Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INDEPENDENT BANK CORP | indb-20210422.htm |

| EX-99.1 - EX-99.1 - PRESS RELEASE DATED APRIL 22, 2021 - INDEPENDENT BANK CORP | exhibit991-loganpressrelea.htm |

Announces Acquisition of Meridian Bancorp, Inc. Creating the premier community-focused commercial bank in Massachusetts April 22, 2021

(2) Disclaimer CAUTION REGARDING FORWARD-LOOKING STATEMENTS This communication may contain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction, the plans, objectives, expectations and intentions of Independent and Meridian, the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; the magnitude and duration of the COVID-19 pandemic and its impact on the global economy and financial market conditions and the business, results of operations, and financial condition of Independent and Meridian; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets; movements in interest rates; reform of LIBOR; increased competition in the markets of Independent and Meridian; success, impact, and timing of business strategies of Independent and Meridian; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); the failure to obtain shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all or other delays in completing the transaction; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement; the outcome of any legal proceedings that may be instituted against Independent or Meridian; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Independent and Meridian do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; the dilution caused by Independent’s issuance of additional shares of its capital stock in connection with the transaction; and other factors that may affect the future results of Independent and Meridian. Additional factors that could cause results to differ materially from those described above can be found in Independent’s Annual Report on Form 10-K for the year ended December 31, 2020 and in its subsequent Quarterly Reports on Form 10-Q, including in the respective Risk Factors sections of such reports, as well as in subsequent SEC filings, each of which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Independent’s website, www.rocklandtrust.com, under the heading “SEC Filings” and in other documents Independent files with the SEC, and in Meridian’s Annual Report on Form 10-K for the year ended December 31, 2020 and in its subsequent Quarterly Reports on Form 10-Q, including in the respective Risk Factors sections of such reports, as well as in subsequent SEC filings, each of which is on file with and available on Meridian’s investor relations website, www.ebsb.com, under the heading “SEC Filings” and in other documents Meridian files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Independent and Meridian assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction, Independent will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of Independent and Meridian and a Prospectus of Independent, as well as other relevant documents concerning the proposed transaction. The proposed transaction involving Independent and Meridian will be submitted to Independent’s shareholders and Meridian’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SHAREHOLDERS OF INDEPENDENT AND MERIDIAN ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about Independent and Meridian, can be obtained without charge, at the SEC’s website (http://www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Independent Investor Relations, 288 Union Street, Rockland, Massachusetts 02370, telephone (781) 982-6737, or to Meridian Investor Relations, 67 Prospect Street, Peabody, Massachusetts 01960, (978) 977-2211. PARTICIPANTS IN THE SOLICITATION Independent, Meridian, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Independent and/or Meridian in connection with the proposed transaction under the rules of the SEC. Information regarding Independent’s directors and executive officers is available in its definitive proxy statement relating to its 2021 Annual Meeting of Shareholders, which was filed with the SEC on April 1, 2021, and its Annual Report on Form 10-K for the year ended December 31, 2020, which was filed with the Commission on February 26, 2021, and other documents filed by Independent with the SEC. Information regarding Meridian’s directors and executive officers is available in its definitive proxy statement relating to its 2021 Annual Meeting of Shareholders, which was filed with the SEC on April 9, 2021, and its Annual Report on Form 10-K for the year ended December 31, 2020, which was filed with the Commission on March 1, 2021 and other documents filed by Meridian with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC, which may be obtained free of charge as described in the preceding paragraph.

(3) Compelling Combination Creates Significant Shareholder Value Reinforces INDB’s position as the Boston area’s premier community-focused commercial bank; pro forma #1 in commercial loans and #2 in deposit market share (Boston MSA) amongst all banks headquartered in Massachusetts Generates strong deal metrics for continued premium valuation multiples of INDB stock: 7.9% accretive to tangible book value per share ~23% EPS accretion (with fully phased in cost saves) Top quartile pro forma ROA and efficiency ratio Builds scale to allow further investments in digital delivery, technology, and risk infrastructure while combining leadership and experienced talent across all major banking functions (commercial, retail, operations) Combines complementary balance sheets – INDB’s core deposit funding to fuel two strong commercial lending franchises + deployment of excess liquidity Continues INDB’s successful acquisition philosophy – expansion into contiguous geography to build market share and generate significant cost savings opportunities

