ 48,244$ Diluted shares outstanding (average) 56,706,289 56,325,476 56,386,153 56,489,809 56,519,199 Diluted EPS (GAAP) 0.04$ 0.36$ 0.53$ 0.56$ 1.02$ Diluted EPS (adjusted) (non-GAAP) 0.20$ 0.52$ 0.53$ 0.68$ 0.85$ (1) See footnote 1 on slide 27 for an explanation of the types of expenses included in the COVID-19 related expenses line item. (2) Tax effect is calculated based on the respective periods’ effective tax rate.

Reconciliation of Non-GAAP Disclosures 30 Return on Average Tangible Common Equity (Adjusted) $ in thousands 1Q20 2Q20 3Q20 4Q20 1Q 2021 Net income (GAAP) 2,008$ 20,130$ 29,992$ 31,521$ 57,908$ Debt prepayment penalties - 90 28 3 - MSR valuation adjustment 9,571 4,951 (828) (1,968) (13,561) Restructuring charges - - - 7,365 292 Swap termination charges - - - 2,040 - COVID-19 related expenses(1) 2,903 6,257 570 613 785 Tax effect of adjustments noted above(2) (3,467) (2,065) 50 (1,443) 2,820 Net income with exclusions (non-GAAP) 11,015$ 29,363$ 29,812$ 38,131$ 48,244$ Amortization of intangibles 1,895 1,834 1,733 1,659 1,598 Tax effect of adjustment noted above(2) (527) (335) (374) (297) (361) Tangible net income with exclusion (non-GAAP) 12,383$ 30,862$ 31,171$ 39,493$ 49,481$ Average shareholders' equity (GAAP) 2,105,143$ 2,101,092$ 2,119,500$ 2,132,375$ 2,172,425$ Intangibles 975,933 974,237 972,394 970,624 969,001 Average tangible shareholders' equity (non-GAAP) 1,129,210$ 1,126,855$ 1,147,106$ 1,161,751$ 1,203,424$ Return on Average Equity (GAAP) 0.38% 3.85% 5.63% 5.88% 10.81% Return on Average Tangible Common Equity (Adjusted) (non-GAAP) 4.41% 11.01% 10.81% 13.52% 16.68% (1) See footnote 1 on slide 27 for an explanation of the types of expenses included in the COVID-19 related expenses line item. (2) Tax effect is calculated based on the respective periods’ effective tax rate.

Reconciliation of Non-GAAP Disclosures Core Net Interest Income (FTE) and Core Net Interest Margin 31 $ in thousands 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Net interest income (FTE) (GAAP) 108,316$ 107,457$ 107,885$ 110,024$ 111,264$ Less: Net interest income collected on problem loans 218 384 282 128 2,180 Accretable yield recognized on purchased loans 5,469 4,700 4,949 4,130 3,088 Interest income on PPP loans - 5,886 7,449 10,271 10,687 Core net interest income (FTE) (non-GAAP) 102,629$ 96,487$ 95,205$ 95,495$ 95,309$ Total average earning assets 11,609,477$ 12,776,644$ 13,034,422$ 13,059,967$ 13,358,677$ Less: Average PPP loans - 866,078 1,305,229 1,252,990 985,561 Adjusted total average earning assets (non-GAAP) 11,609,477$ 11,910,566$ 11,729,193$ 11,806,977$ 12,373,116$ Net interest margin (GAAP) 3.75% 3.38% 3.29% 3.35% 3.37% Core net interest margin (non-GAAP) 3.56% 3.26% 3.23% 3.22% 3.12%

Reconciliation of Non-GAAP Disclosures Core Loan Yield 32 $ in thousands 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Loan interest income (FTE) (GAAP) 118,741$ 113,727$ 112,764$ 113,457$ 113,072$ Less: Net interest income collected on problem loans 218 384 282 128 2,180 Accretable yield recognized on purchased loans 5,469 4,700 4,949 4,130 3,088 Interest income on PPP loans - 5,886 7,449 10,271 10,687 Adjusted loan interest income (FTE) (non-GAAP) 113,054$ 102,757$ 100,084$ 98,928$ 97,117$ Total average loans 9,687,285$ 10,616,147$ 11,041,684$ 11,019,505$ 10,802,991$ Less: Average PPP loans - 866,078 1,305,229 1,252,990 985,561 Adjusted total average loans (non-GAAP) 9,687,285$ 9,750,069$ 9,736,455$ 9,766,515$ 9,817,430$ Loan yield (GAAP) 4.93% 4.31% 4.06% 4.10% 4.24% Core loan yield (non-GAAP) 4.69% 4.24% 4.09% 4.03% 4.01%

Reconciliation of Non-GAAP Disclosures Adjusted Efficiency Ratio 33 $ in thousands 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Net interest income (FTE) (GAAP) 108,316$ 107,457$ 107,885$ 110,024$ 111,264$ Total noninterest income (GAAP) 37,570 64,170 70,928 62,864 81,037 Securities gains (losses) - 31 - 15 1,357 MSR valuation adjustment (9,571) (4,951) 828 1,968 13,561 Adjusted total noninterest income (non-GAAP) 47,141$ 69,090$ 70,100$ 60,881$ 66,119$ Total income (FTE) (non-GAAP) 155,457$ 176,547$ 177,985$ 170,905$ 177,383$ Total noninterest expense (GAAP) 115,041$ 118,285$ 116,510$ 122,152$ 115,935$ Amortization of intangibles 1,895 1,834 1,733 1,659 1,598 Debt prepayment penalty - 90 28 3 - Restructuring charges - - - 7,365 292 Swap termination charges - - - 2,040 - Provision for unfunded commitments 3,400 2,600 2,700 500 - COVID-19 Related Expenses 2,903 6,257 570 613 785 Adjusted total noninterest expense (non-GAAP) 106,843$ 107,504$ 111,479$ 109,972$ 113,260$ Efficiency Ratio (GAAP) 78.86% 68.92% 65.16% 70.65% 60.29% Adjusted Efficiency Ratio (non-GAAP) 68.73% 60.89% 62.63% 64.35% 63.85%

