Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST BUSEY CORP /NV/ | buse-20210427x8k.htm |

| EX-99.1 - EX-99.1 - FIRST BUSEY CORP /NV/ | buse-20210427xex99d1.htm |

Exhibit 99.2

| April 27, 2021 1Q21 QUARTERLY EARNINGS SUPPLEMENT |

| 2 2 Special Note Concerning Forward-Looking Statements Statements made in this document, other than those concerning historical financial information, may be considered forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of the Company’s management and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. Additionally, all statements in this document, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. A number of factors, many of which are beyond the Company’s ability to control or predict, could cause actual results to differ materially from those in the Company’s forward- looking statements. These factors include, among others, the following: (i) the strength of the local, state, national and international economy (including the impact of the new presidential administration); (ii) the economic impact of any future terrorist threats or attacks, widespread disease or pandemics (including the COVID-19 pandemic), or other adverse external events that could cause economic deterioration or instability in credit markets; (iii) changes in state and federal laws, regulations and governmental policies concerning the Company’s general business; (iv) changes in accounting policies and practices, including FASB’s CECL impairment standards; (v) changes in interest rates and prepayment rates of the Company’s assets (including the impact of The London Inter-bank Offered Rate phase-out); (vi) increased competition in the financial services sector and the inability to attract new customers; (vii) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (viii) the loss of key executives or associates; (ix) changes in consumer spending; (x) unexpected results of current and/or future acquisitions, which may include failure to realize the anticipated benefits of any acquisition and the possibility that the transaction costs may be greater than anticipated; (xi) unexpected outcomes of existing or new litigation involving the Company; and (xii) the economic impact of exceptional weather occurrences such as tornadoes, hurricanes, floods, and blizzards. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning the Company and its business, including additional factors that could materially affect its financial results, is included in the Company’s filings with the Securities and Exchange Commission. |

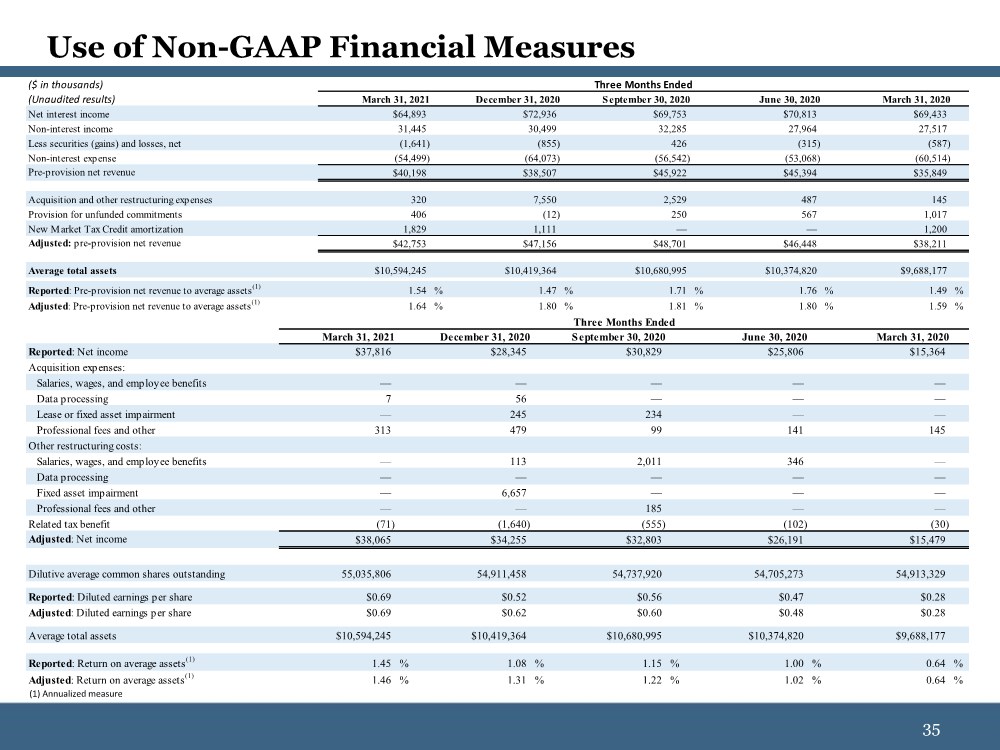

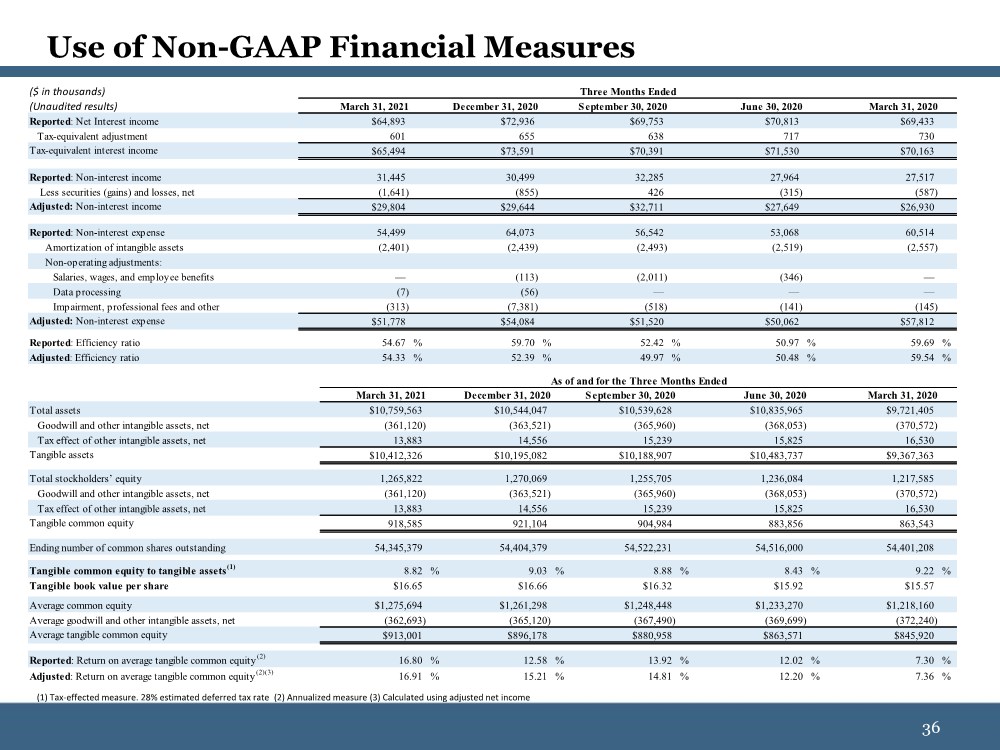

| 3 3 Non-GAAP Financial Measures This document contains financial information determined other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management also believes that these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition, and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this document to the most directly comparable GAAP measures is provided beginning on page 35 of this document. For more details on the Company’s non-GAAP measures, refer to the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. |

| 4 4 Table of Contents Overview of First Busey Corporation (BUSE) 5 Diversified Business Model 6 Attractive Geographic Footprint 7 Experienced Management Team 8 Investment Highlights 9 Protecting a Strong Balance Sheet 10 Robust Capital Foundation 11 High Quality Loan Portfolio 12 Update on COVID - Related Deferral & Modification Trends 18 Participating in the CARES Act Paycheck Protection Program 22 Navigating Credit Cycle from Position of Strength 23 Fortress Reserve Build Following CECL Adoption 24 Ample Sources of Liquidity 25 Quarterly Earnings Review 26 Core Earnings Power 27 Net Interest Margin 28 Diversified and Significant Sources of Fee Income 29 Resilient Wealth Management Platform 30 Focused Control on Expenses Driving Efficiency Gains 31 Acquisition of Cummins-American Corp (Glenview State Bank) 32 Appendix: Use of Non-GAAP Financial Measures 34 |

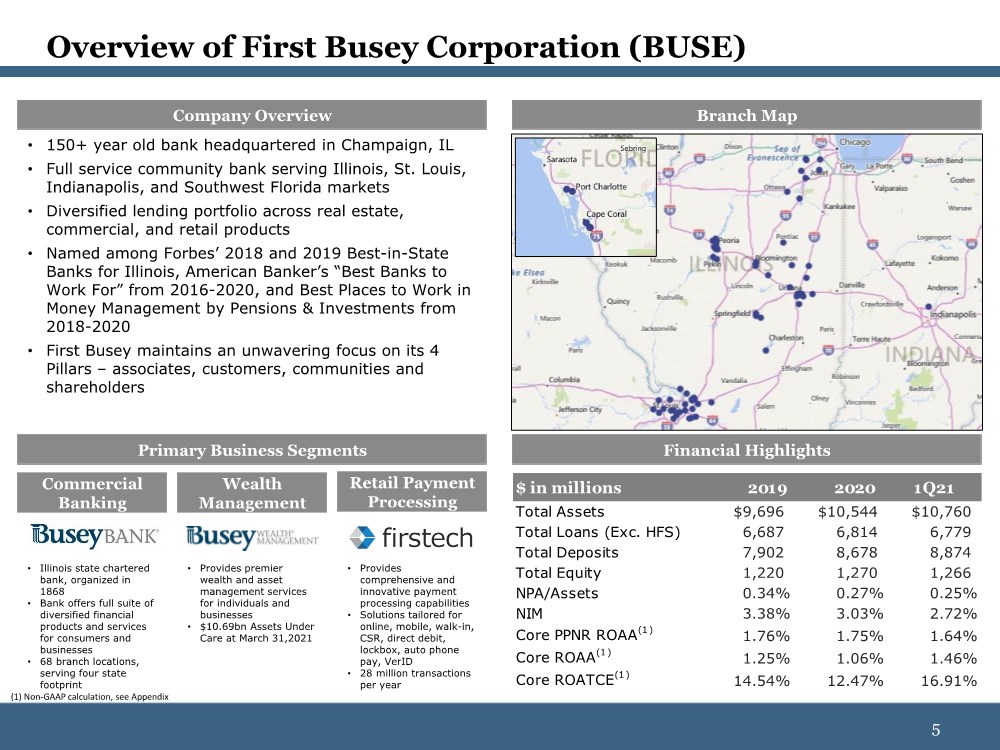

| 5 5 Overview of First Busey Corporation (BUSE) Company Overview Branch Map Primary Business Segments Financial Highlights Commercial Banking Wealth Management Retail Payment Processing • Illinois state chartered bank, organized in 1868 • Bank offers full suite of diversified financial products and services for consumers and businesses • 68 branch locations, serving four state footprint • Provides premier wealth and asset management services for individuals and businesses • $10.69bn Assets Under Care at March 31,2021 • Provides comprehensive and innovative payment processing capabilities • Solutions tailored for online, mobile, walk-in, CSR, direct debit, lockbox, auto phone pay, VerID • 28 million transactions per year • 150+ year old bank headquartered in Champaign, IL • Full service community bank serving Illinois, St. Louis, Indianapolis, and Southwest Florida markets • Diversified lending portfolio across real estate, commercial, and retail products • Named among Forbes’ 2018 and 2019 Best-in-State Banks for Illinois, American Banker’s “Best Banks to Work For” from 2016-2020, and Best Places to Work in Money Management by Pensions & Investments from 2018-2020 • First Busey maintains an unwavering focus on its 4 Pillars – associates, customers, communities and shareholders (1) Non-GAAP calculation, see Appendix $ in millions 2019 2020 1Q21 Total Assets $9,696 $10,544 $10,760 Total Loans (Exc. HFS) 6,687 6,814 6,779 Total Deposits 7,902 8,678 8,874 Total Equity 1,220 1,270 1,266 NPA/Assets 0.34% 0.27% 0.25% NIM 3.38% 3.03% 2.72% Core PPNR ROAA(1 ) 1.76% 1.75% 1.64% Core ROAA(1 ) 1.25% 1.06% 1.46% Core ROATCE(1 ) 14.54% 12.47% 16.91% |

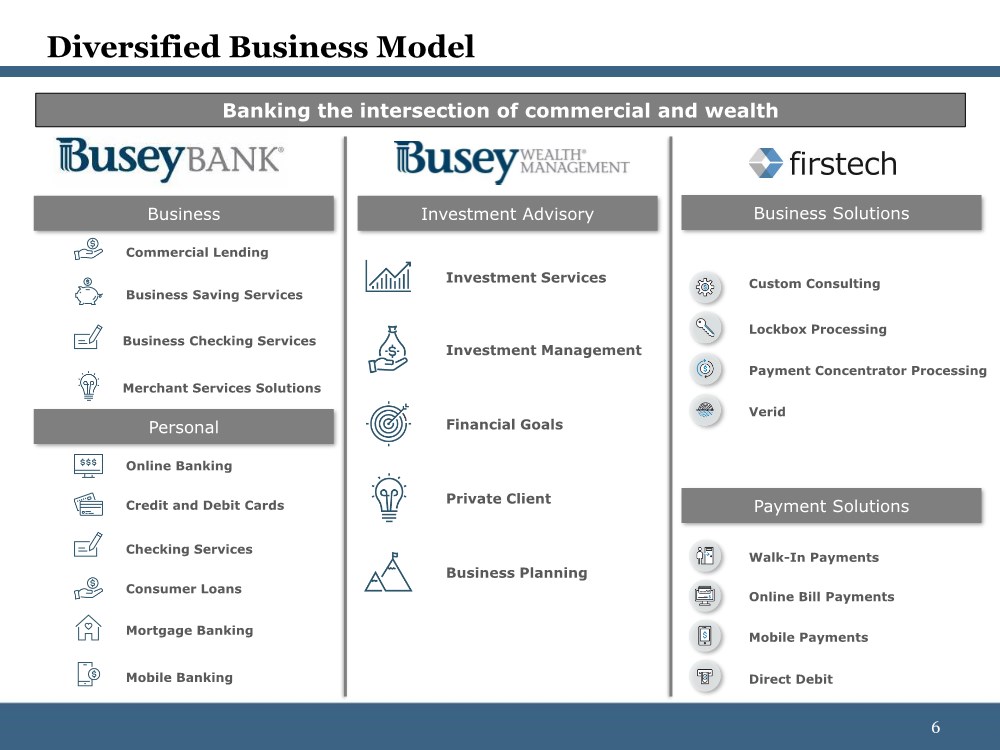

| 6 6 Online Banking Credit and Debit Cards Checking Services Consumer Loans Commercial Lending Business Saving Services Personal Business Mortgage Banking Mobile Banking Diversified Business Model Investment Services Investment Management Financial Goals Private Client Business Planning Business Checking Services Merchant Services Solutions Custom Consulting Lockbox Processing Payment Concentrator Processing Verid Walk-In Payments Online Bill Payments Mobile Payments Direct Debit Business Solutions Payment Solutions Investment Advisory Banking the intersection of commercial and wealth |

