Attached files

| file | filename |

|---|---|

| EX-99.12 - EXHIBIT 99.12 - Trillium Therapeutics Inc. | tm2113451d1_ex99-12.htm |

| EX-99.11 - EXHIBIT 99.11 - Trillium Therapeutics Inc. | tm2113451d1_ex99-11.htm |

| EX-99.10 - EXHIBIT 99.10 - Trillium Therapeutics Inc. | tm2113451d1_ex99-10.htm |

| EX-99.9 - EXHIBIT 99.9 - Trillium Therapeutics Inc. | tm2113451d1_ex99-9.htm |

| EX-99.8 - EXHIBIT 99.8 - Trillium Therapeutics Inc. | tm2113451d1_ex99-8.htm |

| EX-99.7 - EXHIBIT 99.7 - Trillium Therapeutics Inc. | tm2113451d1_ex99-7.htm |

| EX-99.6 - EXHIBIT 99.6 - Trillium Therapeutics Inc. | tm2113451d1_ex99-6.htm |

| EX-99.5 - EXHIBIT 99.5 - Trillium Therapeutics Inc. | tm2113451d1_ex99-5.htm |

| EX-99.4 - EXHIBIT 99.4 - Trillium Therapeutics Inc. | tm2113451d1_ex99-4.htm |

| EX-99.3 - EXHIBIT 99.3 - Trillium Therapeutics Inc. | tm2113451d1_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - Trillium Therapeutics Inc. | tm2113451d1_ex99-1.htm |

| 8-K - FORM 8-K - Trillium Therapeutics Inc. | tm2113451d1_8k.htm |

Exhibit 99.2

NOTICE TO READER

As of June 30, 2020, the last business day of the second quarter of Trillium Therapeutics Inc. (the “Company”), the Company determined that it no longer qualified as a “foreign private issuer” as such term is defined in Rule 405 under the United States Securities Act of 1933, as amended. As a result, effective January 1, 2021, the Company has been required to comply with all of the periodic disclosure requirements of the United States Securities Exchange Act of 1934, as amended, applicable to U.S. domestic issuers, such as Forms 10-K, 10-Q and 8-K, rather than the forms the Company has filed with the Securities and Exchange Commission (“SEC”) in the past as a foreign private issuer, such as Forms 40-F and 6-K, among other requirements.

Accordingly, the Company is now required to prepare its financial statements filed with the SEC in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). As required pursuant to section 4.3(4) of Ontario Securities Commission National Instrument 51-102 – Continuous Disclosure Obligations, the Company must restate its interim financial reports for the fiscal year ended December 31, 2020 in accordance with U.S. GAAP, such interim financial reports having previously been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

The attached amended and restated management’s discussion and analysis (the “MD&A”) for the three months ended March 31, 2020 and 2019, is current as of May 15, 2020 and provides financial information for the three months ended March 31, 2020, as amended and restated on April 23, 2021, solely to reflect the filing of the amended and restated unaudited condensed consolidated financial statements for the three months ended March 31, 2020 and 2019 in accordance with U.S. GAAP. Other than as expressly set forth above, the revised MD&A does not, and does not purport to, update or restate the information in the original MD&A or reflect any events that occurred after the date of the filing of the original MD&A.

The Company’s Annual Report on Form 10-K (the “Annual Report”) dated March 18, 2021 is available under the Company’s profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Readers are cautioned that this MD&A should be read in conjunction with the Annual Report, including the audited consolidated financial statements and the related notes thereto included in Item 8 thereof.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED

MARCH 31, 2020 AND 2019

Dated: May 6, 2020

2488 Dunwin Drive

Mississauga, Ontario, L5L 1J9

www.trilliumtherapeutics.com

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

About This Management’S Discussion and Analysis

All references in this management’s discussion and analysis, or MD&A to “the Company”, “Trillium”, “we”, “us”, or “our” refer to Trillium Therapeutics Inc. and the subsidiaries through which it conducts its business, unless otherwise indicated or the context requires otherwise.

The following amended and restated MD&A is prepared as of May 6, 2020 for Trillium Therapeutics Inc. for the three months ended March 31, 2020 and 2019, as amended and restated on April 23, 2021, solely to reflect the filing of the amended and restated unaudited condensed consolidated financial statements for the three months ended March 31, 2020 and 2019 prepared in accordance with U.S. generally accepted accounting principles, or US GAAP, for interim reporting. Other than as expressly set forth above, the amended and restated MD&A does not, and does not purport to, update or restate the information in the original MD&A or reflect any events that occurred after the date of the filing of the original MD&A.

This amended and restated MD&A should be read in conjunction with the amended and restated unaudited condensed consolidated financial statements for the three months ended March 31, 2020 and 2019, which have been prepared in accordance with US GAAP for interim reporting. All amounts are in thousands of US dollars, except per share amounts and unless otherwise indicated. References to “CDN $” are to Canadian dollars.

On January 1, 2020, our functional currency was changed to US dollars from Canadian dollars. The change was made to reflect that US dollars has become the currency of the primary economic environment in which we operate, counting for a significant part of our labor, clinical operations, and financing. The change has been implemented with prospective effect. Comparative financial information previously expressed in Canadian dollars is now presented in US dollars for all periods shown.

Cautionary Statement About Forward-Looking Statements

This MD&A contains forward-looking statements within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate”, “believe”, “expect”, “estimate”, “may”, “will”, “could”, “leading”, “intend”, “contemplate”, “shall” and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements in this MD&A include, but are not limited to, statements with respect to:

| • | our expected future loss and accumulated deficit levels; |

| • | our projected financial position and estimated cash burn rate; |

| • | our requirements for, and the ability to obtain, future funding on favorable terms or at all; |

| • | our projections for the SIRPαFc development plans and progress of each of our products and technologies, particularly with respect to the timely and successful completion of studies and trials and availability of results from such studies and trials; |

| • | our plans to focus our intravenous TTI-621 & TTI-622 programs on large hematologic malignancy indications, specifically acute myeloid lymphoma & myelodysplastic syndromes, or AML/MDS, peripheral T-cell lymphoma, or PTCL, diffuse large B-cell lymphoma, or DLBCL and multiple myeloma; |

| • | our expectations about our products’ safety and efficacy; |

| • | our expectations regarding our ability to arrange for and scale up the manufacturing of our products and technologies; |

| • | our expectations regarding the progress, and the successful and timely completion, of the various stages of the regulatory approval process; |

| • | our expectations about the timing of achieving milestones and the cost of our development programs; |

| • | our observations and expectations regarding the relative low binding of SIRPαFc to red blood cells, or RBCs, compared to anti-CD47 monoclonal antibodies and proprietary CD47-blocking agents and the potential benefits to patients; |

| • | our ability to intensify the dose of TTI-621 with the goal of achieving increased blockade of CD47; |

- 1 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

| • | our expectation that we will achieve levels of TTI-622 in patients sufficient to obtain sustained CD47 blockade; |

| • | our expectation that TTI-622 is likely to be more effective in combination with agents that provide additional “eat” signals to macrophages or other forms of immune activation; |

| • | our plans to market, sell and distribute our products and technologies; |

| • | our expectations regarding the acceptance of our products and technologies by the market; |

| • | our ability to retain and access appropriate staff, management and expert advisers; |

| • | our ability to secure strategic partnerships with larger pharmaceutical and biotechnology companies; |

| • | our expectations with respect to existing and future corporate alliances and licensing transactions with third parties, and the receipt and timing of any payments to be made by us or to us in respect of such arrangements; and |

| • | our strategy with respect to the protection of our intellectual property. |

All forward-looking statements reflect our beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical facts but rather on management’s expectations regarding future activities, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities.