(4) 15% 46% 16% 23% 3.12% 3.09% EBSB Peer Median Commercial Loans as % of Total Loans(2)FY20 Net Interest Margin Source: S&P Global Market Intelligence; Company documents 1) EBSB peers include major exchange-traded banks in the Northeast region with total assets between $2 billion and $10 billion 2) Commercial loans include CRE, Construction, and C&I loans; data as of 12/31/2020 Demand Deposits Interest- Checking & Savings Time Deposits $5.1bn MMDA Meridian Bancorp: Company Overview o Founded in 1848, Meridian Bancorp is a well-established community-focused financial services company o Leading market position in the best commercial banking markets within Massachusetts o History of strong financial results o Customer centric approach to banking o Expertise in commercial lending o $901 million market capitalization (Nasdaq: EBSB) Company Overview Meridian Bancorp vs. Peers A Leading Franchise With Deep Roots In The Boston Community Key Metrics Q1 ’21 Loan & Deposit Breakdown 12% 10% 62% 15% 1% $5.3bn CRE C&I Consumer & Other Construct. Residential Q1 ’21 Assets FY20 ROA $6.5bn 1.01% FY20 Net Income Branches FY20 Efficiency $65mm 43 46% Deposit CompositionLoan Composition NCO / Avg. Loans 0.00% 5-Year Avg. (1) 4.41% 4.18% 88.5% 61.4% EBSB Peer Median FY20 Yield on Loans:

(5) 1. Bank of America Corporation 91.4 2. Citizens Financial Group Inc. 50.4 3. Banco Santander S.A. 21.7 4. The Toronto-Dominion Bank 17.3 5. Eastern Bankshares Inc. 16.2 Pro Forma 12.6 6. First Republic Bank 10.0 7. Independent Bank Corp. 7.8 8. M&T Bank Corp. 6.8 9. Meridian Bancorp Inc. 4.8 10. SVB Financial Group 4.8 $91,050 $96,785 $67,761 INDB EBSB U.S. National Average Transaction Increases Density in Attractive Boston MSA Source: S&P Global Market Intelligence; Demographics shown are deposit-weighted averages by MSA Note: Deposit market share data pro forma for recently announced transactions (99 branches) (43 branches) Pro Forma Branch Footprint Top Boston MSA Banks by Deposits Pro Forma Deposit Market Share Top Massachusetts Banks by Deposits Demographically Attractive Median Household Income 1. Bank of America Corporation 98.8 2. Citizens Financial Group Inc. 51.3 3. Banco Santander S.A. 24.7 4. The Toronto-Dominion Bank 20.8 5. Eastern Bankshares Inc. 16.5 Pro Forma 15.6 6. Independent Bank Corp. 10.8 7. First Republic Bank 10.0 8. M&T Bank Corp. 9.2 9. Berkshire Hills Bancorp Inc. 6.2 10. Middlesex Bancorp MHC 4.8 11. Meridian Bancorp Inc. 4.8 U.S National Average Total Deposits ($ billion) Total Deposits ($ billion) Consolidation Opportunity

(6) Key Transaction Terms Transaction Structure Independent Bank Corp. to acquire Meridian Bancorp and East Boston Savings Bank to merge into Rockland Trust 100% stock consideration Exchange Ratio Fixed exchange ratio Meridian Bancorp shareholders will receive 0.2750 of a share of INDB stock for each EBSB share Pricing Consideration represents $21.88 per share of EBSB at a 22.1% market premium based on April 21, 2021 close Transaction value of $1.1 billion Represents 1.50x tangible book value Represents 14.9x 2022 estimated EPS and 10.3x 2022 estimated EPS with fully phased-in cost saves Pro Forma Ownership Approximately 70% INDB / 30% EBSB Governance & Management EBSB CEO Richard Gavegnano to serve as business development consultant for 3 years INDB board and management will remain the same Key EBSB team members will be retained Community Support Continuation of Meridian Bancorp’s community leadership in markets of operation, consistent with Independent Bank Corp.’s strong community track record Commitment to ongoing foundation support, including renaming to Rockland Trust-East Boston Foundation Approval & Closing Customary regulatory approvals and Independent and Meridian shareholder approvals Anticipated closing in Q4 2021

(7) Well-Priced Transaction Relative to Recent Comparable Deals 1.50x 1.45x Other Recent Transactions 25.0% 10% Other Recent Transactions Source: S&P Global Market Intelligence; Company documents Note: INDB/EBSB transaction metrics based on INDB stock price as of 4/21/21 Note: Includes nationwide whole bank acquisitions announced since 1/1/2019 with deal values between $500 million and $2 billion at announcement 1) EPS accretion assumes fully phased-in cost saves Price / Tangible Book Value Price / Forward EPS EPS Accretion Tangible Book Value Per Share Impact 14.9x 15.3x Other Recent Transactions 7.9% (2.8%) Other Recent Transactions ~23% (1)