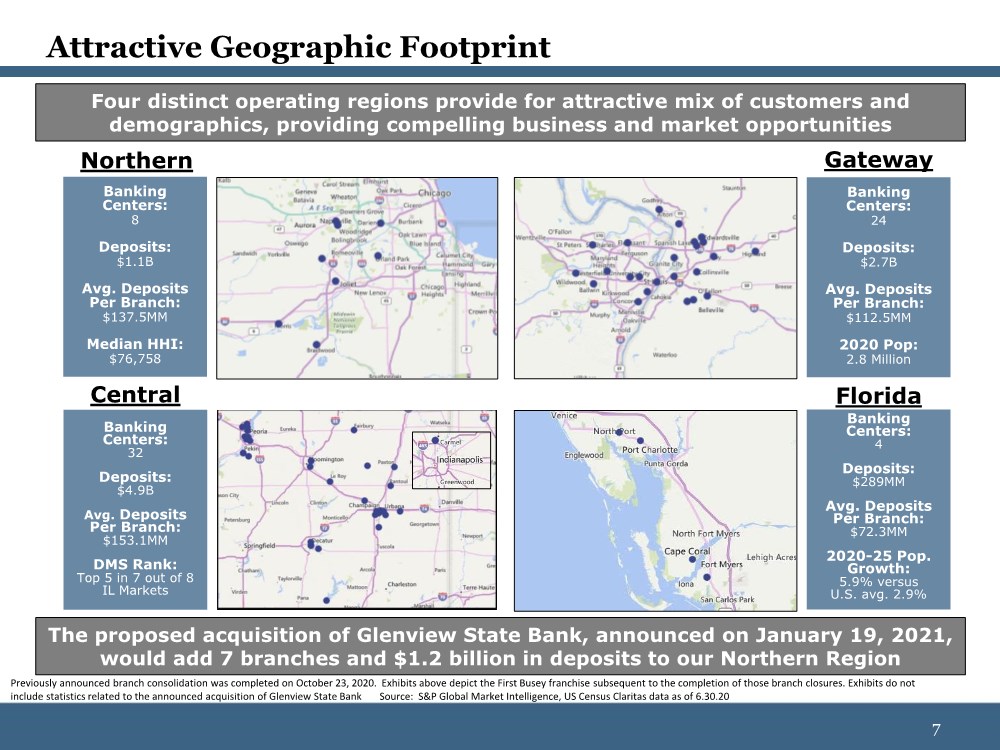

| 7 7 Attractive Geographic Footprint Four distinct operating regions provide for attractive mix of customers and demographics, providing compelling business and market opportunities Northern Gateway Central Florida Banking Centers: 8 Deposits: $1.1B Avg. Deposits Per Branch: $137.5MM Median HHI: $76,758 Banking Centers: 24 Deposits: $2.7B Avg. Deposits Per Branch: $112.5MM 2020 Pop: 2.8 Million Banking Centers: 32 Deposits: $4.9B Avg. Deposits Per Branch: $153.1MM DMS Rank: Top 5 in 7 out of 8 IL Markets Banking Centers: 4 Deposits: $289MM Avg. Deposits Per Branch: $72.3MM 2020-25 Pop. Growth: 5.9% versus U.S. avg. 2.9% Source: S&P Global Market Intelligence, US Census Claritas data as of 6.30.20 Previously announced branch consolidation was completed on October 23, 2020. Exhibits above depict the First Busey franchise subsequent to the completion of those branch closures. Exhibits do not include statistics related to the announced acquisition of Glenview State Bank The proposed acquisition of Glenview State Bank, announced on January 19, 2021, would add 7 branches and $1.2 billion in deposits to our Northern Region |

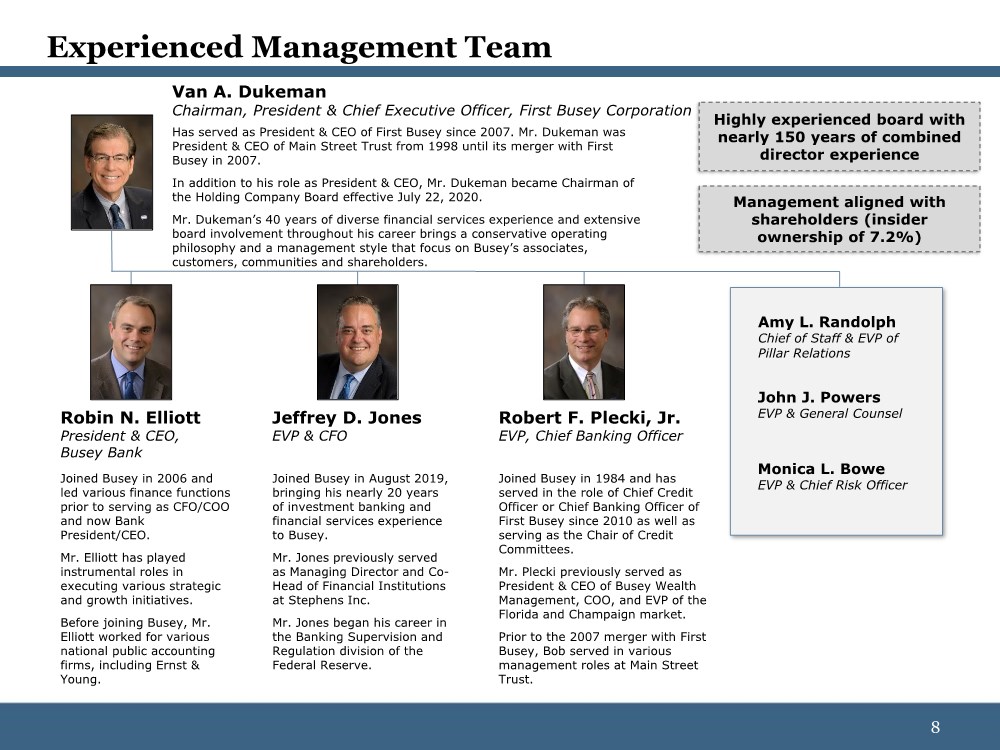

| 8 8 Experienced Management Team Van A. Dukeman Chairman, President & Chief Executive Officer, First Busey Corporation Robin N. Elliott President & CEO, Busey Bank Jeffrey D. Jones EVP & CFO Robert F. Plecki, Jr. EVP, Chief Banking Officer John J. Powers EVP & General Counsel Monica L. Bowe EVP & Chief Risk Officer Has served as President & CEO of First Busey since 2007. Mr. Dukeman was President & CEO of Main Street Trust from 1998 until its merger with First Busey in 2007. In addition to his role as President & CEO, Mr. Dukeman became Chairman of the Holding Company Board effective July 22, 2020. Mr. Dukeman’s 40 years of diverse financial services experience and extensive board involvement throughout his career brings a conservative operating philosophy and a management style that focus on Busey’s associates, customers, communities and shareholders. Joined Busey in 2006 and led various finance functions prior to serving as CFO/COO and now Bank President/CEO. Mr. Elliott has played instrumental roles in executing various strategic and growth initiatives. Before joining Busey, Mr. Elliott worked for various national public accounting firms, including Ernst & Young. Joined Busey in August 2019, bringing his nearly 20 years of investment banking and financial services experience to Busey. Mr. Jones previously served as Managing Director and Co- Head of Financial Institutions at Stephens Inc. Mr. Jones began his career in the Banking Supervision and Regulation division of the Federal Reserve. Joined Busey in 1984 and has served in the role of Chief Credit Officer or Chief Banking Officer of First Busey since 2010 as well as serving as the Chair of Credit Committees. Mr. Plecki previously served as President & CEO of Busey Wealth Management, COO, and EVP of the Florida and Champaign market. Prior to the 2007 merger with First Busey, Bob served in various management roles at Main Street Trust. Highly experienced board with nearly 150 years of combined director experience Management aligned with shareholders (insider ownership of 7.2%) Amy L. Randolph Chief of Staff & EVP of Pillar Relations |

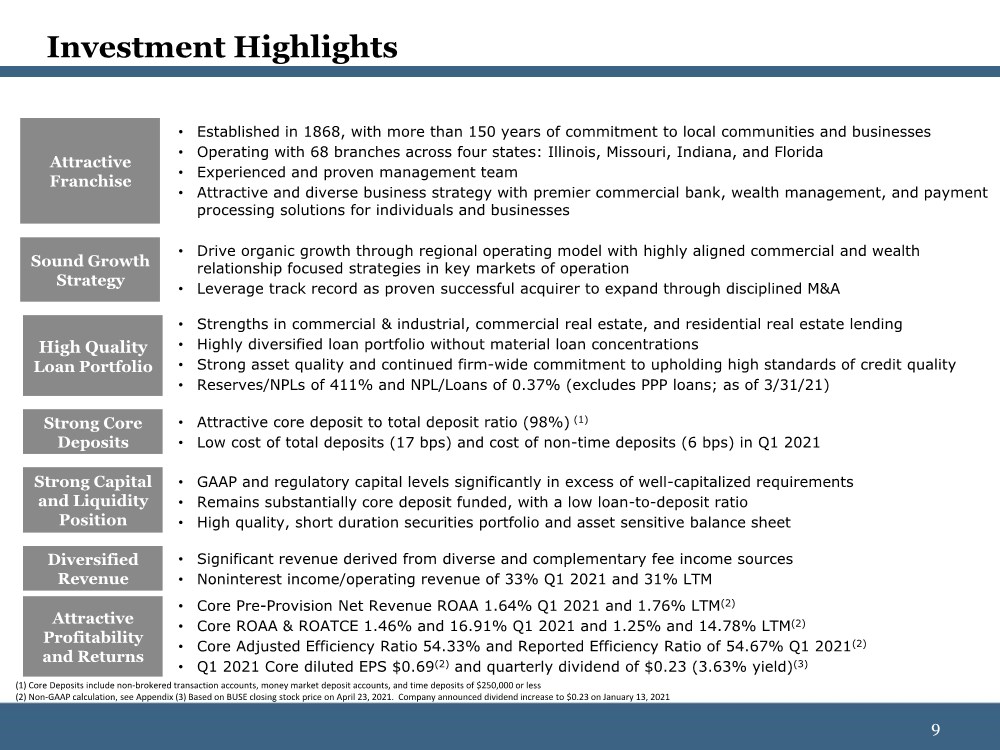

| 9 9 Investment Highlights • Established in 1868, with more than 150 years of commitment to local communities and businesses • Operating with 68 branches across four states: Illinois, Missouri, Indiana, and Florida • Experienced and proven management team • Attractive and diverse business strategy with premier commercial bank, wealth management, and payment processing solutions for individuals and businesses Attractive Franchise Sound Growth Strategy Strong Core Deposits Strong Capital and Liquidity Position High Quality Loan Portfolio Diversified Revenue • Drive organic growth through regional operating model with highly aligned commercial and wealth relationship focused strategies in key markets of operation • Leverage track record as proven successful acquirer to expand through disciplined M&A • Attractive core deposit to total deposit ratio (98%) (1) • Low cost of total deposits (17 bps) and cost of non-time deposits (6 bps) in Q1 2021 • Strengths in commercial & industrial, commercial real estate, and residential real estate lending • Highly diversified loan portfolio without material loan concentrations • Strong asset quality and continued firm-wide commitment to upholding high standards of credit quality • Reserves/NPLs of 411% and NPL/Loans of 0.37% (excludes PPP loans; as of 3/31/21) • Significant revenue derived from diverse and complementary fee income sources • Noninterest income/operating revenue of 33% Q1 2021 and 31% LTM • GAAP and regulatory capital levels significantly in excess of well-capitalized requirements • Remains substantially core deposit funded, with a low loan-to-deposit ratio • High quality, short duration securities portfolio and asset sensitive balance sheet (1) Core Deposits include non-brokered transaction accounts, money market deposit accounts, and time deposits of $250,000 or less (2) Non-GAAP calculation, see Appendix (3) Based on BUSE closing stock price on April 23, 2021. Company announced dividend increase to $0.23 on January 13, 2021 Attractive Profitability and Returns • Core Pre-Provision Net Revenue ROAA 1.64% Q1 2021 and 1.76% LTM(2) • Core ROAA & ROATCE 1.46% and 16.91% Q1 2021 and 1.25% and 14.78% LTM(2) • Core Adjusted Efficiency Ratio 54.33% and Reported Efficiency Ratio of 54.67% Q1 2021(2) • Q1 2021 Core diluted EPS $0.69(2) and quarterly dividend of $0.23 (3.63% yield)(3) |

| 10 10 • Capital ratios significantly in excess of well-capitalized minimums • Regulatory capital relief on CECL implementation and PPP loans • TCE/TA ratio of 8.82% at 3/31/21(1) • Total RBC of 17.39% at 3/31/21 • TBV per share of $16.65 at 3/31/21(1), up 6.9% year-over-year • Diversified portfolio, conservatively underwritten with low levels of concentration • NPAs/Assets: 0.25% Classified Assets/Capital: 7.8% • Substantial reserve build under CECL → ACL/Loans: 1.50%(2) ACL/NPLs: 411.04% • Significant decline in commercial loans in active deferral/modification from 23.1% of total ex-PPP commercial loan portfolio at June 30, 2020 to 3.5% at April 16, 2021 • 100 / 300 Test: 37% C&D 215% CRE • Robust holding company and bank-level liquidity • Strong core deposit franchise – 76.4% loan-to-deposit ratio, 98.2% core deposits (3) • Borrowings accounted for approximately 3.2% of total funding at 3/31/21 • $3.2 billion in cash & securities (80% of securities portfolio unpledged) • Substantial sources of off-balance sheet contingent funding ($3.4 billion) Protecting a Strong Balance Sheet (1) Non-GAAP calculation, see Appendix (2) Excluding amortized cost of PPP loans (3) Core Deposits include non-brokered transaction accounts, money market deposit accounts, and time deposits of $250,000 or less Robust Capital Foundation Resilient Loan Portfolio Strong Core Deposit Franchise & Ample Liquidity |

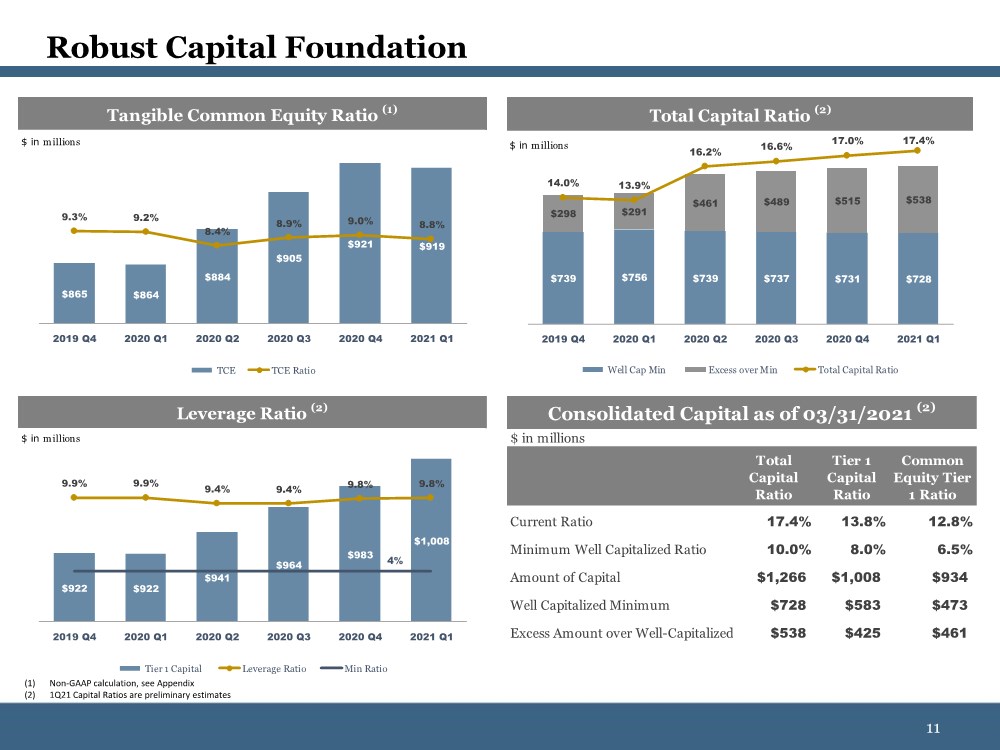

| 11 11 Robust Capital Foundation (1) Non-GAAP calculation, see Appendix (2) 1Q21 Capital Ratios are preliminary estimates ($ in millions) Tangible Common Equity Ratio (1) $865 $864 $884 $905 $921 $919 9.3% 9.2% 8.4% 8.9% 9.0% 8.8% 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 TCE TCE Ratio $ in millions $ in millions Current Ratio 17.4% 13.8% 12.8% Minimum Well Capitalized Ratio 10.0% 8.0% 6.5% Amount of Capital $1,266 $1,008 $934 Well Capitalized Minimum $728 $583 $473 Excess Amount over Well-Capitalized Min $538 $425 $461 Total Capital Ratio Tier 1 Capital Ratio Common Equity Tier 1 Ratio Consolidated Capital as of 03/31/2021 (2) Total Capital Ratio (2) $ in millions $739 $756 $739 $737 $731 $728 $298 $291 $461 $489 $515 $538 14.0% 13.9% 16.2% 16.6% 17.0% 17.4% 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Well Cap Min Excess over Min Total Capital Ratio $ in millions Leverage Ratio (2) $922 $922 $941 $964 $983 $1,008 9.9% 9.9% 9.4% 9.4% 9.8% 9.8% 4% 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Tier 1 Capital Leverage Ratio Min Ratio $ in millions |