By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, known and unknown, that contribute to the possibility that the predictions, forecasts, projections or other forward-looking statements will not occur. In evaluating forward-looking statements, readers should specifically consider various factors, including the risks outlined under the heading “Risk Factors” in this MD&A. Some of these risks and assumptions include, among others:

| • | substantial fluctuation of losses from quarter to quarter and year to year due to numerous external risk factors, and anticipation that we will continue to incur significant losses in the future; |

| • | uncertainty as to our ability to raise additional funding to support operations; |

| • | uncertainty as to the duration and impact of the current COVID-19 pandemic, including its impact on patient enrollment and participation in our clinical trials; |

| • | our ability to generate product revenue to maintain our operations without additional funding; |

| • | the risks associated with the development of our product candidates which are at early stages of development; |

| • | positive results from preclinical and early clinical research are not necessarily predictive of the results of later-stage clinical trials; |

| • | reliance on third parties to plan, conduct and monitor our preclinical studies and clinical trials; |

| • | our product candidates may fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities or may not otherwise produce positive results; |

| • | risks related to filing Investigational New Drug applications, or INDs, to commence clinical trials and to continue clinical trials if approved; |

| • | the risks of delays and inability to complete clinical trials due to difficulties enrolling patients; |

| • | the risk that we may not achieve our publicly announced milestones according to schedule, or at all; |

| • | the risk of being required to repurchase the outstanding warrants in the event of a “Fundamental Transaction”, and possibility of price protection reset of the exercise price of the warrants at prices below the exercise price; |

| • | competition from other biotechnology and pharmaceutical companies; |

| • | our reliance on the capabilities and experience of our key executives and scientists and the resulting loss of any of these individuals; |

| • | our ability to fully realize the benefits of acquisitions; |

| • | our ability to adequately protect our intellectual property and trade secrets; |

| • | our ability to source and maintain licenses from third-party owners; |

| • | the risk of patent-related litigation; |

| • | the risk of loss of our status as a foreign private issuer; and |

| • | our expectations regarding our status as a passive foreign investment company, or PFIC, |

- 2 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

all as further and more fully described under the heading “Risk Factors” in this MD&A.

Although the forward-looking statements contained in this MD&A are based upon what our management believes to be reasonable assumptions, we cannot assure readers that actual results will be consistent with these forward-looking statements. The forward-looking statements in this MD&A do not include a full assessment or reflection of the unprecedented impacts of the COVD-19 pandemic occurring in the first quarter of 2020 and the ongoing and developing indirect global and regional impacts. It is anticipated that the spread of COVID-19 and the global measures to contain it, will have an impact on the Company, however, it is challenging to quantify the potential magnitude of such impact at this time.

Any forward-looking statements represent our estimates only as of the date of this MD&A and should not be relied upon as representing our estimates as of any subsequent date. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events, except as may be required by applicable securities laws.

Business

Overview

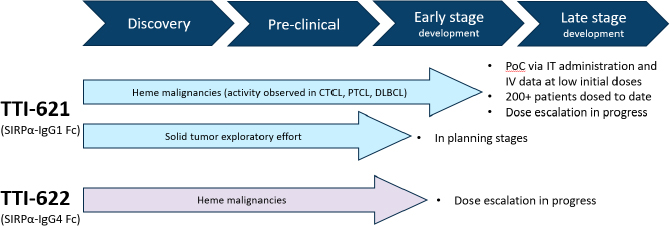

We are a clinical stage immuno-oncology company developing innovative therapies for the treatment of cancer. Our most advanced program, TTI-621, is a SIRPαFc fusion protein that consists of the extracellular CD47-binding domain of human signal regulatory protein alpha, or SIRPα, linked to the Fc region of a human immunoglobulin G1, or IgG1. It is designed to act as a soluble decoy receptor, preventing CD47 from delivering its inhibitory (“do not eat”) signal. Neutralization of the inhibitory CD47 signal enables the activation of macrophage anti-tumor effects by pro-phagocytic (“eat”) signals. The IgG1 Fc region of TTI-621 may also assist in the activation of macrophages by engaging Fc receptors. TTI-621 has shown single agent activity by both local and/or systemic delivery in multiple B- and T-cell lymphoma indications and has been well tolerated in over 200 patients to date.

We are also developing a second SIRPαFc fusion protein, TTI-622, which is in a phase 1 clinical trial. TTI-622 consists of the extracellular CD47-binding domain of human SIRPα linked to a human immunoglobulin G4, or IgG4 Fc region, which has a decreased ability to engage Fc receptors than an IgG1 Fc. Both SIRPαFc fusion proteins enable CD47 blockade with different levels of Fc receptor engagement on macrophages and thus may find unique applications. TTI-622 has been well tolerated with no dose-limiting toxicities observed in the 19 patients dosed to date.

Our Strategy

Our goal is to become a leading innovator in the field of oncology by targeting immune-regulatory pathways that tumor cells exploit to evade the host immune system. We believe we have a differentiated and comprehensive approach to targeting CD47, with the development of two SIRPαFc fusion proteins, TTI-621 and TTI-622. We intend to:

| • | Rapidly advance the clinical development of TTI-621 and TTI-622. We are currently in the process of identifying the maximum tolerated or recommended phase 2 doses for both TTI-621 and TTI-622, and plan to rapidly advance both molecules into phase 1b/2 studies. |

| • | Focus our TTI-621 and TTI-622 clinical programs on promising cancer indications. Because CD47 is highly expressed by multiple liquid and solid tumors, and high expression is correlated with worse clinical outcomes, we believe our SIRPαFc fusion proteins have the potential to be effective in a variety of cancers. We have already identified several cancers where we saw positive responses to TTI-621 in patients, including B- and T-cell lymphomas. |

- 3 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

| • | Focus our TTI-621 and TTI-622 clinical programs on promising combinations. While we believe that a monotherapy path for TTI-621 in certain indications shows promise, we are also planning to evaluate TTI-621 and TTI-622 in combination with other anti-cancer drugs, including immunomodulatory agents. |

Our Pipeline

SIRPαFc

Blocking the CD47 “do not eat” signal using a SIRPαFc decoy receptor

The immune system is the body’s mechanism to identify and eliminate pathogens, and can be divided into the innate immune system and the adaptive immune system. The innate immune system is the body’s first line of defense to identify and eliminate pathogens and consists of proteins and cells, such as macrophages, that identify and provide an immediate response to pathogens. The adaptive immune system is activated by, and adapts to, pathogens, creating a targeted and durable response. Cancer cells often have the ability to reduce the immune system’s ability to recognize and destroy them.

Macrophages are a type of white blood cell that can ingest and destroy (phagocytose) other cells. Macrophage activity is controlled by both positive “eat” and negative “do not eat” signals. Recently, a role for macrophages in the control of tumors has been described. Tumor cells may express “eat” signals (e.g. calreticulin) that make themselves visible to macrophages. To counterbalance this increased visibility the tumor cells often express high levels of CD47, which transmits a “do not eat” signal by binding SIRPα on the surface of macrophages. Elevated expression of CD47 has been observed across a range of hematological and solid tumors. In many cases, high CD47 expression was shown to have negative clinical consequences, correlating with more aggressive disease and poor survival.

Our most advanced program, TTI-621, is a novel SIRPαFc fusion protein that harnesses the innate immune system by blocking the activity of CD47. TTI-621 is a protein that consists of the CD47-binding domain of human SIRPα linked to the Fc region of IgG1. It is designed to act as a soluble decoy receptor, preventing CD47 from delivering its inhibitory signal. Neutralization of the inhibitory CD47 signal enables the activation of macrophage anti-tumor effects by the pro-phagocytic “eat” signals. The IgG1 Fc region of TTI-621 may also assist in the activation of macrophages by engaging Fc receptors. Our second SIRPαFc fusion protein TTI-622 consists of the same CD47-binding domain of human SIRPα and is linked to the Fc region of IgG4. The IgG4 Fc region of TTI-622 is expected to have a decreased ability to engage activating Fc receptors compared to an IgG1 Fc, and thus provide a more modest “eat” signal to macrophages, allowing for greater tolerability and higher CD47 blockade but lower potency. TTI-622 will allow us to assess how higher CD47 blockade with an IgG4-based agent in patients compares to lower CD47 blockade with an IgG1-based drug (TTI-621).

