Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INDEPENDENT BANK CORP /MI/ | brhc10023439_8k.htm |

Exhibit 99.1

INDEPENDENT BANKCORPORATION2021 Annual Shareholders Meeting April 20, 2021

Cautionary note regarding forward-looking statements This presentation contains forward-looking

statements about Independent Bank Corporation. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and

assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of Independent Bank Corporation.

Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. The COVID-19 pandemic is adversely affecting Independent Bank Corporation, its

customers, counterparties, employees, and third-party service providers, and the ultimate extent of the impacts on its business, financial position, results of operations, liquidity, and prospects is uncertain. Continued deterioration in

general business and economic conditions or turbulence in domestic or global financial markets could adversely affect Independent Bank Corporation’s revenues and the values of its assets and liabilities, reduce the availability of funding

from certain financial institutions, lead to a tightening of credit, and increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices could affect Independent Bank Corporation in

substantial and unpredictable ways. Independent Bank Corporation’s results could also be adversely affected by changes in interest rates; further increases in unemployment rates; deterioration in the credit quality of its loan portfolios or

in the value of the collateral securing those loans; deterioration in the value of its investment securities; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in the level of tariffs

and other trade policies of the United States and its global trading partners; changes in customer behavior and preferences; breaches in data security; failures to safeguard personal information; effects of mergers and acquisitions and

related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and

reputation risk. Certain risks and important factors that could affect Independent Bank Corporation's future results are identified in its Annual Report on Form 10-K for the year ended December 31, 2020 and other reports filed with the SEC,

including among other things under the heading “Risk Factors” in such Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and Independent Bank Corporation undertakes no obligation to

update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise. 2

Today’s Agenda Welcome and Call to Order – IBC ChairmanVoting upon matters listed in the Company’s

2021 Proxy Statement – IBC ChairmanBusiness Update by IBC President & CEOQuestion and answer session – IBC President & CEO and IBC EVP & CFOAdjournment 3

Independent Bank Corporation Board of Directors 4

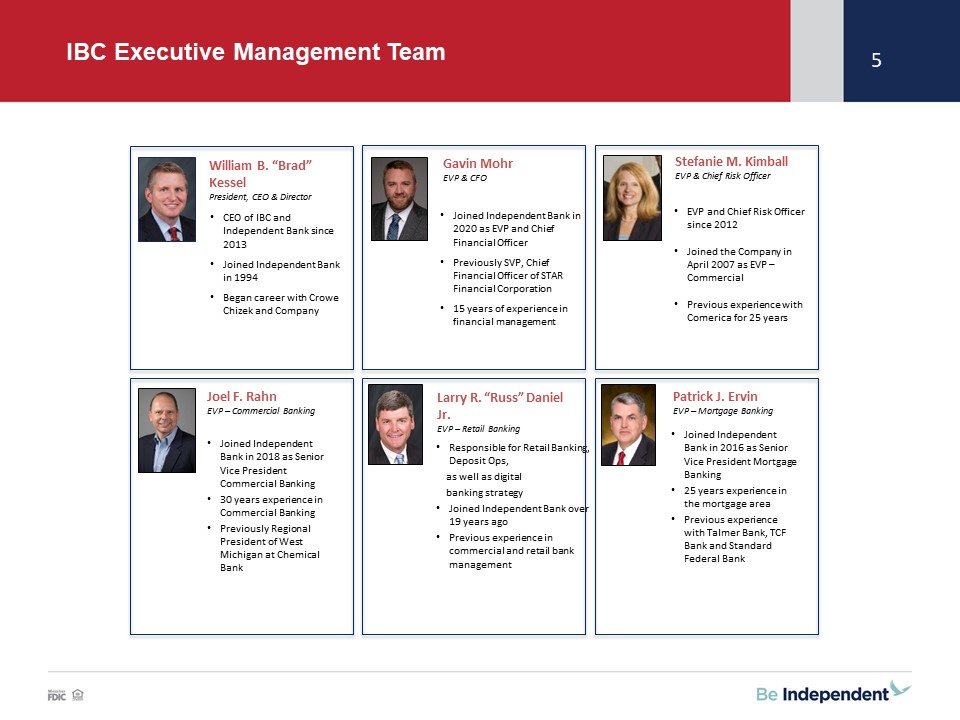

IBC Executive Management Team 5 EVP and Chief Risk Officer since 2012Joined the Company in April 2007

as EVP – Commercial Previous experience with Comerica for 25 years CEO of IBC and Independent Bank since 2013Joined Independent Bank in 1994Began career with Crowe Chizek and Company Joined Independent Bank in 2020 as EVP and Chief

Financial OfficerPreviously SVP, Chief Financial Officer of STAR Financial Corporation15 years of experience in financial management William B. “Brad” KesselPresident, CEO & Director Gavin Mohr EVP & CFO Stefanie M.

