Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Clearfield, Inc. | f8k_042321.htm |

Exhibit 99.1

Good afternoon. Welcome to Clearfield’s fiscal second quarter 2021 earnings conference call. I will be your operator this afternoon.

Joining us for today’s presentation are the Company's President and CEO, Cheri Beranek and CFO, Dan Herzog. Following their commentary, we will open the call for questions.

I would now like to remind everyone that this call will be recorded and made available for replay via a link in the investor relations section of the Company's website. This call is also being webcasted and accompanied by a PowerPoint presentation called the FieldReport, which is also available in the investor relations section of the Company's website.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD The Industry Leader in Craft Friendly Fiber Optic Management and Connectivity Solutions Fiscal Q2 2021 Earnings Call FieldReport

Please note that during this call, management will be making forward-looking statements regarding future events and the future financial performance of the Company. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements.

It’s important to note also that the Company undertakes no obligation to update such statements except as required by law. The Company cautions you to consider risk factors that could cause actual results to differ materially from those in the forward-looking statements contained in today’s press release, FieldReport, and in this conference call. The risk factors section in Clearfield’s most recent Form 10-K filing with the Securities and Exchange Commission and its subsequent filings on Form 10-Q provides descriptions of those risks. As a reminder, the slides in this presentation are controlled you, the listener. Please advance forward through the presentation as the speakers present their remarks.

With that, I would like to turn the call over to Clearfield’s CEO, Cheri Beranek.

Please proceed.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein and in any related presentation or in the related Earnings Release are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “est ima te,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements includ e, for example, statements about the expected impact of COVID - 19 and related economic uncertainty, the Company’s future revenue and operating pe rformance, the impact of the Rural Digital Opportunity Fund (RDOF) or other government programs on the demand for the Company’s products or tim ing of customer orders, and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's b usi ness. Certain important factors could have a material impact on the Company's performance, including, without limitation: the COVID - 19 pandemi c has significantly impacted worldwide economic conditions and could have a material adverse effect on our business, financial condition and oper ati ng results; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders; we depen d on the availability of sufficient supply of certain materials, such as fiber optic cable and resins for plastics, and global disruptions in the supp ly chain for these materials could prevent us from meeting customer demand for our products; a significant percentage of our sales in the last three fisca l y ears have been made to a small number of customers; further consolidation among our customers may result in the loss of some customers and may reduc e s ales during the pendency of business combinations and related integration activities; we may be subject to risks associated with acquisitions ; p roduct defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we ar e dependent on key personnel; our business is dependent on interdependent management information systems; to compete effectively, we must contin ual ly improve existing products and introduce new products that achieve market acceptance; changes in government funding programs may cause ou r customers and prospective customers to delay, reduce, or accelerate purchases, leading to unpredictable and irregular purchase cycles; int ense competition in our industry may result in price reductions, lower gross profits and loss of market share; our success depends upon adequate prot ect ion of our patent and intellectual property rights; if the telecommunications market does not expand as we expect, our business may not grow as fas t a s we expect; we face risks associated with expanding our sales outside of the United States; and other factors set forth in Part I, Item IA. Risk Fac tors of Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2020 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2021 Clearfield, Inc. All Rights Reserved. NASDAQ:CLFD 2

Good afternoon and thank you everyone for joining us today. I hope you are all continuing to stay safe and healthy. It’s a pleasure to speak with you this afternoon to share Clearfield’s results for the fiscal second quarter and first six months of 2021.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Welcome Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 3

During the second quarter we saw demand for fiber-fed broadband networks expand across the community broadband market. As you can see on slide 4, this robust demand helped drive a 45% increase in net sales to a record $29.7 million. Our growth in the period was again led by double-digit increases from our Community Broadband and MSO markets, which were up 68% and 60%, respectively. As our performance demonstrates, Clearfield is strongly executing on its brand promise of providing highly configurable fiber distribution and pathway products to meet broadband service provider requirements.

Sales bookings started strong in January and accelerated through the quarter-end, resulting in a 115% increase in backlog, growing to $19.2 million on March 31, 2021 vs. $9.3 million on March 31, 2020. We expect to ship the majority of our backlog during fiscal Q3 and have begun to receive longer-scheduled orders as service providers establish longer term deployment plans. Our strong topline performance and business model leverage helped produce solid gross profit and net income margins in fiscal Q2. Gross margin dollars totaled a record $12.9 million, up 59% from Q2 last year. As a percentage of net sales, our 43.6% margin was up from 39.9% in Q2 last year.