- 4 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

In preclinical studies, TTI-621 and TTI-622 frequently triggered significant macrophage-mediated tumor cell phagocytosis in vitro compared to control treatment. In vivo, both fusion proteins exhibited anti-tumor activity in human xenograft models.

In addition to their direct anti-tumor activity, macrophages can also function as antigen-presenting cells and stimulate antigen-specific T-cells. Thus, it is possible that increasing tumor cell phagocytosis after SIRPαFc exposure may result in enhanced adaptive immunity. In support of this, CD47 antibody blockade has been recently shown to augment antigen presentation and prime an anti-tumor cytotoxic T-cell response in immune-competent mice. In 2016, we presented data demonstrating that TTI-621 can augment antigen-specific T-cell responses in vitro. CD47 blockade has also been reported to promote tumor-specific T-cell responses through a dendritic cell-based mechanism, although the effect of SIRPαFc on dendritic cells is currently unknown.

The figure below illustrates how SIRPαFc blocks the CD47 “do not eat” signal and engages activating Fc receptors on macrophages, leading to tumor cell phagocytosis and possibly increased antigen presentation and enhanced T-cell responses.

By inhibiting the CD47 “do not eat” signal, we believe SIRPαFc has the ability to promote the macrophage-mediated killing of tumor cells in a broad variety of cancers both as a monotherapy and in combination with other immune therapies. Both SIRPαFc fusion proteins enable CD47 blockade with different levels of Fc receptor engagement on macrophages and thus may find unique applications.

Combination Therapy

We believe that SIRPαFc enhancement of macrophage activity, and possibly T-cell responses, could be synergistic with other immune-mediated therapies. Since many cancer antibodies work at least in part by activating cells of the innate immune system, it may be possible to enhance the potency of these agents by blocking the negative “do not eat” CD47 signal that tumor cells deliver to macrophages. In fact, we have observed anti-tumor activity when combining SIRPαFc with rituximab in both preclinical studies and in B-cell lymphoma patients. We hypothesize that SIRPαFc may act synergistically with other immunological agents, including T-cell checkpoint inhibitors (e.g. pembrolizumab and nivolumab), cancer vaccines, oncolytic viruses or chimeric antigen receptor, or CAR T-cells.

- 5 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

SIRPαFc Clinical Development – TTI-621

A phase 1 multicenter, open-label study in which patients with advanced relapsed or refractory hematologic malignancies receive intravenous TTI-621 is currently in progress (NCT02663518). The study consists of four parts: (a) completed “Parts 1-3” in hematologic malignancies, with dosing up to 0.5 mg/kg, conducted under initial dose-limiting toxicity, or DLT, criteria; and (b) ongoing “Part 4” in cutaneous T-cell lymphoma (CTCL), utilizing revised DLT criteria for thrombocytopenia (as detailed below) and an amended protocol to allow for dosing above 0.5 mg/kg.

On January 7, 2020, we released an update on Parts 1-3 of the TTI-621 intravenous study. Over 200 patients received doses ranging from 0.05 to 0.5 mg/kg, with the majority enrolled at 0.2-0.5 mg/kg dose levels. Updated safety data demonstrate that TTI-621 is generally well tolerated. The most frequent drug related adverse events were low-grade infusion reactions and transient thrombocytopenia that was not associated with bleeding. Monotherapy activity has been observed in patients across a range of hematologic malignancies, including cutaneous T-cell lymphoma, or CTCL (19% objective response rate), peripheral T-cell lymphoma, or PTCL (18% objective response rate), and diffuse large B-cell lymphoma (29% objective response rate). Notably, most patients were at an advanced stage of their disease and heavily pretreated, with median number of prior systemic treatments between 3 and 5 (range 1-26).

Part 4 of the study is now ongoing under an amended protocol. Given the transient nature of thrombocytopenia observed in Parts 1-3 of the study, the DLT definition for thrombocytopenia was revised, from Grade 4 of any duration in Parts 1-3, to Grade 4 lasting 72+ hours or a platelet count less than 10,000/microliter at any time in Part 4. No DLTs have been observed at the 0.5 and 0.7 mg/kg dose levels; furthermore no Grade 4 thrombocytopenia of any duration has been observed. The study is now dosing at the 1.4 mg/kg level, and the protocol allows for higher dosing if appropriate.

We have also conducted an open-label phase 1 trial in which TTI-621 was delivered by intratumoral injection in patients with relapsed and refractory, percutaneously-accessible cancers. As reported at the American Society of Hematology 60th Annual Meeting in December 2018, local delivery of TTI-621 was well tolerated, and reductions in Composite Assessment of Index Lesion Severity, or CAILS, scores, which measure local lesion responses, were observed in 91% of evaluable mycosis fungoides patients, with 41% exhibiting reductions of 50% or greater. These responses occurred rapidly within the 2-week induction period. Collectively, these data provide clinical proof-of-concept for TTI-621. As announced in October 2019, the intratumoral study has been closed and we are now focused on intravenous delivery of TTI-621.

TTI-621 was granted an Orphan Drug Designation by the FDA for the treatment of CTCL. Orphan Drug Designation qualifies the sponsor of the drug candidate for various development incentives, which may include tax credits for qualified clinical testing, an exemption from fees under the Prescription Drug User Fee Act, and a seven-year marketing exclusivity period following approval.

SIRPαFc Clinical Development – TTI-622

A two-part, multicenter, open-label, phase 1a/1b study of TTI-622 in patients with advanced relapsed or refractory lymphoma or multiple myeloma is currently in progress (NCT03530683). In the phase 1a dose-escalation part, patients are being enrolled in sequential dose cohorts to receive TTI-622 once weekly to characterize safety, tolerability, pharmacokinetics, and to determine the maximum tolerated dose. In the phase 1b part, patients with hematologic malignancies will be treated with TTI-622 in combination with other agents.

- 6 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

We recently completed dosing in the fifth dose escalation cohort, where patients received a top dose of 4.0 mg/kg. No DLTs or drug-related serious adverse events have been observed, and enrollment is now open in the sixth cohort, with a dose of 8.0 mg/kg. Although TTI-622 is being developed primarily as a combination therapy, a complete response has been observed in a DLBCL patient receiving 0.8 mg/kg TTI-622 monotherapy.

SIRPαFc Key Takeaways

| • | Multiple clinical approaches. We have a diversified approach to CD47 blockade, with two decoy receptors (TTI-621 and TTI-622) with different pharmacological properties in clinical development. |

| • | Tolerability and safety. TTI-621 has been well tolerated in over 200 patients to date. TTI-622 has been well tolerated with no dose-limiting toxicities observed in the 19 patients dosed to date. |

| • | Demonstrated clear signals of activity. TTI-621 monotherapy has produced positive signals of clinical activity in CTCL, PTCL and DLBCL patients. A signal of activity was also seen in DLBCL patients when combined with rituximab. |

SIRPαFc Competition

There are a number of companies developing blocking agents to the CD47-SIRPα axis, including CD47-specific antibodies, SIRPα-specific antibodies, CD47 bispecific antibodies, a mutated high affinity SIRPαFc, a SIRPαFc-agonist fusion protein and small molecule inhibitors. The most advanced competitor molecule is magrolimab (developed by Forty Seven, Inc., recently acquired by Gilead Sciences Inc.), a CD47-specific antibody currently in phase 2 development.

