Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - META FINANCIAL GROUP INC | cash3312021earningsrelease.htm |

| 8-K - 8-K - META FINANCIAL GROUP INC | cash-20210427.htm |

Q U A R T E R LY I N V E STO R U P D AT E S E C O N D Q U A R T E R F I S C A L Y E A R 2 0 2 1

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH F O R WA R D - LO O K I N G STAT E M E N TS 2 This investor update contains “forward-looking statements” which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” or the negative of those terms, or other words of similar meaning or similar expressions. These forward-looking statements are based on information currently available to us and assumptions about future events, and include statements with respect to the Company’s beliefs, expectations, estimates, and intentions, which are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the Company’s control. Such risks, uncertainties and other factors may cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Such statements address, among others, the following subjects: future operating results; expectations in connection with the impact of the ongoing COVID-19 pandemic and related government actions on our business, our industry and the capital markets; customer retention; loan and other product demand; expectations concerning acquisitions and divestitures; new products and services, including those offered by Meta Payment Systems, Refund Advantage, EPS Financial and Specialty Consumer Services divisions; credit quality; the level of net charge-offs and the adequacy of the allowance for loan and lease losses; technology; and the Company's employees. The following factors, among others, could cause the Company's financial performance and results of operations to differ materially from the expectations, estimates, and intentions expressed in such forward-looking statements: maintaining our executive management team; expected growth opportunities may not be realized or may take longer to realize than expected; the potential adverse effects of the ongoing COVID-19 pandemic and any governmental or societal responses thereto, including the deployment and efficacy of the COVID-19 vaccines, or other unusual and infrequently occurring events; actual changes in interest rates and the Fed Funds rate; additional changes in tax laws; the strength of the United States' economy, in general, and the strength of the local economies in which the Company operates; changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Federal Reserve; inflation, market, and monetary fluctuations; the timely and efficient development of, and acceptance of, new products and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto, and the perceived overall value of these products and services by users; the risks of dealing with or utilizing third parties, including, in connection with the Company’s refund advance business, the risk of reduced volume of refund advance loans as a result of reduced customer demand for or usage of the Company’s strategic partners’ refund advance products; our relationship with, and any actions which may be initiated by, our regulators; the impact of changes in financial services laws and regulations, including, but not limited to, laws and regulations relating to the tax refund industry and the insurance premium finance industry and recent and potential changes in response to the COVID-19 pandemic such as the CARES Act and the rules and regulations that may be promulgated thereunder; technological changes, including, but not limited to, the protection of our electronic systems and information; the impact of acquisitions and divestitures; litigation risk; the growth of the Company’s business, as well as expenses related thereto; continued maintenance by MetaBank of its status as a well-capitalized institution, changes in consumer spending and saving habits; the impact of our participation as prepaid card issuer for the Economic Impact Payment (“EIP”) program and potential similar programs in the future, losses from fraudulent or illegal activity, technological risks and developments and cyber threats, attacks or events; the success of the Company at maintaining its high quality asset level and managing and collecting assets of borrowers in default should problem assets increase; and the other factors described under the caption “Risk Factors” and in other sections of the Company’s Annual Report on Form 10-K for the Company's fiscal year ended September 30, 2020 and in other filings made by the Company with the Securities and Exchange Commission (“SEC”). The forward-looking statements included herein speak only as of the date of this investor update. The Company expressly disclaims any intent or obligation to update any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries, whether as a result of new information, changed circumstances or future events or for any other reason.

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH3 W E A R E A F I N A N C I A L E N A B L E M E N T C O M P A N Y We work with innovators to increase financial availability, choice, and opportunity for all. We strive to remove barriers that traditional institutions put in the way of financial access, and promote economic mobility by providing responsible, secure, high quality financial products that contribute to individuals and communities at the core of the real economy. We work to disrupt traditional banking norms by developing partnerships with fintechs and finservs, affinity groups, government agencies, and other banks to make a range of quality financial products and services available to the communities we serve nationally. Our national bank charter, coordination with regulators, and deep understanding of risk mitigation and compliance allows us to guide our partners and deliver the financial products and services that meet the needs of those who need them most. We believe in financial inclusion for all®.

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH B A N K I N G A S A S E R V I C E ( “ B a a S ” ) 4 D I F F E R E N T I AT E D B U S I N E S S L I N E S W I T H S I G N I F I C A N T G RO W T H O P P O R T U N I T I E S C O M M E R C I A L F I N A N C E Enables fintechs, finservs, and various organizations by issuing prepaid cards, deposit accounts, and payment related transactions to consumers. Directly enables small and medium-sized businesses, as well as large enterprises, with flexible capital solutions P A Y M E N T S T A X S E R V I C E S C O N S U M E R F I N A N C EM E T A V E N T U R E S Enables tax preparation firms to provide underbanked consumers with access to electronic tax payments and refund advances. Enables consumers to better control their financial futures with empowered spending and reliable access to funds. Enables emerging and strategic companies that align with our mission and contribute to our goal of bringing financial inclusion for all®. 47% Net Interest Income $266.5 Payments Fee Income $95.2 Tax Product Income $76.8 Rental Income $41.1 Other Income $27.6 R E V E N U E M A K E U P L A S T T W E L V E M O N T H S E N D I N G M A R C H 3 1 , 2 0 2 1 ($ in millions) Noninterest Income as a percent of Total Revenue in LTM ending March 31, 2021

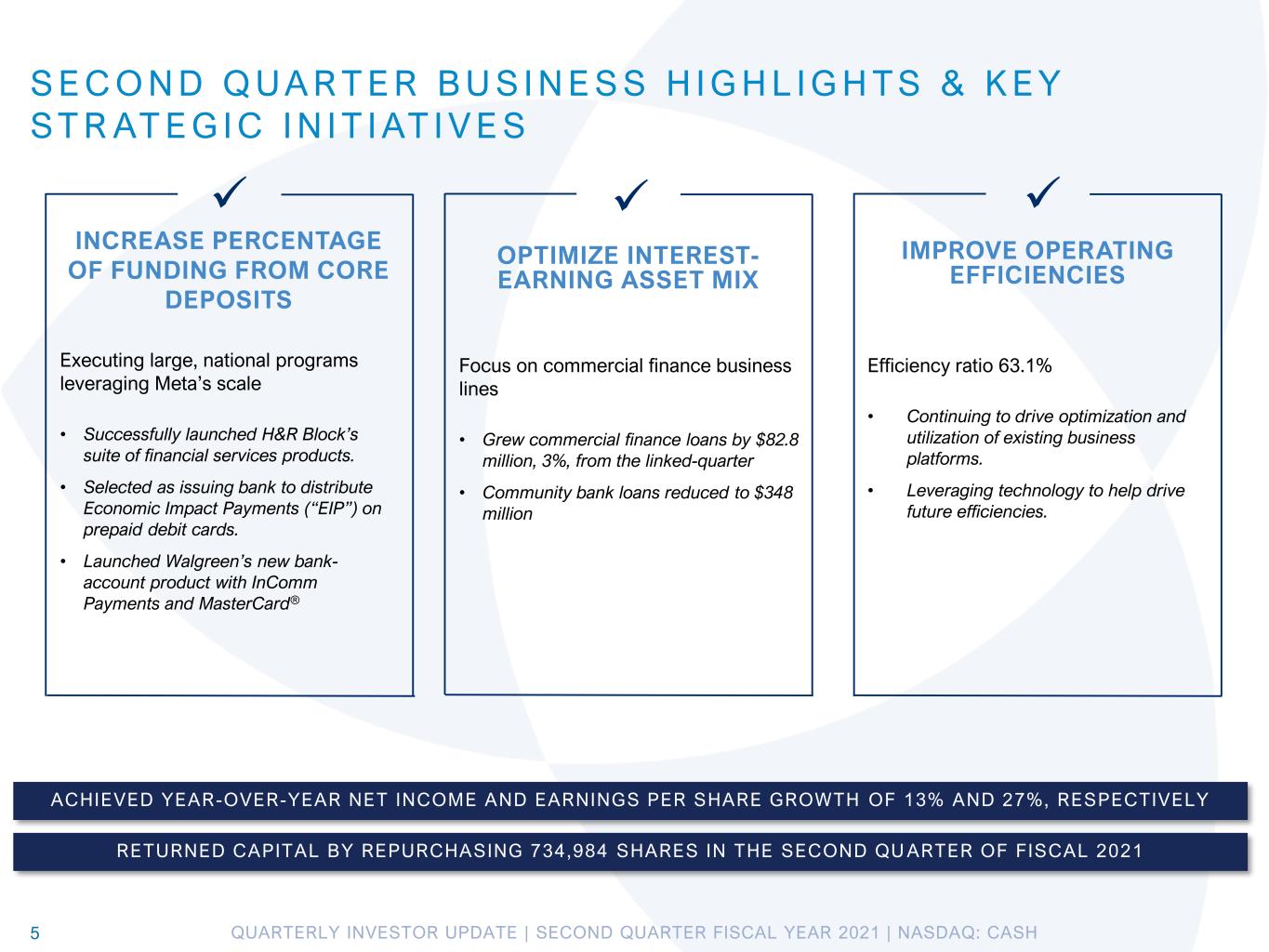

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH5 INCREASE PERCENTAGE OF FUNDING FROM CORE DEPOSITS OPTIMIZE INTEREST- EARNING ASSET MIX IMPROVE OPERATING EFFICIENCIES Efficiency ratio 63.1% • Continuing to drive optimization and utilization of existing business platforms. • Leveraging technology to help drive future efficiencies. ACHIEVED YEAR-OVER-YEAR NET INCOME AND EARNINGS PER SHARE GROWTH OF 13% AND 27%, RESPECTIVELY Executing large, national programs leveraging Meta’s scale • Successfully launched H&R Block’s suite of financial services products. • Selected as issuing bank to distribute Economic Impact Payments (“EIP”) on prepaid debit cards. • Launched Walgreen’s new bank- account product with InComm Payments and MasterCard® RETURNED CAPITAL BY REPURCHASING 734,984 SHARES IN THE SECOND QU ARTER OF FISCAL 2021 Focus on commercial finance business lines • Grew commercial finance loans by $82.8 million, 3%, from the linked-quarter • Community bank loans reduced to $348 million S E C O N D Q UA R T E R B U S I N E S S H I G H L I G H TS & K E Y ST R AT E G I C I N I T I AT I V E S ✓ ✓✓

