Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ARMSTRONG WORLD INDUSTRIES INC | awi-ex991_6.htm |

| 8-K - 8-K - ARMSTRONG WORLD INDUSTRIES INC | awi-8k_20210427.htm |

Earnings Call Presentation 1st Quarter 2021 April 27, 2021 Exhibit 99.2

Our disclosures in this presentation, including without limitation, those relating to future financial results market conditions and guidance, the impacts of COVID-19 on our business, and in our other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that may affect our ability to achieve the projected performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Forms 10-K and 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”). Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-GAAP financial measures within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance with GAAP are included within this presentation and available on the Investor Relations page of our website at www.armstrongceilings.com. The guidance in this presentation is only effective as of the date given, April 27, 2021 and will not be updated or affirmed unless and until we publicly announce updated or affirmed guidance Safe Harbor Statement

All figures throughout the presentation are in $ millions unless otherwise noted. Figures may not add due to rounding. When reporting our financial results within this presentation, we make several adjustments. Management uses these non-GAAP measures in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods. As reported results will be footnoted throughout the presentation on a continuing operations basis (excludes corporate unallocated). Basis of Presentation Explanation Results throughout this presentation are presented on a normalized basis with the exception of cash flow. We remove the impact of certain discrete expenses and income. The Company excludes certain acquisition related expenses (i.e. – changes in the fair value of earnouts, deferred compensation accruals, impact of adjustments related to the fair value of inventory and deferred revenue) for recent acquisitions(1). Examples of other excluded items include plant closures, restructuring actions and related costs, impairments, separation costs, environmental site expenses and related insurance recoveries, endowment level charitable contributions, and other large unusual items. We also adjust for our U.S. pension plan (credit) expense(2). Our tax rate may be adjusted for certain discrete items which are identified in the footnotes. Investors should not consider non-GAAP measures as a substitute for GAAP measures. The deferred compensation accruals are for cash and stock awards that will be recorded over the vesting period, as such payments are subject to the sellers’ and employees’ continued employment with the Company. U.S. pension (credit) expense represents the actuarial net periodic benefit cost expected to be recorded as a component of earnings from continuing operations. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation.

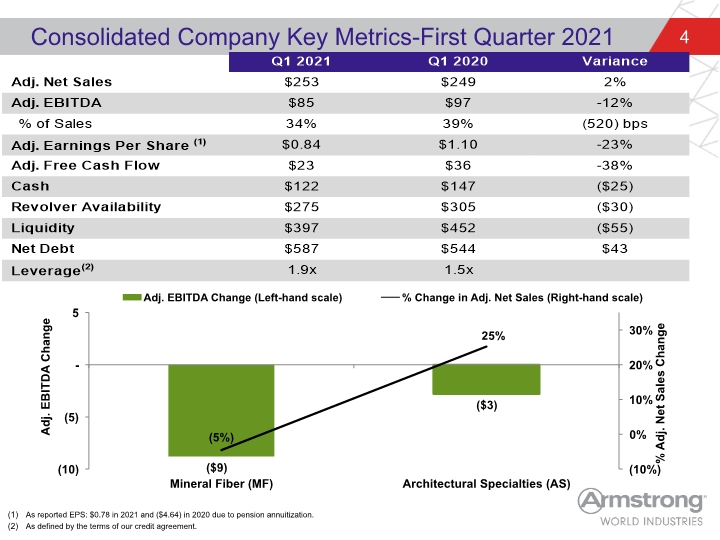

Consolidated Company Key Metrics-First Quarter 2021 As reported EPS: $0.78 in 2021 and ($4.64) in 2020 due to pension annuitization. As defined by the terms of our credit agreement.