We believe that the IgG1 Fc region differentiates TTI-621 from most other CD47 blocking agents. The IgG1 Fc maximizes potency by delivering an activating signal to macrophages through Fc receptors. With this higher potency, we believe that TTI-621 has a higher likelihood of monotherapy activity and therefore is not dependent upon a combination with another IgG1 antibody. Indeed, to our knowledge TTI-621 is the only CD47 blocking agent which has exhibited meaningful monotherapy activity and resulted in complete responses in cancer patients as a monotherapy.

Furthermore, we believe that both TTI-621 and TTI-622 are differentiated from other CD47 blocking agents by minimal binding to human red blood cells. This property confers several possible advantages, including avoidance of drug-induced anemia, avoidance of the “antigen sink effect” (i.e. removal of drug from circulation by RBCs) and non-interference with laboratory blood typing tests.

Plan of Operations

Our main focus in the near term is to 1) identify the maximum tolerated dose or recommended phase 2 dose for TTI-621 under the revised DLT criteria in Part 4 of study NCT02663518 and 2) identify the maximum tolerated dose or recommended phase 2 dose for TTI-622 in the ongoing study NCT03530683. Subsequently, we intend to initiate phase 1b/2 combination studies for both agents. For TTI-621, we are also considering a monotherapy expansion cohort in T-cell lymphoma. We will also undertake research, manufacturing and regulatory activities to support the CD47 clinical programs.

Recent Events since March 31, 2020

On April 23, 2020, we filed a shelf registration statement on Form F-3 (File No. 333-237810) with the United States Securities and Exchange Commission, or SEC, that provides that we may sell from time to time over the following three years up to $250,000, in one or more offerings, of common shares, First Preferred shares, warrants to purchase common shares or First Preferred shares, subscription receipts, or units comprising a combination of common shares, First Preferred shares and/or warrants. The shelf registration statement was declared effective by the SEC on May 4, 2020.

- 7 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

General Business Developments during the three months ended March 31, 2020

In March 2020, the World Health Organization declared COVID-19 a global pandemic. This contagious disease outbreak, which has continued to spread, and any related adverse public health developments, have adversely affected workforces, economies, and financial markets globally, potentially leading to an economic downturn. At this time, it is not possible for us to predict the duration or magnitude of the adverse results of the outbreak and its effects on our business or results of operations.

In January 2020, we completed an underwritten public offering for gross proceeds of $116,955 comprised of 41,279,090 common shares and 1,250,000 Series II Non-Voting Convertible First Preferred Shares, each issued at $2.75 per share.

On January 16, 2020, we announced that we regained compliance with the Nasdaq minimum bid price requirement. According to the letter received from the Nasdaq Listing Qualifications Department, the closing bid price of our common shares had been at $1.00 per common share or greater for a minimum of 10 consecutive days, and we had regained compliance with the minimum bid price requirement set forth in Rule 5550(a)(2) for continued listing on the Nasdaq.

Governance Changes during the three months ended March 31, 2020

Effective February 6, 2020, Mr. Paul Walker joined the Board of Directors and Dr. Ali Behbahani joined as a Board Observer. Both Mr. Walker and Dr. Behbahani are general partners of New Enterprise Associates, a global venture capital firm and an existing significant shareholder of the Company.

We also announced that Dr. Robert Uger stepped down from the Board of Directors effective February 6, 2020 and continues as Trillium’s Chief Scientific Officer.

Effective March 31, 2020, Dr. Robert Kirkman ended his role as Executive Chair and continued as Chair of the Board of Directors.

Legal Proceedings

To our knowledge, there have not been any legal or arbitration proceedings, including those relating to bankruptcy, receivership or similar proceedings, those involving any third party, and governmental proceedings pending or known to be contemplated, which may have, or have had in the recent past, significant effect on our financial position or profitability.

Also, to our knowledge, there have been no material proceedings in which any director, any member of senior management, or any of our affiliates is either a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries.

RESULTS OF OPERATIONS

For the three months ended March 31, 2020 and 2019

Overview

Since inception, we have incurred losses while advancing the research and development of our products. Net loss for the three months ended March 31, 2020 of $16,298 was higher than the loss of $7,734 for the three months ended March 31, 2019. The net loss was higher due mainly to a loss of $9,299 on the revaluation of the deferred share units, or DSU, liability. This was partially offset by lower clinical trial, manufacturing, and salary expenses, as well as a lower net foreign currency loss.

- 8 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

Research and Development

Research and development expenses by program for the three months ended March 31, 2020 and 2019 were as follows:

Three

months March 31, 2020 $ | Three months ended March 31, 2019 $ | |||||||

| SIRPαFc | 4,988 | 6,114 | ||||||

| Small molecule programs(1) | - | 933 | ||||||

| Total(2) | 4,988 | 7,047 | ||||||

Notes:

| (1) | Since our restructuring in October 2019, small molecule programs have been discontinued resulting in no expenses for the three months ended March 31, 2020. |

| (2) | Research and development expenditures in the above table include all direct and indirect costs for the programs, personnel costs, intellectual property, amortization, stock-based compensation and research and development overhead, and is net of government assistance. Research and development overhead costs have been allocated to the programs based mainly on personnel time spent on the programs. |

Most of our resources were focused on the development of our SIRPαFc program, including clinical development, research, manufacturing and regulatory activities, and for working capital and general corporate purposes. For the three months ended March 31, 2020, SIRPαFc research and development costs were lower than the prior year due mainly to lower clinical trial expenses, manufacturing costs, and salaries.

Components of research and development expenses for the three months ended March 31, 2020 and 2019 were as follows:

| 2020 $ | 2019 $ | |||||||

| Research and development programs, excluding the below items | 2,909 | 4,727 | ||||||

| Salaries, fees and short-term benefits | 1,103 | 1,676 | ||||||

| Stock-based compensation | 864 | 526 | ||||||

| Depreciation of property and equipment | 147 | 141 | ||||||

| Tax credits | (35 | ) | (23 | ) | ||||

| 4,988 | 7,047 | |||||||

The research and development program expenses for the three months ended March 31, 2020 of 2,909 were lower than the prior year period of $4,727 due mainly to lower clinical trial expenses and manufacturing costs. Salaries, fees and short-term benefits were lower for the three months ended March 31, 2020 compared to the same period in the prior year due mainly to a lower employee headcount, subsequent to a restructuring event that occurred in October 2019. Stock-based compensation costs were higher compared to the same period last year due mainly to the revaluation of stock option liabilities.

- 9 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

General and Administrative

Components of general and administrative expenses for the three months ended March 31, 2020 and 2019 were as follows:

| 2020 $ | 2019 $ | |||||||

| General and administrative expenses, excluding the below items | 596 | 568 | ||||||

| Salaries, fees and short-term benefits | 859 | 488 | ||||||

| Change in fair value of deferred share units | 9,299 | (374 | ) | |||||

| Stock-based compensation | 921 | 78 | ||||||

| 11,675 | 760 | |||||||

General and administrative expenses for the three months ended March 31, 2020 of $596 were higher than the prior year period of $568, mainly due to higher legal fees and a higher D&O insurance premium in the current year. The increase in salaries, fees and short-term benefits is due to higher incentive compensation and salary costs in the current period. The change in fair value of DSUs was an expense in the three months ended March 31, 2020 due to an increase in the fair value of the DSU liability, resulting from an increased common share price in 2020 as compared to a recovery in the prior year caused by a decreased share price. The stock-based compensation expense related to stock options was higher than the prior year period due to the fair valuation of stock option liabilities.

Interest income and costs, foreign exchange gains and losses, and revaluation of warrant liability

Net interest income, consisting of interest earned on cash and cash equivalents and marketable securities, for the three months ended March 31, 2020 was $412, and was higher than the prior year period of $161 due to higher average cash and cash equivalent balances.