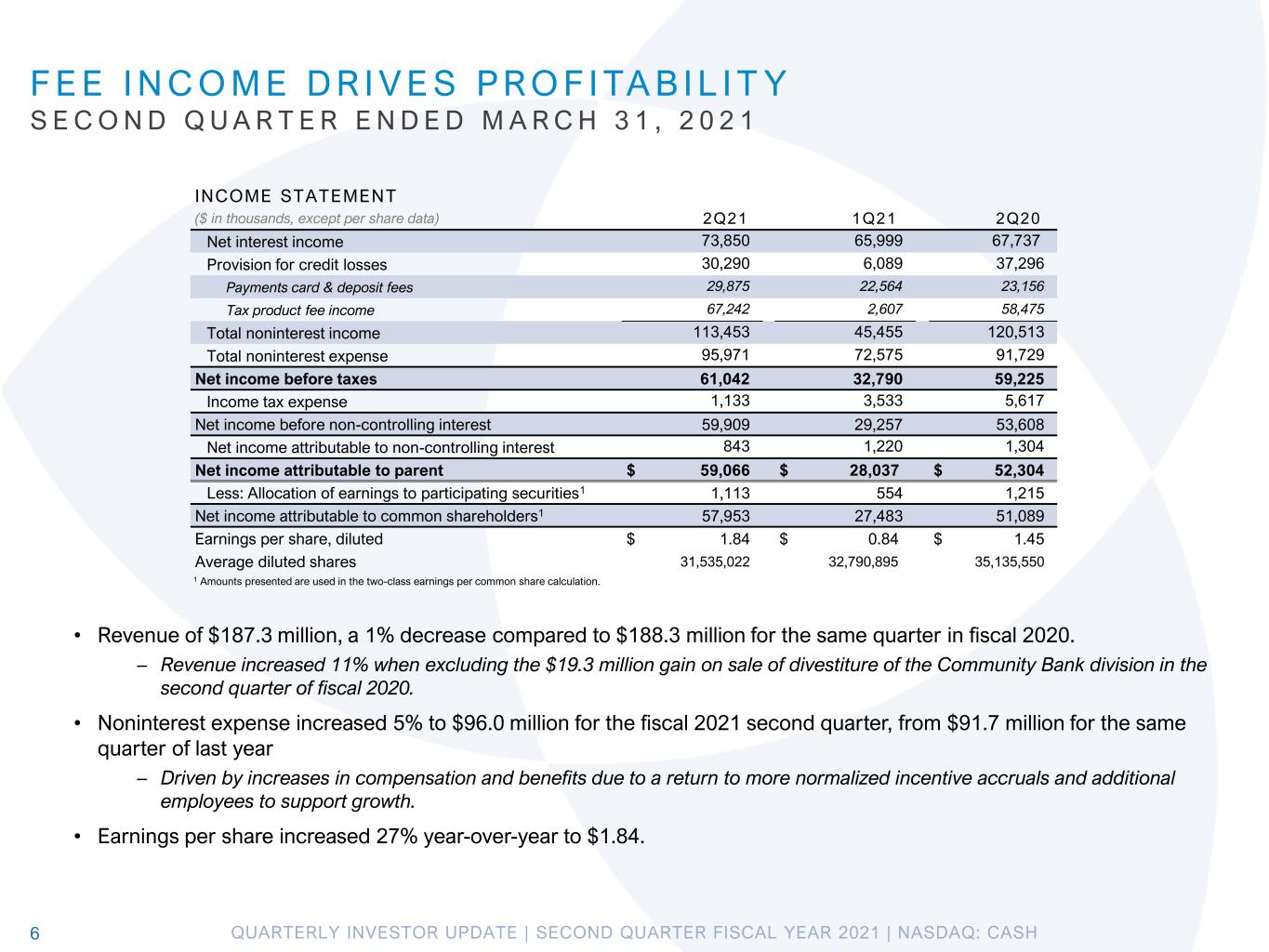

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH6 F E E I N C O M E D R I V E S P RO F I TA B I L I T Y S E C O N D Q U A R T E R E N D E D M A R C H 3 1 , 2 0 2 1 INCOME STATEMENT ($ in thousands, except per share data) 2Q21 1Q21 2Q20 Net interest income 73,850 65,999 67,737 Provision for credit losses 30,290 6,089 37,296 Payments card & deposit fees 29,875 22,564 23,156 Tax product fee income 67,242 2,607 58,475 Total noninterest income 113,453 45,455 120,513 Total noninterest expense 95,971 72,575 91,729 Net income before taxes 61,042 32,790 59,225 Income tax expense 1,133 3,533 5,617 Net income before non-controlling interest 59,909 29,257 53,608 Net income attributable to non-controlling interest 843 1,220 1,304 Net income attributable to parent $ 59,066 $ 28,037 $ 52,304 Less: Allocation of earnings to participating securities1 1,113 554 1,215 Net income attributable to common shareholders1 57,953 27,483 51,089 Earnings per share, diluted $ 1.84 $ 0.84 $ 1.45 Average diluted shares 31,535,022 32,790,895 35,135,550 • Revenue of $187.3 million, a 1% decrease compared to $188.3 million for the same quarter in fiscal 2020. – Revenue increased 11% when excluding the $19.3 million gain on sale of divestiture of the Community Bank division in the second quarter of fiscal 2020. • Noninterest expense increased 5% to $96.0 million for the fiscal 2021 second quarter, from $91.7 million for the same quarter of last year – Driven by increases in compensation and benefits due to a return to more normalized incentive accruals and additional employees to support growth. • Earnings per share increased 27% year-over-year to $1.84. 1 Amounts presented are used in the two-class earnings per common share calculation.

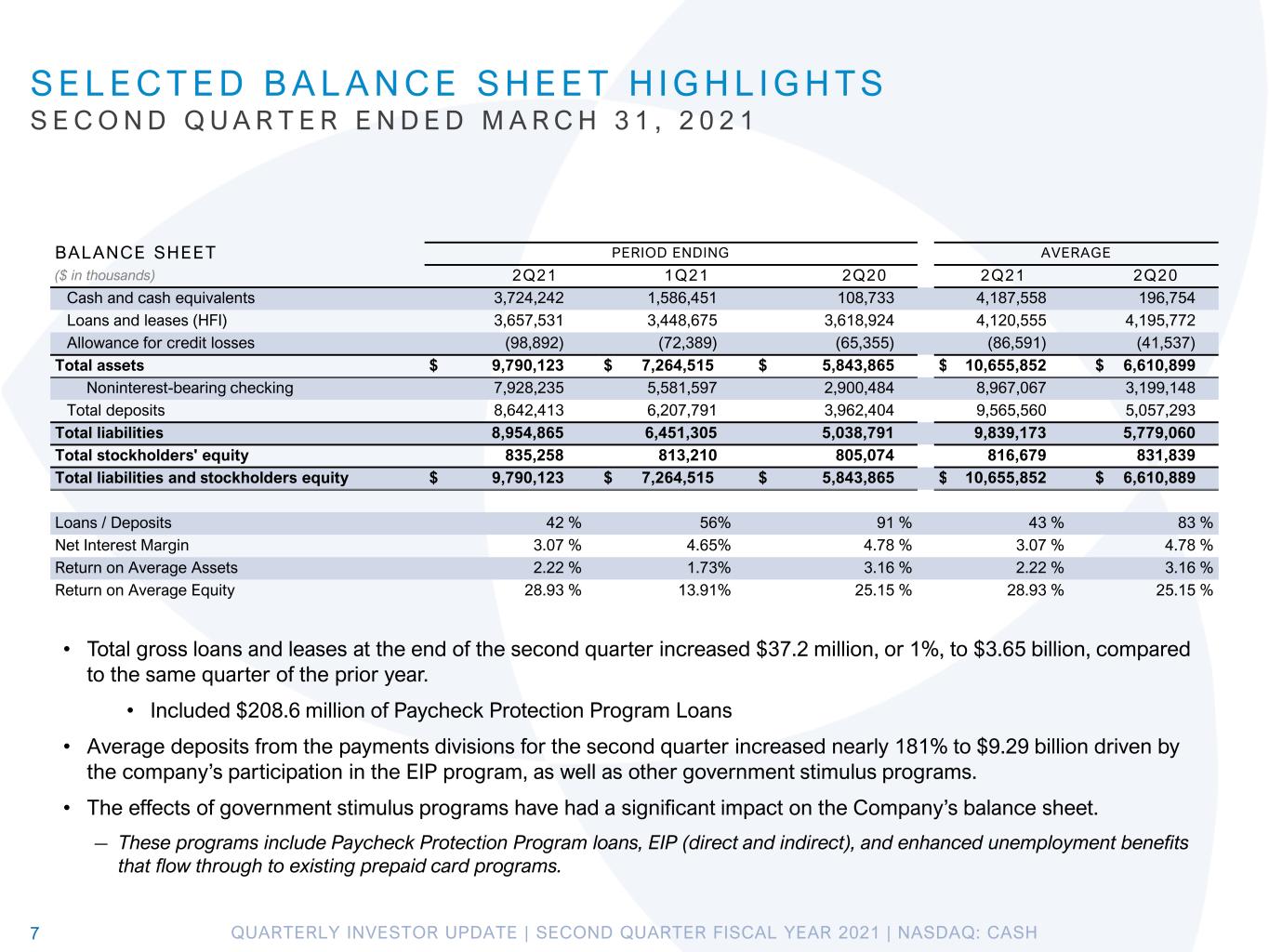

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH7 S E L E C T E D B A L A N C E S H E E T H I G H L I G H TS S E C O N D Q U A R T E R E N D E D M A R C H 3 1 , 2 0 2 1 BALANCE SHEET PERIOD ENDING AVERAGE ($ in thousands) 2Q21 1Q21 2Q20 2Q21 2Q20 Cash and cash equivalents 3,724,242 1,586,451 108,733 4,187,558 196,754 Loans and leases (HFI) 3,657,531 3,448,675 3,618,924 4,120,555 4,195,772 Allowance for credit losses (98,892) (72,389) (65,355) (86,591) (41,537) Total assets $ 9,790,123 $ 7,264,515 $ 5,843,865 $ 10,655,852 $ 6,610,899 Noninterest-bearing checking 7,928,235 5,581,597 2,900,484 8,967,067 3,199,148 Total deposits 8,642,413 6,207,791 3,962,404 9,565,560 5,057,293 Total liabilities 8,954,865 6,451,305 5,038,791 9,839,173 5,779,060 Total stockholders' equity 835,258 813,210 805,074 816,679 831,839 Total liabilities and stockholders equity $ 9,790,123 $ 7,264,515 $ 5,843,865 $ 10,655,852 $ 6,610,889 Loans / Deposits 42 % 56% 91 % 43 % 83 % Net Interest Margin 3.07 % 4.65% 4.78 % 3.07 % 4.78 % Return on Average Assets 2.22 % 1.73% 3.16 % 2.22 % 3.16 % Return on Average Equity 28.93 % 13.91% 25.15 % 28.93 % 25.15 % • Total gross loans and leases at the end of the second quarter increased $37.2 million, or 1%, to $3.65 billion, compared to the same quarter of the prior year. • Included $208.6 million of Paycheck Protection Program Loans • Average deposits from the payments divisions for the second quarter increased nearly 181% to $9.29 billion driven by the company’s participation in the EIP program, as well as other government stimulus programs. • The effects of government stimulus programs have had a significant impact on the Company’s balance sheet. — These programs include Paycheck Protection Program loans, EIP (direct and indirect), and enhanced unemployment benefits that flow through to existing prepaid card programs.