(8) Robust Capital & Reserve Levels (4) Attractive Pro Forma Financial Impact >13% Pro Forma CET1 Ratio at Close ~11% Pro Forma TCE / TA Ratio at Close ~1.7% Pro Forma ACL/Loans HFI Ratio at Close 1) Based on consensus estimates 2) Does not include purchase accounting adjustments or balance sheet restructure 3) Based on consensus estimates; Assumes illustrative 100% phase-in of cost savings in 2022 4) Pro forma financial metrics at close assume consensus estimates per FactSet for each company and other purchase accounting adjustments further outlined in the appendix $20bn Pro Forma Assets $4bn Pro Forma Market Capitalization 7.9% ~16% Internal Rate of Return Tangible Book Value Per Share Accretion at Close ~20% 2022 EPS Accr. (80% phased-in cost saves) ~23% 2022 EPS Accr. (fully phased-in cost saves) (1) (1) >1.2% Pro Forma ROAA >12% Pro Forma ROTCE ~47% Pro Forma Eff. Ratio Top Quartile Profitability (3) Well-Positioned Combined Company (2)Strong Returns

(9) Creates Peer-Leading Financial Performance Source: S&P Global Market Intelligence Note: Peer group includes 27 publicly traded banks nationwide with assets between $15B and $25bn; Profitability metrics based on publicly available 2022 consensus estimates as of 4/21/21 Note: INDB pro forma financial data assumes illustrative 100% phase-in of cost savings in 2022 Benefits to INDB of Increased Scale Fully Realized Cost Synergies 2022E ROA Fully Realized Cost Synergies 2022E ROTCE Fully Realized Cost Synergies 2022E Efficiency Ratio ~20bp Benefit ~160bp Benefit ~13% Improvement 1.24% 1.06% 1.02% Pro Forma 12.2% 10.6% 8.8% Pro Forma 47% 47% 60% Pro Forma

(10) Optimize Liquidity / Profitability Balance Sheet Restructure Assumptions Rationale: ► A two-year plan focusing on reducing excess liquidity, exiting less profitable deposit relationships, and reducing CRE concentration ► The pro forma bank will maintain strong profitability metrics with improved risk profile Improve Margin Reduce Excess Liquidity Immediate payoff of $560mm in FHLB Borrowings Assumes reduction of $1.3bn in excess liquidity over 2 years ‒ Cash earning 10 bps ‒ Deposits with weighted average cost of 25-45 bps Assumes CRE loan balance reduction persists for a short term before growth resumes (estimated $700mm over 2 years) Improve Profitability / Margin Reduce Excess Liquidity Reduce CRE Concentration Lower Short-term Profitability Expected Impact Prudent Risk Management Expected Impact

(11) Retail BankingCommercial Banking Strong demographics attributable to new markets provide upside potential Leverage client facing staff for introductions and opportunities within new client base Capitalize on EBSB relationships to expand centers of influence for new opportunities Leverage INDB’s robust mortgage product offerings and leading technology platform Capitalize on INDB’s proven home equity direct marketing program across expanded customer base Enhance branch contribution through broad product training and established interdepartmental referral programs Complementary Businesses with Potential Synergies Further expansion into MA- North Shore market Seasoned and highly talented Commercial lending team INDB to expand specialty financing C&I product set to new markets (dealer finance, asset-based lending) Leverage INDB cash management and treasury services, 1031 exchange business Wealth Management Capabilities and Enhancement Opportunities

(12) Retail BankingInstitutional Banking Commercial Real EstateALCO & Funding Information TechnologyHuman Resources Accounting & AuditLegal, Regulatory & Risk Mgmt. • Reviewed risk framework, credit policies, strategies, committee materials, and loan files • Assessment of performance trends across credit migration, delinquencies, and historical losses • Focus on commercial loan portfolio o Top lending relationships and exposures o Covid-19 impacted industries Robust Due Diligence Process Diligence Focus Areas Diligence Snapshot Loan & Deposit OperationsCredit & Underwriting Detailed Diligence Process Aligned With Independent Bank Corp.’s Risk Appetite Extensive Assessment of Benefits, Risks, and Opportunities • 75% of CRE portfolio reviewed o 100% hotels o 100% COVID modifications o 100% watch list o Boston real estate exposure • Thorough assessment of risk ratings and collateral -----protection Credit Diligence Approach Focus on CRE Portfolio