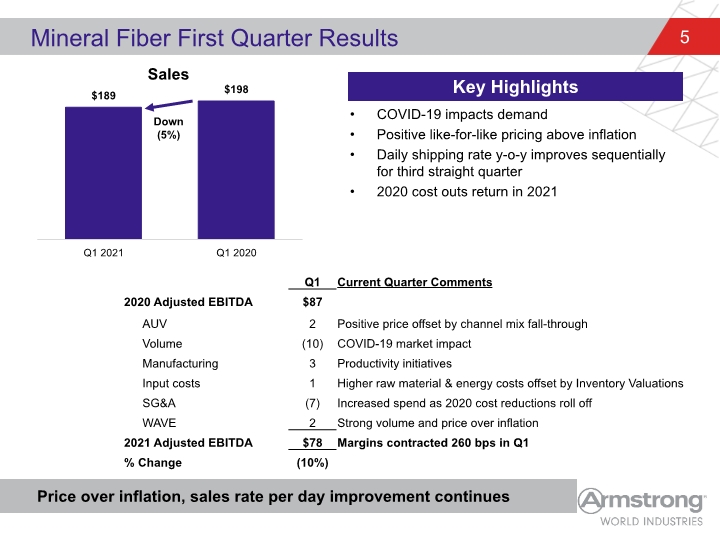

COVID-19 impacts demand Positive like-for-like pricing above inflation Daily shipping rate y-o-y improves sequentially for third straight quarter 2020 cost outs return in 2021 Mineral Fiber First Quarter Results Price over inflation, sales rate per day improvement continues Key Highlights

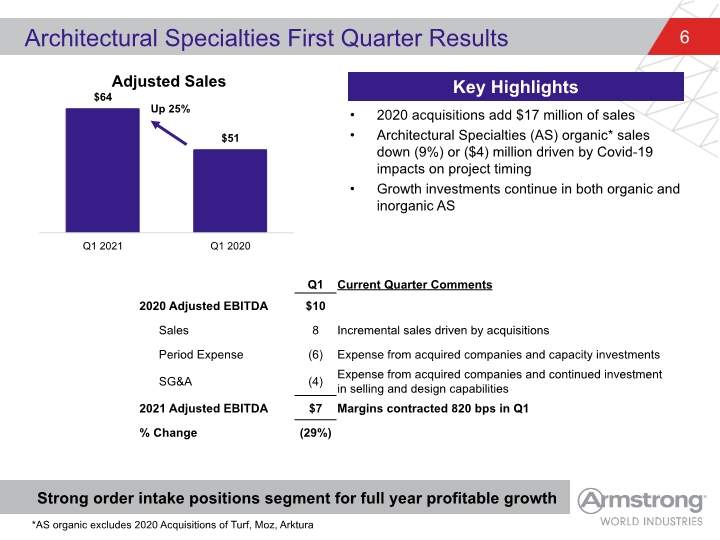

2020 acquisitions add $17 million of sales Architectural Specialties (AS) organic* sales down (9%) or ($4) million driven by Covid-19 impacts on project timing Growth investments continue in both organic and inorganic AS Architectural Specialties First Quarter Results Strong order intake positions segment for full year profitable growth Key Highlights *AS organic excludes 2020 Acquisitions of Turf, Moz, Arktura

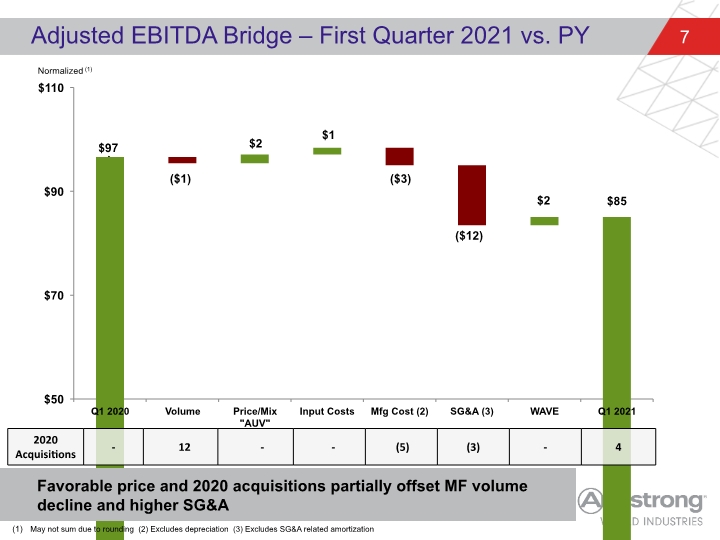

Adjusted EBITDA Bridge – First Quarter 2021 vs. PY ($1) $2 $1 ($12) ($3) $2 Favorable price and 2020 acquisitions partially offset MF volume decline and higher SG&A Normalized (1) May not sum due to rounding (2) Excludes depreciation (3) Excludes SG&A related amortization

