Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Merit Life Insurance Co. | d910966dex232.htm |

| EX-23.1 - EX-23.1 - Merit Life Insurance Co. | d910966dex231.htm |

| EX-16.1 - EX-16.1 - Merit Life Insurance Co. | d910966dex161.htm |

| EX-10.12 - EX-10.12 - Merit Life Insurance Co. | d910966dex1012.htm |

| EX-5.1 - EX-5.1 - Merit Life Insurance Co. | d910966dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 27, 2021.

Registration No. 333-239300

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MERIT LIFE INSURANCE CO.

(Exact name of registrant as specified in its charter)

| Texas | 6311 | 35-1005090 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Merit Life Insurance Co.

2 Corporate Drive

Suite 760

Shelton, CT 06484

(833) 637-4854

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert O’Donnell

President & Chief Executive Officer

Merit Life Insurance Co.

2 Corporate Drive

Suite 760

Shelton, CT 06484

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael K. Renetzky Locke Lord LLP 111 South Wacker Drive Chicago, Illinois 60606 (312) 443-0700

Approximate date of commencement of proposed sale to the public: As soon as practicable after the registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐

Accelerated filer ☐

Non-accelerated filer ☐

Smaller reporting company: ☒

Emerging growth company: ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Calculation of Registration Fee

|

| ||||||||

| Title of Each Class of |

Amount |

Proposed |

Proposed |

Amount of | ||||

| Fixed Contingent Deferred Annuity Contract

|

N/A

|

N/A

|

$22,000,000

|

$2,400.20

| ||||

|

| ||||||||

|

| ||||||||

| (1) | The Contracts are sold based upon the value of protected assets. The proposed maximum aggregate offering price is estimated based upon contracts protecting $4,000,000,000 in account value and is estimated solely for the purpose of determining the registration fee. |

| (2) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated April 27, 2021

FIXED CONTINGENT DEFERRED ANNUITY CONTRACT

ISSUED BY MERIT LIFE INSURANCE CO.

This prospectus provides information about the Fixed Contingent Deferred Annuity Contract issued by Merit Life Insurance Co. that you should know before purchasing the contract, including a description of all of the material rights and obligations under the contract and including any material state variations identified in the state filing and approval process.

It is important that you read the contract. Your contract is the formal contractual agreement between you and Merit Life Insurance Co. This prospectus describes the material rights and obligations under the contract and is meant to help you decide if the contract will meet your needs. Please carefully read this prospectus and any related documents and keep everything together for future reference.

The contract is designed to effectively provide a lifetime income floor for an annuitant. The contracts are made available only to clients of certain Financial Firms with which we have entered into agreements. The contract provides for a fixed stream of payments to an annuitant for life if the value of the related account at the client’s Financial Firm is reduced to zero during the lifetime of the annuitant due to making certain withdrawals. The amount of the periodic payments will be dependent upon the value of the covered account at the time the first withdrawal from the account is made following the contract’s vesting period. The assets in the covered account will continue to be owned by the accountholder and be managed by the client’s investment adviser, and will not be managed by Merit Life Insurance Co.

The contract is a complex insurance vehicle. Prospective purchasers should not construe the contents of this prospectus as legal, tax, or financial advice. You should speak with a financial professional about the contract’s features, benefits, risks and fees, and whether it is appropriate for you based upon your financial situation and objectives. The registrant’s obligations under the Contract are subject to the financial strength and claims paying ability of the registrant.

INTE Securities LLC will act as our principal underwriter and use its best efforts to assist us in the distribution of the Contracts in this offering, but INTE Securities, LLC is not obligated to purchase any Contracts that are being offered in this offering.

An investment in this Contract is subject to risks, including the possible loss of principal. See “Risk Factors” beginning on page 5. The Contracts are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation, Federal Reserve Board, or any other government agency. If Merit’s agreement with your Financial Firm terminates, your Contract will automatically terminate unless it is moved to another Financial Firm with whom we have an agreement in place. Either we or your Financial Firm may, in our or their sole discretion, terminate the contract regardless of what you do.

None of the Securities and Exchange Commission, the Texas Department of Insurance or any state securities commission has approved or disapproved of these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is [●]

Table of Contents

| 1 | ||||

| 3 | ||||

| 5 | ||||

| 10 | ||||

| 12 | ||||

| 29 | ||||

| MANAGEMENTS DISCUSSION & ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

33 | |||

| 39 | ||||

| 47 | ||||

| 52 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

54 | |||

| 54 | ||||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| F-1 | ||||

Table of Contents

This Prospectus

You should rely only on the information contained in this prospectus, and you may refer to the Contract, filed as an exhibit hereto, as well. We have not, and the principal underwriter has not, authorized any other person to provide information that is different from that contained in this prospectus or in the Contract. If anyone provides you with different or inconsistent information, you should not rely on it. We and the principal underwriter are offering to sell and seeking offers to purchase Contracts only in jurisdictions where such offers and sales are permitted. Information contained on our website, or any other website operated by us, is not part of this prospectus and shall not be deemed incorporated by reference herein.

Frequently used Terms

We have used simple, clear language as much as possible in this prospectus. However, by the very nature of the Contracts certain technical words or terms are necessary. Unless the context otherwise requires, as used in this prospectus:

| • | “The Company,” “Merit,” “we,” “us,” “our,” and similar terms mean Merit Life Insurance Co. |

| • | “You” and “your” refer to owners of the Contracts. |

| • | “Account” means your account at your Financial Firm in relation to which we will provide coverage under the Contract. |

| • | “Annuitant” means the person upon whose continued life we will make payments should a Covered Event occur and to whom payments are made. |

| • | “Benefit Amount” means the amount we will pay each Income Year to the Annuitant after the Covered Event has occurred. |

| • | “Code” means the Internal Revenue Code of 1986, as amended. |

| • | “Contract” means the agreement governing the Fixed Contingent Deferred Annuity product embodied in the individual annuity contract or certificate pursuant to a group annuity contract issued by Merit Life Insurance Co. and containing the terms and conditions of such product. |

| • | “Covered Event” means the date the value of your account becomes zero for reasons other than an Excess Withdrawal. |

| • | “Cure Period” means the 30-day period allowed to cure a breach from the target portfolio investment guidelines applicable to the Contract. This period begins to run from the date that we send notice to you and/or your Financial Firm of such breach |

| • | “Eligible Contribution” means a contribution made into your Account after the Issue Date for which the Vesting Period for that contribution has passed. |

| • | “Excess Withdrawal” means either (i) any withdrawal during the Vesting Period; or (ii) any amount withdrawn on or after the Exercise Date that exceeds the Income Amount for the then current Income Year. Excess Withdrawals reduce your subsequent Income Amount proportionately in the manner we specify in the Contract as described herein. |

| • | “Exercise Date” means the date of your first withdrawal after the Vesting Period. This first withdrawal must occur by the Annuitant’s age 95. |

| • | “Fee” means the amount that you owe us for coverage under your Contract. |

1

Table of Contents

| • | “Financial Firm” means a registered investment advisory firm, also sometimes referred to as a wealth management firm, we approve to hold an Account in relation to a Contract. |

| • | “Income Amount” means a value we calculate as of the Exercise Date. We determine the Income Amount initially by applying the guarantee income percentage of 5% to the Income Base. Subsequently, we increase the Income Amount due to Eligible Contributions to your Account or decrease the Income Amount due to Excess Withdrawals. If the Covered Event occurs, the Benefit Amount equals the then current Income Amount. |

| • | “Income Base” means the value we use to determine your Income Amount, and is initially calculated on the Exercise Date. The Income Base is the greater of: |

| (a) | the value of your Account on your Contract’s Issue Date plus any Eligible Contributions and less the proportional impact of Excess Withdrawals from the Issue Date until the Exercise Date; or |

| (b) | the value of your Account on the Exercise Date reduced by the value of (i) any contributions to your Account that have not vested and (ii) the proportional impact of any Excess Withdrawals from the Issue Date until the Exercise Date. |

