Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SILICON LABORATORIES INC. | tm2113472d1_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - SILICON LABORATORIES INC. | tm2113472d1_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - SILICON LABORATORIES INC. | tm2113472d1_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - SILICON LABORATORIES INC. | tm2113472d1_ex2-1.htm |

Exhibit 99.3

| The measure of intelligence is the ability to change. ALBERT EINSTEIN |

| Divestiture of Infrastructure & Automotive Simplify and Focus to Accelerate IoT Market Leadership and Growth 22 April 2021 |

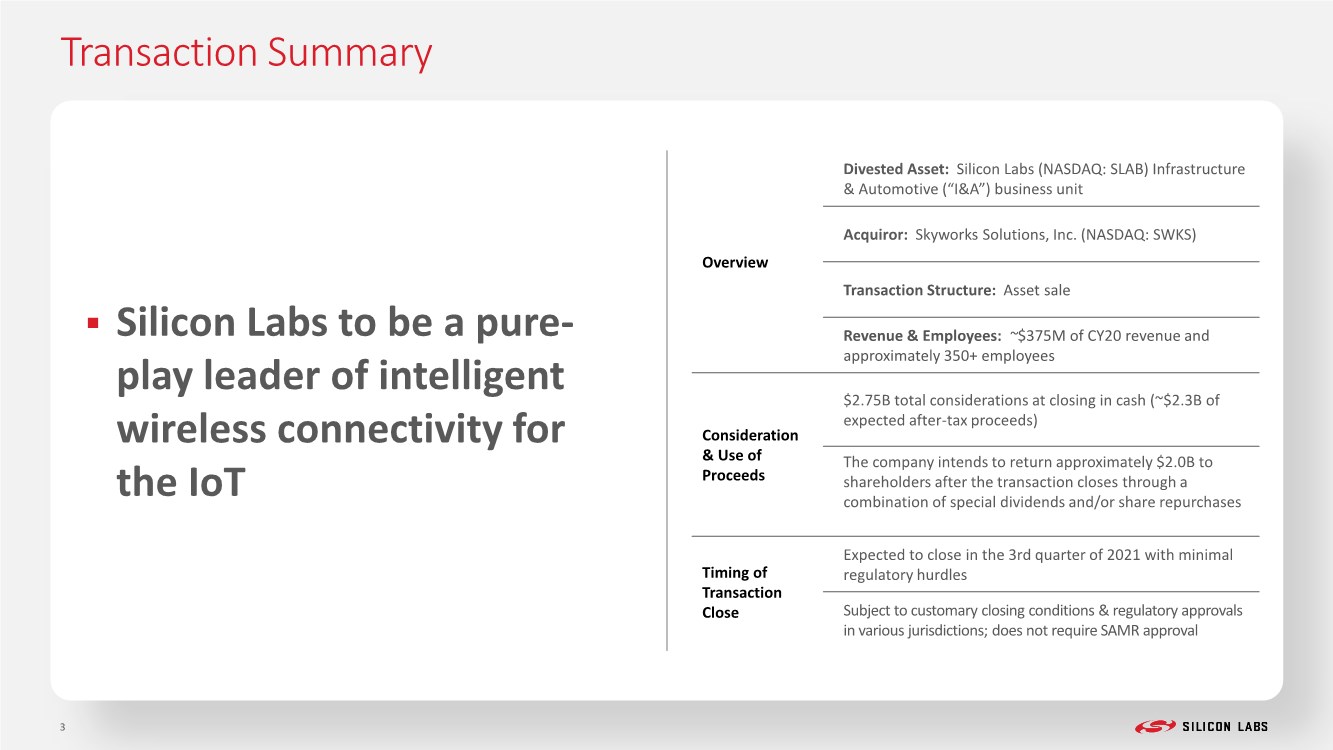

| Transaction Summary Overview Divested Asset: Silicon Labs (NASDAQ: SLAB) Infrastructure & Automotive (“I&A”) business unit Acquiror: Skyworks Solutions, Inc. (NASDAQ: SWKS) Transaction Structure: Asset sale Revenue & Employees: ~$375M of CY20 revenue and approximately 350+ employees Consideration & Use of Proceeds $2.75B total considerations at closing in cash (~$2.3B of expected after-tax proceeds) The company intends to return approximately $2.0B to shareholders after the transaction closes through a combination of special dividends and/or share repurchases Timing of Transaction Close Expected to close in the 3rd quarter of 2021 with minimal regulatory hurdles Subject to customary closing conditions & regulatory approvals in various jurisdictions; does not require SAMR approval ▪ Silicon Labs to be a pure- play leader of intelligent wireless connectivity for the IoT 3 |

| Why Divest I&A Now? Separating, Simplifying and Scaling for the Future Deal Logic • Internet of Things (IoT) and Infrastructure and Automotive (I&A) businesses are different – unique markets, customers, supply chains, R&D, selling motion and corporate organization • By divesting I&A to Skyworks, each business will get focus needed to succeed and grow Announcement • Silicon Labs to be a pure-play leader of intelligent wireless connectivity for the IoT Opportunities • Simplify and focus to accelerate IoT market leadership and growth • Strategically align and scale IoT innovation to create greater customer value Timing • Capitalize on opportunity for long-term value creation |