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH 74% 23% 3% 35% 19% 10% 42% 15% 43% D I V E R S I F I E D E A R N I N G AS S E T P O R T FO L I O 8 QUARTERLY AVERAGE EARNING ASSET MIX MAR 2020 $5.70 billion INTEREST EARNING ASSETS 25% 4% 6% MAR 2021 $9.77 billion INTEREST EARNING ASSETS CASH & FED FUNDSINVESTMENTSLOANS & LEASES Commercial Community Bank Consumer & Warehouse % in charts represent % of total interest earning assets ASPIRATIONAL TARGETS >55% 0% <15% At the Quarter Ended March 31, 2021 March 31, 2020 ($ in thousands) 2 Q 2 1 2 Q 2 0 Y/Y Δ COMMERCIAL FINANCE 2,505,922 2,026,347 24% Term lending 891,414 725,581 23% Asset-based lending 248,735 250,211 (1)% Factoring 277,612 285,495 (3)% Lease financing 308,169 238,788 29% Insurance premium finance 344,841 332,800 4% SBA/USDA¹ 331,917 92,000 261% Other commercial finance 103,234 101,472 2% CONSUMER FINANCE 235,664 258,439 (9)% Consumer credit programs 104,842 113,544 (8)% Other consumer finance 130,822 144,895 (10)% TAX SERVICES 225,921 95,936 135% WAREHOUSE FINANCE 332,456 333,829 0% NATIONAL LENDING 3,299,963 2,714,551 22% COMMUNITY BANKING 348,065 896,234 (61)% TOTAL GROSS LOANS & LEASES HFI 3,648,028 3,610,785 1% TOTAL GROSS LOANS & LEASES HFS 67,635 13,610 397% CASH & INVESTMENTS 5,207,223 1,416,095 268% TOTAL EARNING ASSETS 8,922,886 5,040,490 77% RENTAL EQUIPMENT, NET 211,397 200,837 5% 1 Includes balances of $208.6 million in Paycheck Protection Program loans at March 31, 2021.

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH9 E N V I RO N M E N TA L , S O C I A L , A N D G OV E R N A N G E ( “ E S G ” ) Our mission, financial inclusion for all®, is about equal access to financial opportunity and is inherently ESG oriented. Every day, our team members work to help individuals and organizations improve their economic status and set themselves on secure paths for growth and financial stability. HIRED CHIEF PEOPLE AND INCLUSION OFFICER COMPLETED MATERIALITY ASSESSMENT ON TRACK TO PUBLISH ESG ANNUAL REPORT IN FISCAL Q3 P R O G R E S S O N E S G E F F O R T S D U R I N G T H E Q U A R T E R

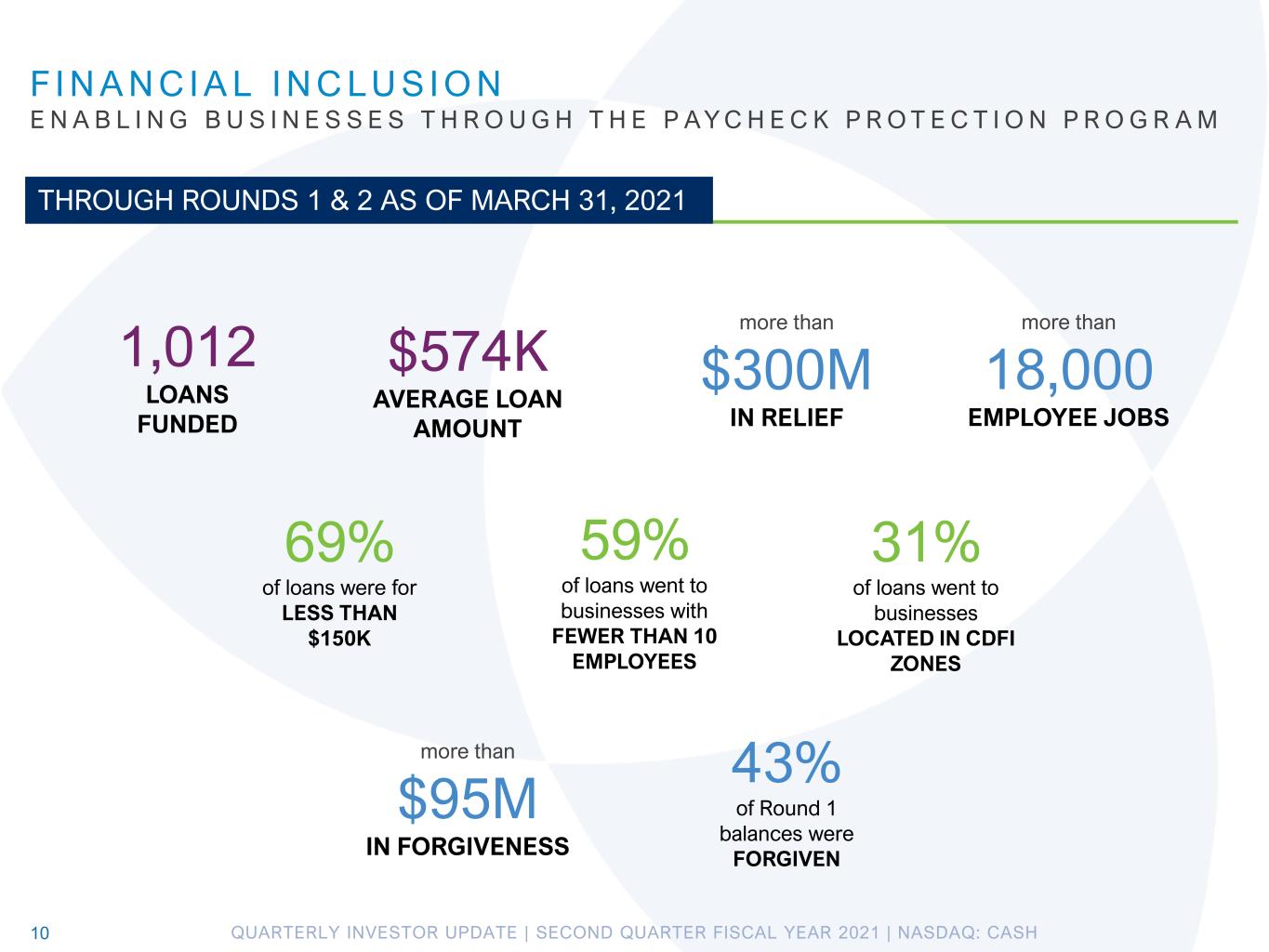

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH F I N A N C I A L I N C LU S I O N E N A B L I N G B U S I N E S S E S T H R O U G H T H E P AY C H E C K P R O T E C T I O N P R O G R A M 10 more than $300M IN RELIEF more than 18,000 EMPLOYEE JOBS 1,012 LOANS FUNDED $574K AVERAGE LOAN AMOUNT 69% of loans were for LESS THAN $150K 59% of loans went to businesses with FEWER THAN 10 EMPLOYEES 31% of loans went to businesses LOCATED IN CDFI ZONES THROUGH ROUNDS 1 & 2 AS OF MARCH 31, 2021 more than $95M IN FORGIVENESS 43% of Round 1 balances were FORGIVEN

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH BANKING AS A SERVICE 11

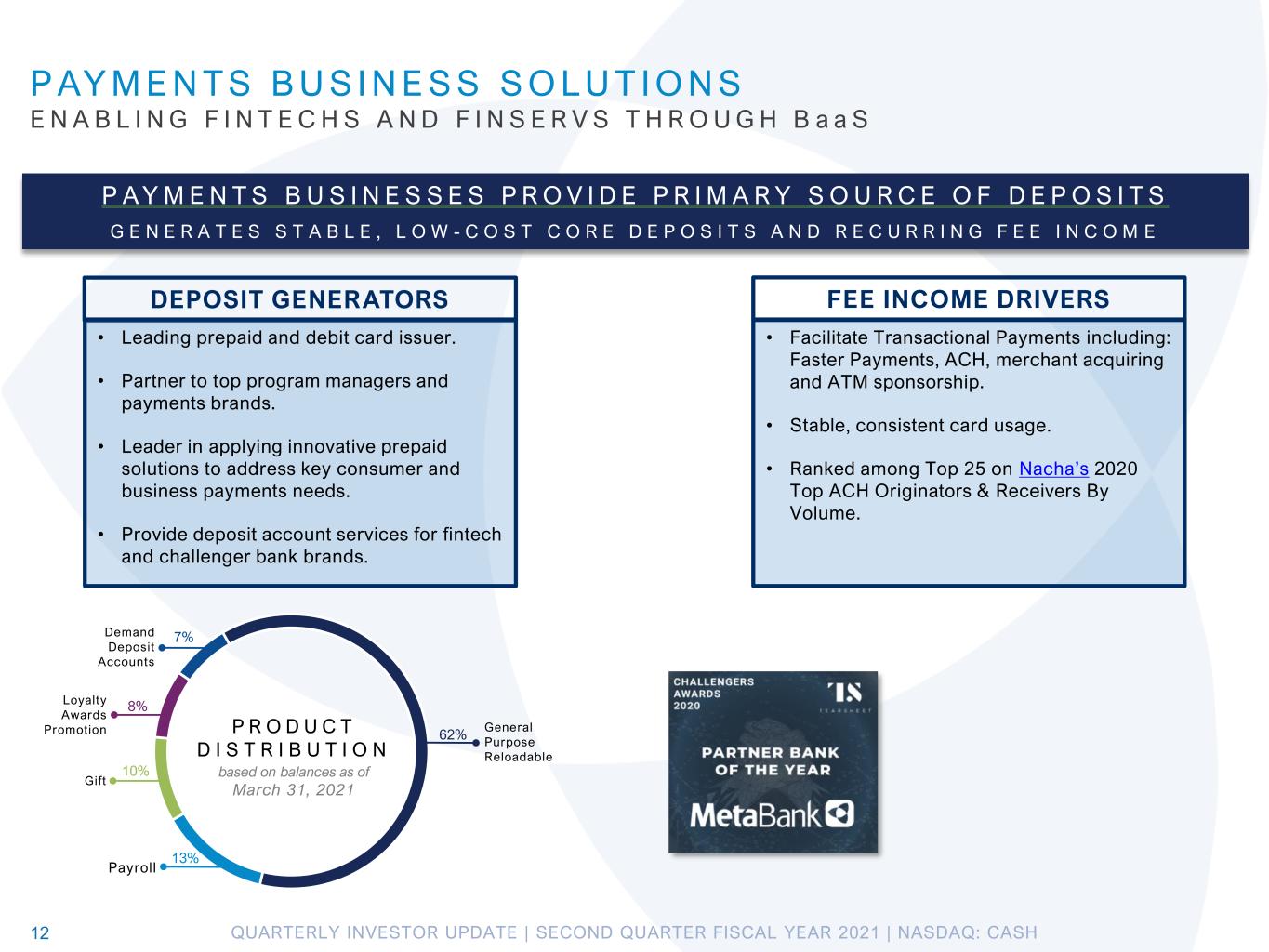

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH12 P AY M E N TS B U S I N E S S S O LU T I O N S E N A B L I N G F I N T E C H S A N D F I N S E R V S T H R O U G H B a a S DEPOSIT GENERATORS • Facilitate Transactional Payments including: Faster Payments, ACH, merchant acquiring and ATM sponsorship. • Stable, consistent card usage. • Ranked among Top 25 on Nacha’s 2020 Top ACH Originators & Receivers By Volume. P AY M E N T S B U S I N E S S E S P R O V I D E P R I M A R Y S O U R C E O F D E P O S I T S G E N E R A T E S S T A B L E , L O W - C O S T C O R E D E P O S I T S A N D R E C U R R I N G F E E I N C O M E • Leading prepaid and debit card issuer. • Partner to top program managers and payments brands. • Leader in applying innovative prepaid solutions to address key consumer and business payments needs. • Provide deposit account services for fintech and challenger bank brands. P R O D U C T D I S T R I B U T I O N based on balances as of March 31, 2021 General Purpose Reloadable Loyalty Awards Promotion Gift Payroll 10% 13% 62% 8% Demand Deposit Accounts 7% FEE INCOME DRIVERS