(13) Total Shareholder Return (1) 3 Year 5 Year 10 Year INDB 18% 84% 228% KBW Regional Bank 8% 48% 131% 20182013 Driving Long Term Growth & Shareholder Value Source: S&P Global Market Intelligence 1) Per FactSet; closing price as of 4/21/2021; Total return defined as stock appreciation inclusive of reinvestment of dividends into new shares 2) CAGR based on INDB most recent quarter EPS and TBV per share as of 3/31/21 3) Does not include purchase accounting adjustments or balance sheet restructure Proven Record of Value Add Transactions Assets ($ billions) 2017 2015 2012 2008 2019 2021 20162009 (3) Strong EPS & TBVPS Growth Over Time 3 Year 5 Year 10 Year INDB TBVPS CAGR 11.4% 10.4% 9.7% INDB EPS CAGR 6.5% 7.9% 7.6% (2) $3.6 $4.5 $4.7 $5.0 $5.8 $6.1 $6.4 $7.2 $7.7 $8.1 $8.9 $11.4 $13.2 $20.7 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Pro Forma

(14) Appendix

(15) Key Assumptions Earnings Estimates Independent Bank Corp: Consensus mean estimates Meridian Bancorp: Consensus mean estimates Synergies & One-time Merger Expenses Identified fully phased-in cost savings of ~$45 million pre-tax – 45% of Meridian Bancorp’s operating non-interest expenses, including anticipated closures / consolidations of certain overlapping branches – Phased in 80% in 2022, 100% thereafter Revenue synergies identified but not modeled Assumes $2 million pre-tax reduction to interchange income due to Durbin Approximately $64 million pre-tax one-time merger expenses Loan Credit & Rate Marks 2.15% gross loan credit mark or 1.8x of Meridian Bancorp’s current reserves Non-PCD reserve 60% established day 2 through provision expense (CECL “double count”) $69 million loan interest mark-up Loan interest rate mark and non-PCD credit mark amortized / accreted over expected loan maturity periods Other Adjustments Other fair value marks, including: – $5 million write-up of deposit portfolio – $24 million write-up of outstanding borrowings portfolio – $16 million write-down of fixed assets / facilities – $5 million tax benefit from vesting of equity awards Core deposit intangible of 0.25% on Meridian Bancorp’s core deposits ($10 million), amortized over 10 years using sum-of-years digits INDB’s $61 million trust preferred securities will no longer receive Tier I capital treatment