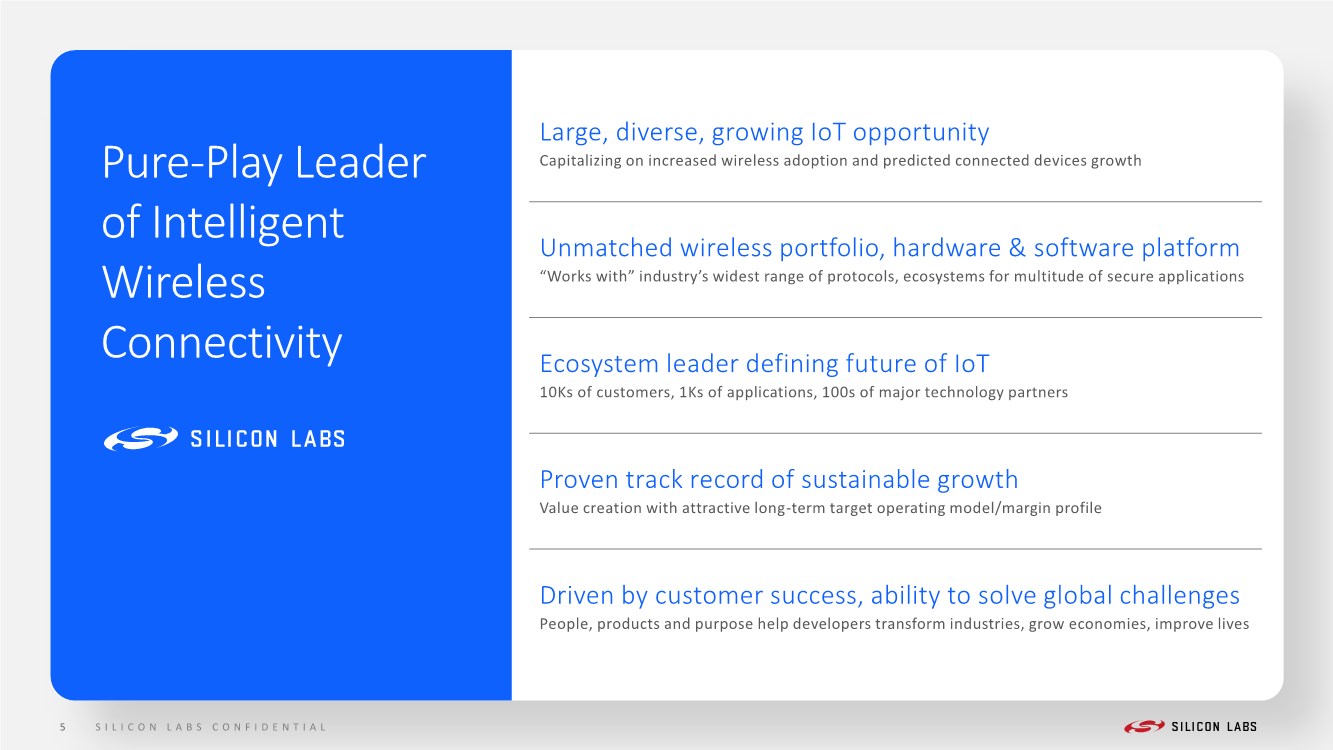

| Pure-Play Leader of Intelligent Wireless Connectivity Large, diverse, growing IoT opportunity Capitalizing on increased wireless adoption and predicted connected devices growth Unmatched wireless portfolio, hardware & software platform “Works with” industry’s widest range of protocols, ecosystems for multitude of secure applications Ecosystem leader defining future of IoT 10Ks of customers, 1Ks of applications, 100s of major technology partners Proven track record of sustainable growth Value creation with attractive long-term target operating model/margin profile Driven by customer success, ability to solve global challenges People, products and purpose help developers transform industries, grow economies, improve lives 5 SILICON LABS CONFIDENTIAL |

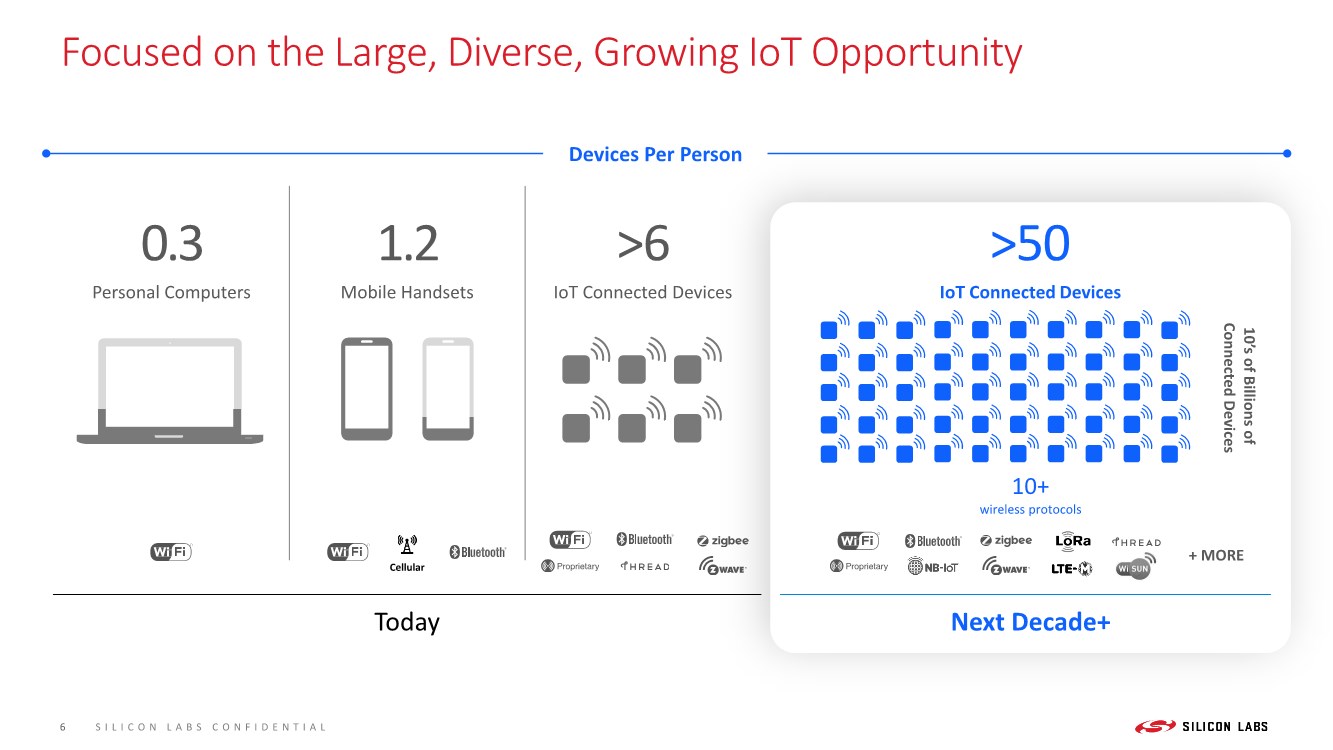

| Focused on the Large, Diverse, Growing IoT Opportunity Today Next Decade+ Mobile Handsets 1.2 Personal Computers 0.3 IoT Connected Devices >6 IoT Connected Devices >50 10+ wireless protocols 10’s of Billions of Connected Devices Devices Per Person + MORE Cellular 6 SILICON LABS CONFIDENTIAL |

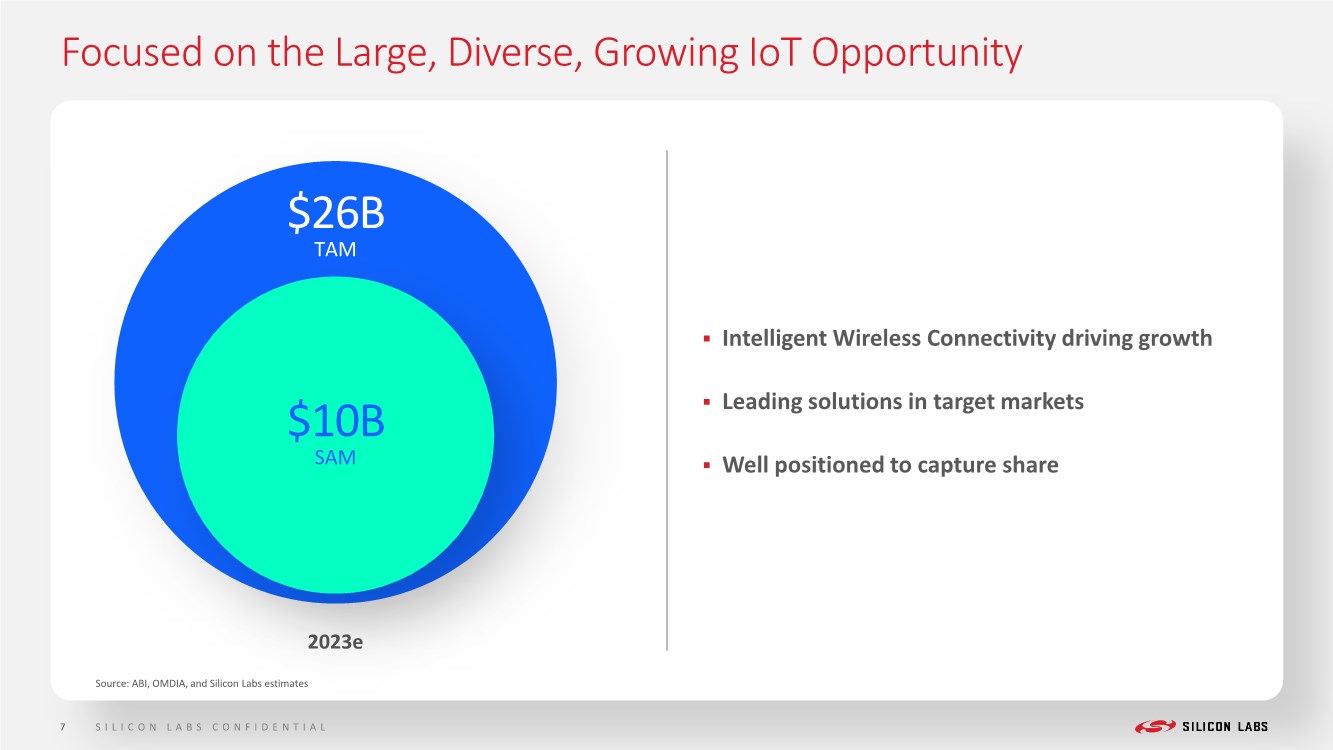

| Focused on the Large, Diverse, Growing IoT Opportunity ▪ Intelligent Wireless Connectivity driving growth ▪ Leading solutions in target markets ▪ Well positioned to capture share 7 SILICON LABS CONFIDENTIAL 2023e $26B TAM $10B SAM Source: ABI, OMDIA, and Silicon Labs estimates |