Moving down the P&L, as expected, our expenses increased modestly year-over-year, resulting in $3.6 million in net income, or $0.27 per diluted share. This was a significant improvement from the $750,000 or $0.05 per diluted share in earnings we generated in Q2 of last year. We anticipate expenses to increase slightly in future quarters as we invest in additional resources within our Community Broadband programs and as business travel limitations start to decrease.

Our robust financial performance in Q2 contributed to a record first half for Clearfield. At a high level, we generated $56.8 million in net sales through our first two quarters of fiscal 2021, which was up 43% from the same period of last year. Our favorable product mix in the period coupled with our ongoing efficiency measures, helped generate $24.3 million in gross profit, an improvement of 53% compared to last year. We also delivered 42.8% gross profit margin for the period, which was up compared to 39.9% last year. From a profitability perspective, we generated $6.8 million in net income, or $0.50 per diluted share, which was a significant improvement compared to $1.2 million or $0.09 per diluted share in the first half of last year.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD FY 21 Q2 and 1H Highlights NASDAQ:CLFD 4 Second Quarter of Fiscal 2021: • Net sales of $29.7M, up 45% y/o/y • Gross profit up 59% to $12.9M (43.6% of net sales) • Net income of $3.6M or $0.27 per diluted share • Order backlog increased 115% to $19.2M • Cash and investments: $57.9M First Six Months of Fiscal 2021: • Net sales of $56.8M, up 43% y/o/y • Gross profit of $24.3M (42.8% of net sales), up 53% y/o/y • Net income of $6.8M or $0.50 per diluted share, up 445% from $1.2M or $0.09 per diluted share last year $20.4M $26.0M $27.3M $27.1M $29.7M Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Quarterly Net Sales $85.6M $110.1M Q2-20 Q2-21 Trailing - Twelve Month (TTM) Net Sales

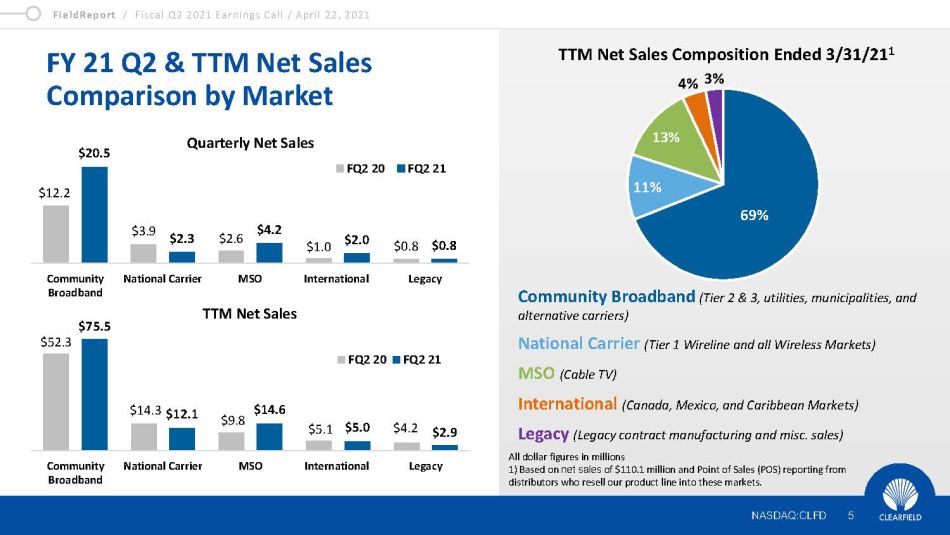

Looking at our market segments by net sales, on slide 5, starting first with our core Community Broadband market. In the second quarter of fiscal 2021 we generated net sales of $20.5 million to this market, which was up 68% from the same period last year. For the trailing 12 months ended March 31, 2021, Community Broadband market net sales totaled $75.5 million, which was up 44% from the comparable period last year.