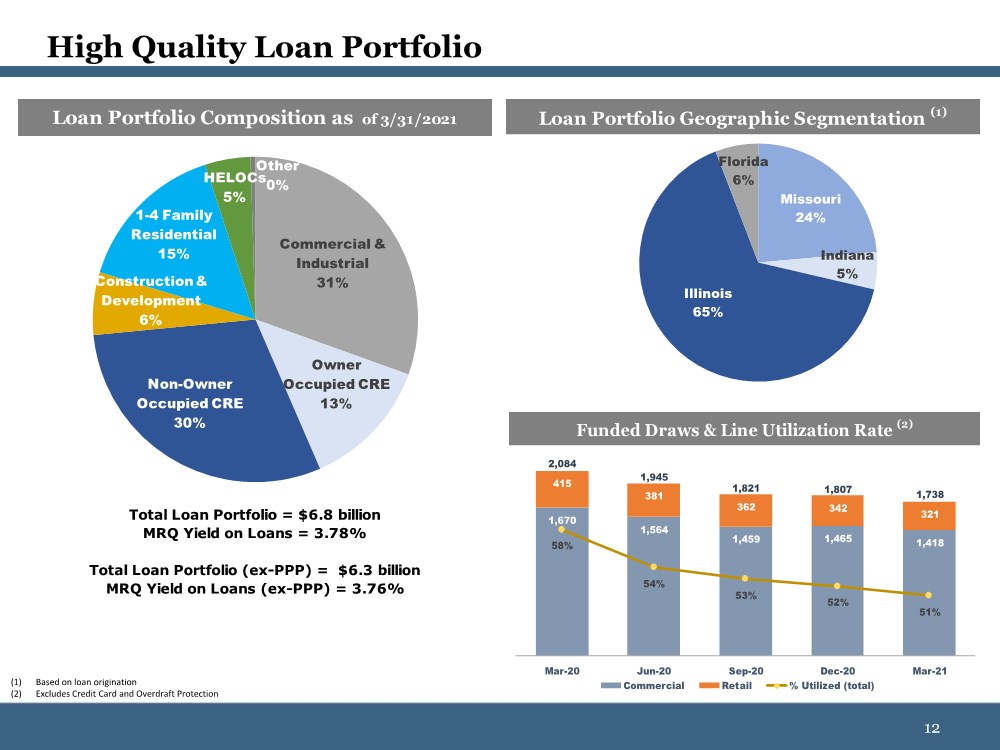

| 12 12 High Quality Loan Portfolio (1) Based on loan origination (2) Excludes Credit Card and Overdraft Protection Loan Portfolio Geographic Segmentation (1) Missouri 24% Indiana 5% Illinois 65% Florida 6% Loan Portfolio Composition as of 3/31/2021 MRQ Yield on Loans (ex-PPP) = 3.76% Total Loan Portfolio (ex-PPP) = $6.3 billion MRQ Yield on Loans = 3.78% Total Loan Portfolio = $6.8 billion Commercial & Industrial 31% Owner Occupied CRE 13% Non-Owner Occupied CRE 30% Construction & Development 6% 1-4 Family Residential 15% HELOCs 5% Other 0% Funded Draws & Line Utilization Rate (2) 1,670 1,564 1,459 1,465 1,418 415 381 362 342 321 2,084 1,945 1,821 1,807 1,738 58% 54% 53% 52% 51% 1 501 1,001 1,501 2,001 Mar-20 Jun-20 Sep-20 Dec-20 Mar-21 Commercial Retail % Utilized (total) |

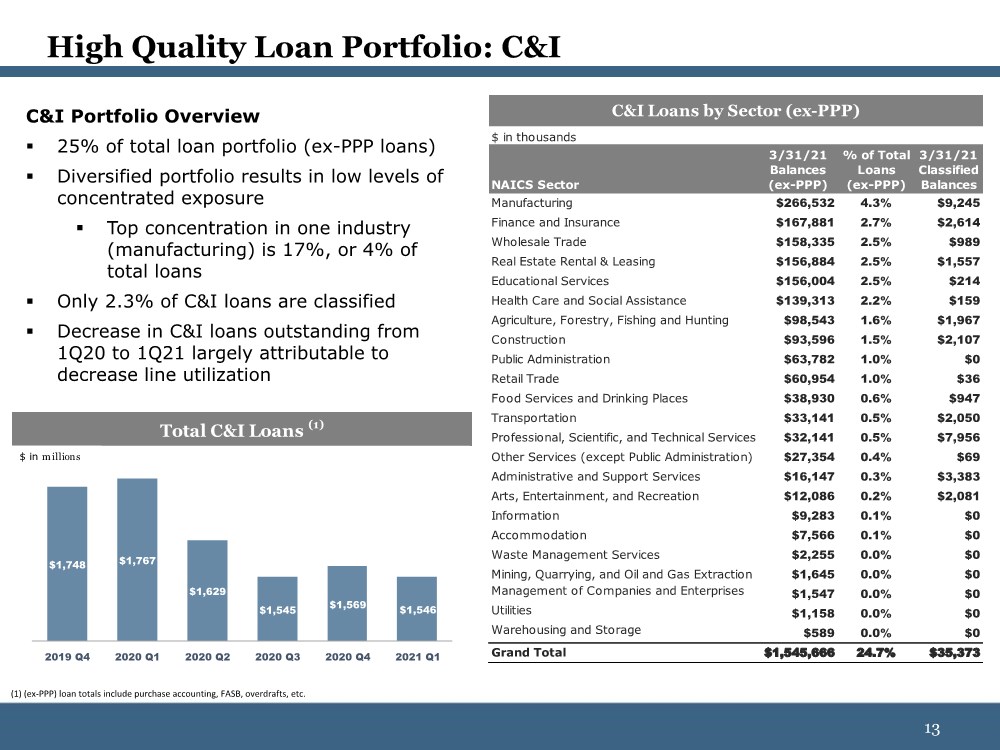

| 13 13 High Quality Loan Portfolio: C&I C&I Portfolio Overview ▪ 25% of total loan portfolio (ex-PPP loans) ▪ Diversified portfolio results in low levels of concentrated exposure ▪ Top concentration in one industry (manufacturing) is 17%, or 4% of total loans ▪ Only 2.3% of C&I loans are classified ▪ Decrease in C&I loans outstanding from 1Q20 to 1Q21 largely attributable to decrease line utilization (1) (ex-PPP) loan totals include purchase accounting, FASB, overdrafts, etc. $ in thousands NAICS Sector 3/31/21 Balances (ex-PPP) % of Total Loans (ex-PPP) 3/31/21 Classified Balances Manufacturing $266,532 4.3% $9,245 Finance and Insurance $167,881 2.7% $2,614 Wholesale Trade $158,335 2.5% $989 Real Estate Rental & Leasing $156,884 2.5% $1,557 Educational Services $156,004 2.5% $214 Health Care and Social Assistance $139,313 2.2% $159 Agriculture, Forestry, Fishing and Hunting $98,543 1.6% $1,967 Construction $93,596 1.5% $2,107 Public Administration $63,782 1.0% $0 Retail Trade $60,954 1.0% $36 Food Services and Drinking Places $38,930 0.6% $947 Transportation $33,141 0.5% $2,050 Professional, Scientific, and Technical Services $32,141 0.5% $7,956 Other Services (except Public Administration) $27,354 0.4% $69 Administrative and Support Services $16,147 0.3% $3,383 Arts, Entertainment, and Recreation $12,086 0.2% $2,081 Information $9,283 0.1% $0 Accommodation $7,566 0.1% $0 Waste Management Services $2,255 0.0% $0 Mining, Quarrying, and Oil and Gas Extraction $1,645 0.0% $0 Management of Companies and Enterprises $1,547 0.0% $0 Utilities $1,158 0.0% $0 Warehousing and Storage $589 0.0% $0 Grand Total $1,545,666 24.7% $35,373 C&I Loans by Sector (ex-PPP) Total C&I Loans (1) $1,748 $1,767 $1,629 $1,545 $1,569 $1,546 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 $ in millions |

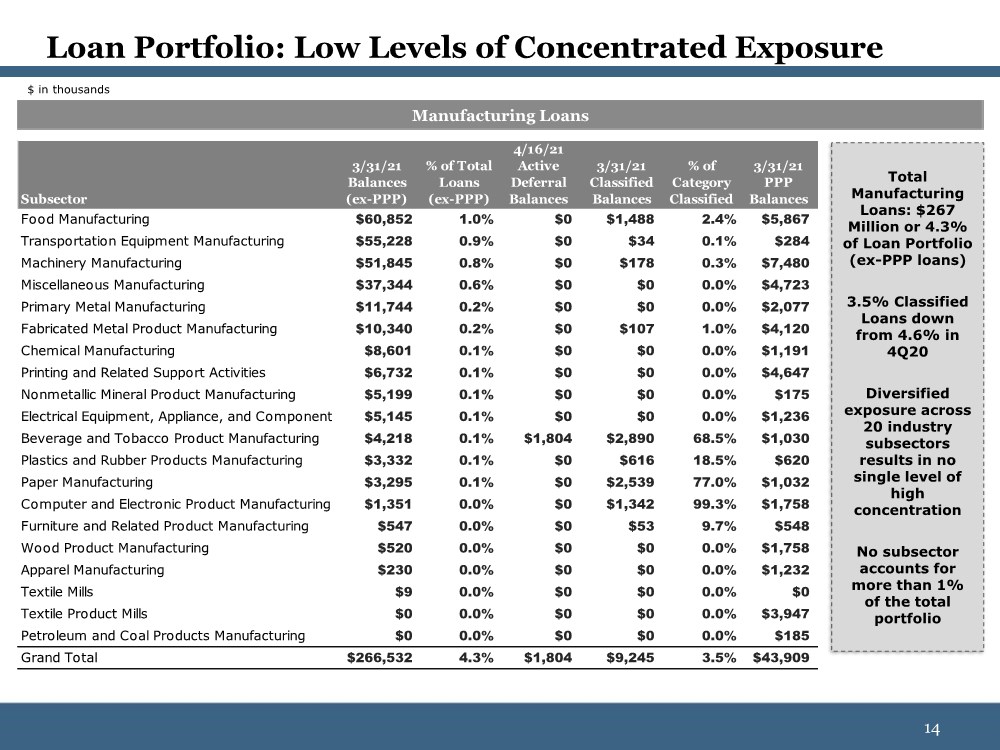

| 14 14 Loan Portfolio: Low Levels of Concentrated Exposure Manufacturing Loans Total Manufacturing Loans: $267 Million or 4.3% of Loan Portfolio (ex-PPP loans) 3.5% Classified Loans down from 4.6% in 4Q20 Diversified exposure across 20 industry subsectors results in no single level of high concentration No subsector accounts for more than 1% of the total portfolio $ in thousands Subsector 3/31/21 Balances (ex-PPP) % of Total Loans (ex-PPP) 4/16/21 Active Deferral Balances 3/31/21 Classified Balances % of Category Classified 3/31/21 PPP Balances Food Manufacturing $60,852 1.0% $0 $1,488 2.4% $5,867 Transportation Equipment Manufacturing $55,228 0.9% $0 $34 0.1% $284 Machinery Manufacturing $51,845 0.8% $0 $178 0.3% $7,480 Miscellaneous Manufacturing $37,344 0.6% $0 $0 0.0% $4,723 Primary Metal Manufacturing $11,744 0.2% $0 $0 0.0% $2,077 Fabricated Metal Product Manufacturing $10,340 0.2% $0 $107 1.0% $4,120 Chemical Manufacturing $8,601 0.1% $0 $0 0.0% $1,191 Printing and Related Support Activities $6,732 0.1% $0 $0 0.0% $4,647 Nonmetallic Mineral Product Manufacturing $5,199 0.1% $0 $0 0.0% $175 Electrical Equipment, Appliance, and Component Manufacturing $5,145 0.1% $0 $0 0.0% $1,236 Beverage and Tobacco Product Manufacturing $4,218 0.1% $1,804 $2,890 68.5% $1,030 Plastics and Rubber Products Manufacturing $3,332 0.1% $0 $616 18.5% $620 Paper Manufacturing $3,295 0.1% $0 $2,539 77.0% $1,032 Computer and Electronic Product Manufacturing $1,351 0.0% $0 $1,342 99.3% $1,758 Furniture and Related Product Manufacturing $547 0.0% $0 $53 9.7% $548 Wood Product Manufacturing $520 0.0% $0 $0 0.0% $1,758 Apparel Manufacturing $230 0.0% $0 $0 0.0% $1,232 Textile Mills $9 0.0% $0 $0 0.0% $0 Textile Product Mills $0 0.0% $0 $0 0.0% $3,947 Petroleum and Coal Products Manufacturing $0 0.0% $0 $0 0.0% $185 Grand Total $266,532 4.3% $1,804 $9,245 3.5% $43,909 |