KimballEVP & Chief Risk Officer Joined Independent Bank in 2016 as Senior Vice President Mortgage Banking25 years experience in the mortgage areaPrevious experience with Talmer Bank, TCF Bank and Standard Federal Bank Responsible for

Retail Banking, Deposit Ops, as well as digital banking strategyJoined Independent Bank over 19 years ago Previous experience in commercial and retail bank management Larry R. “Russ” Daniel Jr.EVP – Retail Banking Patrick J. ErvinEVP –

Mortgage Banking Joel F. RahnEVP – Commercial Banking Joined Independent Bank in 2018 as Senior Vice President Commercial Banking30 years experience in Commercial BankingPreviously Regional President of West Michigan at Chemical Bank

2021 Annual Meeting of Shareholders Secretary for the meeting (Gavin A. Mohr)Record date: February 19,

2021Approximate distribution date of Proxy Statement: March 8, 2021Shares entitled to vote: 21,891,206Determination of quorumVoting on proposals 6

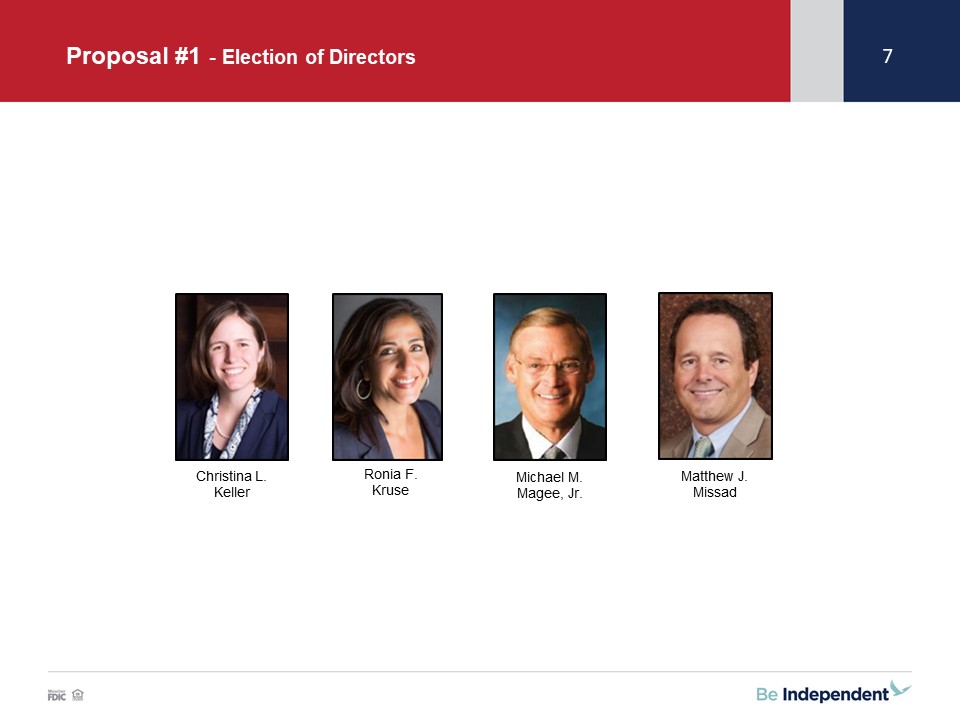

Proposal #1 - Election of Directors 7 Christina L. Keller Ronia F. Kruse Michael M. Magee, Jr.

Matthew J. Missad

Proposal #2 - Ratification of Appointment of Independent Auditors Crowe LLP has served as IBC’s

independent registered public accounting firm since 2005.Crowe LLP was founded in 1942 and is one of the 10 largest accounting and consulting firms in the U.S.IBC is served primarily by Crowe’s Grand Rapids, Michigan and South Bend, Indiana

offices. 8

Proposal #3 - Advisory Vote on Executive Compensation The Board has solicited a non-binding advisory

vote from our shareholders to approve the compensation of our executives as described in our proxy materials. 9

Proposal #4 – Approval of the Independent Bank Corporation 2021 Long-Term Incentive Plan The purpose

of the plan is to promote the long term success of the Company for the benefit of shareholders by aligning the personal interest of participants with those of its shareholders.The Plan will replace the existing Long-Term Incentive Plan

previously approved by shareholders. The Plan provides for the grant of a variety of equity- based awards described in the proxy. Maximum number of shares available for issue is 650,000.Plan termination date of April 20, 2031. 10