Our MSO business comprised 13% of our net sales in fiscal Q2. From a growth standpoint, we built on the momentum we established over the last several quarters, realizing a 60% year-over-year increase in net sales to $4.2 million in the second quarter of fiscal 2021, and a 48% year-over-year increase to $14.6 million for the trailing 12 months ended March 31, 2021. Net sales in our National Carrier market was down 15% year-over-year to $12.1 million for the trailing 12 months ended March 31, 2021. As I’ve talked about previously, our position in the National Carrier market is related to the continuing demand from fiber-to-the-home and fiber-to-the-business applications. As COVID constraints have limited the deployment of 5G solutions into the access part of the network, net sales to our Tier 1 customers for the second quarter of fiscal 2021 decreased 42% year-over-year to $2.3 million.

Although sales in our Tier 1 market have not yet experienced the same robust growth as our other markets, we continue to support our sales presence in the Tier 1 National Carrier market for both fiber to the home and business as well as for 5G initiatives. We shipped several new products into that market during Q2 and are working to gain a stronger foothold with them. As we have previously communicated, the global pandemic has stalled the introduction and training of our new technologies into the Tier 1 market. As 5G deployments into the access network increase, we are optimistic for increasing net sales among Tier 1 markets moving forward.

Net sales to our International market was up 105% year-over-year in the second quarter and remained flat year-over-year for the trailing 12 months ended March 31, 2021. As the Pandemic begins to get under control, fiber-fed broadband in Mexico and Canada is showing a resurgence in demand. Net sales in our Legacy business was flat year-over-year in Q2 and down 31% year-over-year for the trailing 12 months. This legacy part of our business is highly dependent upon two key customers in this segment. We believe the business to be fluctuating from normal levels due to the slowdown in the economy related to COVID.

With that, I’ll now turn the presentation over to Dan, who will walk us through our financial performance for the second quarter of fiscal 2021.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD FY 21 Q2 & TTM Net Sales Comparison by Market NASDAQ:CLFD 5 All dollar figures in millions 1) Based on net sales of $110.1 million and Point of Sales (POS) reporting from distributors who resell our product line into these markets. TTM Net Sales Composition Ended 3/31/21 1 Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) National Carrier (Tier 1 Wireline and all Wireless Markets) MSO (Cable TV) International (Canada, Mexico, and Caribbean Markets) Legacy (Legacy contract manufacturing and misc. sales) 69% 11% 13% 4% 3% $52.3 $14.3 $9.8 $5.1 $4.2 $12.1 $14.6 $5.0 $2.9 Community Broadband National Carrier MSO International Legacy FQ2 20 FQ2 21 Quarterly Net Sales TTM Net Sales $12.2 $3.9 $2.6 $1.0 $0.8 $20.5 $2.3 $4.2 $2.0 $0.8 Community Broadband National Carrier MSO International Legacy FQ2 20 FQ2 21 $75.5

Thank you, Cheri, and good afternoon, everyone. Its great to be speaking with you today.

Now, looking at our second quarter financial results in more detail…

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Financial Update Dan Herzog CHIEF FINANCIAL OFFICER NASDAQ:CLFD 6

As you can see on slide 7, our net sales in the second quarter of fiscal 2021 increased 45% to a record $29.7 million from $20.4 million in the same year-ago period. The increase in net sales was primarily due to higher sales in our Community Broadband, MSO, and International markets, partially offset by decreases in our National Carrier markets.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Quarterly Financial Performance 7 NASDAQ:CLFD Note: Dollar figures in millions $20.4 $26.0 $27.3 $27.1 $29.7 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Net Sales +7% +19% +14% +40% +45% Year - over - Year Growth Rate

Turning to slide 8, gross profit for the second quarter of fiscal 2021 increased 59% to $12.9 million, or 43.6% of net sales, from $8.2 million, or 39.9% of net sales, in the same year-ago quarter. The increase in gross profit dollars was due to higher sales volume. The increase in gross profit margin was due to a favorable product mix associated with the increased net sales in our Community Broadband markets and cost reduction efforts across our product lines including increased production at our Mexico plants, as well as manufacturing efficiencies realized from higher sales volumes.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Quarterly Financial Performance 8 NASDAQ:CLFD Note: Dollar figures in millions $20.4 $26.0 $27.3 $27.1 $29.7 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Net Sales +7% +19% +14% +40% +45% Year - over - Year Growth Rate $8.2 $10.8 $11.2 $11.4 $12.9 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Gross Profit 39.9% 41.5% 41.2% 42.0% 43.6% Gross Profit (%)