After the Exercise Date the Income Base may be adjusted by Eligible Contributions and the proportional impact of any Excess Withdrawals.

| • | “Income Year” means a one year period measured from the Exercise Date or any anniversary of the Exercise Date. |

| • | “Issue Date” means the date we issue the Contract and initiate its protection. |

| • | “Vesting Period” means one period for the Contract and a separate period for each separate contribution to your Account after the Issue Date of your Contract, if any. For the Contract, the Vesting Period is from the Issue Date to the later of the Annuitant’s age 65 or two years from the Issue Date. As to each separate contribution to your Account after the Issue Date, if any, the Vesting Period is two years from the date of that contribution to your Account. Making contributions to your Account after the Issue Date does not lengthen the Vesting Period for the Contract. |

Market and Industry Data

Market data and other statistical information used throughout this prospectus are based on independent industry publications, government publications, publicly available information, reports by market research firms or other published independent sources, none of which has been commissioned by us. Independent industry publications, government publications and other published independent sources generally indicate that the information included therein was obtained from sources believed to be reliable. Some data are based upon good faith estimates derived from our management’s review of the independent sources referenced herein and from experience with partners, licensees and other contacts in the markets in which we operate.

2

Table of Contents

This summary is intended as a basic overview of information contained elsewhere in this prospectus. To fully understand the Contract and a decision of whether or not to purchase, you should read this entire prospectus, noting in particular those circumstances that can lead to termination of your Contract and the discussion of risks identified in the “Risk Factors” section starting on page 5. Note that the Contract may not be currently available in all states, may vary in your state, or may not be available in relation to accounts at all financial firms.

Product Overview

Contingent Deferred Annuities

A fixed contingent deferred annuity (“CDA”) is an insurance product that establishes a life insurance company’s obligation to make periodic payments for the annuitant’s lifetime at the time designated investments, which are not owned or held by the insurer, are depleted to a contractually defined amount due to contractually permitted withdrawals, market performance, fees and/or other charges. A CDA effectively establishes a lifetime income floor, which protects the annuitant from depletion of an account due to adverse market movements or increased longevity. This is because the underlying investment account remains the property of the account owner, and if the value of the investment increases in an amount that is greater than that required to cover the approved withdrawals over the course of the annuitant’s life, the account owner or the owner’s heirs will realize that benefit of any appreciation in their account. A CDA will provide regular periodic payments to the annuitant upon the occurrence of certain specified conditions (such as the annuitant’s account being reduced to zero through permitted withdrawals) which are described in the related CDA contract. The annuitant’s investment account remains owned and controlled by the purchaser.

Merit’s Fixed Contingent Deferred Annuity Contract

The Fixed Contingent Deferred Annuity Contract offered by Merit is a CDA that provides for a fixed stream of payments to the Annuitant for life if the value of the purchaser’s Account is reduced to zero during the lifetime of the Annuitant due to making certain withdrawals. The amount of the cash payments made if a Covered Event occurs depends upon the value of the Account at the time of the first withdrawal from the Account following the Vesting Period. The Contract provides that the purchaser will be able to withdraw up to 5% of the value of the Account (valued at the greater of the value of the Account on the Issue Date or the Exercise Date, as adjusted by contributions and withdrawals). To the extent the Account is reduced to zero due to the withdrawals during the life of the Annuitant, we will pay Benefit Amounts to the Annuitant equal to the Income Amount when the Covered Event occurs. If the purchaser takes withdrawals from the Account during the Vesting Period or in excess of the Income Amount, the Income Amount and future Benefit Amounts which may be paid will be proportionately reduced. Correspondingly, any Eligible Contributions made to the Account will increase the Income Base dollar-for-dollar. The minimum issue age of the Annuitant for a Contract is 45 and the maximum issue age of the Annuitant is 85.

Contracts will be made available only to clients of Financial Firms with which the Company has an agreement.

The client’s assets will continue to be managed by her or his advisor at the Financial Firm. The only amount to be paid for the Contract is a quarterly fee assessed as a percentage of the value of any Account in relation to which our guarantee is provided. Our guarantee is our contractual promise to pay Benefit Amounts should the Covered Event occur, which is supported by our reserves, surplus and claims paying ability. The Financial Firm will deduct the Fee from the Account on our behalf and pay the Fee to the Company, unless you elect to pay the Fee using bank drafting. This Fee is separate and apart from any fee the Financial Firm charges for its services to its clients. We will not compensate the Financial Firms or their advisors in connection with their client’s election to purchase the Contract.

3

Table of Contents

| FIXED CONTINGENT DEFERRED ANNUITY CONTRACT | Merit’s Fixed Contingent Deferred Annuity Contract provides income backed by Merit, for the Annuitant’s life, to clients with wealth management accounts at designated Financial Firms. | |

| INCOME FOR LIFE | • Provides annual income in the amount of 5% of the Income Base

• Can begin any time after the Vesting Period and before age 95

• The yearly withdrawal amount is based on the greater of the Account’s value on the Exercise Date or the Account’s value on the Issue Date adjusted by any Eligible Contributions and any Excess Withdrawals

• Prior to a Covered Event occurring, withdrawals may occur at any time, or on a monthly, quarterly, semi-annual, or annual basis depending on your arrangements with your Financial Firm.

• Following the Covered Event, Benefit Amounts will be paid on a monthly basis.

• Continue if/when the Account’s value reaches zero | |

| VESTING PERIOD | For the Contract, the Vesting Period is from the Issue Date to the later of the Annuitant’s age 65 or two years from the Issue Date. As to each separate contribution to your Account after the Issue Date, if any, the Vesting Period is two years from the date of that contribution to your Account. | |

| AVAILABILITY | Single Annuitant; non-qualified plans that are not eligible for tax-deferral benefits; can be held by IRA and Roth IRA accounts. A non-qualified Account is one that is not being held as part of a tax preferred retirement plan such as an Individual Retirement Account (“IRA”), a Roth IRA, a 403(b) plan, a 457 plan, or a 401(k) plan. | |

| FLEXIBILITY | Contributions may be added to the Account or the Contract may be cancelled at any time | |

| EXCESS WITHDRAWALS | Excess Withdrawals during the Vesting Period, or above the Income Amount, proportionally reduce the Income Amount. We determine the reduction to the Income Amount by calculating the proportion of the Excess Withdrawal to the value of the Account after such withdrawal, and then reducing the Income Amount by that proportion. | |

| INVESTMENT OPTIONS | Approved portfolios of the wealth management Account at a Financial Firm with which we have an agreement. | |

| RISK MANAGEMENT | Risk is mitigated through product design with the Vesting Period ending at the later of age 65 or two years from the Issue Date; establishing and monitoring overall target portfolio investment guidelines with which all portfolios must comply; monitoring the overall mix of portfolios managed by each approved Financial Firm for adherence to a target allocation of 60% equity and 40% fixed income at each Financial Firm; reserving and investing in our general account in accordance with state law insurance requirements; and maintaining capital in excess of insurance requirements See the “Overview”, “Investment Guidelines and Risk Profiles” and “Financial Strength” sections of this prospectus. | |

| IMPORTANT AGES | Minimum Issue Age of the Annuitant: 45 Earliest point at which the Vesting Period may end; the later of (i) age 65 or (ii) two years from the Issue Date Maximum Issue Age of the Annuitant: 85 | |

| ANNUAL FEE | 0.55% per year of the wealth management Account’s value. This annual fee is in addition to the fee for advisory services associated with the wealth management Account charged by the Financial Firm. | |