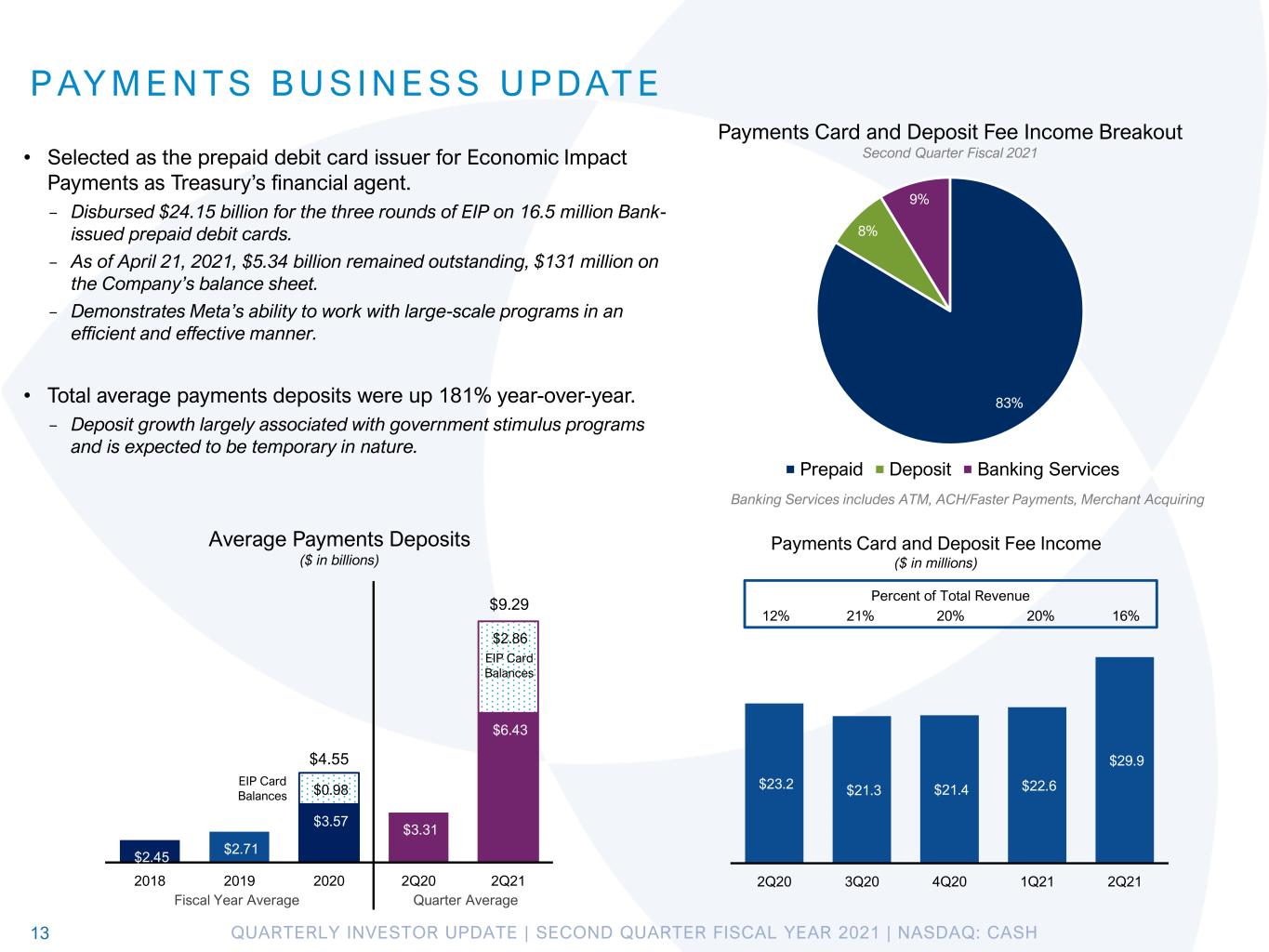

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH $2.45 $2.71 $3.57 $3.31 $6.43 $0.98 $2.86 2018 2019 2020 2Q20 2Q21 Average Payments Deposits ($ in billions) 13 P AY M E N TS B U S I N E S S U P DAT E • Selected as the prepaid debit card issuer for Economic Impact Payments as Treasury’s financial agent. – Disbursed $24.15 billion for the three rounds of EIP on 16.5 million Bank- issued prepaid debit cards. – As of April 21, 2021, $5.34 billion remained outstanding, $131 million on the Company’s balance sheet. – Demonstrates Meta’s ability to work with large-scale programs in an efficient and effective manner. • Total average payments deposits were up 181% year-over-year. – Deposit growth largely associated with government stimulus programs and is expected to be temporary in nature. $23.2 $21.3 $21.4 $22.6 $29.9 2Q20 3Q20 4Q20 1Q21 2Q21 Payments Card and Deposit Fee Income ($ in millions) Percent of Total Revenue 12% 21% 20% 20% 16% 83% 8% 9% Prepaid Deposit Banking Services Banking Services includes ATM, ACH/Faster Payments, Merchant Acquiring Payments Card and Deposit Fee Income Breakout Second Quarter Fiscal 2021 Quarter AverageFiscal Year Average EIP Card Balances EIP Card Balances $9.29 $4.55

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH14 TA X S E AS O N U P DAT E 2 0 2 1 Refund advances (“RAs”) and refund-transfers (“RTs”) leverage BaaS infrastructure and are core to MetaBank’s mission, as they allow consumers quicker access to their money. • RA originations of $1.79 billion compared to $1.33 billion in the 2020 tax season. – 2021 tax season benefited by the addition of H&R Block relationship – Approximate average loan size of $1,323 compared to $1,355 in 2020 • RT volumes and RT product income for the overall tax season expected to be similar to last year. 1 Approximate loss rate calculated by taking provision for loan & lease losses divided by total refund advance originations. TAX SERVICES ECONOMICS Three Months Ended Six Months Ended $ in millions March 31, 2021 March 31, 2020 % Change March 31, 2021 March 31, 2020 % Change Net interest income (expense) (0.29) (1.36) (8)% (0.34) (1.33) (74.8)% Tax advance product income 44.56 29.54 50.9% 46.52 31.81 46.2% RT product income 22.68 28.94 (21.6)% 23.33 29.13 (19.9)% Total revenue $ 66.95 $ 57.12 17.2% $ 69.51 $ 59.61 16.6% Total expense 8.34 9.15 (8.9)% 8.77 10.45 (16.1)% Provision for credit losses 27.68 19.60 41.3% 28.13 20.51 37.2% Net income, pre-tax $ 30.93 $ 28.37 9.1% $ 32.61 $ 28.65 13.8% Total refund advance originations $ 1,727 $ 1,258 37% $ 1,792 $ 1,335 34% Approximate loss rate¹ (6 months) 1.57 % 1.54 % 2% RELATIONSHIPS WITH FRANCHISES (H&R BLOCK, JACKSON HEWITT) RELATIONSHIPS WITH INDEPENDENTS (META TAX) Tax Season at MetaBank ramps up during the first fiscal quarter and peaks during the second fiscal quarter. As a result, performance for the six months ended March 31 is a better reflection on the overall performance for tax season as it alleviates timing differences between quarters.

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH15 M E TA V E N T U R E S | E STA B L I S H E D 2 0 1 7 Formed for the purpose of making strategic minority equity investments¹ in companies or funds in the fintech and financial services industries that are aligned with our mission of financial inclusion for all® and are potential MetaBank customers. ¹Total committed capital is limited to 15% of Risk Based Capital, economics and performances of investments are not material to the Company as of March 31, 2021. $25.9M C O M M I T E D C A P I T A L March 31, 2021 STRATEGY DRIVEN INVESTMENT VERTICALS POTENTIAL PARTNERS | LEAD GENERATION | TECHNOLOGY | ESG 17 T O T A L C O M P A N I E S I N V E S T E D I N INVESTMENTS INCLUDE

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH COMMERCIAL F INANCE & LEGACY COMMUNIT Y BANK PORTFOLIO 16

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH TERM LENDING. Collateralized conventional term loans and notes receivable, weighted average life of 53 months. Exposure is concentrated in solar/alternative energy, most of which are construction projects that will convert to longer term government guaranteed facilities upon completion. Also includes equipment financing relationships, through equipment finance agreements and installment purchase agreements. Average loan size approximately $180 thousand; small ticket equipment finance approximately $70 thousand ASSET-BASED LENDING. Asset-based loans secured by accounts receivable, inventory, machinery & equipment, work-in-process and other assets. Approximately 70% backed by accounts receivable, generally 85% advance rates. Exposure managed within a collateral borrowing base. Well diversified in terms of industry and geographic concentrations. Average loan size approximately $1.8 million. FACTORING. Factoring services where clients provide detailed inventory, accounts receivable, and work-in-process reports for lending arrangements. Bank secures dominion of funds which secures repayment when applicable accounts receivables or invoices are paid. Approximately 95% backed by accounts receivable, generally 85% advance rates. Average loan size approximately $325 thousand. LEASE FINANCING. Leasing solutions for technology, capital equipment and select transportation assets like tractors, trailers and construction equipment. Majority of portfolio relationships are to Fortune 1000 clients. Average lease size approximately $170 thousand. INSURANCE PREMIUM FINANCE. Short-term, primarily collateralized financing to facilitate the purchase of commercial insurance for various forms of risk. Over 90% of insurance company partners have an investment grade rating through AM Best as well as an internal risk rating system. Average loan size approximately $30 thousand. SBA/USDA. Originate loans through SBA or USDA programs, primarily SBA 7(a), USDA B&I, USDA REAP. Focus on specific verticals such as investment advisory practices, insurance agencies and solar. Includes $208.6 million of PPP loans. Average loan size approximately $770 thousand, excluding PPP loans. OTHER COMMERCIAL FINANCE. Includes healthcare receivables loan portfolio primarily comprised of loans to individuals for medical services received. Majority of these loans are guaranteed by the referring hospital. RENTAL EQUIPMENT. Leased assets related to operating leases generated from the commercial finance business line. Primarily consists of solar panels, motor vehicles, and computers and IT networking equipment. C O M M E R C I A L F I N A N C E LO A N A N D L E AS E P O R T FO L I O 17 Top geographic state concentrations1 by % 1. California 16.6% 2. Texas 11.1% 3. Michigan 7.5% 4. Florida 6.5% 5. North Carolina 5.1% 6. Illinois 4.6% 7. New York 4.2% 8. Pennsylvania 3.5% 1 Excludes certain joint ventures; percentages calculated based on aggregate principal amount of commercial finance loans and leases includes operating lease rental equipment of $211.4M $2.72 billion COMMERCIAL FINANCE PORTFOLIO (includes Rental Equipment, net) as of March 31, 2021 Asset-Based Lending $248.7M 9.80% SBA/USDA $331.9M 4.69% Other $103.2M 7.41% Factoring $277.6M 14.05% Insurance Premium Finance $344.8M 5.40% Term Lending $891.4M 6.93% 7.60% 2Q21 Quarterly Yield % in chart represents current quarter yield Rental Equipment, net $211.4M NA% Lease Financing $308.2M 8.50% Small ticket equipment financing $263.5M Solar/alternative energy $273.5M Equipment financing $158.8M Wealth management/ insurance $126.1M Other $69.5M