As you can see on slide 9, our operating expenses for the second quarter of fiscal 2021 were $8.5 million, which were up from $7.4 million in the same year-ago quarter. As a percentage of net sales, operating expenses for the second quarter of fiscal 2021 were 28.6%, down from 36.4% in the same year-ago period. The increase in operating expenses on a dollar basis was primarily due to additional headcount and higher compensation costs related to performance compensation accruals, and increased stock compensation expense, offset by lower travel and entertainment costs.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Quarterly Financial Performance 9 NASDAQ:CLFD Note: Dollar figures in millions $20.4 $26.0 $27.3 $27.1 $29.7 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Net Sales +7% +19% +14% +40% +45% Year - over - Year Growth Rate $8.2 $10.8 $11.2 $11.4 $12.9 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Gross Profit 39.9% 41.5% 41.2% 42.0% 43.6% Gross Profit (%) 36.4% 27.8% 27.7% 28.3% 28.6% OPEX as % of Net Sales $7.4 $7.2 $7.6 $7.7 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Operating Expenses $8.5

Turning to our profitability measures on slide 10, income from operations was $4.5 million in the second quarter of fiscal 2021, which compares to $720,000 in the same year-ago quarter. Income tax expense increased to $935,000 in the second quarter of fiscal 2021, with an effective tax rate of 20.4%, up from $190,000 in the second quarter of 2020, which had an effective tax rate of 20.3%. Net income totaled $3.6 million, or $0.27 per diluted share, an improvement of approximately $2.9 million over the $750,000, or $0.05 per diluted share, in the same year-ago quarter.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Quarterly Financial Performance 10 NASDAQ:CLFD Note: Dollar figures in millions $20.4 $26.0 $27.3 $27.1 $29.7 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Net Sales +7% +19% +14% +40% +45% Year - over - Year Growth Rate $8.2 $10.8 $11.2 $11.4 $12.9 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Gross Profit 39.9% 41.5% 41.2% 42.0% 43.6% Gross Profit (%) 36.4% 27.8% 27.7% 28.3% 28.6% OPEX as % of Net Sales $7.4 $7.2 $7.6 $7.7 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Operating Expenses $8.5 3.7% 11.5% 11.2% 11.7% 12.3% Net Margin $0.7 $3.0 $3.0 $3.2 $3.6 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Net Income

Before I turn it back over to Cheri, I’d like to provide a brief update on the operational measures we’ve taken to protect and support our business, our personnel and customers since the COVID-19 pandemic took hold and how we are continuing to effectively navigate the current environment, both reflected on slide 11.

I am encouraged to report that Clearfield continues to remain fully operational. The majority of our non-production employees are working remotely, effectively using collaboration tools and video conferencing to stay connected.

Our production operations in both the U.S. and Mexico are operating close to normal while adhering to state and federal government social distancing guidelines. As a precautionary measure, we have multiple contingency plans in the event our ability to operate is diminished or eliminated at either location. As many of you know, we dual-source most of our components to cover multiple points of failure and provide purposeful redundancies to reduce potential risks.

While the COVID-19 pandemic has dramatically boosted broadband demand it, has also created supply chain challenges to fulfill that demand. Thankfully, the strong partnerships we have built with our suppliers globally have and will continue to be crucial. At the outset of COVID, we made the decision to maximize the availability of all product lines at all three of our plants by ensuring that each location can manufacture across our broad product portfolio. We are optimistic that we will be able to procure the necessary components for our growth ahead. However, the pressure on the supply chain by increased demand and global supply chain disruptions, caused by the pandemic, the harsh Texas winter, container shortages, the blocking of the Suez Canal and other logistical issues have shown how fragile the supply chain can be. In particular, Clearfield’s manufacturing requires supplies of raw materials, like optical fiber cable and resins necessary for its fiber management product line.

That concludes my prepared remarks. I will now turn the call back over to Cheri.

Cheri?

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD COVID - 19 Operational Update • Critical manufacturer status • Operating at normal capacity and adhering to state and federal government social distancing guidelines • Enhanced safety measures for on - site production personnel • Majority of supply chain remains operational • Maintaining higher minimum stocking levels on component level inventory to ensure customer needs are met NASDAQ:CLFD 11

Thanks, Dan.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Operational Update Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 12