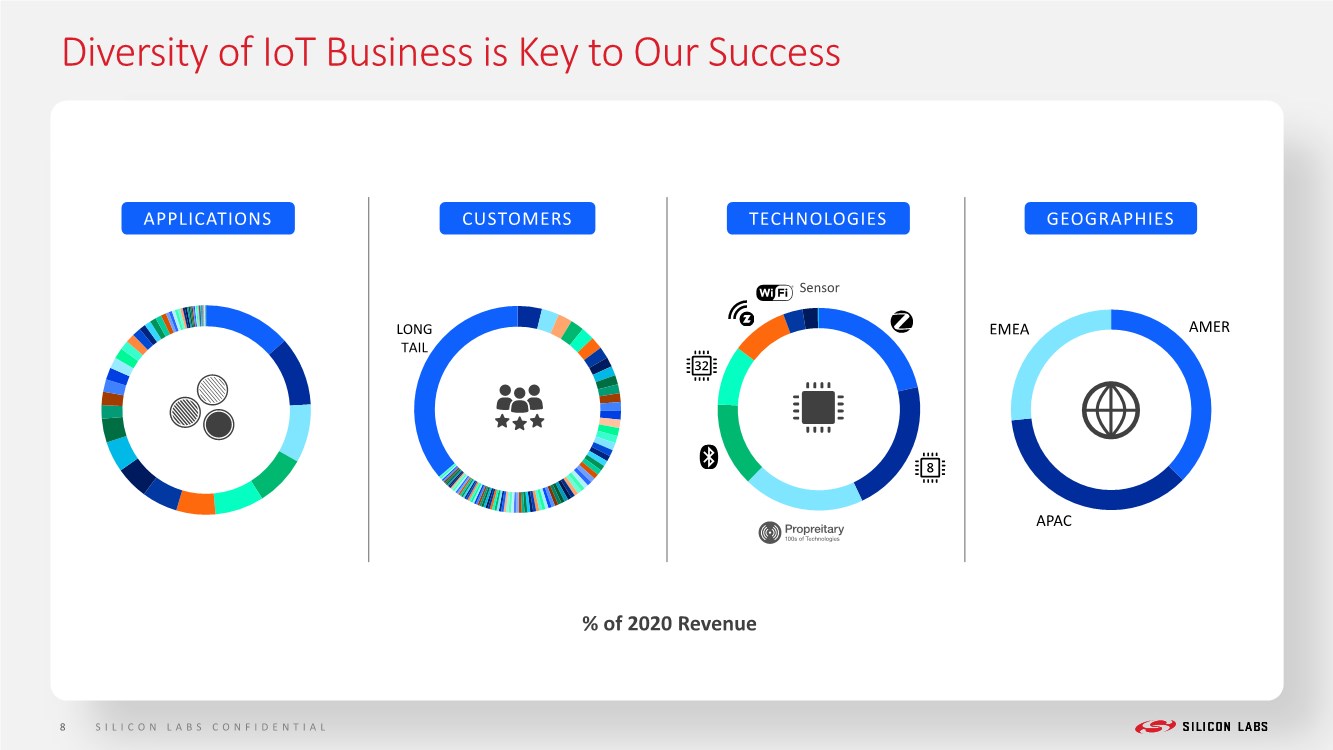

| AMER APAC EMEA Diversity of IoT Business is Key to Our Success GEOGRAPHIES APPLICATIONS % of 2020 Revenue TECHNOLOGIES CUSTOMERS Sensor 8 SILICON LABS CONFIDENTIAL LONG TAIL |

| Leader IoT Wireless Connectivity 2015 BT Smart Modules 2012 Software ZigBee SoC 2015 ZigBee/Thread Modules 2017 Device Management 2013 Low-power 32-bit MCUs 2016 Software RTOS 2018 Smart Home Protocol 2020 Ultra Low Power Wi-Fi Growing Revenue Based on IoT 1st To Market with Multiprotocol, BLE Mesh, BLE 5.1 #1 Share in Mesh Innovation Security, Energy Efficiency, Intelligence, Modules Breadth and Depth of Wireless IoT Protocols 9 SILICON LABS CONFIDENTIAL |

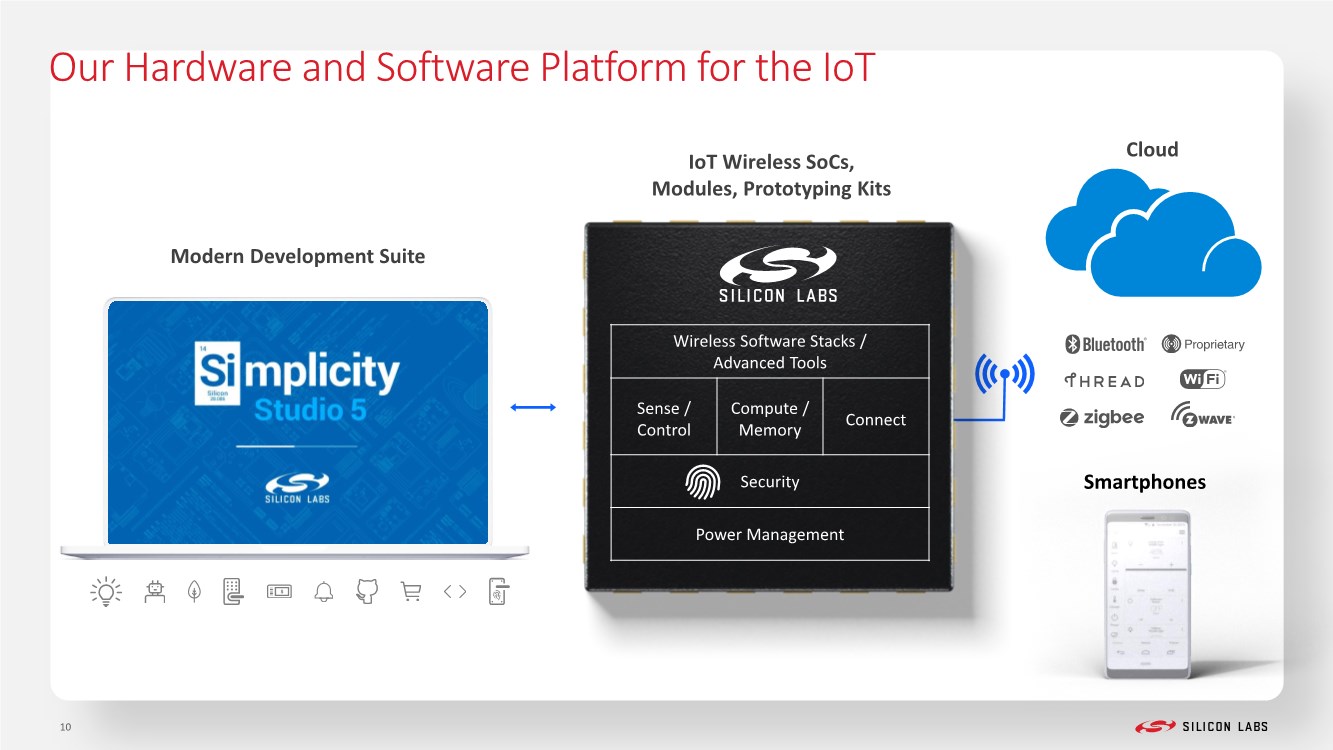

| Our Hardware and Software Platform for the IoT Smartphones Wireless Software Stacks / Advanced Tools Sense / Control Compute / Memory Connect Security Power Management Modern Development Suite Cloud IoT Wireless SoCs, Modules, Prototyping Kits 10 |

