Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BankUnited, Inc. | earningsdocex99120210331.htm |

| 8-K - 8-K - BankUnited, Inc. | bku-20210422.htm |

April 22, 2021 Q1 2021 – Supplemental Information Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of BankUnited, Inc. (“BankUnited,” “BKU” or the “Company”) with respect to, among other things, future events and financial performance. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” "forecasts" or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions, including (without limitations) those relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by the COVID-19 pandemic. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. Information on these factors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are available at the SEC’s website (www.sec.gov). 2

Financial Highlights

Strong Quarterly Results in a Challenging Environment 4 Operating results Continued improvement in deposit mix Asset Quality Robust capital levels • EPS for the quarter of $1.06 • Annualized ROE for the quarter of 13.2% and ROA of 1.14% • Net interest income grew by $3 million linked quarter and $16 million compared to Q1 2020 • NIM of 2.39% compared to 2.33% linked quarter • Recovery of credit losses of $(28) million reflecting an improving economic forecast • Non-interest DDA grew by $957 million for the quarter to 29% of total deposits • Non-interest DDA now 29% of total deposits compared to 25% at 12/31/20 and 18% at 12/31/19 • Average non-interest DDA up $3.1 billion compared to Q1 2020 • Average total cost of deposits continued to decline, to 0.33% for the quarter • “Spot” APY on total deposits was 0.27% at March 31, 2021 • Loans on deferral totaled $126 million or less than 1% of total loans at March 31, 2021 • Commercial: $35 million or less than 1% of commercial loans • Residential: $91 million or 2% of residential loans • CARES Act modifications totaled $636 million at March 31, 2021 • Commercial: $621 million or 4% of commercial loans • Residential: $15 million or less than 1% of residential loans • NPA ratio declined to 0.67% of total assets from 0.71% at December 31, 2020 • CET1 ratios of 13.2% at the holding company and 14.8% at the bank at March 31, 2021 • Book value per share grew to $32.83 and tangible book value grew to $32.00 at March 31, 2021, up from pre-pandemic levels of $31.33 and $30.52, respectively, at December 31, 2019. • Reinstated the share repurchase program that the Company suspended in March 2020.