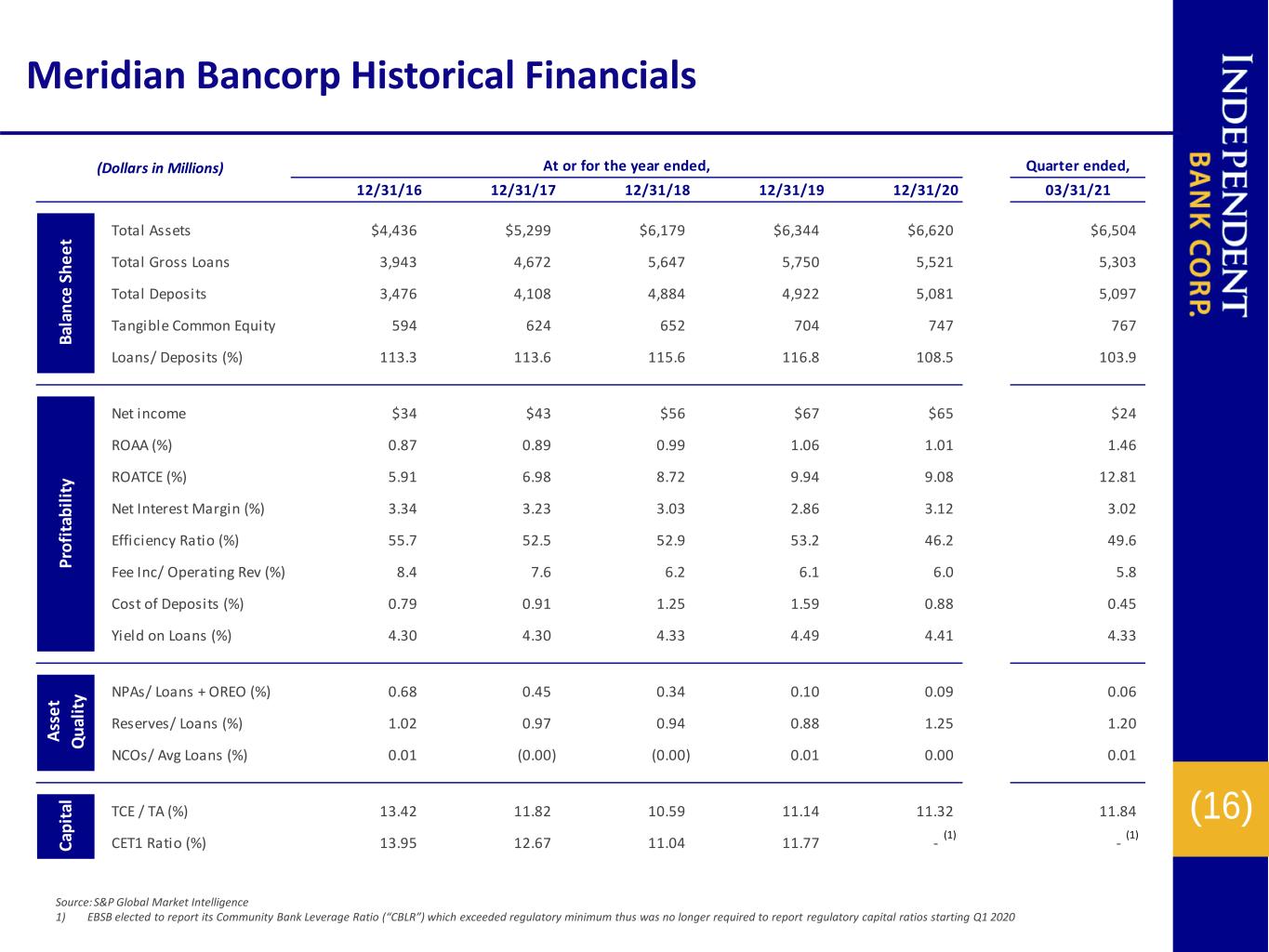

(16) Meridian Bancorp Historical Financials (Dollars in Millions) At or for the year ended, Quarter ended, 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 03/31/21 Total Assets $4,436 $5,299 $6,179 $6,344 $6,620 $6,504 Total Gross Loans 3,943 4,672 5,647 5,750 5,521 5,303 Total Deposits 3,476 4,108 4,884 4,922 5,081 5,097 Tangible Common Equity 594 624 652 704 747 767 Loans/ Deposits (%) 113.3 113.6 115.6 116.8 108.5 103.9 Net income $34 $43 $56 $67 $65 $24 ROAA (%) 0.87 0.89 0.99 1.06 1.01 1.46 ROATCE (%) 5.91 6.98 8.72 9.94 9.08 12.81 Net Interest Margin (%) 3.34 3.23 3.03 2.86 3.12 3.02 Efficiency Ratio (%) 55.7 52.5 52.9 53.2 46.2 49.6 Fee Inc/ Operating Rev (%) 8.4 7.6 6.2 6.1 6.0 5.8 Cost of Deposits (%) 0.79 0.91 1.25 1.59 0.88 0.45 Yield on Loans (%) 4.30 4.30 4.33 4.49 4.41 4.33 NPAs/ Loans + OREO (%) 0.68 0.45 0.34 0.10 0.09 0.06 Reserves/ Loans (%) 1.02 0.97 0.94 0.88 1.25 1.20 NCOs/ Avg Loans (%) 0.01 (0.00) (0.00) 0.01 0.00 0.01 TCE / TA (%) 13.42 11.82 10.59 11.14 11.32 11.84 CET1 Ratio (%) 13.95 12.67 11.04 11.77 - - B a la n ce S h e e t C a p it a l P ro fi ta b il it y A ss e t Q u a li ty Source: S&P Global Market Intelligence 1) EBSB elected to report its Community Bank Leverage Ratio (“CBLR”) which exceeded regulatory minimum thus was no longer required to report regulatory capital ratios starting Q1 2020 (1) (1)