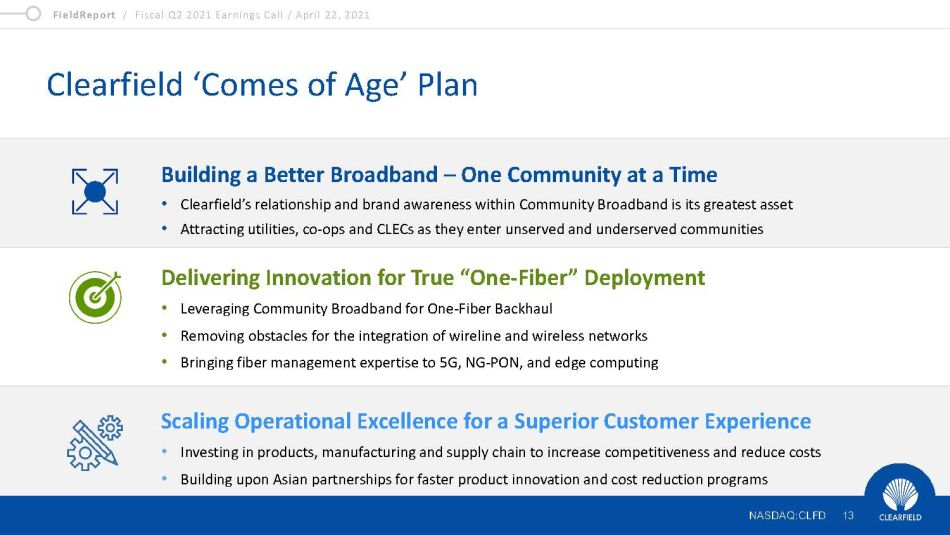

Now, looking at our operational initiatives and focus in fiscal 2021, highlighted on slide 13. Our strategic plan continues its multi-year initiative to enable Clearfield to ‘Come of Age.’ Our organization has specific and measurable objectives designed to increase our topline, reduce our costs and expand our reach. Key to our success remains our loyalty to the providers that have grown alongside us, while delivering new innovations for the integration of wireline and wireless networks as we move into new markets. This brings me to our first pillar, Building a Better Broadband – One Community at a Time, leverages Clearfield’s longstanding customer and partnership relationships to build brand awareness and expertise.

As I mentioned, Clearfield was built to facilitate the enablement of pervasive high-speed broadband to underserved and unserved communities. Clearfield’s position within the Community Broadband market has never been better. Our track record and reputation has positioned us extremely well to continue to grab market share and further capitalize on the expansion that’s currently underway.

Clearfield remains committed to fulfilling the increased demand of smaller providers across the country. We began investing early last fall in our drop-cable production facilities because we anticipated take rates would increase among existing providers as potential subscribers were added to existing networks. This timely investment has proven to be a meaningful competitive advantage as we continue to offer superior lead-times compared to the competition. In addition, as providers with multi-state networks are now overbuilding their networks with fiber, we are developing an increasing presence within the Tier 2 community. We anticipate this market-based demand will continue moving forward.

A key market driver is the government-financed broadband program under the Rural Digital Opportunity Fund, or RDOF, that is currently in the planning stages for providers. In addition, while the recently announced American Jobs Plan within the Biden infrastructure bill is still being debated in Congress, the White House’s request for $100 billion in funding for sustainable high-speed broadband is a positive reflection on expanded fiber opportunities we believe are possible in the years ahead.

Our second pillar is Delivering Innovation for True “One-Fiber” Deployment. The foundation of One-Fiber deployment began with development and introduction of the Clearview Cassette.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Clearfield ‘Comes of Age’ Plan NASDAQ:CLFD 13 Scaling Operational Excellence for a Superior Customer Experience • Investing in products, manufacturing and supply chain to increase competitiveness and reduce costs • Building upon Asian partnerships for faster product innovation and cost reduction programs Building a Better Broadband – One Community at a Time • Clearfield’s relationship and brand awareness within Community Broadband is its greatest asset • Attracting utilities, co - ops and CLECs as they enter unserved and underserved communities Delivering Innovation for True “One - Fiber” Deployment • Leveraging Community Broadband for One - Fiber Backhaul • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing

The Cassette is the central building blocks of every element of Clearfield’s FieldSmart® product portfolio. This 12-port building block is designed in multiple configurations and then manufactured in volume. As it is designed to handle the toughest operating environments, it provides flexibility, as well as reliable performance within the inside plant, outside plant and access networks. Delivering the most scalable fiber management platform in the industry, Clearfield ensures the service provider's investment in capital equipment grows alongside their subscriber’s take rates.