During the three months ended March 31, 2020, we recorded a net foreign currency loss of $24, compared to a net foreign currency loss of $419 for the comparative period in 2019. The net foreign currency loss in the current period reflected a weakening of the Canadian dollar versus the US dollar while holding net Canadian dollar denominated assets.

During the three months ended March 31, 2019, we recorded a recovery relating to the change in fair value of the warrant liability of $333. The revaluation gain in the prior period reflected a decrease in our share price, causing the fair value of the warrant liability to decrease. As of January 1, 2020, as a result of the change in functional currency to US dollars, the warrant liability was reclassified to equity. Accordingly, $13,370 was transferred from warrant liability to equity.

Liquidity and Capital Resources

Cash, working capital and debt

Since inception, we have financed our operations primarily from sales of equity, proceeds from the exercise of warrants and stock options and from interest income on funds available for investment. Our primary capital needs are for funds to support our scientific research and development activities including staffing, facilities, manufacturing, preclinical studies, clinical trials, administrative costs and for working capital.

We have experienced operating losses and cash outflows from operations since incorporation, will require ongoing financing in order to continue our research and development activities and we have not earned significant revenue or reached successful commercialization of our products. Our future operations are dependent upon our ability to finance our cash requirements which will allow us to continue our research and development activities and the commercialization of our products. There can be no assurance that we will be successful in continuing to finance our operations.

- 10 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

We have two series of First Preferred Shares. Series I Non-Voting Convertible First Preferred Shares are non-voting and are convertible into common shares, on a 30-for-one basis (subject to adjustment), at any time at the option of the holder, subject to certain restrictions on conversion. Our Series II Non-Voting Convertible First Preferred Shares are non-voting and are convertible into common shares, on a one-for-one basis (subject to adjustment), at any time at the option of the holder, subject to certain restrictions on conversion. Holders may not convert first preferred shares into common shares if, after giving effect to the exercise of conversion, the holder and its joint actors would have beneficial ownership or direction or control over common shares in excess of 4.99% of the then outstanding common shares. This limit may be raised at the option of the holder on 61 days’ prior written notice: (i) up to 9.99%, (ii) up to 19.99%, subject to clearance of a personal information form submitted by the holder to the TSX, and (iii) above 19.99%, subject to approval by the TSX and shareholder approval. Subsequent to December 31, 2019, all Series I Non-Voting Convertible First Preferred Shares were converted to common shares.

On April 23, 2020, we filed a shelf registration statement on Form F-3 (File No. 333-237810) with the United States Securities and Exchange Commission, or SEC, that provides that we may sell from time to time over the following three years up to $250,000, in one or more offerings, of common shares, First Preferred shares, warrants to purchase common shares or First Preferred shares, subscription receipts, or units comprising a combination of common shares, First Preferred shares and/or warrants. The shelf registration statement was declared effective by the SEC on May 4, 2020. In May 2020 we entered into an at-the-market sales agreement which was subsequently terminated by us. We did not sell any common shares under the sales agreement prior to such termination.

In January 2020, we completed an underwritten public offering of 41,279,090 common shares and 1,250,000 Series II Non-Voting Convertible First Preferred Shares, each issued at $2.75 per share. The number of shares sold include 5,547,272 common shares pursuant to the full exercise by the underwriters of their option to purchase additional common shares. The gross proceeds from this offering were $116,955, before deducting offering expenses of $7,215. The proceeds from this financing will be used towards: (i) the clinical development of our CD47 programs; and (ii) research, manufacturing and regulatory activities, and working capital and general corporate purposes.

Our combined cash and cash equivalents and marketable securities balance at March 31, 2020 was $135,057, compared to $22,666 at December 31, 2019. Working capital at March 31, 2020 was $113,484, compared to a working capital deficit of $3,607 at December 31, 2019. The increase in cash and cash equivalents, marketable securities, and working capital were due mainly to proceeds from an underwritten public offering completed in January 2020.

Cash flows from operating activities

Cash used in operating activities of $7,292 for the three months ended March 31, 2020 was lower than cash used of $8,327 for the three months ended March 31, 2019. The decrease was due mainly to lower research and development expenses.

Cash flows from investing activities

Cash used in investing activities totaled $3,954 for the three months ended March 31, 2020, compared to cash provided of $9,047 for the three months ended March 31, 2019. The change was due mainly to net purchases of marketable securities for the three months ended March 31, 2020.

Cash flows from financing activities

Cash provided by financing activities totaled 119,877 for the three months ended March 31, 2020, compared to cash provided by financing activities of $13,847 for the three months ended March 31, 2019. The change was due mainly to an underwritten public offering of common shares and non-voting convertible preferred shares completed in January 2020.

- 11 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

Contractual Obligations and Contingencies

We enter into research, development and license agreements in the ordinary course of business where we receive research services and rights to proprietary technologies. Milestone and royalty payments that may become due under various agreements are dependent on, among other factors, clinical trials, regulatory approvals and ultimately the successful development of a new drug, the outcome and timing of which is uncertain.

Under the license agreement for SIRPαFc, we have future contingent milestones payable of $19 related to successful patent grants, $154 and $231 on the first patient dosed in phase 2 and 3 clinical trials respectively, and regulatory milestones on their first achievement totaling $3,846, and low single digit royalties payable on net sales.

Under two agreements with Catalent Pharma Solutions, LLC, or Catalent, pursuant to which we acquired the right to use a proprietary expression system for the manufacture of two SIRPαFc constructs, we have future contingent milestones on pre-marketing approval of up to $875 and aggregate sales milestone payments of up to $28,750 for each agreement.

We periodically enter into research and license agreements with third parties that include indemnification provisions customary in the industry. These guarantees generally require us to compensate the other party for certain damages and costs incurred as a result of claims arising from research and development activities undertaken by us or on our behalf. In some cases, the maximum potential amount of future payments that could be required under these indemnification provisions could be unlimited. These indemnification provisions generally survive termination of the underlying agreement. The nature of the indemnification obligations prevents us from making a reasonable estimate of the maximum potential amount we could be required to pay. Historically, we have not made any indemnification payments under such agreements and no amount has been accrued in our consolidated financial statements with respect to these indemnification obligations.

We have entered into agreements with certain vendors for the provision of goods and services, which includes manufacturing services with contract manufacturing organizations and development services with contract research organizations. These agreements may include certain provisions for purchase obligations and termination obligations that could require payments for the cancellation of committed purchase obligations or for early termination of the agreements. The amount of the cancellation or termination payments vary and are based on the timing of the cancellation or termination and the specific terms of the agreement.

Description of Share Capital

The continuity of the number of our issued and outstanding common and preferred shares from December 31, 2018 to the date of this MD&A is presented below:

| Number

of Series I Preferred Shares(1) | Number

of Series II Preferred Shares(2) | Number of Common Shares | ||||||||||

| Balance at December 31, 2018 | 17,171,541 | 4,368,403 | 14,688,831 | |||||||||

| Public offering | - | 12,200,000 | 6,550,000 | |||||||||

| Preferred share conversions | - | (7,700,000 | ) | 7,700,000 | ||||||||

| Balance at December 31, 2019 | 17,171,541 | 8,868,403 | 28,938,831 | |||||||||

| Public offering | - | 1,250,000 | 41,279,090 | |||||||||

| Preferred share conversions | (17,171,541 | ) | (3,868,403 | ) | 4,440,787 | |||||||

| Stock option exercises | - | - | 340,000 | |||||||||

| Warrant exercises | - | 1,750,000 | 7,684,717 | |||||||||

| Balance at March 31, 2020 | - | 8,000,000 | 82,683,425 | |||||||||

| Warrant exercises | - | - | 753,083 | |||||||||

| Balance at the date of this MD&A | - | 8,000,000 | 83,436,508 | |||||||||

- 12 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

Notes:

| (1) | Convertible at a ratio of 30 Series I Preferred Shares for one common share. |

| (2) | Convertible at a ratio of one Series II Preferred Share for one common share. |

Share capital issued – three months ended March 31, 2020

In January 2020, we completed an underwritten public offering of 41,279,090 common shares and 1,250,000 Series II Non-Voting Convertible First Preferred Shares, each issued at $2.75 per share. The number of shares sold include 5,547,272 common shares pursuant to the full exercise by the underwriters of their option to purchase additional common shares. The gross proceeds from this offering were $116,955, before deducting offering expenses of $7,215.