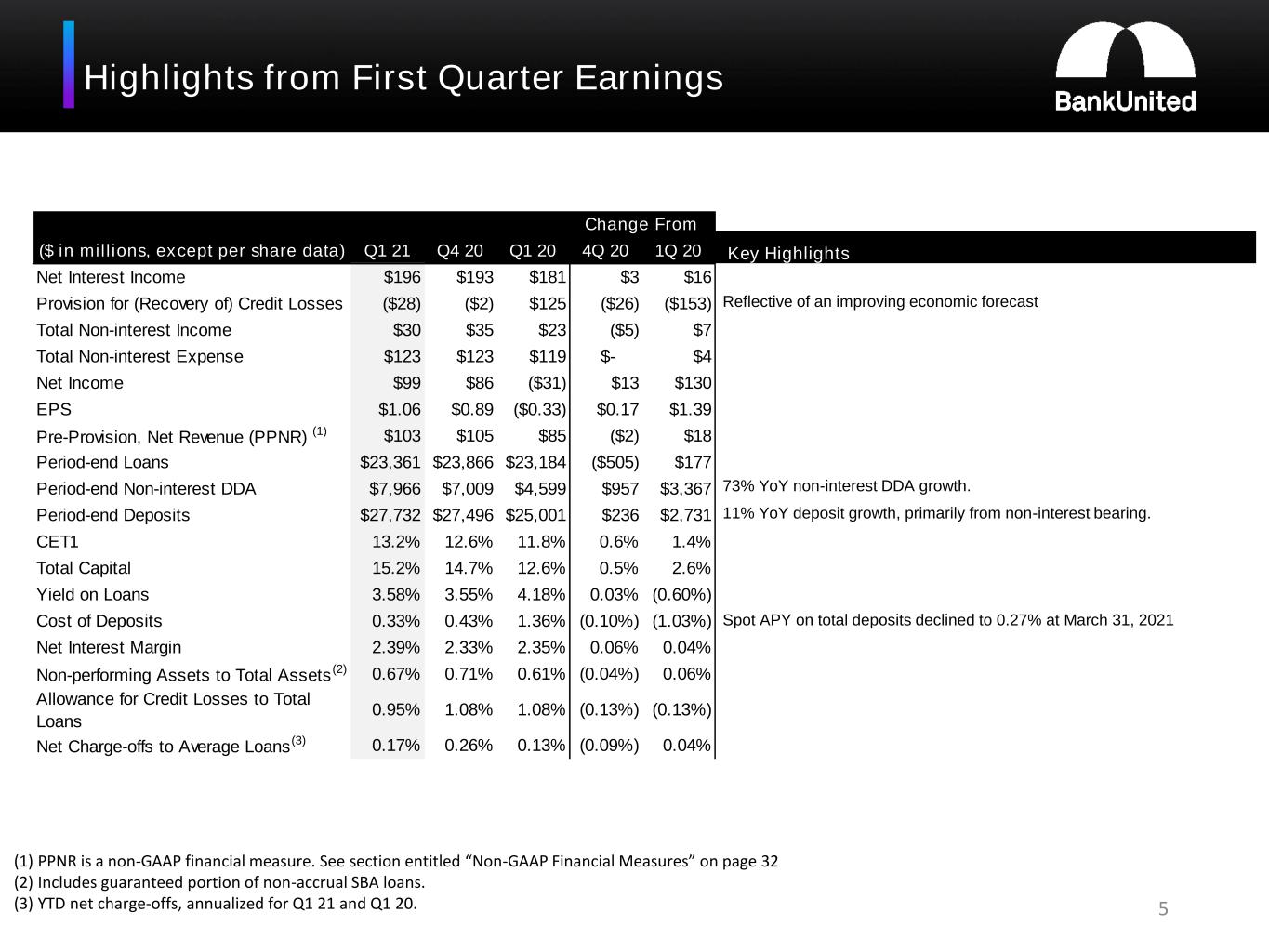

Highlights from First Quarter Earnings 5 Key Highlights Reflective of an improving economic forecast 73% YoY non-interest DDA growth. 11% YoY deposit growth, primarily from non-interest bearing. Spot APY on total deposits declined to 0.27% at March 31, 2021 (1) PPNR is a non-GAAP financial measure. See section entitled “Non-GAAP Financial Measures” on page 32 (2) Includes guaranteed portion of non-accrual SBA loans. (3) YTD net charge-offs, annualized for Q1 21 and Q1 20. ($ in millions, except per share data) Q1 21 Q4 20 Q1 20 4Q 20 1Q 20 Net Interest Income $196 $193 $181 $3 $16 Provision for (Recovery of) Credit Losses ($28) ($2) $125 ($26) ($153) Total Non-interest Income $30 $35 $23 ($5) $7 Total Non-interest Expense $123 $123 $119 $- $4 Net Income $99 $86 ($31) $13 $130 EPS $1.06 $0.89 ($0.33) $0.17 $1.39 Pre-Provision, Net Revenue (PPNR) (1) $103 $105 $85 ($2) $18 Period-end Loans $23,361 $23,866 $23,184 ($505) $177 Period-end Non-interest DDA $7,966 $7,009 $4,599 $957 $3,367 Period-end Deposits $27,732 $27,496 $25,001 $236 $2,731 CET1 13.2% 12.6% 11.8% 0.6% 1.4% Total Capital 15.2% 14.7% 12.6% 0.5% 2.6% Yield on Loans 3.58% 3.55% 4.18% 0.03% (0.60%) Cost of Deposits 0.33% 0.43% 1.36% (0.10%) (1.03%) Net Interest Margin 2.39% 2.33% 2.35% 0.06% 0.04% Non-performing Assets to Total Assets (2) 0.67% 0.71% 0.61% (0.04%) 0.06% Allowance for Credit Losses to Total Loans 0.95% 1.08% 1.08% (0.13%) (0.13%) Net Charge-offs to Average Loans (3) 0.17% 0.26% 0.13% (0.09%) 0.04% Change From

Continuing to Transform our Deposit mix ($ in millions) 6 $7,347 $7,542 $6,731 $5,888 $4,807 $3,784 $10,622 $10,324 $10,590 $11,003 $12,660 $12,885 $2,131 $2,536 $2,866 $2,917 $3,020 $3,097 $4,295 $4,599 $5,883 $6,789 $7,009 $7,966 $24,395 $25,001 $26,070 $26,597 $27,496 $27,732 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Non-interest Demand Interest Demand Money Market / Savings Time Non-interest bearing demand deposits have grown at a compound annual growth rate of 64% since December 31, 2019 Cost of Deposits 1.48% 1.36% 0.80% 0.57% 0.43% 0.33% Non-interest bearing 17.6% 18.4% 22.6% 22.5% 25.5% 28.7% We have consistently priced down our deposit portfolio since the Fed began lowering interest rates in late 2019 Spot Average Annual Percentage Yield (“APY”) At December 31, 2019 At March 31, 2020 At June 30, 2020 At September 30, 2020 At December 31, 2020 At March 31, 2021 Total non-maturity deposits 1.11% 0.83% 0.44% 0.37% 0.29% 0.24% Total interest-bearing deposits 1.71% 1.35% 0.82% 0.65% 0.48% 0.36% Total deposits 1.42% 1.12% 0.65% 0.49% 0.36% 0.27%

Prudently Underwritten and Well-Diversified Loan Portfolio At March 31, 2021 ($ in millions) 7 Loan Portfolio Over Time CRE C&I Non-owner Occupied 73% Multi- family 23% Construction and Land 4% Commercial and Industrial 59% Owner Occupied 28% SBA PPP 13% Lending Subs Residential Loan Product Type Pinnacle 53% Bridge - Franchise 25% Bridge - Equipment 22% $5,661 $5,635 $5,578 $5,941 $6,348 $6,582 $7,493 $7,178 $7,081 $6,984 $6,896 $6,666 $6,718 $7,035 $7,560 $7,309 $7,230 $6,893 $768 $852 $1,161 $1,251 $1,259 $1,146 $2,515 $2,484 $2,455 $2,294 $2,133 $2,074 $23,155 $23,184 $23,835 $23,779 $23,866 $23,361 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Residential CRE C&I(1) Mortgage Warehouse Lending Lending Subs 30 Yr Fixed 18% 15 & 20 Year Fixed 9% 10/1 ARM 18% 5/1 & 7/1 ARM 27% Formerly Covered 2% Govt Insured 26% (1) Includes SBA PPP loans

Allowance for Credit Losses

CECL Methodology 9 Underlying Principles Economic Forecast Key Variables • The ACL under CECL represents management’s best estimate at the balance sheet date of expected credit losses over the life of the loan portfolio. • Required to consider historical information, current conditions and a reasonable and supportable economic forecast. • For most portfolio segments, BankUnited uses econometric models to project PD, LGD and expected losses at the loan level and aggregates those expected losses by segment. • Qualitative adjustments may be applied to the quantitative results. • Accounting standard requires an estimate of expected prepayments which may significantly impact the lifetime loss estimate. • Our ACL estimate was informed by Moody’s economic scenarios published in March 2021. • Unemployment at 6.0% for Q2 2021, steadily declining to 5% through end of 2021, and continuing to 4.2% by end of 2022 • Annualized growth in GDP at 6.2% for Q2 2021, increasing to 7.1% by end of 2021 and 2.3% by end of 2022 • VIX trending at stabilized levels through the forecast horizon • S&P 500 averaging near 3700 through the R&S period • 2 year reasonable and supportable forecast period. • The models ingest numerous national, regional and MSA level economic variables and data points. Economic data and variables to which portfolio segments are most sensitive: • Commercial o Market volatility index o S&P 500 index o Unemployment rate o A variety of interest rates and spreads • CRE o Unemployment o CRE property forecast o 10-year treasury o Baa corporate yield o Real GDP growth • Residential o HPI o Unemployment rate o Real GDP growth o Freddie Mac 30-year rate

