Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - OP Bancorp | opbk-ex992_7.htm |

| EX-99.1 - EX-99.1 - OP Bancorp | opbk-ex991_8.htm |

| 8-K - 8-K - OP Bancorp | opbk-8k_20210422.htm |

2021 First Quarter Earnings Presentation April 23, 2021

Certain matters set forth herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including forward-looking statements relating to the Company’s current business plans and expectations regarding future operating results. These forward-looking statements are subject to risks and uncertainties that could cause actual results, performance or achievements to differ materially from those projected. These risks and uncertainties, some of which are beyond our control, include, but are not limited to: the uncertainties related to the coronavirus pandemic including, but not limited to, the potential adverse effect of the pandemic on the economy, our employees and customers, and our financial performance; the impact of the federal CARES Act and the significant additional lending activities undertaken by the Company in connection with the Small Business Administration’s Paycheck Protection Program enacted thereunder, including risks to the Company with respect to the uncertain application by the Small Business Administration of new borrower and loan eligibility, forgiveness and audit criteria; business and economic conditions, particularly those affecting the financial services industry and our primary market areas; our ability to successfully manage our credit risk and the sufficiency of our allowance for loan losses; factors that can impact the performance of our loan portfolio, including real estate values and liquidity in our primary market areas, the financial health of our commercial borrowers, the success of construction projects that we finance, including any loans acquired in acquisition transactions; our ability to effectively execute our strategic plan and manage our growth; interest rate fluctuations, which could have an adverse effect on our profitability; liquidity issues, including fluctuations in the fair value and liquidity of the securities we hold for sale and our ability to raise additional capital, if necessary; external economic and/or market factors, such as changes in monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve, inflation or deflation, changes in the demand for loans, and fluctuations in consumer spending, borrowing and savings habits, which may have an adverse impact on our financial condition; continued or increasing competition from other financial institutions, credit unions, and non-bank financial services companies, many of which are subject to different regulations than we are; challenges arising from unsuccessful attempts to expand into new geographic markets, products, or services; restraints on the ability of Open Bank to pay dividends to us, which could limit our liquidity; increased capital requirements imposed by banking regulators, which may require us to raise capital at a time when capital is not available on favorable terms or at all; a failure in the internal controls we have implemented to address the risks inherent to the business of banking; inaccuracies in our assumptions about future events, which could result in material differences between our financial projections and actual financial performance; changes in our management personnel or our inability to retain motivate and hire qualified management personnel; disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information technology systems; disruptions, security breaches, or other adverse events affecting the third-party vendors who perform several of our critical processing functions; an inability to keep pace with the rate of technological advances due to a lack of resources to invest in new technologies; risks related to potential acquisitions; political developments, uncertainties or instability, catastrophic events, acts of war or terrorism, or natural disasters, such as earthquakes, fires, drought, pandemic diseases (such as the coronavirus) or extreme weather events, any of which may affect services we use or affect our customers, employees or third parties with which we conduct business; incremental costs and obligations associated with operating as a public company; the impact of any claims or legal actions to which we may be subject, including any effect on our reputation; compliance with governmental and regulatory requirements, including the Dodd-Frank Act and others relating to banking, consumer protection, securities and tax matters, and our ability to maintain licenses required in connection with commercial mortgage origination, sale and servicing operations; changes in federal tax law or policy; and our ability the manage the foregoing and other factors set forth in the Company’s public reports. We describe these and other risks that could affect our results in Item 1A. “Risk Factors,” of our latest Annual Report on Form 10-K for the year ended December 31, 2020 and in our other subsequent filings with the Securities and Exchange Commission. Cautionary Note Regarding Forward-Looking Statements 2

