Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERC HOLDINGS INC | hri-20210422.htm |

| EX-99.1 - EX-99.1 - HERC HOLDINGS INC | herc2021q1pressrelease.htm |

HERC HOLDINGS INC. ©2021 Herc Rentals Inc. All Rights Reserved. First Quarter 2021 Earnings Conference Call April 22, 2021

2NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Herc Rentals Team Aaron Birnbaum Senior Vice President & Chief Operating Officer Larry Silber President & Chief Executive Officer Elizabeth Higashi Vice President, Investor Relations & Sustainability Mark Irion Senior Vice President & Chief Financial Officer

3NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Safe Harbor Statements and Non-GAAP Financial Measures Information Regarding Non-GAAP Financial Measures In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has provided certain information in this presentation that is not calculated according to GAAP (“non-GAAP”), such as adjusted net income, adjusted earnings per diluted share, EBITDA, adjusted EBITDA, adjusted EBITDA margin, REBITDA, REBITDA margin, REBITDA flow- through and free cash flow. Management uses these non-GAAP measures to evaluate operating performance and period-over-period performance of our core business without regard to potential distortions, and believes that investors will likewise find these non- GAAP measures useful in evaluating the Company’s performance. These measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of companies in our industry. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information about management’s use of these measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, please see the appendix that accompanies this presentation. Forward-Looking Statements This presentation includes forward-looking statements as that term is defined by the federal securities laws, including statements concerning our business plans and strategy; projected profitability, performance or cash flows, future capital expenditures; our growth strategy; anticipated financing needs, business trends, the impact of and our response to COVID-19, liquidity and capital management, and other information that is not historical information. Forward looking statements are generally identified by the words "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts," and future or conditional verbs, such as "will," "should," "could" or "may," as well as variations of such words or similar expressions. All forward-looking statements are based upon our current expectations and various assumptions and, there can be no assurance that our current expectations will be achieved. They are subject to future events, risks and uncertainties - many of which are beyond our control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from those in the forward- looking statements. Further information on the risks that may affect our business is included in filings we make with the Securities and Exchange Commission from time to time, including our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and in our other SEC filings. We undertake no obligation to update or revise forward- looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

4NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. A Leader in the Equipment Rental Industry 56 Years in the equipment rental industry HRI Listed on the New York Stock Exchange on July 1, 2016 Locations in 39 states and five Canadian provinces Employees serving North America 282 4,800 (1) Location count as of April 22, 2021 (1)

5NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Sequential improvement in fleet on rent throughout Q1 2021 Rental revenue growth of 3.6% driven by ProSolutions® and entertainment businesses Focus on operating leverage drove adjusted EBITDA increase of 25.0% and a 680 bps improvement in margin to 40.7% Strong Q1 performance is driving our increase in guidance for the year 2021 Takeaways - On Our Way to a Record Year

6NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. First Quarter 2021 Financial Highlights 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 20 Equipment Rental Revenue $400.4M Q1 3.6% YoY Total Revenues $453.8M Q1 4.0% YoY Adjusted EBITDA1 $184.6M Q1 25.0% YoY Net Income $32.9M Earnings Per Diluted Share $1.09 Adjusted EBITDA Margin1 40.7% Q1 +680 bps YoY Q1 989.2% YoY Q1 938.5% YoY

Operations Review

8NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Solid Operational Performance Rental revenue continued to improve with strong sequential growth in Q1 Diversified mix of customers, segments and geography contributed to rental revenue growth Growth was driven by strength in specialty business including ProSolutions® and entertainment-related Business activity returning to normal and all of our end markets are showing positive momentum Operational capabilities to execute strategy and take advantage of opportunities

9NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Focused on Health and Safety Continued focus on health and safety of our employees, customers and communities Enhancing the well-being of our team by investing in training Adhering to CDC guidelines in all of our operations and travel Refining and launching a new Health & Safety Management System this year Achieved 96% Perfect Days at our branches in Q1 2021