Reducing the overall footprint of the fiber management element reduces real estate costs and improves density without compromising critical design elements of access, bend-radius protection, physical fiber protection and route-path diversity.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Our Design Philosophy • Consolidation, Distribution & Protection • Design Flexibility • Modularity, Scalability & Simplicity • Service - Oriented, universal design architecture Use the same cassettes thought out the entire network with Clearfield’s Modular Solutions 14

Our third pillar involves Scaling Operational Excellence for a Superior Customer Experience. Our production facilities in Mexico continue to provide meaningful competitive advantages to both Clearfield and our customers. Not only have our Mexico facilities enhanced our overall production capabilities and produced cost effectiveness, but they have also allowed us to deliver product to customers in a timeframe that our competition simply can’t match. To maintain these advantages, we have systematically added capacity over the last several months to meet the growing demand we are seeing for our products and will continue to evaluate our needs on an ongoing basis.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Clearfield ‘Comes of Age’ Plan NASDAQ:CLFD 15 Scaling Operational Excellence for a Superior Customer Experience • Investing in products, manufacturing and supply chain to increase competitiveness and reduce costs • Building upon Asian partnerships for faster product innovation and cost reduction programs Building a Better Broadband – One Community at a Time • Clearfield’s relationship and brand awareness within Community Broadband is its greatest asset • Attracting utilities, co - ops and CLECs as they enter unserved and underserved communities Delivering Innovation for True “One - Fiber” Deployment • Leveraging Community Broadband for One - Fiber Backhaul • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing

Looking ahead to the balance of fiscal 2021, the rural broadband market remains ripe for growth and the strategic investments we have made and the presence we have established over the last 10 years will be beneficial for Clearfield. While the volatility of the supply chain potentially poses challenges in the near term, our growing backlog, expanding pipeline and building market demand, give us confidence in our ability to realize net sales of $120 million to $125 million in fiscal 2021, which represents year-over-year growth of 32% at the midpoint. As travel re-emerges, we anticipate our Selling, general and administrative costs will grow moderately. In addition, we will be making strategic investments in additional customer-facing positions in order to maintain our leading customer service programs to our expanding customer base. For the remaining quarters of fiscal 2021, we anticipate net income to be at or above 12% as a percentage of net sales.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD $73.9M $77.7M $85.0M $93.1M $120M - $125M FY 2017 FY 2018 FY 2019 FY 2020 FY 2021E Financial Outlook 16 NASDAQ:CLFD FY 2021 guidance issued and effective as of Apr. 22, 2021; growth rate is based on midpoint of net sales guidance range Annual Net Sales ($ in millions)

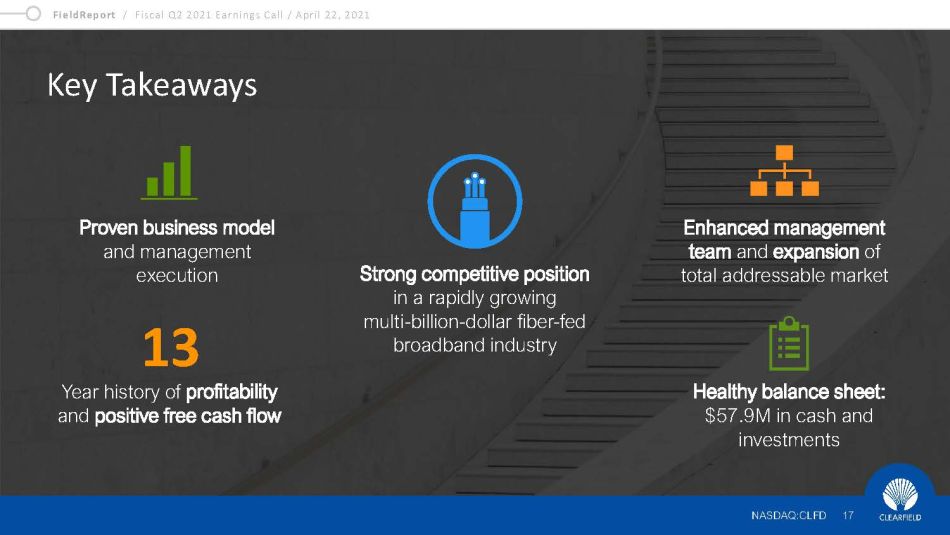

In summary, our consistent financial performance, highlighted by the 13 years of profitability and positive cash flow, demonstrates the durability of our business in a range of environments. Clearfield continues to benefit from and take advantage of robust industry tailwinds and Clearfield’s established presence within our key growth markets.