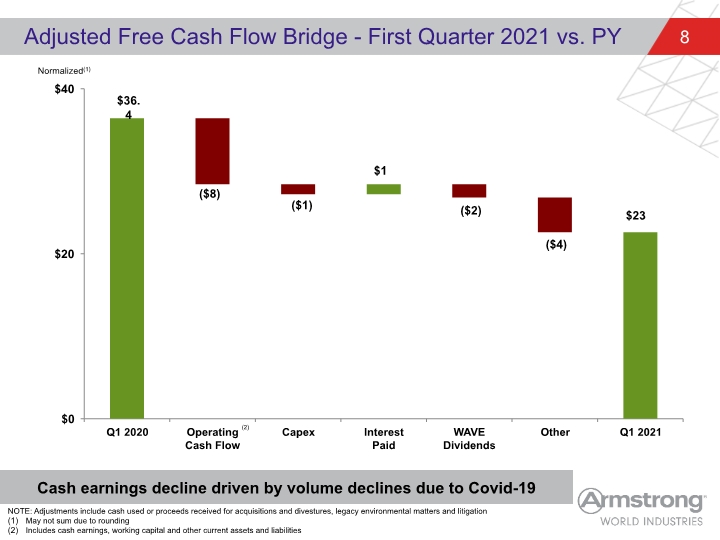

Adjusted Free Cash Flow Bridge - First Quarter 2021 vs. PY ($1) Cash earnings decline driven by volume declines due to Covid-19 ($8) $1 ($4) (2) NOTE: Adjustments include cash used or proceeds received for acquisitions and divestures, legacy environmental matters and litigation May not sum due to rounding Includes cash earnings, working capital and other current assets and liabilities Normalized(1) $23 ($2)

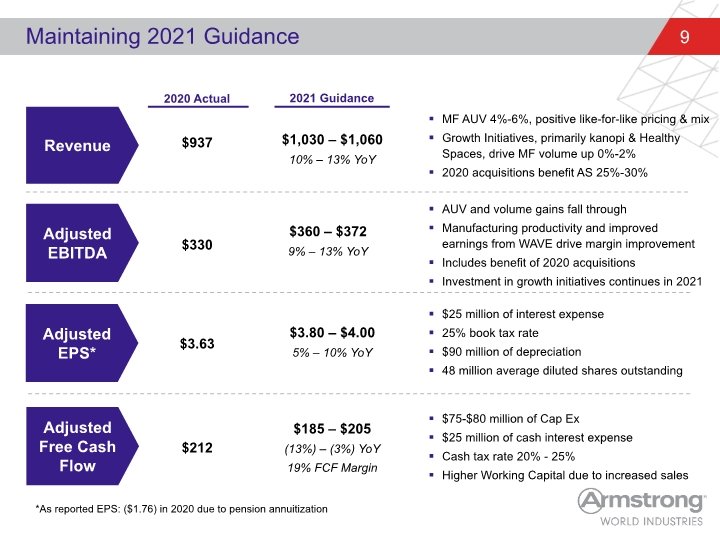

Maintaining 2021 Guidance $3.80 – $4.00 5% – 10% YoY $3.63 Adjusted EBITDA Adjusted EPS* Adjusted Free Cash Flow Revenue $937 $330 $1,030 – $1,060 10% – 13% YoY $360 – $372 9% – 13% YoY MF AUV 4%-6%, positive like-for-like pricing & mix Growth Initiatives, primarily kanopi & Healthy Spaces, drive MF volume up 0%-2% 2020 acquisitions benefit AS 25%-30% AUV and volume gains fall through Manufacturing productivity and improved earnings from WAVE drive margin improvement Includes benefit of 2020 acquisitions Investment in growth initiatives continues in 2021 $75-$80 million of Cap Ex $25 million of cash interest expense Cash tax rate 20% - 25% Higher Working Capital due to increased sales 2020 Actual 2021 Guidance $25 million of interest expense 25% book tax rate $90 million of depreciation 48 million average diluted shares outstanding $185 – $205 (13%) – (3%) YoY 19% FCF Margin $212 *As reported EPS: ($1.76) in 2020 due to pension annuitization