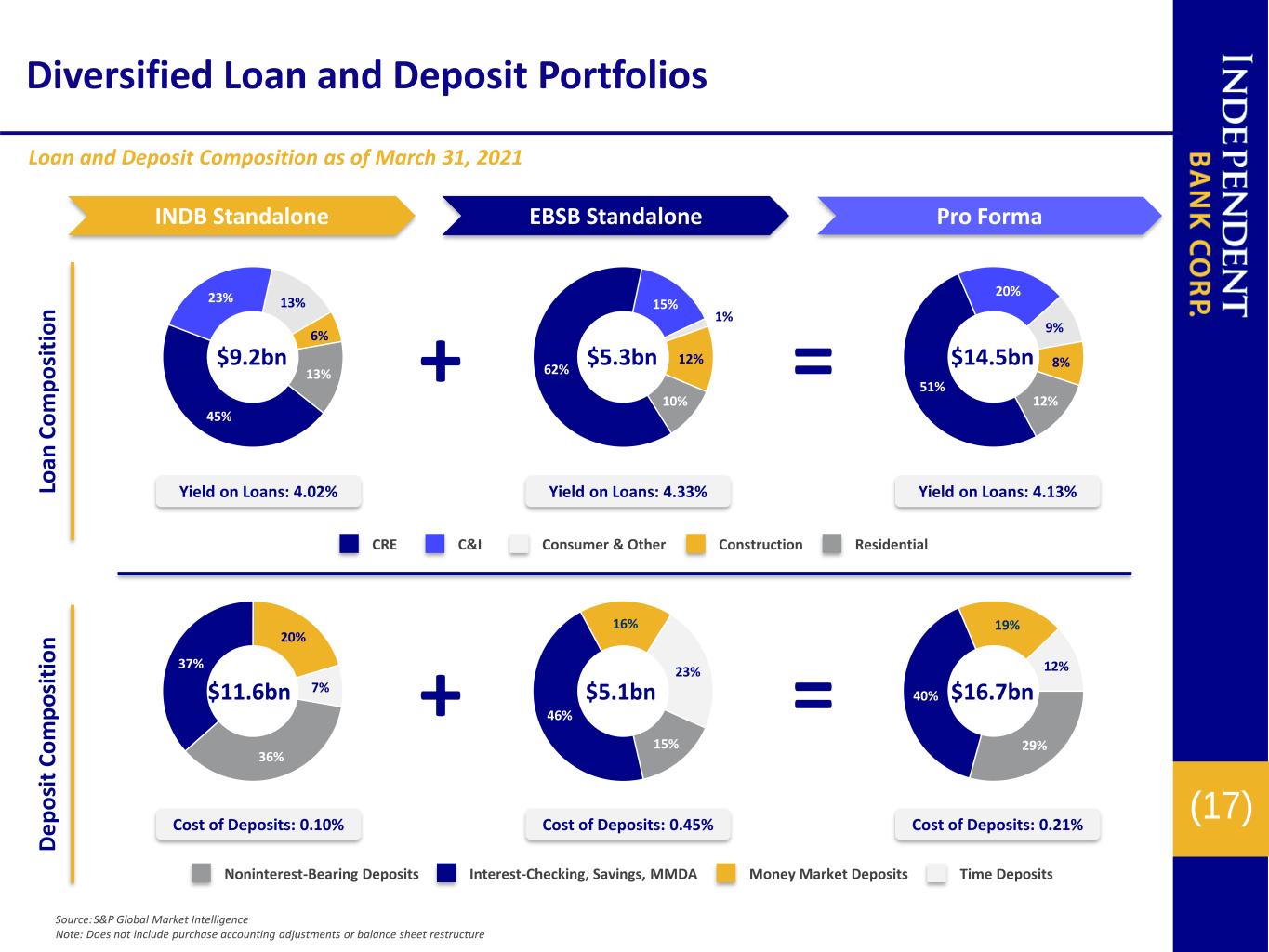

(17) 15% 46% 16% 23% 29% 40% 19% 12% 36% 37% 20% 7% 8% 12% 51% 20% 9% 6% 13% 45% 23% 13% 12% 10% 62% 15% 1% Diversified Loan and Deposit Portfolios Lo a n C o m p o si ti o n D e p o si t C o m p o si ti o n $9.2bn $5.3bn $14.5bn $11.6bn $5.1bn $16.7bn CRE C&I Consumer & Other Construction Residential Interest-Checking, Savings, MMDA Money Market DepositsNoninterest-Bearing Deposits + + = = Cost of Deposits: 0.21%Cost of Deposits: 0.45%Cost of Deposits: 0.10% Yield on Loans: 4.13%Yield on Loans: 4.33%Yield on Loans: 4.02% Source: S&P Global Market Intelligence Note: Does not include purchase accounting adjustments or balance sheet restructure INDB Standalone EBSB Standalone Pro Forma Time Deposits Loan and Deposit Composition as of March 31, 2021