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH D I ST R I B U T I O N O F C O M M E R C I A L F I N A N C E P O R T F O L I O B Y I N D U ST RY ¹ 18 1 Distribution by NAICS codes; excludes certain joint ventures; percentages calculated based on aggregate principal amount of commercial finance loans and leases includes operating lease rental equipment of $211.4M Manufacturing Utilities Transportation and Warehousing Wholesale Trade Finance and Insurance Health Care and Social Assistance Construction Admin and Support and Waste Mgmt and Remediation Services Mining, Quarrying, and Oil and Gas Extraction Other Professional, Scientific, and Technical Services Retail Trade Real Estate and Rental and Leasing Accommodation and Food Services Other Services (except Public Administration) Information Arts, Entertainment, and Recreation Agriculture, Forestry, Fishing and Hunting Educational Services Management of Companies and Enterprises Public Administration $- $100 $200 $300 $400 $500 $ in millions MANUFACTURING 25% Asset-based lending 24% Lease financing 20% Term Lending 11% SBA/USDA 9% Factoring TRANSPORTATION & WAREHOUSING 37% Factoring 28% Term lending 21% Insurance premium finance UTILIT IES 54% Term lending 25% SBA/USDA 15% Rental equipment, net OIL & GAS 36% Term lending 23% SBA/USDA 22% Factoring 9% Lease financing

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH Outstanding Balance % of Total² MANUFACTURING $446.0 11.6% Computer and Electronic Product Manufacturing 67.3 1.7% Fabricated Metal Product Manufacturing 52.1 1.3% Transportation Equipment Manufacturing 48.9 1.3% Machinery Manufacturing 42.8 1.1% Nonmetallic Mineral Product Manufacturing 40.6 1.1% Electrical Equipment, Appliance, and Component Mfg 36.7 1.0% Chemical Manufacturing 30.9 0.8% Plastics and Rubber Products Manufacturing 30.5 0.8% Printing and Related Support Activities 25.1 0.7% Food Manufacturing 24.0 0.6% Other³ 47.1 1.2% Solar Electric Power Generation Other Utilities C O M M E R C I A L F I N A N C E M I X ¹ 19 1 Excludes certain joint ventures; percentages calculated based on aggregate principal amount of loans includes operating lease rental equipment of $211.4M ² Total includes total gross loans & leases of $3.65 billion and rental equipment, net of $211.4M, as of March 31, 2021, exposures are based on current outstanding balances as of March 31, 2021 3 Other includes manufacturing subsectors comprised of less than 0.5% of total² • $46.2 million exposure related to support activities for Oil & Gas Operations - Approximately half of outstandings are in working capital lines, primarily collateralized by accounts receivable, remaining collateralized by machinery and equipment • Limited exposure to single borrowers • Diversified across multiple subsectors – greatest concentration of subsectors is 1.7% of total² • 98% of Utilities exposure is to Solar Electric Power Generation, majority of which is related to permanent solar generators. • Well collateralized, majority backed by power purchase agreements with highly rated, large public utilities • $250.8 million exposure to truck transportation, over 88% in general freight trucking. • Receive invoices and back-up, verify a portion of the purchases and monitor these accounts under a Dominion of Funds to ensure that our balances are covered by collateral MANUFACTURING UTILITIES TRANSPORTATION & WAREHOUSING OIL & GAS Total Exposure $399.2 million % of Total² 10.3% Total Exposure $446.0 million % of Total² 11.6% Total Exposure $442.0 million % of Total² 11.5% Total Exposure $51.4 million % of Total² 1.3%

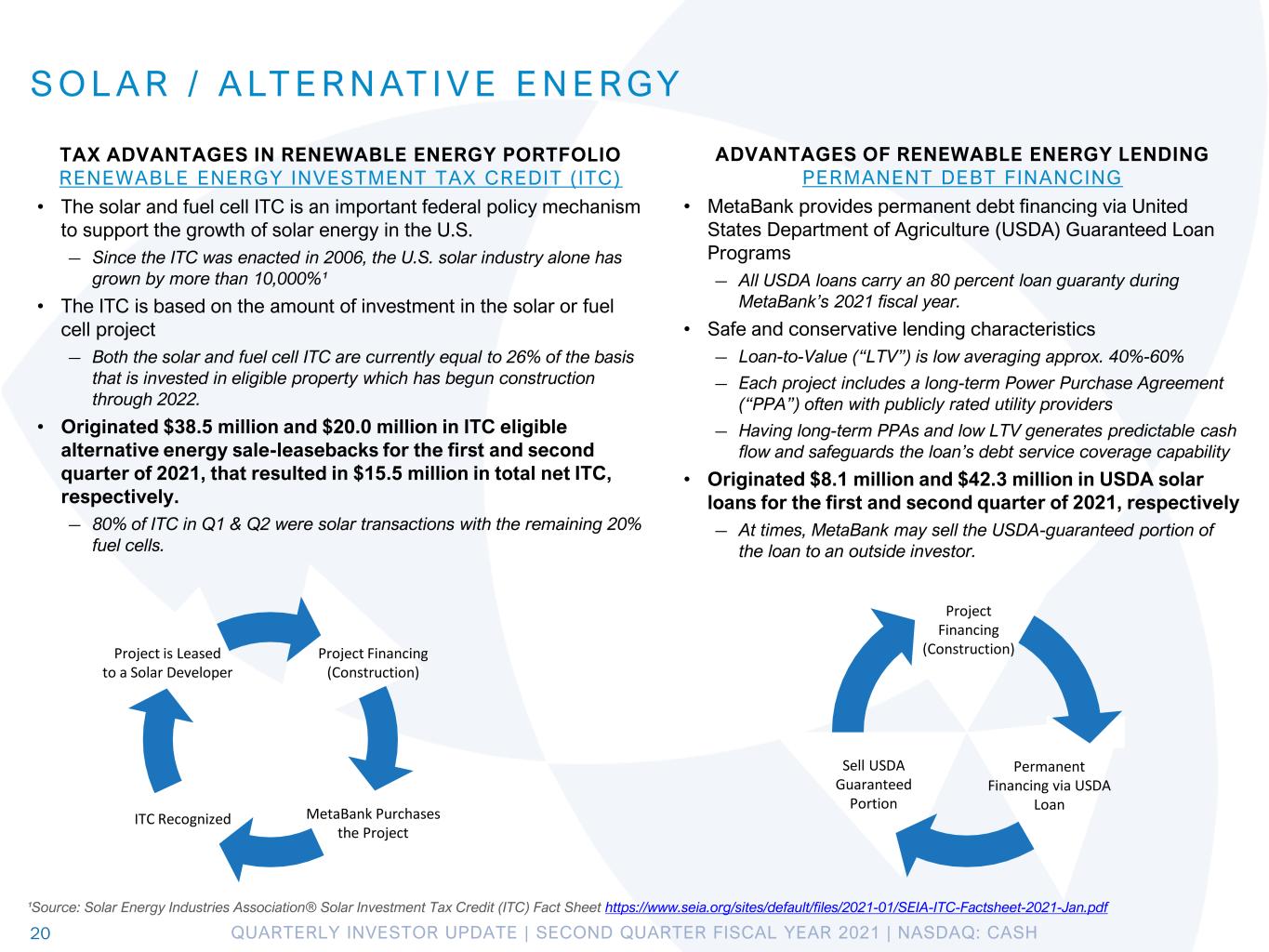

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH S O L A R / A LT E R N AT I V E E N E R GY 20 Project is Leased to a Solar Developer Project Financing (Construction) MetaBank Purchases the Project ITC Recognized TAX ADVANTAGES IN RENEWABLE ENERGY PORTFOLIO RENEWABLE ENERGY INVESTMENT TAX CREDIT (ITC) • The solar and fuel cell ITC is an important federal policy mechanism to support the growth of solar energy in the U.S. — Since the ITC was enacted in 2006, the U.S. solar industry alone has grown by more than 10,000%¹ • The ITC is based on the amount of investment in the solar or fuel cell project — Both the solar and fuel cell ITC are currently equal to 26% of the basis that is invested in eligible property which has begun construction through 2022. • Originated $38.5 million and $20.0 million in ITC eligible alternative energy sale-leasebacks for the first and second quarter of 2021, that resulted in $15.5 million in total net ITC, respectively. — 80% of ITC in Q1 & Q2 were solar transactions with the remaining 20% fuel cells. Project Financing (Construction) Permanent Financing via USDA Loan Sell USDA Guaranteed Portion ADVANTAGES OF RENEWABLE ENERGY LENDING PERMANENT DEBT FINANCING • MetaBank provides permanent debt financing via United States Department of Agriculture (USDA) Guaranteed Loan Programs — All USDA loans carry an 80 percent loan guaranty during MetaBank’s 2021 fiscal year. • Safe and conservative lending characteristics — Loan-to-Value (“LTV”) is low averaging approx. 40%-60% — Each project includes a long-term Power Purchase Agreement (“PPA”) often with publicly rated utility providers — Having long-term PPAs and low LTV generates predictable cash flow and safeguards the loan’s debt service coverage capability • Originated $8.1 million and $42.3 million in USDA solar loans for the first and second quarter of 2021, respectively — At times, MetaBank may sell the USDA-guaranteed portion of the loan to an outside investor. ¹Source: Solar Energy Industries Association® Solar Investment Tax Credit (ITC) Fact Sheet https://www.seia.org/sites/default/files/2021-01/SEIA-ITC-Factsheet-2021-Jan.pdf