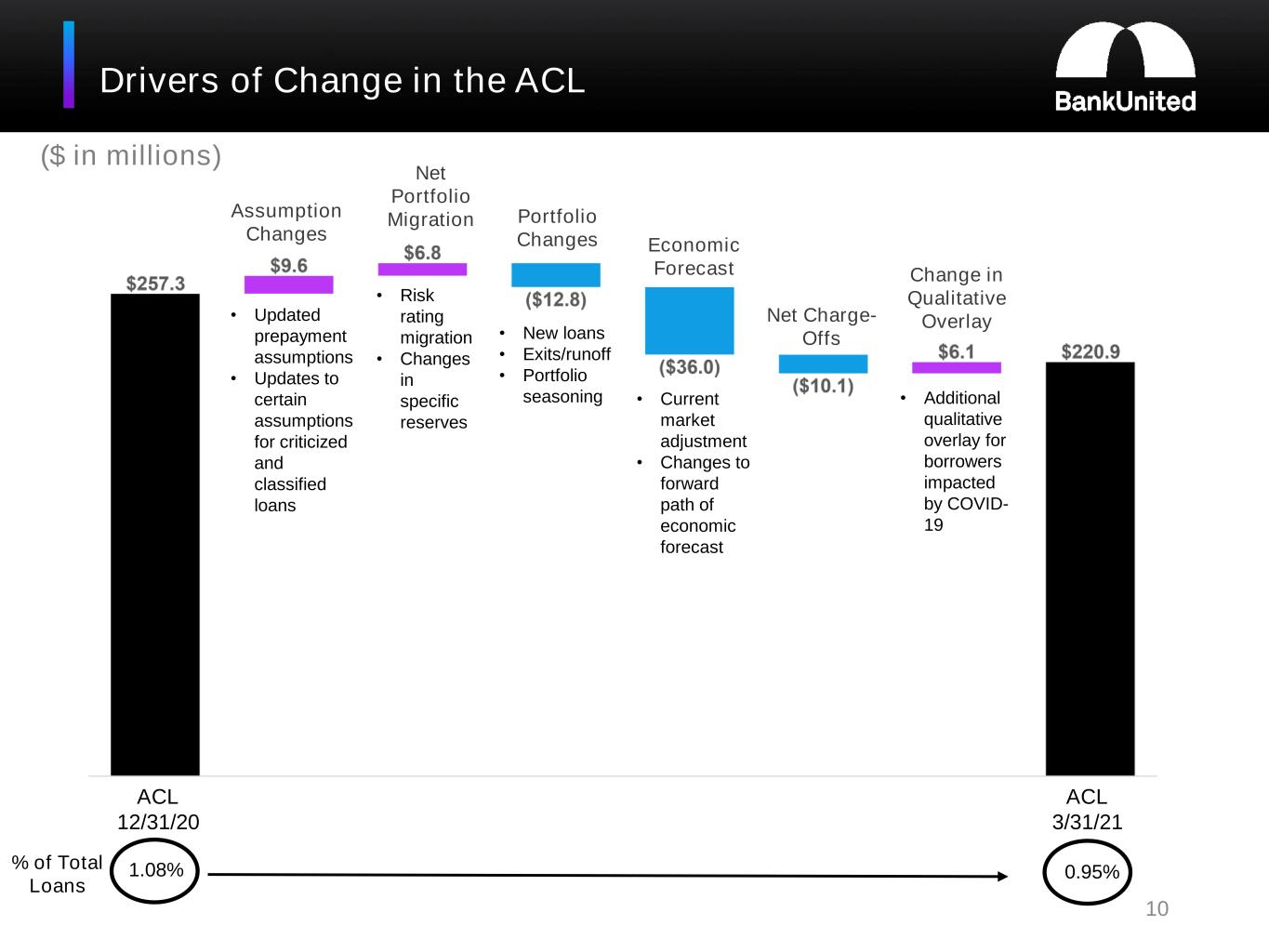

Drivers of Change in the ACL 10 ACL 12/31/20 ACL 3/31/21 Assumption Changes Net Portfolio Migration Portfolio Changes Economic Forecast Net Charge- Offs Change in Qualitative Overlay ($ in millions) % of Total Loans 1.08% 0.95% • Updated prepayment assumptions • Updates to certain assumptions for criticized and classified loans • Risk rating migration • Changes in specific reserves • New loans • Exits/runoff • Portfolio seasoning • Current market adjustment • Changes to forward path of economic forecast • Additional qualitative overlay for borrowers impacted by COVID- 19

Allocation of the ACL 11 ($ in millions) (1) Non-performing loans and assets include the guaranteed portion of non-accrual SBA loans totaling $48.2 million and $51.3 million or 0.21%, and 0.22%, of total loans and 0.14%, and 0.15% of total assets, at March 31, 2021 and December 31, 2020. (2) ACL to total loans, excluding government insured residential loans, PPP loans and MWL, which carry nominal or no reserves, was 1.13% and 1.26% at March 31, 2021 and December 31, 2020, respectively. See section entitled “Non-GAAP Financial Measures” on page 33. Balance % of Loans Balance % of Loans Residential and other consumer 18.7$ 0.29% 15.8$ 0.24% Commercial: Commercial real estate 104.6 1.52% 95.2 1.43% Commercial and industrial 91.0 1.07% 78.6 0.98% Pinnacle 0.3 0.03% 0.2 0.02% Franchise finance 36.3 6.61% 24.4 4.65% Equipment finance 6.4 1.34% 6.7 1.46% Total commercial 238.6 1.36% 205.1 1.22% Allowance for credit losses (2) 257.3$ 1.08% 220.9$ 0.95% December 31, 2020 March 31, 2021 Asset Quality Ratios December 31, 2020 March 31, 2021 Non-performing loans to total loans (1) 1.02% 1.00% Non-performing assets to total assets 0.71% 0.67% Allowance for credit losses to non-performing loans (1) 105.26% 94.56% Net charge-offs to average loans 0.26% 0.17%

Loan Portfolio and Credit

Loan Portfolio – Geographic Distribution At March 31, 2021 Commercial (1) Residential CRE (1) Includes PPP, MWL, BFG and Pinnacle CA 31% FL 10% NY 23% Other 36% FL 54% NY Tri-State Area 37% Other 9% FL 39% NY Tri-State Area 23% Other 38% 13