(18) Residential- Related 35% Commercial Buildings 17% Office Buildings 21% Industrial / Warehouse 12% Hotels / Motels 9% All Other 6% Residential- Related 31% Commercial Buildings 23% Office Buildings 15% Industrial / Warehouse 10% Hotels / Motels 8% All Other 13% Diversified, Well-Secured Commercial Real Estate Portfolios CRE Portfolios as of March 31, 2021 INDB Standalone EBSB Standalone Pro Forma $4.7bn $4.0bn NOO CRE (2) / TRBC Ratio: 278% NOO CRE (2) / TRBC Ratio: 427% Est. NOO CRE (2) / TRBC at Close : ~360% Adjusted NOO CRE (3) / TRBC Ratio (Post-restructure): ~330% Source: S&P Global Market Intelligence 1) Includes $680 million of owner occupied real estate not included in the NOO CRE / TRBC ratio 2) Commercial real estate per regulatory definition: includes non-owner occupied real estate, multifamily loans, construction and development loans and loans to finance commercial real estate, construction and land development activities not secured by real estate 3) Adjust for anticipated runoff of $700mm in CRE loans at close Residential- Related 33% Commercial Buildings 20% Office Buildings 18% Industrial / Warehouse 10% Hotels / Motels 9% All Other 10% $8.7bn (1)

(19) 81% 19% 89% 11% 77% 23% 23% 20% 27% 30% 9% 37% 54% 28% 22%25% 25% Diversified Revenue Mix With Substantial Fee Income Growth Opportunity R e v e n u e C o m p o si ti o n N o n -i n te re st In co m e C o m p o si ti o n $479mm $219mm $698mm Net Interest Income Non-interest Income $110mm $23mm $133mm + + = = OtherWealth Management Mortgage Banking Service Charges Source: S&P Global Market Intelligence Note: Financial data shown for the last twelve month (“LTM”) ended 3/31/21 Note: Pro forma figures do not include purchase accounting adjustments or balance sheet restructure INDB Standalone EBSB Standalone Pro Forma

(20) Tangible Book Value Accretion Reconciliation Tangible Book Value Accretion Aggregate ($ millions) Per Share INDB Estimated TBV (12/31/21) $1,236 $37.36 Plus: Equity Consideration $1,131 Less: Estimated After-tax Buyer Restructuring Charges & Day Two CECL Reserve ($89) Less: Estimated Intangible Assets Created ($371) Pro Forma TBV at Close $1,907 $40.32 Accretion 7.9%

(21) Earnings Per Share Accretion Reconciliation ($ Millions, except per share values) Pro forma Year 1 INDB's Consensus Net Income Estimate $135 EBSB's Consensus Net Income Estimate $71 INDB Consensus EPS Estimate $4.07 EBSB Consensus EPS Estimate $1.47 After-Tax Transaction Adjustments: Cost Savings $26 Intangible Amortization ($1) Impact of Balance Sheet Restructuring ($7) Provision Expense Reversal $5 Net Purchase Accounting, Durbin and Other Adjustments $2 Pro Forma Net Income to Common $231 Pro Forma INDB Average Diluted Shares (millions) 47.3 INDB Pro Forma EPS $4.88 Accretion ($) $0.81 Accretion (%) ~20% Accretion (%) - Cost Savings Fully Phased-in ~23%