We remain confident the demand for fiber-fed broadband will continue through fiscal 2021. Longer term, our enhanced ‘Comes of Age’ Plan, which targets growth in fiber-fed broadband and 5G access fiber positions us for continued success for Clearfield in the years ahead.

And with that, we’re ready to open the call for your questions.

Operator?

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Key Takeaways Proven business model and management execution Enhanced management team and expansion of total addressable market Strong competitive position in a rapidly growing multi - billion - dollar fiber - fed broadband industry Healthy balance sheet: $57.9M in cash and investments Year history of profitability and positive free cash flow 13 NASDAQ:CLFD 17

Thank you.

We will now be taking questions from the Company’s publishing sell-side analysts.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 18 Dan Herzog CHIEF FINANCIAL OFFICER

Operator

[Operator Instructions] Our first question comes from Jaeson Schmidt with Lake Street Capital Markets. Please proceed with your question.

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Hey, guys, thanks for taking my questions. And congrats on really impressive results. Want to start with the outlook, which was also really strong. Obviously expecting some nice growth here in Q3 and Q4. Does this assume any meaningful pickup in the National Carrier business? Or is this largely just continued momentum in the Community Broadband segment?

Cheri Beranek

Chief Executive Officer, President & Director

It's absolutely based upon Community Broadband and the strength that we've seen to date within Community Broadband and the MSO world. The Tier 1 markets, I would say, we've yet to establish true momentum in that area. So that is not part of the growth initiative or growth outlook.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 19 Dan Herzog CHIEF FINANCIAL OFFICER

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay. And then just looking at fiscal 2021, some really nice growth expected. I mean, when you sit here today, are you at all concerned that there has been some pull forward in demand?

Cheri Beranek

Chief Executive Officer, President & Director

Jaeson, I would say there might be a little bit of a pull forward maybe a little bit of what I'd call panic buying to get some stuff, get people in place for their orders, because there certainly have been the supply chain initiatives and general availability concerns. But in general, I wouldn't say this is -- I have no concern about it being ongoing or continually viable. This is absolutely a trend and ongoing momentum. It's not, our perception is not a spike.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 20 Dan Herzog CHIEF FINANCIAL OFFICER

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay, that's helpful. And then just the last one for me, and I'll jump back into queue, just want to clarify some of your comments on the supply chain. Were you at all impacted by constraints in the quarter?

Cheri Beranek

Chief Executive Officer, President & Director

Not at this point, our procurement group has been doing an amazing job. I would call it spinning plates, as we kind of walk through issues between bringing in product. And I think it's just to me think about the standpoint that we've got, your products coming in on boat with their products coming in on air, then you’ve get boats sitting in waiting to unload. Just trying to be able to put that all together has been a little bit of a challenge. But it did not impact our ability to provide products. If you're alluding to the backlog, that backlog came in when we were we were on our call last in January, we talked about that January had started strong. And it just continued to escalate from there and extremely strong March and providing the same level of a general viability as we would ongoing basis. And as I indicated in the call, the preliminary notes, we anticipate to be having majority of the backlog that we have in place shipping in quarter three.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 21 Dan Herzog CHIEF FINANCIAL OFFICER

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay. Thanks a lot, guys.

Cheri Beranek

Chief Executive Officer, President & Director

You're welcome. Thanks talk to you again, Jaeson.

Operator

[Operator Instructions] Our next question comes from Tim Savageaux with Northland Capital Markets. Please proceed with your question.

Tim Savageaux

Northland Capital Markets, Research Division

Hi, good afternoon, and my congratulations as well on the results. I wanted to focus on your commentary about at least the beginnings of some visibility extending beyond what's normally a pretty short cycle business for you guys. And some orders scheduled farther out into the future. I wonder if you could give us a little more color perhaps on how far that visibility might extend. And maybe relative to the backlog that you saw in the quarter significant increase, how meaningful that longer dated demand is, and whether that's also coming from Community Broadband.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 22 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Tim, what we see happening in this space is people from a legacy standpoint, over the course of, I'd say, the last five years, many of our customers would look at their plans, and would identify for us, this is what we're anticipating this year. What we're seeing now is a commitment to build out their entire networks, and having multi-year initiatives that they're committed to building out and passing the majority of their homes, working through projected take rates, because in the past it was more of an orientation of a kind of a build strategy that was success based. Whereas today, I think the success is ensured, because broadband take rates are so high. And so there's a longer term commitment to those builds. As it relates to our backlog, a little of that is staged deployment. And that's for builds that were orders that we were getting in March, some from some larger suppliers that were looking at helping us stage our builds and giving us orders that were not long, long-term, but saying I want X in March, Y in April, Z in June, so that they could get into the production schedule. And we're working to ensure that all of our customers can get the products that they need, and not put ourselves in a position or our customers in a position where customers might see stockpiling equipment and coming at the expense of others. So we're really trying to work collaboratively with all of our customers, so that we can really help ensure they get the products that they need.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 23 Dan Herzog CHIEF FINANCIAL OFFICER