4

Table of Contents

The Contract involves a number of risks. Before making a decision to purchase the Contract, you should carefully consider the following information about these risks, together with the other information contained in this prospectus. Many factors, including the risks described below, could result in a significant or material adverse effect on your Contract.

Your receipt of any benefits under the Contract is subject to our financial strength and claims paying ability.

Our ability to pay Benefit Amounts is subject to our ongoing financial strength and claims paying ability. The Contract is not a separate account contract. This means that the assets supporting the Contract are not held in a segregated account for the exclusive benefit of individual contract holders. Rather, we will pay Benefit Amounts under the Contract from our general account, which is not insulated from the claims of other contract holders and our third-party creditors. Therefore, the Annuitant’s receipt of payments from us is subject to our claims paying ability. You cannot seek enforcement of the guarantee against any other party.

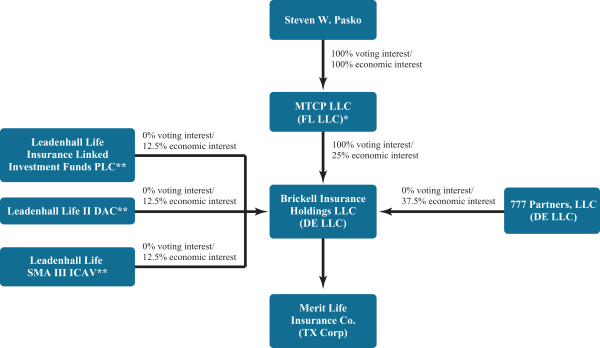

Brickell Insurance Holdings LLC has only controlled Merit since December 31, 2019.

While Merit was founded in 1957 to write credit life, credit disability, term life and disability income insurance, Brickell Insurance Holdings LLC, a Delaware limited liability company (“Brickell”) purchased Merit on December 31, 2019 for the purpose of offering the Contracts. As such, the past performance of Merit may not be indicative of Merit’s future performance.

We may cancel the Contract and pay no Benefit Amounts if assets in your Account fail to meet the target portfolio investment guidelines for your Account.

The assets in an Account must be managed in accordance with target portfolio investment guidelines applicable to your Contract. Whether as a result of your or your Financial Firm’s actions (including by changes made to the Investment Portfolio), if the target portfolio investment guidelines for your Account are breached or the specific investment guidelines associated with your Account change so that they are beyond the parameters of the target portfolio investment guidelines, we may terminate your Contract following a Cure Period. If the breach is not remedied within the Cure Period, the Contract will be cancelled and no Benefit Amounts will be paid. If the breach is remedied within the Cure Period you may incur costs in connection with reallocating the investments in your Account to bring your Account within the target portfolio investment guidelines. Rebalancing, whether as a result of your Financial Firm’s management of your Account or reallocating to bring your Account within the target portfolio guidelines, always involves the risks of buying and selling securities, such as transaction costs or potential tax implications.

Our agreement with your Financial Firm may end and your Contract may be terminated.

Our agreement with your Financial Firm may terminate in the event that either we or your Financial Firm fail to perform our obligations under such agreement upon 30 days’ notice of such failure, or upon the mutual consent of your Financial Firm and us. Either we or your Financial Firm may, in our or their sole discretion, terminate the contract regardless of what you do. In such event, your Contract will be automatically terminated unless it is moved to another Financial Firm with which we have an agreement in place. We will notify you should that occur and provide information regarding how you may continue your Contract. If payment of Benefit Amounts has not begun, it may be possible to transfer your Account to another financial firm within a 30-day period. Such a transfer is subject to our rules. We cannot guarantee we will have an agreement in effect regarding this type of Contract with any other financial firm at such time, that you will find any Financial Firm acceptable to you with which we have an agreement, or that any Financial Firm with which we have an agreement will be willing to have you as its client. Should continuation of your Account at your existing Financial Firm no longer be possible

5

Table of Contents

and a transfer of your Account to a different financial firm not be acceptable to you or be possible, we will terminate your Contract. Should the agreement with your Financial Firm terminate after we have begun to pay the Benefit Amounts, such Benefit Amount payments will not be affected.

Your Contract may be terminated if the ownership designation of your Contract does not match that of your Account.

Ownership designations must meet our underwriting criteria. We may cancel the Contract if the ownership designation of your Account is changed to one we do not accept for the Contract. For example, we would not accept a requested ownership change to a designation we would not accept for the initial issuance of a Contract, such as ownership by a business.

We may terminate the Contract if your Financial Firm does not provide us our Fees and the information necessary to administer your Contract on a timely basis.

The application for a Contract includes an authorization for your Financial Firm to provide us with the information we need to establish and administer the Contract, as well as an authorization for your Financial Firm to assess the Fees for this protection on a periodic basis. We will not issue a Contract if you do not provide such authorization, and we reserve the right to cancel the Contract and not make Benefit Amount payments if such information and Fees are not provided within 30 days after we request the needed information or Fees.

Your investments may perform differently than other investments not available for use with the Contract.

The target portfolio investment guidelines may require your Account to be managed in a different fashion than other investments available to you. If you do not purchase the Contract, it is possible that you may purchase other investments that experience higher growth or lower losses, depending on the market, than the assets held in your Account. You should consult with your financial representative to assist you in determining whether the assets eligible for coverage are suited for your financial needs and risk tolerance. If you reallocate or transfer the investments in your Account so that you are no longer invested in the assets eligible for coverage in accordance with the target portfolio investment guidelines, we will terminate your Contract and no Benefit Amount will be paid.

You may cancel the Contract prior to a severe market downturn.

Once you have cancelled the Contract, our obligation to pay Benefit Amounts will cease. Even if a severe market downturn occurs shortly after you cancel your Contract, Benefit Amounts will not be paid.

You may make Excess Withdrawals, which will reduce and may even eliminate future Benefit Amounts available under the Contract.

Due to the long-term nature of the Contract guarantee, there is a risk that you may encounter a personal financial situation in which you need to make withdrawals before the end of the Vesting Period or after the Exercise Date in excess of the Income Amount. Any such withdrawal is an Excess Withdrawal. Please note that an Excess Withdrawal will reduce the Income Base and/or the Income Amount available each year before the Covered Event. Such Excess Withdrawals will proportionately reduce your Income Base and/or Income Amount (by an amount that could be substantially more than the actual dollar amount of the withdrawal), which in turn will reduce the amount of, or even eliminate, any future Benefit Amounts that the Annuitant would otherwise receive. If you make an Excess Withdrawal, we will not provide you with advance notification regarding the repercussions of the Excess Withdrawal. Before you take any withdrawals, you should discuss the impact of any Excess Withdrawals with your Financial Firm.