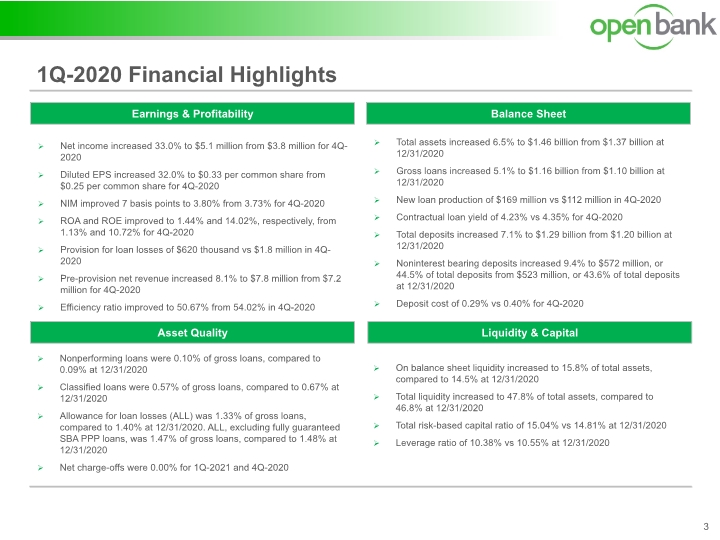

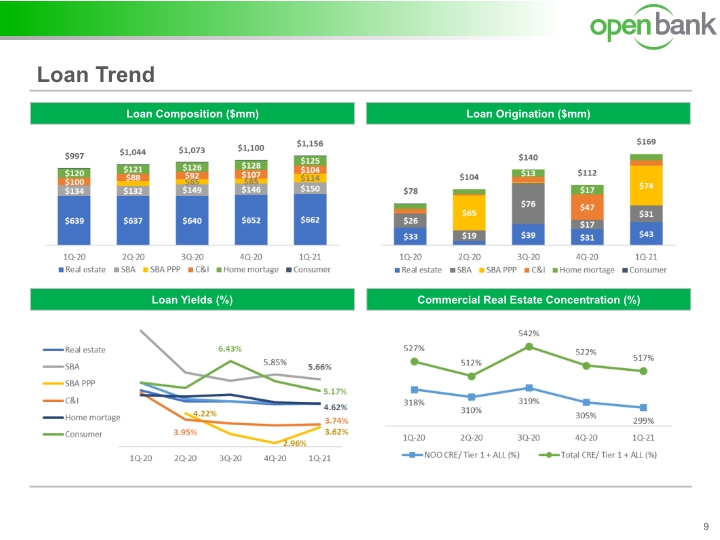

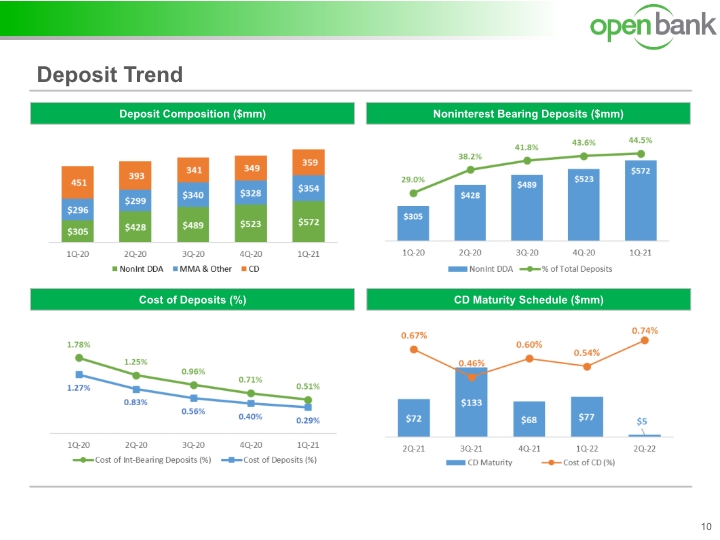

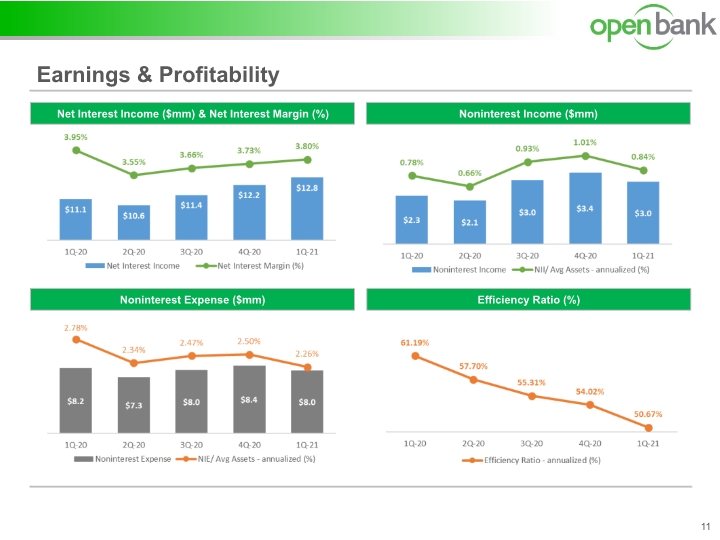

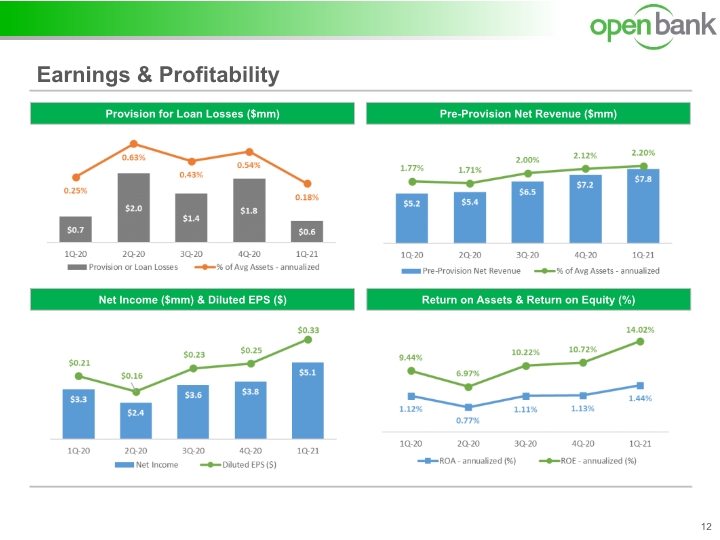

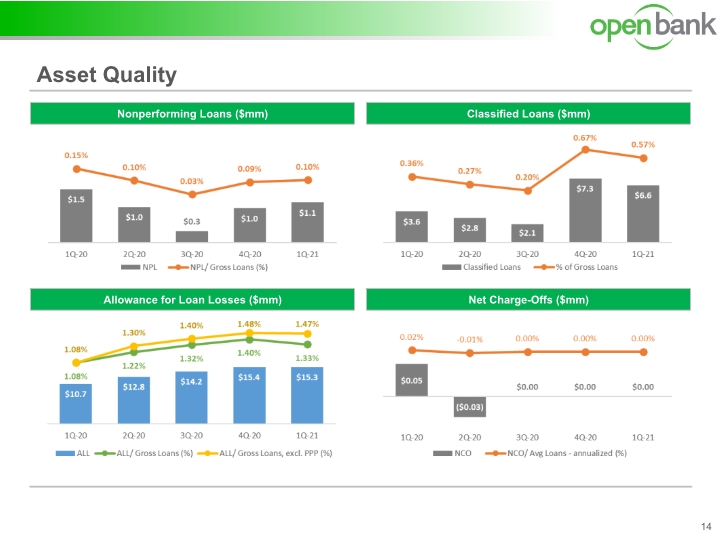

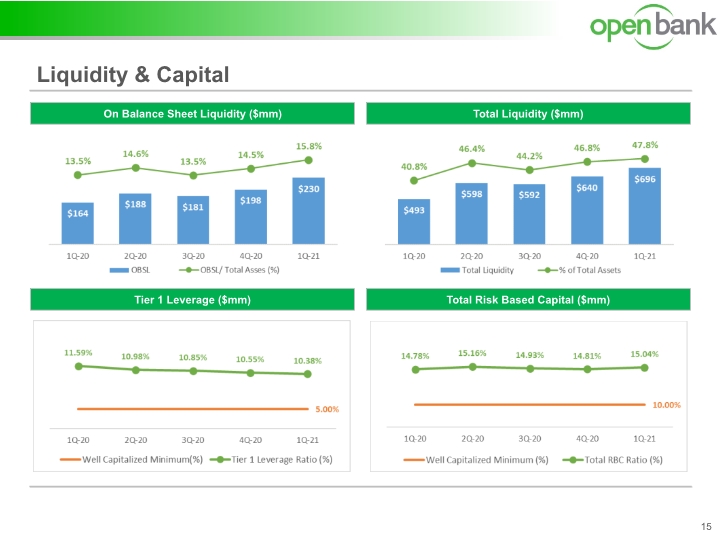

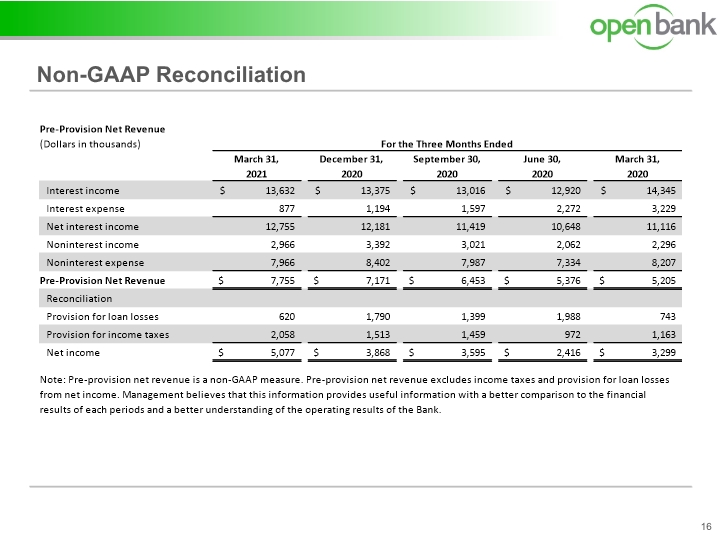

1Q-2020 Financial Highlights 3 Balance Sheet Earnings & Profitability Asset Quality Net income increased 33.0% to $5.1 million from $3.8 million for 4Q-2020 Diluted EPS increased 32.0% to $0.33 per common share from $0.25 per common share for 4Q-2020 NIM improved 7 basis points to 3.80% from 3.73% for 4Q-2020 ROA and ROE improved to 1.44% and 14.02%, respectively, from 1.13% and 10.72% for 4Q-2020 