Tim Savageaux

Northland Capital Markets, Research Division

Okay, thanks. And you mentioned kind of RDOF being in the planning stages, obviously awards have been made. From your perspective is there any dynamic or potential dynamic around kind of spending or planning occurring now, kind of in perhaps in advance of actual receipt of funds, or a lot of these projects are separate and distinct from what you might see in your kind of current or core community Broadband customer base.

Cheri Beranek

Chief Executive Officer, President & Director

Yes, I mean, revenue to-date has very isolated. There's some pockets of RDOF related business, but principally. This is -- we do not see RDOF funds in our current revenues or in our backlog. What we see on the RDOF world is people now getting their plans together, putting out their engineering drawings, really going into markets where they haven't been involved in before. So we believe we're going to start to see that revenue in the very tail end of quarter three, and then in a more meaningful basis in quarter four. But basically, that's a calendar year 2022 opportunity starting and what the feds have asked for and hoping for is that we can see 40% of those funds that have been allocated to happen in the first three years. So I really think that shows significant opportunity for 2022 and 2023, as well.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 24 Dan Herzog CHIEF FINANCIAL OFFICER

Tim Savageaux

Northland Capital Markets, Research Division

Great. Thanks for that. Over on the Tier 1 side of the business, we have seen some dynamics with various of the Tier 1 carriers getting a pretty early and fast start to the year. Now, understanding that your Tier 1 customer base doesn't always match up with some of the kind of near term strength we've seen at least high level spending numbers from guys like AT&T and Verizon. But maybe you can give us a little more color on the dynamics around your Tier 1 business and what might be driving that to the extent it's not just some of the C-band stuff or fiber to the home deployments, larger carriers that you’re doing?

Cheri Beranek

Chief Executive Officer, President & Director

There's a lot of money being spent by the wireless carriers, especially as it relates to C-band, the C-band work where they spent a fortune on spectrum. And that C-band work for deployment is principally going to be based at the tower, it's not going to be based at the small cell. So that's good for the incumbent provider that has those towers and its good for the consumer because it means that they'll get a you get 5G service on their cell phones faster. It means that our opportunity for 5G, which is going to be small cell based has been delayed into the year and potentially into next year. The challenge is, I think that, that doesn't mean that revenue isn't going to be there. It means that true 5G performance that we want to see in regard to true low latency and the high speed as well as is still coming. But it has been the reason that we have seen a lack of the same kind of growth has not shown up in the Tier 1 base because of it.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 25 Dan Herzog CHIEF FINANCIAL OFFICER

Tim Savageaux

Northland Capital Markets, Research Division

Got it. Thanks very much. I'll pass it on and congrats once again.

Cheri Beranek

Chief Executive Officer, President & Director

You're welcome. Thank you.

Operator

At this time, this concludes the company's question and answer session. If your question was not taken, you may contact Clearfield's Investor Relations team at clfd@gatewayir.com. I'd now like to turn the call back over to Ms. Beranek for closing comments.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 26 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Thank you, Paul. And thank you, all of you for joining us today. We look forward to updating you again soon on our progress. Happy spring and talk to you soon.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD

Thank you for joining us today for Clearfield’s fiscal second quarter 2021 earnings conference call. You may now disconnect.

FieldReport / Fiscal Q2 2021 Earnings Call / April 22, 2021 NASDAQ:CLFD Contact Us NASDAQ:CLFD 28 COMPANY CONTACT: Cheri Beranek President & CEO Clearfield, Inc. IR@clfd.net INVESTOR RELATIONS: Matt Glover and Tom Colton Gateway Investor Relations (949) 574 - 3860 CLFD@gatewayir.com