6

Table of Contents

The point in time when you begin taking withdrawals from your Account may impact whether the Annuitant receives payments of the Benefit Amount under your Contract.

The longer you wait to set the Exercise Date and start making withdrawals from your Account, the less likely Benefit Amounts will be paid. This is because waiting to start making withdrawals makes it more likely that the Annuitant will die before the Account is depleted.

The Annuitant may die before your Account is reduced to zero.

If the Annuitant dies before your Account is reduced to zero, no Benefit Amounts will be paid. The Contract does not have any cash value, surrender value, or provide a death benefit. Even if the Annuitant begins to receive Benefit Amounts, the Annuitant may die before receiving an amount equal to or greater than the amount you have paid in Fees.

The owner will pay fees regardless of whether they receive any Benefit Amounts.

Fees accrue from the Issue Date, even if you do not begin taking withdrawals from your Account for many years, or ever, and whether or not we pay any Benefit Amounts. If you choose never to take withdrawals, and/or if the Annuitant never receives any Benefit Amounts, you will not receive a refund of the Fees you have paid.

Your payment of your Contract’s Fee, fees to your Financial Firm, and other fees deducted from your Account before the Exercise Date may affect the Account’s value, potentially affecting the Income Amount and, as a result, Benefit Amounts provided under your Contract.

In addition to your Contract’s Fee and the fee for the investment advisory services provided by your Financial Firm, you may have other fees deducted from your Account for items like IRA custodial fees, if applicable, or fees for other administrative services (including custody and record keeping) (the “Other Account Fees”). Your Contract Fee, the fee for the investment advisory services provided by your Financial Firm, and Other Account Fees reduce the value of your Account, however they are not treated as a withdrawal for purposes of payments available under the Contract, nor as an Excess Withdrawal from your Account. Please consult with your Financial Firm regarding any Other Account Fees, and you should discuss with your Financial Firm how such Other Account Fees should be paid. Also see, “Fixed Contingent Deferred Annuity Contract - Overview” and “Fees.”

Divorce may prompt the need to make changes to a Contract.

Divorce often may lead to the need to change the ownership designation of the Account, which will trigger the need to change the ownership designation of the Contract to match that of the Account. We expect to comply with qualified domestic relations orders issued as a result of a divorce. Divorce after a Covered Event will not affect our making Benefit Payments to the Annuitant. A change in the ownership designation of the Account could result in the original Contract owner losing the Contract as a part of a divorce decree.

A downgrade in our financial strength rating would likely reduce the amount of business we are able to write and could materially adversely impact our competitive position.

Financial strength ratings are an important factor in establishing the competitive position of insurance companies and are important to our ability to market and sell our products. Rating organizations continually review the financial positions of insurers, including us. Our financial strength rating is subject to periodic review by, and may be revised downward or revoked. There can be no assurance that we will maintain our current ratings. Future changes to our rating may adversely affect our competitive position.

7

Table of Contents

We are subject to various regulatory requirements.

The issuance and sale of your Contract is registered in accordance with the Securities Act of 1933 (the “Securities Act”) and must be conducted in accordance with the requirements of the Securities Act of 1933. We are also subject to the rules and regulations of the Texas Department of Insurance and those of the other jurisdictions in which we are licensed. In the event we do not comply with these requirements, rules and regulations we may be subject to investigation or examination by the Securities and Exchange Commission, the Texas Department of Insurance or the departments of insurance of other states and other regulatory agencies, the result of which may be legal actions, fines or injunctive relief, which may have a material adverse effect on our business operations or financial position.

You should be aware of the various regulatory protections that do not apply to the Contract.

The Contracts will not be listed on any exchange. As an issuer of non-equity securities subject to certain insurance regulations, we are not subject to applicable periodic reporting requirements and other requirements imposed by the Securities Exchange Act of 1934. In addition to our exemptions under the Exchange Act, we are not an investment adviser and do not provide investment advice to you in connection with the Contract or your Account. We also are not an investment company and therefore we are not registered under the Investment Company Act of 1940, as amended, and the protections provided by the Investment Company Act of 1940 are not applicable with respect to your Contract. Because we will not be subject to these regulations, while certain regulatory and financial information are available in this registration statement filed under the Securities Act of 1933, the periodic financial and business information publicly available will be limited to the information made available by the Texas Department of Insurance and other insurance departments. Therefore, it could be more difficult for you to obtain all the information necessary to assess our financial strength and ability to continue paying Benefit Amounts.

There are certain cybersecurity risks associated with our and your Financial Firm’s dependence upon the effective operations of computer systems.

Because our business and your Financial Firm’s business are highly dependent upon the effective operation of computer systems, we are vulnerable to disruptions from utility outages and susceptible to operational and information security risks resulting from information system failures (e.g., hardware and software malfunctions) and cyber-risks. These risks include, among other things, the theft, misuse, corruption, and destruction of data maintained online or digitally, denial of service on our website and other operational disruption, and unauthorized release of your confidential information. Such system failures and cyber-attacks affecting us, your Financial Firm and third-parties may adversely affect your Account and/or your Contract. There can be no assurances that we will be able to avoid losses due to cyber-attacks or information security breaches in the future.

Our financial condition and results of operations could be adversely affected by public health epidemics, including the recent and ongoing coronavirus outbreak.

A novel strain of coronavirus has been rapidly spreading across the globe, including in the United States. Any outbreak of contagious disease such as the coronavirus or other adverse public health developments could have a material and adverse effect on our business operations. Such adverse effects could include quarantines, disruptions of or restrictions on our ability and/or the ability of our vendors’ personnel to travel or conduct normal business activities, as well as closures of our facilities or the facilities of our collaborators for an indefinite period of time (including shutdowns that may be requested or mandated by governmental authorities). Any temporary closures of facilities would likely affect our development efforts and operating results, and any disruption to the operations of our vendors would likely impact our development efforts and operating results. The extent to which the coronavirus may impact our results will depend on future developments, which are highly uncertain and cannot be predicted, and on new information that may emerge concerning the severity of the coronavirus. However, current predictions suggest that the impact of sustained business closures and quarantines resulting from the coronavirus on the global economy will be severe, and this may have a material adverse effect on our business.

8

Table of Contents

Account performance may prevent the receipt of any benefit.

If your Account does not go to zero you will see no benefit. The investment performance of your Account directly impacts whether your Account will be reduced to zero and thus whether any Benefit Amounts will be paid. If you comply with the terms of your Contract and your Account is not reduced to zero no Benefit Amounts will be paid, and you will not receive a refund of the Fees you have paid.

There may be tax consequences associated with the Contract.

You should consult a tax advisor before purchasing a Contract. You should inquire of your tax adviser whether there would be any adverse impact on your ability to take withdrawals from your Account or to the tax classification of your Account should you purchase the Contract. See “Federal Income Tax,” below for further discussion of tax issues relating to the Contract.