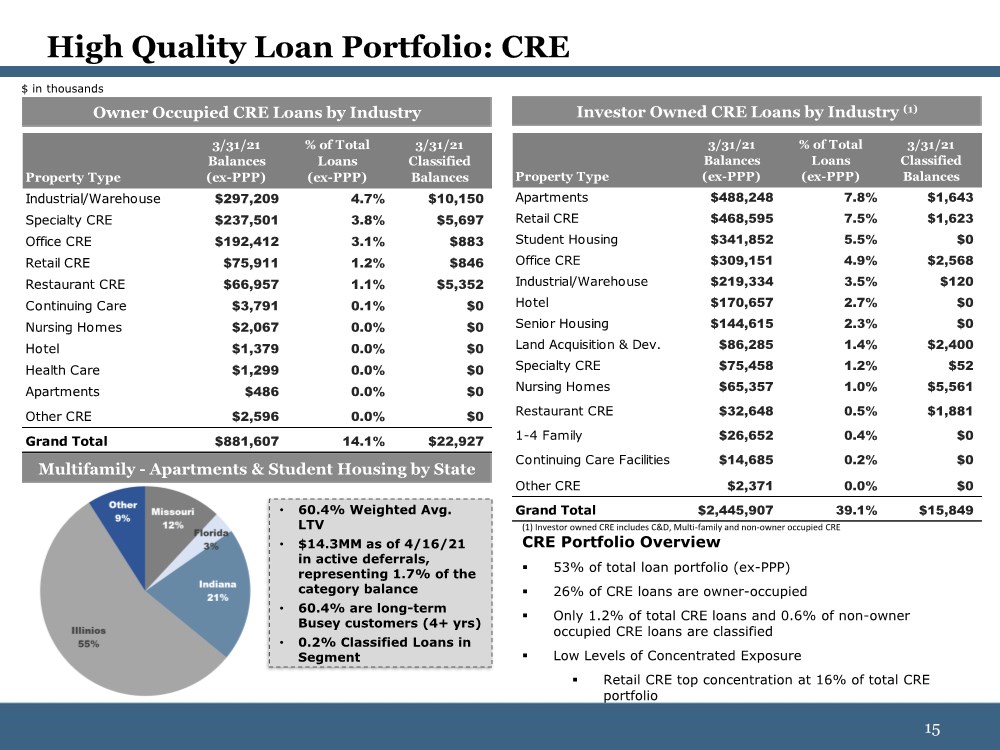

| 15 15 High Quality Loan Portfolio: CRE CRE Portfolio Overview ▪ 53% of total loan portfolio (ex-PPP) ▪ 26% of CRE loans are owner-occupied ▪ Only 1.2% of total CRE loans and 0.6% of non-owner occupied CRE loans are classified ▪ Low Levels of Concentrated Exposure ▪ Retail CRE top concentration at 16% of total CRE portfolio Investor Owned CRE Loans by Industry (1) Owner Occupied CRE Loans by Industry Multifamily - Apartments & Student Housing by State $ in thousands • 60.4% Weighted Avg. LTV • $14.3MM as of 4/16/21 in active deferrals, representing 1.7% of the category balance • 60.4% are long-term Busey customers (4+ yrs) • 0.2% Classified Loans in Segment (1) Investor owned CRE includes C&D, Multi-family and non-owner occupied CRE Property Type 3/31/21 Balances (ex-PPP) % of Total Loans (ex-PPP) 3/31/21 Classified Balances Apartments $488,248 7.8% $1,643 Retail CRE $468,595 7.5% $1,623 Student Housing $341,852 5.5% $0 Office CRE $309,151 4.9% $2,568 Industrial/Warehouse $219,334 3.5% $120 Hotel $170,657 2.7% $0 Senior Housing $144,615 2.3% $0 Land Acquisition & Dev. $86,285 1.4% $2,400 Specialty CRE $75,458 1.2% $52 Nursing Homes $65,357 1.0% $5,561 Restaurant CRE $32,648 0.5% $1,881 1-4 Family $26,652 0.4% $0 Continuing Care Facilities $14,685 0.2% $0 Other CRE $2,371 0.0% $0 Grand Total $2,445,907 39.1% $15,849 Property Type 3/31/21 Balances (ex-PPP) % of Total Loans (ex-PPP) 3/31/21 Classified Balances Industrial/Warehouse $297,209 4.7% $10,150 Specialty CRE $237,501 3.8% $5,697 Office CRE $192,412 3.1% $883 Retail CRE $75,911 1.2% $846 Restaurant CRE $66,957 1.1% $5,352 Continuing Care $3,791 0.1% $0 Nursing Homes $2,067 0.0% $0 Hotel $1,379 0.0% $0 Health Care $1,299 0.0% $0 Apartments $486 0.0% $0 Other CRE $2,596 0.0% $0 Grand Total $881,607 14.1% $22,927 |

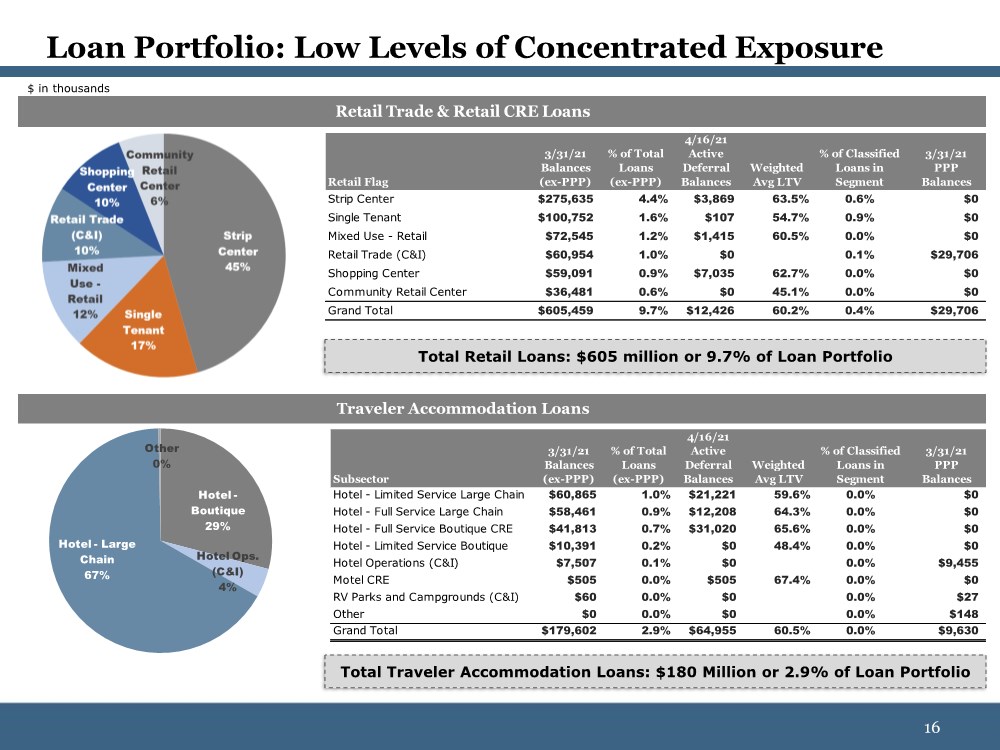

| 16 16 Loan Portfolio: Low Levels of Concentrated Exposure Total Retail Loans: $605 million or 9.7% of Loan Portfolio Total Traveler Accommodation Loans: $180 Million or 2.9% of Loan Portfolio $ in thousands Retail Trade & Retail CRE Loans Retail Flag 3/31/21 Balances (ex-PPP) % of Total Loans (ex-PPP) 4/16/21 Active Deferral Balances Weighted Avg LTV % of Classified Loans in Segment 3/31/21 PPP Balances Strip Center $275,635 4.4% $3,869 63.5% 0.6% $0 Single Tenant $100,752 1.6% $107 54.7% 0.9% $0 Mixed Use - Retail $72,545 1.2% $1,415 60.5% 0.0% $0 Retail Trade (C&I) $60,954 1.0% $0 0.1% $29,706 Shopping Center $59,091 0.9% $7,035 62.7% 0.0% $0 Community Retail Center $36,481 0.6% $0 45.1% 0.0% $0 Grand Total $605,459 9.7% $12,426 60.2% 0.4% $29,706 Subsector 3/31/21 Balances (ex-PPP) % of Total Loans (ex-PPP) 4/16/21 Active Deferral Balances Weighted Avg LTV % of Classified Loans in Segment 3/31/21 PPP Balances Hotel - Limited Service Large Chain $60,865 1.0% $21,221 59.6% 0.0% $0 Hotel - Full Service Large Chain $58,461 0.9% $12,208 64.3% 0.0% $0 Hotel - Full Service Boutique CRE $41,813 0.7% $31,020 65.6% 0.0% $0 Hotel - Limited Service Boutique $10,391 0.2% $0 48.4% 0.0% $0 Hotel Operations (C&I) $7,507 0.1% $0 0.0% $9,455 Motel CRE $505 0.0% $505 67.4% 0.0% $0 RV Parks and Campgrounds (C&I) $60 0.0% $0 0.0% $27 Other $0 0.0% $0 0.0% $148 Grand Total $179,602 2.9% $64,955 60.5% 0.0% $9,630 Traveler Accommodation Loans Hotel - Boutique 29% Hotel Ops. (C&I) 4% Hotel - Large Chain 67% Other 0% |

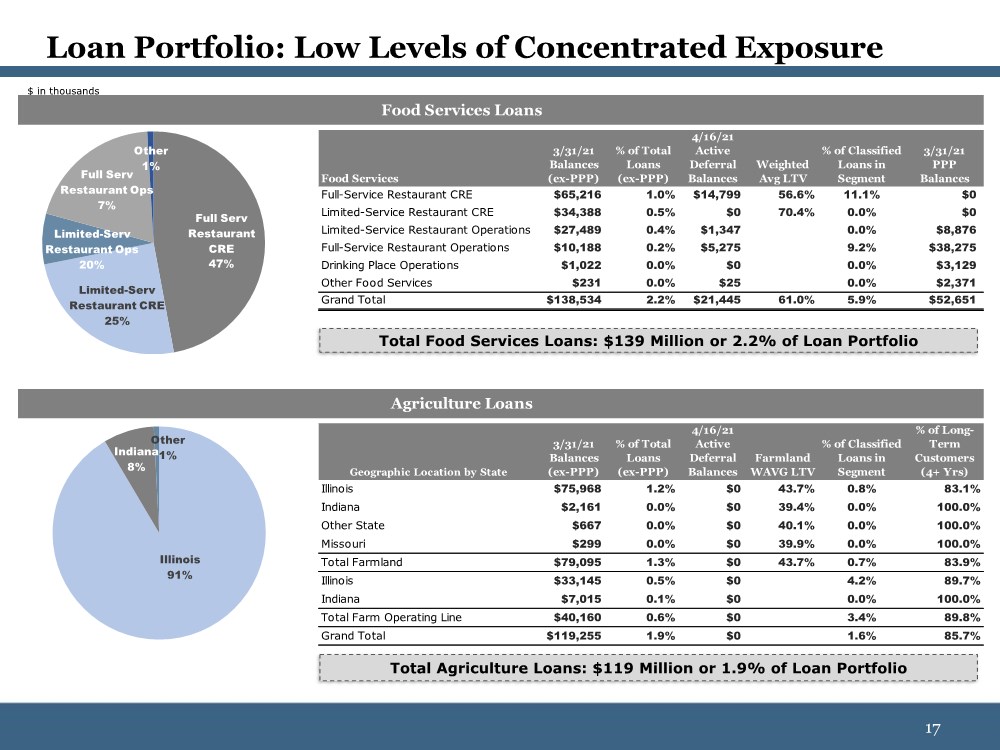

| 17 17 Loan Portfolio: Low Levels of Concentrated Exposure Total Food Services Loans: $139 Million or 2.2% of Loan Portfolio $ in thousands Total Agriculture Loans: $119 Million or 1.9% of Loan Portfolio Food Services 3/31/21 Balances (ex-PPP) % of Total Loans (ex-PPP) 4/16/21 Active Deferral Balances Weighted Avg LTV % of Classified Loans in Segment 3/31/21 PPP Balances Full-Service Restaurant CRE $65,216 1.0% $14,799 56.6% 11.1% $0 Limited-Service Restaurant CRE $34,388 0.5% $0 70.4% 0.0% $0 Limited-Service Restaurant Operations $27,489 0.4% $1,347 0.0% $8,876 Full-Service Restaurant Operations $10,188 0.2% $5,275 9.2% $38,275 Drinking Place Operations $1,022 0.0% $0 0.0% $3,129 Other Food Services $231 0.0% $25 0.0% $2,371 Grand Total $138,534 2.2% $21,445 61.0% 5.9% $52,651 Food Services Loans Full Serv Restaurant CRE 47% Limited-Serv Restaurant CRE 25% Full Serv Restaurant Ops 7% Limited-Serv Restaurant Ops 20% Other 1% Geographic Location by State 3/31/21 Balances (ex-PPP) % of Total Loans (ex-PPP) 4/16/21 Active Deferral Balances Farmland WAVG LTV % of Classified Loans in Segment % of Long- Term Customers (4+ Yrs) Illinois $75,968 1.2% $0 43.7% 0.8% 83.1% Indiana $2,161 0.0% $0 39.4% 0.0% 100.0% Other State $667 0.0% $0 40.1% 0.0% 100.0% Missouri $299 0.0% $0 39.9% 0.0% 100.0% Total Farmland $79,095 1.3% $0 43.7% 0.7% 83.9% Illinois $33,145 0.5% $0 4.2% 89.7% Indiana $7,015 0.1% $0 0.0% 100.0% Total Farm Operating Line $40,160 0.6% $0 3.4% 89.8% Grand Total $119,255 1.9% $0 1.6% 85.7% Agriculture Loans Illinois 91% Indiana 8% Other 1% |

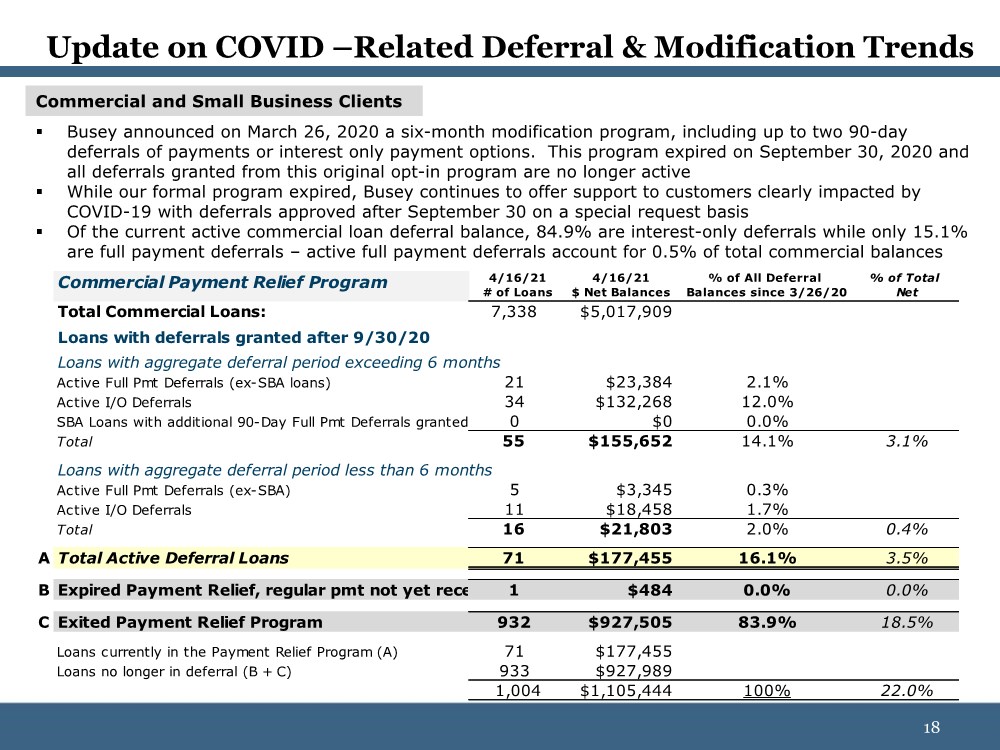

| 18 18 Update on COVID –Related Deferral & Modification Trends Commercial and Small Business Clients ▪ Busey announced on March 26, 2020 a six-month modification program, including up to two 90-day deferrals of payments or interest only payment options. This program expired on September 30, 2020 and all deferrals granted from this original opt-in program are no longer active ▪ While our formal program expired, Busey continues to offer support to customers clearly impacted by COVID-19 with deferrals approved after September 30 on a special request basis ▪ Of the current active commercial loan deferral balance, 84.9% are interest-only deferrals while only 15.1% are full payment deferrals – active full payment deferrals account for 0.5% of total commercial balances Commercial Payment Relief Program 4/16/21 # of Loans 4/16/21 $ Net Balances % of All Deferral Balances since 3/26/20 % of Total Net Total Commercial Loans: 7,338 $5,017,909 Loans with deferrals granted after 9/30/20 Loans with aggregate deferral period exceeding 6 months Active Full Pmt Deferrals (ex-SBA loans) 21 $23,384 2.1% Active I/O Deferrals 34 $132,268 12.0% SBA Loans with additional 90-Day Full Pmt Deferrals granted by Busey 0 $0 0.0% Total 55 $155,652 14.1% 3.1% Loans with aggregate deferral period less than 6 months Active Full Pmt Deferrals (ex-SBA) 5 $3,345 0.3% Active I/O Deferrals 11 $18,458 1.7% Total 16 $21,803 2.0% 0.4% A Total Active Deferral Loans 71 $177,455 16.1% 3.5% B Expired Payment Relief, regular pmt not yet received1 $484 0.0% 0.0% C Exited Payment Relief Program 932 $927,505 83.9% 18.5% Loans currently in the Payment Relief Program (A) 71 $177,455 Loans no longer in deferral (B + C) 933 $927,989 1,004 $1,105,444 100% 22.0% |