Provision for loan losses of $620 thousand vs $1.8 million in 4Q-2020 Pre-provision net revenue increased 8.1% to $7.8 million from $7.2 million for 4Q-2020 Efficiency ratio improved to 50.67% from 54.02% in 4Q-2020 Liquidity & Capital Total assets increased 6.5% to $1.46 billion from $1.37 billion at 12/31/2020 Gross loans increased 5.1% to $1.16 billion from $1.10 billion at 12/31/2020 New loan production of $169 million vs $112 million in 4Q-2020 Contractual loan yield of 4.23% vs 4.35% for 4Q-2020 Total deposits increased 7.1% to $1.29 billion from $1.20 billion at 12/31/2020 Noninterest bearing deposits increased 9.4% to $572 million, or 44.5% of total deposits from $523 million, or 43.6% of total deposits at 12/31/2020 Deposit cost of 0.29% vs 0.40% for 4Q-2020 Nonperforming loans were 0.10% of gross loans, compared to 0.09% at 12/31/2020 Classified loans were 0.57% of gross loans, compared to 0.67% at 12/31/2020 Allowance for loan losses (ALL) was 1.33% of gross loans, compared to 1.40% at 12/31/2020. ALL, excluding fully guaranteed SBA PPP loans, was 1.47% of gross loans, compared to 1.48% at 12/31/2020 Net charge-offs were 0.00% for 1Q-2021 and 4Q-2020 On balance sheet liquidity increased to 15.8% of total assets, compared to 14.5% at 12/31/2020 Total liquidity increased to 47.8% of total assets, compared to 46.8% at 12/31/2020 Total risk-based capital ratio of 15.04% vs 14.81% at 12/31/2020 Leverage ratio of 10.38% vs 10.55% at 12/31/2020