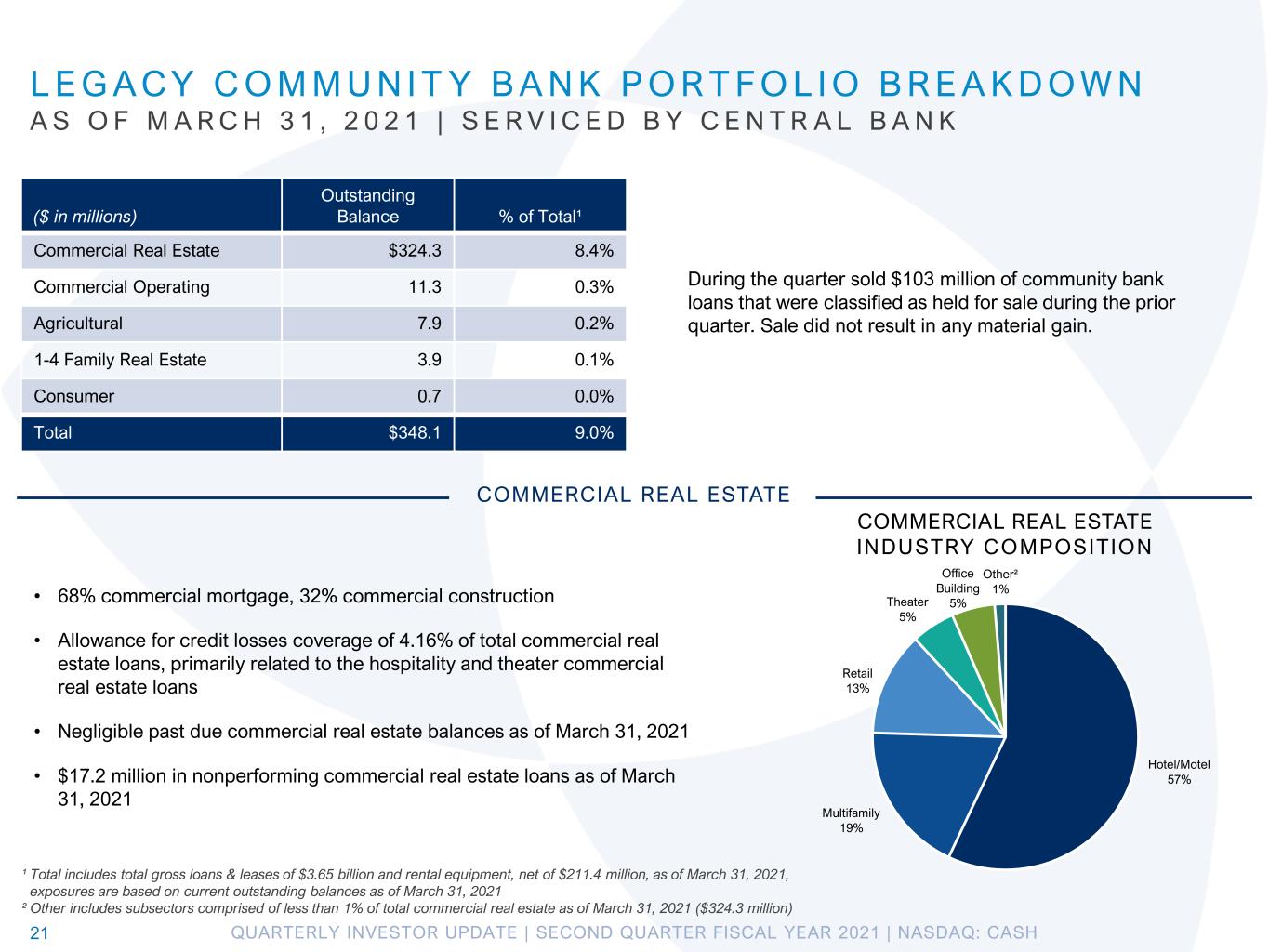

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH L E G ACY C O M M U N I T Y B A N K P O R T F O L I O B R E A K D O W N A S O F M A R C H 3 1 , 2 0 2 1 | S E R V I C E D B Y C E N T R A L B A N K 21 COMMERCIAL REAL ESTATE INDUSTRY COMPOSITION ($ in millions) Outstanding Balance % of Total¹ Commercial Real Estate $324.3 8.4% Commercial Operating 11.3 0.3% Agricultural 7.9 0.2% 1-4 Family Real Estate 3.9 0.1% Consumer 0.7 0.0% Total $348.1 9.0% • 68% commercial mortgage, 32% commercial construction • Allowance for credit losses coverage of 4.16% of total commercial real estate loans, primarily related to the hospitality and theater commercial real estate loans • Negligible past due commercial real estate balances as of March 31, 2021 • $17.2 million in nonperforming commercial real estate loans as of March 31, 2021 COMMERCIAL REAL ESTATE Hotel/Motel 57% Multifamily 19% Retail 13% Theater 5% Office Building 5% Other² 1% ¹ Total includes total gross loans & leases of $3.65 billion and rental equipment, net of $211.4 million, as of March 31, 2021, exposures are based on current outstanding balances as of March 31, 2021 ² Other includes subsectors comprised of less than 1% of total commercial real estate as of March 31, 2021 ($324.3 million) During the quarter sold $103 million of community bank loans that were classified as held for sale during the prior quarter. Sale did not result in any material gain.

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH L E G ACY C O M M U N I T Y B A N K | H OT E L P O R T F O L I O A S O F M A R C H 3 1 , 2 0 2 1 | S E R V I C E D B Y C E N T R A L B A N K 22 $191.4 million outstanding, total exposure of $194.4 million including unfunded commitments • $15.7 million related to construction. $185.0 million in commercial real estate and $6.4 million in C&I • Portfolio comprised of 28 relationships representing 31 individual hotels and 3,017 total rooms • 99% flagged hotel relationships (i.e. Holiday Inn Express, Hampton Inn, Hyatt Place, etc.); 100% limited-service • 24% of balances located in South Dakota and Iowa with majority of the remaining balances through developers headquartered in South Dakota and Iowa - Lower unemployment rate in Sioux Falls & Des Moines MSA, relative to National rates sign of stronger local economies • Majority of loans have guarantees by individuals with a strong combined net worth • Average loan-to-value of 60% at March 31, 2021 • No nonperforming loans as of March 31, 2021 COVID-19 Monitoring • Most hospitality loans that were on deferral are back to P&I payments • 8 hospitality loans upgraded from watch to pass during the quarter • Active COVID-related deferrals and modifications on $40.8 million in hospitality balances outstanding, working with borrowers on a case-by-case basis

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH ASSET QUALIT Y, INTEREST R ATE R ISK, & CAPITAL 23

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH AS S E T Q UA L I T Y 24 Credit quality remains strong. Allowance for credit losses (“ACL”) $98.9 million, or 2.70% of total loans and leases as of March 31, 2021. • ACL 228% of nonperforming loans • Legacy community bank hospitality and theater exposures ACL coverage of 5.70% • Small ticket equipment finance ACL coverage of 5.30% For fiscal 2021 second quarter, $2.7 million of NCOs were related to small ticket equipment finance relationships. Excludes Tax Services NCOs and Related Seasonal Average Loans Tax Services NCOs and related seasonal average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the tax services business line. 1 Non-GAAP measures, see appendix for reconciliations. $39.4 $56.1 $48.0 $53.2 $46.7 0.67% 0.64% 0.79% 0.73% 0.48% 2Q20 3Q20 4Q20 1Q21 2Q21 $ i n m il li o n s Period Ended Nonperforming Assets (“NPAs”) NPAs NPAs / Total Assets $31.5 $39.3 $34.0 $42.3 $43.5 0.87% 1.10% 0.97% 1.18% 1.17% 2Q20 3Q20 4Q20 1Q21 2Q21 $ i n m il li o n s Period Ended Nonperforming Loans (“NPLs”) NPLs NPLs / Total Loans $2.2 $4.9 $5.5 $3.8 $3.8 0.24% 0.55% 0.63% 0.44% 0.44% 2Q20 3Q20 4Q20 1Q21 2Q21 $ i n m il li o n s Period Ended Adjusted Net Charge-Offs (“NCOs”)¹ NCOs NCOs / Average Loans