During the three months ended March 31, 2020, 7,684,717 common shares were issued on the exercise of 7,684,717 common share purchase warrants for proceeds of $7,377, and 1,750,000 Series II First Preferred Shares were issued on the exercise of 1,750,000 Series II First Preferred Share purchase warrants for proceeds of $1,680.

During the three months ended March 31, 2020, 17,171,541 Series I First Preferred Shares were converted into 572,384 common shares, and 3,868,403 Series II First Preferred Shares were converted into 3,868,403 common shares.

Share capital issued – year ended December 31, 2019

In February 2019, we completed an underwritten public offering of 6,550,000 common share units and 12,200,000 Series II Non-Voting Convertible First Preferred Share units, each issued at $0.80 per unit. The gross proceeds from this offering were $15,000, before deducting offering expenses of $1,117. Each common share unit is comprised of one common share of the Company and one common share purchase warrant. Each common share purchase warrant will be exercisable for one common share at a price of $0.96 per common share purchase warrant for sixty months. Each preferred share unit is comprised of one Series II First Preferred Share of the Company and one Series II First Preferred Share purchase warrant. Each Series II First Preferred Share purchase warrant will be exercisable for one Series II First Preferred Share at a price of $0.96 per Series II First Preferred Share purchase warrant for sixty months. Each purchase warrant has a price protection feature that resets the exercise price of the warrant under certain conditions including the issuance of common shares, or securities convertible into common shares, at prices below the exercise price.

In addition, in the event of a “Fundamental Transaction” (as defined in the related warrant agreement, which generally includes any merger with another entity, the sale, transfer or other disposition of all or substantially all of our assets to another entity, or the acquisition by a person of more than 50% of our common stock), each warrant holder will have the right up to 90 days after the consummation of the Fundamental Transaction to require us to repurchase the warrant for a purchase price in cash equal to the Black Scholes value (as calculated under the warrant agreement) of the then remaining unexercised portion of such warrant on the date of such Fundamental Transaction.

During the year ended December 31, 2019, 7,700,000 Series II First Preferred Shares were converted into 7,700,000 common shares.

- 13 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

Warrants

The continuity of the number of issued and outstanding warrants from December 31, 2018 to the date of this MD&A is presented below:

| Preferred Warrants | Common Share Warrants | |||||||

| Balance at December 31, 2018 | - | - | ||||||

| Issued in public offering (3) | 12,200,000 | (1) | 6,550,000 | (2) | ||||

| Conversion to common warrants | (5,050,000 | ) | 5,050,000 | |||||

| Balance at December 31, 2019 | 7,150,000 | 11,600,000 | ||||||

| Exercises | (1,750,000 | ) | (7,684,717 | ) | ||||

| Balance at March 31, 2020 | 5,400,000 | 3,915,283 | ||||||

| Exercises | - | (753,083 | ) | |||||

| Balance at the date of this MD&A | 5,400,000 | 3,162,200 | ||||||

Notes:

| (1) | Each preferred share warrant is exercisable for one Series II First Preferred Share at an exercise price of $0.96 per Series II First Preferred Share. |

| (2) | Each common share warrant is exercisable for one common share at an exercise price of $0.96 per common share. |

| (3) | In the prior period, these warrants were classified as a liability on the Statement of Financial Position. As of January 1, 2020, as a result of the change in functional currency to US dollars, the warrant liability was reclassified to equity. Accordingly $13.4 million was transferred from warrant liability to equity. |

Stock Options

The 2018 Stock Option Plan was approved by our shareholders at the annual meeting held on June 1, 2018. Stock options granted are equity-settled, have a vesting period of between 18 months and four years and have a maximum term of ten years. The total number of common shares available for issuance under the 2018 Stock Option Plan is 3,894,501. As at March 31, 2020, we were entitled to issue an additional 692,439 stock options under the 2018 Stock Option Plan.

We also have an Inducement Stock Option Plan, or 2019 Inducement Plan. The 2019 Inducement Plan is used exclusively for the grant of equity awards to individuals who were not previously an employee or non-employee director of Trillium (or following a bona fide period of non-employment) as an inducement material to such individual’s entering into employment with Trillium in accordance with Nasdaq Listing Rule 5635(c)(4). Stock options that are granted are equity-settled, have a maximum term of ten years and may be subject to vesting provisions as determined by our board. The total number of common shares available for issuance under the 2019 Inducement Plan is 3,000,000. As at March 31, 2020, we were entitled to issue an additional 1,200,000 stock options under the 2019 Inducement Plan.

- 14 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

The continuity of the number of issued and outstanding stock options from December 31, 2018 to the date of this MD&A is presented below:

| Number of Options | Weighted Average Exercise Price | |||||||

| Balance at December 31, 2018 | 2,699,205 | 7.75 | ||||||

| Granted | 3,575,600 | 0.40 | ||||||

| Forfeited | (200,213 | ) | 8.50 | |||||

| Cancelled/Expired | (707,947 | ) | 10.66 | |||||

| Balance at December 31, 2019 | 5,366,645 | 2.44 | ||||||

| Granted | 6,000 | 5.04 | ||||||

| Cancelled/Expired | (30,583 | ) | 14.52 | |||||

| Exercised | (340,000 | ) | 3.23 | |||||

| Balance at March 31, 2020 | 5,002,062 | 2.31 | ||||||

| Granted | 1,000 | 5.36 | ||||||

| Balance at the date of this MD&A | 5,003,062 | 2.31 | ||||||

Deferred Share Unit Plan

For the three months ended March 31, 2020 and 2019, there were nil and 127,430 DSUs issued, respectively. The fair values of DSUs under this plan as at March 31, 2020 and December 31, 2019 were $12,027 and $2,731, respectively. For the three months ended March 31, 2020 and 2019, the DSU expense, comprised of directors’ fees paid and the revaluation of the DSU liability, was an expense of $9,432 for 2020 and an expense recovery of $143 for 2019. The number of DSUs outstanding as at March 31, 2020 and December 31, 2019 were 3,045,821 and 3,045,821, respectively.

On May 6, 2020, the Board of Directors approved the 2020 Omnibus Equity Incentive Plan, or Omnibus Plan, which remains subject to shareholder approval. The Omnibus Plan will govern the terms of the Company’s stock option and DSU grants, and provides for equity settlement of DSUs issued for director compensation.

In conjunction with the approval of the Omnibus Plan, each director holding DSUs under the Cash-Settled DSU Plan entered into an agreement with the Company to have their existing DSUs be governed by the Omnibus Plan, subject to shareholder approval of the Omnibus Plan at the Annual General and Special Meeting to be held on June 30, 2020.

The ratification of the Omnibus Plan will be treated as a modification under ASC 718 Compensation – Stock Compensation and the DSUs will be classified as equity instead of as a liability.