INDEPENDENT BANK CORPORTATION 2021 Annual Shareholders Meeting Business Update Brad Kessel, President

& CEO

COVID-19 Response – To Communities, Customers, and Our Associates 12 When it became apparent that

the threat from the Coronavirus (COVID-19) could pose a threat to our people, our business, and our customers we activated our Business Continuity and Crisis Communication Core Teams to take early and decisive action.Our Team developed the IB

Safe Work Playbook to protect the health and well being of customers and our associates. Approximately 40% of our team members worked remotely through 12/31/20. Through these challenging times service to our customers went uninterrupted

utilizing drive-thru service and lobby by appointment only during two periods when health risks were elevated state-wide. For our Customers:We offered loan payment relief where neededProvided SBA Payroll Protection Program loans to businesses

in our marketsFollowed GSE directives for moratoriums on foreclosures For our Associates:Paid service bonuses to our “front-line” associates Made adjustments to our paid time off policies Implemented extensive health and safety protocols

throughout our facilities

2020 ESG Highlights Enhanced wellness program resulting in 250% increase in participation in 2020Bank

wide training for Diversity, Equity and Inclusion in 20205th Annual Making a Difference Day with 794 team members participating in 88 volunteer projects in the communities we serve, including donations of $110,000Invested over $1.25 million

in sponsorships and donations in the last two years Awarded the Financial Literacy Award for Program and Reach from the Michigan Bankers Association 13

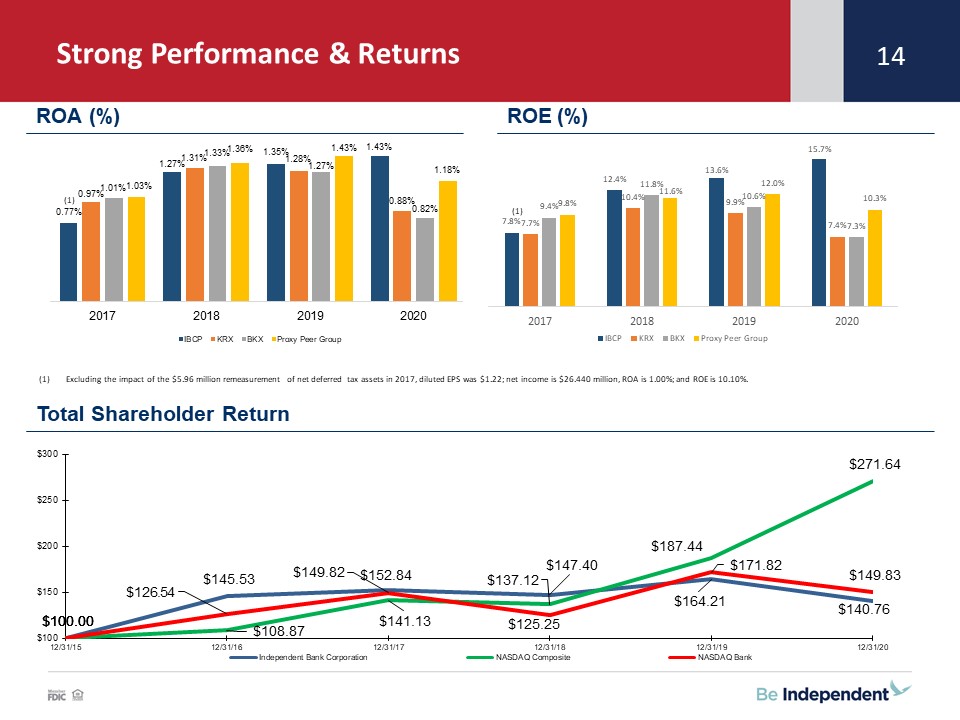

5 Strong Performance & Returns 14 ROA (%) ROE (%) Total Shareholder Return Excluding the

impact of the $5.96 million remeasurement of net deferred tax assets in 2017, diluted EPS was $1.22; net income is $26.440 million, ROA is 1.00%; and ROE is 10.10%. (1) (1)