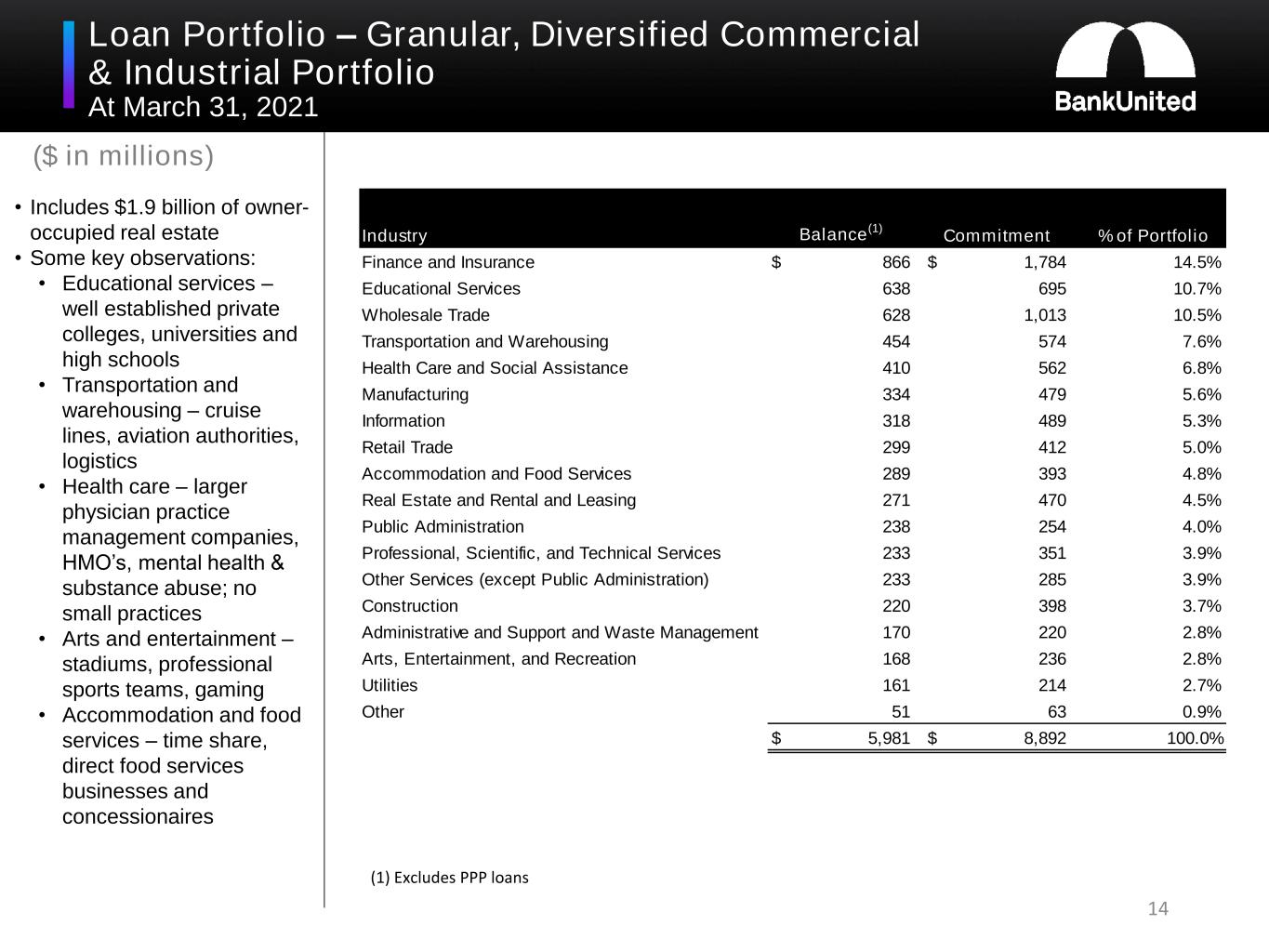

14 Loan Portfolio – Granular, Diversified Commercial & Industrial Portfolio At March 31, 2021 ($ in millions) • Includes $1.9 billion of owner- occupied real estate • Some key observations: • Educational services – well established private colleges, universities and high schools • Transportation and warehousing – cruise lines, aviation authorities, logistics • Health care – larger physician practice management companies, HMO’s, mental health & substance abuse; no small practices • Arts and entertainment – stadiums, professional sports teams, gaming • Accommodation and food services – time share, direct food services businesses and concessionaires (1) Excludes PPP loans Industry Balance (1) Commitment % of Portfolio Finance and Insurance 866$ 1,784$ 14.5% Educational Services 638 695 10.7% Wholesale Trade 628 1,013 10.5% Transportation and Warehousing 454 574 7.6% Health Care and Social Assistance 410 562 6.8% Manufacturing 334 479 5.6% Information 318 489 5.3% Retail Trade 299 412 5.0% Accommodation and Food Services 289 393 4.8% Real Estate and Rental and Leasing 271 470 4.5% Public Administration 238 254 4.0% Professional, Scientific, and Technical Services 233 351 3.9% Other Services (except Public Administration) 233 285 3.9% Construction 220 398 3.7% Administrative and Support and Waste Management 170 220 2.8% Arts, Entertainment, and Recreation 168 236 2.8% Utilities 161 214 2.7% Other 51 63 0.9% 5,981$ 8,892$ 100.0%