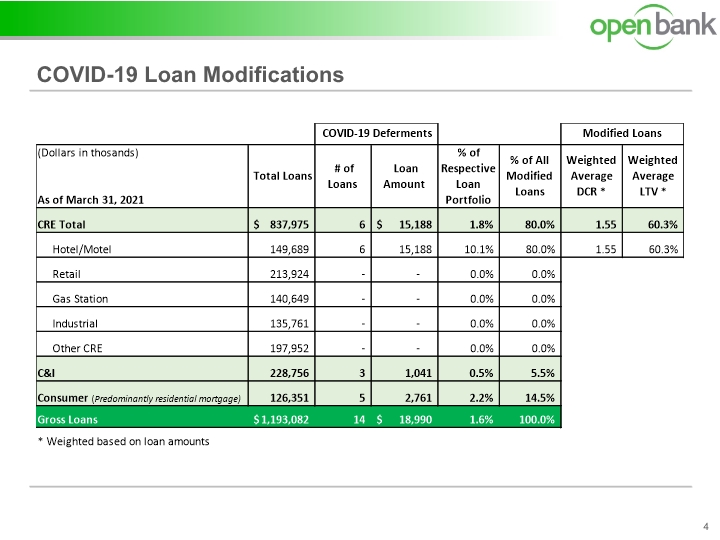

COVID-19 Loan Modifications 4

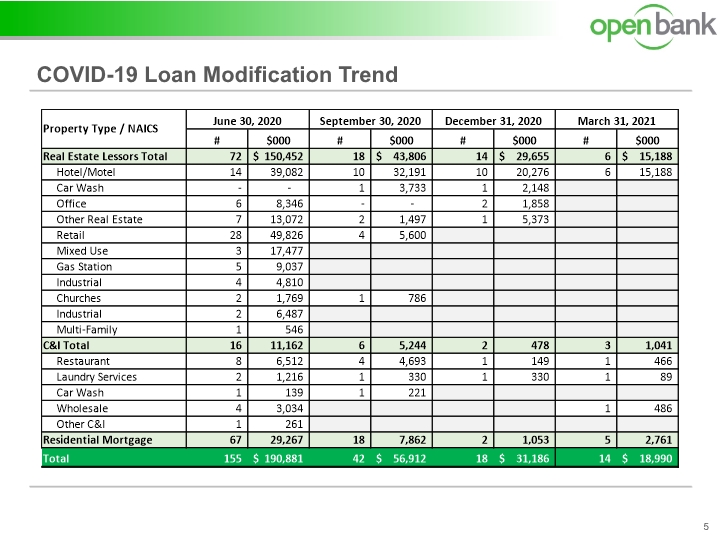

COVID-19 Loan Modification Trend 5

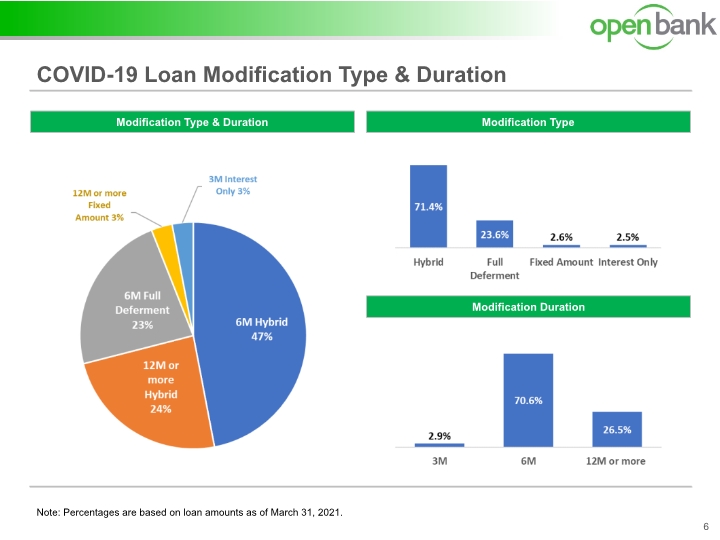

COVID-19 Loan Modification Type & Duration 6 Modification Type Modification Type & Duration Note: Percentages are based on loan amounts as of March 31, 2021. Modification Duration

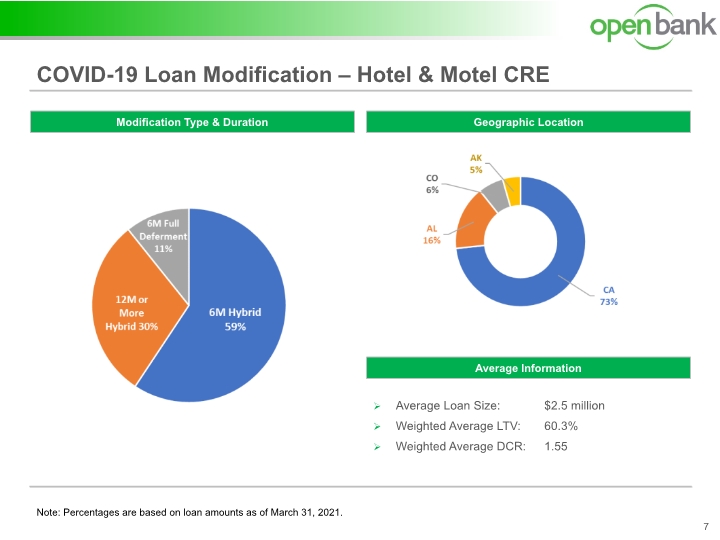

COVID-19 Loan Modification – Hotel & Motel CRE 7 Geographic Location Modification Type & Duration Note: Percentages are based on loan amounts as of March 31, 2021. Average Information Average Loan Size: $2.5 million Weighted Average LTV: 60.3% Weighted Average DCR: 1.55