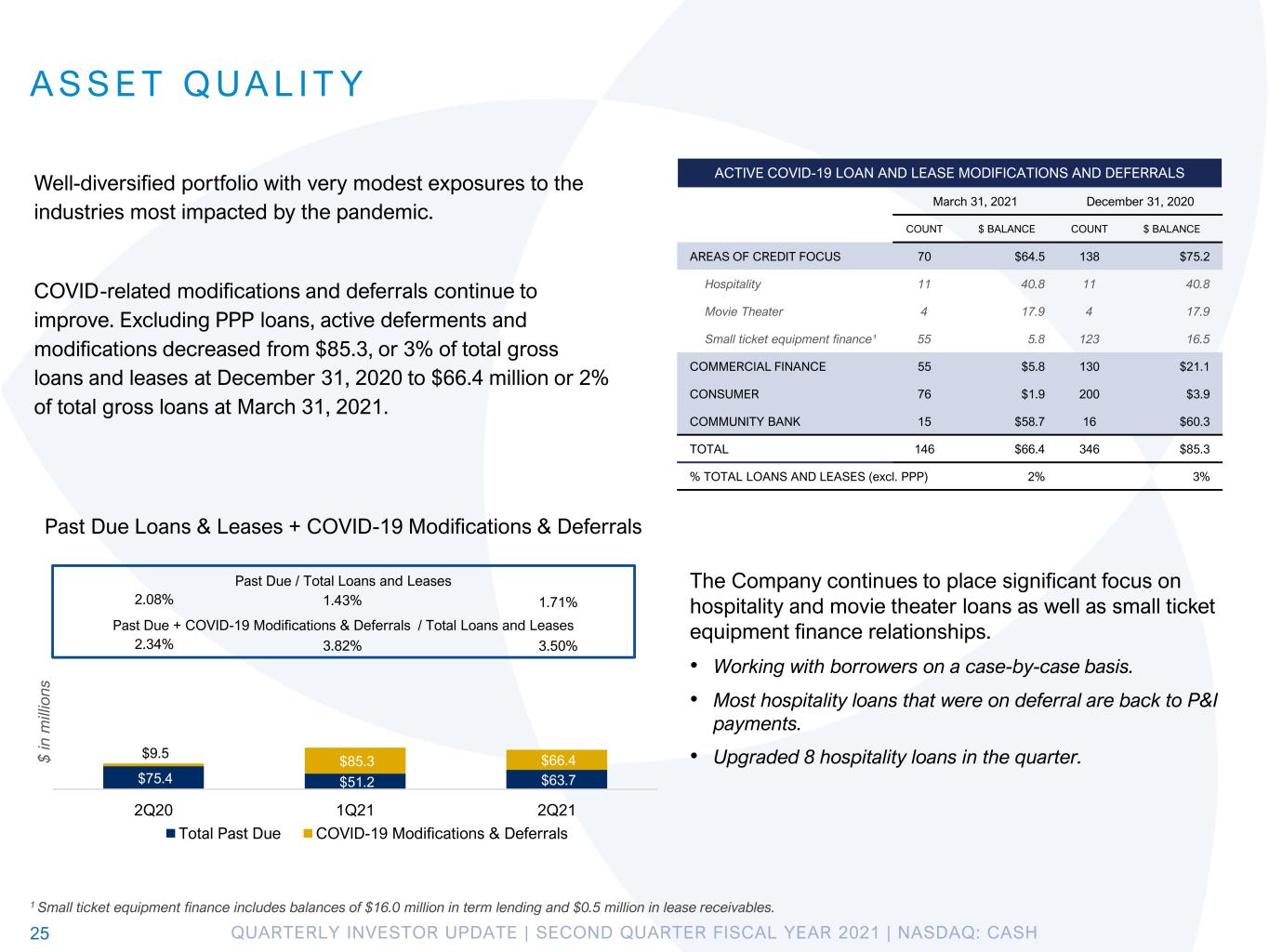

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH $75.4 $51.2 $63.7 $9.5 $85.3 $66.4 2Q20 1Q21 2Q21 $ i n m il li o n s Total Past Due COVID-19 Modifications & Deferrals Past Due Loans & Leases + COVID-19 Modifications & Deferrals AS S E T Q UA L I T Y 25 1 Small ticket equipment finance includes balances of $16.0 million in term lending and $0.5 million in lease receivables. Well-diversified portfolio with very modest exposures to the industries most impacted by the pandemic. COVID-related modifications and deferrals continue to improve. Excluding PPP loans, active deferments and modifications decreased from $85.3, or 3% of total gross loans and leases at December 31, 2020 to $66.4 million or 2% of total gross loans at March 31, 2021. ACTIVE COVID-19 LOAN AND LEASE MODIFICATIONS AND DEFERRALS March 31, 2021 December 31, 2020 COUNT $ BALANCE COUNT $ BALANCE AREAS OF CREDIT FOCUS 70 $64.5 138 $75.2 Hospitality 11 40.8 11 40.8 Movie Theater 4 17.9 4 17.9 Small ticket equipment finance¹ 55 5.8 123 16.5 COMMERCIAL FINANCE 55 $5.8 130 $21.1 CONSUMER 76 $1.9 200 $3.9 COMMUNITY BANK 15 $58.7 16 $60.3 TOTAL 146 $66.4 346 $85.3 % TOTAL LOANS AND LEASES (excl. PPP) 2% 3% Past Due / Total Loans and Leases Past Due + COVID-19 Modifications & Deferrals / Total Loans and Leases 2.08% 1.43% 1.71% 2.34% 3.82% 3.50% The Company continues to place significant focus on hospitality and movie theater loans as well as small ticket equipment finance relationships. • Working with borrowers on a case-by-case basis. • Most hospitality loans that were on deferral are back to P&I payments. • Upgraded 8 hospitality loans in the quarter.

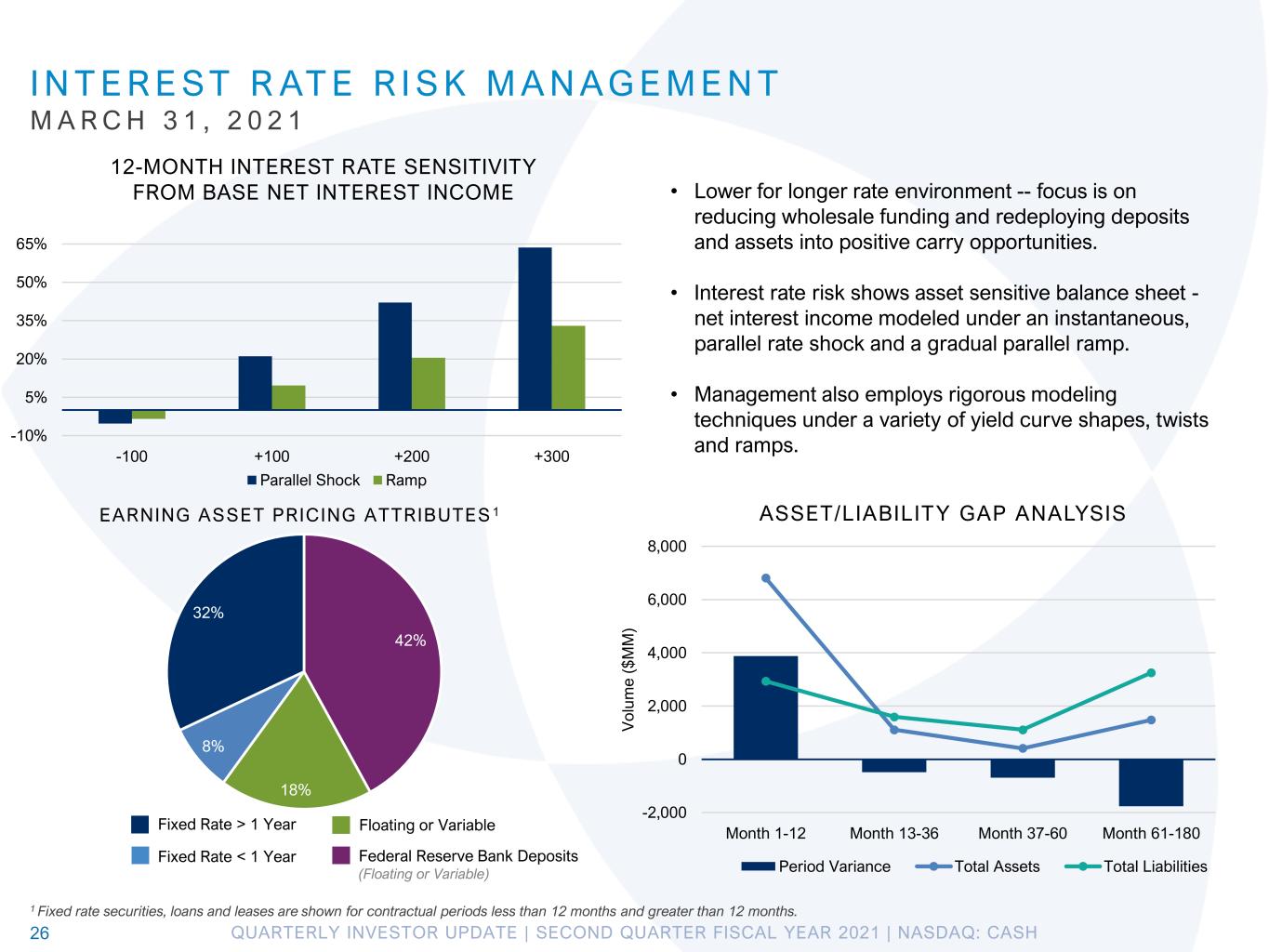

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH -10% 5% 20% 35% 50% 65% -100 +100 +200 +300 12-MONTH INTEREST RATE SENSITIVITY FROM BASE NET INTEREST INCOME Parallel Shock Ramp 42% 18% 8% 32% EARNING ASSET PRICING ATTRIBUTES 1 26 • Lower for longer rate environment -- focus is on reducing wholesale funding and redeploying deposits and assets into positive carry opportunities. • Interest rate risk shows asset sensitive balance sheet - net interest income modeled under an instantaneous, parallel rate shock and a gradual parallel ramp. • Management also employs rigorous modeling techniques under a variety of yield curve shapes, twists and ramps. ASSET/LIABILITY GAP ANALYSIS 1 Fixed rate securities, loans and leases are shown for contractual periods less than 12 months and greater than 12 months. I N T E R E ST R AT E R I S K M A N AG E M E N T M A R C H 3 1 , 2 0 2 1 Fixed Rate > 1 Year Fixed Rate < 1 Year Floating or Variable Federal Reserve Bank Deposits (Floating or Variable) -2,000 0 2,000 4,000 6,000 8,000 Month 1-12 Month 13-36 Month 37-60 Month 61-180 V o lu m e ( $ M M ) Period Variance Total Assets Total Liabilities

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH C A P I TA L A N D S O U RC E S O F L I Q U I D I T Y R E G U L AT O R Y C A P I TA L A S O F M A R C H 3 1 , 2 0 2 1 27 Minimum Requirement to be Well-Capitalized under Prompt Corrective Action Provisions Meta Financial Group, Inc. MetaBank, N.A. CAPITAL RATIO TRENDS At March 31, 2021¹ Meta Financial Group, Inc. MetaBank, N.A. Tier 1 Leverage 4.75% 5.47% Tier 1 Leverage – EIP-adjusted² N/A 7.39% Common Equity Tier 1 11.24% 13.32% Tier 1 Capital 11.58% 13.33% Total Capital 14.59% 14.60% • MetaBank EIP-adjusted Tier 1 Leverage of 7.39% better reflects the balance sheet reducing the impact from the temporary EIP card- related balances. • MetaBank remains well-capitalized. Granted temporary exemption from meeting certain capital leverage ratios by the OCC, related to participation in distributing Bank-issued EIP cards. • Repurchased 734,984 shares at a weighted average price of $40.78 during the 2021 second fiscal quarter. As of April 21, 2021, approximately 1.5 million shares remain under current authorization. Primary & Secondary Liquidity Sources ($ in millions) Cash and Cash Equivalents $3,725 Unpledged Investment Securities $465 FHLB Borrowing Capacity $845 Funds Available through Fed Discount Window $285 PPP Loan Collateral $208 Unsecured Lines of Credit $1,265 - $1,535 EIP Deposit Balances Held at Other Banks $10,768 1 Regulatory capital reflects the Company's election of the five-year CECL transition for regulatory capital purposes. Amounts are preliminary pending completion and filing of the Company's regulatory reports. ² Non-GAAP measure, see appendix for reconciliations. 7.28% 5.91% 6.58% 7.39% 4.75% 8.52% 6.89% 7.56% 8.60% 5.47% 2Q20 3Q20 4Q20 1Q21 2Q21 Tier 1 Leverage Ratio 13.61% 14.99% 15.30% 14.14% 14.59%13.69% 15.12% 15.26% 14.14% 14.60% 2Q20 3Q20 4Q20 1Q21 2Q21 Total Capital Ratio 10% 5%

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH APPENDIX 28

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH N O N - G A A P R E C O N C I L I AT I O N S E I P - R E L AT E D A D J U S T M E N T S 29 ($ in millions) THREE MONTHS ENDED NET INTEREST MARGIN MARCH 31, 2021 DECEMBER 31, 2020 SEPTEMBER 30, 2020 JUNE 30, 2020 Average interest-earning assets 9,768,242 5,636,445 6,806,366 7,608,616 Net interest income 73,850 65,999 64,513 62,137 Net interest margin 3.07% 4.65% 3.77% 3.28% ADJUSTMENT FOR EIP-RELATED ASSETS Interest-earning assets 9,768,242 5,636,445 6,806,366 7,608,618 LESS: Estimated cash adjustment 2,679,372 624,857 1,573,727 2,323,425 EIP-ADJUSTED AVERAGE INTEREST-EARNING ASSETS 7,088,870 5,011,588 5,232,639 5,285,193 Net interest income 73,850 65,999 64,513 62,137 LESS: Estimated cash interest adjustment 661 157 396 578 EIP-ADJUSTED NET INTEREST INCOME 73,189 65,842 64,177 61,559 EIP-ADJUSTED NET INTEREST MARGIN 4.19% 5.21% 4.87% 4.68% ADJUSTMENT FOR INFLATED CASH BALANCES Interest-earning assets 9,768,242 LESS: Estimated cash adjustment 4,187,558 ADJUSTED AVERAGE INTEREST-EARNING ASSETS 5,580,684 Net interest income 73,850 LESS: Estimated cash interest adjustment 1,090 ADJUSTED NET INTEREST INCOME 72,760 ADJUSTED NET INTEREST MARGIN 5.29% RETURN ON AVERAGE ASSETS (“ROAA”) MARCH 31, 2021 DECEMBER 31, 2020 SEPTEMBER 30, 2020 JUNE 30, 2020 Net income 59,066 28,037 13,158 18,190 Average assets 10,655,852 6,481,823 7,672,773 8,439,206 ROAA 2.22% 1.73% 0.69% 0.86% LESS: Estimated cash adjustment 2,679,372 624,857 1,573,727 2,323,425 LESS: Estimated cash interest adjustment 661 157 396 578 EIP-ADJUSTED AVERAGE ASSETS 7,976,480 5,856,966 6,099,046 6,115,781 EIP-ADJUSTED NET INCOME 58,405 27,880 12,762 17,612 EIP-ADJUSTED ROAA 2.93% 1.90% 0.84% 1.15%