9

Table of Contents

This prospectus contains “forward-looking” statements that are intended to enhance the reader’s ability to assess our future financial and business performance. Forward-looking statements include, but are not limited to, statements that represent our beliefs concerning future operations, strategies, financial results or other developments, and contain words and phrases such as “may,” “expects,” “should,” “believes,” “anticipates,” “estimates,” “intends” or similar expressions. In addition, statements that refer to our future financial performance, anticipated growth and trends in our business and in our industry and other characterizations of future events or circumstances are forward-looking statements. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond our control or are subject to change, actual results could be materially different.

Consequently, such forward-looking statements should be regarded solely as our current plans, estimates and beliefs with respect to, among other things, future events and financial performance. Except as required under the federal securities laws, we do not intend, and do not undertake, any obligation to update any forward-looking statements to reflect future events or circumstances after the date of such statements.

The forward-looking statements include, among other things, the factors discussed under “Risk Factors” and those listed below:

| • | effects of fluctuations in interest rates, including a prolonged low interest rate environment, a rapidly rising interest rate environment, or a flat or inverted yield curve, as well as management’s ability to anticipate and timely respond to any such fluctuations; |

| • | general economic, market or business conditions, including economic downturns or other adverse conditions in the global and domestic capital and credit markets; |

| • | changes in laws or regulations, or their interpretation, including those that could increase our business costs, reserve levels and required capital levels, or that could restrict the manner in which we do business and produce sales, including uncertainty related to: |

| • | the Tax Cuts and Jobs Act of 2017 (the “2017 Tax Act”), which brought significant changes to the U.S. tax code and may negatively impact the determination of insurance tax reserves, the reinsurance market, the calculation of risk-based capital (RBC), our competitors and the Financial Firms; |

| • | financial regulation reform, particularly the status of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; and |

| • | the evolving and potentially conflicting standard of care requirements applicable to the sale of our Contracts, including requirements from the Securities and Exchange Commission (the “SEC”), the National Association of Insurance Commissioners (the “NAIC”), and the legislatures and regulators of multiple states; |

| • | effects of catastrophic events, both natural and man-made, that could adversely affect our operations and results, including impacts to claims and mortality experience, investment portfolio performance, and business operations; |

| • | effects of significant corporate refinance activity; |

| • | our ability to successfully execute on our strategies; |

| • | accuracy and adequacy of recorded reserves, including the actuarial and other assumptions upon which those reserves are established, adjusted and maintained; |

| • | deviations from assumptions used in setting prices for annuity products or establishing cash flow testing reserves; |

10

Table of Contents

| • | significant changes in projected future cash flows underlying the value of our intangible assets, including projections of future sales and profitability; |

| • | continued viability of our products under various economic, regulatory and other conditions; |

| • | market pricing and competitive trends related to annuity products and services, especially if well-capitalized new entrants enter the insurance industry; |

| • | retention of key personnel and business partners; |

| • | financial strength or credit ratings changes, particularly ours but also of other companies in our industry sector; |

| • | our ability to maintain adequate telecommunications, information technology, or other operational systems; |

| • | our ability to prevent or timely detect and remediate any unauthorized access to or disclosure of customer information and other sensitive business data; |

| • | availability and cost of capital and financing; |

| • | the availability and cost of reinsurance coverage, should we pursue reinsurance; |

| • | our ability to implement effective risk management policies and procedures; and |

| • | initiation of regulatory investigations or litigation against us and the results of any regulatory proceedings. |

You should review carefully the section captioned “Risk Factors” in this prospectus for a complete discussion of the material risks of purchasing a Contract.

11

Table of Contents

FIXED CONTINGENT DEFERRED ANNUITY CONTRACT

Overview

The Contract provides coverage against the loss of income taken as withdrawals from your Account. That occurs if the value of the Account is reduced to zero as defined by the conditions specified in the Contract and described in this prospectus. Should that occur, we then pay the Benefit Amount for the Annuitant’s lifetime. Should there be value in the Account at the time of the Annuitant’s death (if no Covered Event has occurred), no payments shall be made.

Overview of Whom the Contract is Appropriate For

The Contracts may be appropriate for persons concerned that the person to be named as Annuitant may outlive the income intended to support such individual. The Annuitant usually is the Contract owner or the person for whose benefit a custodial account or trust is maintained. The Contracts are only offered to provide coverage to Annuitant’s who are at least age 45 on the Issue Date of the Contract.

The Contracts may not be appropriate for persons with an impaired life expectancy or who otherwise do not expect to outlive the assets held in their Accounts. Additionally, this Contract may not be appropriate for people who plan or may need to take Excess Withdrawals.

Overview of the Contract

The Benefit Amount we pay each Income Year will equal the Income Amount in effect when the Covered Event occurs. On the Exercise Date, we determine the initial Income Amount. The Exercise Date is the date of your first withdrawal from the Account after the Vesting Period. We require you take your first withdrawal from the Account no later than the Annuitant’s 95th birthday. You may elect to not begin to take withdrawals (and establish your initial Income Base and Income Amount) before that date.

The Vesting Period ends upon the later of the Annuitant’s 65th birthday or two years measured from the Issue Date of the Contract. The earliest you can take a withdrawal from your account and not have the entire amount treated as an Excess Withdrawal would be after the Vesting Period ends. If you make contributions into your Account after the Issue Date, there is a two year Vesting Period in relation to each such contribution, measured from the date of each contribution. A Contribution that has been maintained in your Account for at least its Vesting Period is an Eligible Contribution.

The initial Income Amount is determined by applying a guaranteed income percentage of 5% to the Income Base as of the Exercise Date. On the Exercise Date, the Income Base is the higher of the value of the Account on the Exercise Date or the Account’s value on the Contract’s Issue Date, adjusted by any Eligible Contributions or Excess Withdrawals. This means that if you do not make any Eligible Contributions or Excess Withdrawals, either before or after the Exercise Date, your Income Amount cannot be less than 5% of the value of your Account on the Issue Date of your Contract, irrespective of the performance of the investments in your Account. Your Account’s value on the Exercise Date will be affected by the fees assessed by your Financial Firm, our Fee from the Issue Date up to and including the Exercise Date, and the Other Account Fees.

Eligible Contributions and Excess Withdrawals result in adjustments to the Income Base and, as a result, to the Income Amount. We describe the impact of such adjustments in this prospectus; see Impact of Excess Withdrawals on the Income Base and Eligible Contributions. Adding this protection does not affect your right to withdraw funds from your Account at any time, or dictate the size of any withdrawal. However, the amount and timing of your withdrawals may have an impact on your Income Amount and therefore on the Benefit Amount if a Covered Event occurs.

12

Table of Contents

Overview of Our Relationship with Your Financial Firm

This Contract is provided in relation to an Account you have established at a Financial Firm that you have engaged as an investment adviser. You can find a list of Financial Firms with whom we offer Contracts on our website.

We seek an aggregate target allocation for all Accounts at a Financial Firm for which we issue Contracts of approximately 60% equities and 40% fixed income. This aggregate target allocation at the Financial Firm level is part of our overall risk mitigation strategies and it is one factor, among many, that impact which Financial Firms we approve for issuance of new Contracts. This will not, however, impact your ability to maintain your Contract unless our agreement with your Financial Firm ends as described under Termination below. Moreover, this Merit Life risk mitigation strategy at the Financial Firm level does not impact or influence the target portfolio investment guidelines described below. It only impacts whether we offer our contracts with a particular Financial Firm. Your Financial Firm may have a conflict of interest between managing an individual Account and remaining within the aggregate target allocation.