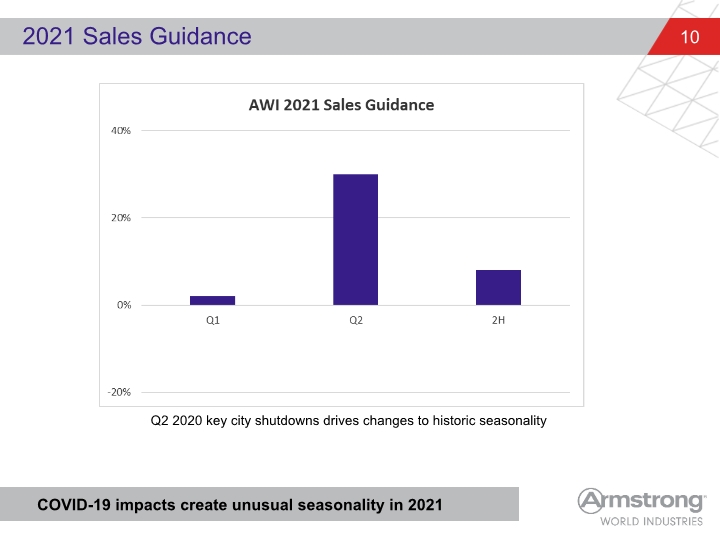

2021 Sales Guidance COVID-19 impacts create unusual seasonality in 2021 Q2 2020 key city shutdowns drives changes to historic seasonality

Appendix

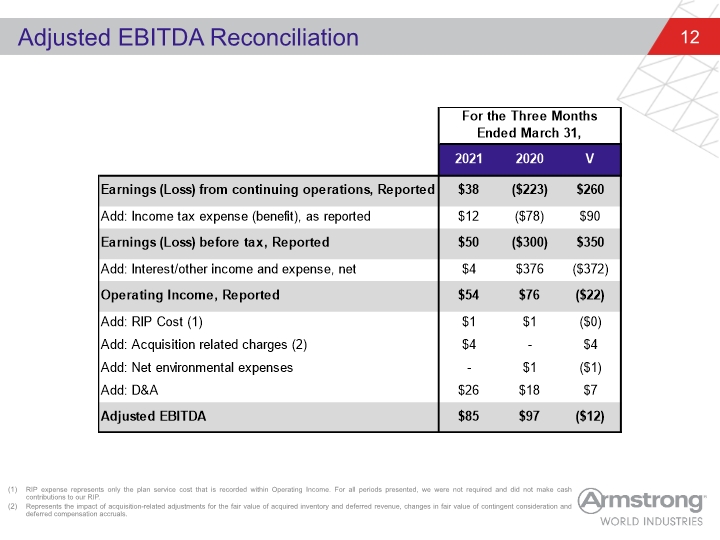

Adjusted EBITDA Reconciliation RIP expense represents only the plan service cost that is recorded within Operating Income. For all periods presented, we were not required and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration and deferred compensation accruals.

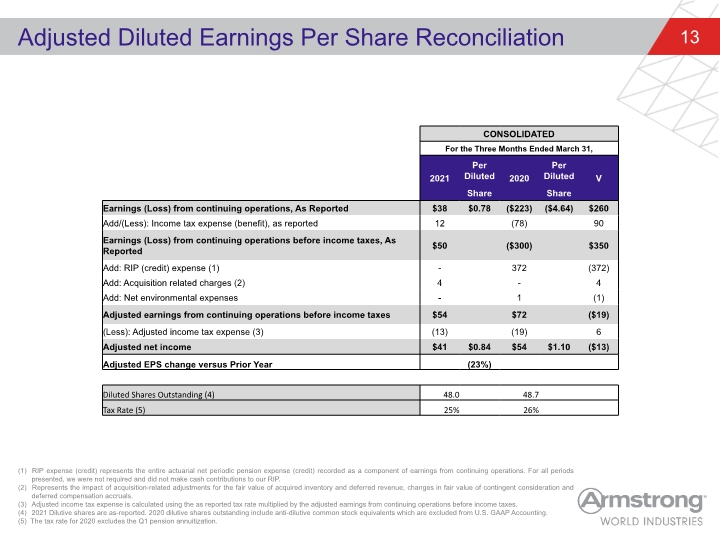

Adjusted Diluted Earnings Per Share Reconciliation (1) RIP expense (credit) represents the entire actuarial net periodic pension expense (credit) recorded as a component of earnings from continuing operations. For all periods presented, we were not required and did not make cash contributions to our RIP. (2) Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration and deferred compensation accruals. (3) Adjusted income tax expense is calculated using the as reported tax rate multiplied by the adjusted earnings from continuing operations before income taxes. (4) 2021 Dilutive shares are as-reported. 2020 dilutive shares outstanding include anti-dilutive common stock equivalents which are excluded from U.S. GAAP Accounting. (5) The tax rate for 2020 excludes the Q1 pension annuitization.