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH N O N - G A A P R E C O N C I L I AT I O N S E I P - R E L AT E D C A P I TA L A D J U S T M E N T S 30 ($ in millions) METABANK TIER 1 LEVERAGE MARCH 31, 2020 DECEMBER 31, 2020 SEPTEMBER 30, 2020 JUNE 30, 2020 Total stockholder's equity $ 934,010 $ 912,143 $ 933,430 $ 923,520 LESS: Goodwill, net of associated deferred tax liabilities 301,602 301,999 302,396 302,815 LESS: Certain other intangible assets 36,780 39,403 40,946 42,865 LESS: Net deferred tax assets from operating loss and tax credit carry-forwards 19,306 24,105 18,361 10,360 LESS: Net unrealized gains (losses) on available-for-sale securities 12,458 19,894 17,762 8,382 LESS: Non-controlling interest 1,092 1,536 3,603 3,787 Common Equity Tier 1 Capital ("CET1") 562,772 525,206 550,344 555,311 Tier 1 minority interest not included in common equity tier 1 capital 690 750 1,894 1,894 Total Tier 1 capital 563,462 525,956 552,238 557,205 Total Assets (Quarter Average) $ 10,662,731 $ 6,487,231 $ 7,679,897 $ 8,446,393 ADD: Available for sale securities amortized cost (20,219) (24,694) (22,844) (8,420) ADD: Deferred tax 5,077 6,201 5,724 2,104 ADD: CECL adoption 10,439 10,439 0 0 LESS: Deductions from CET1 357,688 365,507 361,721 356,040 ADJUSTED TOTAL ASSETS $ 10,300,340 $ 6,113,671 $ 7,301,056 $ 8,084,037 METABANK REGULATORY TIER 1 LEVERAGE 5.47 % 8.60 % 7.56 % 6.89% ADJUSTMENT FOR EIP-RELATED ASSETS Adjusted total assets $ 10,300,340 $ 6,113,671 $ 7,301,056 $ 8,084,037 LESS: EIP prepaid card-related assets (cash) 2,679,372 624,857 1,573,727 2,323,425 EIP-ADJUSTED TOTAL ASSETS $ 7,620,968 $ 5,488,814 $ 5,727,329 $ 5,760,612 METABANK EIP-ADJUSTED TIER 1 LEVERAGE 7.39 % 9.58 % 9.64 % 9.67%

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH F I N A N C I A L M E AS U R E R E C O N C I L I AT I O N S 31 Efficiency Ratio For the last twelve months ended ($ in thousands) Mar 31, 2021 Dec 31, 2020 Sep 30, 2020 Jun 30, 2020 Mar 31, 2020 Noninterest Expense - GAAP 320,070 315,828 319,051 314,911 316,138 Net Interest Income 266,499 260,386 259,038 260,142 264,973 Noninterest Income 240,706 247,766 239,794 235,024 237,766 Total Revenue: GAAP 507,205 508,152 498,832 495,166 502,739 Efficiency Ratio, LTM 63.10% 62.15% 63.96 % 63.60 % 62.88 % Non-GAAP Reconciliation Adjusted Annualized NCOs and Adjusted Average Loans and Leases For the quarter ended ($ in thousands) Mar 31, 2021 Dec 31, 2020 Sep 30, 2020 Jun 30, 2020 Mar 31, 2020 Net Charge-offs 3,696 2,836 18,538 14,700 2,117 Less: Tax services net charge-offs (54) (956) 13,034 9,782 (74) Adjusted Net Charge-offs $ 3,750 $ 3,792 $ 5,504 $ 4,918 $ 2,191 Quarterly Average Loans and Leases 4,120,555 3,495,696 3,536,997 3,622,928 4,195,772 Less: Quarterly Average Tax Services Loans 714,789 25,104 16,650 39,845 516,491 Adjusted Quarterly Loans and Leases $ 3,405,766 $ 3,470,592 $ 3,520,347 $ 3,583,083 $ 3,679,281 Annualized NCOs/Average Loans and Leases 0.36% 0.32% 2.10 % 1.62 % 0.20 % Adjusted Annualized NCOs/Adjusted Average Loans and Leases1 0.44% 0.44% 0.63 % 0.55 % 0.24 % 1 Tax Services NCOs and average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the Company's tax services business line.

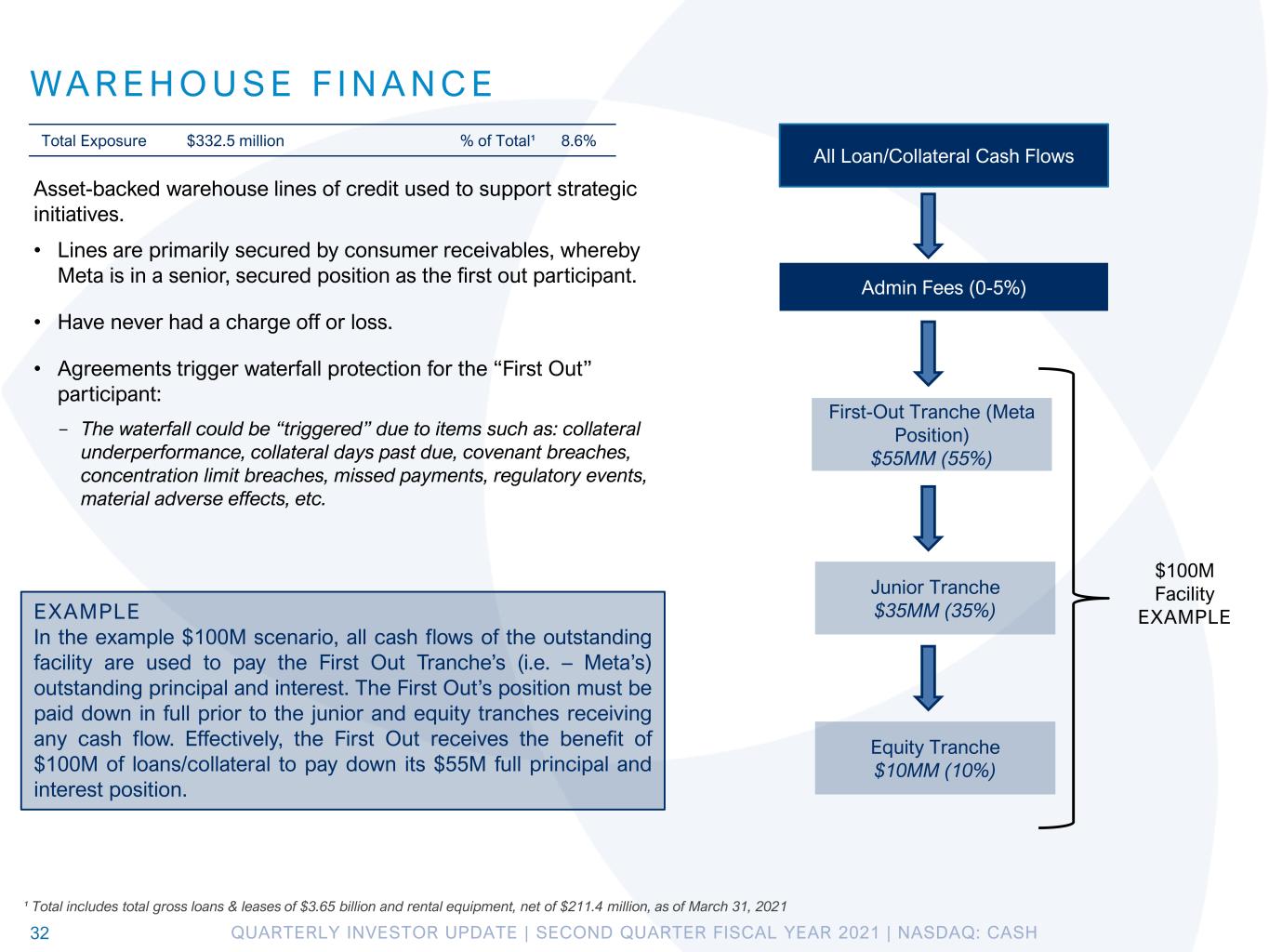

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH WA R E H O U S E F I N A N C E 32 Asset-backed warehouse lines of credit used to support strategic initiatives. • Lines are primarily secured by consumer receivables, whereby Meta is in a senior, secured position as the first out participant. • Have never had a charge off or loss. • Agreements trigger waterfall protection for the “First Out” participant: - The waterfall could be “triggered” due to items such as: collateral underperformance, collateral days past due, covenant breaches, concentration limit breaches, missed payments, regulatory events, material adverse effects, etc. All Loan/Collateral Cash Flows Admin Fees (0-5%) Junior Tranche $35MM (35%) Equity Tranche $10MM (10%) First-Out Tranche (Meta Position) $55MM (55%) $100M Facility EXAMPLEEXAMPLE In the example $100M scenario, all cash flows of the outstanding facility are used to pay the First Out Tranche’s (i.e. – Meta’s) outstanding principal and interest. The First Out’s position must be paid down in full prior to the junior and equity tranches receiving any cash flow. Effectively, the First Out receives the benefit of $100M of loans/collateral to pay down its $55M full principal and interest position. Total Exposure $332.5 million % of Total¹ 8.6% ¹ Total includes total gross loans & leases of $3.65 billion and rental equipment, net of $211.4 million, as of March 31, 2021

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH I N D I R E C T C O N S U M E R C R E D I T P RO G R A M S 33 Consumer Payments Principal, Interest, Fees Principal Losses to Meta Collection Account Principal Repayment to Meta Servicing Meta’s Agreed upon interest return Remaining Excess Spread to Meta-owned escrow reserve Consumer credit programs with marketplace lenders offer Meta a risk adjusted return, protected by certain layers of credit support and balance sheet flexibility. Programs are offered to strategic partners with payments distribution potential. • Agreements typically provide for “excess spread” build-up and protection through a priority of payment within a waterfall • Consumer interest rate and fees flow through a waterfall: - Covers principal losses and Meta’s required rate of interest. Meta’s interest rate is substantially less than the consumer’s APR - Structure provides for a build up of excess spread to allow protection from loan losses and ensure Meta’s contractual rate of interest is covered - Structure provides for ALLL on a portfolio basis rather than loan level basis - Excess spread in the escrow account only released to partner when certain conditions are satisfied - Escrow account balance has increased since program inception • As of March 31, 2021, MetaBank had two consumer credit programs with strategic partners. Reserve release to partner is conditional (subordinate) based on product performance Total Exposure $104.8 million % of Total¹ 2.7% ¹ Total includes total gross loans & leases of $3.65 billion and rental equipment, net of $211.4 million, as of March 31, 2021