Fully Diluted Share Capital

The number of issued and outstanding common shares, Series II First Preferred Shares, warrants and stock options on a fully converted basis as at March 31, 2020 were as follows:

| Number of Common Share Equivalents | ||||

| Common shares | 82,683,425 | |||

| Series II First Preferred Shares | 8,000,000 | |||

| Warrants | 9,315,283 | |||

| Stock options | 5,002,062 | |||

| Total | 105,000,770 | |||

- 15 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

Trend Information

Historical patterns of expenditures cannot be taken as an indication of future expenditures. The amount and timing of expenditures and therefore liquidity and capital resources vary substantially from period to period depending on the number of research and development programs being undertaken at any one time, the stage of the development programs, the timing of significant expenditures for manufacturing, toxicology and pharmacology studies and clinical trials, and the availability of funding from investors and prospective commercial partners.

Selected Quarterly Financial Information

Q1-2020 $ | Q4-2019 $ | Q3-2019 $ | Q2-2019 $ | |||||||||||||

| Revenue | - | - | 99 | 25 | ||||||||||||

| Research and development expenses | 4,988 | 5,314 | 6,040 | 8,297 | ||||||||||||

| General and administrative expenses | 11,675 | 3,117 | 926 | 911 | ||||||||||||

| Net loss for the period | 16,298 | 19,114 | 6,050 | 5,183 | ||||||||||||

| Basic and diluted net loss per share | 0.25 | 0.67 | 0.22 | 0.19 | ||||||||||||

| Cash and cash equivalents and marketable securities | 135,057 | 22,666 | 27,437 | 32,648 | ||||||||||||

Q1-2019 $ | |||||

| Revenue | - | ||||

| Research and development expenses | 7,047 | ||||

| General and administrative expenses | 760 | ||||

| Net loss for the period | 7,734 | ||||

| Basic and diluted net loss per share | 0.44 | ||||

| Cash and cash equivalents and marketable securities | 39,435 | ||||

The change in net loss in the second quarter and third quarter of 2019 was due mainly to the fluctuation in the revaluation of the warrant liability. In the fourth quarter of 2019, the increase in net loss was mainly caused by a warrant liability revaluation loss of $10.7 million. The increase in net loss in the first quarter of 2020 was due mainly to a revaluation loss of $9.3 million on the DSU liability.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” under the US Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and will continue to qualify as an “emerging growth company” until the earliest to occur of: (a) the last day of the fiscal year during which we have total annual gross revenues of $1.07 billion (as such amount is indexed for inflation every 5 years by the SEC) or more; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common shares pursuant to an effective registration statement under the US Securities Act of 1933 which is December 31, 2020; (c) the date on which we have, during the previous 3-year period, issued more than $1.0 billion in non-convertible debt; or (d) the date on which we are deemed to be a “large accelerated filer”, as defined in Rule 12b–2 of the US Securities Exchange Act of 1934, or the Exchange Act.

- 16 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

Generally, a company that registers any class of its securities under Section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act, a management report on internal control over financial reporting and, subject to an exemption available to companies that meet the definition of a “smaller reporting company” in Rule 12b-2 under the Exchange Act, an auditor attestation report on management’s assessment of the company’s internal control over financial reporting. However, for so long as we continue to qualify as an emerging growth company, we will be exempt from the requirement to include an auditor attestation report in our annual reports filed under the Exchange Act, even if we do not qualify as a “smaller reporting company”. In addition, Section 103(a)(3) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, has been amended by the JOBS Act to provide that, among other things, auditors of an emerging growth company are exempt from any rules of the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the company.

Any US domestic issuer that is an emerging growth company is able to avail itself of the reduced disclosure obligations regarding executive compensation in periodic reports and proxy statements, and to not present to its shareholders a non-binding advisory vote on executive compensation, obtain approval of any golden parachute payments not previously approved, or present the relationship between executive compensation actually paid and our financial performance. So long as we are a foreign private issuer, we are not subject to such requirements, and will not become subject to such requirements even if we were to cease to be an emerging growth company.

As a reporting issuer under the securities legislation of the Canadian provinces of Ontario, British Columbia, Manitoba, Nova Scotia and Alberta, we are required to comply with all new or revised accounting standards that apply to Canadian public companies. Pursuant to Section 107(b) of the JOBS Act, an emerging growth company may elect to utilize an extended transition period for complying with new or revised accounting standards for public companies until such standards apply to private companies. We have elected not to utilize this extended transition period.

Critical Accounting Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the application of accounting policies and the reported amounts of assets and liabilities at the date of the consolidated financial statements, reported amounts of revenue and expenses during the reporting periods, and related disclosures in the accompanying notes. Significant estimates and assumptions reflected in these consolidated financial statements include, but are not limited to, accrued clinical and contract research organization costs, stock-based compensation expense and valuation of warrant liability. The Company reviews its estimates and underlying assumptions on an ongoing basis. Revisions are recognized in the period in which the estimates are revised and may impact future periods. Actual results could differ materially from these estimates and assumptions.

RISK FACTORS

The following information sets forth material risks and uncertainties that may affect our business, including our future financing and operating results and could cause our actual results to differ materially from those contained in forward-looking statements we have made in this MD&A. The risks and uncertainties below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we believe to be immaterial may also adversely affect our business. Further, if we fail to meet the expectations of the public market in any given period, the market price of our common shares could decline. We operate in a highly competitive environment that involves significant risks and uncertainties, some of which are outside of our control.

- 17 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

Risks Related to Our Financial Position and Need for Additional Capital

We expect to incur future losses and we may never become profitable.

We have incurred losses of $16,298, $38,082 and $31,565 for the three months ended March 31, 2020 and for the years ended 2019 and 2018, respectively, and expect to incur an operating loss for the year ending December 31, 2020. We have an accumulated deficit since inception through March 31, 2020 of $206,327. We believe that operating losses will continue as we are planning to incur significant costs associated with the clinical development of our SIRPαFc molecules. Our net losses have had and will continue to have an adverse effect on, among other things, our shareholders’ equity, total assets and working capital. We expect that losses will fluctuate from quarter to quarter and year to year, and that such fluctuations may be substantial. We cannot predict when we will become profitable, if at all.

We will require additional capital to finance our operations, which may not be available to us on acceptable terms, or at all. As a result, we may not complete the development and commercialization of our product candidates or develop new product candidates.

As a research and development company, our operations have consumed substantial amounts of cash since inception. We expect to spend substantial funds to continue the research, development and testing of our product candidates and to prepare to commercialize products subject to approval of the FDA, in the US and similar approvals in other jurisdictions. We will also require significant additional funds if we expand the scope of our current clinical plans or if we were to acquire any new assets and advance their development. Therefore, for the foreseeable future, we will have to fund all of our operations and development expenditures from cash on hand, equity or debt financings, through collaborations with other biotechnology or pharmaceutical companies or through financings from other sources. We expect that our existing combined cash and cash equivalents and marketable securities as at March 31, 2020 of $135,057 will enable us to fund our current operating plan requirements for at least the next twelve months. Additional financing will be required to meet our longer term liquidity needs. If we do not succeed in raising additional funds on acceptable terms, we might not be able to complete preclinical studies and clinical trials or pursue and obtain approval of any product candidates from the FDA and other regulatory authorities. It is possible that future financing will not be available or, if available, may not be on favorable terms. The availability of financing will be affected by the achievement of our corporate goals, the results of scientific and clinical research, the ability to obtain regulatory approvals, the state of the capital markets generally and with particular reference to drug development companies, the status of strategic alliance agreements and other relevant commercial considerations. If adequate funding is not available, we may be required to delay, reduce or eliminate one or more of our product development programs, or obtain funds through corporate partners or others who may require us to relinquish significant rights to product candidates or obtain funds on less favorable terms than we would otherwise accept. To the extent that external sources of capital become limited or unavailable or available on onerous terms, our intangible assets and our ability to continue our clinical development plans may become impaired, and our assets, liabilities, business, financial condition and results of operations may be materially or adversely affected.