Reconciliation of Non-GAAP Disclosures Tangible Common Equity and Tangible Book Value 34 $ in thousands 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Actual shareholders' equity (GAAP) 2,070,512$ 2,082,946$ 2,104,300$ 2,132,578$ 2,173,701$ Intangibles 975,048 973,214 971,481 969,823 968,225 Actual tangible shareholders' equity (non-GAAP) 1,095,464$ 1,109,732$ 1,132,819$ 1,162,755$ 1,205,476$ Actual total assets (GAAP) 13,890,550$ 14,897,207$ 14,808,933$ 14,929,666$ 15,622,571$ Intangibles 975,048 973,214 971,481 969,823 968,225 Actual tangible assets (non-GAAP) 12,915,502$ 13,923,993$ 13,837,452$ 13,959,843$ 14,654,346$ PPP Loans - 1,281,278 1,307,972 1,128,703 860,864 Actual tangible assets exc. PPP loans (non-GAAP) 12,915,502$ 12,642,715$ 12,529,480$ 12,831,140$ 13,793,482$ Tangible Common Equity Ratio Shareholders' equity to (actual) assets (GAAP) 14.91% 13.98% 14.21% 14.28% 13.91% Effect of adjustment for intangible assets 6.43% 6.01% 6.02% 5.95% 5.68% Tangible common equity ratio (non-GAAP) 8.48% 7.97% 8.19% 8.33% 8.23% Effect of adjustment for PPP loans - -0.81% -0.85% -0.73% -0.51% Tangible common equity ratio exc. PPP loans (non-GAAP) 8.48% 8.78% 9.04% 9.06% 8.74% Tangible Book Value Shares Outstanding 56,141,018 56,181,962 56,193,705 56,200,487 56,294,346 Book Value (GAAP) 36.88$ 37.07$ 37.45$ 37.95$ 38.61$ Tangible Book Value (non-GAAP) 19.51$ 19.75$ 20.16$ 20.69$ 21.41$

Reconciliation of Non-GAAP Disclosures Asset Quality Ratios excluding PPP loans 35 $ in thousands Q1 2020 Q2 2020 Q3 2020 Q4 2020 1Q 2021 Total loans (GAAP) 9,769,377$ 10,997,304$ 11,084,738$ 10,933,647$ 10,688,408$ Less: PPP loans - 1,281,278 1,307,972 1,128,703 860,864 Adjusted total loans (non-GAAP) 9,769,377$ 9,716,026$ 9,776,766$ 9,804,944$ 9,827,544$ Loans 30-89 Days Past Due 45,524 9,675 16,644 26,286 21,801 Loans 30-89 Days Past Due / Total Loans 0.47% 0.09% 0.15% 0.24% 0.20% Loans 30-89 Days Past Due / Total Loans excluding PPP loans 0.47% 0.10% 0.17% 0.27% 0.22% Classified Loans 144,509 163,364 219,583 236,062 229,244 Classified Loans / Total Loans 1.48% 1.49% 1.98% 2.16% 2.14% Classified Loans / Total Loans excluding PPP loans 1.48% 1.68% 2.25% 2.41% 2.33% Nonperforming Loans 50,037 44,103 45,796 55,470 56,105 Nonperforming Loans / Total Loans 0.51% 0.40% 0.41% 0.51% 0.52% Nonperforming Loans / Total Loans excluding PPP loans 0.51% 0.45% 0.47% 0.57% 0.57% Allowance for Credit Losses on Loans 120,185 145,387 168,098 176,144 173,106 ACL / Total Loans 1.23% 1.32% 1.52% 1.61% 1.62% ACL / Total Loans excluding PPP loans 1.23% 1.50% 1.72% 1.80% 1.76%

Reconciliation of Non-GAAP Disclosures Asset Quality Ratios excluding PPP loans, continued 36 $ in thousands Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Total average loans (GAAP) 9,687,285$ 10,616,147$ 11,041,684$ 11,019,505$ 10,802,991$ Less: Average PPP loans - 866,078 1,305,229 1,252,990 985,561 Adjusted total average loans (non-GAAP) 9,687,285$ 9,750,069$ 9,736,455$ 9,766,515$ 9,817,430$ Total assets (GAAP) 13,890,550$ 14,897,207$ 14,808,933$ 14,929,612$ 15,622,571$ Less: PPP loans - 1,281,278 1,307,972 1,128,703 860,864 Adjusted total assets (non-GAAP) 13,890,550$ 13,615,929$ 13,500,961$ 13,800,909$ 14,761,707$ Nonperforming Assets 58,708 53,228 53,948 61,442 62,076 Nonperforming Assets / Total Assets 0.42% 0.36% 0.36% 0.41% 0.40% Nonperforming Assets / Total Assets excluding PPP loans 0.42% 0.39% 0.40% 0.45% 0.42% Net charge-offs 811 1,698 389 954 3,038 Annualized Net charge-offs / Average Loans 0.03% 0.06% 0.01% 0.03% 0.11% Annualized Net charge-offs / Average Loans excluding PPP loans 0.03% 0.07% 0.02% 0.04% 0.13%

37