Your Financial Firm will have one or more model portfolios, custom portfolios or combinations of both which it makes available to clients and that are acceptable to us. These portfolios are available to clients of such Financial Firms whether or not they purchase our Contract. Often the model portfolios will have been established before we agree to make the Contract available to clients of your Financial Firm. Pursuant to your advisor’s fiduciary duty to act in your best interest, you and your advisor may have already decided before any consideration of whether you should apply for our Contract that you should be invested in one of the model portfolios that we come to determine is acceptable for use with our Contract.

Where a Financial Firm uses model portfolios, we evaluate each model portfolio prior to determining that such model portfolio would be eligible to underlie a Contract. We intend to use portfolio analysis software developed by Markov Process International (MPI) in connection with this determination. The results of this analysis are subject to stress testing. This approach has many advantages, including variable volatility for both United States Treasuries and equities and is subject to a quarterly parameter review. We believe this approach is robust, thorough and sophisticated. Our primary criteria are liquidity, diversification, volatility and expenses.

Overview of Investments

The mix of investments that you may hold in your Account is not necessarily the same as any other client of your Financial Firm. Some Financial Firms use model portfolios, others use custom portfolios and others use combinations of both. Even if two Accounts use the same model portfolio from the same Financial Firm, it is likely that the actual portfolios of those two Accounts will not be the same. Portfolios will vary from Account to Account and also from Financial Firm to Financial Firm.

Our underwriting process for determining whether a Financial Firm and its portfolios are acceptable focuses on whether the investments are in a well-diversified mix of Exchange Traded Funds (ETFs), mutual funds or other securities. Our process seeks to align our risk appetite in relation to our risks in offering the Contracts with your risk appetite in providing income for life through the investments held in your Account. Our choices of acceptable risk profiles and model portfolios are one of the tools we use to mitigate our risk of having to pay Benefit Amounts to the Annuitant. As such, our interest is maximizing the probability that your Account will provide you with cash flow for the duration of your life so that we will not be required to pay any Benefit Amounts as your Account would maintain value throughout your life.

Target Portfolio Investment Guidelines

You may apply to purchase a Contract with respect to a portfolio managed by a Financial Firm so long as the target investment allocations of such portfolio fall within the asset class and investment category ranges outlined below.

13

Table of Contents

| Target Portfolio Investment Guidelines | ||||||

| Asset Class |

Investment Category |

Investment Category Definitions |

Allocation | |||

| Equity |

US Large Cap | Contains stocks and other equity securities from companies across various industries with market values of more than $10 billion. These companies are typically more mature and are diversified with many products and services. The investment style represented by this category can include a mix of both growth and value characteristics. | 5-50% | |||

| Equity |

US Mid Cap | Contains stocks and other equity securities from companies with market values typically between $2 billion and $10 billion. These companies are often established and growing. The investment style represented by this category can include a mix of both growth and value characteristics. | 0-15% | |||

| Equity |

US Small Cap | Contains stocks and other equity securities from companies with less than $2 billion in capitalization. These companies include start-up companies. These smaller companies can grow much faster than larger companies, but smaller company stocks tend to be more volatile. The investment style represented by this category can include a mix of both growth and value characteristics. | 0-15% | |||

| Equity |

International Large Cap | Contains stocks and other equity securities from companies across various industries with market values of more than $10 billion. Typically at least 75% of these equity assets are in companies located outside of the United States. | 0-30% | |||

| Equity |

International Small / Mid Cap | Contains stocks and other equity securities from companies with market values typically less than $10 billion. Typically at least 75% of these equity assets are in companies located outside of the United States. | 0-15% | |||

| Equity |

Global Equity | Contains stocks and other equity securities without limitation regarding market capitalization. Typically at least 25% of these equity assets are in companies located outside of the United States. | 0-25% | |||

| Equity |

Emerging Markets Equity | Contains stocks and other equity securities from companies not headquartered in the United States, with an emphasis on companies located in less-developed countries. These countries may include Brazil, Russia, India and China, among others, and will change as countries become more developed. The investment markets in these countries have the potential for very high growth rates but can also be extremely volatile and unpredictable. | 0-15% | |||

| Equity |

Sector Funds | Contains stocks and other equity securities of companies that operate in a particular industry or sector of the market, such as technology or financial services, for example. | 0-10% | |||

| Total Equity | 45-75% | |||||

| Fixed Income | Investment Grade Government Bond | Contains high quality government issued bonds which have a lower level of relative risk and receive higher ratings by credit rating agencies. | 5-40% | |||

| Fixed Income | Investment Grade Corporate Bond | Contains high quality corporate issued bonds which have a lower level of relative risk and receive higher ratings by credit rating agencies. | 0-15% | |||

| Fixed Income | Short Duration Bond | Contains short-term bonds issued by the U.S. Treasury and federal agencies and having maturities ranging between one to three years. | 0-10% | |||

| Fixed Income | Inflation Protected Bonds (TIPs) | Contains U.S. Treasury securities that are indexed to inflation to protect from a decline in the purchasing power of money. | 0-10% | |||

| Fixed Income | High Yield Bonds | Contains lower quality bonds that pay higher interest rates. High yield bonds have lower credit ratings and are at a higher risk of default. | 0-10% | |||

| Fixed Income | International Fixed Income | Contains bonds issued by foreign governments or foreign companies in a variety of markets, industries, and currencies. | 0-10% | |||

| Total Fixed Income | 25-55% | |||||

| Alternatives | US Real Estate Investment Trusts (REITs) | Contains securities of real estate investment trusts, which focus on owning, operating or financing income-producing properties. REITs vary in their specific focus, including apartment, factory-outlet, health-care, hotel, industrial, mortgage, office, and shopping center REITs. | 0-5% | |||

14

Table of Contents

| Target Portfolio Investment Guidelines | ||||||

| Asset Class |

Investment Category |

Investment Category Definitions |

Allocation | |||

| Alternatives | Commodities / Real Assets | Contains securities and real assets of commodity-based industries such as energy, chemicals, minerals, and forest products in the United States or outside of the United States. | 0-5% | |||

| Total Alternatives | 0-10% | |||||

| Cash | Money Market / Cash | Contains principally financial instruments issued or guaranteed by the U.S. government., its agencies, or instrumentalities with dollar-weighted average maturities of less than 90 days. | 0-5% | |||

| Total Cash | 0-5% | |||||

Equity, fixed income and alternative investments may include securities registered under the securities laws or those exempt from such registration. There are no allocation restrictions or limitations with respect to the allocation between registered and unregistered securities. Equity securities typically represent an ownership interest in a company and include securities such as common stock and preferred stock. Fixed income securities typically represent an obligation on the part of a company to repay an amount loaned to the company and include securities such as corporate bonds and U.S. treasuries. Alternative securities typically include securities that do not otherwise fit within the asset classes of equity, fixed income or cash. The chart above provides descriptions of the investment categories within each asset class which comprise our target portfolio investment guidelines. Merit uses a third party data and analytics provider in accordance with industry standards in order to determine which investments in a portfolio are allocated to each investment category. The allocation range may be made up of many securities, or even a single security, that fits within the investment category. Each security will be allocated into only one investment category described above.