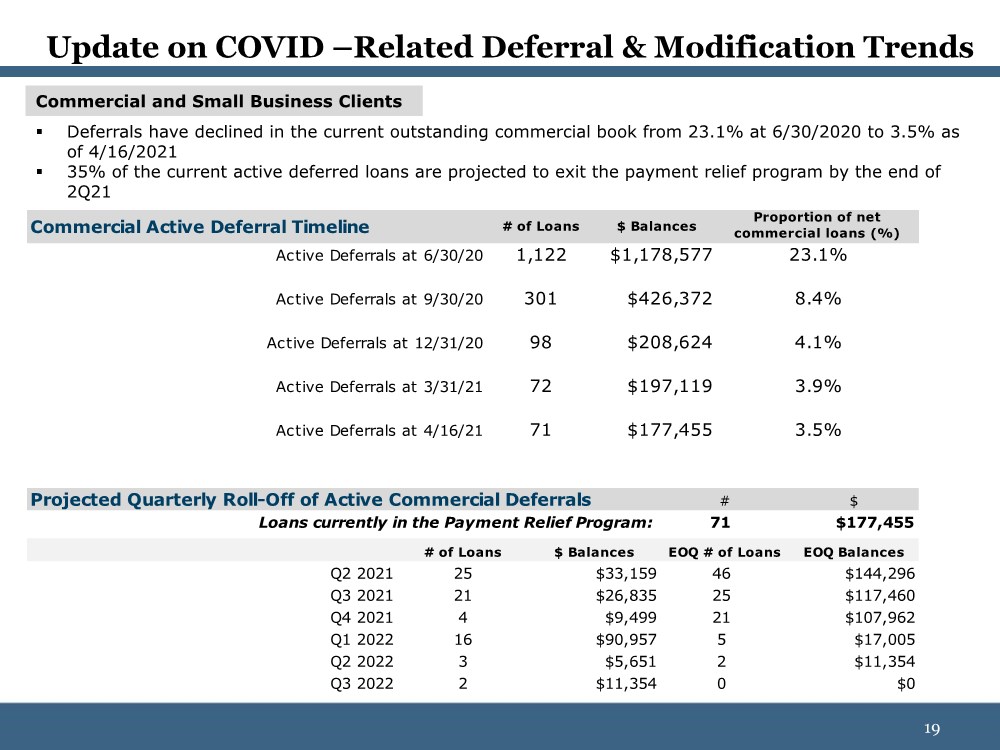

| 19 19 Update on COVID –Related Deferral & Modification Trends Commercial and Small Business Clients ▪ Deferrals have declined in the current outstanding commercial book from 23.1% at 6/30/2020 to 3.5% as of 4/16/2021 ▪ 35% of the current active deferred loans are projected to exit the payment relief program by the end of 2Q21 Commercial Active Deferral Timeline # of Loans $ Balances Proportion of net commercial loans (%) Active Deferrals at 6/30/20 1,122 $1,178,577 23.1% Active Deferrals at 9/30/20 301 $426,372 8.4% Active Deferrals at 12/31/20 98 $208,624 4.1% Active Deferrals at 3/31/21 72 $197,119 3.9% Active Deferrals at 4/16/21 71 $177,455 3.5% Projected Quarterly Roll-Off of Active Commercial Deferrals # $ 71 $177,455 # of Loans $ Balances EOQ # of Loans EOQ Balances Q2 2021 25 $33,159 46 $144,296 Q3 2021 21 $26,835 25 $117,460 Q4 2021 4 $9,499 21 $107,962 Q1 2022 16 $90,957 5 $17,005 Q2 2022 3 $5,651 2 $11,354 Q3 2022 2 $11,354 0 $0 Loans currently in the Payment Relief Program: |

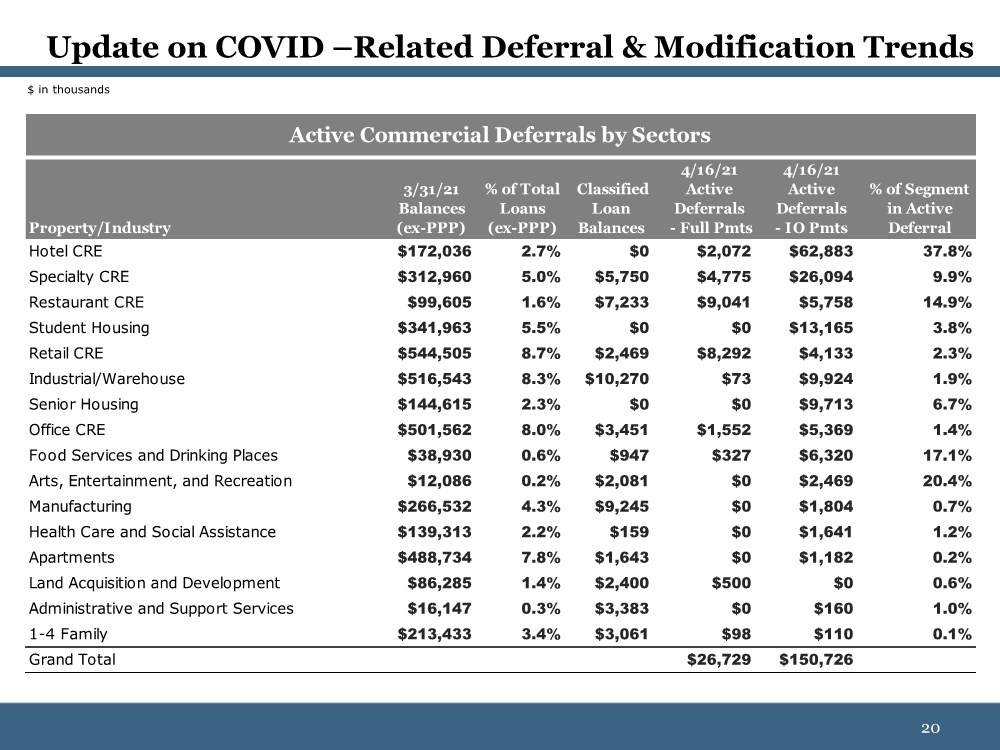

| 20 20 Update on COVID –Related Deferral & Modification Trends $ in thousands Property/Industry 3/31/21 Balances (ex-PPP) % of Total Loans (ex-PPP) Classified Loan Balances 4/16/21 Active Deferrals - Full Pmts 4/16/21 Active Deferrals - IO Pmts % of Segment in Active Deferral Hotel CRE $172,036 2.7% $0 $2,072 $62,883 37.8% Specialty CRE $312,960 5.0% $5,750 $4,775 $26,094 9.9% Restaurant CRE $99,605 1.6% $7,233 $9,041 $5,758 14.9% Student Housing $341,963 5.5% $0 $0 $13,165 3.8% Retail CRE $544,505 8.7% $2,469 $8,292 $4,133 2.3% Industrial/Warehouse $516,543 8.3% $10,270 $73 $9,924 1.9% Senior Housing $144,615 2.3% $0 $0 $9,713 6.7% Office CRE $501,562 8.0% $3,451 $1,552 $5,369 1.4% Food Services and Drinking Places $38,930 0.6% $947 $327 $6,320 17.1% Arts, Entertainment, and Recreation $12,086 0.2% $2,081 $0 $2,469 20.4% Manufacturing $266,532 4.3% $9,245 $0 $1,804 0.7% Health Care and Social Assistance $139,313 2.2% $159 $0 $1,641 1.2% Apartments $488,734 7.8% $1,643 $0 $1,182 0.2% Land Acquisition and Development $86,285 1.4% $2,400 $500 $0 0.6% Administrative and Support Services $16,147 0.3% $3,383 $0 $160 1.0% 1-4 Family $213,433 3.4% $3,061 $98 $110 0.1% Grand Total $26,729 $150,726 Active Commercial Deferrals by Sectors |

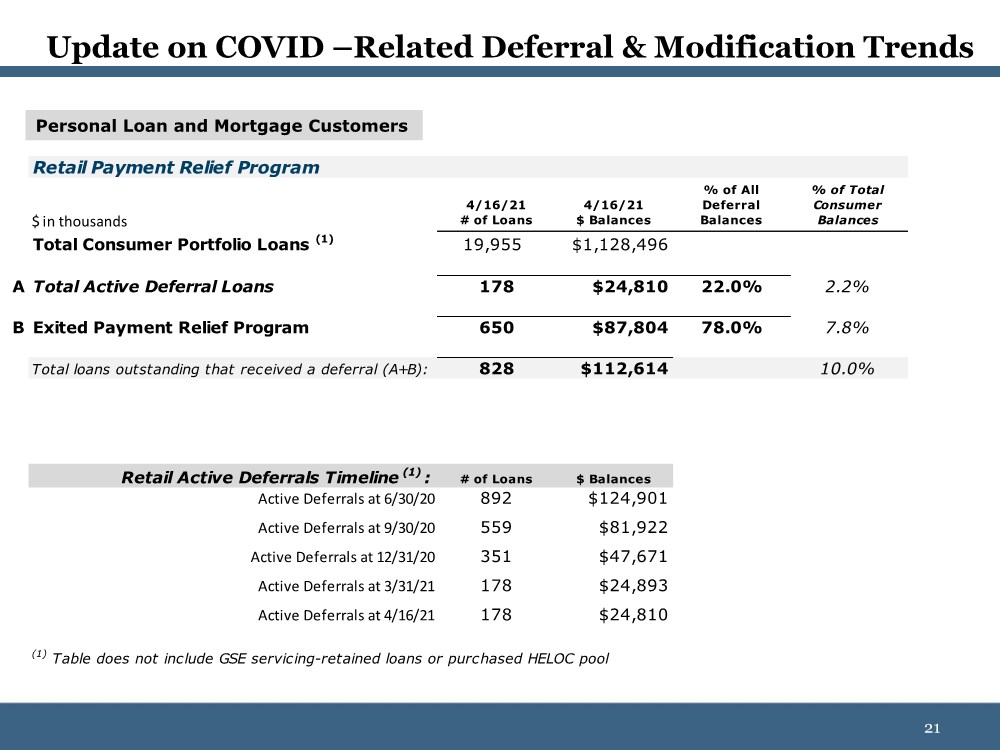

| 21 21 Update on COVID –Related Deferral & Modification Trends Personal Loan and Mortgage Customers Retail Payment Relief Program $ in thousands 4/16/21 # of Loans 4/16/21 $ Balances % of All Deferral Balances % of Total Consumer Balances Total Consumer Portfolio Loans (1) 19,955 $1,128,496 A Total Active Deferral Loans 178 $24,810 22.0% 2.2% B Exited Payment Relief Program 650 $87,804 78.0% 7.8% Total loans outstanding that received a deferral (A+B): 828 $112,614 10.0% Retail Active Deferrals Timeline (1) :# of Loans $ Balances Active Deferrals at 6/30/20 892 $124,901 Active Deferrals at 9/30/20 559 $81,922 Active Deferrals at 12/31/20 351 $47,671 Active Deferrals at 3/31/21 178 $24,893 Active Deferrals at 4/16/21 178 $24,810 (1) Table does not include GSE servicing-retained loans or purchased HELOC pool |

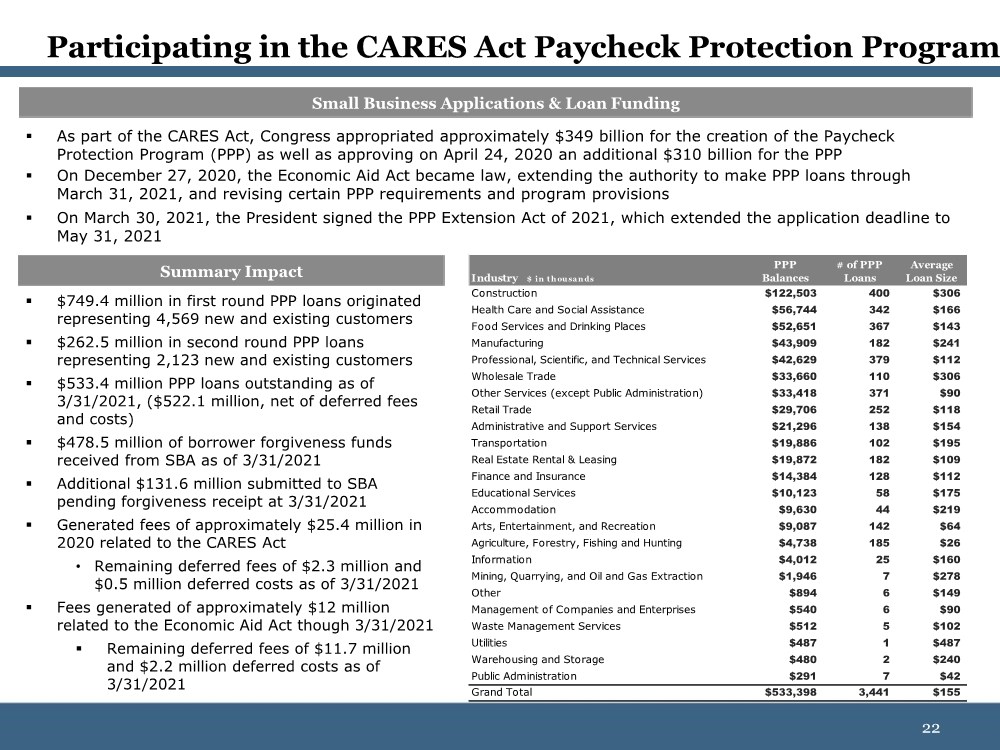

| 22 22 ▪ As part of the CARES Act, Congress appropriated approximately $349 billion for the creation of the Paycheck Protection Program (PPP) as well as approving on April 24, 2020 an additional $310 billion for the PPP ▪ On December 27, 2020, the Economic Aid Act became law, extending the authority to make PPP loans through March 31, 2021, and revising certain PPP requirements and program provisions ▪ On March 30, 2021, the President signed the PPP Extension Act of 2021, which extended the application deadline to May 31, 2021 ▪ $749.4 million in first round PPP loans originated representing 4,569 new and existing customers ▪ $262.5 million in second round PPP loans representing 2,123 new and existing customers ▪ $533.4 million PPP loans outstanding as of 3/31/2021, ($522.1 million, net of deferred fees and costs) ▪ $478.5 million of borrower forgiveness funds received from SBA as of 3/31/2021 ▪ Additional $131.6 million submitted to SBA pending forgiveness receipt at 3/31/2021 ▪ Generated fees of approximately $25.4 million in 2020 related to the CARES Act • Remaining deferred fees of $2.3 million and $0.5 million deferred costs as of 3/31/2021 ▪ Fees generated of approximately $12 million related to the Economic Aid Act though 3/31/2021 ▪ Remaining deferred fees of $11.7 million and $2.2 million deferred costs as of 3/31/2021 Participating in the CARES Act Paycheck Protection Program Summary Impact Small Business Applications & Loan Funding Industry $ in t h ou sands PPP Balances # of PPP Loans Average Loan Size Construction $122,503 400 $306 Health Care and Social Assistance $56,744 342 $166 Food Services and Drinking Places $52,651 367 $143 Manufacturing $43,909 182 $241 Professional, Scientific, and Technical Services $42,629 379 $112 Wholesale Trade $33,660 110 $306 Other Services (except Public Administration) $33,418 371 $90 Retail Trade $29,706 252 $118 Administrative and Support Services $21,296 138 $154 Transportation $19,886 102 $195 Real Estate Rental & Leasing $19,872 182 $109 Finance and Insurance $14,384 128 $112 Educational Services $10,123 58 $175 Accommodation $9,630 44 $219 Arts, Entertainment, and Recreation $9,087 142 $64 Agriculture, Forestry, Fishing and Hunting $4,738 185 $26 Information $4,012 25 $160 Mining, Quarrying, and Oil and Gas Extraction $1,946 7 $278 Other $894 6 $149 Management of Companies and Enterprises $540 6 $90 Waste Management Services $512 5 $102 Utilities $487 1 $487 Warehousing and Storage $480 2 $240 Public Administration $291 7 $42 Grand Total $533,398 3,441 $155 |