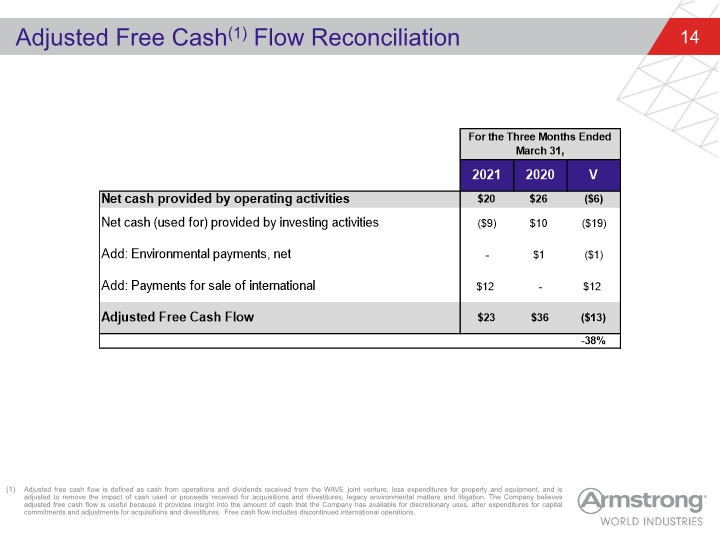

Adjusted Free Cash(1) Flow Reconciliation Adjusted free cash flow is defined as cash from operations and dividends received from the WAVE joint venture, less expenditures for property and equipment, and is adjusted to remove the impact of cash used or proceeds received for acquisitions and divestitures, legacy environmental matters and litigation. The Company believes adjusted free cash flow is useful because it provides insight into the amount of cash that the Company has available for discretionary uses, after expenditures for capital commitments and adjustments for acquisitions and divestitures. Free cash flow includes discontinued international operations.

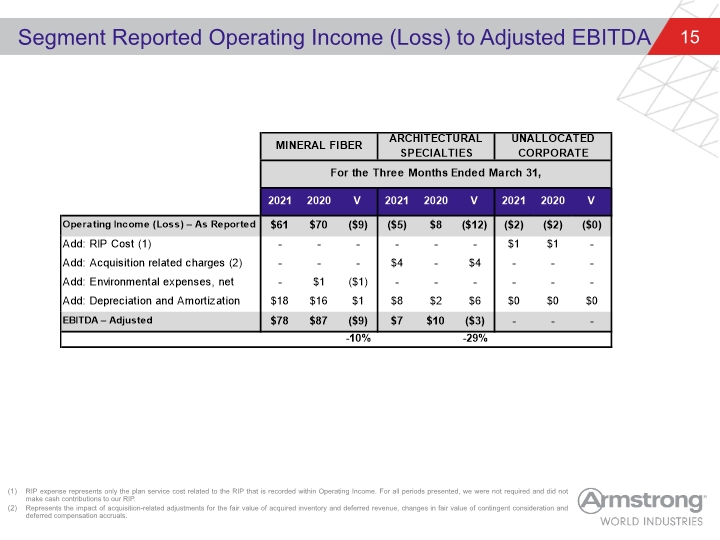

Segment Reported Operating Income (Loss) to Adjusted EBITDA RIP expense represents only the plan service cost related to the RIP that is recorded within Operating Income. For all periods presented, we were not required and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration and deferred compensation accruals.