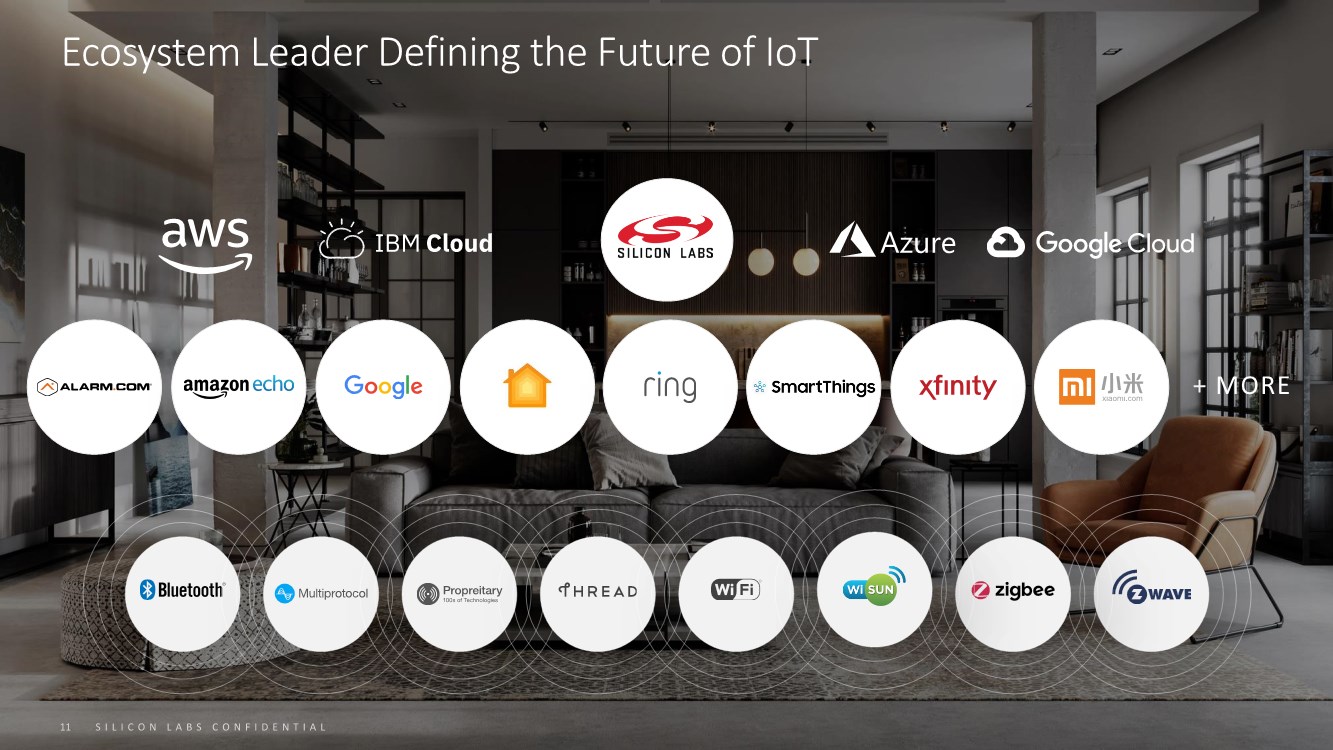

| Ecosystem Leader Defining the Future of IoT 11 SILICON LABS CONFIDENTIAL + MORE |

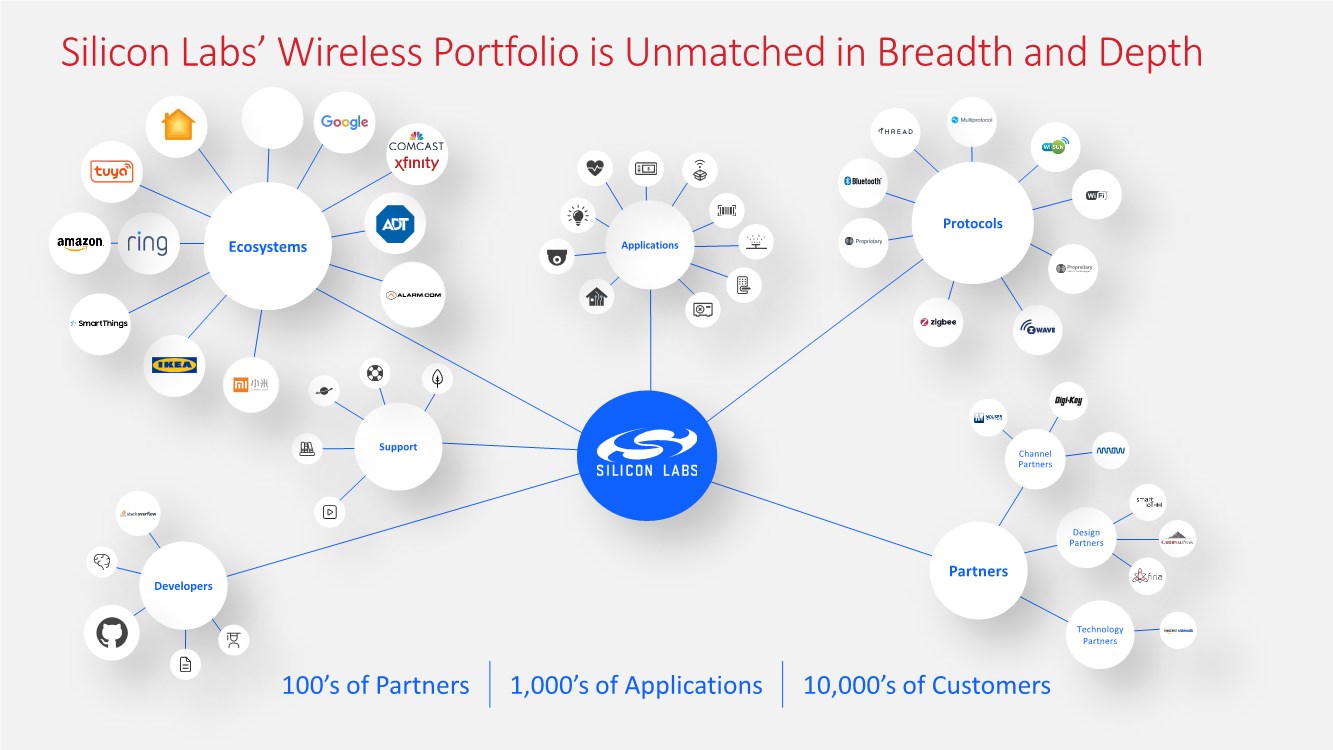

| Silicon Labs’ Wireless Portfolio is Unmatched in Breadth and Depth 100’s of Partners 1,000’s of Applications 10,000’s of Customers Ecosystems Applications Protocols Developers Support Partners Design Partners Channel Partners Technology Partners |