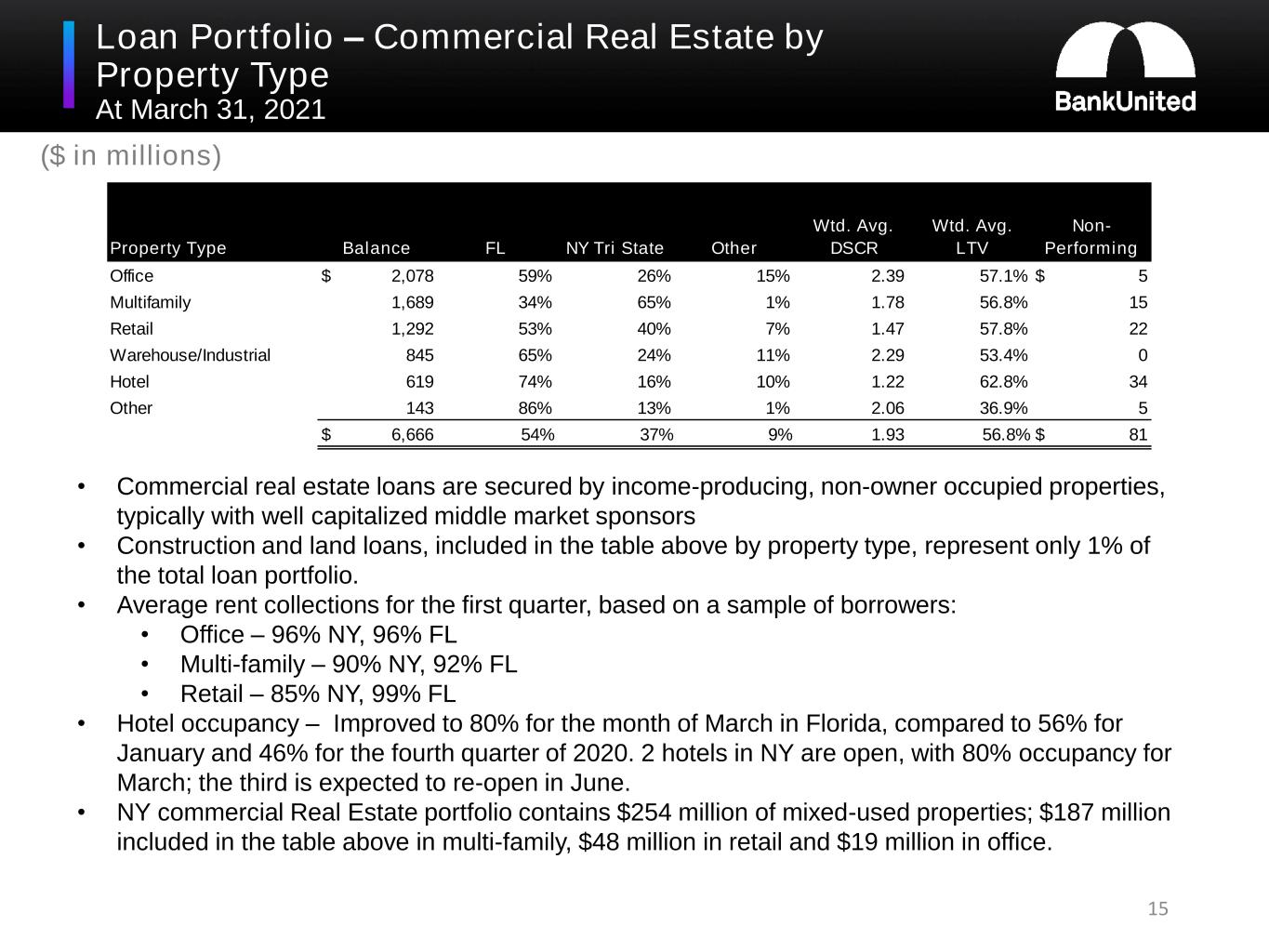

Loan Portfolio – Commercial Real Estate by Property Type At March 31, 2021 Property Type Balance FL NY Tri State Other Wtd. Avg. DSCR Wtd. Avg. LTV Non- Performing Office 2,078$ 59% 26% 15% 2.39 57.1% 5$ Multifamily 1,689 34% 65% 1% 1.78 56.8% 15 Retail 1,292 53% 40% 7% 1.47 57.8% 22 Warehouse/Industrial 845 65% 24% 11% 2.29 53.4% 0 Hotel 619 74% 16% 10% 1.22 62.8% 34 Other 143 86% 13% 1% 2.06 36.9% 5 6,666$ 54% 37% 9% 1.93 56.8% 81$ • Commercial real estate loans are secured by income-producing, non-owner occupied properties, typically with well capitalized middle market sponsors • Construction and land loans, included in the table above by property type, represent only 1% of the total loan portfolio. • Average rent collections for the first quarter, based on a sample of borrowers: • Office – 96% NY, 96% FL • Multi-family – 90% NY, 92% FL • Retail – 85% NY, 99% FL • Hotel occupancy – Improved to 80% for the month of March in Florida, compared to 56% for January and 46% for the fourth quarter of 2020. 2 hotels in NY are open, with 80% occupancy for March; the third is expected to re-open in June. • NY commercial Real Estate portfolio contains $254 million of mixed-used properties; $187 million included in the table above in multi-family, $48 million in retail and $19 million in office. ($ in millions) 15

16 Loan Portfolio – Deferrals and Modifications At March 31, 2021 ($ in millions) • Loans subject to COVID related deferral or modification under the CARES Act totaled $762 million or 3% of the total loan portfolio at March 31, 2021. By comparison, at the end of Q2 2020, we reported that we had granted 90-day payment deferrals on $3.6 billion of loans or 15% of the total loan portfolio. • Commercial CARES Act modifications are most often 9 to 12- month interest only periods. • Percentage of the portfolio subject to deferral or CARES Act modification remained consistent with the prior quarter-end Residential – Excluding Government Insured Through March 31, 2021, a total of $525 million of residential loans, excluding government insured loans, had been granted an initial short-term payment deferral. The status of those loans at March 31, 2021 is presented in the table below: Currently Under Short-Term Deferral CARES Act Modification Total % of Portfolio Residential -excluding government insured 91$ 15$ 106$ 2% CRE by Property Type: Retail 18$ 19$ 37$ 3% Hotel - 343 343 55% Office 13 43 56 3% Multifamily - 24 24 1% Other - - - 0% Total CRE 31$ 429$ 460$ 7% C&I - Industry: Accomm. and Food Services -$ 25$ 25$ 9% Retail Trade - 34 34 11% Manufacturing - 13 13 4% Transportation and Warehousing (cruise lines) - 48 48 10% Finance and Insurance - 18 18 2% Other 4 16 20 1% Total C&I 4$ 154$ 158$ 3% BFG - Franchise -$ 38$ 38$ 7% Total Commercial 35$ 621$ 656$ 4% Total 126$ 636$ 762$ 3% % of Total Loans <1% 3% 3% Balance % of Loans Inititally Granted Short-Term Deferral Balance % of Loans Rolled Off Short-Term Deferral Balance % of Loans Rolled Off Short-Term Deferral 91$ 17% 408$ 94% 26$ 6% Loans Still Under Short-Term Deferral Paid Off or Paying as Agreed Not Resumed Regular Payments Loans That Have Rolled Off of Short-Term Deferral