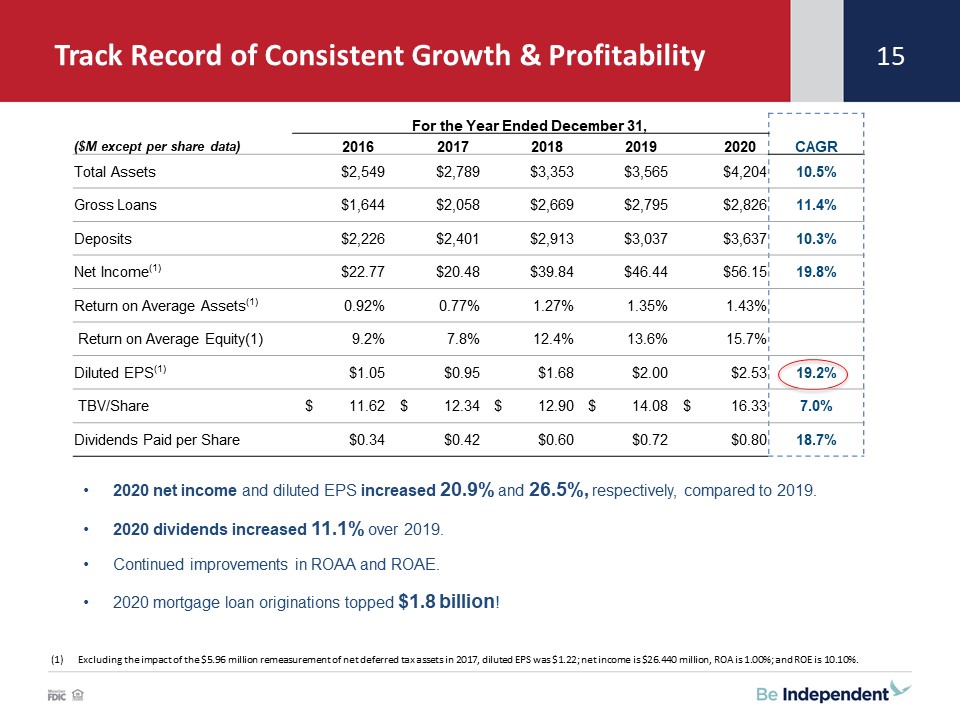

Track Record of Consistent Growth & Profitability 15 2020 net income and diluted EPS increased

20.9% and 26.5%, respectively, compared to 2019.2020 dividends increased 11.1% over 2019.Continued improvements in ROAA and ROAE.2020 mortgage loan originations topped $1.8 billion! Excluding the impact of the $5.96 million remeasurement of

net deferred tax assets in 2017, diluted EPS was $1.22; net income is $26.440 million, ROA is 1.00%; and ROE is 10.10%. For the Year Ended December 31, ($M except per share

data) 2016 2017 2018 2019 2020 CAGR Total Assets $2,549 $2,789 $3,353 $3,565 $4,204 10.5% Gross Loans $1,644 $2,058 $2,669 $2,795 $2,826 11.4% Deposits $2,226 $2,401 $2,913 $3,037 $3,637

10.3% Net Income(1) $22.77 $20.48 $39.84 $46.44 $56.15 19.8% Return on Average Assets(1) 0.92% 0.77% 1.27% 1.35% 1.43% Return on Average Equity(1) 9.2% 7.8% 12.4% 13.6% 15.7% Diluted EPS(1) $1.05

$0.95 $1.68 $2.00 $2.53 19.2% TBV/Share $ 11.62 $ 12.34 $ 12.90 $ 14.08 $ 16.33 7.0% Dividends Paid per Share $0.34 $0.42 $0.60 $0.72 $0.80 18.7%