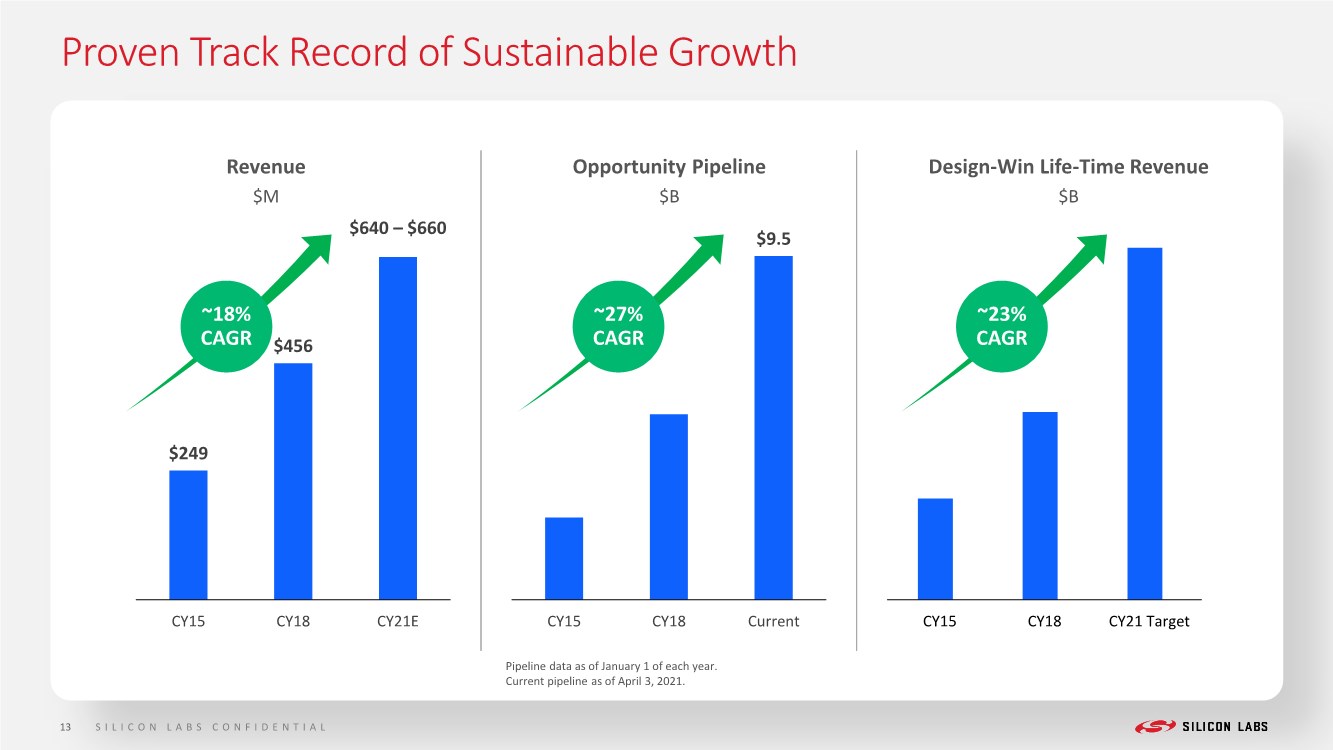

| $9.5 CY15 CY18 Current CY15 CY18 CY21 Target Proven Track Record of Sustainable Growth Pipeline data as of January 1 of each year. Current pipeline as of April 3, 2021. $249 $456 $640 – $660 CY15 CY18 CY21E ~18% CAGR ~27% CAGR ~23% CAGR Revenue $M Opportunity Pipeline $B Design-Win Life-Time Revenue $B 13 SILICON LABS CONFIDENTIAL |

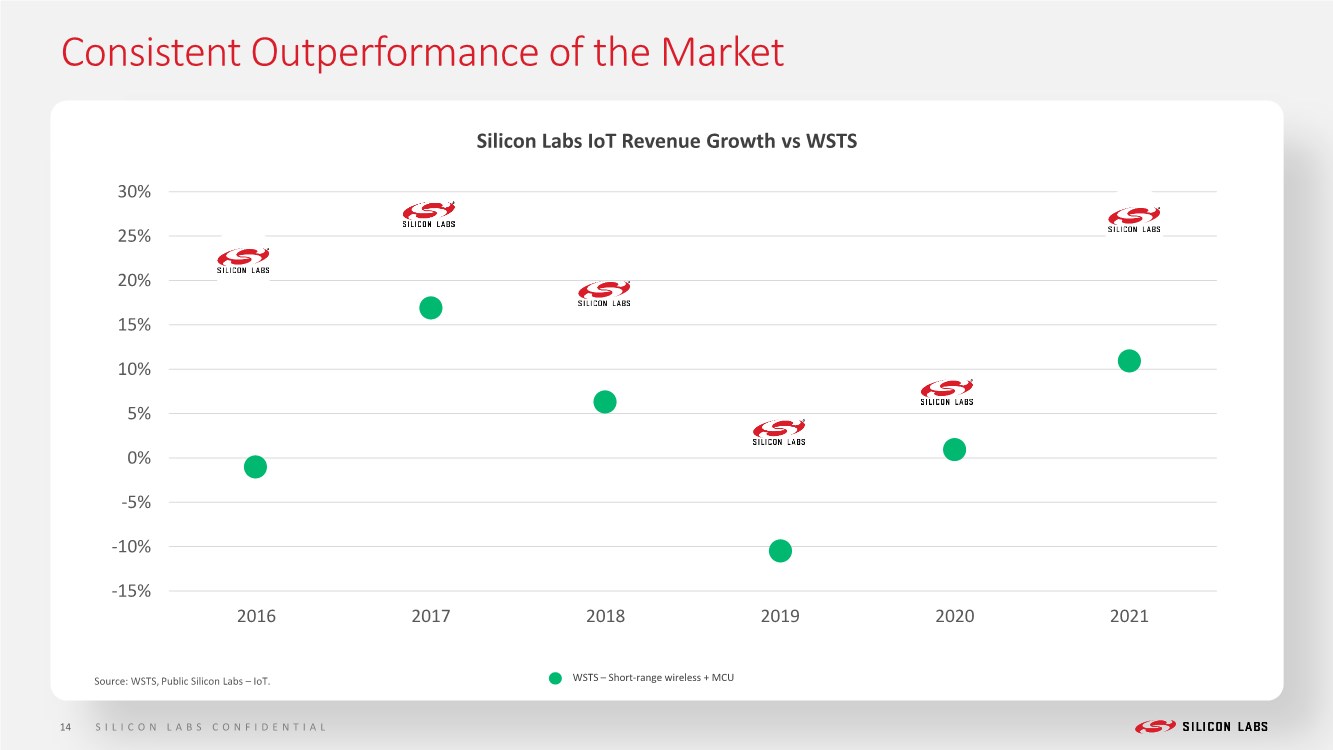

| Consistent Outperformance of the Market 14 -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% 2016 2017 2018 2019 2020 2021 Silicon Labs IoT Revenue Growth vs WSTS SILICON LABS CONFIDENTIAL Source: WSTS, Public Silicon Labs – IoT. WSTS – Short-range wireless + MCU |