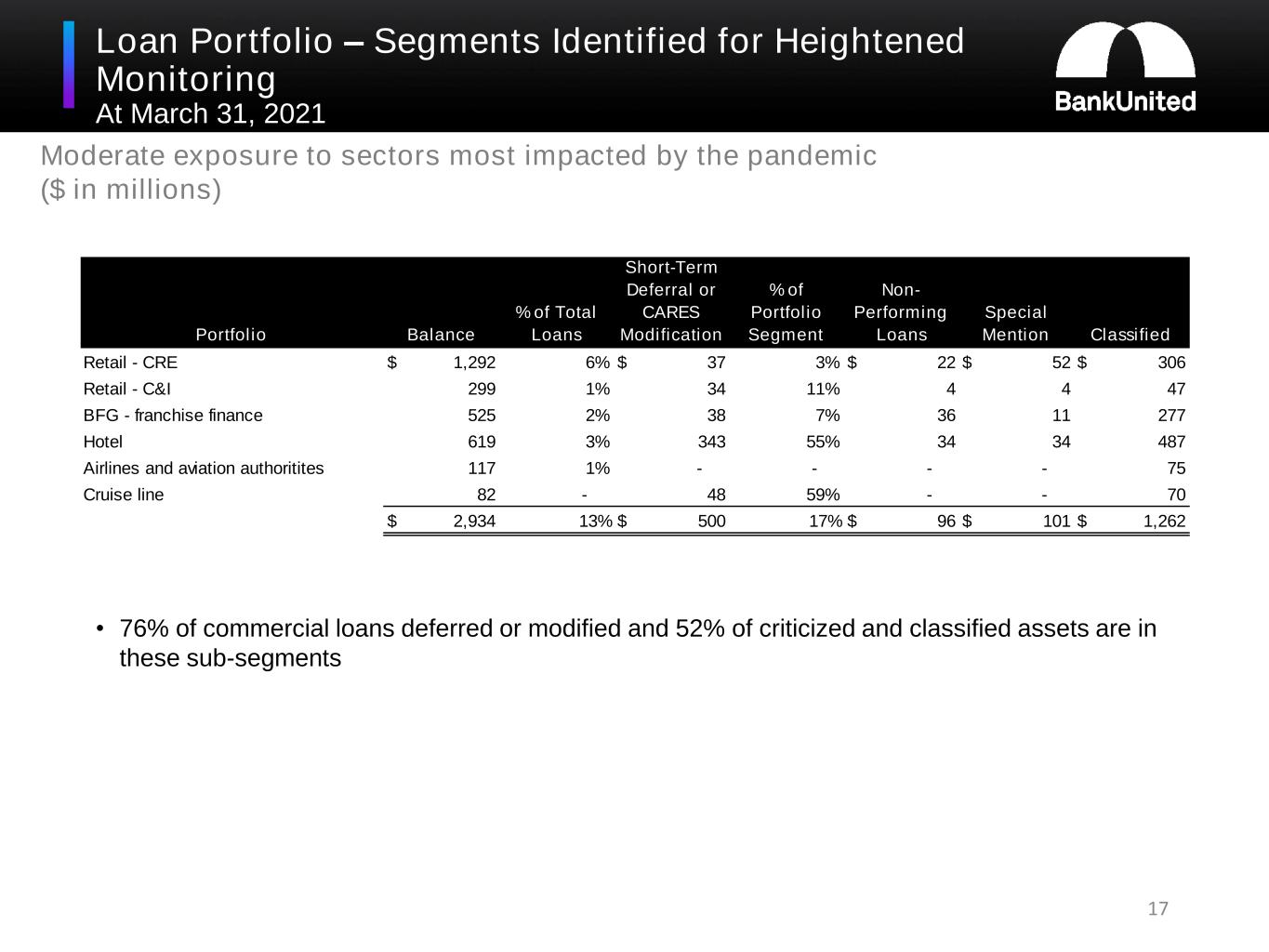

Loan Portfolio – Segments Identified for Heightened Monitoring At March 31, 2021 Moderate exposure to sectors most impacted by the pandemic ($ in millions) • 76% of commercial loans deferred or modified and 52% of criticized and classified assets are in these sub-segments Portfolio Balance % of Total Loans Short-Term Deferral or CARES Modification % of Portfolio Segment Non- Performing Loans Special Mention Classified Retail - CRE 1,292$ 6% 37$ 3% 22$ 52$ 306$ Retail - C&I 299 1% 34 11% 4 4 47 BFG - franchise finance 525 2% 38 7% 36 11 277 Hotel 619 3% 343 55% 34 34 487 Airlines and aviation authoritites 117 1% - - - - 75 Cruise line 82 - 48 59% - - 70 2,934$ 13% 500$ 17% 96$ 101$ 1,262$ 17

Loan Portfolio – Retail At March 31, 2021 ($ in millions) Retail - Commercial Real Estate Property Type Balance Currently Under Short-Term Deferral CARES Act Modification Retail - Anchored 634$ -$ 6$ Retail - Unanchored 603 18 13 Construction to Perm 7 - - Gas Station 24 - - Restaurant 24 - - 1,292$ 18$ 19$ • No significant mall or “big box” exposure • $43 million and $18 million of Retail-Unanchored and Retail- Anchored, respectively, are mixed-used properties Retail – Commercial & Industrial Industry Not Secured by Real Estate Owner Occupied Real Estate Total Balance Currently Under Short- Term Deferral CARES Act Modification Gasoline Stations 1$ 84$ 85$ -$ -$ Health and Personal Care Stores 30 7 37 - 14 Furniture Stores 15 5 20 - - Vending Machine Operators 20 - 20 - 20 Specialty Food Stores 1 12 13 - - Grocery Stores 2 18 20 - - Automobile Dealers 7 6 13 - - Clothing Stores 1 11 12 - - Florists 11 - 11 - - Other 19 49 68 - - 107$ 192$ 299$ -$ 34$ 18

Loan Portfolio – BFG Franchise Finance At March 31, 2021 ($ in millions) Portfolio Breakdown by Concept Restaurant Concepts Balance % of BFG Franchise Currently Under Short- Term Deferral CARES Act Modification Burger King 61$ 12% -$ -$ Popeyes 28 5% - - Dunkin Donuts 27 5% - - Jimmy John's 19 4% - - Domino's 17 3% - - Other 154 29% - 13 306$ 58% -$ 13$ Portfolio Breakdown by Geography Non-Restaurant Concepts Balance % of BFG Franchise Currently Under Short- Term Deferral CARES Act Modifications Planet Fitness 95$ 18% -$ 25$ Orange Theory Fitness 83 16% - - Other 41 8% - - 219$ 42% -$ 25$ CA 20% FL 9% TX 7% UT 6% Other 58% 19