Portfolios may include multiple individual securities such as bonds, notes, common stock, preferred stock, or, in general, any interest or instrument commonly known as a “security”, which fits within an investment category described in the chart above. Additionally, and most often, these securities make up pooled investment vehicles which are daily priced, liquid and diversified. Pooled investment vehicles combine money from multiple investors into a pool that invests in multiple individual securities, and include such vehicles as Exchange Traded Funds (ETFs), mutual funds and bank collective trusts. When a portfolio invests in pooled investment vehicles, we determine compliance with the target portfolio investment guidelines by looking through the pooled investment vehicles to the asset class and investment category of the underlying individual securities held by those vehicles. Our process for determining whether a portfolio is acceptable focuses on whether the underlying investments are in a well-diversified mix of securities, as indicated in the chart above.

The available portfolios vary from Financial Firm to Financial Firm. These portfolios are available through the Financial Firms irrespective of whether you purchase our Contract. Some Financial Firms offer custom designed portfolios and some offer model portfolios which we have already reviewed and approved as meeting the target portfolio investment guidelines above. For more information regarding the details of your portfolio, please refer to disclosure received from your Financial Firm, including your Financial Firm’s Form ADV brochure and portfolio fact sheet. The mix of investments that you may hold in your Account is not necessarily the same as any other client of your Financial Firm. The specific securities and pooled investment vehicles in which a portfolio invests are determined by you and your Financial Firm.

At all times, we reserve the right to approve or reject any application to purchase a Contract. Once we have issued you a Contract, the investments held in your Account will not cause your Contract to be terminated so long as those holdings remain within the target portfolio investment guidelines discussed above. We may terminate your Contract if you or your Financial Firm invest the assets in your Account outside of the aforementioned target portfolio investment guidelines and your Account is not revised to fall within these guidelines within the Cure Period.

15

Table of Contents

Overview of Termination of the Contract

We may terminate your Contract if you or your Financial Firm invest the assets in your Account outside of the target portfolio investment guidelines and you don’t remedy this situation within the Cure Period provided in the Contract.

We rely on your Financial Firm to provide us with certain information about your Account. Should you elect bank drafting for paying our Fee, we rely on your Financial Firm to provide us the information we need to determine the amount to be drafted from your bank account. That is the information we need to administer the Contract and determine our liability, for which we must maintain required reserves and surplus. We also rely on your Financial Firm to properly assess and forward our Fee for this protection. We may terminate the Contract as of the date your Financial Firm fails to provide timely and accurate information about your Account or properly assess and forward our Fee.

Given the role of your Financial Firm in investing your assets, providing us necessary information and assessing our Fees, you need to understand that the continuation of the Contract depends on your Financial Firm’s ongoing participation in its agreement with us. If our agreement with your Financial Firm ends, you must move your Account to another approved Financial Firm within the Cure Period in order to maintain your Contract.

Overview of the Fee

Your Contract’s Fee and the fee for the investment advisory services provided by your Financial Firm are not treated as withdrawals from your Account for purposes of the Contract, however they will be treated as withdrawals against your Account Value. However, you may have Other Account Fees deducted from your Account by your Financial Firm. The amount deducted from your Account to pay such fees will be treated as withdrawals against your Account value; however, will not be treated as a withdrawal for purposes of payments available under the Contract, nor as an Excess Withdrawal.

Overview of Withdrawals

After the Exercise Date, you are not required to take any further withdrawals or to take withdrawals of any particular amount. However, the Income Amount in any Income Year is not increased if you take withdrawals of less than the Income Amount in prior Income Years.

The better the investment performance of your Account before the Exercise Date, the higher the Income Base and therefore the higher the initial Income Amount. Conversely, to the extent that the investment performance of your Account before the Exercise Date is poorer than expected, the Income Base and therefore the initial Income Amount may be lower than you hoped or expected. However, if you do not make any Excess Withdrawals before the Exercise Date, the Contract provides that your initial Income Base will not be less than your Account’s value on the Issue Date plus the value of any then Eligible Contributions, irrespective of the investment performance of your Account.

You may elect to wait a number of years to take your first withdrawal from your Account, in the hope that market performance will increase your Account’s value at the Exercise Date. That provides the possibility of obtaining a higher Income Base and, as a result, a higher Income Amount.

Free Look Right

Purchasers have the right to cancel and return a Contract purchased within 30 days after receipt, or longer if required by law. A purchaser may return a Contract for any reason, after which we will return any amounts paid. Contracts may be returned by delivering or mailing the Contract to our administrative office at 2 Corporate Drive, Suite 760, Shelton, Connecticut 06484.

16

Table of Contents

Eligible Purchasers

We are offering this Contract only in United States’ jurisdictions in which we are a licensed insurance company and in which we have obtained any required regulatory approvals. We are offering this Contract only in relation to Accounts held at Financial Firms with which we have an agreement. Contracts may be established in connection with both existing and new Accounts.

We are offering this Contract in relation to Accounts that, for income tax purposes, are considered to be “non-qualified”, as well as Accounts that are designed to qualify as individual retirement accounts (“IRAs”) or Roth IRAs (these are types of “qualified” retirement plans). Non-qualified accounts are not maintained or established pursuant to any individual or employment-related retirement plan.

Owners of Contracts to be used in relation to non-qualified Accounts may be a single natural person, a married couple or an entity such as a trust acting as agent for a natural person. Owners of IRA or Roth IRA Accounts usually will be custodial accounts maintained for such purposes at the Financial Firm and held for the benefit of the named IRA or Roth IRA participant. We make no representations or guarantees as to whether such Accounts are established and maintained in accordance with all relevant laws and regulations applicable to IRAs and/or Roth IRAs. When a Contract is owned in conjunction with an IRA or Roth IRA, the custodial account (or sometimes a trust) must own the Contract. In all cases, we require the ownership designation of the Contract to match the ownership designation of your Account.

Annuitant Designations

Unless the Account is owned by an entity, the Annuitant must be the Owner of the Contract or one of the joint owners of the Contract when owned by a married couple. For Contracts purchased by an IRA or Roth IRA, the Annuitant will be the IRA participant. In each case, the Annuitant must be the person for whose benefit the Account is maintained when the Account is a custodial account or trust. Note that we pay any Benefit Amounts due after a Covered Event to an account for the benefit of the Annuitant, who is the person upon whose continued life we will make payments should a Covered Event occur.

Underwriting Requirements

We have certain restrictions and limitations as to the issuance of a Contract. These include, but are not limited to:

| • | The Annuitant must be at least 45 years old and not more than 85 as of the Issue Date. |

| • | The Account’s value must not be more than $10,000,000.00 as of the Issue Date. We have no minimum Account value requirement. |

| • | The Account must be at a Financial Firm which has an effective operating agreement with us. |

| • | The Account must be invested in accordance with the target portfolio investment guidelines agreed to by your Financial Firm and us. |

| • | The ownership designation requested for the Contract must match that of the Account. |

| • | Any joint owners must be spouses or entity owners (i.e. trusts and custodial accounts) which are for the benefit of the Annuitant. |

Purchasing a Contract

You must complete and sign our application in order to request a Contract. As part of the application, you will need to identify your Financial Firm, your financial advisor and your Account number for the Account in relation to which you are seeking protection. Note that while you may have multiple Accounts at your Financial Firm, we will only issue a Contract in relation to all the assets in one Account. We do not issue Contracts in relation to a portion of your Account’s value. If you wish to obtain protection on more than one Account, you must apply for a Contract separately for each such Account.