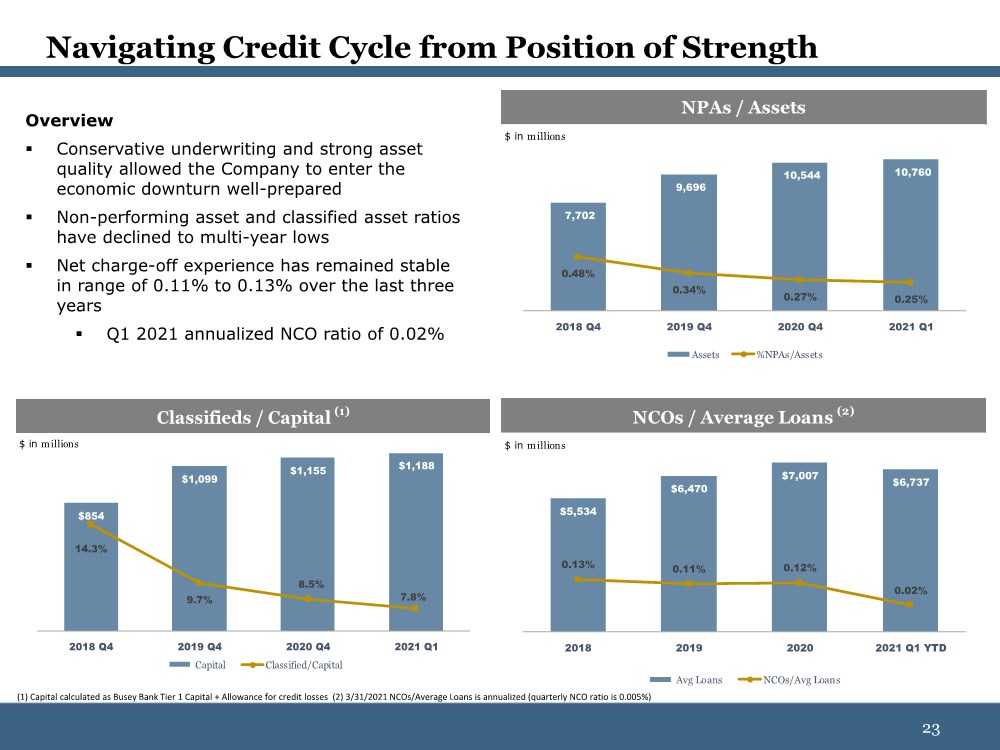

| 23 23 Navigating Credit Cycle from Position of Strength Overview ▪ Conservative underwriting and strong asset quality allowed the Company to enter the economic downturn well-prepared ▪ Non-performing asset and classified asset ratios have declined to multi-year lows ▪ Net charge-off experience has remained stable in range of 0.11% to 0.13% over the last three years ▪ Q1 2021 annualized NCO ratio of 0.02% (1) Capital calculated as Busey Bank Tier 1 Capital + Allowance for credit losses (2) 3/31/2021 NCOs/Average Loans is annualized (quarterly NCO ratio is 0.005%) NPAs / Assets 7,702 9,696 10,544 10,760 0.48% 0.34% 0.27% 0.25% 2018 Q4 2019 Q4 2020 Q4 2021 Q1 Assets %NPAs/Assets $ in millions ($ in millions) NCOs / Average Loans (2) $5,534 $6,470 $7,007 $6,737 0.13% 0.11% 0.12% 0.02% 2018 2019 2020 2021 Q1 YTD Avg Loans NCOs/Avg Loans $ in millions Classifieds / Capital (1) $854 $1,099 $1,155 $1,188 14.3% 9.7% 8.5% 7.8% 2018 Q4 2019 Q4 2020 Q4 2021 Q1 Capital Classified/Capital $ in millions |

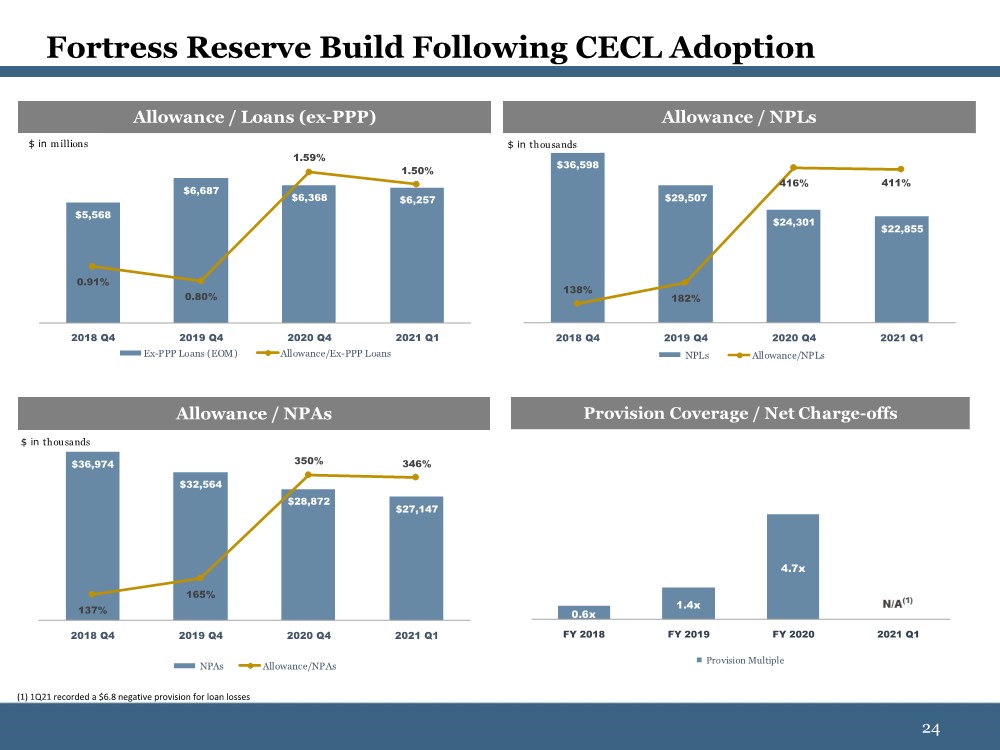

| 24 24 Fortress Reserve Build Following CECL Adoption Allowance / Loans (ex-PPP) $5,568 $6,687 $6,368 $6,257 0.91% 0.80% 1.59% 1.50% 2018 Q4 2019 Q4 2020 Q4 2021 Q1 Ex-PPP Loans (EOM) Allowance/Ex-PPP Loans $ in millions Allowance / NPLs $36,598 $29,507 $24,301 $22,855 138% 182% 416% 411% 2018 Q4 2019 Q4 2020 Q4 2021 Q1 NPLs Allowance/NPLs $ in thousands ($ in millions) Allowance / NPAs $36,974 $32,564 $28,872 $27,147 137% 165% 350% 346% 2018 Q4 2019 Q4 2020 Q4 2021 Q1 NPAs Allowance/NPAs $ in thousands (1) 1Q21 recorded a $6.8 negative provision for loan losses Provision Coverage / Net Charge-offs 0.6x 1.4x 4.7x FY 2018 FY 2019 FY 2020 2021 Q1 Provision Multiple |

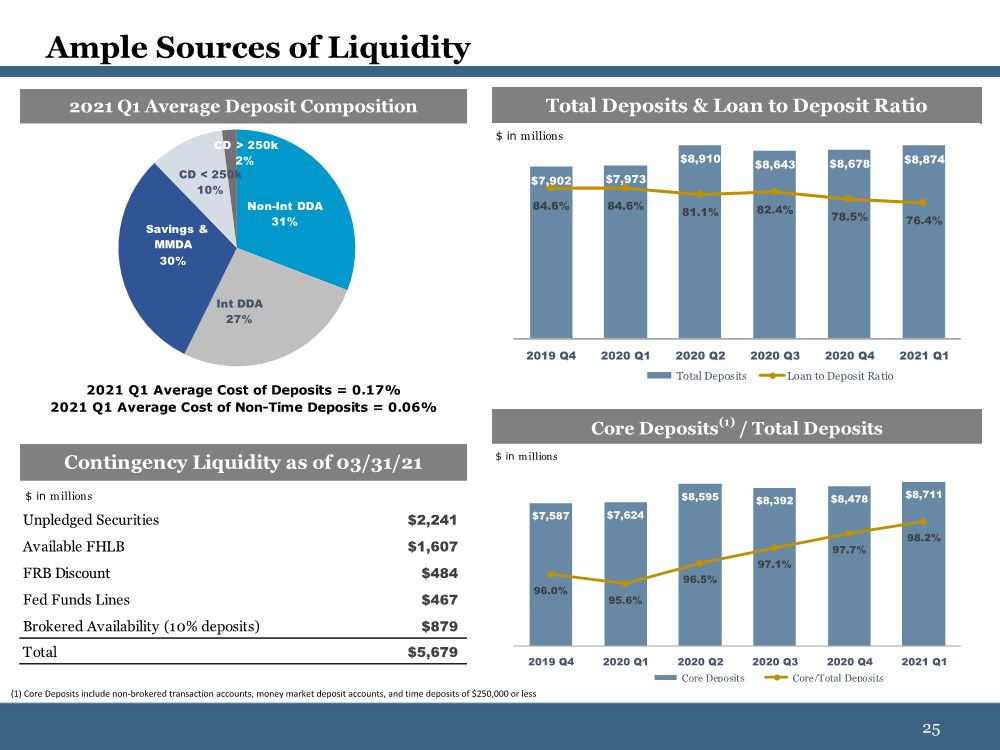

| 25 25 Ample Sources of Liquidity (1) Core Deposits include non-brokered transaction accounts, money market deposit accounts, and time deposits of $250,000 or less Total Deposits & Loan to Deposit Ratio $7,902 $7,973 $8,910 $8,643 $8,678 $8,874 84.6% 84.6% 81.1% 82.4% 78.5% 76.4% 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Total Deposits Loan to Deposit Ratio $ in millions ($ in millions) Core Deposits(1) / Total Deposits $7,587 $7,624 $8,595 $8,392 $8,478 $8,711 96.0% 95.6% 96.5% 97.1% 97.7% 98.2% 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Core Deposits Core/Total Deposits $ in millions Unpledged Securities $2,241 Available FHLB $1,607 FRB Discount $484 Fed Funds Lines $467 Brokered Availability (10% deposits) $879 Total $5,679 Contingency Liquidity as of 03/31/21 $ in millions 2021 Q1 Average Cost of Deposits = 0.17% 2021 Q1 Average Cost of Non-Time Deposits = 0.06% 2021 Q1 Average Deposit Composition Non-Int DDA 31% Int DDA 27% Savings & MMDA 30% CD < 250k 10% CD > 250k 2% |

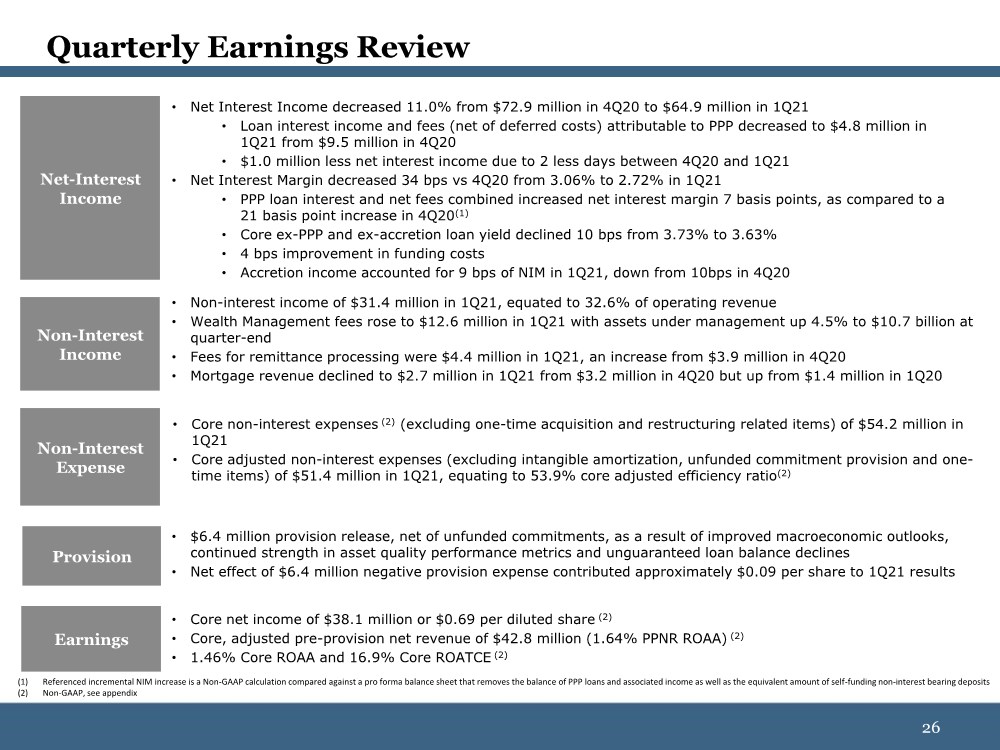

| 26 26 • Net Interest Income decreased 11.0% from $72.9 million in 4Q20 to $64.9 million in 1Q21 • Loan interest income and fees (net of deferred costs) attributable to PPP decreased to $4.8 million in 1Q21 from $9.5 million in 4Q20 • $1.0 million less net interest income due to 2 less days between 4Q20 and 1Q21 • Net Interest Margin decreased 34 bps vs 4Q20 from 3.06% to 2.72% in 1Q21 • PPP loan interest and net fees combined increased net interest margin 7 basis points, as compared to a 21 basis point increase in 4Q20(1) • Core ex-PPP and ex-accretion loan yield declined 10 bps from 3.73% to 3.63% • 4 bps improvement in funding costs • Accretion income accounted for 9 bps of NIM in 1Q21, down from 10bps in 4Q20 Non-Interest Expense • Non-interest income of $31.4 million in 1Q21, equated to 32.6% of operating revenue • Wealth Management fees rose to $12.6 million in 1Q21 with assets under management up 4.5% to $10.7 billion at quarter-end • Fees for remittance processing were $4.4 million in 1Q21, an increase from $3.9 million in 4Q20 • Mortgage revenue declined to $2.7 million in 1Q21 from $3.2 million in 4Q20 but up from $1.4 million in 1Q20 • Core non-interest expenses (2) (excluding one-time acquisition and restructuring related items) of $54.2 million in 1Q21 • Core adjusted non-interest expenses (excluding intangible amortization, unfunded commitment provision and one- time items) of $51.4 million in 1Q21, equating to 53.9% core adjusted efficiency ratio(2) • Core net income of $38.1 million or $0.69 per diluted share (2) • Core, adjusted pre-provision net revenue of $42.8 million (1.64% PPNR ROAA) (2) • 1.46% Core ROAA and 16.9% Core ROATCE (2) Earnings Non-Interest Income Net-Interest Income Quarterly Earnings Review (1) Referenced incremental NIM increase is a Non-GAAP calculation compared against a pro forma balance sheet that removes the balance of PPP loans and associated income as well as the equivalent amount of self-funding non-interest bearing deposits (2) Non-GAAP, see appendix Provision • $6.4 million provision release, net of unfunded commitments, as a result of improved macroeconomic outlooks, continued strength in asset quality performance metrics and unguaranteed loan balance declines • Net effect of $6.4 million negative provision expense contributed approximately $0.09 per share to 1Q21 results |