Loan Portfolio – Hotel At March 31, 2021 ($ in millions) • 74% of our exposure is in Florida, followed by 16% in New York • Includes $60.3 million in SBA loans • All hotel properties in Florida and two of three properties in New York are now open Exposure by Flag Marriott $170 27% Independent $162 26% Others $103 17% Hilton $86 14% IHG $59 10% Sheraton $39 6% Total Portfolio: $619 million 20

Credit Quality – Residential At March 31, 2021 High quality residential portfolio consists of primarily prime jumbo mortgages with de-minimis charge- offs since inception as well as fully government insured assets FICO Distribution(1) Breakdown by LTV(1) Breakdown by Vintage(1) (1) Excludes government insured residential loans. FICOs are refreshed routinely. LTVs are typically based on valuation at origination. <720 or NA 12% 720-759 19% >759 69% 60% or less 33% 61% - 70% 25% 71% - 80% 40% More than 80% 2% Prior 40% 2017 11% 2018 7% 2019 12% 2020 26% 2021 4% 21

Asset Quality Metrics Non-performing Loans to Total Loans Non-performing Assets to Total Assets Net Charge-offs to Average Loans(1) (1) YTD net charge-offs, annualized at March 31, 2021. 0.88% 0.85% 0.86% 0.84% 1.02% 1.00% 0.68% 0.64% 0.67% 0.66% 0.80% 0.79% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 0.63% 0.61% 0.60% 0.58% 0.71% 0.67% 0.49% 0.46% 0.47% 0.46% 0.56% 0.53% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 22 0.05% 0.26% 0.17% 0.00% 0.20% 0.40% 0.60% 12/31/19 12/31/20 3/31/21

Non-Performing Loans by Portfolio Segment ($ in millions) (1) Includes the guaranteed portion of non-accrual SBA loans totaling $48.2 million, $51.3 million, $43.6 million, $45.7 million, $49.1 million, and $45.7 million at March 31, 2021, December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020, and December 31, 2019, respectively. $19 $17 $13 $12 $29 $26 $18 $11 $22 $31 $36 $38 $6 $6 $6 $24 $13 $65 $51 $66 $65 $43 $58 $21 $11 $1 $14 $38 $33 $33 $45 $36 $62 $64 $64 $59 $67 $63 $205 $198 $204 $200 $244 $234 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Residential CRE Multifamily C&I Equipment Franchise SBA(1) 23

Criticized and Classified Loans ($ in millions) Commercial Real Estate Commercial & Industrial (2) Franchise Finance(1) Equipment Finance SBA(3) (1) Substandard non-accruing and doubtful includes $0.5 million of loans rated doubtful at March 31, 2021. (2) Substandard non-accruing and doubtful includes $17.4 million of loans rated doubtful at March 31, 2021. (3) Includes the guaranteed portion of non-accrual SBA loans totaling $48.2 million, $51.3 million, $43.6 million, $45.7 million, $49.1 million, $45.7 million at March 31, 2021, December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020, and December 31, 2019, respectively. $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 24

Criticized and Classified – CRE by Property Type ($ in millions) Office Multifamily Retail Warehouse/Industrial Hotel Other $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 25

Criticized and Classified – BFG Franchise Finance ($ in millions) Restaurant Concepts (1) Fitness Concepts Other (1) Substandard non-accruing and doubtful includes $0.5 million of loans rated doubtful at March 31, 2021. $0 $20 $40 $60 $80 $100 $120 $140 $160 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $0 $20 $40 $60 $80 $100 $120 $140 $160 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $0 $20 $40 $60 $80 $100 $120 $140 $160 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 26

Asset Quality – Delinquencies ($ in millions) Commercial(1) CRE Residential (2) (1) Includes lending subsidiaries (2) Excludes government insured residential loans. $0 $20 $40 $60 $80 $100 $120 $140 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $0 $20 $40 $60 $80 $100 $120 $140 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $0 $20 $40 $60 $80 $100 $120 $140 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 27

Investment Portfolio

29 Investment Securities AFS ($ in thousands) The AFS debt securities portfolio of $9.1 billion was in a net unrealized gain position of $51.5 million at March 31, 2021 Portfolio Composition Ratings Distribution Gov 35% AAA 58% AA 5% A 2% US Government and agency 32% Private label RMBS and CMOs 13% Private label CMBS 29% Residential real estate lease- backed securities 7% CLO 12% State Municipal Obligations 3% Other 4% Portfolio Net Unrealized Gain(Loss) Fair Value Net Unrealized Gain(Loss) Fair Value Net Unrealized Gain(Loss) Fair Value US Government and agency 10,516$ 2,826,207$ 23,750$ 2,944,924$ 14,913$ 2,814,349$ Private label RMBS and CMOs 10,840 1,012,177 15,713 998,603 7,407 1,160,968 Private label CMBS 5,456 1,724,684 12,083 2,526,354 7,667 2,647,050 Residential real estate lease-backed securities 2,566 470,025 14,819 650,888 11,101 647,423 CLOs (7,539) 1,197,366 (8,450) 1,140,274 (6,770) 1,097,257 State and Municipal Obligations 15,774 273,302 21,966 235,709 18,562 230,672 Other 733 194,904 5,754 565,657 (1,394) 534,449 38,346$ 7,698,665$ 85,635$ 9,062,409$ 51,486$ 9,132,168$ December 31, 2020 March 31, 2021December 31, 2019

30 Investment Securities – Asset Quality of Select Non-Agency Securities At March 31, 2021 Strong credit enhancement levels on CLOs and CMBS AAA 90% AA 7% A 3% Rating Min Max Avg AAA 29.4 99.1 43.0 12.2 AA 31.1 60.4 39.9 11.3 A 24.5 69.8 39.3 10.5 Wtd. Avg. 29.3 95.5 42.6 12.1 Wtd. Avg. Stress Scenario Loss Subordination Rating Min Max Avg AAA 36.1 56.5 44.0 18.9 AA 27.7 40.7 34.2 21.5 A 24.5 29.9 26.6 21.7 Wtd. Avg. 34.6 53.4 42.1 19.4 Subordination Wtd. Avg. Stress Scenario Loss AAA 83% AA 13% A 4% Collateralized Loan Obligations (CLOs) Private Label Commercial Mortgage-Backed Securities (CMBS)