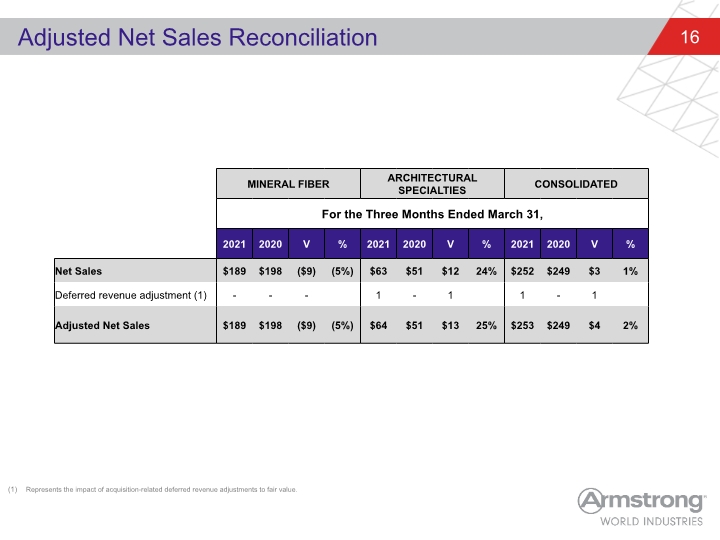

Adjusted Net Sales Reconciliation Represents the impact of acquisition-related deferred revenue adjustments to fair value.

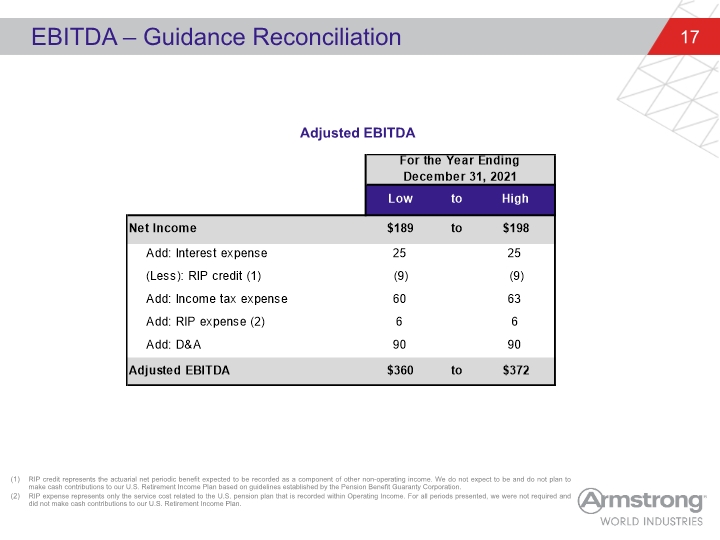

EBITDA – Guidance Reconciliation Adjusted EBITDA RIP credit represents the actuarial net periodic benefit expected to be recorded as a component of other non-operating income. We do not expect to be and do not plan to make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation. RIP expense represents only the service cost related to the U.S. pension plan that is recorded within Operating Income. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan.

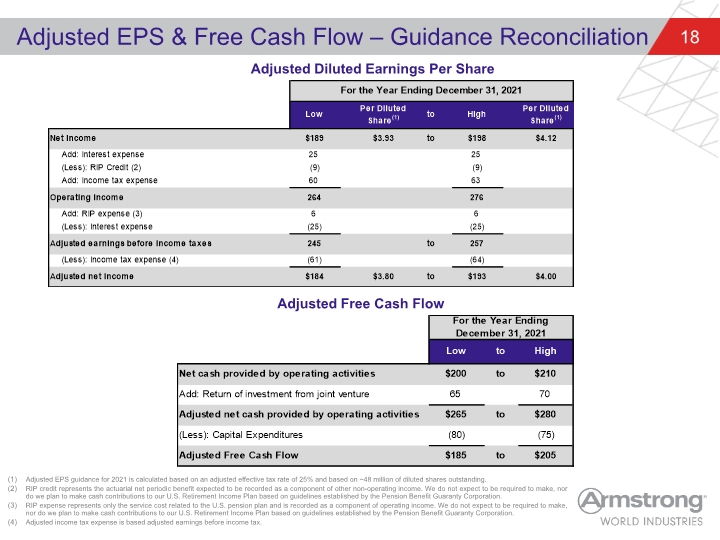

Adjusted EPS & Free Cash Flow – Guidance Reconciliation Adjusted Diluted Earnings Per Share Adjusted Free Cash Flow Adjusted EPS guidance for 2021 is calculated based on an adjusted effective tax rate of 25% and based on ~48 million of diluted shares outstanding. RIP credit represents the actuarial net periodic benefit expected to be recorded as a component of other non-operating income. We do not expect to be required to make, nor do we plan to make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation. RIP expense represents only the service cost related to the U.S. pension plan and is recorded as a component of operating income. We do not expect to be required to make, nor do we plan to make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation. Adjusted income tax expense is based adjusted earnings before income tax.