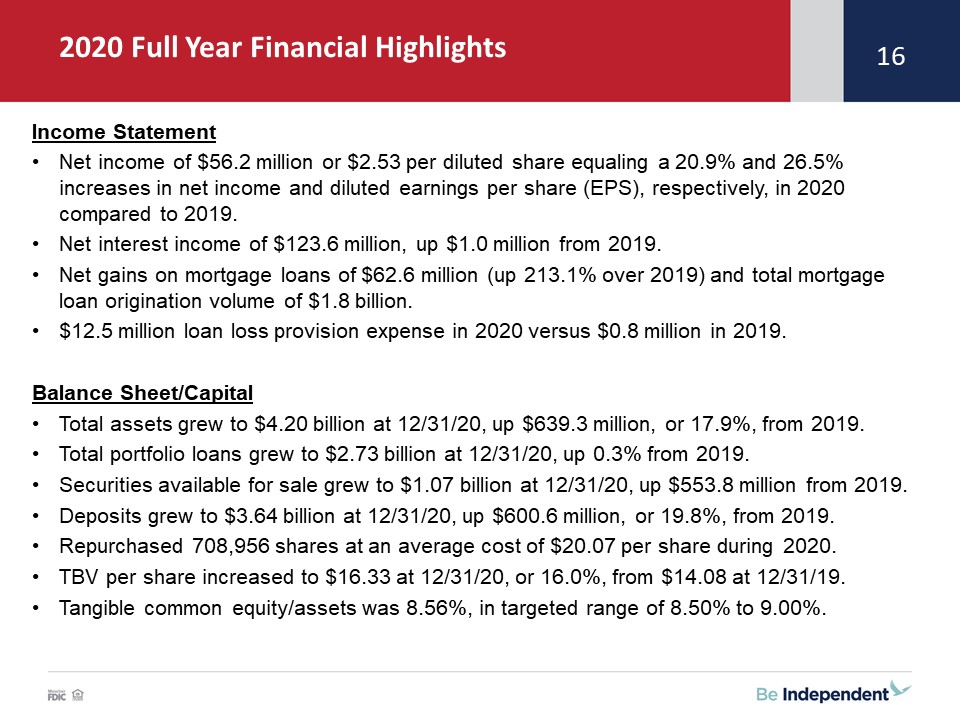

6 2020 Full Year Financial Highlights Income StatementNet income of $56.2 million or $2.53 per

diluted share equaling a 20.9% and 26.5% increases in net income and diluted earnings per share (EPS), respectively, in 2020 compared to 2019. Net interest income of $123.6 million, up $1.0 million from 2019.Net gains on mortgage loans of

$62.6 million (up 213.1% over 2019) and total mortgage loan origination volume of $1.8 billion.$12.5 million loan loss provision expense in 2020 versus $0.8 million in 2019. Balance Sheet/CapitalTotal assets grew to $4.20 billion at 12/31/20,

up $639.3 million, or 17.9%, from 2019. Total portfolio loans grew to $2.73 billion at 12/31/20, up 0.3% from 2019. Securities available for sale grew to $1.07 billion at 12/31/20, up $553.8 million from 2019.Deposits grew to $3.64 billion at

12/31/20, up $600.6 million, or 19.8%, from 2019. Repurchased 708,956 shares at an average cost of $20.07 per share during 2020.TBV per share increased to $16.33 at 12/31/20, or 16.0%, from $14.08 at 12/31/19.Tangible common equity/assets was

8.56%, in targeted range of 8.50% to 9.00%. 16

Strategic Initiatives 17 Serve consumers and businesses in our markets in an inclusive way with

straight forward marketing and outreach efforts and fostering relationships and strong customer engagement.Improve net interest income via balanced loan growth, disciplined risk adjusted loan pricing and active management of deposit pricing.

Add new customers and grow revenue through outbound calling.Add new customers and grow revenue through the addition of new talented sales professionals in our existing markets. Supplement our organic growth initiatives via selective and

opportunistic bank acquisitions and branch acquisitions. Growth Enhance process improvement expertise, enabling all business lines and departments to streamline/automate operating processes and workflows.Successfully complete 2021

core conversion, capitalizing upon opportunity to streamline and improve bank processes.Leverage virtual capabilities to make more effective meetings, training and customer engagement.Optimize branch delivery channel including assessing

existing locations, new locations, service hours, staffing, & workflow and leveraging our existing technology. Expand Digital Branch services.Build/enhance dashboard reporting and business intelligence. Process Improvement & Cost

Controls Create and maintain an engaged workforce through a culture and environment that promotes diversity, equity, inclusion and professional development. Empower and support our team members to serve our customers. Demonstrate that we

are committed to the well-being of our team members who ensure our success. This entails recognizing and rewarding contributions, developing new talent via internships, providing coaching and development, and planning for succession and new

opportunities. Talent Management Produce strong and consistent earnings and capital levels. Maintain good credit quality aided by strong proactive asset quality monitoring and problem resolution.Practice sound risk management with

effective reporting to include fair banking and scenario planning.Actively manage and monitor liquidity and interest rate risk.Promote strong, independent & collaborative risk management, utilizing three layers of defense (business unit,

risk management and internal audit). Ensure effective operational controls with special emphasis on cyber security, fraud prevention, core system conversion and regulatory compliance.Maintain effective relationships with regulators &

other outside oversight parties. Risk Management

INDEPENDENT BANK CORPORTATION 2021 Annual Shareholders Meeting Question and Answer Session Brad

Kessel, President & CEOGavin A. Mohr, Chief Financial Officer

Independent Bank Corporation2021 Annual Shareholders Meeting Voting ResultsShares entitled to vote:

21,891,206Proposal #1 – Election of DirectorsProposal #2 – Ratification of AuditorsProposal #3 – Advisory (Non-Binding) Vote on Executive CompensationProposal #4 – Vote upon the Independent Bank Corporation 2021 Long-Term Incentive Plan 19

Independent Bank Corporation2021 Annual Shareholders Meeting Closing RemarksThank you for

attending!NASDAQ: IBCP 20