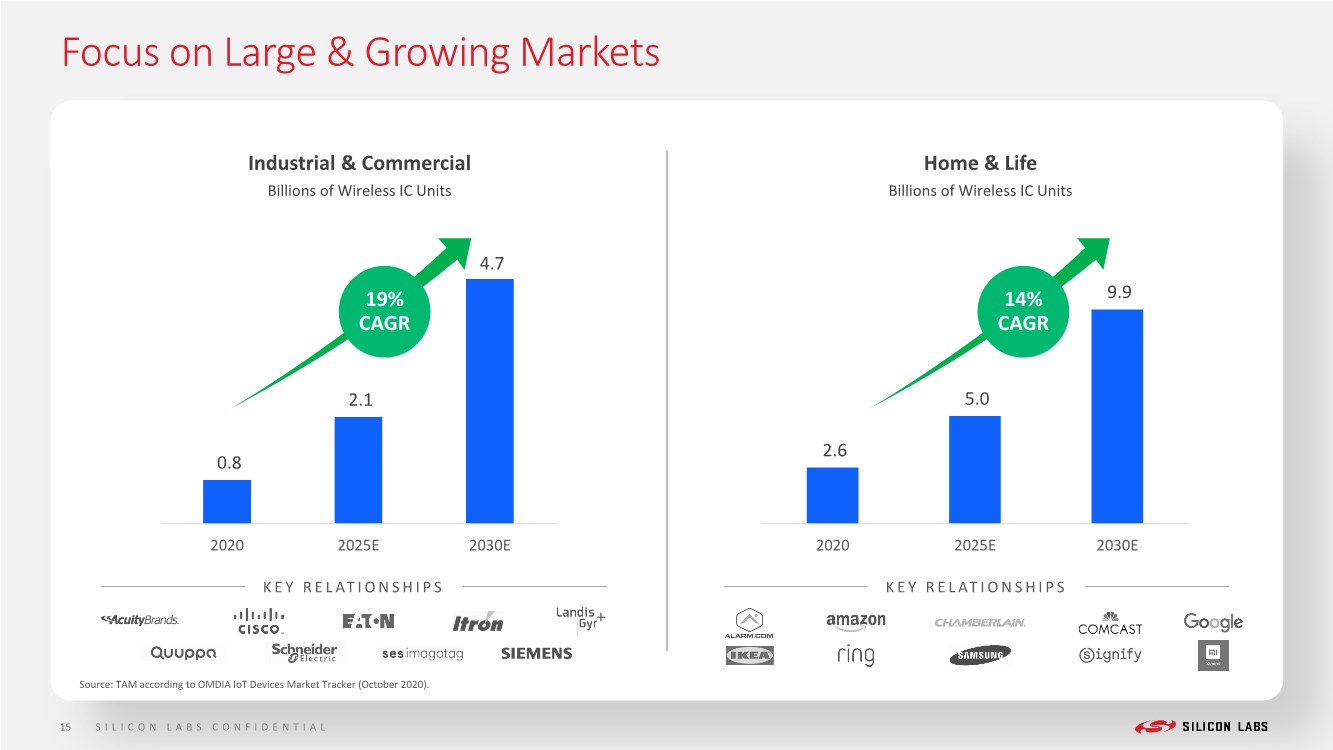

| 0.8 2.1 4.7 2020 2025E 2030E 2.6 5.0 9.9 2020 2025E 2030E Focus on Large & Growing Markets Source: TAM according to OMDIA IoT Devices Market Tracker (October 2020). 14% CAGR Industrial & Commercial Billions of Wireless IC Units Home & Life Billions of Wireless IC Units 19% CAGR KEY RELATIONSHIPS KEY RELATIONSHIPS 15 SILICON LABS CONFIDENTIAL |

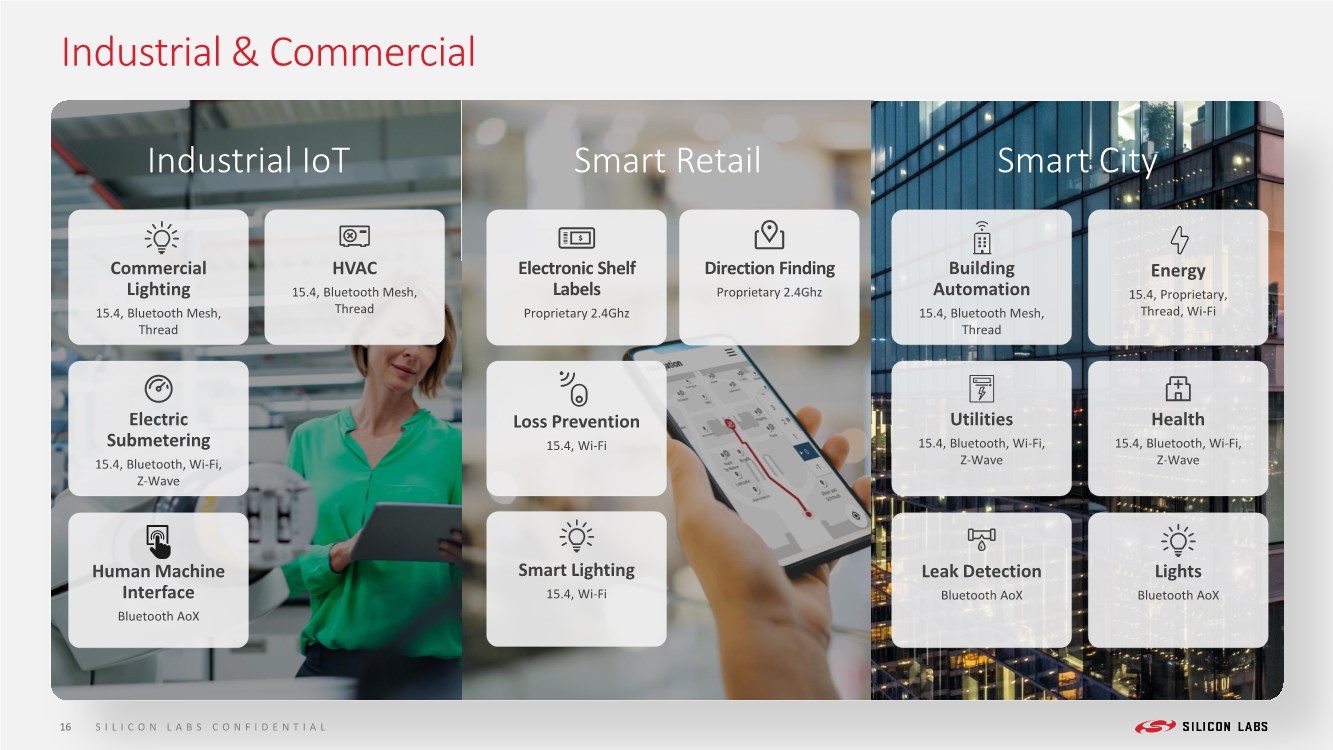

| Industrial & Commercial Electric Submetering 15.4, Bluetooth, Wi-Fi, Z-Wave Energy 15.4, Proprietary, Thread, Wi-Fi Loss Prevention 15.4, Wi-Fi Electronic Shelf Labels Proprietary 2.4Ghz Commercial Lighting 15.4, Bluetooth Mesh, Thread Human Machine Interface Bluetooth AoX Smart Lighting 15.4, Wi-Fi Utilities 15.4, Bluetooth, Wi-Fi, Z-Wave Building Automation 15.4, Bluetooth Mesh, Thread Leak Detection Bluetooth AoX Health 15.4, Bluetooth, Wi-Fi, Z-Wave Lights Bluetooth AoX HVAC 15.4, Bluetooth Mesh, Thread Direction Finding Proprietary 2.4Ghz Industrial IoT Smart Retail Smart City 16 SILICON LABS CONFIDENTIAL |