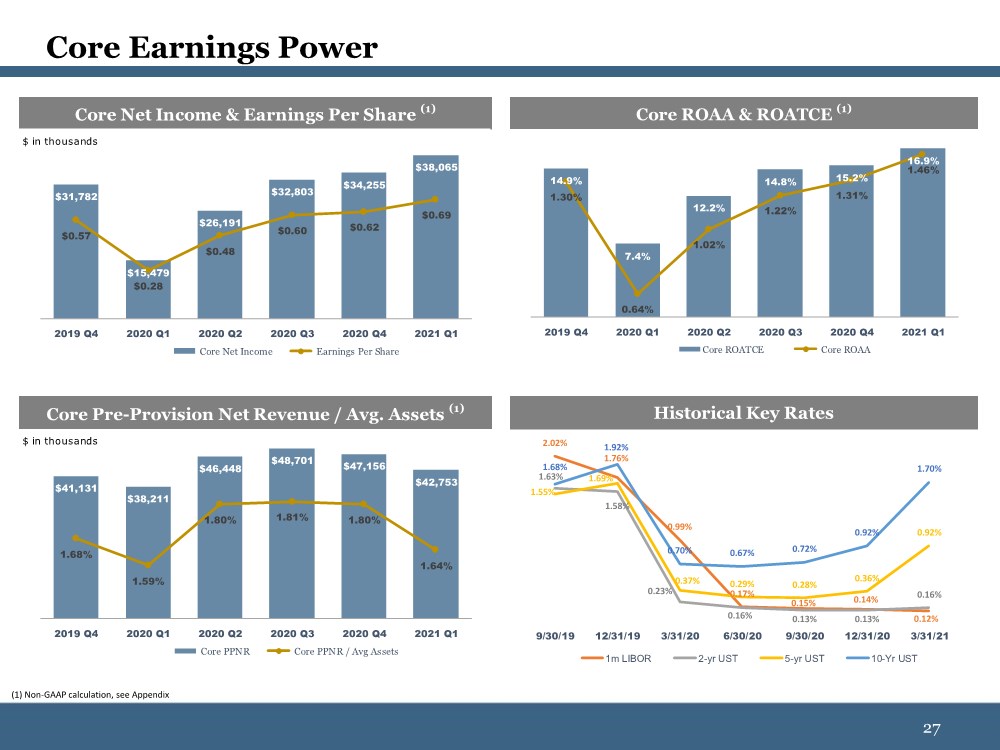

| 27 27 Core Earnings Power (1) Non-GAAP calculation, see Appendix Core ROAA & ROATCE (1) 14.9% 7.4% 12.2% 14.8% 15.2% 16.9% 1.30% 0.64% 1.02% 1.22% 1.31% 1.46% 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Core ROATCE Core ROAA ($ in millions) Core Net Income & Earnings Per Share (1) $31,782 $15,479 $26,191 $32,803 $34,255 $38,065 $0.57 $0.28 $0.48 $0.60 $0.62 $0.69 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Core Net Income Earnings Per Share $ in thousands ($ in millions) Core Pre-Provision Net Revenue / Avg. Assets (1) $41,131 $38,211 $46,448 $48,701 $47,156 $42,753 1.68% 1.59% 1.80% 1.81% 1.80% 1.64% 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Core PPNR Core PPNR / Avg Assets $ in thousands Historical Key Rates 1.63% 1.58% 0.23% 0.16% 0.13% 0.13% 0.16% 1.68% 1.92% 0.70% 0.67% 0.72% 0.92% 1.70% 2.02% 1.76% 0.99% 0.17% 0.15% 0.14% 0.12% 1.55% 1.69% 0.37% 0.29% 0.28% 0.36% 0.92% 9/30/19 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 1m LIBOR 2-yr UST 5-yr UST 10-Yr UST |

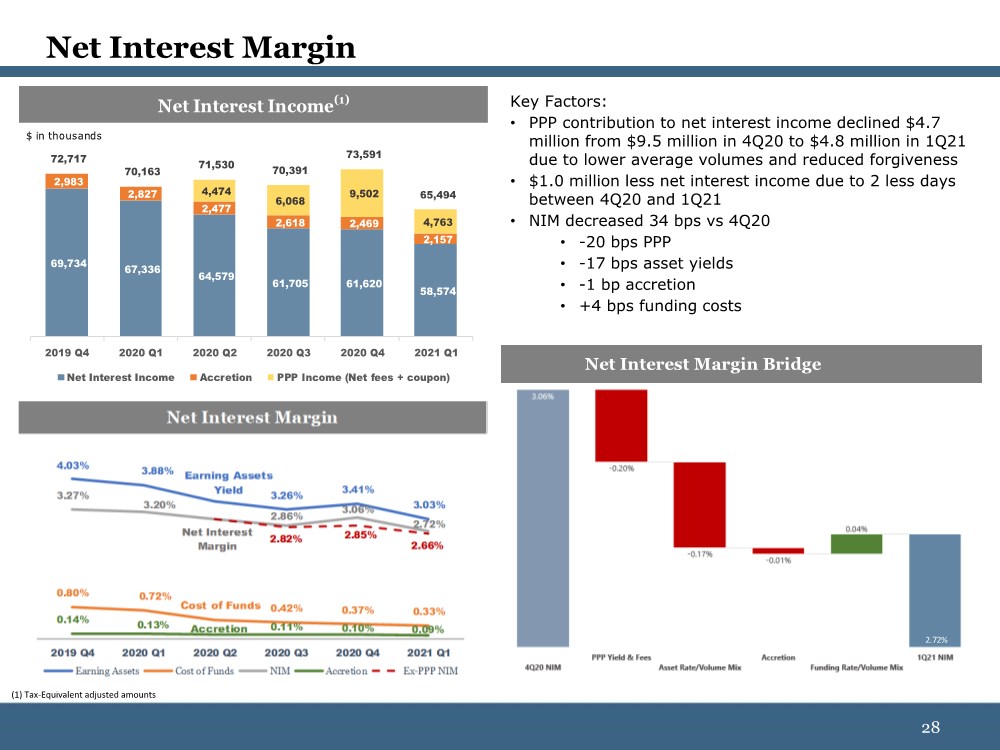

| 28 28 Net Interest Margin Key Factors: • PPP contribution to net interest income declined $4.7 million from $9.5 million in 4Q20 to $4.8 million in 1Q21 due to lower average volumes and reduced forgiveness • $1.0 million less net interest income due to 2 less days between 4Q20 and 1Q21 • NIM decreased 34 bps vs 4Q20 •-20 bps PPP •-17 bps asset yields •-1 bp accretion • +4 bps funding costs Net Interest Margin Bridge 2.72% 2.72% (1) Tax-Equivalent adjusted amounts Net Interest Income(1) 69,734 67,336 64,579 61,705 61,620 58,574 2,983 2,827 2,477 2,618 2,469 2,157 4,474 6,068 9,502 4,763 72,717 70,163 71,530 70,391 73,591 65,494 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Net Interest Income Accretion PPP Income (Net fees + coupon) $ in thousands |

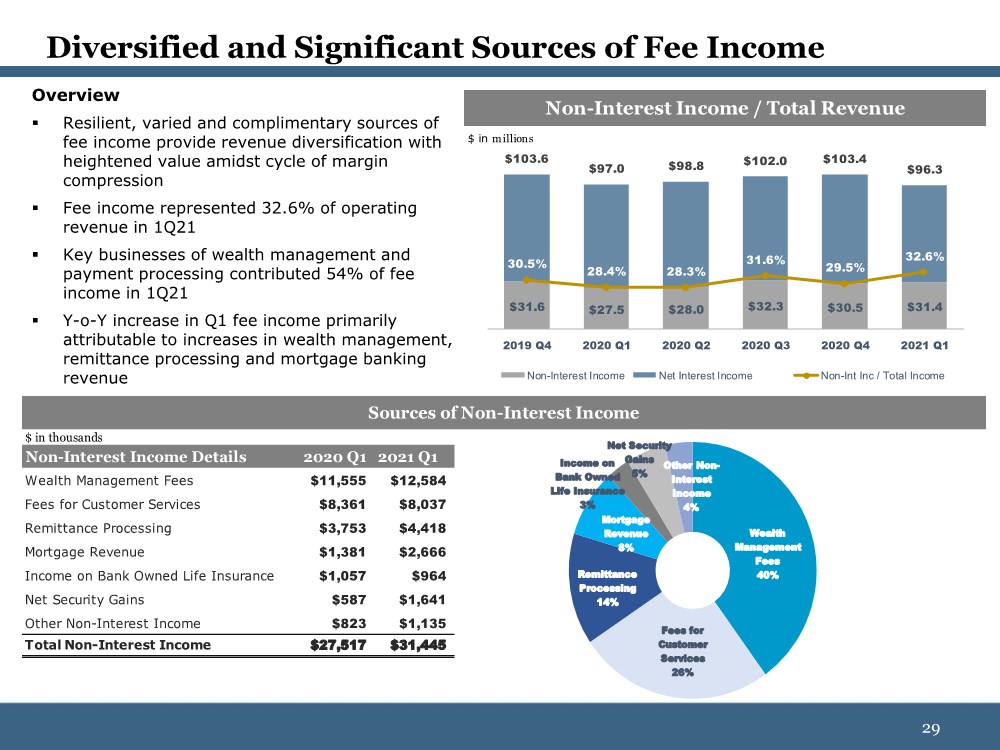

| 29 29 Overview ▪ Resilient, varied and complimentary sources of fee income provide revenue diversification with heightened value amidst cycle of margin compression ▪ Fee income represented 32.6% of operating revenue in 1Q21 ▪ Key businesses of wealth management and payment processing contributed 54% of fee income in 1Q21 ▪ Y-o-Y increase in Q1 fee income primarily attributable to increases in wealth management, remittance processing and mortgage banking revenue Diversified and Significant Sources of Fee Income Non-Interest Income / Total Revenue $31.6 $27.5 $28.0 $32.3 $30.5 $31.4 $103.6 $97.0 $98.8 $102.0 $103.4 $96.3 30.5% 28.4% 28.3% 31.6% 29.5% 32.6% 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Non-Interest Income Net Interest Income Non-Int Inc / Total Income $ in millions $ in thousands 2020 Q1 2021 Q1 Wealth Management Fees $11,555 $12,584 Fees for Customer Services $8,361 $8,037 Remittance Processing $3,753 $4,418 Mortgage Revenue $1,381 $2,666 Income on Bank Owned Life Insurance $1,057 $964 Net Security Gains $587 $1,641 Other Non-Interest Income $823 $1,135 Total Non-Interest Income $27,517 $31,445 Non-Interest Income Details Sources of Non-Interest Income Wealth Management Fees 40% Fees for Customer Services 26% Remittance Processing 14% Mortgage Revenue 8% Income on Bank Owned Life Insurance 3% Net Security Gains 5% Other Non- Interest Income 4% |

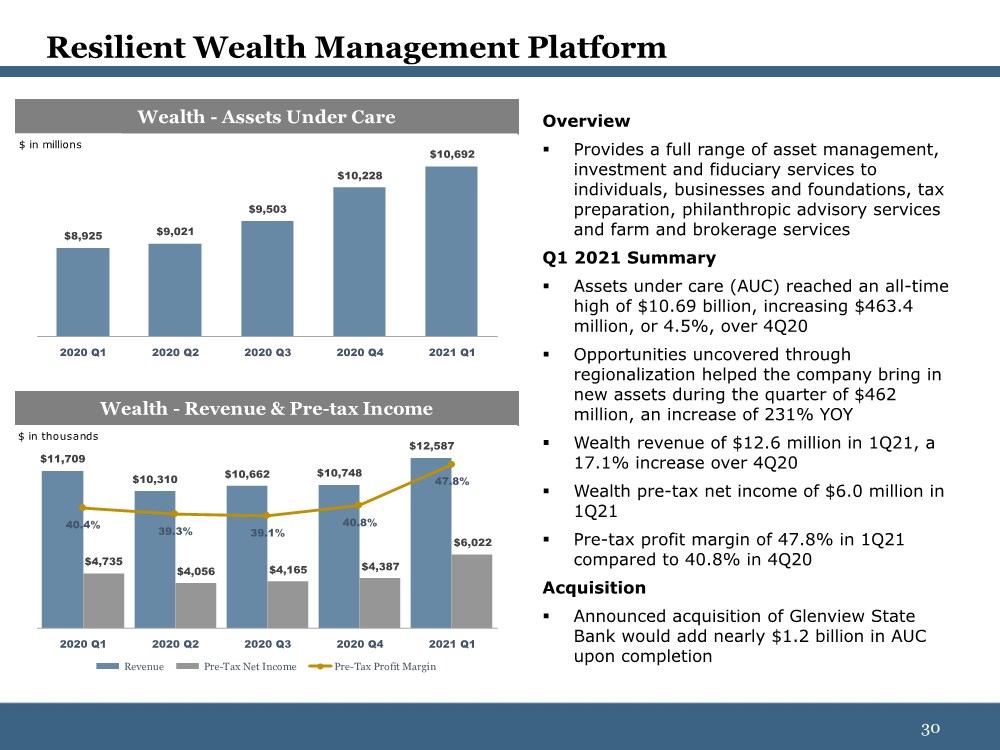

| 30 30 Resilient Wealth Management Platform Overview ▪ Provides a full range of asset management, investment and fiduciary services to individuals, businesses and foundations, tax preparation, philanthropic advisory services and farm and brokerage services Q1 2021 Summary ▪ Assets under care (AUC) reached an all-time high of $10.69 billion, increasing $463.4 million, or 4.5%, over 4Q20 ▪ Opportunities uncovered through regionalization helped the company bring in new assets during the quarter of $462 million, an increase of 231% YOY ▪ Wealth revenue of $12.6 million in 1Q21, a 17.1% increase over 4Q20 ▪ Wealth pre-tax net income of $6.0 million in 1Q21 ▪ Pre-tax profit margin of 47.8% in 1Q21 compared to 40.8% in 4Q20 Acquisition ▪ Announced acquisition of Glenview State Bank would add nearly $1.2 billion in AUC upon completion ($ in millions) Wealth - Assets Under Care $8,925 $9,021 $9,503 $10,228 $10,692 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 $ in millions ($ in millions) Wealth - Revenue & Pre-tax Income $11,709 $10,310 $10,662 $10,748 $12,587 $4,735 $4,056 $4,165 $4,387 $6,022 40.4% 39.3% 39.1% 40.8% 47.8% 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Revenue Pre-Tax Net Income Pre-Tax Profit Margin $ in thousands |