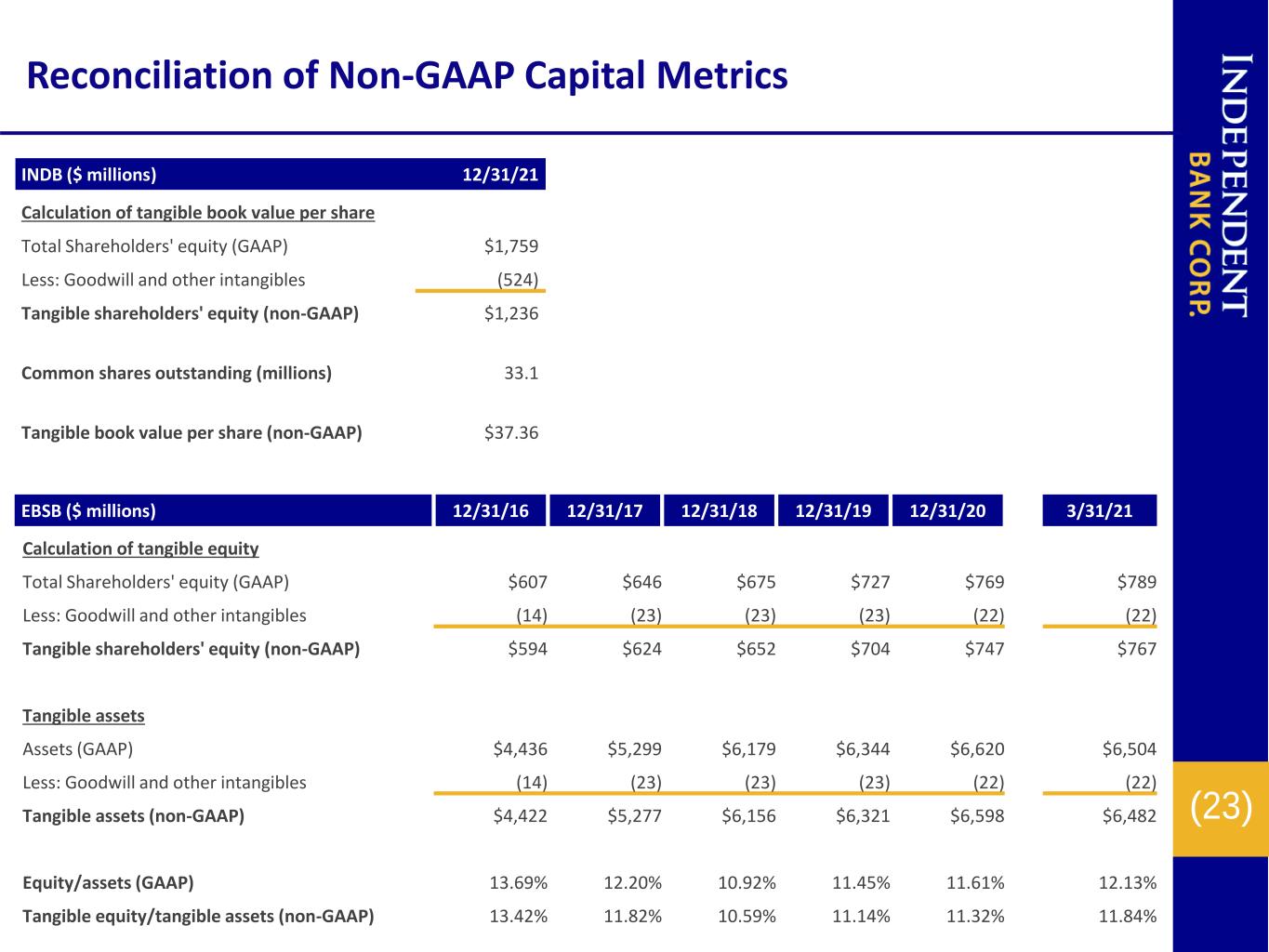

(22) Non-GAAP Financial Measures In addition to results presented in accordance with GAAP, this presentation contains certain non-GAAP financial measures. A reconciliation of tangible equity and/or tangible book value is included on page 23. Management believes that providing certain non-GAAP financial measures provides investors with information useful in understanding our financial performance, our performance trends and financial position. Management utilizes these measures for internal planning and forecasting purposes and management, as well as securities analysts, investors, and other interested parties, also use these measures to compare peer company operating performance. These non-GAAP measures should not be considered a substitute for GAAP basis measures and results. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names.

(23) Reconciliation of Non-GAAP Capital Metrics EBSB ($ millions) 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 3/31/21 Calculation of tangible equity Total Shareholders' equity (GAAP) $607 $646 $675 $727 $769 $789 Less: Goodwill and other intangibles (14) (23) (23) (23) (22) (22) Tangible shareholders' equity (non-GAAP) $594 $624 $652 $704 $747 $767 Tangible assets Assets (GAAP) $4,436 $5,299 $6,179 $6,344 $6,620 $6,504 Less: Goodwill and other intangibles (14) (23) (23) (23) (22) (22) Tangible assets (non-GAAP) $4,422 $5,277 $6,156 $6,321 $6,598 $6,482 Equity/assets (GAAP) 13.69% 12.20% 10.92% 11.45% 11.61% 12.13% Tangible equity/tangible assets (non-GAAP) 13.42% 11.82% 10.59% 11.14% 11.32% 11.84% INDB ($ millions) 12/31/21 Calculation of tangible book value per share Total Shareholders' equity (GAAP) $1,759 Less: Goodwill and other intangibles (524) Tangible shareholders' equity (non-GAAP) $1,236 Common shares outstanding (millions) 33.1 Tangible book value per share (non-GAAP) $37.36