Non-GAAP Financial Measures

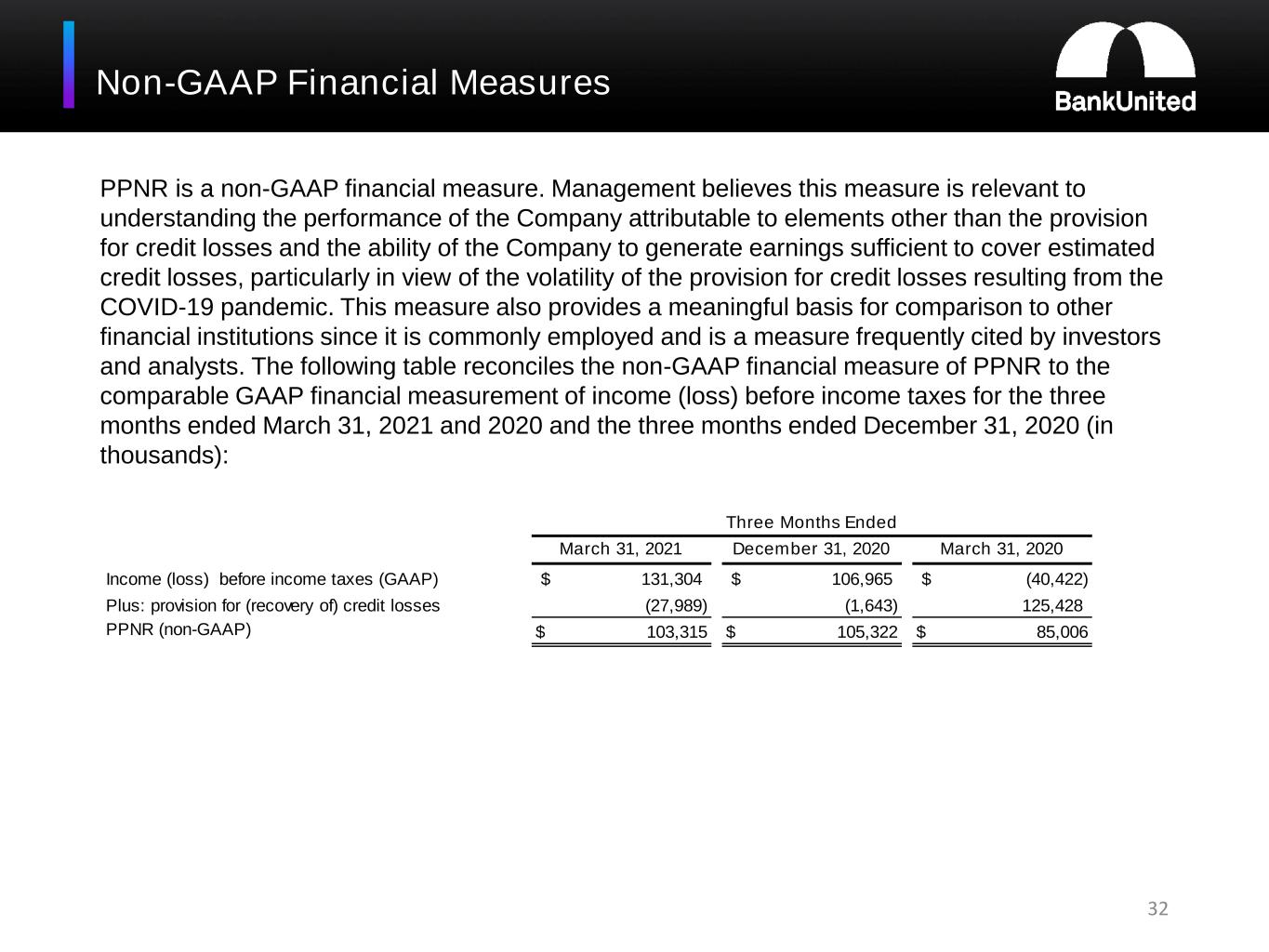

32 Non-GAAP Financial Measures PPNR is a non-GAAP financial measure. Management believes this measure is relevant to understanding the performance of the Company attributable to elements other than the provision for credit losses and the ability of the Company to generate earnings sufficient to cover estimated credit losses, particularly in view of the volatility of the provision for credit losses resulting from the COVID-19 pandemic. This measure also provides a meaningful basis for comparison to other financial institutions since it is commonly employed and is a measure frequently cited by investors and analysts. The following table reconciles the non-GAAP financial measure of PPNR to the comparable GAAP financial measurement of income (loss) before income taxes for the three months ended March 31, 2021 and 2020 and the three months ended December 31, 2020 (in thousands): March 31, 2021 December 31, 2020 March 31, 2020 Income (loss) before income taxes (GAAP) 131,304$ 106,965$ (40,422)$ Plus: provision for (recovery of) credit losses (27,989) (1,643) 125,428 PPNR (non-GAAP) 103,315$ 105,322$ 85,006$ Three Months Ended

33 Non-GAAP Financial Measures (continued) ACL to total loans, excluding government insured residential loans, PPP and MWL is a non-GAAP financial measure. Management believes this measure is relevant to understanding the adequacy of the ACL coverage, excluding the impact of loans which carry nominal or no reserves. Disclosure of this non-GAAP financial measure also provides meaningful basis for comparison to other financial institutions. The following table reconciles the non-GAAP financial measurement of ACL to total loans, excluding government insured residential loans, PPP loans and MWL to the comparable GAAP financial measurement of ACL to total loans at March 31, 2021 and December 31, 2020 (dollars in thousands): March 31, 2020 December 31, 2020 Total loans (GAAP) 23,361,067$ 23,866,042$ Less: Government insured residential loans 1,759,289 1,419,074 Less: PPP loans 911,951 781,811 Less: MWL 1,145,957 1,259,408 Total loans, excluding government insured residential loans, PPP loans and MWL (non-GAAP) 19,543,870$ 20,405,749$ ACL 220,934$ 257,323$ ACL to total loans (GAAP) 0.95% 1.08% ACL to total loans, excluding government insured residential loans, PPP loans and MWL (non-GAAP) 1.13% 1.26%