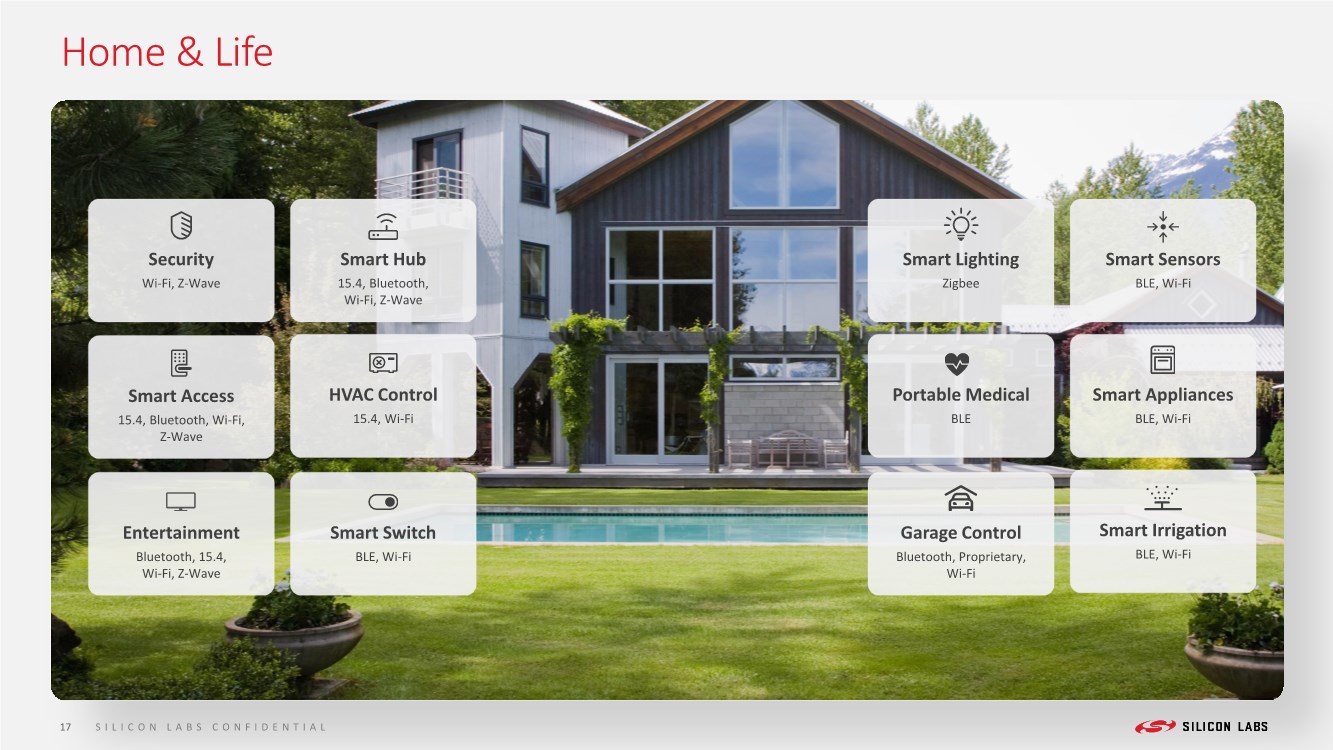

| Home & Life Entertainment Bluetooth, 15.4, Wi-Fi, Z-Wave Smart Access 15.4, Bluetooth, Wi-Fi, Z-Wave Security Wi-Fi, Z-Wave Smart Hub 15.4, Bluetooth, Wi-Fi, Z-Wave HVAC Control 15.4, Wi-Fi Smart Switch BLE, Wi-Fi Garage Control Bluetooth, Proprietary, Wi-Fi Portable Medical BLE Smart Lighting Zigbee Smart Appliances BLE, Wi-Fi Smart Irrigation BLE, Wi-Fi Smart Sensors BLE, Wi-Fi 17 SILICON LABS CONFIDENTIAL |

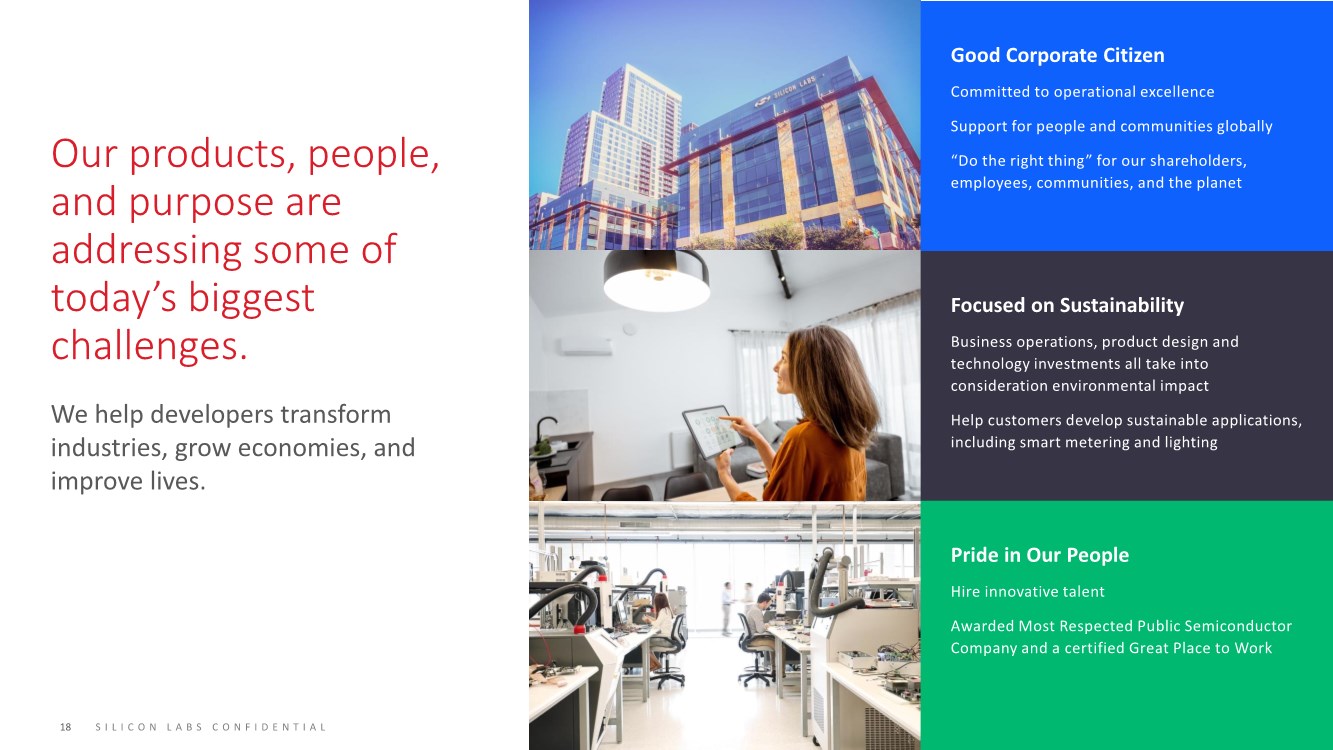

| We help developers transform industries, grow economies, and improve lives. Our products, people, and purpose are addressing some of today’s biggest challenges. Good Corporate Citizen Committed to operational excellence Support for people and communities globally “Do the right thing” for our shareholders, employees, communities, and the planet SILICON LABS CONFIDENTIAL 18 Focused on Sustainability Business operations, product design and technology investments all take into consideration environmental impact Help customers develop sustainable applications, including smart metering and lighting Pride in Our People Hire innovative talent Awarded Most Respected Public Semiconductor Company and a certified Great Place to Work |

| Matt Johnson Promoted to President SILICON LABS CONFIDENTIAL 19 ▪ Joined company in 2018 as SVP & GM of IoT ▪ Experienced business, engineering and operations leader ▪ Expanded role to include management of day-to- day business operations and product execution ▪ Previous experience at NXP, Freescale, and Fairchild ▪ Bachelor of Electrical Engineering Technology degree from University of Maine and executive programs from Harvard and Stanford |