17

Table of Contents

Given that Excess Withdrawals have a negative impact on future benefits, you should discuss with your financial advisor whether you should maintain a portion of your assets outside the Account in order to meet: (a) expenses until your expected Exercise Date; and (b) unexpected expenses on and after the Exercise Date. The application for a Contract includes an authorization you provide for your Financial Firm to provide us with the information we need to establish and administer your Contract, as well as an authorization for your Financial Firm to assess your Account the Fees for this protection on a periodic basis. We will not issue a Contract if you do not provide such authorizations. You may elect at any time to have our Fee withdrawn periodically from a bank account you designate.

Issuing a Contract

If an applicant meets our underwriting requirements, we will issue a Contract. Wherever permitted, we will issue Contracts electronically. In any case, you may request a printed copy of your Contract at any time.

Fees

The annual Fee associated with the Contract is 0.55% of the value of your Account, paid in arrears. The Fee is withdrawn from an Account quarterly. We pro-rate the Fee due for the period between the Issue Date and the date the first Fee is assessed. We also pro-rate the Fee for the period between the end of the prior calendar quarter and the date your Contract ends if your Contract terminates.

You may elect bank drafting for paying the Fees. You may make such an election at any time. You also may change the bank and/or the account from which funds will be withdrawn to pay the Fee. You also may terminate bank drafting and have the Fee assessed against your Account at any time. You may obtain the forms we require for such elections from our website or by providing notice to us in the manner described in your Contract.

Your Contract Fee and the fee for the investment advisory services provided by your Financial Firm reduce the value of your Account, however they are not treated as a withdrawal for purposes of payments available under the Contract, nor as an Excess Withdrawal from your Account. However, Other Account Fees may be deducted from your Account. The amount deducted from your Account will reduce the value of your Account, but will not be treated as a withdrawal for purposes of payments available under the Contract, nor as an Excess Withdrawal.

After the Covered Event we will deliver payments electronically to an account for the benefit of the Annuitant at the financial institution that you designate. We reserve the right to reduce each payment by a $20.00 payment processing fee if an alternate form of delivery is elected.

Benefit

The Contract shall provide ongoing payments for the Annuitant’s life if a Covered Event occurs. That happens if and when the value of your Account goes to zero for reasons other than an Excess Withdrawal. We will provide such payments if your Contract is then in effect, if there is no legal impediment at such time for our providing the payments, and you have provided us with the information we need to make such payments.

We may require proof that the Annuitant is alive from time-to-time.

We make these payments to an account for the benefit of the Annuitant.

Benefit if the Covered Event Occurs

As of the date of the Covered Event, we begin payments of the Benefit Amount each Income Year for the Annuitant’s lifetime. In the Income Year the Covered Event occurs the Benefit Amount is the Income Amount at the time of the Covered Event minus any withdrawals in that Income Year. In subsequent Income Years, the Benefit Amount we pay each Income Year for the Annuitant’s lifetime equals the Income Amount in effect when the Covered Event happens. We pay Benefit Amounts monthly.

18

Table of Contents

Income Base

On the Exercise Date, we determine your initial Income Amount – the maximum amount you can withdraw from your Account each Income Year without any part of such withdrawals being considered an Excess Withdrawal (which reduces your Income Amount going forward). We calculate your initial Income Amount using the Income Base, as indicated below.

As of the Exercise Date, the Income Base is the higher of:

| (a) | the value of your Account on your Contract’s Issue Date plus any Eligible Contributions and less the proportional impact of Excess Withdrawals from the Issue Date until the Exercise Date; or |

| (b) | the value of your Account on the Exercise Date reduced by the value of (i) any contributions to your Account that have not vested and (ii) the proportional impact of any Excess Withdrawals from the Issue Date until the Exercise Date. |

Following the Exercise Date, the Income Base can increase or decrease as a result of Contributions and Excess Withdrawals, respectively.

Income Amount

The Income Amount is determined by applying the guaranteed income percentage of 5% to the then current Income Base. You are not required to take the Income Amount in any Income Year. Any portion of the Income Amount you do not take in an Income Year remains in your Account and does not increase the Income Amount in subsequent Income Years.

The Income Amount is the guaranteed amount you may withdraw in each Income Year without reducing future benefits. The initial Income Amount is determined on the Exercise Date.

Excess Withdrawals

Any withdrawal during the Vesting Period is an Excess Withdrawal. Any amount withdrawn on or after the end of the Vesting Period that exceeds the Income Amount for the Income Year in which that withdrawal occurs is an Excess Withdrawal. An Excess Withdrawal that reduces your Account’s value to zero results in termination of your Contract.

Excess Withdrawals can happen at any time. Any Excess Withdrawal will proportionally reduce your guaranteed income amount. During the Vesting Period, any withdrawal is considered an Excess Withdrawal. The amount of the reduction is calculated by dividing the amount of the Excess Withdrawal by the remaining Account value immediately following such withdrawal. After the Vesting Period, an Excess Withdrawal is any withdrawal greater than the Income Amount (i.e. Excess Withdrawal / remaining Account value). The amount of the Excess Withdrawal is calculated by dividing the total withdrawal less the Income Amount by the remaining Account value following such withdrawal (i.e. (total withdrawal – Income Amount) / remaining Account value after such total withdrawal). Examples of Excess Withdrawals are reflected in the hypotheticals under “Fixed Contingent Deferred Annuity Contract – Examples.”

Impact of Excess Withdrawals on the Income Base

An Excess Withdrawal reduces the Income Base by the ratio of the Excess Withdrawal to the value of your Account as of the date of the Excess Withdrawal, after any other withdrawal taken on the same date. The smaller the Account’s value is relative to the Income Base with respect to an Excess Withdrawal, the greater impact on the Income Base such Excess Withdrawal will have. This is because the Excess Withdrawal will be a higher proportion of your Account’s value. See Hypothetical #5 below for an example showing the impact of an Excess Withdrawal.

19

Table of Contents

Required Minimum Distributions

During an Income Year, with respect to a Contract issued to an entity established as an IRA or Roth IRA, you may withdraw from your Account an amount necessary to avoid a penalty under the Code’s provisions regarding required minimum distributions (generally distributions required to be taken from certain IRAs starting at age 72 (or 70-1⁄2 if you reached age 70-1⁄2 before January 1, 2020)). The amount you withdraw may exceed your Income Amount for that Income Year. We will not treat the amount which exceeds the Income Amount for the then current Income Year as an Excess Withdrawal to the extent that amount was needed to meet the required minimum distribution amount based solely on the value of your Account.

Eligible Contributions

Contributions into your Account after the Issue Date may increase your Income Base, but only if they are Eligible Contributions. We treat contributions as Eligible Contributions when they have satisfied the Vesting Period.

Contributions that become Eligible Contributions before the Exercise Date increase your initial Income Base as calculated on the Exercise Date, and, as a result, your initial Income Amount (see the Income Base section, above). Eligible Contributions increase your Income Base dollar-for-dollar and thereby increase the Income Amount by 5% of the value of such Eligible Contributions. See Hypothetical #6 below.

Contribution Limit

We may limit the total value of your Eligible Contributions. The limit is determined to be your Account’s value on the Issue Date plus the value of all Eligible Contributions. The limit is $10,000,000.00.

Termination