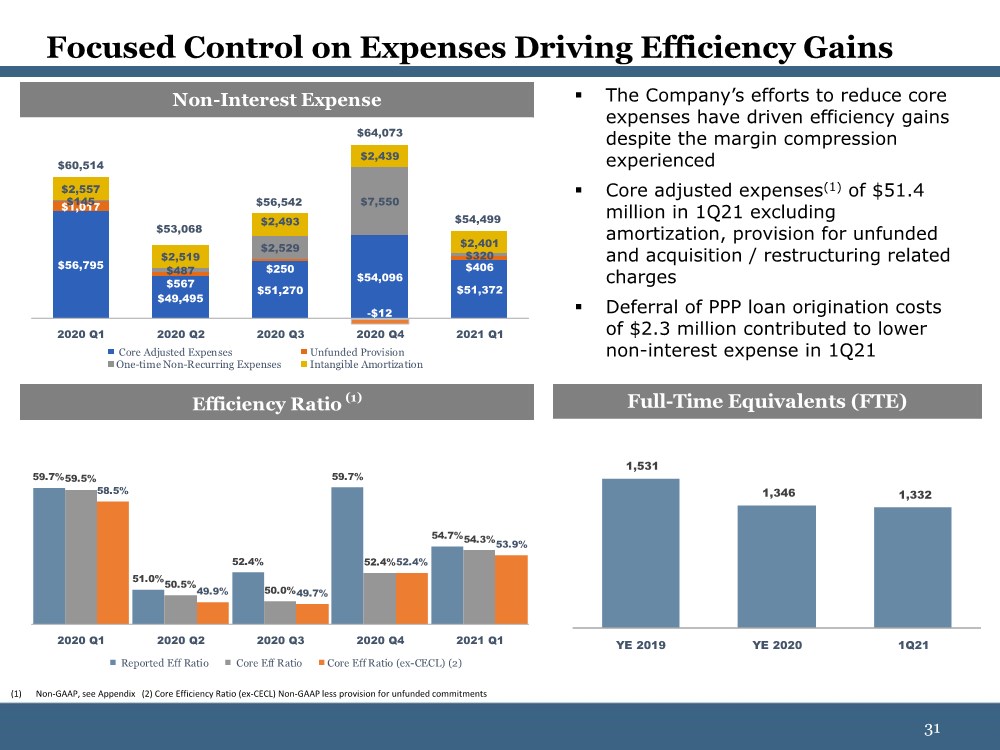

| 31 31 Focused Control on Expenses Driving Efficiency Gains (1) Non-GAAP, see Appendix (2) Core Efficiency Ratio (ex-CECL) Non-GAAP less provision for unfunded commitments ▪ The Company’s efforts to reduce core expenses have driven efficiency gains despite the margin compression experienced ▪ Core adjusted expenses(1) of $51.4 million in 1Q21 excluding amortization, provision for unfunded and acquisition / restructuring related charges ▪ Deferral of PPP loan origination costs of $2.3 million contributed to lower non-interest expense in 1Q21 ($ in millions) Non-Interest Expense $56,795 $49,495 $51,270 $54,096 $51,372 $1,017 $567 $250 $406 $145 $487 $2,529 $7,550 $320 $2,557 $2,519 $2,493 $2,439 $2,401 $60,514 $53,068 $56,542 $64,073 $54,499 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Core Adjusted Expenses Unfunded Provision One-time Non-Recurring Expenses Intangible Amortization -$12 ($ in millions) Full-Time Equivalents (FTE) 1,531 1,346 1,332 YE 2019 YE 2020 1Q21 ($ in millions) Efficiency Ratio (1) 59.7% 51.0% 52.4% 59.7% 54.7% 59.5% 50.5% 50.0% 52.4% 54.3% 58.5% 49.9% 49.7% 52.4% 53.9% 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Reported Eff Ratio Core Eff Ratio Core Eff Ratio (ex-CECL) (2) |

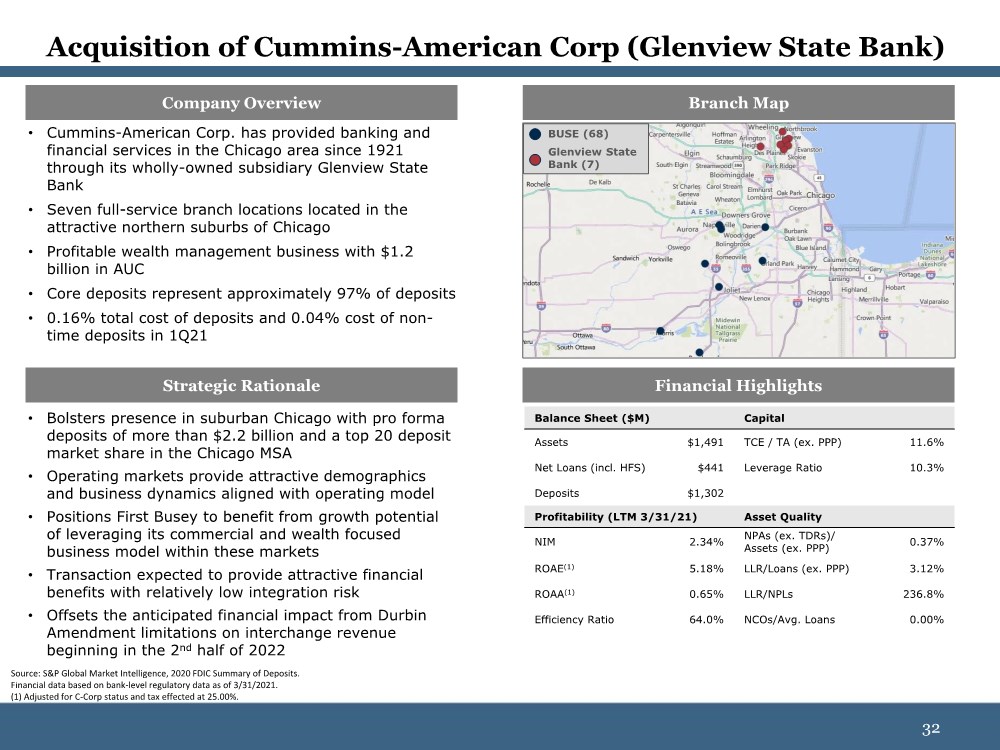

| 32 32 Company Overview Acquisition of Cummins-American Corp (Glenview State Bank) Source: S&P Global Market Intelligence, 2020 FDIC Summary of Deposits. Financial data based on bank-level regulatory data as of 3/31/2021. (1) Adjusted for C-Corp status and tax effected at 25.00%. • Cummins-American Corp. has provided banking and financial services in the Chicago area since 1921 through its wholly-owned subsidiary Glenview State Bank • Seven full-service branch locations located in the attractive northern suburbs of Chicago • Profitable wealth management business with $1.2 billion in AUC • Core deposits represent approximately 97% of deposits • 0.16% total cost of deposits and 0.04% cost of non- time deposits in 1Q21 Strategic Rationale Branch Map Financial Highlights Balance Sheet ($M) Capital Assets $1,491 TCE / TA (ex. PPP) 11.6% Net Loans (incl. HFS) $441 Leverage Ratio 10.3% Deposits $1,302 Profitability (LTM 3/31/21) Asset Quality NIM 2.34% NPAs (ex. TDRs)/ Assets (ex. PPP) 0.37% ROAE(1) 5.18% LLR/Loans (ex. PPP) 3.12% ROAA(1) 0.65% LLR/NPLs 236.8% Efficiency Ratio 64.0% NCOs/Avg. Loans 0.00% • Bolsters presence in suburban Chicago with pro forma deposits of more than $2.2 billion and a top 20 deposit market share in the Chicago MSA • Operating markets provide attractive demographics and business dynamics aligned with operating model • Positions First Busey to benefit from growth potential of leveraging its commercial and wealth focused business model within these markets • Transaction expected to provide attractive financial benefits with relatively low integration risk • Offsets the anticipated financial impact from Durbin Amendment limitations on interchange revenue beginning in the 2nd half of 2022 BUSE (68) Glenview State Bank (7) |

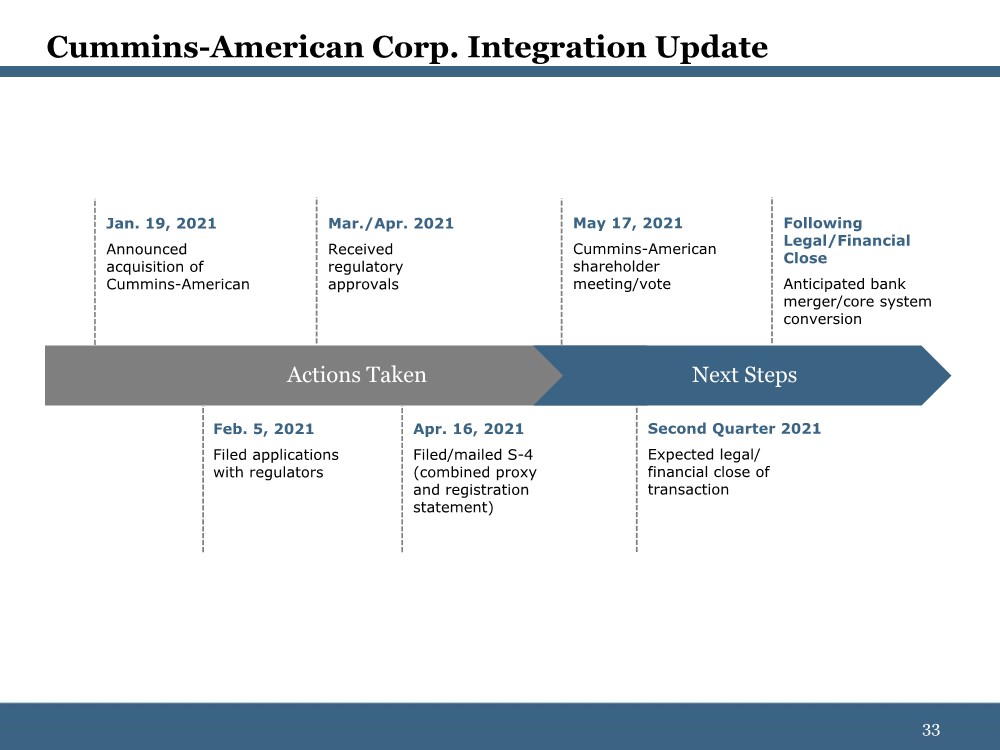

| 33 33 Cummins-American Corp. Integration Update Actions Taken Next Steps Jan. 19, 2021 Announced acquisition of Cummins-American Feb. 5, 2021 Filed applications with regulators Mar./Apr. 2021 Received regulatory approvals Apr. 16, 2021 Filed/mailed S-4 (combined proxy and registration statement) May 17, 2021 Cummins-American shareholder meeting/vote Following Legal/Financial Close Anticipated bank merger/core system conversion Second Quarter 2021 Expected legal/ financial close of transaction |

| 34 34 APPENDIX 34 |

| 35 35 Use of Non-GAAP Financial Measures (1) Annualized measure ($ in thousands) (Unaudited results) March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 Net interest income $64,893 $72,936 $69,753 $70,813 $69,433 Non-interest income 31,445 30,499 32,285 27,964 27,517 Less securities (gains) and losses, net (1,641) (855) 426 (315) (587) Non-interest expense (54,499) (64,073) (56,542) (53,068) (60,514) Pre-provision net revenue $40,198 $38,507 $45,922 $45,394 $35,849 Acquisition and other restructuring expenses 320 7,550 2,529 487 145 Provision for unfunded commitments 406 (12) 250 567 1,017 New Market Tax Credit amortization 1,829 1,111 — — 1,200 Adjusted: pre-provision net revenue $42,753 $47,156 $48,701 $46,448 $38,211 Average total assets $10,594,245 $10,419,364 $10,680,995 $10,374,820 $9,688,177 Reported: Pre-provision net revenue to average assets(1) 1.54 % 1.47 % 1.71 % 1.76 % 1.49 % Adjusted: Pre-provision net revenue to average assets(1) 1.64 % 1.80 % 1.81 % 1.80 % 1.59 % Three Months Ended March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 Reported: Net income $37,816 $28,345 $30,829 $25,806 $15,364 Acquisition expenses: Salaries, wages, and employee benefits — — — — — Data processing 7 56 — — — Lease or fixed asset impairment — 245 234 — — Professional fees and other 313 479 99 141 145 Other restructuring costs: Salaries, wages, and employee benefits — 113 2,011 346 — Data processing — — — — — Fixed asset impairment — 6,657 — — — Professional fees and other — — 185 — — Related tax benefit (71) (1,640) (555) (102) (30) Adjusted: Net income $38,065 $34,255 $32,803 $26,191 $15,479 Dilutive average common shares outstanding 55,035,806 54,911,458 54,737,920 54,705,273 54,913,329 Reported: Diluted earnings per share $0.69 $0.52 $0.56 $0.47 $0.28 Adjusted: Diluted earnings per share $0.69 $0.62 $0.60 $0.48 $0.28 Average total assets $10,594,245 $10,419,364 $10,680,995 $10,374,820 $9,688,177 Reported: Return on average assets(1) 1.45 % 1.08 % 1.15 % 1.00 % 0.64 % Adjusted: Return on average assets(1) 1.46 % 1.31 % 1.22 % 1.02 % 0.64 % Three Months Ended |

| 36 36 Use of Non-GAAP Financial Measures (1) Tax-effected measure. 28% estimated deferred tax rate (2) Annualized measure (3) Calculated using adjusted net income March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 Total assets $10,759,563 $10,544,047 $10,539,628 $10,835,965 $9,721,405 Goodwill and other intangible assets, net (361,120) (363,521) (365,960) (368,053) (370,572) Tax effect of other intangible assets, net 13,883 14,556 15,239 15,825 16,530 Tangible assets $10,412,326 $10,195,082 $10,188,907 $10,483,737 $9,367,363 Total stockholders’ equity 1,265,822 1,270,069 1,255,705 1,236,084 1,217,585 Goodwill and other intangible assets, net (361,120) (363,521) (365,960) (368,053) (370,572) Tax effect of other intangible assets, net 13,883 14,556 15,239 15,825 16,530 Tangible common equity 918,585 921,104 904,984 883,856 863,543 Ending number of common shares outstanding 54,345,379 54,404,379 54,522,231 54,516,000 54,401,208 Tangible common equity to tangible assets(1) 8.82 % 9.03 % 8.88 % 8.43 % 9.22 % Tangible book value per share $16.65 $16.66 $16.32 $15.92 $15.57 Average common equity $1,275,694 $1,261,298 $1,248,448 $1,233,270 $1,218,160 Average goodwill and other intangible assets, net (362,693) (365,120) (367,490) (369,699) (372,240) Average tangible common equity $913,001 $896,178 $880,958 $863,571 $845,920 Reported: Return on average tangible common equity(2) 16.80 % 12.58 % 13.92 % 12.02 % 7.30 % Adjusted: Return on average tangible common equity(2)(3) 16.91 % 15.21 % 14.81 % 12.20 % 7.36 % As of and for the Three Months Ended ($ in thousands) (Unaudited results) March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 Reported: Net Interest income $64,893 $72,936 $69,753 $70,813 $69,433 Tax-equivalent adjustment 601 655 638 717 730 Tax-equivalent interest income $65,494 $73,591 $70,391 $71,530 $70,163 Reported: Non-interest income 31,445 30,499 32,285 27,964 27,517 Less securities (gains) and losses, net (1,641) (855) 426 (315) (587) Adjusted: Non-interest income $29,804 $29,644 $32,711 $27,649 $26,930 Reported: Non-interest expense 54,499 64,073 56,542 53,068 60,514 Amortization of intangible assets (2,401) (2,439) (2,493) (2,519) (2,557) Non-operating adjustments: Salaries, wages, and employee benefits — (113) (2,011) (346) — Data processing (7) (56) — — — Impairment, professional fees and other (313) (7,381) (518) (141) (145) Adjusted: Non-interest expense $51,778 $54,084 $51,520 $50,062 $57,812 Reported: Efficiency ratio 54.67 % 59.70 % 52.42 % 50.97 % 59.69 % Adjusted: Efficiency ratio 54.33 % 52.39 % 49.97 % 50.48 % 59.54 % Three Months Ended |