We currently have no product revenue and will not be able to maintain our operations and research and development without additional funding.

To date, we have generated no product revenue and cannot predict when and if we will generate product revenue. Our ability to generate product revenue and ultimately become profitable depends upon our ability, alone or with partners, to successfully develop our product candidates, obtain regulatory approval, and commercialize products, including any of our current product candidates, or other product candidates that we may develop, in-license or acquire in the future. We do not anticipate generating revenue from the sale of products for the foreseeable future. We expect our research and development expenses to increase in connection with our ongoing activities, particularly as we advance our product candidates through clinical trials.

- 18 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

The duration and impact of the current COVID-19 pandemic is uncertain.

Our business relies, to a certain extent, on free movement of goods, services and capital from around the world, which has been significantly restricted as a result of COVID-19. We have implemented a response designed to maintain our operations despite the outbreak of the virus. However, we may experience direct or indirect impacts from the pandemic, including delays in the enrollment of new patients in our TTI-621 and TTI-622 clinical studies. We may also have some risk that our contracting counterparties could fail to meet their obligations due to restrictions on the movement of goods that may be required for the manufacturing of the our clinical drugs. Given the ongoing and dynamic nature of the circumstances surrounding COVID-19, it is difficult to predict how significant the impact of COVID-19, including any responses to it, will be on the global economy and our business or for how long any disruptions are likely to continue. The extent of such impact will depend on future developments, which are highly uncertain, rapidly evolving and difficult to predict, including new information which may emerge concerning the severity of COVID-19 and additional actions which may be taken to contain COVID-19. Such developments could have an adverse effect on our business, financial condition, results of operations and cash flow.

We may be subject to significant cash payouts in connection with our outstanding warrants in the event of a “Fundamental Transaction”.

In the event of a “Fundamental Transaction” (as defined in the related warrant agreement, which generally includes any merger with another entity, the sale, transfer or other disposition of all or substantially all of our assets to another entity, or the acquisition by a person of more than 50% of our common stock), each warrant holder will have the right up to 90 days after the consummation of the Fundamental Transaction to require us to repurchase the warrant for a purchase price in cash equal to the Black Scholes value (as calculated under the warrant agreement) of the then remaining unexercised portion of such warrant on the date of such Fundamental Transaction, which may materially adversely affect our financial condition and/or results of operations. There can be no assurance that in the event of a Fundamental Transaction we will be able to sufficiently compensate the holders of the warrants in accordance with the terms thereof. The warrant provisions may delay or prevent our ability to undertake a strategic transaction that may be beneficial to shareholders. These restrictions may also adversely affect the market price of our common shares.

We are exposed to the financial risk related to the fluctuation of foreign exchange rates and the degrees of volatility of those rates.

We may be adversely affected by foreign currency fluctuations. To date, we have been primarily funded through issuances of equity, proceeds from the exercise of warrants and stock options and from interest income on funds available for investment, which are denominated both in Canadian and US dollars. Also, a sizeable portion of our expenditures are in Canadian dollars, and we are therefore subject to foreign currency fluctuations which may, from time to time, impact our financial position and results of operations.

Risks Related to Our Business and Our Industry

Our prospects depend on the success of our product candidates which are at early stages of development, and we may not generate revenue for several years, if at all, from these products.

Given the early stage of our product development, we can make no assurance that our research and development programs will result in regulatory approval or commercially viable products. To achieve profitable operations, we, alone or with others, must successfully develop, gain regulatory approval, and market our future products. We currently have no products that have been approved by the FDA, Health Canada, or any similar regulatory authority. To obtain regulatory approvals for our product candidates being developed and to achieve commercial success, clinical trials must demonstrate that the product candidates are safe for human use and that they demonstrate efficacy. While we have commenced clinical trials for SIRPαFc, we have not yet completed later stage clinical trials for any of our product candidates.

- 19 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

Many product candidates never reach the stage of clinical testing and even those that do have only a small chance of successfully completing clinical development and gaining regulatory approval. Product candidates may fail for a number of reasons, including, but not limited to, being unsafe for human use or due to the failure to provide therapeutic benefits equal to or better than the standard of treatment at the time of testing. Unsatisfactory results obtained from a particular study relating to a research and development program may cause us or our collaborators to abandon commitments to that program.

The early stage of our product development makes it particularly uncertain whether any of our product development efforts will prove to be successful and meet applicable regulatory requirements, and whether any of our product candidates will receive the requisite regulatory approvals, be capable of being manufactured at a reasonable cost or be successfully marketed. If we are successful in developing our current and future product candidates into approved products, we will still experience many potential obstacles such as the need to develop or obtain manufacturing, marketing and distribution capabilities. If we are unable to successfully commercialize any of our products, our financial condition and results of operations may be materially and adversely affected.

Positive results from preclinical and early clinical research of TTI-621 and TTI-622 are not necessarily predictive of the results of later clinical trials of TTI-621 or TTI-622. If we cannot replicate the positive results from preclinical and early clinical research in our later clinical trials, we may be unable to successfully develop, obtain regulatory approval for and commercialize TTI-621 or TTI-622.

Positive results of preclinical and early clinical research of TTI-621 and TTI-622 may not be indicative of the results that will be obtained in later-stage clinical trials. For example, we have focused our near-term clinical product development on T-cell malignancies based on preliminary results of our intravenous and intratumoral trials. There can be no assurance that the preliminary results we have seen in a small number of T-cell lymphoma patients will be reproducible in a larger population of patients. We can make no assurance that any future studies, if undertaken, will yield favorable results.

Many companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in later-stage clinical trials after achieving positive results in early-stage development, and we cannot be certain that we will not face similar setbacks. These setbacks have been caused by, among other things, preclinical findings made while clinical trials were underway or safety or efficacy observations made in clinical trials, including previously unreported adverse events. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that believed their product candidates performed satisfactorily in preclinical studies and clinical trials nonetheless failed to obtain FDA approval. If we fail to produce positive results in our clinical trials of TTI-621 or TTI-622, the development timeline and regulatory approval and commercialization prospects for our leading product candidates, and, correspondingly, our business and financial prospects, would be materially adversely affected.

We rely and will continue to rely on third parties to plan, conduct and monitor our preclinical studies and clinical trials, and their failure to perform as required could cause substantial harm to our business.

We rely and will continue to rely on third parties to conduct a significant portion of our preclinical and clinical development activities. Preclinical activities include in vivo studies providing access to specific disease models, pharmacology and toxicology studies, and assay development. Clinical development activities include trial design, regulatory submissions, clinical patient and site recruitment, clinical trial monitoring, clinical data management and analysis, safety monitoring and project management. If there is any dispute or disruption in our relationship with third parties, or if they are unable to provide quality services in a timely manner and at a feasible cost, our active development programs will face delays. Further, if any of these third parties fails to perform as we expect or if their work fails to meet regulatory requirements, our testing could be delayed, cancelled or rendered ineffective.

- 20 -

TRILLIUM THERAPEUTICS INC.

Management’s Discussion and Analysis

We rely on contract manufacturers over whom we have limited control. If we are subject to quality, cost or delivery issues with the preclinical and clinical grade materials supplied by contract manufacturers, our business operations could suffer significant harm.

We have limited manufacturing experience and rely on contract manufacturing organizations, or CMOs to manufacture our product candidates for larger preclinical studies and clinical trials. We rely on CMOs for manufacturing, filling, packaging, storing and shipping of drug product in compliance with current Good Manufacturing Practice, or cGMP, regulations applicable to our products. The FDA ensures the quality of drug products by carefully monitoring drug manufacturers’ compliance with cGMP regulations. The cGMP regulations for drugs contain minimum requirements for the methods, facilities and controls used in manufacturing, processing and packaging of a drug product.