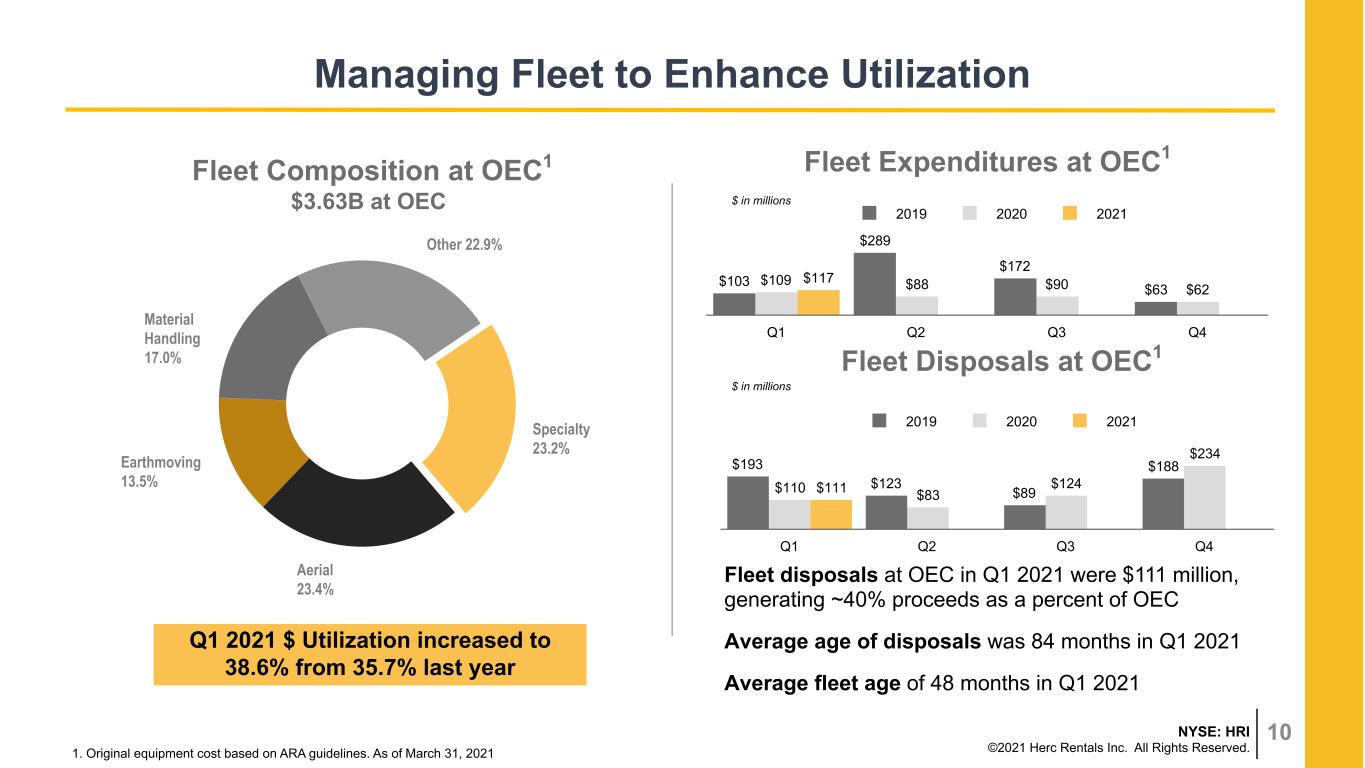

10NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Managing Fleet to Enhance Utilization Fleet Composition at OEC1 $3.63B at OEC 1. Original equipment cost based on ARA guidelines. As of March 31, 2021 Fleet Expenditures at OEC1 Fleet Disposals at OEC1 Fleet disposals at OEC in Q1 2021 were $111 million, generating ~40% proceeds as a percent of OEC Average age of disposals was 84 months in Q1 2021 Average fleet age of 48 months in Q1 2021 $ in millions $ in millions Specialty 23.2% Aerial 23.4% Earthmoving 13.5% Material Handling 17.0% Other 22.9% $103 $289 $172 $63 $109 $88 $90 $62 $117 2019 2020 2021 Q1 Q2 Q3 Q4 $193 $123 $89 $188 $110 $83 $124 $234 $111 2019 2020 2021 Q1 Q2 Q3 Q4 Q1 2021 $ Utilization increased to 38.6% from 35.7% last year

11NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Contractors 33% Industrial 29% Infrastructure and Government 17% Other 21% Successful, Diversified Business Model 1. Refer to our 10-K for description of industries related to each customer classification. Other includes commercial and retail service, hospitality, healthcare, recreation, and entertainment and special events Q1 Revenue by Customer1 Q1 Local vs National Mix National: 46% Local: 54% Our diverse customer mix, base of national customers and expanded specialty business continues to provide growth opportunities Providing excellent customer service and premium equipment to our customers Entertainment activities are exceeding pre-pandemic highs Expanding in fast-growing urban markets to drive top- line growth Continued investment in ProSolutions® business Delivering a lean cost structure and improving margins

Financial Review

13NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. First Quarter 2021 Results Three Months Ended March 31, $ in millions, except per share data 2021 2020 % Chg. Equipment Rental Revenue $400.4 $386.5 3.6% Total Revenues $453.8 $436.2 4.0% Net Income (Loss) $32.9 $(3.7) NM Earnings (Loss) Per Diluted Share $1.09 $(0.13) NM Adjusted Net Income (Loss)1 $33.3 $1.1 NM Adjusted Earnings Per Diluted Share1 $1.10 $0.04 NM Adjusted EBITDA1 $184.6 $147.7 25.0% Adjusted EBITDA Margin1 40.7 % 33.9 % 680 bps REBITDA Margin1,2 43.8 % 38.1 % 570 bps REBITDA YoY Flow-Through1,2 200.7% Average Fleet3 (5.1)% YoY Pricing3 (0.3)% YoY 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 20 2. REBITDA measures contribution from our core rental business without impact of sales of equipment, parts and supplies 3. Based on ARA guidelines NM - Not meaningful

14NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. (0.3)% (1.6)% (1.3)%(2.0)% (16.1)% (8.8)% (6.0)% (1.7)% 2019 2020 2021 Q1 Q2 Q3 Q4 2.0% (1.3)% 0.4% 0.7% 1.7% (0.5)% (4.5)% (6.0)% (5.1)% 2019 2020 2021 Q1 Q2 Q3 Q4 Pricing1 35.6% 38.0% 40.8% 40.5% 35.7% 30.8% 37.6% 40.6% 38.6% 2019 2020 2021 Q1 Q2 Q3 Q4 Pricing and Utilization Performance 1. YoY Change. Based on ARA guidelines. 2. Based on ARA guidelines 3.8% 4.6% 4.5% 3.3% 2.4% (0.3)% (0.8)% (0.8)% (0.3)% 2019 2020 2021 Q1 Q2 Q3 Q4 0.0% Average Fleet at OEC1 Average Fleet on Rent at OEC1 $ Utilization2

15NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Adjusted EBITDA increased 25.0% or $36.9 million to $184.6 million in Q1 2021 DOE fell $6.2 million primarily due to lower personnel, re-rent and maintenance expenses in Q1 2021 SG&A declined $4.3 million in Q1 2021 primarily due to reductions in selling and travel expense REBITDA margin1,3 increased 570 bps YoY to 43.8% in Q1 2021 REBITDA margin flow-through was 200.7% in Q1 2021 Strong Margin Trends for Q1 Adjusted EBITDA1 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 20 2. Gain / loss on sales of rental equipment, new equipment, parts and supplies. 3. REBITDA measures contribution from our core rental business without impact of sales of equipment, parts and supplies 29.5% 25.1% 30.8% 29.9% 33.9% 40.7% Q1 2016 Q1 2017 Q1 2018 Q1 2019 Q1 2020 Q1 2021 First Quarter Adjusted EBITDA Margins (2016 through 2021)

16NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. $73M Free cash flow3 of approximately $73 million for Q1 2021 2.2x Net leverage3 of 2.2x compared with 2.7x in March 2020 New net leverage target of 2.0x to 3.0x Credit Ratings Upgraded: Moody’s CFR to Ba3 from B1/ S&P (BB-/Stable) $1,200.0 $190.0$175.0 2020 2021 2022 2023 2024 2025 2026 2027 Disciplined Capital Management 1. The AR Facility is excluded from current maturities of long-term debt as the Company has the intent and ability to consummate refinancing and extend the term of the agreement 2. Total liquidity includes cash and cash equivalents and the unused commitments under the ABL Credit Facility and AR Facility. 3. For a definition and reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 20 $ in millions, as of March 31, 2021 ABL Credit Facility Senior Unsecured Notes Total debt of $1.6 billion as of March 31, 2021, down by approximately $67 million from December 31, 2020 No near-term maturities and ample liquidity of $1.4 billion provides financial flexibility2 AR Facility1 Maturities $38.7 Finance Leases 2021-2027 ABL Credit Facility

17NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Ja n- 05 Ja n- 06 Ja n- 07 Ja n- 08 Ja n- 09 Ja n- 10 Ja n- 11 Ja n- 12 Ja n- 13 Ja n- 14 Ja n- 15 Ja n- 16 Ja n- 17 Ja n- 18 Ja n- 19 Ja n- 20 Ja n- 21 A New Cycle in the Making 50 1. Source: ARA / IHS Global Insights as of February 2021 3. Source: The American Institute of Architects (AIA) as of April 2021 2. Source: Dodge Analytics U.S. as of March 2021 Architecture Billings Index3 Equipment rental market forecast to grow from about $52 billion in 2020 to $62 billion in 2024 Secular trends favor rental versus ownership Healthcare, warehouse and infrastructure sectors reflect strong growth Select Market Forecasts2 U.S. Nonresidental Building Starts History Forecast 2018 2019 2020 2021 2022 2023 2024 YOY Growth +4% +5% (22)% +3% +8% +7% +3% Sectors with Tailwinds History Forecast 2018 2019 2020 2021 2022 2023 2024 Healthcare (3)% +3% (7)% +9% +8% +7% +5% Warehouse +2% +26% +6% +8% +7% +1% (1)% Infrastructure (1)% +10% (12)% +5% +6% +3% +2% March 55.6 $38 $31 $32 $35 $38 $41 $44 $47 $49 $51 $55 $58 $52 $53 $58 $61 $62 08 09 10 11 12 13 14 15 16 17 18 19 20E 21E 22E 23E 24E N.A. Equipment Rental Market1 ’20-'2 4E CA GR: ~ 4%

18NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Previous Current Adjusted EBITDA $730 to $760 million $800 to $840 million Net Rental Equipment Capital Expenditures $400 to $450 million $400 to $450 million Updating 2021 Full Year Guidance

19NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Improving Metrics Position Future Growth 4.1x 3.6x 3.1x 2.8x 2.4x 2.2x 2016 2017 2018 2019 2020 Q1 2021 34.5% 33.4% 34.6% 37.1% 38.7% 40.4% 2016 2017 2018 2019 2020 TTM Q1 2021 Net Leverage2 Adjusted EBITDA Margin1 1. For a definition and reconciliation to the most comparable GAAP financial measure, see slides 25 and 26 and previously filed presentations 2. For a definition and calculation, see slide 28 Focus on top line growth and operating leverage to continue to improve margins over time Strong free cash flow provides liquidity for growth initiatives Will continue opening greenfield locations and seeking accretive M&A in select geographies We are focused on disciplined fleet investment to fuel our strategic growth

Appendix

21NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Develop Our People and Culture Attract and retain diverse talent Align performance to shared purpose Support a safe and healthy work place culture Expand continuous learning to all employees Our Strategic Initiatives are Delivering Results Improve Operating Effectiveness Improve sales force effectiveness Improve safety and labor productivity Increase density in large urban markets Improve vendor management and fleet availability Enhance Customer Experience Provide premium products and solutions-based services Introduce innovative technology solutions Maintain COVID-19 protocols to protect customers and employees Disciplined Capital Management Drive EBITDA margin growth Maximize fleet management and utilization Operate within new net leverage target range of 2.0x to 3.0x Expand and Diversify Revenues Broaden customer base Expand products and services Grow pricing and ancillary revenues Seek accretive M&A in selective geographies, verticals and selected products

22NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. $536.2 $585.4 $684.8 $741.0 $689.4 $726.3 2016 2017 2018 2019 2020 TTM Q1 2021 Margin and Net Leverage Show Positive Trends Equipment Rental Revenue 4.1x 3.6x 3.1x 2.8x 2.4x 2.2x 2016 2017 2018 2019 2020 Q1 2021 34.5% 33.4% 34.6% 37.1% 38.7% 40.4% 2016 2017 2018 2019 2020 TTM Q1 2021 Net Leverage2Adjusted EBITDA Margin1 Adjusted EBITDA1 1. For a definition and reconciliation to the most comparable GAAP financial measure, see slides 25 and 26 and previously filed presentations 2. For a definition and calculation, see slide 28 $ in millions $ in millions $1,352.7 $1,499.0 $1,658.3 $1,701.8 $1,543.7 $1,557.6 2016 2017 2018 2019 2020 TTM Q1 2021 ’16-‘20 CAGR: 3.4% ’16-‘2 0 CA GR: 6 .5%

23NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. OEC: Original Equipment Cost which is an operating measure based on the guidelines of the American Rental Association (ARA), which is calculated as the cost of the asset at the time it was first purchased plus additional capitalized refurbishment costs (with the basis of refurbished assets reset at the refurbishment date). Fleet Age: The OEC weighted age of the entire fleet, based on ARA guidelines. Glossary of Terms Commonly Used in the Industry Net Fleet Capital Expenditures: Capital expenditures of rental equipment minus the proceeds from disposal of rental equipment. Dollar Utilization ($ UT): Dollar utilization is an operating measure calculated by dividing rental revenue by the average OEC of the equipment fleet for the relevant time period, based on ARA guidelines. Pricing: Change in pure pricing achieved in one period versus another period. This is applied both to year-over-year and sequential comparisons. Rental rates are based on ARA guidelines and are calculated based on the category class rate variance achieved either year-over-year or sequentially for any fleet that qualifies for the fleet base and weighted by the prior year revenue mix.

24NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Three Months Ended March 31, 2021 2020 Net income $32.9 $(3.7) Impairment — 6.3 Other(1) 0.6 0.2 Tax impact of adjustments(2) (0.2) (1.7) Adjusted net income $33.3 $1.1 Diluted common shares 30.2 29.3 Adjusted earnings per diluted share $1.10 $0.04 Reconciliation of Adjusted Net Income and Adjusted Earnings Per Diluted Share Adjusted Net Income and Adjusted Earnings Per Diluted Share - Adjusted Net Income represents the sum of net income (loss), restructuring and restructuring related charges, spin-off costs, loss on extinguishment of debt, impairment charges, gain (loss) on the disposal of a business and certain other items. Adjusted Earnings per Diluted Share represents Adjusted Net Income divided by diluted shares outstanding. Adjusted Net Income and Adjusted Earnings Per Diluted Share are important measures to evaluate our results of operations between periods on a more comparable basis and to help investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provide useful information to both management and investors by excluding certain items that may not be indicative of our core operating results and operational strength of our business. (1) Merger and acquisition related and spin-off costs are included in Other. (2) The tax rate applied for adjustments is 25.7% and reflects the statutory rates in the applicable entities.

25NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Reconciliation of Net Income to Adj. EBITDA, Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through EBITDA, Adjusted EBITDA, and REBITDA - EBITDA represents the sum of net income (loss), provision (benefit) for income taxes, interest expense, net, depreciation of rental equipment and non-rental depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of merger and acquisition related costs, restructuring and restructuring related charges, spin-off costs, non-cash stock based compensation charges, loss on extinguishment of debt (which is included in interest expense, net), impairment charges, gain (loss) on disposal of a business and certain other items. REBITDA represents Adjusted EBITDA excluding the gain (loss) on sales of rental equipment and new equipment, parts and supplies. EBITDA, Adjusted EBITDA and REBITDA do not purport to be alternatives to net income as an indicator of operating performance. Additionally, none of these measures purports to be an alternative to cash flows from operating activities as a measure of liquidity, as they do not consider certain cash requirements such as interest payments and tax payments. Adjusted EBITDA Margin, REBITDA Margin and REBITDA Flow-Through - Adjusted EBITDA Margin (Adjusted EBITDA / Total Revenues) is a commonly used profitability ratio. REBITDA Margin (REBITDA / Equipment rental, service and other revenues) and REBITDA Flow-Through (the year-over-year change in REBITDA/the year-over-year change in Equipment rental, service, and other revenues) are useful operating profitability ratios to management and investors.

26NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. $ in millions Three Months Ended March 31, 2021 2020 Net income $32.9 ($3.7) Income tax provision 8.2 1.1 Interest expense, net 21.4 24.4 Depreciation of rental equipment 100.4 100.4 Non-rental depreciation and amortization 15.8 15.8 EBITDA 178.7 138.0 Non-cash stock-based compensation charges 5.3 3.2 Impairment — 6.3 Other(1) 0.6 0.2 Adjusted EBITDA 184.6 147.7 Less: Gain (loss) on sales of rental equipment 5.8 (2.4) Less: Gain (loss) on sales of new equipment, parts and supplies 1.9 1.9 Rental Adjusted EBITDA (REBITDA) $176.9 $148.2 Total Revenues $453.8 $436.2 Less: Sales of rental equipment 44.2 40.0 Less: Sales of new equipment, parts and supplies 6.1 7.0 Equipment rental, service and other revenues $403.5 $389.2 Total Revenues $453.8 $436.2 Adjusted EBITDA $184.6 $147.7 Adjusted EBITDA Margin 40.7 % 33.9 % Equipment rental, service and other revenues $403.5 $389.2 REBITDA $176.9 $148.2 REBITDA Margin 43.8 % 38.1 % YOY Change in REBITDA $28.7 YOY Change in Equipment rental, service and other revenues $14.3 YOY REBITDA Flow-Through 200.7 % Reconciliation of Net Income to Adj. EBITDA, Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through (1) Merger and acquisition related and spin-off costs are included in Other.

27NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. $ in millions Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q1 2021 Total Revenues $436.2 $368.0 $456.7 $520.4 $1,781.3 $453.8 Less: Sales of rental equipment 40.0 31.4 45.3 81.8 198.5 44.2 Less: Sales of new equipment, parts and supplies 7.0 7.0 6.2 8.0 28.2 6.1 Equipment rental, service and other revenues $389.2 $329.6 $405.2 $430.6 $1,554.6 $403.5 Net income (loss) ($3.7) $2.0 $39.9 $35.5 $73.7 $32.9 Income tax provision (benefit) 1.1 (1.9) 11.7 9.5 20.4 8.2 Interest expense, net 24.4 23.3 22.4 22.5 92.6 21.4 Depreciation of rental equipment 100.4 101.4 101.9 100.2 403.9 100.4 Non-rental depreciation and amortization 15.8 15.7 15.5 15.5 62.5 15.8 EBITDA $138.0 $140.5 $191.4 $183.2 $653.1 $178.7 Restructuring — 0.7 — — 0.7 — Non-cash stock-based compensation charges 3.2 1.7 5.4 6.1 16.4 5.3 Loss on disposal of business — 2.8 — — 2.8 — Impairment 6.3 3.2 — 5.9 15.4 — Other(1) 0.2 0.5 (0.1) 0.4 1.0 0.6 Adjusted EBITDA $147.7 $149.4 $196.7 $195.6 $689.4 $184.6 Less: Gain (loss) on sales of rental equipment (2.4) 1.8 (1.0) (3.5) (5.1) 5.8 Less: Gain on sales of new equipment, parts and supplies 1.9 1.9 1.8 2.1 7.7 1.9 Rental Adjusted EBITDA (REBITDA) $148.2 $145.7 $195.9 $197.0 $686.8 $176.9 REBITDA Margin 38.1 % 44.2 % 48.3 % 45.8 % 44.2 % 43.8 % YOY REBITDA Flow-Through 107.4 % 31.0 % 20.9 % 59.4 % 27.9 % 200.7 % REBITDA Margin Trend (1) Merger and acquisition related and spin-off costs are included in Other.

28NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Calculation of Net Leverage Ratio $ in millions Q1 2021 Q4 2020 Q1 2020 Long-Term Debt, Net $1,585.2 $1,651.5 $2,041.6 (Plus) Current maturities of long-term debt 11.7 12.2 22.2 (Plus) Unamortized debt issuance costs 6.8 7.1 7.7 (Less) Cash and Cash Equivalents (32.9) (33.0) (55.8) Net Debt $1,570.8 $1,637.8 $2,015.7 Trailing Twelve-Month Adjusted EBITDA $726.3 $689.4 $746.4 Net Leverage 2.2 x 2.4 x 2.7 x Net Leverage Ratio –The Company has defined its net leverage ratio as net debt, as calculated below, divided by adjusted EBITDA for the trailing twelve- month period. This measure should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The Company’s definition of this measure may differ from similarly titled measures used by other companies.

29NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Reconciliation of Free Cash Flow Free cash flow is not a recognized term under GAAP and should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP. Further, since all companies do not use identical calculations, our definition and presentation of this measure may not be comparable to similarly titled measures reported by other companies. Free cash flow represents net cash provided by (used in) operating activities less rental equipment expenditures and non-rental capital expenditures, plus proceeds from disposal of rental equipment, proceeds from disposal of property and equipment, and other investing activities. Free cash flow is used by management in analyzing the Company’s ability to service and repay its debt and to forecast future periods. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service debt or for other non-discretionary expenditures. $ in millions Three Months Ended March 31, Years Ended December 31, 2021 2020 2020 2019 2018 Net cash provided by operating activities $134.7 $101.5 $610.9 $635.6 $559.1 Rental equipment expenditures (90.9) (83.0) (344.1) (638.4) (771.4) Proceeds from disposal of rental equipment 40.3 34.6 192.5 224.2 272.3 Net Fleet Capital Expenditures (50.6) (48.4) (151.6) (414.2) (499.1) Non-rental capital expenditures (13.4) (15.5) (41.4) (56.9) (77.6) Proceeds from disposal of property and equipment 1.8 1.6 6.6 7.7 9.7 Other — — — 4.0 — Free Cash Flow $72.5 $39.2 $424.5 $176.2 ($7.9)

30NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Historical Fleet at OEC1 $ in millions FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 Q1 2020 Q1 2021 Beginning Balance $3,384 $3,556 $3,651 $3,777 $3,822 $3,822 $3,589 Expenditures $495 $524 $774 $627 $349 $109 $117 Disposals ($328) ($442) ($607) ($593) ($551) ($110) ($111) Foreign Currency / Other $5 $13 ($41) $11 ($31) ($21) $31 Ending Balance $3,556 $3,651 $3,777 $3,822 $3,589 $3,800 $3,626 Proceeds as a percent of OEC 41.7 % 39.8 % 37.8 % 40.9 % 37.0 % 37.1 % 40.1 % 1. Original equipment cost based on ARA guidelines

31NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Fleet Mix 1. Original equipment cost based on ARA guidelines March 31, 2021 March 31, 2020 Aerial - Booms 16.2 % 17.0 % Aerial - Scissors & Other 7.2 % 7.3 % Earthmoving - Compact 7.9 % 8.1 % Earthmoving - Heavy 5.6 % 5.7 % Material Handling - Telehandlers 13.1 % 13.6 % Material Handling - Industrial 3.9 % 4.0 % Trucks and Trailers 14.9 % 14.2 % ProSolutions® 17.3 % 16.0 % ProContractor 5.9 % 6.0 % Air Compressors 2.4 % 2.4 % Other 2.3 % 2.5 % Lighting 2.0 % 1.8 % Compaction 1.3 % 1.4 % Total 100.0 % 100.0 % OEC1 $3.63B $3.80B

NYSE: HRI ©2021 Herc Rentals Inc. All Rights Reserved. Investor Contact: Elizabeth M. Higashi, CFA Vice President, Investor Relations & Sustainability elizabeth.higashi@hercrentals.com