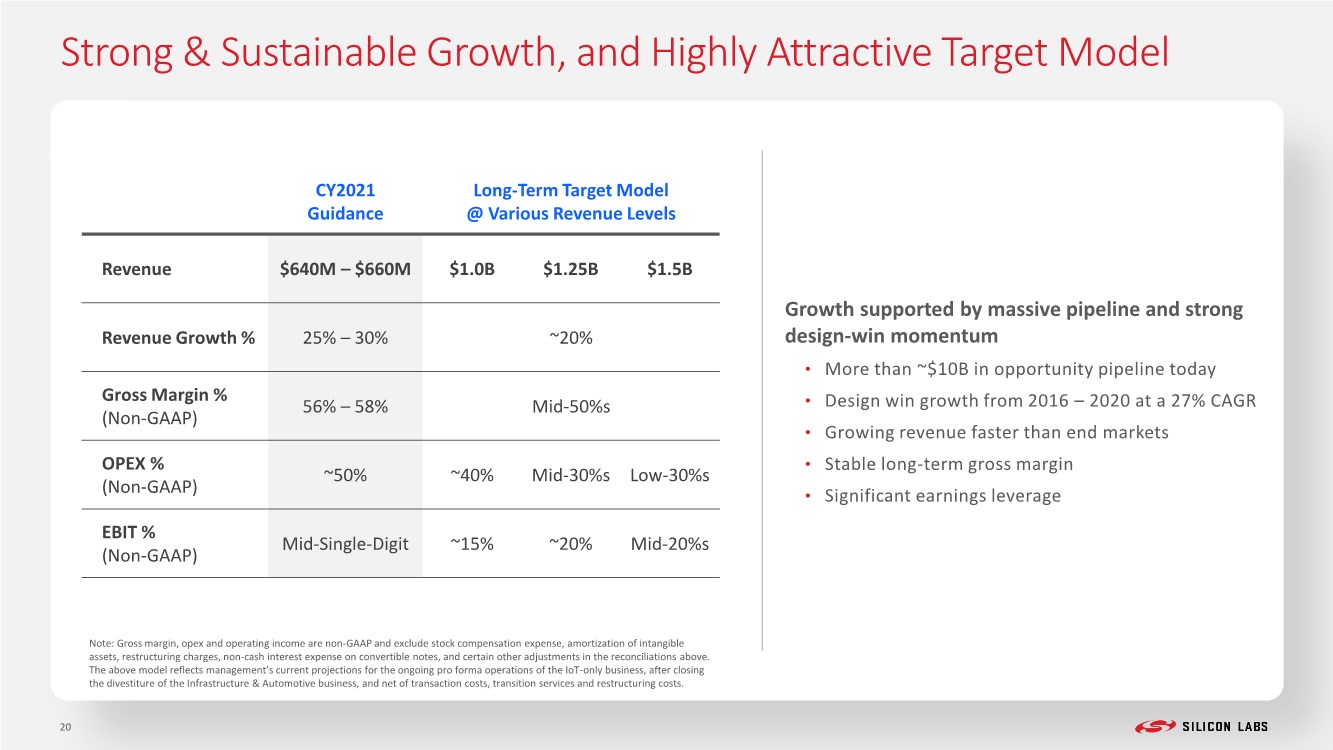

| Strong & Sustainable Growth, and Highly Attractive Target Model Growth supported by massive pipeline and strong design-win momentum • More than ~$10B in opportunity pipeline today • Design win growth from 2016 – 2020 at a 27% CAGR • Growing revenue faster than end markets • Stable long-term gross margin • Significant earnings leverage Note: Gross margin, opex and operating income are non-GAAP and exclude stock compensation expense, amortization of intangible assets, restructuring charges, non-cash interest expense on convertible notes, and certain other adjustments in the reconciliations above. The above model reflects management’s current projections for the ongoing pro forma operations of the IoT-only business, after closing the divestiture of the Infrastructure & Automotive business, and net of transaction costs, transition services and restructuring costs. CY2021 Guidance Long-Term Target Model @ Various Revenue Levels Revenue $640M – $660M $1.0B $1.25B $1.5B Revenue Growth % 25% – 30% ~20% Gross Margin % (Non-GAAP) 56% – 58% Mid-50%s OPEX % (Non-GAAP) ~50% ~40% Mid-30%s Low-30%s EBIT % (Non-GAAP) Mid-Single-Digit ~15% ~20% Mid-20%s 20 |

| Why We Lead the IoT Markets and Financial • Large, diverse, growing IoT opportunity • Proven track record of high-quality, sustainable growth Technology • Wireless portfolio with unmatched breadth/depth • Robust IoT hardware & software platform Ecosystem • Ecosystem leader defining future of connectivity Mission • Driven by customer success • Good corporate citizen 21 SUMMARY |

| This presentation contains forward-looking statements based on Silicon Labs’ current expectations. The words "believe," "estimate," "expect," "intend," "anticipate," "plan," "project," "will" and similar phrases as they relate to Silicon Labs are intended to identify such forward-looking statements. These forward-looking statements reflect the current views and assumptions of Silicon Labs and are subject to various risks and uncertainties that could cause actual results to differ materially from expectations. Among the factors that could cause actual results to differ materially from those in the forward-looking statements are the following: the occurrence of any event, change or other circumstance that could give rise to the termination of the asset purchase agreement; the failure to satisfy any of the conditions to the completion of the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Silicon Labs to retain and hire key personnel and maintain relationships with its customers, suppliers, advertisers, partners and others with whom it does business, or on its operating results and businesses generally; risks associated with the disruption of management’s attention from ongoing business operations due to the proposed transaction; the ability to meet expectations regarding the timing and completion of the proposed transaction, including with respect to receipt of required regulatory approvals; the timing and scope of anticipated share repurchases and/or dividends; the impact of COVID-19 on the U.S. and global economy, including the restrictions on travel and transportation and other actions taken by governmental authorities and disruptions to the business of our customers or our global supply chain that have occurred or may occur in the future, the ongoing impact of COVID-19 on our employees and our ability to provide services to our customers and respond to their needs; risks that Silicon Labs may not be able to maintain its historical growth; quarterly fluctuations in revenues and operating results; difficulties developing new products that achieve market acceptance; risks associated with international activities (including trade barriers, particularly with respect to China); intellectual property litigation risks; risks associated with acquisitions and divestitures; product liability risks; difficulties managing Silicon Labs’ distributors, manufacturers and subcontractors; dependence on a limited number of products; absence of long-term commitments from customers; inventory- related risks; difficulties managing international activities; risks that Silicon Labs may not be able to manage strains associated with its growth; credit risks associated with its accounts receivable; dependence on key personnel; stock price volatility; geographic concentration of manufacturers, assemblers, test service providers and customers in Asia that subjects Silicon Labs’ business and results of operations to risks of natural disasters, epidemics or pandemics, war and political unrest; debt-related risks; capital-raising risks; the competitive and cyclical nature of the semiconductor industry; average selling prices of products may decrease significantly and rapidly; information technology risks; cyber- attacks against Silicon Labs’ products and its networks and other factors that are detailed in the SEC filings of Silicon Laboratories Inc. The level of share repurchases and/or dividends depends on market conditions and the level of other uses of cash. Silicon Labs disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. References in this presentation to Silicon Labs shall mean Silicon Laboratories Inc. Legal Notice 22 SILICON LABS CONFIDENTIAL |