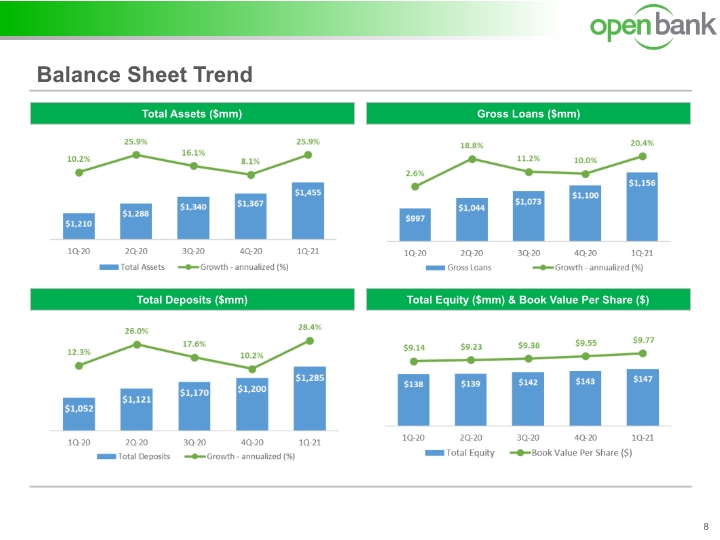

Balance Sheet Trend 8 Gross Loans ($mm) Total Assets ($mm) Total Equity ($mm) & Book Value Per Share ($) Total Deposits ($mm)

Loan Trend 9 Loan Origination ($mm) Loan Composition ($mm) Loan Yields (%) Commercial Real Estate Concentration (%)

Deposit Trend 10 Noninterest Bearing Deposits ($mm) Deposit Composition ($mm) Cost of Deposits (%) CD Maturity Schedule ($mm)

Earnings & Profitability 11 Noninterest Income ($mm) Net Interest Income ($mm) & Net Interest Margin (%) Noninterest Expense ($mm) Efficiency Ratio (%)

Earnings & Profitability 12 Pre-Provision Net Revenue ($mm) Provision for Loan Losses ($mm) Net Income ($mm) & Diluted EPS ($) Return on Assets & Return on Equity (%)

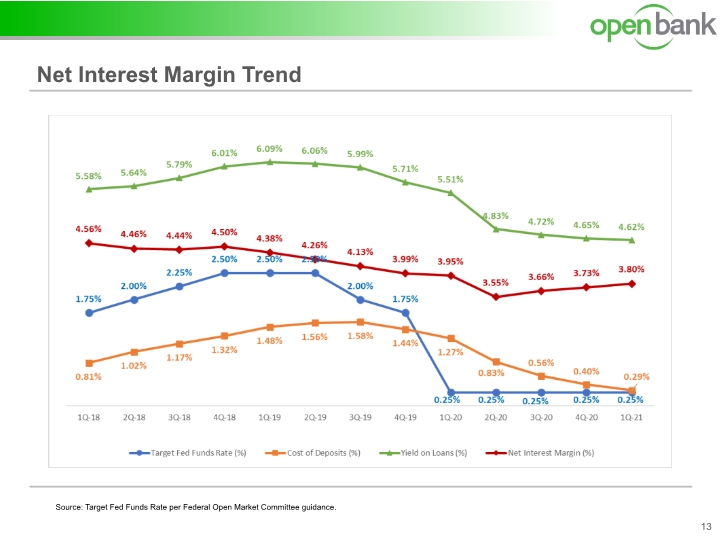

Source: Target Fed Funds Rate per Federal Open Market Committee guidance. Net Interest Margin Trend 13

Asset Quality 14 Classified Loans ($mm) Nonperforming Loans ($mm) Net Charge-Offs ($mm) Allowance for Loan Losses ($mm)

Liquidity & Capital 15 Total Liquidity ($mm) On Balance Sheet Liquidity ($mm) Tier 1 Leverage ($mm) Total Risk Based Capital ($mm)

Non-GAAP Reconciliation 16